Document

Magnolia Oil & Gas Corporation Announces Second Quarter 2022 Results

HOUSTON, TX, August 2, 2022 - Magnolia Oil & Gas Corporation (“Magnolia,” “we,” “our,” or the “Company”) (NYSE: MGY) today announced its financial and operational results for the second quarter of 2022.

Second Quarter 2022 Highlights:

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions, except per share data) |

For the

Quarter Ended

June 30, 2022 |

For the

Quarter Ended

June 30, 2021 |

Percentage increase (decrease) |

| Net income |

$ |

299.9 |

|

$ |

116.2 |

|

158 |

% |

Adjusted net income(1) |

$ |

293.6 |

|

$ |

135.0 |

|

117 |

% |

Diluted weighted average total shares outstanding(2) |

222.4 |

|

242.2 |

|

(8) |

% |

| Earnings per share - diluted |

$ |

1.32 |

|

$ |

0.48 |

|

175 |

% |

Adjusted EBITDAX(1) |

$ |

393.4 |

|

$ |

195.1 |

|

102 |

% |

| Capital expenditures - D&C |

$ |

122.0 |

|

$ |

53.8 |

|

127 |

% |

| Average daily production (Mboe/d) |

74.2 |

|

64.9 |

|

14 |

% |

| Cash balance as of period end |

$ |

501.9 |

|

$ |

190.3 |

|

164 |

% |

Second Quarter 2022 Highlights:

•Magnolia reported second quarter 2022 net income attributable to Class A Common Stock of $250.6 million, or $1.32 per diluted share. Second quarter 2022 total adjusted net income increased 117% to $293.6 million and diluted weighted average total shares outstanding decreased by 8% to 222.4 million(2) compared to second quarter 2021.

•Adjusted EBITDAX was $393.4 million during the second quarter of 2022, driven by strong production growth and significantly higher product prices as compared to prior year results. Total drilling and completions (“D&C”) capital during the second quarter was $122.0 million, representing just 31% of adjusted EBITDAX.

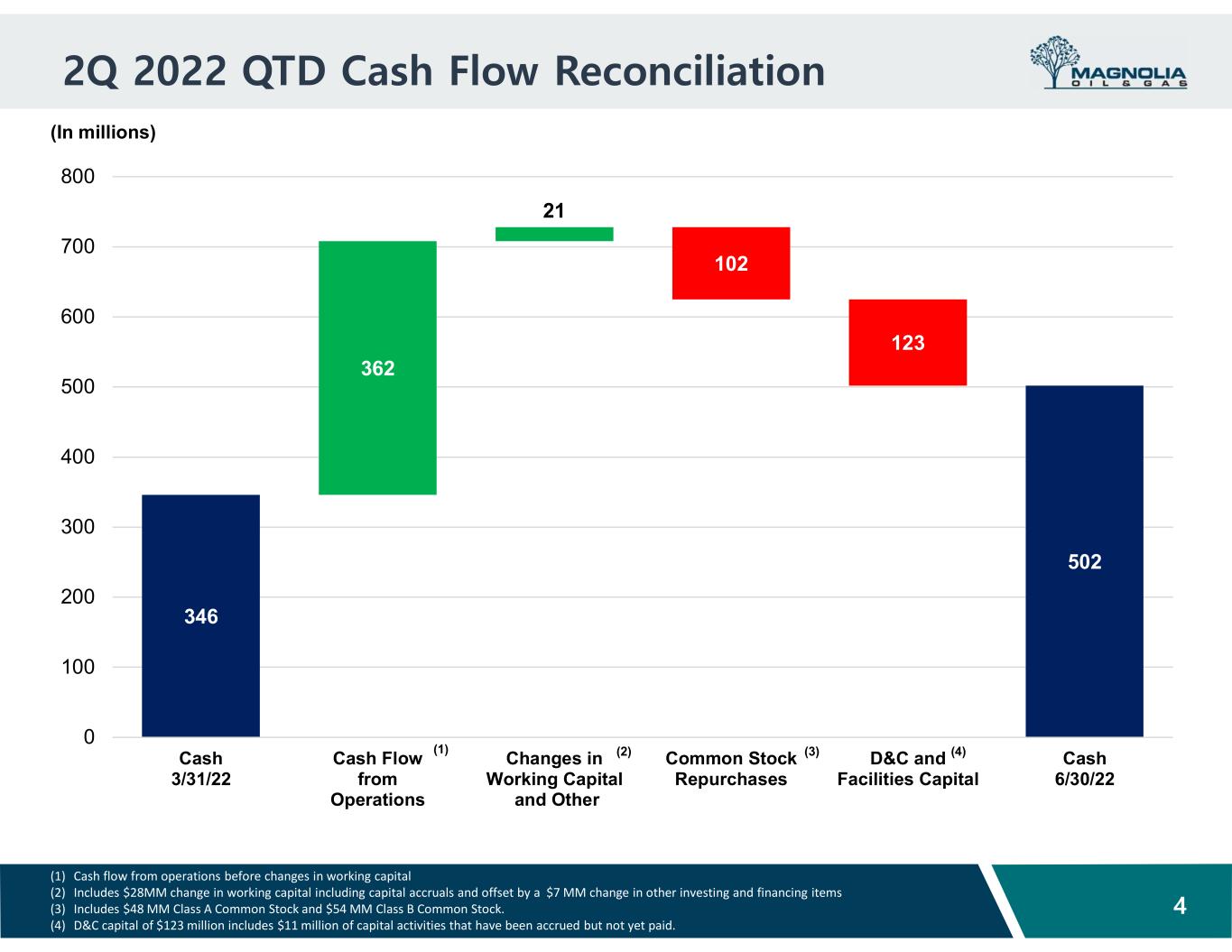

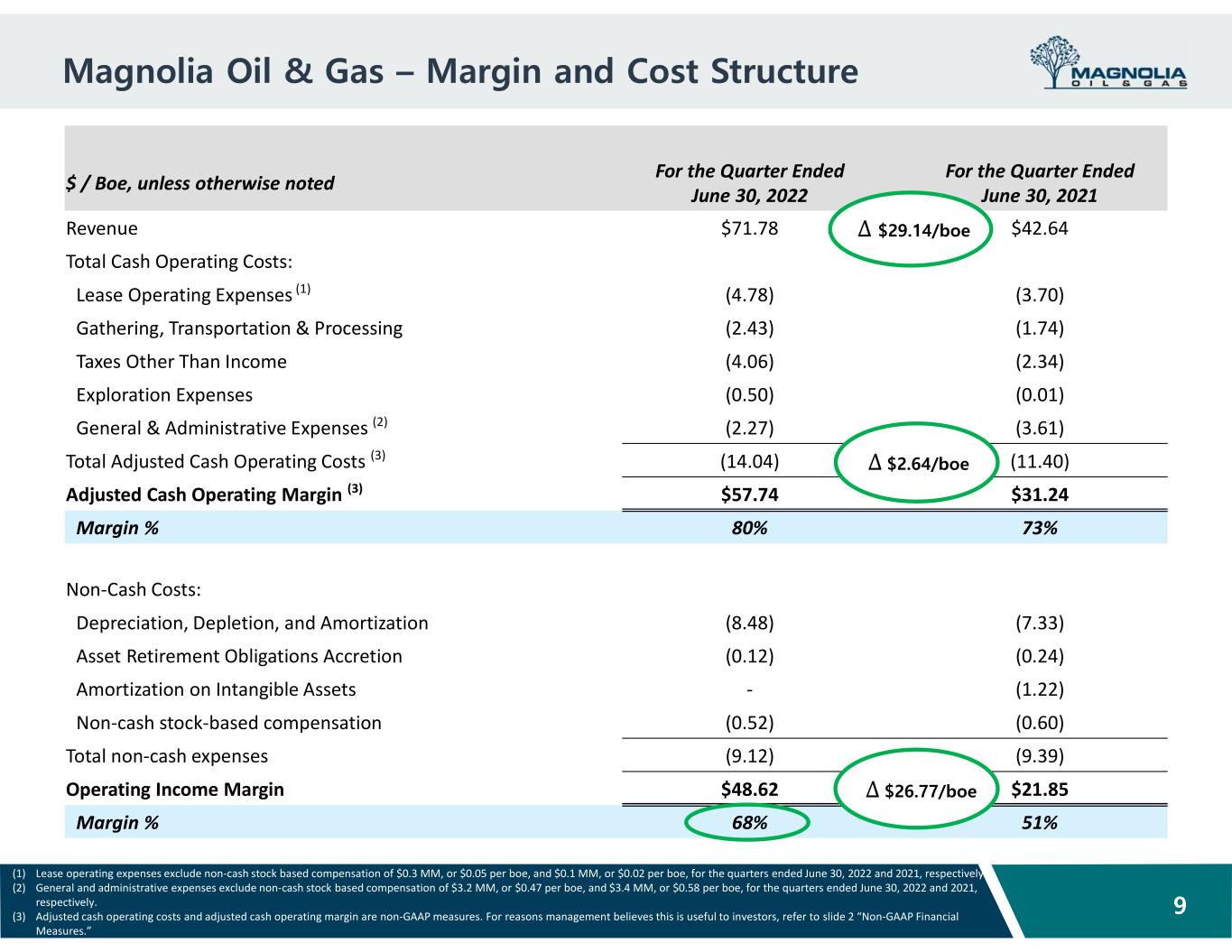

•Net cash provided by operating activities was $379.1 million during the second quarter and the Company generated free cash flow(1) of $250.8 million. Magnolia generated operating income as a percentage of revenue of 68%.

•Total production in the second quarter of 2022 grew 14% to 74.2 thousand barrels of oil equivalent per day (“Mboe/d”) compared to the prior-year quarter and exceeding the high end of our earlier production guidance. As a result, we currently expect full year 2022 production growth in the range of 12% to 14% compared to 2021 levels.

•During the second quarter, Magnolia repurchased a total of 4.1 million shares of Class A and Class B Common Stock, for $102.4 million, and bringing the total shares repurchased during 2022 to 10.1 million shares. At the end of the second quarter 2022, Magnolia had 12.3 million Class A Common shares remaining under its current repurchase authorization.

•As previously announced, the Board of Directors declared a cash dividend of $0.10 per share of Class A common stock, and a cash distribution of $0.10 per Class B unit payable on September 1, 2022 to shareholders of record as of August 12, 2022. Beginning with this distribution, Magnolia will move to a quarterly dividend payment from a semi-annual distribution schedule. This represents a $0.40 per share annualized base payout rate or a 43% increase to Magnolia’s dividend compared to the $0.28 per share distribution for full year 2021. We expect our dividend to grow at least 10 percent annually and will reassess the dividend rate in early 2023.

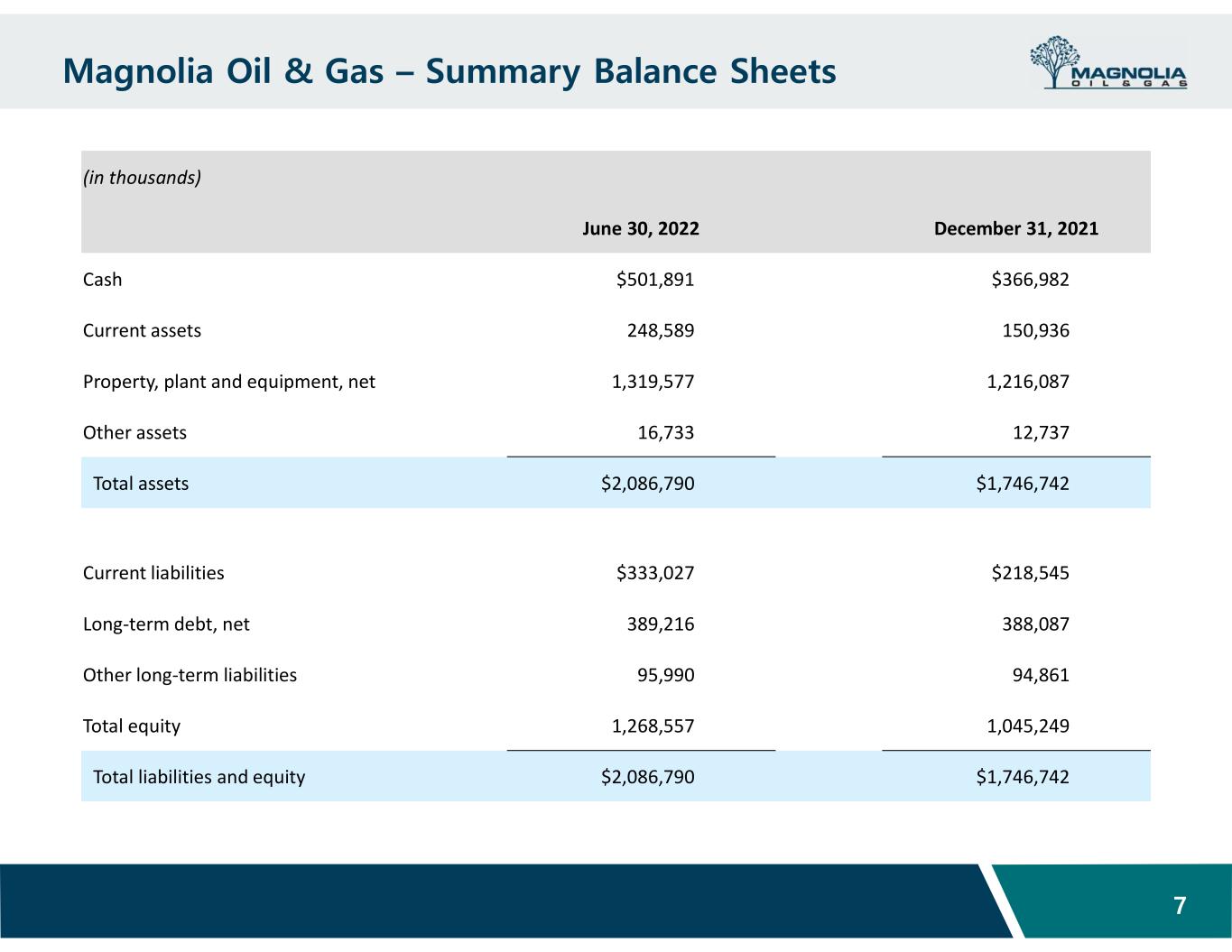

•Magnolia ended the quarter with $501.9 million of cash on the balance sheet and remains undrawn on its $450.0 million revolving credit facility, with no debt maturities until 2026 and has no plans to increase its debt levels.

(1) Adjusted net income, adjusted EBITDAX and free cash flow are non-GAAP financial measures. For reconciliations to the most comparable GAAP measures, please see “Non-GAAP Financial Measures” at the end of this press release.

(2) Weighted average total shares outstanding include diluted weighted average shares of Class A Common Stock outstanding during the period and shares of Class B Common Stock, which are anti-dilutive in the calculation of weighted average number of common shares outstanding.

“Magnolia has just completed its fourth year as a public company, and our business model remains the same. We have consistently executed our strategy, which prioritizes disciplined capital spending, moderate and steady production growth, generating high pre-tax margins and significant free cash flow, while maintaining low levels of debt,” said Chairman, President, and CEO Steve Chazen. “We remain efficient in allocating our cash flows and limit our spending on drilling and completing wells to 55 percent of our EBITDAX, though we will run well below that level this year. These principles in addition to improved operating efficiencies have led to continued profitable growth while generating attractive returns for our shareholders.

“Our strong second quarter financial results benefited from record quarterly production and high product price realizations which boosted our pretax operating margins to 68 percent. While we spent just 31 percent of our adjusted EBITDAX drilling and completing wells during the second quarter, our capital was somewhat higher than expected partly due to increased non-operated activity. Continued drilling efficiencies at Giddings and the higher non-op activity added more net wells and more production, resulting in 3 percent sequential volume growth. Compared to year-ago levels, we increased our total production 14 percent, and reduced the fully diluted share count by 8 percent. We returned more than 40 percent of the $251 million of free cash flow generated during the second quarter through share repurchases, while ending the period with more than half a billion dollars of cash.

“We plan to continue operating two drilling rigs during the remainder of the year. Continued strong well performance and ongoing drilling efficiencies at Giddings, combined with higher non-op activity, is expected to provide full-year 2022 production growth of 12 to 14 percent. Additionally, we plan to repurchase at least 1 percent of our outstanding shares each quarter. Magnolia’s board has declared a cash dividend of 10 cents per share payable next month. This payment will transition Magnolia to a quarterly from a semi-annual dividend distribution schedule. Next month’s payment represents a 40 cent per share annualized base rate or a 43 percent increase to Magnolia’s dividend for 2021. Consistent and moderate production growth combined with ongoing share reductions supports our long-term investment proposition of double-digit annual dividend growth.”

Operational Update

Second quarter 2022 total company production averaged 74.2 Mboe/d, representing more than a 3 percent sequential increase and 14 percent higher than the prior year’s second quarter. Overall production grew during the quarter despite spending only 31 percent of adjusted EBITDAX on drilling and completing wells. Production was above the high end of our guidance mainly due to better well performance from both of our operating areas as well as higher non-op activity.

Magnolia continues to operate two drilling rigs and expects to maintain this level of activity for the balance of the year. One rig will continue to drill multi-well development pads in our Giddings asset. The second rig will drill a mix of wells in both the Karnes and Giddings areas, including some appraisal wells in Giddings. We continue to drive improved operating efficiencies to help mitigate some of the oil field service cost inflation. Prices for most goods and services have only recently exceeded levels seen prior to the pandemic when commodity prices were substantially lower resulting in continued high returns on capital and operating income margins.

Additional Guidance

Magnolia has shown consistent and steady production growth due to strong well performance and faster cycle times. Additional non-operated activity has increased in the Eagle Ford which has contributed to both higher production and capital. As a result, we now expect our full-year 2022 production to grow by 12 to 14 percent compared to 2021. Third quarter production is expected to be 74 to 76 Mboe/d and D&C capital is expected to be in the range of $105 to $115 million. Oil price differentials are anticipated to be approximately a $2 to $3 per barrel discount to Magellan East Houston and Magnolia remains completely unhedged for all its oil and natural gas production. The fully diluted total share count for the third quarter of 2022 is expected to be approximately 219 million shares which is 7 percent lower than third quarter 2021 levels.

Quarterly Report on Form 10-Q

Magnolia's financial statements and related footnotes will be available in its Quarterly Report on Form 10-Q for the three months ended June 30, 2022, which is expected to be filed with the U.S. Securities and Exchange Commission (“SEC”) on August 3, 2022.

Conference Call and Webcast

Magnolia will host an investor conference call on Wednesday, August 3, 2022 at 10:00 a.m. Central (11:00 a.m. Eastern) to discuss these operating and financial results. Interested parties may join the webcast by visiting Magnolia's website at www.magnoliaoilgas.com/investors/events-and-presentations and clicking on the webcast link or by dialing 1-844-701-1059. A replay of the webcast will be posted on Magnolia's website following completion of the call.

About Magnolia Oil & Gas Corporation

Magnolia (MGY) is a publicly traded oil and gas exploration and production company with operations primarily in South Texas in the core of the Eagle Ford Shale and Austin Chalk formations. Magnolia focuses on generating value for shareholders through steady production growth, strong pre-tax margins, and free cash flow. For more information, visit www.magnoliaoilgas.com.

Cautionary Note Regarding Forward-Looking Statements

The information in this press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Magnolia’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, the words could, should, will, may, believe, anticipate, intend, estimate, expect, project, the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that the forward looking statements contained in this press release are subject to the following factors: (i) the economic effects of the COVID-19 pandemic and actions taken by federal, state and local governments and other third parties in response to the pandemic; (ii) the outcome of any legal proceedings that may be instituted against Magnolia; (iii) Magnolia’s ability to realize the anticipated benefits of its acquisitions, which may be affected by, among other things, competition and the ability of Magnolia to grow and manage growth profitably; (iv) changes in applicable laws or regulations; (v) geopolitical and business conditions in key regions of the world; and (vi) the possibility that Magnolia may be adversely affected by other economic, business, and/or competitive factors, including inflation. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Magnolia’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Contacts for Magnolia Oil & Gas Corporation

Investors

Brian Corales

(713) 842-9036

bcorales@mgyoil.com

Media

Art Pike

(713) 842-9057

apike@mgyoil.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Magnolia Oil & Gas Corporation |

| Operating Highlights |

|

|

|

|

|

|

|

|

|

| |

|

For the Quarters Ended |

|

For the Six Months Ended |

| |

|

June 30, 2022 |

|

June 30, 2021 |

|

June 30, 2022 |

|

June 30, 2021 |

| Production: |

|

|

|

|

|

|

|

|

| Oil (MBbls) |

|

3,019 |

|

|

2,903 |

|

|

5,835 |

|

|

5,495 |

|

| Natural gas (MMcf) |

|

12,464 |

|

|

9,947 |

|

|

24,842 |

|

|

20,188 |

|

| Natural gas liquids (MBbls) |

|

1,656 |

|

|

1,349 |

|

|

3,242 |

|

|

2,654 |

|

| Total (Mboe) |

|

6,752 |

|

|

5,910 |

|

|

13,217 |

|

|

11,514 |

|

|

|

|

|

|

|

|

|

|

| Average daily production: |

|

|

|

|

|

|

|

|

| Oil (Bbls/d) |

|

33,178 |

|

|

31,897 |

|

|

32,239 |

|

|

30,361 |

|

| Natural gas (Mcf/d) |

|

136,966 |

|

|

109,313 |

|

|

137,247 |

|

|

111,536 |

|

| Natural gas liquids (Bbls/d) |

|

18,194 |

|

|

14,830 |

|

|

17,911 |

|

|

14,661 |

|

| Total (boe/d) |

|

74,200 |

|

|

64,946 |

|

|

73,024 |

|

|

63,611 |

|

|

|

|

|

|

|

|

|

|

| Revenues (in thousands): |

|

|

|

|

|

|

|

|

| Oil revenues |

|

$ |

332,791 |

|

|

$ |

188,701 |

|

|

$ |

595,459 |

|

|

$ |

335,659 |

|

| Natural gas revenues |

|

85,345 |

|

|

33,314 |

|

|

141,925 |

|

|

68,977 |

|

| Natural gas liquids revenues |

|

66,513 |

|

|

30,035 |

|

|

125,105 |

|

|

56,521 |

|

| Total Revenues |

|

$ |

484,649 |

|

|

$ |

252,050 |

|

|

$ |

862,489 |

|

|

$ |

461,157 |

|

|

|

|

|

|

|

|

|

|

| Average sales price: |

|

|

|

|

|

|

|

|

| Oil (per Bbl) |

|

$ |

110.22 |

|

|

$ |

65.01 |

|

|

$ |

102.04 |

|

|

$ |

61.08 |

|

| Natural gas (per Mcf) |

|

6.85 |

|

|

3.35 |

|

|

5.71 |

|

|

3.42 |

|

| Natural gas liquids (per Bbl) |

|

40.17 |

|

|

22.26 |

|

|

38.59 |

|

|

21.30 |

|

| Total (per boe) |

|

$ |

71.78 |

|

|

$ |

42.64 |

|

|

$ |

65.25 |

|

|

$ |

40.05 |

|

|

|

|

|

|

|

|

|

|

| NYMEX WTI (per Bbl) |

|

$ |

108.42 |

|

|

$ |

66.06 |

|

|

$ |

101.44 |

|

|

$ |

61.95 |

|

| NYMEX Henry Hub (per Mcf) |

|

$ |

7.17 |

|

|

$ |

2.83 |

|

|

$ |

6.05 |

|

|

$ |

2.77 |

|

| Realization to benchmark: |

|

|

|

|

|

|

|

|

| Oil (% of WTI) |

|

102 |

% |

|

98 |

% |

|

101 |

% |

|

99 |

% |

| Natural Gas (% of Henry Hub) |

|

96 |

% |

|

118 |

% |

|

94 |

% |

|

123 |

% |

|

|

|

|

|

|

|

|

|

| Operating expenses (in thousands): |

|

|

|

|

|

|

|

|

| Lease operating expenses |

|

$ |

32,604 |

|

|

$ |

21,971 |

|

|

$ |

61,348 |

|

|

$ |

41,363 |

|

| Gathering, transportation and processing |

|

16,381 |

|

|

10,287 |

|

|

32,221 |

|

|

20,530 |

|

| Taxes other than income |

|

27,411 |

|

|

13,812 |

|

|

48,293 |

|

|

24,574 |

|

| Depreciation, depletion and amortization |

|

57,254 |

|

|

43,332 |

|

|

110,360 |

|

|

86,275 |

|

|

|

|

|

|

|

|

|

|

| Operating costs per boe: |

|

|

|

|

|

|

|

|

| Lease operating expenses |

|

$ |

4.83 |

|

|

$ |

3.72 |

|

|

$ |

4.64 |

|

|

$ |

3.59 |

|

| Gathering, transportation and processing |

|

2.43 |

|

|

1.74 |

|

|

2.44 |

|

|

1.78 |

|

| Taxes other than income |

|

4.06 |

|

|

2.34 |

|

|

3.65 |

|

|

2.13 |

|

| Depreciation, depletion and amortization |

|

8.48 |

|

|

7.33 |

|

|

8.35 |

|

|

7.49 |

|

Magnolia Oil & Gas Corporation

Consolidated Statements of Operations

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

|

For the Six Months Ended |

| |

|

June 30, 2022 |

|

June 30, 2021 |

|

June 30, 2022 |

|

June 30, 2021 |

| REVENUES |

|

|

|

|

|

|

|

|

| Oil revenues |

|

$ |

332,791 |

|

|

$ |

188,701 |

|

|

$ |

595,459 |

|

|

$ |

335,659 |

|

| Natural gas revenues |

|

85,345 |

|

|

33,314 |

|

|

141,925 |

|

|

68,977 |

|

| Natural gas liquids revenues |

|

66,513 |

|

|

30,035 |

|

|

125,105 |

|

|

56,521 |

|

| Total revenues |

|

484,649 |

|

|

252,050 |

|

|

862,489 |

|

|

461,157 |

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

| Lease operating expenses |

|

32,604 |

|

|

21,971 |

|

|

61,348 |

|

|

41,363 |

|

| Gathering, transportation and processing |

|

16,381 |

|

|

10,287 |

|

|

32,221 |

|

|

20,530 |

|

| Taxes other than income |

|

27,411 |

|

|

13,812 |

|

|

48,293 |

|

|

24,574 |

|

| Exploration expenses |

|

3,408 |

|

|

62 |

|

|

8,946 |

|

|

2,124 |

|

| Asset retirement obligations accretion |

|

802 |

|

|

1,405 |

|

|

1,590 |

|

|

2,736 |

|

| Depreciation, depletion and amortization |

|

57,254 |

|

|

43,332 |

|

|

110,360 |

|

|

86,275 |

|

| Amortization of intangible assets |

|

— |

|

|

7,233 |

|

|

— |

|

|

9,346 |

|

| General and administrative expenses |

|

18,530 |

|

|

24,757 |

|

|

35,601 |

|

|

45,122 |

|

| Total operating expenses |

|

156,390 |

|

|

122,859 |

|

|

298,359 |

|

|

232,070 |

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

328,259 |

|

|

129,191 |

|

|

564,130 |

|

|

229,087 |

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(7,017) |

|

|

(8,752) |

|

|

(16,374) |

|

|

(16,046) |

|

| Loss on derivatives, net |

|

— |

|

|

(2,004) |

|

|

— |

|

|

(2,486) |

|

| Other income (expense), net |

|

6,538 |

|

|

135 |

|

|

6,744 |

|

|

(94) |

|

| Total other expense, net |

|

(479) |

|

|

(10,621) |

|

|

(9,630) |

|

|

(18,626) |

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

327,780 |

|

|

118,570 |

|

|

554,500 |

|

|

210,461 |

|

| Income tax expense |

|

27,875 |

|

|

2,398 |

|

|

45,975 |

|

|

2,797 |

|

| NET INCOME |

|

299,905 |

|

|

116,172 |

|

|

508,525 |

|

|

207,664 |

|

| LESS: Net income attributable to noncontrolling interest |

|

49,322 |

|

|

31,727 |

|

|

91,903 |

|

|

59,975 |

|

| NET INCOME ATTRIBUTABLE TO CLASS A COMMON STOCK |

|

250,583 |

|

|

84,445 |

|

|

416,622 |

|

|

147,689 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME PER COMMON SHARE |

|

|

|

|

| Basic |

|

$ |

1.32 |

|

|

$ |

0.48 |

|

|

$ |

2.23 |

|

|

$ |

0.86 |

|

| Diluted |

|

$ |

1.32 |

|

|

$ |

0.48 |

|

|

$ |

2.22 |

|

|

$ |

0.85 |

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING |

|

|

|

|

| Basic |

|

188,146 |

|

|

175,169 |

|

|

185,377 |

|

|

171,083 |

|

| Diluted |

|

188,589 |

|

|

176,129 |

|

|

185,894 |

|

|

172,085 |

|

WEIGHTED AVERAGE NUMBER OF CLASS B SHARES OUTSTANDING (1) |

|

33,779 |

|

|

66,088 |

|

|

38,994 |

|

|

73,131 |

|

(1) Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding.

Magnolia Oil & Gas Corporation

Summary Cash Flow Data

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

|

For the Six Months Ended |

|

|

June 30, 2022 |

|

June 30, 2021 |

|

June 30, 2022 |

|

June 30, 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

| NET INCOME |

|

$ |

299,905 |

|

|

$ |

116,172 |

|

|

$ |

508,525 |

|

|

$ |

207,664 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation, depletion and amortization |

|

57,254 |

|

|

43,332 |

|

|

110,360 |

|

|

86,275 |

|

| Amortization of intangible assets |

|

— |

|

|

7,233 |

|

|

— |

|

|

9,346 |

|

| Asset retirement obligations accretion |

|

802 |

|

|

1,405 |

|

|

1,590 |

|

|

2,736 |

|

| Amortization of deferred financing costs |

|

967 |

|

|

1,108 |

|

|

3,779 |

|

|

2,018 |

|

| Unrealized loss on derivatives, net |

|

— |

|

|

1,838 |

|

|

— |

|

|

2,320 |

|

| Stock based compensation |

|

3,517 |

|

|

3,528 |

|

|

6,402 |

|

|

6,233 |

|

| Other |

|

— |

|

|

— |

|

|

— |

|

|

(85) |

|

| Net change in operating assets and liabilities |

|

16,690 |

|

|

13,263 |

|

|

(12,652) |

|

|

(10,476) |

|

| Net cash provided by operating activities |

|

379,135 |

|

|

187,879 |

|

|

618,004 |

|

|

306,031 |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

| Acquisitions |

|

(3,292) |

|

|

(8,851) |

|

|

(4,347) |

|

|

(9,409) |

|

| Additions to oil and natural gas properties |

|

(123,231) |

|

|

(54,190) |

|

|

(207,461) |

|

|

(94,356) |

|

| Changes in working capital associated with additions to oil and natural gas properties |

|

11,548 |

|

|

13,558 |

|

|

25,494 |

|

|

11,814 |

|

| Other investing |

|

(1,149) |

|

|

(239) |

|

|

(1,018) |

|

|

(655) |

|

| Net cash used in investing activities |

|

(116,124) |

|

|

(49,722) |

|

|

(187,332) |

|

|

(92,606) |

|

|

|

|

|

|

|

|

|

|

| CASH FLOW FROM FINANCING ACTIVITIES |

|

|

|

|

| Class A Common Stock repurchases |

|

(48,669) |

|

|

(24,047) |

|

|

(92,155) |

|

|

(44,328) |

|

| Class B Common Stock purchase and cancellation |

|

(54,020) |

|

|

(71,750) |

|

|

(138,753) |

|

|

(122,531) |

|

| Non-compete settlement |

|

— |

|

|

(24,922) |

|

|

— |

|

|

(42,074) |

|

| Dividends paid |

|

(2) |

|

|

— |

|

|

(37,176) |

|

|

— |

|

| Cash paid for debt modification |

|

— |

|

|

(4,976) |

|

|

(5,272) |

|

|

(4,976) |

|

| Distributions to noncontrolling interest owners |

|

(4,606) |

|

|

(276) |

|

|

(16,243) |

|

|

(431) |

|

| Other financing activities |

|

(219) |

|

|

(98) |

|

|

(6,164) |

|

|

(1,364) |

|

| Net cash used in financing activities |

|

(107,516) |

|

|

(126,069) |

|

|

(295,763) |

|

|

(215,704) |

|

|

|

|

|

|

|

|

|

|

| NET CHANGE IN CASH AND CASH EQUIVALENTS |

|

155,495 |

|

|

12,088 |

|

|

134,909 |

|

|

(2,279) |

|

| Cash and cash equivalents – Beginning of period |

|

346,396 |

|

|

178,194 |

|

|

366,982 |

|

|

192,561 |

|

| Cash and cash equivalents – End of period |

|

$ |

501,891 |

|

|

$ |

190,282 |

|

|

$ |

501,891 |

|

|

$ |

190,282 |

|

Magnolia Oil & Gas Corporation

Summary Balance Sheet Data

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

December 31, 2021 |

| Cash and cash equivalents |

|

$ |

501,891 |

|

|

$ |

366,982 |

|

| Other current assets |

|

248,589 |

|

|

150,936 |

|

| Property, plant and equipment, net |

|

1,319,577 |

|

|

1,216,087 |

|

| Other assets |

|

16,733 |

|

|

12,737 |

|

| Total assets |

|

$ |

2,086,790 |

|

|

$ |

1,746,742 |

|

|

|

|

|

|

| Current liabilities |

|

$ |

333,027 |

|

|

$ |

218,545 |

|

| Long-term debt, net |

|

389,216 |

|

|

388,087 |

|

| Other long-term liabilities |

|

95,990 |

|

|

94,861 |

|

| Common stock |

|

24 |

|

|

24 |

|

| Additional paid in capital |

|

1,647,637 |

|

|

1,689,500 |

|

| Treasury stock |

|

(257,837) |

|

|

(164,599) |

|

| Accumulated deficit |

|

(291,546) |

|

|

(708,168) |

|

| Noncontrolling interest |

|

170,279 |

|

|

228,492 |

|

| Total liabilities and equity |

|

$ |

2,086,790 |

|

|

$ |

1,746,742 |

|

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of net income to adjusted EBITDAX

In this press release, we refer to adjusted EBITDAX, a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders, and rating agencies. We define adjusted EBITDAX as net income before interest expense, income taxes, depreciation, depletion and amortization, amortization of intangible assets, exploration costs, and accretion of asset retirement obligations, adjusted to exclude the effect of certain items included in net income. Adjusted EBITDAX is not a measure of net income in accordance with GAAP.

Our management believes that adjusted EBITDAX is useful because it allows them to more effectively evaluate our operating performance and compare the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We also believe that securities analysts, investors, and other interested parties may use adjusted EBITDAX in the evaluation of our Company. We exclude the items listed above from net income in arriving at adjusted EBITDAX because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of adjusted EBITDAX. Our presentation of adjusted EBITDAX should not be construed as an inference that our results will be unaffected by unusual or non-recurring items. Our computations of adjusted EBITDAX may not be comparable to other similarly titled measures of other companies.

The following table presents a reconciliation of net income to adjusted EBITDAX, our most directly comparable financial measure, calculated and presented in accordance with GAAP:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

| (In thousands) |

|

June 30, 2022 |

|

June 30, 2021 |

| NET INCOME |

|

$ |

299,905 |

|

|

$ |

116,172 |

|

| Exploration expenses |

|

3,408 |

|

|

62 |

|

| Asset retirement obligations accretion |

|

802 |

|

|

1,405 |

|

| Depreciation, depletion and amortization |

|

57,254 |

|

|

43,332 |

|

| Amortization of intangible assets |

|

— |

|

|

7,233 |

|

| Interest expense, net |

|

7,017 |

|

|

8,752 |

|

| Income tax expense |

|

27,875 |

|

|

2,398 |

|

| EBITDAX |

|

396,261 |

|

|

179,354 |

|

Service agreement transition costs (1) |

|

— |

|

|

10,345 |

|

| Other income adjustment |

|

(6,333) |

|

|

— |

|

| Non-cash stock based compensation expense |

|

3,517 |

|

|

3,528 |

|

| Unrealized loss on derivatives, net |

|

— |

|

|

1,838 |

|

| Adjusted EBITDAX |

|

$ |

393,445 |

|

|

$ |

195,065 |

|

(1) Costs incurred during the transition period related to the termination of the Services Agreement with EnerVest Operating L.L.C. included within “General and administrative expenses” on the Company's consolidated statements of operations.

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

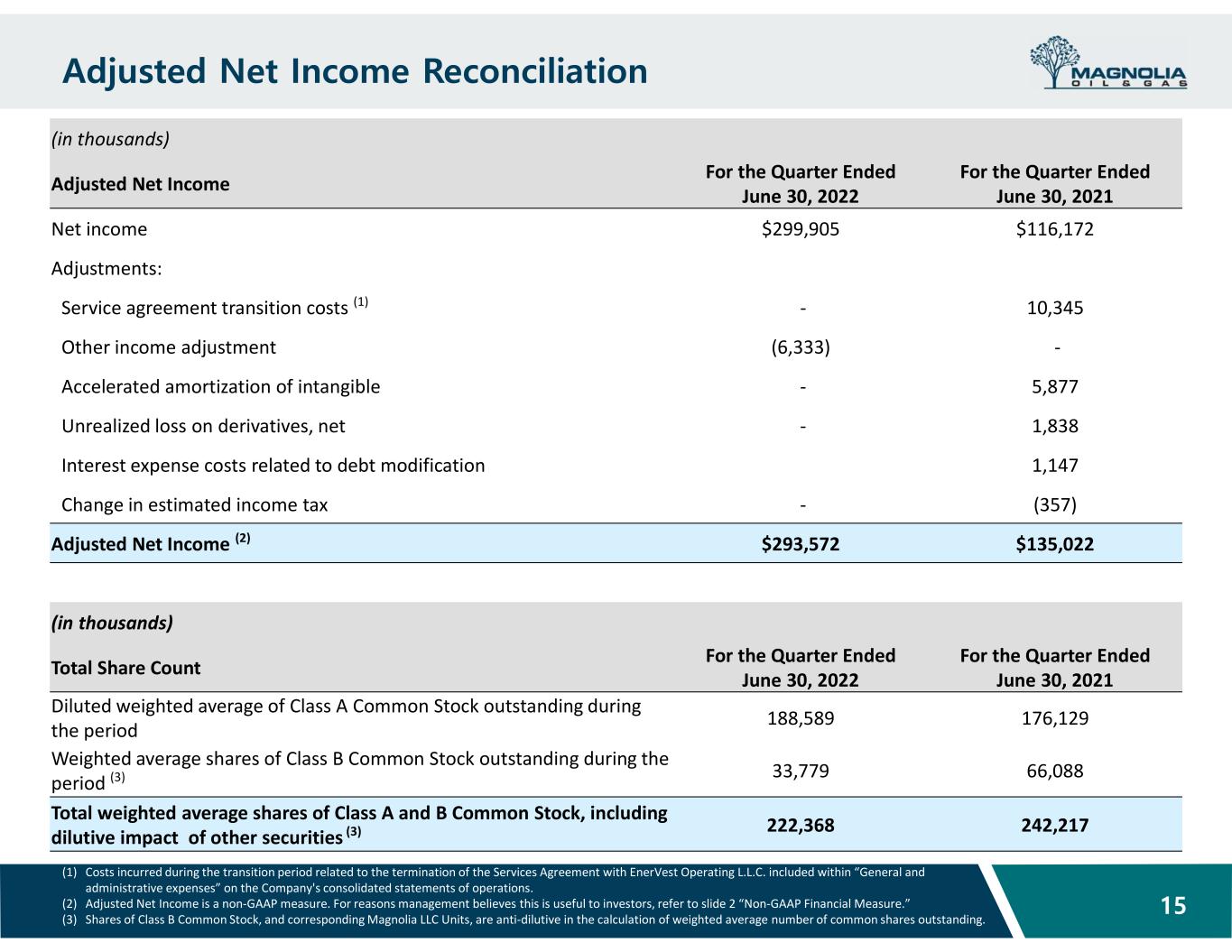

Reconciliation of net income to adjusted net income

Our presentation of adjusted net income is a non-GAAP measures because it excludes the effect of certain items included in net income. Management uses adjusted net income to evaluate our operating and financial performance because it eliminates the impact of certain items that management does not consider to be representative of the Company’s on-going business operations. As a performance measure, adjusted net income may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes adjusting these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted net income may not be comparable to similar measures of other companies in our industry.

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

| (In thousands) |

June 30, 2022 |

|

June 30, 2021 |

| NET INCOME |

$ |

299,905 |

|

|

$ |

116,172 |

|

| Adjustments: |

|

|

|

Service agreement transition costs (1) |

— |

|

|

10,345 |

|

| Other income adjustment |

(6,333) |

|

|

— |

|

| Accelerated amortization of intangible |

— |

|

|

5,877 |

|

| Unrealized loss on derivatives, net |

— |

|

|

1,838 |

|

| Interest expense costs related to debt modification |

— |

|

|

1,147 |

|

| Change in estimated income tax |

— |

|

|

(357) |

|

| ADJUSTED NET INCOME |

$ |

293,572 |

|

|

$ |

135,022 |

|

|

|

|

|

| Diluted weighted average shares of Class A Common Stock outstanding during the period |

188,589 |

|

|

176,129 |

|

Weighted average shares of Class B Common Stock outstanding during the period (2) |

33,779 |

|

|

66,088 |

|

Total weighted average shares of Class A and B Common Stock, including dilutive impact of other securities (2) |

222,368 |

|

|

242,217 |

|

(1) Costs incurred during the transition period related to the termination of the Services Agreement with EnerVest Operating L.L.C. included within “General and administrative expenses” on the Company's consolidated statements of operations.

(2) Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding.

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of revenue to adjusted cash operating margin and to operating income margin

Our presentation of adjusted cash operating margin and total adjusted cash operating costs are supplemental non-GAAP financial measures that are used by management. Total adjusted cash operating costs exclude the impact of non-cash activity. We define adjusted cash operating margin per boe as total revenues per boe less operating expenses per boe. Management believes that total adjusted cash operating costs per boe and adjusted cash operating margin per boe provide relevant and useful information, which is used by our management in assessing the Company’s profitability and comparability of results to our peers.

As a performance measure, total adjusted cash operating costs and adjusted cash operating margin may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted cash operating margin may not be comparable to similar measures of other companies in our industry.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

| (in $/boe) |

|

June 30, 2022 |

|

June 30, 2021 |

| Revenue |

|

$ |

71.78 |

|

|

$ |

42.64 |

|

| Total cash operating costs: |

|

|

|

|

Lease operating expenses (1) |

|

(4.78) |

|

|

(3.70) |

|

| Gathering, transportation and processing |

|

(2.43) |

|

|

(1.74) |

|

| Taxes other than income |

|

(4.06) |

|

|

(2.34) |

|

| Exploration expenses |

|

(0.50) |

|

|

(0.01) |

|

General and administrative expenses (2) |

|

(2.27) |

|

|

(3.61) |

|

| Total adjusted cash operating costs |

|

(14.04) |

|

|

(11.40) |

|

| Adjusted cash operating margin |

|

$ |

57.74 |

|

|

$ |

31.24 |

|

| Margin (%) |

|

80 |

% |

|

73 |

% |

| Non-cash costs: |

|

|

|

|

| Depreciation, depletion and amortization |

|

$ |

(8.48) |

|

|

$ |

(7.33) |

|

| Asset retirement obligations accretion |

|

(0.12) |

|

|

(0.24) |

|

| Amortization of intangible assets |

|

— |

|

|

(1.22) |

|

| Non-cash stock based compensation |

|

(0.52) |

|

|

(0.60) |

|

| Total non-cash costs |

|

(9.12) |

|

|

(9.39) |

|

| Operating income margin |

|

$ |

48.62 |

|

|

$ |

21.85 |

|

| Margin (%) |

|

68 |

% |

|

51 |

% |

(1) Lease operating expenses exclude non-cash stock based compensation of $0.3 million, or $0.05 per boe, and $0.1 million, or $0.02 per boe, for the quarters ended June 30, 2022 and 2021, respectively.

(2) General and administrative expenses exclude non-cash stock based compensation of $3.2 million, or $0.47 per boe, and $3.4 million, or $0.58 per boe, for the quarters ended June 30, 2022 and 2021, respectively.

Magnolia Oil & Gas Corporation

Non-GAAP Financial Measures

Reconciliation of net cash provided by operating activities to free cash flow

Free cash flow is a non-GAAP financial measure. Free cash flow is defined as cash flows from operations before net change in operating assets and liabilities less additions to oil and natural gas properties and changes in working capital associated with additions to oil and natural gas properties. Management believes free cash flow is useful for investors and widely accepted by those following the oil and gas industry as financial indicators of a company’s ability to generate cash to internally fund drilling and completion activities, fund acquisitions, and service debt. It is also used by research analysts to value and compare oil and gas exploration and production companies and are frequently included in published research when providing investment recommendations. Free cash flow is used by management as an additional measure of liquidity. Free cash flow is not a measure of financial performance under GAAP and should not be considered an alternative to cash flows from operating, investing, or financing activities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarters Ended |

| (In thousands) |

|

June 30, 2022 |

|

June 30, 2021 |

| Net cash provided by operating activities |

|

$ |

379,135 |

|

|

$ |

187,879 |

|

| Add back: net change in operating assets and liabilities |

|

(16,690) |

|

|

(13,263) |

|

| Cash flows from operations before net change in operating assets and liabilities |

|

362,445 |

|

|

174,616 |

|

| Additions to oil and natural gas properties |

|

(123,231) |

|

|

(54,190) |

|

| Changes in working capital associated with additions to oil and natural gas properties |

|

11,548 |

|

|

13,558 |

|

| Free cash flow |

|

$ |

250,762 |

|

|

$ |

133,984 |

|