false000170471500017047152023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 4, 2023

ALPHA METALLURGICAL RESOURCES, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

001-38735 |

81-3015061 |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

340 Martin Luther King Jr. Blvd.

Bristol, Tennessee 37620

|

(Address of Principal Executive Offices, zip code) |

(423) 573-0300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

AMR |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On August 4, 2023, the Company made available a written presentation that management may use from time to time in connection with meetings with current and potential investors. A copy of the presentation is attached hereto as Exhibit 99.1.

This Current Report on Form 8-K and the presentation attached hereto are being furnished by the Registrant pursuant to Item 7.01, “Regulation FD Disclosure.” In accordance with General Instruction B.2 of Form 8-K, the information contained in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference into any of the Registrant’s filings with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

| Exhibit 99.1 |

Investor presentation dated August 4, 2023 |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

Alpha Metallurgical Resources, Inc. |

|

|

|

Date: August 4, 2023 |

By: |

/s/ J. Todd Munsey |

|

|

Name: J. Todd Munsey |

|

|

Title: Chief Financial Officer |

EXHIBIT INDEX

|

|

|

|

|

|

| Exhibit No. |

Description |

| Exhibit 99.1 |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

EX-99.1

2

amrinvestorpresentation8.htm

INVESTOR PRESENTATION DATED AUGUST 4, 2023

amrinvestorpresentation8

August 2023

August 2023 2 FORWARD LOOKING STATEMENTS This document includes forward-looking statements. These forward-looking statements are based on Alpha's expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha's control. The following factors are among those that may cause actual results to differ materially from our forward-looking statements: • the financial performance of the company; • our liquidity, results of operations and financial condition; • our ability to generate sufficient cash or obtain financing to fund our business operations; • depressed levels or declines in coal prices; • railroad, barge, truck and other transportation availability, performance and costs; • changes in domestic or international environmental laws and regulations, and court decisions, including those directly affecting our coal mining and production and those affecting our customers’ coal usage, including potential climate change initiatives; • our ability to obtain or renew surety bonds on acceptable terms or maintain our current bonding status; • worldwide market demand for coal and steel, including demand for U.S. coal exports, and competition in coal markets; • attracting and retaining key personnel and other employee workforce factors, such as labor relations; • our ability to pay dividends on our common stock and execute our share repurchase program; • our ability to self-insure certain of our black lung obligations without a significant increase in required collateral; • our ability to meet collateral requirements and fund employee benefit obligations; • inflationary pressures on supplies and labor and significant or rapid increases in commodity prices; • disruptions in delivery or changes in pricing from third-party vendors of key equipment and materials that are necessary for our operations, such as diesel fuel, steel products, explosives, tires and purchased coal; • our ability to consummate financing or refinancing transactions, and other services, and the form and degree of these services available to us, which may be significantly limited by the lending, investment and similar policies of financial institutions and insurance companies regarding carbon energy producers and the environmental impacts of coal combustion; • failures in performance, or non-performance, of services by third-party contractors, including contract mining and reclamation contractors; • disruption in third-party coal supplies; • cybersecurity attacks or failures, threats to physical security, extreme weather conditions or other natural disasters; • the imposition or continuation of barriers to trade, such as tariffs; • increased market volatility and uncertainty on worldwide markets and our customers as a result of developments in and around Ukraine and the consequent export controls and financial and economic sanctions; • changes in, renewal or acquisition of, terms of and performance of customers under coal supply arrangements and the refusal by our customers to receive coal under agreed-upon contract terms; • reductions or increases in customer coal inventories and the timing of those changes; • our production capabilities and costs; • our ability to obtain, maintain or renew any necessary permits or rights, and our ability to mine properties due to defects in title on leasehold interests; • the effects of the COVID-19 pandemic on our operations and the world economy; • inherent risks of coal mining, including those that are beyond our control; • changes in, interpretations of, or implementations of domestic or international tax or other laws and regulations, including the Inflation Reduction Act of 2022 and its related regulations; • our relationships with, and other conditions affecting, our customers, including the inability to collect payments from our customers if their creditworthiness declines; • our indebtedness and potential future indebtedness; • reclamation and mine closure obligations; • utilities and steel and coke producers switching to alternative energy sources such as natural gas, renewables and coal from basins where we do not operate; and • our assumptions concerning economically recoverable coal reserve estimates. Forward-looking statements in this document or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this document or elsewhere. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward- looking statement made in this document may not occur. Third Party Information: This presentation, including certain forward-looking statements herein, includes information obtained from third party sources that we believe to be reliable. However, we have not independently verified this third-party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any third-party data contained in this presentation, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed in detail in our filings with the U.S. Securities and Exchange Commission. We assume no obligation to revise or update this third-party information to reflect future events or circumstances.

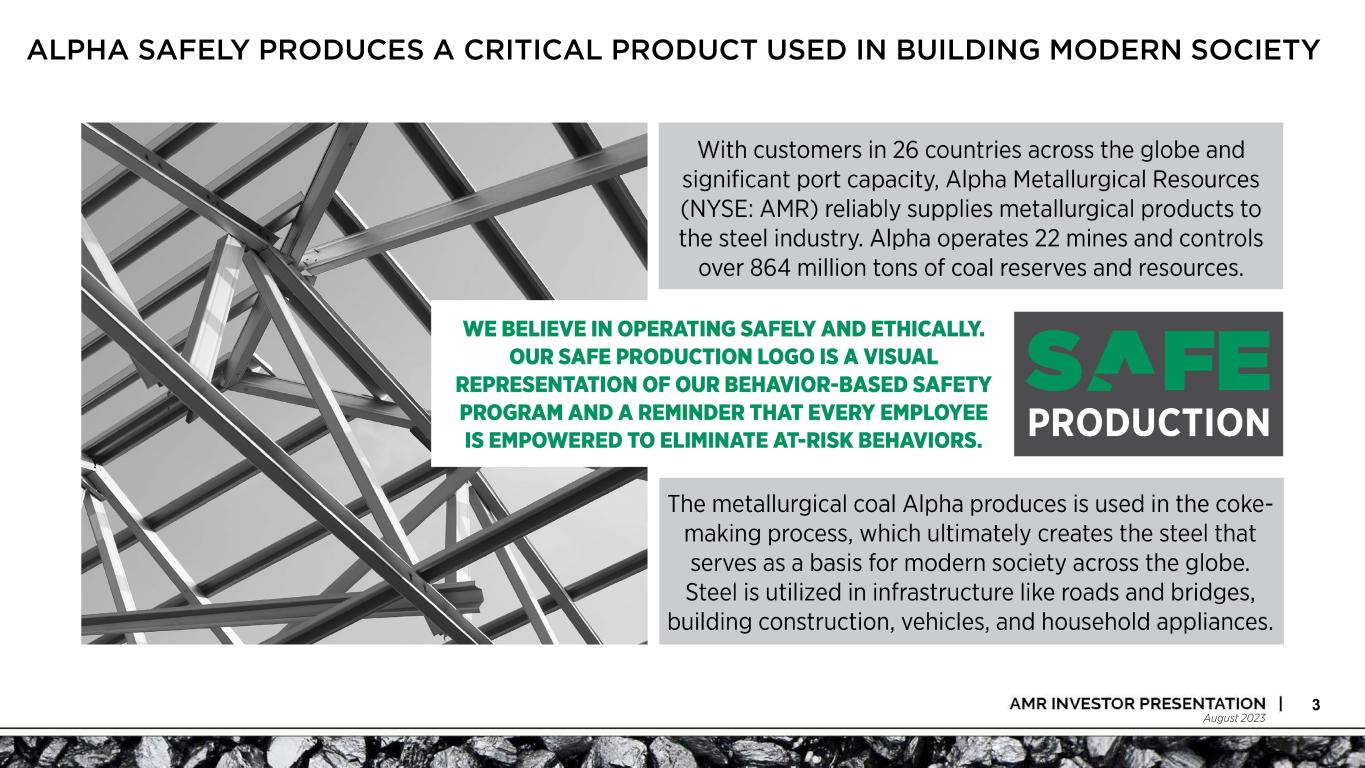

August 2023 ALPHA SAFELY PRODUCES A CRITICAL PRODUCT USED IN BUILDING MODERN SOCIETY 3

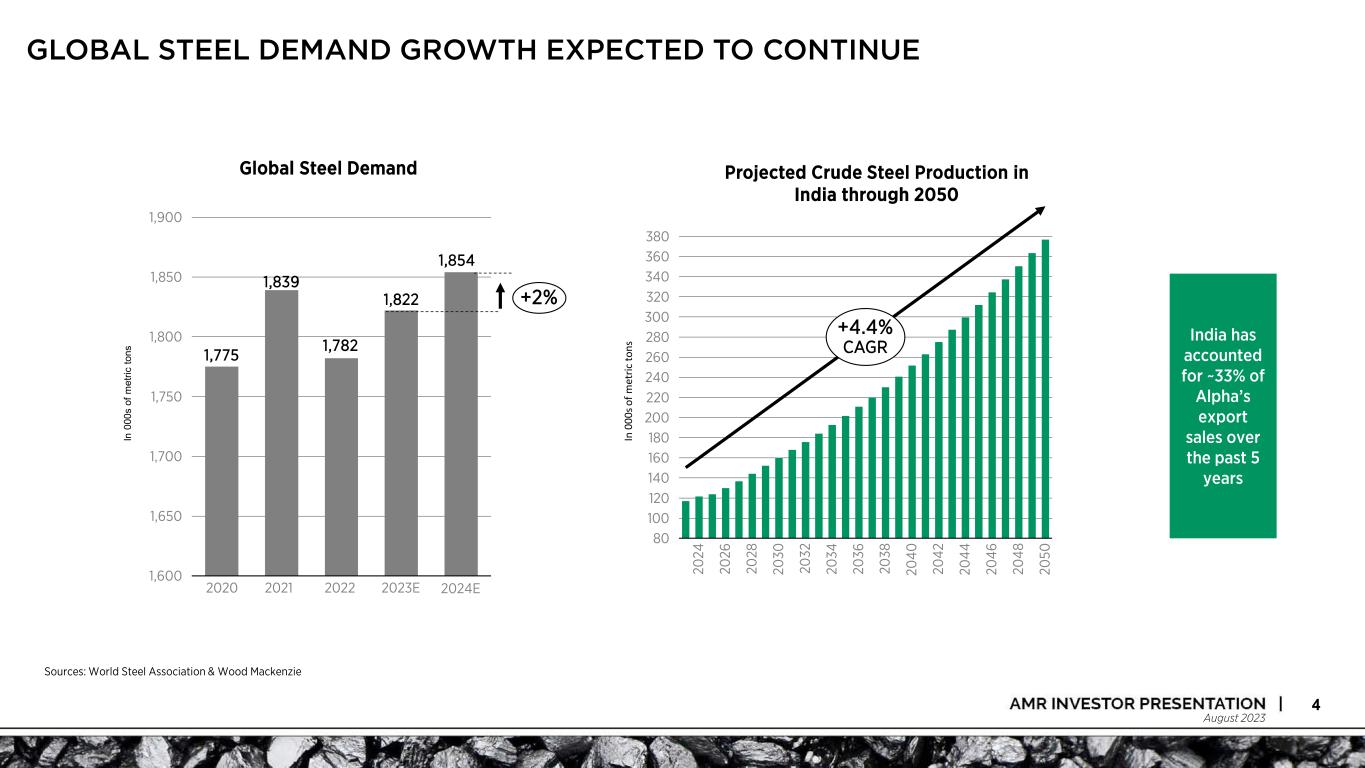

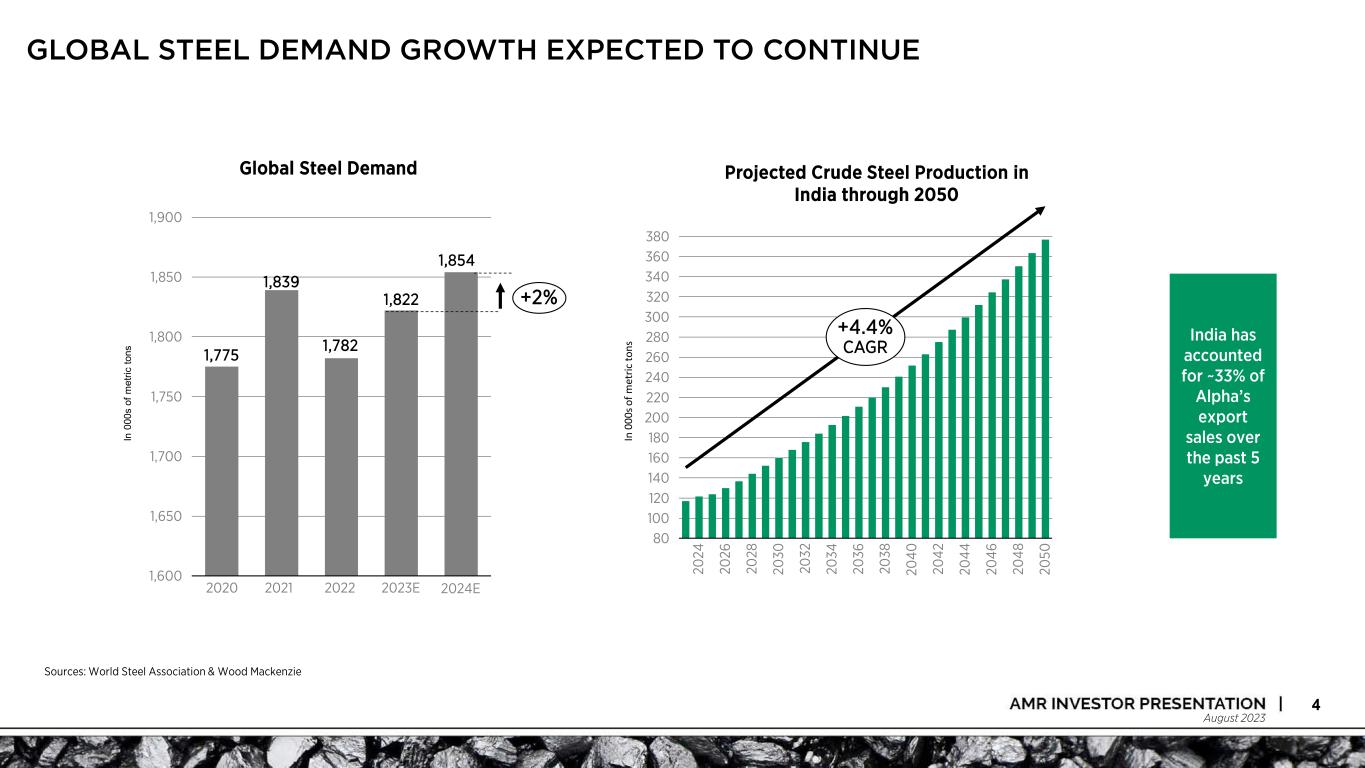

August 2023 4 India has accounted for ~33% of Alpha’s export sales over the past 5 years Sources: World Steel Association & Wood Mackenzie Global Steel Demand Projected Crude Steel Production in India through 2050 200 80 220 100 140 120 340 160 180 240 260 320 360 280 300 380 20 26 20 30 20 24 20 28 20 34 20 36 20 38 20 40 20 44 20 42 20 46 20 48 20 50 20 32 +4.4% CAGR In 0 00 s o f m et ric to ns GLOBAL STEEL DEMAND GROWTH EXPECTED TO CONTINUE 1,775 1,839 1,822 1,750 1,650 1,600 1,900 1,700 1,800 1,850 20222020 1,782 2021 2023E +2% In 0 00 s of m et ric to ns 1,854 2024E

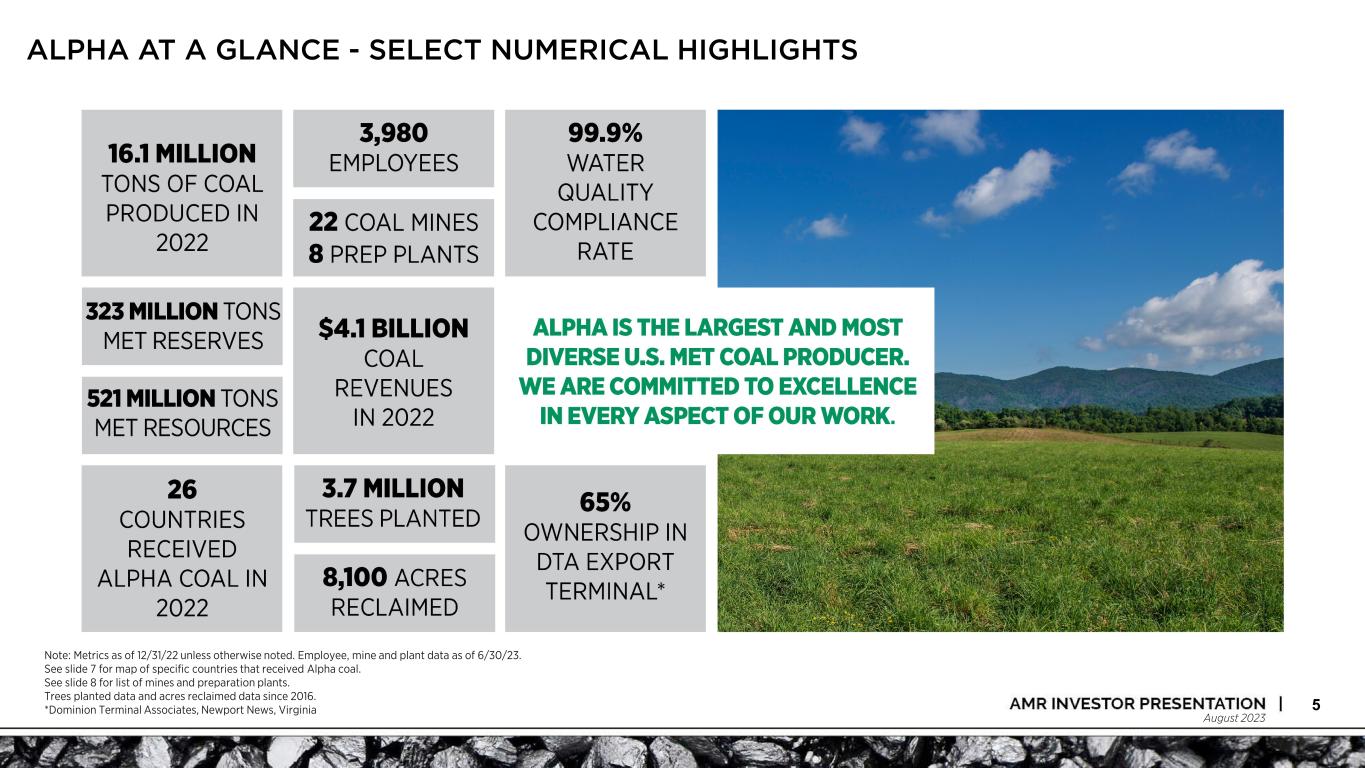

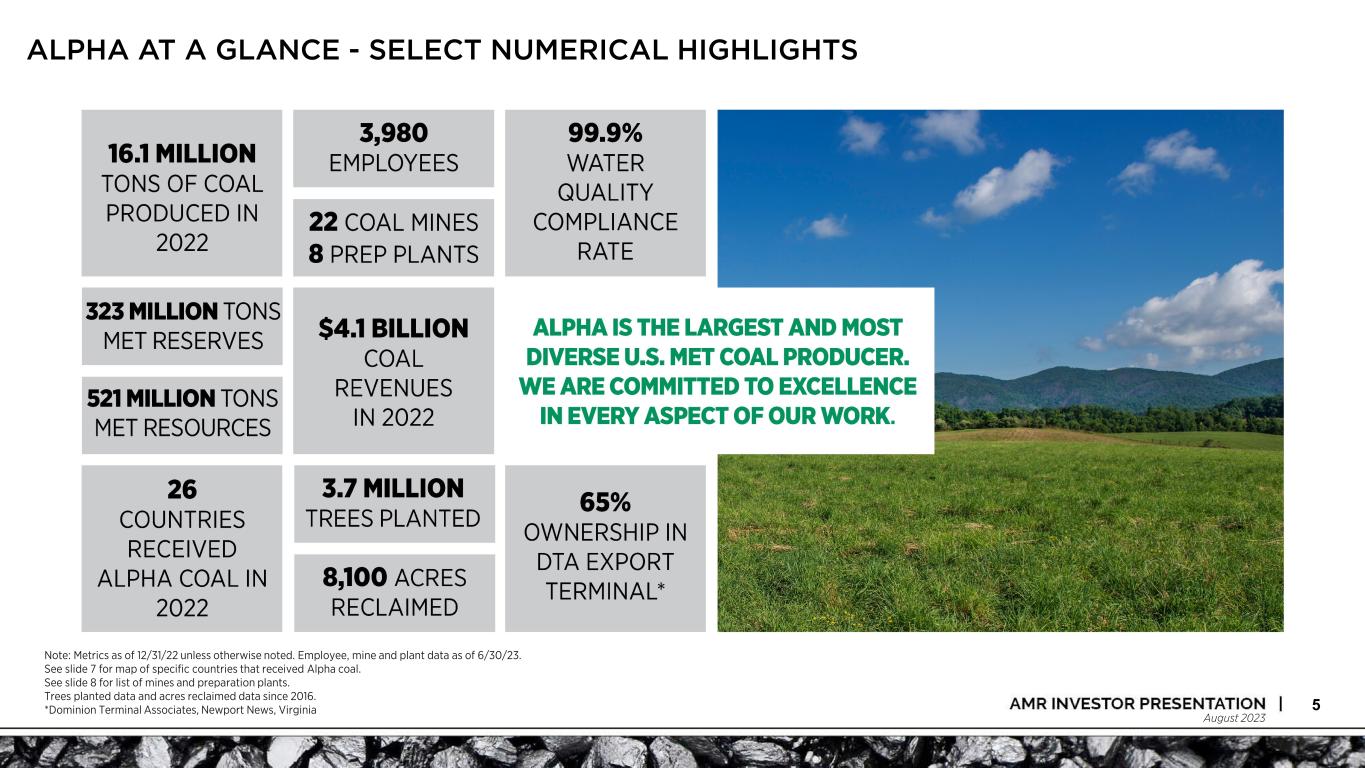

August 2023 ALPHA AT A GLANCE - SELECT NUMERICAL HIGHLIGHTS 5 Note: Metrics as of 12/31/22 unless otherwise noted. Employee, mine and plant data as of 6/30/23. See slide 7 for map of specific countries that received Alpha coal. See slide 8 for list of mines and preparation plants. Trees planted data and acres reclaimed data since 2016. *Dominion Terminal Associates, Newport News, Virginia

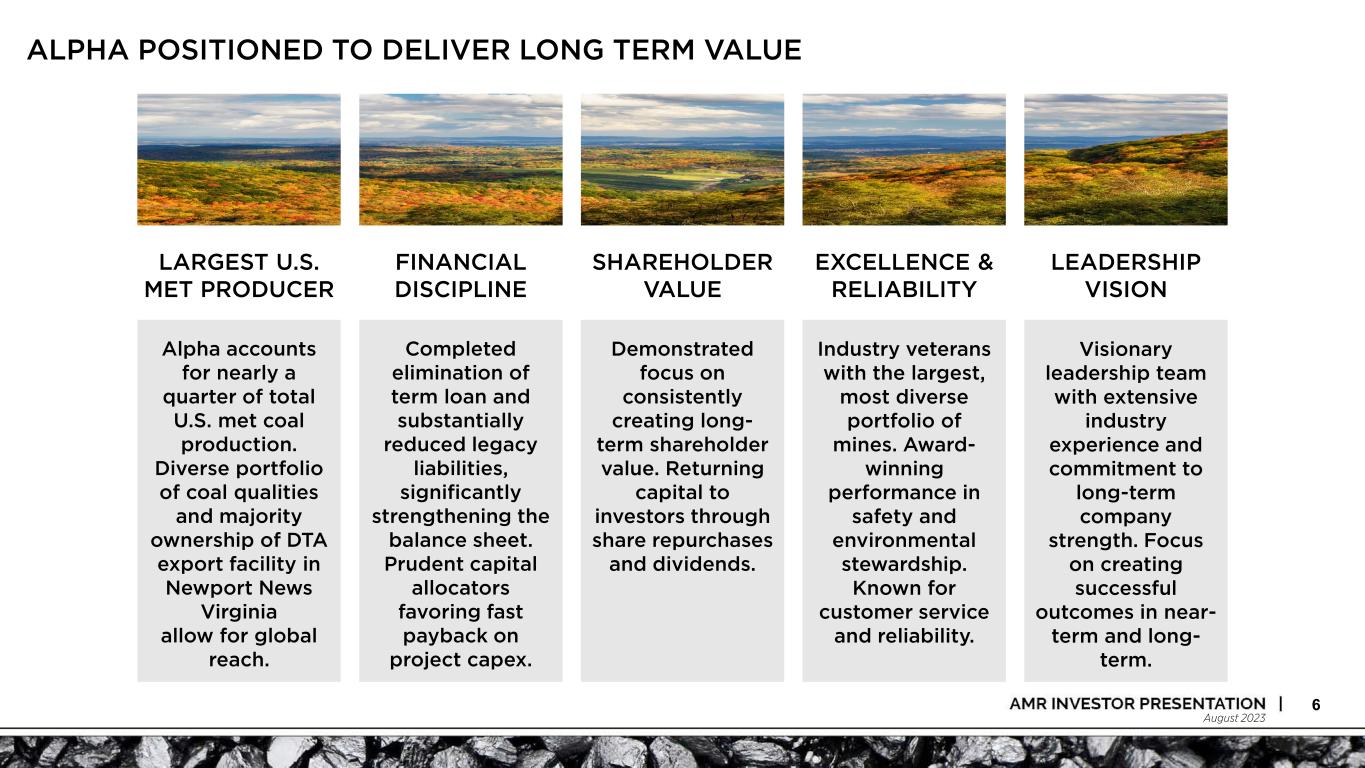

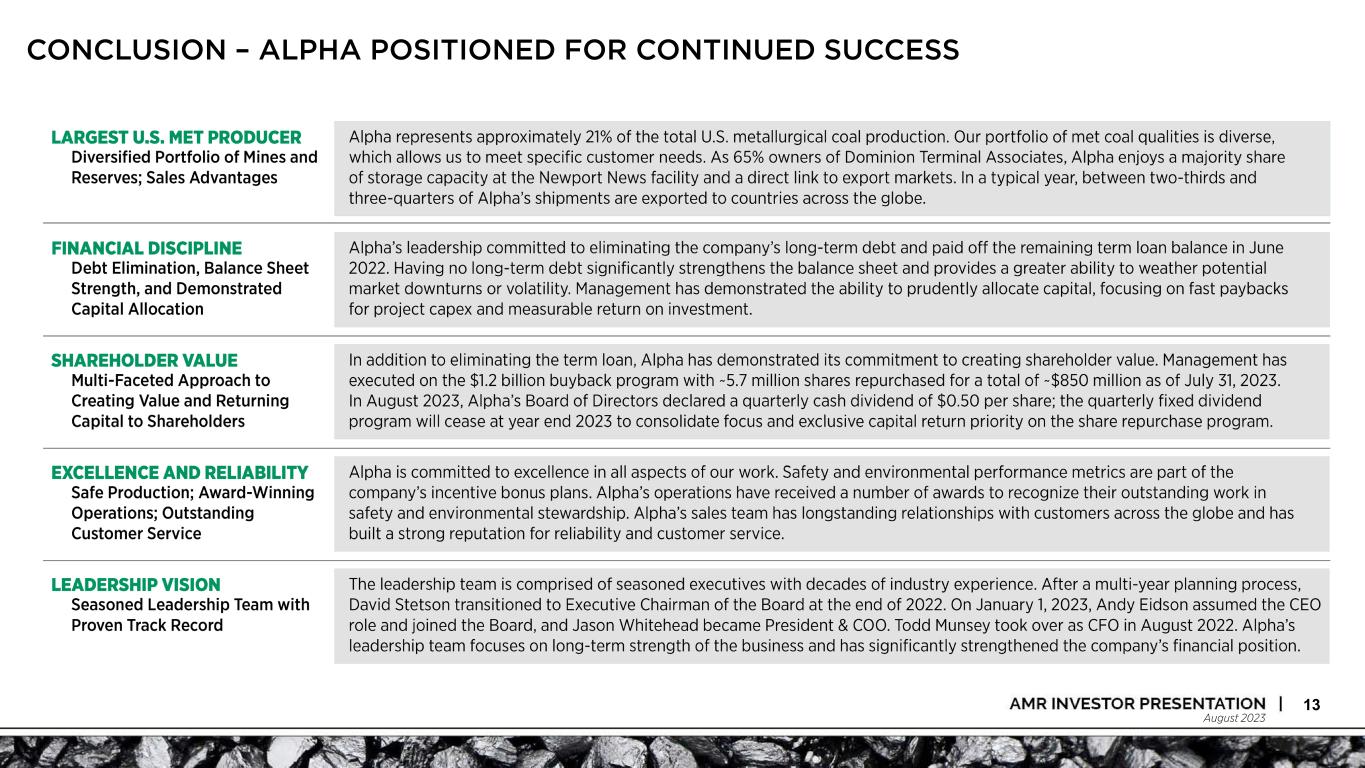

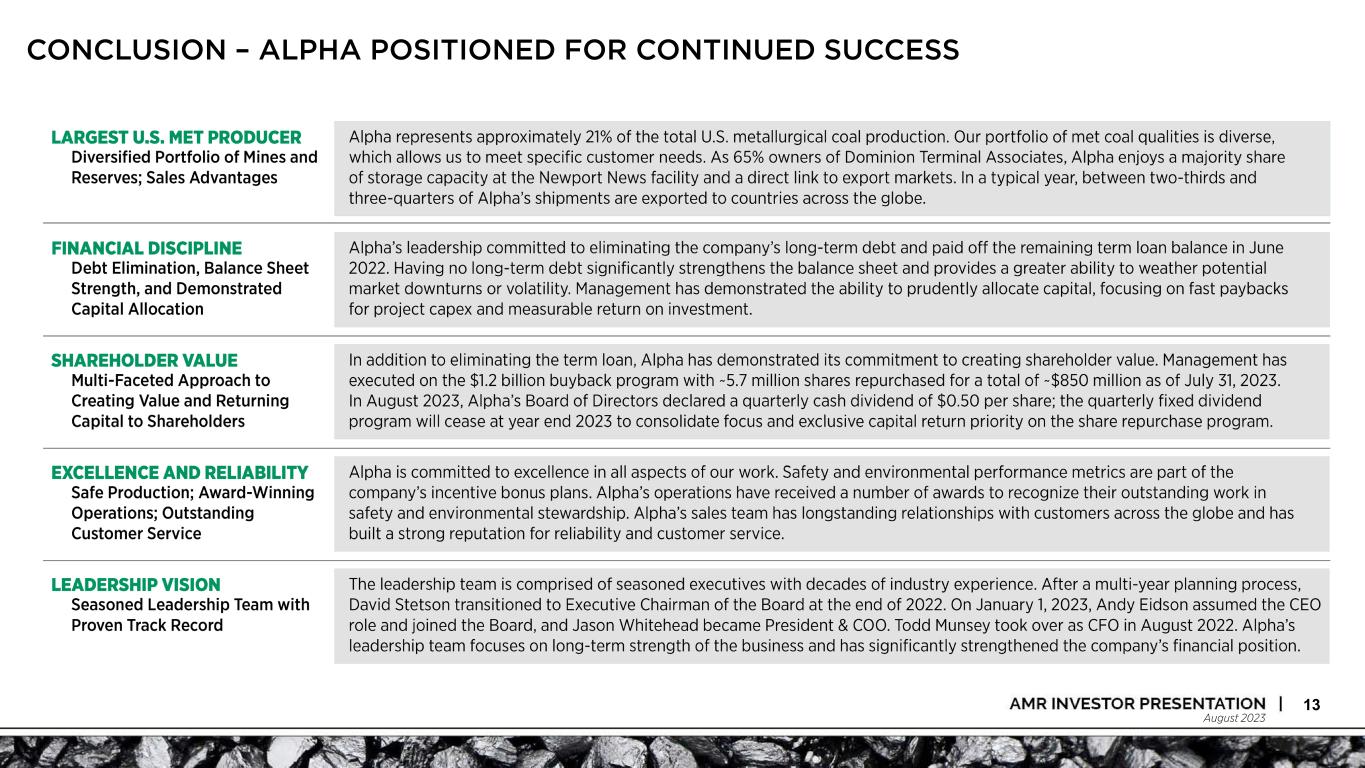

August 2023 ALPHA POSITIONED TO DELIVER LONG TERM VALUE 6 LARGEST U.S. MET PRODUCER SHAREHOLDER VALUE EXCELLENCE & RELIABILITY LEADERSHIP VISION Alpha accounts for nearly a quarter of total U.S. met coal production. Diverse portfolio of coal qualities and majority ownership of DTA export facility in Newport News Virginia allow for global reach. Demonstrated focus on consistently creating long- term shareholder value. Returning capital to investors through share repurchases and dividends. Industry veterans with the largest, most diverse portfolio of mines. Award- winning performance in safety and environmental stewardship. Known for customer service and reliability. Visionary leadership team with extensive industry experience and commitment to long-term company strength. Focus on creating successful outcomes in near- term and long- term. FINANCIAL DISCIPLINE Completed elimination of term loan and substantially reduced legacy liabilities, significantly strengthening the balance sheet. Prudent capital allocators favoring fast payback on project capex.

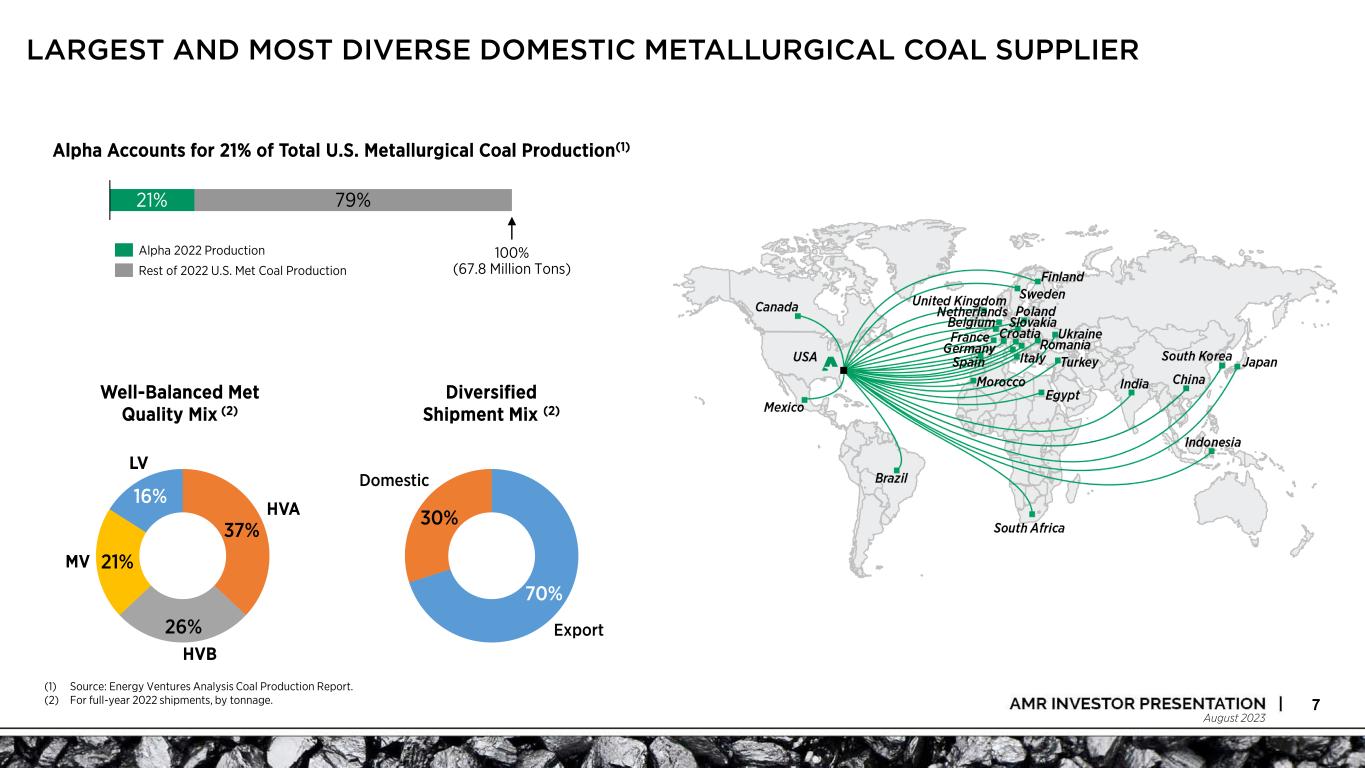

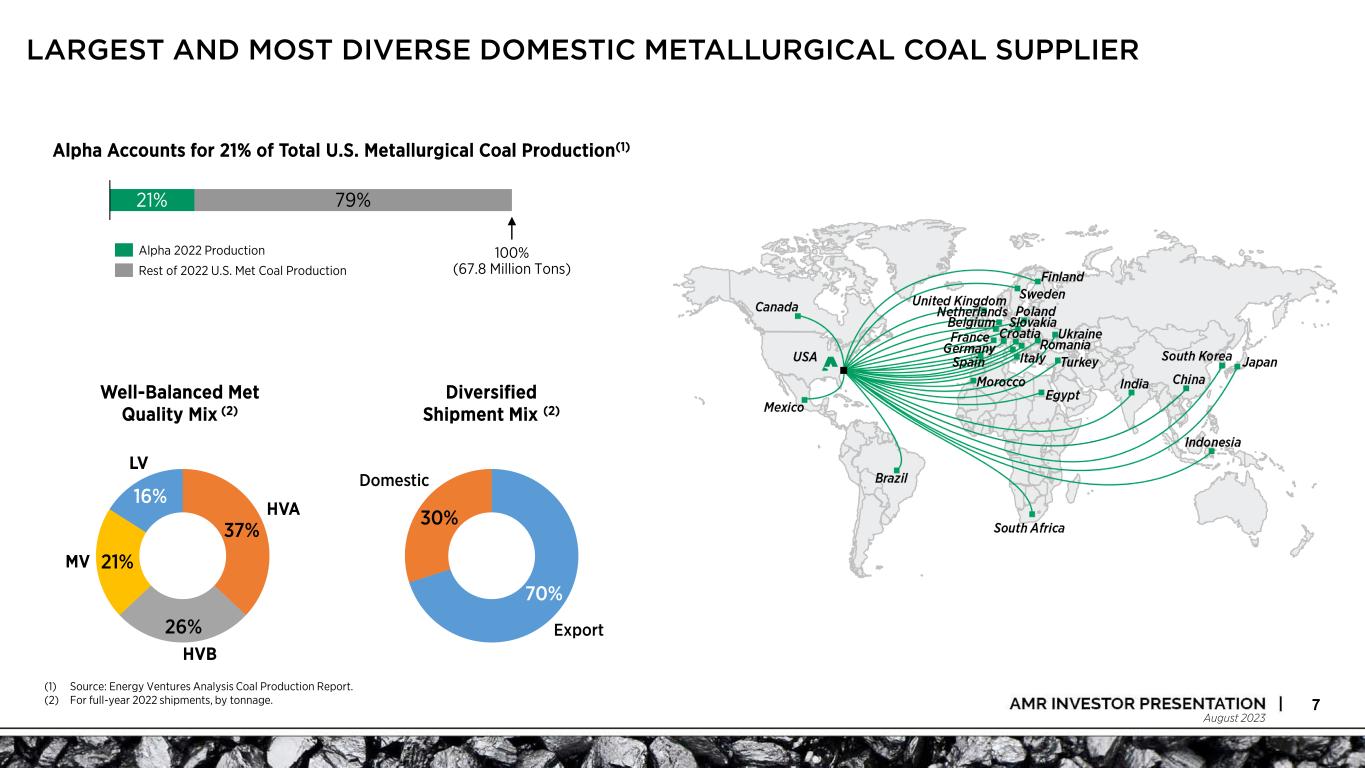

August 2023 7 70% 30% Export Domestic 37% 26% 21% 16% MV HVA HVB LV LARGEST AND MOST DIVERSE DOMESTIC METALLURGICAL COAL SUPPLIER Well-Balanced Met Quality Mix (2) Diversified Shipment Mix (2) (1) Source: Energy Ventures Analysis Coal Production Report. (2) For full-year 2022 shipments, by tonnage. 21% 79% 100% (67.8 Million Tons) Alpha 2022 Production Rest of 2022 U.S. Met Coal Production Alpha Accounts for 21% of Total U.S. Metallurgical Coal Production(1)

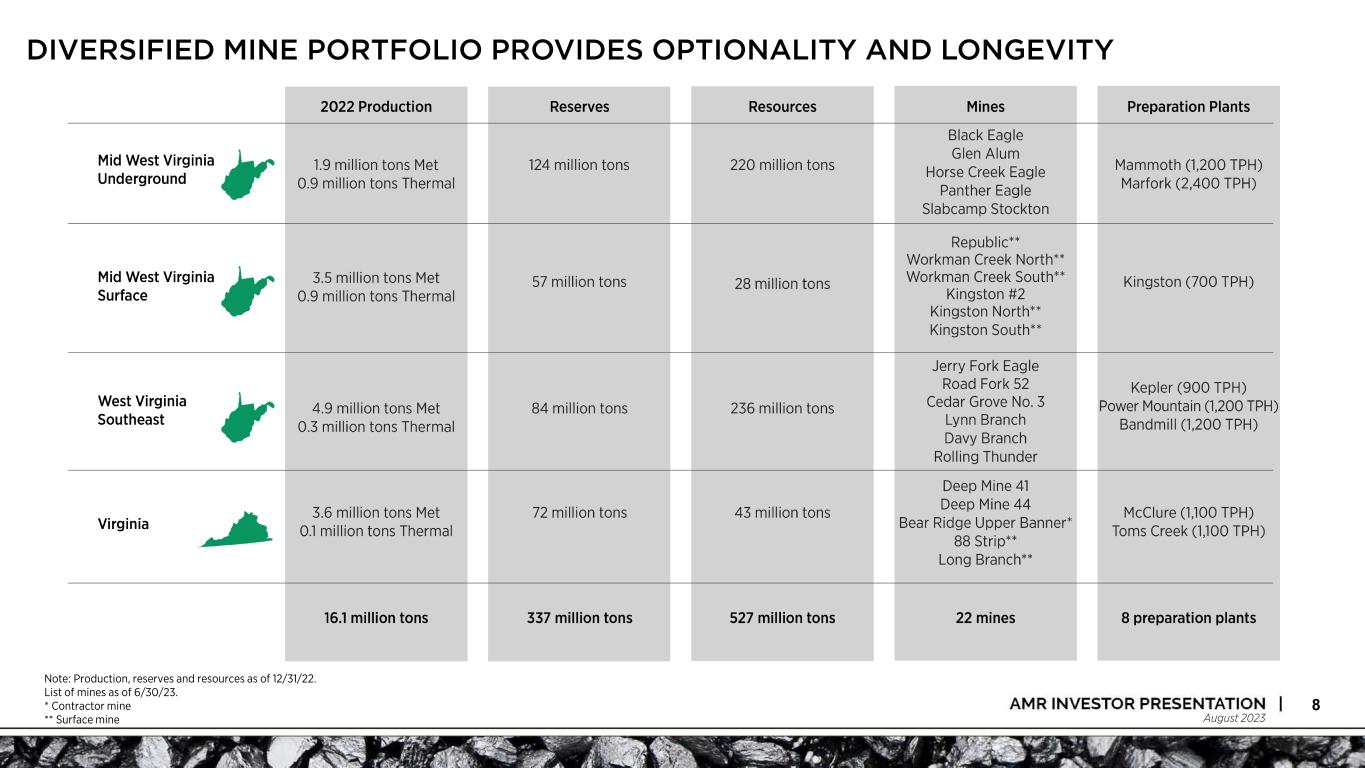

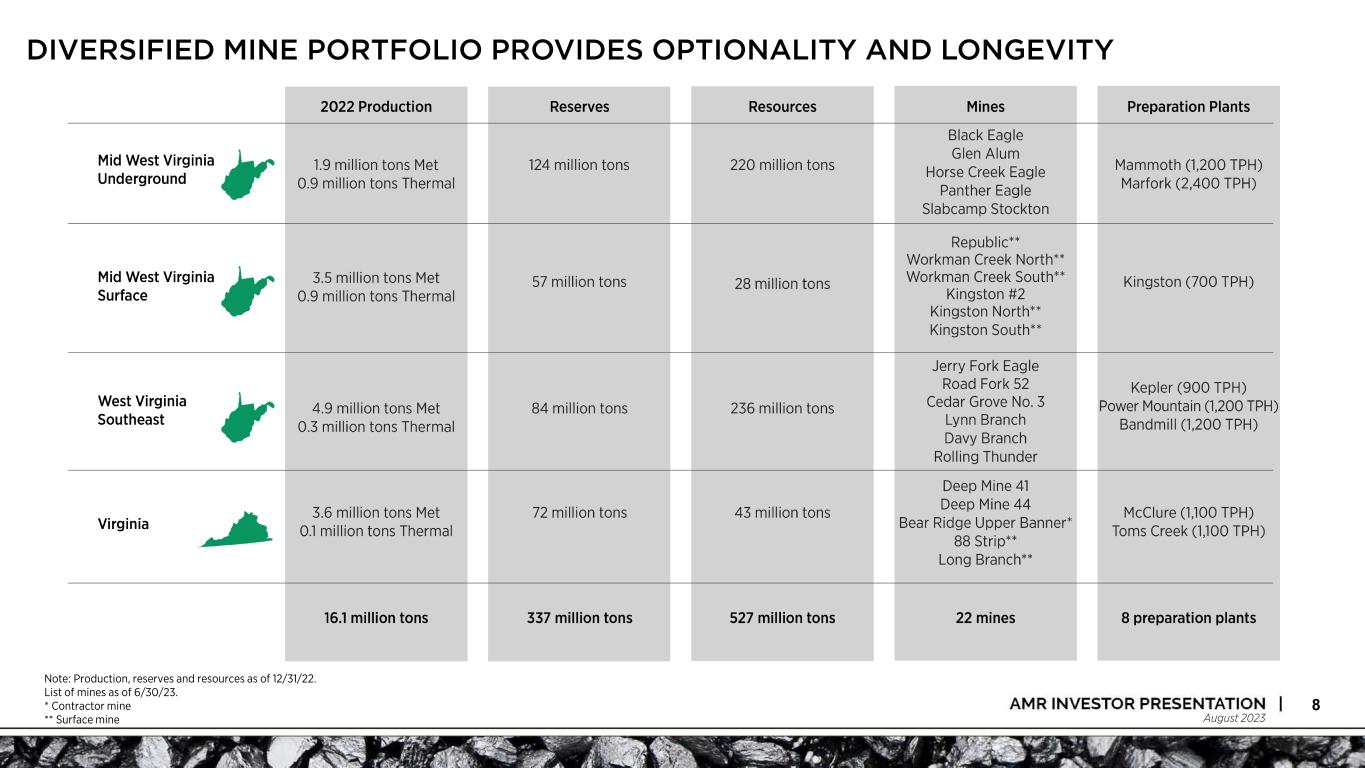

August 2023 DIVERSIFIED MINE PORTFOLIO PROVIDES OPTIONALITY AND LONGEVITY 8 Note: Production, reserves and resources as of 12/31/22. List of mines as of 6/30/23. * Contractor mine ** Surface mine

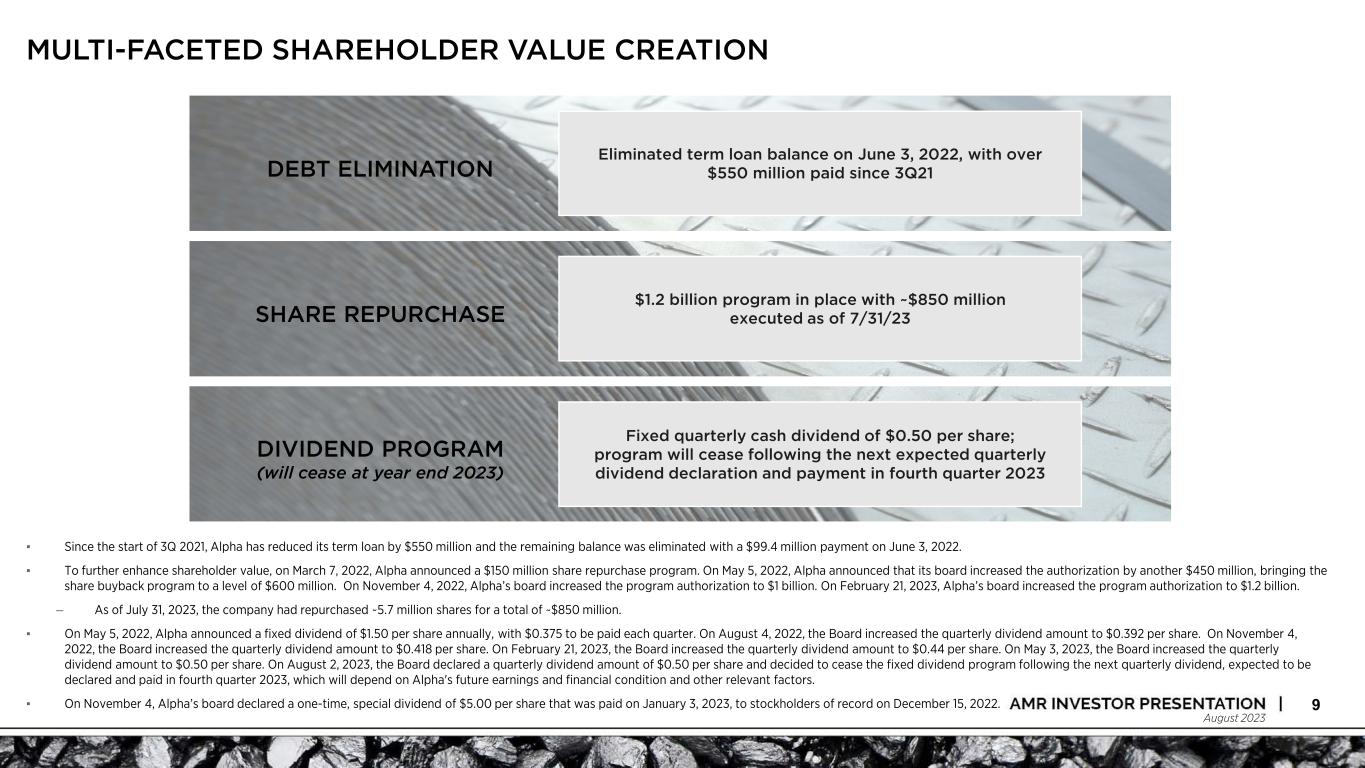

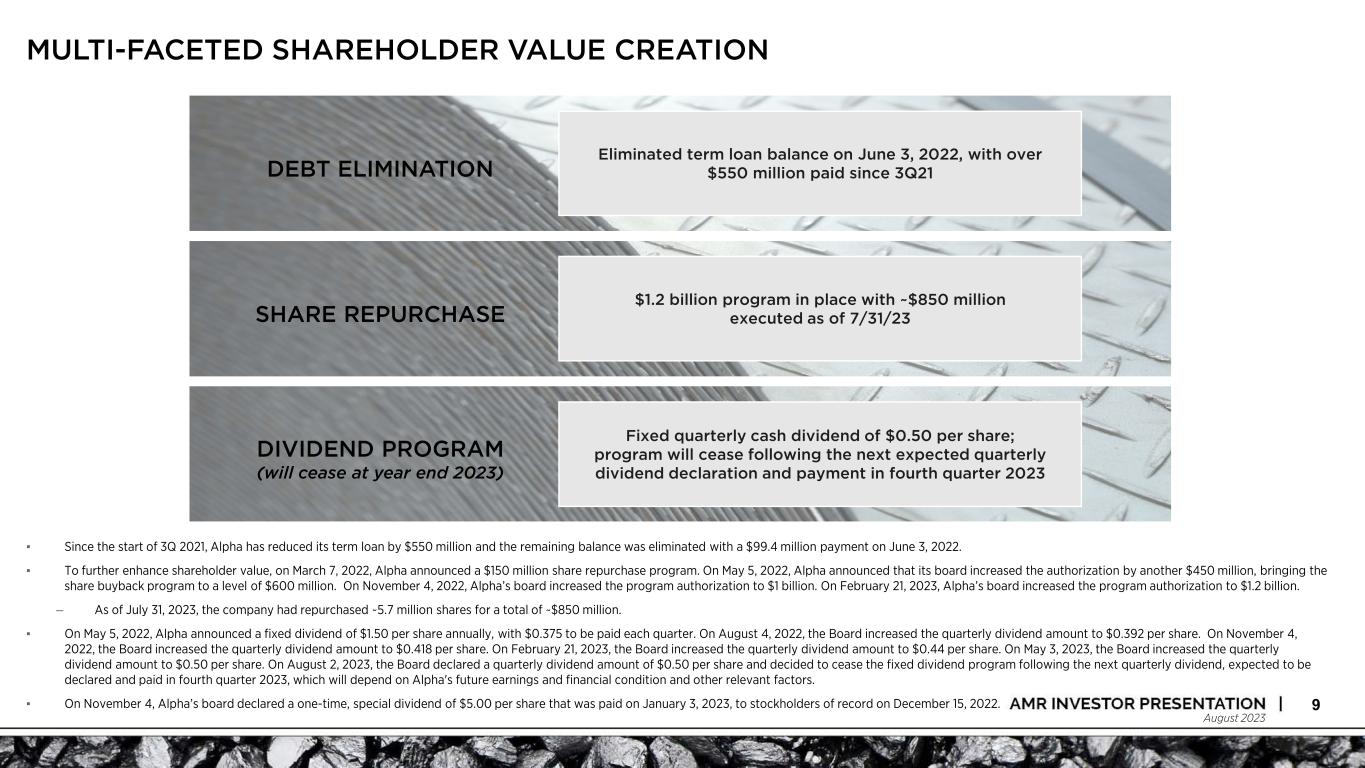

August 2023 MULTI-FACETED SHAREHOLDER VALUE CREATION 9 ▪ Since the start of 3Q 2021, Alpha has reduced its term loan by $550 million and the remaining balance was eliminated with a $99.4 million payment on June 3, 2022. ▪ To further enhance shareholder value, on March 7, 2022, Alpha announced a $150 million share repurchase program. On May 5, 2022, Alpha announced that its board increased the authorization by another $450 million, bringing the share buyback program to a level of $600 million. On November 4, 2022, Alpha’s board increased the program authorization to $1 billion. On February 21, 2023, Alpha’s board increased the program authorization to $1.2 billion. – As of July 31, 2023, the company had repurchased ~5.7 million shares for a total of ~$850 million. ▪ On May 5, 2022, Alpha announced a fixed dividend of $1.50 per share annually, with $0.375 to be paid each quarter. On August 4, 2022, the Board increased the quarterly dividend amount to $0.392 per share. On November 4, 2022, the Board increased the quarterly dividend amount to $0.418 per share. On February 21, 2023, the Board increased the quarterly dividend amount to $0.44 per share. On May 3, 2023, the Board increased the quarterly dividend amount to $0.50 per share. On August 2, 2023, the Board declared a quarterly dividend amount of $0.50 per share and decided to cease the fixed dividend program following the next quarterly dividend, expected to be declared and paid in fourth quarter 2023, which will depend on Alpha's future earnings and financial condition and other relevant factors. ▪ On November 4, Alpha’s board declared a one-time, special dividend of $5.00 per share that was paid on January 3, 2023, to stockholders of record on December 15, 2022. Eliminated term loan balance on June 3, 2022, with over $550 million paid since 3Q21 Fixed quarterly cash dividend of $0.50 per share; program will cease following the next expected quarterly dividend declaration and payment in fourth quarter 2023 $1.2 billion program in place with ~$850 million executed as of 7/31/23 DEBT ELIMINATION SHARE REPURCHASE DIVIDEND PROGRAM (will cease at year end 2023)

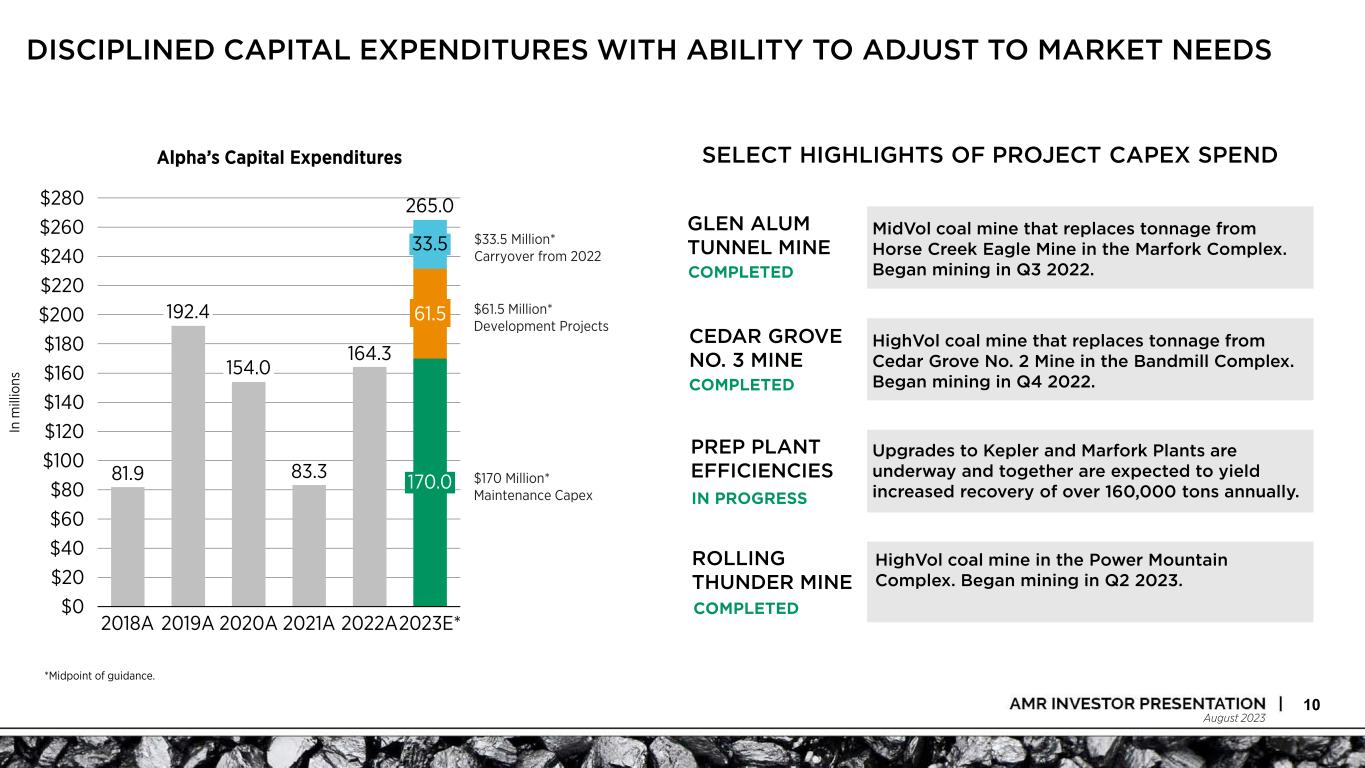

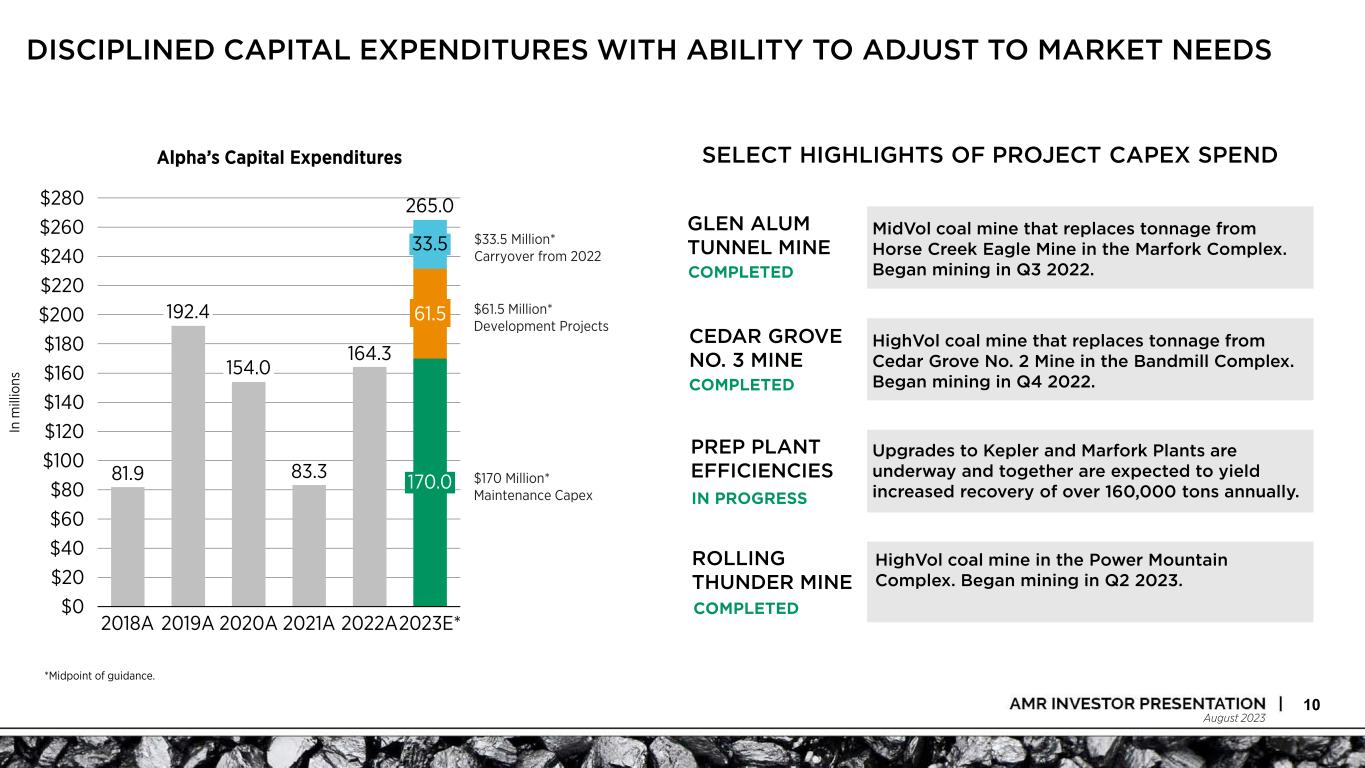

August 2023 DISCIPLINED CAPITAL EXPENDITURES WITH ABILITY TO ADJUST TO MARKET NEEDS 10 81.9 83.3 164.3 61.5 $100 $260 $80 $0 $60 $20 $200 $120 $160 $40 $140 $180 $220 $240 $280 192.4 In m illi on s 265.0 2018A 2019A 2020A 2021A 2022A 170.0 2023E* 154.0 33.5 $33.5 Million* Carryover from 2022 $170 Million* Maintenance Capex SELECT HIGHLIGHTS OF PROJECT CAPEX SPENDAlpha’s Capital Expenditures *Midpoint of guidance. $61.5 Million* Development Projects MidVol coal mine that replaces tonnage from Horse Creek Eagle Mine in the Marfork Complex. Began mining in Q3 2022. HighVol coal mine that replaces tonnage from Cedar Grove No. 2 Mine in the Bandmill Complex. Began mining in Q4 2022. HighVol coal mine in the Power Mountain Complex. Began mining in Q2 2023. Upgrades to Kepler and Marfork Plants are underway and together are expected to yield increased recovery of over 160,000 tons annually. GLEN ALUM TUNNEL MINE CEDAR GROVE NO. 3 MINE ROLLING THUNDER MINE PREP PLANT EFFICIENCIES COMPLETED COMPLETED IN PROGRESS COMPLETED

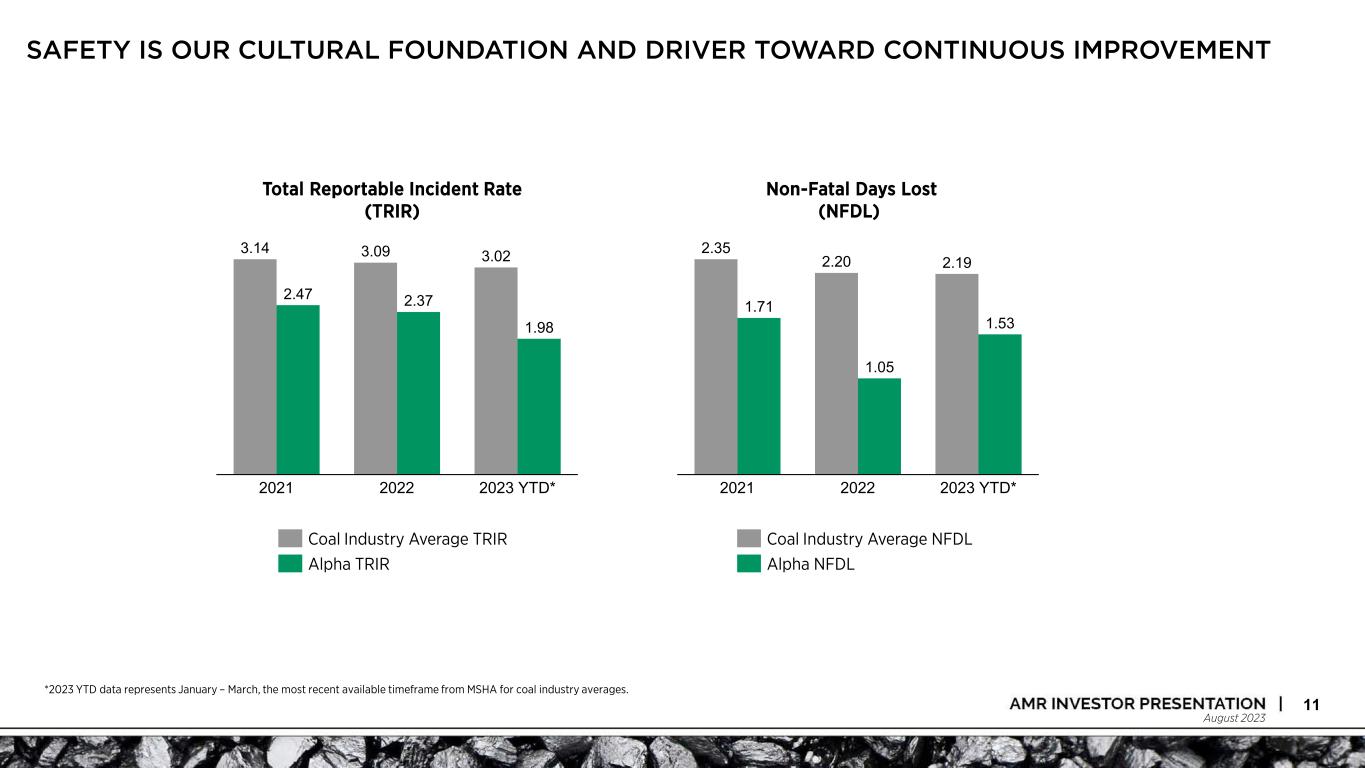

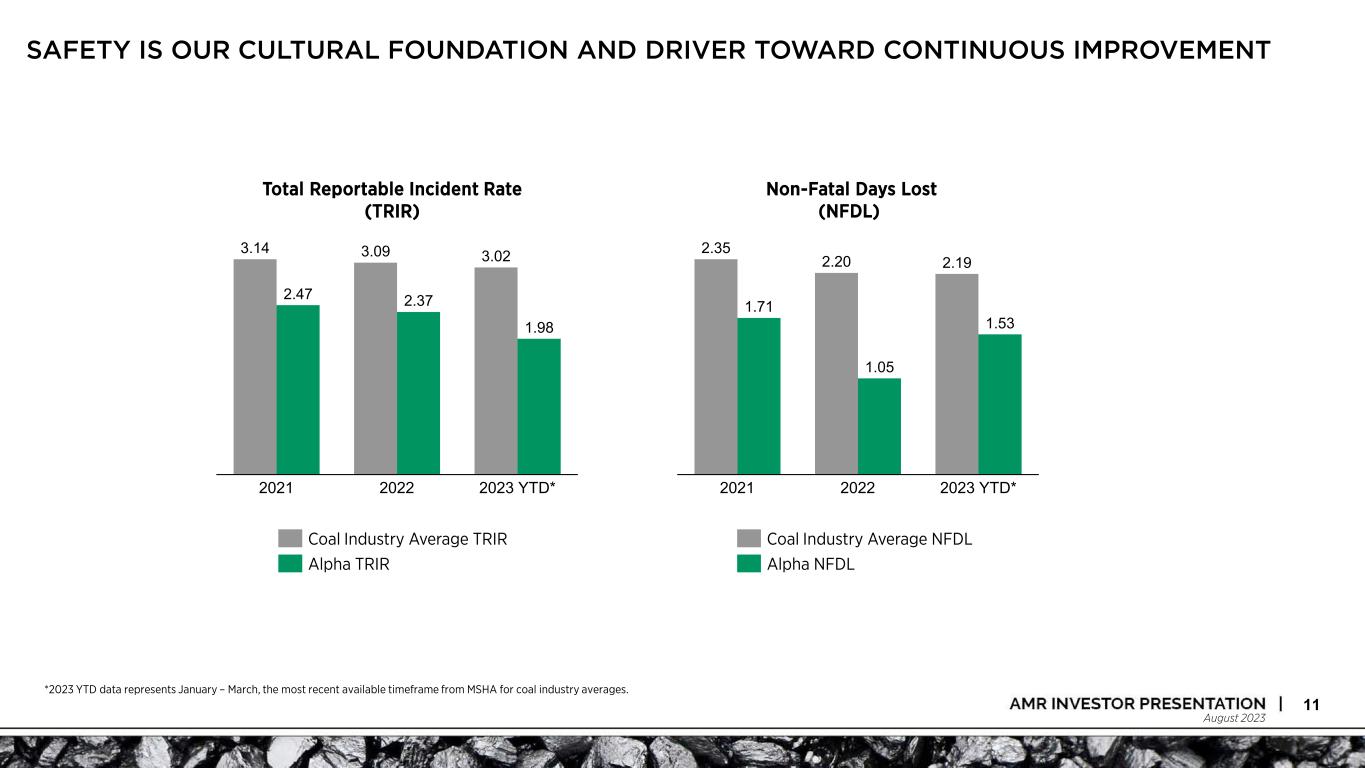

August 2023 SAFETY IS OUR CULTURAL FOUNDATION AND DRIVER TOWARD CONTINUOUS IMPROVEMENT 11 3.14 3.09 3.02 2.47 2.37 1.98 2021 2022 2023 YTD* Coal Industry Average TRIR Alpha TRIR Total Reportable Incident Rate (TRIR) 2.35 2.20 2.19 1.71 1.05 1.53 2021 2022 2023 YTD* Coal Industry Average NFDL Alpha NFDL Non-Fatal Days Lost (NFDL) *2023 YTD data represents January – March, the most recent available timeframe from MSHA for coal industry averages.

August 2023 ALPHA’S LEADERSHIP TEAM PRIORITIZES LONG-TERM STRENGTH OF THE BUSINESS 12

August 2023 CONCLUSION – ALPHA POSITIONED FOR CONTINUED SUCCESS 13

August 2023

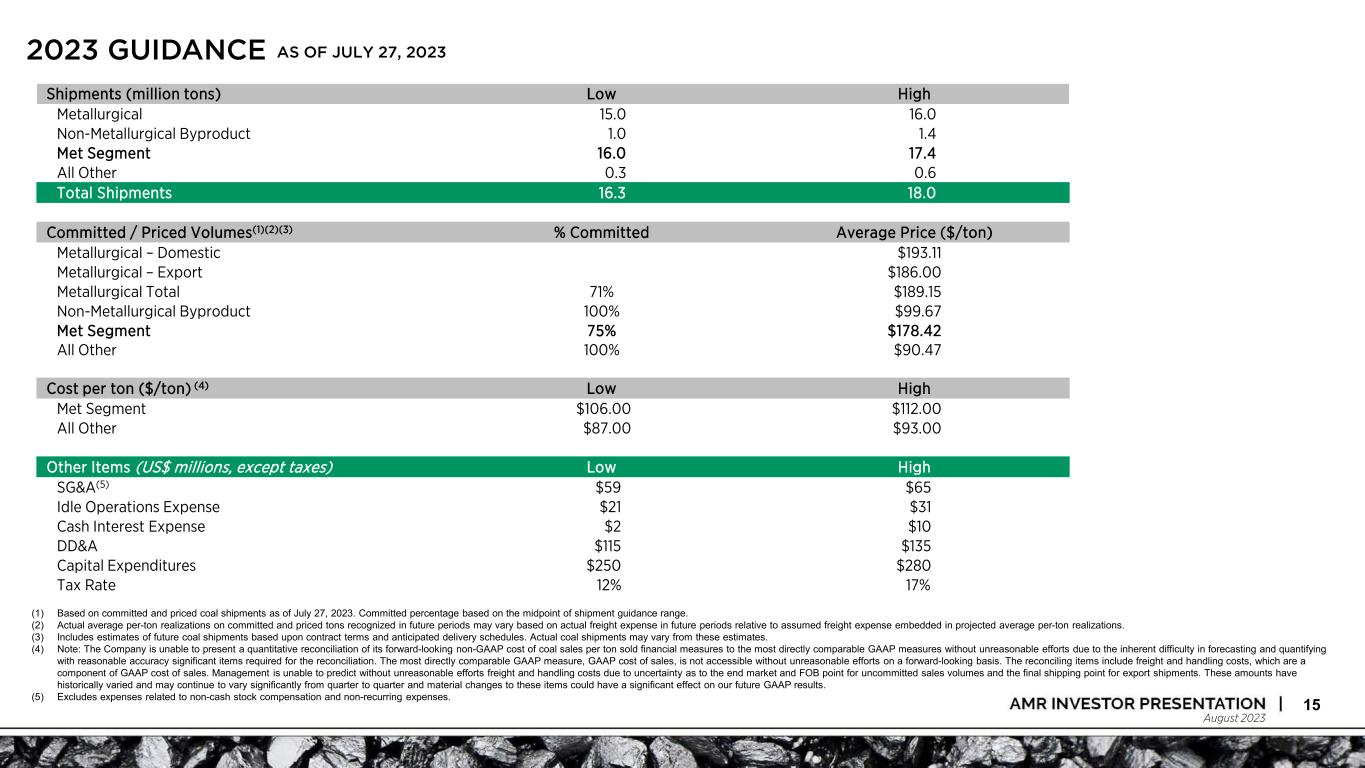

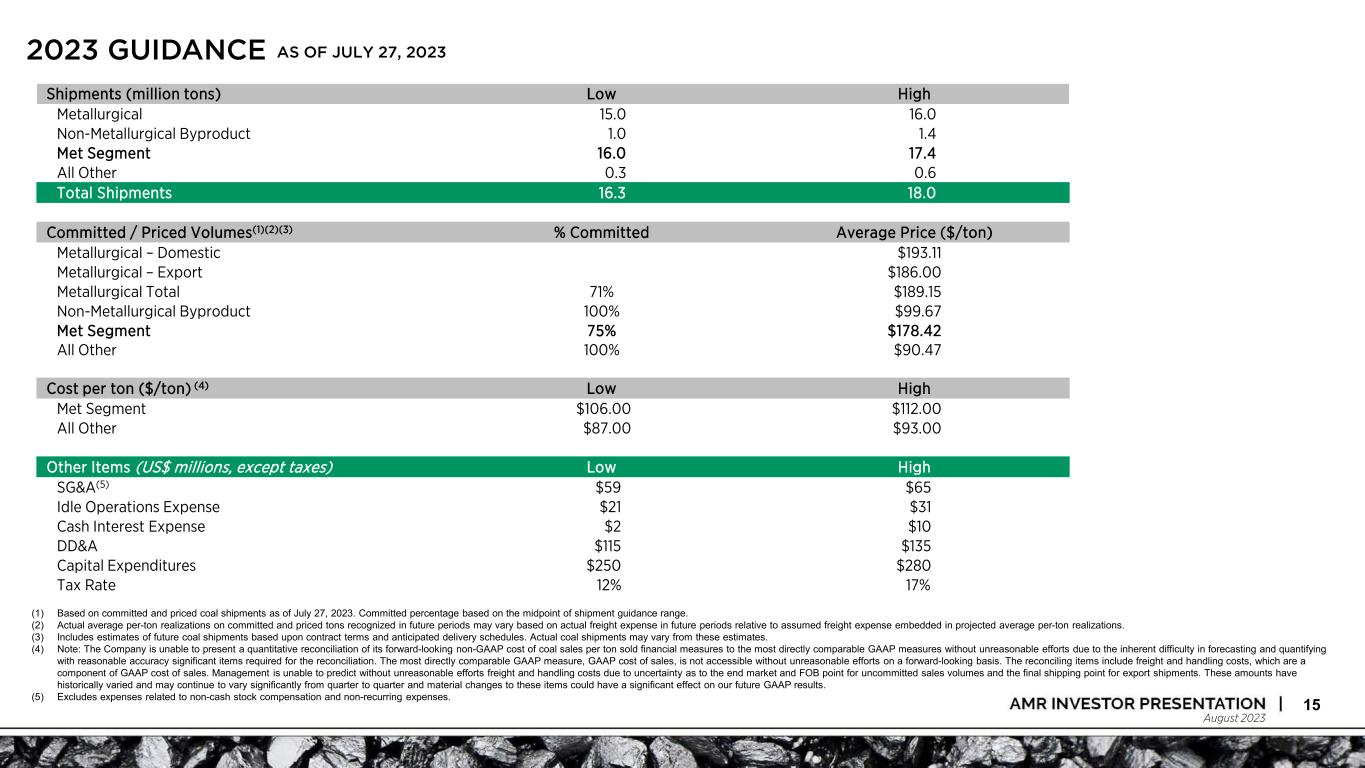

August 2023 2023 GUIDANCE 15 (1) Based on committed and priced coal shipments as of July 27, 2023. Committed percentage based on the midpoint of shipment guidance range. (2) Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations. (3) Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates. (4) Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results. (5) Excludes expenses related to non-cash stock compensation and non-recurring expenses. AS OF JULY 27, 2023 Shipments (million tons) Low High Metallurgical 15.0 16.0 Non-Metallurgical Byproduct 1.0 1.4 Met Segment 16.0 17.4 All Other 0.3 0.6 Total Shipments 16.3 18.0 Committed / Priced Volumes(1)(2)(3) % Committed Average Price ($/ton) Metallurgical – Domestic $193.11 Metallurgical – Export $186.00 Metallurgical Total 71% $189.15 Non-Metallurgical Byproduct 100% $99.67 Met Segment 75% $178.42 All Other 100% $90.47 Cost per ton ($/ton) (4) Low High Met Segment $106.00 $112.00 All Other $87.00 $93.00 Other Items (US$ millions, except taxes) Low High SG&A(5) $59 $65 Idle Operations Expense $21 $31 Cash Interest Expense $2 $10 DD&A $115 $135 Capital Expenditures $250 $280 Tax Rate 12% 17%

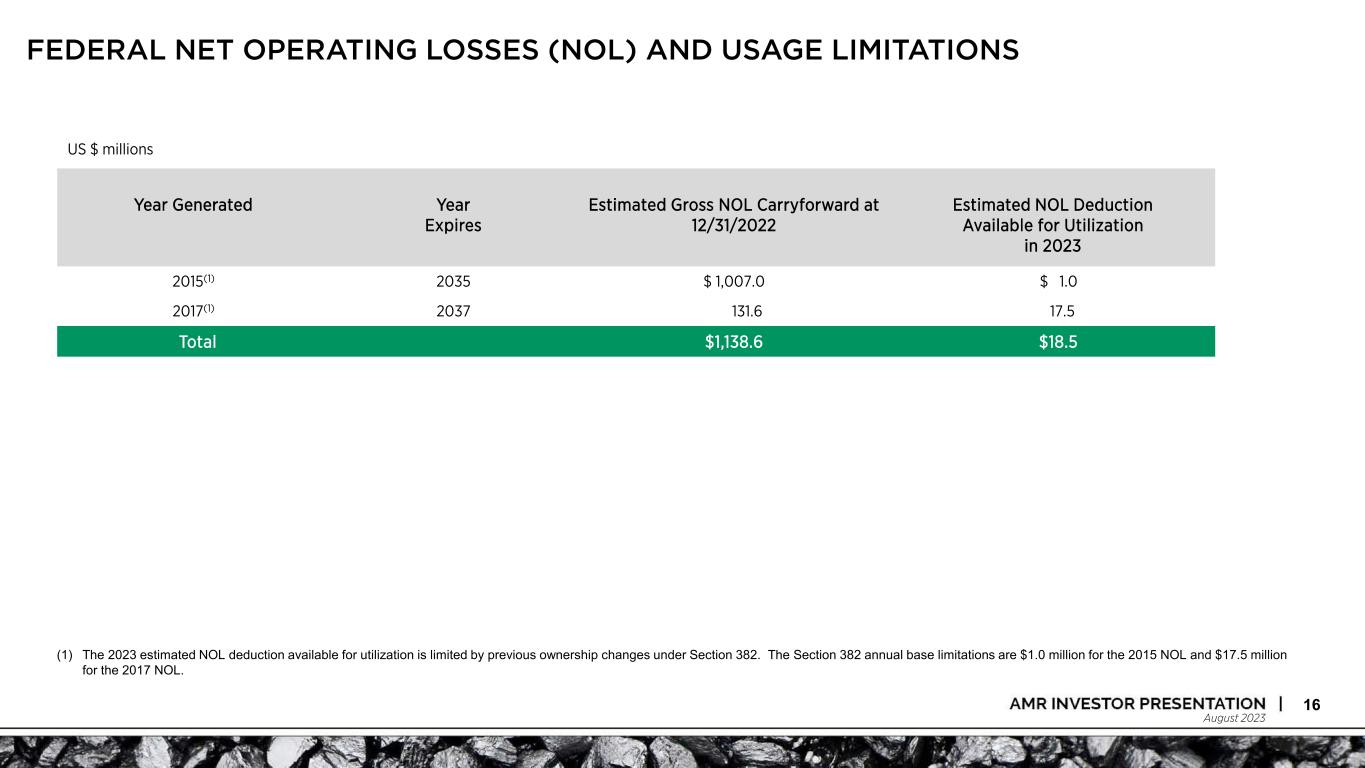

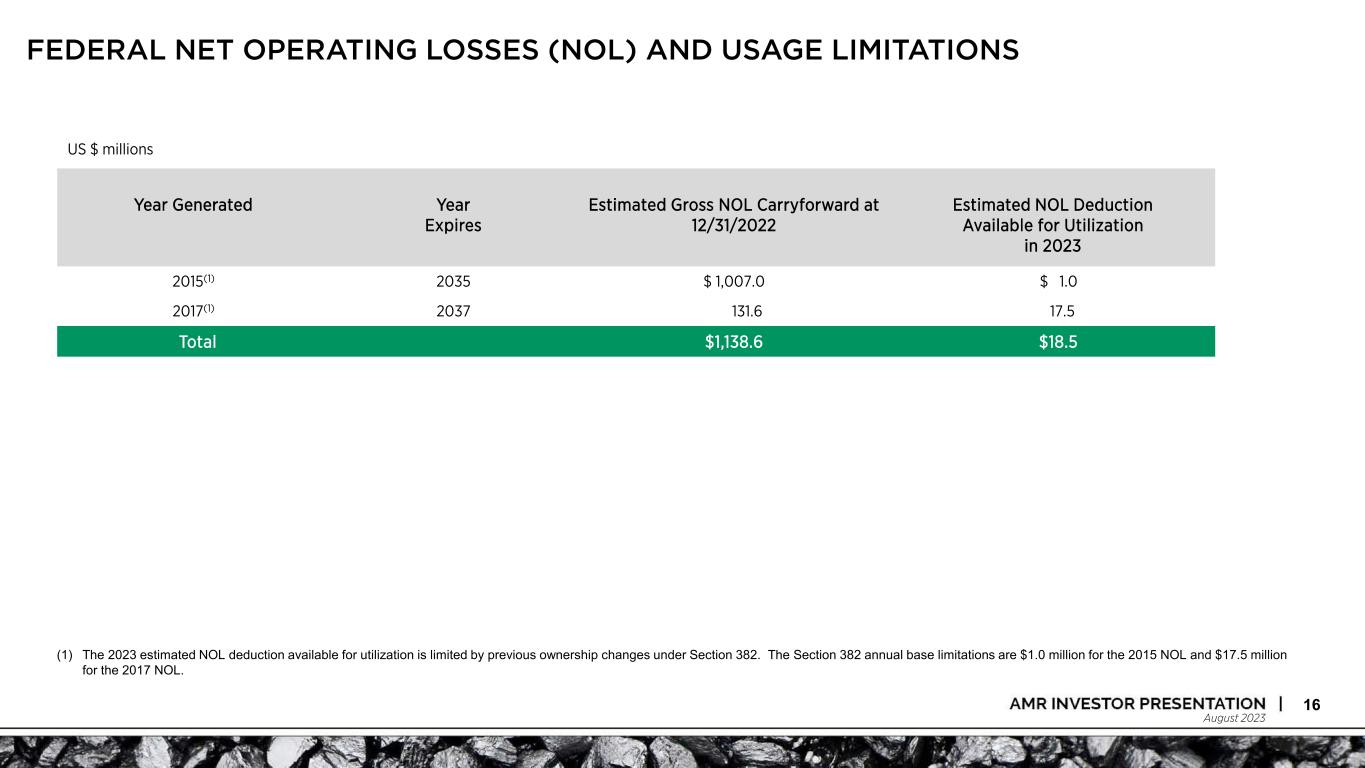

August 2023 FEDERAL NET OPERATING LOSSES (NOL) AND USAGE LIMITATIONS 16 US $ millions (1) The 2023 estimated NOL deduction available for utilization is limited by previous ownership changes under Section 382. The Section 382 annual base limitations are $1.0 million for the 2015 NOL and $17.5 million for the 2017 NOL. Year Generated Year Expires Estimated Gross NOL Carryforward at 12/31/2022 Estimated NOL Deduction Available for Utilization in 2023 2015(1) 2035 $ 1,007.0 $ 1.0 2017(1) 2037 131.6 17.5 Total $1,138.6 $18.5

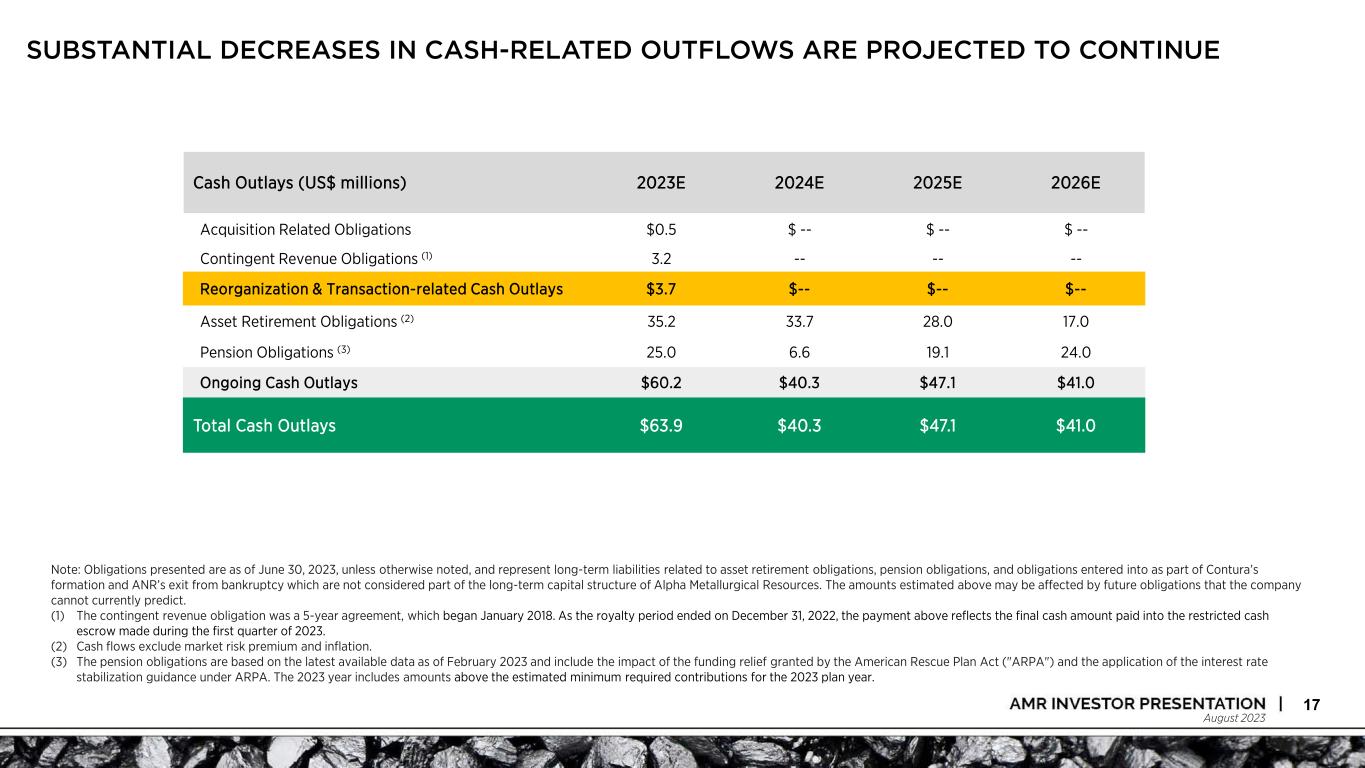

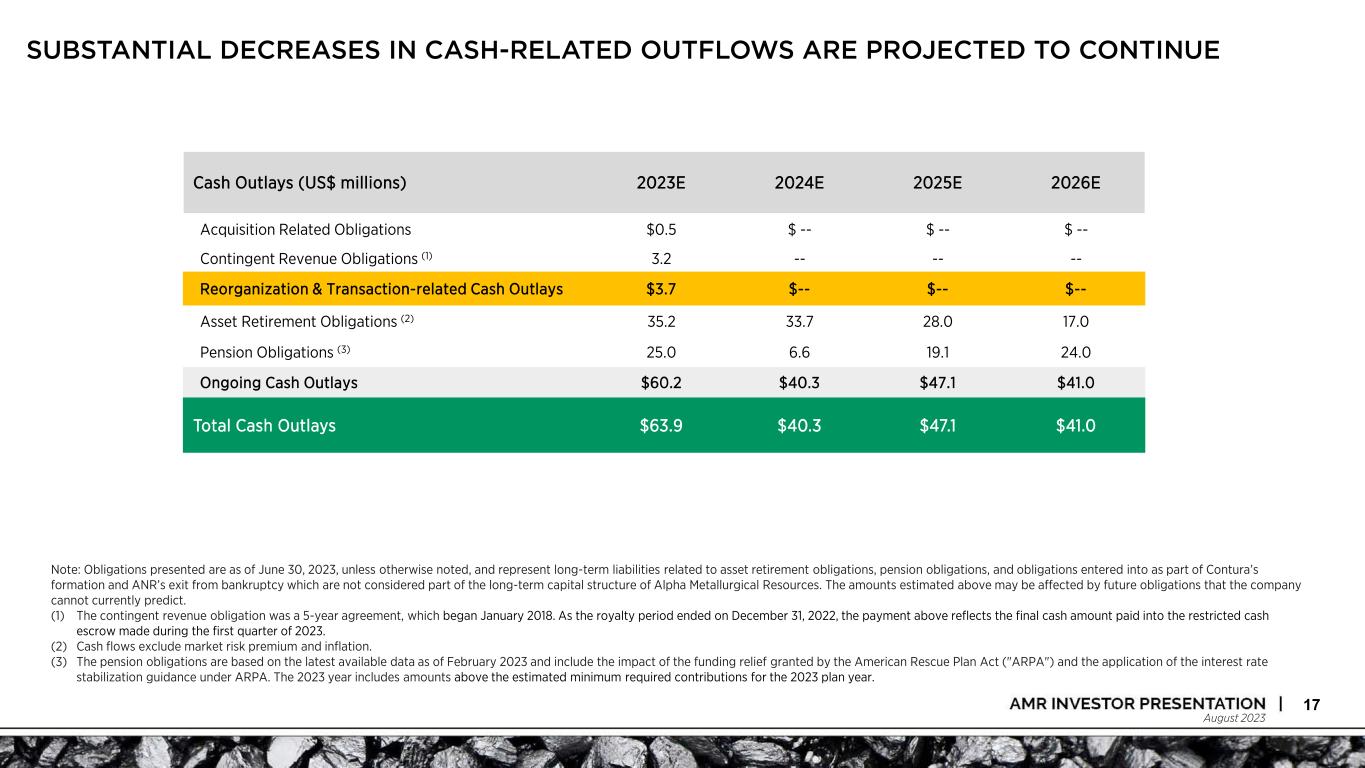

August 2023 SUBSTANTIAL DECREASES IN CASH-RELATED OUTFLOWS ARE PROJECTED TO CONTINUE 17 Cash Outlays (US$ millions) 2023E 2024E 2025E 2026E Acquisition Related Obligations $0.5 $ -- $ -- $ -- Contingent Revenue Obligations (1) 3.2 -- -- -- Reorganization & Transaction-related Cash Outlays $3.7 $-- $-- $-- Asset Retirement Obligations (2) 35.2 33.7 28.0 17.0 Pension Obligations (3) 25.0 6.6 19.1 24.0 Ongoing Cash Outlays $60.2 $40.3 $47.1 $41.0 Total Cash Outlays $63.9 $40.3 $47.1 $41.0 Note: Obligations presented are as of June 30, 2023, unless otherwise noted, and represent long-term liabilities related to asset retirement obligations, pension obligations, and obligations entered into as part of Contura’s formation and ANR’s exit from bankruptcy which are not considered part of the long-term capital structure of Alpha Metallurgical Resources. The amounts estimated above may be affected by future obligations that the company cannot currently predict. (1) The contingent revenue obligation was a 5-year agreement, which began January 2018. As the royalty period ended on December 31, 2022, the payment above reflects the final cash amount paid into the restricted cash escrow made during the first quarter of 2023. (2) Cash flows exclude market risk premium and inflation. (3) The pension obligations are based on the latest available data as of February 2023 and include the impact of the funding relief granted by the American Rescue Plan Act ("ARPA") and the application of the interest rate stabilization guidance under ARPA. The 2023 year includes amounts above the estimated minimum required contributions for the 2023 plan year.

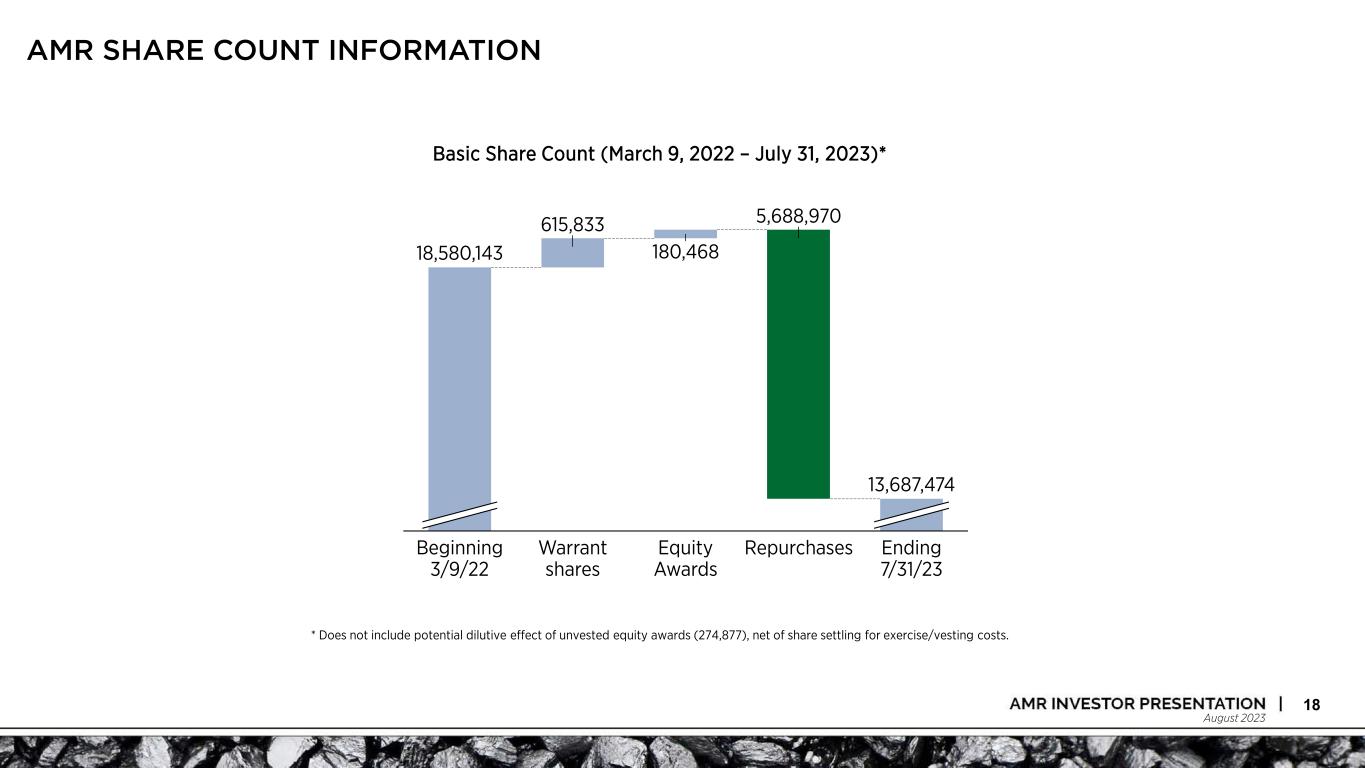

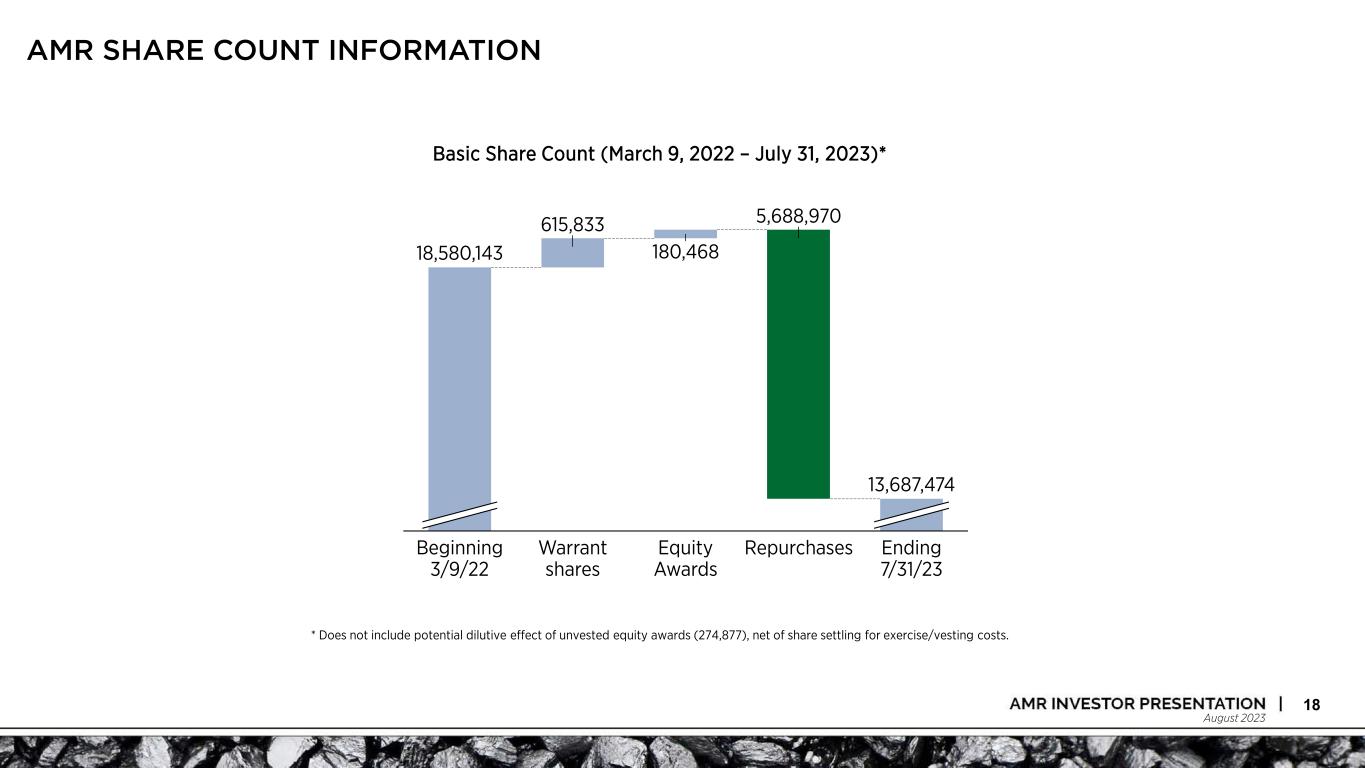

August 2023 AMR SHARE COUNT INFORMATION 18 Basic Share Count (March 9, 2022 – July 31, 2023)* * Does not include potential dilutive effect of unvested equity awards (274,877), net of share settling for exercise/vesting costs. 615,833 180,468 5,688,970 Beginning 3/9/22 Warrant shares Equity Awards Repurchases Ending 7/31/23 18,580,143 13,687,474