Q3 2024 Letter to Shareholders Exhibit 99.2

Q3 2024 highlights Revenue was $348.4 million, an increase of 68% year-over-year Gross margin was 90.1%, an improvement of 280 basis points from the prior year GAAP Profitable with Net Income of $29.9 million and net margin of 8.6%, an improvement of $37.2 million from the prior year Adjusted EBITDA¹ was $94.1 million and Adjusted EBITDA margin was 27.0%, an improvement of $101.0 million from the prior year Operating cash flow was $71.6 million, an improvement of $79.3 million from the prior year Free Cash Flow² was $70.3 million, an improvement of $81.9 million from the prior year Capital expenditures were $1.4 million, less than 1% of revenue Cash, cash equivalents, and marketable securities were $1.74 billion as of September 30, 2024 Financial highlights Business highlights Daily Active Uniques (“DAUq”) averaged 97.2 million in the third quarter 2024, an all-time high and an increase of 47% year-over-year Reached new levels of user traffic and exceeded 100 million DAUq on select days during the quarter Weekly Active Uniques (“WAUq”) averaged 365.4 million in the third quarter, an increase of 53% year-over-year Strong user growth across the platform, Logged-in users up 27% and Logged-out users up 70% year-over-year U.S. DAUq grew 51% year-over-year and International DAUq grew 44% year-over-year, driven by 53% year-over- year growth in our focus countries Our product strategies and ML investments are driving deeper engagement. Total conversation page views in Q3 were over 90 billion and up over 40% from last year Machine translation drove 4x incremental DAUq in Q3 versus Q2 and we are accelerating our roadmap to expand to additional countries in Q4 and into 2025 Sustained, differentiated revenue growth. Advertising revenue of $315.1 million grew 56% year-over-year, and Other revenue of $33.2 million, which includes data licensing revenue, increased over 547% year-over-year Average revenue per unique (“ARPU”) was $3.58, up 14% year-over-year Advertising revenue grew across the full funnel, driven by performance revenue (mid- and lower-funnel) which grew high double-digits year-over-year Scaled and diversified our advertising business with over 80% year-over-year growth in our scaled channel, which includes Mid-Market and Small and Medium-Sized Business (“SMB”) customers 2 Q3 2024 • Letter to Shareholders

Dear fellow shareholders, I’m excited to share that Q3 was a landmark quarter for Reddit. We averaged over 97 million daily active uniques, an increase of 47% from last year, and for the first time, we exceeded 100 million a few times during the quarter, which has been a longstanding milestone for us. Our Q3 revenue grew 68% year-over-year, and I’m proud to announce that we achieved GAAP profitability. Reddit’s influence continues to grow across the broader internet. In 2024 so far, "Reddit" was the sixth most Googled word in the U.S., underscoring that when people are looking for answers, advice, or community, they’re turning to Reddit. We saw this play out in real-time when the White House came to Reddit to share critical information during recent hurricanes, reaching people in the affected areas with timely updates. We remain focused on making Reddit the best place on the internet for conversations and community. Which means—quite simply—we are continuously improving the user experience by making discovery easier, making the platform faster and smarter, enabling seamless contribution, and simplifying moderation. A few highlights from the quarter include: Our conversation page views exceeded 90 billion and grew 40% year-over-year in Q3 as users are getting into the conversations faster and more often. We refreshed the Ask Me Anything (“AMA”) product, which led to a fivefold increase in the number of AMAs created in the new format, and we launched better tools for posting that have both increased posts and reduced moderator removals, which makes a better experience for everybody. And as for growing beyond the US, our efforts are proving successful. International DAU grew 44% year-over-year, led by 53% growth in our focus markets, most notably in France, India, and the Philippines. This year, we started using AI to translate Reddit’s corpus into other languages, making it more accessible for non-English speakers to enjoy in their native languages. After promising results with French in the first half of this year, we expanded our coverage to include Spanish, Portuguese, Italian, and German. Q3 2024 • Letter to Shareholders 3

This quarter, machine translation drove four times more users than last quarter, and based on the success we’ve seen so far, we plan to expand machine translation to over 30 countries through 2025. As Reddit becomes a truly global platform, we are focused on ensuring everyone, regardless of their language, can participate in and benefit from the communities on Reddit. Looking ahead, improving the search experience on Reddit is a key part of our strategy. We want to ensure that all users have the best experience possible. This includes users coming to Reddit from external search and those searching directly on Reddit looking for recommendations on what to buy, what to watch, or which products or services are the best. We know many users are looking for more than just answers; they are looking for authentic, real-world insights and advice from the communities on Reddit. We are focused on making the experience of navigating conversations and content on Reddit easier and more intuitive. As we look to 2025 and beyond, we’ll seek opportunities to accelerate our roadmap, whether through new product developments, global expansion, or growing our ads business, all while maintaining our commitment to scaling profitably and ensuring that Reddit continues to be the go-to place for conversations and community on the internet. Thank you again for being part of this exciting journey with us. Steve Huffman Co-Founder & Chief Executive Officer Q3 2024 • Letter to Shareholders 4

Community highlights: Reddit in France r/phryge TRANSLATE La France est l'un des marchés de Reddit qui connaît la croissance la plus rapide. On y observe une augmentation du nombre d'utilisateurs mais aussi un développement des communautés locales, parfois de niche, et qui commencent à prospérer. France is one of Reddit’s fastest growing markets where we are seeing new user growth and local and culturally niche communities begin to thrive. User growth in France is accelerating, driven in part by machine translation (“MT”) and content localization. MT is paving the way for French redditors to access more relevant content, connect to communities they find meaningful, and immerse in conversations in their native language. At its core, Reddit has always had a certain je ne sais quoi. But, does that translate into the same special experience for non-English speakers outside of the United States? Could it ever be considered uniquely…French? Oui. Local communities are thriving Not only are top-of-funnel metrics growing in France, engagement is also growing as posts, comments, and votes reached all-time highs in Q3. The French are known for their pride in being French, and French Reddit reflects this spirit—vibrant, unique, and full of character, much like the country itself. French redditors feel right at home in: r/rance: An alternative meme-y community to r/france with its own language, humor, and rules. 651k+ members r/askfrance: The main Q&A community in France, with questions ranging from relationship advice to numismatics and, of course, French holiday destinations. 302k+ members The machine translation effect Growth: As the first market in which we implemented machine translation, France has seen strong growth with both logged-out and logged-in traffic and French subreddits gaining new levels of members. r/france recently crossed the 2M member mark Deeper Engagement: In r/phryge, a community that celebrates the Paris Olympics mascot, English-speaking moderators use machine translation to engage with French-speaking redditors–working across the language barrier A French-speaking redditor who worked as the mascot hosted an Ask Me Anything (“AMA”) about their experience, using MT to respond to redditors who submitted questions in English Community Discovery: Translated posts are surfacing in search engines and driving traffic to local French communities that tackle complex topics like finance, law, and education, including: r/vosfinances, r/conseiljuridique, r/pasdequestionidiote, r/arnaques, and r/etudiants France DAUq growth accelerated for the third consecutive quarter, reaching nearly 50% year- over-year in Q3 Q3 2024 • Letter to Shareholders La Phryge, the mascot of the Paris Olympics, is celebrated in the r/phryge community on Reddit 5

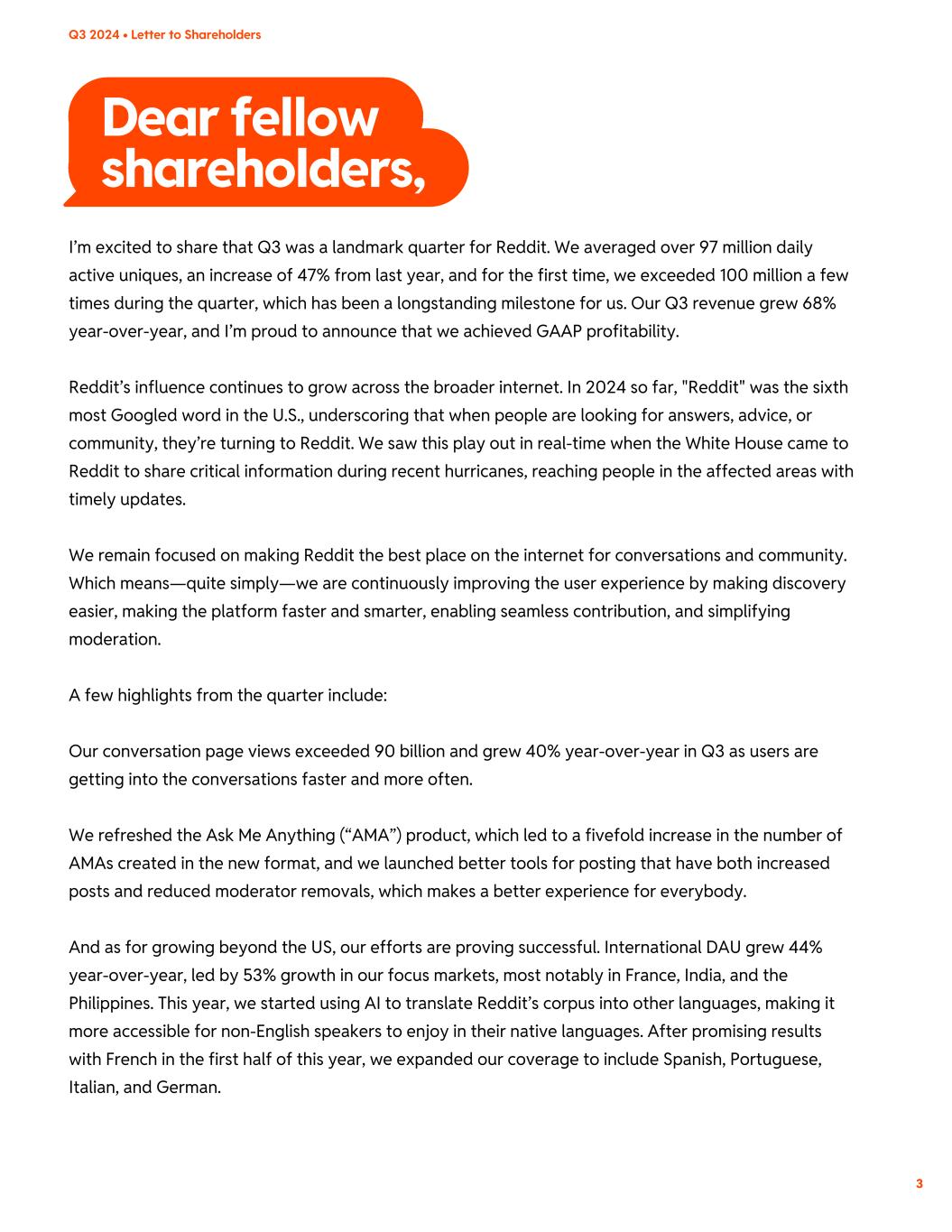

User & product highlights (IN MILLIONS)US DAUq INT’L DAUq TOTAL DAUq 47% Y/Y Machine Translation drove 4x incremental DAUq in Q3 versus the prior quarter In Q3, we saw strong user growth across the platform and Reddit continued to be one of the most visited sites in the world Quarterly average DAUq of 97.2 million grew 47% year-over-year, led by strong growth in both the U.S. and International markets Over 365 million WAUq visited Reddit in Q3, growing 53% year-over- year More than half of the user growth from Q2 was driven by international traffic, as we are seeing early momentum with our machine translation strategy across geographies Quarterly results Q3 2024 • Letter to Shareholders 48.2 Q3 ‘23 Q4 '23 Q2 '24Q1 '24 Q3 '24 32.0 36.4 41.5 45.5 49.034.0 36.7 41.2 45.7 97.2 66.0 73.1 82.7 91.2 Q3 ‘24 DAUq 97.2M Machine translated content is indexed and discoverable in search engines, driving incremental user traffic to Reddit International growth We are still in the early stages of expanding Reddit globally In Q3, International DAUq grew 44% year-over-year, led by strong growth in some of our focus markets, notably France, the U.K., India, Italy, and the Philippines Large-language model (“LLM”) driven machine translation is showing early traction in breaking the language barrier and driving millions of incremental users to the platform As Reddit’s content is translated and indexed in search engines, we are seeing an acceleration in top-of-funnel traffic and growth in logged-in users As of the end of Q3, MT is fully available in France and Spain and we started translation in Germany, Brazil, and Italy as we accelerate our roadmap to over 30 additional countries in Q4 and into 2025 Translation is becoming more efficient as the cost to translate Reddit’s corpus has decreased, while the technology and the speed to translate continue to improve. Machine translation costs accounted for less than 1% of revenue in Q3 DAUq GROWTH BY COUNTRY Q3 2024 6

Advertising & monetization highlights Reddit’s Content and Data Licensing Advertiser diversification Our diversification strategy continued in Q3 as we experienced growth across objectives, channels, verticals, and geographies Objectives: Performance revenue (middle- and lower- funnel) growth accelerated year-over-year and drove more than half of the growth in the quarter. Performance revenue accounted for about 60% of total advertising revenue Channels: We saw continued momentum across channels. The Scaled business (Mid-Market and SMB) grew over 80% year-over-year, driven by SMB revenue, which grew over 100% year-over-year Verticals: Strong growth in industry verticals led by Auto, Consumer Goods, Financial Services, and Pharmaceuticals Geographies: Continued strength in the EMEA markets across both large and mid-sized customers In Q3, we generated Total revenue of $348.4 million and sustained differentiated revenue growth of 68% year-over-year Advertising revenue of $315.1 million grew 56% year-over-year, and Other revenue of $33.2 million increased over 547% year-over-year, primarily driven by data licensing agreements signed earlier this year Total U.S. revenue grew 70% year-over-year and International revenue grew 57% year-over-year, the fastest growth rate in over two years Advertising revenue growth year-over-year was primarily driven by increases in impressions delivered from higher user growth, more efficient ad load, and expansion of conversation placement ads, while pricing was consistent with the prior period In Q3, advertising revenue growth was across the funnel. We launched new conversion API (“CAPI”) integration partnerships and CAPI adoption grew over 2x from Q2 Quarterly results We continue to address the data licensing opportunity and are in contact with potential partners In Q3, we entered into a new partnership with Meltwater, a media and social intelligence company Meltwater accesses Reddit’s content through our data API, which allows their customers to uncover brand insights, monitor industry trends, and tap into the discussions happening on the platform Q3 2024 • Letter to Shareholders 7

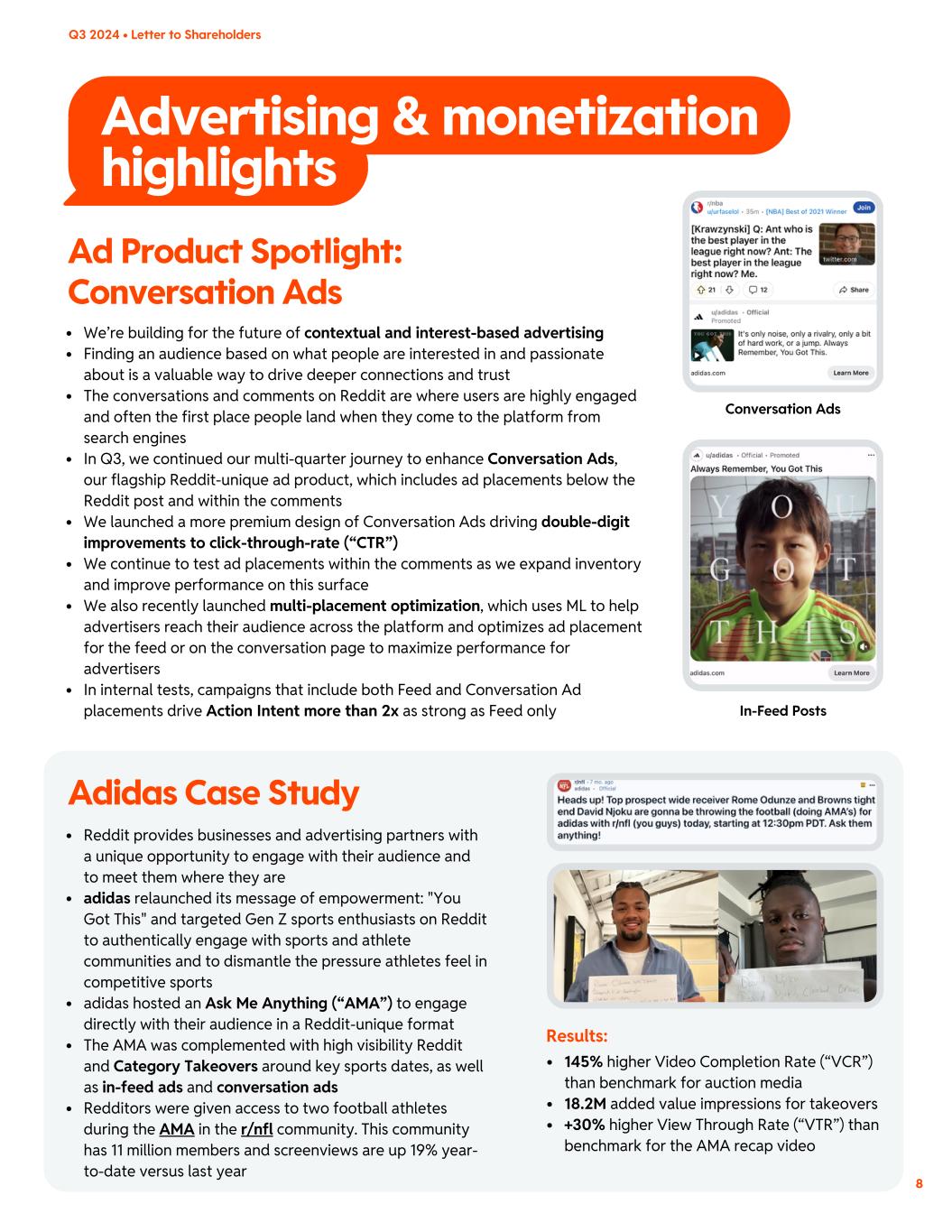

We’re building for the future of contextual and interest-based advertising Finding an audience based on what people are interested in and passionate about is a valuable way to drive deeper connections and trust The conversations and comments on Reddit are where users are highly engaged and often the first place people land when they come to the platform from search engines In Q3, we continued our multi-quarter journey to enhance Conversation Ads, our flagship Reddit-unique ad product, which includes ad placements below the Reddit post and within the comments We launched a more premium design of Conversation Ads driving double-digit improvements to click-through-rate (“CTR”) We continue to test ad placements within the comments as we expand inventory and improve performance on this surface We also recently launched multi-placement optimization, which uses ML to help advertisers reach their audience across the platform and optimizes ad placement for the feed or on the conversation page to maximize performance for advertisers In internal tests, campaigns that include both Feed and Conversation Ad placements drive Action Intent more than 2x as strong as Feed only Advertising & monetization highlights Q3 2024 • Letter to Shareholders Ad Product Spotlight: Conversation Ads Conversation Ads In-Feed Posts Adidas Case Study Reddit provides businesses and advertising partners with a unique opportunity to engage with their audience and to meet them where they are adidas relaunched its message of empowerment: "You Got This" and targeted Gen Z sports enthusiasts on Reddit to authentically engage with sports and athlete communities and to dismantle the pressure athletes feel in competitive sports adidas hosted an Ask Me Anything (“AMA”) to engage directly with their audience in a Reddit-unique format The AMA was complemented with high visibility Reddit and Category Takeovers around key sports dates, as well as in-feed ads and conversation ads Redditors were given access to two football athletes during the AMA in the r/nfl community. This community has 11 million members and screenviews are up 19% year- to-date versus last year 145% higher Video Completion Rate (“VCR”) than benchmark for auction media 18.2M added value impressions for takeovers +30% higher View Through Rate (“VTR”) than benchmark for the AMA recap video Results: 8

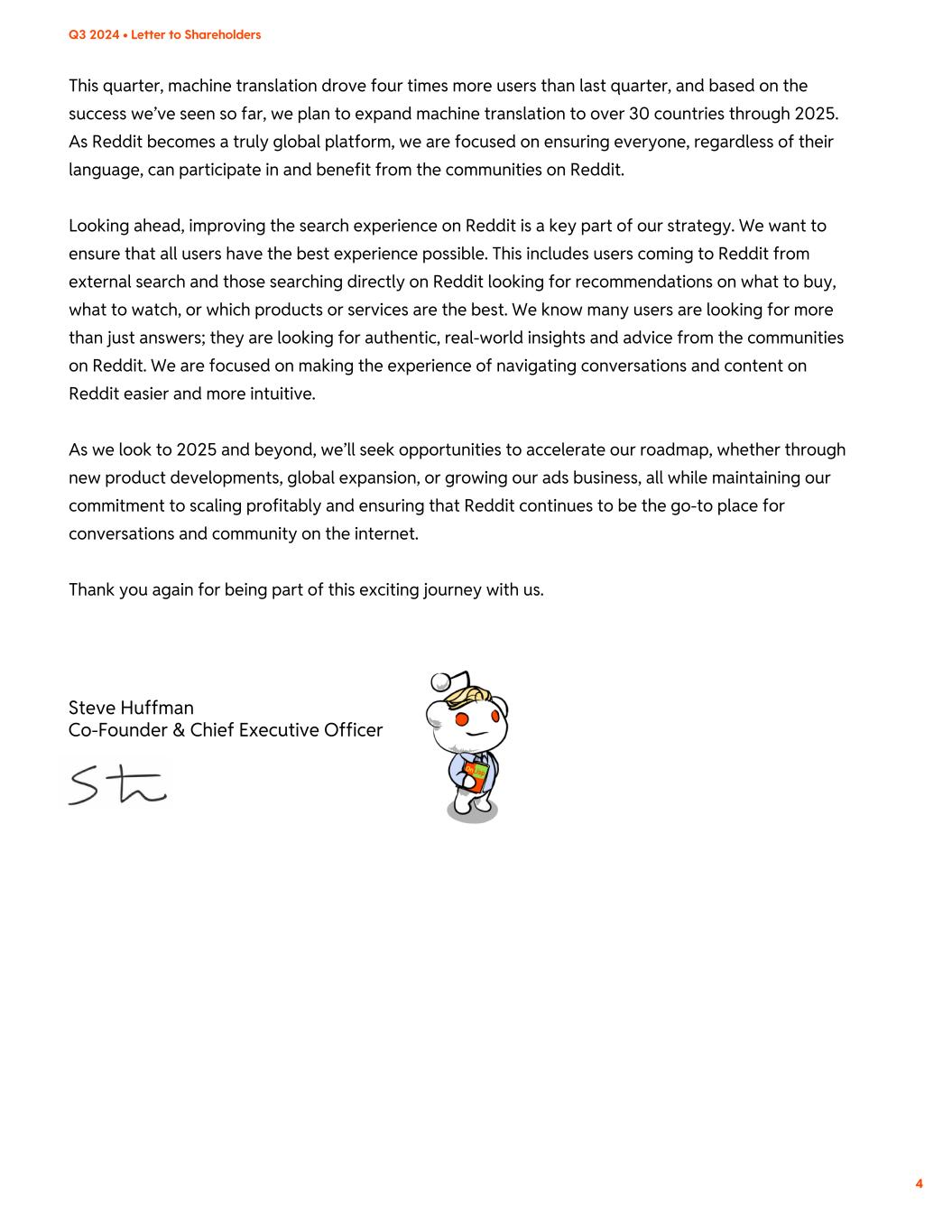

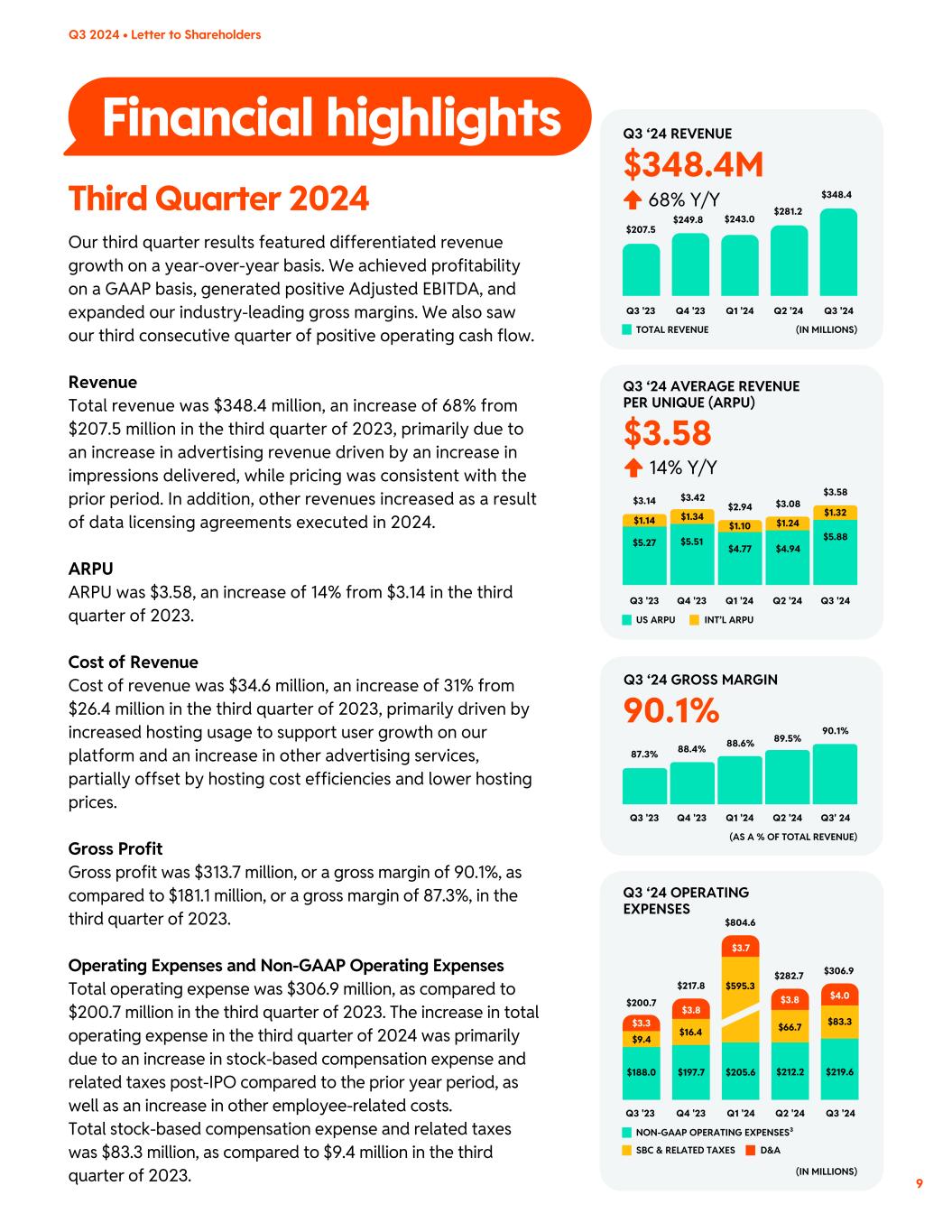

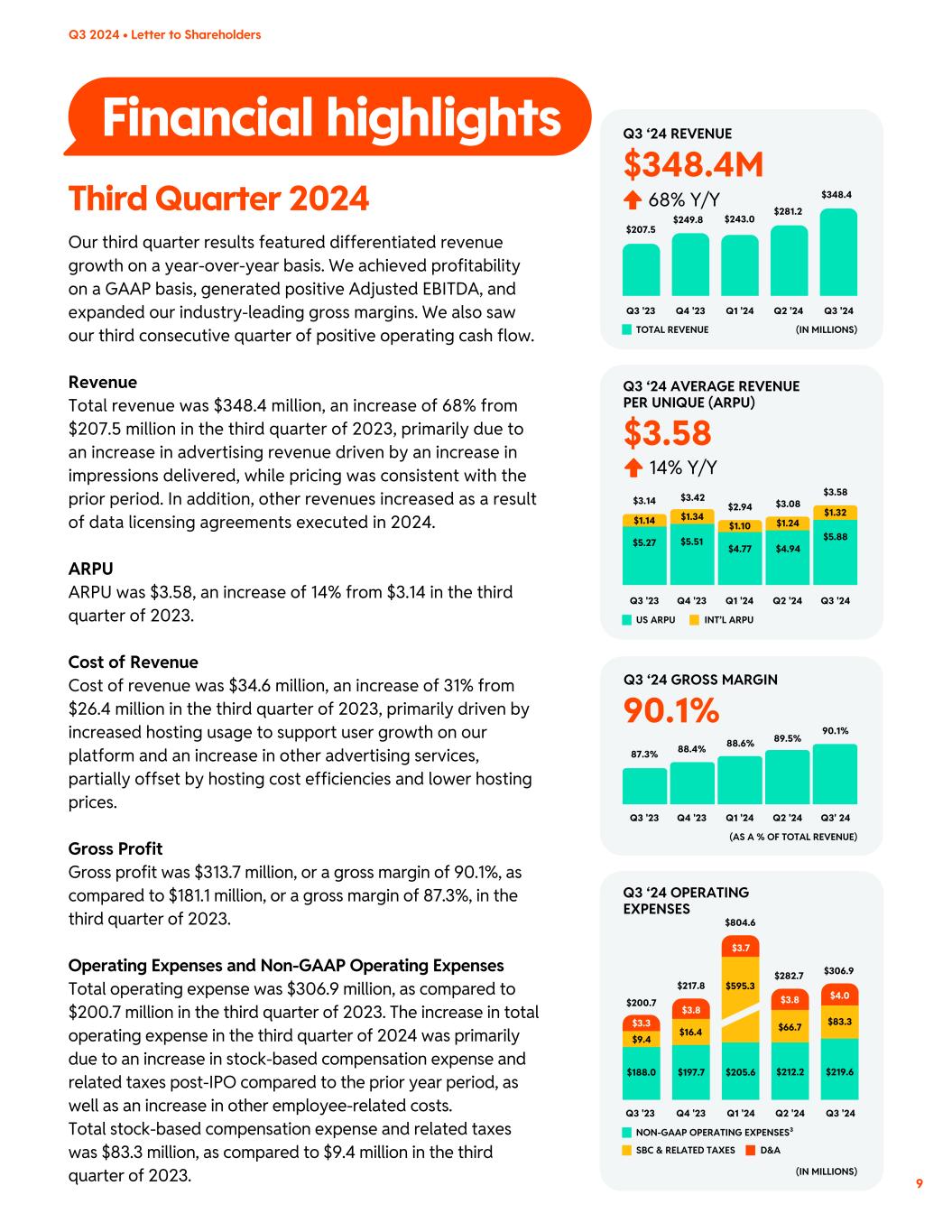

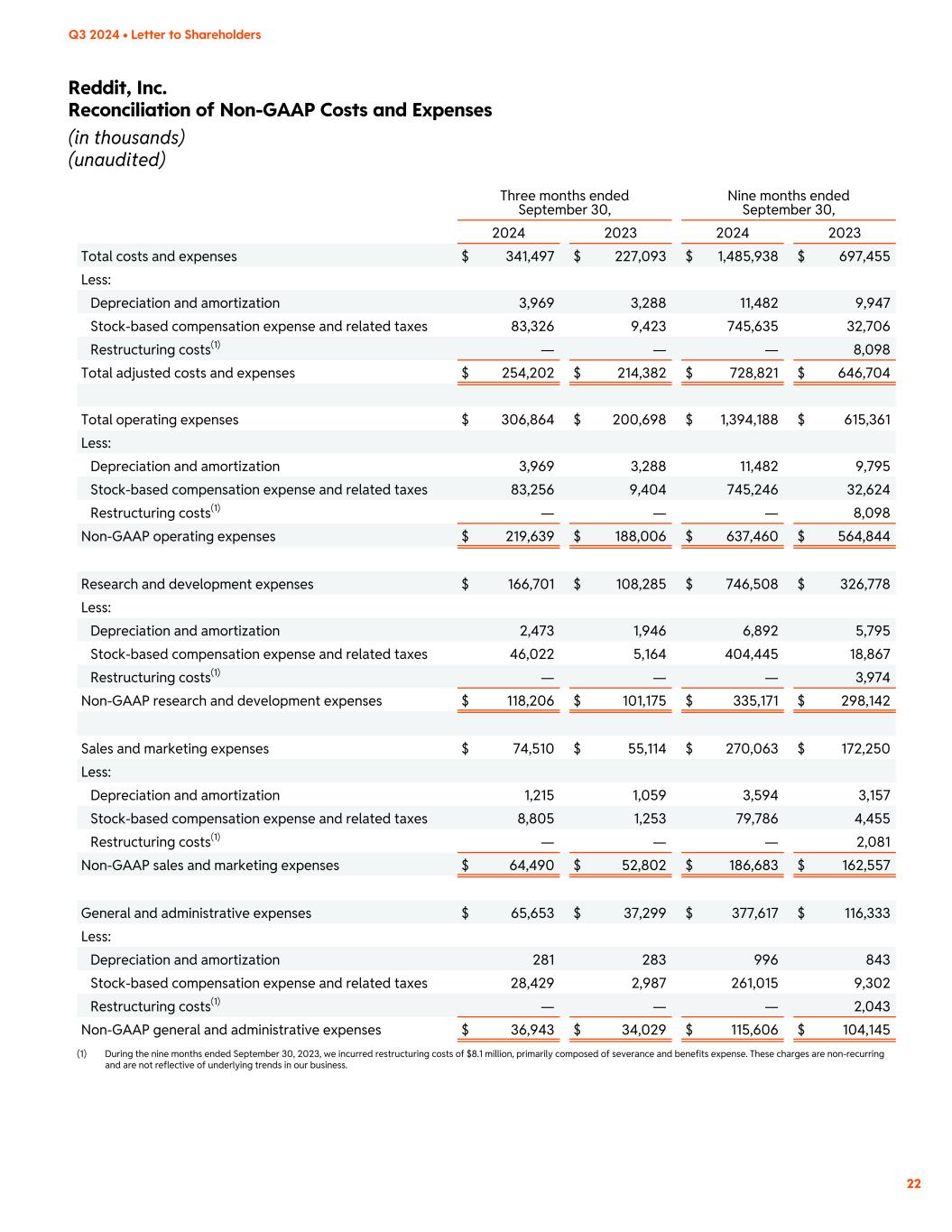

Financial highlights Our third quarter results featured differentiated revenue growth on a year-over-year basis. We achieved profitability on a GAAP basis, generated positive Adjusted EBITDA, and expanded our industry-leading gross margins. We also saw our third consecutive quarter of positive operating cash flow. Revenue Total revenue was $348.4 million, an increase of 68% from $207.5 million in the third quarter of 2023, primarily due to an increase in advertising revenue driven by an increase in impressions delivered, while pricing was consistent with the prior period. In addition, other revenues increased as a result of data licensing agreements executed in 2024. ARPU ARPU was $3.58, an increase of 14% from $3.14 in the third quarter of 2023. Cost of Revenue Cost of revenue was $34.6 million, an increase of 31% from $26.4 million in the third quarter of 2023, primarily driven by increased hosting usage to support user growth on our platform and an increase in other advertising services, partially offset by hosting cost efficiencies and lower hosting prices. Gross Profit Gross profit was $313.7 million, or a gross margin of 90.1%, as compared to $181.1 million, or a gross margin of 87.3%, in the third quarter of 2023. Operating Expenses and Non-GAAP Operating Expenses Total operating expense was $306.9 million, as compared to $200.7 million in the third quarter of 2023. The increase in total operating expense in the third quarter of 2024 was primarily due to an increase in stock-based compensation expense and related taxes post-IPO compared to the prior year period, as well as an increase in other employee-related costs. Total stock-based compensation expense and related taxes was $83.3 million, as compared to $9.4 million in the third quarter of 2023. Third Quarter 2024 Q3 2024 • Letter to Shareholders $348.4M Q3 ‘24 REVENUE 68% Y/Y 14% Y/Y $3.58 Q3 ‘24 AVERAGE REVENUE PER UNIQUE (ARPU) TOTAL REVENUE (IN MILLIONS) SBC & RELATED TAXES NON-GAAP OPERATING EXPENSES³ D&A US ARPU INT’L ARPU $243.0 $2.94 $281.2 $3.08 $348.4 $3.58 $207.5 $3.14 $249.8 $3.42 Q4 '23 Q1 '24 Q2 '24 Q3 '24Q3 '23 90.1% Q3 ‘24 GROSS MARGIN 87.3% 88.4% 88.6% 89.5% 90.1% (AS A % OF TOTAL REVENUE) Q4 '23 Q1 '24 Q2 '24 Q3 '24Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3' 24Q3 '23 $4.77 $5.88$5.27 $5.51 $4.94 $1.10 $1.32 $1.14 $1.34 $1.24 Q3 ‘24 OPERATING EXPENSES (IN MILLIONS) Q4 '23 Q1 '24 Q2 '24 Q3 '24Q3 '23 $200.7 $217.8 $3.3 $3.8 $4.0$3.8 $3.7 $188.0 $9.4 $197.7 $16.4 $205.6 $595.3 $212.2 $219.6 $83.3$66.7 $306.9$282.7 $804.6 9

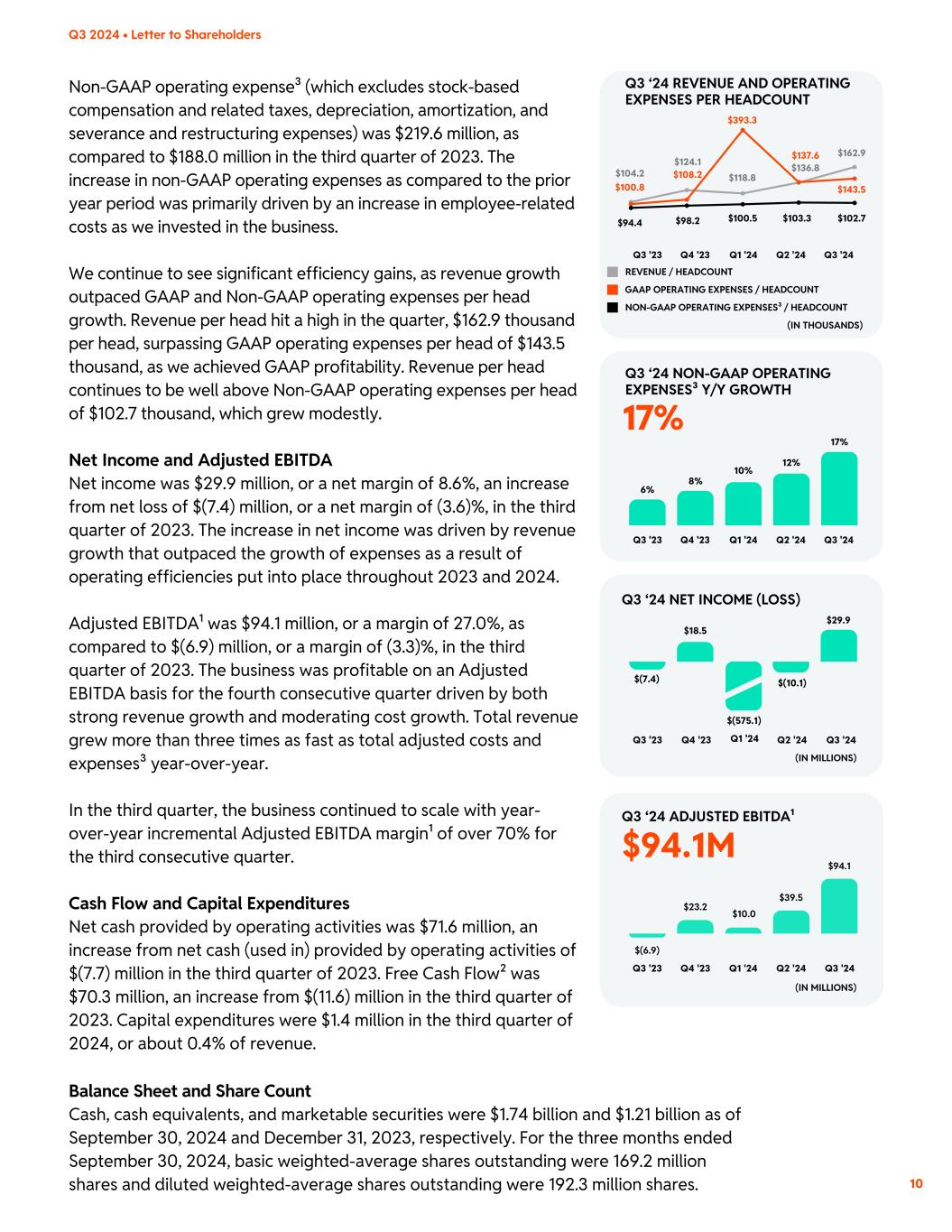

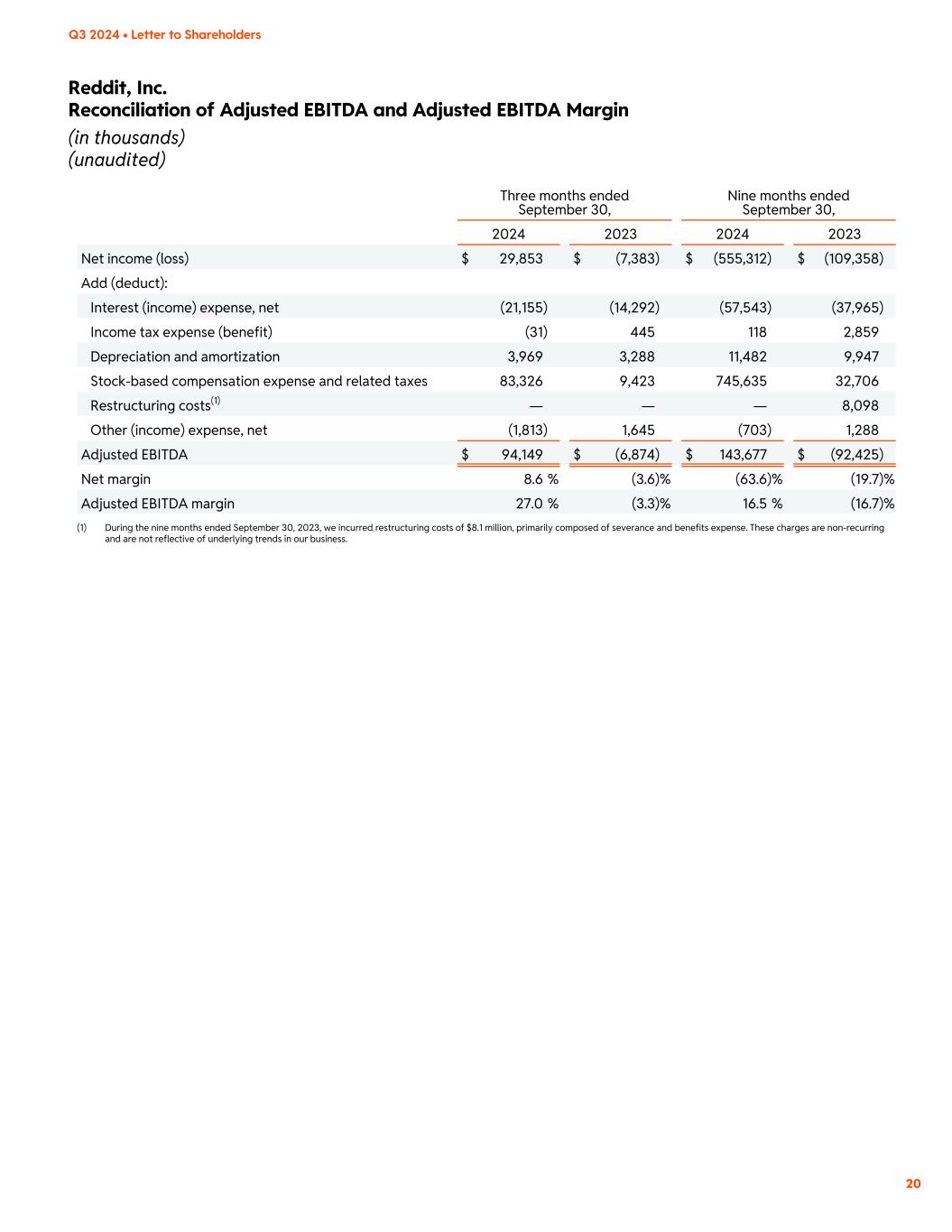

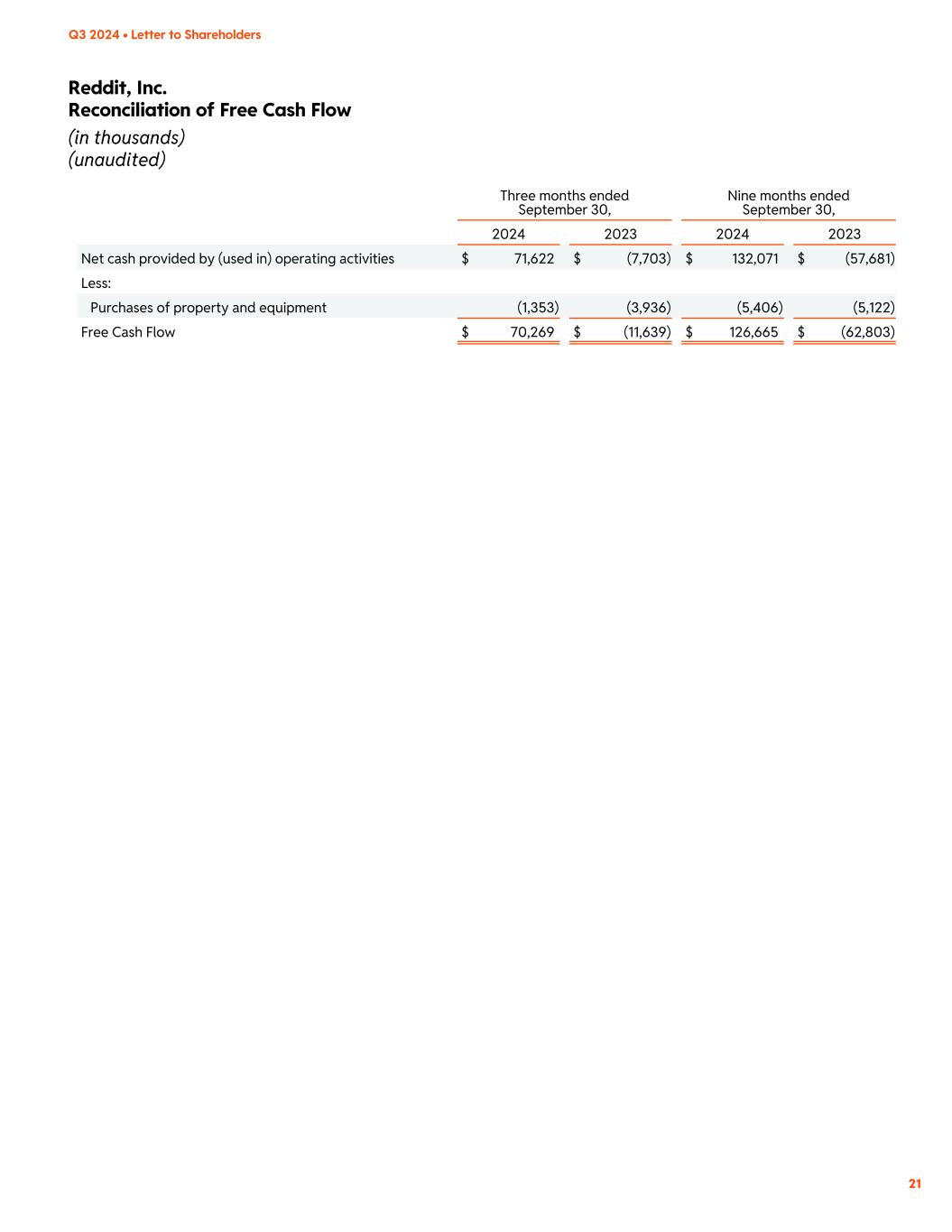

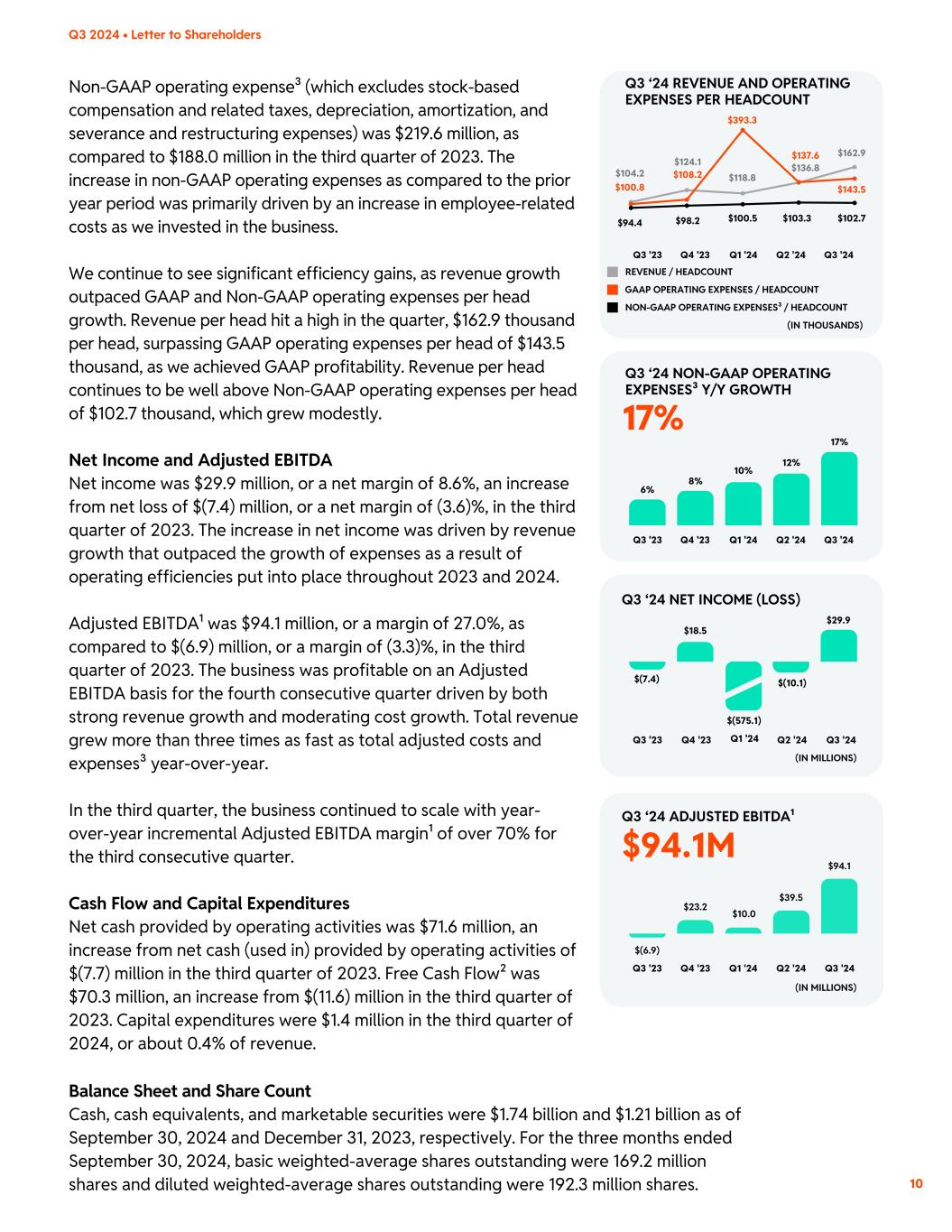

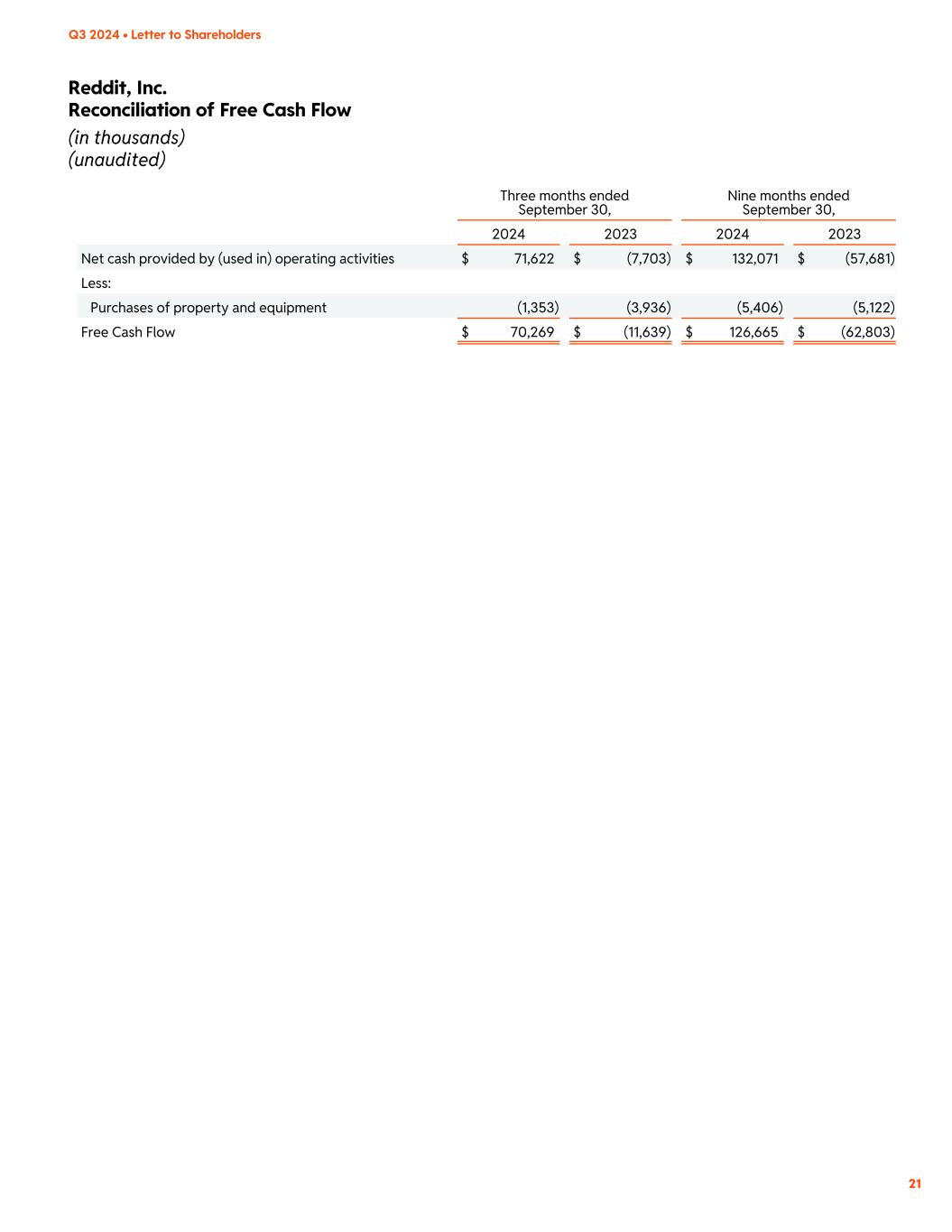

Non-GAAP operating expense³ (which excludes stock-based compensation and related taxes, depreciation, amortization, and severance and restructuring expenses) was $219.6 million, as compared to $188.0 million in the third quarter of 2023. The increase in non-GAAP operating expenses as compared to the prior year period was primarily driven by an increase in employee-related costs as we invested in the business. We continue to see significant efficiency gains, as revenue growth outpaced GAAP and Non-GAAP operating expenses per head growth. Revenue per head hit a high in the quarter, $162.9 thousand per head, surpassing GAAP operating expenses per head of $143.5 thousand, as we achieved GAAP profitability. Revenue per head continues to be well above Non-GAAP operating expenses per head of $102.7 thousand, which grew modestly. Net Income and Adjusted EBITDA Net income was $29.9 million, or a net margin of 8.6%, an increase from net loss of $(7.4) million, or a net margin of (3.6)%, in the third quarter of 2023. The increase in net income was driven by revenue growth that outpaced the growth of expenses as a result of operating efficiencies put into place throughout 2023 and 2024. Adjusted EBITDA¹ was $94.1 million, or a margin of 27.0%, as compared to $(6.9) million, or a margin of (3.3)%, in the third quarter of 2023. The business was profitable on an Adjusted EBITDA basis for the fourth consecutive quarter driven by both strong revenue growth and moderating cost growth. Total revenue grew more than three times as fast as total adjusted costs and expenses³ year-over-year. In the third quarter, the business continued to scale with year- over-year incremental Adjusted EBITDA margin¹ of over 70% for the third consecutive quarter. Cash Flow and Capital Expenditures Net cash provided by operating activities was $71.6 million, an increase from net cash (used in) provided by operating activities of $(7.7) million in the third quarter of 2023. Free Cash Flow² was $70.3 million, an increase from $(11.6) million in the third quarter of 2023. Capital expenditures were $1.4 million in the third quarter of 2024, or about 0.4% of revenue. (IN MILLIONS) (IN MILLIONS) $94.1M Q3 ‘24 ADJUSTED EBITDA¹ $(6.9) $23.2 $10.0 $94.1 $39.5 6% $94.4 $100.8 $104.2 Q4 '23 Q4 '23 Q1 '24 Q1 '24 Q2 '24 Q2 '24 Q3 '24 Q3 '24 Q3 '23 Q3 '23 Q3 ‘24 NON-GAAP OPERATING EXPENSES³ Y/Y GROWTH 17% Q3 ‘24 REVENUE AND OPERATING EXPENSES PER HEADCOUNT 8% $98.2 $108.2 $124.1 $393.3 $118.8 $103.3 $137.6 $136.8 $100.5 $102.7 $143.5 $162.9 10% 12% 17% Q3 ‘24 NET INCOME (LOSS) $(7.4) $18.5 $29.9 $(575.1) $(10.1) Q4 '23 Q4 '23 Q1 '24 Q1 '24 Q2 '24 Q2 '24 Q3 '24 Q3 '24 Q3 '23 Q3 '23 GAAP OPERATING EXPENSES / HEADCOUNT REVENUE / HEADCOUNT NON-GAAP OPERATING EXPENSES³ / HEADCOUNT Balance Sheet and Share Count Cash, cash equivalents, and marketable securities were $1.74 billion and $1.21 billion as of September 30, 2024 and December 31, 2023, respectively. For the three months ended September 30, 2024, basic weighted-average shares outstanding were 169.2 million shares and diluted weighted-average shares outstanding were 192.3 million shares. Q3 2024 • Letter to Shareholders (IN THOUSANDS) 10

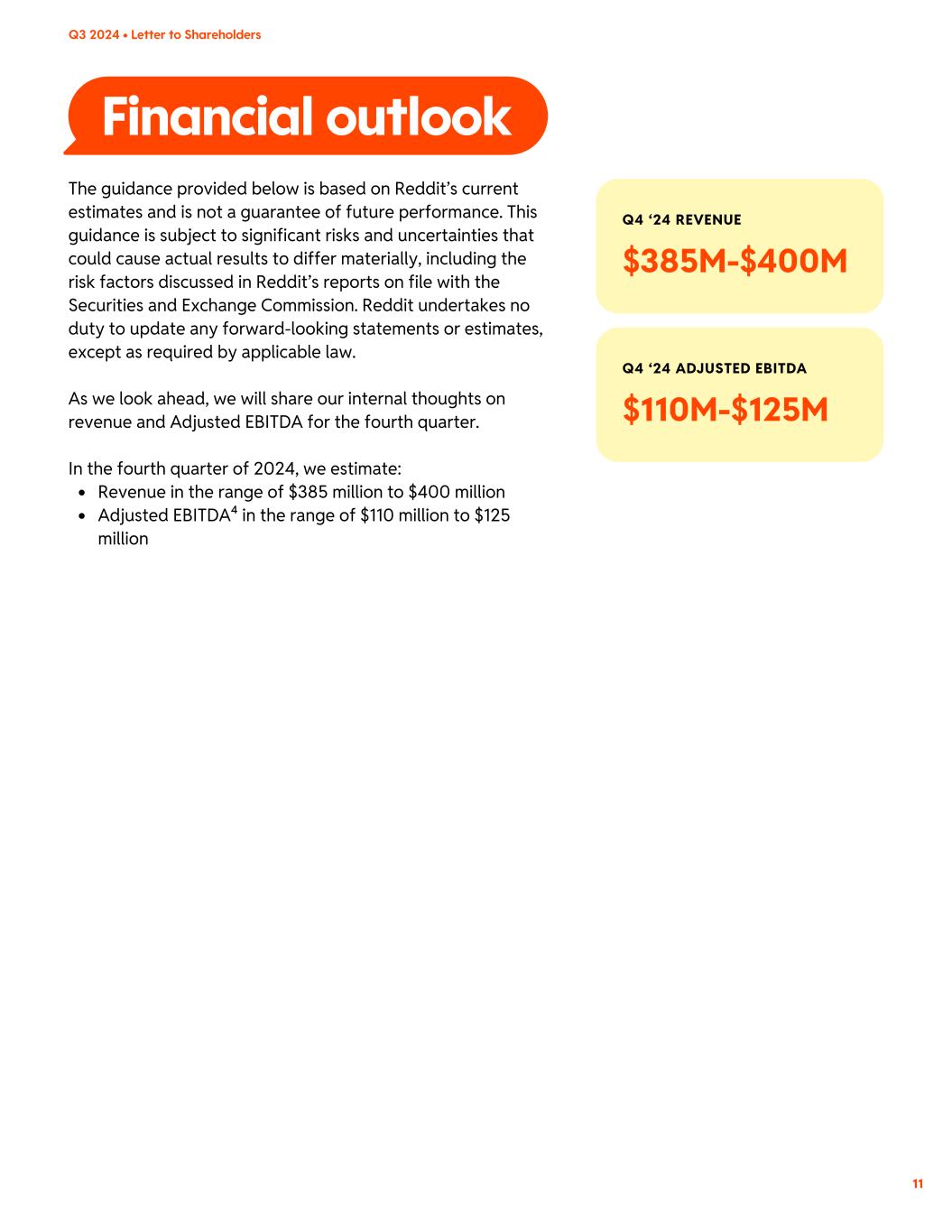

Financial outlook Q4 ‘24 REVENUE $385M-$400M Q4 ‘24 ADJUSTED EBITDA $110M-$125M The guidance provided below is based on Reddit’s current estimates and is not a guarantee of future performance. This guidance is subject to significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in Reddit’s reports on file with the Securities and Exchange Commission. Reddit undertakes no duty to update any forward-looking statements or estimates, except as required by applicable law. As we look ahead, we will share our internal thoughts on revenue and Adjusted EBITDA for the fourth quarter. In the fourth quarter of 2024, we estimate: Revenue in the range of $385 million to $400 million Adjusted EBITDA⁴ in the range of $110 million to $125 million Q3 2024 • Letter to Shareholders 11

Reddit will host a conference call to discuss the results for the third quarter of 2024 on October 29, 2024, at 2:00 p.m. PT / 5:00 p.m. ET. A live webcast of the call can be accessed on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. A replay of the webcast and transcript will be available following the conclusion of the conference call on the same websites. Reddit will solicit questions from the community at r/RDDT on Tuesday, October 29, 2024, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. Steve Huffman Co-Founder & Chief Executive Officer Drew Vollero Chief Financial Officer Q3 2024 • Letter to Shareholders Earnings conference call & community update 12

Appendix Notes The definition of Adjusted EBITDA, Adjusted EBITDA margin, and incremental Adjusted EBITDA margin and a reconciliation of net income (loss) to Adjusted EBITDA and Adjusted EBITDA margin can be found on subsequent pages of this appendix 1. The definition of Free Cash Flow and a reconciliation of Free Cash Flow to net cash provided by (used in) operating activities can be found on subsequent pages of this appendix 2. The definition of total adjusted costs and expenses and non-GAAP operating expenses and a reconciliation of total adjusted costs and expenses and non-GAAP operating expenses to the comparable U.S. GAAP measures can be found on subsequent pages of this appendix 3. We have not provided a reconciliation to the forward-looking U.S. GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding U.S. GAAP guidance measures is not available without unreasonable effort 4. About Reddit Reddit is a community of communities. It’s built on shared interests, passion, and trust and is home to the most open and authentic conversations on the internet. Every day, Reddit users submit, vote, and comment on the topics they care most about. With 100,000+ active communities and approximately 97+ million daily active unique visitors, Reddit is one of the internet’s largest sources of information. For more information, visit www.redditinc.com. Forward Looking Statements This letter contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Reddit's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Reddit's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements regarding Reddit’s priorities, future financial and operating performance, including headcount strategy, breakeven performance objective, capitalization of training data, evolution of AI, international growth strategies to increase content consumption and improve local user experience, consumer product strategy with respect to growth and engagement, data licensing opportunities, GAAP and non-GAAP guidance, strategies, and expectations of growth. Reddit's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including those more fully described under the caption “Risk Factors” and elsewhere in documents that Reddit files with the Securities and Q3 2024 • Letter to Shareholders 13

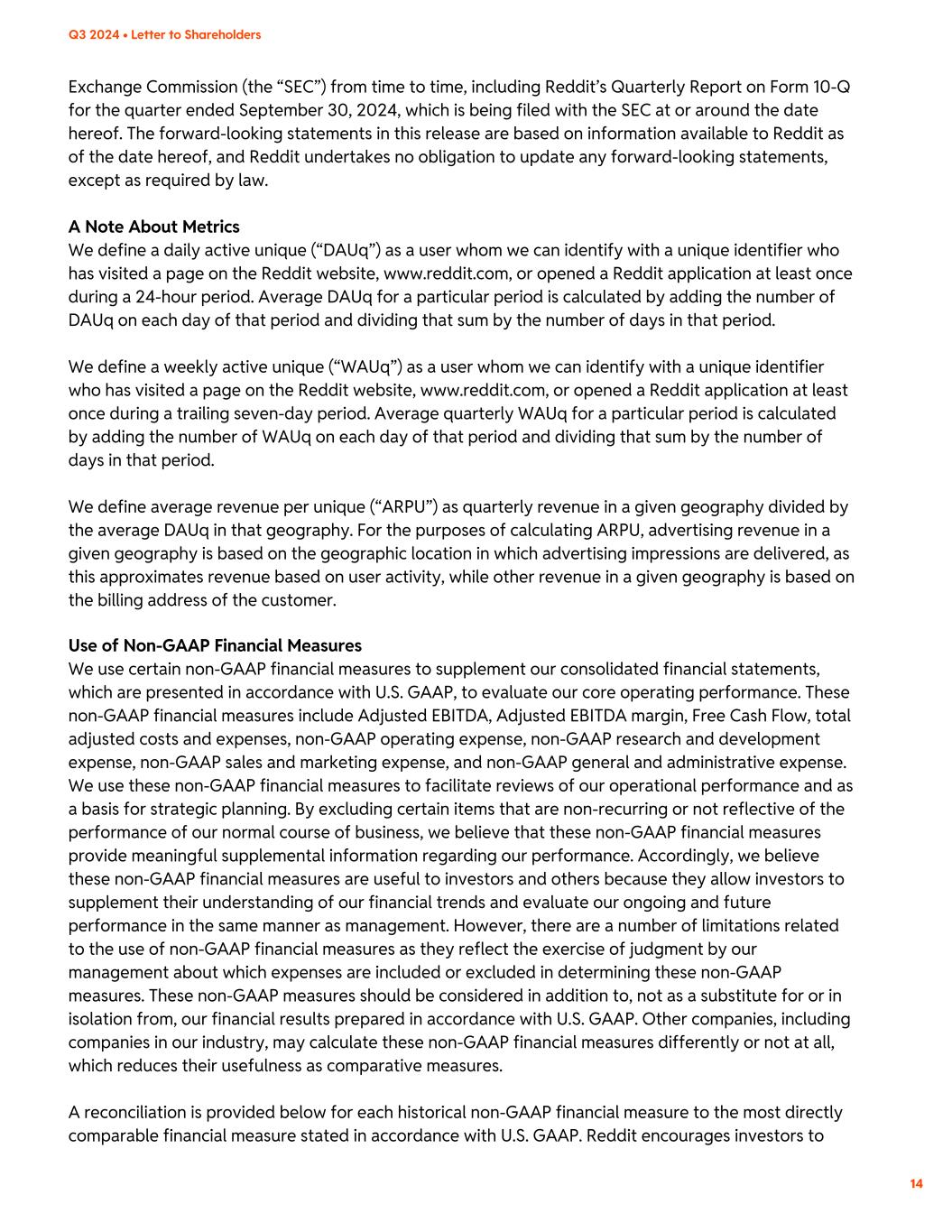

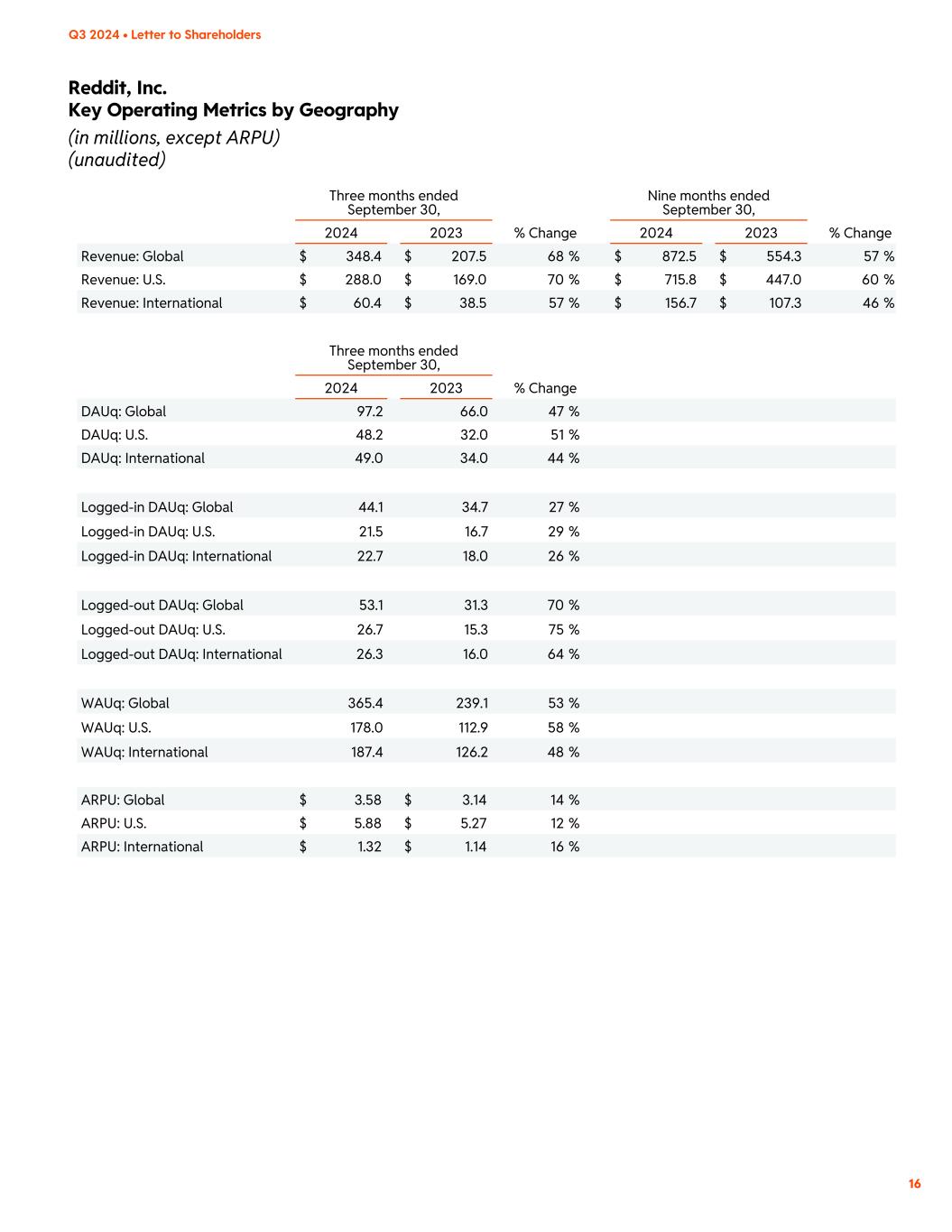

Exchange Commission (the “SEC”) from time to time, including Reddit’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which is being filed with the SEC at or around the date hereof. The forward-looking statements in this release are based on information available to Reddit as of the date hereof, and Reddit undertakes no obligation to update any forward-looking statements, except as required by law. A Note About Metrics We define a daily active unique (“DAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a 24-hour period. Average DAUq for a particular period is calculated by adding the number of DAUq on each day of that period and dividing that sum by the number of days in that period. We define a weekly active unique (“WAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a trailing seven-day period. Average quarterly WAUq for a particular period is calculated by adding the number of WAUq on each day of that period and dividing that sum by the number of days in that period. We define average revenue per unique (“ARPU”) as quarterly revenue in a given geography divided by the average DAUq in that geography. For the purposes of calculating ARPU, advertising revenue in a given geography is based on the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity, while other revenue in a given geography is based on the billing address of the customer. Use of Non-GAAP Financial Measures We use certain non-GAAP financial measures to supplement our consolidated financial statements, which are presented in accordance with U.S. GAAP, to evaluate our core operating performance. These non-GAAP financial measures include Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, total adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense. We use these non-GAAP financial measures to facilitate reviews of our operational performance and as a basis for strategic planning. By excluding certain items that are non-recurring or not reflective of the performance of our normal course of business, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are a number of limitations related to the use of non-GAAP financial measures as they reflect the exercise of judgment by our management about which expenses are included or excluded in determining these non-GAAP measures. These non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. A reconciliation is provided below for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with U.S. GAAP. Reddit encourages investors to Q3 2024 • Letter to Shareholders 14

review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures, and not to rely on any single financial measure to evaluate Reddit’s business. Adjusted EBITDA is defined as net income (loss) excluding interest (income) expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense and related taxes, other (income) expense, net, and certain other non-recurring or non-cash items impacting net income (loss) that we do not consider indicative of our ongoing business performance. Other (income) expense, net consists primarily of realized gains and losses on sales of marketable securities, foreign currency transaction gains and losses, and other income and expense that are not indicative of our core operating performance. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Incremental Adjusted EBITDA margin is defined as the change in Adjusted EBITDA divided by the change in revenue over the same period. We consider the exclusion of certain non-recurring or non- cash items in calculating Adjusted EBITDA and Adjusted EBITDA margin to provide a useful measure for investors and others to evaluate our operating results in the same manner as management. Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property and equipment. We believe that Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Total adjusted costs and expenses represents cost of revenue and operating expenses excluding stock- based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting cost of revenue and operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP operating expenses represents operating expenses excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP research and development expense, non- GAAP sales and marketing expense, and non-GAAP general and administrative expense represent their respective operating expense line items excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items. We consider adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense to be useful measures as they exclude expenses that are not reflective of our operational performance and could mask underlying trends in our business. Investor Relations Jesse Rose ir@reddit.com Media Relations Gina Antonini press@reddit.com Q3 2024 • Letter to Shareholders 15

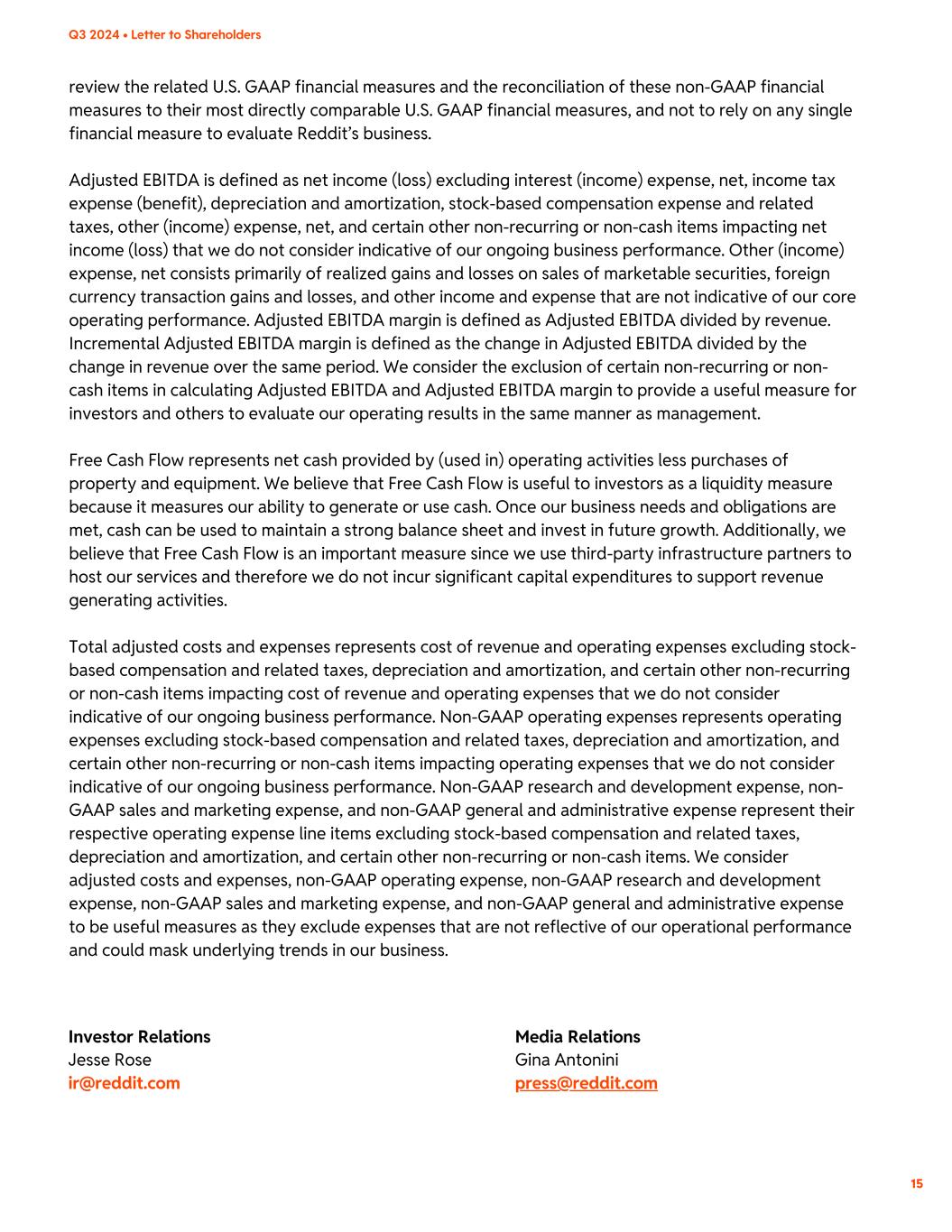

Reddit, Inc. Key Operating Metrics by Geography (in millions, except ARPU) (unaudited) 16 Q3 2024 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2024 2023 % Change 2024 2023 % Change Revenue: Global $ 348.4 $ 207.5 68 % $ 872.5 $ 554.3 57 % Revenue: U.S. $ 288.0 $ 169.0 70 % $ 715.8 $ 447.0 60 % Revenue: International $ 60.4 $ 38.5 57 % $ 156.7 $ 107.3 46 % Three months ended September 30, 2024 2023 % Change DAUq: Global 97.2 66.0 47 % DAUq: U.S. 48.2 32.0 51 % DAUq: International 49.0 34.0 44 % Logged-in DAUq: Global 44.1 34.7 27 % Logged-in DAUq: U.S. 21.5 16.7 29 % Logged-in DAUq: International 22.7 18.0 26 % Logged-out DAUq: Global 53.1 31.3 70 % Logged-out DAUq: U.S. 26.7 15.3 75 % Logged-out DAUq: International 26.3 16.0 64 % WAUq: Global 365.4 239.1 53 % WAUq: U.S. 178.0 112.9 58 % WAUq: International 187.4 126.2 48 % ARPU: Global $ 3.58 $ 3.14 14 % ARPU: U.S. $ 5.88 $ 5.27 12 % ARPU: International $ 1.32 $ 1.14 16 %

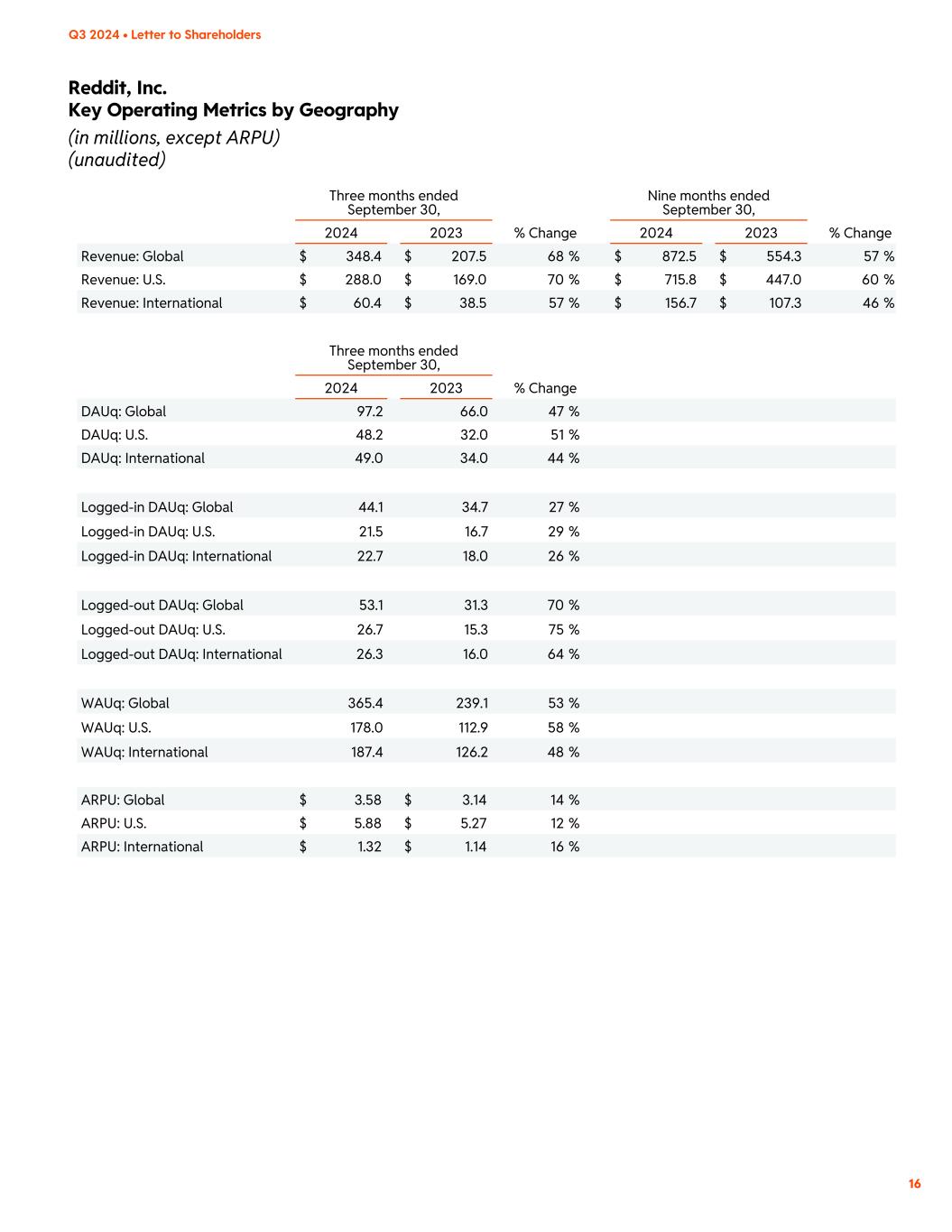

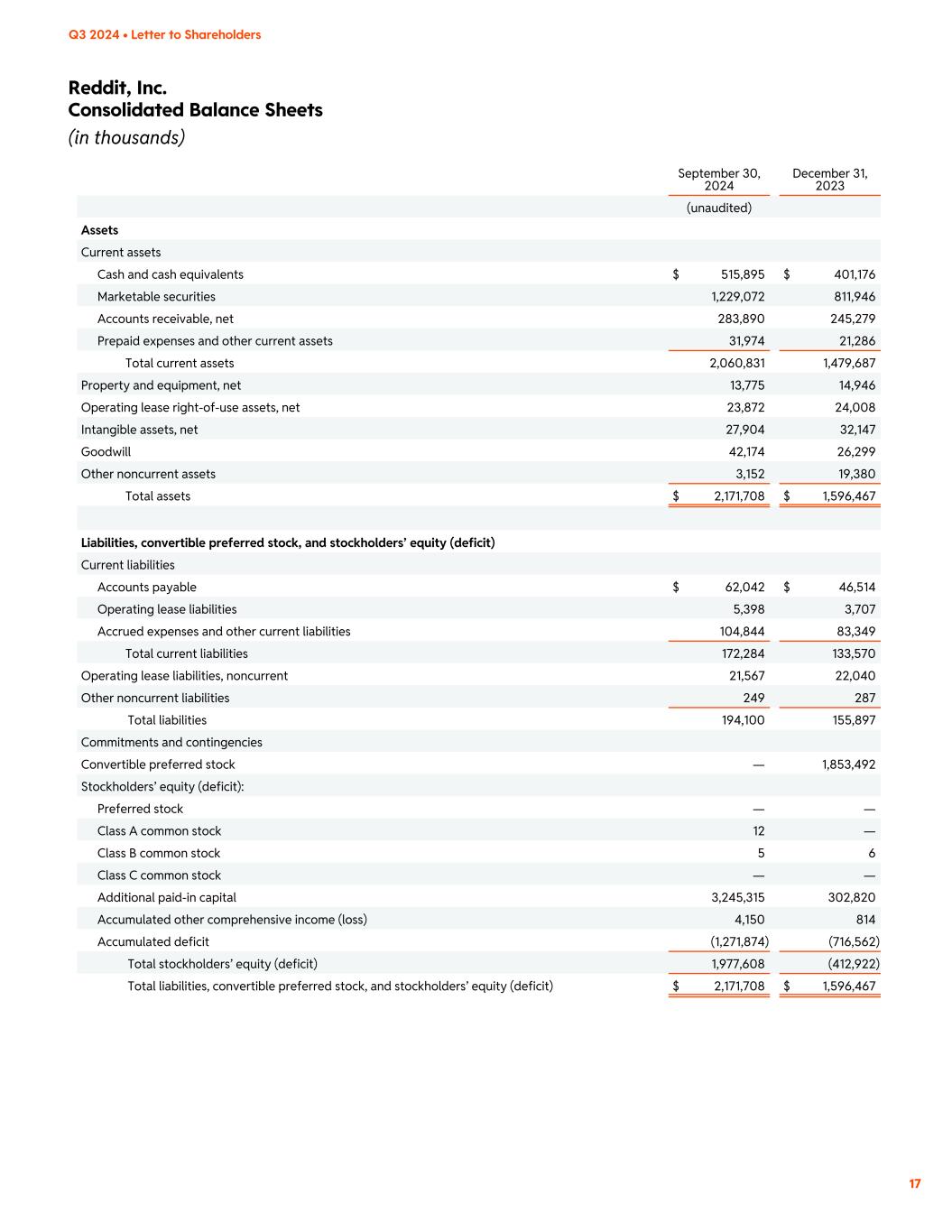

17 Q3 2024 • Letter to Shareholders Reddit, Inc. Consolidated Balance Sheets (in thousands) September 30, 2024 December 31, 2023 (unaudited) Assets Current assets Cash and cash equivalents $ 515,895 $ 401,176 Marketable securities 1,229,072 811,946 Accounts receivable, net 283,890 245,279 Prepaid expenses and other current assets 31,974 21,286 Total current assets 2,060,831 1,479,687 Property and equipment, net 13,775 14,946 Operating lease right-of-use assets, net 23,872 24,008 Intangible assets, net 27,904 32,147 Goodwill 42,174 26,299 Other noncurrent assets 3,152 19,380 Total assets $ 2,171,708 $ 1,596,467 Liabilities, convertible preferred stock, and stockholders’ equity (deficit) Current liabilities Accounts payable $ 62,042 $ 46,514 Operating lease liabilities 5,398 3,707 Accrued expenses and other current liabilities 104,844 83,349 Total current liabilities 172,284 133,570 Operating lease liabilities, noncurrent 21,567 22,040 Other noncurrent liabilities 249 287 Total liabilities 194,100 155,897 Commitments and contingencies Convertible preferred stock — 1,853,492 Stockholders’ equity (deficit): Preferred stock — — Class A common stock 12 — Class B common stock 5 6 Class C common stock — — Additional paid-in capital 3,245,315 302,820 Accumulated other comprehensive income (loss) 4,150 814 Accumulated deficit (1,271,874) (716,562) Total stockholders’ equity (deficit) 1,977,608 (412,922) Total liabilities, convertible preferred stock, and stockholders’ equity (deficit) $ 2,171,708 $ 1,596,467

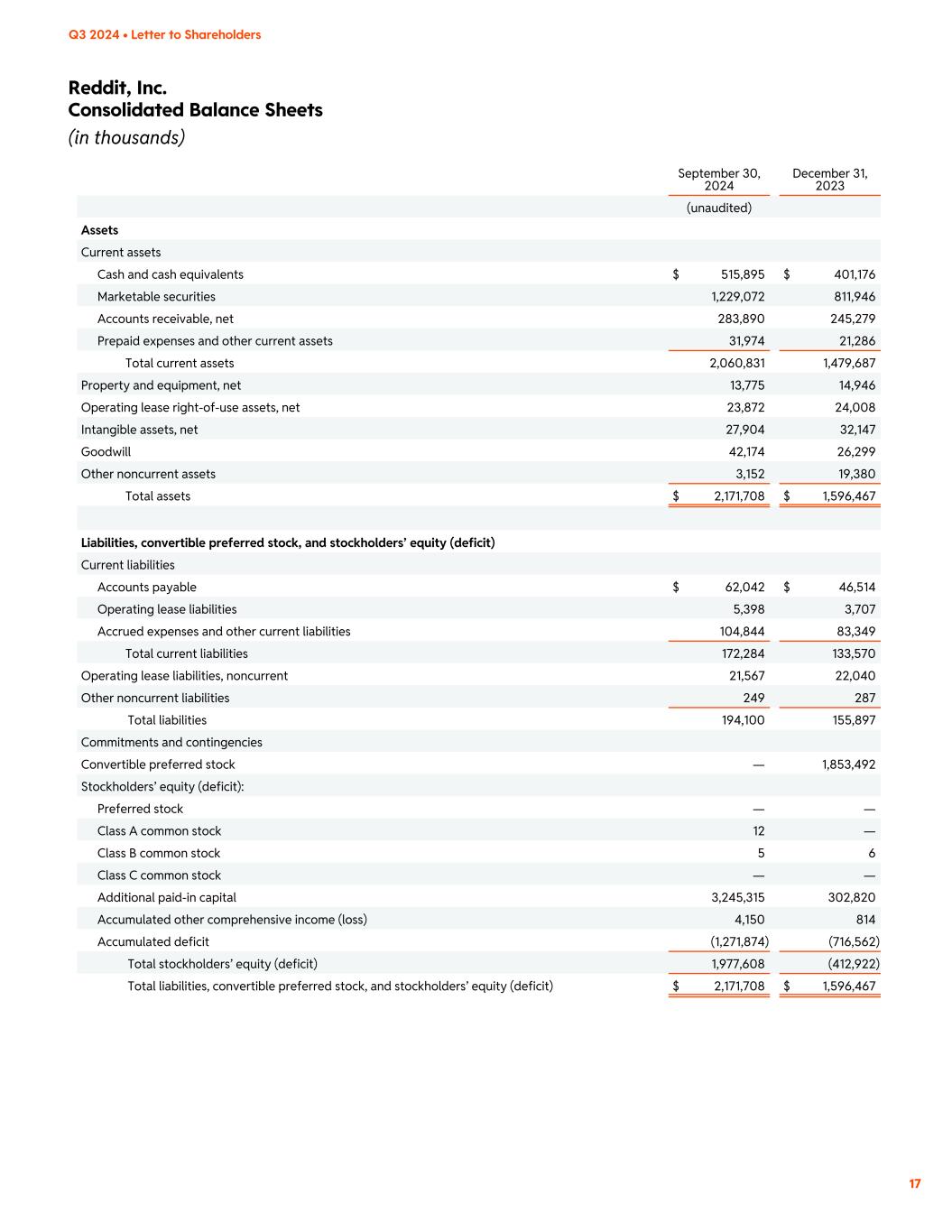

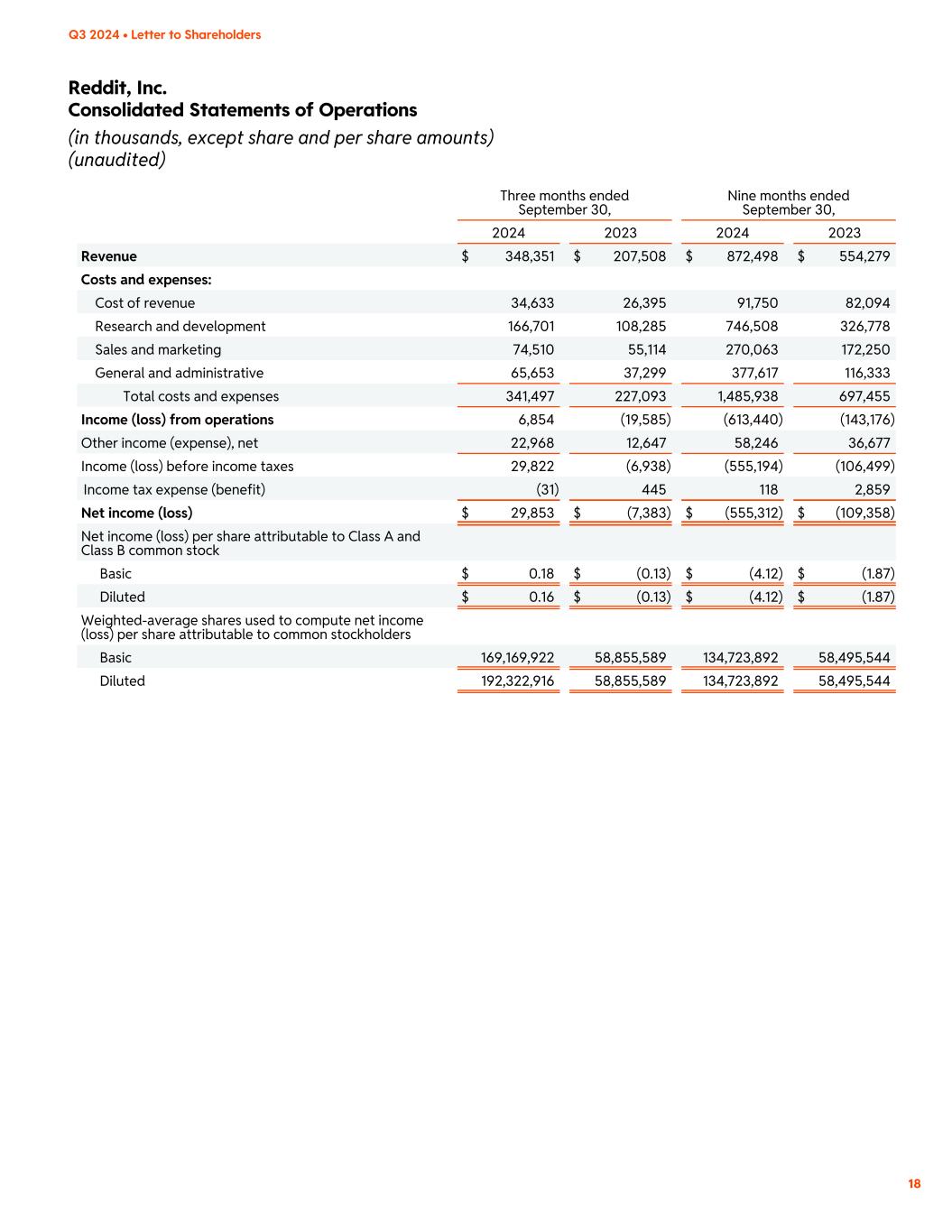

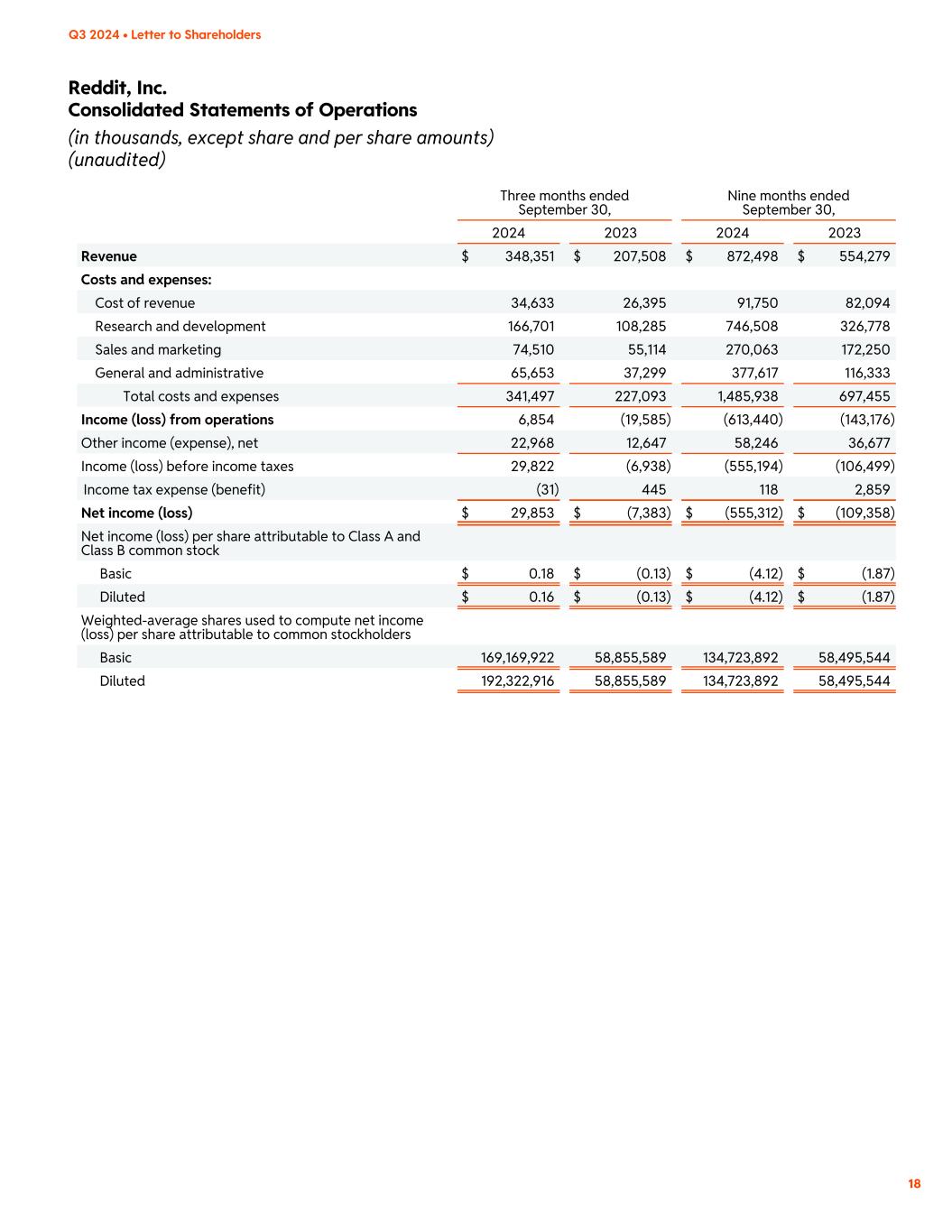

18 Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Revenue $ 348,351 $ 207,508 $ 872,498 $ 554,279 Costs and expenses: Cost of revenue 34,633 26,395 91,750 82,094 Research and development 166,701 108,285 746,508 326,778 Sales and marketing 74,510 55,114 270,063 172,250 General and administrative 65,653 37,299 377,617 116,333 Total costs and expenses 341,497 227,093 1,485,938 697,455 Income (loss) from operations 6,854 (19,585) (613,440) (143,176) Other income (expense), net 22,968 12,647 58,246 36,677 Income (loss) before income taxes 29,822 (6,938) (555,194) (106,499) Income tax expense (benefit) (31) 445 118 2,859 Net income (loss) $ 29,853 $ (7,383) $ (555,312) $ (109,358) Net income (loss) per share attributable to Class A and Class B common stock Basic $ 0.18 $ (0.13) $ (4.12) $ (1.87) Diluted $ 0.16 $ (0.13) $ (4.12) $ (1.87) Weighted-average shares used to compute net income (loss) per share attributable to common stockholders Basic 169,169,922 58,855,589 134,723,892 58,495,544 Diluted 192,322,916 58,855,589 134,723,892 58,495,544 Q3 2024 • Letter to Shareholders Reddit, Inc. Consolidated Statements of Operations (in thousands, except share and per share amounts) (unaudited)

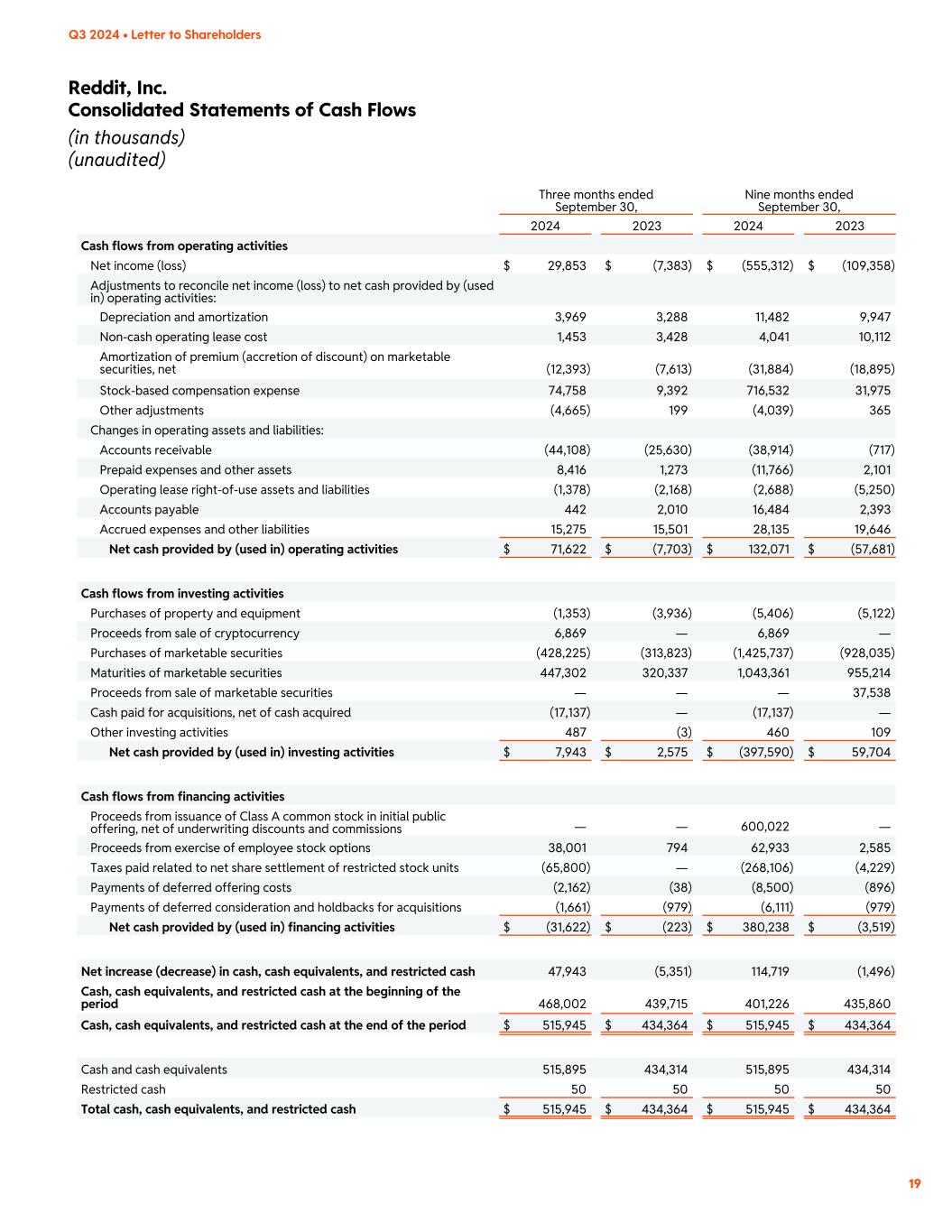

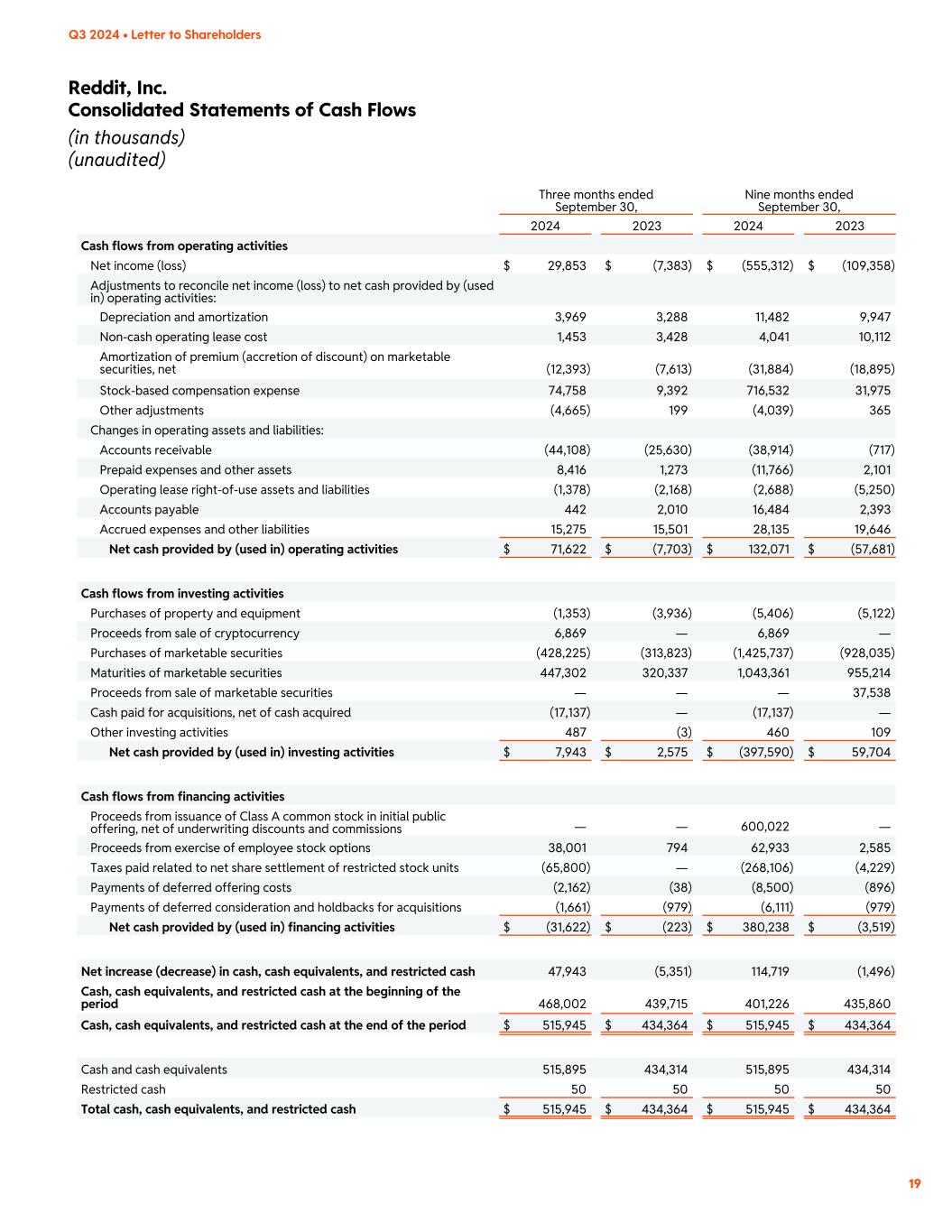

19 Q3 2024 • Letter to Shareholders Reddit, Inc. Consolidated Statements of Cash Flows (in thousands) (unaudited) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Cash flows from operating activities Net income (loss) $ 29,853 $ (7,383) $ (555,312) $ (109,358) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization 3,969 3,288 11,482 9,947 Non-cash operating lease cost 1,453 3,428 4,041 10,112 Amortization of premium (accretion of discount) on marketable securities, net (12,393) (7,613) (31,884) (18,895) Stock-based compensation expense 74,758 9,392 716,532 31,975 Other adjustments (4,665) 199 (4,039) 365 Changes in operating assets and liabilities: Accounts receivable (44,108) (25,630) (38,914) (717) Prepaid expenses and other assets 8,416 1,273 (11,766) 2,101 Operating lease right-of-use assets and liabilities (1,378) (2,168) (2,688) (5,250) Accounts payable 442 2,010 16,484 2,393 Accrued expenses and other liabilities 15,275 15,501 28,135 19,646 Net cash provided by (used in) operating activities $ 71,622 $ (7,703) $ 132,071 $ (57,681) Cash flows from investing activities Purchases of property and equipment (1,353) (3,936) (5,406) (5,122) Proceeds from sale of cryptocurrency 6,869 — 6,869 — Purchases of marketable securities (428,225) (313,823) (1,425,737) (928,035) Maturities of marketable securities 447,302 320,337 1,043,361 955,214 Proceeds from sale of marketable securities — — — 37,538 Cash paid for acquisitions, net of cash acquired (17,137) — (17,137) — Other investing activities 487 (3) 460 109 Net cash provided by (used in) investing activities $ 7,943 $ 2,575 $ (397,590) $ 59,704 Cash flows from financing activities Proceeds from issuance of Class A common stock in initial public offering, net of underwriting discounts and commissions — — 600,022 — Proceeds from exercise of employee stock options 38,001 794 62,933 2,585 Taxes paid related to net share settlement of restricted stock units (65,800) — (268,106) (4,229) Payments of deferred offering costs (2,162) (38) (8,500) (896) Payments of deferred consideration and holdbacks for acquisitions (1,661) (979) (6,111) (979) Net cash provided by (used in) financing activities $ (31,622) $ (223) $ 380,238 $ (3,519) Net increase (decrease) in cash, cash equivalents, and restricted cash 47,943 (5,351) 114,719 (1,496) Cash, cash equivalents, and restricted cash at the beginning of the period 468,002 439,715 401,226 435,860 Cash, cash equivalents, and restricted cash at the end of the period $ 515,945 $ 434,364 $ 515,945 $ 434,364 Cash and cash equivalents 515,895 434,314 515,895 434,314 Restricted cash 50 50 50 50 Total cash, cash equivalents, and restricted cash $ 515,945 $ 434,364 $ 515,945 $ 434,364

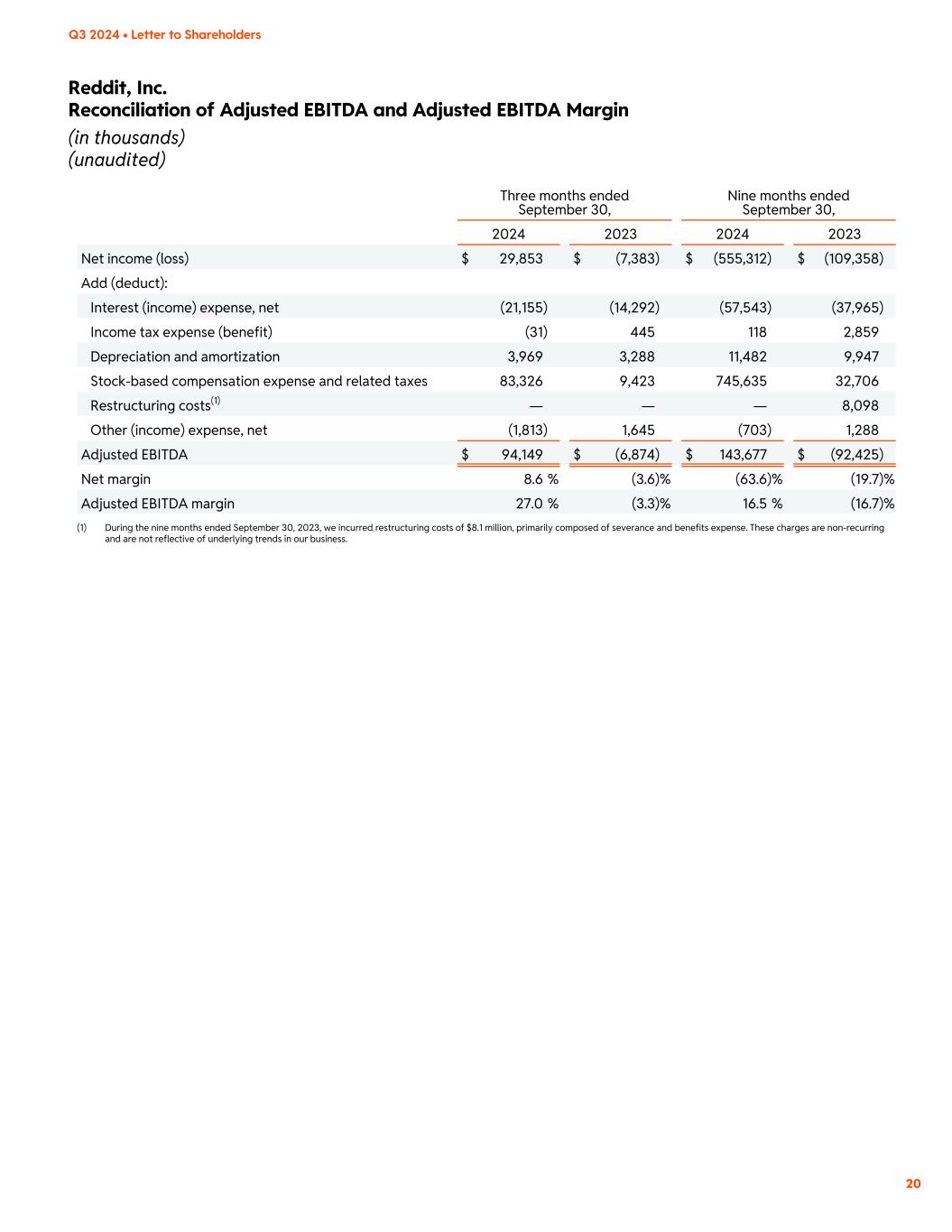

20 Q3 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin (in thousands) (unaudited) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Net income (loss) $ 29,853 $ (7,383) $ (555,312) $ (109,358) Add (deduct): Interest (income) expense, net (21,155) (14,292) (57,543) (37,965) Income tax expense (benefit) (31) 445 118 2,859 Depreciation and amortization 3,969 3,288 11,482 9,947 Stock-based compensation expense and related taxes 83,326 9,423 745,635 32,706 Restructuring costs(1) — — — 8,098 Other (income) expense, net (1,813) 1,645 (703) 1,288 Adjusted EBITDA $ 94,149 $ (6,874) $ 143,677 $ (92,425) Net margin 8.6 % (3.6) % (63.6) % (19.7) % Adjusted EBITDA margin 27.0 % (3.3) % 16.5 % (16.7) % (1) During the nine months ended September 30, 2023, we incurred restructuring costs of $8.1 million, primarily composed of severance and benefits expense. These charges are non-recurring and are not reflective of underlying trends in our business.

21 Q3 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Free Cash Flow (in thousands) (unaudited) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Net cash provided by (used in) operating activities $ 71,622 $ (7,703) $ 132,071 $ (57,681) Less: Purchases of property and equipment (1,353) (3,936) (5,406) (5,122) Free Cash Flow $ 70,269 $ (11,639) $ 126,665 $ (62,803)

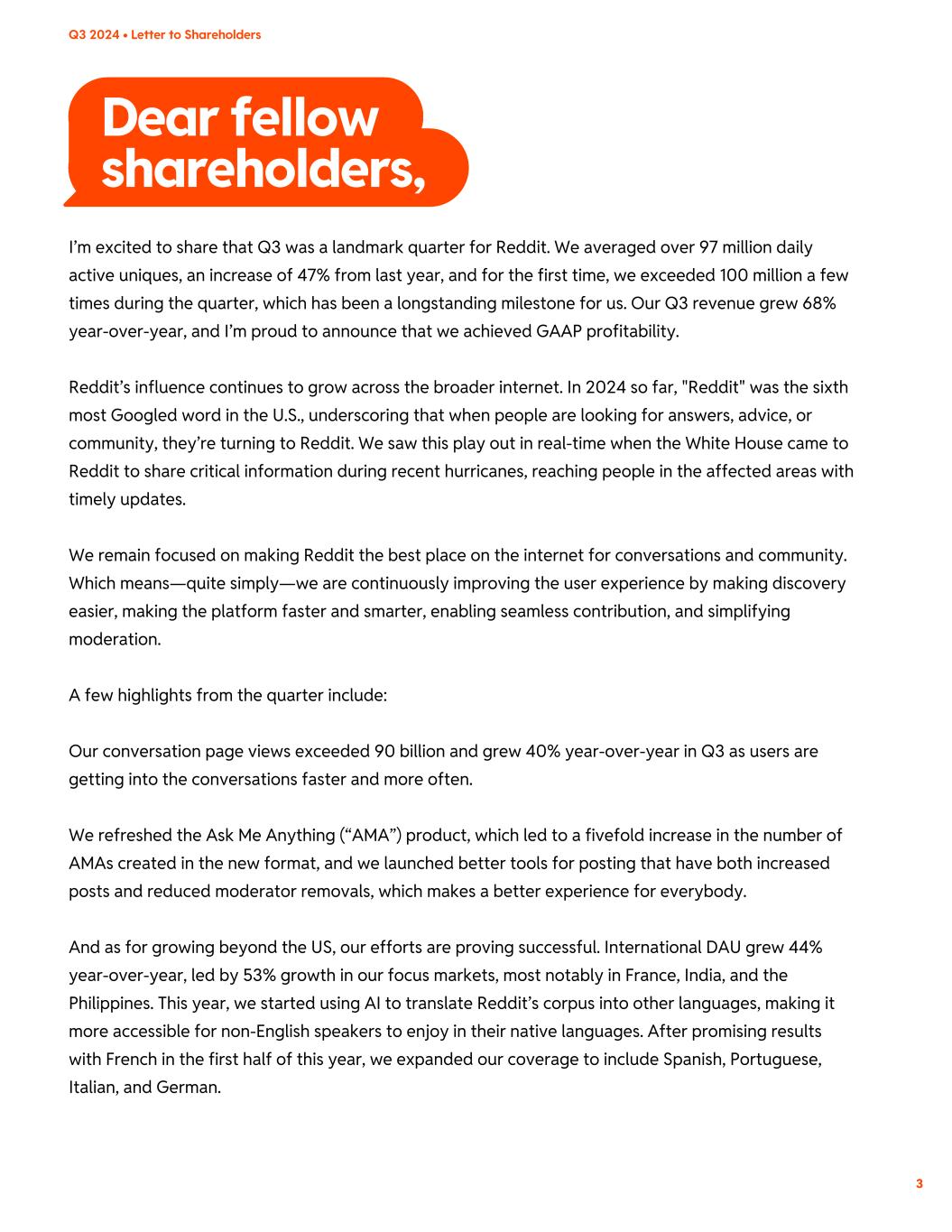

22 Q3 2024 • Letter to Shareholders Reddit, Inc. Reconciliation of Non-GAAP Costs and Expenses (in thousands) (unaudited) Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Total costs and expenses $ 341,497 $ 227,093 $ 1,485,938 $ 697,455 Less: Depreciation and amortization 3,969 3,288 11,482 9,947 Stock-based compensation expense and related taxes 83,326 9,423 745,635 32,706 Restructuring costs(1) — — — 8,098 Total adjusted costs and expenses $ 254,202 $ 214,382 $ 728,821 $ 646,704 Total operating expenses $ 306,864 $ 200,698 $ 1,394,188 $ 615,361 Less: Depreciation and amortization 3,969 3,288 11,482 9,795 Stock-based compensation expense and related taxes 83,256 9,404 745,246 32,624 Restructuring costs(1) — — — 8,098 Non-GAAP operating expenses $ 219,639 $ 188,006 $ 637,460 $ 564,844 Research and development expenses $ 166,701 $ 108,285 $ 746,508 $ 326,778 Less: Depreciation and amortization 2,473 1,946 6,892 5,795 Stock-based compensation expense and related taxes 46,022 5,164 404,445 18,867 Restructuring costs(1) — — — 3,974 Non-GAAP research and development expenses $ 118,206 $ 101,175 $ 335,171 $ 298,142 Sales and marketing expenses $ 74,510 $ 55,114 $ 270,063 $ 172,250 Less: Depreciation and amortization 1,215 1,059 3,594 3,157 Stock-based compensation expense and related taxes 8,805 1,253 79,786 4,455 Restructuring costs(1) — — — 2,081 Non-GAAP sales and marketing expenses $ 64,490 $ 52,802 $ 186,683 $ 162,557 General and administrative expenses $ 65,653 $ 37,299 $ 377,617 $ 116,333 Less: Depreciation and amortization 281 283 996 843 Stock-based compensation expense and related taxes 28,429 2,987 261,015 9,302 Restructuring costs(1) — — — 2,043 Non-GAAP general and administrative expenses $ 36,943 $ 34,029 $ 115,606 $ 104,145 (1) During the nine months ended September 30, 2023, we incurred restructuring costs of $8.1 million, primarily composed of severance and benefits expense. These charges are non-recurring and are not reflective of underlying trends in our business.