Document

Accel Entertainment Announces Q2 2024 Operating Results

Chicago, IL – July 30, 2024 – Accel Entertainment, Inc. (NYSE: ACEL) today announced certain financial and operating results for the second quarter ended June 30, 2024.

Highlights:

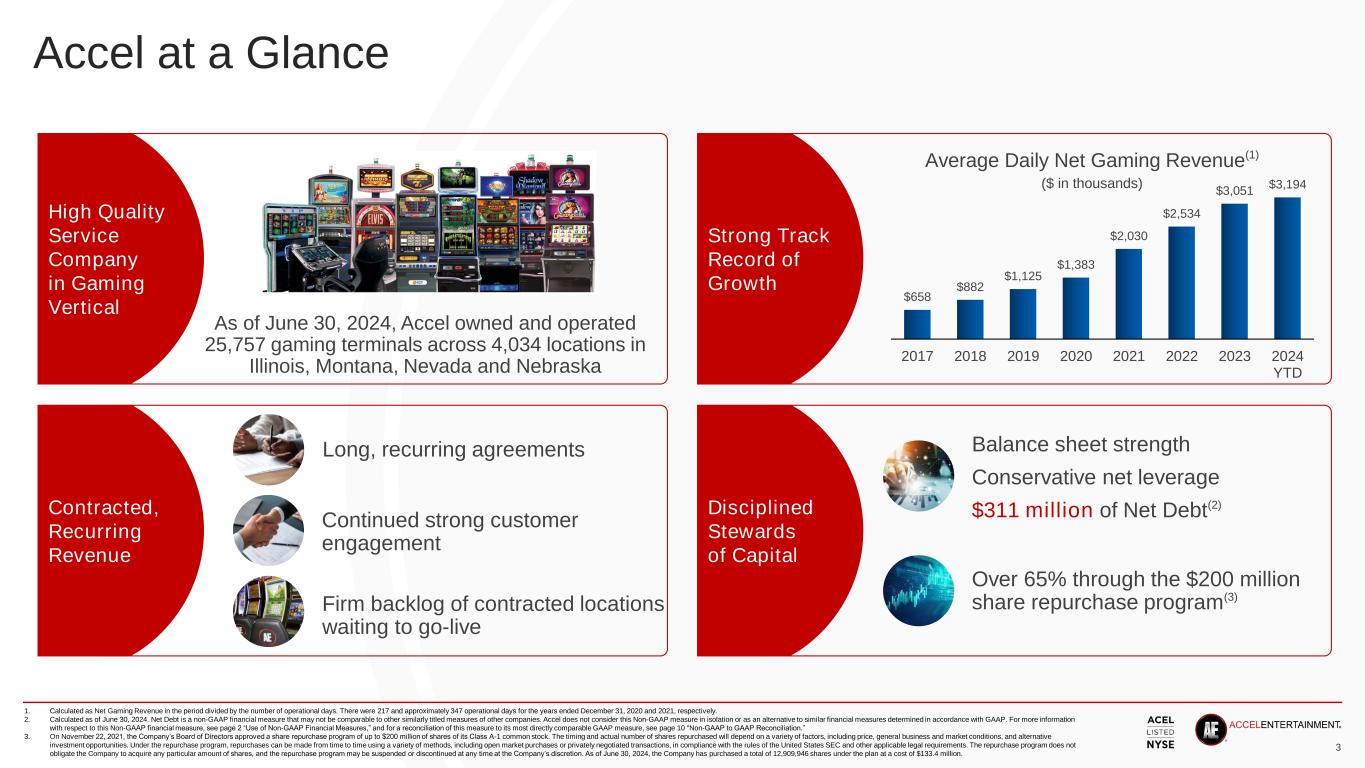

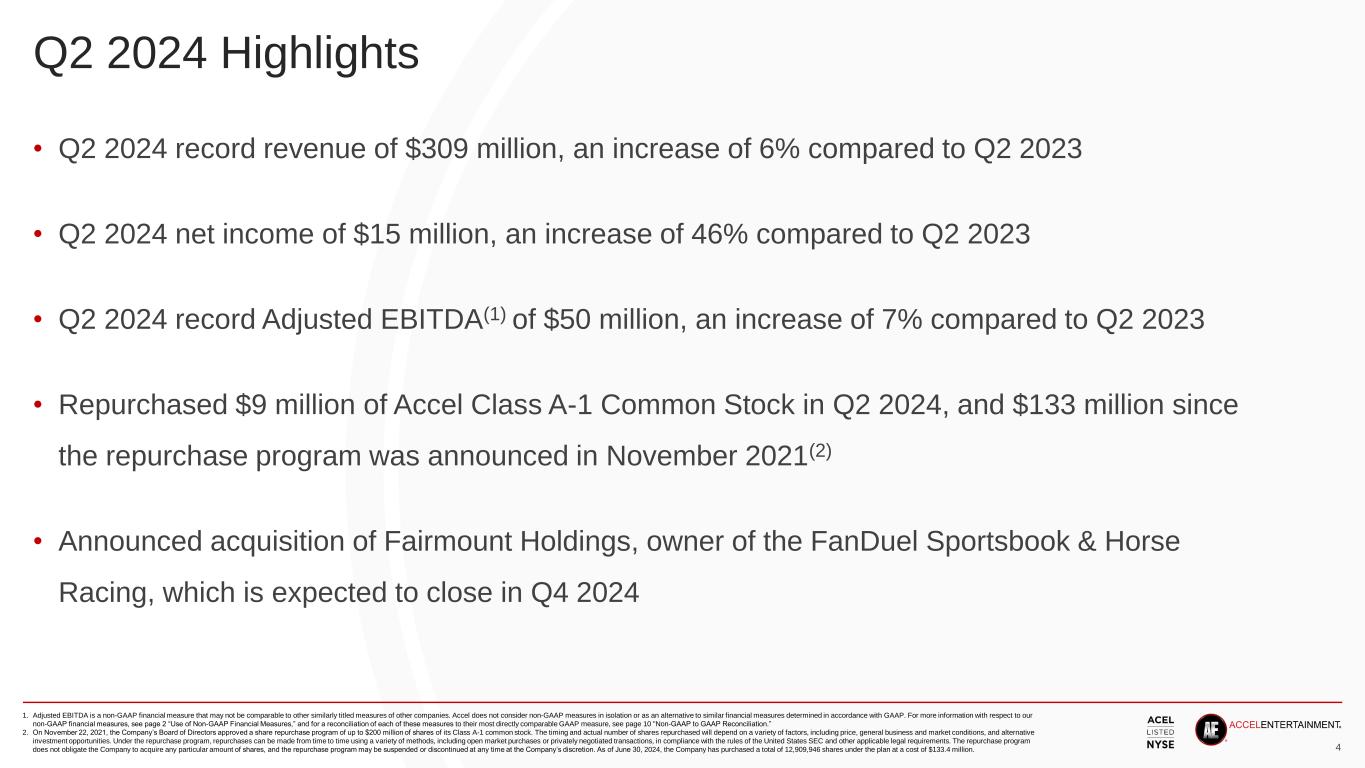

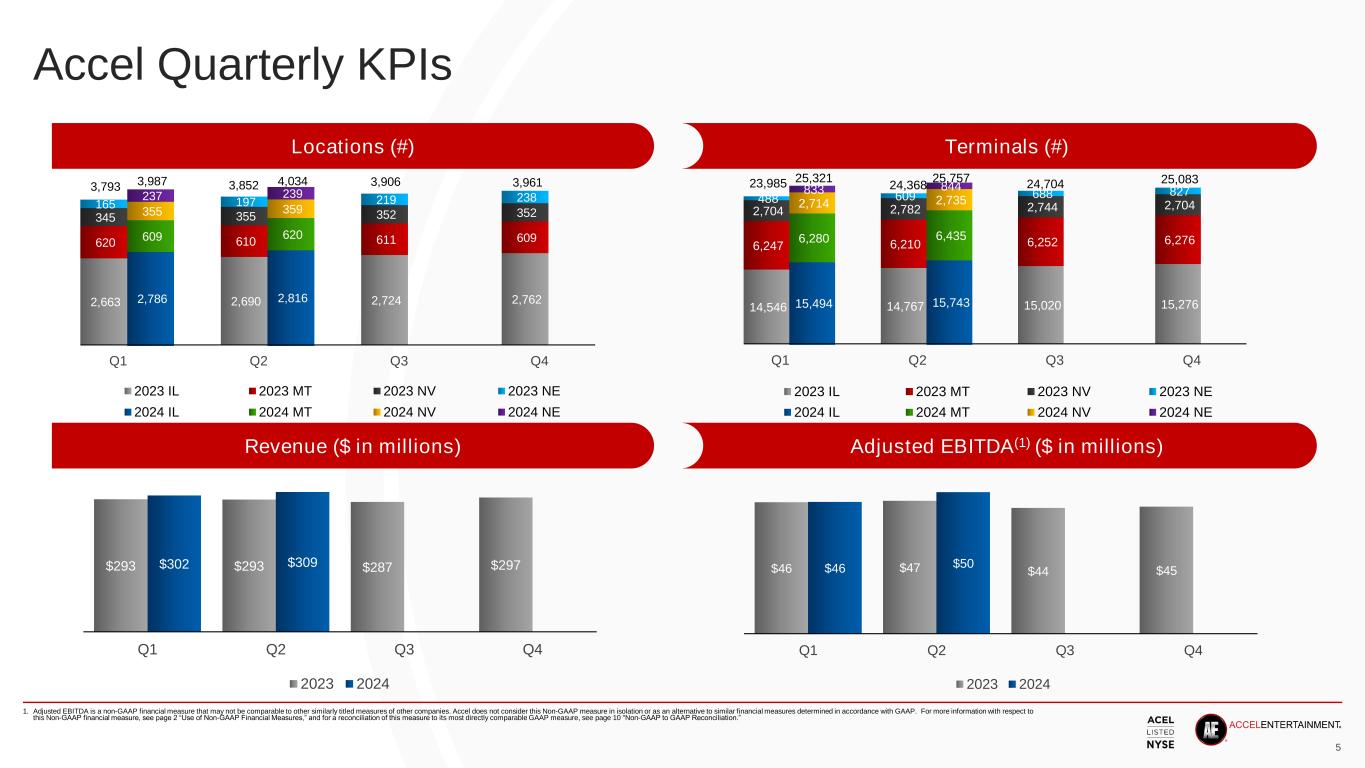

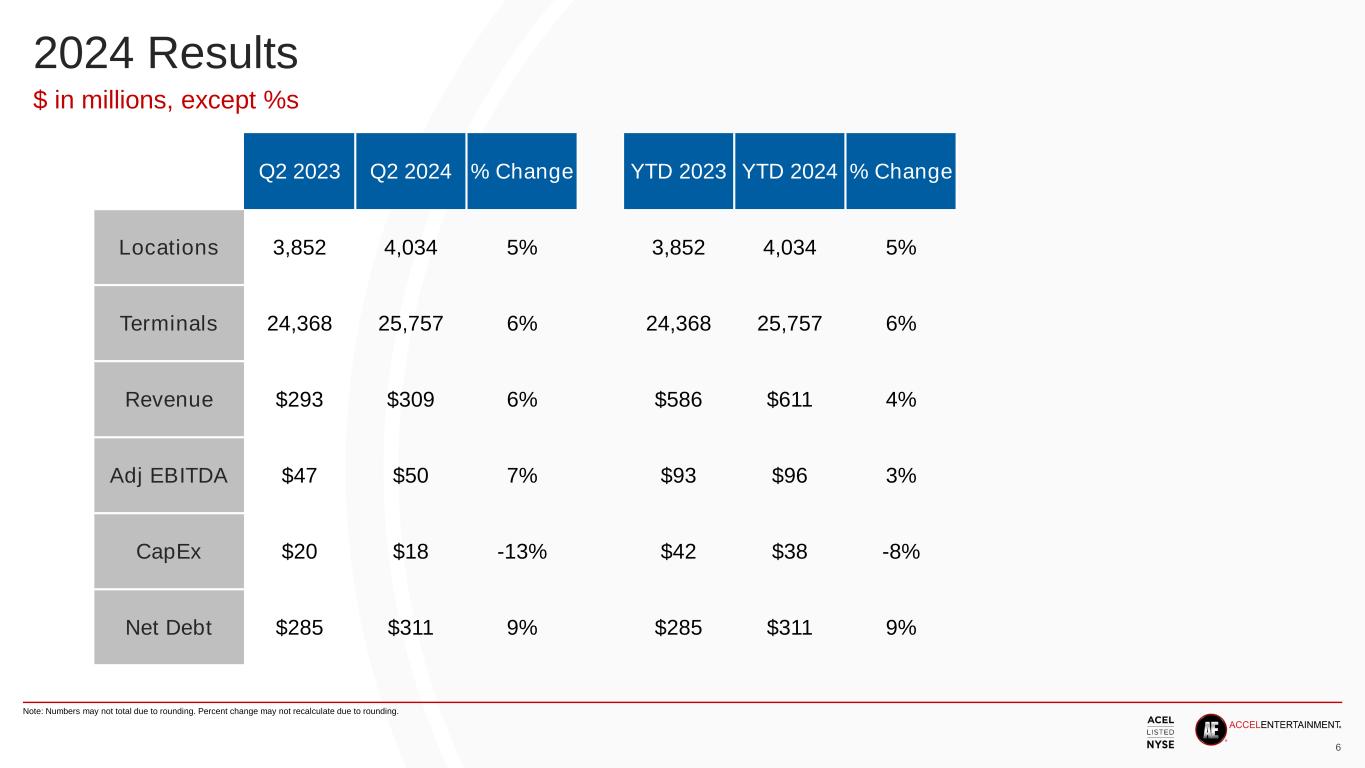

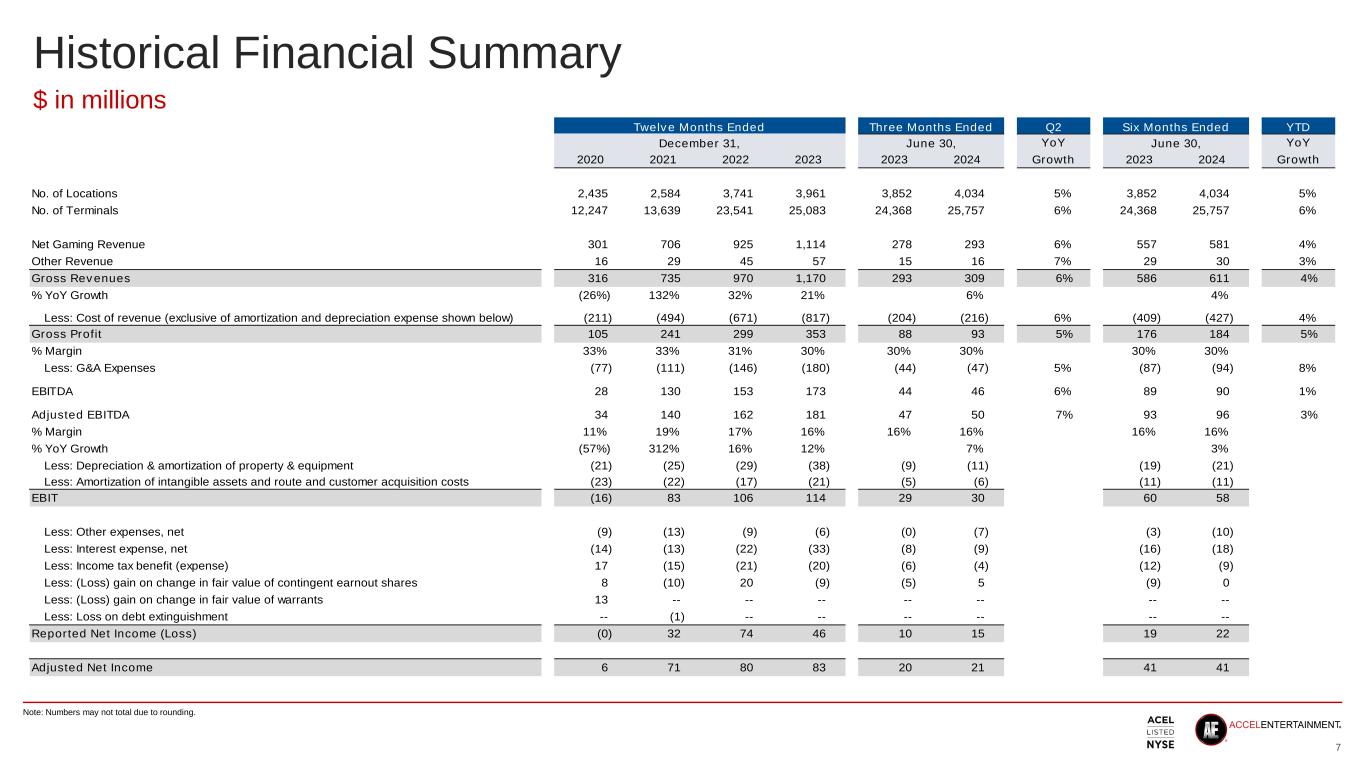

•Ended Q2 2024 with 4,034 locations; an increase of 4.7% compared to Q2 2023

•Ended Q2 2024 with 25,757 gaming terminals; an increase of 5.7% compared to Q2 2023

•Record revenues of $309.4 million for Q2 2024; an increase of 5.7% compared to Q2 2023

•Net income of $14.6 million for Q2 2024; an increase of 46.1% compared to Q2 2023

•Record Adjusted EBITDA of $49.7 million for Q2 2024; an increase of 6.5% compared to Q2 2023

•Q2 2024 ended with $311 million of net debt; an increase of 9% compared to Q2 2023

•Repurchased approximately $9.2 million of Accel Class A-1 common stock in Q2 2024

•Announced acquisition of Fairmount Holdings, the owner of the FanDuel Sportsbook & Horse Racing in Collinsville, Illinois, which is expected to close in Q4 2024

Accel CEO Andy Rubenstein commented, “I am happy to report that we delivered another record-setting quarter, continuing to demonstrate the strength of our local, convenience-based gaming model. We are excited to leverage our strengths in catering to local markets with our announcement to acquire the FanDuel Sportsbook & Horse Racing, a single-site, easily accessible, local gaming venue and a natural extension of our route-based gaming platform. As we continue to strengthen our core and expand our offerings, we believe we can continue to generate attractive low-teens returns on capital and improve our trading multiples, making Accel a compelling investment opportunity.”

Condensed Consolidated Statements of Operations and Other Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Total net revenues |

$ |

309,413 |

|

|

$ |

292,647 |

|

|

$ |

611,230 |

|

|

$ |

585,855 |

|

| Operating income |

22,683 |

|

|

29,164 |

|

|

48,242 |

|

|

56,836 |

|

| Income before income tax expense |

18,519 |

|

|

16,085 |

|

|

30,702 |

|

|

31,267 |

|

| Net income |

14,586 |

|

|

9,983 |

|

|

22,002 |

|

|

19,165 |

|

| Other Financial Data: |

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

49,665 |

|

|

46,612 |

|

|

95,912 |

|

|

92,730 |

|

Adjusted net income (2) |

21,383 |

|

|

20,435 |

|

|

40,888 |

|

|

41,499 |

|

(1)Adjusted EBITDA is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to GAAP.

(2)Adjusted net income is a non-GAAP metric. See "Non-GAAP Financial Measures" for a reconciliation to GAAP.

Net Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

Three Months Ended

June 30, |

|

|

|

Six Months Ended

June 30, |

|

2024 |

|

2023 |

|

|

|

|

|

2024 |

|

2023 |

| Net revenues by state: |

|

|

|

|

|

|

|

|

|

|

|

| Illinois |

$ |

227,093 |

|

|

$ |

215,947 |

|

|

|

|

|

|

$ |

451,956 |

|

|

$ |

435,790 |

|

| Montana |

42,583 |

|

|

39,275 |

|

|

|

|

|

|

80,724 |

|

|

75,726 |

|

| Nevada |

29,322 |

|

|

29,869 |

|

|

|

|

|

|

58,531 |

|

|

59,830 |

|

| Nebraska |

6,249 |

|

|

4,488 |

|

|

|

|

|

|

12,083 |

|

|

8,412 |

|

| Other |

4,166 |

|

|

3,068 |

|

|

|

|

|

|

7,936 |

|

|

6,097 |

|

| Total net revenues |

$ |

309,413 |

|

|

$ |

292,647 |

|

|

|

|

|

|

$ |

611,230 |

|

|

$ |

585,855 |

|

Key Business Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Locations (1) |

As of June 30, |

|

Increase / (Decrease) |

|

2024 |

|

2023 |

|

Change |

|

Change (%) |

| Illinois |

2,816 |

|

|

2,690 |

|

|

126 |

|

|

4.7 |

% |

| Montana |

620 |

|

|

610 |

|

|

10 |

|

|

1.6 |

% |

| Nevada |

359 |

|

|

355 |

|

|

4 |

|

|

1.1 |

% |

| Nebraska |

239 |

|

|

197 |

|

|

42 |

|

|

21.3 |

% |

| Total locations |

4,034 |

|

|

3,852 |

|

|

182 |

|

|

4.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gaming terminals (1) |

As of June 30, |

|

Increase / (Decrease) |

|

2024 |

|

2023 |

|

Change |

|

Change (%) |

| Illinois |

15,743 |

|

|

14,767 |

|

|

976 |

|

|

6.6 |

% |

| Montana |

6,435 |

|

|

6,210 |

|

|

225 |

|

|

3.6 |

% |

| Nevada |

2,735 |

|

|

2,782 |

|

|

(47) |

|

|

(1.7) |

% |

| Nebraska |

844 |

|

|

609 |

|

|

235 |

|

|

38.6 |

% |

| Total gaming terminals |

25,757 |

|

|

24,368 |

|

|

1,389 |

|

|

5.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location hold-per-day (2) |

Three Months Ended June 30, |

|

Increase / (Decrease) |

|

2024 |

|

2023 |

|

Change ($) |

|

Change (%) |

| Illinois |

$ |

862 |

|

|

$ |

858 |

|

|

$ |

4 |

|

|

0.5 |

% |

| Montana |

612 |

|

|

569 |

|

|

43 |

|

|

7.6 |

% |

| Nevada |

843 |

|

|

860 |

|

|

(17) |

|

|

(2.0) |

% |

| Nebraska |

255 |

|

|

237 |

|

|

18 |

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

Increase / (Decrease) |

|

2024 |

|

2023 |

|

Change ($) |

|

Change (%) |

| Illinois |

$ |

861 |

|

|

$ |

871 |

|

|

$ |

(10) |

|

|

(1.1) |

% |

| Montana |

601 |

|

|

573 |

|

|

28 |

|

|

4.9 |

% |

| Nevada |

845 |

|

|

860 |

|

|

(15) |

|

|

(1.7) |

% |

| Nebraska |

243 |

|

|

229 |

|

|

14 |

|

|

6.1 |

% |

|

|

|

|

|

|

|

|

(1)Based on a combination of third-party portal data and data from our internal systems. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions.

(2)Location hold-per-day is calculated by dividing net gaming revenue in the period by the average number of locations. We then divide the calculated amount by the number of operational days. We utilize this metric to compare market and location performance on a normalized basis. The percent change in location hold-per-day is the underlying metric used to determine the change in same-store sales.

Condensed Consolidated Statements of Cash Flows Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

Increase / (Decrease) |

| (in thousands) |

2024 |

|

2023 |

|

Change ($) |

|

Change (%) |

| Net cash provided by operating activities |

$ |

57,614 |

|

|

$ |

63,845 |

|

|

$ |

(6,231) |

|

|

(9.8) |

% |

| Net cash used in investing activities |

(69,324) |

|

(16,245) |

|

(53,079) |

|

326.7 |

% |

| Net cash provided by (used in) financing activities |

5,022 |

|

(38,279) |

|

43,301 |

|

113.1 |

% |

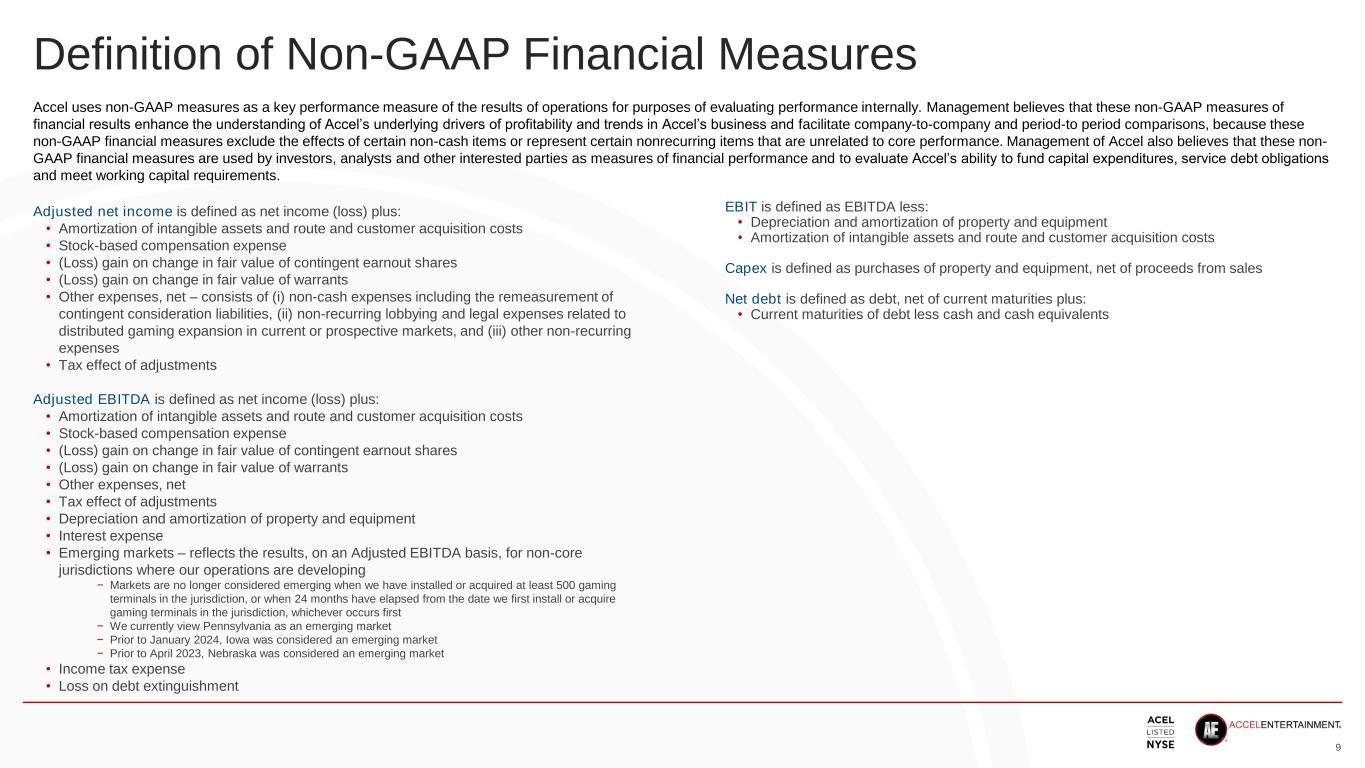

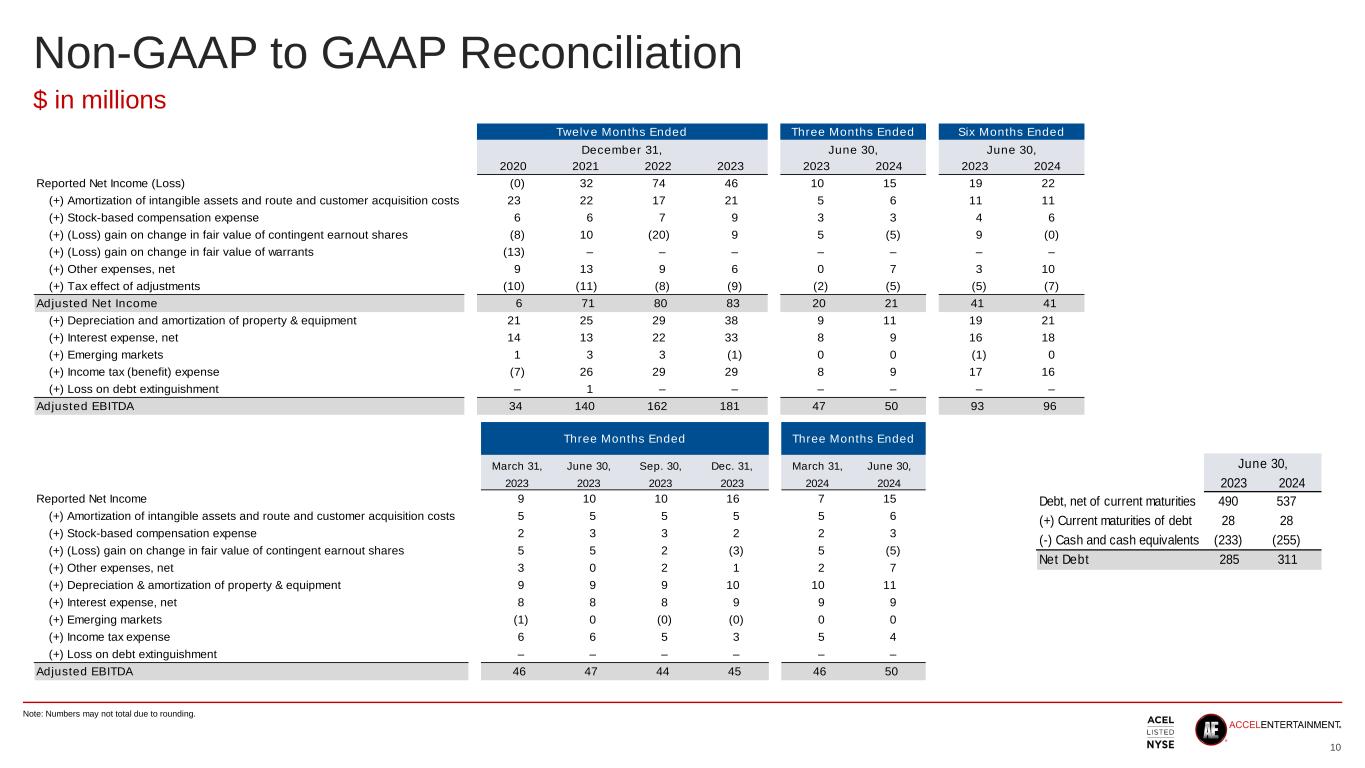

Non-GAAP Financial Measures

Adjusted net income is defined as net income plus:

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•(Gain) loss on change in fair value of contingent earnout shares

•Other expenses, net which consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses

•Tax effect of adjustments

Adjusted EBITDA is defined as net income plus:

•Amortization of intangible assets and route and customer acquisition costs

•Stock-based compensation expense

•(Gain) loss on change in fair value of contingent earnout shares

•Other expenses, net

•Tax effect of adjustments

•Depreciation and amortization of property and equipment

•Interest expense, net

•Emerging markets, which reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing

◦Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first

◦We currently view Pennsylvania as an emerging market

◦Prior to January 2024, Iowa was considered an emerging market

◦Prior to April 2023, Nebraska was considered an emerging market Net debt is defined as debt, net of current maturities plus:

•Income tax expense

•Current maturities of debt

•less Cash and cash equivalents

Adjusted net income and Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

|

|

Six Months Ended

June 30, |

| (in thousands) |

2024 |

|

2023 |

|

|

|

|

|

2024 |

|

2023 |

| Net income |

$ |

14,586 |

|

|

$ |

9,983 |

|

|

|

|

|

|

$ |

22,002 |

|

|

$ |

19,165 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets and route and customer acquisition costs |

5,589 |

|

|

5,284 |

|

|

|

|

|

|

11,027 |

|

|

10,526 |

|

Stock-based compensation expense |

3,235 |

|

|

2,567 |

|

|

|

|

|

|

5,585 |

|

|

4,255 |

|

(Gain) loss on change in fair value of contingent earnout shares |

(4,742) |

|

|

4,836 |

|

|

|

|

|

|

(26) |

|

|

9,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expenses, net |

7,327 |

|

|

73 |

|

|

|

|

|

|

9,753 |

|

|

3,324 |

|

Tax effect of adjustments |

(4,612) |

|

|

(2,308) |

|

|

|

|

|

|

(7,453) |

|

|

(5,209) |

|

| Adjusted net income |

21,383 |

|

|

20,435 |

|

|

|

|

|

|

40,888 |

|

|

41,499 |

|

| Depreciation and amortization of property and equipment |

10,794 |

|

|

9,446 |

|

|

|

|

|

|

21,228 |

|

|

18,509 |

|

| Interest expense, net |

8,906 |

|

|

8,243 |

|

|

|

|

|

|

17,566 |

|

|

16,131 |

|

Emerging markets |

38 |

|

|

78 |

|

|

|

|

|

|

78 |

|

|

(720) |

|

| Income tax expense |

8,544 |

|

|

8,410 |

|

|

|

|

|

|

16,152 |

|

|

17,311 |

|

| Adjusted EBITDA |

$ |

49,665 |

|

|

$ |

46,612 |

|

|

|

|

|

|

$ |

95,912 |

|

|

$ |

92,730 |

|

Net Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, |

| (in thousands) |

2024 |

|

2023 |

| Debt, net of current maturities |

$ |

537,252 |

|

|

$ |

489,721 |

|

| Plus: Current maturities of debt |

28,489 |

|

|

28,472 |

|

| Less: Cash and cash equivalents |

(254,923) |

|

|

(233,434) |

|

| Net debt |

$ |

310,818 |

|

|

$ |

284,759 |

|

Conference Call

Accel will host an investor conference call on July 30, 2024 at 4:00 p.m. Central time (5:00 p.m. Eastern time) to discuss these financial and operating results. Interested parties may join the live webcast by registering at https://www.netroadshow.com/events/login?show=70f3f5e5&confId=66550 or accessing the webcast via the company’s investor relations website: ir.accelentertainment.com. Following completion of the call, a replay of the webcast will be posted on Accel’s investor relations website.

About Accel

Accel is a leading distributed gaming operator in the United States and a preferred partner for local business owners in the markets it serves. Accel offers turnkey full-service gaming solutions to authorized non-casino locations such as bars, restaurants, convenience stores, truck stops, and fraternal and veteran establishments across the country. Accel installs, maintains, operates and services gaming terminals and related equipment for its location partners as well as redemption devices, stand-alone ATMs and amusement devices, including jukeboxes, dartboards, pool tables, and other entertainment related equipment. Accel also designs and manufactures gaming terminals and related equipment.

Media Contact:

Eric Bonach

H/Advisors Abernathy

212-371-5999

eric.bonach@h-advisors.global

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA and capital expenditures, our ability to continue to generate returns on capital and improve our trading multiples, and our proposed acquisition of Fairmount Holdings, Inc. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; the parties' ability to satisfy the conditions to the consummation of the proposed acquisition of Fairmount Holdings, Inc.

and the risk that the proposed acquisition may not be completed in a timely manner or at all; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31,2023 filed by Accel with the SEC on February 28, 2024 (the "Form 10-K"), as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other press releases or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this press release does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this press release.

Non-GAAP Financial Information

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA, Adjusted net income, and Net Debt are non-GAAP financial measures and are key metrics used to monitor ongoing core operations. Management of Accel believes Adjusted EBITDA, Adjusted net income, and Net Debt enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitates company-to-company and period-to-period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items, represents certain nonrecurring items that are unrelated to core performance, or excludes non-core operations. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance.

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share amounts) |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net revenues: |

|

|

|

|

|

|

|

| Net gaming |

$ |

293,240 |

|

|

$ |

277,551 |

|

|

$ |

581,377 |

|

|

$ |

556,931 |

|

| Amusement |

5,539 |

|

|

5,630 |

|

|

11,668 |

|

|

12,428 |

|

| Manufacturing |

5,208 |

|

|

4,430 |

|

|

7,417 |

|

|

6,552 |

|

| ATM fees and other |

5,426 |

|

|

5,036 |

|

|

10,768 |

|

|

9,944 |

|

| Total net revenues |

309,413 |

|

|

292,647 |

|

|

611,230 |

|

|

585,855 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Cost of revenue (exclusive of depreciation and amortization expense shown below) |

213,317 |

|

|

202,306 |

|

|

422,484 |

|

|

405,860 |

|

| Cost of manufacturing goods sold (exclusive of depreciation and amortization expense shown below) |

3,162 |

|

|

2,154 |

|

|

4,321 |

|

|

3,562 |

|

| General and administrative |

46,541 |

|

|

44,220 |

|

|

94,175 |

|

|

87,238 |

|

| Depreciation and amortization of property and equipment |

10,794 |

|

|

9,446 |

|

|

21,228 |

|

|

18,509 |

|

| Amortization of intangible assets and route and customer acquisition costs |

5,589 |

|

|

5,284 |

|

|

11,027 |

|

|

10,526 |

|

| Other expenses, net |

7,327 |

|

|

73 |

|

|

9,753 |

|

|

3,324 |

|

| Total operating expenses |

286,730 |

|

|

263,483 |

|

|

562,988 |

|

|

529,019 |

|

| Operating income |

22,683 |

|

|

29,164 |

|

|

48,242 |

|

|

56,836 |

|

| Interest expense, net |

8,906 |

|

|

8,243 |

|

|

17,566 |

|

|

16,131 |

|

(Gain) loss on change in fair value of contingent earnout shares |

(4,742) |

|

|

4,836 |

|

|

(26) |

|

|

9,438 |

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

18,519 |

|

|

16,085 |

|

|

30,702 |

|

|

31,267 |

|

| Income tax expense |

3,933 |

|

|

6,102 |

|

|

8,700 |

|

|

12,102 |

|

| Net income |

$ |

14,586 |

|

|

$ |

9,983 |

|

|

$ |

22,002 |

|

|

$ |

19,165 |

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.17 |

|

|

$ |

0.12 |

|

|

$ |

0.26 |

|

|

$ |

0.22 |

|

| Diluted |

0.17 |

|

|

0.11 |

|

|

0.26 |

|

|

0.22 |

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

83,911 |

|

|

86,184 |

|

|

84,105 |

|

|

86,529 |

|

| Diluted |

85,054 |

|

|

86,820 |

|

|

85,178 |

|

|

86,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except par value and share amounts) |

June 30, |

|

December 31, |

|

2024 |

|

2023 |

| Assets |

(Unaudited) |

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

254,923 |

|

|

$ |

261,611 |

|

| Accounts receivable, net |

15,149 |

|

|

13,467 |

|

| Prepaid expenses |

8,765 |

|

|

6,287 |

|

| Inventories |

7,533 |

|

|

7,681 |

|

|

|

|

|

| Interest rate caplets |

8,801 |

|

|

8,140 |

|

|

|

|

|

| Other current assets |

11,111 |

|

|

8,853 |

|

| Total current assets |

322,201 |

|

|

312,594 |

|

| Property and equipment, net |

276,477 |

|

|

260,813 |

|

| Noncurrent assets: |

|

|

|

| Route and customer acquisition costs, net |

23,705 |

|

|

19,188 |

|

| Location contracts acquired, net |

181,350 |

|

|

176,311 |

|

| Goodwill |

101,859 |

|

|

101,554 |

|

| Other intangible assets, net |

19,324 |

|

|

20,542 |

|

| Interest rate caplets, net of current |

3,730 |

|

|

4,871 |

|

|

|

|

|

| Other assets |

21,702 |

|

|

17,020 |

|

| Total noncurrent assets |

351,670 |

|

|

339,486 |

|

| Total assets |

$ |

950,348 |

|

|

$ |

912,893 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Current maturities of debt |

$ |

28,489 |

|

|

$ |

28,483 |

|

|

|

|

|

| Current portion of route and customer acquisition costs payable |

2,014 |

|

|

1,505 |

|

| Accrued location gaming expense |

9,129 |

|

|

9,350 |

|

| Accrued state gaming expense |

17,177 |

|

|

18,364 |

|

| Accounts payable and other accrued expenses |

34,476 |

|

|

36,012 |

|

| Accrued compensation and related expenses |

11,195 |

|

|

12,648 |

|

| Current portion of consideration payable |

3,275 |

|

|

3,288 |

|

| Total current liabilities |

105,755 |

|

|

109,650 |

|

| Long-term liabilities: |

|

|

|

| Debt, net of current maturities |

537,252 |

|

|

514,091 |

|

| Route and customer acquisition costs payable, less current portion |

7,482 |

|

|

4,955 |

|

| Consideration payable, less current portion |

9,794 |

|

|

4,201 |

|

| Contingent earnout share liability |

31,801 |

|

|

31,827 |

|

| Other long-term liabilities |

6,713 |

|

|

7,015 |

|

| Deferred income tax liability, net |

42,463 |

|

|

42,750 |

|

| Total long-term liabilities |

635,505 |

|

|

604,839 |

|

| Stockholders’ equity: |

|

|

|

Preferred Stock, par value of $0.0001; 1,000,000 shares authorized; 0 shares issued and outstanding at June 30, 2024 and December 31, 2023 |

— |

|

|

— |

|

| Class A-1 Common Stock, par value $0.0001; 250,000,000 shares authorized; 95,352,477 shares issued and 82,958,153 shares outstanding at June 30, 2024; 95,016,960 shares issued and 84,123,385 shares outstanding at December 31, 2023 |

8 |

|

|

8 |

|

|

|

|

|

| Additional paid-in capital |

207,199 |

|

|

203,046 |

|

| Treasury stock, at cost |

(127,545) |

|

|

(112,070) |

|

| Accumulated other comprehensive income |

7,940 |

|

|

7,936 |

|

| Accumulated earnings |

121,486 |

|

|

99,484 |

|

| Total stockholders' equity |

209,088 |

|

|

198,404 |

|

| Total liabilities and stockholders' equity |

$ |

950,348 |

|

|

$ |

912,893 |

|