Document

Accel Entertainment Reports Second Quarter Results

Highlights Include Record Quarterly Revenue

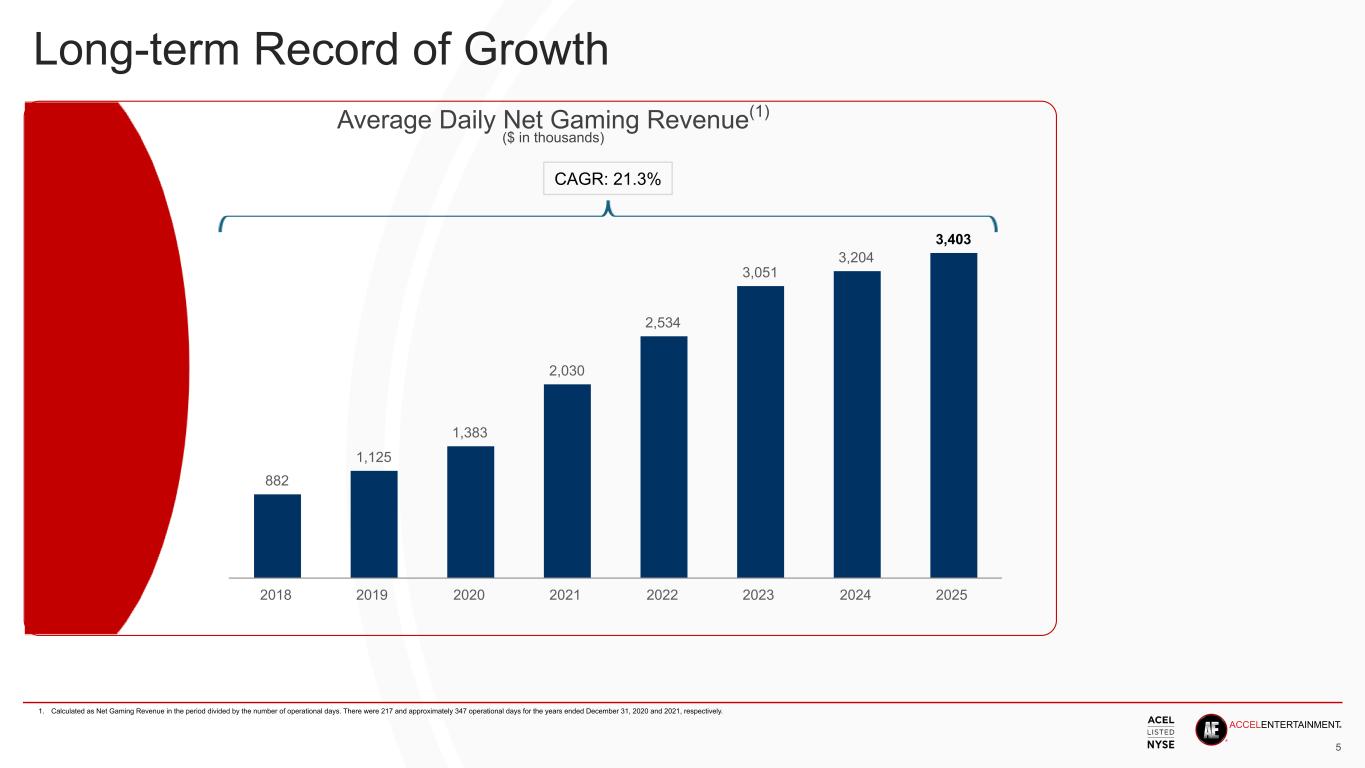

Chicago, IL – August 5, 2025 – Accel Entertainment, Inc. (NYSE: ACEL) today announced financial and operating results for the second quarter ended June 30, 2025.

Highlights:

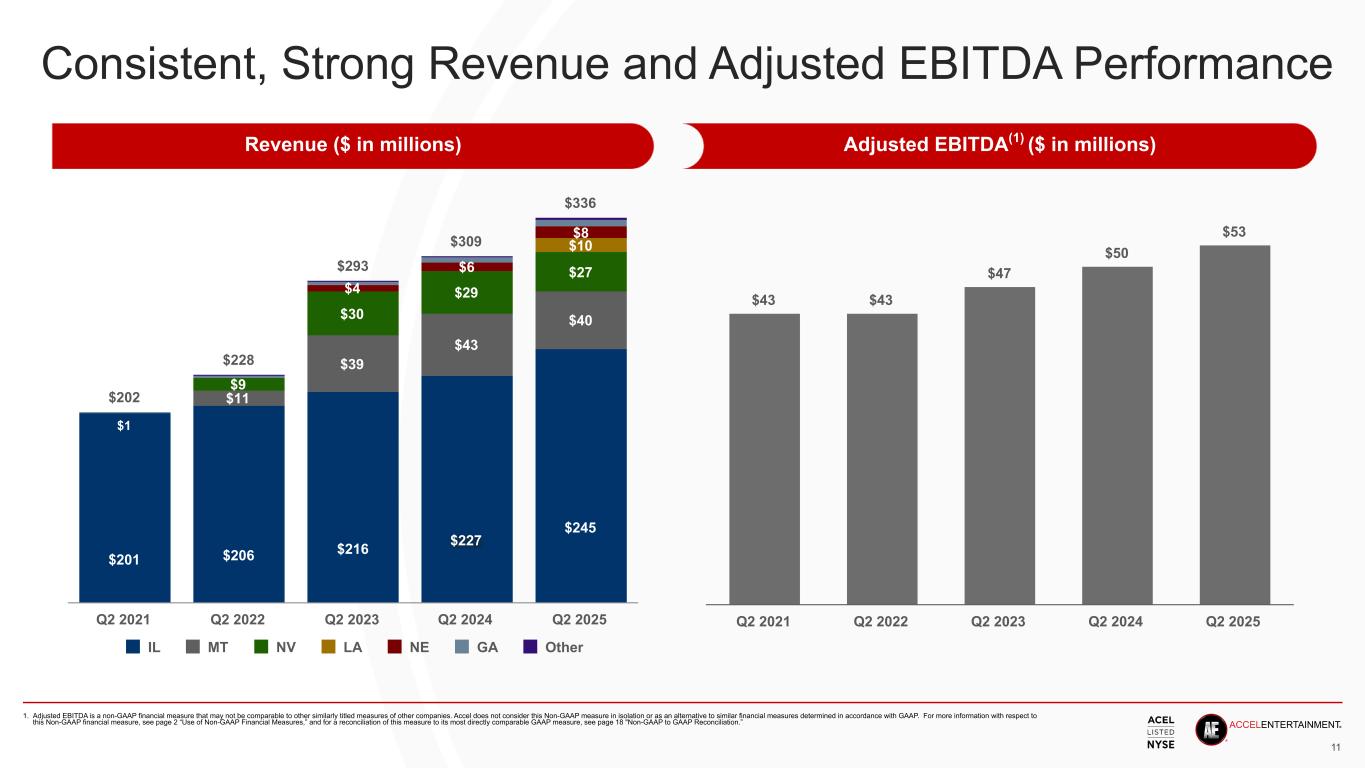

•Record quarterly revenues of $335.9 million in Q2 '25; an increase of 8.6% compared to Q2 '24

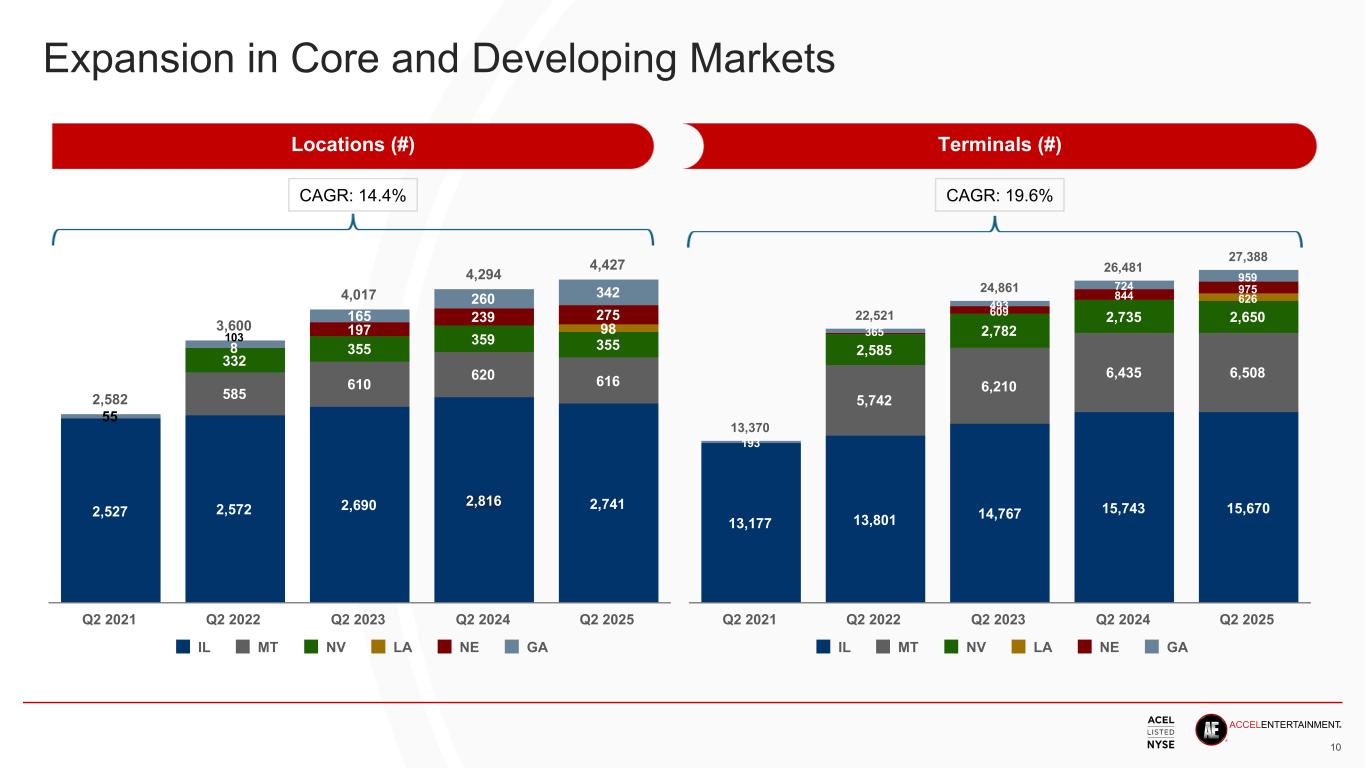

◦Ended Q2 '25 with 4,427 locations; an increase of 3.1% compared to Q2 '24

◦Ended Q2 '25 with 27,388 gaming terminals; an increase of 3.4% compared to Q2 '24

•Net income of $7.3 million for Q2 '25; a decrease of 50.2% compared to Q2 '24, partially attributable to a loss on the change in the fair value of the contingent earnout shares (Accel Class A-2 common stock) compared to a gain in the prior period

•Record quarterly Adjusted EBITDA of $53.2 million for Q2 '25; an increase of 7.1% compared to Q2 '24

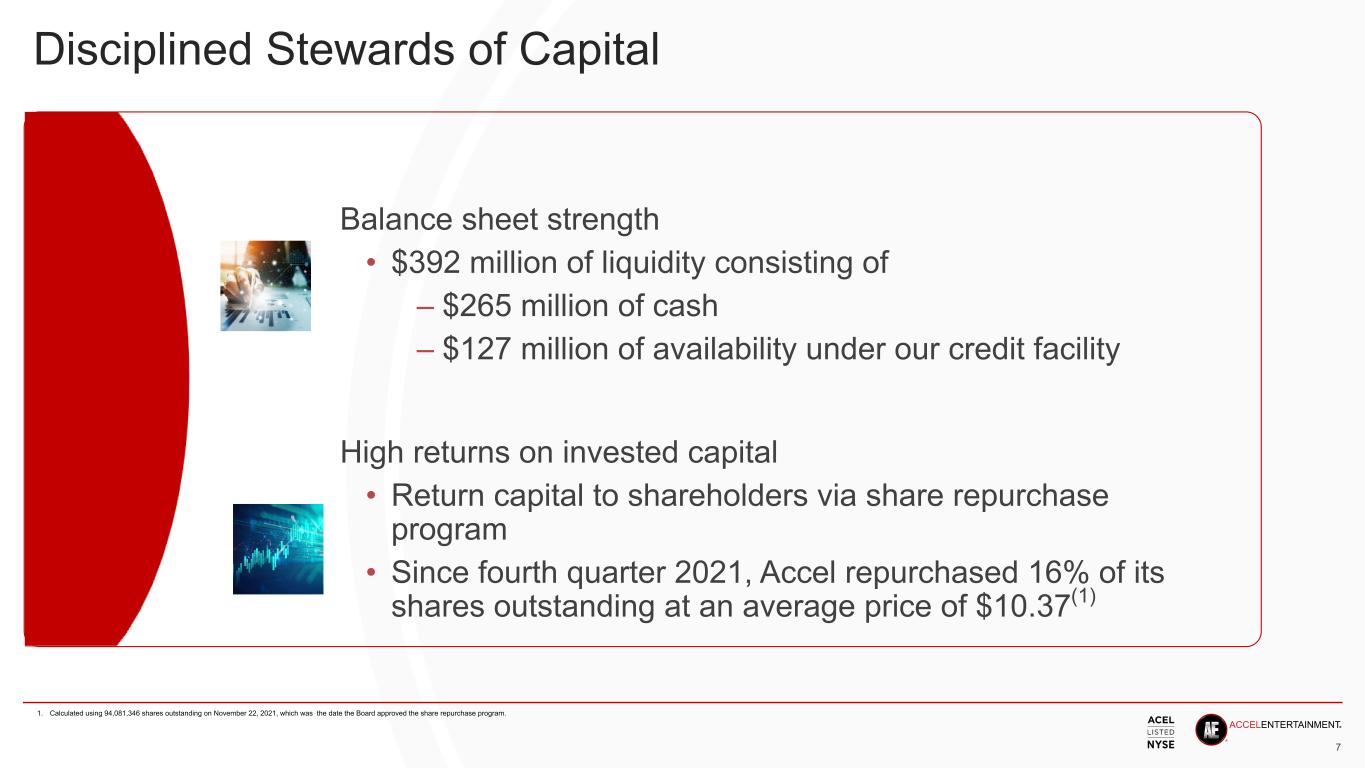

•Net debt of $331 million at June 30, 2025

•Repurchased 0.6 million shares of Accel Class A-1 common stock in Q2 '25 for approximately $6.7 million

•Commenced our casino and racing operations at Fairmount Park Casino & Racing in April 2025

Accel CEO Andy Rubenstein commented,

“Our record second quarter results demonstrate continued progress and consistent execution with year-over-year revenue and Adjusted EBITDA growth in all of our core and developing markets. Our results reflect the benefits of our disciplined expansion strategy and our successful improvement of the operating results in new and acquired locations.

“In our core markets, Illinois and Montana, we continue to use our market-leading position to drive economies of scale and are focused on leveraging our operating expertise to generate growth. Profitability is improving in our developing markets, Nebraska, Georgia and Nevada, where our strategic early investments are now beginning to contribute to our overall growth. Finally, in our new markets, recent results from Toucan Gaming in Louisiana and Fairmount Park Casino & Racing in Illinois, reinforce our confidence that these acquisitions will contribute even more as we move into next year.

“Accel is a leader in a resilient and growing market segment, with large untapped potential. This presents us with multiple opportunities to continue to generate strong and consistent financial performance to support our goal of delivering enhanced long-term value to our shareholders.”

Condensed Consolidated Statements of Operations and Other Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (in thousands) |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

Total net revenues |

$ |

335,909 |

|

|

$ |

309,413 |

|

|

$ |

659,821 |

|

|

$ |

611,230 |

|

| Operating income |

26,874 |

|

|

22,683 |

|

|

52,826 |

|

|

48,242 |

|

| Income before income tax expense |

12,352 |

|

|

18,519 |

|

|

31,958 |

|

|

30,702 |

|

| Net income |

7,262 |

|

|

14,586 |

|

|

21,875 |

|

|

22,002 |

|

| Other Financial Data: |

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

53,180 |

|

|

49,665 |

|

|

102,694 |

|

|

95,912 |

|

Adjusted net income (2) |

22,491 |

|

|

21,383 |

|

|

42,709 |

|

|

40,888 |

|

(1)Adjusted EBITDA is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to the most directly comparable GAAP metric.

(2)Adjusted net income is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to the most directly comparable GAAP metric.

Net Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

Three Months Ended

June 30, |

|

|

|

Six Months Ended

June 30, |

|

2025 |

|

2024 |

|

|

|

|

|

2025 |

|

2024 |

| Net revenues by state: |

|

|

|

|

|

|

|

|

|

|

|

| Illinois |

$ |

245,434 |

|

|

$ |

227,093 |

|

|

|

|

|

|

$ |

478,913 |

|

|

$ |

451,956 |

|

Montana(1) |

40,107 |

|

|

42,583 |

|

|

|

|

|

|

81,243 |

|

|

80,724 |

|

Nevada |

27,078 |

|

|

29,322 |

|

|

|

|

|

|

54,695 |

|

|

58,531 |

|

Louisiana |

9,630 |

|

|

— |

|

|

|

|

|

|

18,655 |

|

|

— |

|

| Nebraska |

7,881 |

|

|

6,249 |

|

|

|

|

|

|

15,111 |

|

|

12,083 |

|

Georgia |

4,814 |

|

|

3,137 |

|

|

|

|

|

|

9,139 |

|

|

5,761 |

|

| Other |

965 |

|

|

1,029 |

|

|

|

|

|

|

2,065 |

|

|

2,175 |

|

| Total net revenues |

$ |

335,909 |

|

|

$ |

309,413 |

|

|

|

|

|

|

$ |

659,821 |

|

|

$ |

611,230 |

|

(1)Includes $38.3 million and $75.6 million of net gaming revenues and $1.8 million and $5.6 million of manufacturing revenues for the three and six months ended June 30, 2025, respectively. In comparison, includes $37.4 million and $73.3 million of net gaming revenues and $5.2 million and $7.4 million of manufacturing revenues for the three and six months ended June 30, 2024, respectively.

Key Business Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Locations (1) |

As of June 30, |

|

Increase / (Decrease) |

|

2025 |

|

2024 |

|

Change |

|

Change (%) |

| Illinois |

2,741 |

|

|

2,816 |

|

|

(75) |

|

|

(2.7) |

% |

| Montana |

616 |

|

|

620 |

|

|

(4) |

|

|

(0.6) |

% |

| Nevada |

355 |

|

|

359 |

|

|

(4) |

|

|

(1.1) |

% |

| Louisiana |

98 |

|

|

— |

|

|

98 |

|

|

N/A |

| Nebraska |

275 |

|

|

239 |

|

|

36 |

|

|

15.1 |

% |

| Georgia |

342 |

|

|

260 |

|

|

82 |

|

|

31.5 |

% |

| Total locations |

4,427 |

|

|

4,294 |

|

|

133 |

|

|

3.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gaming terminals (1) |

As of June 30, |

|

Increase / (Decrease) |

|

2025 |

|

2024 |

|

Change |

|

Change (%) |

| Illinois |

15,670 |

|

|

15,743 |

|

|

(73) |

|

|

(0.5) |

% |

| Montana |

6,508 |

|

|

6,435 |

|

|

73 |

|

|

1.1 |

% |

| Nevada |

2,650 |

|

|

2,735 |

|

|

(85) |

|

|

(3.1) |

% |

| Louisiana |

626 |

|

|

— |

|

|

626 |

|

|

N/A |

| Nebraska |

975 |

|

|

844 |

|

|

131 |

|

|

15.5 |

% |

Georgia |

959 |

|

|

724 |

|

|

235 |

|

|

32.5 |

% |

| Total gaming terminals |

27,388 |

|

|

26,481 |

|

|

907 |

|

|

3.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location hold-per-day (2) |

Three Months Ended

June 30, |

|

Increase / (Decrease) |

|

2025 |

|

2024 |

|

Change ($) |

|

Change (%) |

| Illinois |

$ |

910 |

|

|

$ |

862 |

|

|

$ |

48 |

|

|

5.6 |

% |

| Montana |

622 |

|

|

612 |

|

|

10 |

|

|

1.6 |

% |

| Nevada |

784 |

|

|

843 |

|

|

(59) |

|

|

(7.0) |

% |

Louisiana |

994 |

|

|

— |

|

|

994 |

|

|

N/A |

| Nebraska |

285 |

|

|

255 |

|

|

30 |

|

|

11.8 |

% |

Georgia |

149 |

|

|

111 |

|

|

38 |

|

|

34.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

Increase / (Decrease) |

|

2025 |

|

2024 |

|

Change ($) |

|

Change (%) |

| Illinois |

$ |

896 |

|

|

$ |

861 |

|

|

$ |

35 |

|

|

4.1 |

% |

| Montana |

616 |

|

|

601 |

|

|

15 |

|

|

2.5 |

% |

| Nevada |

792 |

|

|

845 |

|

|

(53) |

|

|

(6.3) |

% |

Louisiana |

978 |

|

|

— |

|

|

978 |

|

|

N/A |

Nebraska |

271 |

|

|

243 |

|

|

28 |

|

|

11.5 |

% |

Georgia |

146 |

|

|

107 |

|

|

39 |

|

|

36.4 |

% |

|

|

|

|

|

|

|

|

(1)Based on a combination of third-party portal data and data from our internal systems. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions.

(2)Location hold-per-day is calculated by dividing net gaming revenue in the period by the average number of locations. We then divide the calculated amount by the number of operational days. We utilize this metric to compare market and location performance on a normalized basis. The percent change in location hold-per-day is the underlying metric used to determine the change in same-store sales.

Condensed Consolidated Statements of Cash Flows Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

June 30, |

|

Increase / (Decrease) |

| (in thousands) |

2025 |

|

2024 |

|

Change ($) |

|

Change (%) |

| Net cash provided by operating activities |

$ |

64,557 |

|

|

$ |

57,614 |

|

|

$ |

6,943 |

|

|

12.1 |

% |

| Net cash used in investing activities |

(59,963) |

|

(69,324) |

|

9,361 |

|

13.5 |

% |

Net cash (used in) provided by financing activities |

(21,269) |

|

5,022 |

|

(26,291) |

|

(523.5) |

% |

Non-GAAP Financial Information

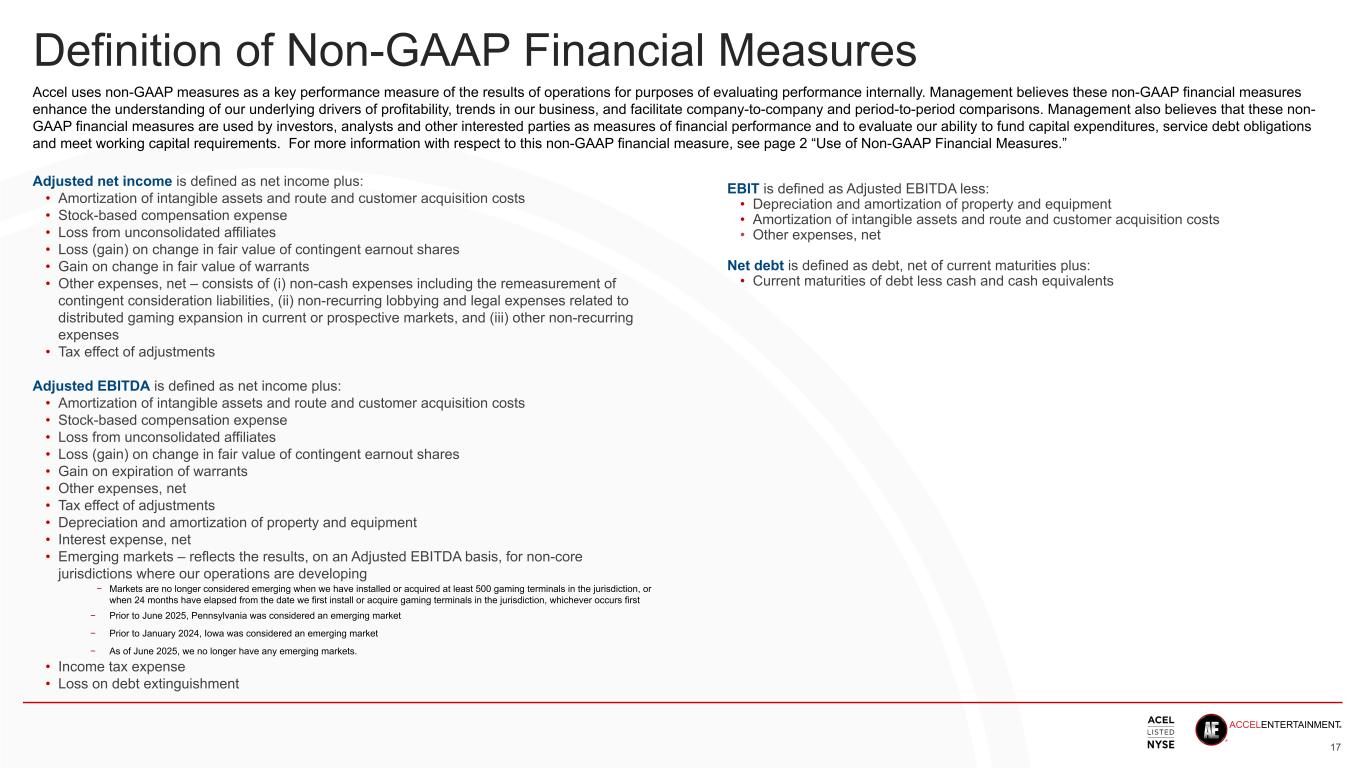

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA, Adjusted net income and Net debt. Adjusted EBITDA, Adjusted net income and Net debt are non-GAAP financial measures and are key metrics used to monitor ongoing core operations. Accel’s management believes Adjusted EBITDA, Adjusted net income and Net debt enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitates company-to-company and period-to-period comparisons because these non-GAAP financial measures exclude the effects of certain non-cash items or nonrecurring items that are unrelated to core operating performance. Accel’s management also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties to more fully assess Accel’s financial performance. The non-GAAP financial measures presented in this press release should be viewed in addition to, and not as an alternative for, financial measures prepared in accordance with GAAP that are also presented in this press release. These measures are not substitutes for their comparable GAAP financial measures and there are limitations to using non-GAAP financial measures. For example, the non-GAAP financial measures presented in this press release may differ from similarly titled non-GAAP financial measures presented by other companies, and other companies may not define these non-GAAP financial measures the same way as Accel does.

Adjusted net income is defined as net income plus:

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•Loss from unconsolidated affiliates

•Loss (gain) on change in fair value of contingent earnout shares

•Other expenses, net which consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses Adjusted EBITDA is defined as net income plus:

•Tax effect of adjustments

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•Loss from unconsolidated affiliates

•Loss (gain) on change in fair value of contingent earnout shares

•Other expenses, net

•Tax effect of adjustments

•Depreciation and amortization of property and equipment

•Interest expense, net

•Emerging markets, which reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing

◦Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first

◦Prior to June 2025, Pennsylvania was considered an emerging market

◦Prior to January 2024, Iowa was considered an emerging market

◦As of June 2025, we no longer have any emerging markets.

•Income tax expense

Net debt is defined as debt, net of current maturities:

•plus Current maturities of debt

•less Cash and cash equivalents

Reconciliation of Net income to Adjusted Net income and Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

|

|

Six Months Ended

June 30, |

|

|

| (in thousands) |

2025 |

|

2024 |

|

|

|

|

|

2025 |

|

2024 |

|

|

|

|

| Net income |

$ |

7,262 |

|

|

$ |

14,586 |

|

|

|

|

|

|

$ |

21,875 |

|

|

$ |

22,002 |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets and route and customer acquisition costs |

6,322 |

|

|

5,589 |

|

|

|

|

|

|

12,612 |

|

|

11,027 |

|

|

|

|

|

Stock-based compensation expense |

2,789 |

|

|

3,235 |

|

|

|

|

|

|

4,880 |

|

|

5,585 |

|

|

|

|

|

| Loss from unconsolidated affiliates |

17 |

|

|

— |

|

|

|

|

|

|

33 |

|

|

— |

|

|

|

|

|

Loss (gain) on change in fair value of contingent earnout shares |

5,734 |

|

|

(4,742) |

|

|

|

|

|

|

3,379 |

|

|

(26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses, net |

4,096 |

|

|

7,327 |

|

|

|

|

|

|

6,913 |

|

|

9,753 |

|

|

|

|

|

Tax effect of adjustments |

(3,729) |

|

|

(4,612) |

|

|

|

|

|

|

(6,983) |

|

|

(7,453) |

|

|

|

|

|

| Adjusted net income |

22,491 |

|

|

21,383 |

|

|

|

|

|

|

42,709 |

|

|

40,888 |

|

|

|

|

|

| Depreciation and amortization of property and equipment |

13,095 |

|

|

10,794 |

|

|

|

|

|

|

25,396 |

|

|

21,228 |

|

|

|

|

|

| Interest expense, net |

8,771 |

|

|

8,906 |

|

|

|

|

|

|

17,456 |

|

|

17,566 |

|

|

|

|

|

Emerging markets |

4 |

|

|

38 |

|

|

|

|

|

|

67 |

|

|

78 |

|

|

|

|

|

| Income tax expense |

8,819 |

|

|

8,544 |

|

|

|

|

|

|

17,066 |

|

|

16,152 |

|

|

|

|

|

| Adjusted EBITDA |

$ |

53,180 |

|

|

$ |

49,665 |

|

|

|

|

|

|

$ |

102,694 |

|

|

$ |

95,912 |

|

|

|

|

|

Reconciliation of Debt, net of maturities to Net debt

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, |

| (in thousands) |

2025 |

|

2024 |

| Debt, net of current maturities |

$ |

561,450 |

|

|

$ |

537,252 |

|

| Plus: Current maturities of debt |

34,033 |

|

|

28,489 |

|

| Less: Cash and cash equivalents |

(264,630) |

|

|

(254,923) |

|

| Net debt |

$ |

330,853 |

|

|

$ |

310,818 |

|

Conference Call

Accel will host an investor conference call on August 5, 2025 at 4:30 p.m. Central time (5:30 p.m. Eastern time) to discuss these financial and operating results. Interested parties may join the live webcast by registering at www.netroadshow.com/events/login?show=41dce4e6&confId=85454 or accessing the webcast via the company’s investor relations website: ir.accelentertainment.com. Following completion of the call, a replay of the webcast will be posted on Accel’s investor relations website.

About Accel

Accel Entertainment, Inc. (NYSE: ACEL) is a growing provider of locals-focused gaming and one of the largest terminal operators in the United States, supporting more than 27,000 electronic gaming terminals in over 4,400 third-party local and regional establishments and 20 self-operated gaming locations across ten states. Through exclusive long-term contracts, Accel serves licensed non-casino locations including bars, restaurants, convenience stores, truck stops, gaming cafes, and fraternal and veteran establishments. Accel also owns and operates a racino venue.

Accel provides its local partners with a turnkey, full-service, capital-efficient gaming solution that encompasses manufacturing, content, payments, loyalty, 24/7 customer service, data analysis and reporting and cash logistics. The Company’s racino, Fairmount Park - Casino & Racing, opened in April 2025 and features over 270 electronic gaming machines, food and beverage amenities, a sports book, para-mutuel betting and 55 days of thoroughbred horse racing a year.

Contact:

Joseph Jaffoni, Norberto Aja

JCIR

212-835-8500

acel@jcir.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA, and Adjusted net income, our ability to continue to generate strong and consistent revenue and returns on capital and improve profitability, the opportunities in local gaming within the broader gaming market, and our expansion into casino operations and horse racing, including at Fairmount. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: the significant variability and unpredictability in Accel’s operating results; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions and related regulations; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; Accel's expansion into casino operations and horse racing; unfavorable adverse economic conditions or decreased discretionary spending due to other factors such as terrorist activity or threat thereof, epidemics, pandemics or other public health issues, civil unrest or other economic or political uncertainties that could impact Accel’s business; Accel’s ability to operate in existing markets or expand into new jurisdictions; the geographical concentration of Accel’s business, which subjects it to greater risks from changes in local or regional conditions; Accel’s ability to maintain or improve its competitive advantages in a highly competitive industry; strict government regulations that are constantly evolving and may be amended, repealed, or subject to new interpretations, which may limit existing operations, have an adverse impact on Accel’s ability to grow or may expose Accel to fines or other penalties; Accel’s dependence on the protection of trademarks and other intellectual property; opponents’ persistence in efforts to curtail the expansion of legalized gaming; Accel’s dependence on the security and integrity of the systems and products offered, which, if breached or disrupted, could expose Accel to liability; and other risks and uncertainties indicated from time to time in documents filed or to be filed with the U.S. Securities and Exchange Commission (the "SEC") including those described in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the "Form 10-K").

Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law. In addition, the inclusion of any statement in this press release does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements.

Industry and Market Data

Unless otherwise indicated, information contained in this press release concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Form 10-K, as well as Accel's other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

ACCEL ENTERTAINMENT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share amounts) |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

| Net gaming |

$ |

313,919 |

|

|

$ |

293,240 |

|

|

$ |

615,870 |

|

|

$ |

581,377 |

|

|

|

| Amusement |

5,517 |

|

|

5,539 |

|

|

11,425 |

|

|

11,668 |

|

|

|

| Manufacturing |

1,763 |

|

|

5,208 |

|

|

5,621 |

|

|

7,417 |

|

|

|

| ATM fees and other |

14,710 |

|

|

5,426 |

|

|

26,905 |

|

|

10,768 |

|

|

|

| Total net revenues |

335,909 |

|

|

309,413 |

|

|

659,821 |

|

|

611,230 |

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

| Cost of revenue (exclusive of depreciation and amortization expense shown below) |

229,758 |

|

|

213,317 |

|

|

451,230 |

|

|

422,484 |

|

|

|

| Cost of manufacturing goods sold (exclusive of depreciation and amortization expense shown below) |

886 |

|

|

3,162 |

|

|

2,962 |

|

|

4,321 |

|

|

|

| General and administrative |

54,878 |

|

|

46,541 |

|

|

107,882 |

|

|

94,175 |

|

|

|

| Depreciation and amortization of property and equipment |

13,095 |

|

|

10,794 |

|

|

25,396 |

|

|

21,228 |

|

|

|

| Amortization of intangible assets and route and customer acquisition costs |

6,322 |

|

|

5,589 |

|

|

12,612 |

|

|

11,027 |

|

|

|

| Other expenses, net |

4,096 |

|

|

7,327 |

|

|

6,913 |

|

|

9,753 |

|

|

|

| Total operating expenses |

309,035 |

|

|

286,730 |

|

|

606,995 |

|

|

562,988 |

|

|

|

| Operating income |

26,874 |

|

|

22,683 |

|

|

52,826 |

|

|

48,242 |

|

|

|

| Interest expense, net |

8,771 |

|

|

8,906 |

|

|

17,456 |

|

|

17,566 |

|

|

|

| Loss from unconsolidated affiliates |

17 |

|

|

— |

|

|

33 |

|

|

— |

|

|

|

Loss (gain) on change in fair value of contingent earnout shares |

5,734 |

|

|

(4,742) |

|

|

3,379 |

|

|

(26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

12,352 |

|

|

18,519 |

|

|

31,958 |

|

|

30,702 |

|

|

|

| Income tax expense |

5,090 |

|

|

3,933 |

|

|

10,083 |

|

|

8,700 |

|

|

|

| Net income |

$ |

7,262 |

|

|

$ |

14,586 |

|

|

$ |

21,875 |

|

|

$ |

22,002 |

|

|

|

| Less: Net income attributed to redeemable noncontrolling interests |

(53) |

|

|

— |

|

|

(79) |

|

|

— |

|

|

|

| Net income attributable to Accel Entertainment, Inc. |

$ |

7,315 |

|

|

$ |

14,586 |

|

|

$ |

21,954 |

|

|

$ |

22,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.09 |

|

|

$ |

0.17 |

|

|

$ |

0.26 |

|

|

$ |

0.26 |

|

|

|

| Diluted |

0.08 |

|

|

0.17 |

|

|

0.25 |

|

|

0.26 |

|

|

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

| Basic |

85,710 |

|

|

83,911 |

|

|

85,856 |

|

|

84,105 |

|

|

|

| Diluted |

86,943 |

|

|

85,054 |

|

|

87,082 |

|

|

85,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCEL ENTERTAINMENT, INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except par value and share amounts) |

June 30, |

|

December 31, |

|

2025 |

|

2024 |

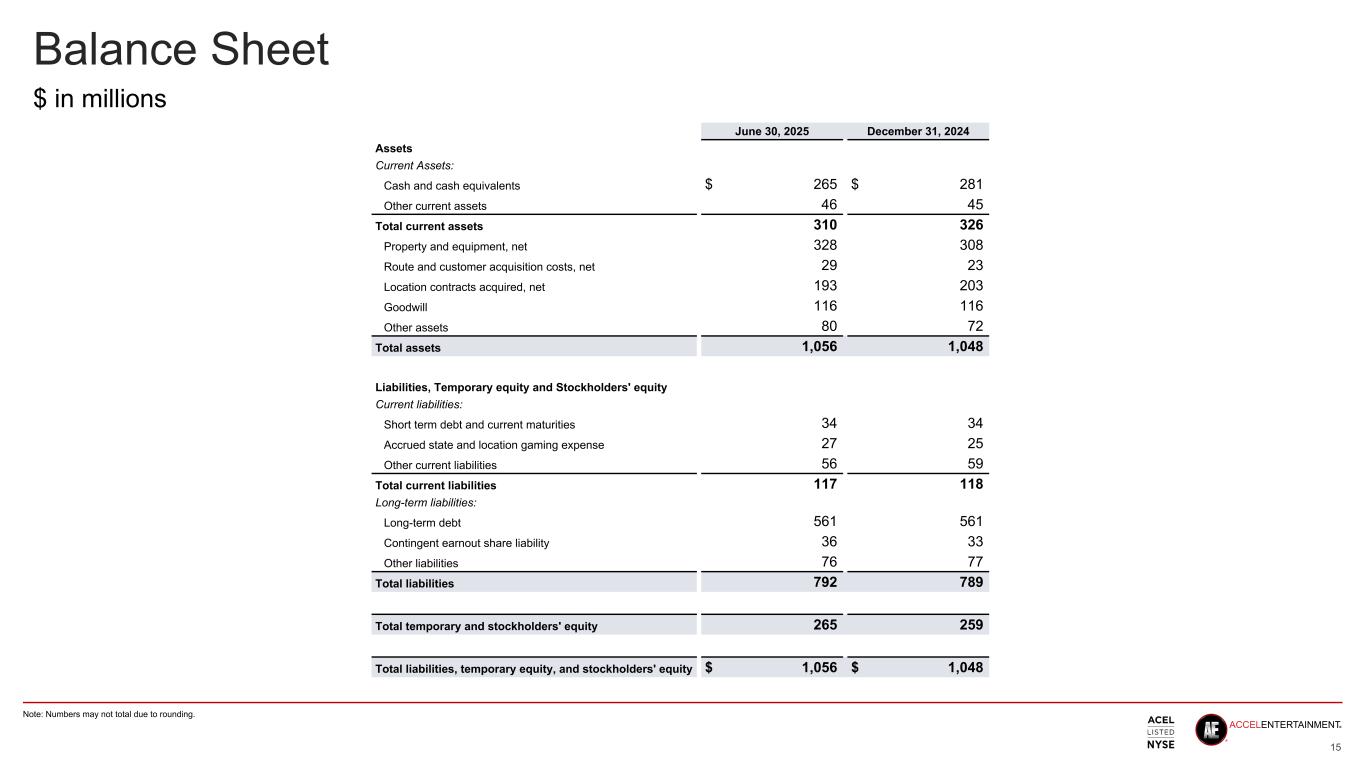

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

264,630 |

|

|

$ |

281,305 |

|

| Accounts receivable, net |

11,764 |

|

|

10,550 |

|

| Prepaid expenses |

8,716 |

|

|

8,950 |

|

| Inventories |

9,690 |

|

|

8,122 |

|

|

|

|

|

| Interest rate caplets |

3,644 |

|

|

6,342 |

|

|

|

|

|

|

|

|

|

| Other current assets |

11,731 |

|

|

10,883 |

|

| Total current assets |

310,175 |

|

|

326,152 |

|

| Property and equipment, net |

328,304 |

|

|

307,997 |

|

| Noncurrent assets: |

|

|

|

| Route and customer acquisition costs, net |

28,594 |

|

|

23,258 |

|

| Location contracts acquired, net |

192,710 |

|

|

202,618 |

|

| Goodwill |

116,252 |

|

|

116,252 |

|

| Other intangible assets, net |

62,207 |

|

|

53,940 |

|

|

|

|

|

|

|

|

|

| Other assets |

18,014 |

|

|

18,181 |

|

| Total noncurrent assets |

417,777 |

|

|

414,249 |

|

| Total assets |

$ |

1,056,256 |

|

|

$ |

1,048,398 |

|

Liabilities, Temporary equity, and Stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Current maturities of debt |

$ |

34,033 |

|

|

$ |

34,443 |

|

|

|

|

|

| Current portion of route and customer acquisition costs payable |

2,584 |

|

|

2,197 |

|

| Accrued location gaming expense |

8,952 |

|

|

4,734 |

|

| Accrued state gaming expense |

18,028 |

|

|

19,802 |

|

| Accounts payable and other accrued expenses |

37,397 |

|

|

41,944 |

|

| Accrued compensation and related expenses |

13,114 |

|

|

12,117 |

|

| Current portion of consideration payable |

3,173 |

|

|

3,116 |

|

| Total current liabilities |

117,281 |

|

|

118,353 |

|

| Long-term liabilities: |

|

|

|

| Debt, net of current maturities |

561,450 |

|

|

560,936 |

|

| Route and customer acquisition costs payable, less current portion |

9,985 |

|

|

7,160 |

|

| Consideration payable, less current portion |

14,800 |

|

|

14,596 |

|

| Contingent earnout share liability |

36,482 |

|

|

33,103 |

|

| Other long-term liabilities |

7,461 |

|

|

7,571 |

|

| Deferred income tax liability, net |

44,059 |

|

|

47,372 |

|

| Total long-term liabilities |

674,237 |

|

|

670,738 |

|

|

|

|

|

| Temporary equity - Redeemable noncontrolling interest |

4,199 |

|

|

4,278 |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

Preferred Stock, par value of $0.0001; 1,000,000 shares authorized; 0 shares issued and outstanding at June 30, 2025 and December 31, 2024 |

— |

|

|

— |

|

Class A-1 Common Stock, par value $0.0001; 250,000,000 shares authorized; 96,289,273 shares issued and 84,471,410 shares outstanding at June 30, 2025; 95,865,026 shares issued and 85,670,255 shares outstanding at December 31, 2024 |

8 |

|

|

8 |

|

|

|

|

|

| Additional paid-in capital |

224,229 |

|

|

221,625 |

|

| Treasury stock, at cost |

(122,570) |

|

|

(105,485) |

|

| Accumulated other comprehensive income |

2,182 |

|

|

4,145 |

|

| Accumulated earnings |

156,690 |

|

|

134,736 |

|

| Total stockholders' equity |

260,539 |

|

|

255,029 |

|

| Total liabilities, temporary equity, and stockholders' equity |

$ |

1,056,256 |

|

|

$ |

1,048,398 |

|