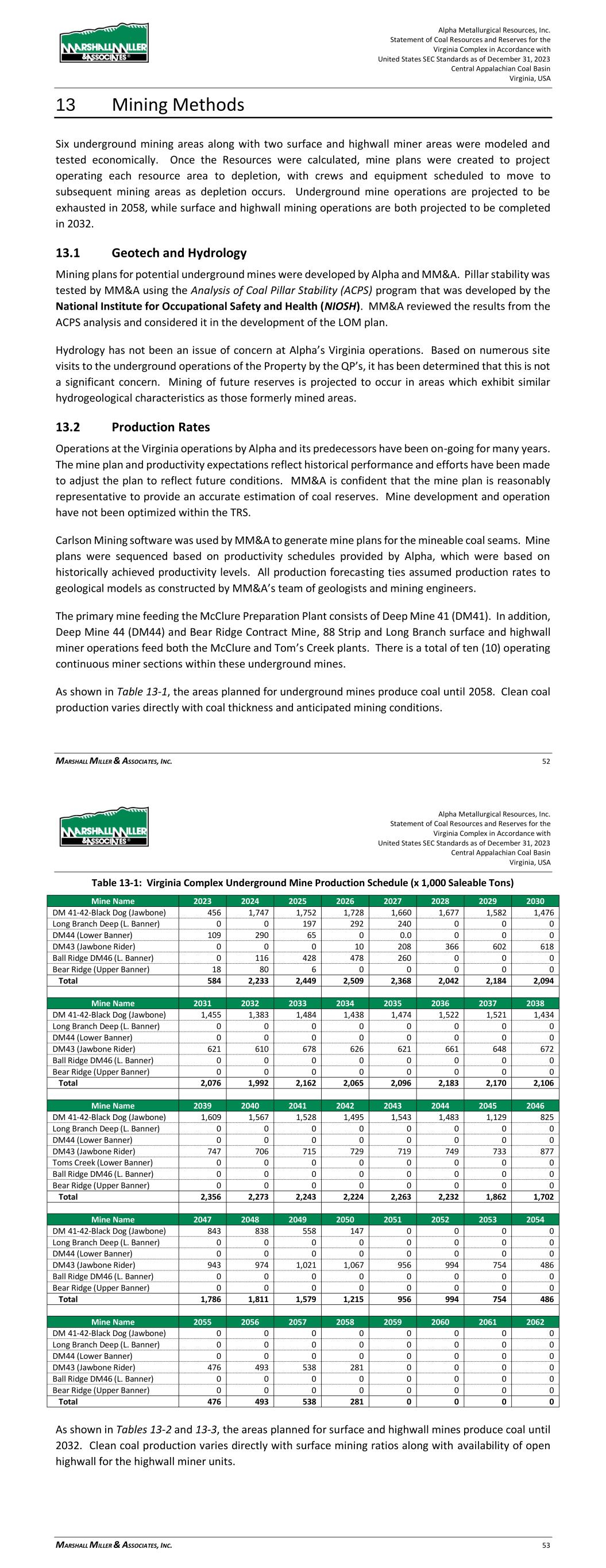

00017047152023FYfalseP1Y11111http://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://www.alphametresources.com/20231231#AccruedLiabilitiesAndOtherLiabilitiesCurrenthttp://www.alphametresources.com/20231231#AccruedLiabilitiesAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://www.alphametresources.com/20231231#TradingSecuritiesMemberhttp://www.alphametresources.com/20231231#TradingSecuritiesMemberhttp://www.alphametresources.com/20231231#TradingSecuritiesMemberhttp://www.alphametresources.com/20231231#AcquisitionRelatedObligationsChangesInFairValueGainLosshttp://www.alphametresources.com/20231231#AcquisitionRelatedObligationsChangesInFairValueGainLosshttp://fasb.org/us-gaap/2023#FairValueMeasuredAtNetAssetValuePerShareMemberhttp://fasb.org/us-gaap/2023#FairValueMeasuredAtNetAssetValuePerShareMember00017047152023-01-012023-12-3100017047152023-06-30iso4217:USD00017047152024-02-19xbrli:shares00017047152022-01-012022-12-3100017047152021-01-012021-12-31iso4217:USDxbrli:shares00017047152023-12-3100017047152022-12-3100017047152021-12-3100017047152020-12-310001704715us-gaap:CommonStockMember2020-12-310001704715us-gaap:AdditionalPaidInCapitalMember2020-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001704715us-gaap:TreasuryStockCommonMember2020-12-310001704715us-gaap:RetainedEarningsMember2020-12-310001704715us-gaap:RetainedEarningsMember2021-01-012021-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001704715us-gaap:CommonStockMember2021-01-012021-12-310001704715us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001704715us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001704715us-gaap:CommonStockMember2021-12-310001704715us-gaap:AdditionalPaidInCapitalMember2021-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001704715us-gaap:TreasuryStockCommonMember2021-12-310001704715us-gaap:RetainedEarningsMember2021-12-310001704715us-gaap:RetainedEarningsMember2022-01-012022-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001704715us-gaap:CommonStockMember2022-01-012022-12-310001704715us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001704715us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001704715us-gaap:CommonStockMember2022-12-310001704715us-gaap:AdditionalPaidInCapitalMember2022-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001704715us-gaap:TreasuryStockCommonMember2022-12-310001704715us-gaap:RetainedEarningsMember2022-12-310001704715us-gaap:RetainedEarningsMember2023-01-012023-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001704715us-gaap:CommonStockMember2023-01-012023-12-310001704715us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001704715us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001704715us-gaap:CommonStockMember2023-12-310001704715us-gaap:AdditionalPaidInCapitalMember2023-12-310001704715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001704715us-gaap:TreasuryStockCommonMember2023-12-310001704715us-gaap:RetainedEarningsMember2023-12-310001704715srt:MinimumMemberamr:MiningEquipmentBuildingsandOtherFixedAssetsMember2023-12-310001704715amr:MiningEquipmentBuildingsandOtherFixedAssetsMembersrt:MaximumMember2023-12-310001704715us-gaap:MiningPropertiesAndMineralRightsMember2023-01-012023-12-310001704715us-gaap:MiningPropertiesAndMineralRightsMember2022-01-012022-12-310001704715us-gaap:MiningPropertiesAndMineralRightsMember2021-01-012021-12-310001704715amr:MinePermitsMember2023-12-310001704715amr:MinePermitsMember2022-12-310001704715amr:MinePermitsMember2023-01-012023-12-310001704715amr:MinePermitsMember2022-01-012022-12-310001704715amr:MinePermitsMember2021-01-012021-12-310001704715us-gaap:CoalSupplyAgreementsMember2023-01-012023-12-310001704715us-gaap:CoalSupplyAgreementsMember2022-01-012022-12-310001704715us-gaap:CoalSupplyAgreementsMember2021-01-012021-12-310001704715amr:FreightHaulingAndTransportationServicesBusinessMember2023-01-012023-01-310001704715amr:FreightHaulingAndTransportationServicesBusinessMember2023-01-310001704715amr:MiningEquipmentComponentManufacturingAndRebuildingBusinessMember2022-12-012022-12-310001704715amr:MiningEquipmentComponentManufacturingAndRebuildingBusinessMember2022-12-310001704715us-gaap:WorkersCompensationInsuranceMember2023-12-310001704715us-gaap:WorkersCompensationInsuranceMember2022-12-31amr:segment0001704715country:US2023-01-012023-12-310001704715us-gaap:NonUsMemberamr:CoalMetMember2023-01-012023-12-310001704715us-gaap:NonUsMemberamr:CoalMetMember2022-01-012022-12-310001704715us-gaap:NonUsMemberamr:CoalMetMember2021-01-012021-12-310001704715amr:CoalThermalMemberus-gaap:NonUsMember2023-01-012023-12-310001704715amr:CoalThermalMemberus-gaap:NonUsMember2022-01-012022-12-310001704715amr:CoalThermalMemberus-gaap:NonUsMember2021-01-012021-12-310001704715us-gaap:NonUsMemberus-gaap:PublicUtilitiesInventoryCoalMember2023-01-012023-12-310001704715us-gaap:NonUsMemberus-gaap:PublicUtilitiesInventoryCoalMember2022-01-012022-12-310001704715us-gaap:NonUsMemberus-gaap:PublicUtilitiesInventoryCoalMember2021-01-012021-12-310001704715amr:CoalMetMembercountry:US2023-01-012023-12-310001704715amr:CoalMetMembercountry:US2022-01-012022-12-310001704715amr:CoalMetMembercountry:US2021-01-012021-12-310001704715amr:CoalThermalMembercountry:US2023-01-012023-12-310001704715amr:CoalThermalMembercountry:US2022-01-012022-12-310001704715amr:CoalThermalMembercountry:US2021-01-012021-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMembercountry:US2023-01-012023-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMembercountry:US2022-01-012022-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMembercountry:US2021-01-012021-12-310001704715amr:CoalMetMember2023-01-012023-12-310001704715amr:CoalMetMember2022-01-012022-12-310001704715amr:CoalMetMember2021-01-012021-12-310001704715amr:CoalThermalMember2023-01-012023-12-310001704715amr:CoalThermalMember2022-01-012022-12-310001704715amr:CoalThermalMember2021-01-012021-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMember2023-01-012023-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMember2022-01-012022-12-310001704715us-gaap:PublicUtilitiesInventoryCoalMember2021-01-012021-12-3100017047152024-01-012023-12-3100017047152025-01-012023-12-3100017047152026-01-012023-12-3100017047152027-01-012023-12-3100017047152028-01-012023-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001704715us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberamr:AccumulatedDefinedBenefitPlantAdjustmentSettlementGainLossAttributableToParentMember2023-01-012023-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberamr:AccumulatedDefinedBenefitPlantAdjustmentSettlementGainLossAttributableToParentMember2022-01-012022-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberamr:AccumulatedDefinedBenefitPlantAdjustmentSettlementGainLossAttributableToParentMember2021-01-012021-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001704715us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001704715us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001704715us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001704715us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001704715us-gaap:StockCompensationPlanMember2023-01-012023-12-310001704715us-gaap:StockCompensationPlanMember2022-01-012022-12-310001704715us-gaap:StockCompensationPlanMember2021-01-012021-12-3100017047152023-02-2100017047152023-10-3100017047152022-03-042023-12-310001704715amr:AnnualDividendMember2022-05-032022-05-0300017047152022-05-032022-05-0300017047152023-02-212023-02-2100017047152023-04-032023-04-0300017047152023-05-032023-05-0300017047152023-07-052023-07-0500017047152023-08-022023-08-0200017047152023-10-032023-10-0300017047152023-10-312023-10-3100017047152023-12-152023-12-1500017047152016-07-2600017047152022-12-1500017047152023-03-1500017047152023-06-150001704715amr:PlantandMiningEquipmentMember2023-12-310001704715amr:PlantandMiningEquipmentMember2022-12-310001704715us-gaap:MineDevelopmentMember2023-12-310001704715us-gaap:MineDevelopmentMember2022-12-310001704715us-gaap:LandMember2023-12-310001704715us-gaap:LandMember2022-12-310001704715amr:OfficeEquipmentSoftwareandOtherMember2023-12-310001704715amr:OfficeEquipmentSoftwareandOtherMember2022-12-310001704715us-gaap:ConstructionInProgressMember2023-12-310001704715us-gaap:ConstructionInProgressMember2022-12-310001704715amr:DepreciationDepletionandAmortizationMember2023-01-012023-12-310001704715amr:DepreciationDepletionandAmortizationMember2022-01-012022-12-310001704715amr:DepreciationDepletionandAmortizationMember2021-01-012021-12-310001704715amr:EquipmentPurchaseCommitmentsMember2023-12-310001704715amr:DominionTerminalAssociatesLLPMember2023-12-31xbrli:pure0001704715amr:ABLFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-060001704715amr:ABLFacilityMemberus-gaap:LetterOfCreditMember2021-12-060001704715amr:ABLFacilityMemberus-gaap:LineOfCreditMember2021-12-062021-12-060001704715amr:ABLFacilityMemberus-gaap:RevolvingCreditFacilityMemberamr:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2021-12-062021-12-060001704715amr:ABLFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2021-12-062021-12-060001704715amr:ABLFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001704715amr:ABLFacilityMemberus-gaap:LetterOfCreditMember2021-12-062021-12-060001704715amr:ABLFacilityMemberus-gaap:LineOfCreditMember2022-12-310001704715amr:ABLFacilityMember2023-10-272023-10-270001704715us-gaap:RevolvingCreditFacilityMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-270001704715us-gaap:LetterOfCreditMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-270001704715us-gaap:LetterOfCreditMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-12-310001704715us-gaap:LetterOfCreditMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-272023-10-270001704715amr:SecuredOvernightFinancingRateSOFRMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-272023-10-270001704715us-gaap:BaseRateMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-272023-10-270001704715us-gaap:RevolvingCreditFacilityMemberamr:NewAssetBasedRevolvingCreditFacilityMember2023-10-272023-10-270001704715amr:NewAssetBasedRevolvingCreditFacilityMember2023-12-310001704715amr:ContingentRevenueObligationMember2023-12-310001704715amr:ContingentRevenueObligationMember2022-12-310001704715amr:EnvironmentalSettlementObligationsMember2023-12-310001704715amr:EnvironmentalSettlementObligationsMember2022-12-310001704715amr:ContingentRevenueObligationThresholdOneMember2018-11-090001704715amr:ContingentRevenueObligationThresholdTwoMember2018-11-090001704715us-gaap:FairValueMeasurementsRecurringMember2023-12-310001704715us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001704715us-gaap:FairValueMeasurementsRecurringMember2022-12-310001704715us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001704715us-gaap:FairValueInputsLevel3Member2022-12-310001704715us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001704715us-gaap:FairValueInputsLevel3Member2023-12-310001704715us-gaap:FairValueInputsLevel3Member2021-12-310001704715us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001704715us-gaap:DomesticCountryMemberamr:IRSSection382LimitationOneMember2023-12-310001704715amr:IRSSection382LimitationTwoMemberus-gaap:DomesticCountryMember2023-12-310001704715us-gaap:CapitalLossCarryforwardMemberus-gaap:DomesticCountryMember2023-12-310001704715us-gaap:TaxYear2016Memberus-gaap:DomesticCountryMember2021-09-300001704715amr:ANRInc.andAlphaNaturalResourcesHoldingsInc.Member2018-11-092018-11-09amr:plan0001704715amr:ANRInc.andAlphaNaturalResourcesHoldingsInc.Memberus-gaap:PensionPlansDefinedBenefitMemberamr:FrozenDefinedBenefitPensionPlanPre2004BalanceMember2023-12-310001704715amr:ANRInc.andAlphaNaturalResourcesHoldingsInc.Memberus-gaap:PensionPlansDefinedBenefitMemberamr:FrozenDefinedBenefitPensionPlanPost2004BalanceMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2021-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001704715us-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMember2024-01-012024-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMember2024-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMembersrt:ScenarioForecastMember2024-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberamr:DefinedBenefitPlanOtherInvestmentsMember2024-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanOtherInvestmentsMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMember2024-12-310001704715us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquitySecuritiesMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2023-12-31amr:fundedStatusLevel0001704715us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2021-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2023-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMemberus-gaap:FairValueInputsLevel1Member2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMemberus-gaap:FairValueInputsLevel2Member2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMember2023-12-310001704715amr:DefinedBenefitPlanReceivablesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsAfterReceivablesForInvestmentsSoldMember2023-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanDebtSecurityMember2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2022-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanGuaranteeInsuranceContractMember2022-12-310001704715us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMemberus-gaap:FairValueInputsLevel1Member2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMemberus-gaap:FairValueInputsLevel2Member2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsBeforeReceivablesForInvestmentsSoldMember2022-12-310001704715amr:DefinedBenefitPlanReceivablesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberamr:DefinedBenefitPlanAssetsAfterReceivablesForInvestmentsSoldMember2022-12-310001704715us-gaap:PensionPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2022-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001704715us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-01-012023-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-01-012022-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-01-012021-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2021-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMemberamr:CurrentLiabilitiesMember2023-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMemberamr:CurrentLiabilitiesMember2022-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMemberamr:NoncurrentLiabilitiesMember2023-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMemberamr:NoncurrentLiabilitiesMember2022-12-310001704715us-gaap:DefinedBenefitPostretirementLifeInsuranceMember2023-12-310001704715us-gaap:DefinedBenefitPostretirementLifeInsuranceMemberamr:CurrentLiabilitiesMember2023-12-310001704715us-gaap:DefinedBenefitPostretirementLifeInsuranceMember2022-12-310001704715us-gaap:DefinedBenefitPostretirementLifeInsuranceMemberamr:CurrentLiabilitiesMember2022-12-3100017047152022-07-012022-09-300001704715amr:ManagementIncentivePlanMember2023-12-310001704715amr:LongTermIncentivePlanMember2023-12-310001704715amr:ANRInc.2017EquityIncentivePlanMember2018-11-092018-11-090001704715amr:ANRInc.2017EquityIncentivePlanMember2023-12-31amr:award_type0001704715us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001704715us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001704715us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001704715amr:ManagementIncentivePlanAndLongTermIncentivePlanMember2023-01-012023-12-310001704715amr:ManagementIncentivePlanAndLongTermIncentivePlanMember2022-01-012022-12-310001704715amr:ManagementIncentivePlanAndLongTermIncentivePlanMember2021-01-012021-12-310001704715srt:BoardOfDirectorsChairmanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-01-012023-12-310001704715amr:LongTermIncentivePlanMemberamr:RestrictedStockUnitsRSUsTimeBasedMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMembersrt:MinimumMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMembersrt:MaximumMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:OperationalPerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMemberamr:ClosingStockPriceOnTradingDayBeforeGrantDateMember2023-01-012023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:MonteCarloSimulationMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2023-01-012023-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2023-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2023-01-012023-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2022-01-012022-12-31utr:D0001704715amr:ManagementIncentivePlanAndLongTermIncentivePlanMemberamr:RestrictedStockUnitsRSUsTimeBasedMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMembersrt:MinimumMemberamr:LongTermIncentivePlanMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMembersrt:MaximumMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:OperationalPerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:MonteCarloSimulationMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2022-01-012022-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2022-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMembersrt:MinimumMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMembersrt:MaximumMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-01-012022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:A2022LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:A2022LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:MonteCarloSimulationMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-01-012022-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2022-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2022-01-012022-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2021-01-012021-12-310001704715amr:ManagementIncentivePlanAndLongTermIncentivePlanMemberamr:RestrictedStockUnitsRSUsTimeBasedMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMembersrt:MinimumMemberamr:LongTermIncentivePlanMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:PerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMembersrt:MaximumMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:OperationalPerformanceBasedRestrictedStockUnitsMemberamr:LongTermIncentivePlanMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:MonteCarloSimulationMemberamr:LongTermIncentivePlanMemberamr:RelativePerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2021-12-310001704715amr:RelativePerformanceBasedRestrictedStockUnitsMember2020-01-012020-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMembersrt:MinimumMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:LongTermIncentivePlanMembersrt:MaximumMemberamr:PerformanceBasedCashIncentiveAwardsMember2021-01-012021-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:A2021LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2023-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:A2021LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2022-12-310001704715us-gaap:ShareBasedPaymentArrangementEmployeeMemberamr:MonteCarloSimulationMemberamr:LongTermIncentivePlanMemberamr:PerformanceBasedCashIncentiveAwardsMember2021-01-012021-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2021-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2020-01-012020-12-310001704715amr:RestrictedStockUnitsRSUsTimeBasedMember2022-12-310001704715amr:RestrictedStockUnitsRSUsTimeBasedMember2023-01-012023-12-310001704715amr:RestrictedStockUnitsRSUsTimeBasedMember2023-12-310001704715amr:RestrictedStockUnitsRSUsShareUnitsDeferredSettlementMember2023-01-012023-12-310001704715amr:RestrictedStockUnitsRSUsTimeBasedMember2022-01-012022-12-310001704715amr:RestrictedStockUnitsRSUsTimeBasedMember2021-01-012021-12-310001704715amr:OperationalPerformanceBasedRestrictedStockUnitsMember2022-12-310001704715amr:OperationalPerformanceBasedRestrictedStockUnitsMember2023-01-012023-12-310001704715amr:OperationalPerformanceBasedRestrictedStockUnitsMember2023-12-310001704715amr:ThirtyDayVolumeWeightedAveragePriceStockOptionsMember2022-12-310001704715amr:ThirtyDayVolumeWeightedAveragePriceStockOptionsMember2022-01-012022-12-310001704715amr:ThirtyDayVolumeWeightedAveragePriceStockOptionsMember2023-01-012023-12-310001704715amr:ThirtyDayVolumeWeightedAveragePriceStockOptionsMember2023-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2023-01-012023-12-310001704715amr:PerformanceBasedCashIncentiveAwardsMember2023-12-310001704715amr:PrivatelyNegotiatedTransactionWithAContingentRevenueObligationCreditorMemberamr:ShareholderMember2021-01-012021-12-310001704715amr:PrivatelyNegotiatedTransactionWithAContingentRevenueObligationCreditorMemberamr:ShareholderMember2021-12-310001704715us-gaap:RoyaltyAgreementsMemberus-gaap:PublicUtilitiesInventoryCoalMember2023-12-310001704715amr:CoalPurchaseAgreementsMember2023-12-310001704715amr:CoalTransportationAgreementsMember2023-12-310001704715amr:CoalTransportationAgreementsMemberamr:DominionTerminalAssociatesDTAMember2023-12-310001704715amr:AdditionalDTAInvestmentMember2023-12-310001704715amr:CumberlandBackToBackCoalSupplyAgreementsMember2023-01-012023-06-30utr:T0001704715amr:CumberlandBackToBackCoalSupplyAgreementsMember2022-01-012022-12-310001704715us-gaap:SuretyBondMember2023-12-310001704715amr:ReclamationRelatedObligationsMemberus-gaap:CollateralPledgedMember2023-12-310001704715amr:WorkersCompensationAndBlackLungObligationMember2023-12-310001704715amr:WorkersCompensationAndBlackLungObligationMember2022-12-310001704715amr:ReclamationRelatedObligationsMember2023-12-310001704715amr:ReclamationRelatedObligationsMember2022-12-310001704715amr:FinancialPaymentsAndOtherPerformanceObligationsMember2023-12-310001704715amr:FinancialPaymentsAndOtherPerformanceObligationsMember2022-12-310001704715amr:ContingentRevenueObligationMember2023-12-310001704715amr:ContingentRevenueObligationMember2022-12-310001704715amr:WorkersCompensationObligationsMember2023-12-310001704715amr:WorkersCompensationObligationsMember2022-12-310001704715amr:OtherOperatingAgreementsMember2023-12-310001704715amr:OtherOperatingAgreementsMember2022-12-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2020-02-210001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2020-02-200001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMember2022-02-100001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMembersrt:MinimumMember2023-01-310001704715us-gaap:DefinedBenefitPostretirementHealthCoverageMembersrt:MaximumMember2023-01-310001704715amr:ExportCoalRevenueMember2023-01-012023-12-310001704715amr:ExportCoalRevenueMember2022-01-012022-12-310001704715amr:ExportCoalRevenueMember2021-01-012021-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:CustomerOneMember2023-01-012023-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:CustomerOneMember2022-01-012022-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:CustomerOneMember2021-01-012021-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:TopTenCustomersMember2023-01-012023-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:TopTenCustomersMember2022-01-012022-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberamr:TopTenCustomersMember2021-01-012021-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-12-31amr:customer0001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-12-310001704715us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2021-12-310001704715amr:DomesticCoalRevenueMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2023-01-012023-12-310001704715amr:DomesticCoalRevenueMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001704715amr:DomesticCoalRevenueMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001704715us-gaap:SalesRevenueNetMemberamr:ExportCoalRevenueMemberus-gaap:GeographicConcentrationRiskMember2023-01-012023-12-310001704715us-gaap:SalesRevenueNetMemberamr:ExportCoalRevenueMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001704715us-gaap:SalesRevenueNetMemberamr:ExportCoalRevenueMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:SalesVolumeProductLineMemberamr:CoalMetMember2023-01-012023-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:SalesVolumeProductLineMemberamr:CoalMetMember2022-01-012022-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:SalesVolumeProductLineMemberamr:CoalMetMember2021-01-012021-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:CoalThermalMemberamr:SalesVolumeProductLineMember2023-01-012023-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:CoalThermalMemberamr:SalesVolumeProductLineMember2022-01-012022-12-310001704715us-gaap:ProductConcentrationRiskMemberamr:CoalThermalMemberamr:SalesVolumeProductLineMember2021-01-012021-12-310001704715amr:MetMemberstpr:VAus-gaap:OperatingSegmentsMember2023-01-012023-12-31amr:mineamr:plant0001704715stpr:WVamr:MetMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001704715stpr:WVamr:OtherOperatingSegmentsAndIntersegmentEliminationsMember2023-01-012023-12-310001704715amr:MetMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001704715amr:OtherOperatingSegmentsAndIntersegmentEliminationsMember2023-01-012023-12-310001704715amr:MetMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001704715amr:OtherOperatingSegmentsAndIntersegmentEliminationsMember2022-01-012022-12-310001704715amr:MetMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001704715amr:OtherOperatingSegmentsAndIntersegmentEliminationsMember2021-01-012021-12-3100017047152023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

|

|

|

|

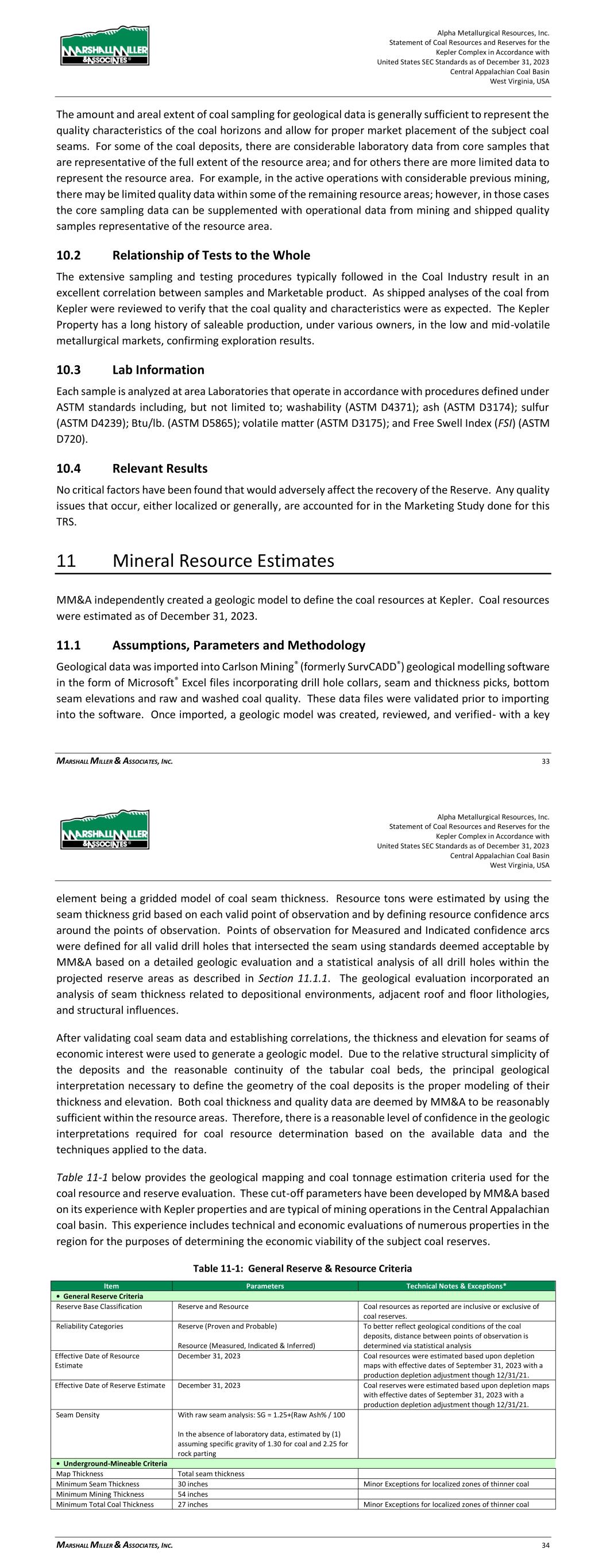

| (Mark One) |

| ☒ |

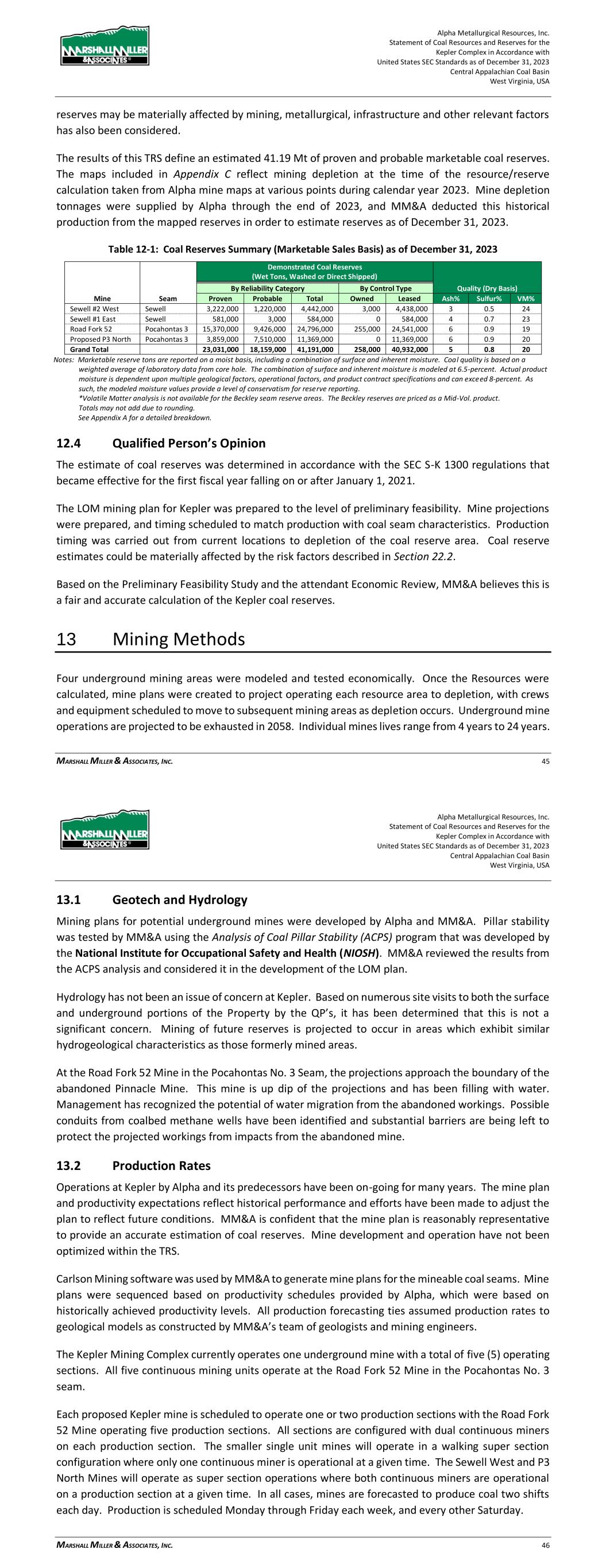

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

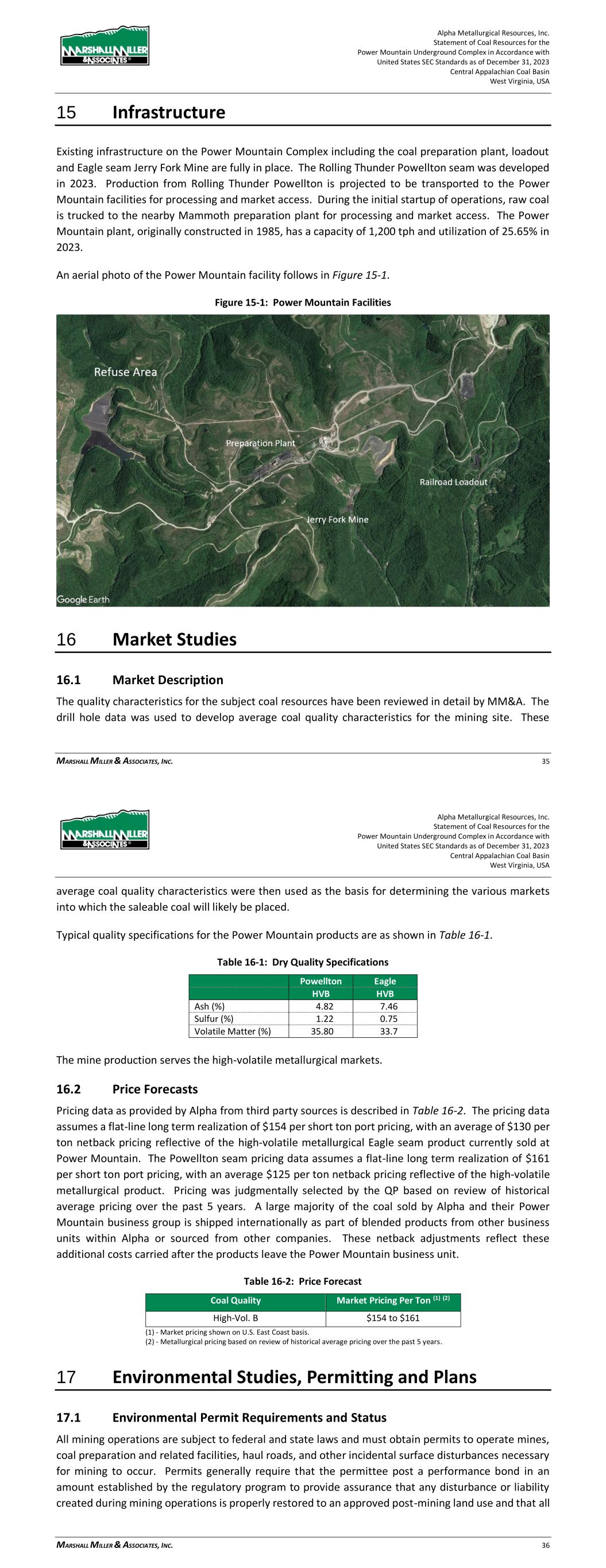

OR

|

|

|

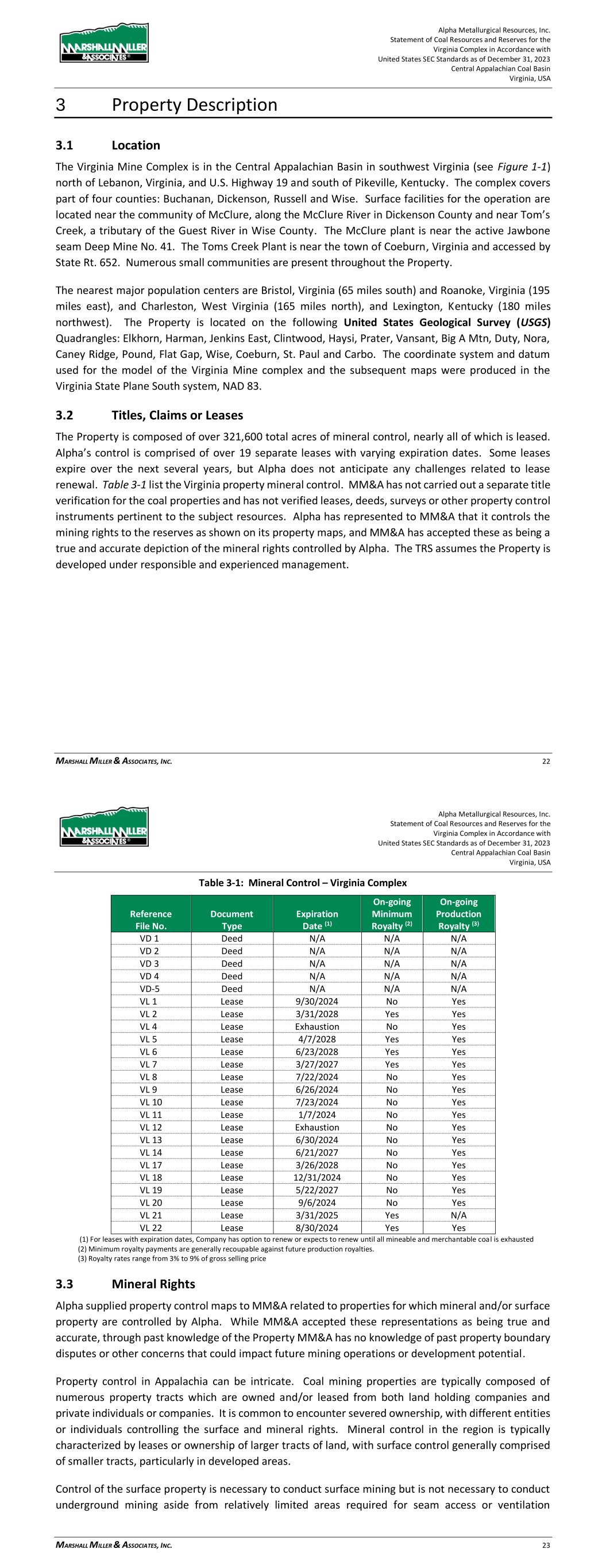

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-38735

ALPHA METALLURGICAL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

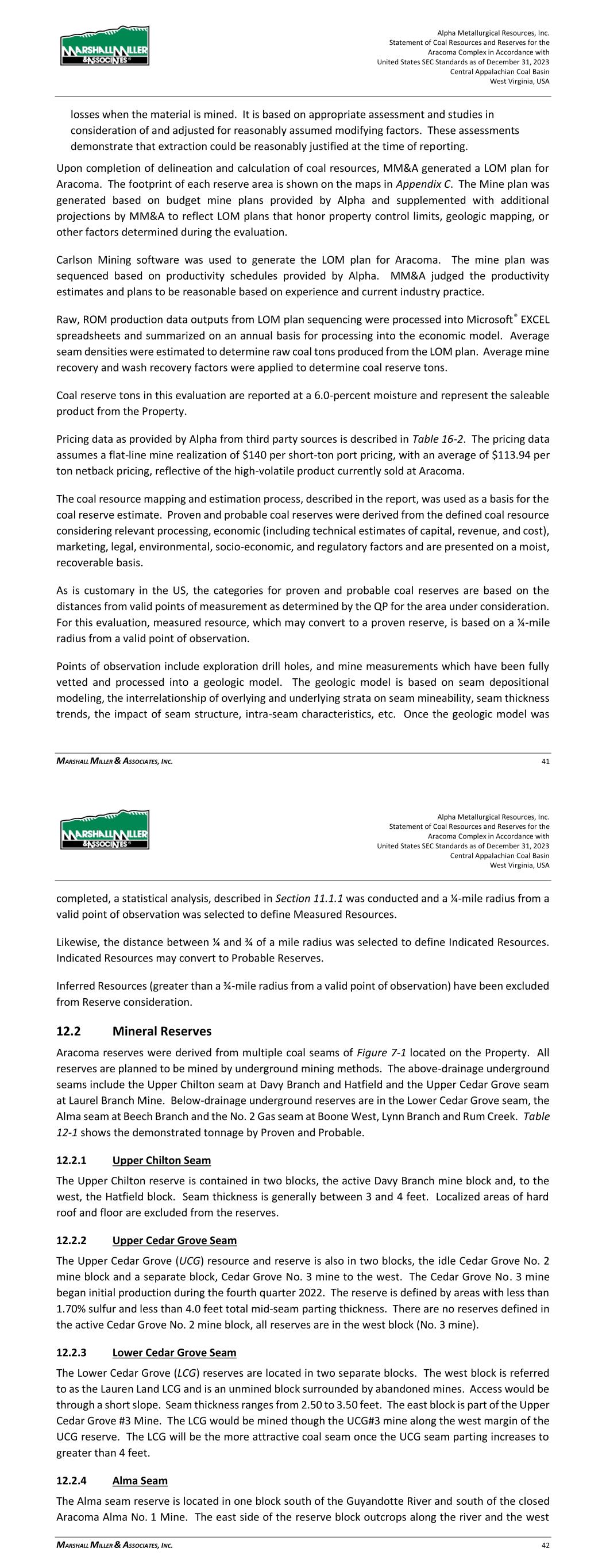

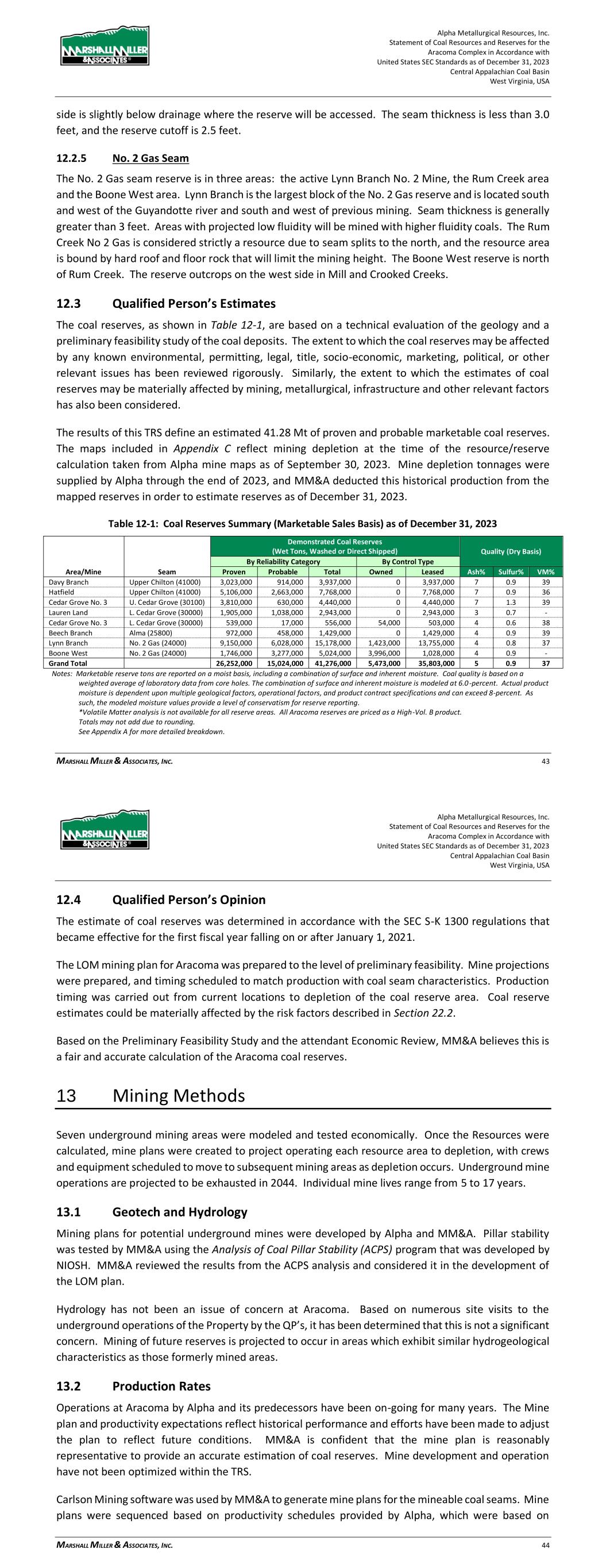

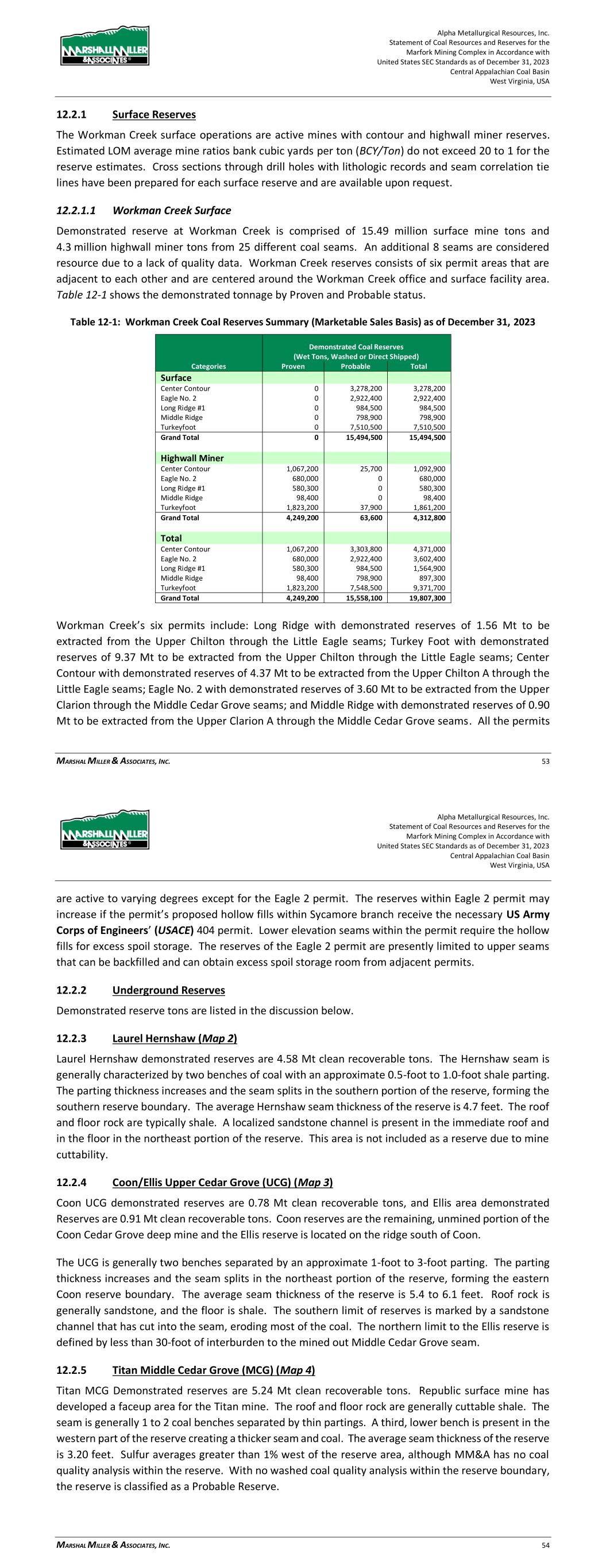

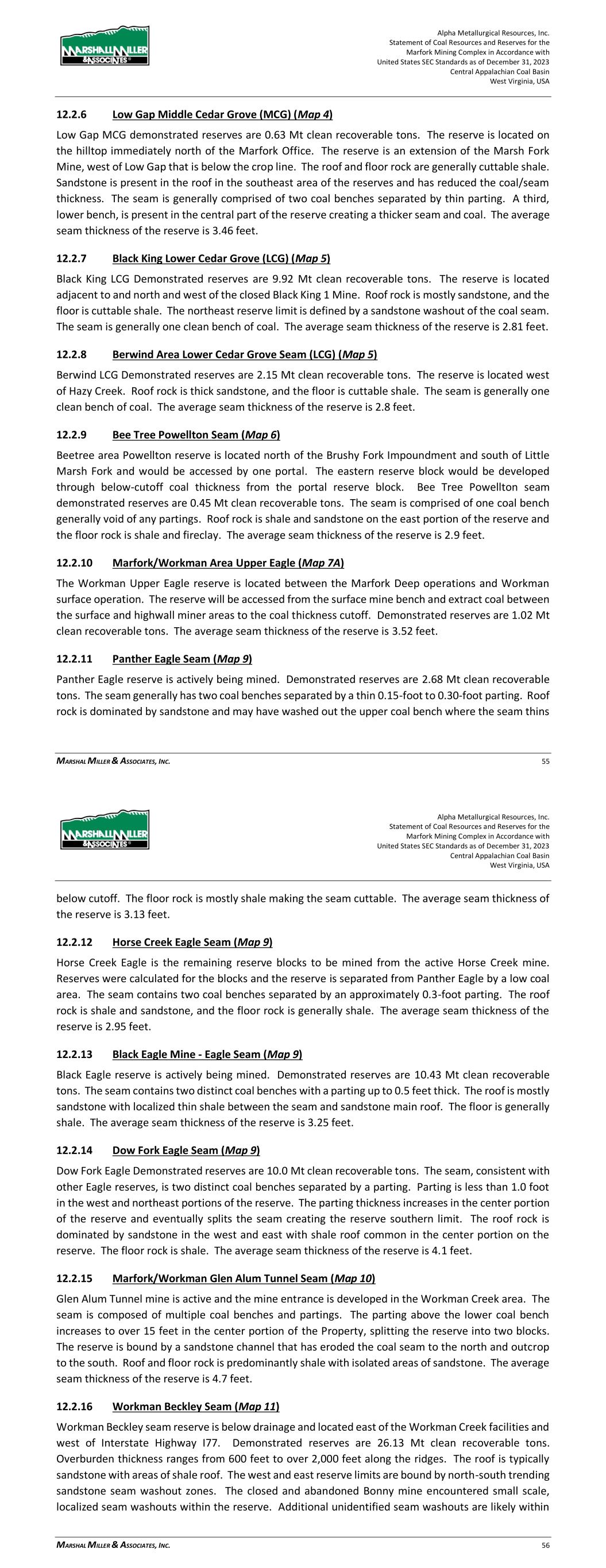

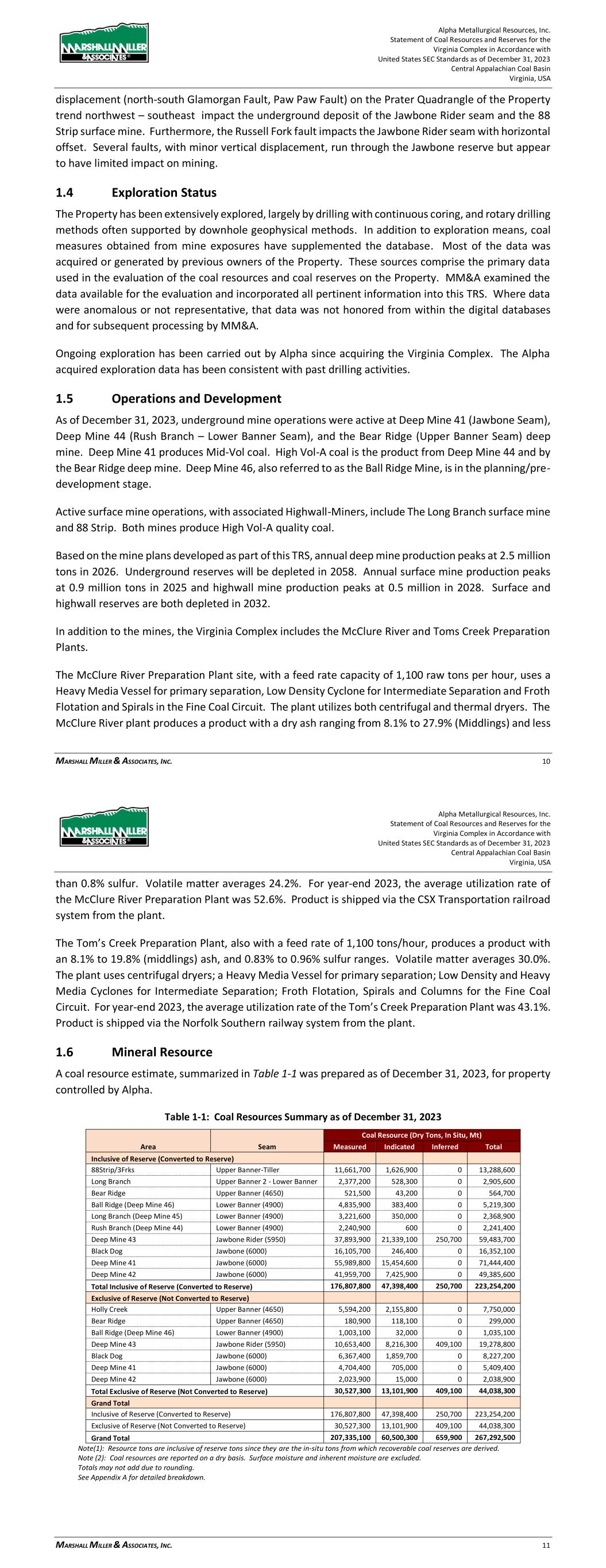

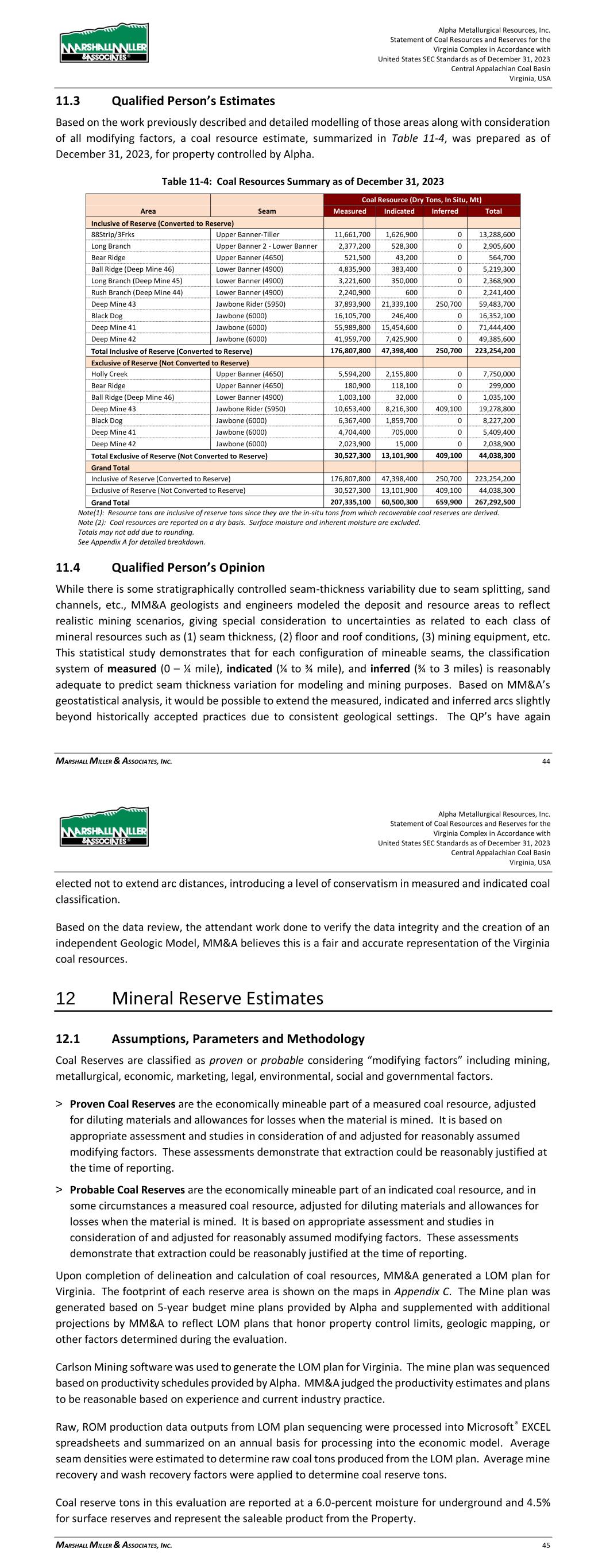

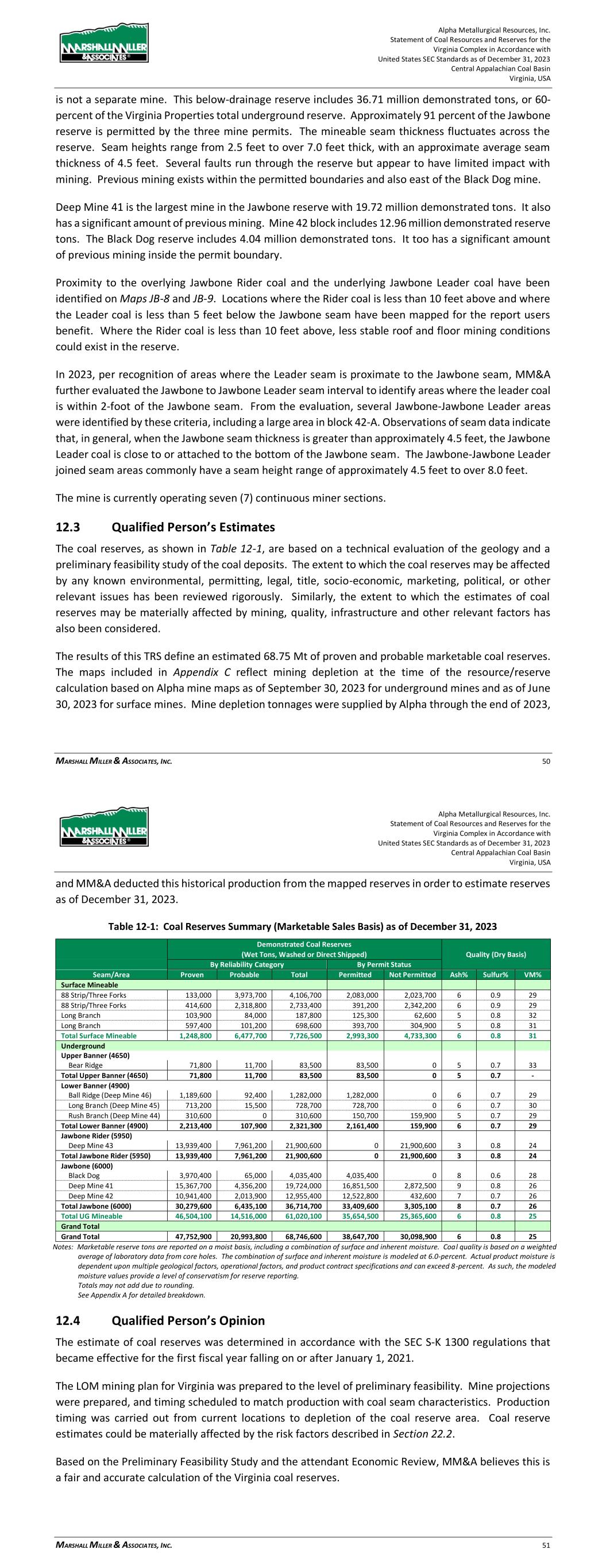

|

|

|

|

|

|

| Delaware |

|

81-3015061 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

|

|

| 340 Martin Luther King Jr. Blvd. |

Bristol, Tennessee 37620 |

| (Address of principal executive offices, zip code) |

(423) 573-0300 |

| (Registrant’s telephone number, including area code) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

AMR |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Sec.232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes x No

The aggregate market value of the Common Stock held by non-affiliates of the registrant (excluding outstanding shares beneficially owned by directors, executive officers, and other affiliates) on June 30, 2023, was approximately $1.3 billion based on the closing price of the Company’s common stock as reported that date on the New York Stock Exchange of $164.36 per share. Such assumptions should not be deemed to be conclusive for any other purpose.

Number of shares of the registrant’s Common Stock, $0.01 par value, outstanding as of February 19, 2024: 12,994,558

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant’s definitive proxy statement for the 2024 annual meeting of stockholders (the “Proxy Statement”), which will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2023.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements.” These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to our future prospects, developments and business strategies. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should” and similar terms and phrases, including references to assumptions, in this report to identify forward-looking statements, but these terms and phrases are not the exclusive means of identifying such statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those expressed in or implied by these forward-looking statements.

The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

•the financial performance of the company;

•our liquidity, results of operations and financial condition;

•our ability to generate sufficient cash or obtain financing to fund our business operations;

•depressed levels or declines in coal prices;

•railroad, barge, truck, port and other transportation availability, performance and costs;

•changes in domestic or international environmental laws and regulations, and court decisions, including those directly affecting our coal mining and production and those affecting our customers’ coal usage, including potential climate change initiatives;

•steel and coke producers switching to alternative energy sources such as natural gas, renewables and coal from basins where we do not operate;

•our ability to obtain or renew surety bonds on acceptable terms or maintain our current bonding status;

•worldwide market demand for coal and steel, including demand for U.S. coal exports, and competition in coal markets;

•attracting and retaining key personnel and other employee workforce factors, such as labor relations;

•our ability to execute our share repurchase program;

•our ability to self-insure certain of our black lung obligations without a significant increase in required collateral;

•our ability to meet collateral requirements and fund employee benefit obligations;

•inflationary pressures on supplies and labor and significant or rapid increases in commodity prices;

•disruptions in delivery or changes in pricing from third-party vendors of key equipment and materials that are necessary for our operations, such as diesel fuel, steel products, explosives, tires and purchased coal;

•our ability to consummate financing or refinancing transactions, and other services, and the form and degree of these services available to us, which may be significantly limited by the lending, investment and similar policies of financial institutions and insurance companies regarding carbon energy producers and the environmental impacts of coal combustion;

•failures in performance, or non-performance, of services by third-party contractors, including contract mining and reclamation contractors;

•disruption in third-party coal supplies;

•cybersecurity attacks or failures, threats to physical security, extreme weather conditions or other natural disasters;

•the imposition or continuation of barriers to trade, such as tariffs;

•increased volatility and uncertainty regarding worldwide markets, seaborne transportation and our customers as a result of developments in and around Ukraine and the Middle East;

•changes in, renewal or acquisition of, terms of and performance of customers under coal supply arrangements and the refusal by our customers to receive coal under agreed-upon contract terms;

•reductions or increases in customer coal inventories and the timing of those changes;

•our production capabilities and costs;

•our ability to obtain, maintain or renew any necessary permits or rights;

•inherent risks of coal mining, including those that are beyond our control;

•changes in, interpretations of, or implementations of domestic or international tax or other laws and regulations, including the Inflation Reduction Act of 2022 and its related regulations;

•our relationships with, and other conditions affecting, our customers, including the inability to collect payments from our customers if their creditworthiness declines;

•our indebtedness as we may incur it from time to time;

•reclamation and mine closure obligations; and

•our assumptions concerning economically recoverable coal reserve estimates.

The list of factors identified above is not exhaustive. We caution readers not to place undue reliance on any forward looking statements, which are based on information currently available to us and speak only as of the dates on which they are made. When considering these forward-looking statements, you should keep in mind the cautionary statements in this report. We do not undertake any responsibility to publicly revise these forward-looking statements to take into account events or circumstances that occur after the date of this report. Additionally, except as expressly required by federal securities laws, we do not undertake any responsibility to update you on the occurrence of any unanticipated events, which may cause actual results to differ from those expressed or implied by the forward-looking statements contained in this report.

Part I

Item 1. Business

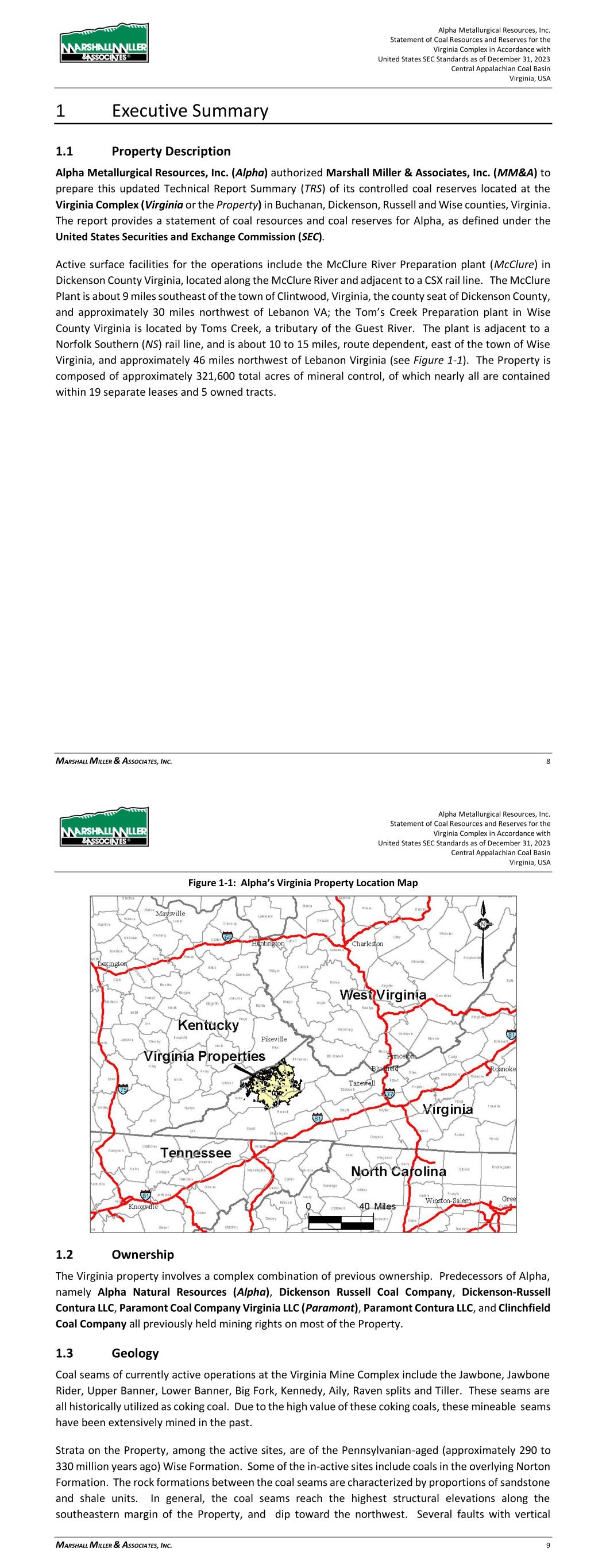

Unless otherwise indicated or the context otherwise requires, references in this “Item 1. Business” section to “the combined company,” “we,” “us” and other similar terms refer to Alpha Metallurgical Resources, Inc. and its consolidated subsidiaries (previously Contura Energy, Inc. and its consolidated subsidiaries). Disclosures in this “Item 1. Business” section should be read in conjunction with “Item 1A. Risk Factors” for further discussion of factors impacting our business. Effective February 1, 2021, we changed our corporate name from Contura Energy, Inc. to Alpha Metallurgical Resources, Inc. to more accurately reflect our strategic focus on the production of metallurgical coal. Following the effectiveness of our name change, our ticker symbol on the New York Stock Exchange changed from “CTRA” to “AMR” effective on February 4, 2021.

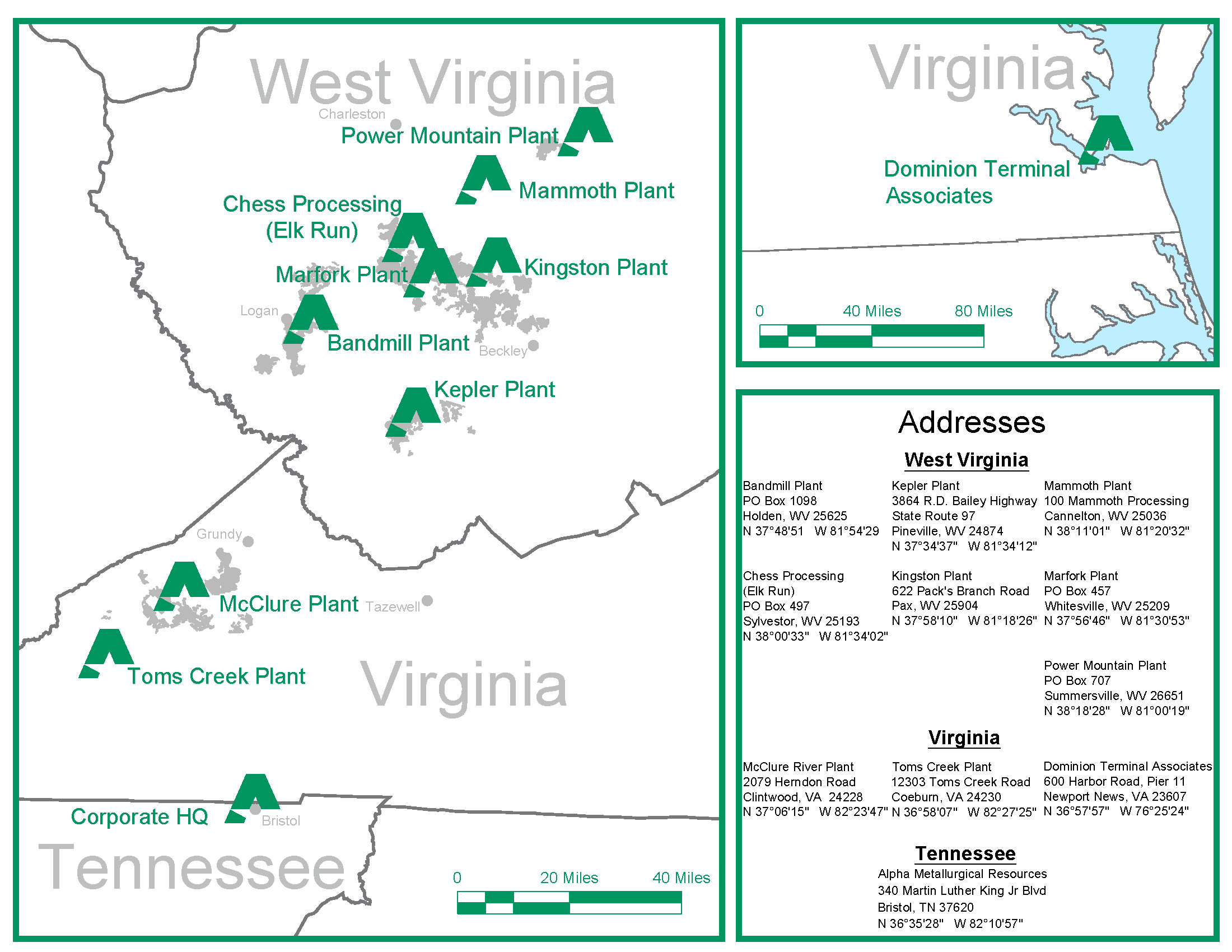

Our Company

We are a Tennessee-based mining company with operations in Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, we reliably supply metallurgical coal products to the steel industry. We operate highly productive, cost-competitive coal mines across the CAPP coal basin. Our portfolio of mining operations consists of 15 underground mines, seven surface mines and nine coal preparation plants. We own a 65.0% interest in Dominion Terminal Associates (“DTA”), a coal export terminal in Newport News, Virginia. DTA provides us with the ability to fulfill a broad range of customer coal quality requirements through coal blending, while also providing storage capacity and transportation flexibility.

We predominantly produce metallurgical (“met”) coal, which is shipped to domestic and international steel and coke producers. Although our strategic focus is on the production of met coal, we also produce thermal coal as byproduct and it is primarily sold to large utilities and industrial customers both in the United States and across the world. Refer to Notes 22 and 23 to the Consolidated Financial Statements for geographical information about our coal sales and additional segment information.

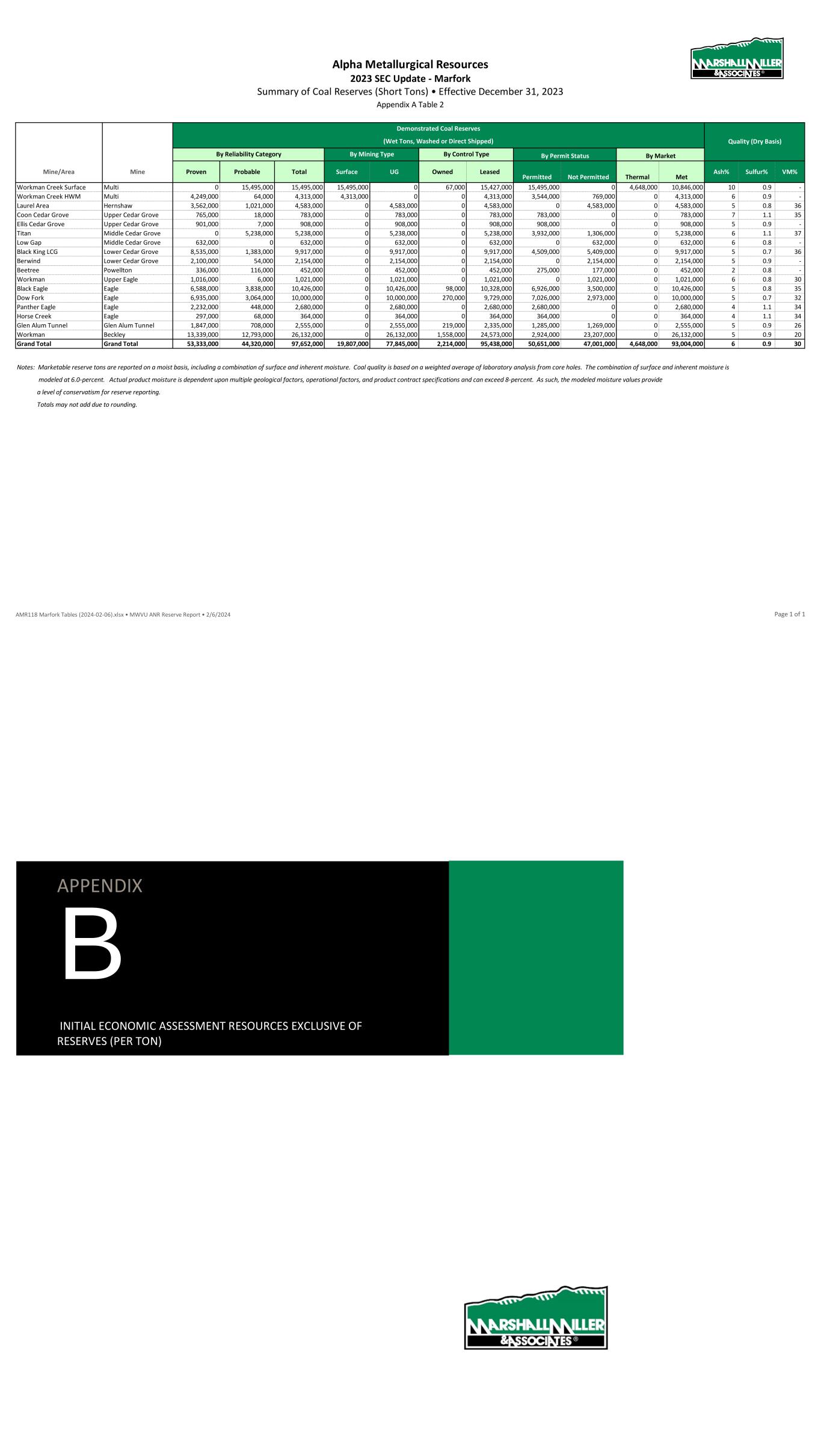

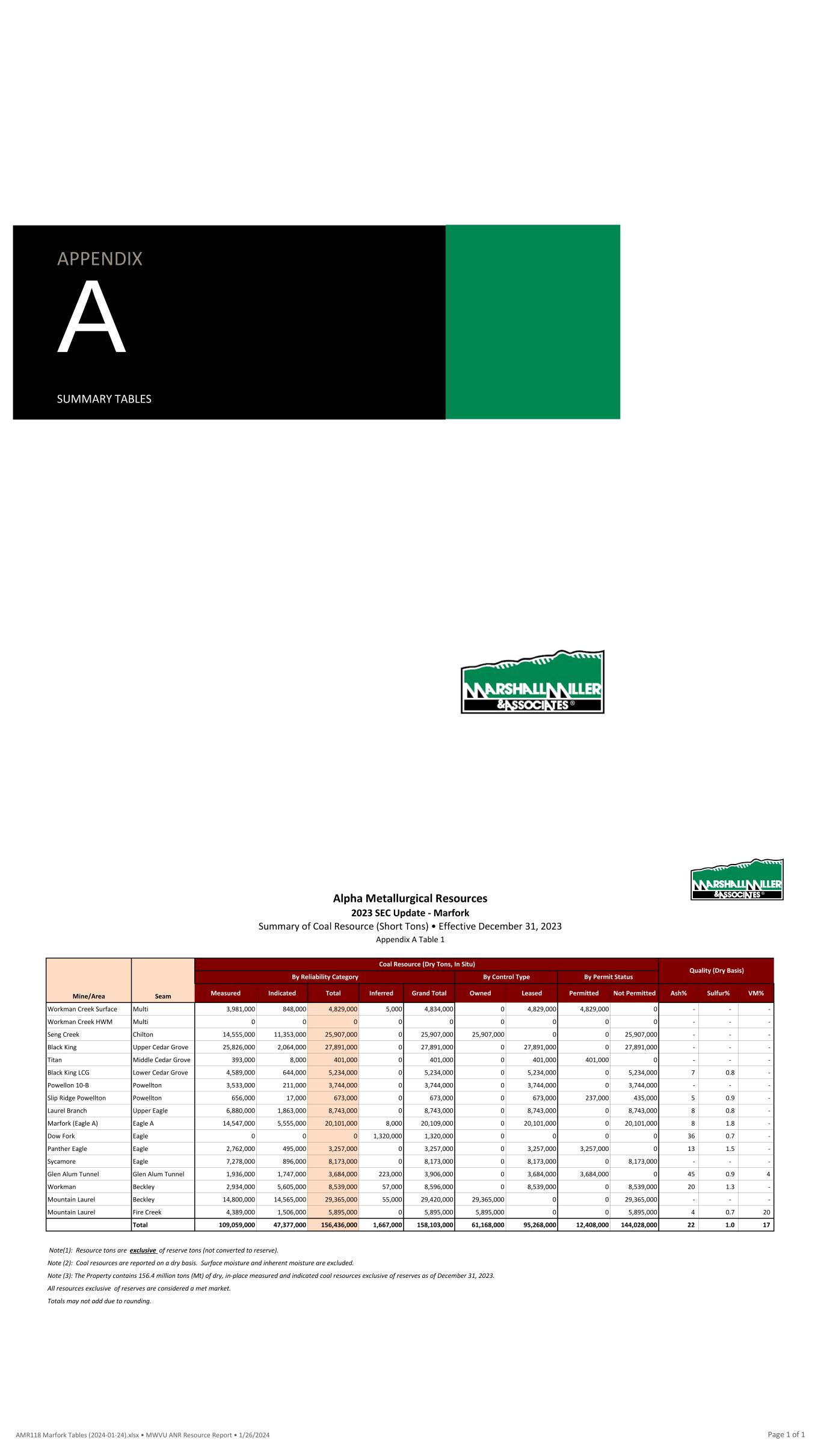

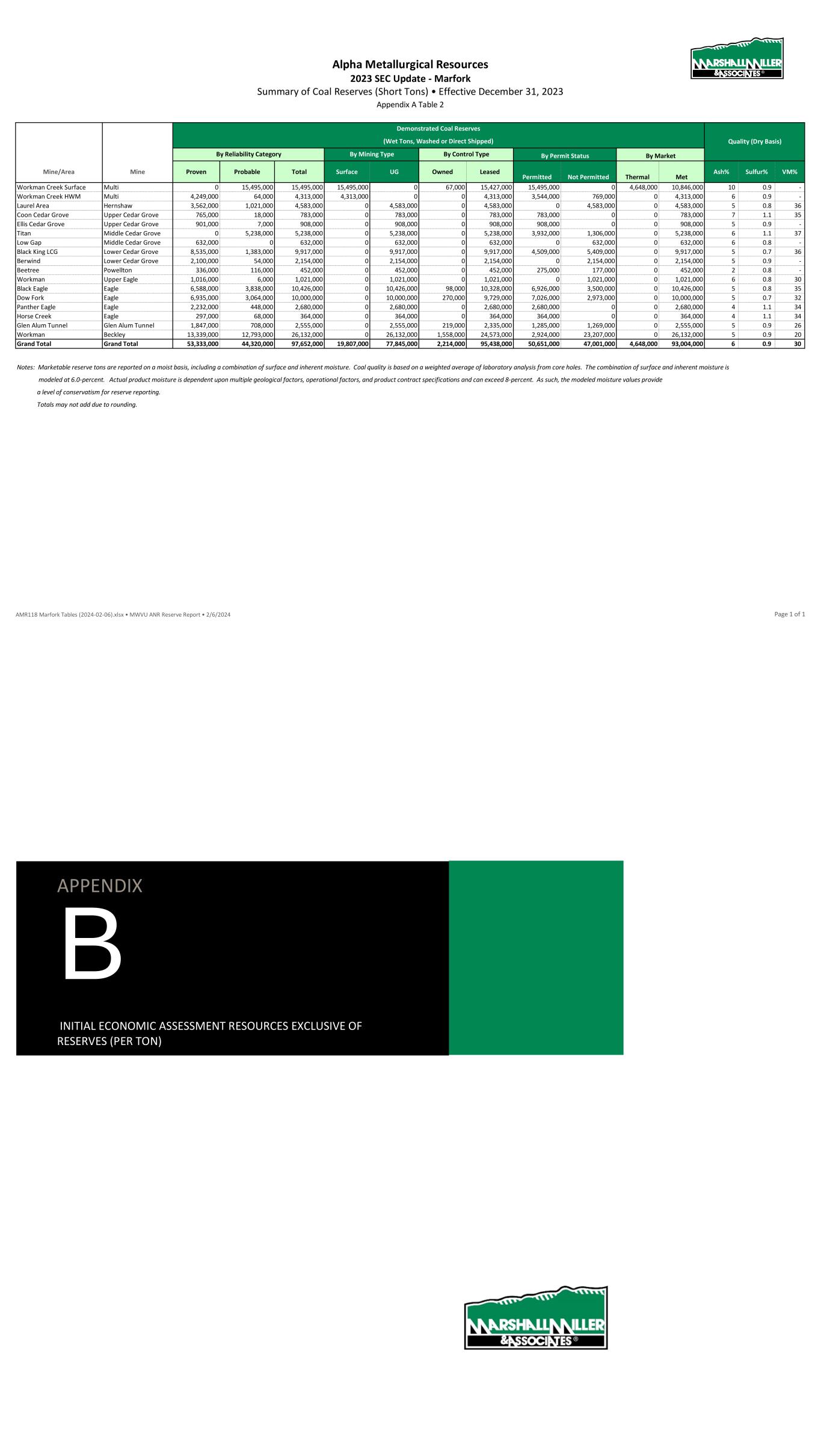

We have a substantial reserve base of 316.0 million tons of proven and probable reserves as of December 31, 2023. Our reserve base consists of 303.0 million tons of proven and probable metallurgical reserves, and 12.9 million tons of proven and probable thermal reserves.

Through our operations across the CAPP coal basin in Virginia and West Virginia, we are able to source coal from multiple mines to meet the needs of a long-standing global customer base, many of which have been served by us or our predecessors for decades. We are continuously evaluating opportunities to strategically cultivate current relationships to drive new business in our target growth markets. In addition, our experienced management team regularly analyzes potential acquisitions, joint ventures and other opportunities that would be accretive and synergistic to our existing asset portfolio.

Other Business Developments

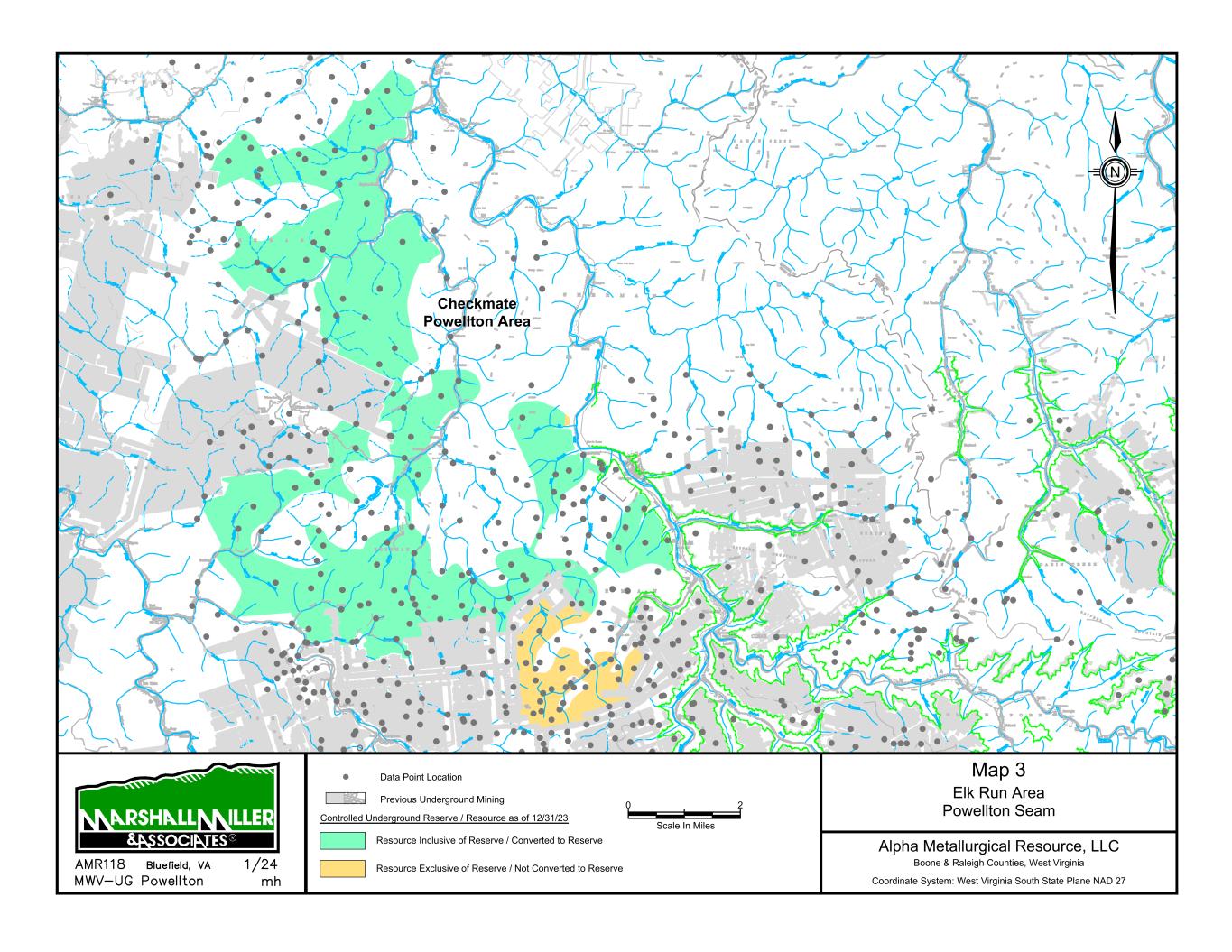

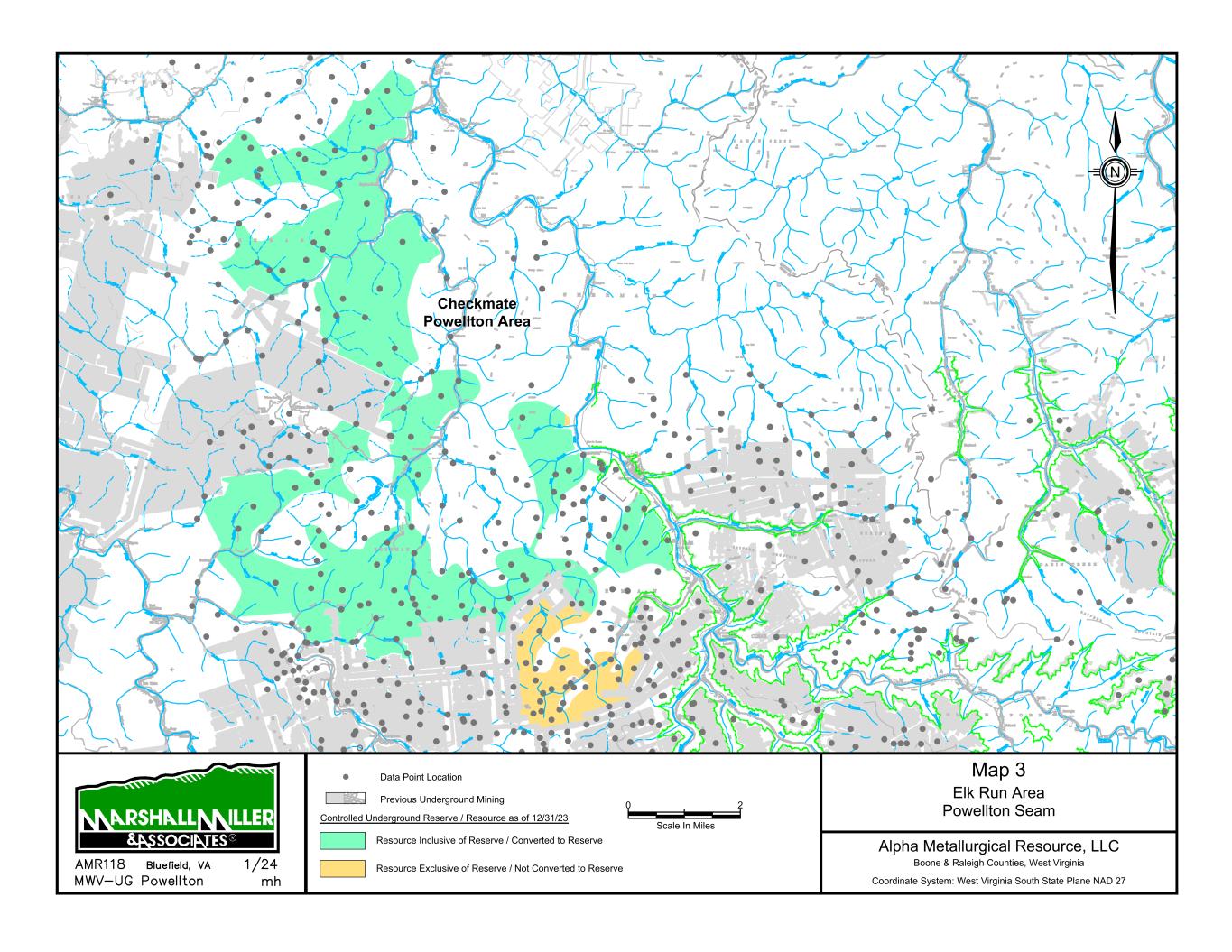

During 2023, development was completed and production began at our Rolling Thunder and Checkmate Powellton mines within our Power Mountain and Elk Run mining complexes, respectively, which produce High-Vol. B quality met coal from the Powellton coal seam.

In August 2023, we completed our transition to a pure-play metallurgical producer with the closure of Slabcamp, which was our last remaining thermal mine.

Our History

We were formed in 2016 to acquire and operate certain of Alpha Natural Resources, Inc.’s former core coal operations, as part of the Alpha Natural Resources, Inc. Plan of Reorganization. We entered into various settlement agreements with the Debtors, their bankruptcy successor, and third parties as part of the Debtors’ bankruptcy reorganization process. We assumed acquisition-related obligations through those settlement agreements, which became effective on July 26, 2016, the effective date of the Debtors’ Plan of Reorganization. As of December 31, 2023, we did not have any remaining acquisition-related obligations. Refer to Note 14 to the Consolidated Financial Statements for further information on our acquisition-related obligations.

On December 8, 2017, we closed a transaction with Blackjewel to sell our Western Mines located in the PRB, Wyoming, along with related coal reserves, equipment, infrastructure and other real properties. On October 4, 2019, we closed on the ESM Transaction in connection with Blackjewel’s subsequent bankruptcy filing.

On May 29, 2020, certain of our subsidiaries (Contura Coal West, LLC and Contura Wyoming Land, LLC), one of which held the mining permits for the Western Mines, were merged with certain subsidiaries of ESM to become wholly-owned subsidiaries of ESM and to complete the permit transfer process in connection with the ESM Transaction.

On November 9, 2018, we merged with Alpha Natural Resources Holdings, Inc. and ANR, Inc. Upon the consummation of the transactions contemplated by a definitive merger agreement (the “Merger Agreement”), our common stock began trading on the New York Stock Exchange under the ticker “CTRA.” Previously, our shares traded on the OTC market under the ticker “CNTE.”

On December 10, 2020, we closed on a transaction with Iron Senergy Holdings, LLC, to sell our thermal coal mining operations located in Pennsylvania consisting primarily of our Cumberland mining complex and related property (our former NAPP operations). This transaction accelerated our strategic exit from thermal coal production to shift our focus to met coal production.

Effective February 1, 2021, we changed our corporate name from Contura Energy, Inc. to Alpha Metallurgical Resources, Inc. to more accurately reflect our strategic focus on the production of met coal. Following the effectiveness of our name change, our ticker symbol on the New York Stock Exchange changed from “CTRA” to “AMR” effective on February 4, 2021.

Our Mining Operations and Properties

The following table provides a summary of information regarding our active mining complexes as of December 31, 2023 (see also “Item 2. Properties” for further information):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Amounts in thousands, except for mine data) |

|

|

|

|

|

Tons Sold (4) |

|

|

|

|

| Mining Complex |

|

Location |

|

Acquired |

|

Mines (1) |

|

Equipment (2) |

|

Rail (3) |

|

2023 |

|

2022 |

|

2021 |

|

Carrying Value (5) |

|

Reserves (6) |

| Aracoma |

|

WV |

|

2018 |

|

3 |

|

CM |

|

CSX |

|

2,607 |

|

|

2,643 |

|

|

2,221 |

|

|

$ |

174,652 |

|

|

41,276 |

|

| Kepler |

|

WV |

|

2018 |

|

1 |

|

CM |

|

CSX/NS |

|

1,958 |

|

|

1,897 |

|

|

1,571 |

|

|

$ |

235,203 |

|

|

41,190 |

|

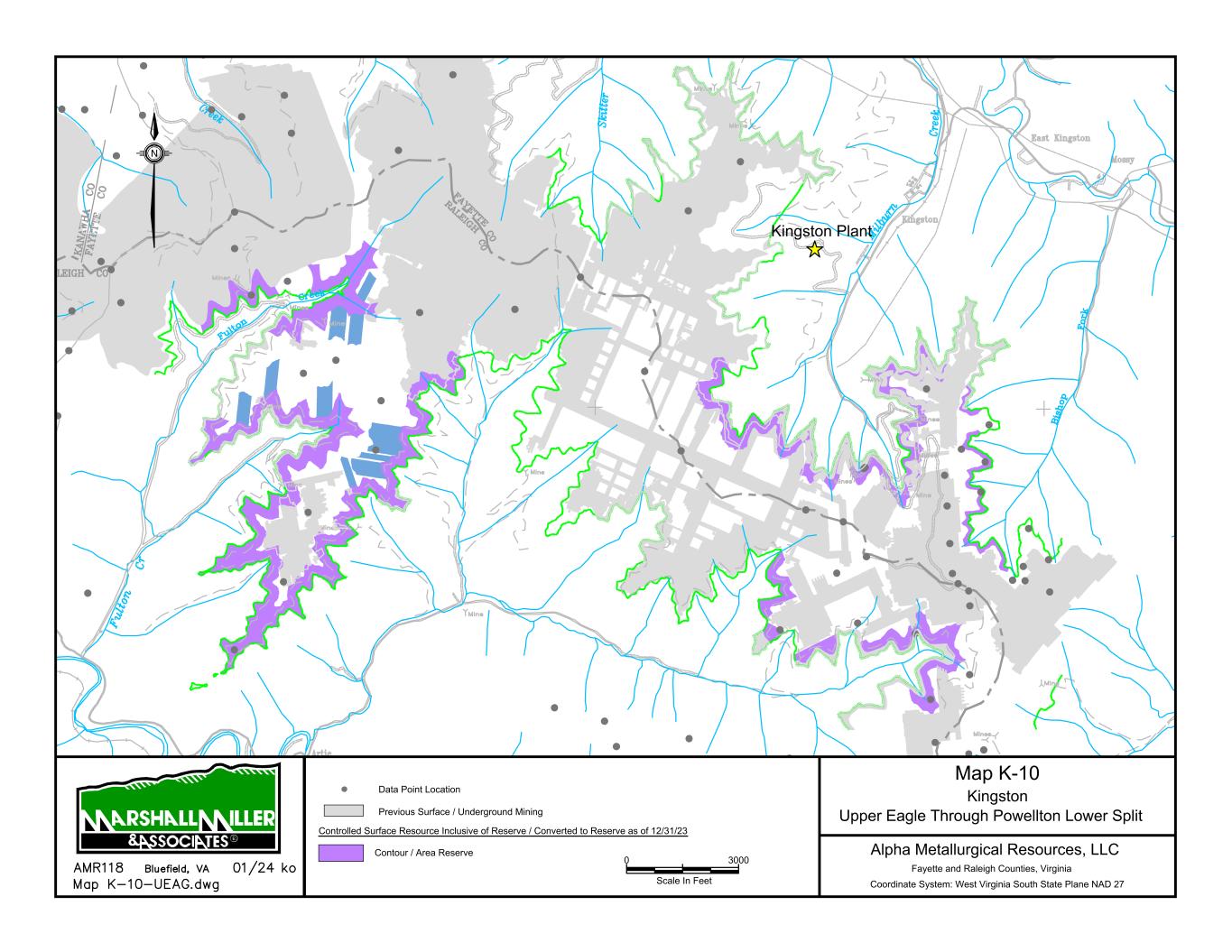

| Kingston |

|

WV |

|

2018 |

|

4 |

|

CM/S/H |

|

CSX |

|

2,254 |

|

|

1,935 |

|

|

2,348 |

|

|

$ |

34,208 |

|

|

38,657 |

|

| Marfork |

|

WV |

|

2018 |

|

6 |

|

CM/S/H |

|

CSX |

|

4,345 |

|

|

4,106 |

|

|

4,032 |

|

|

$ |

322,733 |

|

|

97,653 |

|

| McClure/Toms Creek |

|

VA |

|

2016 |

|

5 |

|

CM/S/H |

|

CSX/NS |

|

4,071 |

|

|

3,703 |

|

|

4,033 |

|

|

$ |

114,530 |

|

|

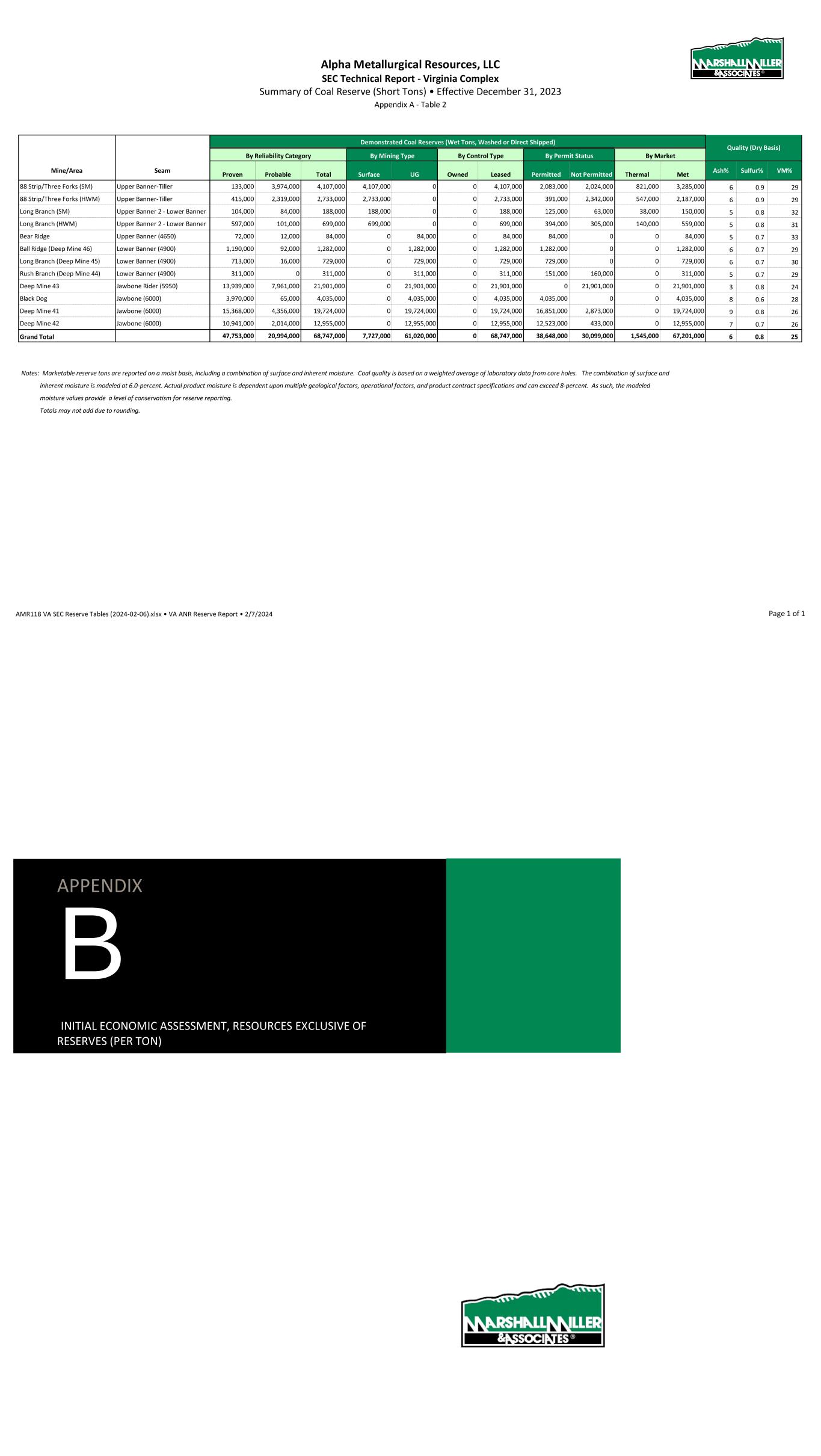

68,747 |

|

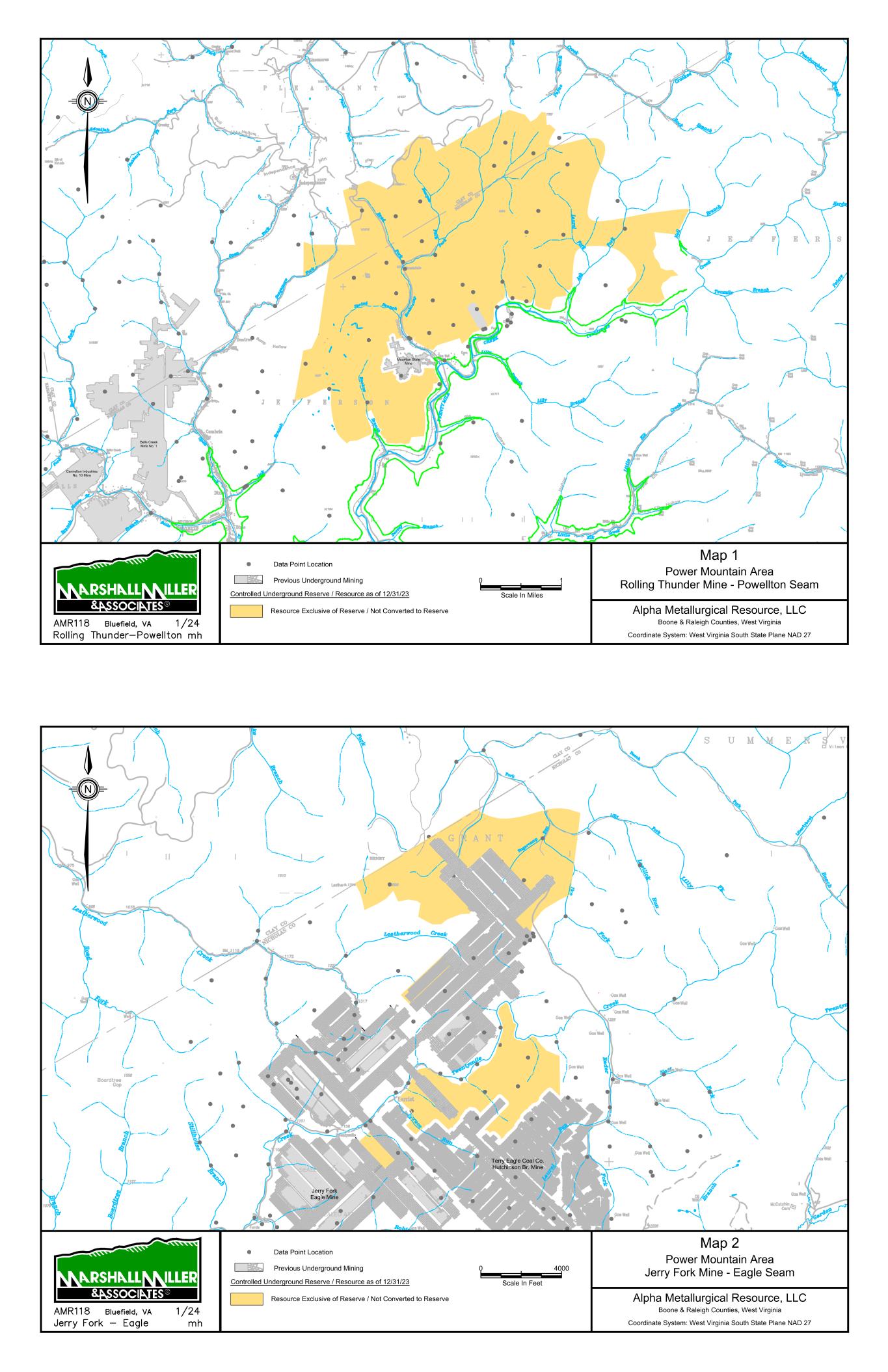

| Power Mountain |

|

WV |

|

2016 |

|

2 |

|

CM |

|

NS |

|

718 |

|

|

832 |

|

|

837 |

|

|

$ |

70,594 |

|

|

— |

|

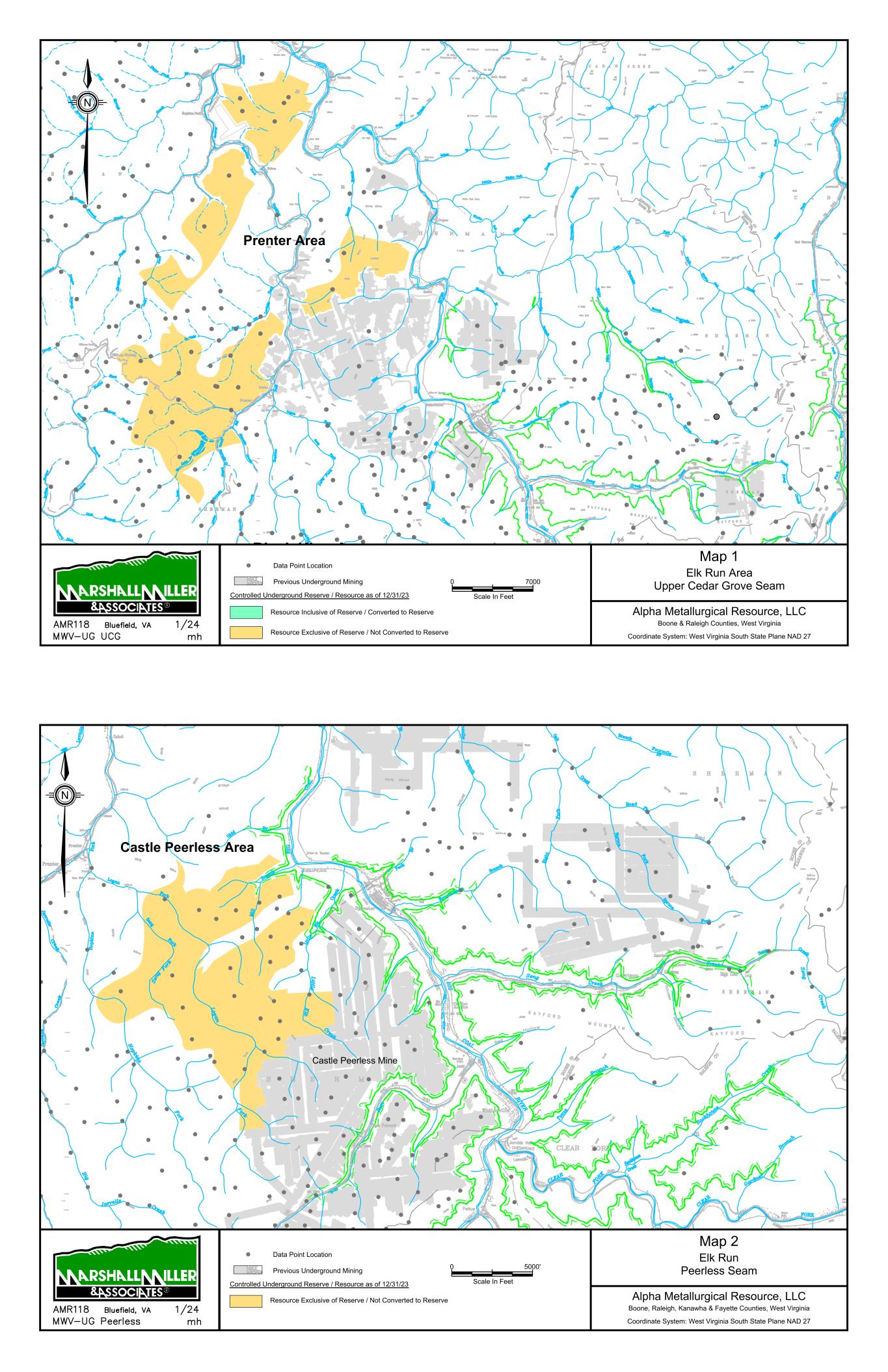

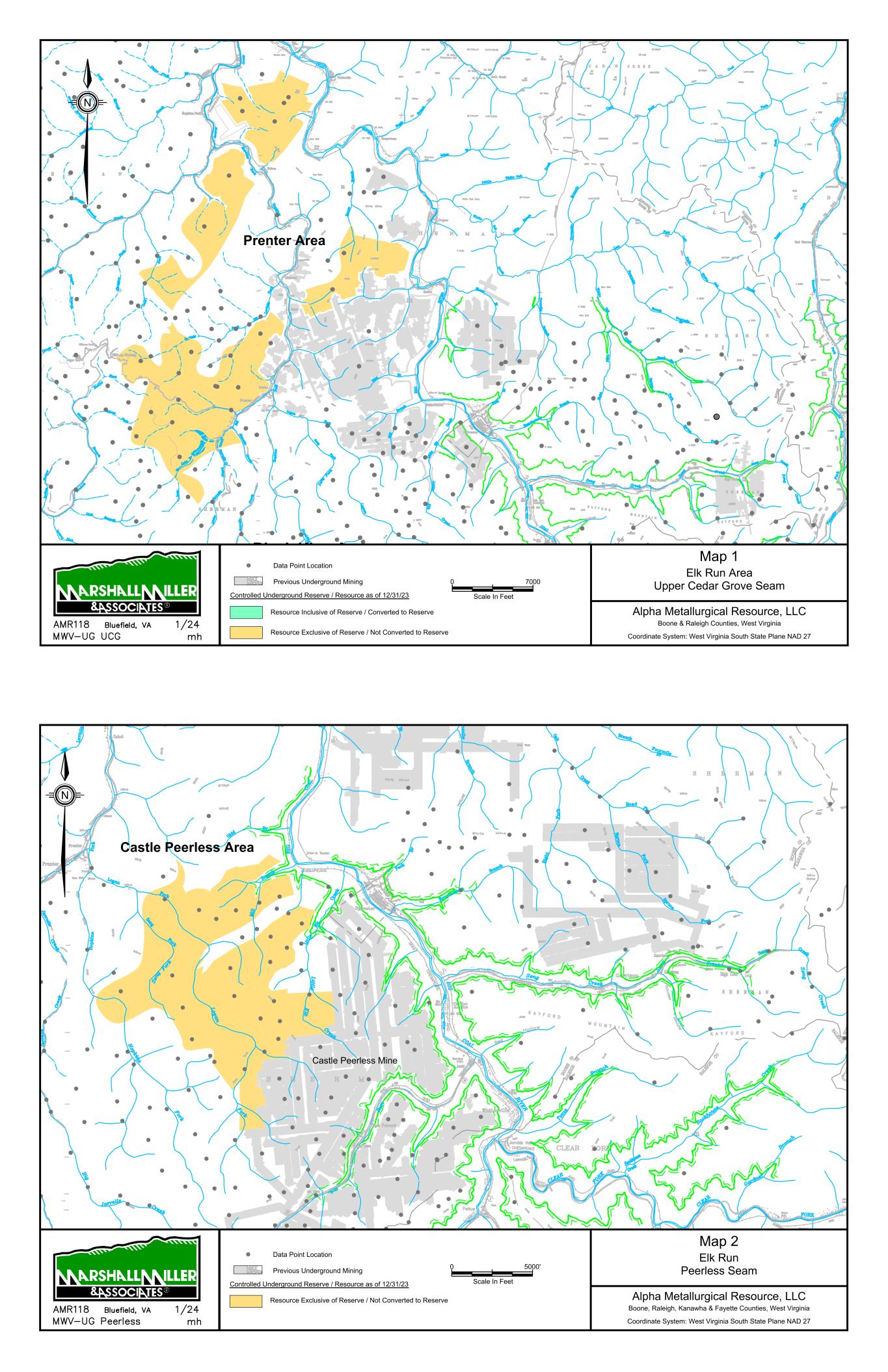

| Elk Run |

|

WV |

|

2018 |

|

1 |

|

CM |

|

CSX |

|

— |

|

|

— |

|

|

— |

|

|

$ |

35,535 |

|

|

28,434 |

|

(1) Number of active mines as of December 31, 2023.

(2) Equipment: S = Shovel/Excavator/Loader/Trucks; CM = Continuous Miner; H = Highwall Miner

(3) CSX = CSX Transportation; NS = Norfolk Southern Railway Company

(4) Tons of coal purchased from third parties and not processed are not included.

(5) Net book value of property, plant and equipment and owned and leased mineral rights as of December 31, 2023.

(6) Proven and probable reserves as of December 31, 2023. Refer to Item 2. Properties for further information. Feasibility/Pre-feasibility study not considered cost beneficial for Power Mountain complex.

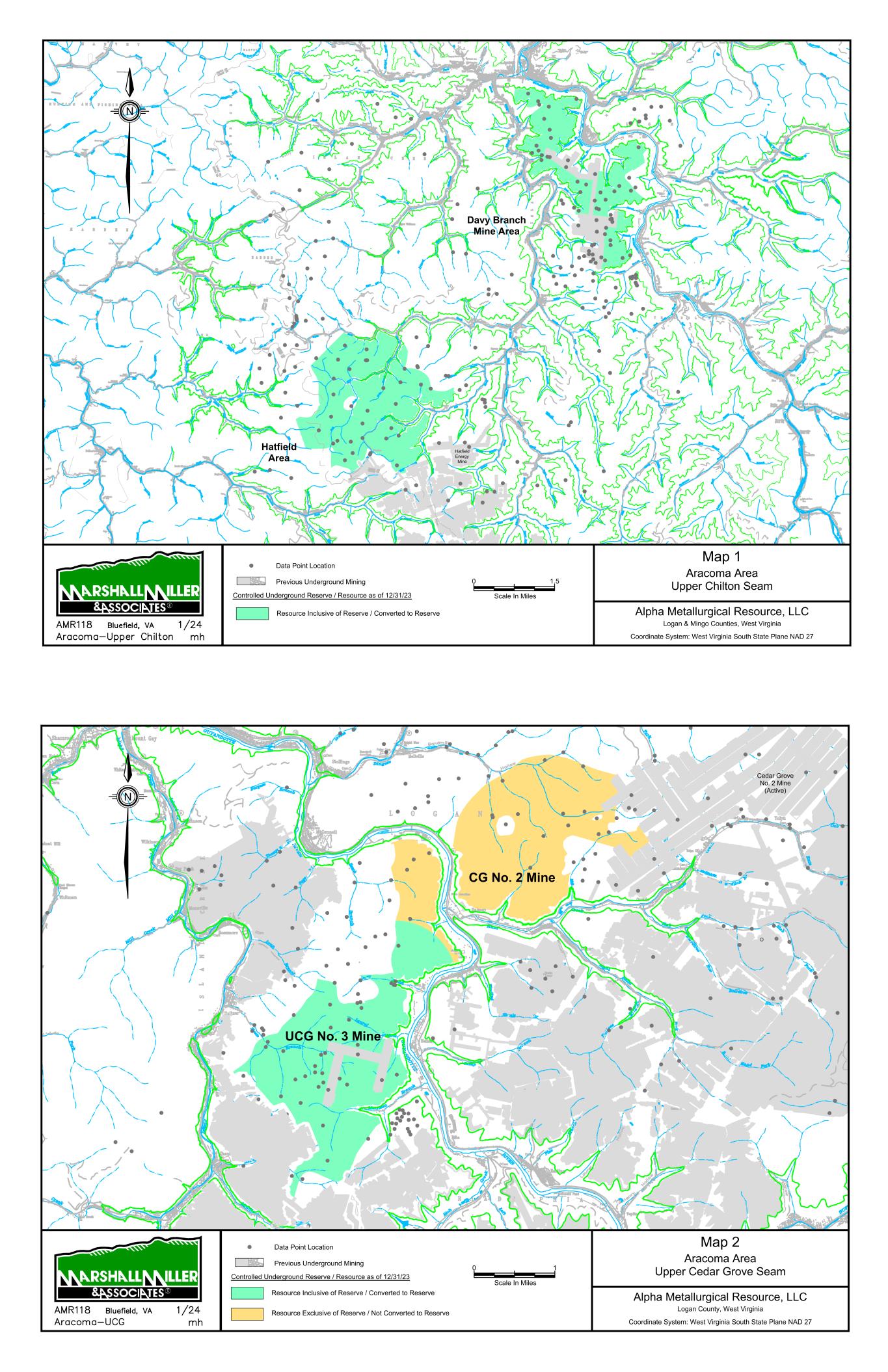

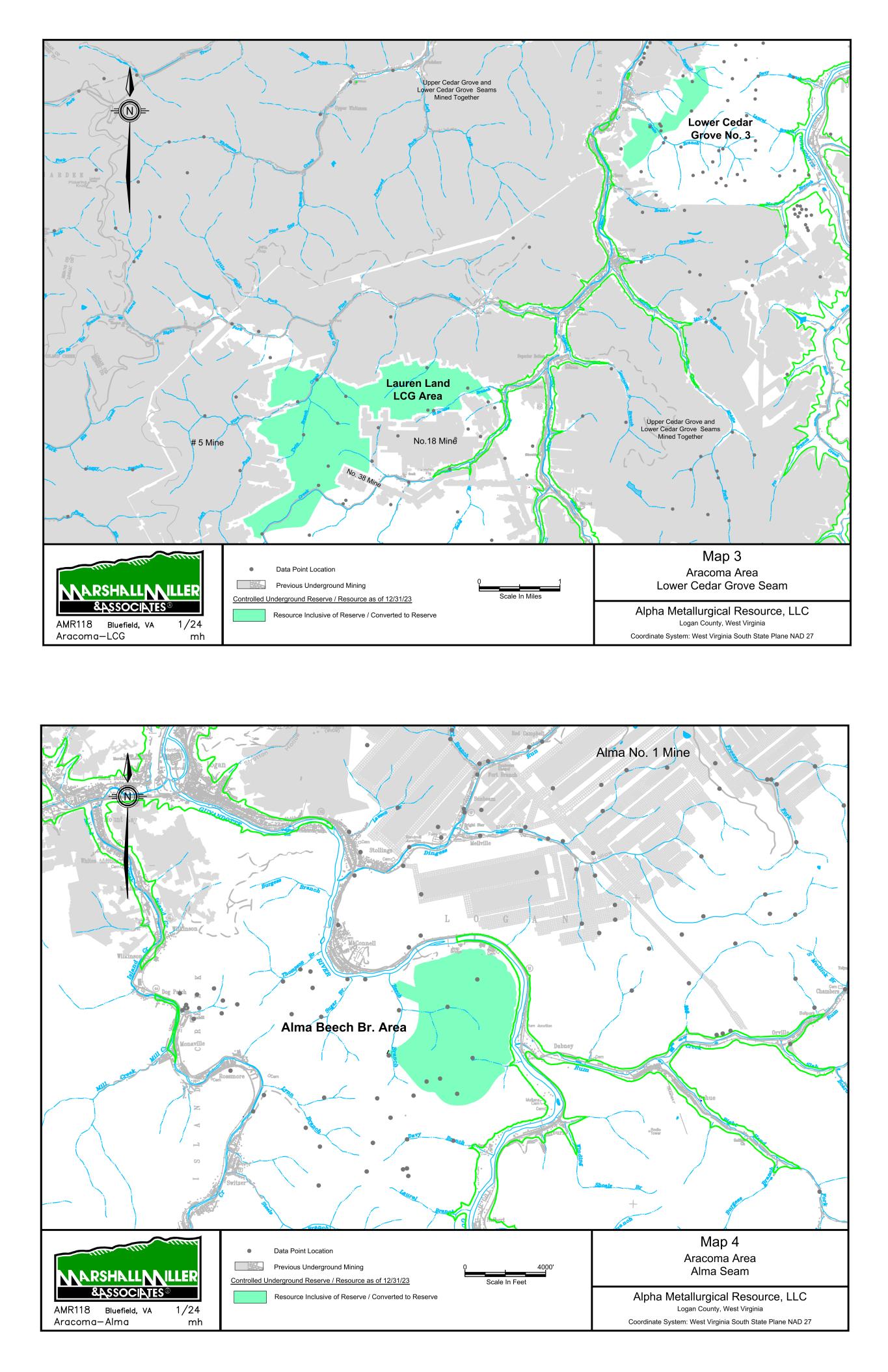

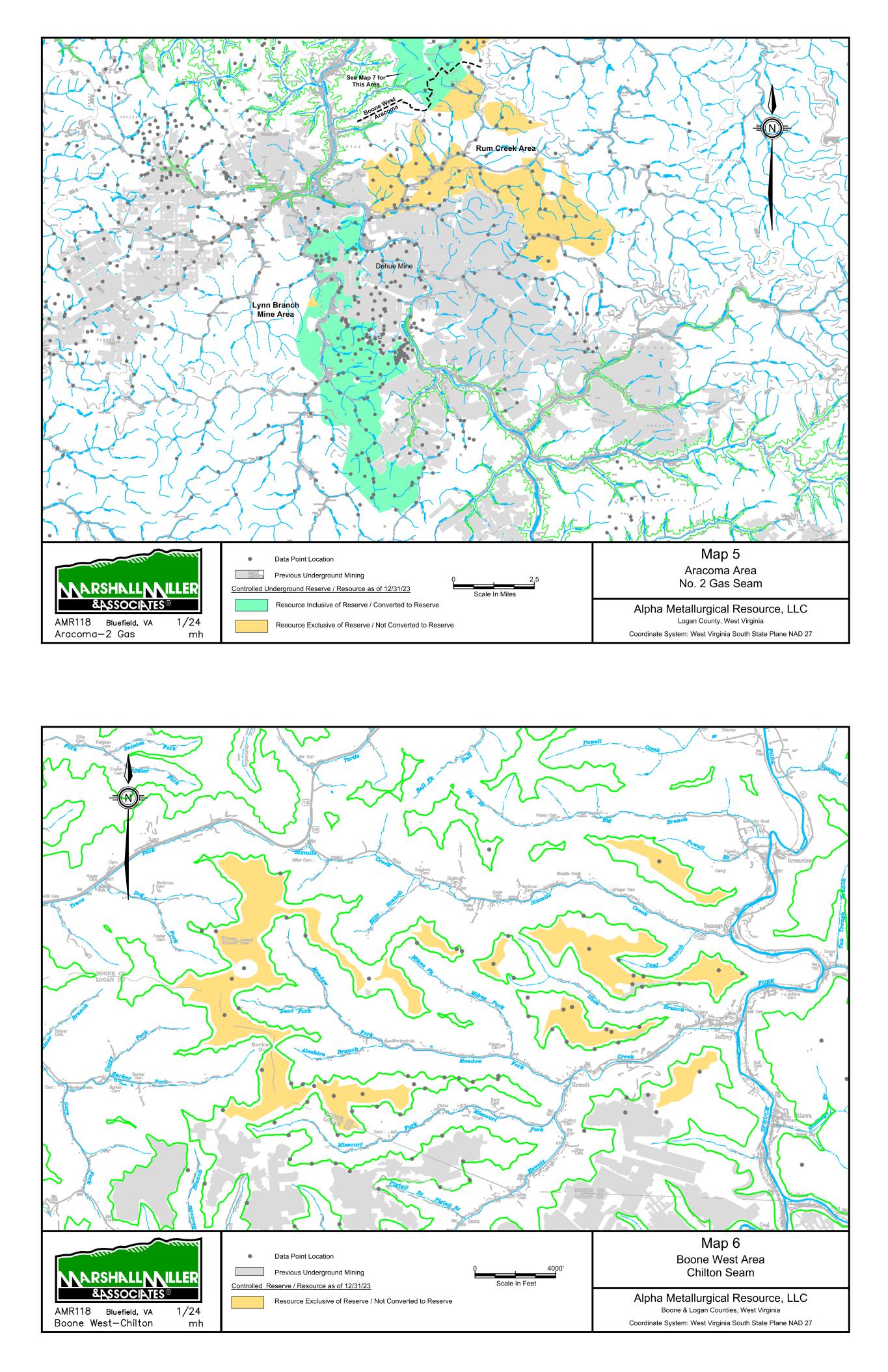

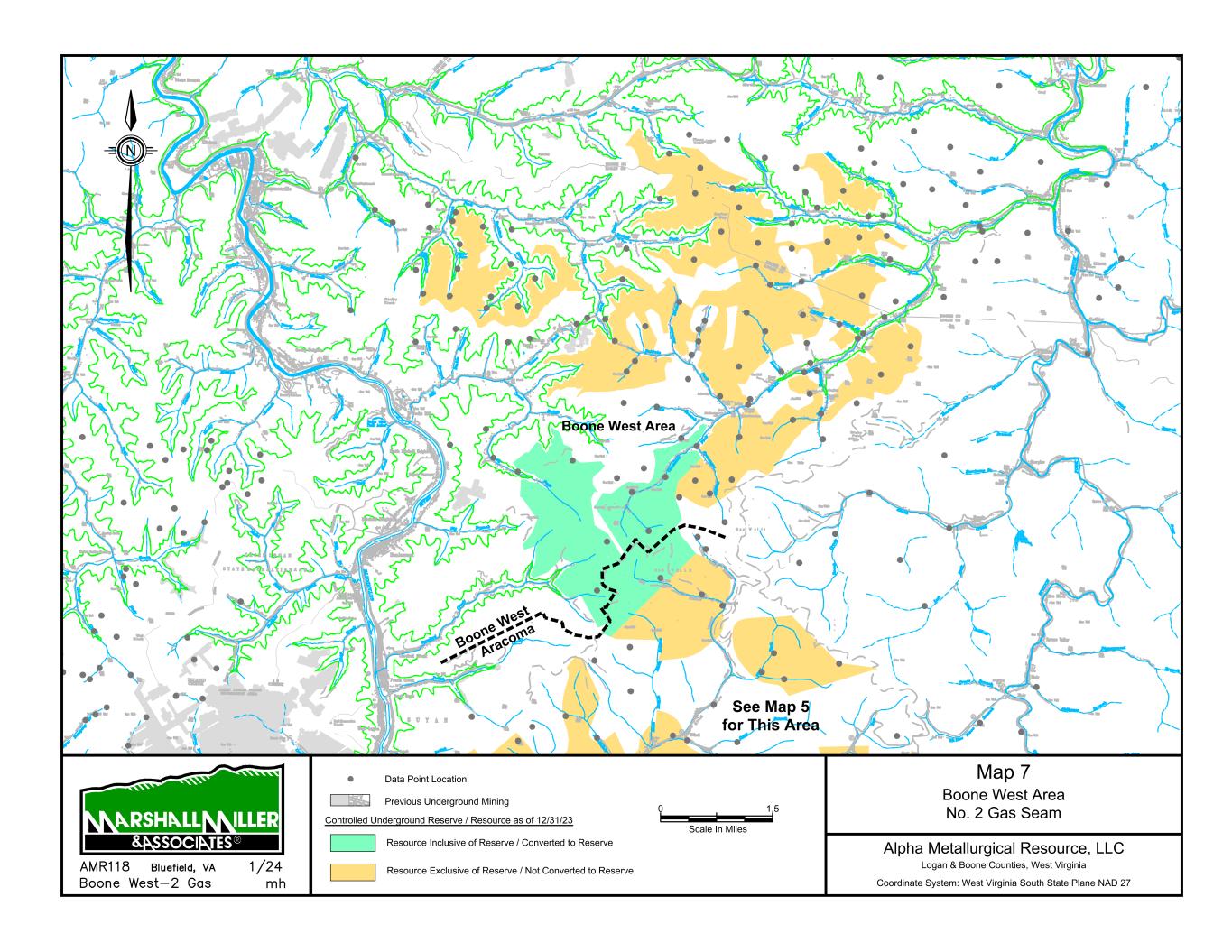

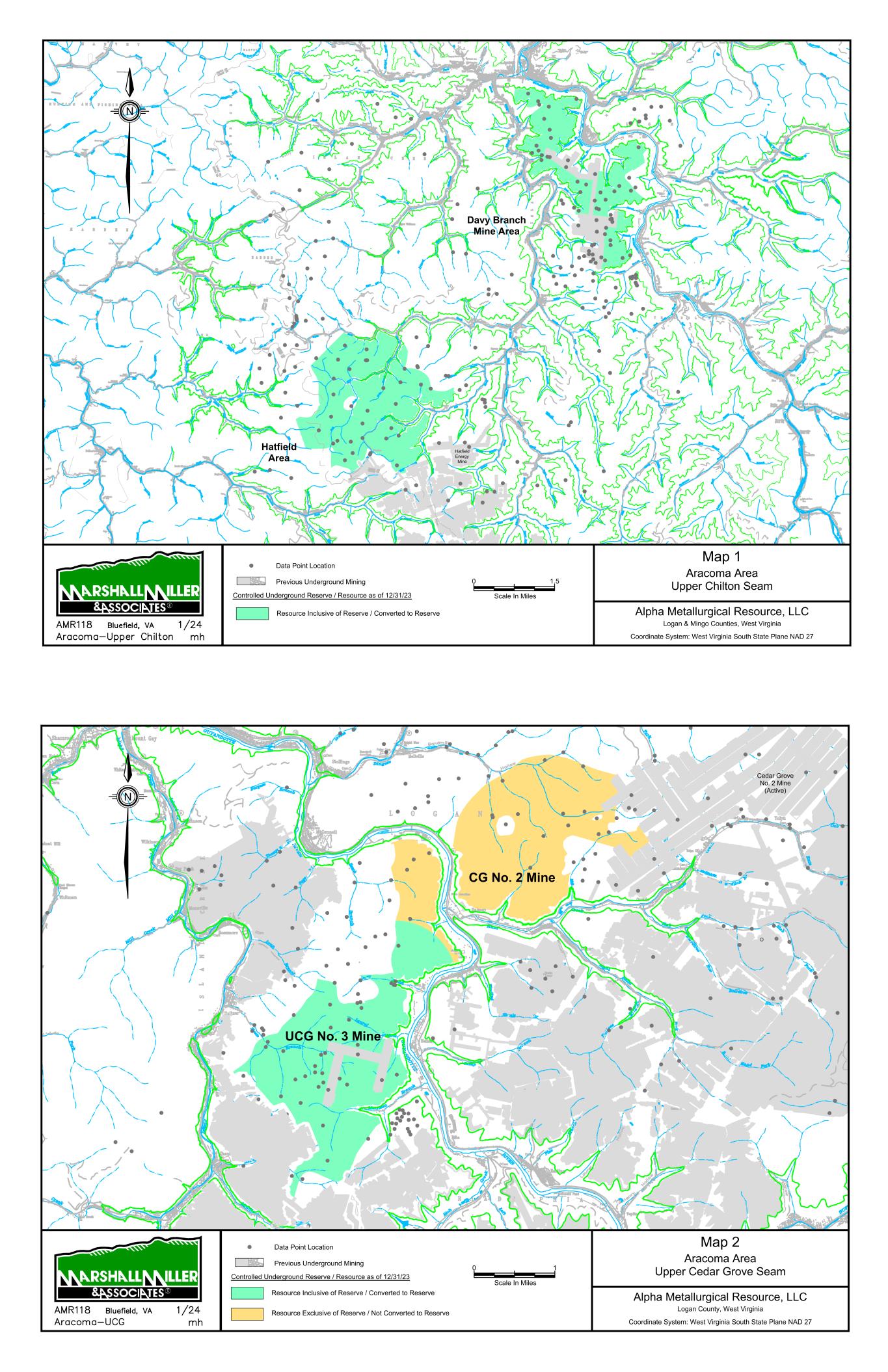

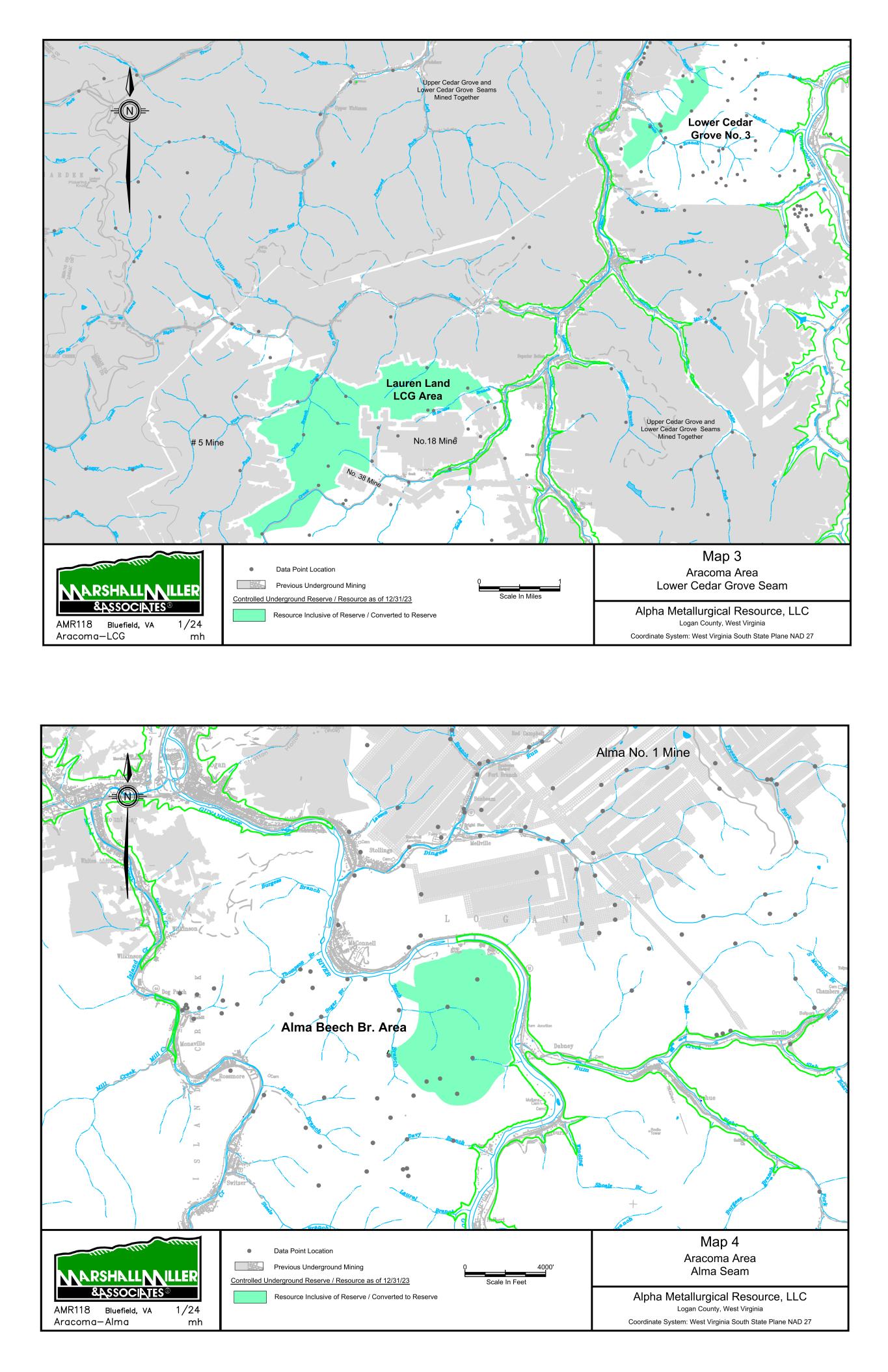

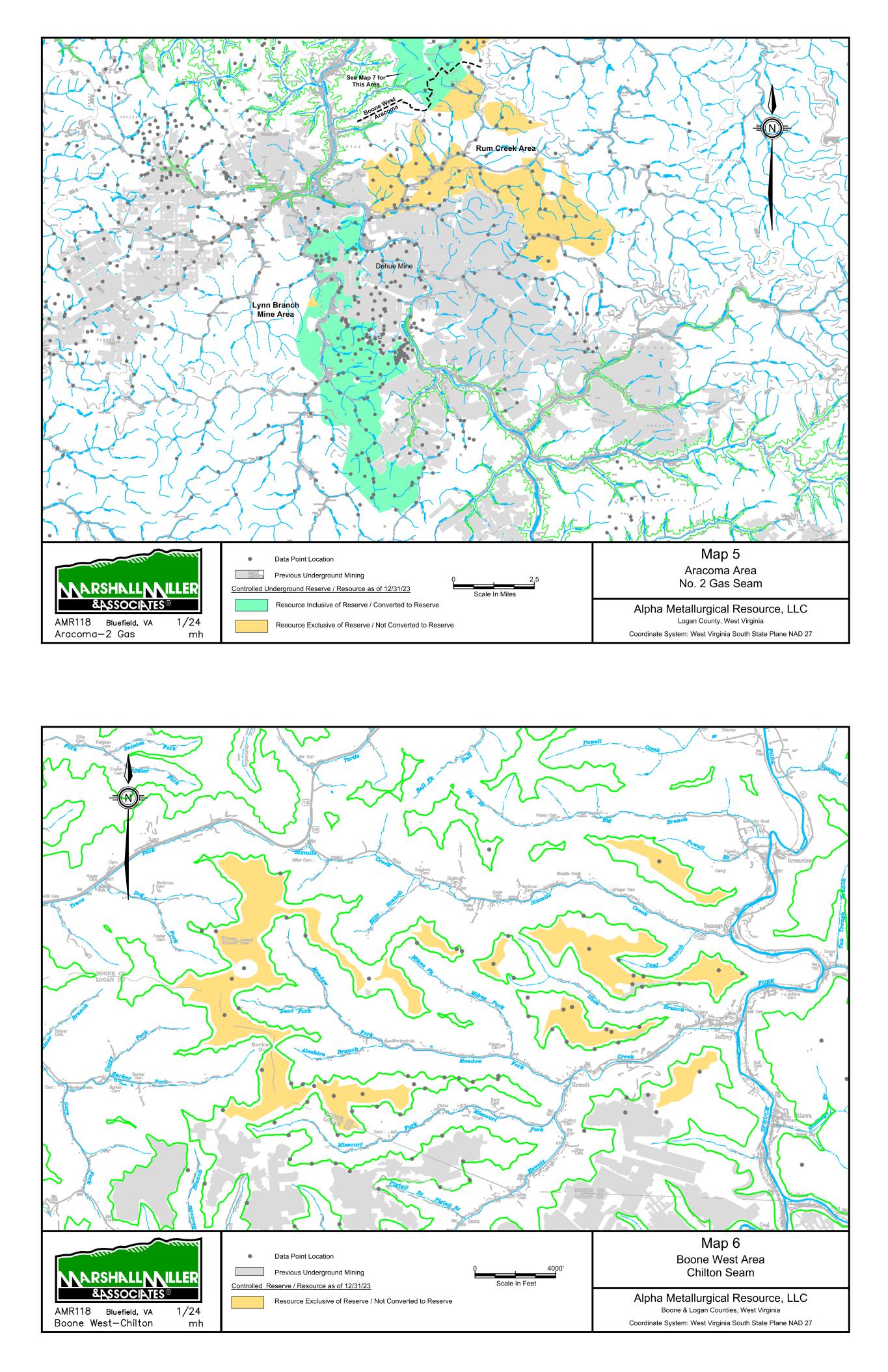

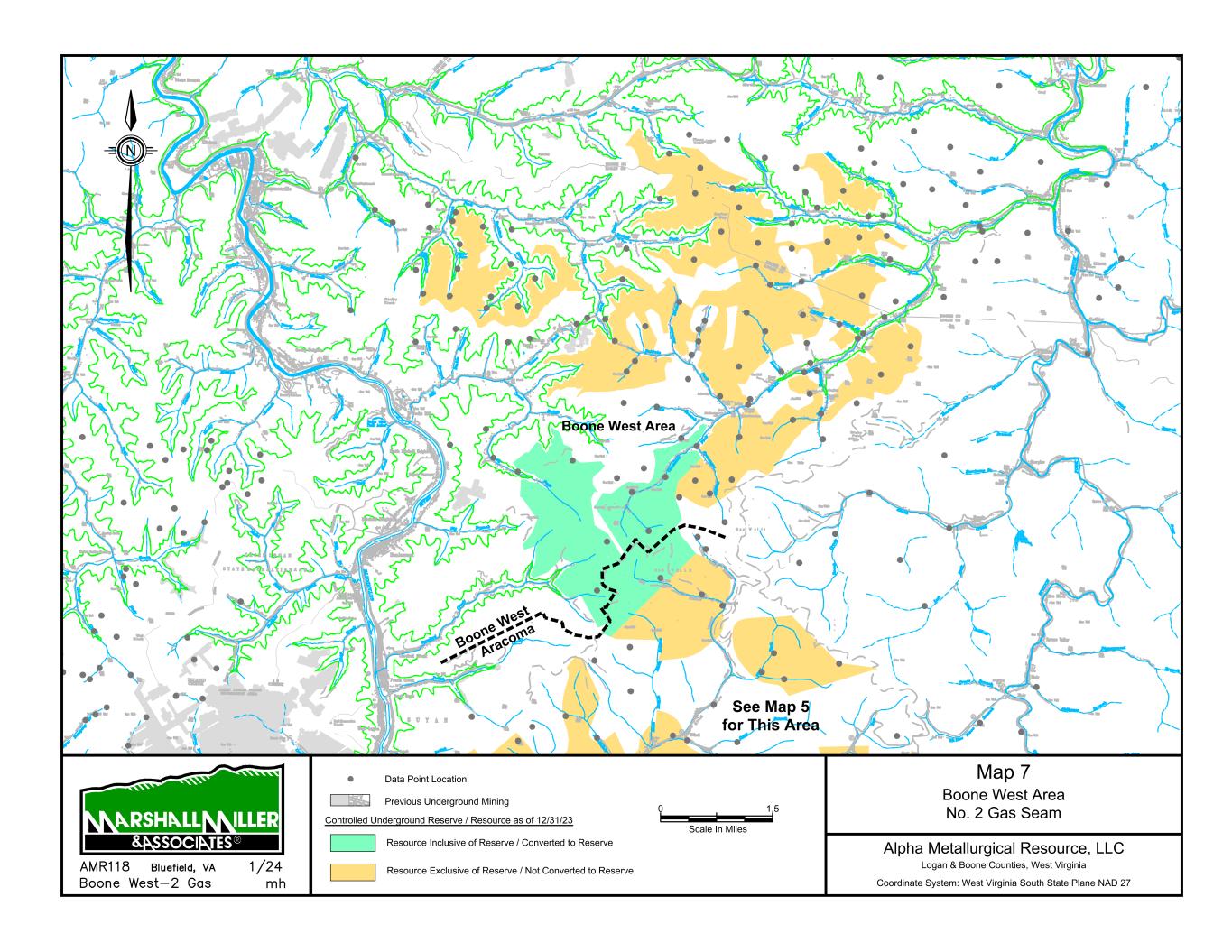

Aracoma – Aracoma is a mining complex located in Logan, Mingo, and Boone counties, West Virginia. The complex has three active underground mines which produce primarily High-Vol. B quality met coal from the Upper Chilton, Upper Cedar Grove, and No. 2 Gas coal seams. Mine lives range from 5 to 16 years. Coal is processed at the Bandmill Preparation Plant and loaded onto CSX rail for delivery to customers.

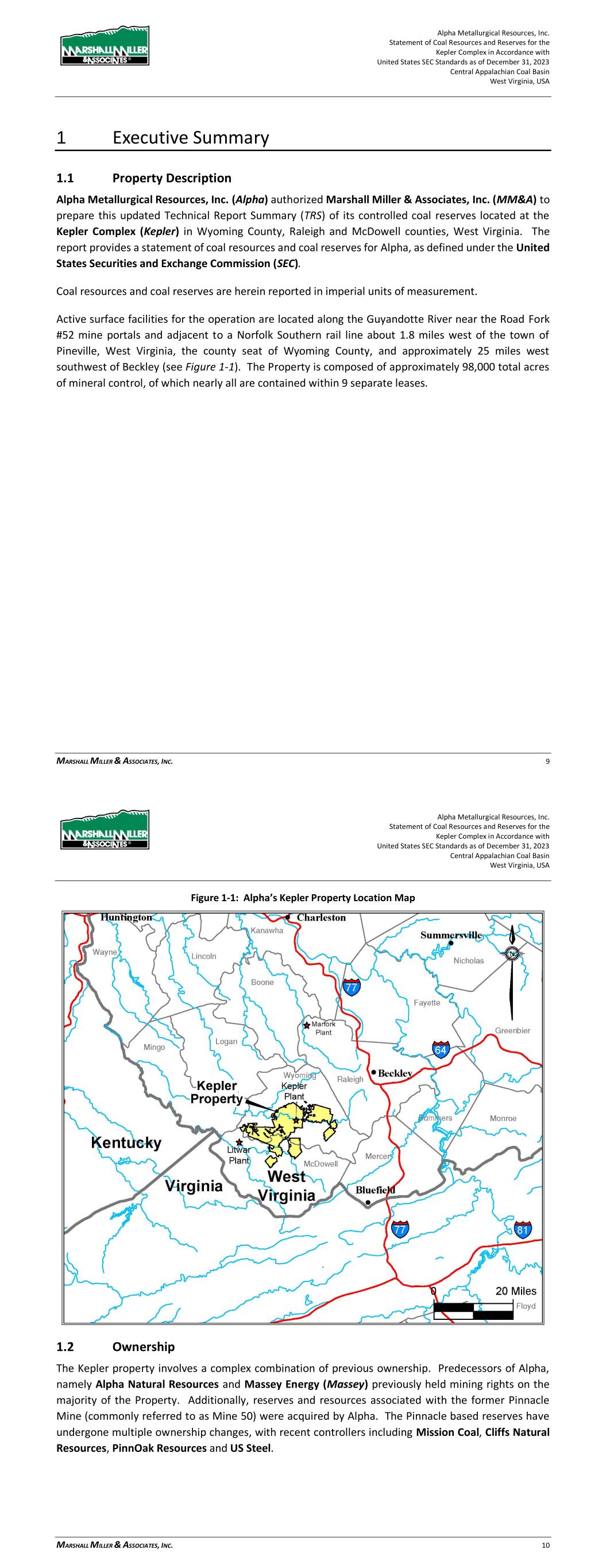

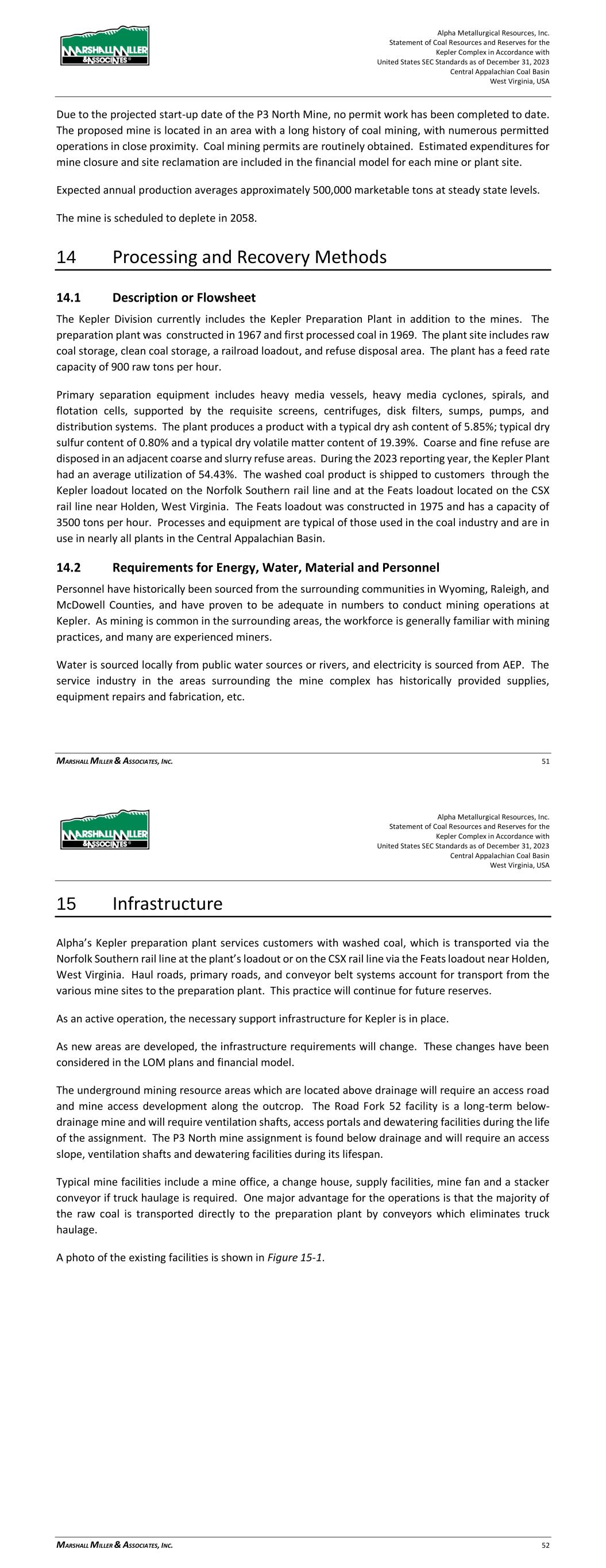

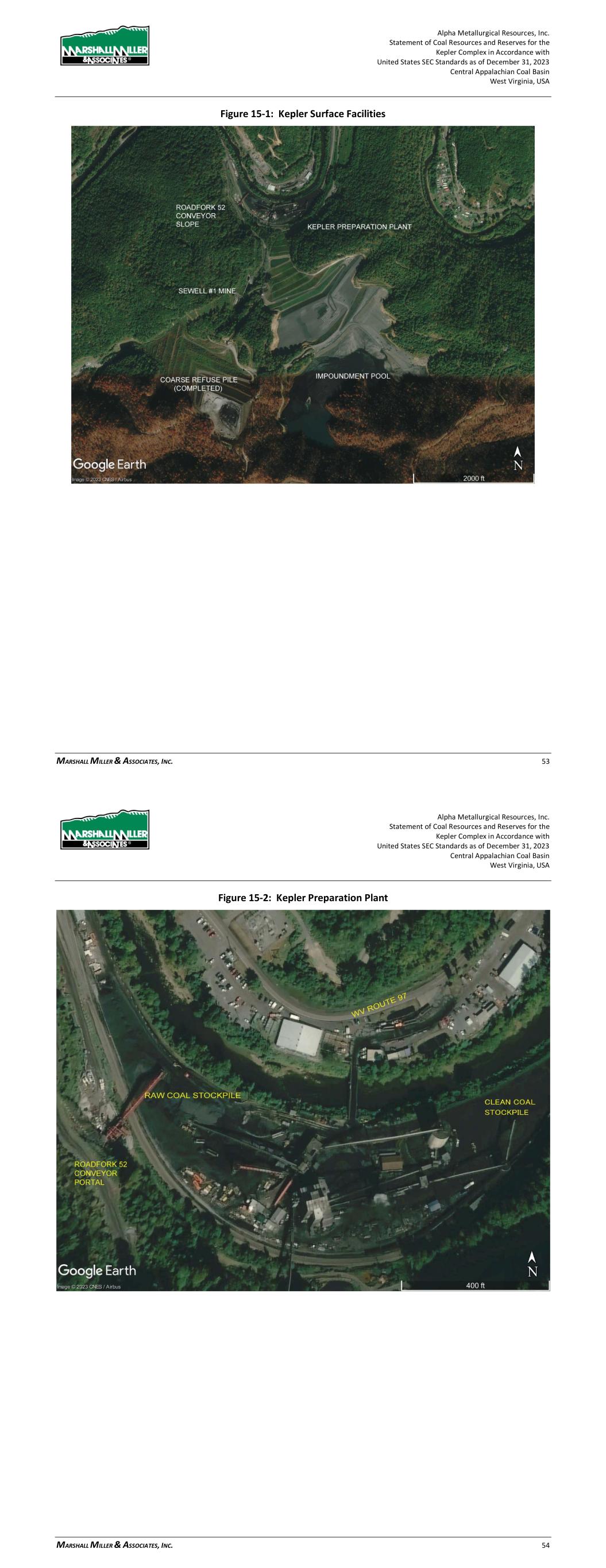

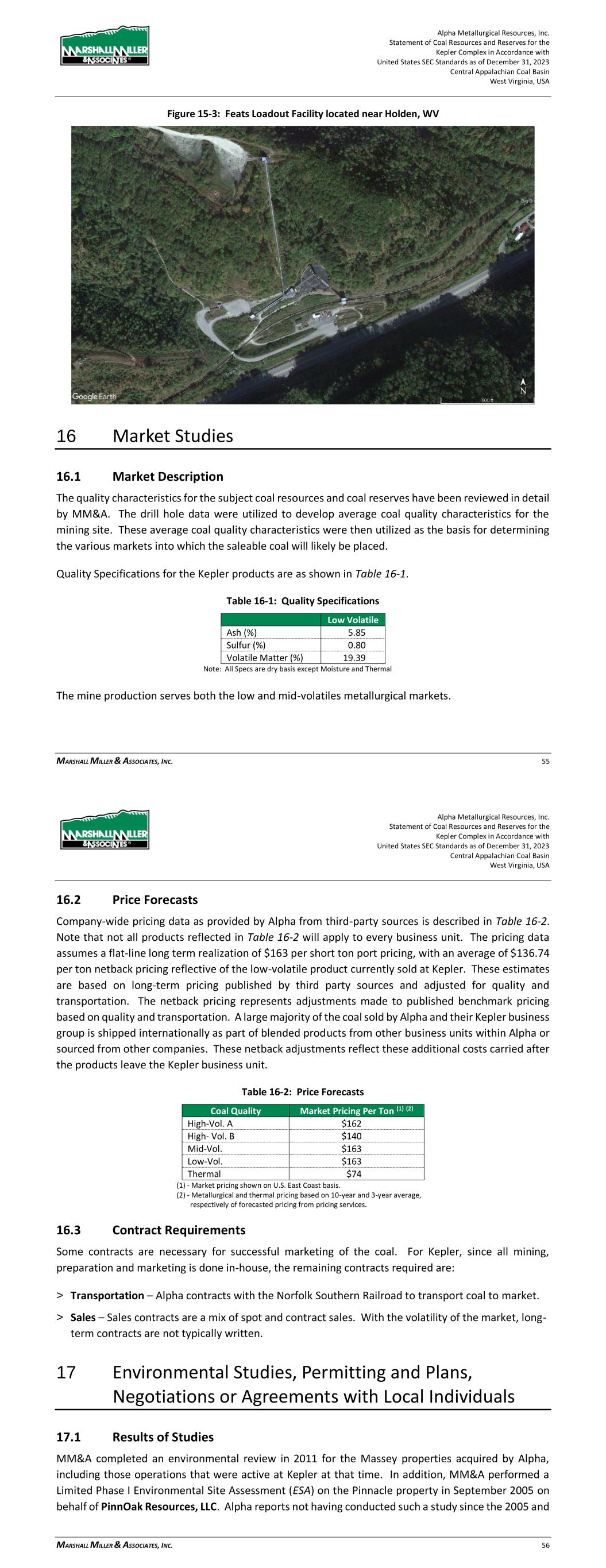

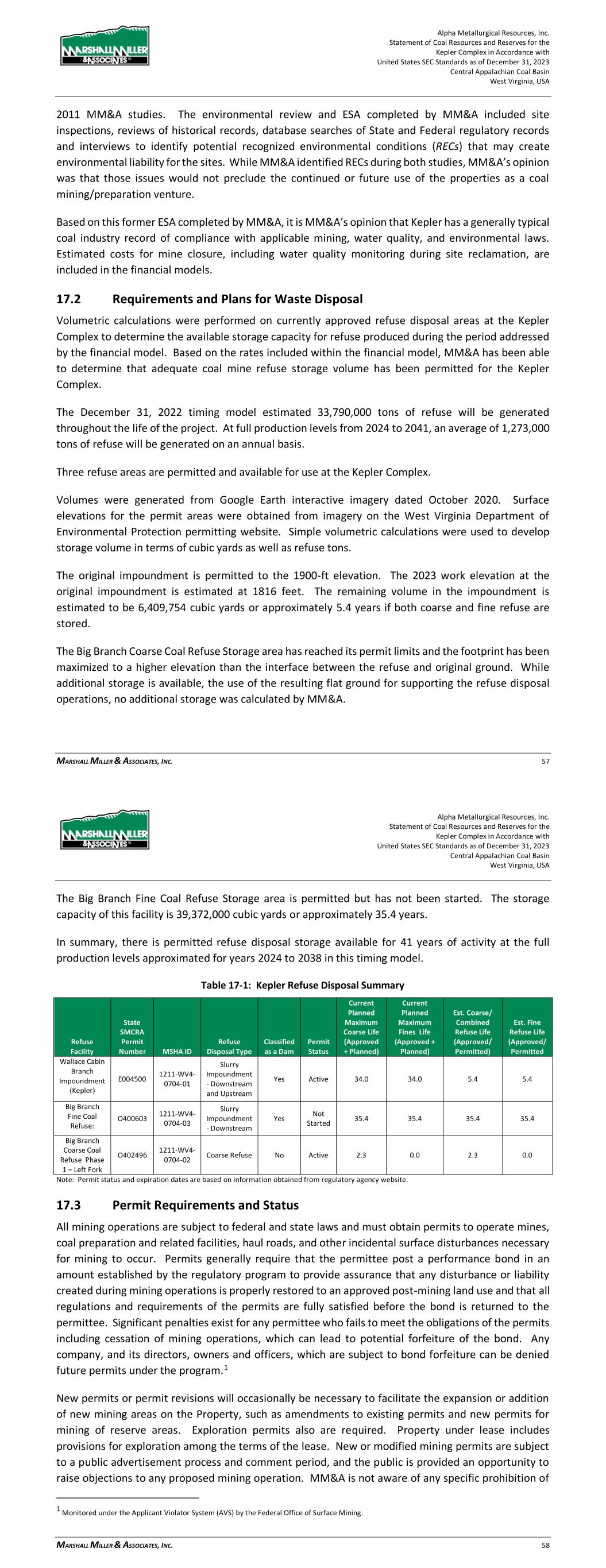

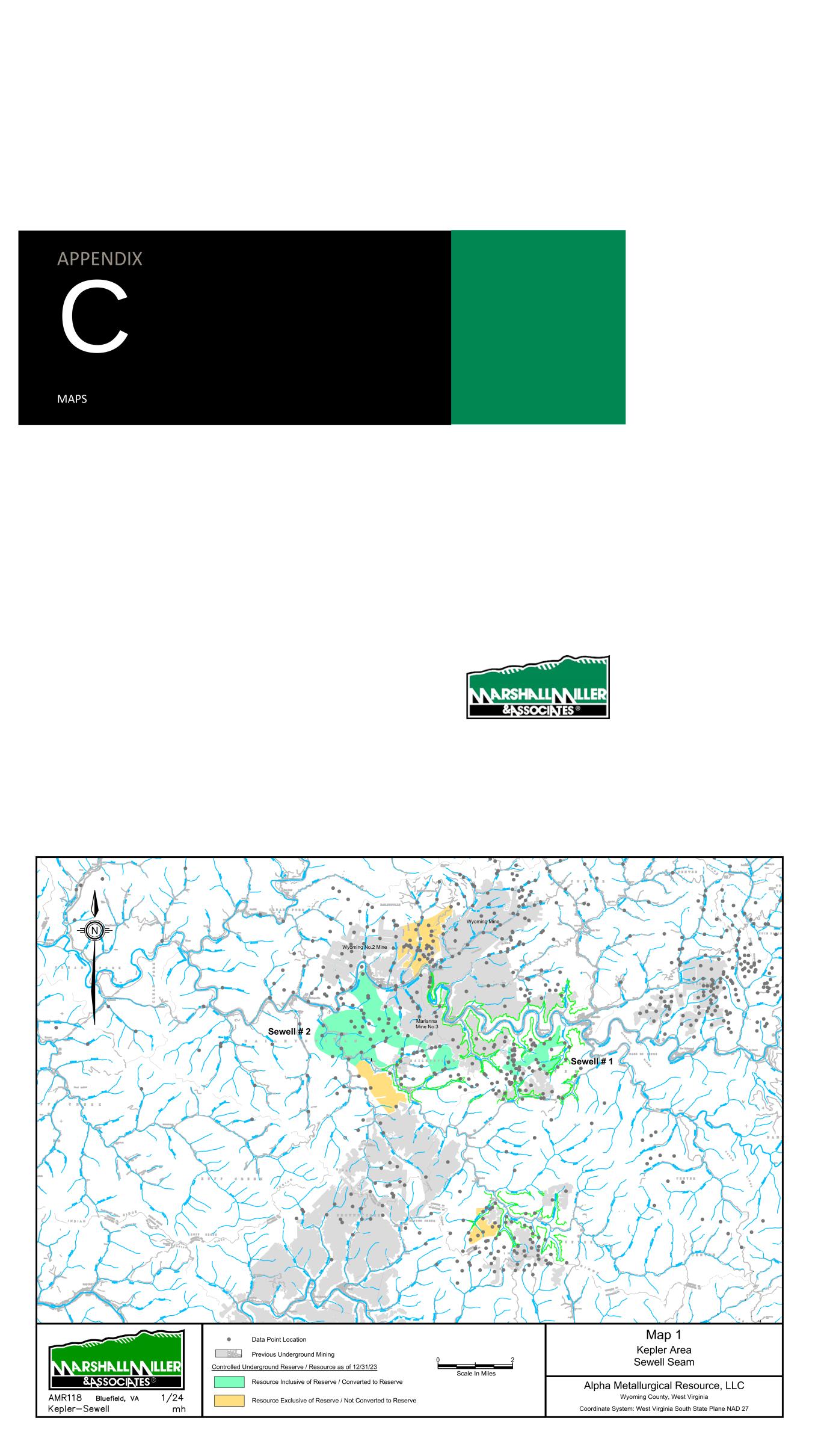

Kepler – Kepler is a mining complex located in Wyoming, McDowell, and Raleigh counties, West Virginia. The complex has one active underground mine (with an estimated life of 15 years) which produces primarily Low-Vol. quality met coal from the Pocahontas No. 3 coal seam. Coal is processed at the Kepler Preparation Plant and either loaded onto NS rail or trucked to the Feats Loadout and loaded onto the CSX rail for delivery to customers.

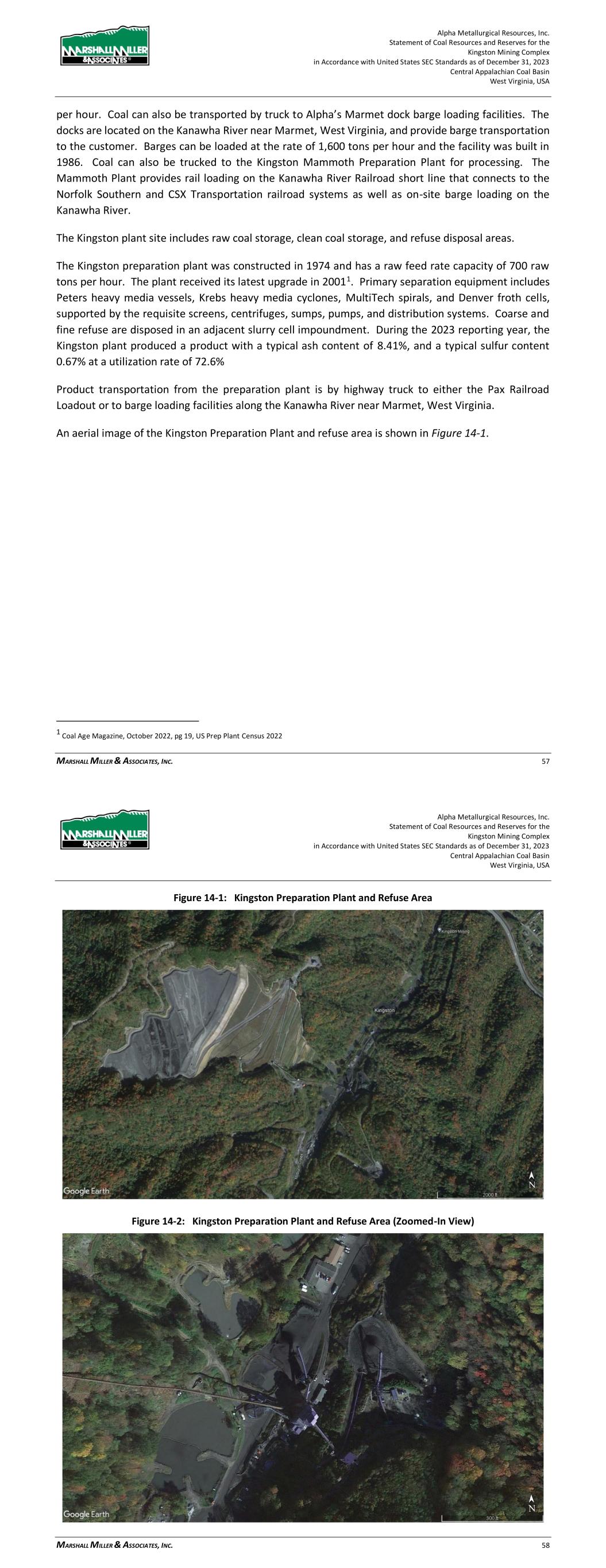

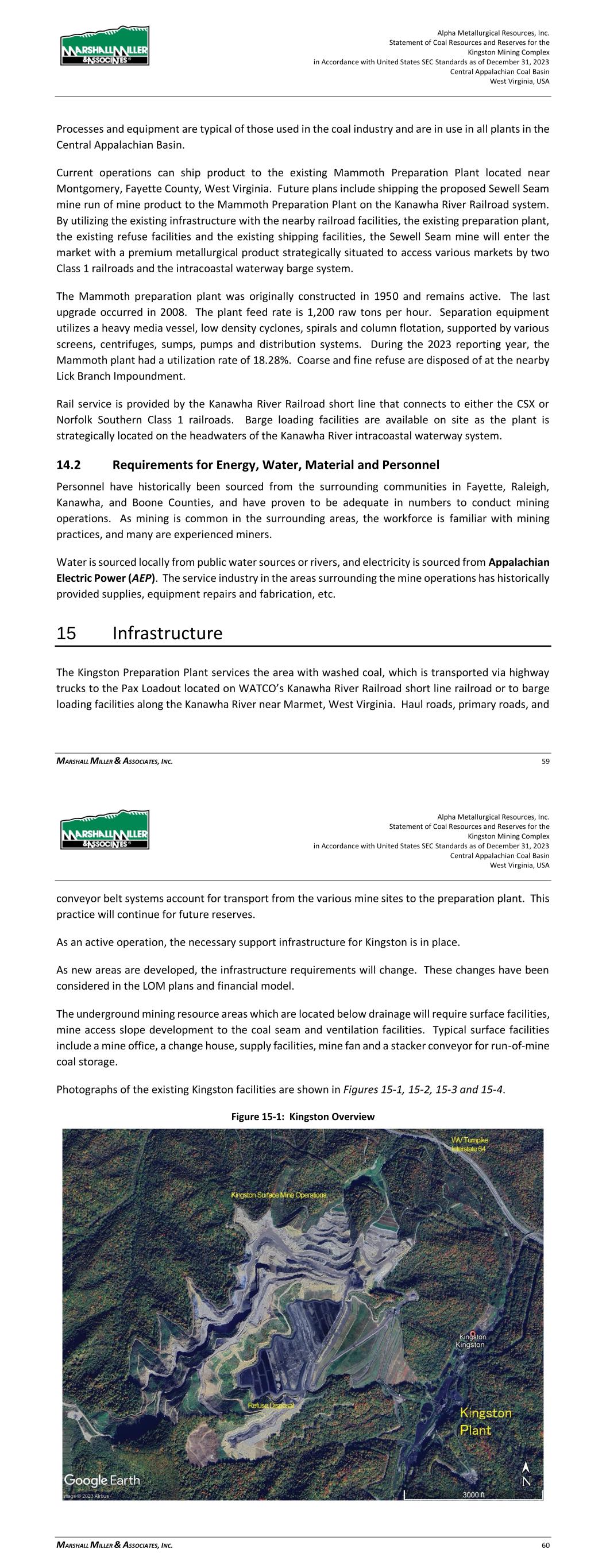

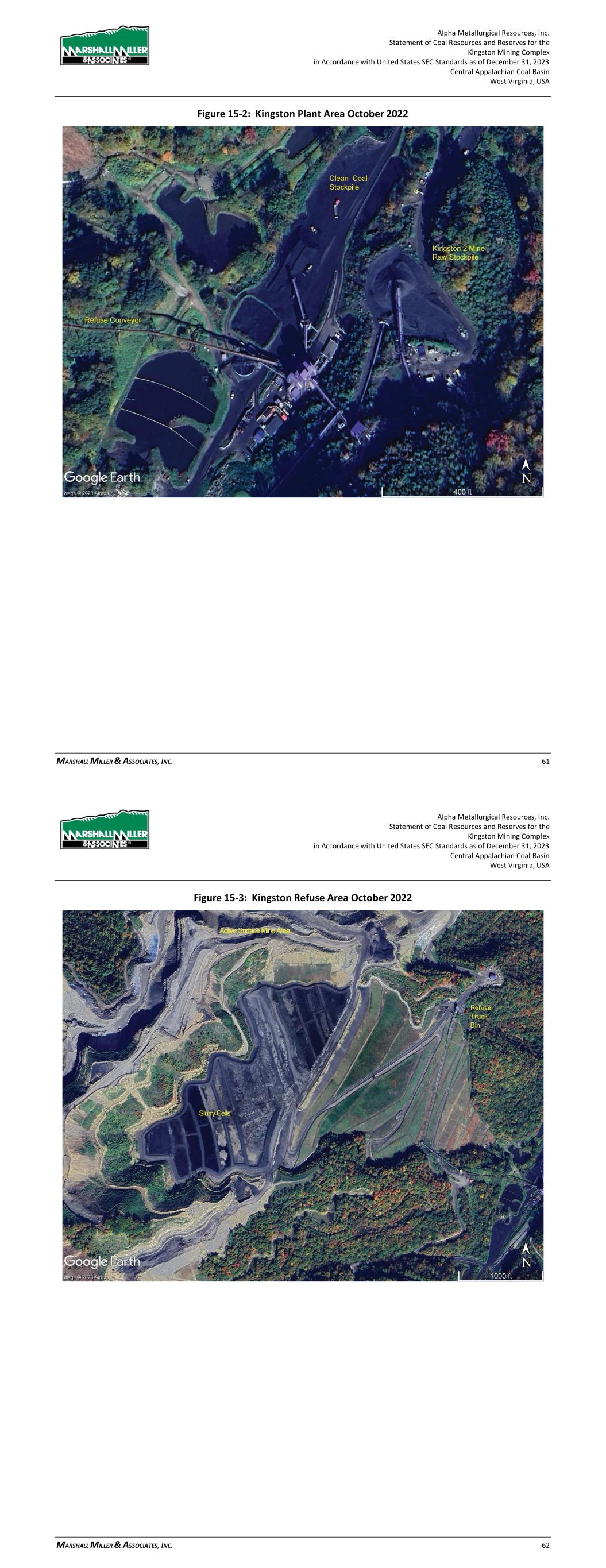

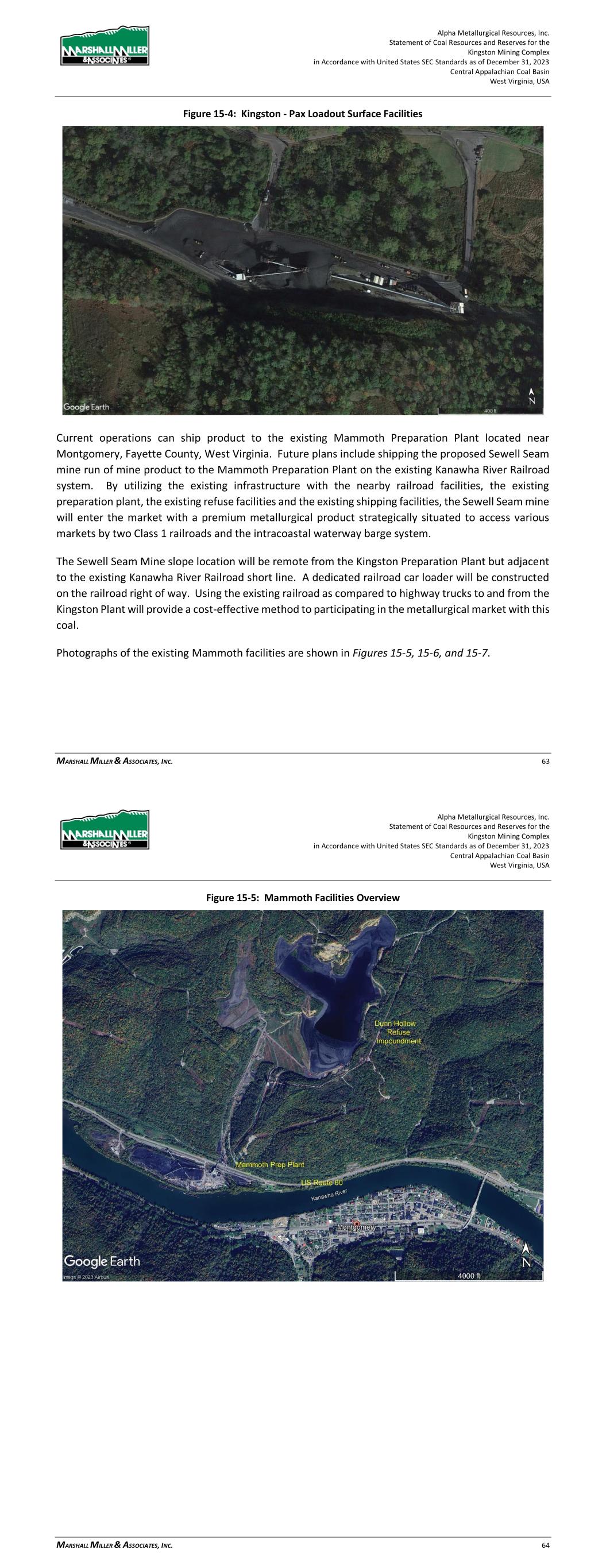

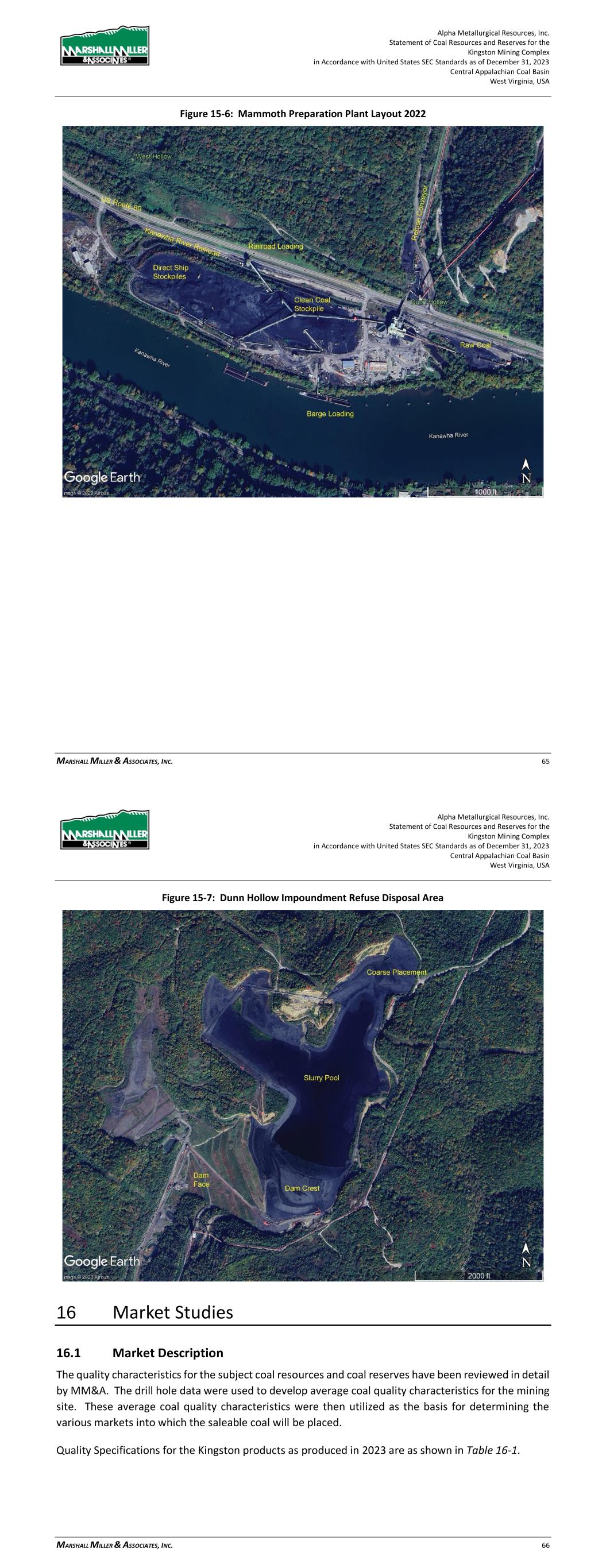

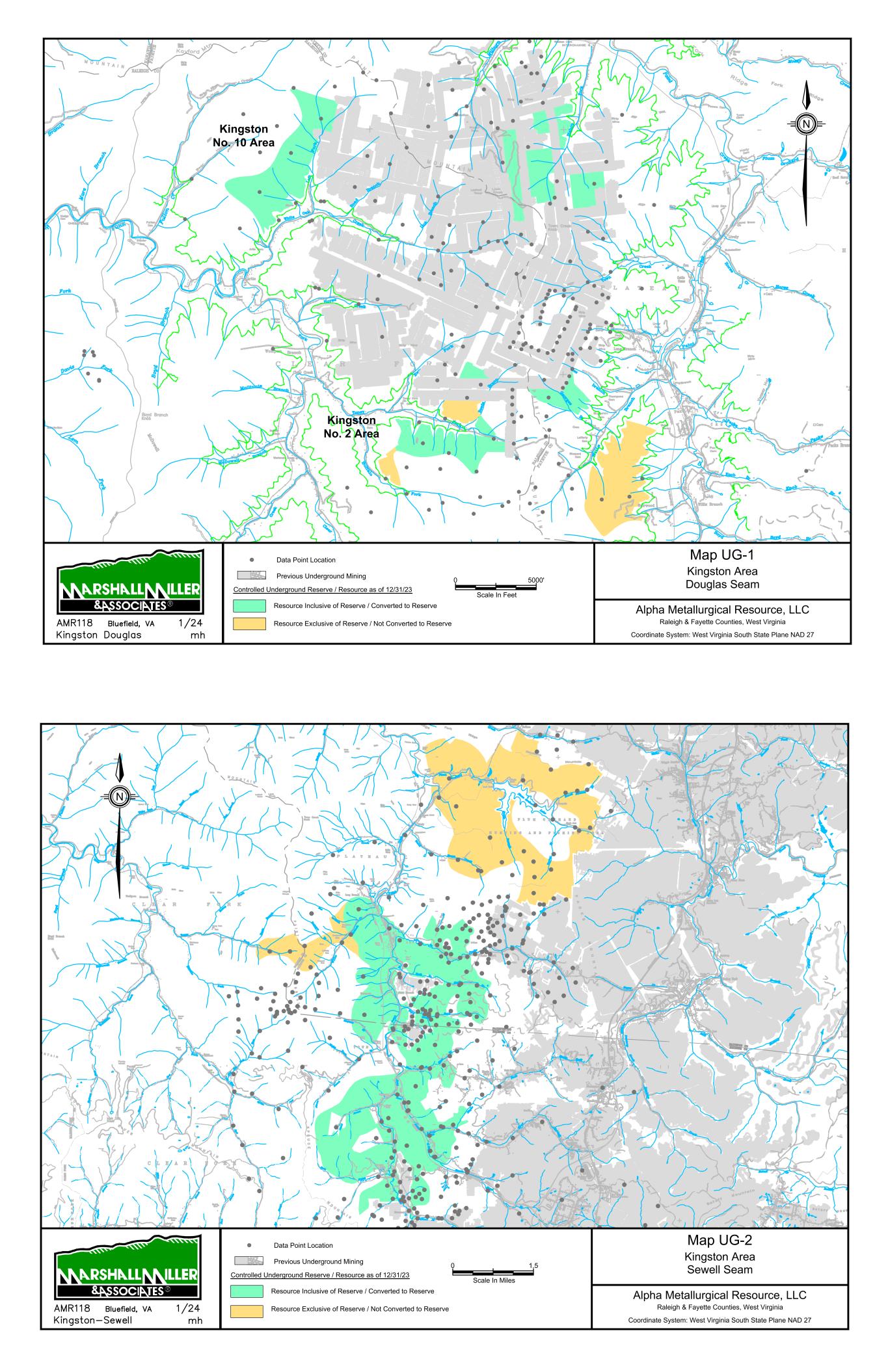

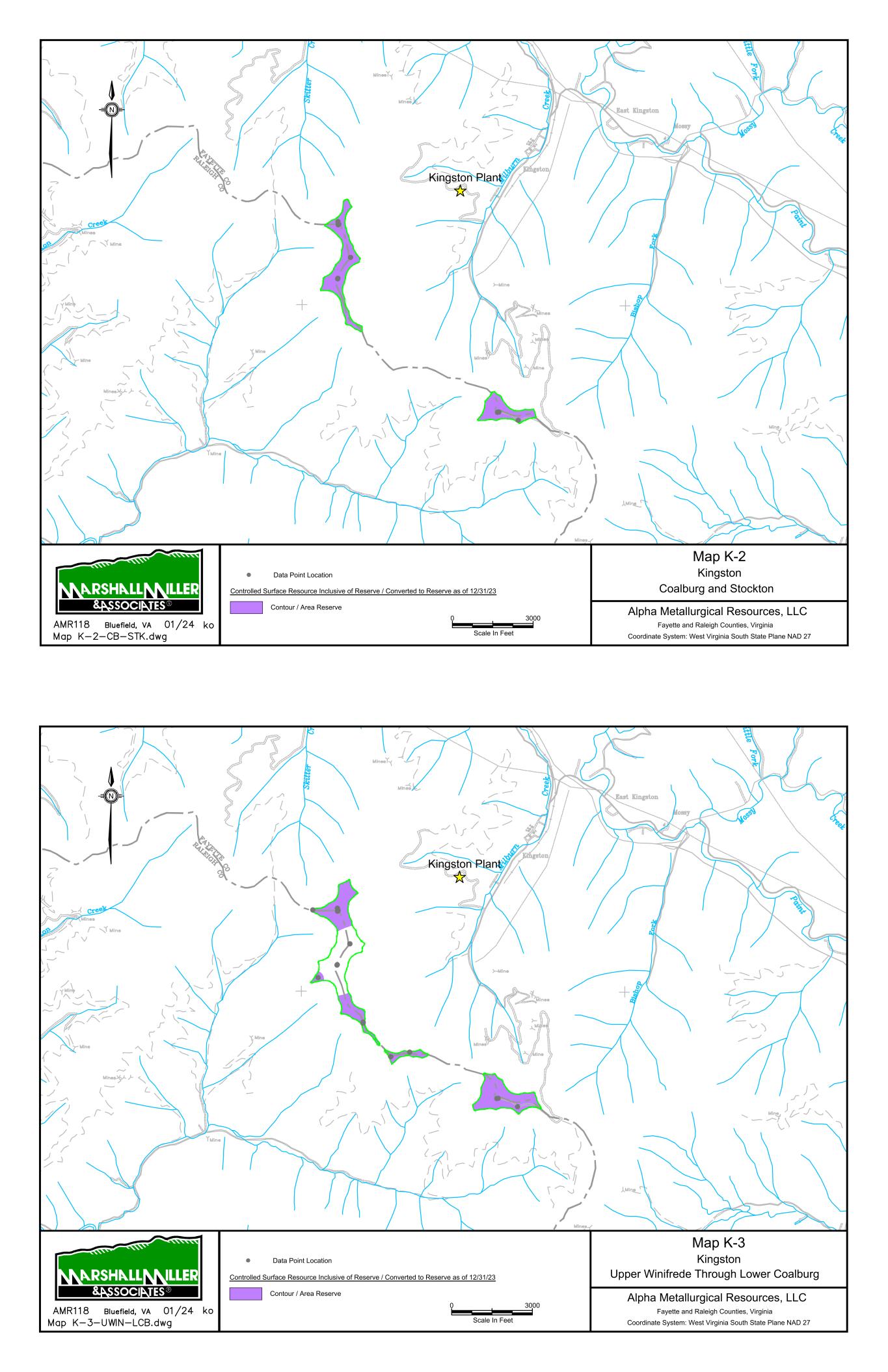

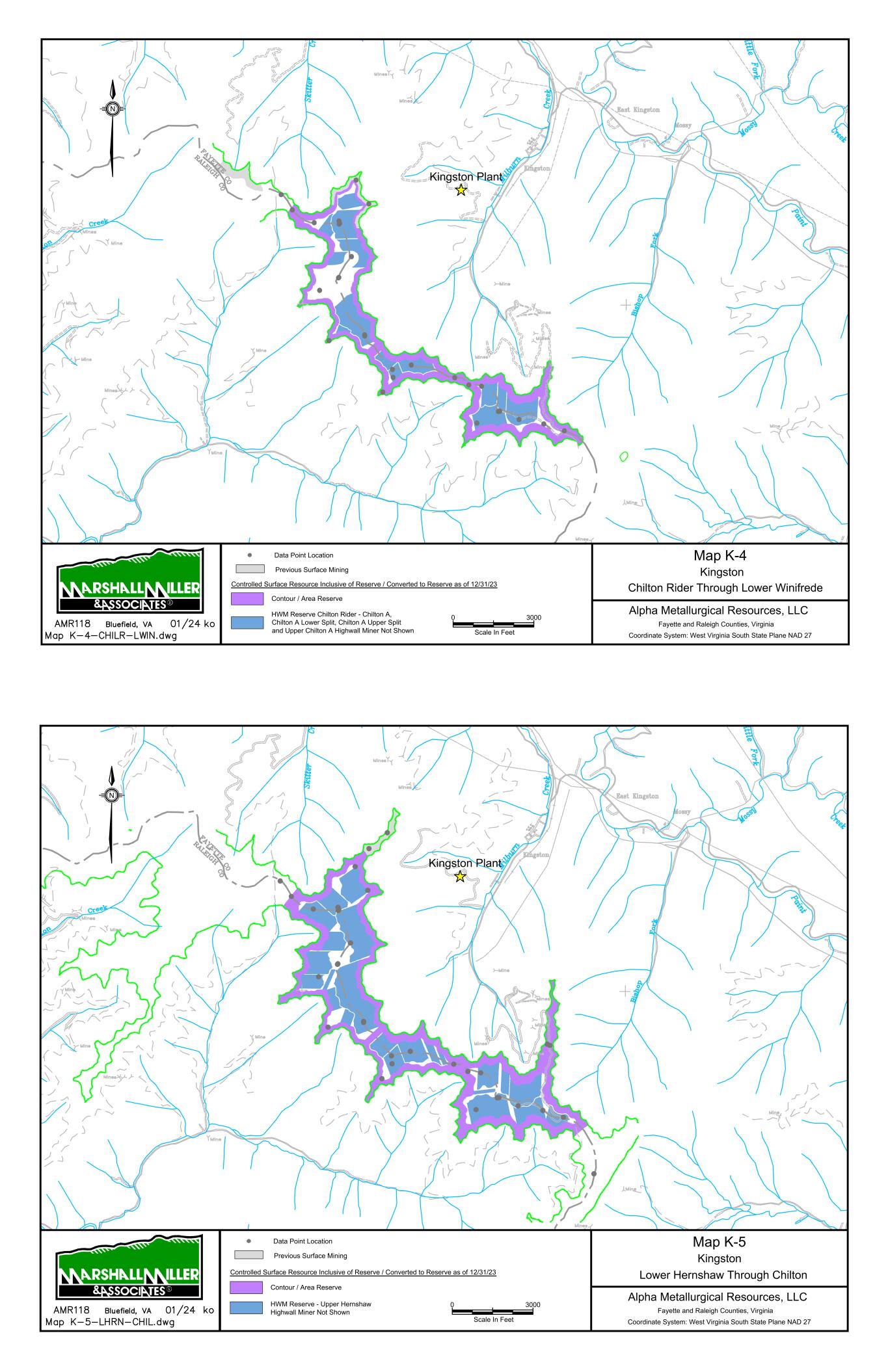

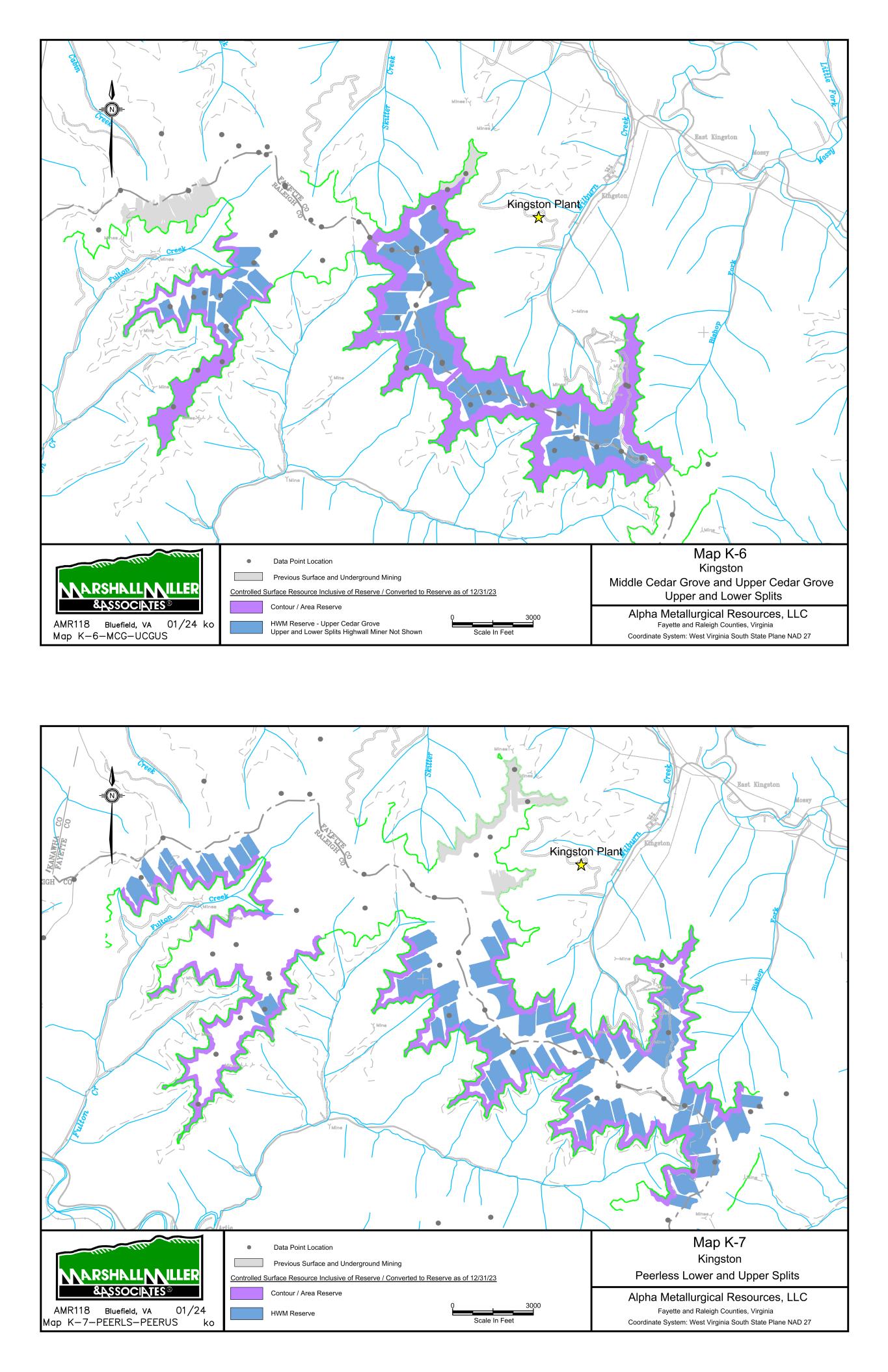

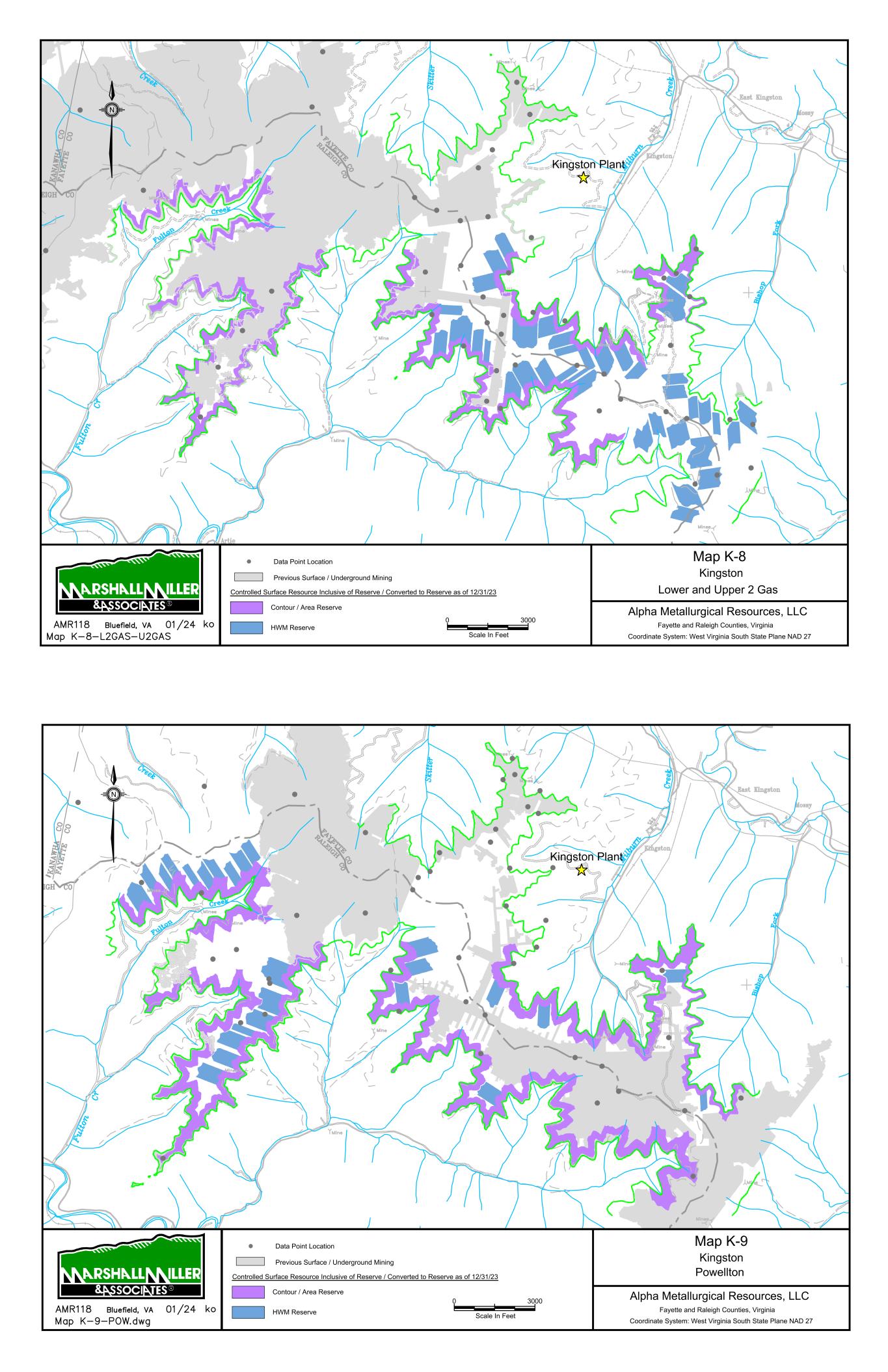

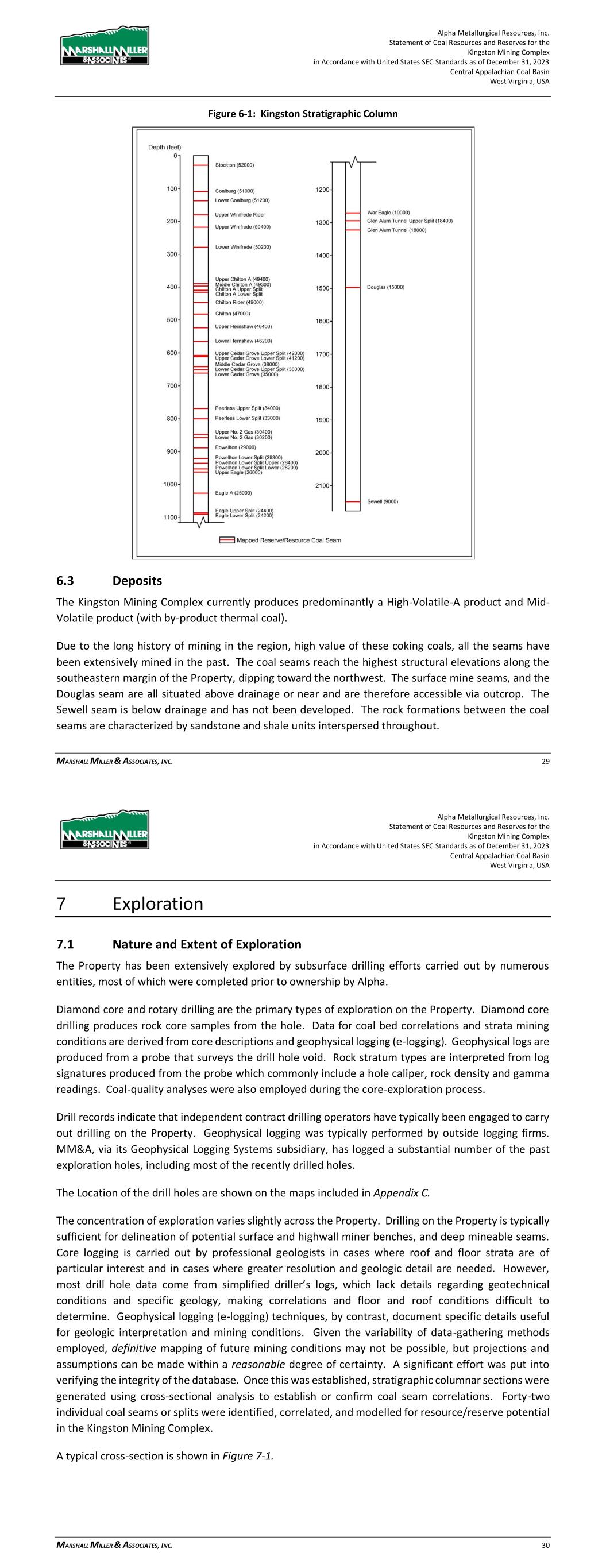

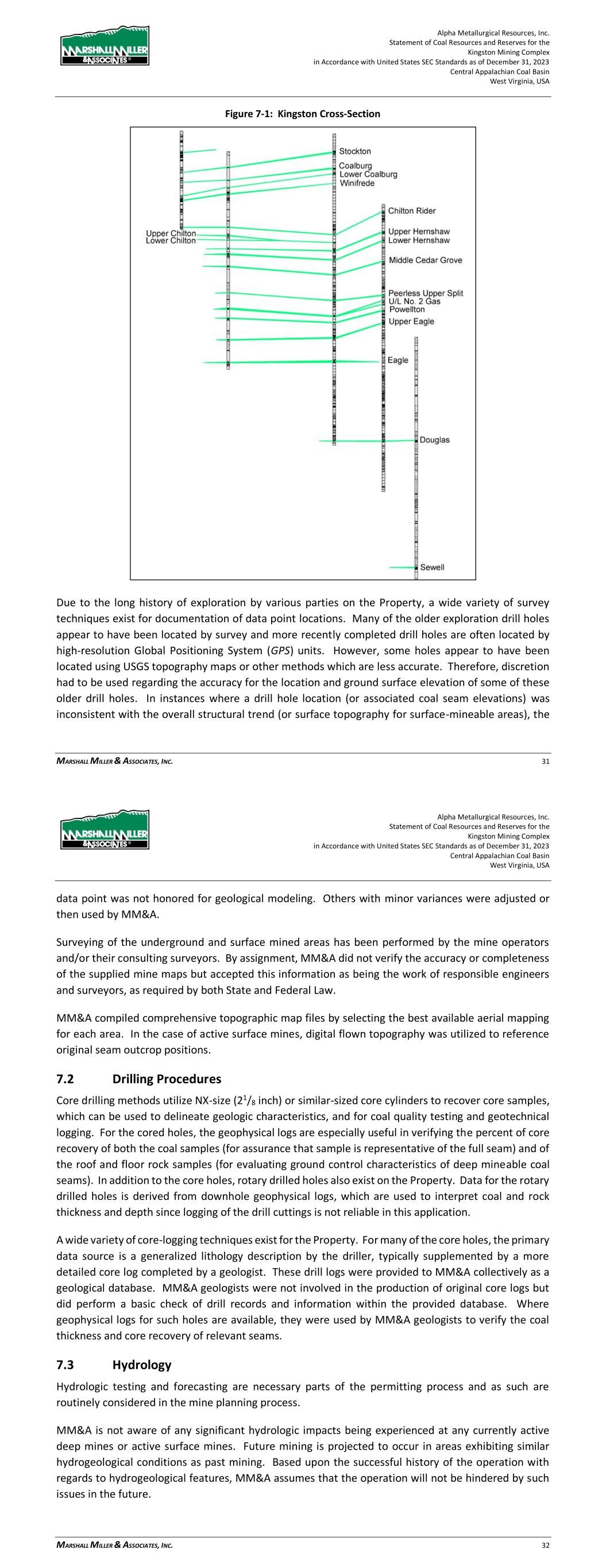

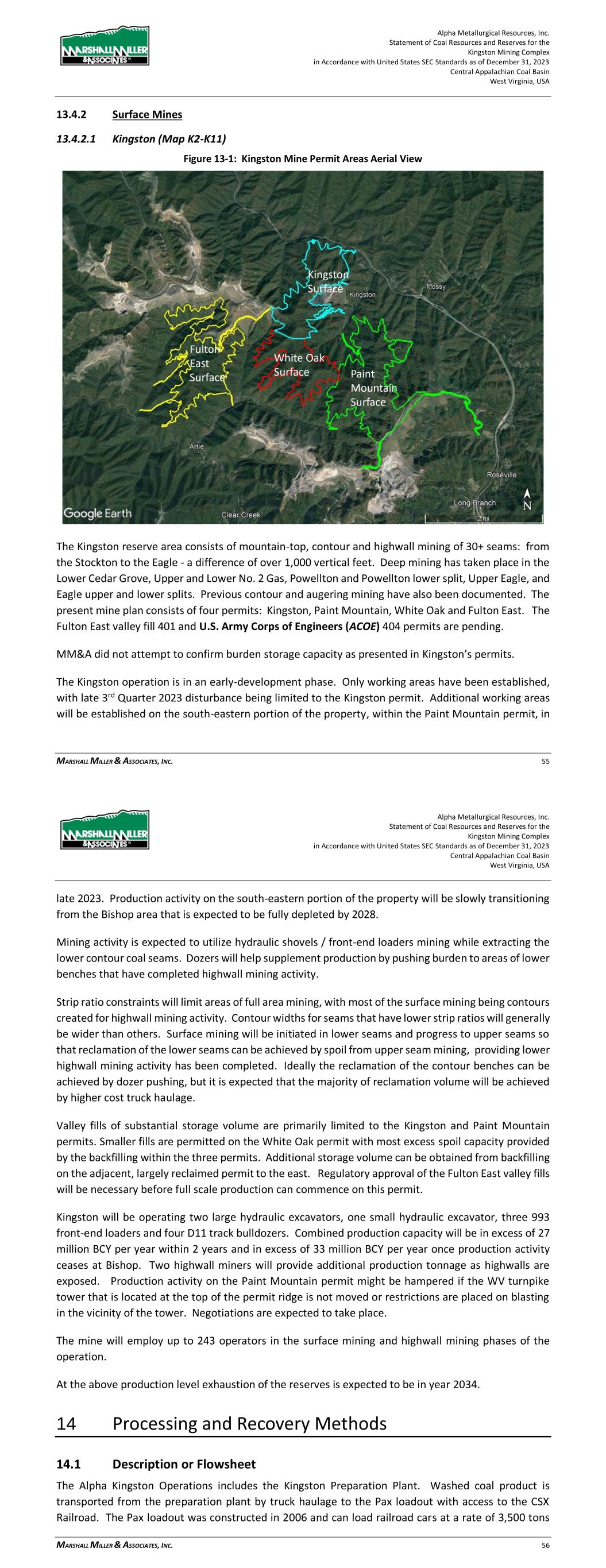

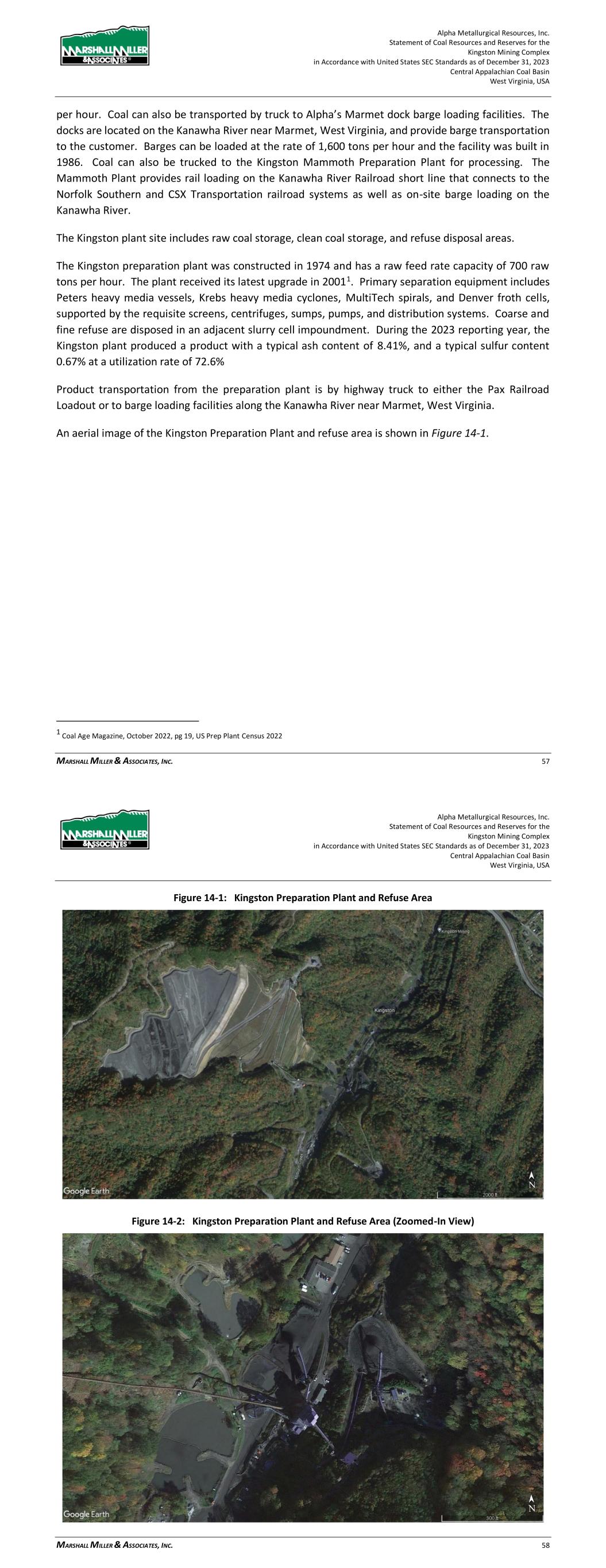

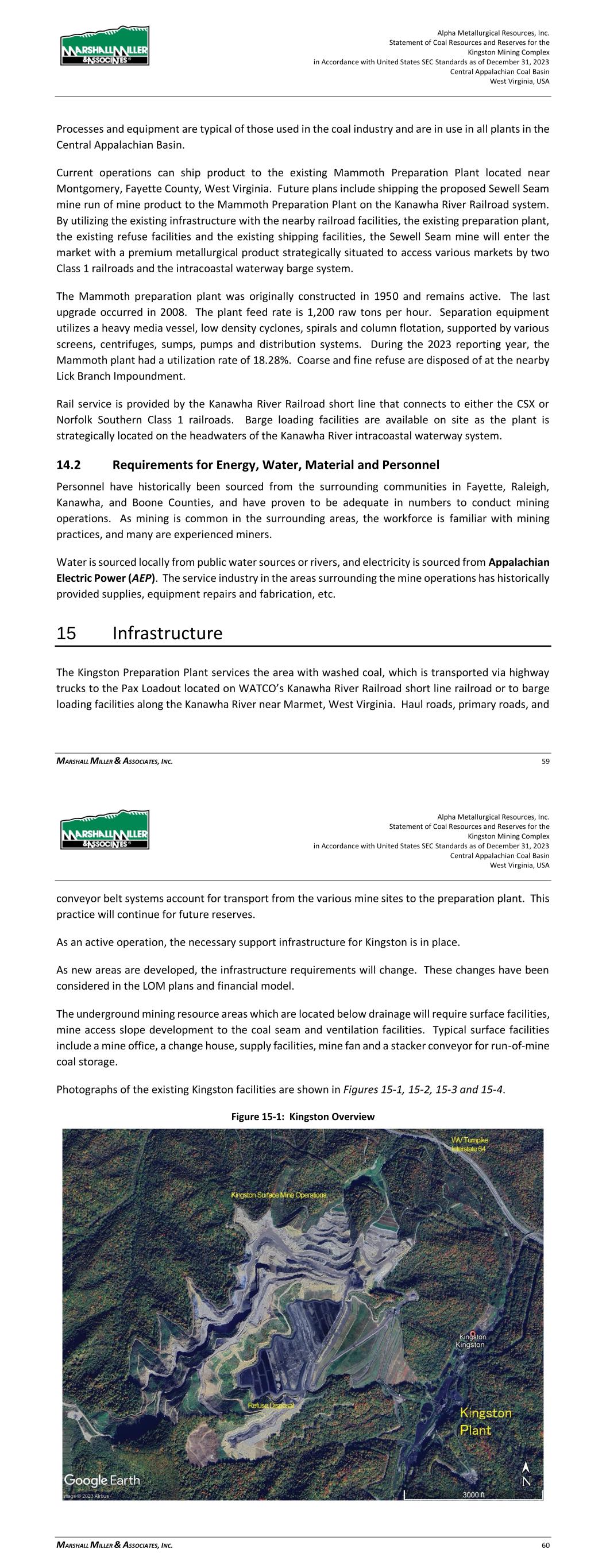

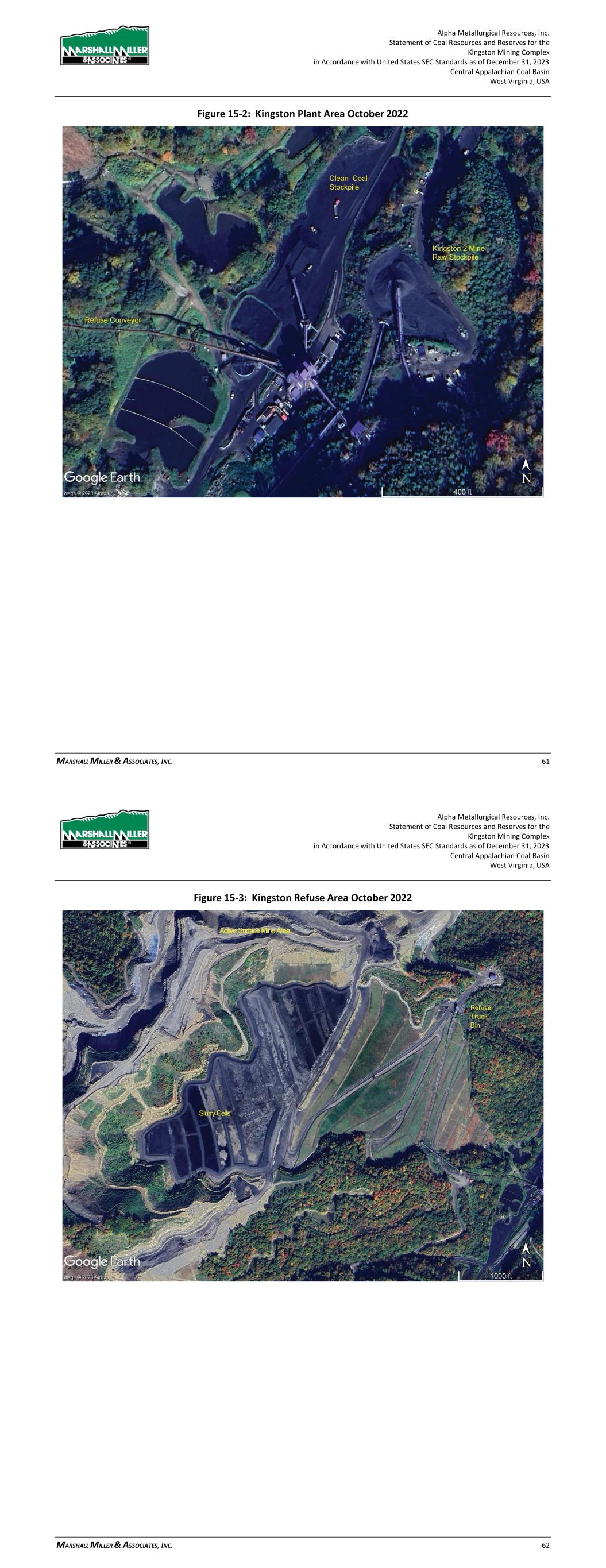

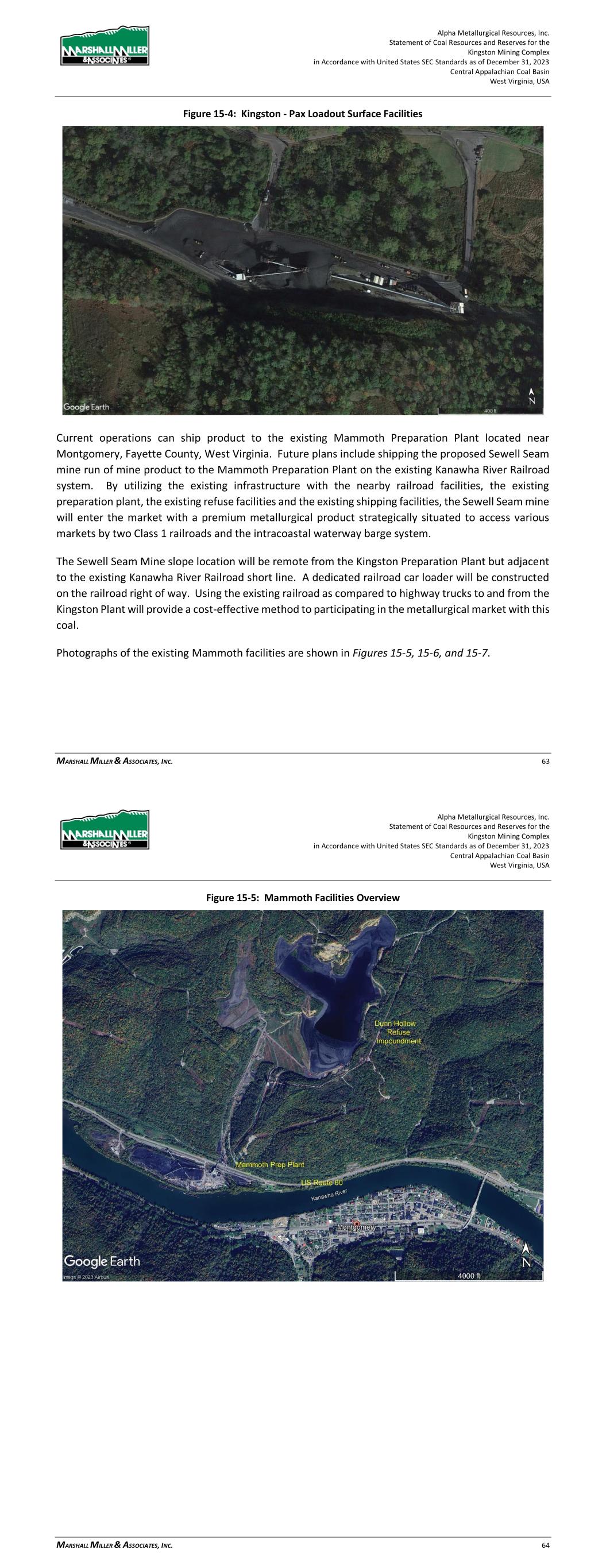

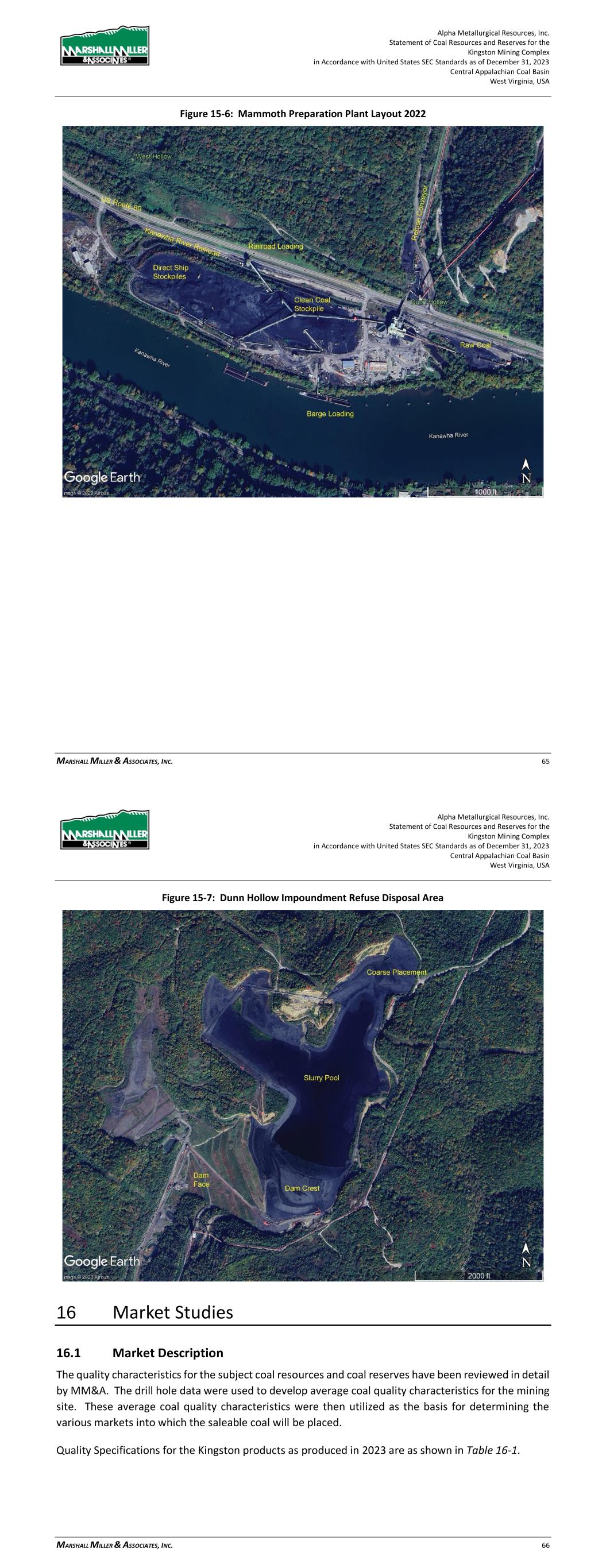

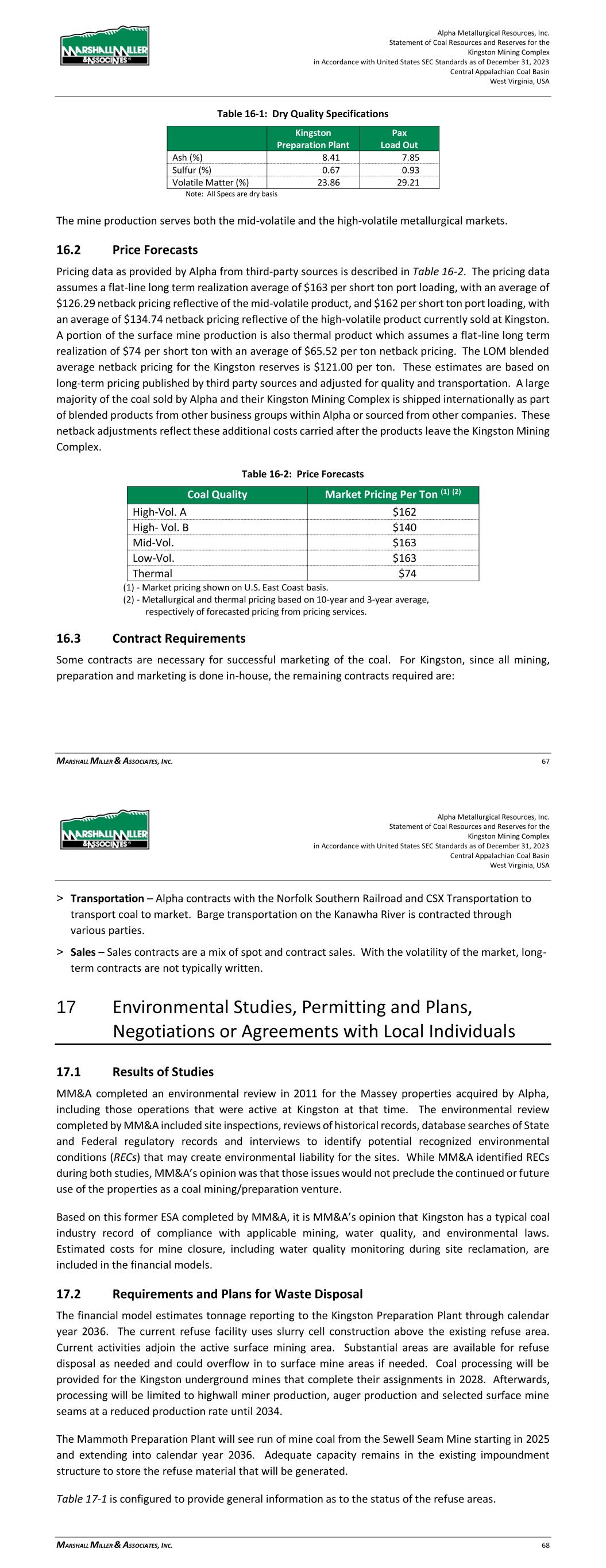

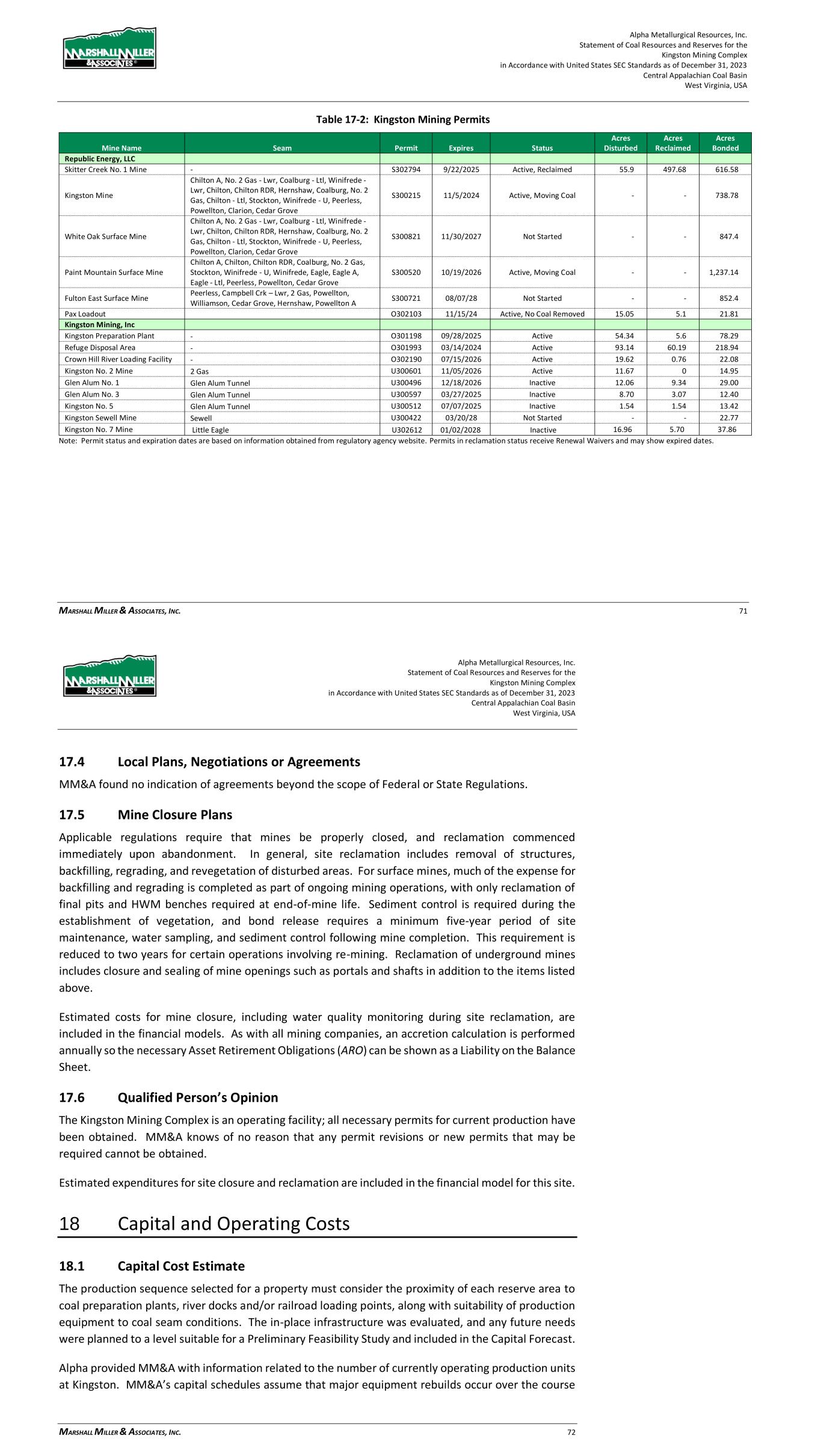

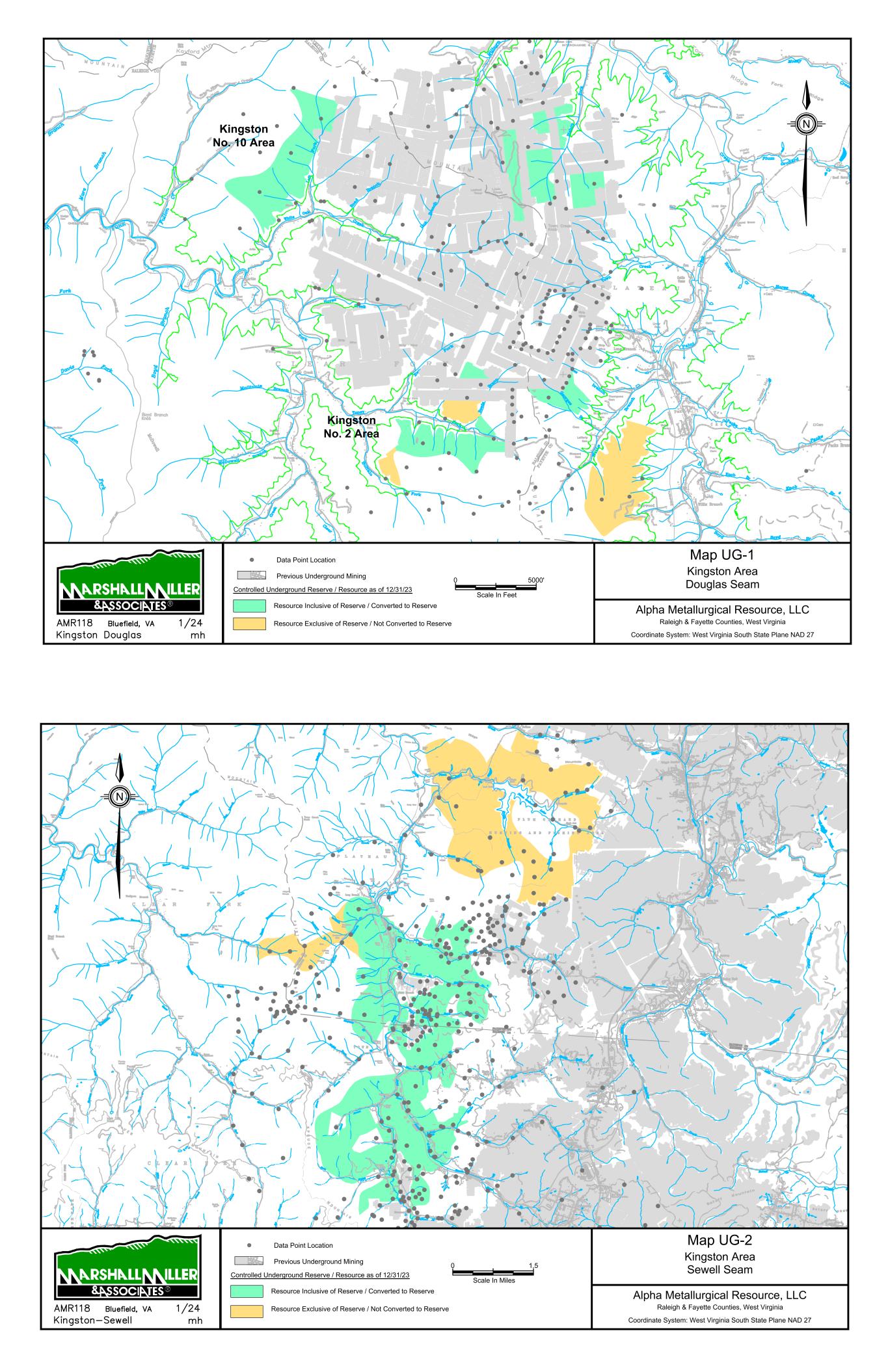

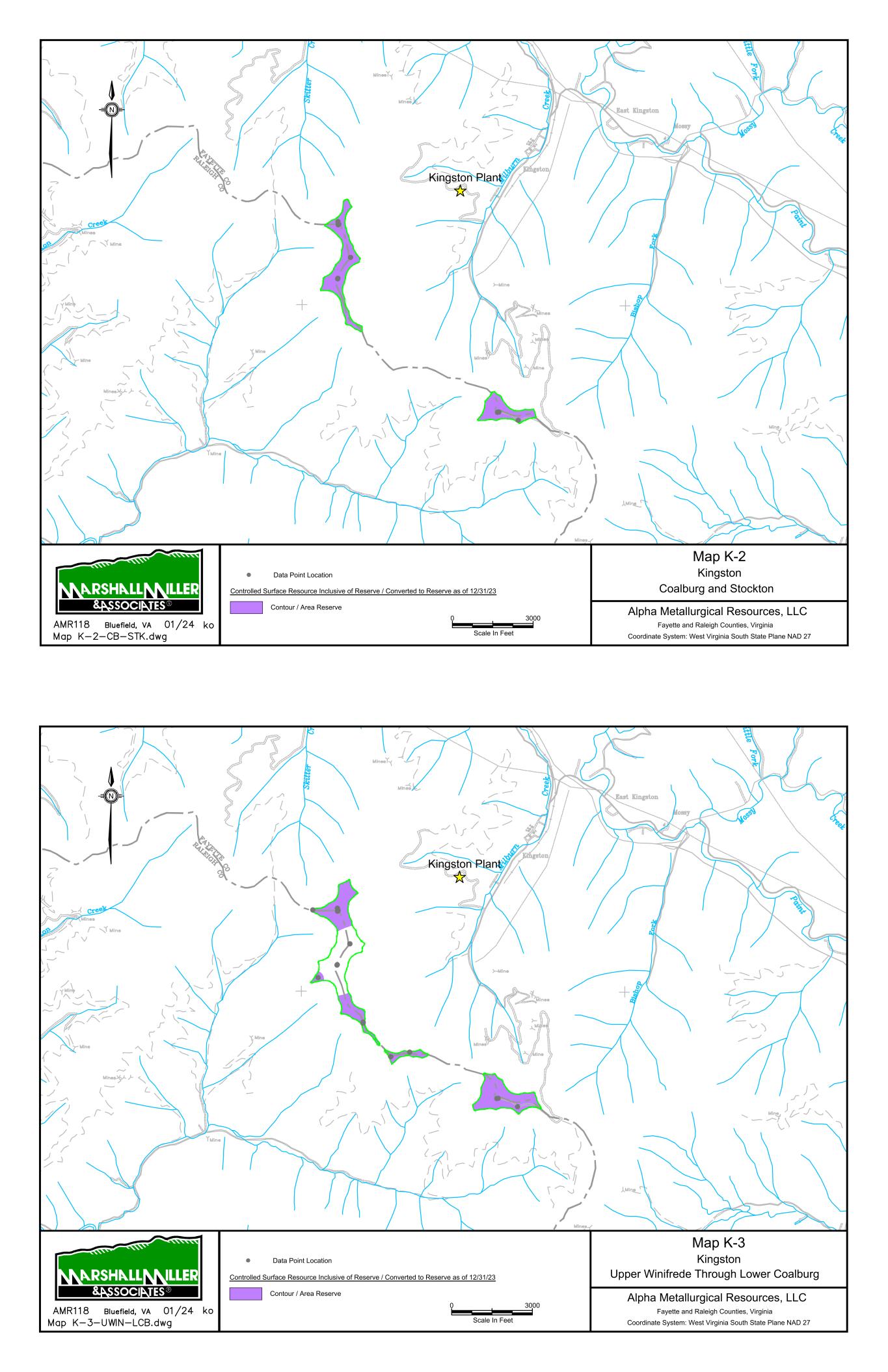

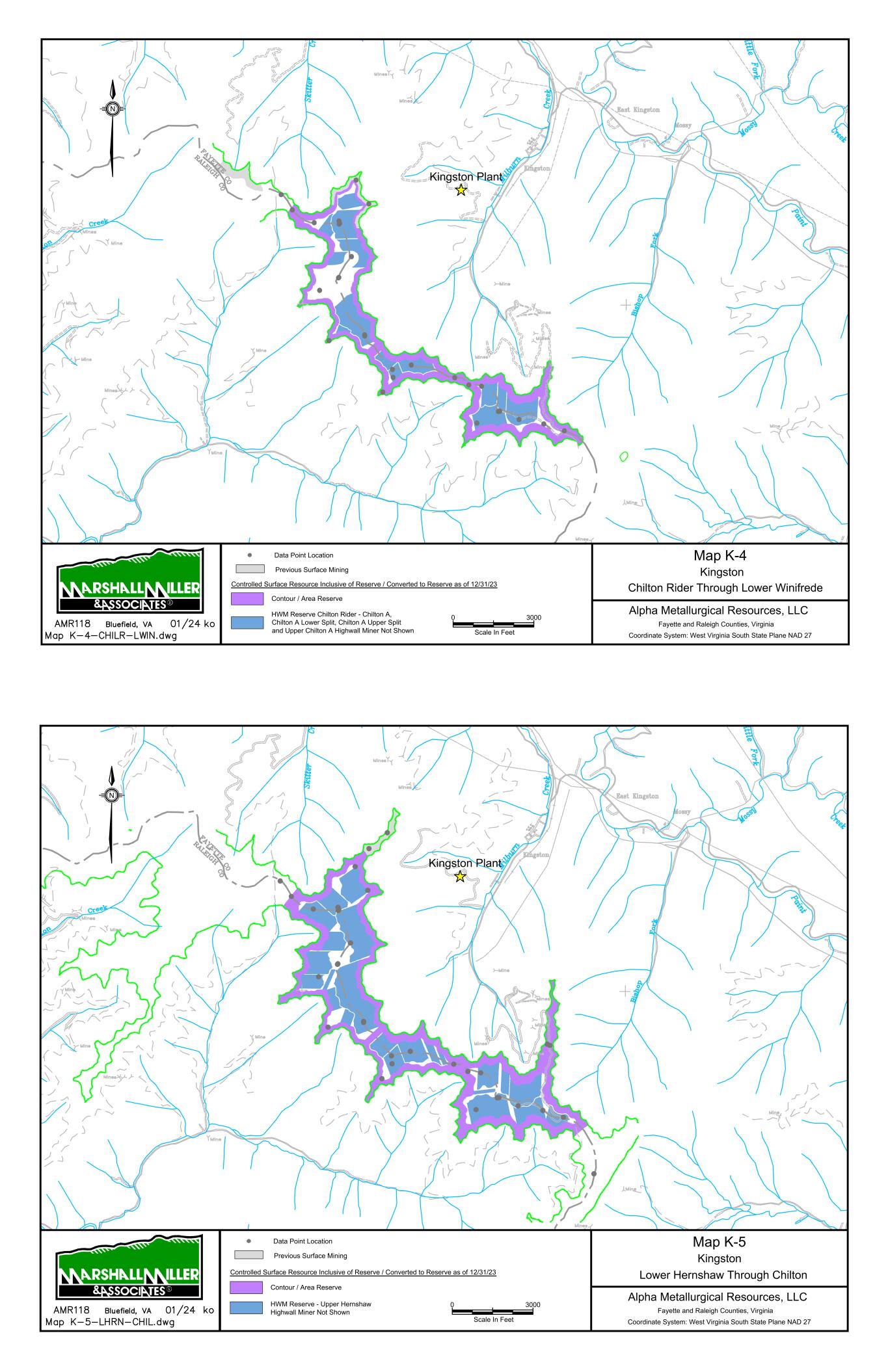

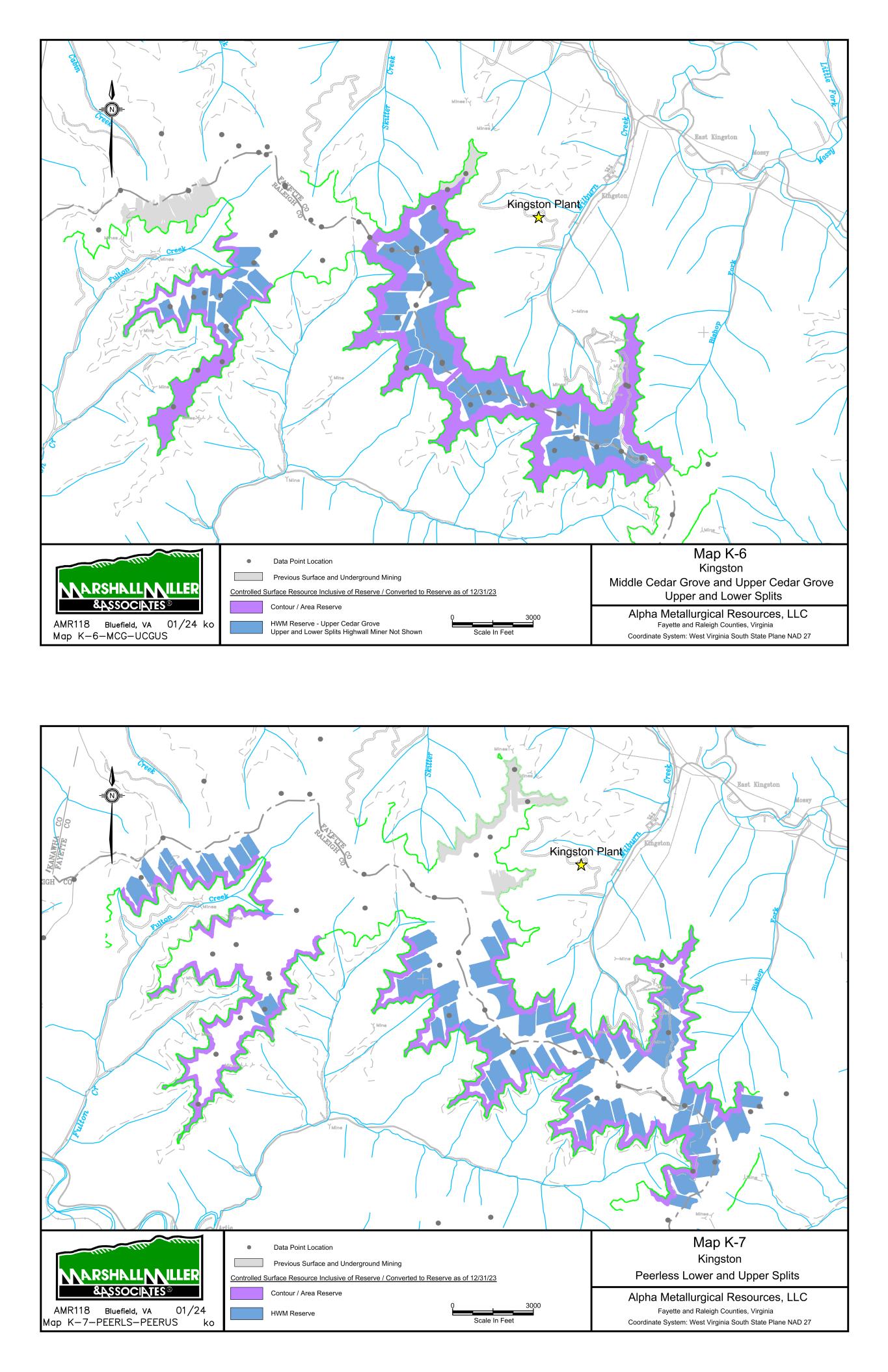

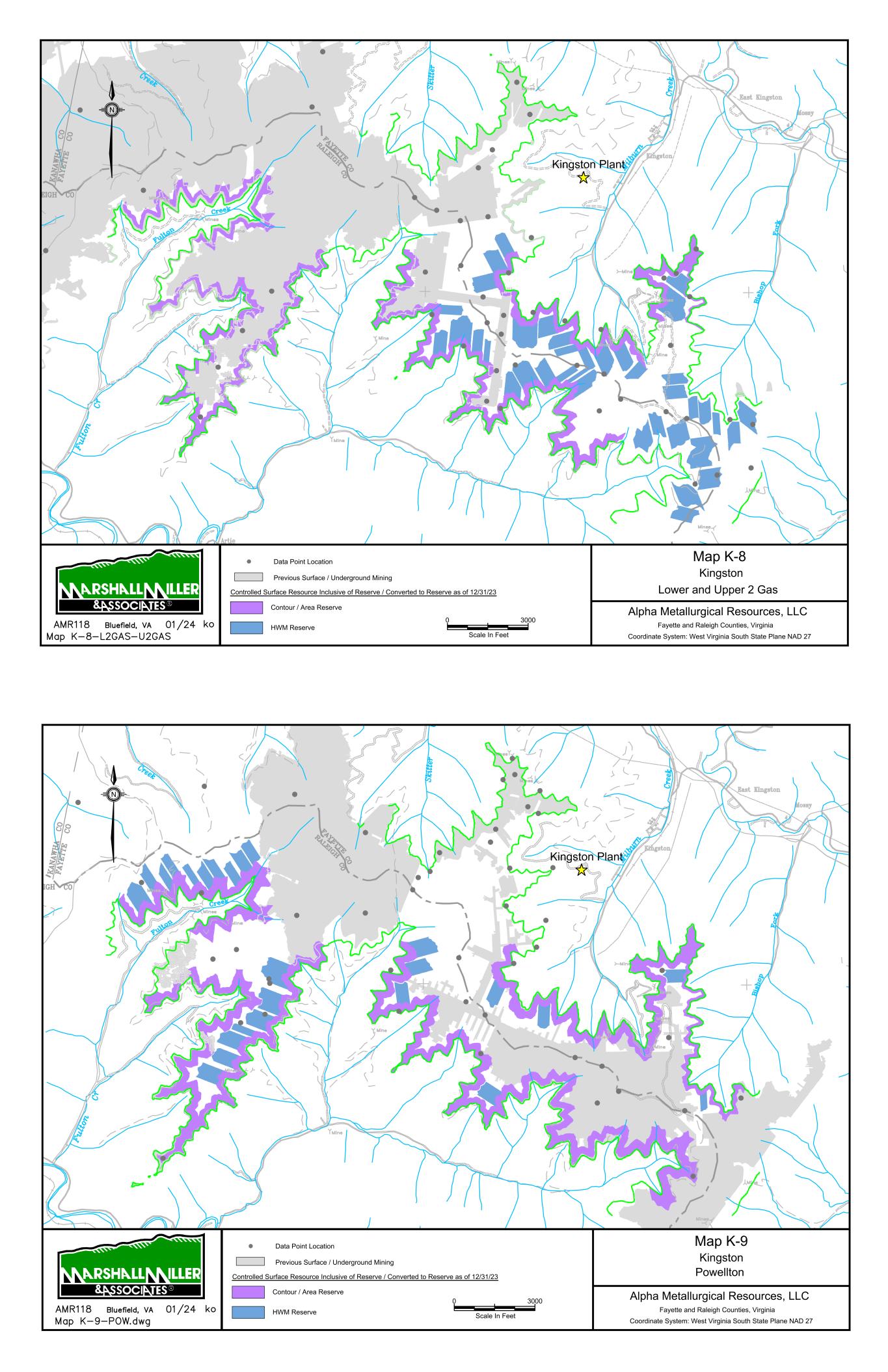

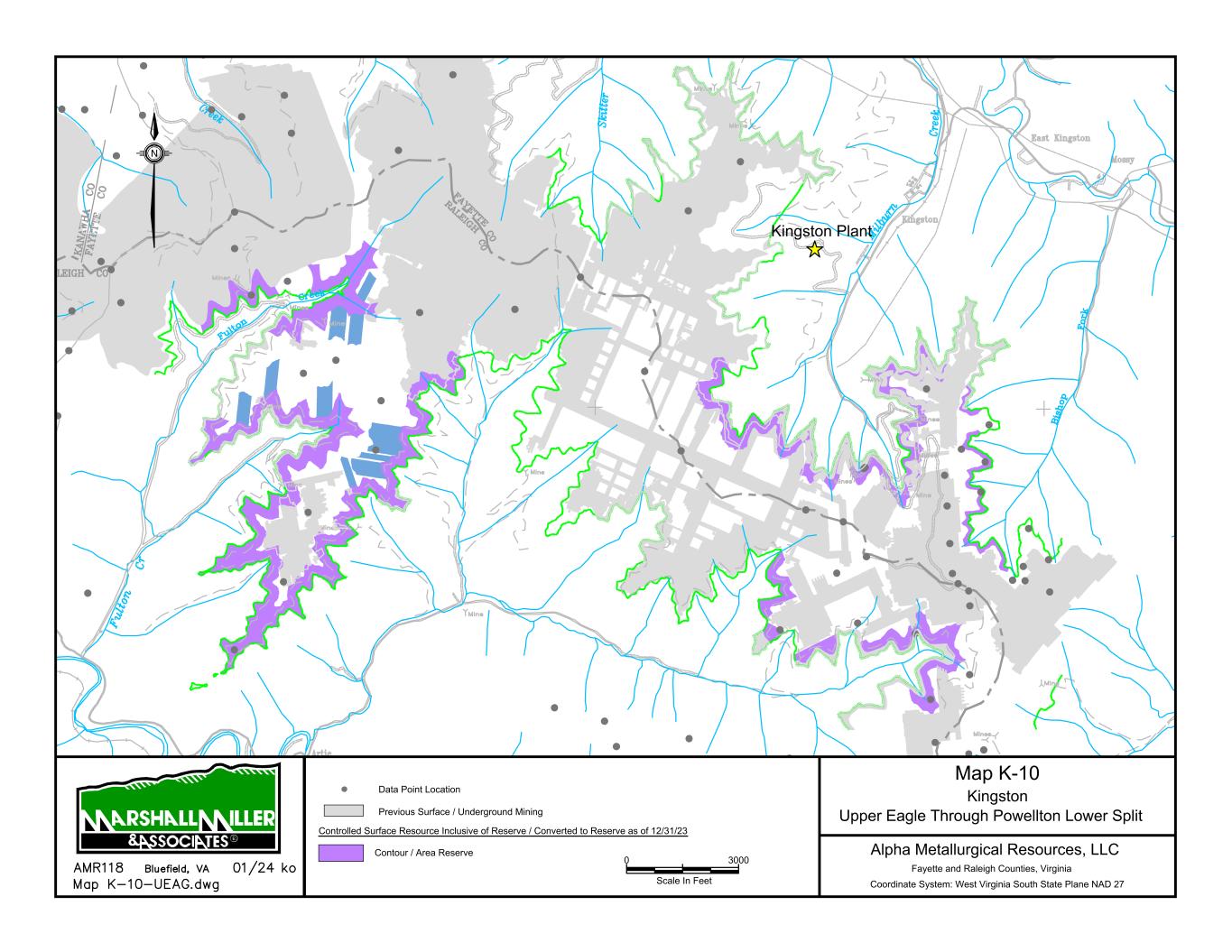

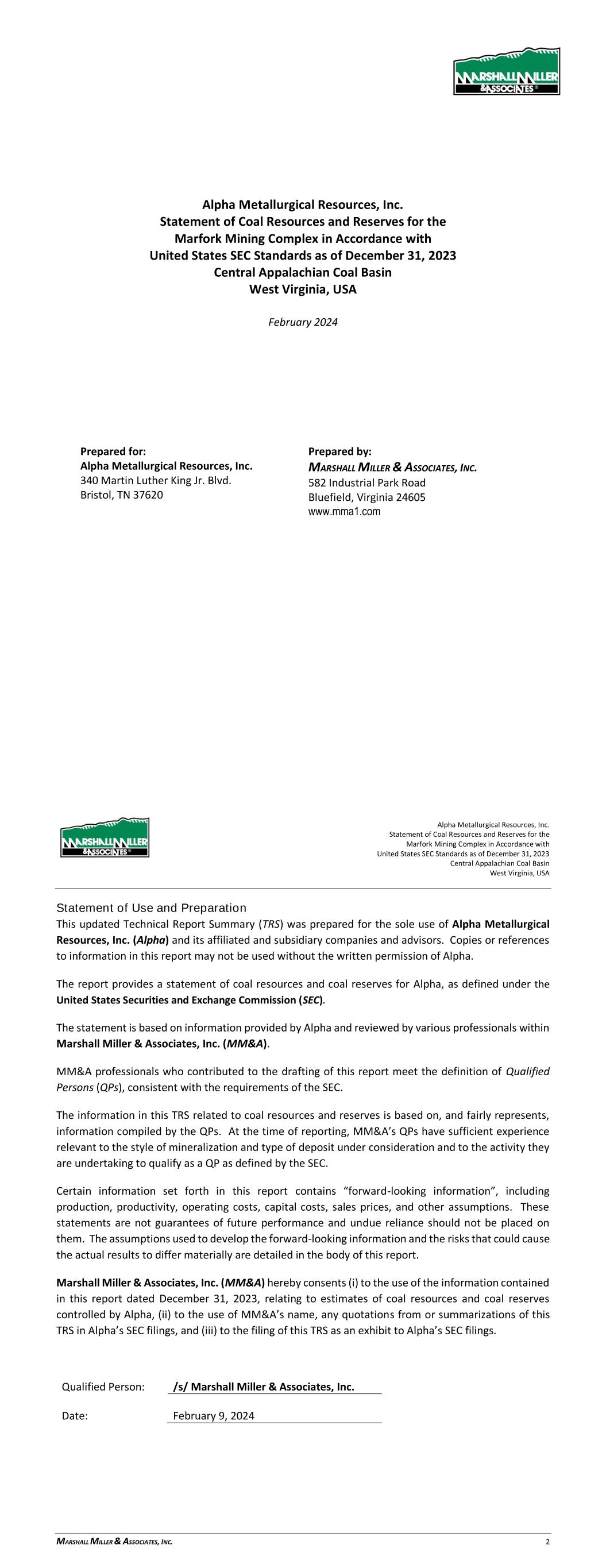

Kingston – Kingston is a mining complex located in Fayette and Raleigh counties, West Virginia. The complex has one active underground mine, which produces primarily Mid-Vol. quality met coal from the Douglas coal seam. The complex also has three active surface mines which produced High-Vol. A quality met coal as well as some thermal quality coal as a by-product of mining from multiple coal seams. Mine lives range from 2 to 11 years. Coal from the underground mine is processed at the Kingston Preparation Plant and trucked to the Pax Loadout to be loaded onto CSX rail for delivery to customers. Coal from the surface mines may be processed through the Kingston Preparation Plant, trucked to and processed through the Mammoth Plant, or trucked directly to the Pax Loadout or Marmet Dock for delivery to customers.

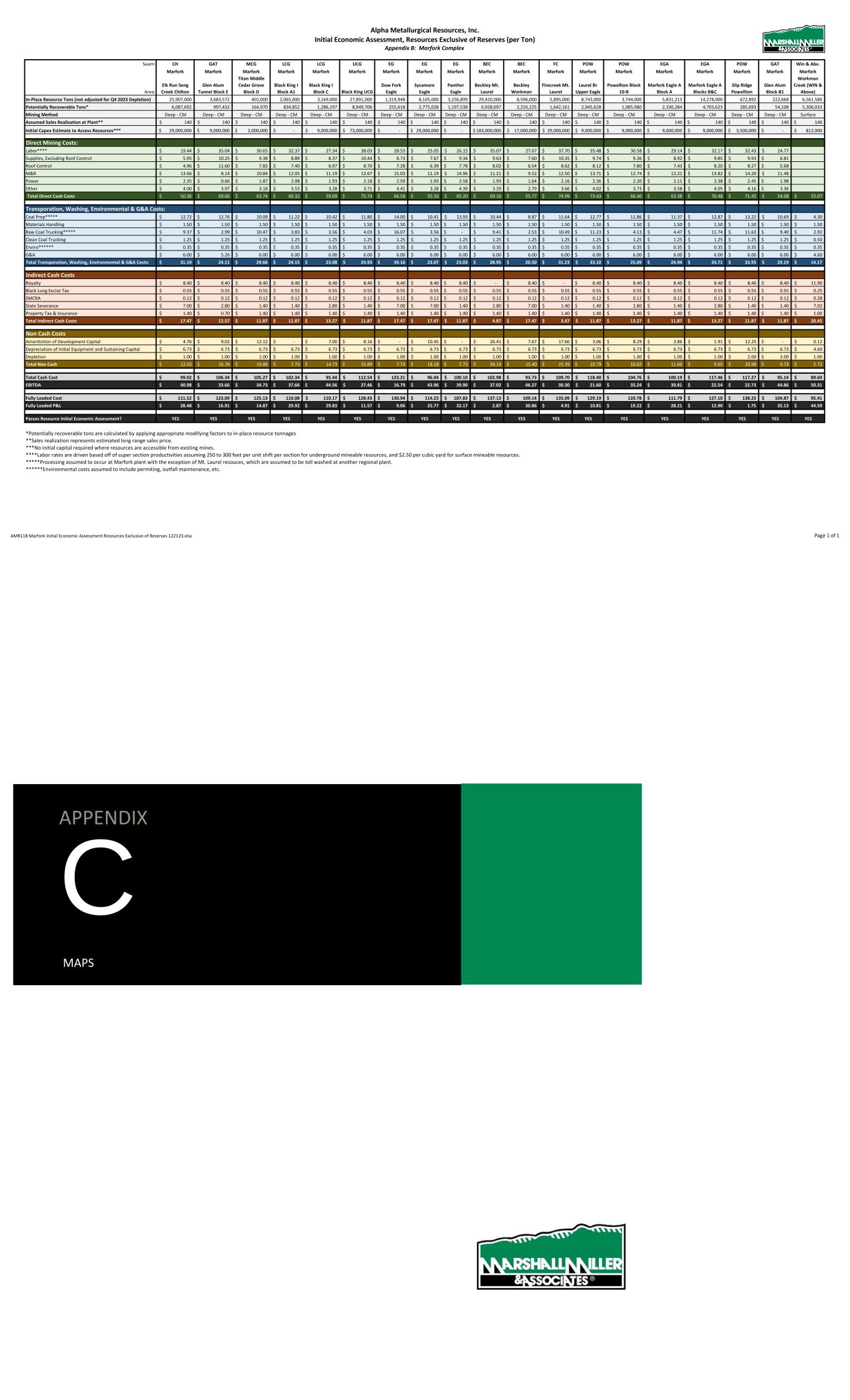

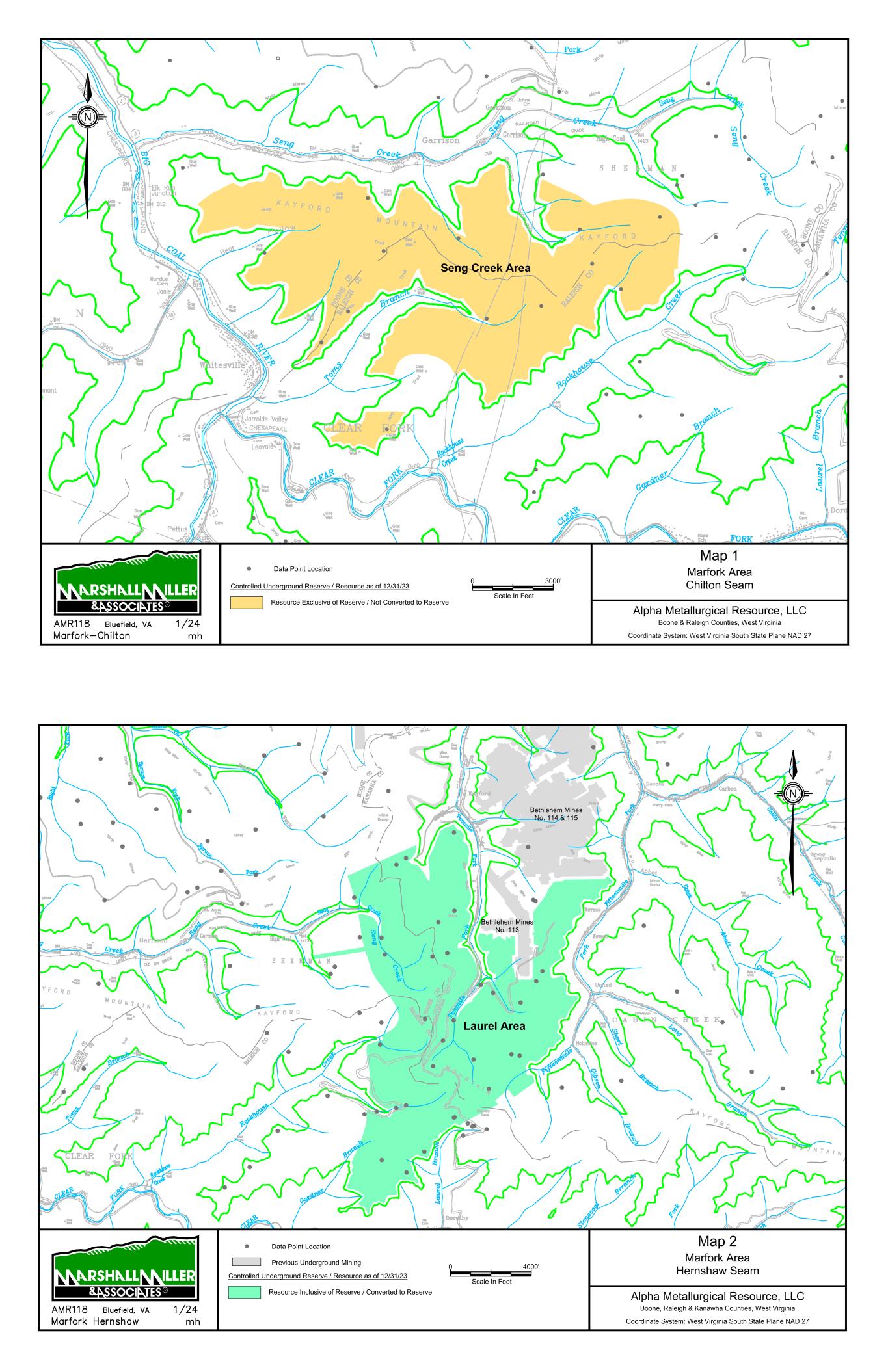

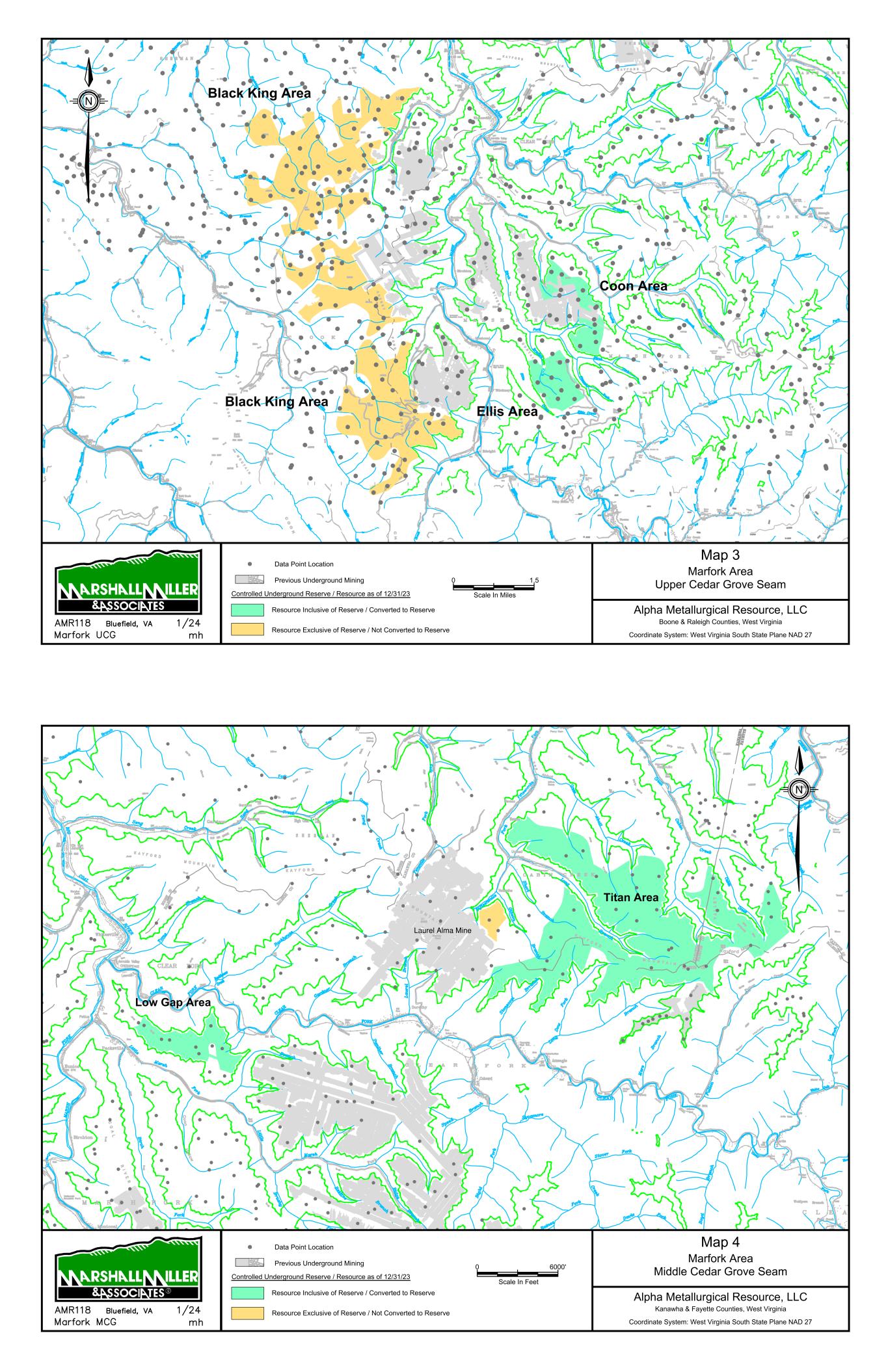

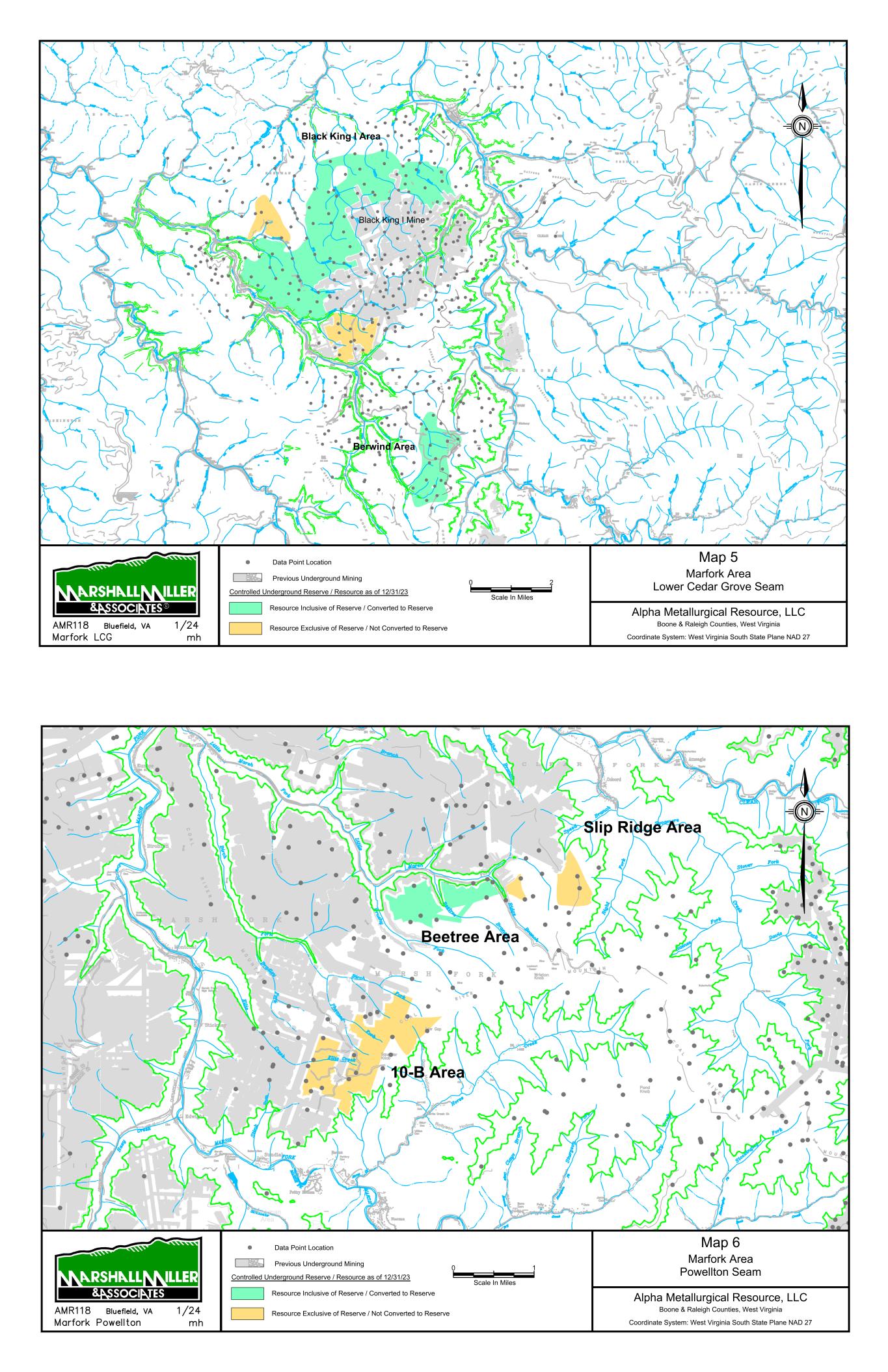

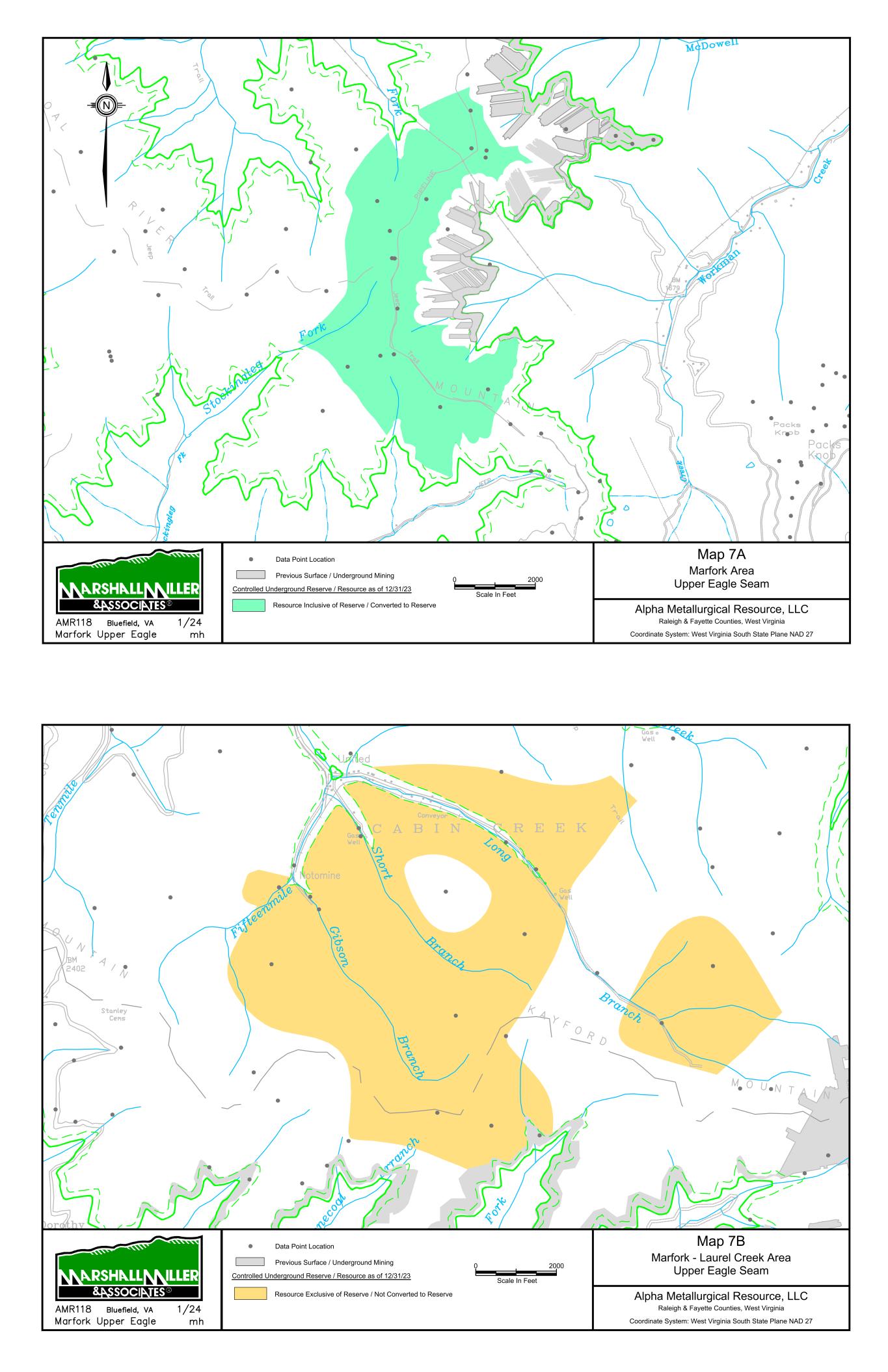

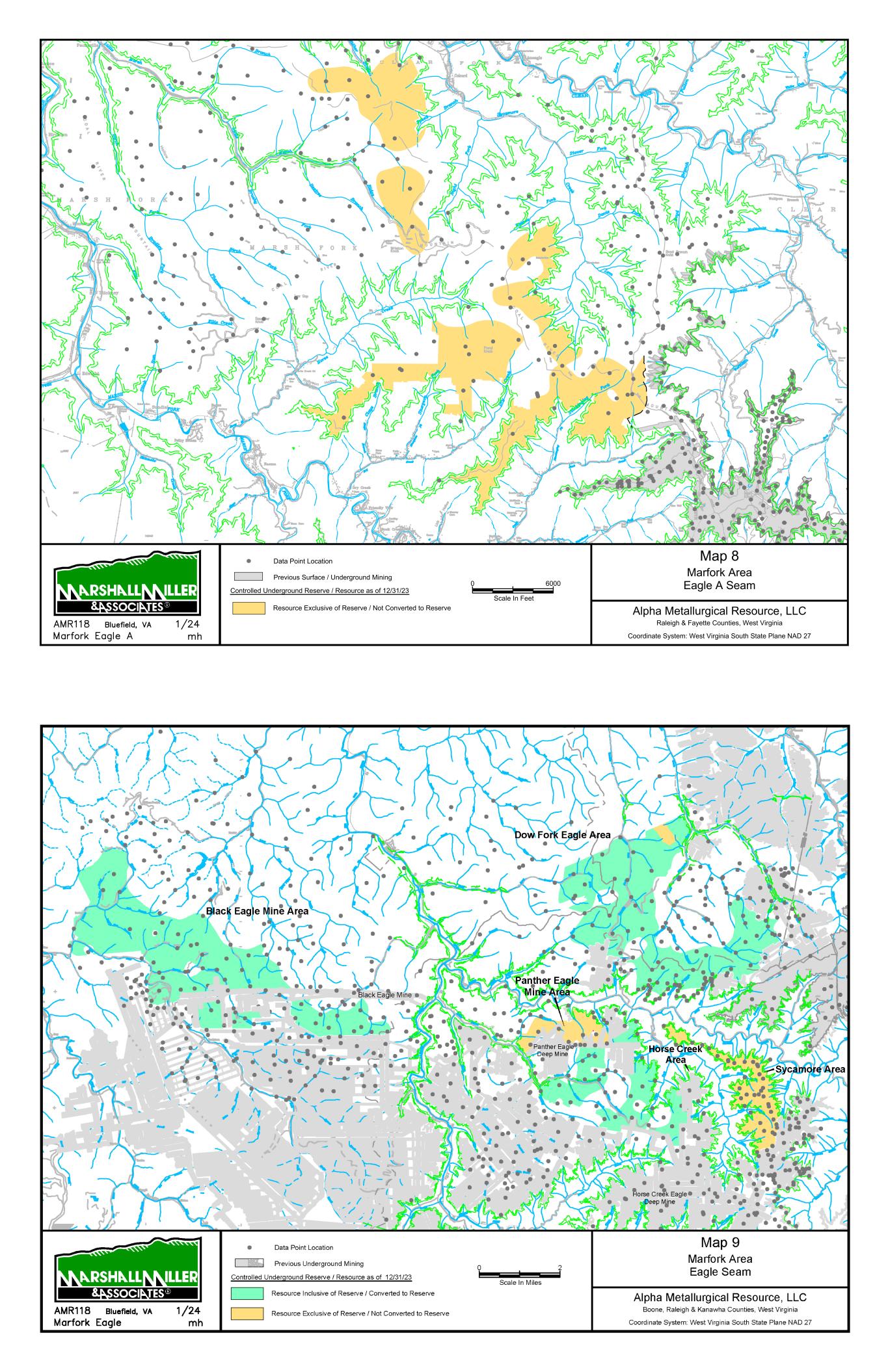

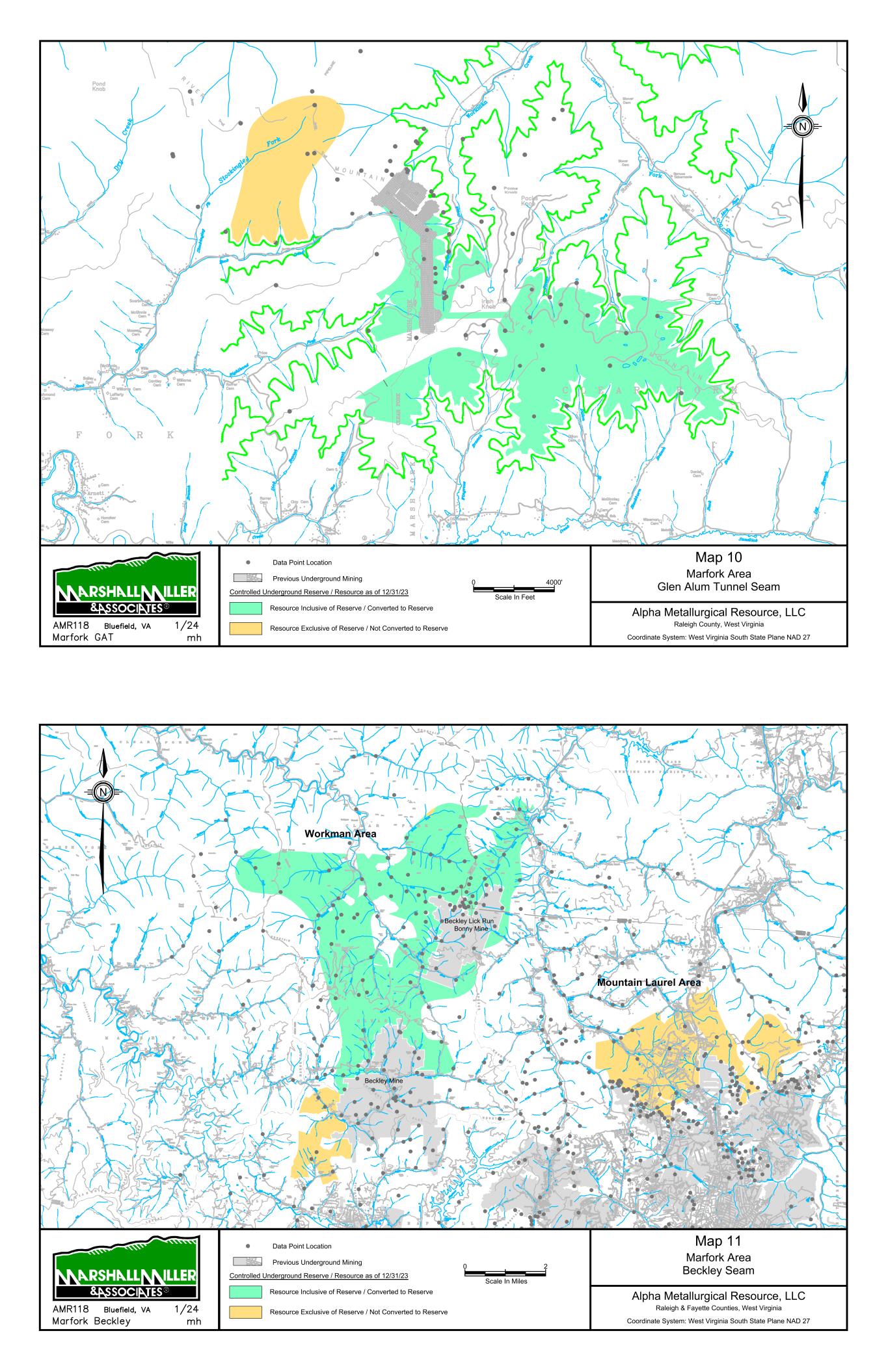

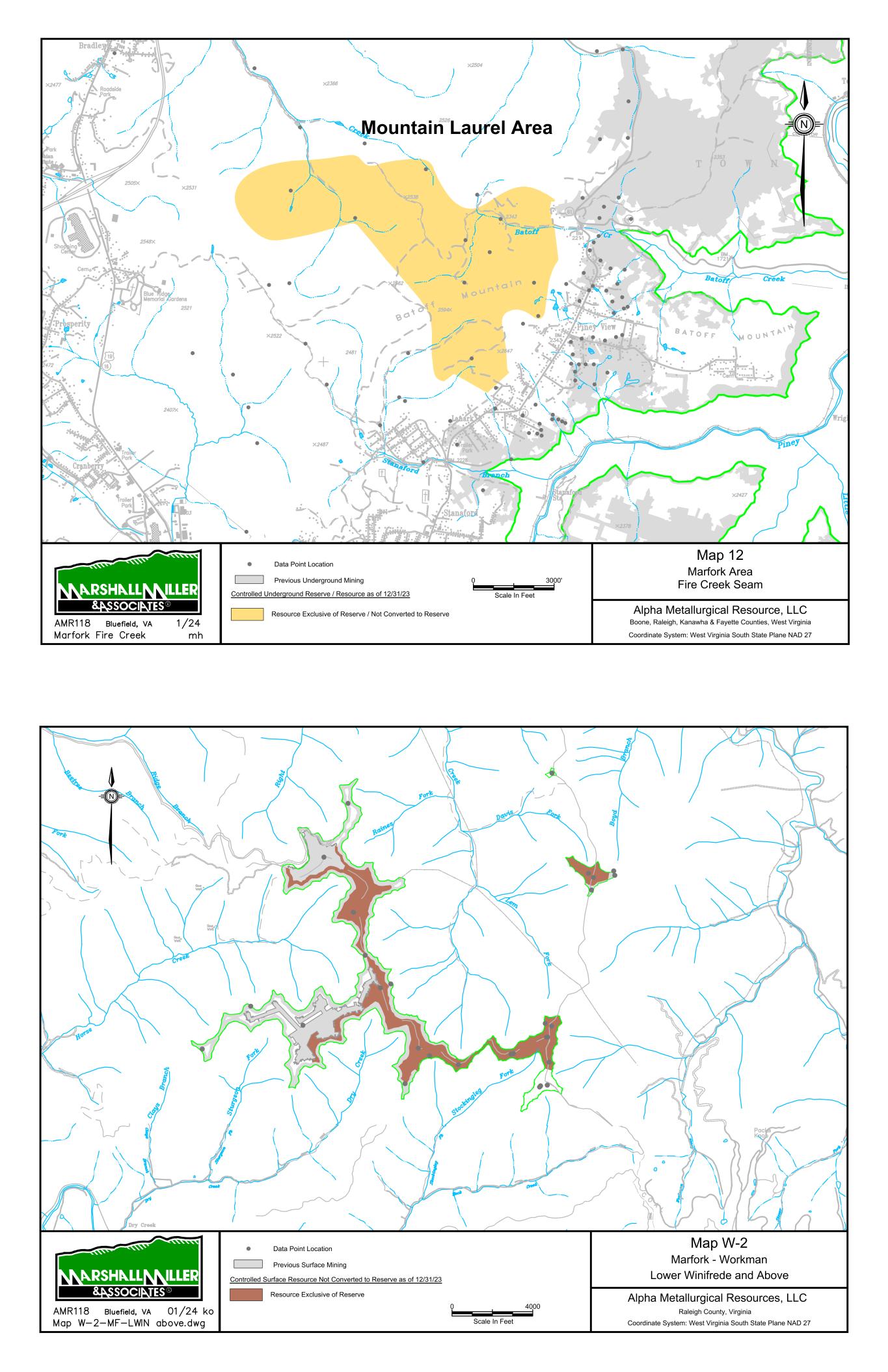

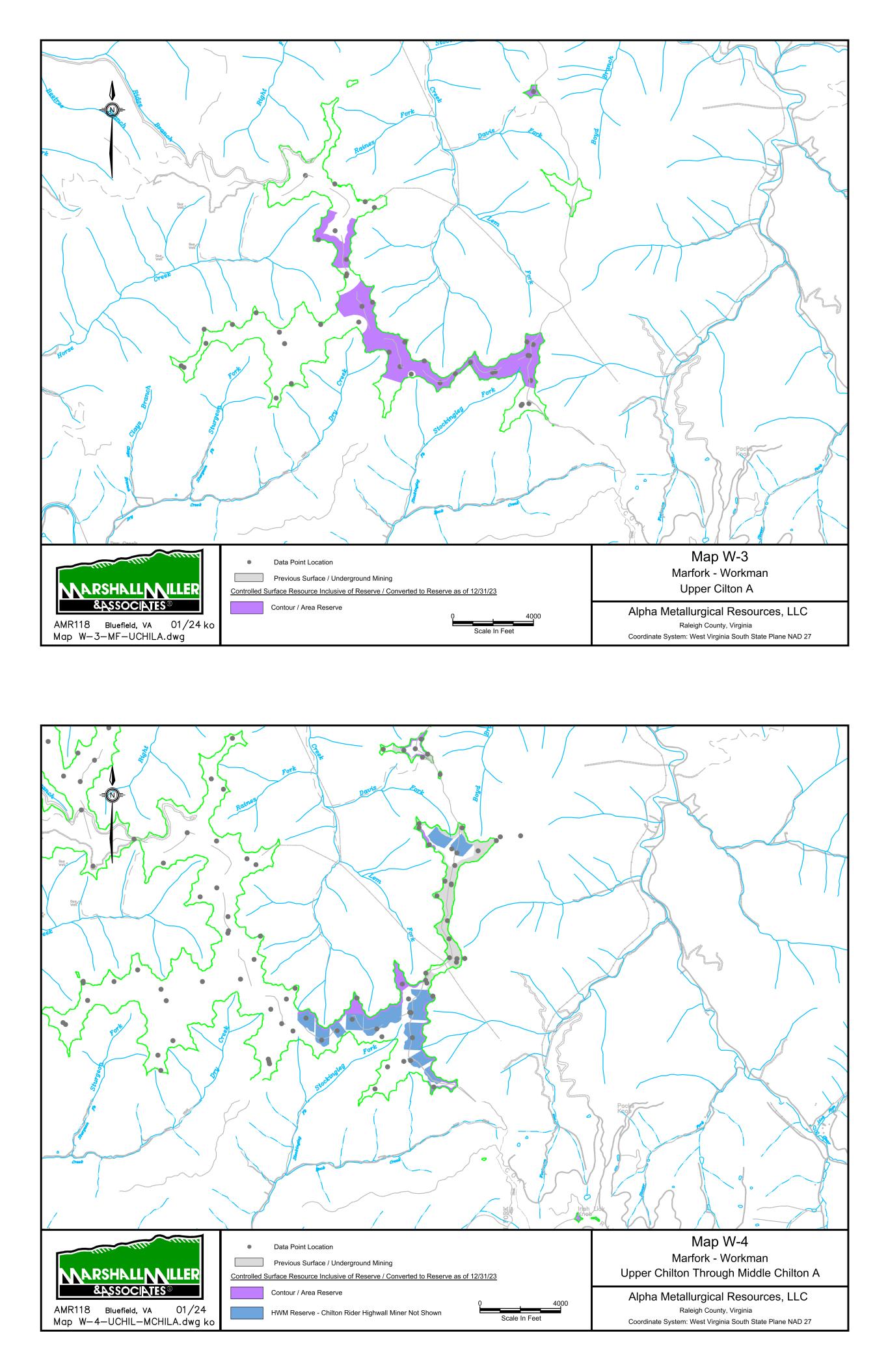

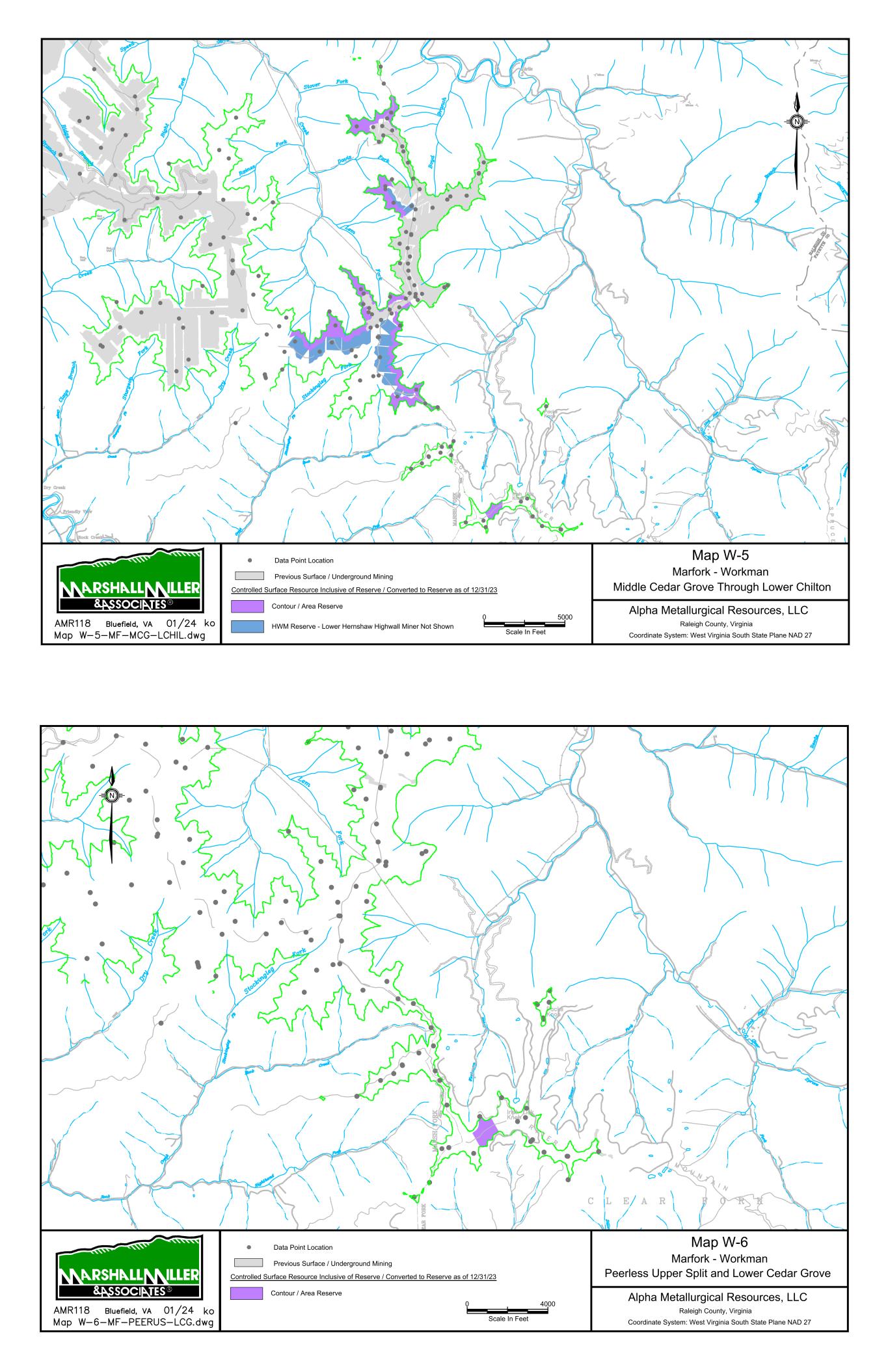

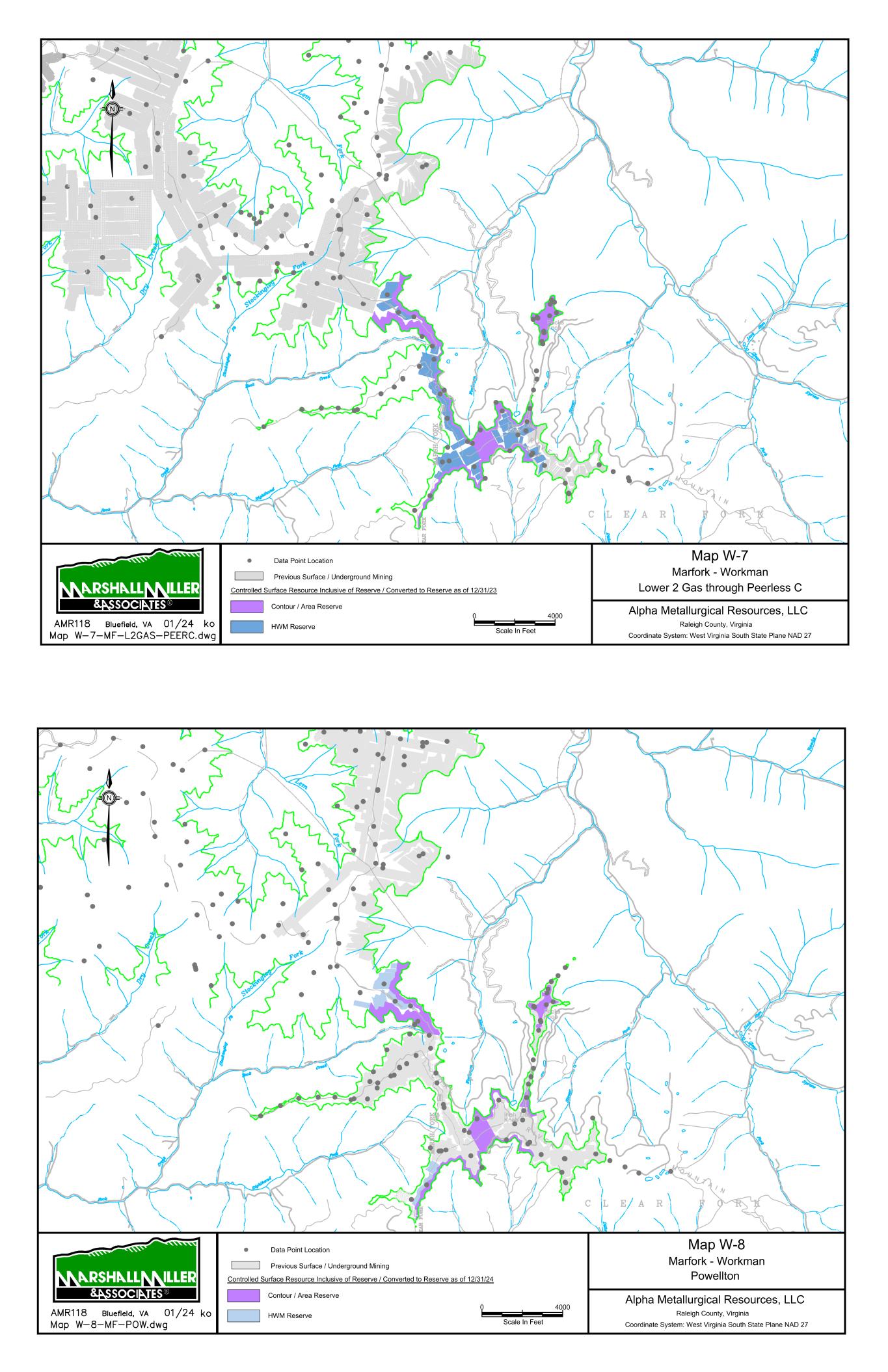

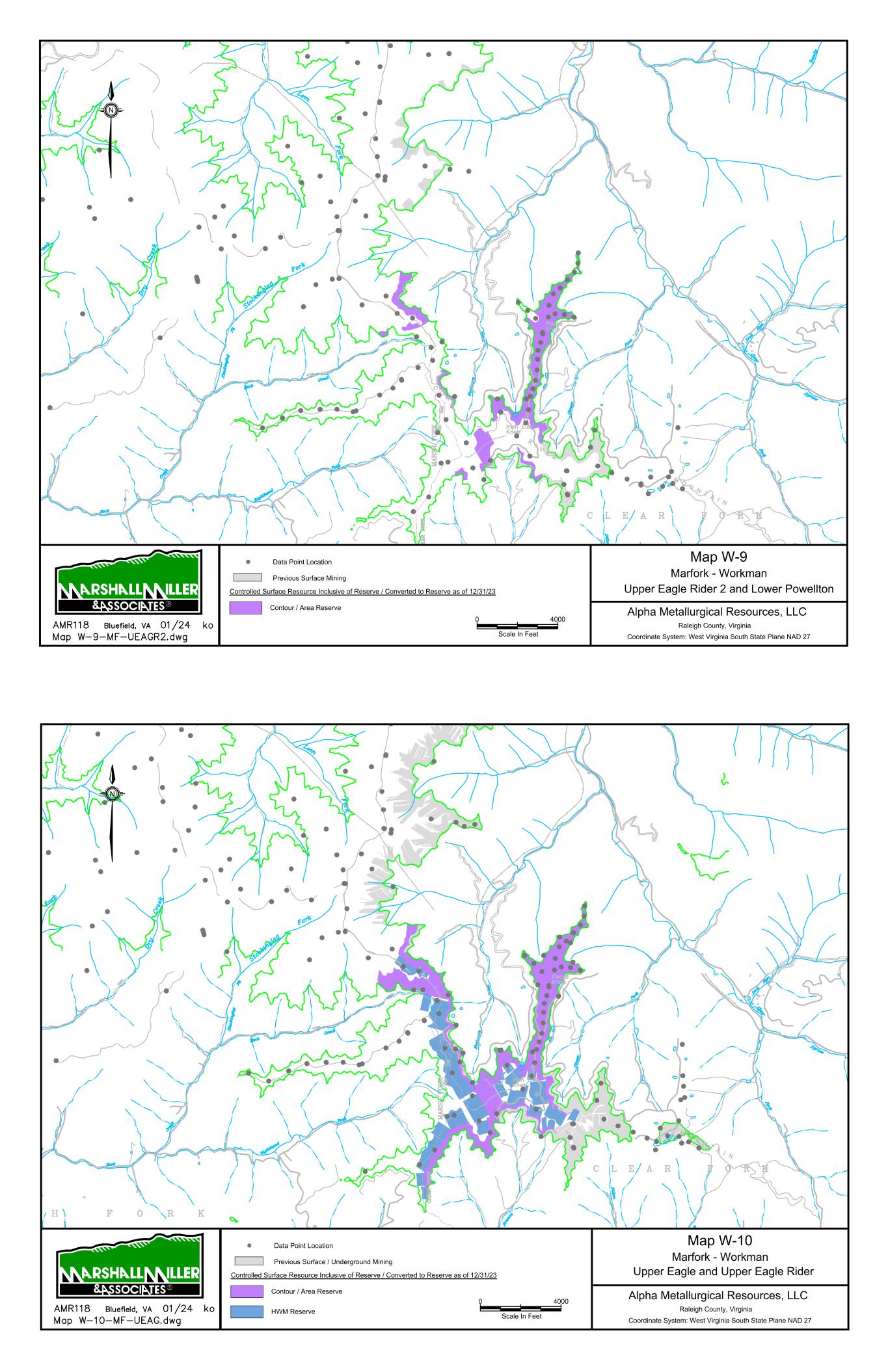

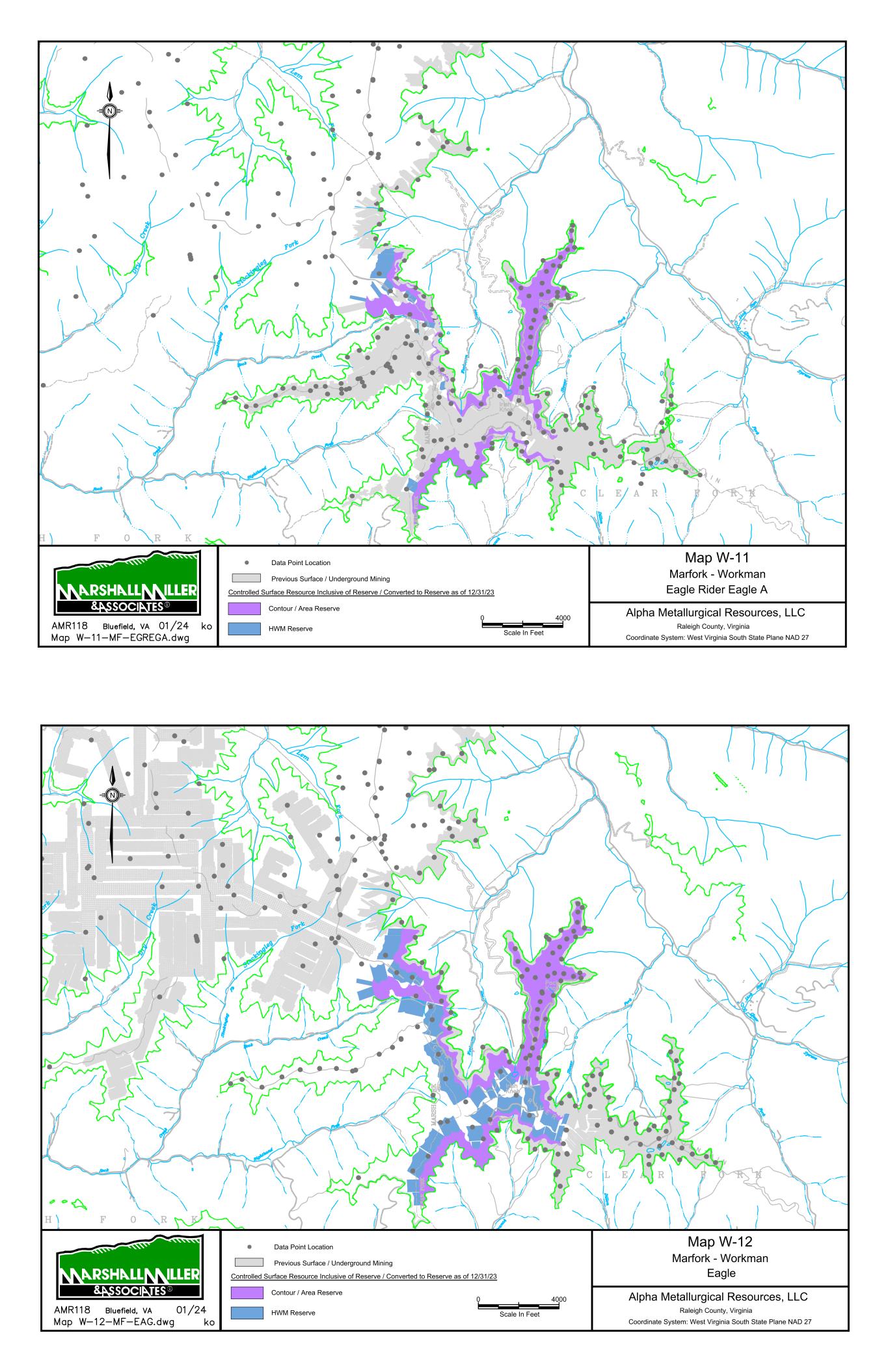

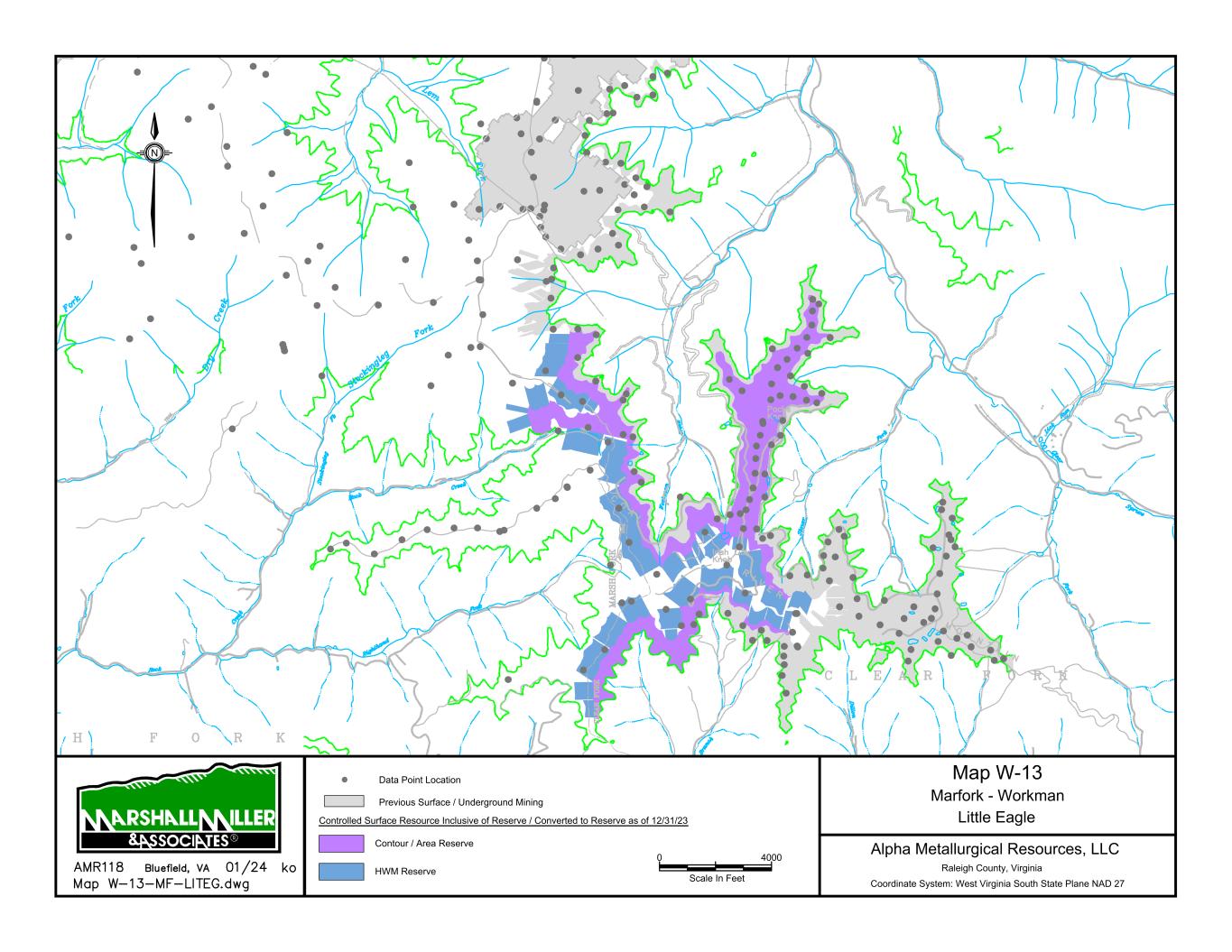

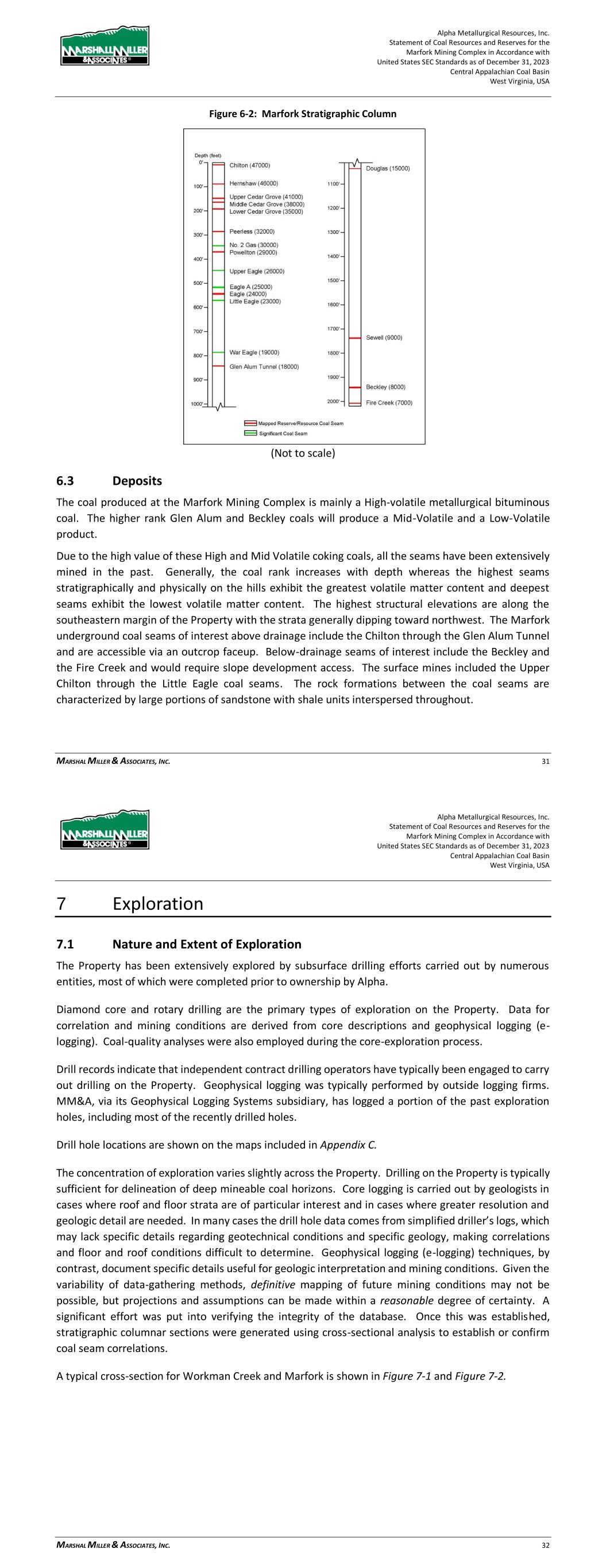

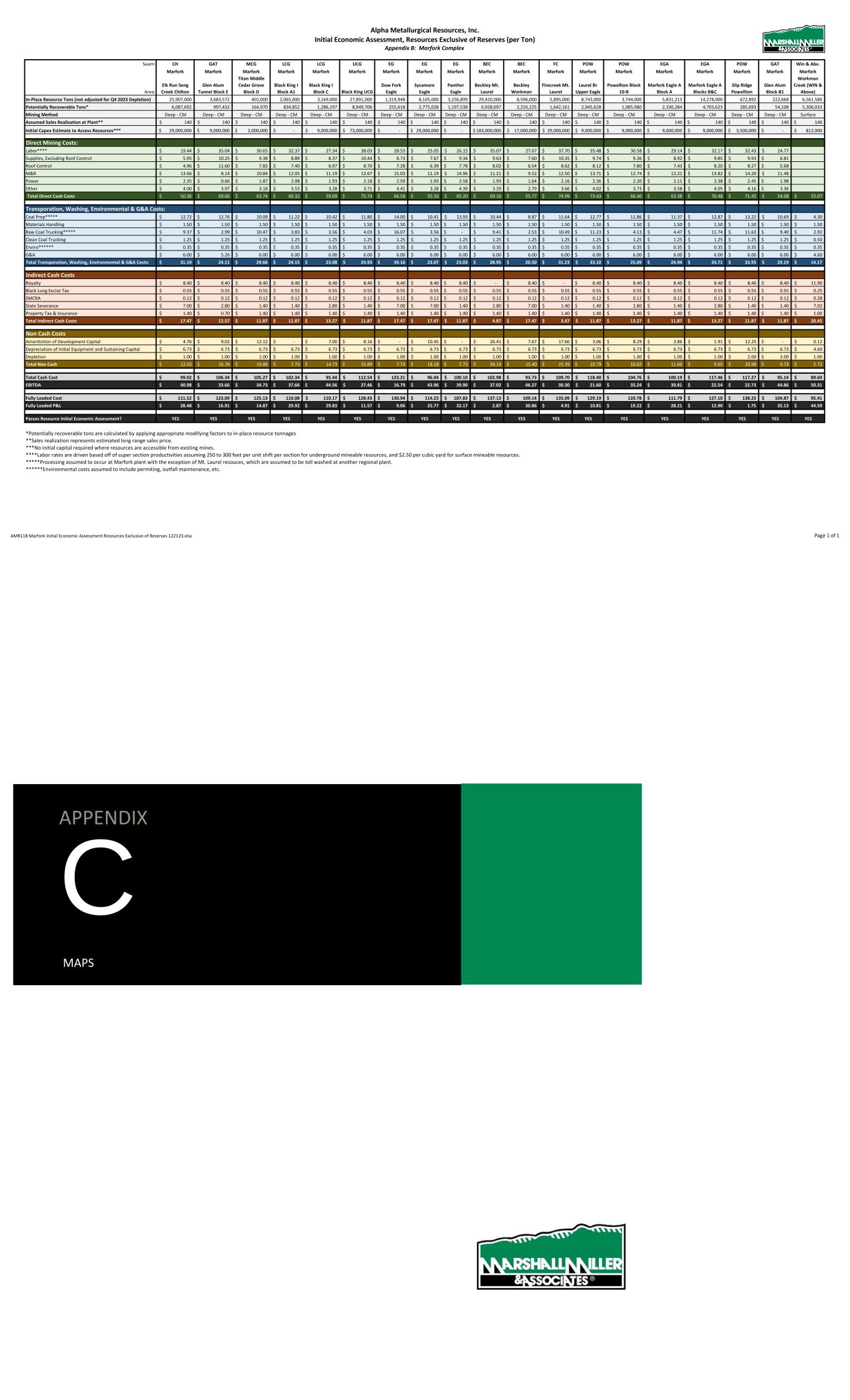

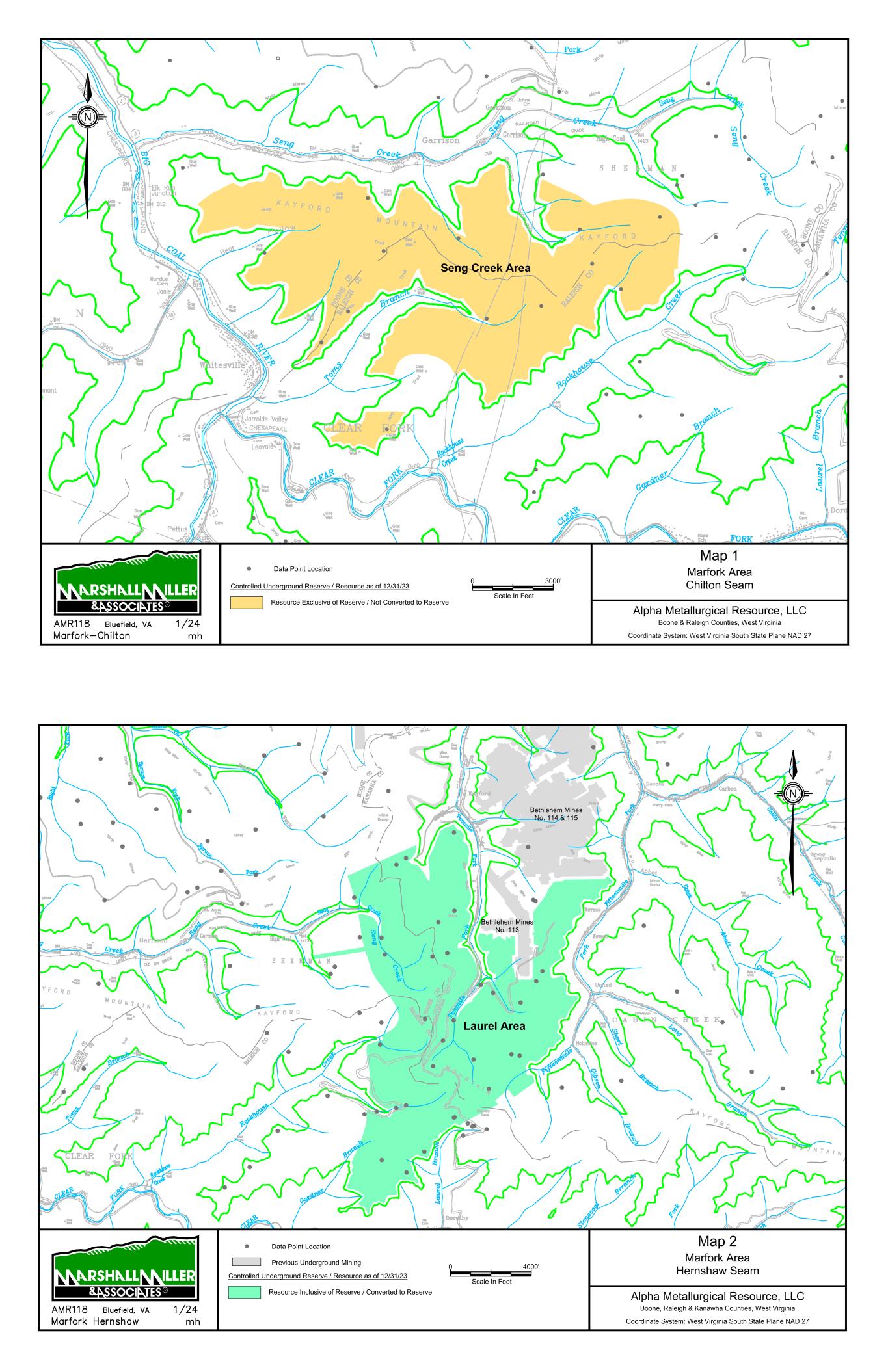

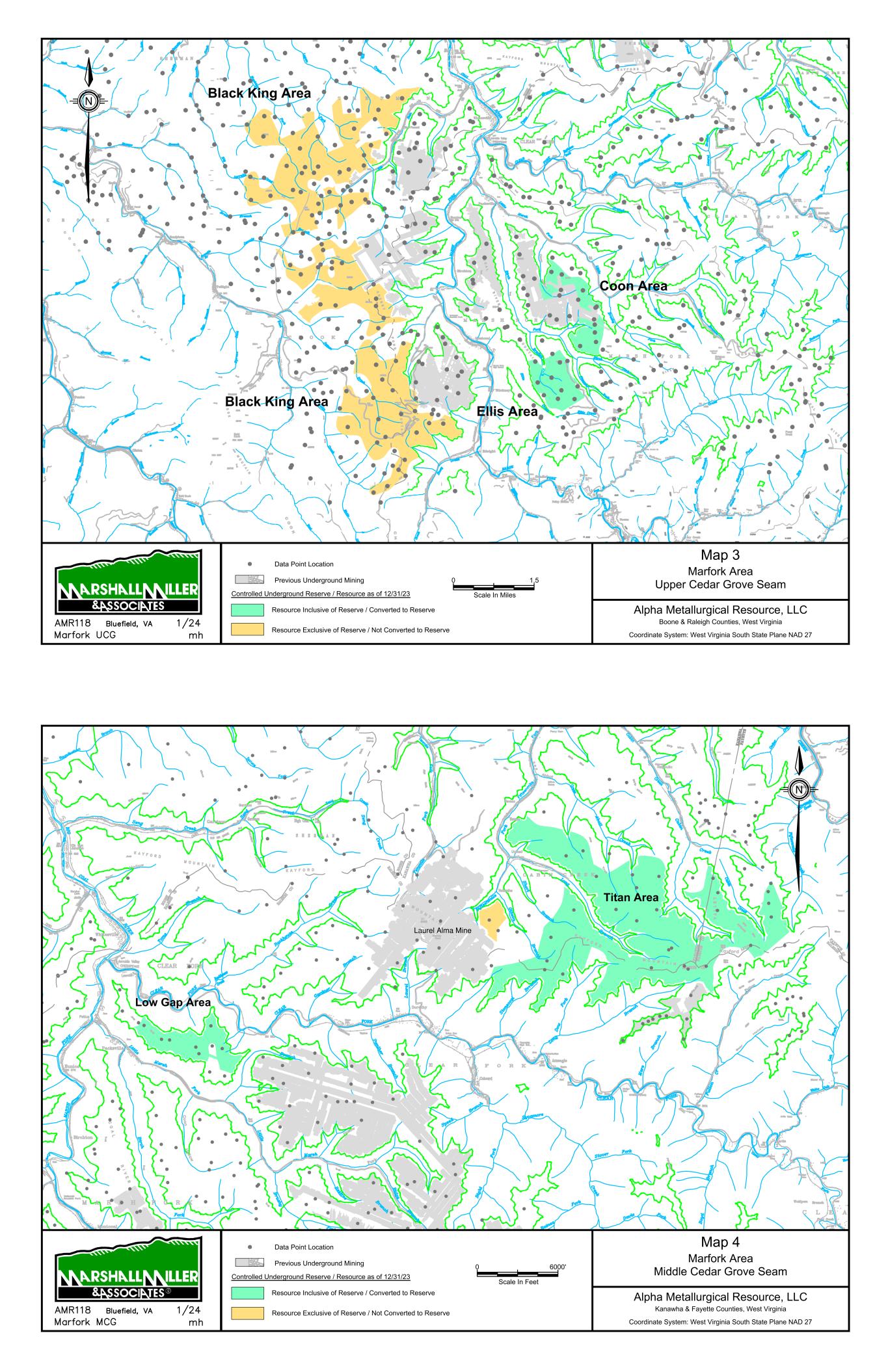

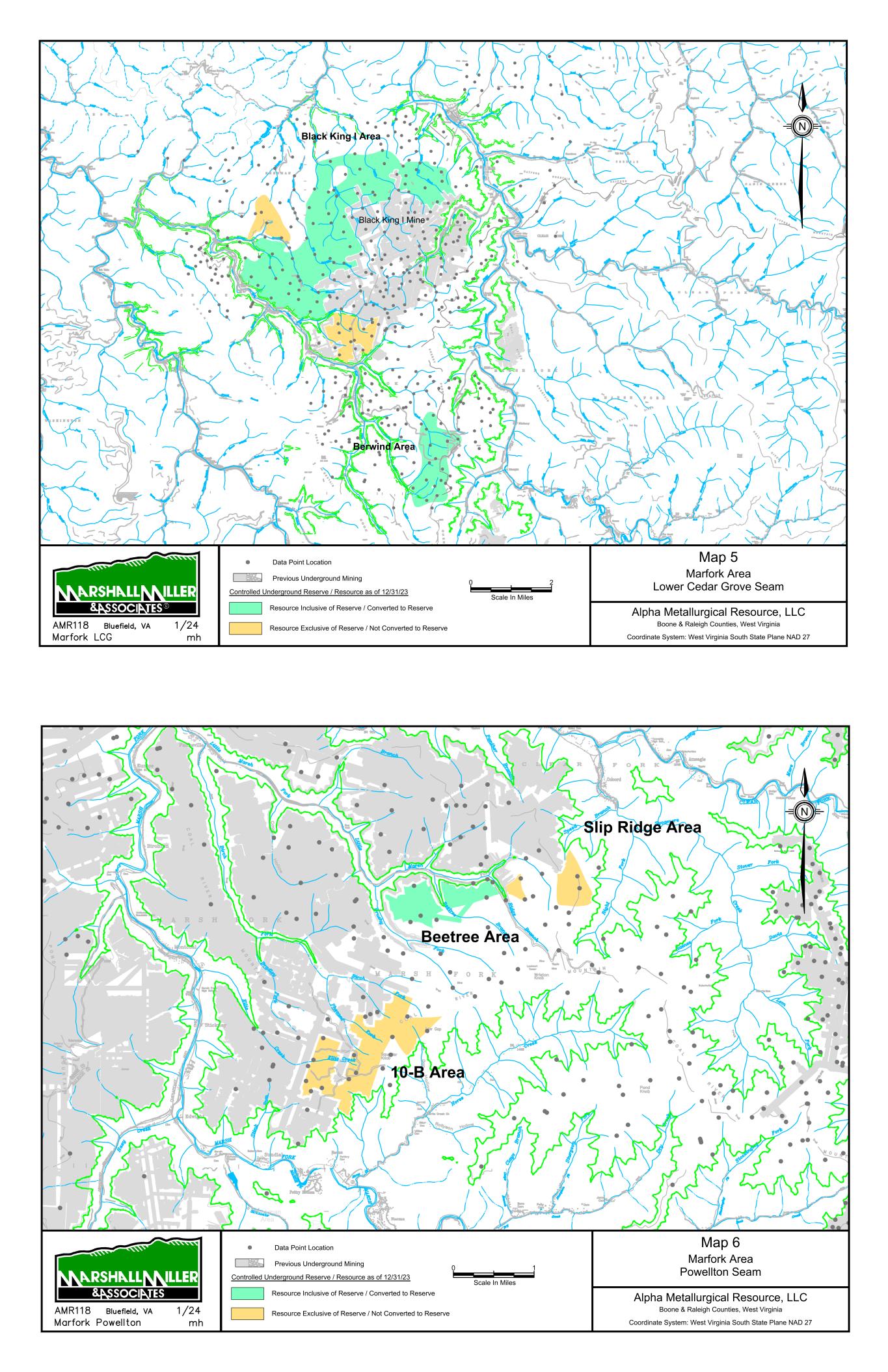

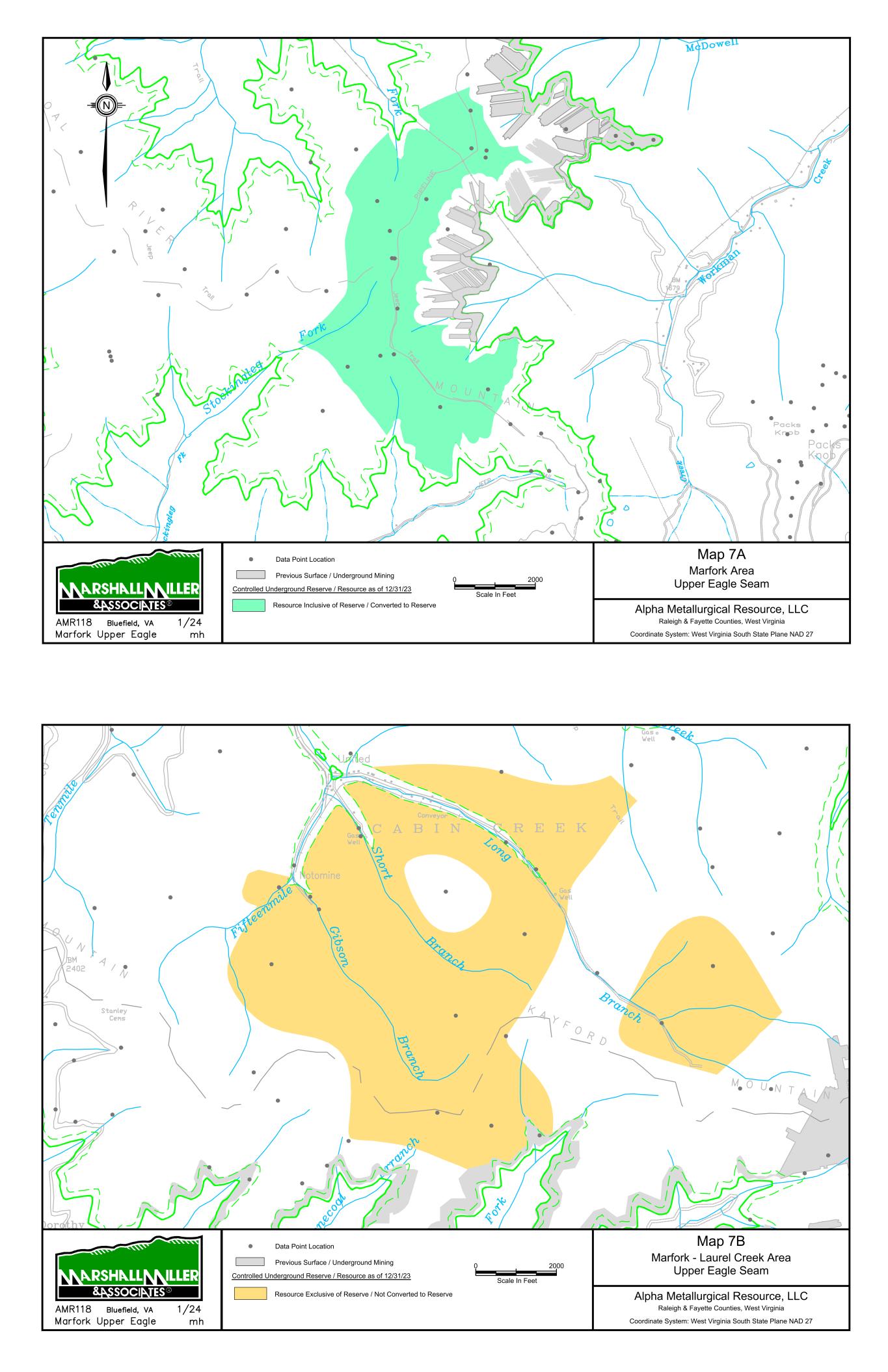

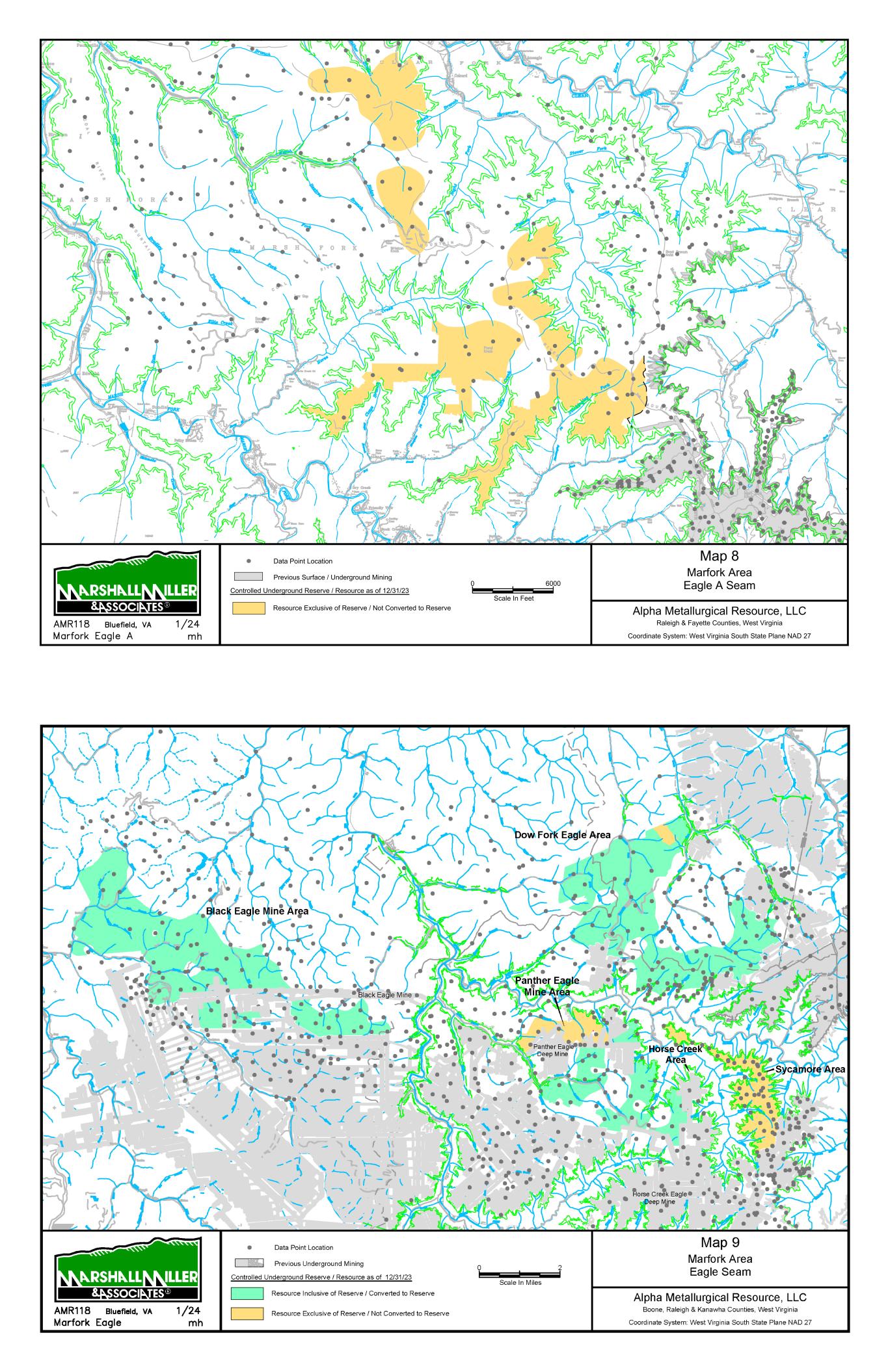

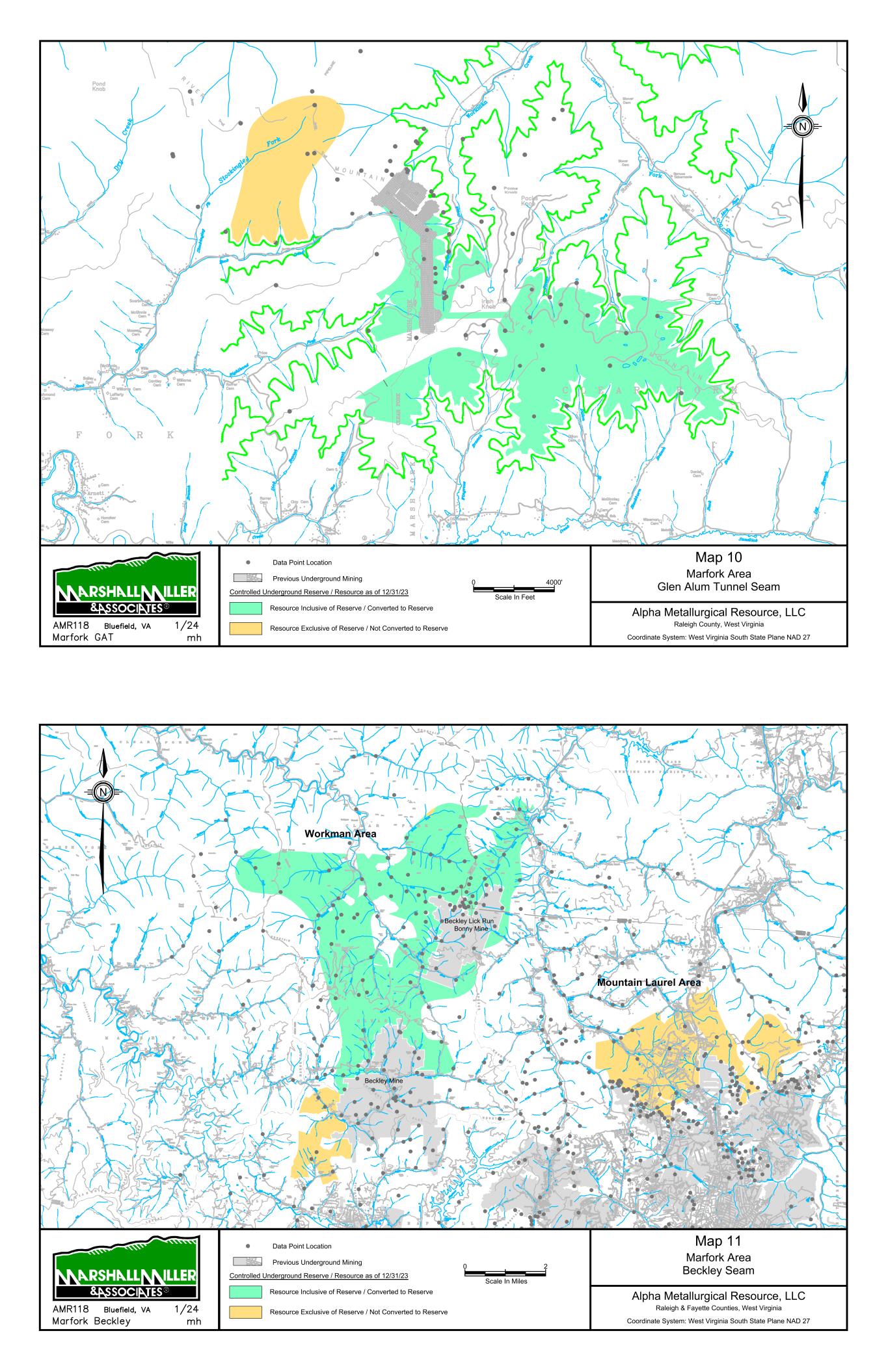

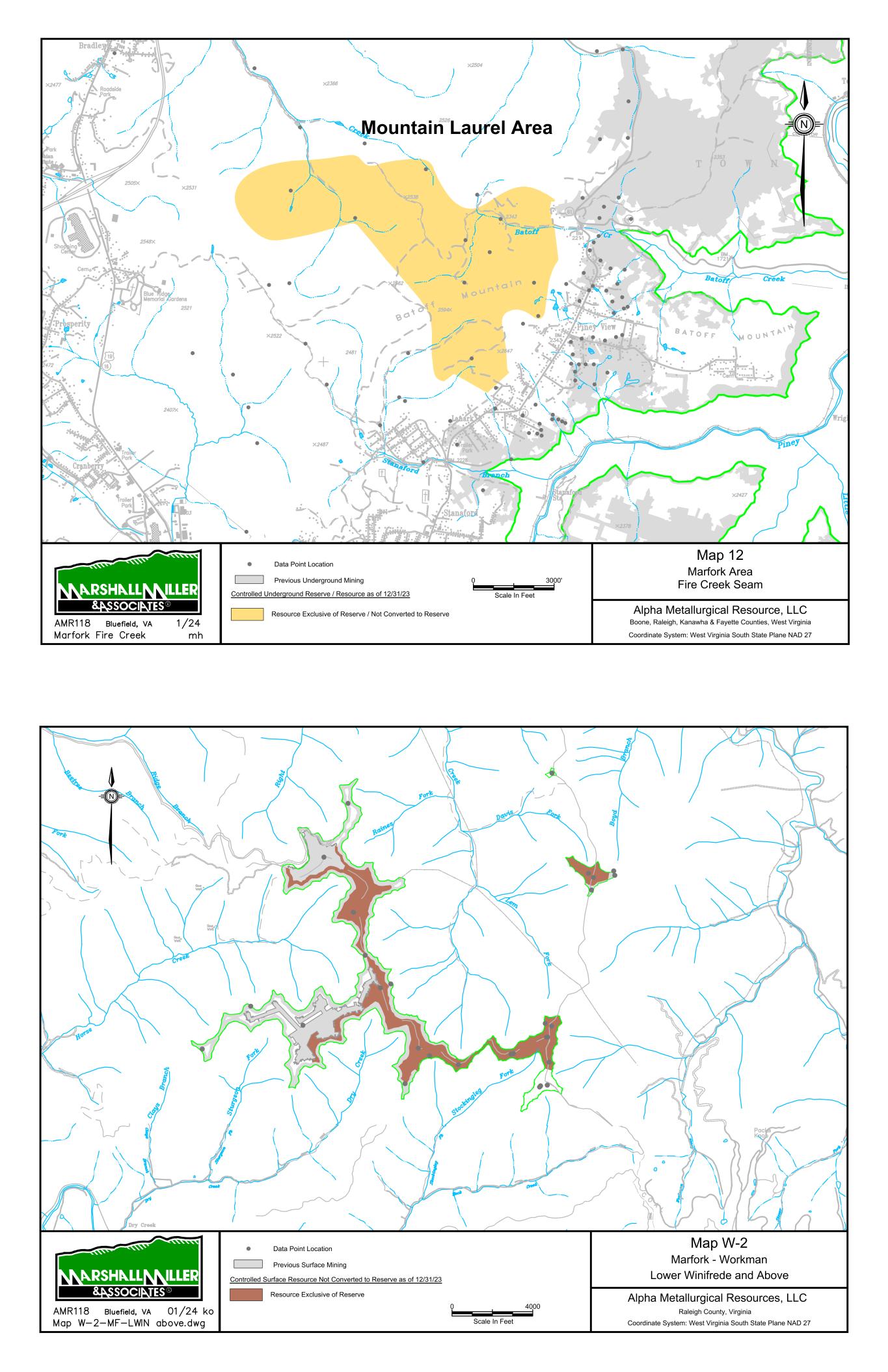

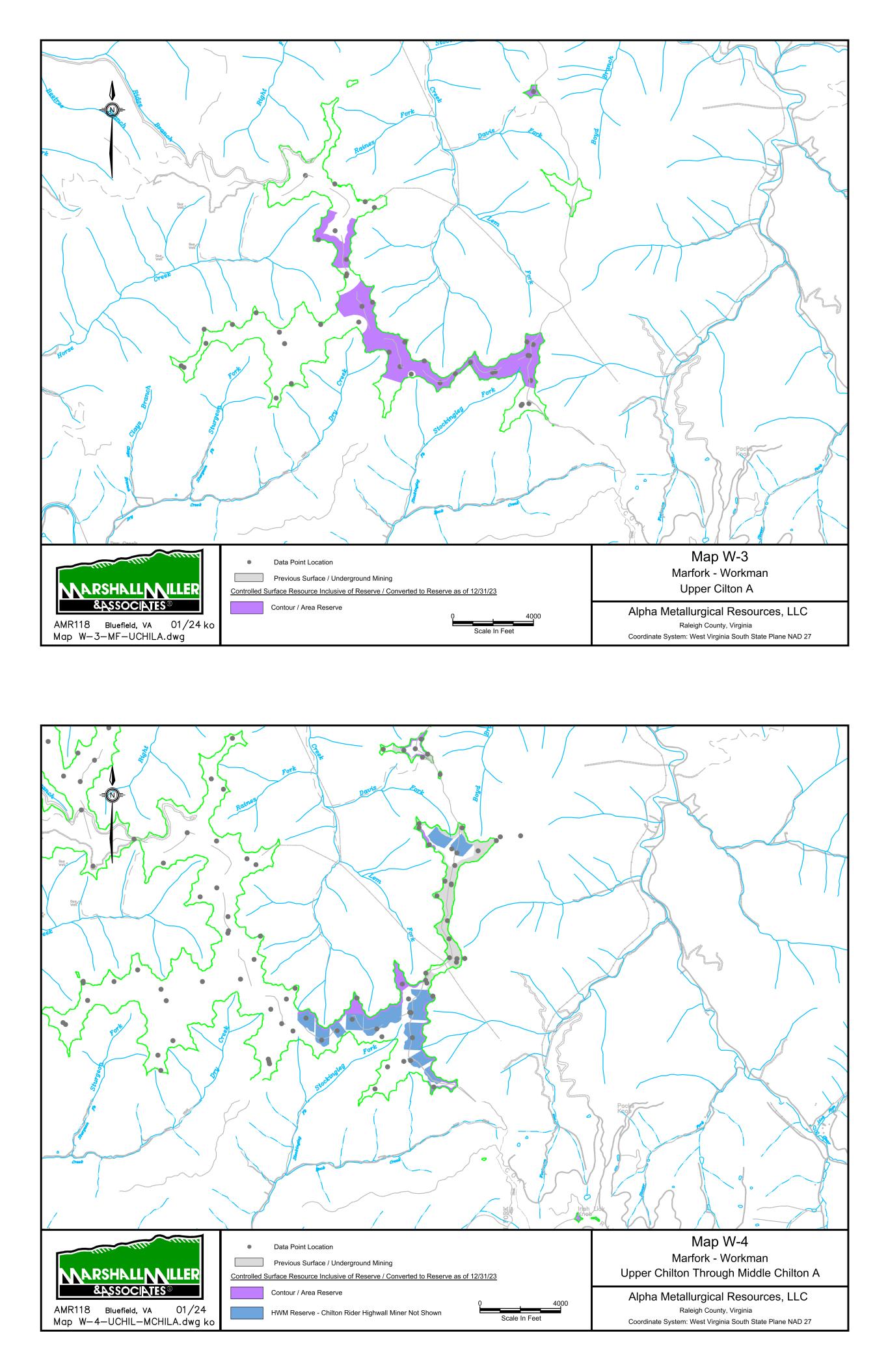

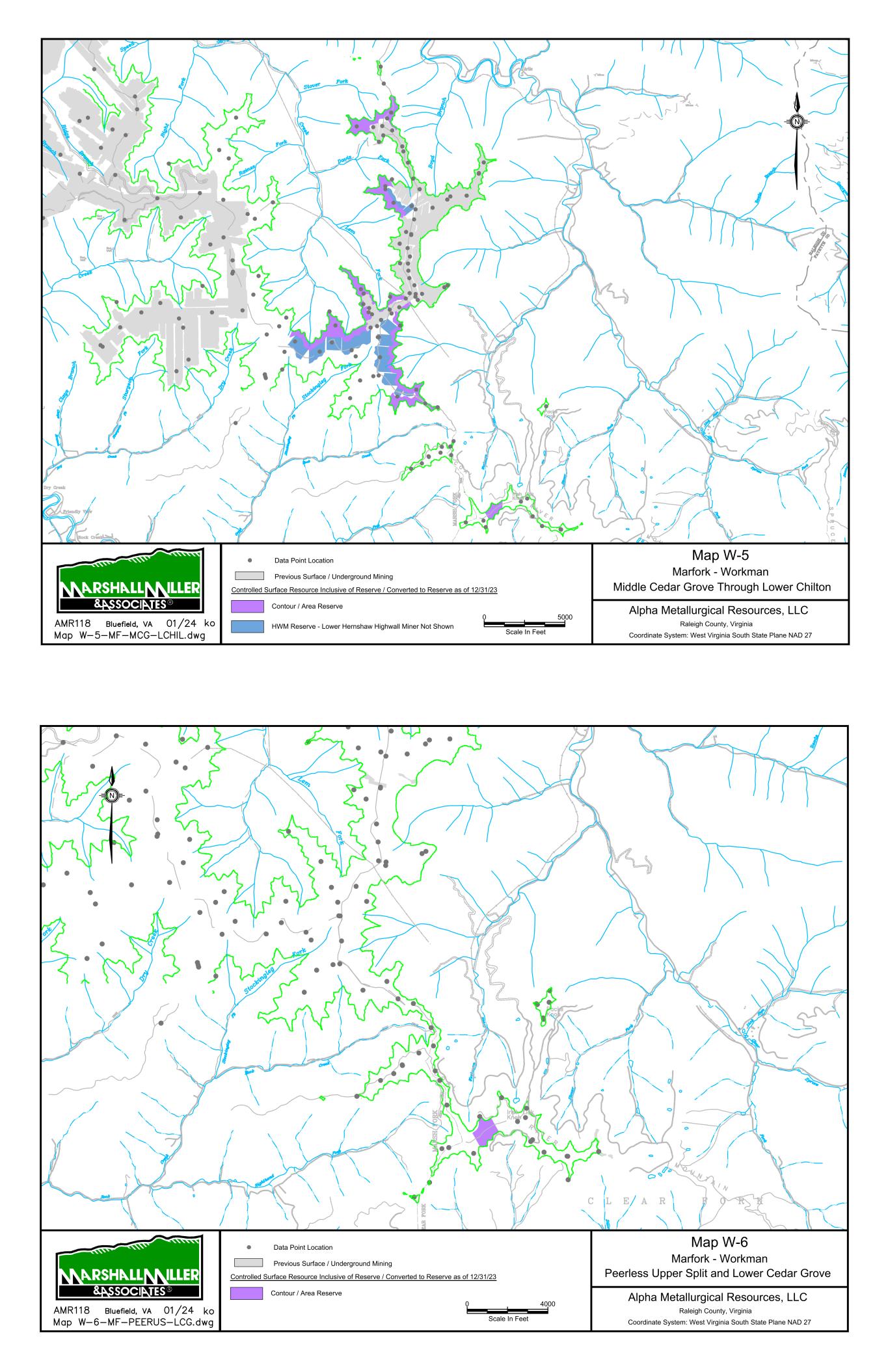

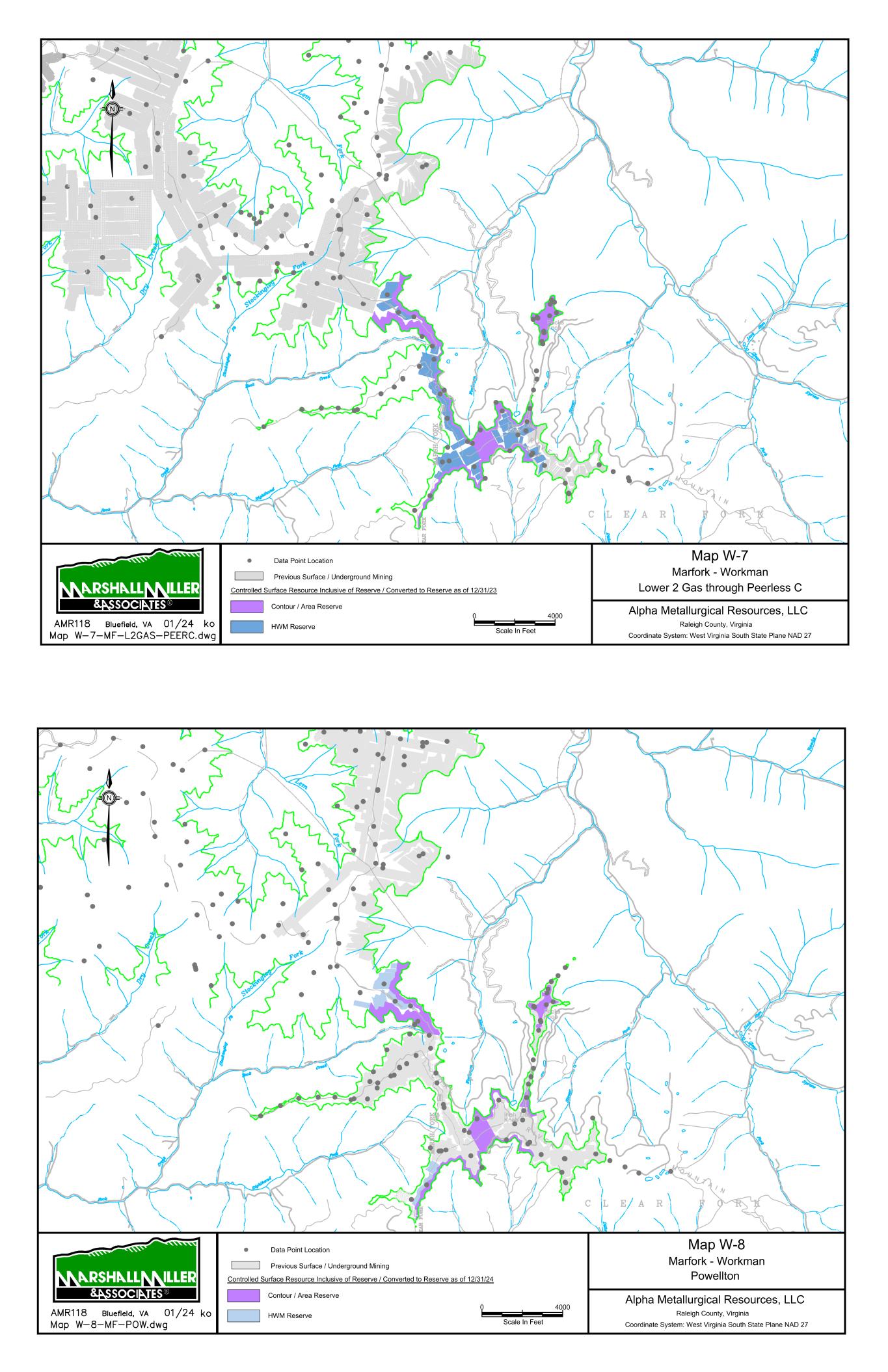

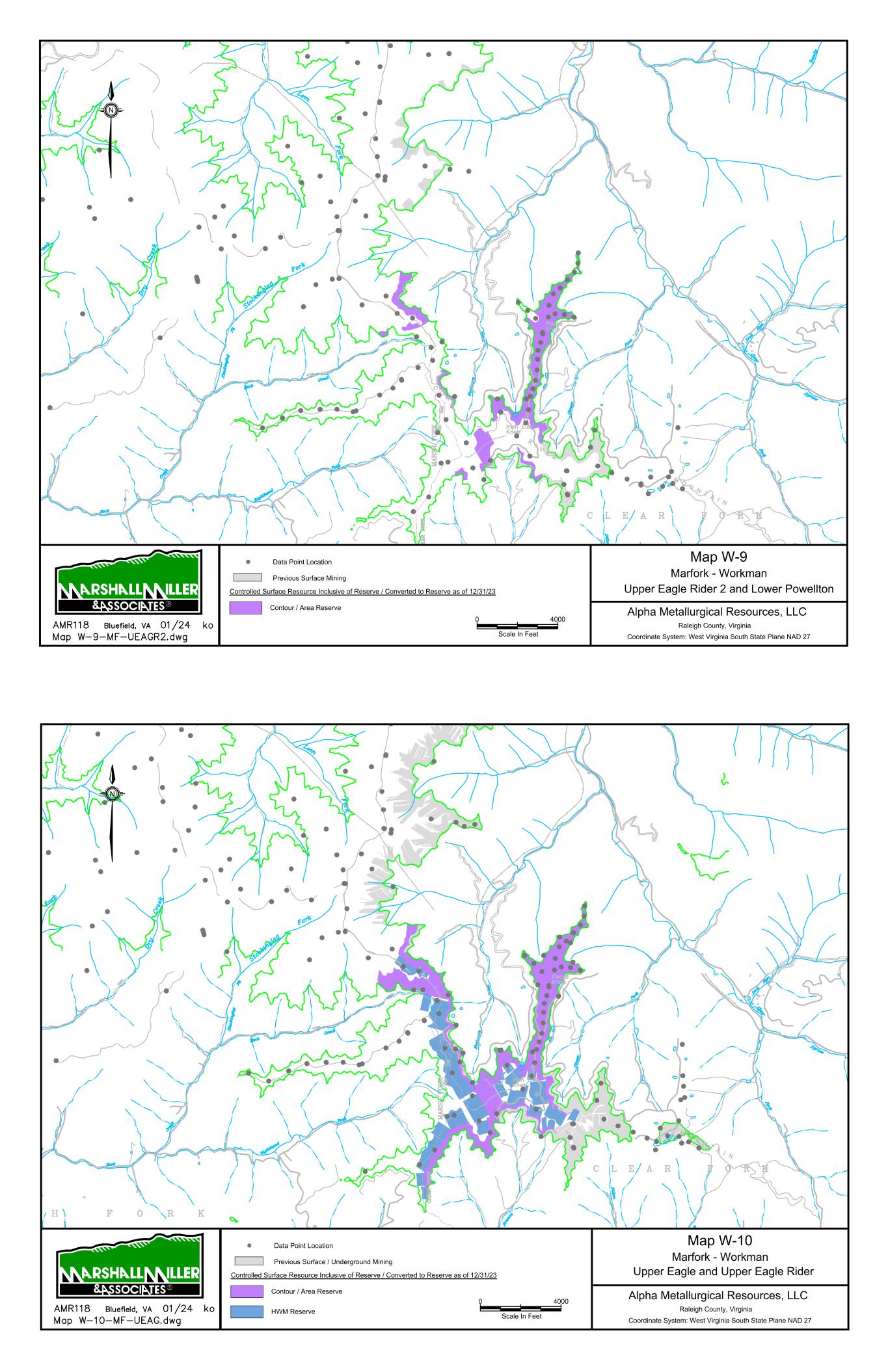

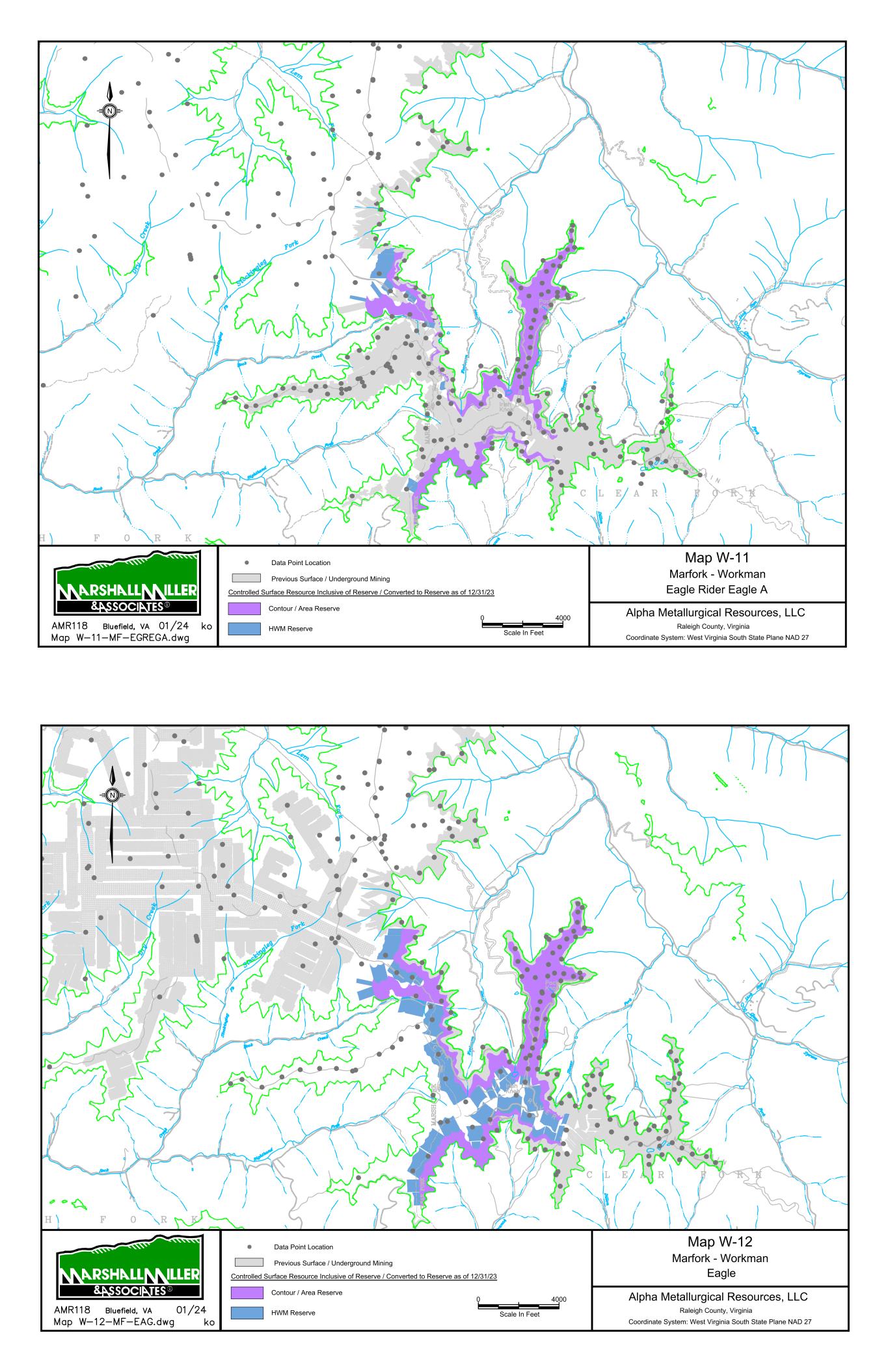

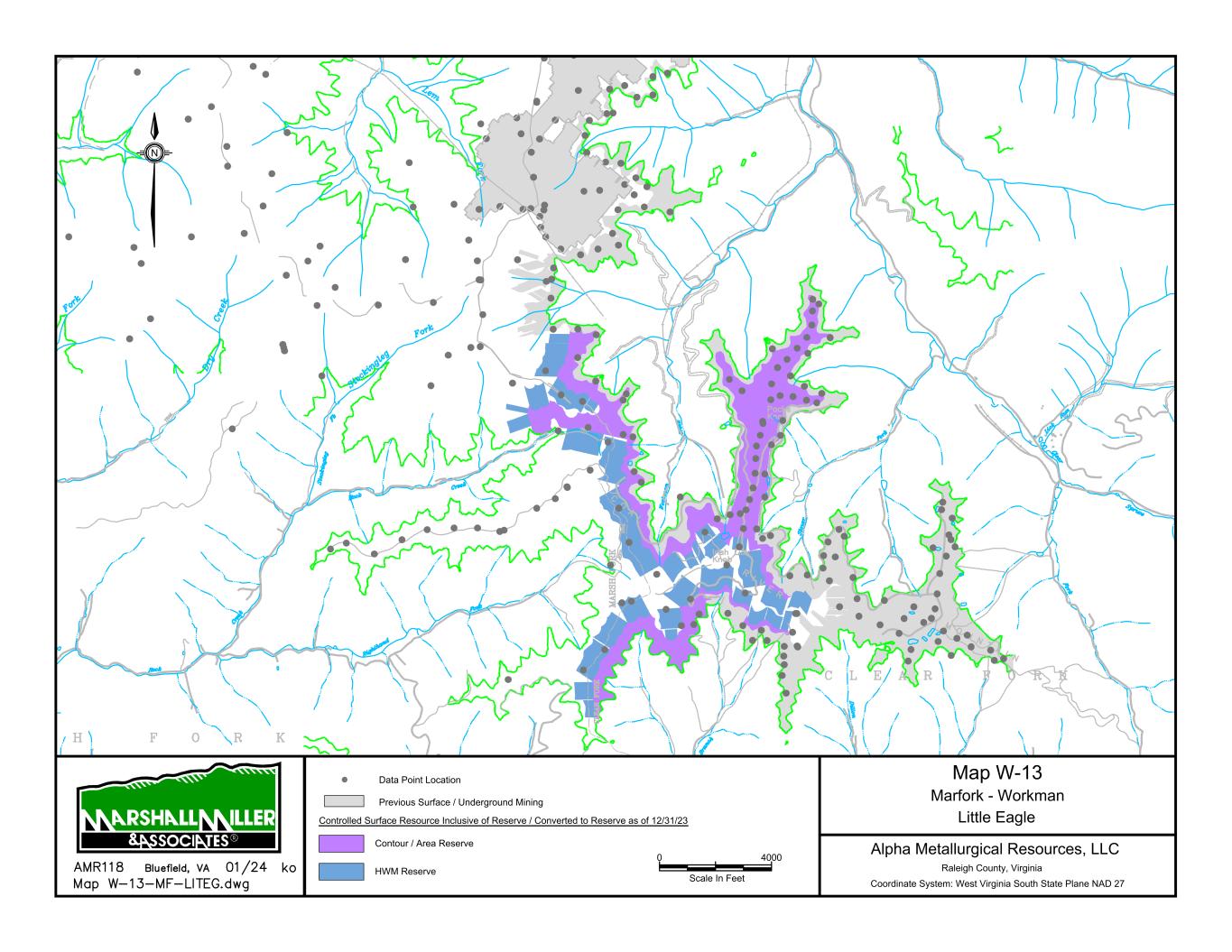

Marfork – Marfork is a mining complex located in Raleigh, Boone, Kanawha, and Fayette counties, West Virginia. The complex has three active underground mines which produce High-Vol. A quality met coal from the Eagle coal seam and one active underground mine that produces mid-vol quality met coal from the Glen Alum Tunnel seam. The complex also has two active surface mines which produce High-Vol. A quality met coal as well as some thermal quality coal as a by-product of mining from multiple coal seams. Mine lives range from 2 to 17 years. Coal from the underground mines is processed at the Marfork Preparation Plant and loaded onto the CSX rail for delivery to customers. Coal from the surface mines may be processed through the Marfork Preparation Plant or trucked directly to the Pax Loadout or the Marmet Dock for delivery to customers.

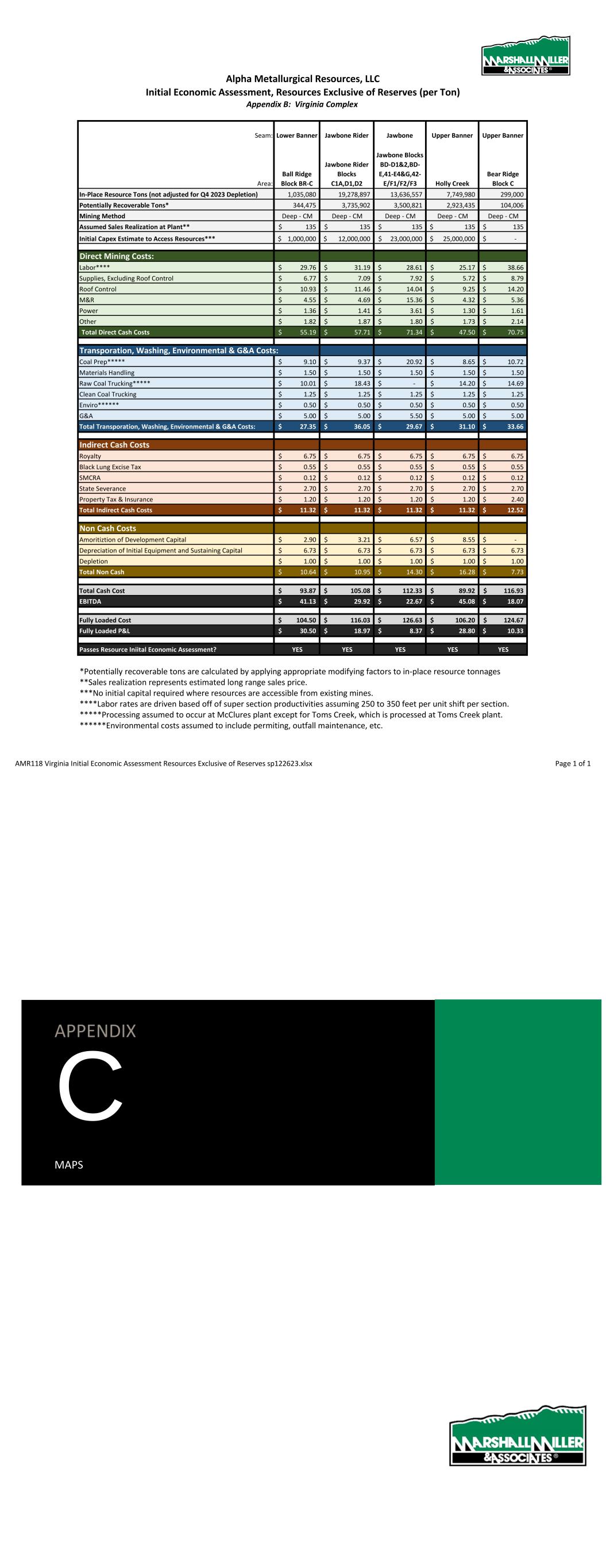

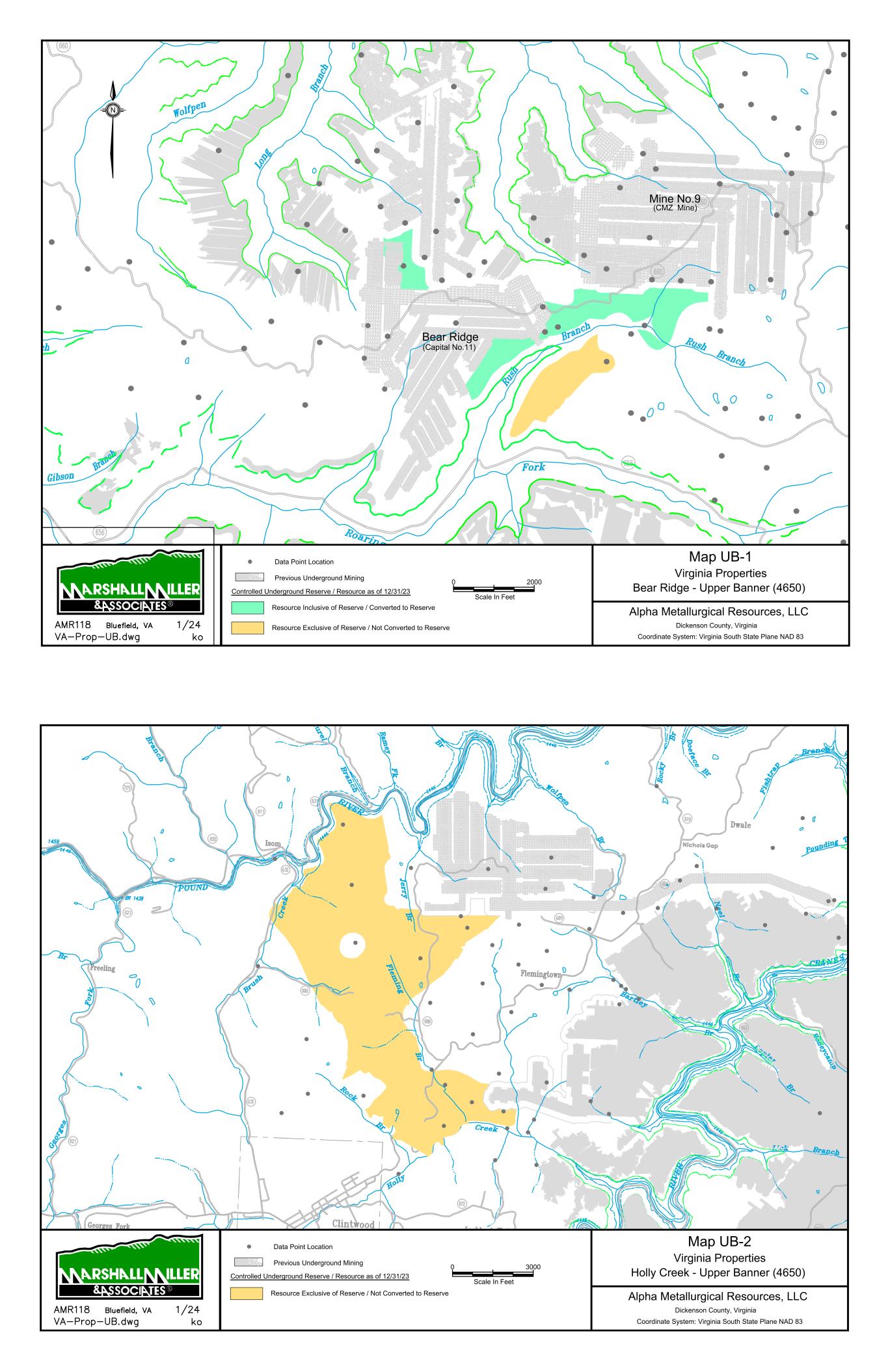

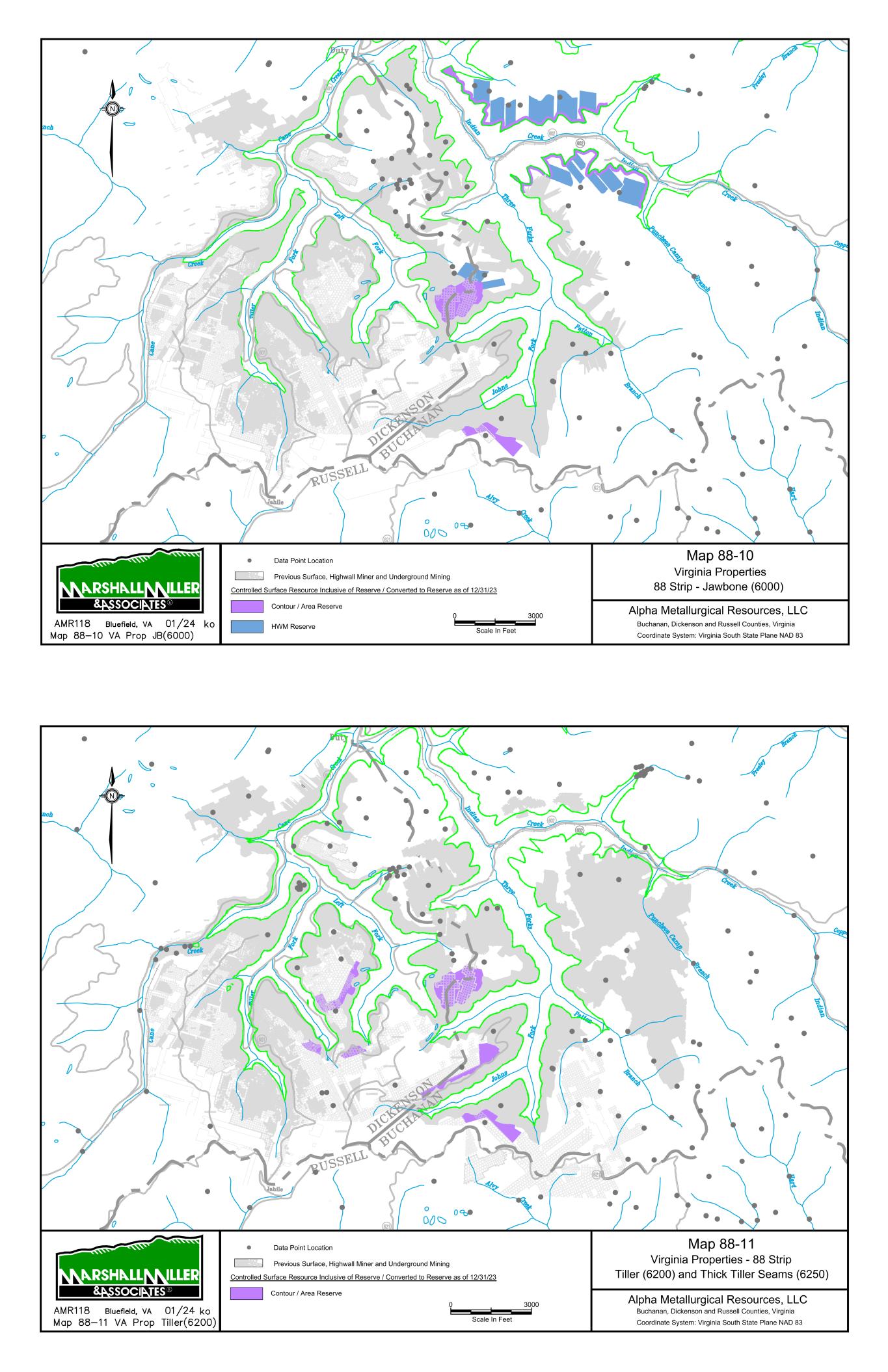

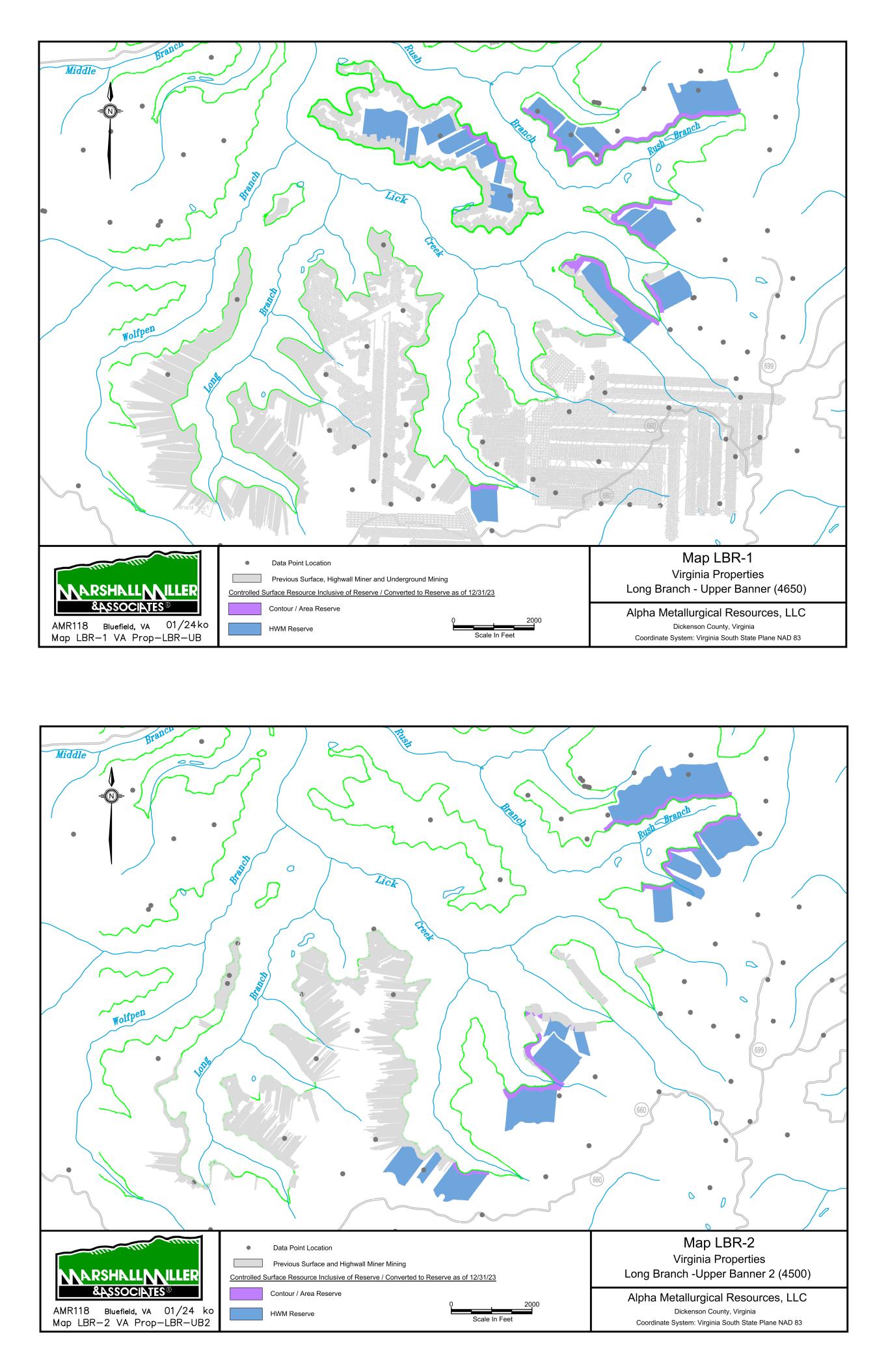

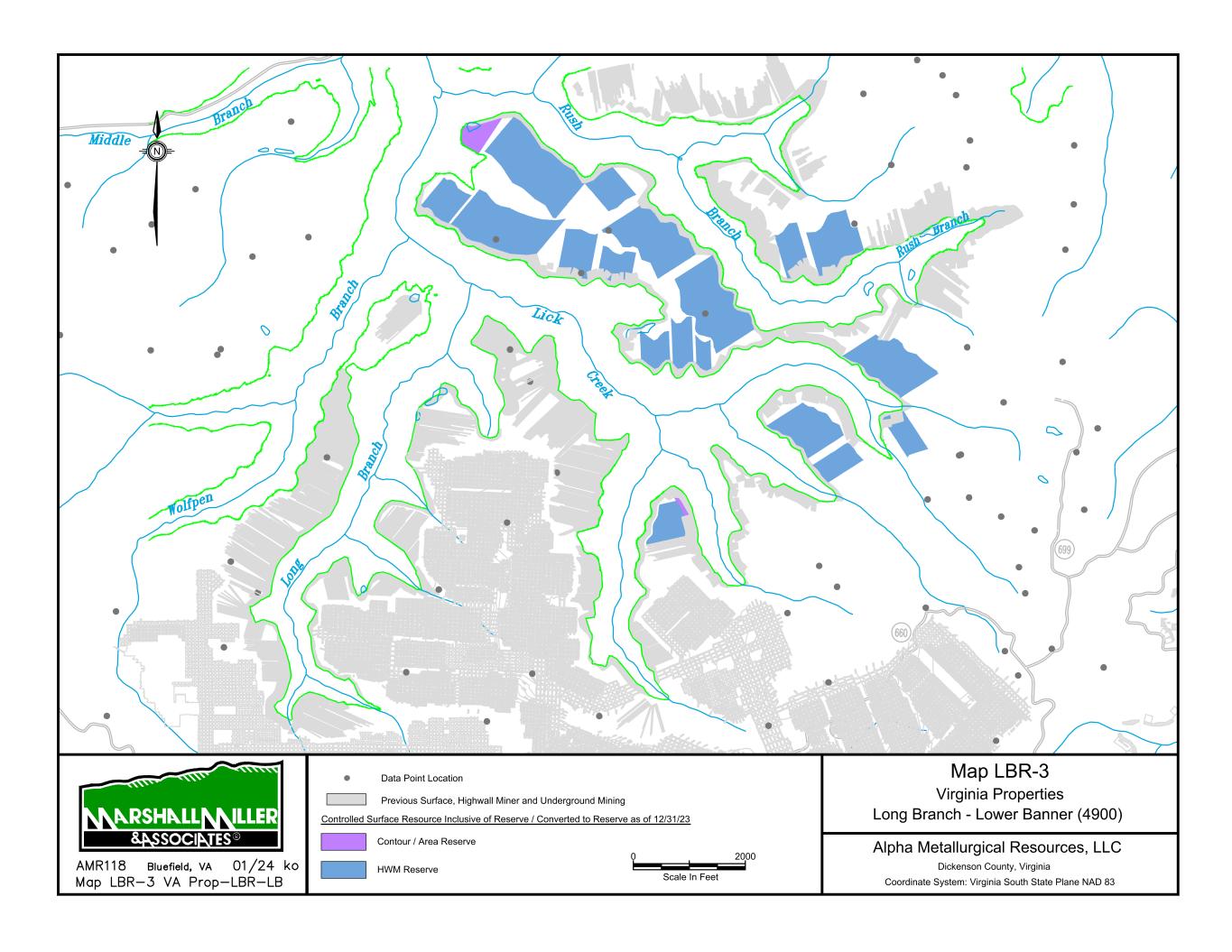

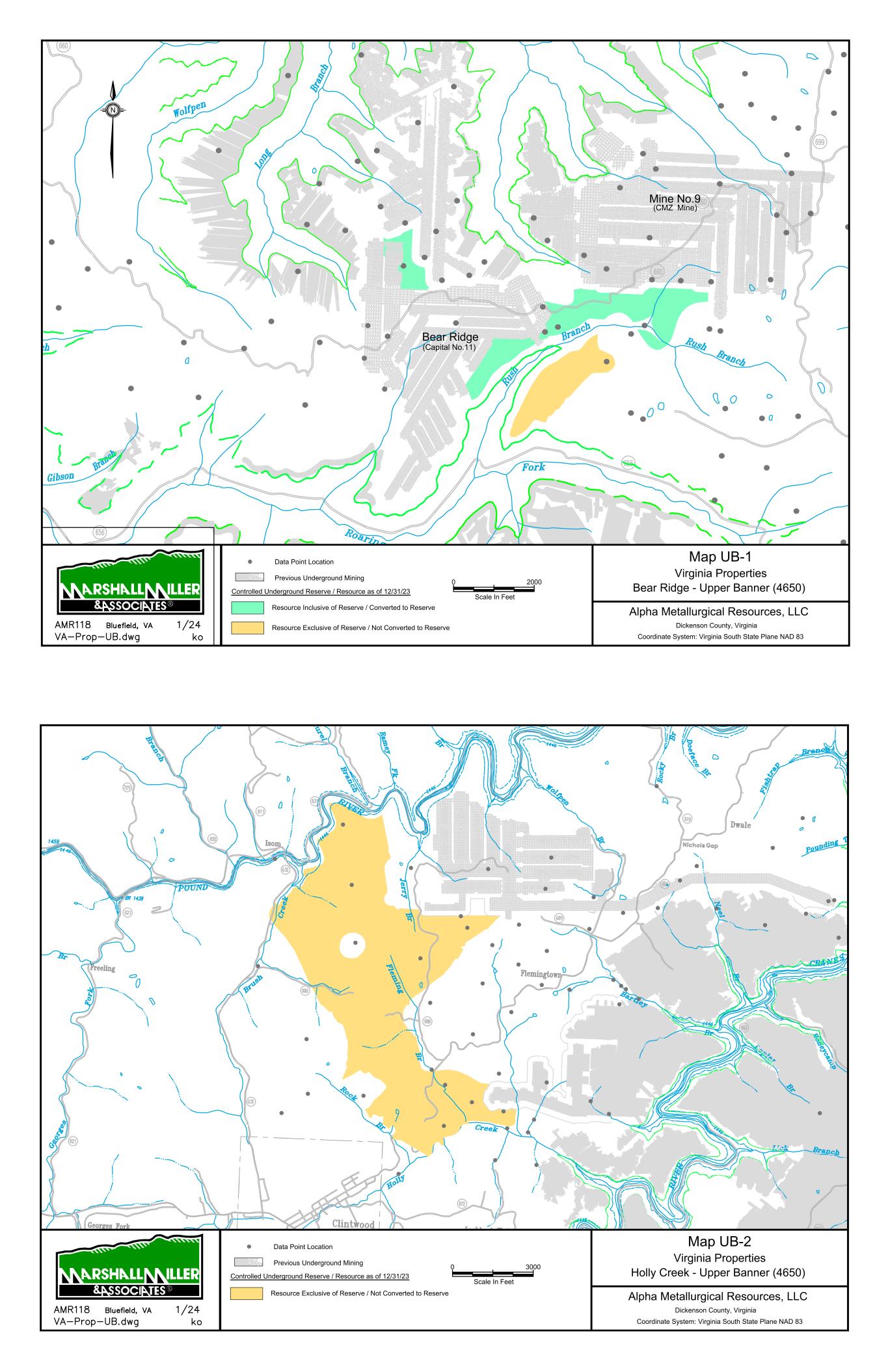

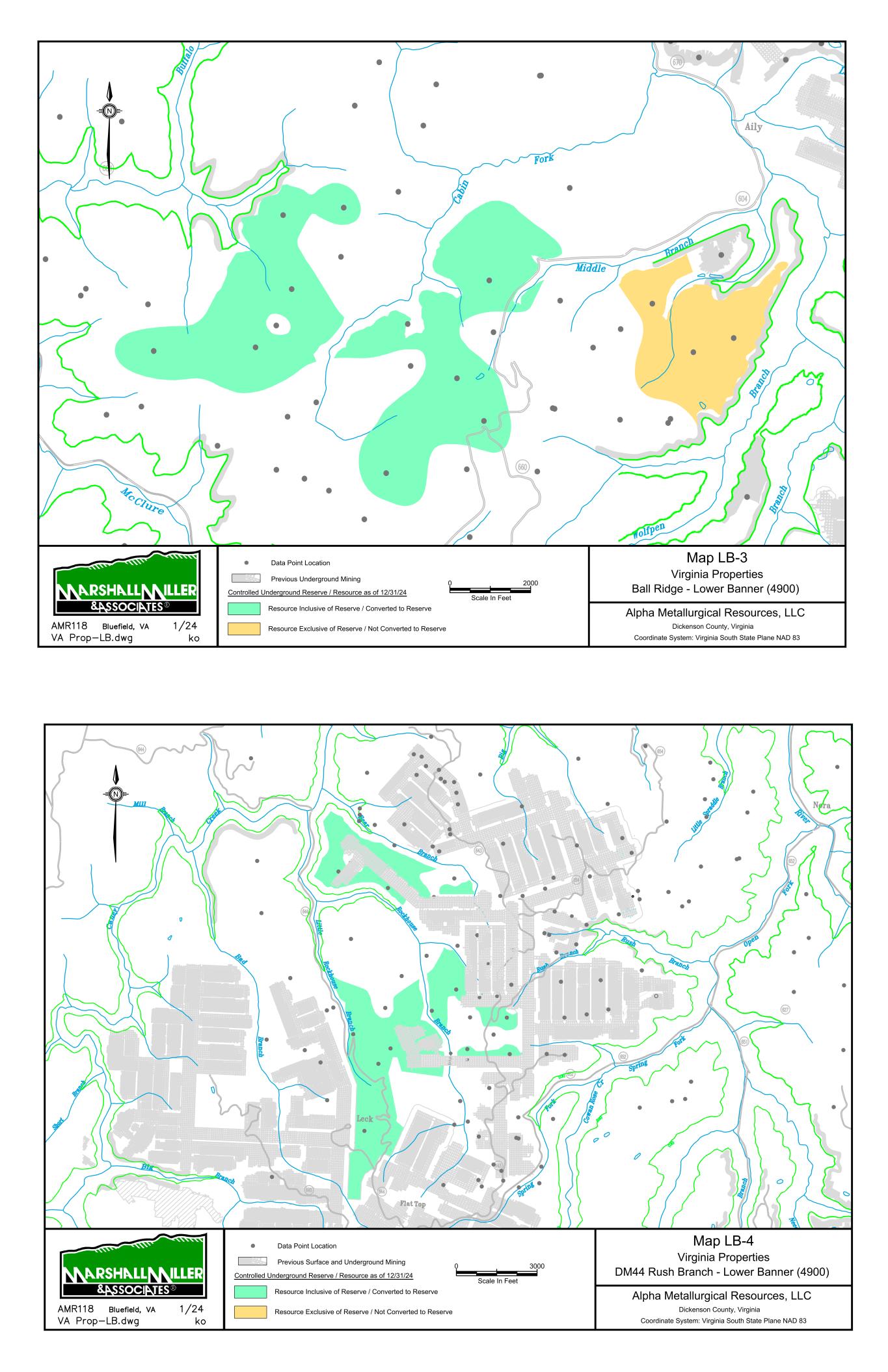

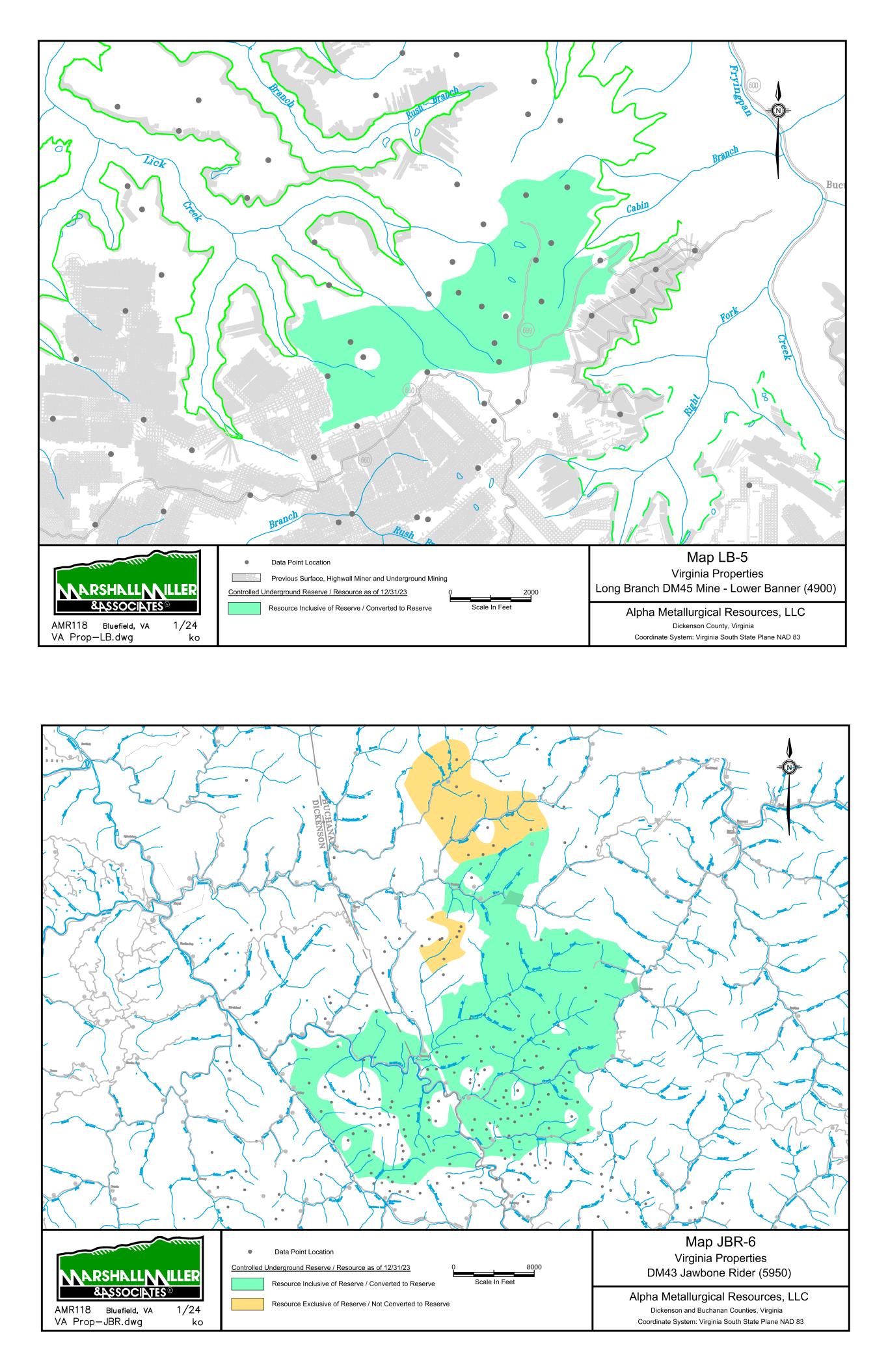

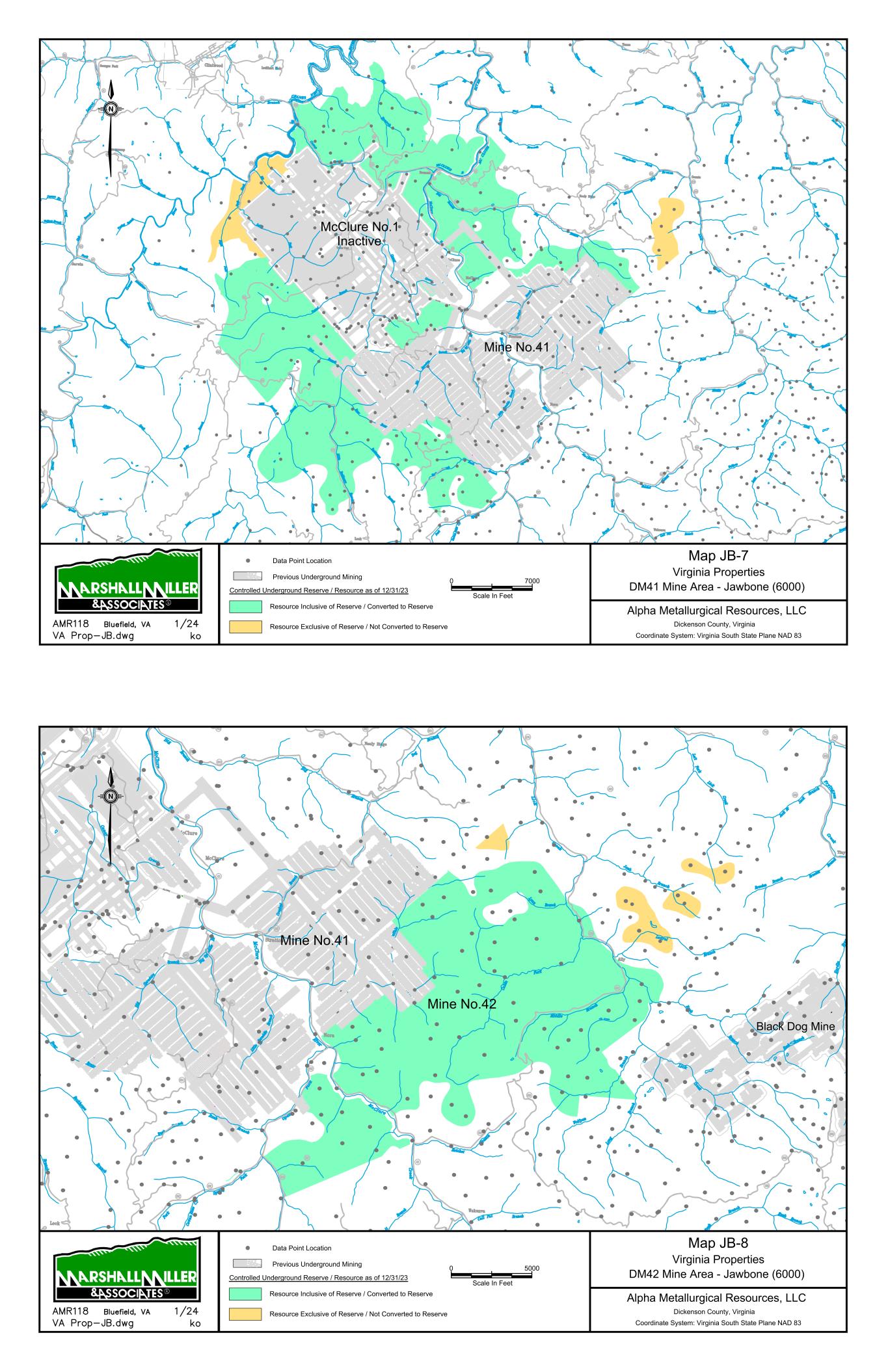

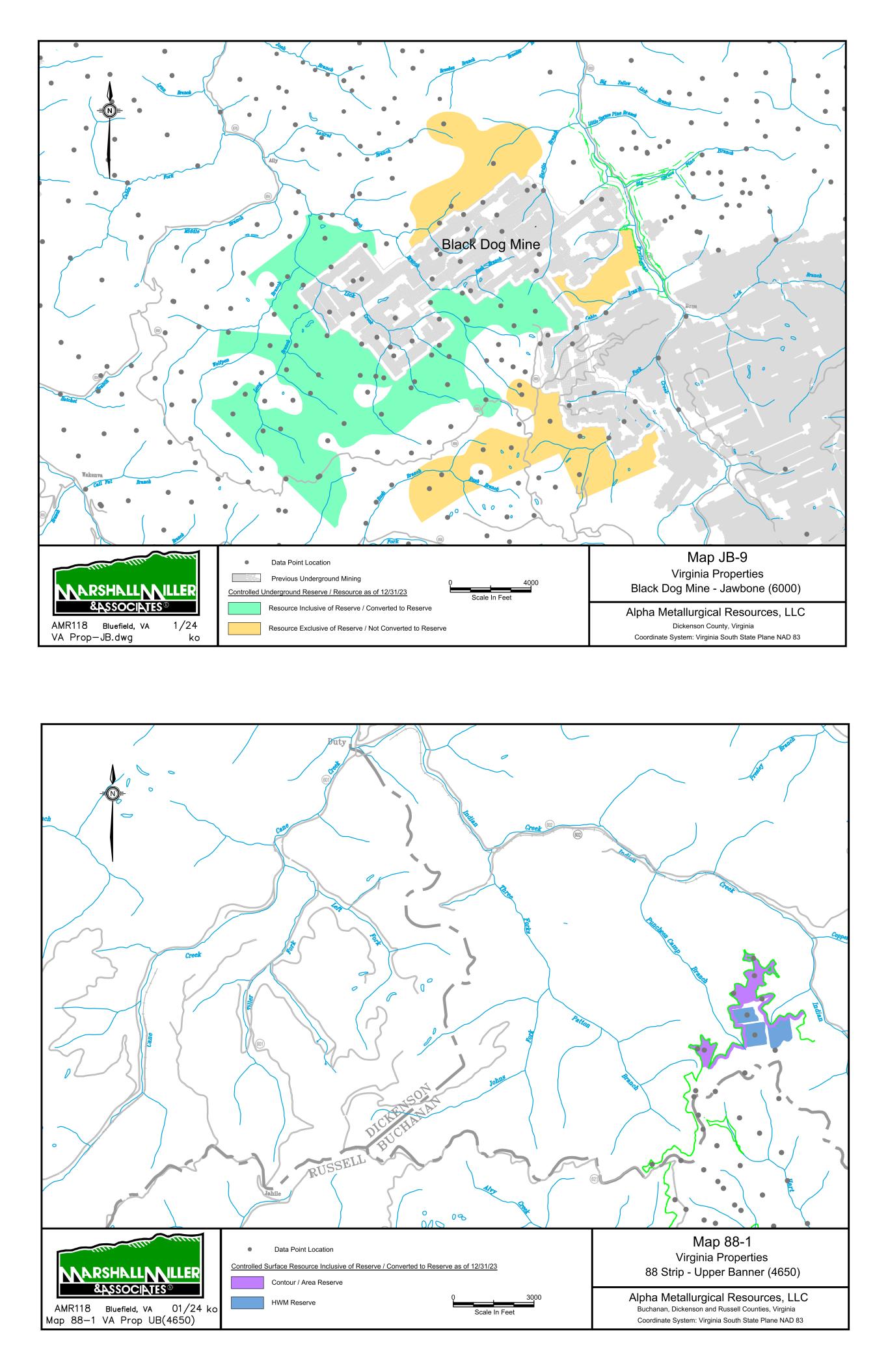

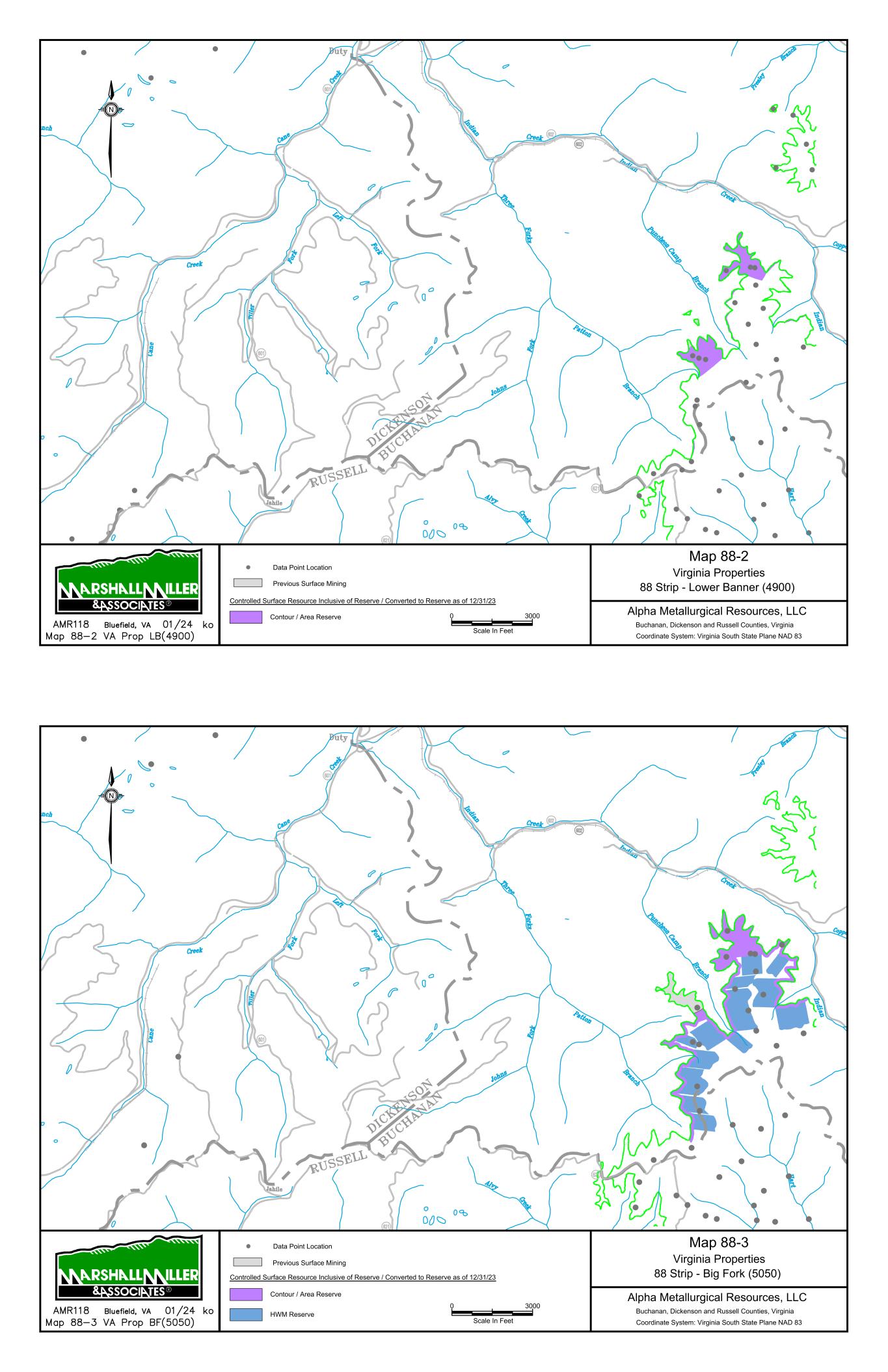

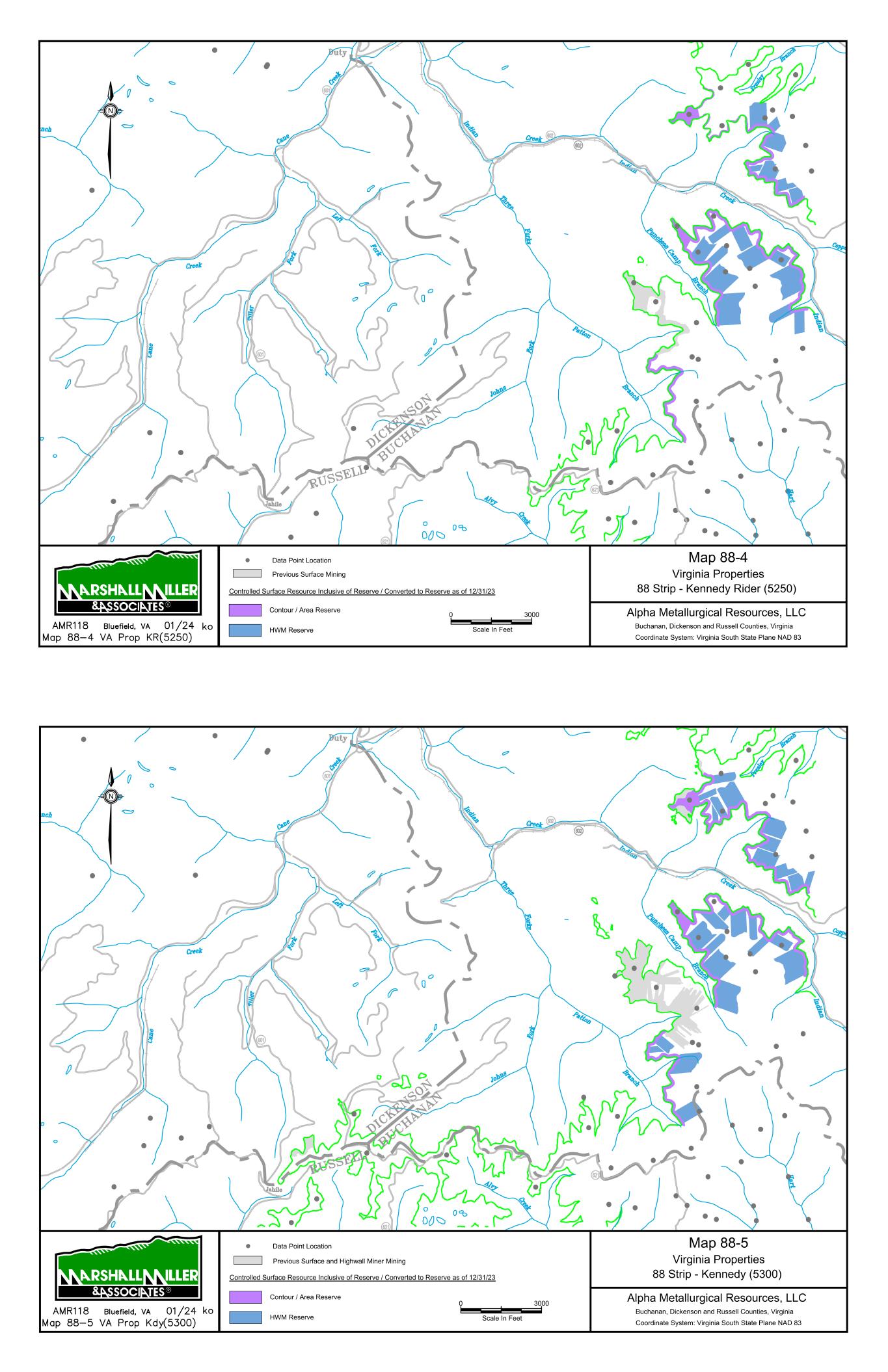

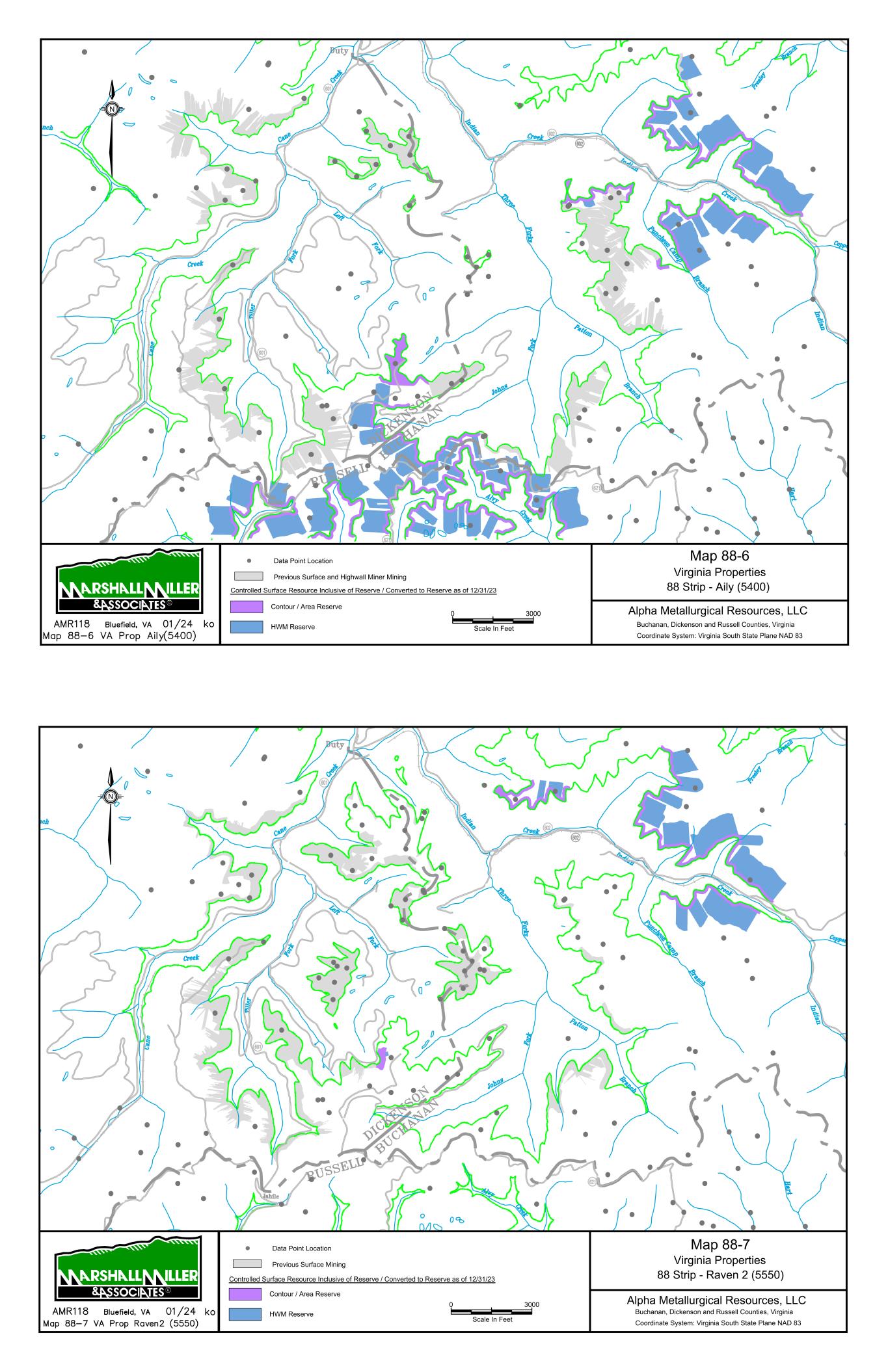

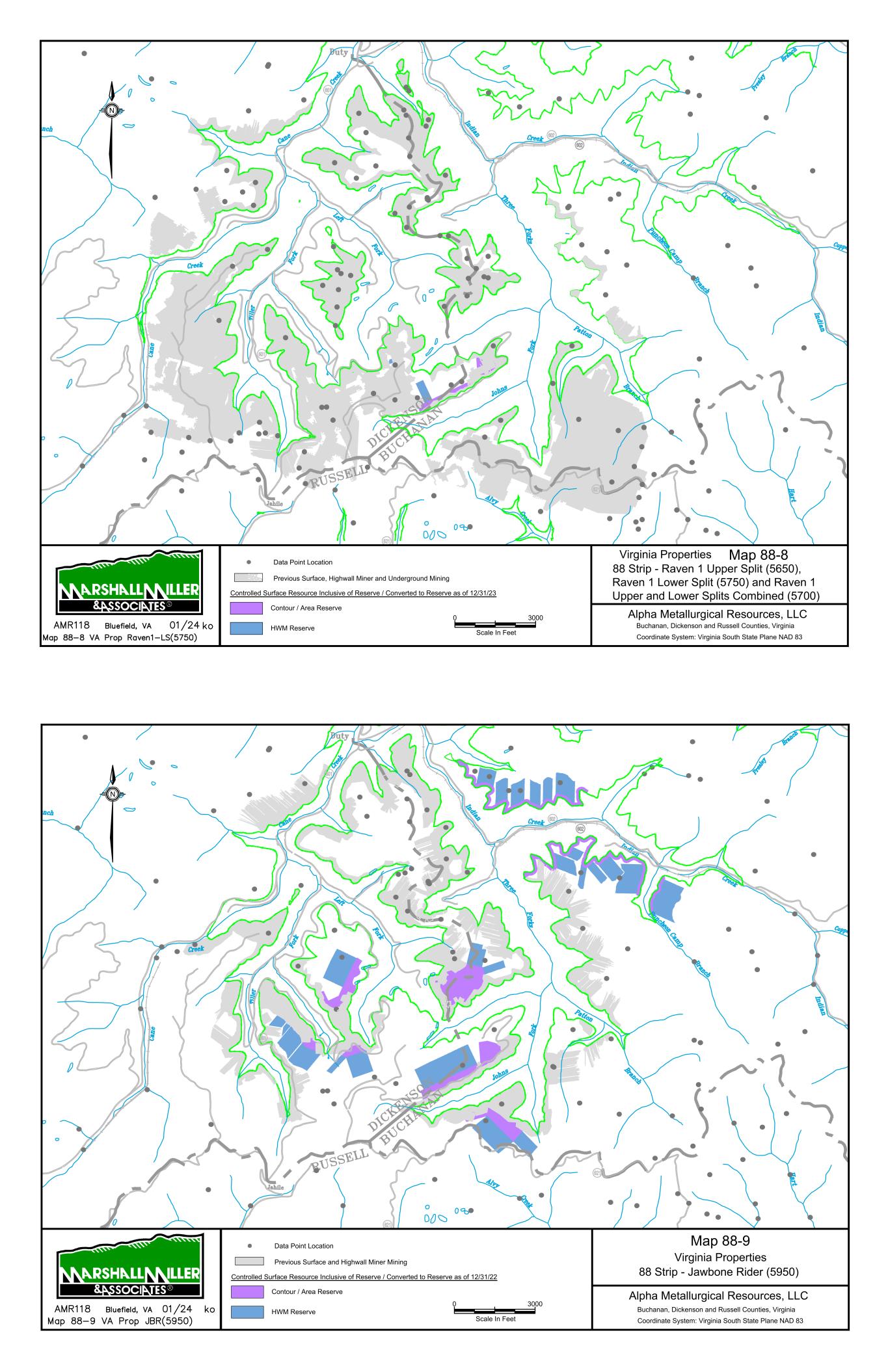

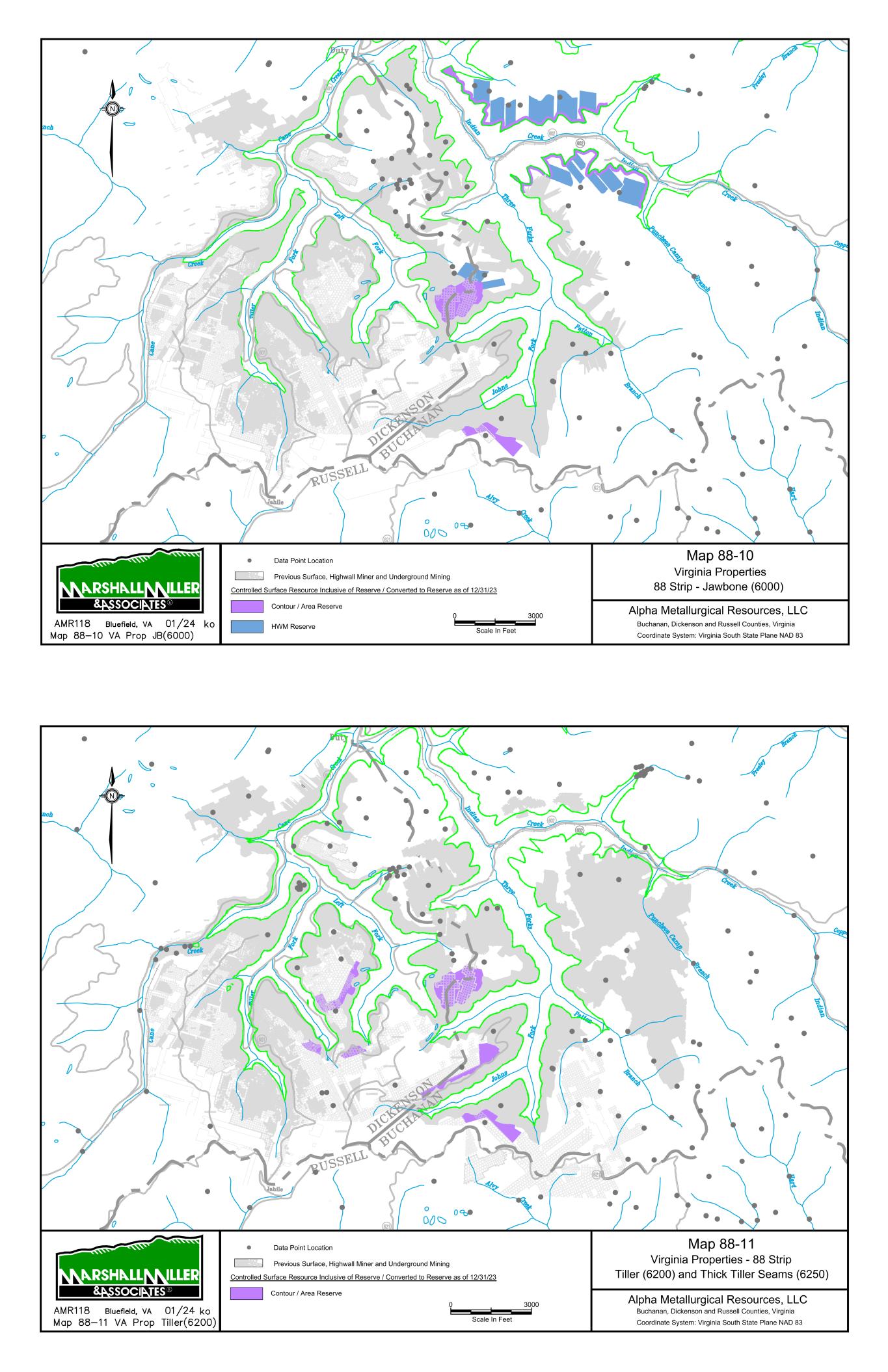

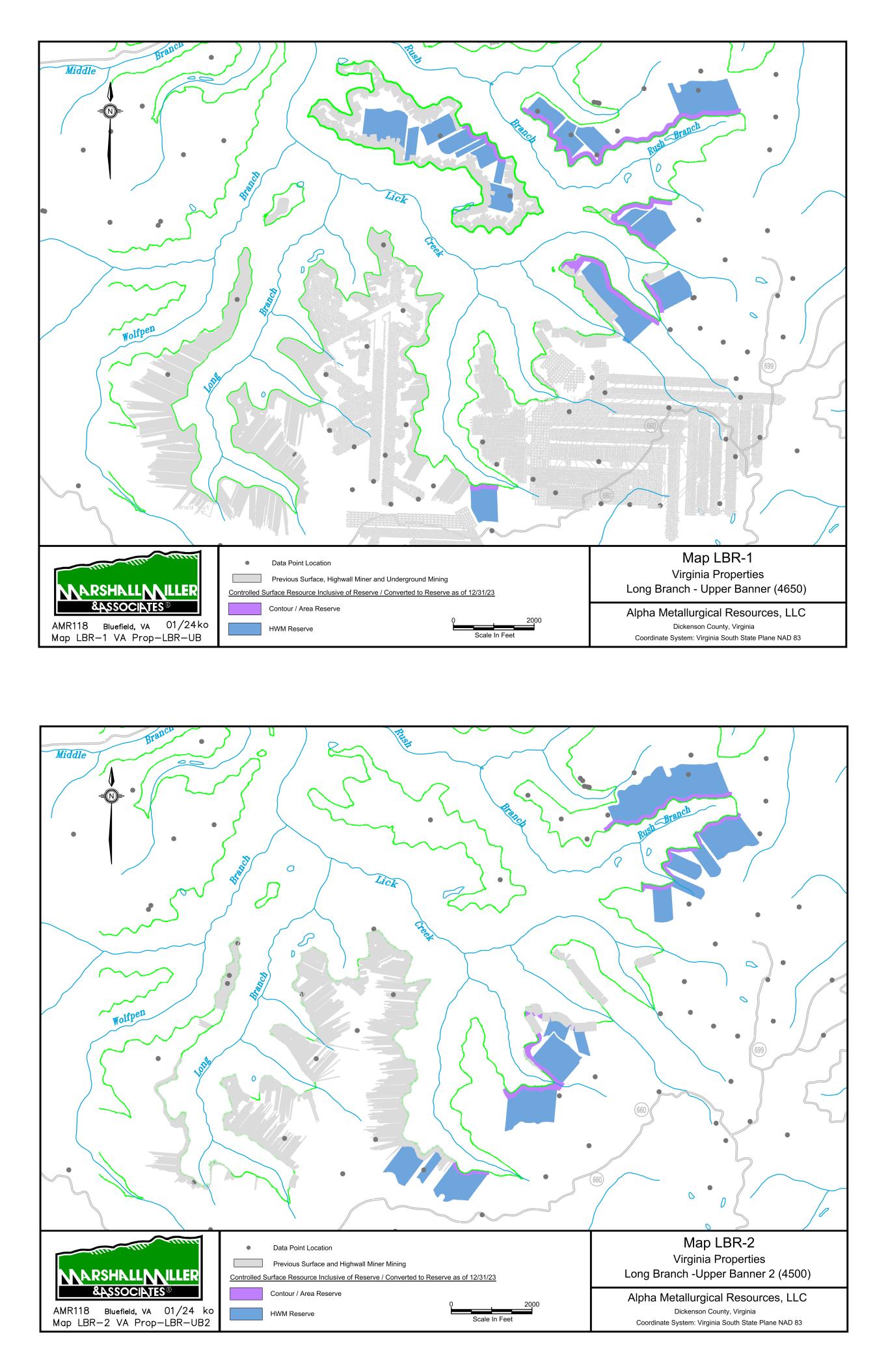

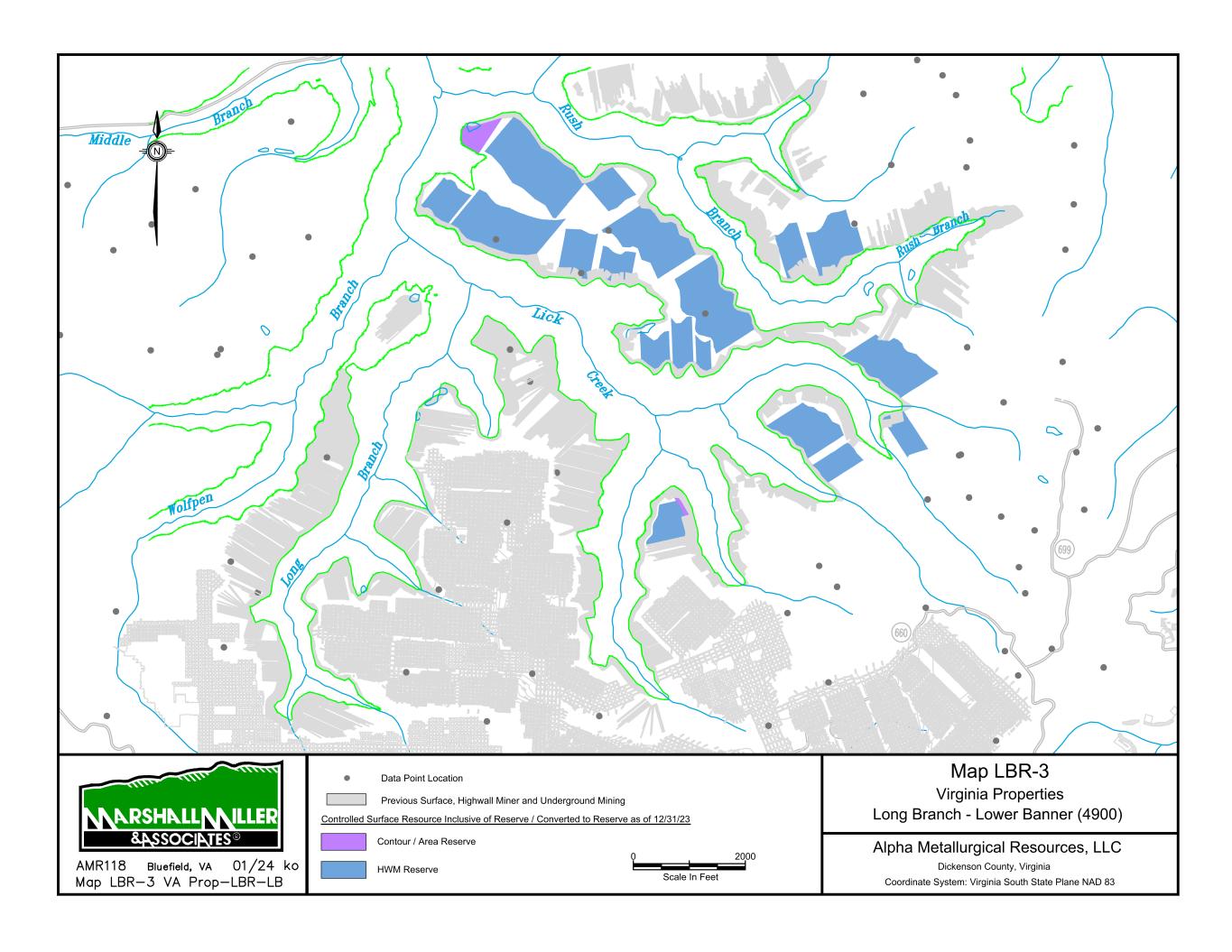

McClure/Toms Creek – McClure/Toms Creek is a mining complex located in Dickenson, Buchanan, Russell, and Wise counties, Virginia. The complex has three active underground mines which produce High-Vol. A and Mid-Vol. quality met coal from the Upper Banner, Lower Banner, and Jawbone coal seams. The complex also has two active surface mines which produce primarily High-Vol. A quality met coal as well as some thermal quality coal as a by-product of mining from multiple coal seams. Mine lives range from 2 to 27 years. Coal is processed at either the McClure Preparation Plant or the Toms Creek Preparation Plant and loaded on the CSX or NS rail, respectively for delivery to customers.

Power Mountain – Power Mountain is a mining complex located in Nicholas County, West Virginia. The complex has one active underground mine (with an estimated life of 3 years) which produces High-Vol. B quality met coal from the Eagle coal seam. Coal is processed at the Power Mountain Preparation Plant and loaded onto NS rail for delivery to customers. In addition, during 2023 development was completed and production began at a second underground mine (with an estimated life of 15 years) which produces High-Vol. B quality met coal from the Powellton coal seam. Coal from the mine is currently trucked to and processed through the Mammoth Preparation Plant. Following the expected development of a haul road in 2024, coal is expected to be trucked to and processed through the Power Mountain Preparation Plant.

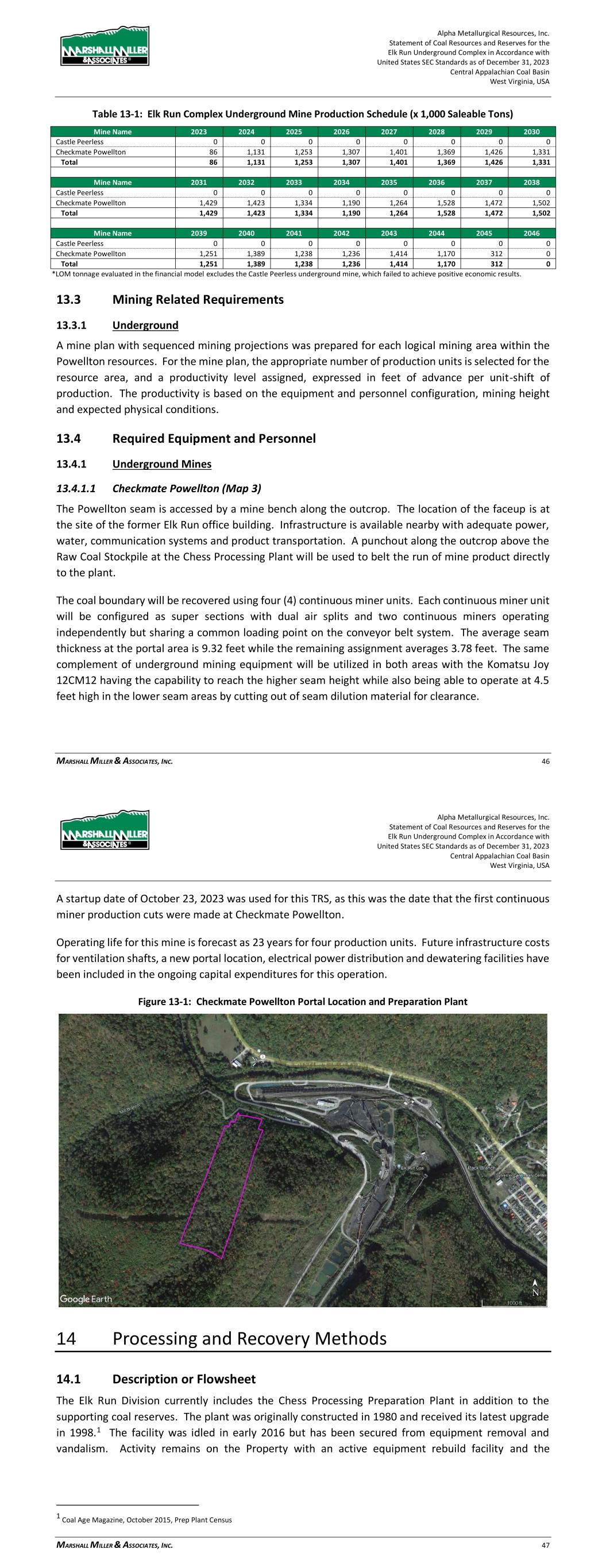

Elk Run – Elk Run is a mining complex located in Boone County, West Virginia. During 2023, development was completed and production began at an underground mine (with an estimated life of 22 years) which produces High-Vol. B quality met coal from the Powellton coal seam. Coal from the mine is processed at the Chess Processing Plant and loaded onto CSX rail for delivery to customers.

Equipment

Our plant and equipment, including underground and surface equipment, are of varying age, in good operational condition, and are regularly maintained and serviced by a dedicated maintenance workforce and third-party suppliers, including scheduled preventive maintenance.

Preparation Plants, Loadouts, and Docks

The following is a summary of information regarding our active preparation plants as of December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preparation Plant |

|

Year Constructed/Upgraded |

|

Processing Capacity (Tons per hour) |

|

Utilization % |

|

Power Source |

| Bandmill |

|

2010 |

|

1,200 |

|

66% |

|

American Electric Power |

| Kepler |

|

1967 |

|

900 |

|

54% |

|

American Electric Power |

| Kingston |

|

1974/2001 |

|

700 |

|

73% |

|

American Electric Power |

| Marfork |

|

1994/2019 |

|

2,400 |

|

70% |

|

American Electric Power |

| McClure |

|

1979/2019 |

|

1,100 |

|

53% |

|

American Electric Power |

| Toms Creek |

|

1980/2004 |

|

1,100 |

|

43% |

|

American Electric Power |

| Power Mountain |

|

1985/2010 |

|

1,200 |

|

26% |

|

American Electric Power |

Chess Processing (1) |

|

1980/1998 |

|

2,200 |

|

N/A |

|

American Electric Power |

| Mammoth |

|

1950/2008 |

|

1,200 |

|

18% |

|

American Electric Power |

(1) Plant refurbished in 2023. Produced tons received during the fourth quarter of 2023 but not processed until the first quarter of 2024.

The following is a summary of information regarding our active loadouts and docks as of December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loadout/Dock |

|

Year Constructed |

|

Loading Capacity (Tons per hour) |

| Pax Loadout |

|

2006 |

|

3,500 |

| Feats Loadout |

|

1975 |

|

3,500 |

| Marmet Dock |

|

1986 |

|

1,600 |

Export Terminal

The following is a summary of information regarding DTA (in which we own a 65% interest) as of December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Export Terminal |

|

Year Constructed |

|

Loading Capacity (Tons per hour) |

|

Storage Capacity (Net tons) |

| DTA |

|

1984 |

|

Up to 6,500 |

|

1.7 million |

Coal Mining Techniques

We use four different mining techniques to extract coal from the ground: room-and-pillar mining, truck-and-shovel mining and truck and front-end loader mining, contour mining, and highwall mining. We do not use mountaintop removal mining and currently have no plans to do so in the future.

Room-and-Pillar Mining

Certain of our mines in CAPP use room-and-pillar mining methods. In this type of mining, main airways and transportation entries are developed and maintained while remote-controlled continuous miners extract coal from the seam, leaving pillars to support the roof. Shuttle cars or battery coal haulers are used to transport coal from the continuous miner to the conveyor belt for transport to the surface. This method is more flexible than longwall mining and often used to mine smaller coal blocks or thinner seams of coal. Ultimate seam recovery of in-place reserves is less than that achieved with longwall mining. All of this production is also processed in preparation plants to remove rock and impurities before it becomes saleable clean coal.

Truck-and-Shovel Mining and Truck and Front-End Loader Mining

We utilize truck/shovel and truck/front-end loader mining methods at some of our CAPP surface mines. These methods are similar and involve using large, electric or hydraulic-powered shovels or diesel-powered front-end loaders to remove earth and rock (overburden) covering a coal seam which is later used to refill the excavated coal pits after the coal is removed. The loading equipment places the coal into trucks for transportation to a preparation plant or loadout area. Ultimate seam recovery of in-place reserves on average exceeds 90%. Depending on geology and market destination, surface-mined coal may need to be processed in a preparation plant before sale. In the case of some metallurgical grade coals, as much as 80% of surface mined coal may need to be processed in a preparation plant to enhance the sales value of the coal. Productivity depends on overburden and coal thickness (strip ratio), equipment utilized and geologic factors.

Contour Mining

We use contour mining at certain of our CAPP surface mines, which limits the overburden removal from above a coal seam or series of coal seams. In contour mining, surface mining machinery follows the contours of a coal seam or seams around a ridge, excavating the overburden and recovering the coal seam or seams as a “contour bench” around the ridge is created. This contour bench is then backfilled and graded in accordance with an approved reclamation plan. Highwall mining methods are used in connection with some contour mining operations. Depending on geology and market destination, coal mined by contour mining may need to be processed in preparation plants to remove rock and impurities before it becomes a saleable clean coal.

Highwall Mining

We utilize highwall mining methods at certain of our CAPP surface mines. A highwall mining system consists of a remotely controlled continuous miner, which extracts coal and conveys it via augers or belt conveyors to the surface. The cut is typically a rectangular, horizontal opening in the highwall (the unexcavated face of exposed overburden and coal in a surface mine) 9-feet or 11-feet wide and reaching depths of up to 1,000 feet. Multiple parallel openings are driven into the highwall, separated by narrow pillars that extend the full depth of the hole. All of the coal mined at our highwall mining operations is processed in preparation plants to remove rock and impurities before it becomes saleable clean coal.

Financial Information About Reportable Segments and Geographic Areas

Refer to “Item 7. Management’s Discussion and Analysis of Financial Condition—Results of Operations” and Notes 22 and 23 to the Consolidated Financial Statements for financial information about our reportable segment and geographic areas.

Marketing, Sales and Customer Contracts

We market coal produced at our operations and purchase and resell coal mined by others. We have coal supply commitments with a wide range of steel and coke manufacturers, industrial customers, and electric utilities. Our marketing efforts are centered on meeting customer needs and requirements. By offering coal of various grades, we are able to provide the specific qualities relevant to our customers and to serve a global customer base. Through this global platform, our coals are shipped to customers on five continents. Our broad customer and product base allows us to adjust to changing market conditions. Many of our larger customers are well-established steel manufacturers and public utilities.

Our coal volumes include coal produced and processed by us, our “captive coal,” as well as coal purchased from third-party producers to blend with our produced coal in order to meet customer specifications. These volumes are processed by us, meaning that we washed, crushed or blended the coal at one of our preparation plants or loading facilities prior to resale. Our coal volumes within our Met segment operations also include met coal volumes purchased from domestic third-party producers and sold into international markets.

Our export shipments serviced customers in 25 and 26 countries during the years ended December 31, 2023 and 2022, respectively. Asia was our largest export market for the years ended December 31, 2023 and 2022, with coal sales to Asia accounting for approximately 46% and 53%, respectively of export coal revenues and 34% and 43%, respectively, of coal revenues. All of our sales are conducted in U.S. dollars. Refer to Note 22 to the Consolidated Financial Statements for additional export coal revenue information.

Met coal accounted for approximately 95% of our coal revenues for each of the years ended December 31, 2023 and 2022. Our met coal sales are typically made with customers with whom we have a long-term relationship. Domestic met customers typically enter into one-year agreements with a fixed price for the entire contract year. Any longer-term agreement would generally have a renegotiation of price each subsequent contract year. Export sales are generally made on an annual, quarterly, or spot cargo basis. Annual and quarterly agreements typically have market-indexed pricing that changes with the market monthly. Any export agreement with a term greater than one year would generally have a renegotiation of pricing terms for each subsequent contract year. Volume for future years is generally contingent on both parties agreeing to a pricing mechanism to cover the contract year.

Thermal coal accounted for approximately 5% of our coal revenues for each of the years ended December 31, 2023 and 2022. We sometimes enter into long-term contracts with our thermal coal customers. Terms of these agreements may address coal quality requirements, quantity parameters, flexibility and adjustment mechanisms, permitted sources of supply, treatment of environmental constraints, options to extend, force majeure, suspension, termination and assignment issues, the allocation between the parties of the cost of complying with future governmental regulations and many other matters.

Generally, our long-term thermal coal agreements contain committed volumes and fixed prices for a period or a certain number of periods pursuant to which thermal coal will be delivered under these agreements. After a fixed price period elapses, the long-term agreement may provide for a price negotiation/determination period prior to the commencement of the pending unpriced contract period. The price negotiations generally consider either then current market prices and/or relevant market indices. Provisions of this sort increase the difficulty of predicting the exact prices a coal supplier will receive for its coal during the course of the long-term agreement. During the years ended December 31, 2023 and 2022, approximately 21% and 54%, respectively, of our thermal coal sales volume were delivered pursuant to long-term contracts.

Distribution and Transportation

Coal consumed domestically is usually sold at the mine and transportation costs are normally borne by the purchaser. Export coal is usually sold at the loading port, with purchasers responsible for further transportation.

For our export sales, we negotiate transportation agreements with various providers, including railroads, trucks, barge lines, and terminal facilities to transport shipments to the relevant loading port. We coordinate with customers, mining facilities and transportation providers to establish shipping schedules that meet each customer’s needs. Our captive coal is loaded from our preparation plants, loadout facilities, and in certain cases directly from our mines. The coal we purchase is loaded in some cases directly from mines and preparation plants operated by third parties or from an export terminal. Virtually all of our coal is transported from the mine to our preparation plants by truck or belt conveyor systems. It is transported from preparation plants and loading facilities to the customer by means of railroads, trucks, barge lines, and lake-going and ocean-going vessels from terminal facilities.

We depend upon rail, barge, trucking and other systems to deliver coal to markets. In the years ended December 31, 2023 and 2022, our produced coal was transported from the mines and to the customer primarily by rail, with the main rail carriers being CSX Transportation and Norfolk Southern Railway Company. Rail shipments constituted approximately 89% and 84% of total shipments of coal volume from our mines during the years ended December 31, 2023 and 2022, respectively. The balance was shipped from our preparation plants, loadout facilities or mines via truck or barge. Our export sales are primarily shipped to DTA and Pier 6 (Lambert’s Point) shipping ports in the Hampton Roads area of Virginia. We may ship limited export quantities through other U.S. ports when warranted by logistics and economics.

Procurement

Principal goods and services used in our business include mining equipment, replacement parts and materials such as explosives, diesel fuel, tires, conveyance structure, ventilation supplies, lubricants, steel, magnetite and other raw materials, maintenance and repair services, electricity, and roof control and support items. We rely substantially on third-party suppliers to provide mining materials and equipment. Although there continues to be consolidation, which has resulted in a limited number of suppliers for certain types of equipment and supplies, we believe that adequate substitute suppliers are available.

In the first quarter of 2023, we completed a series of transactions to acquire a number of coal trucks and related equipment and facilities to secure trucking services for our operations. In December 2022, we purchased substantially all of the assets of a mining equipment component manufacturing and rebuild business to help secure the supply of certain underground mining equipment parts needed for our operations.

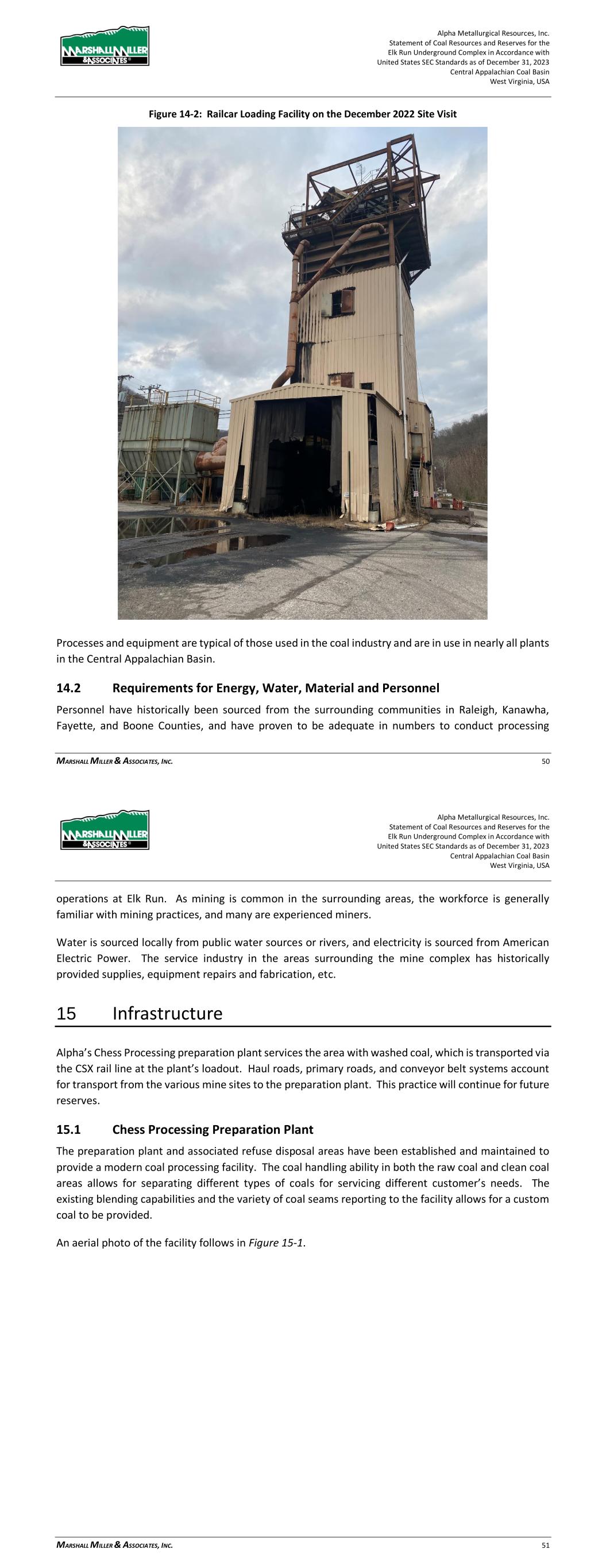

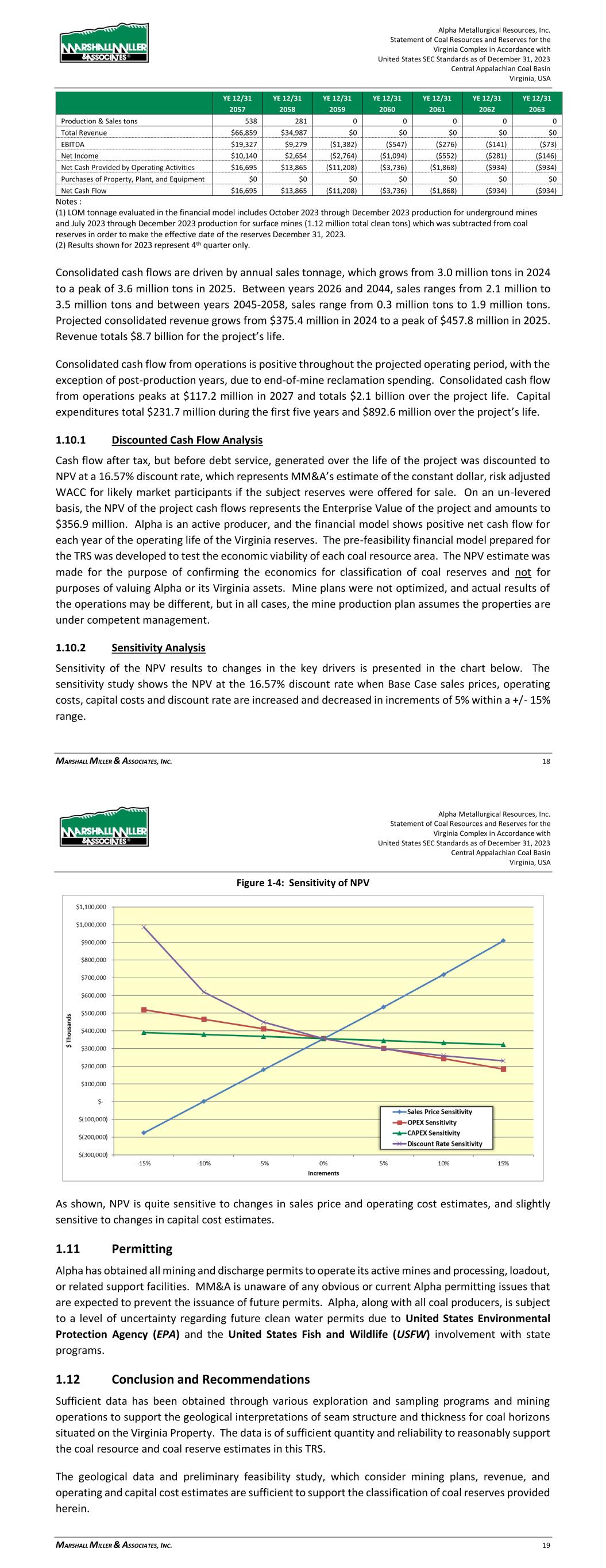

We incur substantial expenses each year to procure goods and services in support of our respective business activities in addition to capital expenditures. We use suppliers for a significant portion of our equipment rebuilds and repairs, as well as construction and reclamation activities.