Annual Report 2024

2024 Annual Report including the Annual Financial Statements for the year ended December 31, 2024 This Annual Report is filed with the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten, AFM). The following main items included in our annual report on Form 20-F for the year ended December 31, 2024 (2024 20-F) filed with the United States Securities and Exchange Commission (SEC) on or about the date of this Annual Report have not been included in this Annual Report: • Form 20-F cover page; • Item 7 – Major Shareholders and Related Party Transactions; • Item 10E – Taxation; • Item 16E – Purchases of Equity Securities by the Issuer and Affiliated Purchasers; • Item 16G – Corporate Governance; • Report of Independent Registered Public Accounting Firm in respect of Internal Control over Financial Reporting for the SEC filing; • Report of Independent Registered Public Accounting Firm in respect of the PCAOB audits of the 2024 financial statements for the SEC filing; • Exhibits; and • Signatures. The following main sections of our Annual Report have not been included in our 2024 20-F: • Shareholder Letter; • Outlook 2025; • Statement of the Board of Directors; • Risk Appetite and Control; • Share Classes and Principal Shareholders; • Non-Financial Information (including Sustainability Statement); • The Company Financial Statements under Section Financial Statements (prepared pursuant to Dutch law); • Independent auditor’s report - Report on the audit of the financial statements 2024 included in the Annual Report with respect to the AFM Filing; • Limited Assurance Report of the Independent Auditor on the Sustainability Statement; and • Glossary. Certain defined terms Unless otherwise indicated, “argenx,” “argenx SE,” “the Company,” “our company,” “we,” “us”, “our” our “Group” refer to argenx SE and its consolidated subsidiaries. argenx SE is a European public company (Societas Europaea) incorporated under the laws of the Netherlands with its statutory seat in Amsterdam, the Netherlands. It is publicly listed in Belgium and the United States of America (the U.S.) The applicable regulations with respect to public information and protection of investors, as well as the commitments we make to securities and market authorities, are described in this Annual Report. We own various trademark registrations and applications, and unregistered trademarks, including but not limited to VYVGART®, VYVGART HYTRULO™, VYVDURA®, ARGENX™, ABDEG™, NHANCE™, SIMPLE argenx Annual Report 2024 2

ANTIBODY™, ARGENXMEDHUB™, MG UNITED™, SHINING THROUGH CIDP™ and our corporate logo. Trade names, trademarks and service marks of other companies appearing in this Annual Report are the property of their respective holders. Solely for convenience, the trademarks and trade names in this Annual Report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship, any other companies. VYVGART® (efgartigimod alfa) (VYVGART) has been approved in the U.S., Japan, the European Union (the EU), the United Kingdom (UK), Switzerland, Israel, mainland China (Mainland China), Canada, South Korea and United Arab Emirates for the intravenous treatment of generalized myasthenia gravis (gMG). We have now commercialized VYVGART in the U.S., several countries in the EU, Japan, Mainland China (through our partner Zai Lab Ltd (Zai Lab)), Israel (through our Medison Pharma Ltd. (Medison)) and Canada. VYVGART is now also approved and launched in Japan for the treatment of ITP. VYVGART subcutaneous (SC) (efgartigimod alfa + hyaluronidase qvfc) (VYVGART SC) has been approved in the U.S. and China as VYVGART HYTRULO™ (VYVGART HYTRULO), in Japan as VYVDURA® (VYVDURA) and in the EU and the UK as VYVGART for the treatment of gMG. VYVGART SC has also been approved in Israel for the treatment of gMG. We have now commercialized VYVGART SC for gMG in the U.S. and China (as VYVGART HYTRULO), in Japan (as VYVDURA) and in several countries in the EU (as VYVGART). Pricing and reimbursement discussions for VYVGART SC remain ongoing in multiple other countries, including more countries in the EU. VYVGART SC has now also been approved in the U.S., China and Japan for the treatment of chronic inflammatory demyelinating polyneuropathy (CIDP). We have now commercialized VYVGART SC for CIDP in the U.S. and China (as VYVGART HYTRULO) and in Japan (as VYVDURA). For both VYVGART and VYVGART SC, we are aiming for further approvals and we are working to expand commercialization in other jurisdictions. Unless otherwise specified, references in this Annual Report to VYVGART should be read as references to VYVGART and/or VYVGART SC, including VYVGART HYTRULO in relation to the U.S. and China, VYVGART in relation to the EU and the UK and VYVDURA in relation to Japan, depending on the context. Basis of preparation of our audited consolidated financial statements Our consolidated financial statements are prepared in accordance with the IFRS® Accounting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) as adopted by the EU (EU-IFRS) and in accordance with the legal requirements of Part 9 of Book 2 of the Dutch Civil Code. Our consolidated financial statements are presented in this Annual Report in U.S. dollars. All references in this Annual Report to “$,” “US$,” “U.S.$,” “U.S. dollars,” “dollars” and “USD” mean U.S. dollars and all references to “€,” “EUR,” and “euros” mean euros, unless otherwise noted. Throughout this Annual Report, references to ADSs mean American depositary shares (ADSs) or ordinary shares represented by ADSs, as the case may be. Forward-looking Statements This Annual Report contains certain forward-looking statements. A forward-looking statement is any statement that does not relate to historical facts or events or to facts or events as of the date of this Annual Report or that are derived from our management’s beliefs and assumptions based on information currently available to our management. Forward-looking statements are generally identified by the use of forward- looking words, such as “anticipate”, “aspire”, “believe”, “can”, “continue”, “could”, “estimate”, “expect”, “entail”, “hope”, “intend”, “is designed to”, “look forward to”, “may”, “might”, “objective”, “plan”, “potential”, “pursue”, “project”, “predict”, “seek”, “should”, “target”, “will” or other or comparable variations or the negative of such argenx Annual Report 2024 3

terms, or by discussion of strategy, plans, objectives, goals, future events or intentions, although not all forward-looking statements contain these identifying words. These statements relate to our future results of operations and financial positions, prospects, developments, growth, business strategies, plans and our objectives for future operations, results of clinical trials and regulatory approvals, and are based on analyses or forecasts of future developments and estimates of amounts not yet determinable. These forward-looking statements represent the view of management only as of the date of this Annual Report, and we expressly disclaim any obligation or undertaking to update, review or revise forward-looking statements (whether as a result of new information, future developments or otherwise), except as may be otherwise required by applicable law. The forward-looking statements in this Annual Report involve known and unknown risks, future events, assumptions, uncertainties and other factors that could cause our actual future results of operations and financial positions, prospects, developments, growth, business strategies, plans and our objectives for future operations, results of clinical trials and regulatory approvals to differ materially from those forecasted or suggested herein. Forward-looking statements include, but are not limited to, statements about: • the initiation, timing, progress, development and results of clinical trials of our product candidates, including new indications, alternative dosing regimens, treatment modalities, and methods of administration, including statements regarding when results or interim analysis of the clinical trials will be available or made public; • the expansion of our business, including the further development of our sales and marketing abilities and our IIP, and the value of our pipeline; • the potential attributes, benefits, and side effects of our products and product candidates, including new indications, alternative dosing regimens and treatment modalities, and their competitive position with respect to other alternative treatments; • our ability to advance product candidates into, and successfully complete, clinical trials; • our estimates of the number of patients who suffer from the diseases we are targeting and the number of patients that will enroll in our clinical trials; • the demand and commercialization of our products and product candidates, including new indications, alternative dosing regimens, treatment modalities, and methods of administration, if approved; • the anticipated timing or likelihood of market or regulatory decisions relating to or of our products, including new indications, alternative dosing regimens, treatment modalities, and methods of administration; • the anticipated pricing and reimbursement of our products and product candidates, if approved; • our plans to have various programs to help patients afford our products, including patient assistance and co-pay coupon programs for eligible patients; • our ability to establish sales, marketing and distribution capabilities for any of our products and product candidates that achieve regulatory approval; • our regulatory strategy and our ability to establish and maintain manufacturing arrangements for our products and product candidates; • the scope and duration of protection, including any exclusivity period, we are able to establish and maintain for intellectual property rights covering our products and product candidates, platform and technology, including our intention to seek patent term extensions where available; • our estimates regarding expenses, future revenues, cash flow, capital requirements and our needs for additional financing; • our expectation that we will benefit from the Belgian innovation income deduction; • our financial performance, including potential volatility in the price of our ordinary shares and ADSs; • the competition we face in our drug discovery, development, and commercialization efforts; • the rate and degree of market acceptance of our products and product candidates, if approved; • the potential benefits of our current collaborations, including the possibility to access partner technology platforms or capabilities; argenx Annual Report 2024 4

• our plans and ability to enter into or maintain current collaborations for additional programs or product candidates; • our plans and ability to enter into or maintain current new distribution partnerships; • our long-term growth strategy to develop and market additional products and product candidates, including efgartigimod for new indications, empasibrubart and ARGX-119; • the impact of government laws and regulations on our business; • our expectations with respect to the timing and amount of any dividends (if any); • our plans regarding our supply chain, including our reliance on third parties, including contract manufacturing organizations (CMOs); and • our business strategies, plans, projects, goals and targets and the timing, outcomes and benefits thereof. These include changes in general economic and business conditions. You should refer to Section 2 ”Risk Factors” of this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should read this Annual Report and the documents that we reference in this Annual Report and have filed as exhibits to the Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Information regarding market and industry statistics contained in this Annual Report is included based on information available to us that we believe is accurate. Forecasts and other forward-looking information obtained from this available information is subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. In addition, statements that include “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements. argenx Annual Report 2024 5

Table of Contents To our Shareholders Shareholder Letter 10 2024 In Brief 11 2025 Outlook 23 1 Presentation of the Group 1.1 Company Profile 25 1.2 Strategy and Objectives 29 1.3 Our Products and Products Candidates 31 1.4 Collaborations and licenses 49 1.5 Manufacturing and Supply 56 1.6 Intellectual Property 56 1.7 Regulation 59 1.8 Documents on display 80 2 Risk Factors 2.1 Summary Risk Factors 82 2.2 Risk Factors Related to Commercialization of argenx’s Products and Product Candidates, Including for New Indications 84 2.3 Risk Factors Related to the Development and Clinical Testing of argenx’s Products and Product Candidates 91 2.4 Risk Factors Related to argenx’s Dependence on Third Parties 94 2.5 Risk Factors Related to Other Government Regulations 98 2.6 Risk Factors Related to argenx’s Financial Position 103 2.7 Risk Factors Related to argenx’s Business and Industry 104 2.8 Risk Factors Related to argenx’s Intellectual Property 107 2.9 Risk Factors Related to argenx’s Organization and Operations 111 2.10 Risk Factors Related to the ADSs 114 2.11 Risk Factors Related to being a Foreign Private Issuer or a Dutch Company 116 argenx Annual Report 2024 6

3 Corporate Governance 3.1 Dutch Corporate Governance Code 120 3.2 Management Structure 121 3.3 Report of the Non-Executive Directors 140 3.4 Remuneration Report and Compensation Statement 143 3.5 Corporate Governance – Nasdaq Listing Rules 183 3.6 Share Ownership 183 3.7 Insider Trading 183 3.8 Cybersecurity 184 3.9 Risk Appetite & Control 185 4 General Description of the Company and its Share Capital 4.1 Legal Information on the Company 190 4.2 Share Capital 190 4.3 Share Classes and Principal Shareholders 194 4.4 Limitations on the right to hold securities 196 4.5 General Meeting, Voting Rights and Admission 197 4.6 Anti-Takeover Provisions 199 4.7 Change of Control 199 4.8 Exchange Controls 199 4.9 Amendments of Articles of Association 199 4.10 Transparency Directive 199 4.11 Dutch Financial Reporting Supervision Act 200 4.12 Dividends and Other Distributions 200 4.13 Right to a surplus in the event of a liquidation 201 4.14 Material Modifications to the Rights of Security Holders and Use of Proceeds 201 4.15 Enforcement of civil liabilities 202 4.16 Controls and Procedures 203 4.17 Financial Calendar 2025 204 argenx Annual Report 2024 7

5 Operating and Financial Review and Prospects 5.1 Overview 206 5.2 Basis of presentation 208 5.3 Critical Accounting Judgements and Major Sources of Estimation Uncertainty 210 5.4 Results of Operation 212 5.5 Liquidity and Capital Resources 215 5.6 Research and development, patents and licenses 218 5.7 Trend information 218 5.8 Off-Balance Sheet Arrangements 219 5.9 Contractual Obligations 219 5.10 Information Regarding the Independent Auditor 219 5.11 Material Contracts and Related Party Transactions 219 5.12 Employees 222 5.13 Insurance 222 5.14 Legal and Arbitration Proceedings 222 5.15 Taxation 223 6 Financial Statements 6.1 Consolidated Financial Statements 242 6.2 Notes to the Consolidated Financial Statements 249 6.3 Company Financial Statements of argenx SE for the Year ended December 31, 2024 285 6.4 Other information 291 7 Non-Financial Information 7.1 Sustainability Statement 313 7.2 Sustainability Strategy 320 7.3 Environment 335 7.4 Social 352 7.5 Patients 357 7.6 Industry Specific Disclosures 364 7.7 Governance 369 7.8 Other Considerations 373 7.9 Appendix 375 8 Glossary 8.1 Cross Reference table for annual reporting requirements 383 8.2 Management Confirmations 384 8.3 Definitions 385 argenx Annual Report 2024 8

To our Shareholders Shareholder Letter 10 2024 In Brief 11 2025 Outlook 23 argenx Annual Report 2024 9

Shareholder Letter Dear Shareholder, As we reflect on 2024, we are filled with pride and gratitude for the remarkable progress and achievements that have defined this year for argenx. We are more committed than ever to transforming the treatment of severe autoimmune diseases and the milestones we have reached are a testament to the dedication and resilience of our entire team. This year, we made significant steps in expanding the reach and impact of VYVGART® (efgartigimod alfa- fcab), our first-in-class antibody fragment targeting FcRn. With approvals for both intravenous and subcutaneous formulations in multiple indications, including gMG, primary immune thrombocytopenia (ITP), and CIDP, we are now able to offer life-changing treatments to more than 10,000 patients globally. Our financial performance has been robust, with global product net sales reaching $2.2bn in 2024. With our continued commercial execution, we expect to reach sustainable profitability during 2025, giving us the financial flexibility to fuel the next generation of groundbreaking therapies. This growth reflects the strong demand for our innovative therapies and the successful execution of our strategic initiatives. We are particularly proud of the initial success of our CIDP launch, with approximately 1,000 patients on therapy in first two quarters of launch. Looking ahead, we remain focused on our Vision 2030, which aims to transform the treatment landscape for autoimmune diseases. Our goals include reaching at least 50,000 patients globally, advancing our pipeline to achieve 10 labelled indications, and bringing five new molecules into Phase 3 by 2030. This vision has already started to take shape as we continue to innovate on the patient experience with our pre- filled syringe (VYVGART SC) (with an expected Prescription Drug User Fee Act target action date (PDUFA Date) of April 10, 2025) and the auto-injector approval expected in 2027. We are also advancing our clinical programs bringing us to 10 Phase 3 clinical trials and 10 Phase 2 clinical trials across our 3 clinical assets (efgartigimod, empasiprubart, ARGX-119). We continue investing in our growing pipeline by progressing 4 INDs into Phase 1 in 2025. We are confident that our continued investment in innovation leading to differentiated antibody candidates will drive transformative outcomes for patients. None of this would be possible without the relentless commitment of all argonauts i.e., all employees, management and our board of directors (Board of Directors) to our mission and in particular the unwavering support of our shareholders. Your belief in our mission and your trust in our vision have been instrumental in our success. As we move forward, we remain committed to delivering value to our shareholders while making a meaningful difference in the lives of patients. Thank you for your continued support. Sincerely, Tim Van Hauwermeiren & Peter Verhaeghe argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Shareholder Letter 10 Peter Verhaeghe Tim van Hauwermeiren

2024 In Brief In 2024, we established our ‘Vision 2030’ outlining our long-term commitment to transform the treatment of severe autoimmune disease with VYVGART, empasiprubart and our expanding pipeline of antibody- based therapeutics. With our eyes set on 2030, we are targeting the treatment of 50,000 patients globally, securing 10 labeled indications across all approved medicines, and advancing five pipeline candidates into Phase 3 development. In 2024, we made important progress to reach this goal. We grew our global commercial footprint in gMG to reach more than 10,000 patients and we remain on track to expand into additional regions throughout 2025. We received FDA approval for VYVGART HYTRULO for the treatment of CIDP and have been working hard to bring VYVGART HYTRULO to CIDP patients, reaching approximately 1,000 patients by the end of 2024. This, together with our continued growth in MG, translated in $2.2 billion in product net sales in 2024. We look forward to continued commercial execution as we expand our patient reach through label enabling studies in seronegative gMG and ocular MG patient populations and we continue to innovate on the patient experience with our pre-filled syringe (PFS) with VYVGART SC, with an PDUFA Date of April 10, 2025. We made significant progress in evaluating efgartigimod across additional autoimmune diseases. We announced the GO-decisions for primary Sjögren’s disease (SjD) and three subsets of myositis (immune- mediated necrotizing myopathy (IMNM), anti-synthetase syndrome (ASyS), dermatomyositis (DM)), for which we are currently running Phase 3 clinical trials. We continue to evaluate efgartigimod in more than 10 additional indications, and this year, we added autoimmune encephalitis to the line-up. We are excited to add another indication in 2025. In 2024 we made significant progress with our second asset, empasiprubart (ARGX-117) targeting complement component 2 (C2). empasiprubart has now shown proof-of-concept in multifocal motor neuropathy (MMN) and has started its first Phase 3 in this indication. We additionally announced CIDP as the 4th indication for which we go straight to a Phase 3 clinical trial, expected to start in 2025. Beyond our first two assets, efgartigimod and empasiprubart, we worked to further advance our third clinical pipeline asset, ARGX-119, targeting muscle-specific kinase (MuSK). ARGX-119 has started its first proof-of- concept clinical trial in congenital myasthenic syndrome (CMS) and amyotrophic lateral sclerosis (ALS) this year and we have announced a 3rd indication, spinal muscular atrophy (SMA). We believe ARGX-119 has potential as a novel treatment modality in multiple serious indications. Our immunology innovation program (IIP) is a key driver for our future sustainable growth. This is reflected in 4 new investigational new drugs (INDs) that will start Phase 1 clinical trials in 2025 to continue to deliver immunology innovations to the patients who need them. argenx Annual Report 2024 2024 In Brief 11 Operational Highlights

Reach More Patients Globally with VYVGART • VYVGART is now approved in the U.S., Japan, the EU, the UK, Switzerland, Israel, Mainland China, Canada, South Korea, United Arab Emirates, Australia and Kuwait (through Genpharm Services FZ-LLC (Genpharm)) for the treatment of gMG. VYVGART is now also approved and launched in Japan for the treatment of ITP. VYVGART SC is now approved in the U.S., the EU, the UK, Japan, China (through Zai Lab), Australia and Kuwait (through Genpharm) for the treatment of gMG and in the U.S., Japan, and China for the treatment of CIDP. VYVGART is the only gMG treatment available as both an intravenous (IV) and a simple SC injection, providing choice to patients in how and where they are treated. • In 2024, we generated product net sales of $2.2 billion. • Pricing and reimbursement discussions for VYVGART and VYVGART SC remain ongoing in multiple jurisdictions, including in several countries in the EU, with new agreements in place in France, Luxembourg, Belgium, the Netherlands, Poland, Slovakia and Austria. • We filed for approval of VYVGART for gMG in Saudi Arabia and are expecting a decision on approval in 2025. • We filed for approval of VYVGART SC for CIDP in the EU and are expecting a decision on approval in 2025. • We received approval of the PFS for gMG in Europe on February 13, 2025. • We filed for approval of the PFS for gMG and CIDP in the U.S. with a PDUFA Date of April 10, 2025. We also filed for approval in Canada and Japan with expected decisions on approval in 2025. argenx Annual Report 2024 2024 In Brief 12 The science of co-creation drives our quest to engineer life-changing immunology solutions, the resilient spirit of patients fuels our urgency to deliver them. The infinity sign symbolizes our commitment to science and patients; it has no bounds. Our potential is infinite. Our purpose is immunology innovation.

Advance Extensive Pipeline We continue to demonstrate breadth and depth within our immunology pipeline and have advanced multiple pipeline-in-a-product candidates. With efgartigimod, we are furthering our leadership in neonatal Fc receptor (FcRn) and we are continuing its development in more than 10 indications today. Beyond efgartigimod, we are advancing our other clinical pipeline programs, including empasiprubart (C2 inhibitor) which has now shown proof-of-concept in MMN and initiated its first Phase 3 clinical trial, and is in Phase 2 POC clinical trials in delayed graft function (DGF) and DM. We also announced CIDP as the 4th indication for empasiprubart during our R&D Day on July 16, 2024 and plan to start a registrational study in CIDP evaluating empasiprubart head-to-head versus intravenous IgG (IVIg) in first half of 2025. In addition, we have initiated Phase 1b/2a clinical trials of ARGX-119, a MuSK agonist, in CMS congenital myasthenic syndromes and ALS. Four new pipeline candidates were nominated in 2024 from our immunology innovation program (IIP), including: ARGX-213, ARGX-121 and ARGX-220 and ARGX-109. Phase 1 results expected for ARGX-109 in second half of 2025 and for ARGX-213 and ARGX-121 in first half of 2026. argenx Annual Report 2024 2024 In Brief 13

Pioneer the FcRn Pathway with efgartigimod Neurology indications: • CIDP (ADHERE): following the positive topline results from the ADHERE clinical trial in CIDP, a supplemental biologics license application (sBLA) for efgartigimod SC was approved for the treatment of CIDP and launched in July 2024 in the U.S. We also received approval in Japan and China for the treatment of CIDP. • Myositis (ALKIVIA): In November 2024, we announced the GO decision to continue Phase 3 of the ALKIVIA clinical trial. ◦ The decision to continue clinical development of efgartigimod SC in each of the three myositis subtypes, including IMNM, ASyS and DM, is supported by the efficacy and safety results from the Phase 2 portion of the seamless Phase 2/3 ALKIVIA clinical trial. Overall, the clinical trial met its primary endpoint, demonstrating a statistically significant treatment effect in mean total improvement score (TIS) at week 24, and showed improvement across all six core set measures of the TIS in favor of efgartigimod SC compared to placebo. The observed safety and tolerability profile was consistent to that demonstrated with other clinical trials. ◦ Topline results expected 2H 2026. • TED (UplighTED): registrational clinical trials in thyroid eye disease (TED) ongoing with efgartigimod PFS. Topline results expected 2H 2026. • Seronegative gMG (ADAPT-SERON): registrational clinical trial in seronegative gMG patients ongoing with efgartigimod IV. Topline results expected 2H 2025. • Ocular MG (ADAPT-OCULUS): registrational clinical trial in ocular MG patients ongoing with efgartigimod PFS. Topline results expected 1H 2026. argenx Annual Report 2024 2024 In Brief 14 efgartigimod

Hematology/rheumatology indications: • ITP (ADVANCE-IV): positive clinical trial results formed the basis of approval in Japan for ITP, received on March 26, 2024. • ITP (ADVANCE-NXT): confirmatory clinical trial in ITP ongoing with efgartigimod IV in the U.S. Topline results expected in 2H 2026. • Primary SjD (RHO): following the analysis of topline data from the Phase 2 POC clinical trial through our partnership with IQVIA Ltd (IQVIA) in SjD we decided to continue the development of efgartigimod PFS to Phase 3 (UNITY), which was initiated at the end of 2024. Topline results expected in 2027. • Systemic Sclerosis (SSc): Phase 2 POC clinical trial ongoing. Topline results expected in 2H 2026. Nephrology indications: • Lupus Nephritis: Phase 2 POC clinical trial ongoing through our partnership with Zai Lab. Topline results expected in 2H 2025. • Antibody-mediated rejection: shAMRock Phase 2 POC clinical trial in antibody- mediated rejection (AMR) has been initiated. In 2024 we made the decision to stop development in PC-POTS (ALPHA), Bullous Pemphigoid (BALLAD) and membranous nephrology based on review of the Phase 2 data. argenx Annual Report 2024 2024 In Brief 15

Broaden Immunology Pipeline with empasiprubart and ARGX-119 empasiprubart (C2 inhibitor): • MMN (ARDA): based on the positive Phase 2 POC data of empasiprubart in MMN we have advanced empasiprubart into Phase 3 (EMPASSION). Topline results expected in 2H 2026. ◦ In January 2024, we reported positive clinical data from the first cohort of the Phase 2 POC ARDA clinical trial establishing POC in MMN. empasiprubart demonstrated a 91% reduction in the need for IVIg rescue compared to placebo [HR (95% CI) = 0.09 (0.2 : 0.44)]. ◦ In July 2024, we reported positive clinical data from the second cohort of the Phase 2 POC ARDA clinical trial confirming POC in MMN. empasiprubart demonstrated a 84% reduction in the need for IVIg rescue compared to placebo [HR: (95% CI) = 0.16 (0.02 : 1.54)]. ◦ Safety profile was consistent with Phase 1 data in both cohorts. ◦ We are also conducting a natural history study (IMMERSION) in MMN. • DGF (VARVARA) and DM (EMPACIFIC) Phase 2 POC clinical trials ongoing in DGF and DM. Topline results expected 2H 2025 and 1H 2026, respectively. • CIDP (EMVIGORATE): Phase 3 clinical trial in CIDP expected to start in 1H 2025. ARGX-119 (MuSK agonist): • Phase 1 dose-escalation clinical trial in healthy volunteers completed; data supports advancement in POC studies. • CMS: Phase 1b clinical trial started to assess early signal detection in patients with CMS. Topline results expected in 2H 2025. • ALS (reALiSe): Phase2a clinical trial started to assess early signal detection in patients with ALS. Topline results expected 1H 2026. argenx Annual Report 2024 2024 In Brief 16 empasiprubart ARGX-119

Build out the Innovation Ecosystem In January 2024, we announced the nomination of four new pipeline candidates, including: ARGX-213 targeting FcRn, furthering argenx’s leadership in this new class of medicine; ARGX-121 targeting Immunoglobulin A (IgA) and ARGX-220, which are first-in-class targets broadening argenx’s focus across the immune system; and ARGX-109, targeting IL-6, which plays an important role in inflammation. Preclinical work is ongoing in each candidate and the first healthy volunteer studies are expected to start in 2025. argenx Annual Report 2024 2024 In Brief 17

Corporate Achievements Dr. Brian Kotzin Dr. Brian Kotzin joined the Board of Directors in May 2024 as a non-executive director and chairperson of the research and development committee Mr. Peter Verhaeghe Mr. Peter Verhaeghe, who has served as a non- executive director since July 2014, was reappointed as a non-executive director and chairperson of the Board of Directors for a term of 2 years Dr. Pamela Klein Dr. Pamela Klein, who has served as a non- executive director since April 2016, was reappointed as a non-executive director for a term of 2 years 1,599 Expansion to 1,599 full-time employees (as of December 31, 2024) to support further growth of our business, including fully staffed commercial teams in the U.S., Europe, Japan and CanadaEmployees argenx Annual Report 2024 2024 In Brief 18

Financial Highlights $2.2 $1.0 billion billion Product net sales Research & development Transition to sustainable operating profitability in 2025 enables continued investment in innovation. argenx Annual Report 2024 2024 In Brief 19

argenx Annual Report 2024 This is the story of Nicola 20 The future belongs to those who dare to do more. Nicola “I think it's really important that people with MG are able to feel like they're still in control of their health.”

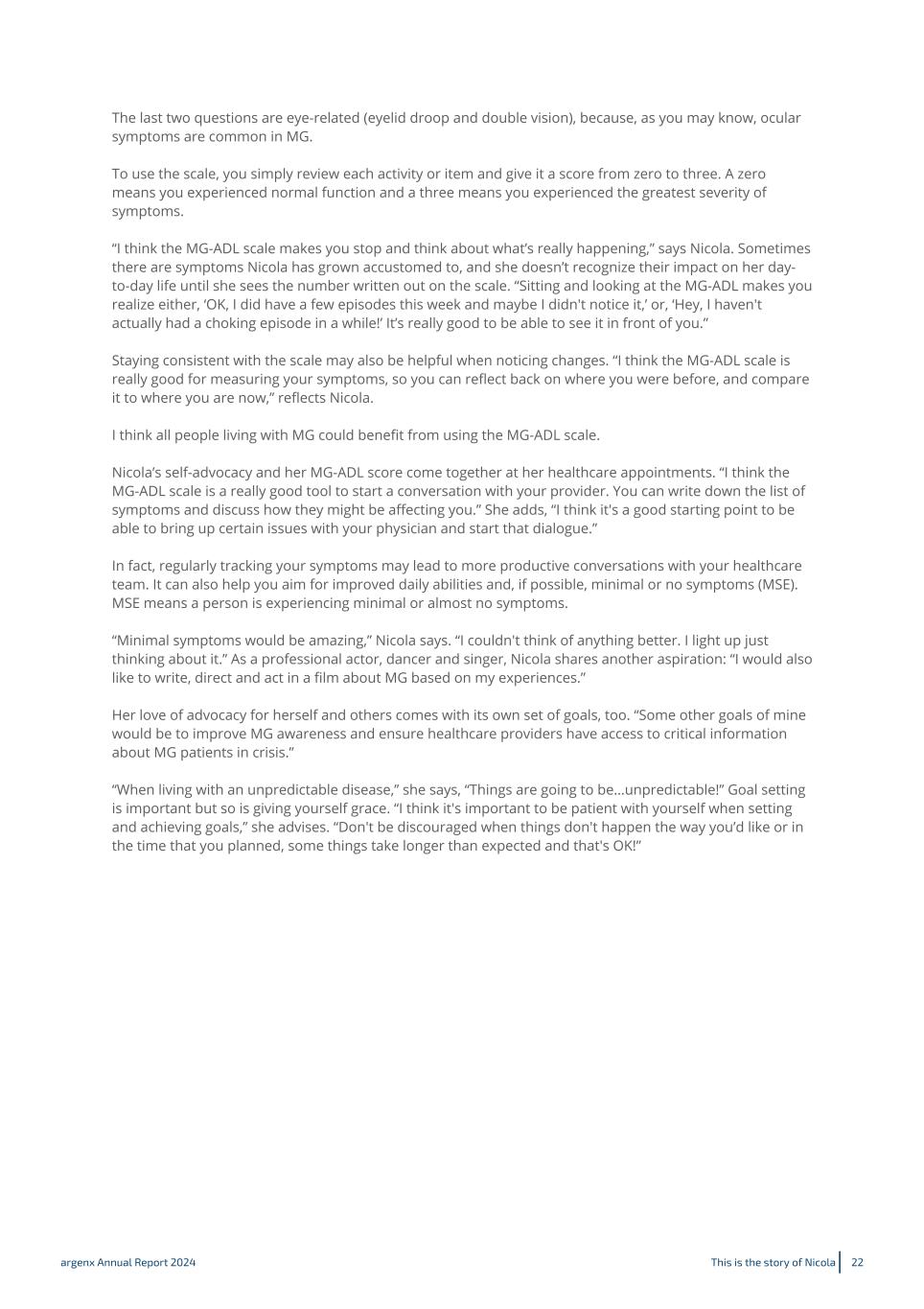

Living with an autoimmune disease can come with many unknowns. And trying to navigate the ups and downs may make you feel like you’re not in control of your own life. Nicola, who is living with myasthenia gravis (MG), says, “MG, as a disease, can take so much away from you. In terms of the symptoms themselves, it can feel like a loss of power in your own self in some ways.” But this didn’t sit well with Nicola. “Myasthenia gravis is such an unpredictable disease because everyone's symptoms are so different. On top of that, our symptoms will fluctuate day to day, week to week and sometimes even hour to hour.” She goes on to say, “Because of this, I think being able to have a sense of agency is so important, and you can have a say to help direct your treatment path.” Meet Nicola as she shares her journey with self-advocacy, why she uses the Myasthenia Gravis Activities of Daily Living (MG-ADL) scale and more. Being a self-advocate was something that Nicola herself had to practice. One of Nicola’s favorite instances of self-advocacy was when she was told that despite her diagnosis, she wasn’t the typical age to have MG. But because of the thorough research she did on her own, she knew that while MG can happen at any time, it commonly impacts young adult women under the age of 40. Looking back on that moment, Nicola thinks it may seem small, but it really wasn’t. Because she had been so hesitant to stand up for herself in the past and was frustrated by feeling that she lacked power in managing her MG, not only was it a win, but it was also a stepping stone for other opportunities in the future. She says, “I really like having agency over my healthcare and feeling like I'm in control.” What fuels her confidence with self-advocacy is her drive to keep learning. When she was first experiencing MG symptoms, she took it upon herself to read medical textbooks and join multiple MG support groups online. Not only were the groups good for emotional support, but she says the group members would also compare notes and share tips. She also has a “Myasthenia Gravis” alert set up on her internet browser so she can get notified whenever there’s new information and then talk about it with her healthcare provider. “I think it is so important to take a proactive approach to your health,” she says. Nicola’s advice on how to be your own best advocate? “Know the facts and the most current research about MG so you can properly articulate any questions or concerns.” She goes on to say, “It's important you have the confidence to stand firm when it comes to your experiences. And it’s especially helpful when you know that information to be true, whether that's through your own medical research or shared anecdotal evidence from other people living with MG.” But she acknowledges it’s not always easy and it’s perfectly OK to lean on your support system, “I always bring my boyfriend with me to appointments. It's so helpful to have someone else there to take notes and advocate for me, especially if I'm too short of breath to get out everything I need to say.” “I think it's really important that people with MG are able to feel like they're still in control of their health.” Nicola In step with her knowledge-is-power approach, Nicola embraces tools like the Myasthenia Gravis Activities of Daily Living scale (or MG-ADL). “It's so important for us to find resources that can help us be equipped with the best knowledge,” says Nicola. The MG-ADL scale is a tool that helps identify the impact MG has on a person’s daily life by providing an assessment of the severity of some common symptoms associated with MG. It’s made up of eight questions, six of which are about daily activities like breathing, brushing teeth and getting up out of a chair. argenx Annual Report 2024 This is the story of Nicola 21

The last two questions are eye-related (eyelid droop and double vision), because, as you may know, ocular symptoms are common in MG. To use the scale, you simply review each activity or item and give it a score from zero to three. A zero means you experienced normal function and a three means you experienced the greatest severity of symptoms. “I think the MG-ADL scale makes you stop and think about what’s really happening,” says Nicola. Sometimes there are symptoms Nicola has grown accustomed to, and she doesn’t recognize their impact on her day- to-day life until she sees the number written out on the scale. “Sitting and looking at the MG-ADL makes you realize either, ‘OK, I did have a few episodes this week and maybe I didn't notice it,’ or, ‘Hey, I haven't actually had a choking episode in a while!’ It’s really good to be able to see it in front of you.” Staying consistent with the scale may also be helpful when noticing changes. “I think the MG-ADL scale is really good for measuring your symptoms, so you can reflect back on where you were before, and compare it to where you are now,” reflects Nicola. I think all people living with MG could benefit from using the MG-ADL scale. Nicola’s self-advocacy and her MG-ADL score come together at her healthcare appointments. “I think the MG-ADL scale is a really good tool to start a conversation with your provider. You can write down the list of symptoms and discuss how they might be affecting you.” She adds, “I think it's a good starting point to be able to bring up certain issues with your physician and start that dialogue.” In fact, regularly tracking your symptoms may lead to more productive conversations with your healthcare team. It can also help you aim for improved daily abilities and, if possible, minimal or no symptoms (MSE). MSE means a person is experiencing minimal or almost no symptoms. “Minimal symptoms would be amazing,” Nicola says. “I couldn't think of anything better. I light up just thinking about it.” As a professional actor, dancer and singer, Nicola shares another aspiration: “I would also like to write, direct and act in a film about MG based on my experiences.” Her love of advocacy for herself and others comes with its own set of goals, too. “Some other goals of mine would be to improve MG awareness and ensure healthcare providers have access to critical information about MG patients in crisis.” “When living with an unpredictable disease,” she says, “Things are going to be…unpredictable!” Goal setting is important but so is giving yourself grace. “I think it's important to be patient with yourself when setting and achieving goals,” she advises. “Don't be discouraged when things don't happen the way you’d like or in the time that you planned, some things take longer than expected and that's OK!” argenx Annual Report 2024 This is the story of Nicola 22

2025 Outlook argenx Annual Report 2024 2025 Outlook 23

Presentation of the Group 1.1 Company Profile 25 1.2 Strategy and Objectives 29 1.3 Our Products and Product Candidates 31 1.4 Collaborations and licenses 49 1.5 Manufacturing and Supply 56 1.6 Intellectual Property 56 1.7 Regulation 59 1.8 Documents on display 80 argenx Annual Report 2024 24 1

1 Presentation of the Group 1.1 Company Profile 1.1.1 General We are a commercial-stage, global, fully-integrated biopharma company developing a deep pipeline of differentiated therapies for the treatment of severe autoimmune diseases. By combining our suite of antibody engineering technologies with the disease biology expertise of our research collaborators, we aim to translate immunology breakthroughs into a pipeline of novel antibody-based medicines through our discovery engine, the IIP. We developed and are commercializing the first approved FcRn blocker in more than 30 countries and we are evaluating efgartigimod in multiple serious autoimmune diseases. We are also advancing our second asset, empasiprubart, a C2 inhibitor, now in Phase 3. Several earlier stage experimental medicines, including ARGX-119, a MuSK agonist, are now in its first patient proof-of-concept studies. Our legal and commercial name is argenx SE. We were incorporated under the laws of the Netherlands on April 25, 2008, as a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid). From incorporation until August 28, 2009, our research and development activities were initially performed in the Netherlands, then Belgium, by argenx N.V. and its legal predecessors. Since August 28, 2009, all our research and development activities have been performed by our wholly-owned subsidiary, argenx BV, under a license provided by argenx N.V. Throughout this time, argenx BV assigned all resulting intellectual property to argenx N.V. On May 28, 2014, we converted to a Dutch public company with limited liability (naamloze vennootschap). On April 26, 2017, we converted to a Dutch European public company with limited liability (Societas Europaea or SE). On May 5, 2017, we transferred the legal ownership of all intellectual property rights of argenx SE to argenx BV, effective retroactively as of January 1, 2017. As a result, since January 1, 2017, (i) argenx BV holds all legal and economic ownership of our intellectual property rights, and (ii) the research and development agreement between argenx SE and argenx BV has been terminated. Our official seat is in Amsterdam, the Netherlands, and our registered office is at Laarderhoogtweg 25, 1101 EB Amsterdam, the Netherlands. We are registered with the trade register of the Dutch Chamber of Commerce under number 24435214. Our European legal entity identifier number (LEI) is 7245009C5FZE6G9ODQ71. Our telephone number is +31 (0) 10 70 38 441. Our website address is www.argenx.com. This website is not incorporated by reference in this Annual Report. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The registered agent for service of process in the U.S. is CT Corporation System, with an address at 111 8th Avenue, New York, NY 10011. Our ordinary shares are listed on the regulated market of Euronext Brussels in Belgium under ISIN NL0010832176 under the symbol “ARGX” since 2014 and ADSs, each representing one ordinary share in argenx (or a right to receive such share), are listed on the Nasdaq Global Select Market (Nasdaq) under the symbol “ARGX” since 2017. argenx SE is the parent entity of the Group and the sole shareholder of: • argenx B.V., a private company with limited liability (besloten vennootschap/société à responsabilité limitée) incorporated under the laws of Belgium, having its registered seat in Zwijnaarde, Belgium and its address at Industriepark-Zwijnaarde 7, 9052 Zwijnaarde, Belgium. argenx B.V. is the sole shareholder of: ◦ argenx US, Inc., incorporated under the laws of the state of Delaware, U.S., having its registered office in Wilmington, Delaware and its address at 33 Arch Street, Boston, Massachusetts 02110; ◦ argenx Japan KK., incorporated under the laws of Japan, having its registered office in Tokyo, Japan and its address at HULIC JP Akasaka Building 2-5-8, Akasaka, Minato-ku, Tokyo, 107-0052, Japan; argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Company Profile 25

◦ argenx Benelux B.V. (prior to October 31, 2022 known as argenx IIP BV), incorporated under the laws of Belgium, having its registered seat in Zwijnaarde, Belgium and its address at Industriepark- Zwijnaarde 7, 9052 Zwijnaarde, Belgium; ◦ argenx Switzerland, S.A., incorporated under the laws of Switzerland, having its registered office in Geneva, Switzerland, and its address at Rue du Pré-de-la-Bichette 1, 1202 Geneva, Switzerland; ◦ argenx France SAS, incorporated under the laws of France, having its registered office in Paris, France, and its address at Rue Camille Desmoulins 13, 92130 Issy-Les-Moulineaux, France; ◦ argenx UK Ltd., incorporated under the laws of the UK, having its registered office in Gerrards Cross, UK, and its address at Spaces Gerrards Cross Chalfont Park, Building 1 Gerrards Cross, SL9 0BG, UK; ◦ argenx Netherlands Services B.V., incorporated under the laws of the Netherlands, having its registered office in Laarderhoogteweg 25, 1101 EB Amsterdam, the Netherlands; ◦ argenx Germany GmbH, incorporated under the laws of Germany, having its registered office in Munich, Germany, and its address at Konrad-Zuse-Platz 8, 81829 Munich, Germany; ◦ argenx Canada Inc., incorporated under the laws of Ontario, having its registered office in Ontario, Canada and its address at 9131 Keele Street Suite A4, Vaughan, Ontario, Canada, L4K 0G7; ◦ argenx Italy S.r.l., incorporated under the laws of Italy, having its registered office in Milan, Italy and its address at Largo Francesco Richini 6 CAP, 20122 Milan, Italy; ◦ argenx Spain S.L., incorporated under the laws of Spain, having its registered office in Madrid, Spain and its address at Paseo dela Castellana 200, Planta 8a, Oficina 819, 28046 Madrid, Spain, with the branch office: argenx Spain S.L. - Sucursal em Portugal, organized under the laws of Portugal, having its registered office and address at Palácio Sottomayor, Rua Sousa Martins, nº1, 1º esquerdo 1050 217, Lisboa Portugal; ◦ argenx Australia Pty. Ltd., incorporated under the laws of Australia, having its registered office and address at Level 14, 2 Riverside Quay, Melbourne VIC 3006, Australia (since January 12, 2024); and, ◦ argenx Austria Services GmbH, incorporated under the laws of Austria, having its registered office and address at Graben 19, 4th & 5th floor Vienna A-1010 Austria. The following chart provides an overview of the Group as of the date of this Annual Report. Percentages refer to both the share of capital and voting rights. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Company Profile 26

argenx Corporate Legal Structure 1.1.2 Overview Our Medicines VYVGART is a first-in-class antibody fragment targeting FcRn. VYVGART is the only gMG treatment available as both an IV and a simple SC injection (VYVGART SC). VYVGART is approved in more than 30 countries and VYVGART SC is now approved in the U.S., the EU, the UK, Japan, Israel, China and in Australia for the treatment of gMG. VYVGART SC is now also approved in the U.S., China and Japan (as VYVDURA) for the treatment of CIDP. VYVDURA is also approved for the treatment of ITP in Japan. Our Pipeline • efgartigimod is an IgG1 antibody Fc fragment that has been engineered for increased affinity to FcRn compared to endogenous IgG. efgartigimod selectively reduces IgG by blocking FcRn-mediated IgG recycling without impacting antibody production, or affecting other parts of the immune system. It is approved in three indications, including gMG, CIDP and ITP, and is being evaluated in more than 10 additional serious autoimmune indications. • empasiprubart (C2 inhibitor): empasiprubart is a novel complement inhibitor targeting C2, blocking the function of both the classical and lectin pathways while leaving the alternative pathway intact. We believe empasiprubart has the potential to be a pipeline-in-a-product candidate and is being evaluated in 4 serious autoimmune diseases, of which 2 indications are in Phase 3. • ARGX-119 (MusK agonist): ARGX-119 is an agonist SIMPLE ANTIBODY™ to the MuSK receptor with potential in multiple neuromuscular indications. It is currently in proof-of-concept studies for CMS (Phase 1b clinical trial), ALS (Phase 2a) and will start in SMA in 2025. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Company Profile 27

• Preclinical Candidates: Four INDs to start Phase 1 studies in 2025: ◦ ARGX-213, targets FcRn, furthering argenx’s leadership in this new class of medicine ◦ ARGX-121 targeting IgA and ARGX-220 both broadening argenx’s focus across the immune system ◦ ARGX-109, targets IL-6, which plays an important role in inflammation • In addition to our wholly-owned pipeline, we have candidates that emerged from our IIP that we out- licensed to a partner for further development and for which we have milestone, royalty or profit-share agreements. These candidates include, amongst others: cusatuzumab (anti-CD70 antibody – OncoVerity), ARGX-112 (LP-0145 – anti-IL-22R antibody – LEO Pharma), ARGX-114 (AGMB-101 – agonistic anti-MET antibody – Agomab) and ARGX-115 (ABBV-151 – anti-GARP antibody – AbbVie). Immunology Innovation Program (IIP) Our IIP is central to our core business strategy of co-creation and innovation. The IIP also serves as our discovery engine to identify novel targets and together, in collaboration with our scientific and academic partners, to build potential new pipeline candidates. Every current pipeline candidate from both our wholly- owned and partnered pipeline emerged from an IIP collaboration. The IIP enables us to build our broad pipeline of products and product candidates and advance our long-term strategy to be a sustainable, integrated immunology company. Examples of our IIP programs include: • efgartigimod emerged from a collaboration with Professor Sally Ward at the University of Texas Southwestern Medical Center and later became one of the blueprints for our IIP collaborations. Professor Ward’s research identified the crucial role that FcRn plays in maintaining and distributing IgGs throughout the body. efgartigimod is a human IgG1 Fc fragment that is equipped with ABDEG™ mutations, which we in-licensed from the University of Texas Southwestern Medical Center. These proprietary mutations modified efgartigimod to increase its affinity for FcRn while retaining the pH- dependent binding that is characteristic of FcRn interactions with its natural ligand, endogenous IgG. • empasiprubart was built in collaboration with Broteio Pharma B.V. (Broteio). Broteio was launched in 2017 with support from Professor Erik Hack and the University of Utrecht, to conduct research demonstrating preclinical POC of the mechanism of action of empasiprubart. Professor Hack is a renowned researcher in the role of inflammation in disease, specifically in the complement system, and has contributed research and expertise to the approval of two complement inhibitors. His understanding of the mild phenotype associated with a natural C2 deficiency and C2’s unique positioning at the junction of the classical and lectin pathways led to our interest in engineering empasiprubart with our proprietary NHANCE™ mutations and LALA mutations. • ARGX-119 was built in collaboration with the Leiden University Medical Center (LUMC) and New York University (NYU) with support from teams led by Professor Verschuuren and Professor Steve Burden, respectively. Both groups have world-class expertise in unraveling the biological mechanism of neuromuscular disease and translating these insights from the lab to the patient. We bring to the collaboration our unique suite of antibody discovery and antibody engineering technologies and experience in clinical development to complement our partners’ expertise in disease and target biology. Our suite of technologies include amongst others our SIMPLE ANTIBODY™ platform technology and NHANCE™, ABDEG™, POTELLIGENT®, and DHS mutations that focus on engineering the Fc region of antibodies in order to augment their intrinsic therapeutic properties. For more information, please see Section “1.3.7 IIP”. Our Suite of Technologies • Through our IIP, we collaborate with scientific and academic partners to identify immunology breakthroughs and build potential pipeline candidates. This is done through co-creation. We bring to the collaboration our unique suite of antibody engineering technologies and experience in clinical development to complement our partners’ expertise in disease and target biology. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Company Profile 28

• SIMPLE ANTIBODY™ platform technology: Our proprietary SIMPLE ANTIBODY™ platform technology, based on the powerful llama immune system, allows us to exploit novel and complex disease biology targets. The platform sources antibody variable regions (V-regions) from the immune system of outbred llamas, each of which has a different genetic background. The llama produces highly diverse panels of antibodies with a high human homology, or similarity, in their V-regions when immunized with targets of human disease. Our SIMPLE ANTIBODY™ platform technology allows us to access and explore a broad target universe while potentially minimizing the long timelines associated with generating antibody candidates using traditional methods. • NHANCE™, ABDEG™, POTELLIGENT®, and DHS mutations focus on engineering the Fc region of antibodies in order to augment their intrinsic therapeutic properties. In addition, we obtained a non- exclusive research license and option from Chugai Pharmaceutical Co., Ltd. (Chugai) for the SMART-Ig® (‘Recycling Antibody’ and part of ‘Sweeping Antibody’) and ACT-Ig® (Antibody half-life extending) technologies. These technologies are designed to enable us to expand the therapeutic index of our product candidates, which is the ratio between toxic and therapeutic dose, by potentially modifying their half-life, tissue penetration, rate of disease target clearance and potency. In 2020, we also entered into a non-exclusive research agreement with the Clayton Foundation under which we may access the Clayton Foundation’s proprietary DHS mutations to extend the serum half-life of therapeutic antibodies. 1.2 Strategy and Objectives 1.2.1 Company’s Strategies Our goal is to transform the lives of at least 50,000 patients and their communities before 2030 by providing them with life-changing medicines built on scientific breakthroughs in immunology. To reach this goal, we plan to deliver a set of different strategies: • Maximize the VYVGART® opportunity: redefine treatment expectations for MG and CIDP, and deliver 6 additional labelled indications We plan to do this through our differentiated scientific and clinical activities and our commercial execution to drive VYVGART preference. Our PFS with PDUFA Date in April 2025 as a perfect example of our continued innovation for the patient experience. Beyond neurology, we plan to establish argenx and VYVGART in rheumatology as we prepare for data in Myositis and SjD, while also maximizing the therapeutic potential of VYVGART in other indications through the execution of multiple Phase 2 and Phase 3 studies. • Maximize the empasiprubart opportunity: establish its potential as a pipeline-in-a-product We plan to develop argenx as scientific leader in complement inhibitions and elevate the differentiation story. In particular, we have advanced the clinical development of empasiprubart in MMN, currently in Phase 3, DGF in the context of kidney transplants and DM, currently in Phase 2, and expect to start a registrational clinical trial for our fourth selected indication, CIDP in 2025. For both MMN and CIDP we will prepare for launches, building on key elements of the VYVGART playbook. • Build a sustainable, diversified portfolio of breakthrough and differentiated antibody-based products We plan to further advance ARGX-119 to a differentiated first-in-class MuSK agonist in multiple indications (CMS, ALS, SMA, 1 new indication), maximize our leadership position in the FcRn space through multiple generations of projects (e.g. ARGX-213), substantially grow our clinical portfolio of differentiated pipeline-in-a-product opportunities (ARGX-109, ARGX-121, ARGX-220, ARGX-213, other), create an exciting portfolio of promising new assets (through our IIP) and advance our clinical trial designs and speed. • Grow a unique, global biotech company by scaling the argenx Way: one company, one plan, on a mission to achieve the unthinkable We plan to embed the argenx Way throughout the organization, who we are through our cultural pillars and how we work through our operating principles. We want to demystify innovation and make it everyone’s business, strengthen the ‘winning’ competencies to share the future of argenx and advance our partnership approach to access. To be able to continue in this way, we plan to remain a magnet for talent and create unlimited opportunities for growth and development of our people, an important driver of developing the business. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Company Profile 29

• Ensure long-term sustainability We plan to continue to seek out, listen to and prioritize on behalf of the patient in all what we do, accelerate the science of immunology by being an active and trusted partner in the global immunology ecosystem through high-quality publications and patent applications, elevate and expand our relationships with regulatory, payors and policy stakeholders and create long- term shareholder value. • In our 2030 vision, we aim to build on our strong strategic pillars to have a continuous pipeline of innovation, strengthen our FcRn leadership and scale in a disciplined way. Our goal is to have 5 new molecules in Phase 3 development, 10 labelled indications and reaching 50,000 patients who are on treatment by 2030. 1.2.2 Competitive position We participate in a highly innovative industry characterized by a rapidly growing understanding of disease biology, quickly changing technologies, strong intellectual property barriers to entry, and a multitude of companies involved in the creation, development and commercialization of novel therapeutics. Many of these companies are highly sophisticated and often strategically collaborate with each other. Competition in the autoimmune field is intense and involves multiple monoclonal antibodies (mAbs), other biologics and small molecules either already marketed or in development by many different companies, including large pharmaceutical companies. We compete with a wide range of biopharmaceutical companies, who are developing products for the treatment of gMG, CIDP, ITP and other autoimmune diseases, including products that are in the same class as VYVGART, as well as products that are similar to some of our product candidates. We are aware of several FcRn inhibitors that are in clinical development or marketed. Competitive product launches may erode future sales of our products, including our existing products and those currently under development, or result in unanticipated product obsolescence. Such launches continue to occur, and potentially competitive products are in various stages of development. We could also face competition for use of limited international infusion sites, particularly in new markets as competitors launch new products. We cannot predict with accuracy the timing or impact of the introduction of competitive products that treat diseases and conditions like those treated by our products or product candidates. In addition, our competitors compete with us to recruit and retain qualified scientific and management personnel, establish clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, the development of our products. Please see the risk factor titled ”We face significant competition for our drug discovery and development efforts. for further details on the competition we face. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Strategy and Objectives 30

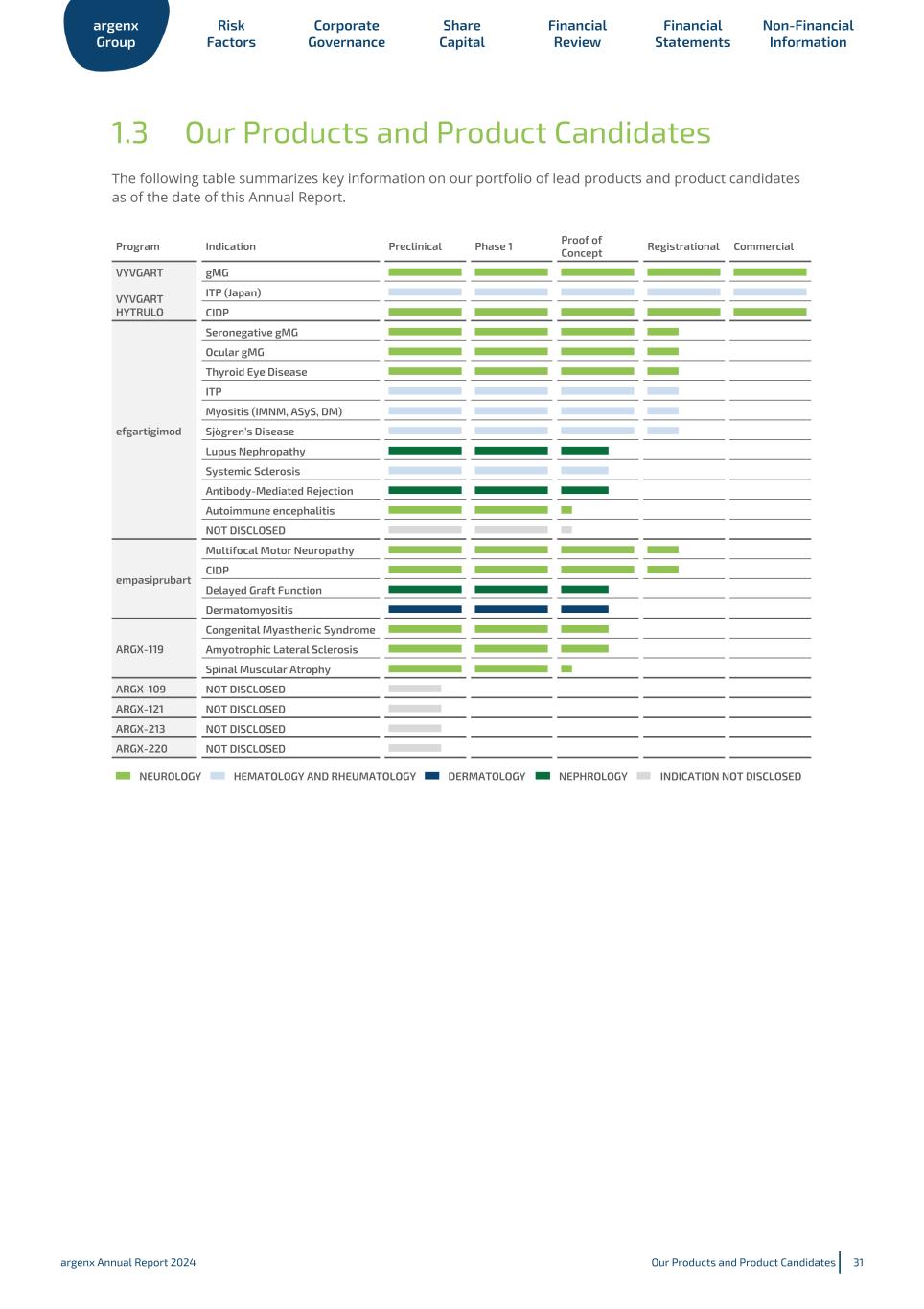

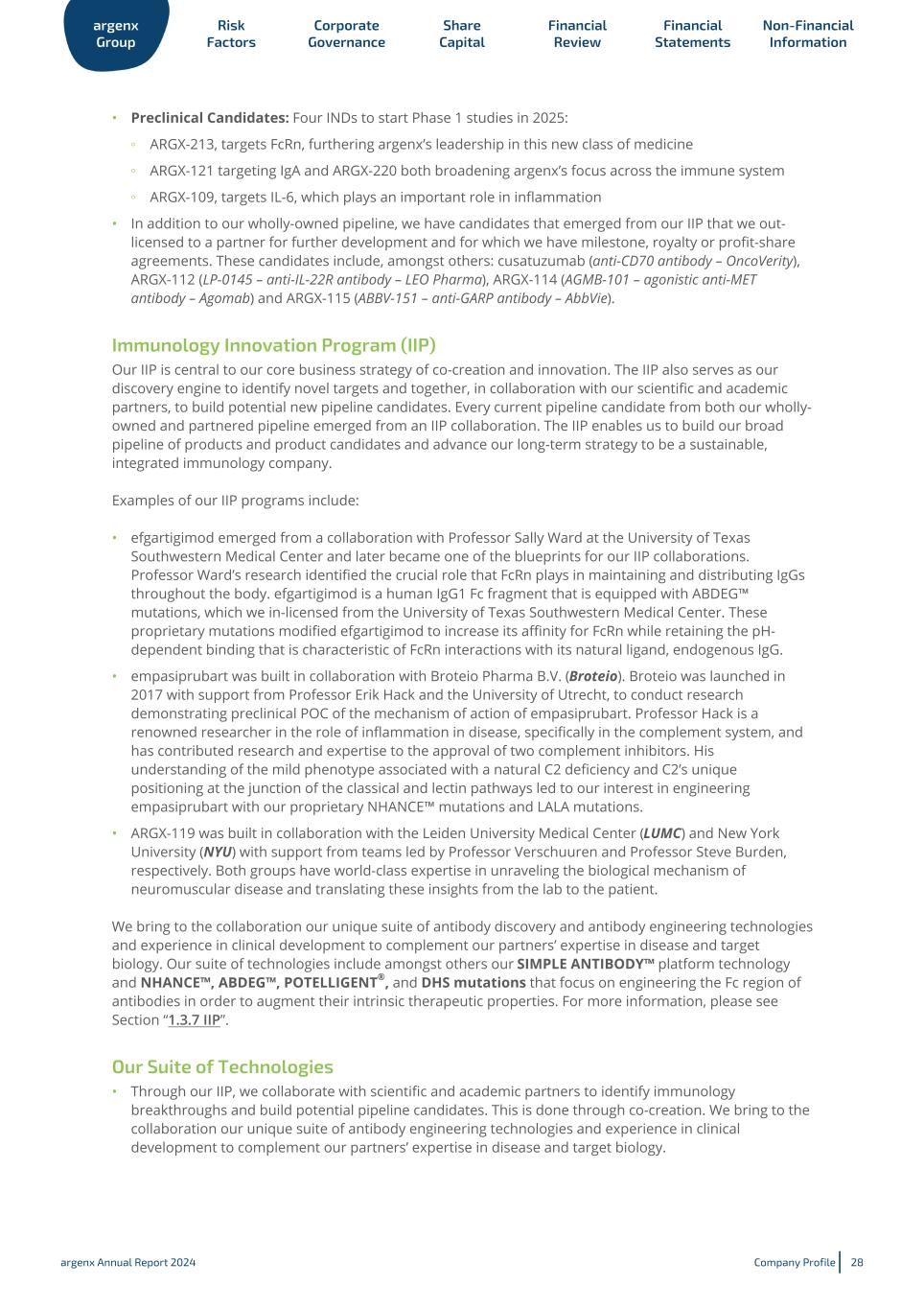

1.3 Our Products and Product Candidates The following table summarizes key information on our portfolio of lead products and product candidates as of the date of this Annual Report. Program Indication Preclinical Phase 1 Proof of Concept Registrational Commercial VYVGART VYVGART HYTRULO gMG ITP (Japan) CIDP efgartigimod Seronegative gMG Ocular gMG Thyroid Eye Disease ITP Myositis (IMNM, ASyS, DM) Sjögren’s Disease Lupus Nephropathy Systemic Sclerosis Antibody-Mediated Rejection Autoimmune encephalitis NOT DISCLOSED empasiprubart Multifocal Motor Neuropathy CIDP Delayed Graft Function Dermatomyositis ARGX-119 Congenital Myasthenic Syndrome Amyotrophic Lateral Sclerosis Spinal Muscular Atrophy ARGX-109 NOT DISCLOSED ARGX-121 NOT DISCLOSED ARGX-213 NOT DISCLOSED ARGX-220 NOT DISCLOSED NEUROLOGY HEMATOLOGY AND RHEUMATOLOGY DERMATOLOGY NEPHROLOGY INDICATION NOT DISCLOSED argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 31

1.3.1 VYVGART Approvals and Regulatory Plan Our two approved medicines, VYVGART and VYVGART SC, are FcRn blockers. VYVGART is approved in more than 30 countries for the treatment of adults with gMG who are anti-acetylcholine receptor (AChR) antibody positive (AChR-AB+) and for the treatment of adults with gMG who do not have sufficient response to steroids or non-steroidal immunosuppressive therapies (ISTs), including seronegative patients, in Japan. VYVGART is now also approved for the treatment of adult patients with ITP in Japan. Our second product, VYVGART SC, is a subcutaneous combination of efgartigimod alfa and recombinant human hyaluronidase PH20 (rHuPH20), Halozyme Therapeutics, Inc.’s (Halozyme) ENHANZE® SC drug delivery technology. It has been approved for the treatment of adults with gMG who are AChR-AB+ as VYVGART HYTRULO in the U.S. and China, as VYVGART in the EU, and as VYVGART SC in the UK, Israel. It has also been approved as VYVDURA in Japan for the treatment of adults with gMG who do not have sufficient response to steroids or non-steroidal ISTs, including seronegative patients. VYVGART SC has now also been approved for the treatment of adults with CIDP in the U.S. and China as VYVGART HYTRULO and in Japan as VYVDURA. More approvals and launches of both VYVGART and VYVGART SC in multiple jurisdictions and countries are planned following pricing and reimbursement negotiations. The following table summarizes the status of regulatory approvals and commercialization efforts for VYVGART IV, VYVGART SC and PFS as March 17, 2025: Product Product name Indication Geography Submission Approval Launched VYVGART IV VYVGART gMG US December 17, 2021 December 17, 2021 VYVGART gMG Europe August 10, 2022 Germany was the first European country to launch on September 1, 2022 VYVGART gMG Canada September 19, 2023 November 6, 2023 VYVGART gMG Israel April 24, 2023 Not marketed VYVGART gMG Japan January 20, 2022 May 9, 2022 VYVGART gMG The UK March 14, 2023 Not marketed VYVGART gMG China June 30, 2023 September 5, 2023 VYVGART gMG Australia February 24, 2025 Not available VYVGART gMG Kuwait February 19, 2025 Not available VYVGART gMG Saudi Arabia Submitted Not available Not available VYVGART gMG Korea (the Republic of) January 20, 2025 Not available VYVGART gMG United Arab Emirates October 30, 2024 Not marketed VYVGART gMG Switzerland October 3, 2024 Not marketed VYVGART ITP Japan March 26, 2024 On the market since launch of IV product Not available gMG Brazil Planned submission 2H 2025 Not available Not available Not available gMG Singapore Not available Not available Not available argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 32

VYVGART SC VYVGART HYTRULO gMG US June 20, 2023 June 20, 2023 VYVGART HYTRULO CIDP US June 21, 2024 On the market since launch of SC product VYVGART gMG Australia February 24, 2025 Not available VYVGART gMG Europe November 15, 2023 Germany was the first European country to launch on December 15, 2023 VYVGART CIDP Europe Submitted Expected in 2H Not available Not available gMG Switzerland February 10, 2025 Not available VYVGART gMG The UK February 6, 2024 Not marketed VYVGART SC gMG Israel September 23, 2024 Not marketed VYVGART HYTRULO gMG China July 9, 2024 December 3, 2024 VYVGART HYTRULO CIDP China November 5, 2024 On the market since launch of SC product VYVDURA gMG Japan January 18, 2024 April 17, 2024 VYVDURA CIDP Japan December 27, 2024 On the market since launch of SC product PFS VYVDURA gMG Japan Submitted Expected in 2H 2025 Not available VYVDURA CIDP Japan Submitted Expected in 2H 2025 Not available Not available gMG U.S. Submitted Expected in 1H 2025 Not available Not available CIDP U.S. Submitted Expected in 1H 2025 Not available VYVGART gMG Europe February 13, 2025 February 13, 2025 VYVGART CIDP Europe Submitted Expected in 1H 2025 Not available Not available gMG Canada Submitted Expected in 2H 2025 Not available Not available CIDP Canada Submitted Expected in 2H 2025 Not available Not available gMG The UK Submitted Not available Not available Commercialization We have established our own sales force in the U.S., Japan, Europe and Canada for VYVGART for the treatment of gMG and CIDP (where approved). We plan to expand our own sales and marketing capabilities and promote our products and product candidates in other regions if we decide there is a business case to do so after regulatory approval has been obtained. Development and commercialization may also be done through collaborations with third parties. In January 2021, we entered into an exclusive out-license agreement with Zai Lab (Zai Lab Agreement), a commercial- stage biopharmaceutical company, for the development and commercialization of efgartigimod in Greater China, (which includes Mainland China, Hong Kong, Taiwan and Macau, Greater China). Zai Lab announced approval of VYVGART in Mainland China in June 2023 for the treatment of adult gMG patients and in 2024 Zai Lab also announced the approval of VYVGART SC for gMG and CIDP. Under the Zai Lab Agreement, we received and continue to be eligible for certain sales-based milestone payments and royalties based on annual product net sales of efgartigimod in Greater China. In October 2021, we announced an exclusive distribution agreement with Medison to commercialize efgartigimod for gMG in Israel (Medison Agreement). Medison filed for and obtained approval for VYVGART in April 2023 and for VYVGART SC in September 2024. On June 6, 2022 we announced an exclusive multi- regional agreement with Medison to commercialize efgartigimod in 14 countries, including Poland, Hungary, Slovenia, Czech Republic, Romania, Bulgaria, Lithuania, Croatia, Slovakia, Estonia, Latvia, Greece, and Cyprus, for the treatment of adult patients with gMG (Medison Multi-Regional Agreement). argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 33

In January 2022, we entered into a partnership agreement with Genpharm, under which Genpharm shall purchase VYVGART from us for the resale in the Gulf Cooperation Council (comprising Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain and Oman) on an exclusive basis for Genpharm’s own account and own name (Genpharm Agreement). In 2023, we entered into the Handok Agreement for the distribution of VYVGART in South Korea and in 2024 we received approval for VYVGART in South Korea. We intend to sign additional distribution partnerships for other territories. In the U.S., argenx advertises certain products via digital and traditional media channels, including the internet and television. For a discussion of total revenues by geographic market, please see “Note 17 Segment Reporting” in our consolidated financial statements. Pre-Approval Access Program We are committed to improving the lives of people suffering from rare diseases. We are driven to discover new treatment approaches fueled by the resilience of patients to urgently deliver them. We aim to do this in partnership; we listen to patients, supporters and advocacy communities, and we hear their stories. Their insights guide us as we develop our investigational therapies and motivate us to advance the understanding of rare diseases. We have a Pre-Approval Access program (PAA) for patients with gMG which opened on February 21, 2021 for patients who are unable to participate in an ongoing clinical trial. In 2024, we approved access to this PAA for over 403 gMG patients in 14 countries. The PAA program remains open in countries where VYVGART is not yet launched or reimbursed. 1.3.2 efgartigimod (formerly ARGX-113) Development Mechanism of Action As shown in Figure 1, efgartigimod is a human IgG1 Fc fragment equipped with our ABDEG™ mutations that is designed to target the FcRn and reduce IgG. FcRn is foundational to the immune system and functions to recycle IgG, extending its serum half-life over other IgGs that are not recycled by FcRn. IgGs that bind to FcRn are rescued from lysosomal degradation. By binding to FcRn, efgartigimod can reduce IgG recycling and increase IgG degradation. Compared to alternative immunosuppressive approaches, such as B-lymphocyte (B-cell) depleting agents, efgartigimod acts in a highly selective manner. For efgartigimod, we now have an estimated 8,000 patients years of safety follow-up between clinical trials and real world experience. efgartigimod has been observed to significantly reduce concentrations of all IgG subtypes without decreasing levels of other IgGs or human serum albumin, which is also recycled by FcRn, discussed in more detail in the paragraph of this section on formulations below. Based on its mechanism of action in targeting FcRn to selectively reducing IgGs, efgartigimod has the potential to address a multitude of severe autoimmune diseases where pathogenic IgGs are believed to be mediators of disease. As of the end of 2024, we are evaluating efgartigimod in more than 10 serious autoimmune indications and plan to continue to expand into new indications. argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 34

Figure 1: efgartigimod’s mechanism of action blocks the recycling of IgG antibodies and removes them from circulation Indication Selection Strategy We utilize the following strategy to select indications for efgartigimod: • We first start with a strong, unifying biological rationale. The indications in our pipeline are unified in that there exists a wide range of supportive evidence that demonstrates that each is IgG-mediated. This ranges from published literature, clinical trials with currently used therapies such as IVIg, PLEX, or rituximab, and other experiments, such as passive transfer models. • We also look at indications where a significant clinical or commercial opportunity exists. These are disease areas where there is a significant unmet need for innovation as patients are often not well- managed by current therapies and their respective side effects. • Furthermore, for each indication, there is a defined path forward with established precedent for how to run POC and registrational clinical trials with generally accepted clinical and regulatory endpoints. Formulations Overview We are developing two formulations of efgartigimod to address the needs of patients, physicians, and payers across indications and geographies, including efgartigimod IV (VYVGART) and efgartigimod SC (VYVGART SC). Scientific Publications We refer to our key scientific publications from our Phase 3 studies with either the IV or SC formulation in gMG, ITP and CIDP. • Publication in The Lancet Neurology of Phase 3 ADAPT study data in generalized myasthenia gravis: thelancet.com/journals/laneur/article/PIIS1474-4422(21)00159-9/abstract argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 35

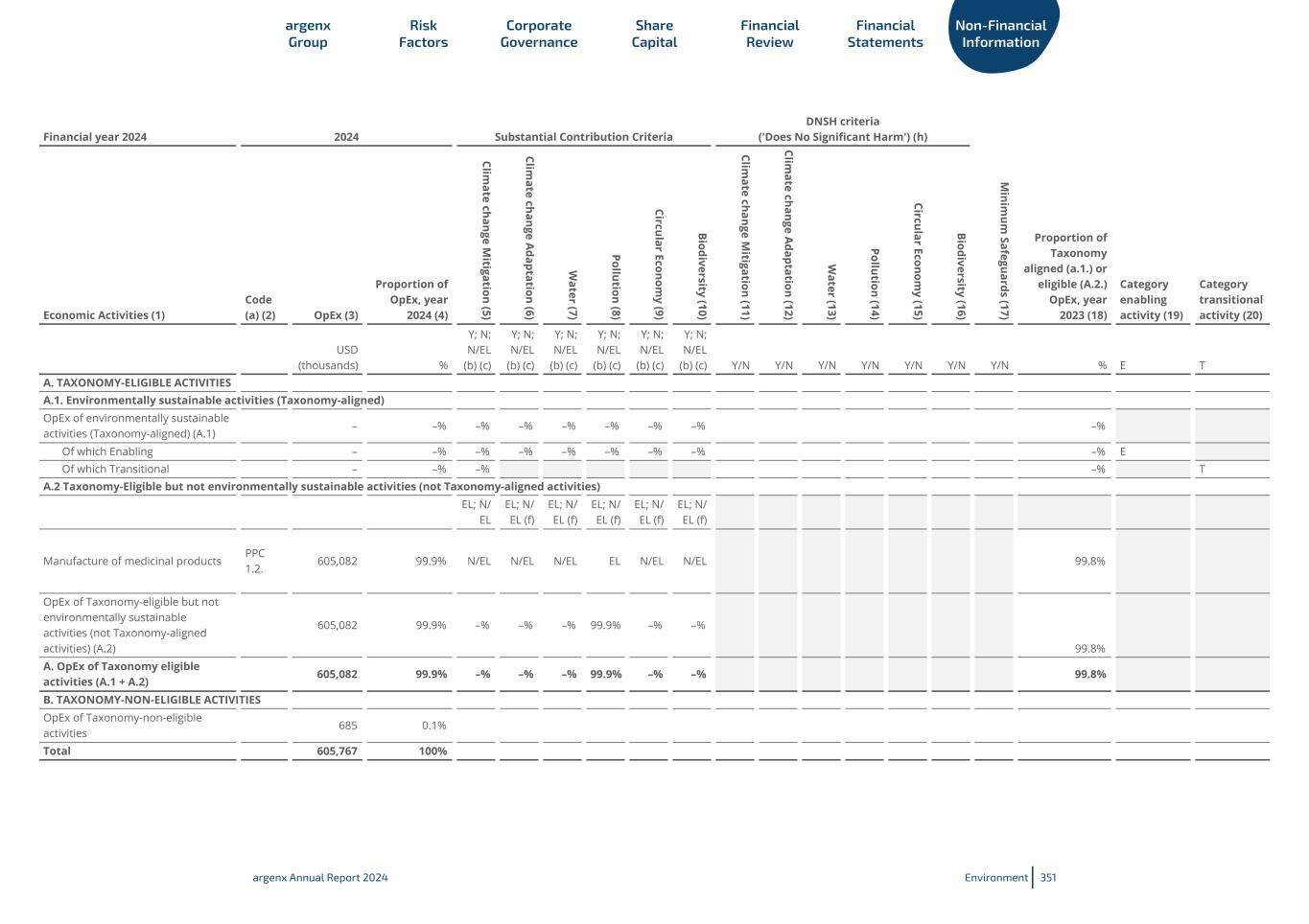

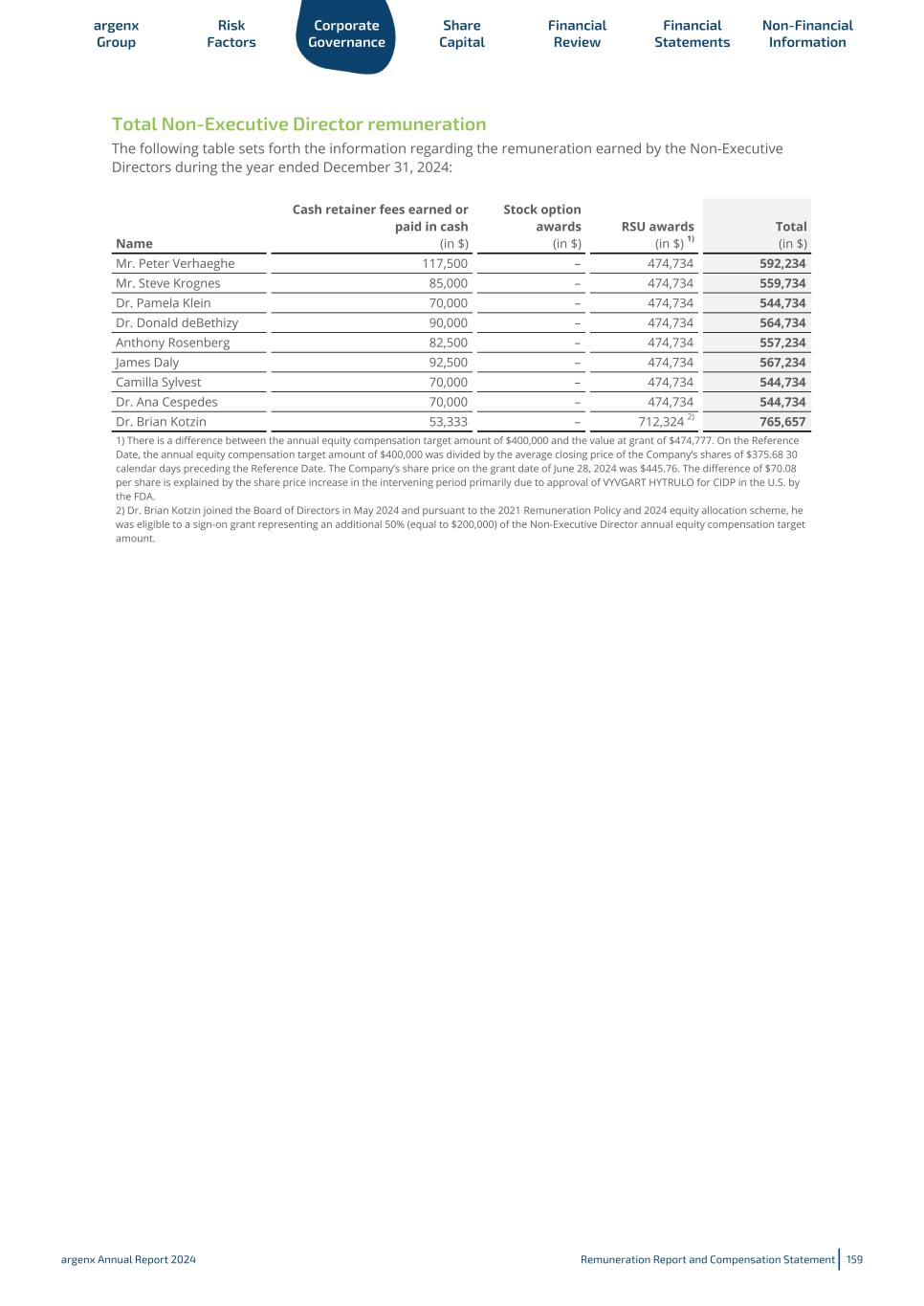

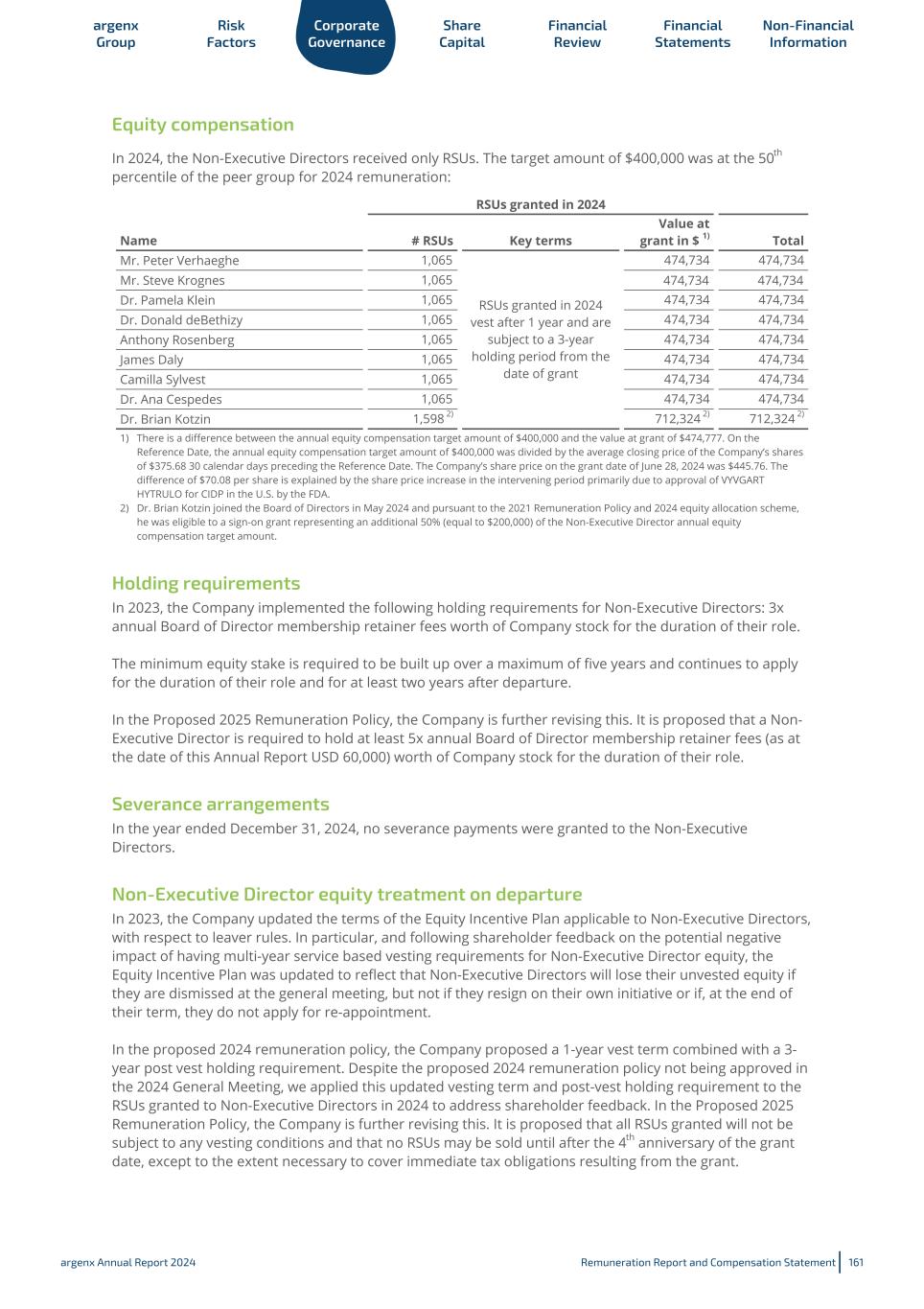

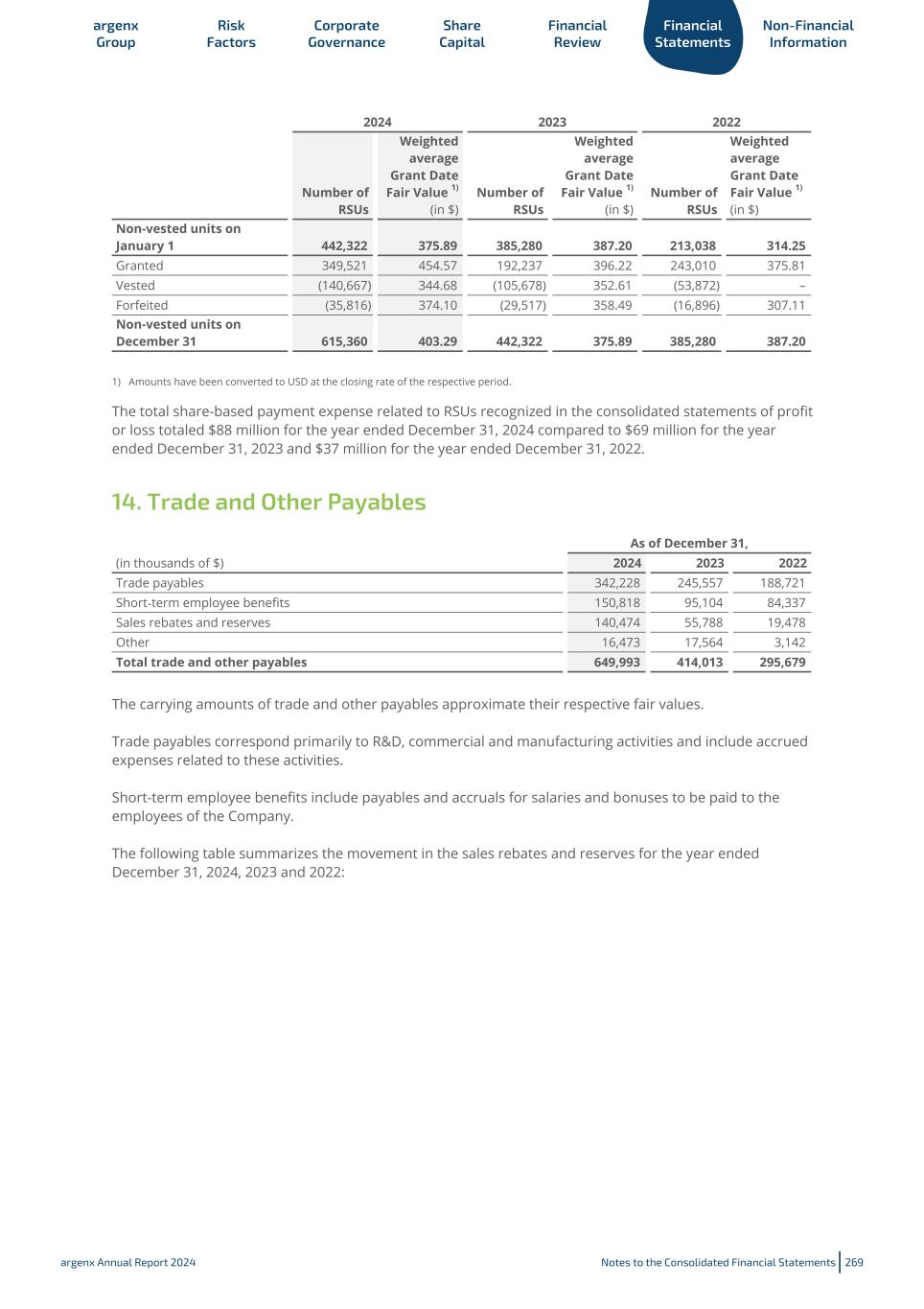

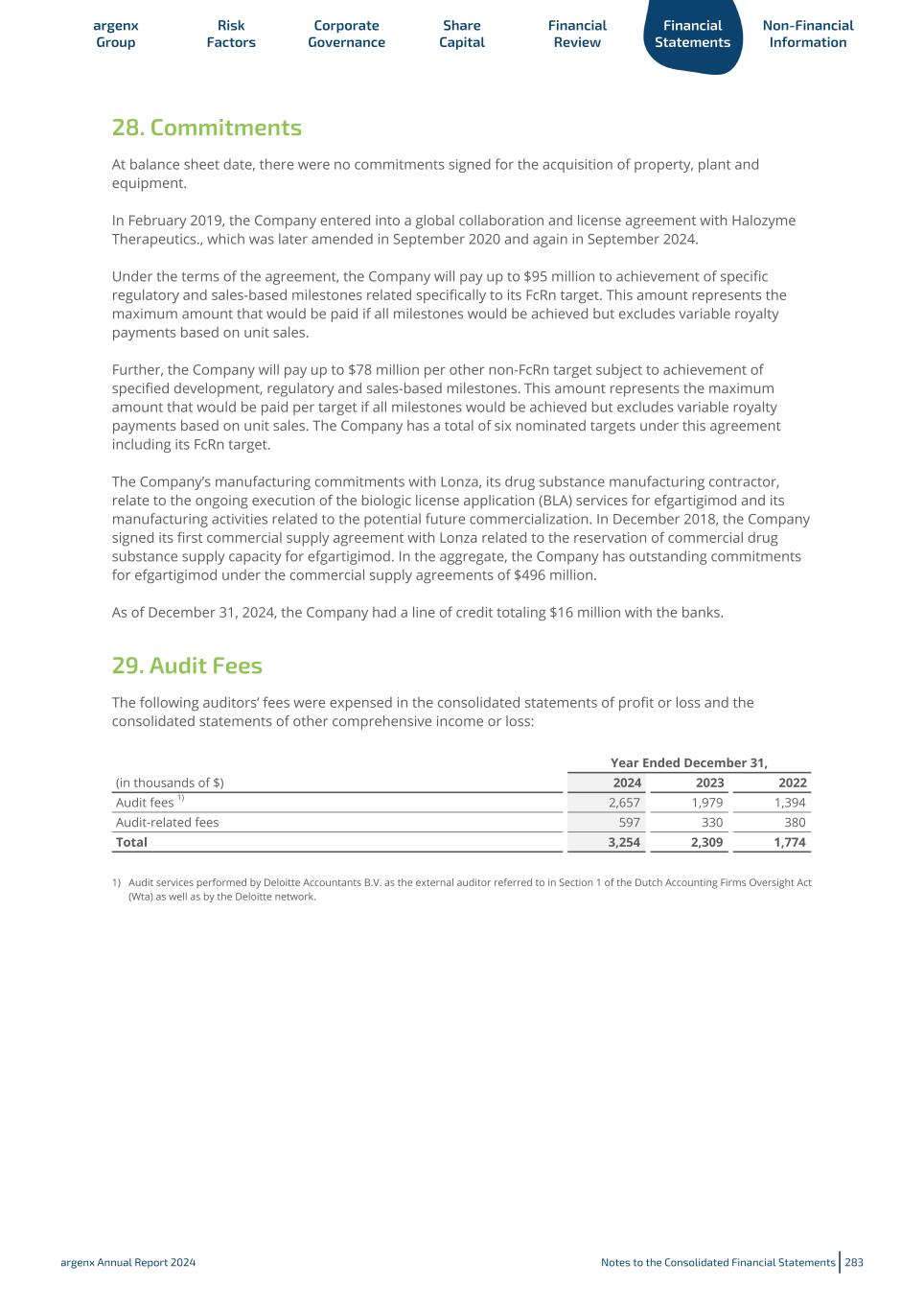

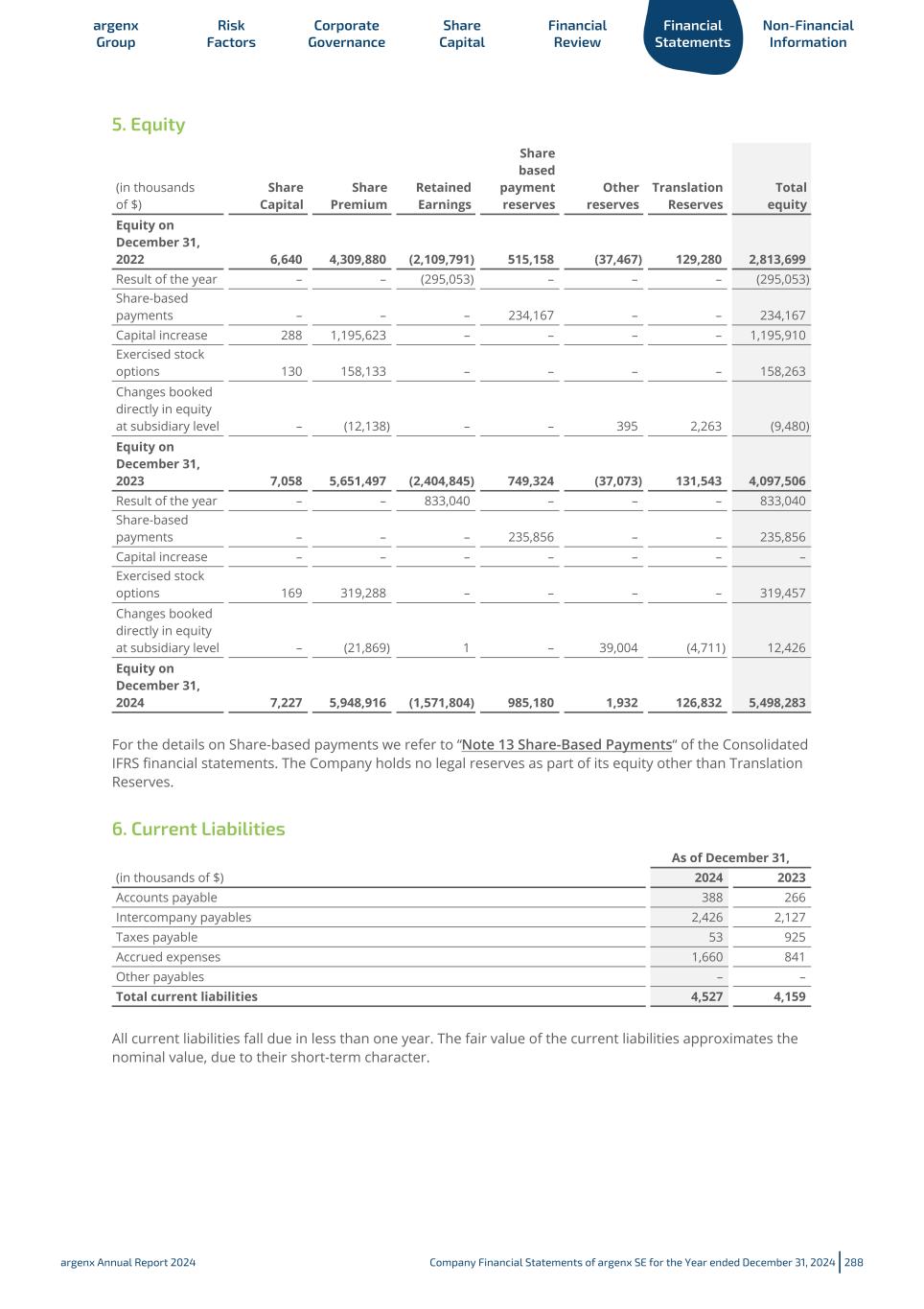

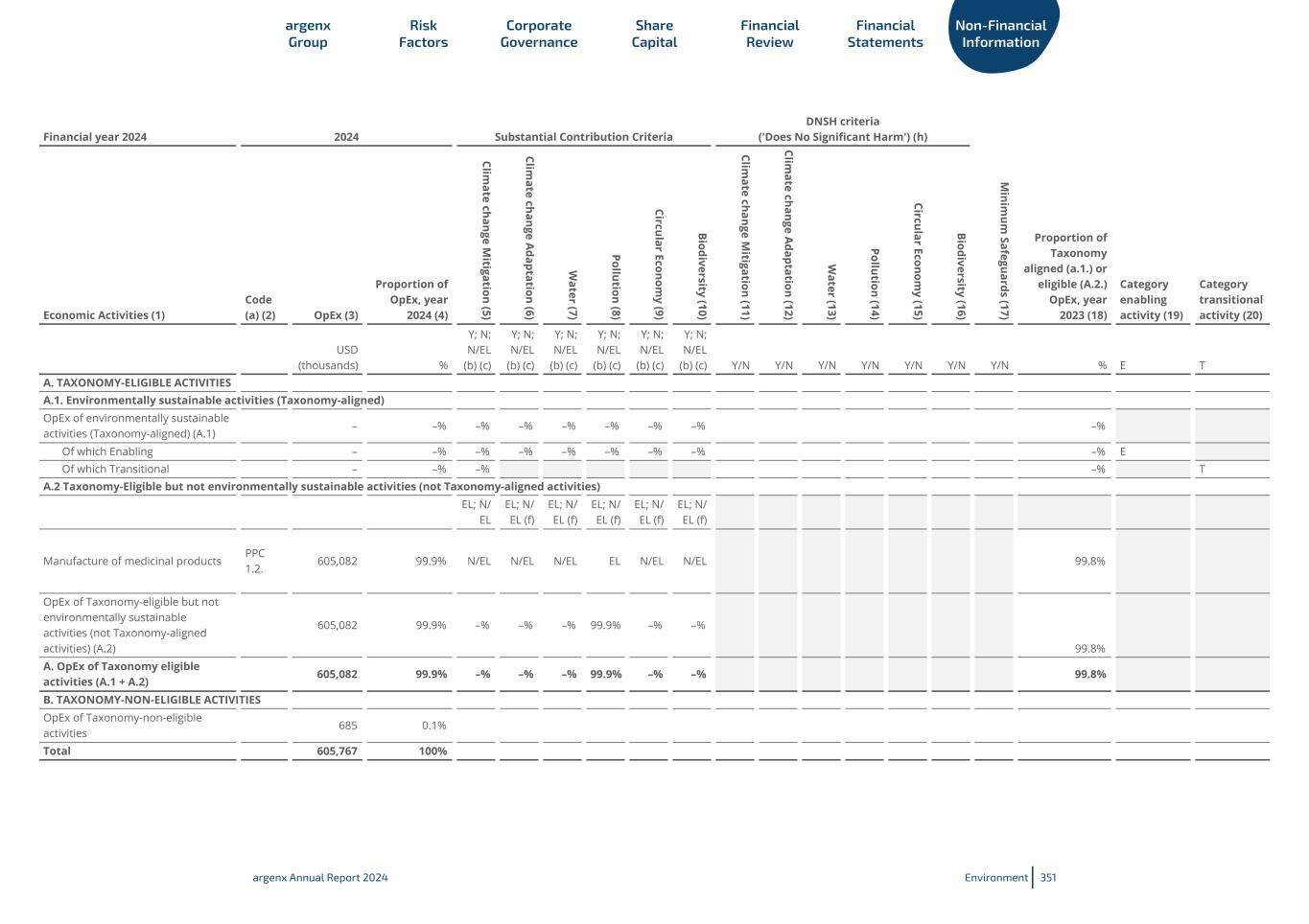

• Publication in The Lancet of Phase 3 ADVANCE-IV study data in primary immune thrombocytopenia: thelancet.com/journals/lancet/article/PIIS0140-6736(23)01460-5/abstract • Publication in The Lancet Neurology of Phase 3 ADHERE study data in chronic inflammatory demyelinating polyneuropathy: thelancet.com/journals/laneur/article/PIIS1474-4422(24)00309-0/ abstract 1.3.3 efgartigimod Indications Clinical trial overview Clinical Trial Stage Indica tion Patients Primary Endpoint Status ADAPT Registrational gMG The proportion of responders based on the Myasthenia Gravis Activities of Daily Living (MG-ADL) score Marketed ADAPT-SC Registrational gMG The proportion of responders based on the Myasthenia Gravis Activities of Daily Living (MG-ADL) score Marketed ADAPT- SERON Registrational seronega tive gMG 110 MG-ADL total score change from baseline to day 29 (w4) Ongoing clinical trial results expected 2H 2025 ADAPT- OCULUS Registrational ocular MG 92-124 Change in MGII PRO ocular score from baseline to day 29 (w4) Ongoing clinical trial results expected 1H 2026 ADHERE Registrational CIDP 322 The hazard ratio for the time to first adjusted INCAT deterioration Marketed ADVANCE-IV Registrational ITP The proportion of patients that achieved sustained platelet response Marketed ADVANCE- NXT Registrational ITP 63 Extent of disease control (cumulative number of weeks over the planned 24- week treatment period with platelet counts of ≥ 50×109/L Ongoing clinical trial results expected in 2H 2026 BALLAD Registrational BP 98 The proportion of participants in complete remission while off oral corticosteroids for at least eight weeks at week 36 Clinical trial discontinued in 2024 ALKIVIA Registrational Myositis Target 240 The total improvement score (TIS) at the end of treatment period Ongoing clinical trial results expected in 2H 2026 RHO PoC Primary SjD Target 30 The proportion of responders to the Composite of Relevant endpoints for SjD (CRESS; response on ≥ three out of five items) at week 24 GO decision made in 2024 advanced in Phase 3 UNITY Registrational Primary SjD Target 580 The change from baseline on the ClinESSDAI score (w48) Ongoing clinical trial results expected in 2027 ALPHA PoC POTS post- COVID19 53 The co-primary endpoints are 1) COMPASS-31 and 2) the Malmö POTS Symptom score at the end of the 24- week treatment period Clinical trial discontinued in 2024 In partnership with Zai Lab PoC LN Target 60 The change in urine protein creatinine ratio from baseline to end of the treatment period Ongoing clinical trial results expected in 2H 2025 In partnership with Zai Lab PoC MN Target 70 The change in urine protein creatinine ratio from baseline to end of the treatment period in the anti-PLA2R Ab seropositive population Clinical trial discontinued in 2024 argenx Group Risk Factors Corporate Governance Share Capital Financial Review Financial Statements Non-Financial Information argenx Annual Report 2024 Our Products and Product Candidates 36