Document

NEWS RELEASE

AbCellera Reports Full Year 2023 Business Results

2/20/2024

●Total revenue of $38 million, compared to $485 million in FY 2022

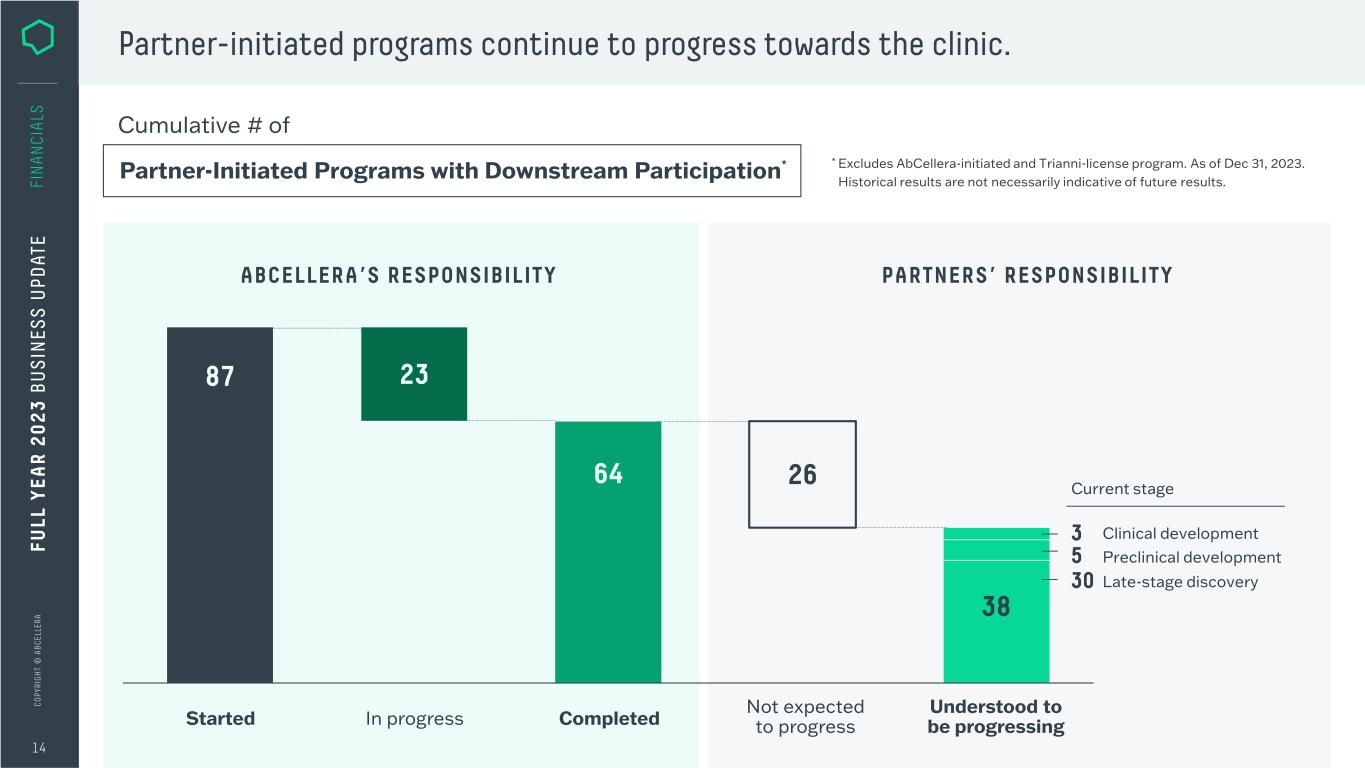

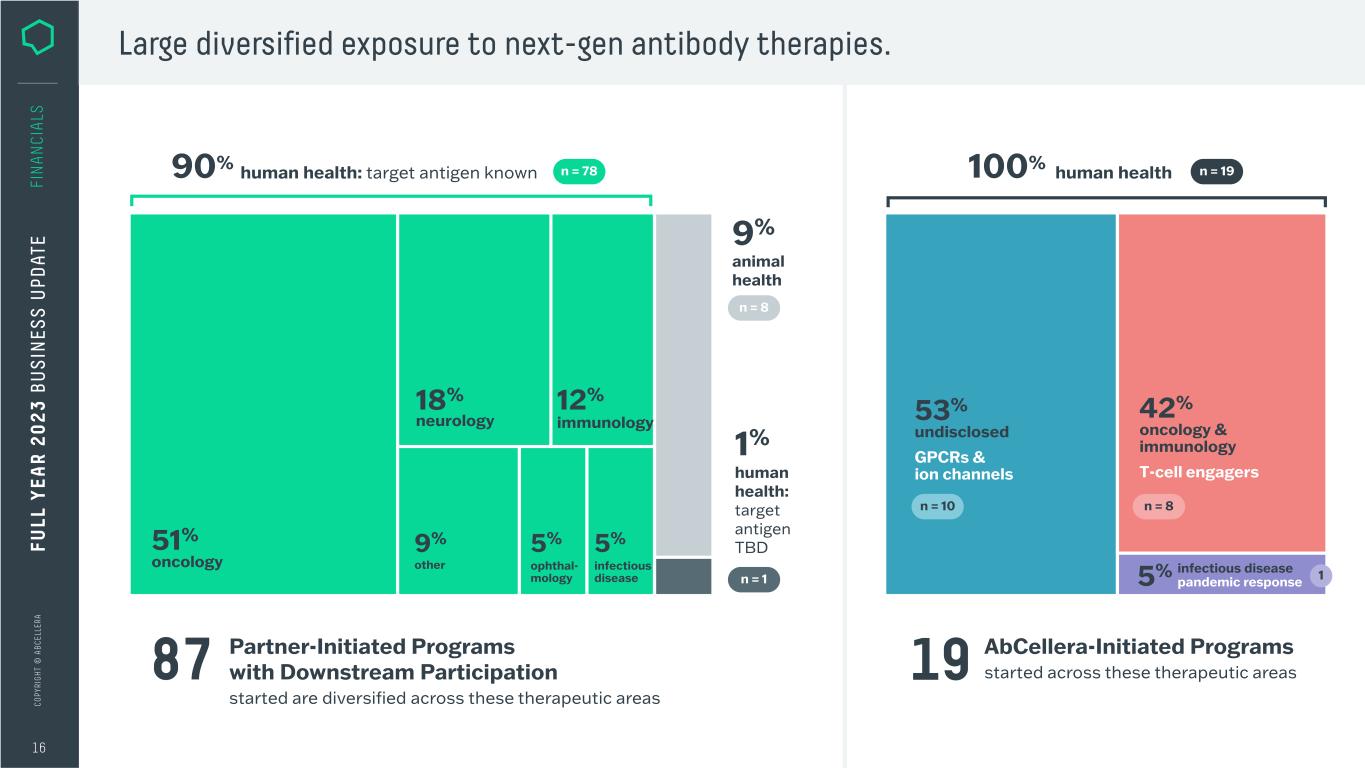

●Total cumulative partner-initiated program starts with downstreams of 87, with 12 new starts in the year

●Net loss of $0.51 per share on a basic and diluted basis, compared to earnings of $0.56 (basic) and $0.50 (diluted) per share in 2022

VANCOUVER, British Columbia--(BUSINESS WIRE)-- AbCellera (Nasdaq: ABCL) today announced financial results for the full year 2023. All financial information in this press release is reported in U.S. dollars, unless otherwise indicated.

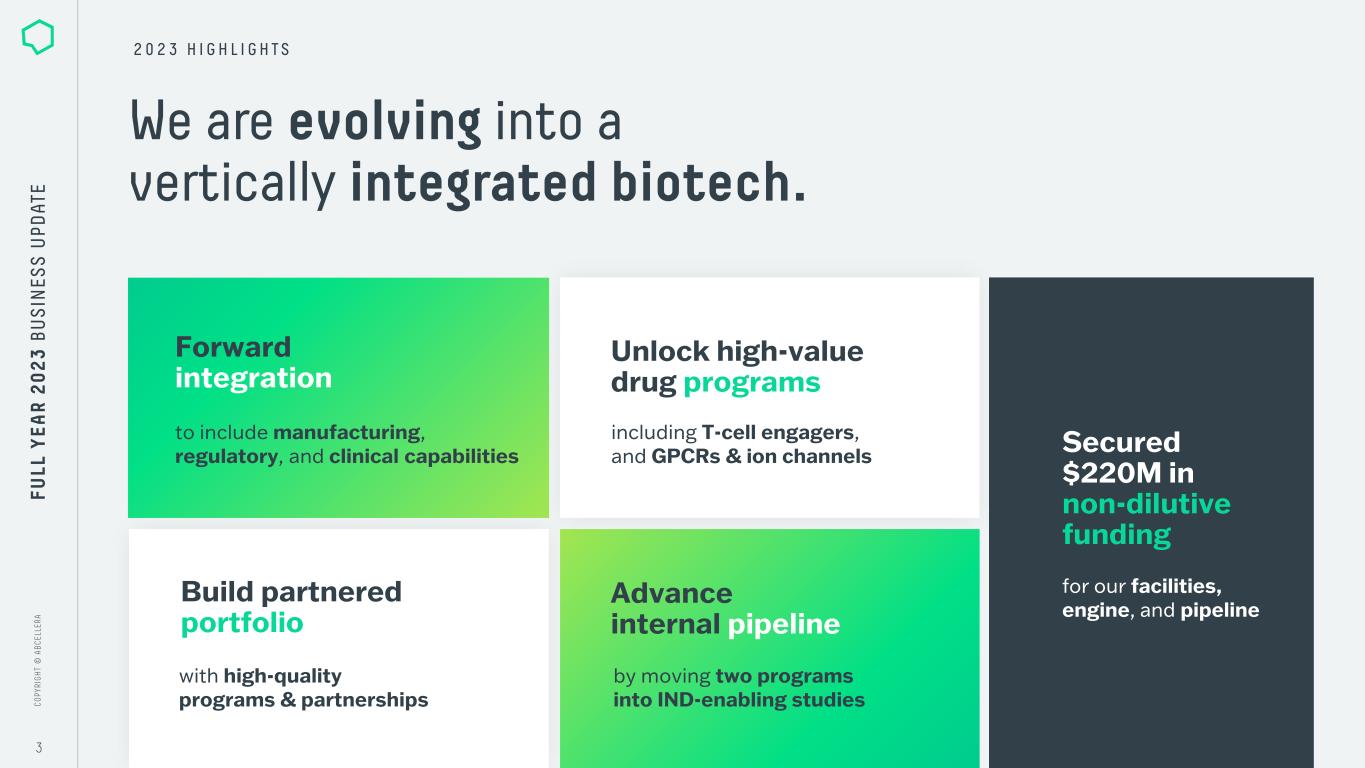

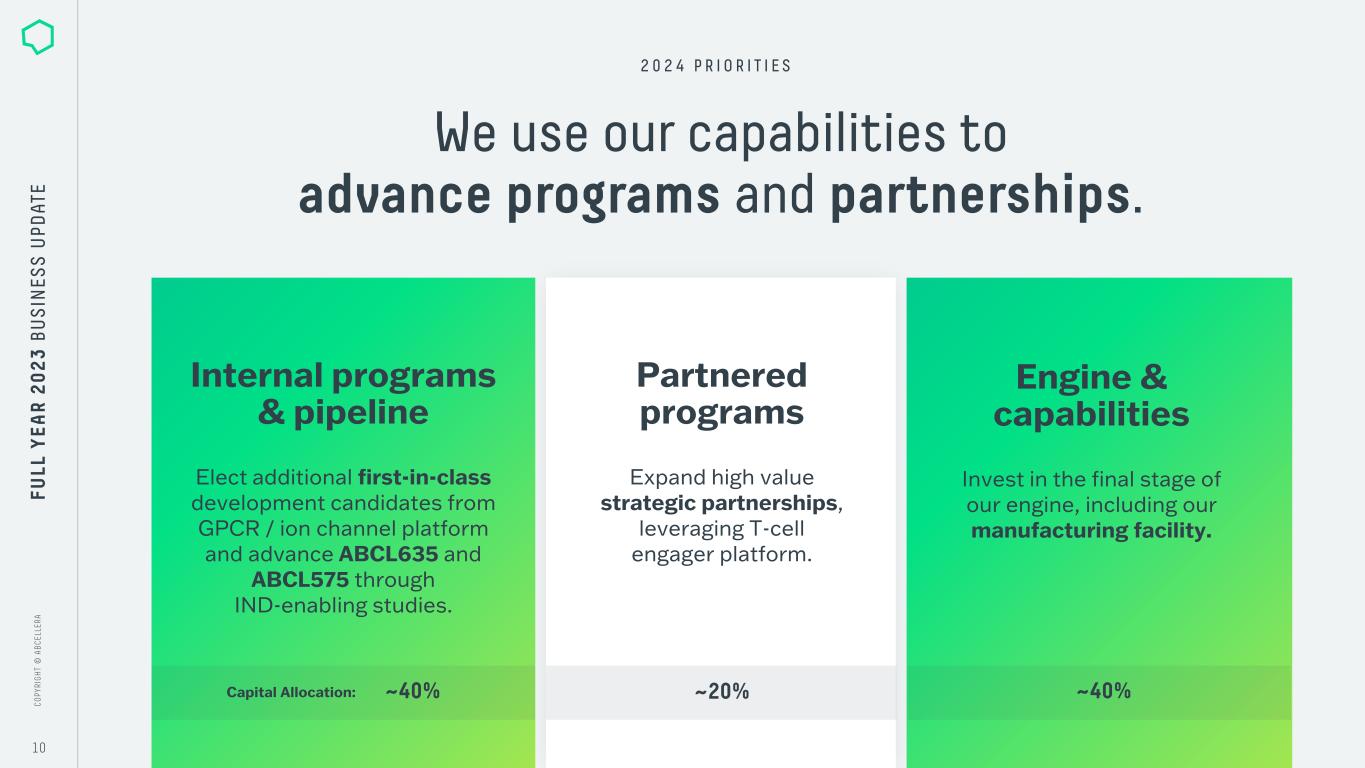

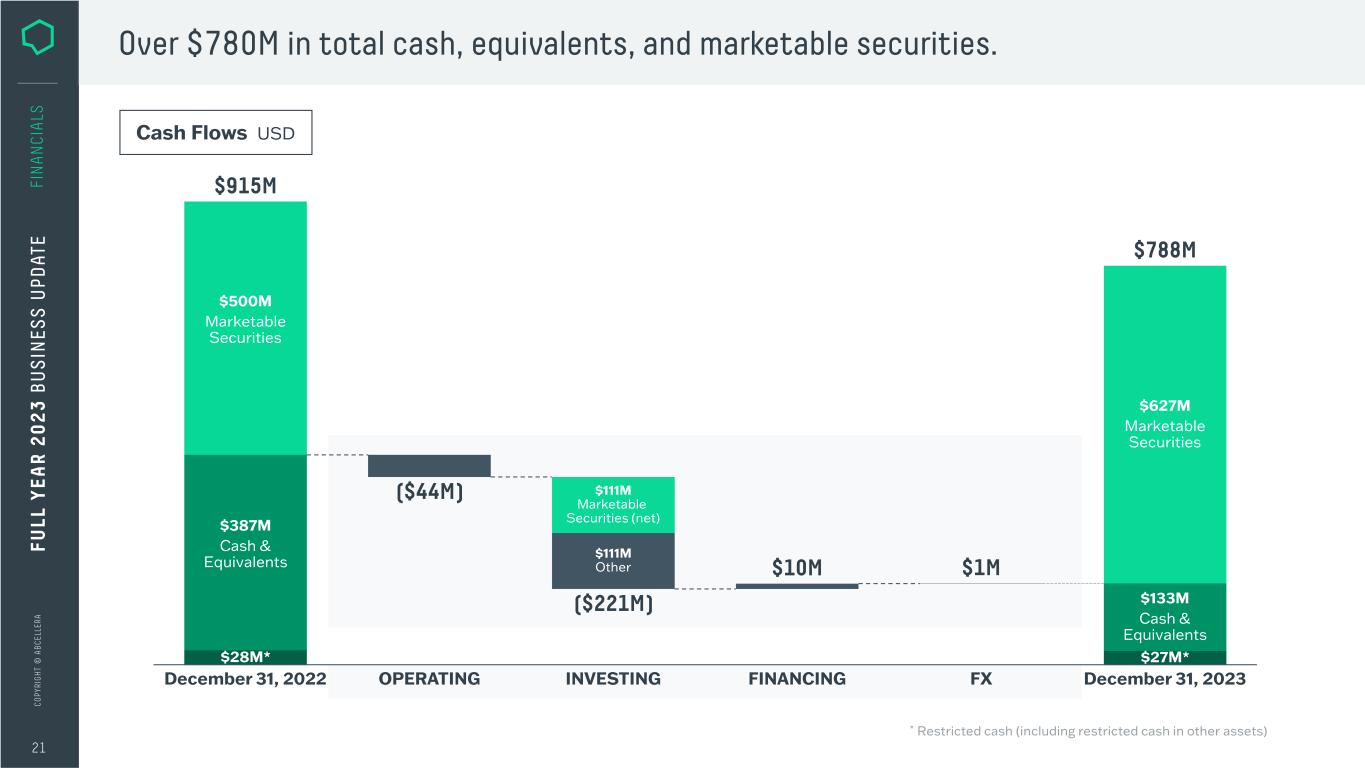

“In 2023 we began shifting capital allocation from building capabilities to using them, which includes advancement of our first internal programs and strategic partnerships,” said Carl Hansen, Ph.D., founder and CEO of AbCellera. “We are in the final stages of building our platform. We exited the year with approximately $1 billion in available liquidity and are well-positioned to execute on our strategy.”

FY 2023 Business Summary

●Earned $38.0 million in total revenue.

●Generated a net loss of $146.4 million, compared to net earnings of $158.5 million in 2022.

●Reached a cumulative total of 87 partner-initiated program starts with downstreams.

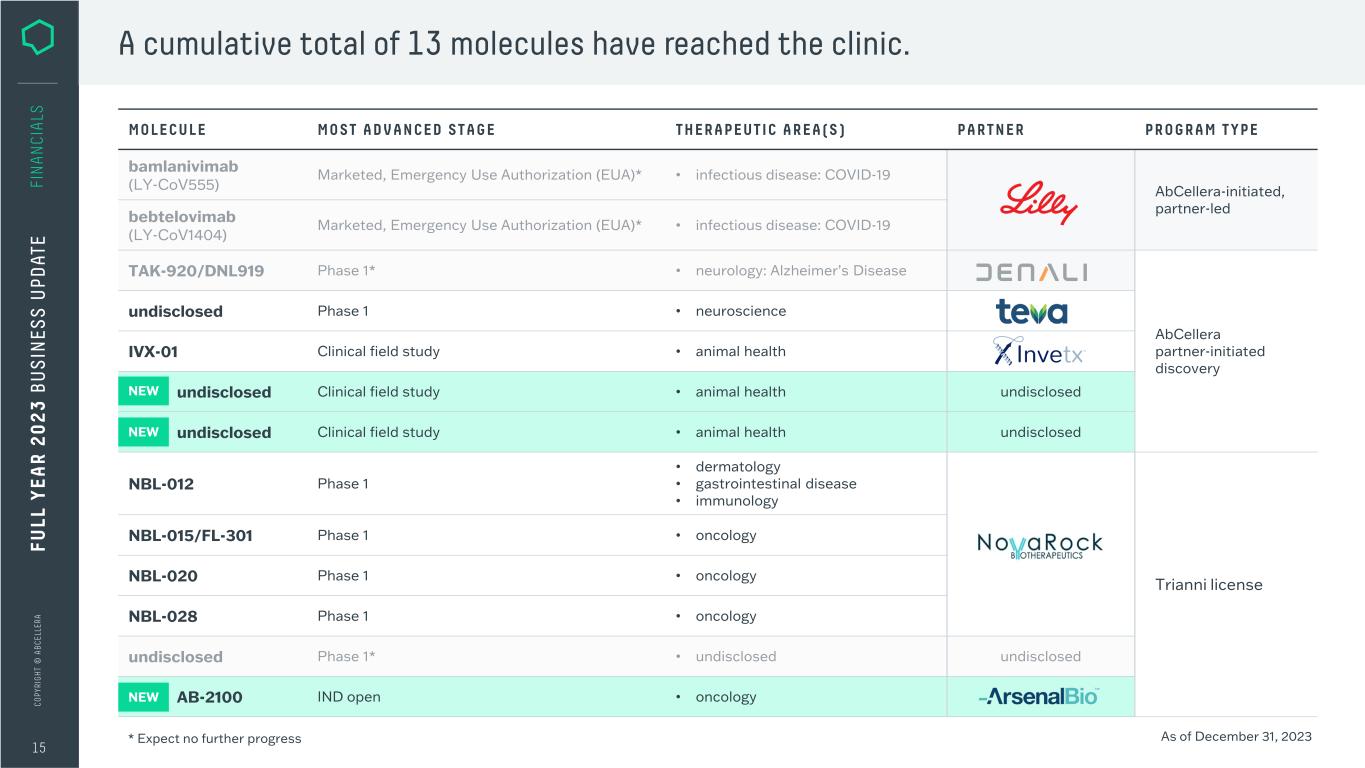

●Reporting the advancement of five additional molecules in the clinic, bringing the cumulative total to thirteen molecules to have reached the clinic.

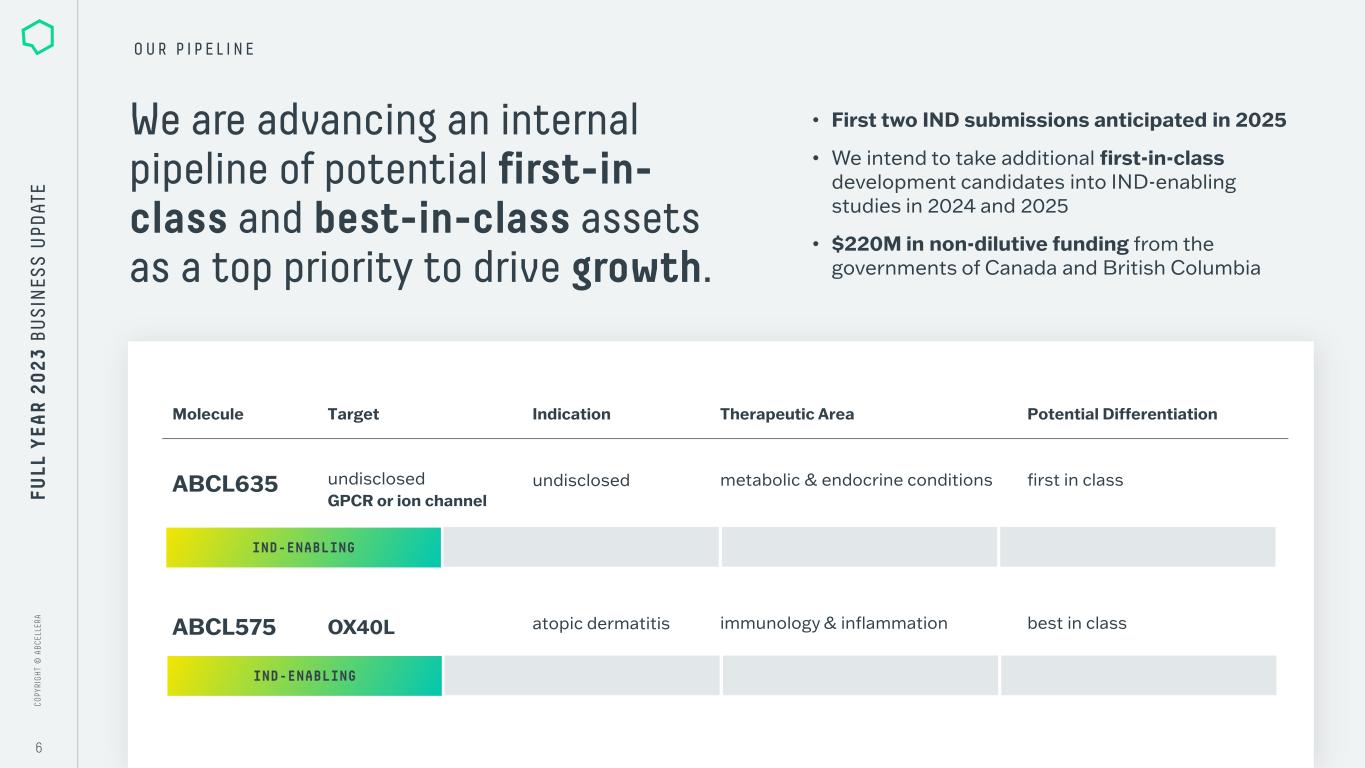

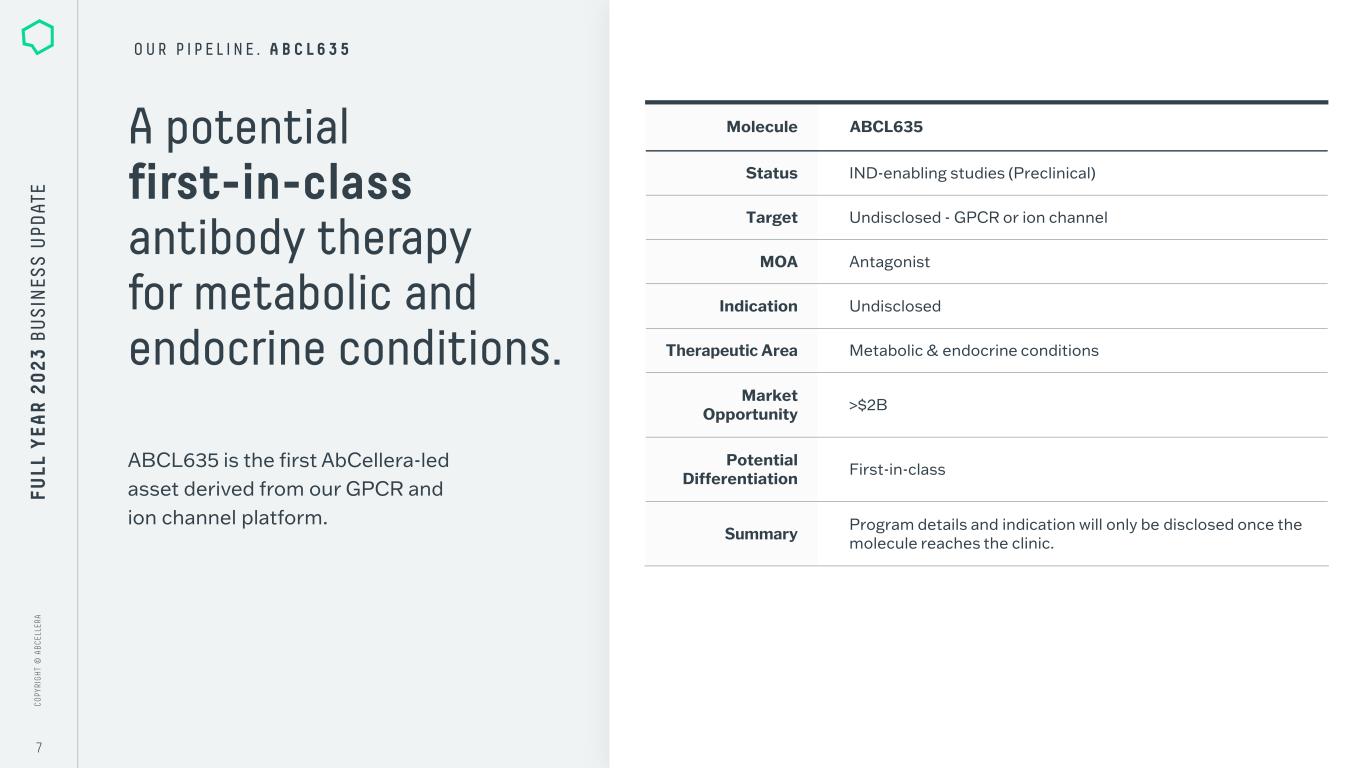

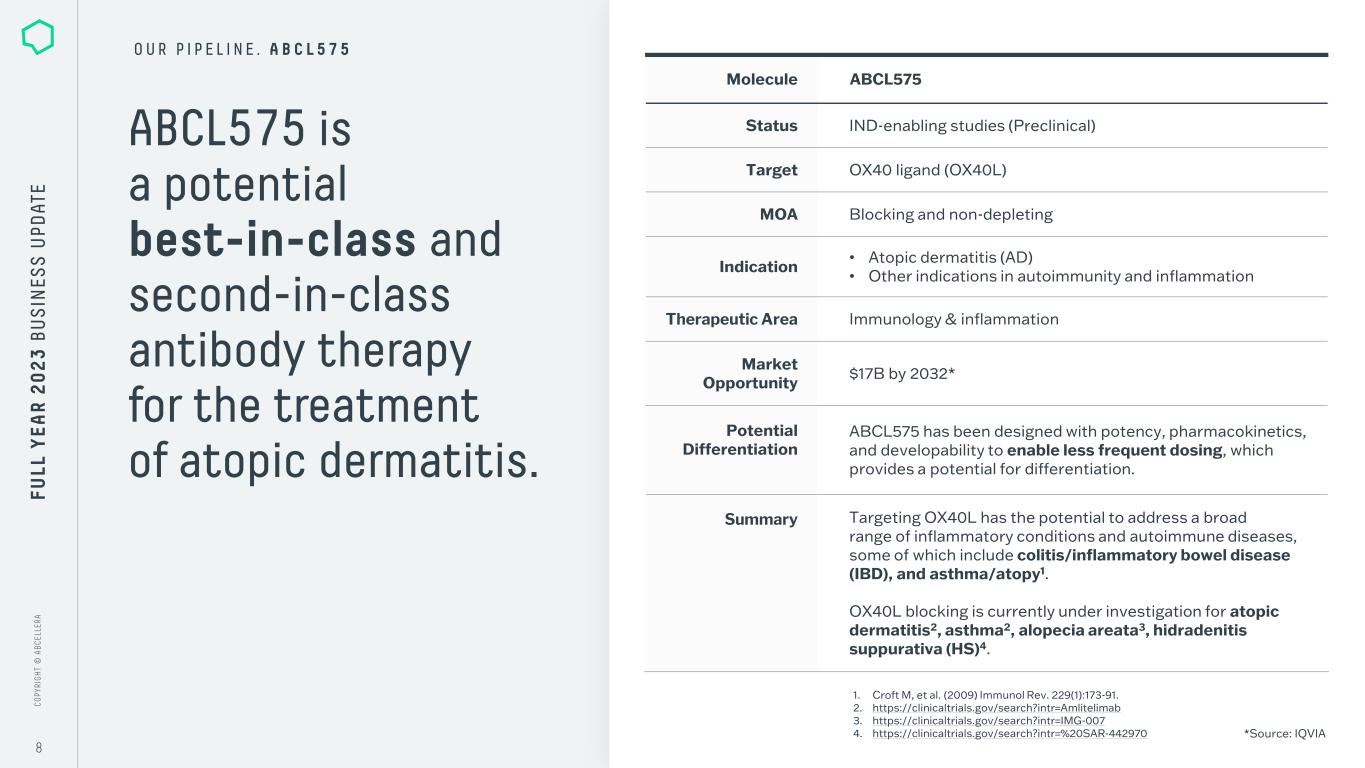

●Advanced two AbCellera-led programs into IND-enabling studies.

Key Business Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative Metrics |

|

December 31, 2022 |

|

December 31, 2023 |

|

Change % |

| Number of discovery partners |

|

40 |

|

46 |

|

15 |

% |

| Programs under contract |

|

174 |

|

203 |

|

17 |

% |

| Partner-initiated program starts with downstreams* |

|

75 |

|

87 |

|

16 |

% |

| Molecules in the clinic |

|

8 |

|

13 |

|

63 |

% |

* Metric adjusted from prior reporting

AbCellera reached a cumulative total of 203 programs under contract (up from 174 on December 31, 2022) that are either completed, in progress, or under contract with 46 different partners as of December 31, 2023 (up from 40 on December 31, 2022). AbCellera started discovery on an additional twelve partner-initiated programs with downstreams to reach a cumulative total of 87 partner-initiated program starts with downstreams in 2023 (up from 75 on December 31, 2022). AbCellera’s partners have advanced a cumulative total of thirteen molecules into the clinic (up from eight on December 31, 2022).

Discussion of FY 2023 Financial Results

●Revenue – Total revenue was $38.0 million, compared to $485.4 million in 2022. The partnership business generated research fees of $35.6 million, compared to $40.8 million in 2022. Licensing revenue was $1.0 million.

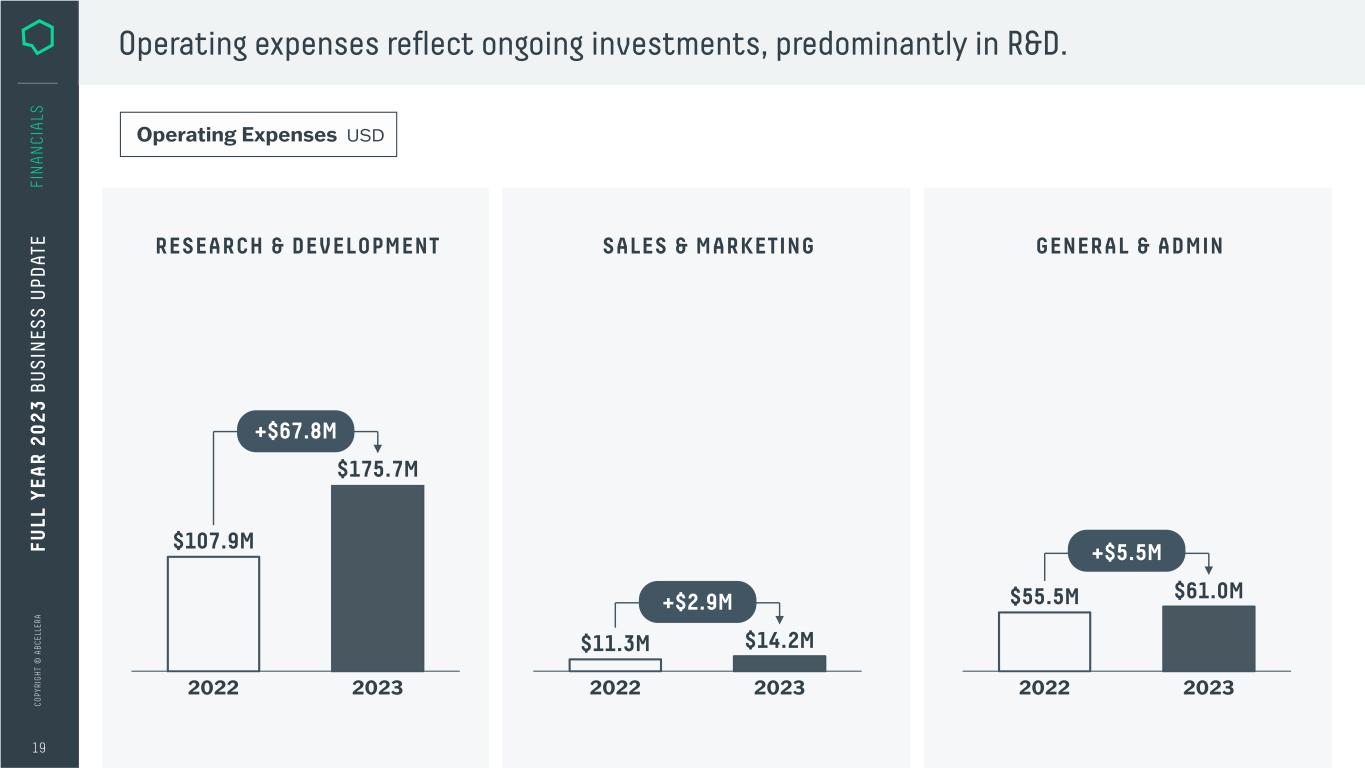

●Research & Development (R&D) Expenses – R&D expenses were $175.7 million, compared to $107.9 million in 2022, reflecting growth in program execution, platform development, and investments in internal programs.

●Sales & Marketing (S&M) Expenses – S&M expenses were $14.2 million, compared to $11.3 million in 2022.

●General & Administrative (G&A) Expenses – G&A expenses were $61.0 million, compared to $55.5 million in 2022.

●Net Loss – Net loss of $146.4 million, or $(0.51) per share on a basic and diluted basis, compared to net earnings of $158.5 million, or $0.56 and $0.50 per share on a basic and diluted basis, respectively, in 2022.

●Liquidity – $787.9 million of total cash, cash equivalents, and marketable securities, including restricted cash.

Q4 Highlights and Financial Results

•Advanced two internal programs into IND-enabling studies, ABCL635 and ABCL575.

•Started three partner-initiated programs with downstreams.

•Reporting the advancement of three additional molecules by partners into the clinic.

Revenue for the fourth quarter of 2023 was $9.2 million, representing 24% of total revenue for 2023. $8.7 million was generated from research fees, representing 25% of the total research fees for 2023.

Operating expenses totaled $75.2 million in the fourth quarter, or 27% of the total for 2023, and included investments made in co-development and internal programs.

The net loss for the fourth quarter was $47.2 million, or $(0.16) per share, on a basic and diluted basis.

Conference Call and Webcast

AbCellera will host a conference call and live webcast to discuss these results today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

The live webcast of the earnings conference call can be accessed on the Events and Presentations section of AbCellera’s Investor Relations website. A replay of the webcast will be available through the same link following the conference call.

About AbCellera Biologics Inc.

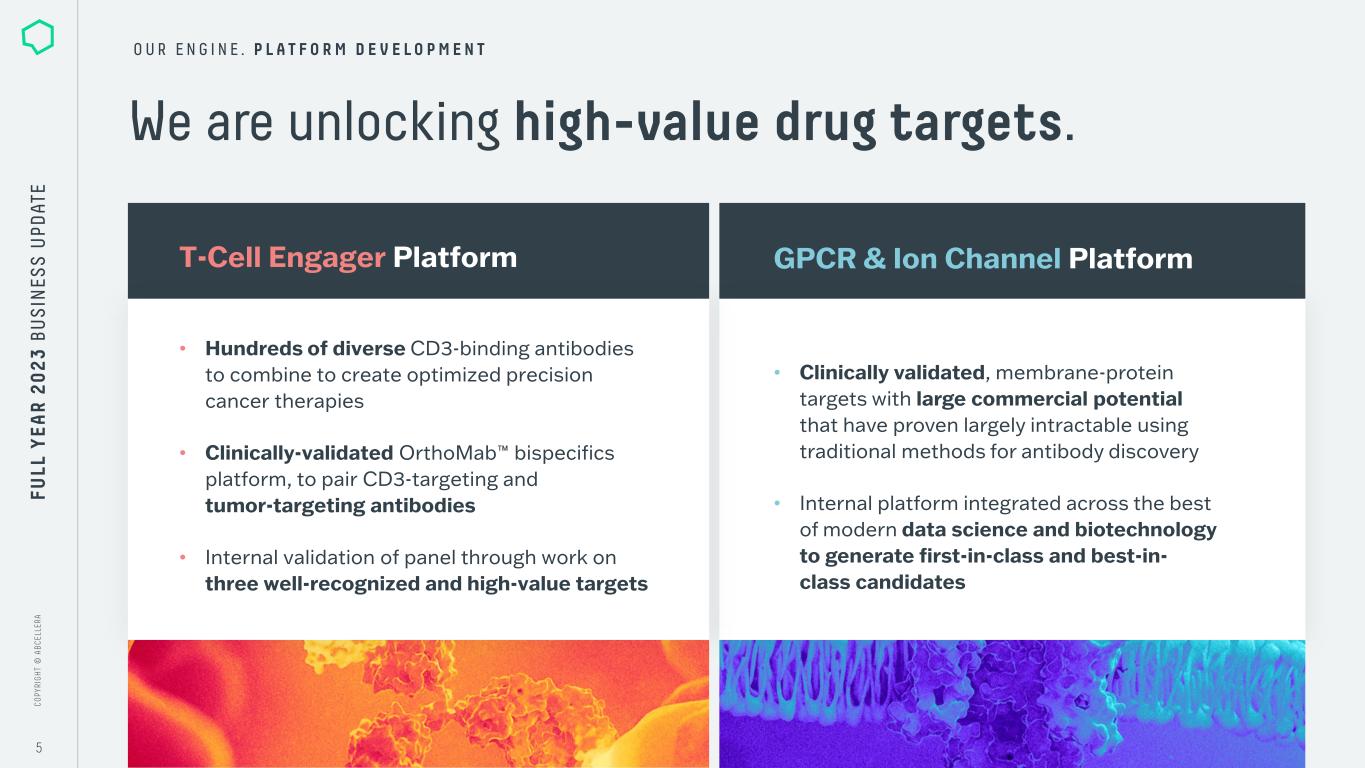

AbCellera is breaking the barriers of conventional antibody discovery to bring better medicines to patients, sooner. AbCellera’s engine integrates expert teams, technology, and facilities with the data science and automation needed to propel antibody-based medicines from target to clinic in nearly every therapeutic area with precision and speed. AbCellera provides innovative biotechs and leading pharmaceutical companies with a competitive advantage that empowers them to move quickly, reduce cost, and tackle the toughest problems in drug development. For more information, please visit www.abcellera.com.

Definition of Key Business Metrics

We regularly review the following key business metrics to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections, and make strategic decisions. We believe that the following metrics are important to understand our current business. These metrics may change or may be substituted for additional or different metrics as our business develops. Information on changes is set forth in our Annual Report on Form 10-K for the year ended December 31, 2023.

Number of discovery partners represents the unique number of partners with whom we have executed partnership contracts. We view this metric as an indication of the competitiveness of our engine and our level of market penetration. The metric also relates to our opportunities to secure programs under contract.

Programs under contract represent the number of antibody development programs that are under contract for delivery of discovery research activities. A program under contract is counted when a contract is executed with a partner under which we commit to discover or deliver antibodies against one selected target. A target is any relevant antigen for which a partner seeks our support in developing binding antibodies. We view this metric as an indication of commercial success and technological competitiveness. It further relates to revenue from access fees. The cumulative number of programs under contract with downstream participation is related to our ability to generate future revenue from milestone payments and royalties.

Partner-initiated program starts with downstreams represent the number of unique partner-initiated programs where we stand to participate financially in downstream success for which we have commenced the discovery effort. The discovery effort commences on the later of (i) the day on which we receive sufficient reagents to start discovery of antibodies against a target and (ii) the day on which the kick-off meeting for the program is held. We view this metric as an indication of the selection and initiation of projects by our partners and the resulting potential for near-term payments. Cumulatively, partner-initiated program starts with downstream participation indicate our total opportunities to earn downstream revenue from milestone fees and royalties (or royalty equivalents) in the mid- to long-term.

Molecules in the clinic represent the count of unique molecules for which an Investigational New Drug, or IND, New Animal Drug, or equivalent under other regulatory regimes, application has reached "open" status or has otherwise been approved based on an antibody that was discovered either by us or by a partner using licensed AbCellera technology. Where the date of such application approval is not known to us, the date of the first public announcement of a clinical trial will be used for the purpose of this metric.

We view this metric as an indication of our near- and mid-term potential revenue from milestone fees and potential royalty payments in the long term.

AbCellera Forward-Looking Statements

This press release contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. All statements contained in this release other than statements of historical fact are forward-looking statements, including statements regarding our ability to develop, commercialize and achieve market acceptance of our current and planned products and services, our research and development efforts, and other matters regarding our business strategies, use of capital, results of operations and financial position, and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and other factors are described under “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. We caution you that forward-looking statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a result, the forward-looking statements may not prove to be accurate. The forward-looking statements in this press release represent our views as of the date hereof. We undertake no obligation to update any forward-looking statements for any reason, except as required by law.

Source: AbCellera Biologics Inc.

Inquiries

Media: Kathleen Reid; media@abcellera.com, +1(604)724-1242 Business Development: Murray McCutcheon, Ph.D.; bd@abcellera.com, +1(604)559-9005 Investor Relations: Melanie Solomon; ir@abcellera.com, +1(778)729-9116 (1) Exclusive of depreciation, amortization, and impairment

AbCellera Biologics Inc.

Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(All figures in U.S. dollars. Amounts are expressed in thousands except share and per share data.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, |

|

|

|

2021 |

|

2022 |

|

2023 |

| Revenue: |

|

|

|

|

|

|

|

| Research fees |

|

|

$ |

19,076 |

|

|

$ |

40,802 |

|

|

$ |

35,556 |

|

| Licensing revenue |

|

|

20,778 |

|

|

696 |

|

|

969 |

|

| Milestone payments |

|

|

8,000 |

|

|

900 |

|

|

1,500 |

|

| Royalty revenue |

|

|

327,349 |

|

|

443,026 |

|

|

— |

|

| Total revenue |

|

|

375,203 |

|

|

485,424 |

|

|

38,025 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Royalty fees |

|

|

45,516 |

|

|

66,436 |

|

|

— |

|

Research and development(1) |

|

|

62,062 |

|

|

107,879 |

|

|

175,658 |

|

Sales and marketing(1) |

|

|

6,913 |

|

|

11,270 |

|

|

14,180 |

|

General and administrative(1) |

|

|

41,848 |

|

|

55,485 |

|

|

60,999 |

|

| Depreciation, amortization, and impairment |

|

|

14,451 |

|

|

27,843 |

|

|

24,395 |

|

| Total operating expenses |

|

|

170,790 |

|

|

268,913 |

|

|

275,232 |

|

| Income (loss) from operations |

|

|

204,413 |

|

|

216,511 |

|

|

(237,207) |

|

| Other (income) expense |

|

|

|

|

|

|

|

| Interest (income) |

|

|

(3,330) |

|

|

(16,079) |

|

|

(42,247) |

|

| Grants and incentives |

|

|

(17,486) |

|

|

(10,554) |

|

|

(14,155) |

|

| Other |

|

|

6,080 |

|

|

4,045 |

|

|

(6,776) |

|

| Total other (income) |

|

|

(14,736) |

|

|

(22,588) |

|

|

(63,178) |

|

| Net earnings (loss) before income tax |

|

|

219,149 |

|

|

239,099 |

|

|

(174,029) |

|

| Income tax (recovery) expense |

|

|

65,685 |

|

|

80,580 |

|

|

(27,631) |

|

| Net earnings (loss) |

|

|

$ |

153,464 |

|

|

$ |

158,519 |

|

|

$ |

(146,398) |

|

| Foreign currency translation adjustment |

|

|

280 |

|

|

(1,671) |

|

|

(329) |

|

| Comprehensive income (loss) |

|

|

$ |

153,744 |

|

|

$ |

156,848 |

|

|

$ |

(146,727) |

|

|

|

|

|

|

|

|

|

| Net earnings (loss) per share attributable to common shareholders |

|

|

|

|

|

|

|

| Basic |

|

|

$ |

0.56 |

|

|

$ |

0.56 |

|

|

$ |

(0.51) |

|

| Diluted |

|

|

$ |

0.48 |

|

|

$ |

0.50 |

|

|

$ |

(0.51) |

|

| Weighted-average common shares outstanding |

|

|

|

|

|

|

|

| Basic |

|

|

275,763,745 |

|

285,056,606 |

|

289,166,486 |

| Diluted |

|

|

318,294,236 |

|

314,827,255 |

|

289,166,486 |

AbCellera Biologics Inc.

Consolidated Balance Sheet

(All figures in U.S. dollars. Amounts are expressed in thousands except share data.)

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

386,535 |

|

|

$ |

133,320 |

|

| Marketable securities |

499,950 |

|

|

627,265 |

|

| Total cash, cash equivalents, and marketable securities |

886,485 |

|

|

760,585 |

|

| Accounts and accrued receivable |

38,593 |

|

|

30,590 |

|

| Restricted cash |

25,000 |

|

|

25,000 |

|

| Other current assets |

75,413 |

|

|

55,810 |

|

| Total current assets |

1,025,491 |

|

|

871,985 |

|

| Long-term assets: |

|

|

|

| Property and equipment, net |

217,255 |

|

|

287,696 |

|

| Intangible assets, net |

131,502 |

|

|

120,425 |

|

| Goodwill |

47,806 |

|

|

47,806 |

|

| Investments in and loans to equity accounted investees |

72,522 |

|

|

65,938 |

|

| Other long-term assets |

46,331 |

|

|

94,244 |

|

| Total long-term assets |

515,416 |

|

|

616,109 |

|

| Total assets |

$ |

1,540,907 |

|

|

$ |

1,488,094 |

|

| Liabilities and shareholders' equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable and other liabilities |

$ |

52,497 |

|

|

$ |

49,580 |

|

| Contingent consideration payable |

44,211 |

|

|

50,475 |

|

|

|

|

|

|

|

|

|

| Deferred revenue |

21,612 |

|

|

18,958 |

|

| Total current liabilities |

118,320 |

|

|

119,013 |

|

| Long-term liabilities: |

|

|

|

| Operating lease liability |

76,675 |

|

|

71,222 |

|

| Deferred revenue |

19,516 |

|

|

8,195 |

|

| Deferred government contributions |

40,801 |

|

|

95,915 |

|

| Contingent consideration payable |

16,054 |

|

|

4,913 |

|

| Deferred tax liability |

33,178 |

|

|

30,612 |

|

| Other long-term liabilities |

3,086 |

|

|

5,906 |

|

| Total long-term liabilities |

189,310 |

|

|

216,763 |

|

| Total liabilities |

307,630 |

|

|

335,776 |

|

| Commitments and contingencies |

|

|

|

| Shareholders' equity: |

|

|

|

| Common shares: no par value, unlimited authorized shares at December 31, 2022 and December 31, 2023: 286,851,595 and 290,824,970 shares issued and outstanding at December 31, 2022 and December 31, 2023, respectively |

734,365 |

|

|

753,199 |

|

| Additional paid-in capital |

74,118 |

|

|

121,052 |

|

| Accumulated other comprehensive income (loss) |

(1,391) |

|

|

(1,720) |

|

| Accumulated earnings |

426,185 |

|

|

279,787 |

|

| Total shareholders' equity |

1,233,277 |

|

|

1,152,318 |

|

| Total liabilities and shareholders' equity |

$ |

1,540,907 |

|

|

$ |

1,488,094 |

|

AbCellera Biologics Inc.

Consolidated Statement of Cash Flows

(Expressed in thousands of U.S. dollars.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2021 |

December 31, 2022 |

December 31, 2023 |

| Cash flows from operating activities: |

|

|

|

|

| Net earnings (loss) |

|

$ |

153,464 |

|

$ |

158,519 |

|

$ |

(146,398) |

|

| Cash flows from operating activities: |

|

|

|

|

| Depreciation of property and equipment |

|

4,403 |

|

8,953 |

|

12,758 |

|

| Amortization and impairment of intangible assets |

|

10,062 |

|

18,890 |

|

11,637 |

|

| Amortization of operating lease right-of-use assets |

|

2,785 |

|

5,259 |

|

6,499 |

|

| Stock-based compensation |

|

30,646 |

|

49,481 |

|

64,183 |

|

| Deferred tax (expense) recovery |

|

(2,018) |

|

(2,114) |

|

1,960 |

|

| Change in fair value of contingent consideration and investments |

|

2,284 |

|

3,091 |

|

(8,018) |

|

| Other |

|

1,286 |

|

5,456 |

|

277 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

| Research fee and grant receivable |

|

(37,386) |

|

(22,715) |

|

(45,933) |

|

| Accrued royalties receivable |

|

59,864 |

|

129,171 |

|

9,273 |

|

| Income taxes (payable) receivable |

|

(13,530) |

|

(88,609) |

|

30,464 |

|

| Accounts payable and other liabilities |

|

(3,237) |

|

(2,094) |

|

(15,104) |

|

| Deferred revenue |

|

8,624 |

|

6,183 |

|

(13,976) |

|

| Deferred grant income |

|

30,718 |

|

9,264 |

|

39,521 |

|

| Other assets |

|

(3,381) |

|

(1,375) |

|

8,980 |

|

| Net cash provided by (used in) operating activities |

|

244,584 |

|

277,360 |

|

(43,877) |

|

| Cash flows from investing activities: |

|

|

|

|

| Purchases of property and equipment |

|

(58,452) |

|

(70,660) |

|

(76,947) |

|

| Purchase of intangible assets |

|

— |

|

(2,000) |

|

(560) |

|

| Purchase of marketable securities |

|

(274,710) |

|

(763,982) |

|

(1,021,510) |

|

| Proceeds from marketable securities |

|

27,608 |

|

510,631 |

|

910,937 |

|

| Receipt of grant funding |

|

32,621 |

|

16,434 |

|

25,311 |

|

| Acquisitions |

|

(11,457) |

|

— |

|

— |

|

| Long-term investments and other assets |

|

(17,534) |

|

(17,369) |

|

(44,649) |

|

| Investment in and loans to equity accounted investees |

|

(30,323) |

|

(25,679) |

|

(13,690) |

|

| Net cash used in investing activities |

|

(332,247) |

|

(352,625) |

|

(221,108) |

|

| Cash flows from financing activities: |

|

|

|

|

| Payment of liability for in-licensing agreement, contingent consideration, and other |

|

(9,373) |

|

(4,383) |

|

(1,234) |

|

| Proceeds from long-term liabilities and exercise of stock options |

|

5,487 |

|

2,755 |

|

11,590 |

|

| Net cash provided by (used in) financing activities |

|

(3,886) |

|

(1,628) |

|

10,356 |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

(1,425) |

|

(9,599) |

|

589 |

|

| Decrease in cash and cash equivalents |

|

(92,974) |

|

(86,492) |

|

(254,040) |

|

| Cash and cash equivalents and restricted cash, beginning of period |

|

594,116 |

|

501,142 |

|

414,650 |

|

| Cash and cash equivalents and restricted cash, end of period |

|

$ |

501,142 |

|

$ |

414,650 |

|

$ |

160,610 |

|

| Restricted cash included in other assets |

|

— |

|

3,115 |

|

2,290 |

|

| Total cash, cash equivalents, and restricted cash shown on the balance sheet |

|

$ |

501,142 |

|

$ |

411,535 |

|

$ |

158,320 |

|

| Supplemental disclosure of non-cash investing and financing activities |

|

|

|

|

| Property and equipment in accounts payable |

|

5,397 |

|

5,868 |

|

13,625 |

|

| Right-of-use assets obtained in exchange for operating lease obligation |

|

36,638 |

|

50,694 |

|

1,199 |

|