Loma Negra Reports 2Q24 results Buenos Aires, August 7, 2024 – Loma Negra, (NYSE: LOMA; BYMA: LOMA), (“Loma Negra” or the “Company”), the leading cement producer in Argentina, today announced results for the three-month period ended June 30, 2024 (our “2Q24 Results”). 2Q24 Key Highlights ▪ Net sales revenues stood at Ps. 136,102 million (US$ 147 million), and decreased by 28.0% YoY, mainly explained by a decrease of 32,5% in the Cement segment sales volumes, as the other businesses follow the same trend. ▪ Consolidated Adjusted EBITDA reached Ps. 38,271 million, decreasing 11.7% YoY in adjusted pesos, while in dollars it reached 51 million, down 19.2% from 2Q23. ▪ The Consolidated Adjusted EBITDA margin stood at 28.1%, with an expansion of 520 basis points YoY from 22.9%. On a sequential basis, the margin also improved, with a significant increase of 552 basis points. ▪ Net Profit of Ps. 29,584 million, up 225.9% from Ps. 9,076 million in the same period of the previous year, mainly due to the solid operational results despite a volume decrease and the improvement in the net total finance gain. ▪ Net Debt stood at Ps. 197,915 million (US$ 217 million), representing a Net Debt/LTM Adjusted EBITDA ratio of 1.26x compared with 1.40x in FY23. The Company has presented certain financial figures, Table 1b and Table 11, in U.S. dollars and Pesos without giving effect to IAS 29. The Company has prepared all other financial information herein by applying IAS 29. Commenting on the financial and operating performance for the second quarter of 2024, Sergio Faifman, Loma Negra’s Chief Executive Officer, noted: “We are glad to report another set of solid results. Despite the year-on-year volume decline our business delivered an expansion of the Adjusted EBITDA margin that demonstrates our strong capability for efficiency and flexibility in adapting to challenging scenarios and our constant focus on profitability. As the stabilization program implemented by the Milei administration begins to show positive results in reducing inflation and consolidating a fiscal surplus, construction activity is beginning to show signs of recovery. Cement volumes have been displaying a positive trend of continuous sequential growth since reaching a low in March. Although economic challenges remain, we believe that we are in a transition period. As macroeconomic variables stabilize and the economic environment improves, we expect to see a much stronger recovery. Meanwhile, our focus is on efficiency and cost control while maintaining our leadership position and commitment to our clients and suppliers. In this regard, in the second quarter, we delivered an Adjusted EBITDA of US$51 million, achieving an impressive EBITDA per ton of US$45, posting an improvement of 23% year-on-year and 16% on a sequential basis. We are optimistic that this positive trend in the industry will consolidate, as July's dispatch figures already show significant improvement. Therefore, we have strong indications to expect further recovery in the second half of the year.”

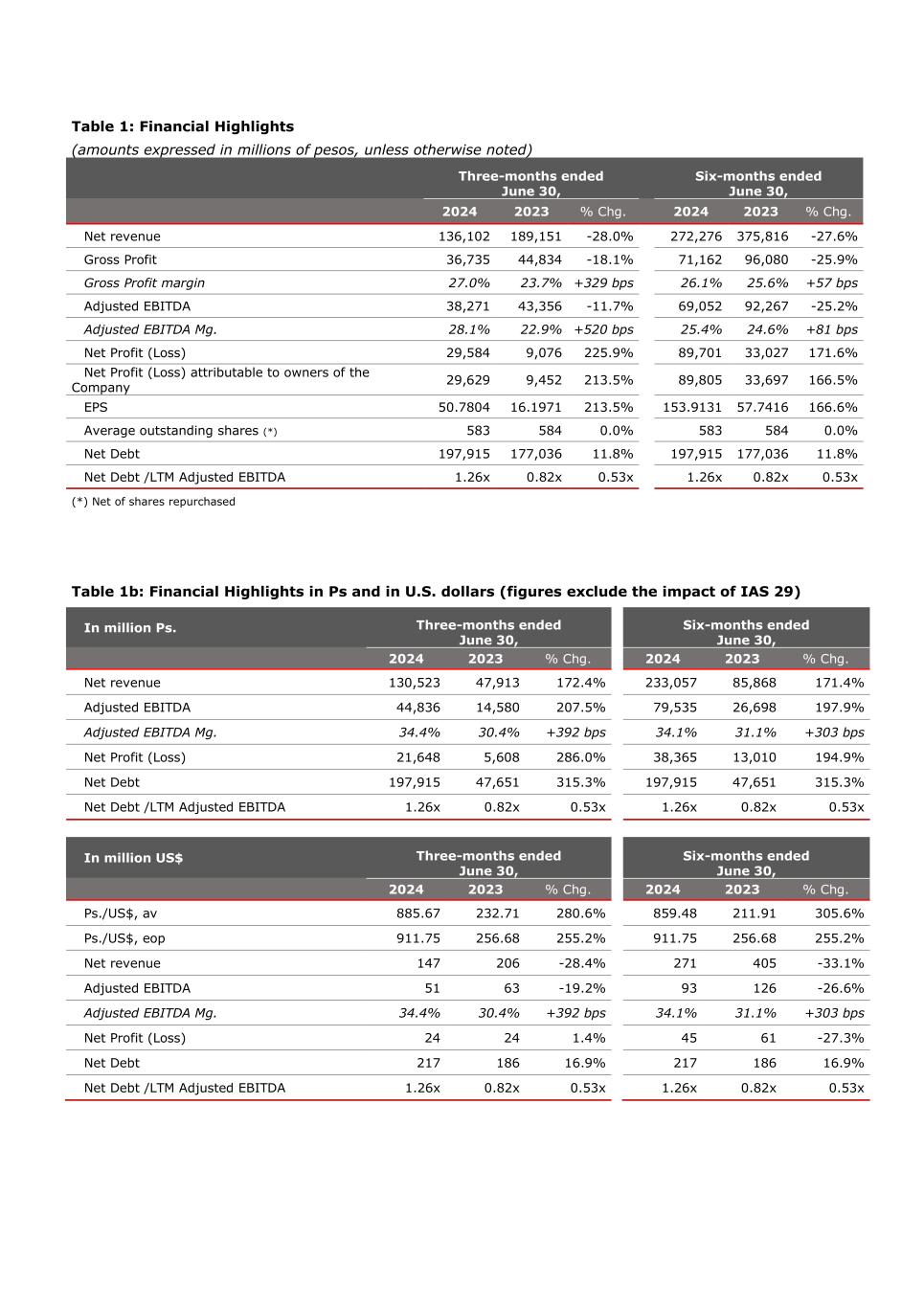

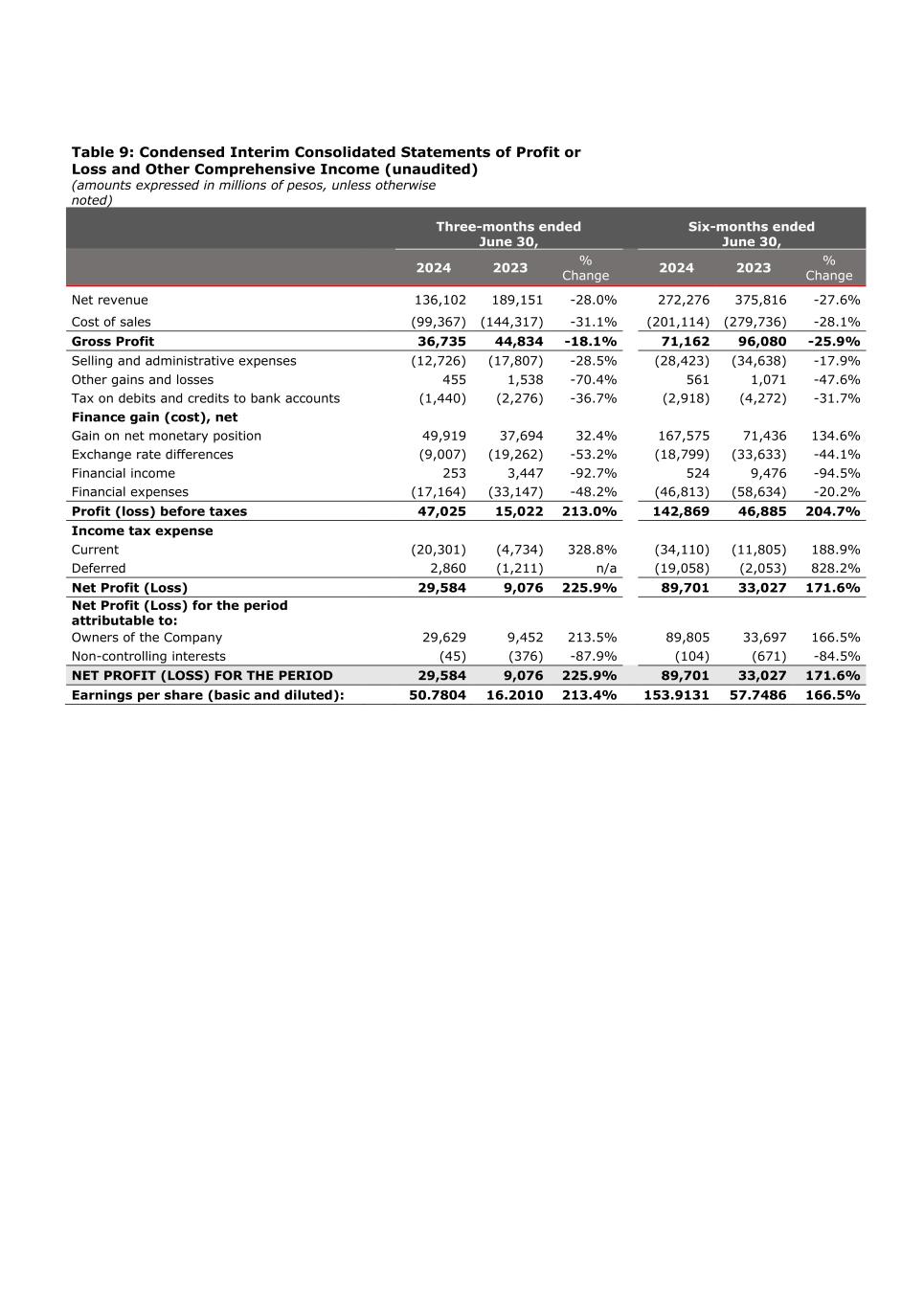

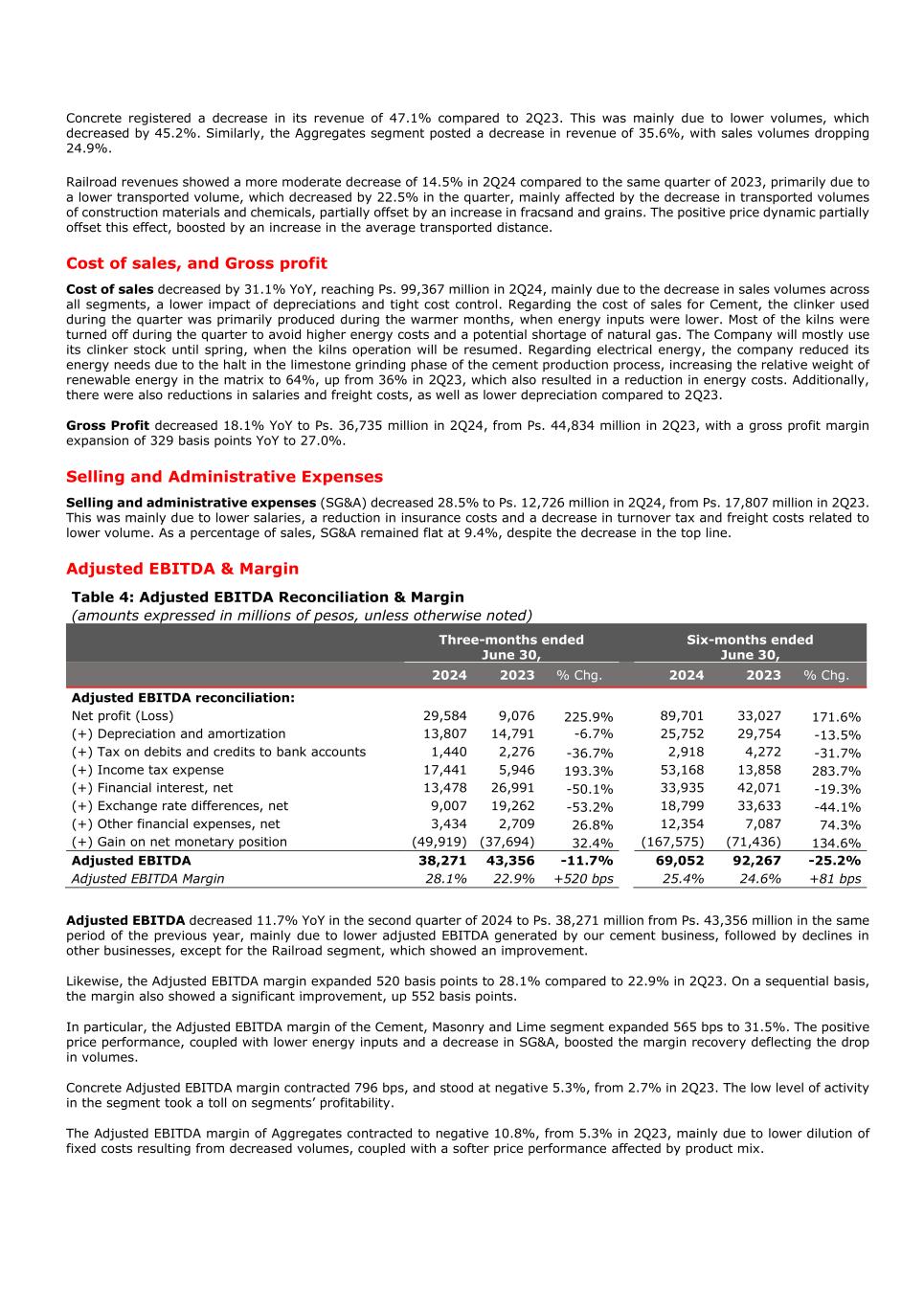

Table 1: Financial Highlights (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Net revenue 136,102 189,151 -28.0% 272,276 375,816 -27.6% Gross Profit 36,735 44,834 -18.1% 71,162 96,080 -25.9% Gross Profit margin 27.0% 23.7% +329 bps 26.1% 25.6% +57 bps Adjusted EBITDA 38,271 43,356 -11.7% 69,052 92,267 -25.2% Adjusted EBITDA Mg. 28.1% 22.9% +520 bps 25.4% 24.6% +81 bps Net Profit (Loss) 29,584 9,076 225.9% 89,701 33,027 171.6% Net Profit (Loss) attributable to owners of the Company 29,629 9,452 213.5% 89,805 33,697 166.5% EPS 50.7804 16.1971 213.5% 153.9131 57.7416 166.6% Average outstanding shares (*) 583 584 0.0% 583 584 0.0% Net Debt 197,915 177,036 11.8% 197,915 177,036 11.8% Net Debt /LTM Adjusted EBITDA 1.26x 0.82x 0.53x 1.26x 0.82x 0.53x (*) Net of shares repurchased Table 1b: Financial Highlights in Ps and in U.S. dollars (figures exclude the impact of IAS 29) In million Ps. Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Net revenue 130,523 47,913 172.4% 233,057 85,868 171.4% Adjusted EBITDA 44,836 14,580 207.5% 79,535 26,698 197.9% Adjusted EBITDA Mg. 34.4% 30.4% +392 bps 34.1% 31.1% +303 bps Net Profit (Loss) 21,648 5,608 286.0% 38,365 13,010 194.9% Net Debt 197,915 47,651 315.3% 197,915 47,651 315.3% Net Debt /LTM Adjusted EBITDA 1.26x 0.82x 0.53x 1.26x 0.82x 0.53x In million US$ Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Ps./US$, av 885.67 232.71 280.6% 859.48 211.91 305.6% Ps./US$, eop 911.75 256.68 255.2% 911.75 256.68 255.2% Net revenue 147 206 -28.4% 271 405 -33.1% Adjusted EBITDA 51 63 -19.2% 93 126 -26.6% Adjusted EBITDA Mg. 34.4% 30.4% +392 bps 34.1% 31.1% +303 bps Net Profit (Loss) 24 24 1.4% 45 61 -27.3% Net Debt 217 186 16.9% 217 186 16.9% Net Debt /LTM Adjusted EBITDA 1.26x 0.82x 0.53x 1.26x 0.82x 0.53x

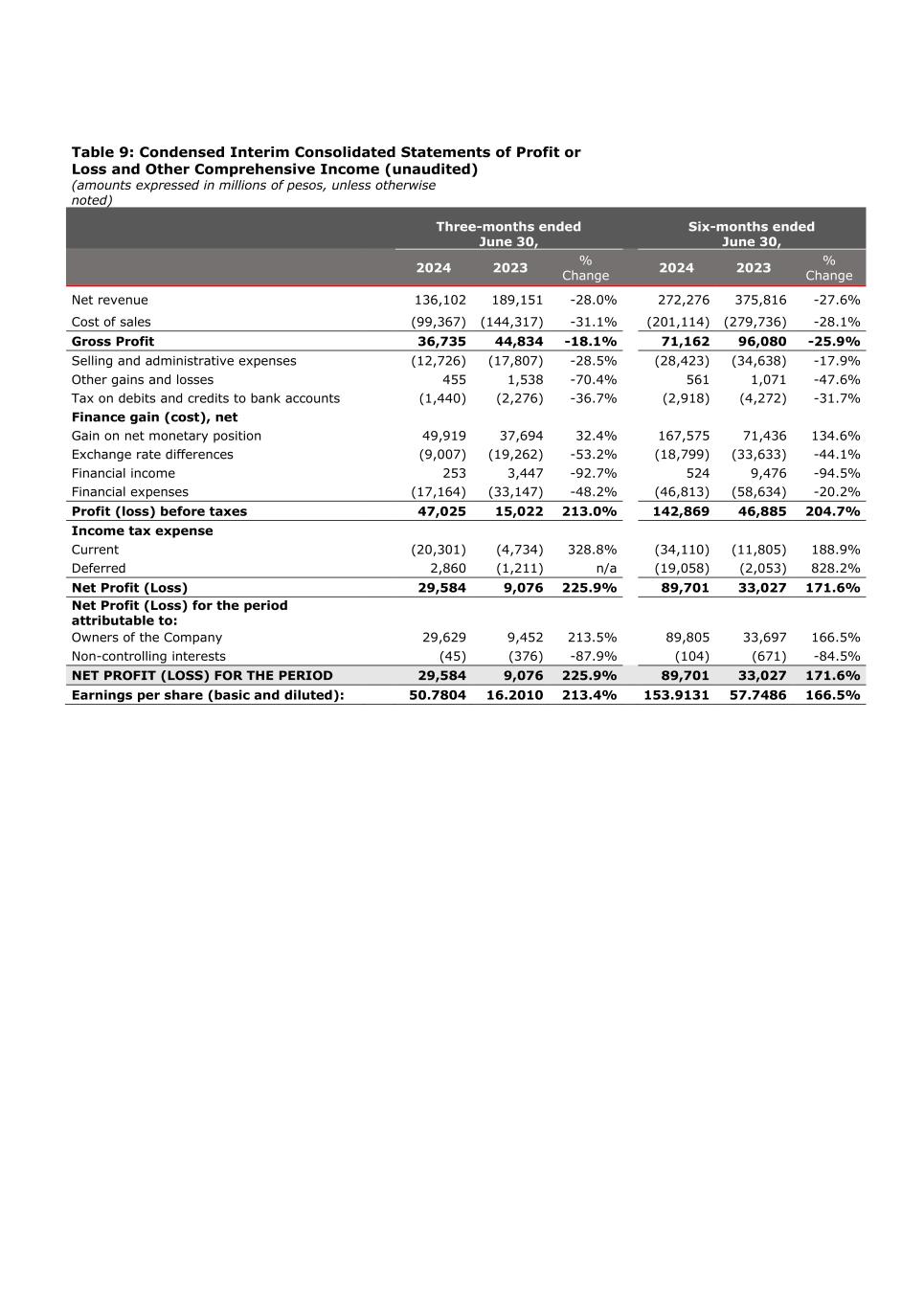

Overview of Operations Sales Volumes Table 2: Sales Volumes2 Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Cement, masonry & lime MM Tn 1.09 1.61 -32.5% 2.15 3.15 -31.9% Concrete MM m3 0.09 0.17 -45.2% 0.17 0.31 -45.1% Railroad MM Tn 0.83 1.07 -22.5% 1.53 2.04 -25.2% Aggregates MM Tn 0.22 0.30 -24.9% 0.44 0.65 -32.4% 2 Sales volumes include inter-segment sales Sales volumes of Cement, masonry, and lime during 2Q24 decreased by 32.5% to 1.1 million tons, although cement volumes have shown a gradual recovery since March. In this regard, we must consider that although June dispatches showed a sequential decrease in volumes, this was due to the effect of fewer working days. The average daily dispatches, however, indicate growth figures on a sequential basis. This recovery is more evident in bagged cement sales, as the bulk mode remains more affected by macroeconomic conditions and the low presence of public works and large private works. Regarding of the volume of the Concrete segment, there was a decrease of 45.2% year-over-year. Segment volumes followed the trend of bulk cement dispatches, as concrete producers remained among the most affected due to lower activity levels in their target construction projects. Public sector works are still almost halted, although some projects transferred from the national government to the provincial governments are starting to resume activities. Similarly, volumes for the Aggregates segment declined year-over-year but at a slower pace, decreasing by 24.9% The Railway segment experienced a contraction of 22.5% compared to the same quarter of 2023. The lower transported volume of construction materials and chemicals was partially offset by an improvement in grains and fracsand. Review of Financial Results Table 3: Condensed Interim Consolidated Statements of Profit or Loss and Other Comprehensive Income (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Net revenue 136,102 189,151 -28.0% 272,276 375,816 -27.6% Cost of sales (99,367) (144,317) -31.1% (201,114) (279,736) -28.1% Gross profit 36,735 44,834 -18.1% 71,162 96,080 -25.9% Selling and administrative expenses (12,726) (17,807) -28.5% (28,423) (34,638) -17.9% Other gains and losses 455 1,538 -70.4% 561 1,071 -47.6% Tax on debits and credits to bank accounts (1,440) (2,276) -36.7% (2,918) (4,272) -31.7% Finance gain (cost), net Gain on net monetary position 49,919 37,694 32.4% 167,575 71,436 134.6% Exchange rate differences (9,007) (19,262) -53.2% (18,799) (33,633) -44.1% Financial income 253 3,447 -92.7% 524 9,476 -94.5% Financial expense (17,164) (33,147) -48.2% (46,813) (58,634) -20.2% Profit (Loss) before taxes 47,025 15,022 213.0% 142,869 46,885 204.7% Income tax expense Current (20,301) (4,734) 328.8% (34,110) (11,805) 188.9% Deferred 2,860 (1,211) n/a (19,058) (2,053) 828.2% Net profit (Loss) 29,584 9,076 225.9% 89,701 33,027 171.6% Net Revenues Net revenue decreased 28.0% to Ps. 136,102 million in 2Q24, from Ps. 189,151 million in the comparable quarter last year, mainly due to a lower top line performance of the Cement business, followed by the rest of the segments. The Cement, masonry cement, and lime segment was down 26.1% YoY, with volumes contracting by 32.5%. Even though lower demand affected both modes of dispatches, bulk cement was more impacted by the economic environment, the standstill of public works a lower level of activity in larger private works. However, this effect was partially offset by a positive price dynamic.

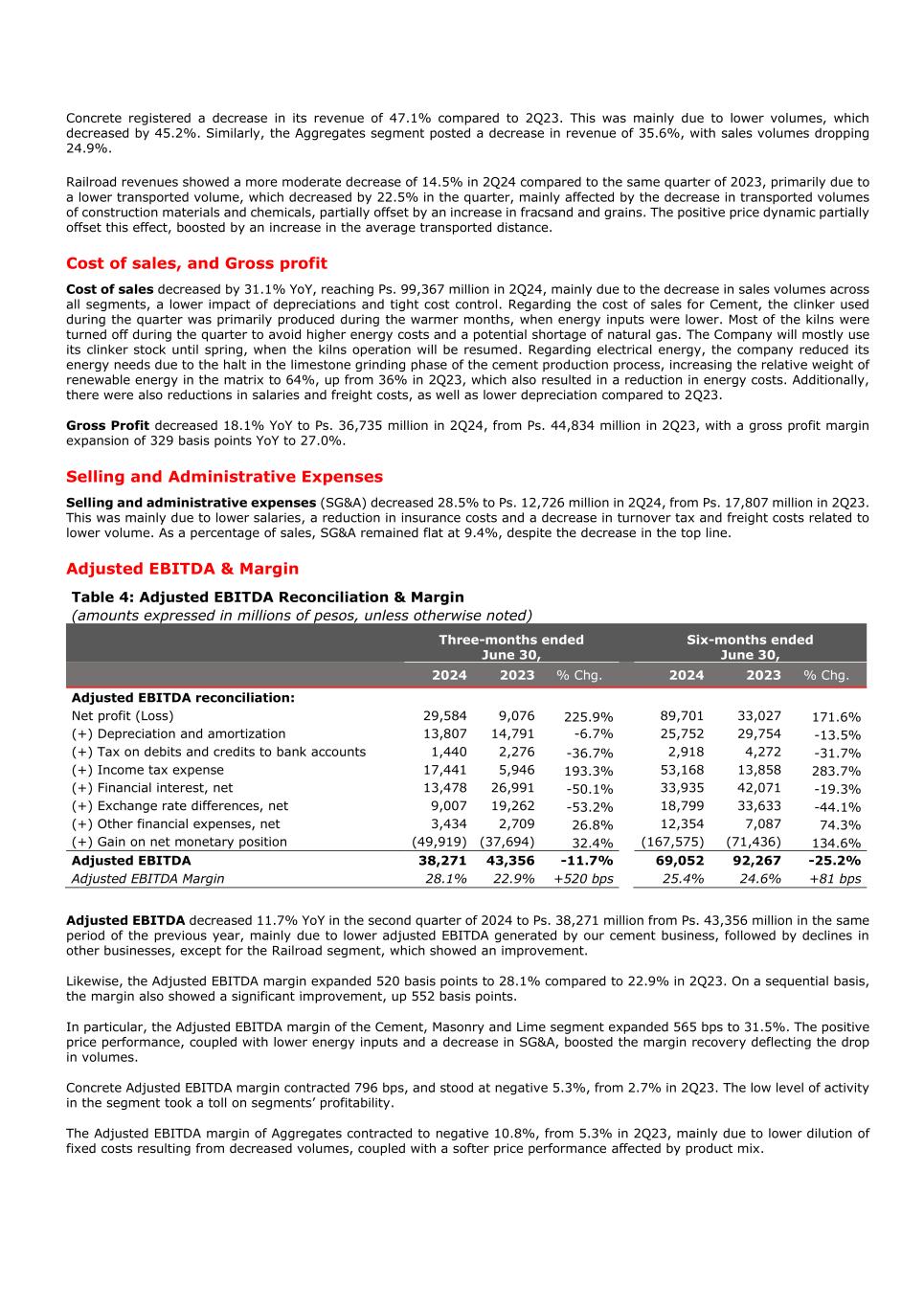

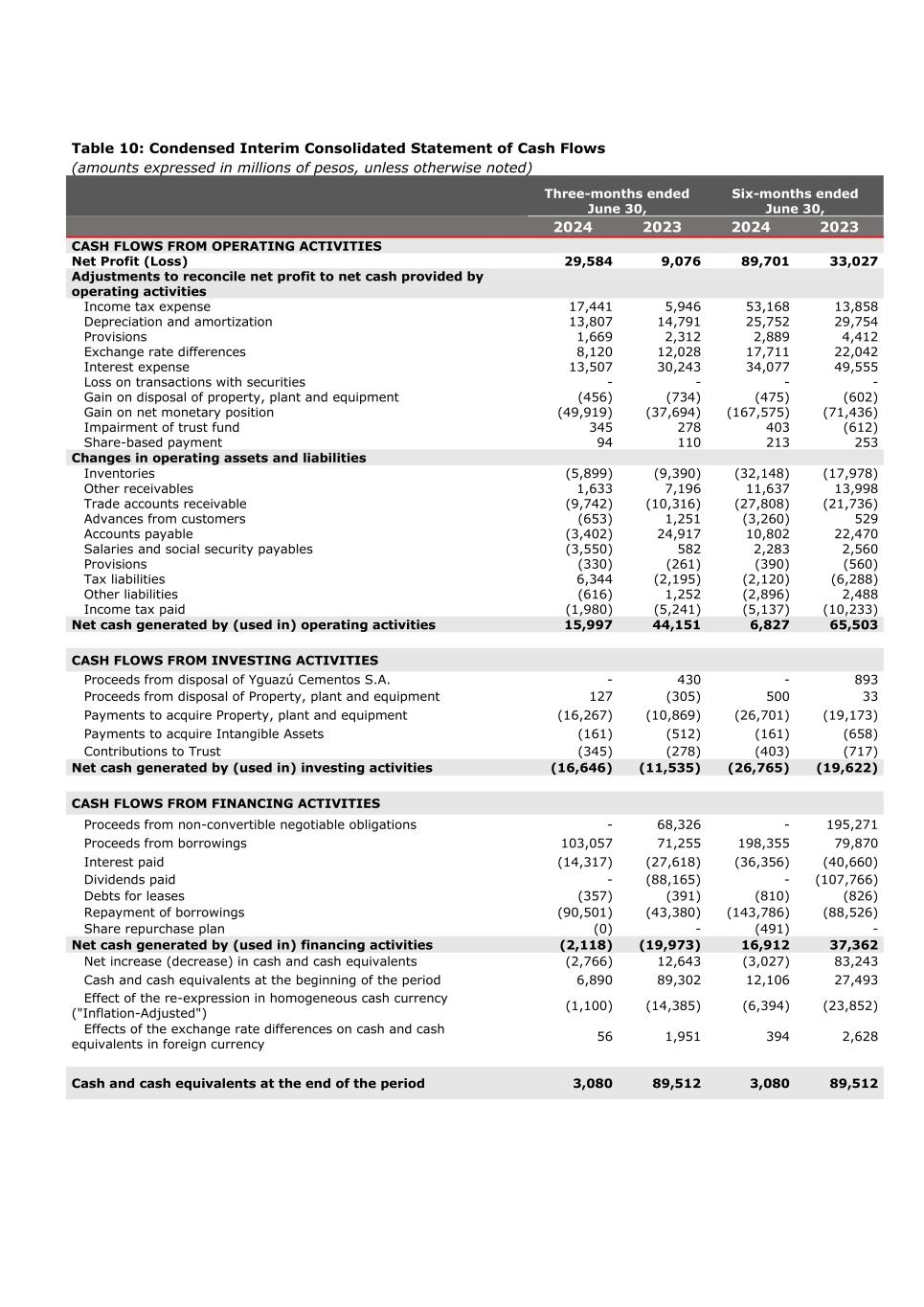

Concrete registered a decrease in its revenue of 47.1% compared to 2Q23. This was mainly due to lower volumes, which decreased by 45.2%. Similarly, the Aggregates segment posted a decrease in revenue of 35.6%, with sales volumes dropping 24.9%. Railroad revenues showed a more moderate decrease of 14.5% in 2Q24 compared to the same quarter of 2023, primarily due to a lower transported volume, which decreased by 22.5% in the quarter, mainly affected by the decrease in transported volumes of construction materials and chemicals, partially offset by an increase in fracsand and grains. The positive price dynamic partially offset this effect, boosted by an increase in the average transported distance. Cost of sales, and Gross profit Cost of sales decreased by 31.1% YoY, reaching Ps. 99,367 million in 2Q24, mainly due to the decrease in sales volumes across all segments, a lower impact of depreciations and tight cost control. Regarding the cost of sales for Cement, the clinker used during the quarter was primarily produced during the warmer months, when energy inputs were lower. Most of the kilns were turned off during the quarter to avoid higher energy costs and a potential shortage of natural gas. The Company will mostly use its clinker stock until spring, when the kilns operation will be resumed. Regarding electrical energy, the company reduced its energy needs due to the halt in the limestone grinding phase of the cement production process, increasing the relative weight of renewable energy in the matrix to 64%, up from 36% in 2Q23, which also resulted in a reduction in energy costs. Additionally, there were also reductions in salaries and freight costs, as well as lower depreciation compared to 2Q23. Gross Profit decreased 18.1% YoY to Ps. 36,735 million in 2Q24, from Ps. 44,834 million in 2Q23, with a gross profit margin expansion of 329 basis points YoY to 27.0%. Selling and Administrative Expenses Selling and administrative expenses (SG&A) decreased 28.5% to Ps. 12,726 million in 2Q24, from Ps. 17,807 million in 2Q23. This was mainly due to lower salaries, a reduction in insurance costs and a decrease in turnover tax and freight costs related to lower volume. As a percentage of sales, SG&A remained flat at 9.4%, despite the decrease in the top line. Adjusted EBITDA & Margin Table 4: Adjusted EBITDA Reconciliation & Margin (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Adjusted EBITDA reconciliation: Net profit (Loss) 29,584 9,076 225.9% 89,701 33,027 171.6% (+) Depreciation and amortization 13,807 14,791 -6.7% 25,752 29,754 -13.5% (+) Tax on debits and credits to bank accounts 1,440 2,276 -36.7% 2,918 4,272 -31.7% (+) Income tax expense 17,441 5,946 193.3% 53,168 13,858 283.7% (+) Financial interest, net 13,478 26,991 -50.1% 33,935 42,071 -19.3% (+) Exchange rate differences, net 9,007 19,262 -53.2% 18,799 33,633 -44.1% (+) Other financial expenses, net 3,434 2,709 26.8% 12,354 7,087 74.3% (+) Gain on net monetary position (49,919) (37,694) 32.4% (167,575) (71,436) 134.6% Adjusted EBITDA 38,271 43,356 -11.7% 69,052 92,267 -25.2% Adjusted EBITDA Margin 28.1% 22.9% +520 bps 25.4% 24.6% +81 bps Adjusted EBITDA decreased 11.7% YoY in the second quarter of 2024 to Ps. 38,271 million from Ps. 43,356 million in the same period of the previous year, mainly due to lower adjusted EBITDA generated by our cement business, followed by declines in other businesses, except for the Railroad segment, which showed an improvement. Likewise, the Adjusted EBITDA margin expanded 520 basis points to 28.1% compared to 22.9% in 2Q23. On a sequential basis, the margin also showed a significant improvement, up 552 basis points. In particular, the Adjusted EBITDA margin of the Cement, Masonry and Lime segment expanded 565 bps to 31.5%. The positive price performance, coupled with lower energy inputs and a decrease in SG&A, boosted the margin recovery deflecting the drop in volumes. Concrete Adjusted EBITDA margin contracted 796 bps, and stood at negative 5.3%, from 2.7% in 2Q23. The low level of activity in the segment took a toll on segments’ profitability. The Adjusted EBITDA margin of Aggregates contracted to negative 10.8%, from 5.3% in 2Q23, mainly due to lower dilution of fixed costs resulting from decreased volumes, coupled with a softer price performance affected by product mix.

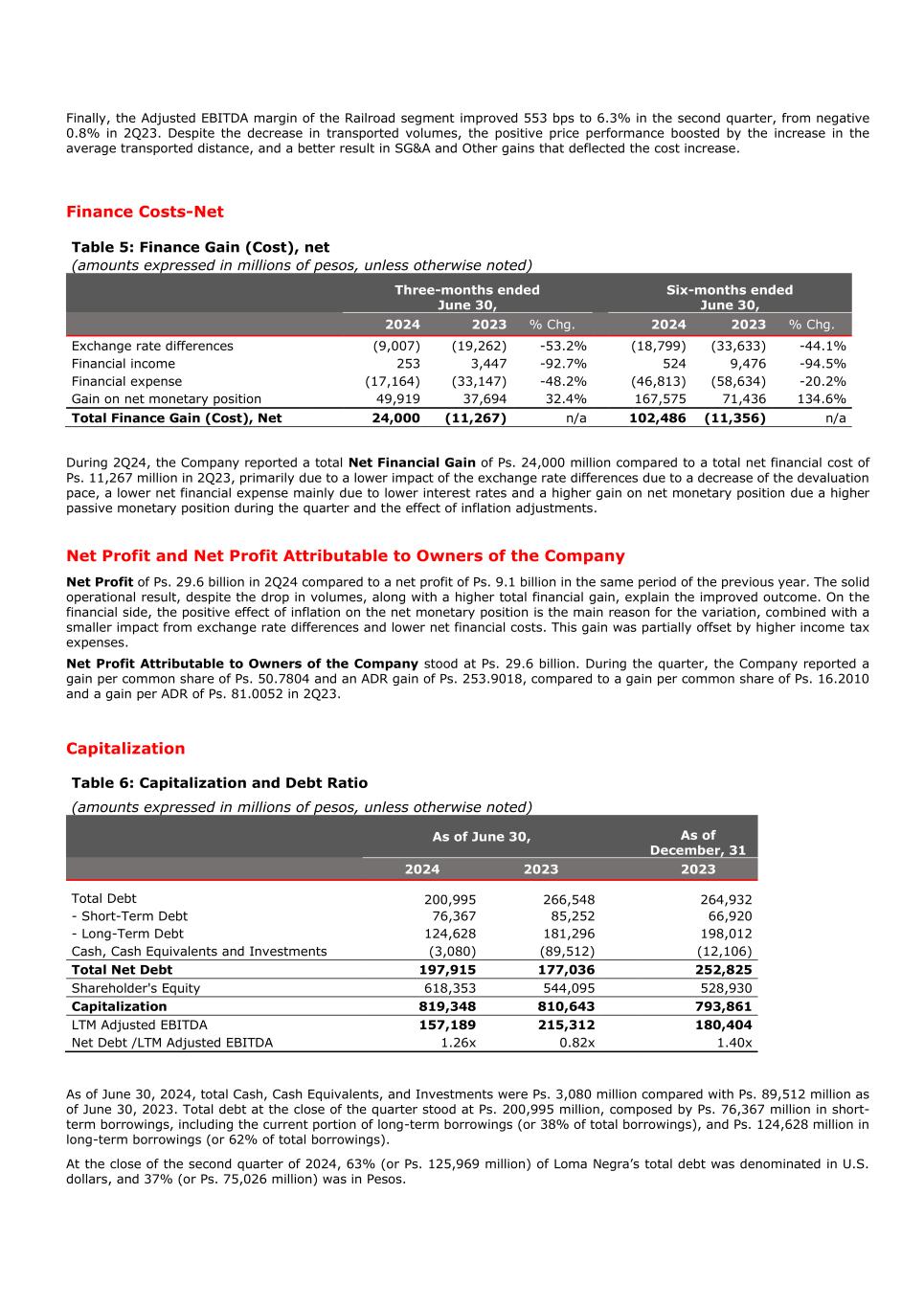

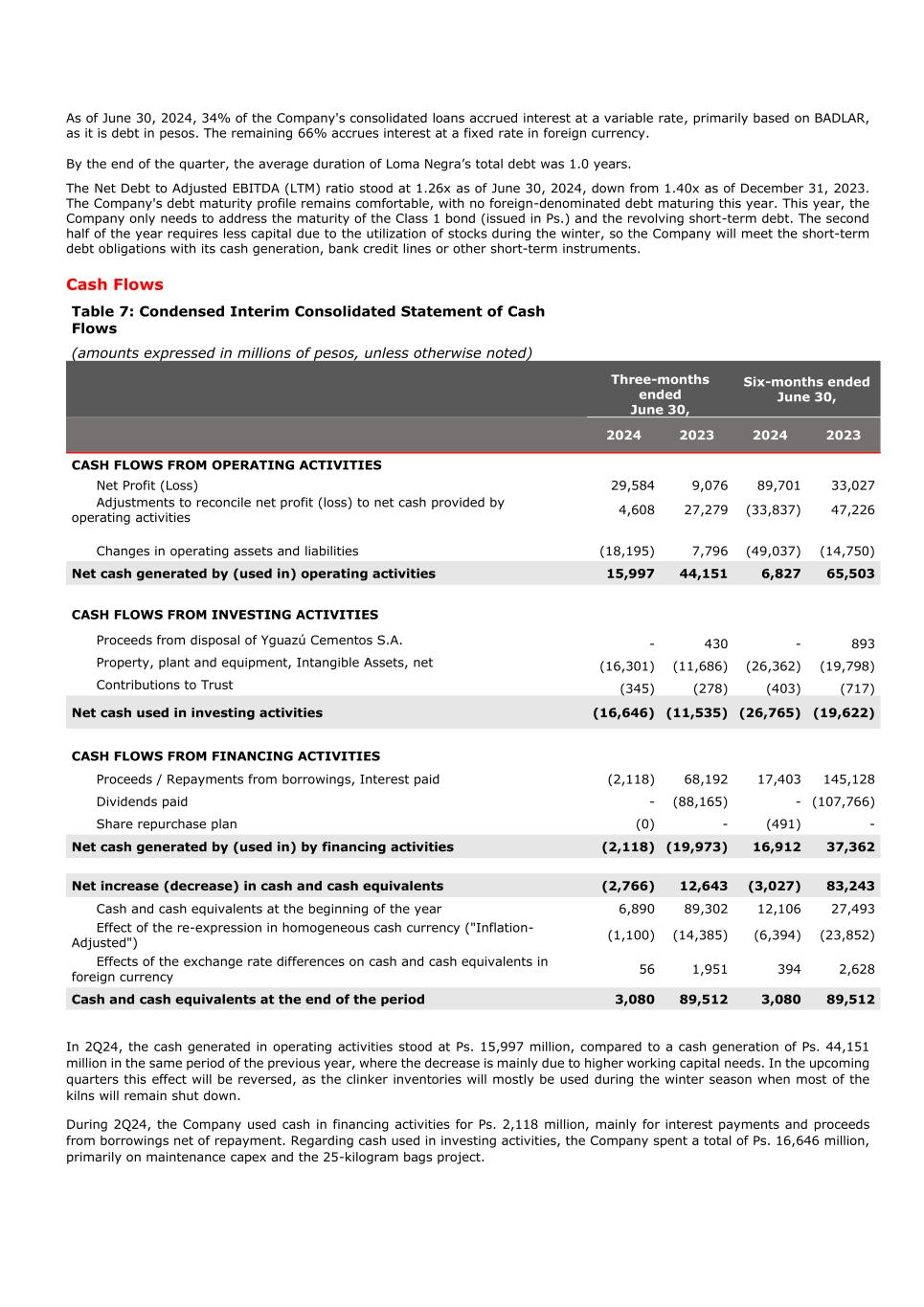

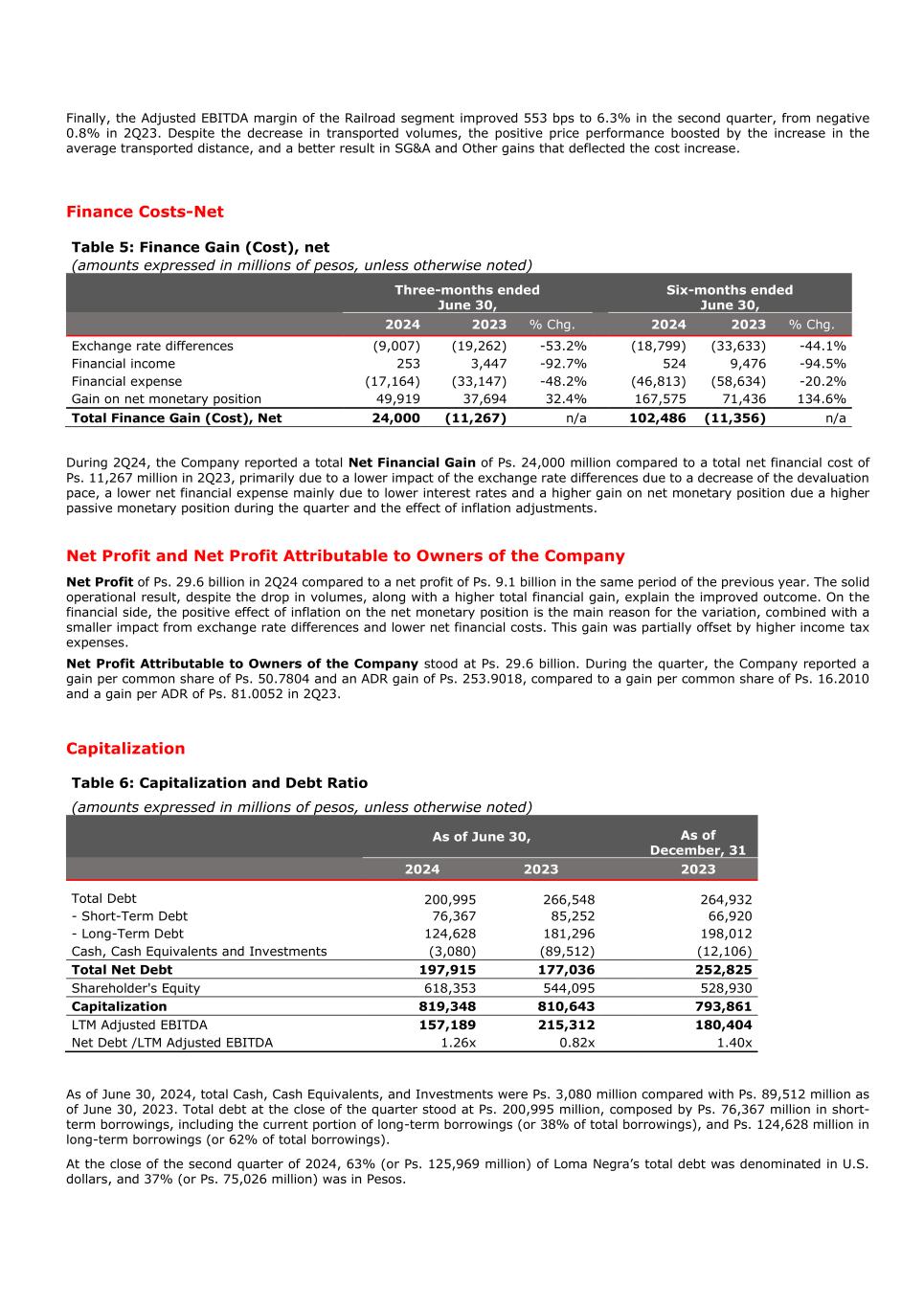

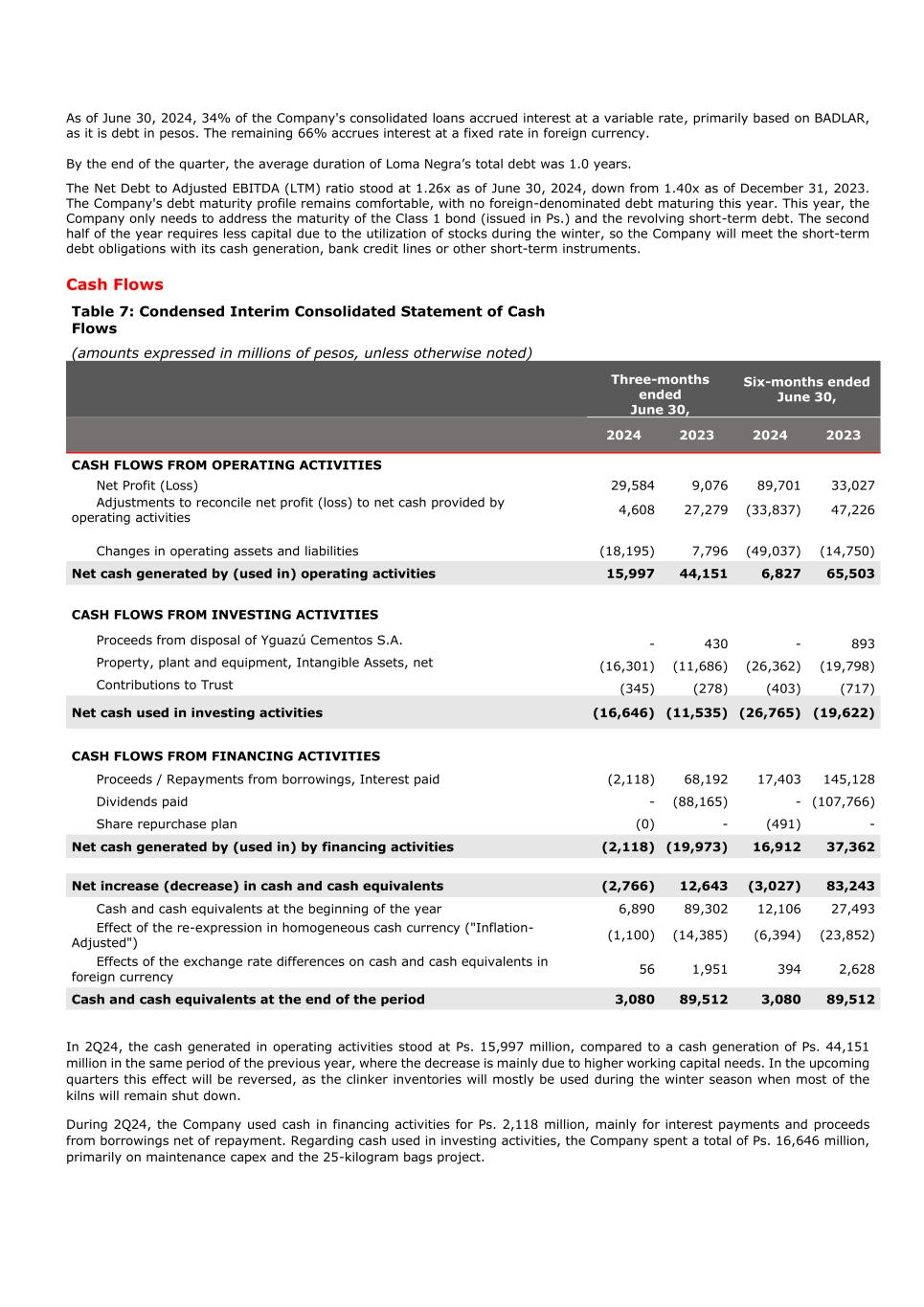

Finally, the Adjusted EBITDA margin of the Railroad segment improved 553 bps to 6.3% in the second quarter, from negative 0.8% in 2Q23. Despite the decrease in transported volumes, the positive price performance boosted by the increase in the average transported distance, and a better result in SG&A and Other gains that deflected the cost increase. Finance Costs-Net Table 5: Finance Gain (Cost), net (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 % Chg. 2024 2023 % Chg. Exchange rate differences (9,007) (19,262) -53.2% (18,799) (33,633) -44.1% Financial income 253 3,447 -92.7% 524 9,476 -94.5% Financial expense (17,164) (33,147) -48.2% (46,813) (58,634) -20.2% Gain on net monetary position 49,919 37,694 32.4% 167,575 71,436 134.6% Total Finance Gain (Cost), Net 24,000 (11,267) n/a 102,486 (11,356) n/a During 2Q24, the Company reported a total Net Financial Gain of Ps. 24,000 million compared to a total net financial cost of Ps. 11,267 million in 2Q23, primarily due to a lower impact of the exchange rate differences due to a decrease of the devaluation pace, a lower net financial expense mainly due to lower interest rates and a higher gain on net monetary position due a higher passive monetary position during the quarter and the effect of inflation adjustments. Net Profit and Net Profit Attributable to Owners of the Company Net Profit of Ps. 29.6 billion in 2Q24 compared to a net profit of Ps. 9.1 billion in the same period of the previous year. The solid operational result, despite the drop in volumes, along with a higher total financial gain, explain the improved outcome. On the financial side, the positive effect of inflation on the net monetary position is the main reason for the variation, combined with a smaller impact from exchange rate differences and lower net financial costs. This gain was partially offset by higher income tax expenses. Net Profit Attributable to Owners of the Company stood at Ps. 29.6 billion. During the quarter, the Company reported a gain per common share of Ps. 50.7804 and an ADR gain of Ps. 253.9018, compared to a gain per common share of Ps. 16.2010 and a gain per ADR of Ps. 81.0052 in 2Q23. Capitalization Table 6: Capitalization and Debt Ratio (amounts expressed in millions of pesos, unless otherwise noted) As of June 30, As of December, 31 2024 2023 2023 Total Debt 200,995 266,548 264,932 - Short-Term Debt 76,367 85,252 66,920 - Long-Term Debt 124,628 181,296 198,012 Cash, Cash Equivalents and Investments (3,080) (89,512) (12,106) Total Net Debt 197,915 177,036 252,825 Shareholder's Equity 618,353 544,095 528,930 Capitalization 819,348 810,643 793,861 LTM Adjusted EBITDA 157,189 215,312 180,404 Net Debt /LTM Adjusted EBITDA 1.26x 0.82x 1.40x As of June 30, 2024, total Cash, Cash Equivalents, and Investments were Ps. 3,080 million compared with Ps. 89,512 million as of June 30, 2023. Total debt at the close of the quarter stood at Ps. 200,995 million, composed by Ps. 76,367 million in short- term borrowings, including the current portion of long-term borrowings (or 38% of total borrowings), and Ps. 124,628 million in long-term borrowings (or 62% of total borrowings). At the close of the second quarter of 2024, 63% (or Ps. 125,969 million) of Loma Negra’s total debt was denominated in U.S. dollars, and 37% (or Ps. 75,026 million) was in Pesos.

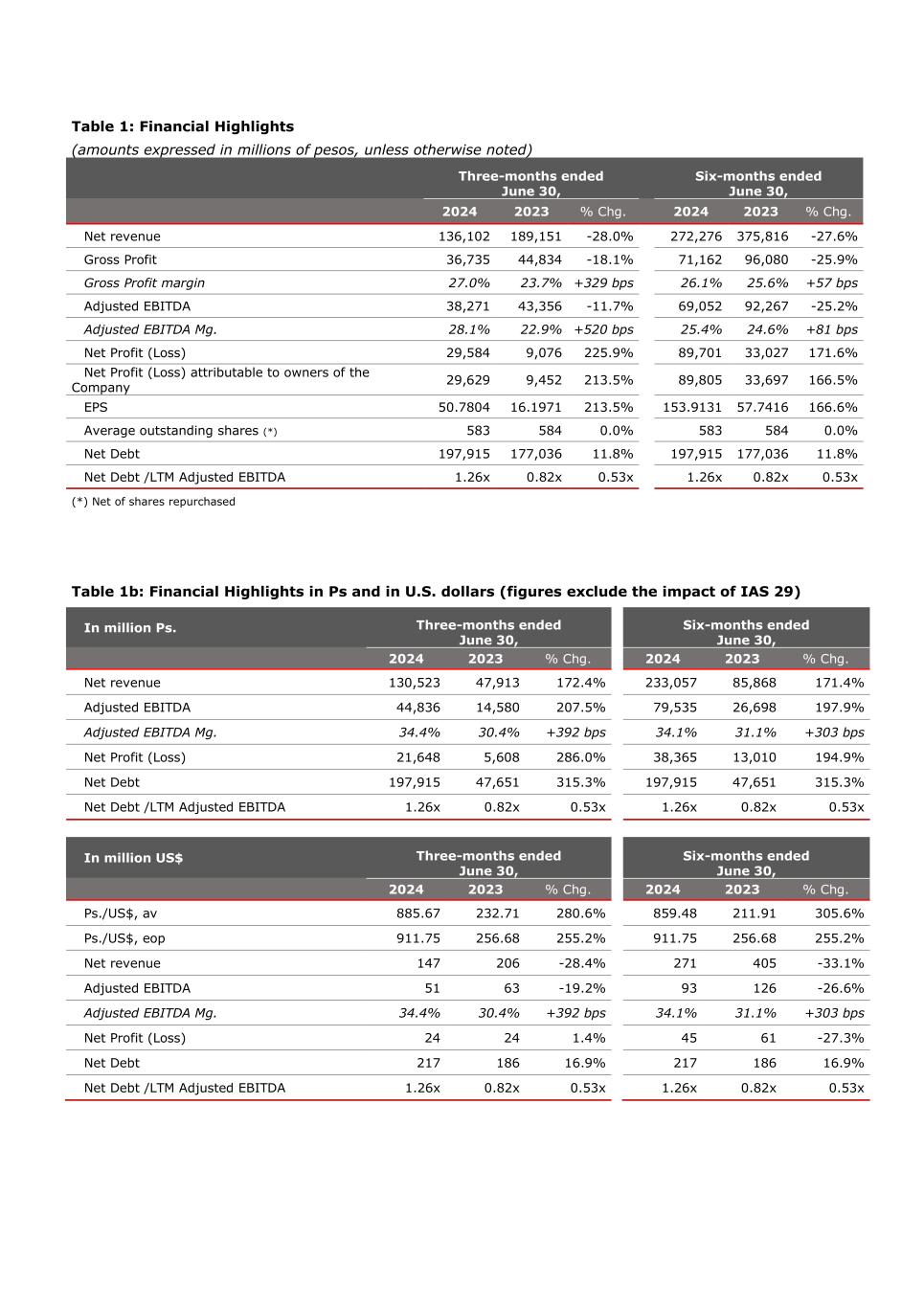

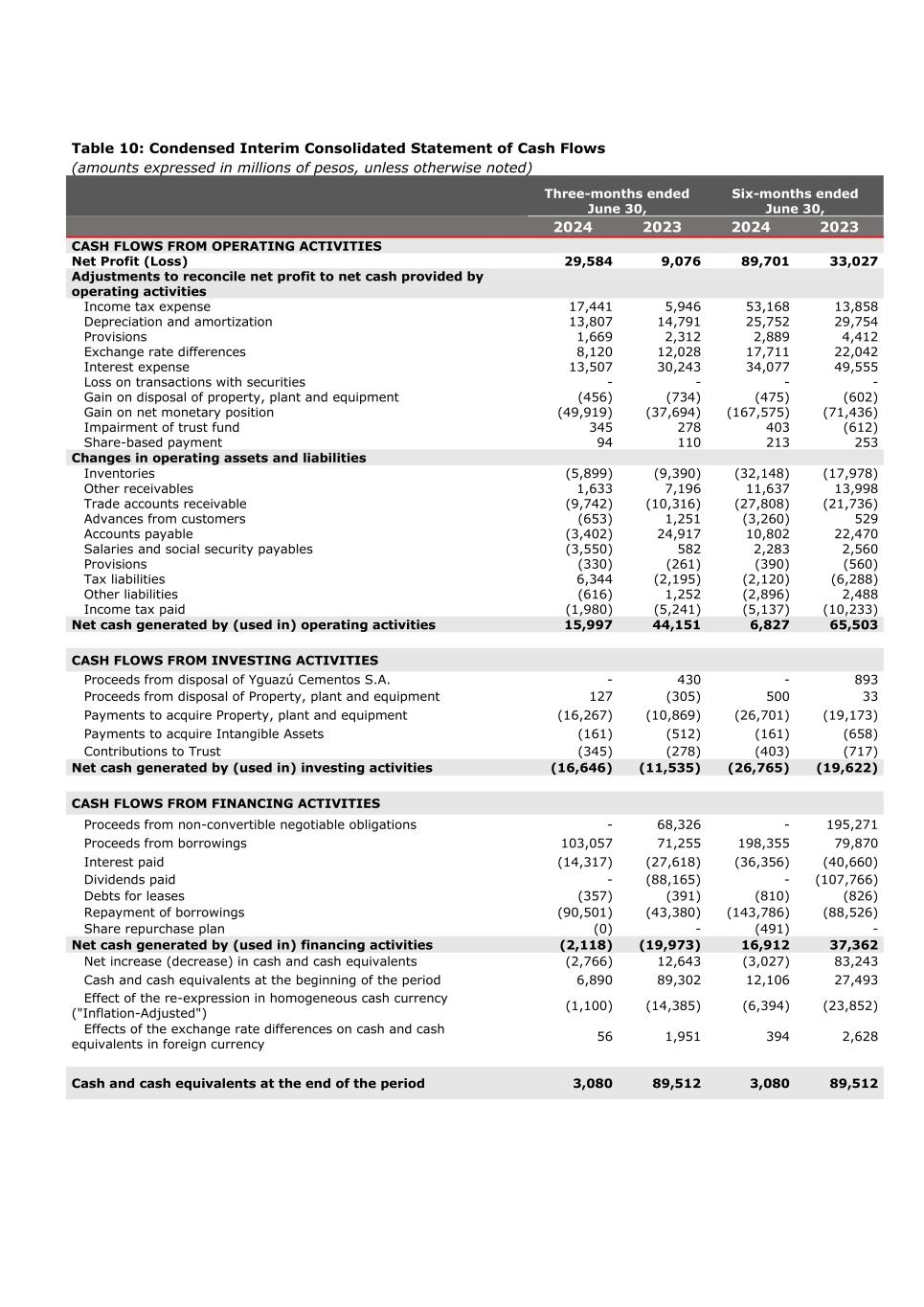

As of June 30, 2024, 34% of the Company's consolidated loans accrued interest at a variable rate, primarily based on BADLAR, as it is debt in pesos. The remaining 66% accrues interest at a fixed rate in foreign currency. By the end of the quarter, the average duration of Loma Negra’s total debt was 1.0 years. The Net Debt to Adjusted EBITDA (LTM) ratio stood at 1.26x as of June 30, 2024, down from 1.40x as of December 31, 2023. The Company's debt maturity profile remains comfortable, with no foreign-denominated debt maturing this year. This year, the Company only needs to address the maturity of the Class 1 bond (issued in Ps.) and the revolving short-term debt. The second half of the year requires less capital due to the utilization of stocks during the winter, so the Company will meet the short-term debt obligations with its cash generation, bank credit lines or other short-term instruments. Cash Flows Table 7: Condensed Interim Consolidated Statement of Cash Flows (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net Profit (Loss) 29,584 9,076 89,701 33,027 Adjustments to reconcile net profit (loss) to net cash provided by operating activities 4,608 27,279 (33,837) 47,226 Changes in operating assets and liabilities (18,195) 7,796 (49,037) (14,750) Net cash generated by (used in) operating activities 15,997 44,151 6,827 65,503 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from disposal of Yguazú Cementos S.A. - 430 - 893 Property, plant and equipment, Intangible Assets, net (16,301) (11,686) (26,362) (19,798) Contributions to Trust (345) (278) (403) (717) Net cash used in investing activities (16,646) (11,535) (26,765) (19,622) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds / Repayments from borrowings, Interest paid (2,118) 68,192 17,403 145,128 Dividends paid - (88,165) - (107,766) Share repurchase plan (0) - (491) - Net cash generated by (used in) by financing activities (2,118) (19,973) 16,912 37,362 Net increase (decrease) in cash and cash equivalents (2,766) 12,643 (3,027) 83,243 Cash and cash equivalents at the beginning of the year 6,890 89,302 12,106 27,493 Effect of the re-expression in homogeneous cash currency ("Inflation- Adjusted") (1,100) (14,385) (6,394) (23,852) Effects of the exchange rate differences on cash and cash equivalents in foreign currency 56 1,951 394 2,628 Cash and cash equivalents at the end of the period 3,080 89,512 3,080 89,512 In 2Q24, the cash generated in operating activities stood at Ps. 15,997 million, compared to a cash generation of Ps. 44,151 million in the same period of the previous year, where the decrease is mainly due to higher working capital needs. In the upcoming quarters this effect will be reversed, as the clinker inventories will mostly be used during the winter season when most of the kilns will remain shut down. During 2Q24, the Company used cash in financing activities for Ps. 2,118 million, mainly for interest payments and proceeds from borrowings net of repayment. Regarding cash used in investing activities, the Company spent a total of Ps. 16,646 million, primarily on maintenance capex and the 25-kilogram bags project.

2Q24 Earnings Conference Call When: 10:00 a.m. U.S. ET (11:00 a.m. BAT), August 8, 2024 Dial-in: 0800-444-2930 (Argentina), 1-833-255-2824 (U.S.), 1-866-605-3852 (Canada), 1-412-902-6701 (International) Password: Loma Negra Call Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=DW1h9RV5 Replay: A telephone replay of the conference call will be available until May 17, 2024. The replay can be accessed by dialing 1-877-344-7529 (U.S. toll free), or 1-412-317-0088 (International). The passcode for the replay is 7325773. The audio of the conference call will also be archived on the Company’s website at www.lomanegra.com Definitions Adjusted EBITDA is calculated as net profit plus financial interest, net plus income tax expense plus depreciation and amortization plus exchange rate differences plus other financial expenses, net plus tax on debits and credits to bank accounts, plus share of loss of associates, plus net Impairment of Property, plant and equipment, and less income from discontinued operation. Loma Negra believes that excluding tax on debits and credits to bank accounts from its calculation of Adjusted EBITDA is a better measure of operating performance when compared to other international players. Net Debt is calculated as borrowings less cash, cash equivalents and short-term investments. About Loma Negra Founded in 1926, Loma Negra is the leading cement company in Argentina, producing and distributing cement, masonry cement, aggregates, concrete and lime, products primarily used in private and public construction. Loma Negra is a vertically-integrated cement and concrete company, with nationwide operations, supported by vast limestone reserves, strategically located plants, top-of-mind brands and established distribution channels. Loma Negra is listed both on BYMA and on NYSE in the U.S., where it trades under the symbol “LOMA”. One ADS represents five (5) common shares. For more information, visit www.lomanegra.com. Note The Company presented some figures converted from Pesos to U.S. dollars for comparison purposes. The exchange rate used to convert Pesos to U.S. dollars was the reference exchange rate (Communication “A” 3500) reported by the Central Bank for U.S. dollars. The information presented in U.S. dollars is for the convenience of the reader only. Certain figures included in this report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figures presented in previous quarters. Rounding: We have made rounding adjustments to reach some of the figures included in this annual report. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. Disclaimer This release contains forward-looking statements within the meaning of federal securities law that are subject to risks and uncertainties. These statements are only predictions based upon our current expectations and projections about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “seek,” “forecast,” or the negative of these terms or other similar expressions. The forward-looking statements are based on the information currently available to us. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, among others things: changes in general economic, political, governmental and business conditions globally and in Argentina, changes in inflation rates, fluctuations in the exchange rate of the peso, the level of construction generally, changes in cement demand and prices, changes in raw material and energy prices, changes in business strategy and various other factors. You should not rely upon forward-looking statements as predictions of future events. Although we believe in good faith that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Any or all of Loma Negra’s forward-looking statements in this release may turn out to be wrong. You should consider these forward-looking statements in light of other factors discussed under the heading “Risk Factors” in the prospectus filed with the Securities and Exchange Commission on October 31, 2017 in connection with Loma Negra’s initial public offering. Therefore, readers are cautioned not to place undue reliance on these forward- looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in our expectations. IR Contacts Marcos I. Gradin, Chief Financial Officer and Investor Relations Diego M. Jalón, Investor Relations Manager +54-11-4319-3050 investorrelations@lomanegra.com --- Financial Tables Follow ---

Table 8: Condensed Interim Consolidated Statements of Financial Position (amounts expressed in millions of pesos, unless otherwise noted) As of June 30, As of December, 31 2024 2023 ASSETS Non-current assets Property, plant and equipment 864,441 866,734 Right to use assets 2,934 4,578 Intangible assets 2,502 2,850 Investments 57 57 Goodwill 571 571 Inventories 47,161 40,755 Other receivables 5,693 3,322 Total non-current assets 923,359 918,869 Current assets Inventories 165,845 137,500 Other receivables 18,661 39,097 Trade accounts receivable 44,463 40,897 Investments 228 3,075 Cash and banks 2,852 9,031 Total current assets 232,049 229,600 TOTAL ASSETS 1,155,409 1,148,469 SHAREHOLDER'S EQUITY Capital stock and other capital related accounts 219,001 219,279 Reserves 309,683 297,322 Retained earnings 89,805 12,361 Accumulated other comprehensive income - - Equity attributable to the owners of the Company 618,489 528,962 Non-controlling interests (136) (32) TOTAL SHAREHOLDER'S EQUITY 618,353 528,930 LIABILITIES Non-current liabilities Borrowings 124,628 198,012 Accounts payables - - Provisions 8,889 12,119 Salaries and social security payables 188 947 Debts for leases 1,925 4,985 Other liabilities 542 859 Deferred tax liabilities 210,694 191,637 Total non-current liabilities 346,867 408,558 Current liabilities Borrowings 76,367 66,920 Accounts payable 59,827 102,929 Advances from customers 3,596 7,878 Salaries and social security payables 10,579 15,953 Other liabilities - Related companies - - Tax liabilities 32,361 5,305 Debts for leases 1,116 2,183 Other liabilities 6,345 9,812 Total current liabilities 190,189 210,980 TOTAL LIABILITIES 537,056 619,539 TOTAL SHAREHOLDER'S EQUITY AND LIABILITIES 1,155,409 1,148,469

Table 9: Condensed Interim Consolidated Statements of Profit or Loss and Other Comprehensive Income (unaudited) (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 % Change 2024 2023 % Change Net revenue 136,102 189,151 -28.0% 272,276 375,816 -27.6% Cost of sales (99,367) (144,317) -31.1% (201,114) (279,736) -28.1% Gross Profit 36,735 44,834 -18.1% 71,162 96,080 -25.9% Selling and administrative expenses (12,726) (17,807) -28.5% (28,423) (34,638) -17.9% Other gains and losses 455 1,538 -70.4% 561 1,071 -47.6% Tax on debits and credits to bank accounts (1,440) (2,276) -36.7% (2,918) (4,272) -31.7% Finance gain (cost), net Gain on net monetary position 49,919 37,694 32.4% 167,575 71,436 134.6% Exchange rate differences (9,007) (19,262) -53.2% (18,799) (33,633) -44.1% Financial income 253 3,447 -92.7% 524 9,476 -94.5% Financial expenses (17,164) (33,147) -48.2% (46,813) (58,634) -20.2% Profit (loss) before taxes 47,025 15,022 213.0% 142,869 46,885 204.7% Income tax expense Current (20,301) (4,734) 328.8% (34,110) (11,805) 188.9% Deferred 2,860 (1,211) n/a (19,058) (2,053) 828.2% Net Profit (Loss) 29,584 9,076 225.9% 89,701 33,027 171.6% Net Profit (Loss) for the period attributable to: Owners of the Company 29,629 9,452 213.5% 89,805 33,697 166.5% Non-controlling interests (45) (376) -87.9% (104) (671) -84.5% NET PROFIT (LOSS) FOR THE PERIOD 29,584 9,076 225.9% 89,701 33,027 171.6% Earnings per share (basic and diluted): 50.7804 16.2010 213.4% 153.9131 57.7486 166.5%

Table 10: Condensed Interim Consolidated Statement of Cash Flows (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 2023 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net Profit (Loss) 29,584 9,076 89,701 33,027 Adjustments to reconcile net profit to net cash provided by operating activities Income tax expense 17,441 5,946 53,168 13,858 Depreciation and amortization 13,807 14,791 25,752 29,754 Provisions 1,669 2,312 2,889 4,412 Exchange rate differences 8,120 12,028 17,711 22,042 Interest expense 13,507 30,243 34,077 49,555 Loss on transactions with securities - - - - Gain on disposal of property, plant and equipment (456) (734) (475) (602) Gain on net monetary position (49,919) (37,694) (167,575) (71,436) Impairment of trust fund 345 278 403 (612) Share-based payment 94 110 213 253 Changes in operating assets and liabilities Inventories (5,899) (9,390) (32,148) (17,978) Other receivables 1,633 7,196 11,637 13,998 Trade accounts receivable (9,742) (10,316) (27,808) (21,736) Advances from customers (653) 1,251 (3,260) 529 Accounts payable (3,402) 24,917 10,802 22,470 Salaries and social security payables (3,550) 582 2,283 2,560 Provisions (330) (261) (390) (560) Tax liabilities 6,344 (2,195) (2,120) (6,288) Other liabilities (616) 1,252 (2,896) 2,488 Income tax paid (1,980) (5,241) (5,137) (10,233) Net cash generated by (used in) operating activities 15,997 44,151 6,827 65,503 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from disposal of Yguazú Cementos S.A. - 430 - 893 Proceeds from disposal of Property, plant and equipment 127 (305) 500 33 Payments to acquire Property, plant and equipment (16,267) (10,869) (26,701) (19,173) Payments to acquire Intangible Assets (161) (512) (161) (658) Contributions to Trust (345) (278) (403) (717) Net cash generated by (used in) investing activities (16,646) (11,535) (26,765) (19,622) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from non-convertible negotiable obligations - 68,326 - 195,271 Proceeds from borrowings 103,057 71,255 198,355 79,870 Interest paid (14,317) (27,618) (36,356) (40,660) Dividends paid - (88,165) - (107,766) Debts for leases (357) (391) (810) (826) Repayment of borrowings (90,501) (43,380) (143,786) (88,526) Share repurchase plan (0) - (491) - Net cash generated by (used in) financing activities (2,118) (19,973) 16,912 37,362 Net increase (decrease) in cash and cash equivalents (2,766) 12,643 (3,027) 83,243 Cash and cash equivalents at the beginning of the period 6,890 89,302 12,106 27,493 Effect of the re-expression in homogeneous cash currency ("Inflation-Adjusted") (1,100) (14,385) (6,394) (23,852) Effects of the exchange rate differences on cash and cash equivalents in foreign currency 56 1,951 394 2,628 Cash and cash equivalents at the end of the period 3,080 89,512 3,080 89,512

Table 11: Financial Data by Segment (figures exclude the impact of IAS 29) (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended June 30, Six-months ended June 30, 2024 % 2023 % 2024 % 2023 % Net revenue 130,523 100.0% 47,913 100.0% 233,057 100.0% 85,868 100.0% Cement, masonry cement and lime 115,987 88.9% 41,458 86.5% 207,478 89.0% 74,602 86.9% Concrete 10,526 8.1% 5,267 11.0% 18,613 8.0% 8,955 10.4% Railroad 12,165 9.3% 3,733 7.8% 21,020 9.0% 6,693 7.8% Aggregates 3,305 2.5% 1,354 2.8% 6,051 2.6% 2,600 3.0% Others 1,227 0.9% 274 0.6% 2,029 0.9% 447 0.5% Eliminations (12,686) -9.7% (4,173) -8.7% (22,134) -9.5% (7,430) -8.7% Cost of sales 76,076 100.0% 30,582 100.0% 134,192 100.0% 53,894 100.0% Cement, masonry cement and lime 63,306 83.2% 25,129 82.2% 111,063 82.8% 44,178 82.0% Concrete 10,495 13.8% 4,862 15.9% 18,595 13.9% 8,434 15.7% Railroad 10,835 14.2% 3,362 11.0% 19,471 14.5% 6,189 11.5% Aggregates 3,403 4.5% 1,220 4.0% 5,993 4.5% 2,210 4.1% Others 724 1.0% 182 0.6% 1,205 0.9% 313 0.6% Eliminations (12,686) -16.7% (4,173) -13.6% (22,134) -16.5% (7,430) -13.8% Selling, admin. expenses and other gains & losses 10,880 100.0% 3,670 100.0% 21,840 100.0% 6,992 100.0% Cement, masonry cement and lime 10,003 91.9% 3,189 86.9% 19,876 91.0% 6,067 86.8% Concrete 232 2.1% 202 5.5% 767 3.5% 349 5.0% Railroad 364 3.3% 181 4.9% 634 2.9% 395 5.6% Aggregates 36 0.3% 14 0.4% 65 0.3% 25 0.4% Others 245 2.3% 84 2.3% 499 2.3% 157 2.2% Depreciation and amortization 1,269 100.0% 919 100.0% 2,510 100.0% 1,716 100.0% Cement, masonry cement and lime 924 72.8% 694 75.5% 1,706 68.0% 1,359 79.2% Concrete 53 4.1% 25 2.7% 103 4.1% 40 2.4% Railroad 206 16.2% 143 15.6% 560 22.3% 232 13.5% Aggregates 85 6.7% 57 6.2% 138 5.5% 82 4.8% Others 1 0.1% 1 0.1% 3 0.1% 2 0.1% Adjusted EBITDA 44,836 100.0% 14,580 100.0% 79,535 100.0% 26,698 100.0% Cement, masonry cement and lime 43,602 97.2% 13,834 94.9% 78,246 98.4% 25,717 96.3% Concrete (148) -0.3% 228 1.6% (646) -0.8% 212 0.8% Railroad 1,172 2.6% 333 2.3% 1,476 1.9% 342 1.3% Aggregates (50) -0.1% 176 1.2% 131 0.2% 448 1.7% Others 260 0.6% 9 0.1% 328 0.4% (20) -0.1% Reconciling items: Effect by translation in homogeneous cash currency ("Inflation-Adjusted") (6,565) 28,776 (10,483) 65,569 Depreciation and amortization (13,807) (14,791) (25,752) (29,754) Tax on debits and credits banks accounts (1,440) (2,276) (2,918) (4,272) Finance gain (cost), net 24,000 (11,267) 102,486 (11,356) Income tax (17,441) (5,946) (53,168) (13,858) NET PROFIT (LOSS) FOR THE PERIOD 29,584 9,076 89,701 33,027