0001701756false00017017562023-03-212023-03-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2025

Commission File Number 001-39223

SADOT GROUP INC.

(Exact name of small business issuer as specified in its charter)

|

|

|

|

|

|

|

|

|

Nevada |

|

47-2555533 |

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

295 E. Renfro Street, Suite 209, Burleson Texas 76028

(Address of principal executive offices)

(832) 604-9568

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value |

|

SDOT |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 20, 2025, Sadot Group Inc. (the “Company”) entered into a Settlement Agreement and Mutual Release (the “Settlement Agreement”) with Aggia LLC FZ (“Aggia”).

Pursuant to the Settlement Agreement, the Company and Aggia agreed to terminate the Services Agreement dated as of November 14, 2022, as amended (collectively, the “Agreement Documents”), and to fully settle, compromise, and discharge all claims, debts, obligations, and liabilities arising out of or related to the Agreement Documents. In full and complete satisfaction of the debt and termination of the Agreement Documents, the Company agreed to issue to Aggia, or to Aggia’s designees, an aggregate of 1,050,000 shares of the Company’s common stock, par value $0.0001 per share (the “Settlement Shares”) and make a payment of $75,000.

The issuance of 257,000 Settlement Shares (the “Initial Shares”) will occur within five business days following the execution of the Settlement Agreement. The issuance of the remaining 793,000 Settlement Shares (the “Subsequent Shares”) is subject to obtaining requisite shareholder approval, which the Company will seek promptly by preparing and filing with the Securities and Exchange Commission all necessary proxy materials and/or other disclosures and using commercially reasonable efforts to obtain such approval at its next annual or special meeting of shareholders. If shareholder approval is not obtained by March 31, 2026, the obligation to issue the Subsequent Shares will be suspended until such approval is obtained, and the Company will continue to seek approval at subsequent meetings.

The Company commit it will not issue any Subsequent Shares under the Settlement Agreement unless and until the requisite shareholder approval under Nasdaq Rule 5635(d) has been obtained. Apart from the initial issuance of Initial Shares (which is below the 19.99% threshold), no further Settlement Shares will be issued without such shareholder approval.

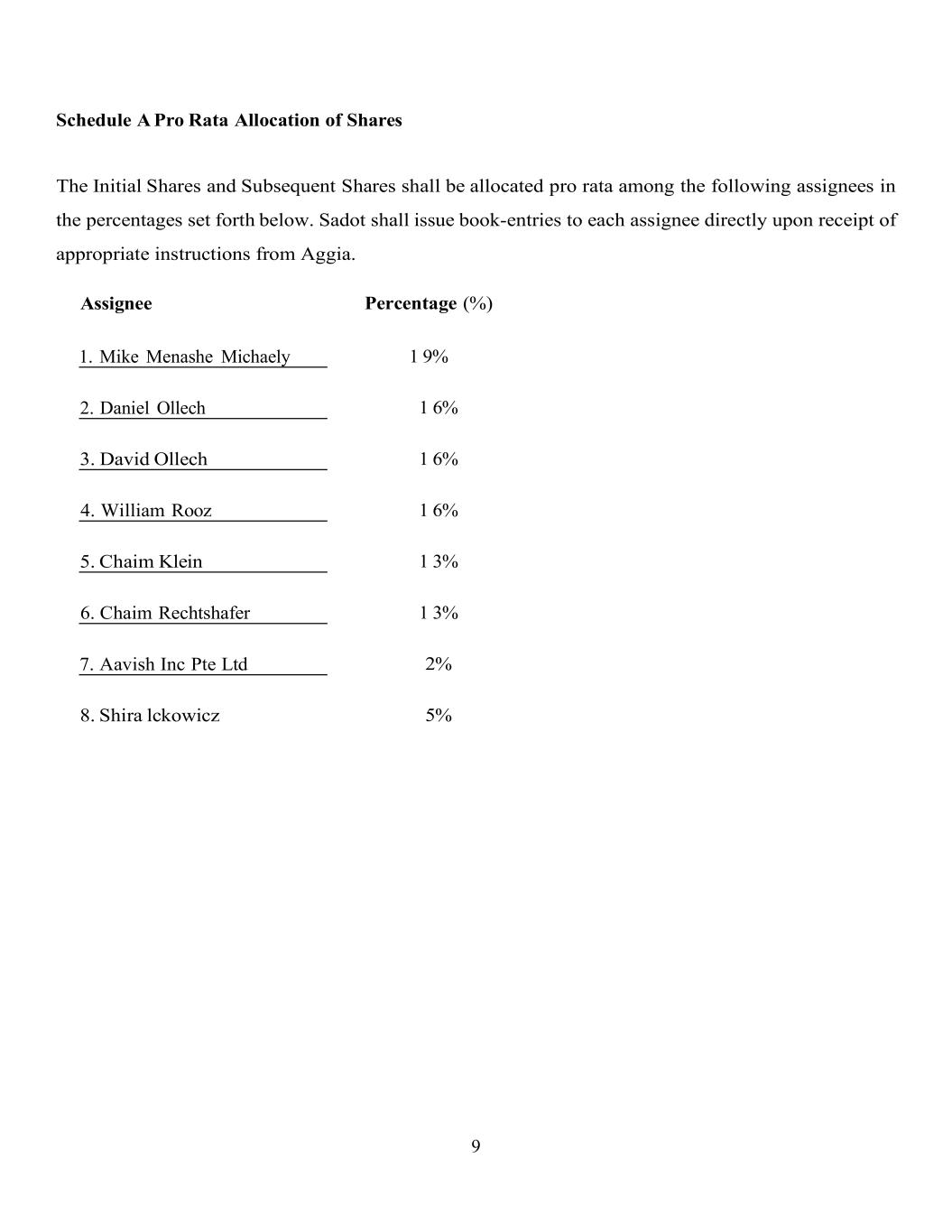

The Settlement Shares will be allocated pro rata among Aggia’s designated assignees as set forth in the Settlement Agreement. The Settlement Agreement also terminates any related ancillary documents, including promissory notes issued thereunder (which will be deemed cancelled and satisfied in full upon issuance of the Settlement Shares), and eliminates any ongoing obligations under the Agreement Documents, such as services, compensation, board nomination rights, managing member representative roles, non-compete, confidentiality, or other covenants.

The Settlement Agreement includes mutual releases of all claims related to the Agreement Documents and prior transactions between the parties, as well as customary representations and warranties, confidentiality provisions, governing law (State of Texas), dispute resolution (exclusive jurisdiction in federal or state courts in Dallas County, Texas, with jury trial waiver), and other miscellaneous terms.

The foregoing description of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Settlement Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K regarding the issuance of the Settlement Shares is incorporated by reference into this Item 3.02.

The Settlement Shares were issued in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof. The Settlement Shares will bear restrictive legends as required under applicable securities laws and will be subject to resale restrictions under Rule 144 thereunder.

Item 9.01 Financial Statements and Exhibits

(d)Index of Exhibits

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

| 10.1 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

SADOT GROUP INC. |

|

|

|

|

By: |

/s/ Chagay Ravid |

|

Name: |

Chagay Ravid |

|

Title: |

Chief Executive Officer |

|

|

|

| Date: November 24, 2025 |

|

|

EX-10.1

2

ex101_agreement.htm

EX-10.1

ex101_agreement

1 SETTLEMENT AGREEMENT AND MUTUAL RELEASE This Settlement Agreement and Mutual Release (this "Agreement") is entered into as of November 20, 2025 (the "Effective Date"), by and between Sadot Group Inc., a Nevada corporation (formerly known as Muscle Maker, Inc.) with its principal place of business at 295 E. Renfro Street, Suite 209, Burleson, Texas 76028 (Nasdaq: SDOT) ("Sadot"), and AGGIA LLC FZ, a company organized under the laws of the United Arab Emirates with its principal place of business at [Business Centre 1, M Floor The medan hotel , Nad Al sheba , Dubai , UAE ] ("Aggia"). Sadot and Aggia are sometimes referred to herein individually as a "Party" and collectively as the "Parties. RECITALS WHEREAS, SadotGroup Inc. (formerly Muscle Maker Inc.) entered into that certain Services Agreement dated as of November 14, 2022 (the "Services Agreement"), as amended by Addendum 1 dated as of November 17, 2022 ("Addendum 1") and further amended by Addendum 2 dated as of June 30, 2025 (collectively, the "Agreement Documents"), pursuant to which Aggia provided certain consulting and advisory services to Sadot in connection with strategic advisory, business development, creation and management of departments and teams, acquisition of assets, and other services related to the business of delivering food farm to table, wholesaling food, and engaging in the purchase and sale of physical food commodities (the "Business"); WHEREAS, the Parties have threatened litigation to address their claimed issues and liabilities owed; WHEREAS, under the Agreement Documents and related transactions, including the issuance of any promissory notes and other obligations, Sadot and Aggia are seeking to terminate their relationship and settle all matters to avoid potentially costly litigation;

2 WHEREAS, the Parties desire to fully and finally settle, compromise, and discharge all claims, debts, obligations, and liabilities arising out of or related to the Agreement Documents including any rights to board nominations, management representation, or other governance provisions under the Agreement Documents; WHEREAS, in full and final settlement of any and all debts, obligations, and liabilities that may be owed by Sadot to Aggia or by Aggia to Sadot, and in consideration of the termination of the Agreement Documents, Sadot has agreed to (i) issue to Aggia, or to Aggia's designees as directed by Aggia, an aggregate of 1,050,000 shares of Sadot's common stock, par value $0.0001 per share (the "Common Stock"), subject to obtaining any required shareholder approval (the "Shares"), (ii) pay to Aggia an additional $75,000 in cash consideration, and (iii) acknowledge and confirm that all payments previously made to Aggia are final, valid, and non-refundable; WHEREAS, the Parties intend for the issuance of the Shares to be pro rata among Aggia's designated assignees as set forth in Schedule A attached hereto, with such pro rata allocation to apply to the Initial Issuance (as defined below) and Aggia is to provide the designated assignees up to 7 days prior to any subsequent issuance of shares. WHEREAS, the Parties desire to terminate the Agreement Documents effective as of the Effective Date, with no further obligations thereunder, including but not limited to any ongoing services, compensation, board nomination rights, managing member representative roles, or other covenants, and to provide each other with a full and mutual release of all claims related thereto; NOW, THEREFORE, in consideration of the mutual promises, covenants, and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows: 1. Termination of Agreement Documents

3 1.1 Effective as of the Effective Date, the Agreement Documents are hereby terminated in their entirety, and neither Party shall have any further rights, duties, or obligations thereunder, except as expressly provided in this Agreement. Without limiting the foregoing, any services obligations, payment obligations (other than the issuance of the Shares as consideration hereunder), board nomination rights under Section 2 of the Services Agreement, managing member representative provisions under Section 3(c) of the Services Agreement, compensation provisions under Section 5 of the Services Agreement, non-compete, confidentiality, or other covenants under the Agreement Documents shall cease and be of no further force or effect. For clarity, any rights of Aggia to nominate Designated Directors to the Board of Directors of Sadot, or to appoint a Managing Member Representative, are hereby irrevocably terminated and waived. 1.2 Any related agreements contemplated by the Agreement Documents, including the Limited Liability Company Operating Agreement of Sadot LLC (as amended and subsequently terminated upon merger), any promissory notes issued thereunder (the "Notes"), the Lock-Up Agreement, and any other ancillary documents (collectively, the "Ancillary Documents"), are hereby terminated to the extent they relate to obligations under the Agreement Documents, except as necessary to effectuate the releases and share issuance herein. Any outstanding Notes shall be deemed cancelled and satisfied in full upon issuance of the Shares. 2. Settlement Payment via Issuance of Shares and cash consideration 2.1 Initial Issuance. Subject to the terms herein, within five (5) business days following the execution of this Agreement by both Parties, Sadot shall issue and deliver to Aggia (or to such designees of Aggia as Aggia shall direct in writing, including the assignees listed in Schedule A) an aggregate of 257,000 Shares of Common Stock (the "Initial Shares"), pro rata in accordance with the percentages set forth in Schedule A. The Initial Shares shall be issued in book-entry form, free and clear of all liens, encumbrances, and restrictions (except as provided in Section 3 below). Aggia shall provide any necessary instructions for distribution to its designees concurrently with the execution of this Agreement. Concurrently with the Initial Share issuance described above, Sadot shall pay to Aggia the sum of $75,000 by wire transfer to an account designated by Aggia in writing.

4 2.2 Subsequent Issuance. Subject to receipt of the requisite shareholder approval if needed, as described in Section 2.3, within five (5) business days following such approval, Sadot shall issue and deliver to Aggia (or to such designees of Aggia as Aggia shall direct in writing) the amount of shares requested by Aggia up to an aggregate of 793,000 Shares of Common Stock (the "Subsequent Shares"), pro rata in accordance with the percentages set forth in Schedule A. The Subsequent Shares shall be issued on the same terms as the Initial Shares. Provided that Aggia requests the issuance of shares such that its total holdings — including the newly issued shares — do not exceed 19.99% of Sadot’s total outstanding shares (per assignee), no shareholder approval shall be required to complete and execute such issuance 2.3 Shareholder Approval. Sadot shall, promptly following the Effective Date, prepare and file with the Securities and Exchange Commission (the "SEC") all necessary proxy materials and/or other disclosures required under applicable securities laws to seek shareholder approval for the issuance of the Subsequent Shares (the "Shareholder Approval") if required. Sadot shall use commercially reasonable efforts to obtain the Shareholder Approval at its next annual or special meeting of shareholders following the Effective Date, unless Aggia and any of its assigness hold less the 19.99% each where by a shareholders approval will not be required and not be a condition for this issuance . Aggia agrees to cooperate reasonably with Sadot in connection with obtaining such approval (when required), including providing any necessary representations or information. If Shareholder Approval is not obtained by March 31, 2026, this Agreement shall not terminate, but the obligation to issue the Subsequent Shares shall be in accordance with clause 2.2 , where by Aggia’s assignees will not exceed 19.99% of the total shares issued at any given time. 2.4 Consideration. The issuance of the Shares (Initial Shares and Subsequent Shares) constitutes full and complete satisfaction, settlement, and discharge of all potential debts payable by Sadot to Aggia and from Aggia to Sadot and all other obligations, claims, or liabilities of any kind owed by Sadot to Aggia or its affiliates and from Aggia to Sadot or its afiliates, including under the Agreement Documents and Ancillary Documents. Upon issuance and conclusion of the of the issuance of the total agreed upon Shares, all debts and obligations payable by Sadot to Aggia and from Aggia to Sadot shall be deemed fully paid, extinguished, and cancelled, and Aggia nor Sadot shall have no further recourse against each other with respect thereto.

5 2.5 Representations Regarding Shares. Sadot represents and warrants to Aggia that the Shares, when issued in accordance with this Agreement, will be validly issued, fully paid, and non-assessable shares of Common Stock. Aggia represents and warrants to Sadot that it is acquiring the Shares (or directing issuance to its designees) for investment purposes only and not with a view to distribution, and that it (and its designees) are accredited investors as defined under Rule 501 of Regulation D promulgated under the Securities Act of 1933, as amended (the "Securities Act"), or otherwise qualified to receive the Shares without registration under the Securities Act. 3. Legends and Restrictions; Voting Agreement 3.1 The Shares shall bear such restrictive legends as may be required under applicable securities laws. The Shares shall be subject to resale restrictions under Rule 144 under the Securities Act, and Aggia (and its designees) agree not to sell, transfer, or otherwise dispose of the Shares except in compliance with applicable securities laws. Sadot shall, upon request, provide an opinion of counsel reasonably satisfactory to remove such legends when eligible under Rule 144. Any prior Lock-Up Agreement under the Agreement Documents is hereby terminated and of no further effect. 3.2 4. Mutual Releases 4.1 Release by Aggia. Aggia, on behalf of itself and its affiliates, officers, directors, employees, agents, successors, (collectively, the "Aggia Releasing Parties"), hereby fully, finally, and irrevocably releases, acquits, and forever discharges Sadot and its affiliates, officers, directors, employees, agents, successors, and assigns (collectively, the "Sadot Released Parties") from any and all claims, demands, actions, causes of action, suits, debts, dues, accounts, covenants, contracts, agreements, damages, costs, expenses, or liabilities of any kind whatsoever, whether known or unknown, suspected or unsuspected, arising out of or related to the Agreement Documents, the Ancillary Documents, all debts, or any other transaction between the Parties prior to the Effective Date (the "Aggia Released Claims"). Consequently, under this Settlement Agreement, Aggia is no longer owed or is entitled to any money, and all existing balances are rendered void .

6 4.2 Release by Sadot. Sadot, on behalf of itself and the Sadot Released Parties, hereby fully, finally, and irrevocably releases, acquit, and forever discharge the Aggia Releasing Parties from any and all claims, demands, actions, causes of action, suits, debts, dues, accounts, covenants, contracts, agreements, damages, costs, expenses, or liabilities of any kind whatsoever, whether known or unknown, suspected or unsuspected, arising out of or related to the Agreement Documents, the Ancillary Documents, or any other transaction between the Parties prior to the Effective Date (the "Sadot Released Claims"). 4.3 Scope of Releases. The releases in this Section 4 are intended to be broad and inclusive and extend to all claims, including those under contract, tort, statute, or common law, whether known or unknown. 5. Representations and Warranties Each Party represents and warrants to the other that: (i) it has full power and authority to enter into this Agreement and perform its obligations hereunder; (ii) this Agreement has been duly executed and delivered and constitutes a valid and binding obligation, enforceable in accordance with its terms; (iii) the execution and performance of this Agreement do not violate any other agreement to which it is a party; and (iv) there are no actions, suits, or proceedings pending or threatened that would materially impair its ability to perform hereunder. 6. Confidentiality The Parties agree to keep the terms of this Agreement confidential, except as required by law (including SEC disclosure requirements) or with the prior written consent of the other Party. Notwithstanding the foregoing, Sadot may disclose this Agreement in its SEC filings as necessary.

7 7. Governing Law; Dispute Resolution 7.1 This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard to conflict of laws principles. 7.2 Any disputes arising hereunder shall be resolved exclusively in the federal courts of the United States or the courts of the State of Texas located in Dallas County, Texas, and the Parties consent to the personal jurisdiction thereof. Each Party hereby waives, to the fullest extent permitted by applicable law, any right it may have to a trial by jury in any legal proceeding directly or indirectly arising out of or relating to this Agreement or the transactions contemplated hereby. 8. Miscellaneous 8.1 Entire Agreement. This Agreement constitutes the entire understanding between the Parties and supersedes all prior agreements, whether oral or written, relating to the subject matter hereof, including the Agreement Documents and Ancillary Documents. 8.2 Amendments. No amendment or waiver of any provision shall be effective unless in writing and signed by both Parties. 8.3 Severability. If any provision is held invalid or unenforceable, the remaining provisions shall remain in full force. 8.4 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, and all of which together shall constitute one instrument. Electronic signatures shall be binding. 8.5 Notices. All notices shall be in writing and delivered via email or certified mail to the addresses set forth below or as updated by notice: If to Sadot: Sadot Group, Inc. Attn: Haggai Ravid 295 E. Renfro Street, Suite 209 Burleson, Texas 76028 Email:

8 If to Aggia: AGGIA LLC FZ [ ] Attention Sameep Sudheer Shah Email: Sameep@aggia.net 8.6 Further Assurances. Each Party agrees to execute such further documents and take such further actions as may be reasonably necessary to effectuate the terms hereof, including the cancellation of any Notes or termination of Ancillary Documents. 8.7 Specific Performance. Each Party agrees that irreparable damage would occur if any provision of this Agreement were not performed in accordance with its terms and that each Party shall be entitled to seek specific performance of the terms hereof in addition to any other remedy at law or equity. 8.8 Attorneys' Fees. If any Party is required to engage in litigation against any other Party to enforce or defend any rights under this Agreement, the prevailing Party shall be entitled to recover reasonable attorneys' fees and costs. IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date. Sadot Group Inc. AGGIA LLC FZ 6) By: _ By: _ Name: Haggai Ravid Name: Sameep Sudheer Shah Title: Chief Executive Officer Title: Director Date: _ Date: 24.11.2025 _

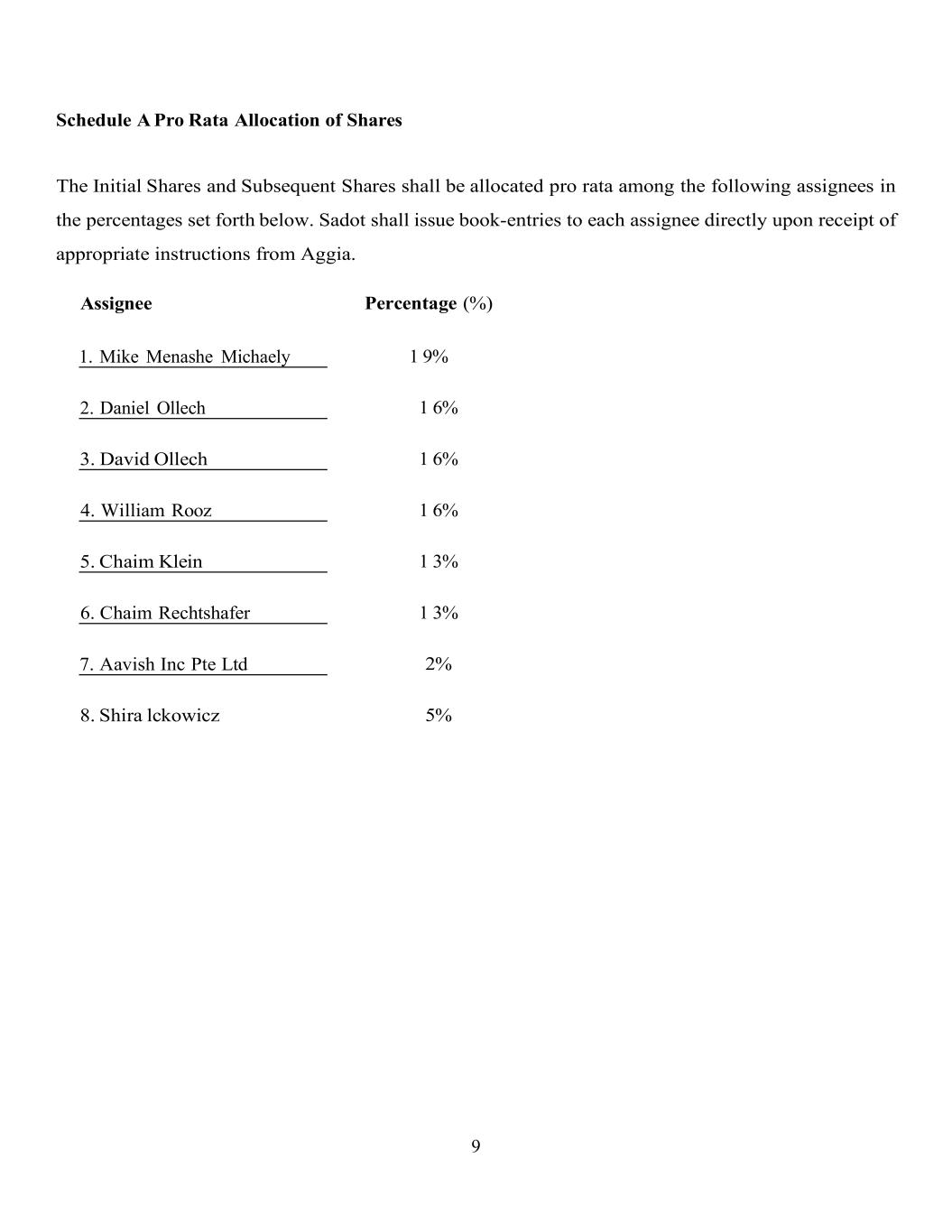

9 Schedule A Pro Rata Allocation of Shares The Initial Shares and Subsequent Shares shall be allocated pro rata among the following assignees in the percentages set forth below. Sadot shall issue book-entries to each assignee directly upon receipt of appropriate instructions from Aggia. Assignee 1. Mike Menashe Michaely Percentage (%) 1 9% 2. Daniel Ollech 1 6% 3. David Ollech 1 6% 4. William Rooz 1 6% 5. Chaim Klein 1 3% 6. Chaim Rechtshafer 1 3% 7. Aavish Inc Pte Ltd 2% 8. Shira lckowicz 5%