Document

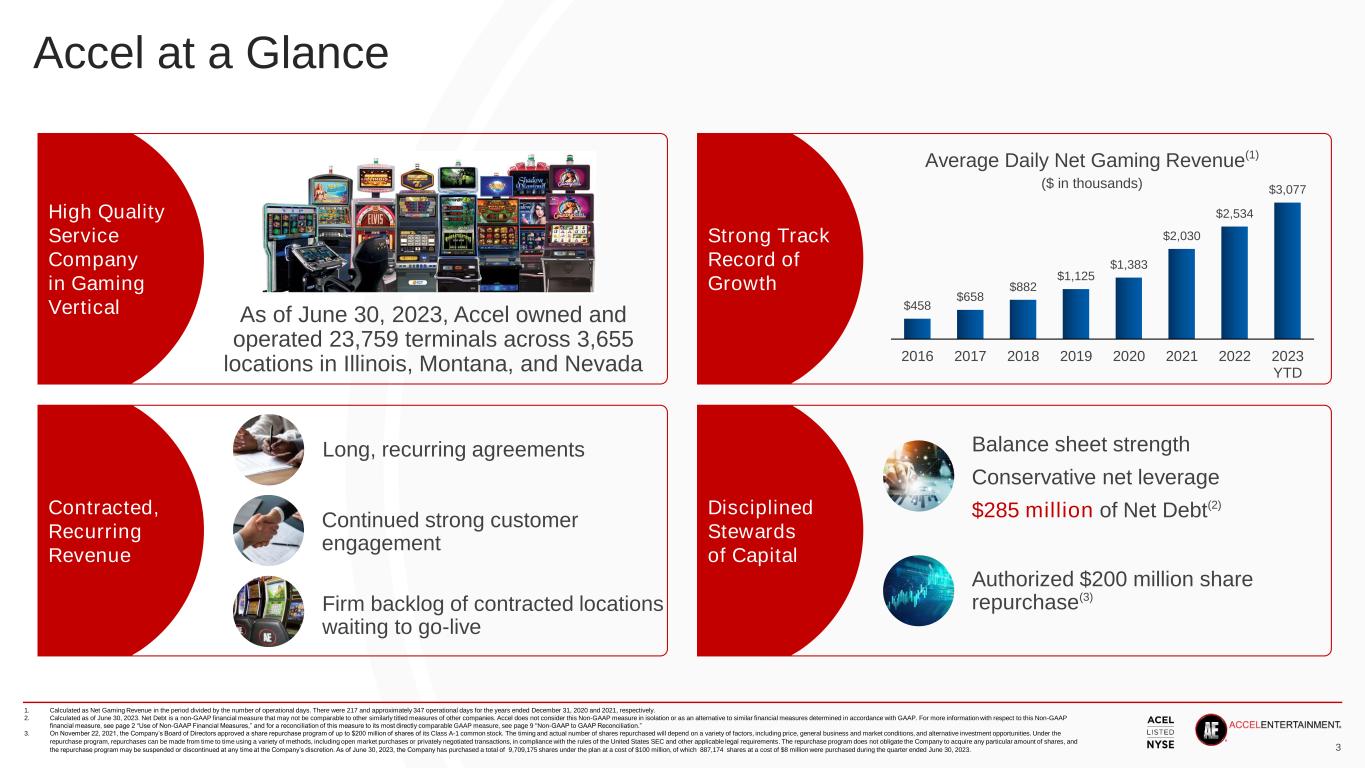

Accel Entertainment Announces Q2 2023 Operating Results

Chicago, IL – August 3, 2023 – Accel Entertainment, Inc. (NYSE: ACEL) today announced certain financial and operating results for the second quarter ended June 30, 2023.

Highlights:

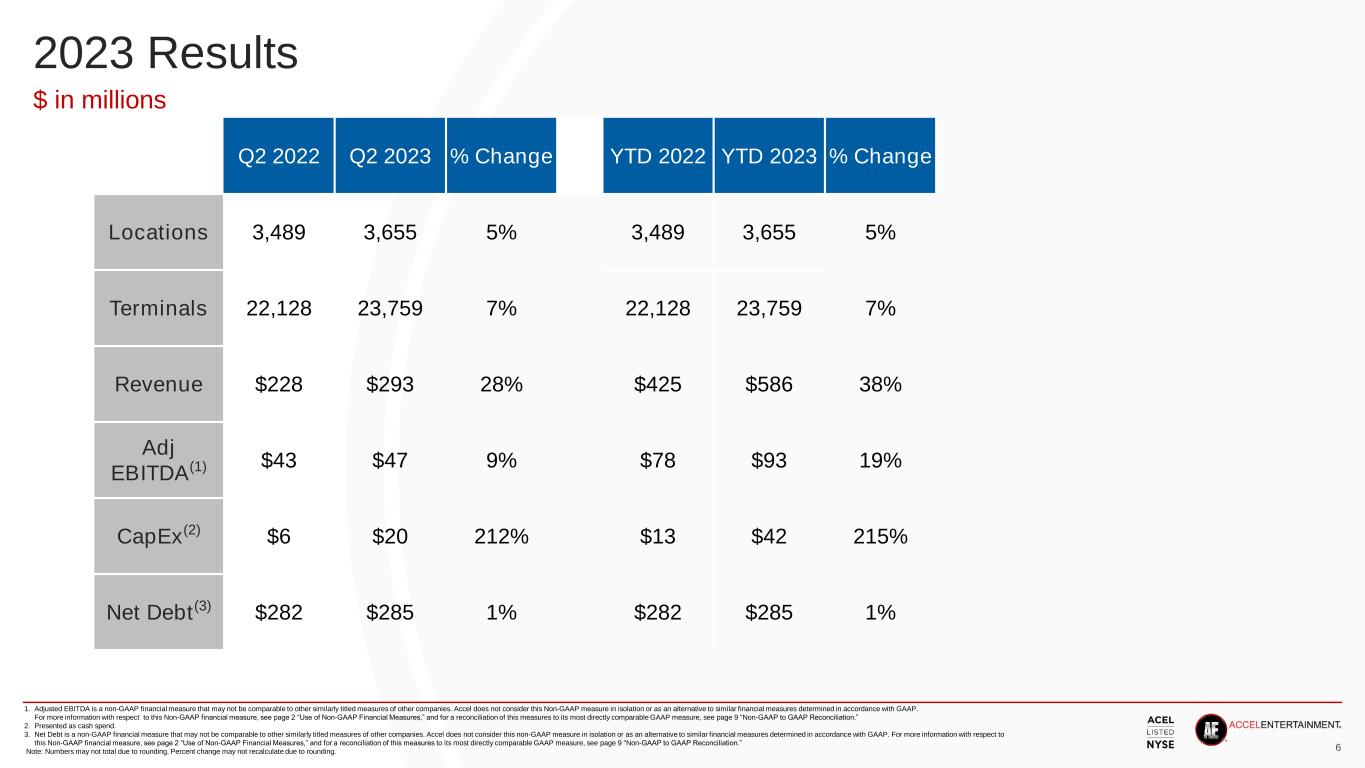

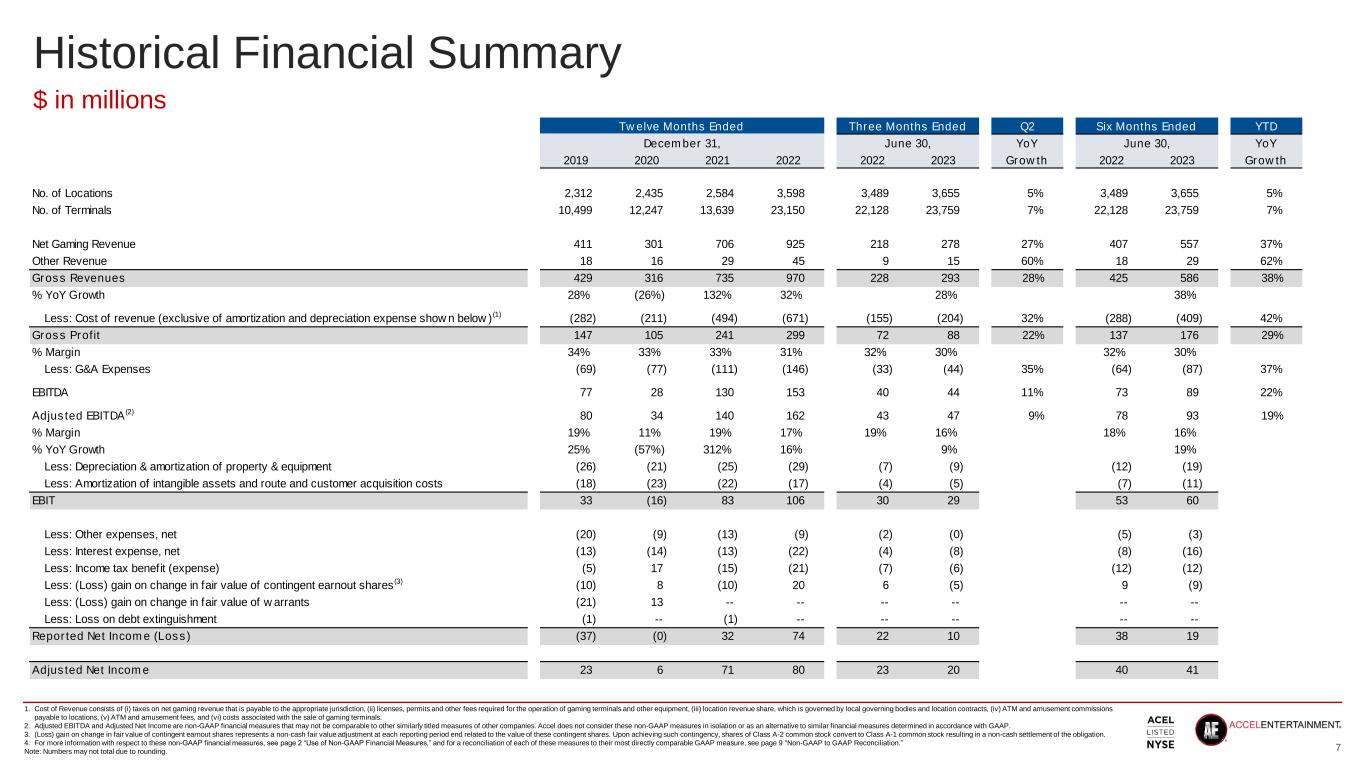

•Ended Q2 2023 with 3,655 locations; an increase of 5% compared to Q2 2022

•Ended Q2 2023 with 23,759 gaming terminals; an increase of 7% compared to Q2 2022

•Revenue of $292.6 million for Q2 2023, an increase of 28% compared to Q2 2022

•Net income of $10.0 million for Q2 2023; a decrease of 56% compared to Q2 2022 primarily attributable to the $4.8 million loss on the change in fair value of the contingent earnout shares in Q2 2023 compared to the $5.7 million gain in Q2 2022

•Adjusted EBITDA of $46.6 million for Q2 2023; an increase of 9% compared to Q2 2022 primarily due to the acquisition of Century and Illinois same stores sales growth of 0.4%

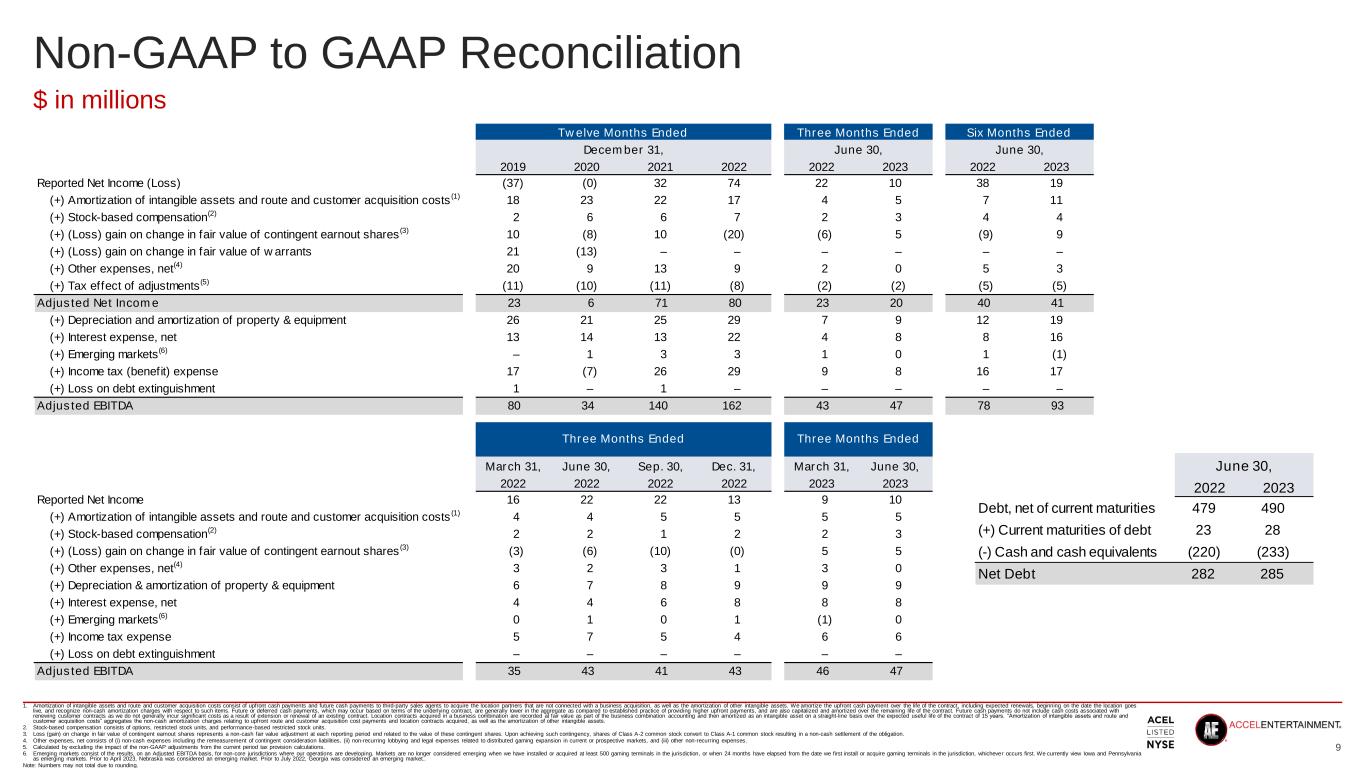

•Q2 2023 ended with $285 million of net debt; an increase of 1% compared to Q2 2022

•Repurchased approximately $8 million of Accel Class A-1 common stock in Q2 2023

•Reached a settlement to resolve the disciplinary complaint with the Illinois Gaming Board for $1.1 million, which is included in Net income and Adjusted EBITDA in our Q2 2023 results

Accel CEO Andy Rubenstein commented, “We are pleased to deliver another record-breaking quarter and I am excited by our future growth opportunities. Despite uncertain economic times, our revenues continue to grow organically outside of acquisitions. As we look beyond Illinois, we have greater visibility on new ways to further extend our position as a national leader in distributed gaming. We expect our strong balance sheet and locally focused business model will offer what we believe is one of the best returns in gaming.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Operations and Other Data |

|

Three Months Ended June 30, |

|

Six Months Ended

June 30, |

| (in thousands) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Total net revenue |

$ |

292,647 |

|

|

$ |

227,869 |

|

|

$ |

585,855 |

|

|

$ |

424,760 |

|

| Operating income |

29,164 |

|

|

27,315 |

|

|

56,836 |

|

|

48,522 |

|

| Income before income tax expense |

16,085 |

|

|

29,246 |

|

|

31,267 |

|

|

49,869 |

|

| Net income |

9,983 |

|

|

22,464 |

|

|

19,165 |

|

|

38,252 |

|

| Other Financial Data: |

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

46,612 |

|

|

42,716 |

|

|

92,730 |

|

|

77,958 |

|

Adjusted net income (2) |

20,435 |

|

|

22,516 |

|

|

41,499 |

|

|

40,121 |

|

|

|

|

|

|

|

| (1) |

Adjusted EBITDA is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; interest expense; emerging markets; and income tax expense. For additional information on Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, see “Non-GAAP Financial Measures—Adjusted EBITDA and Adjusted net income.” |

| (2) |

Adjusted net income is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; and tax effect of adjustments. For additional information on Adjusted net income and a reconciliation of net income to Adjusted net income, see "Non-GAAP Financial Measures—Adjusted net income and Adjusted EBITDA.” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues |

|

|

|

|

|

|

|

| (in thousands) |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net revenues by state: |

|

|

|

|

|

|

|

| Illinois |

$ |

215,947 |

|

|

$ |

205,962 |

|

|

$ |

435,790 |

|

|

$ |

400,821 |

|

| Montana |

39,275 |

|

|

10,825 |

|

|

75,726 |

|

|

10,825 |

|

| Nevada |

29,869 |

|

|

8,920 |

|

|

59,830 |

|

|

8,920 |

|

| Other |

7,556 |

|

|

2,162 |

|

|

14,509 |

|

|

4,194 |

|

| Total net revenues |

$ |

292,647 |

|

|

$ |

227,869 |

|

|

$ |

585,855 |

|

|

$ |

424,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Business Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Locations (1) |

As of June 30, |

|

|

|

2023 |

|

2022 |

|

|

|

|

| Illinois |

2,690 |

|

|

2,572 |

|

|

|

|

|

| Montana |

610 |

|

|

585 |

|

|

|

|

|

| Nevada |

355 |

|

|

332 |

|

|

|

|

|

| Total locations |

3,655 |

|

|

3,489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Terminals (1) |

As of June 30, |

|

|

|

2023 |

|

2022 |

|

|

|

|

| Illinois |

14,767 |

|

|

13,801 |

|

|

|

|

|

| Montana |

6,210 |

|

|

5,742 |

|

|

|

|

|

| Nevada |

2,782 |

|

|

2,585 |

|

|

|

|

|

| Total terminals |

23,759 |

|

|

22,128 |

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Based on a combination of third-party portal data and data from our internal systems. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows Data |

|

Six Months Ended June 30, |

| (in thousands) |

2023 |

|

2022 |

| Net cash provided by operating activities |

$ |

63,845 |

|

|

$ |

41,211 |

|

| Net cash used in investing activities |

(16,245) |

|

(137,267) |

| Net cash (used in) provided by financing activities |

(38,279) |

|

117,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures |

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (in thousands) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income |

$ |

9,983 |

|

|

$ |

22,464 |

|

|

$ |

19,165 |

|

|

$ |

38,252 |

|

| Adjustments: |

|

|

|

|

|

|

|

Amortization of intangible assets and route and customer acquisition costs (1) |

5,284 |

|

|

3,574 |

|

|

10,526 |

|

|

7,122 |

|

Stock-based compensation (2) |

2,567 |

|

|

2,281 |

|

|

4,255 |

|

|

3,886 |

|

Loss (gain) on change in fair value of contingent earnout shares (3) |

4,836 |

|

|

(5,722) |

|

|

9,438 |

|

|

(9,139) |

|

|

|

|

|

|

|

|

|

Other expenses, net (4) |

73 |

|

|

2,232 |

|

|

3,324 |

|

|

4,788 |

|

Tax effect of adjustments (5) |

(2,308) |

|

|

(2,313) |

|

|

(5,209) |

|

|

(4,788) |

|

| Adjusted net income |

$ |

20,435 |

|

|

$ |

22,516 |

|

|

$ |

41,499 |

|

|

$ |

40,121 |

|

| Depreciation and amortization of property and equipment |

9,446 |

|

|

6,598 |

|

|

18,509 |

|

|

12,439 |

|

| Interest expense, net |

8,243 |

|

|

3,791 |

|

|

16,131 |

|

|

7,792 |

|

Emerging markets (6) |

78 |

|

|

716 |

|

|

(720) |

|

|

1,201 |

|

| Income tax expense |

8,410 |

|

|

9,095 |

|

|

17,311 |

|

|

16,405 |

|

| Adjusted EBITDA |

$ |

46,612 |

|

|

$ |

42,716 |

|

|

$ |

92,730 |

|

|

$ |

77,958 |

|

(1)Amortization of intangible assets and route and customer acquisition costs consist of upfront cash payments and future cash payments to third-party sales agents to acquire the location partners that are not connected with a business acquisition, as well as the amortization of other intangible assets. We amortize the upfront cash payment over the life of the contract, including expected renewals, beginning on the date the location goes live, and recognizes non-cash amortization charges with respect to such items. Future or deferred cash payments, which may occur based on terms of the underlying contract, are generally lower in the aggregate as compared to established practice of providing higher upfront payments, and are also capitalized and amortized over the remaining life of the contract. Future cash payments do not include cash costs associated with renewing customer contracts as we do not generally incur significant costs as a result of extension or renewal of an existing contract. Location contracts acquired in a business combination are recorded at fair value as part of the business combination accounting and then amortized as an intangible asset on a straight-line basis over the expected useful life of the contract of 15 years. “Amortization of intangible assets and route and customer acquisition costs” aggregates the non-cash amortization charges relating to upfront route and customer acquisition cost payments and location contracts acquired, as well as the amortization of other intangible assets.

(2)Stock-based compensation consists of options, restricted stock units, and performance-based restricted stock units.

(3)Loss (gain) on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation.

(4)Other expenses, net consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses.

(5)Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations.

(6)Emerging markets consist of the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing. Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first. We currently view Iowa and Pennsylvania as emerging markets. Prior to April 2023, Nebraska was considered an emerging market. Prior to July 2022, Georgia was considered an emerging market.

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Debt to Net Debt |

|

As of June 30, |

| (in thousands) |

2023 |

|

2022 |

| Debt, net of current maturities |

$ |

489,721 |

|

|

$ |

478,635 |

|

| Plus: Current maturities of debt |

28,472 |

|

23,460 |

| Less: Cash and cash equivalents |

(233,434) |

|

(220,168) |

| Net debt |

$ |

284,759 |

|

|

$ |

281,927 |

|

Conference Call

Accel will host an investor conference call on August 3, 2023 at 4:30 p.m. Central Time (5:30 p.m. Eastern Time) to discuss these operating and financial results. Interested parties may join the live webcast by registering at https://www.netroadshow.com/events/login?show=b22ebdaa&confId=52872. Registering in advance of the call will provide listeners with a personalized link to view the webcast and an individual dial-in for the call. This registration link to the live webcast will also be available on Accel’s investor relations website, as well as a replay of the webcast following completion of the call: ir.accelentertainment.com.

About Accel

Accel believes it is the leading distributed gaming operator in the United States on an Adjusted EBITDA basis, and a preferred partner for local business owners in the markets Accel serves. Accel’s business consists of the installation, maintenance and operation of gaming terminals, redemption devices that disburse winnings and contain automated teller machine (“ATM”) functionality, and other amusement devices in authorized non-casino locations such as restaurants, bars, taverns, convenience stores, liquor stores, truck stops, and grocery stores.

Media Contact:

Eric Bonach

H/Advisors Abernathy

212-371-5999

eric.bonach@h-advisors.global

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA and capital expenditures. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel's ability to successfully integrate its business with the business of Century and realize the full benefits of the Century acquisition; Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to manage its growth effectively; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as increased interest rates, increased inflation, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other press releases or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this press release does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this press release.

Non-GAAP Financial Information

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA, Adjusted net income, and Net Debt are non-GAAP financial measures and are key metrics used to monitor ongoing core operations. Management of Accel believes Adjusted EBITDA, Adjusted net income, and Net Debt enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitates company-to-company and period-to-period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items, represents certain nonrecurring items that are unrelated to core performance, or excludes non-core operations. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance.

Adjusted EBITDA, Adjusted net income, and Net Debt

Although Accel excludes amortization of intangible assets and route and customer acquisition costs from Adjusted EBITDA and Adjusted net income, Accel believes that it is important for investors to understand that these route, customer and other intangible assets contribute to revenue generation. Any future acquisitions may result in amortization of intangible assets and route and customer acquisition costs.

Adjusted EBITDA, Adjusted net income, and Net Debt are not recognized terms under GAAP. These non-GAAP financial measures exclude some, but not all, items that affect net income, and these measures may vary among companies. These non-GAAP financial measures are unaudited and have important limitations as an analytical tool, should not be viewed in isolation and do not purport to be alternatives to net income as indicators of operating performance.

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands, except per share amounts) |

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues: |

|

|

|

|

|

|

|

| Net gaming |

$ |

277,551 |

|

|

$ |

218,423 |

|

|

$ |

556,931 |

|

|

$ |

406,885 |

|

| Amusement |

5,630 |

|

|

4,693 |

|

|

12,428 |

|

|

9,683 |

|

| Manufacturing |

4,430 |

|

|

919 |

|

|

6,552 |

|

|

919 |

|

| ATM fees and other |

5,036 |

|

|

3,834 |

|

|

9,944 |

|

|

7,273 |

|

| Total net revenues |

292,647 |

|

|

227,869 |

|

|

585,855 |

|

|

424,760 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Cost of revenue (exclusive of depreciation and amortization expense shown below) |

202,306 |

|

|

154,666 |

|

|

405,860 |

|

|

287,286 |

|

| Cost of manufacturing goods sold (exclusive of depreciation and amortization expense shown below) |

2,154 |

|

|

765 |

|

|

3,562 |

|

|

765 |

|

| General and administrative |

44,220 |

|

|

32,719 |

|

|

87,238 |

|

|

63,838 |

|

| Depreciation and amortization of property and equipment |

9,446 |

|

|

6,598 |

|

|

18,509 |

|

|

12,439 |

|

| Amortization of intangible assets and route and customer acquisition costs |

5,284 |

|

|

3,574 |

|

|

10,526 |

|

|

7,122 |

|

| Other expenses, net |

73 |

|

|

2,232 |

|

|

3,324 |

|

|

4,788 |

|

| Total operating expenses |

263,483 |

|

|

200,554 |

|

|

529,019 |

|

|

376,238 |

|

| Operating income |

29,164 |

|

|

27,315 |

|

|

56,836 |

|

|

48,522 |

|

| Interest expense, net |

8,243 |

|

|

3,791 |

|

|

16,131 |

|

|

7,792 |

|

| Loss (gain) on change in fair value of contingent earnout shares |

4,836 |

|

|

(5,722) |

|

|

9,438 |

|

|

(9,139) |

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

16,085 |

|

|

29,246 |

|

|

31,267 |

|

|

49,869 |

|

| Income tax expense |

6,102 |

|

|

6,782 |

|

|

12,102 |

|

|

11,617 |

|

| Net income |

$ |

9,983 |

|

|

$ |

22,464 |

|

|

$ |

19,165 |

|

|

$ |

38,252 |

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.12 |

|

|

$ |

0.24 |

|

|

$ |

0.22 |

|

|

$ |

0.41 |

|

| Diluted |

0.11 |

|

|

0.24 |

|

|

0.22 |

|

|

0.41 |

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

| Basic |

86,184 |

|

|

92,328 |

|

|

86,529 |

|

|

92,484 |

|

| Diluted |

86,820 |

|

|

93,001 |

|

|

86,971 |

|

|

93,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCEL ENTERTAINMENT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except par value and share amounts) |

June 30, |

|

December 31 |

|

2023 |

|

2022 |

| Assets |

(Unaudited) |

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

233,434 |

|

|

$ |

224,113 |

|

| Accounts receivable, net |

9,713 |

|

|

11,166 |

|

| Prepaid expenses |

8,009 |

|

|

7,407 |

|

| Inventories |

7,313 |

|

|

6,941 |

|

| Income taxes receivable |

909 |

|

|

538 |

|

| Interest rate caplets |

9,603 |

|

|

8,555 |

|

| Investment in convertible notes |

— |

|

|

32,065 |

|

| Other current assets |

11,930 |

|

|

8,427 |

|

| Total current assets |

280,911 |

|

|

299,212 |

|

| Property and equipment, net |

235,682 |

|

|

211,844 |

|

| Noncurrent assets: |

|

|

|

| Route and customer acquisition costs, net |

18,303 |

|

|

18,342 |

|

| Location contracts acquired, net |

181,960 |

|

|

189,343 |

|

| Goodwill |

101,554 |

|

|

100,707 |

|

| Other intangible assets, net |

21,761 |

|

|

22,979 |

|

| Interest rate caplets, net of current |

9,677 |

|

|

11,364 |

|

|

|

|

|

| Other assets |

13,446 |

|

|

8,978 |

|

| Total noncurrent assets |

346,701 |

|

|

351,713 |

|

| Total assets |

$ |

863,294 |

|

|

$ |

862,769 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Current maturities of debt |

$ |

28,472 |

|

|

$ |

23,466 |

|

|

|

|

|

| Current portion of route and customer acquisition costs payable |

1,497 |

|

|

1,487 |

|

| Accrued location gaming expense |

6,264 |

|

|

7,791 |

|

| Accrued state gaming expense |

16,470 |

|

|

16,605 |

|

| Accounts payable and other accrued expenses |

24,513 |

|

|

22,302 |

|

| Accrued compensation and related expenses |

8,039 |

|

|

10,607 |

|

| Current portion of consideration payable |

7,497 |

|

|

7,647 |

|

| Total current liabilities |

92,752 |

|

|

89,905 |

|

| Long-term liabilities: |

|

|

|

| Debt, net of current maturities |

489,721 |

|

|

518,566 |

|

| Route and customer acquisition costs payable, less current portion |

4,566 |

|

|

5,137 |

|

| Consideration payable, less current portion |

5,945 |

|

|

6,872 |

|

| Contingent earnout share liability |

32,726 |

|

|

23,288 |

|

| Other long-term liabilities |

5,514 |

|

|

3,390 |

|

| Deferred income tax liability, net |

43,322 |

|

|

37,021 |

|

| Total long-term liabilities |

581,794 |

|

|

594,274 |

|

| Stockholders’ equity: |

|

|

|

Preferred Stock, par value of $0.0001; 1,000,000 shares authorized; 0 shares issued and outstanding at June 30, 2023 and December 31, 2022 |

— |

|

|

— |

|

| Class A-1 Common Stock, par value $0.0001; 250,000,000 shares authorized; 94,799,278 shares issued and 85,605,725 shares outstanding at June 30, 2023; 94,504,051 shares issued and 86,674,390 shares outstanding at December 31, 2022 |

9 |

|

|

9 |

|

|

|

|

|

| Additional paid-in capital |

197,690 |

|

|

194,157 |

|

| Treasury stock, at cost |

(94,133) |

|

|

(81,697) |

|

| Accumulated other comprehensive income |

12,136 |

|

|

12,240 |

|

| Accumulated earnings |

73,046 |

|

|

53,881 |

|

| Total stockholders' equity |

188,748 |

|

|

178,590 |

|

| Total liabilities and stockholders' equity |

$ |

863,294 |

|

|

$ |

862,769 |

|