Delaware |

001-38142 |

35-2581557 |

|||||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|||||||||

|

|||||||||||

310 Seven Springs Way, Suite 500 |

Brentwood | Tennessee | 37027 |

||||||||

(Address of Principal Executive) |

(Zip Code) |

||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | DK | New York Stock Exchange | ||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |||||||

Dated: November 6, 2024 |

DELEK US HOLDINGS, INC

|

||||

/s/ Reuven Spiegel |

|||||

Name: Reuven Spiegel |

|||||

|

Title: Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

|

|||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| ($ in millions, except per share data) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

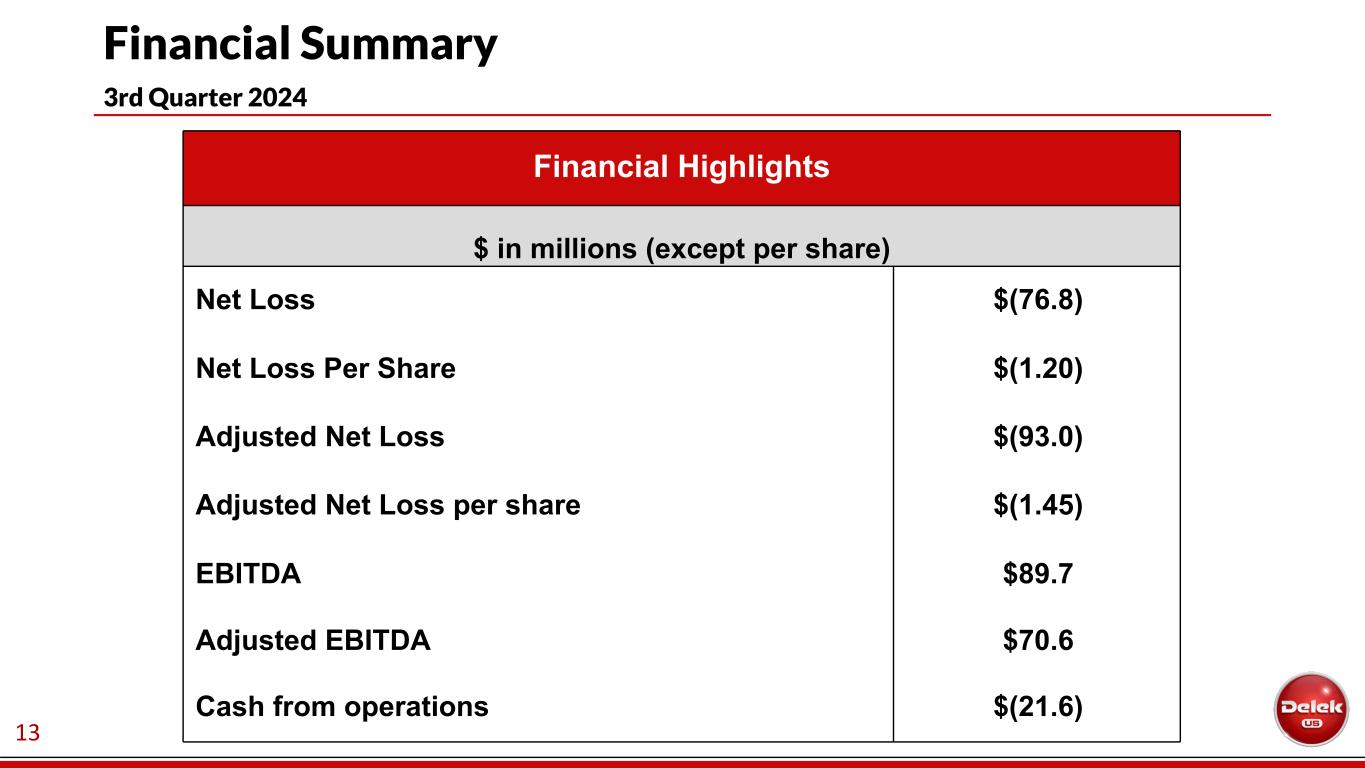

| Net (loss) income attributable to Delek US | $ | (76.8) | $ | 128.7 | $ | (146.6) | $ | 184.7 | ||||||||||||||||||

| Total diluted (loss) income per share | $ | (1.20) | $ | 1.97 | $ | (2.29) | $ | 2.78 | ||||||||||||||||||

| Adjusted net (loss) income | $ | (93.0) | $ | 131.9 | $ | (178.5) | $ | 289.8 | ||||||||||||||||||

| Adjusted net (loss) income per share | $ | (1.45) | $ | 2.02 | $ | (2.78) | $ | 4.37 | ||||||||||||||||||

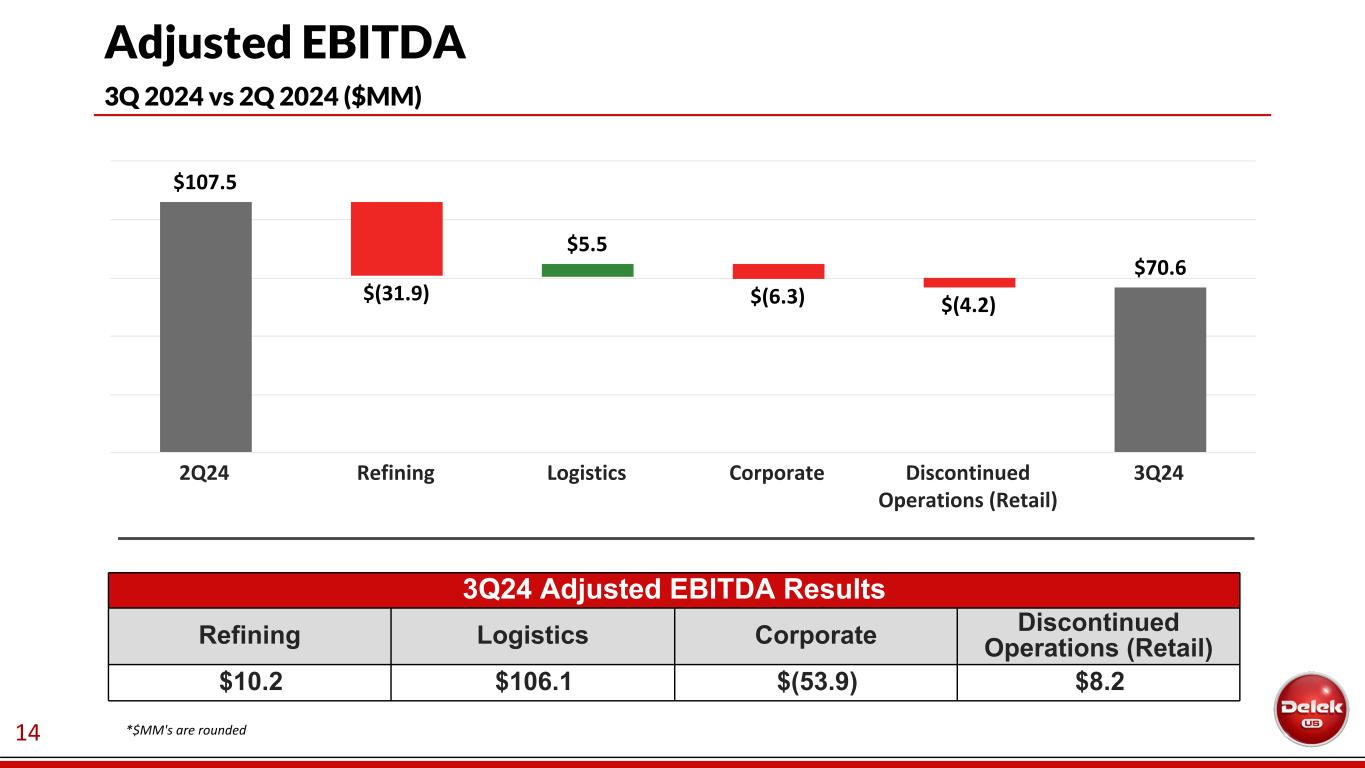

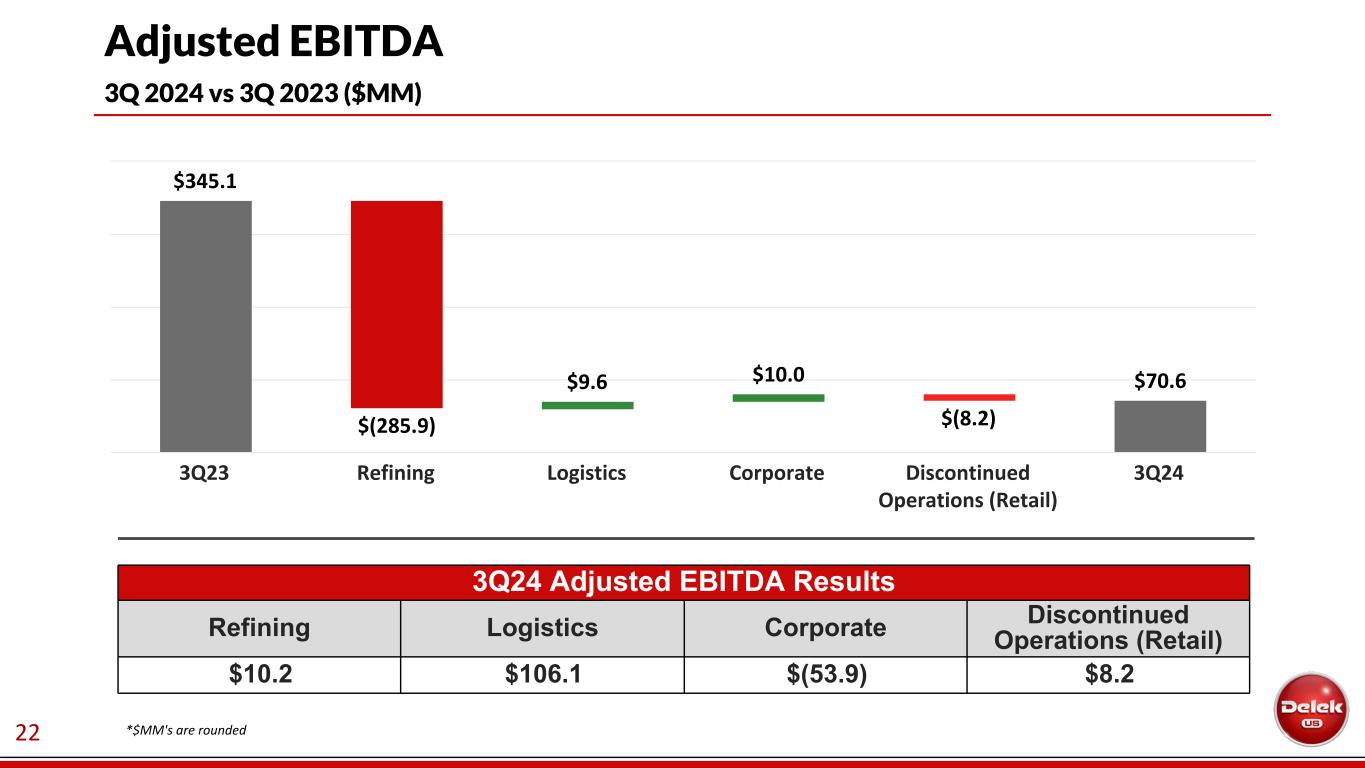

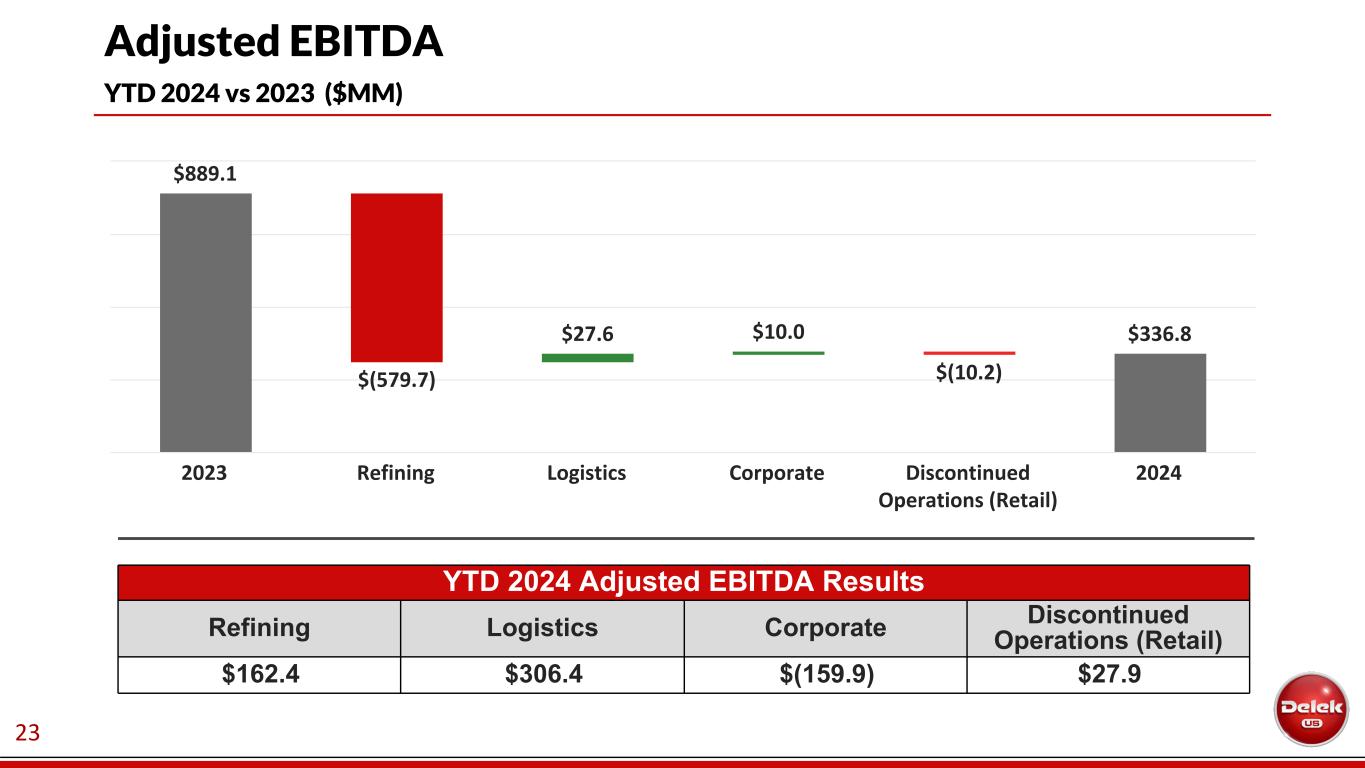

| Adjusted EBITDA | $ | 70.6 | $ | 345.1 | $ | 336.8 | $ | 889.1 | ||||||||||||||||||

1 | |

|||||

2 | |

|||||

3 | |

|||||

4 | |

|||||

| Delek US Holdings, Inc. | ||||||||||||||

Condensed Consolidated Balance Sheets (Unaudited) | ||||||||||||||

($ in millions, except share and per share data) | ||||||||||||||

| September 30, 2024 | December 31, 2023 | |||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | 1,037.6 | $ | 821.8 | ||||||||||

| Accounts receivable, net | 561.6 | 783.7 | ||||||||||||

| Inventories, net of inventory valuation reserves | 915.0 | 941.2 | ||||||||||||

| Current assets of discontinued operations | — | 41.5 | ||||||||||||

| Other current assets | 50.6 | 77.8 | ||||||||||||

| Total current assets | 2,564.8 | 2,666.0 | ||||||||||||

| Property, plant and equipment: | ||||||||||||||

| Property, plant and equipment | 4,790.7 | 4,460.3 | ||||||||||||

| Less: accumulated depreciation | (1,961.7) | (1,764.0) | ||||||||||||

| Property, plant and equipment, net | 2,829.0 | 2,696.3 | ||||||||||||

| Operating lease right-of-use assets | 98.8 | 121.5 | ||||||||||||

| Goodwill | 687.5 | 687.5 | ||||||||||||

| Other intangibles, net | 328.6 | 287.7 | ||||||||||||

| Equity method investments | 408.7 | 360.7 | ||||||||||||

| Non-current assets of discontinued operations | — | 228.1 | ||||||||||||

| Other non-current assets | 112.9 | 124.0 | ||||||||||||

| Total assets | $ | 7,030.3 | $ | 7,171.8 | ||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 1,713.6 | $ | 1,814.3 | ||||||||||

| Current portion of long-term debt | 9.5 | 44.5 | ||||||||||||

| Current portion of obligation under Inventory Intermediation Agreement | 3.6 | 0.4 | ||||||||||||

| Current portion of operating lease liabilities | 45.6 | 50.1 | ||||||||||||

| Current liabilities of discontinued operations | — | 11.5 | ||||||||||||

| Accrued expenses and other current liabilities | 694.7 | 764.3 | ||||||||||||

| Total current liabilities | 2,467.0 | 2,685.1 | ||||||||||||

| Non-current liabilities: | ||||||||||||||

| Long-term debt, net of current portion | 2,779.9 | 2,555.3 | ||||||||||||

| Obligation under Inventory Intermediation Agreement | 385.3 | 407.2 | ||||||||||||

| Environmental liabilities, net of current portion | 33.7 | 110.9 | ||||||||||||

| Asset retirement obligations | 24.4 | 36.4 | ||||||||||||

| Deferred tax liabilities | 243.9 | 264.1 | ||||||||||||

| Operating lease liabilities, net of current portion | 63.7 | 85.7 | ||||||||||||

| Non-current liabilities of discontinued operations | — | 34.3 | ||||||||||||

| Other non-current liabilities | 87.0 | 33.1 | ||||||||||||

| Total non-current liabilities | 3,617.9 | 3,527.0 | ||||||||||||

| Redeemable non-controlling interest | 70.0 | — | ||||||||||||

| Stockholders’ equity: | ||||||||||||||

| Preferred stock, $0.01 par value, 10,000,000 shares authorized, no shares issued and outstanding | — | — | ||||||||||||

| Common stock, $0.01 par value, 110,000,000 shares authorized, 81,231,308 shares and 81,539,871 shares issued at September 30, 2024 and December 31, 2023, respectively | 0.8 | 0.8 | ||||||||||||

| Additional paid-in capital | 1,172.7 | 1,113.6 | ||||||||||||

| Accumulated other comprehensive loss | (4.8) | (4.8) | ||||||||||||

| Treasury stock, 17,575,527 shares, at cost, at September 30, 2024 and December 31, 2023, respectively | (694.1) | (694.1) | ||||||||||||

| Retained earnings | 228.5 | 430.0 | ||||||||||||

| Non-controlling interests in subsidiaries | 172.3 | 114.2 | ||||||||||||

| Total stockholders’ equity | 875.4 | 959.7 | ||||||||||||

| Total liabilities, redeemable non-controlling interest and stockholders’ equity | $ | 7,030.3 | $ | 7,171.8 | ||||||||||

5 | |

|||||

| Delek US Holdings, Inc. | ||||||||||||||||||||||||||

| Condensed Consolidated Statements of Income (Unaudited) | ||||||||||||||||||||||||||

| ($ in millions, except share and per share data) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net revenues | $ | 3,042.4 | $ | 4,628.8 | $ | 9,478.5 | $ | 12,525.1 | ||||||||||||||||||

| Cost of sales: | ||||||||||||||||||||||||||

| Cost of materials and other | 2,788.7 | 4,049.4 | 8,547.1 | 11,111.2 | ||||||||||||||||||||||

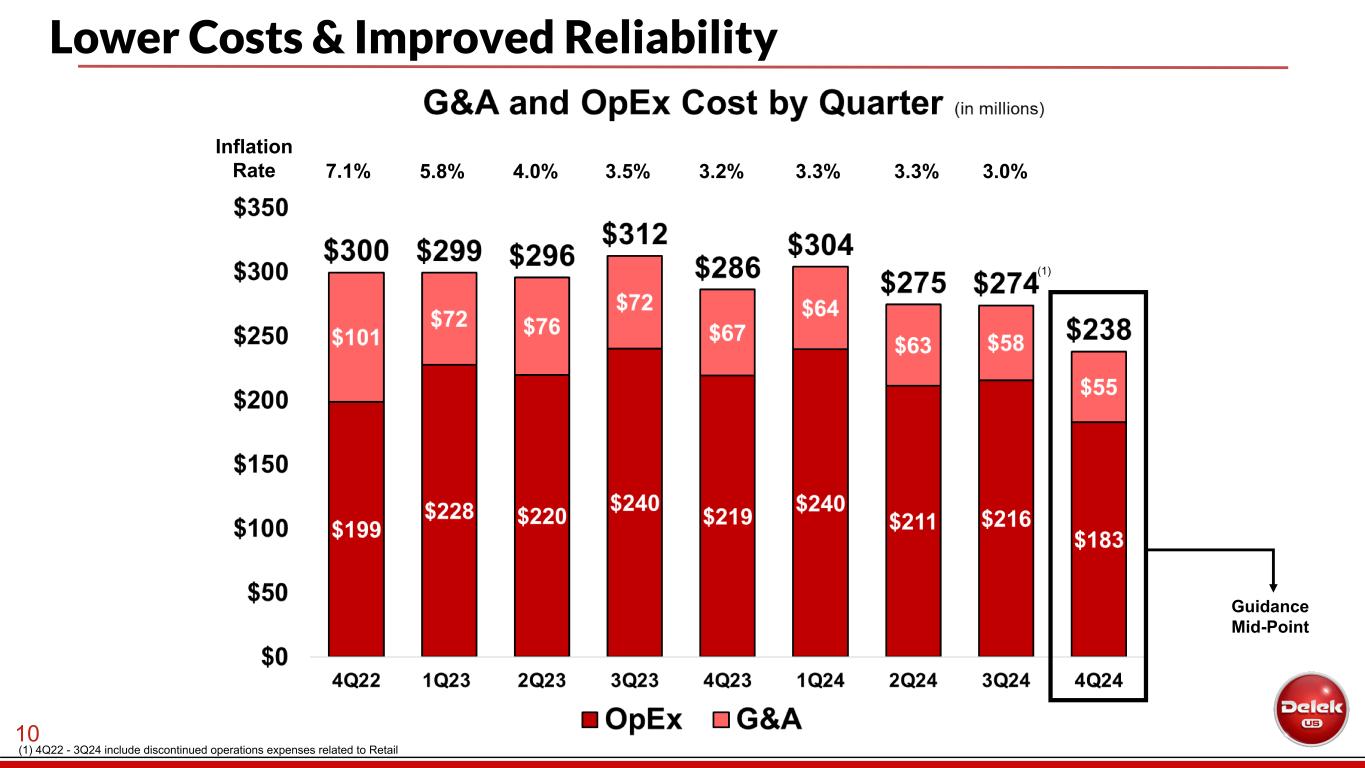

| Operating expenses (excluding depreciation and amortization presented below) | 181.4 | 217.7 | 580.3 | 577.2 | ||||||||||||||||||||||

| Depreciation and amortization | 92.5 | 83.7 | 259.6 | 243.1 | ||||||||||||||||||||||

| Total cost of sales | 3,062.6 | 4,350.8 | 9,387.0 | 11,931.5 | ||||||||||||||||||||||

| Operating expenses related to wholesale business (excluding depreciation and amortization presented below) | 3.7 | (3.7) | 5.7 | 3.9 | ||||||||||||||||||||||

| General and administrative expenses | 70.4 | 67.7 | 191.6 | 208.0 | ||||||||||||||||||||||

| Depreciation and amortization | 5.6 | 4.0 | 18.6 | 12.1 | ||||||||||||||||||||||

| Asset impairment | 9.2 | — | 31.3 | — | ||||||||||||||||||||||

| Other operating expense (income), net | 12.8 | (2.1) | (67.6) | (19.0) | ||||||||||||||||||||||

| Total operating costs and expenses | 3,164.3 | 4,416.7 | 9,566.6 | 12,136.5 | ||||||||||||||||||||||

| Operating (loss) income | (121.9) | 212.1 | (88.1) | 388.6 | ||||||||||||||||||||||

| Interest expense, net | 78.8 | 82.4 | 244.1 | 239.1 | ||||||||||||||||||||||

| Income from equity method investments | (25.1) | (27.0) | (77.4) | (67.1) | ||||||||||||||||||||||

| Other (income) expense, net | (0.5) | 2.0 | (1.1) | (4.6) | ||||||||||||||||||||||

| Total non-operating expense, net | 53.2 | 57.4 | 165.6 | 167.4 | ||||||||||||||||||||||

| (Loss) income from continuing operations before income tax (benefit) expense | (175.1) | 154.7 | (253.7) | 221.2 | ||||||||||||||||||||||

| Income tax (benefit) expense | (40.3) | 29.1 | (56.7) | 38.3 | ||||||||||||||||||||||

| (Loss) income from continuing operations, net of tax | (134.8) | 125.6 | (197.0) | 182.9 | ||||||||||||||||||||||

| Discontinued operations: | ||||||||||||||||||||||||||

| Income from discontinued operations, including gain on sale of discontinued operations | 95.4 | 12.9 | 107.8 | 29.1 | ||||||||||||||||||||||

| Income tax expense | 28.1 | 2.4 | 29.6 | 5.2 | ||||||||||||||||||||||

| Income from discontinued operations, net of tax | 67.3 | 10.5 | 78.2 | 23.9 | ||||||||||||||||||||||

| Net (loss) income | (67.5) | 136.1 | (118.8) | 206.8 | ||||||||||||||||||||||

| Net income attributable to: | ||||||||||||||||||||||||||

| Non-controlling interests | 9.3 | 7.4 | 27.8 | 22.1 | ||||||||||||||||||||||

| Net (loss) income attributable to Delek | $ | (76.8) | $ | 128.7 | $ | (146.6) | $ | 184.7 | ||||||||||||||||||

| Basic (loss) income per share: | ||||||||||||||||||||||||||

| (Loss) income from continuing operations | $ | (2.25) | $ | 1.82 | $ | (3.51) | $ | 2.44 | ||||||||||||||||||

| Income from discontinued operations | 1.05 | 0.16 | $ | 1.22 | $ | 0.36 | ||||||||||||||||||||

| Total basic (loss) income per share | $ | (1.20) | $ | 1.98 | $ | (2.29) | $ | 2.80 | ||||||||||||||||||

| Diluted (loss) income per share: | ||||||||||||||||||||||||||

| (Loss) income from continuing operations | $ | (2.25) | $ | 1.81 | $ | (3.51) | $ | 2.42 | ||||||||||||||||||

| Income from discontinued operations | 1.05 | 0.16 | $ | 1.22 | $ | 0.36 | ||||||||||||||||||||

| Total diluted (loss) income per share | $ | (1.20) | $ | 1.97 | $ | (2.29) | $ | 2.78 | ||||||||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||||||||

| Basic | 64,063,609 | 64,889,504 | 64,099,700 | 65,864,141 | ||||||||||||||||||||||

| Diluted | 64,063,609 | 65,464,970 | 64,099,700 | 66,372,335 | ||||||||||||||||||||||

6 | |

|||||

| Delek US Holdings, Inc. | ||||||||||||||||||||||||||

| Condensed Cash Flow Data (Unaudited) | ||||||||||||||||||||||||||

| ($ in millions) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 |

2024 | 2023 |

|||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||||

| Cash (used in) provided by operating activities - continuing operations | $ | (22.1) | $ | 420.2 | $ | 78.9 | $ | 891.7 | ||||||||||||||||||

| Cash provided by operating activities - discontinued operations | 0.5 | 12.4 | 17.8 | 31.1 | ||||||||||||||||||||||

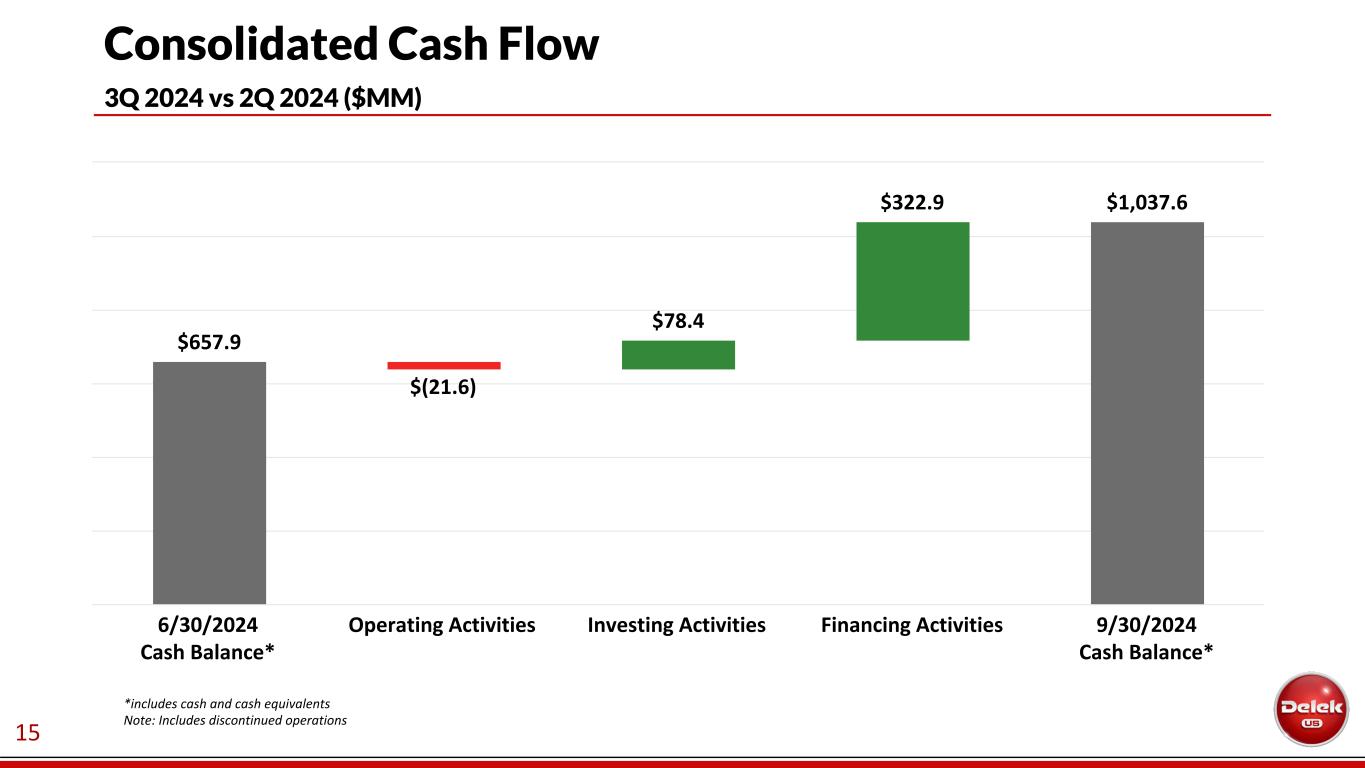

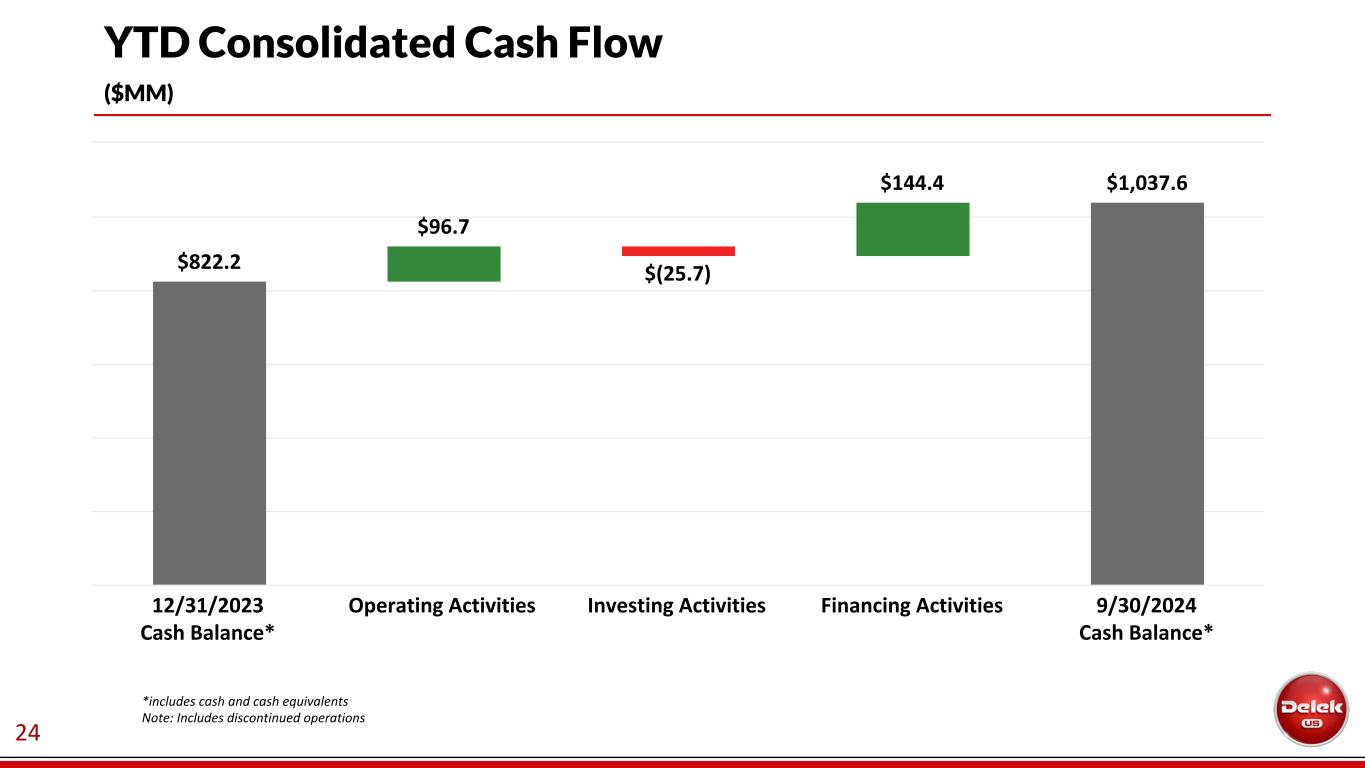

| Net cash (used in) provided by operating activities | (21.6) | 432.6 | 96.7 | 922.8 | ||||||||||||||||||||||

| Cash flows from investing activities: | ||||||||||||||||||||||||||

| Cash used in investing activities - continuing operations | (298.4) | (50.5) | (387.4) | (320.6) | ||||||||||||||||||||||

| Cash provided by (used in) investing activities - discontinued operations | 376.8 | (8.2) | 361.7 | (18.0) | ||||||||||||||||||||||

| Net cash provided by (used in) investing activities | 78.4 | (58.7) | (25.7) | (338.6) | ||||||||||||||||||||||

| Cash flows from financing activities: | ||||||||||||||||||||||||||

| Cash provided by (used in) financing activities - continuing operations | 322.9 | (293.8) | 144.4 | (523.8) | ||||||||||||||||||||||

| Net cash provided by (used in) financing activities | 322.9 | (293.8) | 144.4 | (523.8) | ||||||||||||||||||||||

| Net increase in cash and cash equivalents | 379.7 | 80.1 | 215.4 | 60.4 | ||||||||||||||||||||||

| Cash and cash equivalents at the beginning of the period | 657.9 | 821.6 | 822.2 | 841.3 | ||||||||||||||||||||||

| Cash and cash equivalents at the end of the period | 1,037.6 | 901.7 | 1,037.6 | 901.7 | ||||||||||||||||||||||

| Less cash and cash equivalents of discontinued operations at the end of the period | — | 0.4 | — | 0.4 | ||||||||||||||||||||||

| Cash and cash equivalents of continuing operations at the end of the period | $ | 1,037.6 | $ | 901.3 | $ | 1,037.6 | $ | 901.3 | ||||||||||||||||||

7 | |

|||||

8 | |

|||||

| Reconciliation of Net Income (Loss) Attributable to Delek US to Adjusted Net Income (Loss) | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| $ in millions (unaudited) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

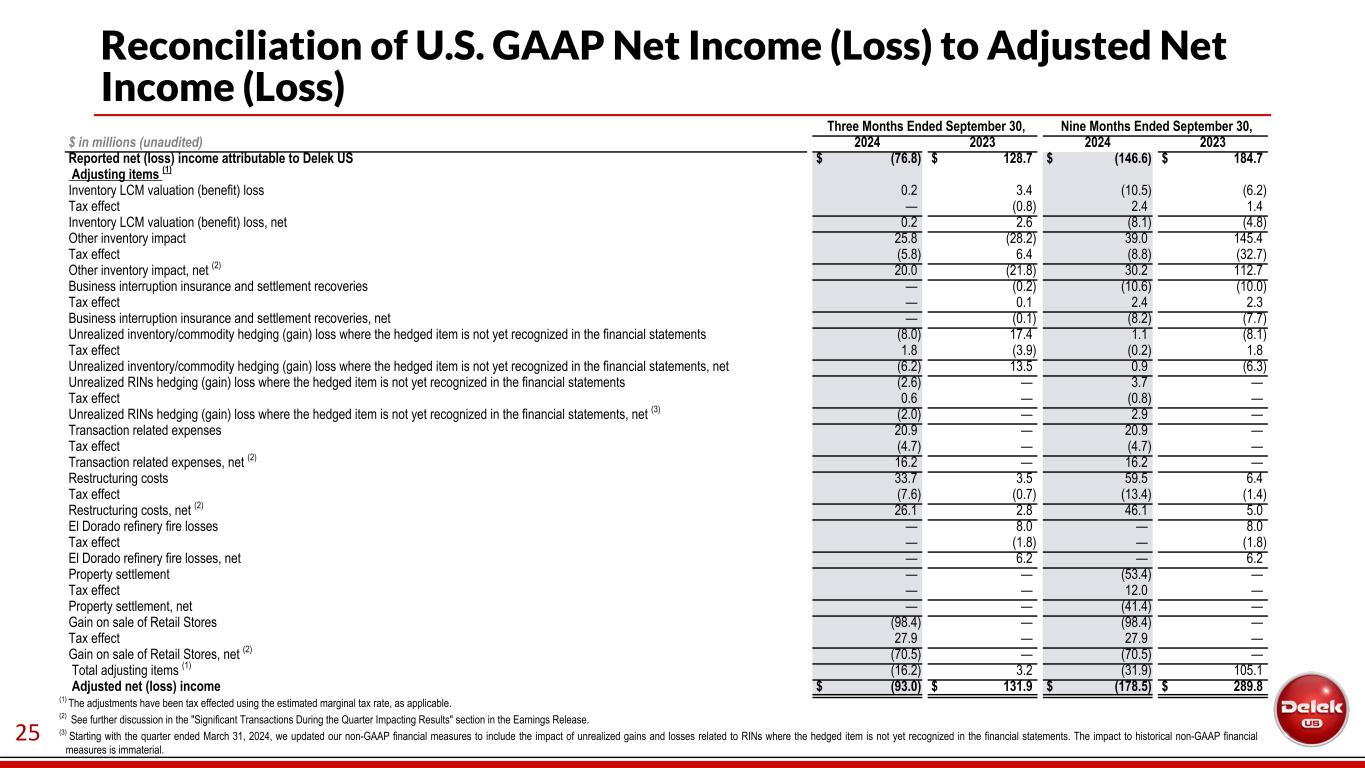

| Reported net (loss) income attributable to Delek US | $ | (76.8) | $ | 128.7 | $ | (146.6) | $ | 184.7 | ||||||||||||||||||

Adjusting items (1) |

||||||||||||||||||||||||||

| Inventory LCM valuation (benefit) loss | 0.2 | 3.4 | (10.5) | (6.2) | ||||||||||||||||||||||

| Tax effect | — | (0.8) | 2.4 | 1.4 | ||||||||||||||||||||||

| Inventory LCM valuation (benefit) loss, net | 0.2 | 2.6 | (8.1) | (4.8) | ||||||||||||||||||||||

| Other inventory impact | 25.8 | (28.2) | 39.0 | 145.4 | ||||||||||||||||||||||

| Tax effect | (5.8) | 6.4 | (8.8) | (32.7) | ||||||||||||||||||||||

Other inventory impact, net (2) |

20.0 | (21.8) | 30.2 | 112.7 | ||||||||||||||||||||||

| Business interruption insurance and settlement recoveries | — | (0.2) | (10.6) | (10.0) | ||||||||||||||||||||||

| Tax effect | — | 0.1 | 2.4 | 2.3 | ||||||||||||||||||||||

| Business interruption insurance and settlement recoveries, net | — | (0.1) | (8.2) | (7.7) | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.0) | 17.4 | 1.1 | (8.1) | ||||||||||||||||||||||

| Tax effect | 1.8 | (3.9) | (0.2) | 1.8 | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements, net | (6.2) | 13.5 | 0.9 | (6.3) | ||||||||||||||||||||||

| Transaction related expenses | 20.9 | — | 20.9 | — | ||||||||||||||||||||||

| Tax effect | (4.7) | — | (4.7) | — | ||||||||||||||||||||||

Transaction related expenses, net (2) |

16.2 | — | 16.2 | — | ||||||||||||||||||||||

| Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (2.6) | — | 3.7 | — | ||||||||||||||||||||||

| Tax effect | 0.6 | — | (0.8) | — | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements, net (3) |

(2.0) | — | 2.9 | — | ||||||||||||||||||||||

| Restructuring costs | 33.7 | 3.5 | 59.5 | 6.4 | ||||||||||||||||||||||

| Tax effect | (7.6) | (0.7) | (13.4) | (1.4) | ||||||||||||||||||||||

Restructuring costs, net (2) |

26.1 | 2.8 | 46.1 | 5.0 | ||||||||||||||||||||||

| El Dorado refinery fire losses | — | 8.0 | — | 8.0 | ||||||||||||||||||||||

| Tax effect | — | (1.8) | — | (1.8) | ||||||||||||||||||||||

| El Dorado refinery fire losses, net | — | 6.2 | — | 6.2 | ||||||||||||||||||||||

| Property settlement | — | — | (53.4) | — | ||||||||||||||||||||||

| Tax effect | — | — | 12.0 | — | ||||||||||||||||||||||

| Property settlement, net | — | — | (41.4) | — | ||||||||||||||||||||||

| Gain on sale of Retail Stores | (98.4) | — | (98.4) | — | ||||||||||||||||||||||

| Tax effect | 27.9 | — | 27.9 | — | ||||||||||||||||||||||

Gain on sale of Retail Stores, net (2) |

(70.5) | — | (70.5) | — | ||||||||||||||||||||||

Total adjusting items (1) |

(16.2) | 3.2 | (31.9) | 105.1 | ||||||||||||||||||||||

| Adjusted net (loss) income | $ | (93.0) | $ | 131.9 | $ | (178.5) | $ | 289.8 | ||||||||||||||||||

9 | |

|||||

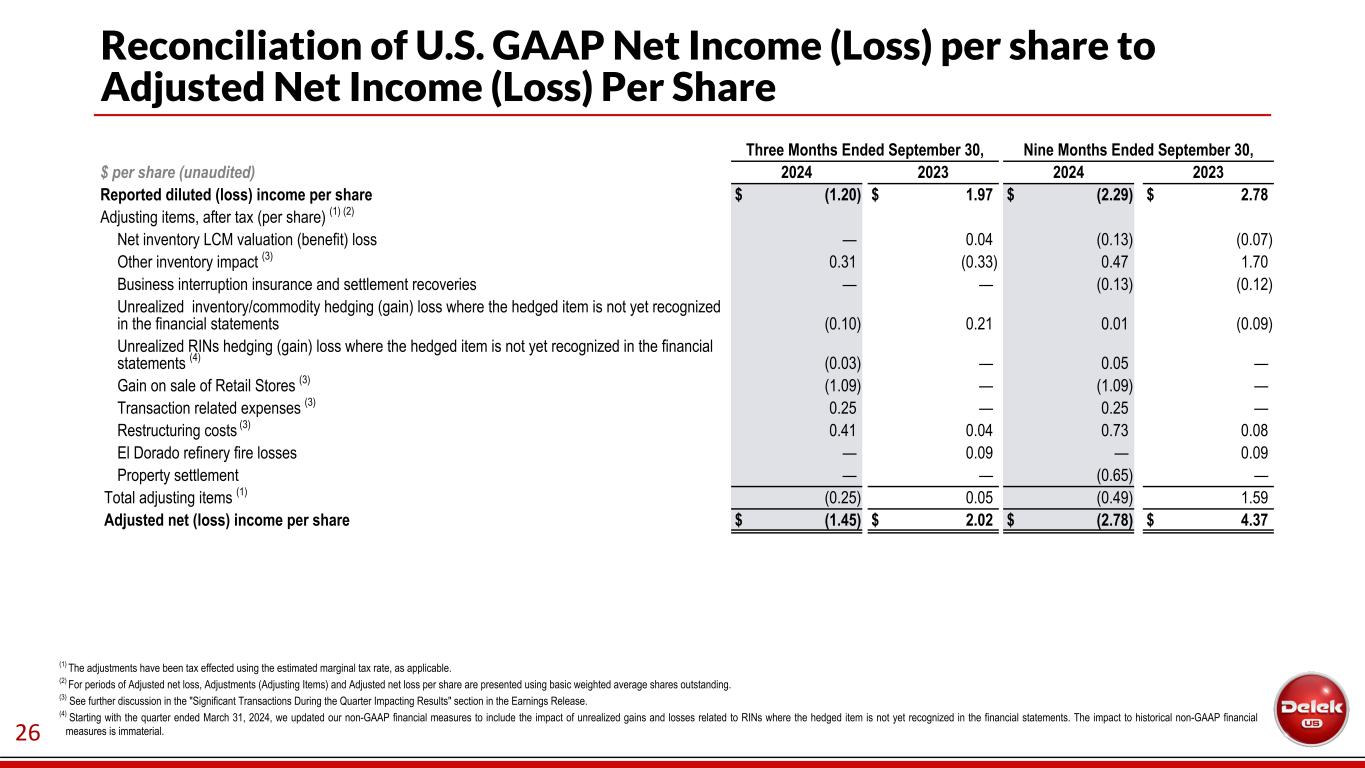

| Reconciliation of U.S. GAAP Income (Loss) per share to Adjusted Net Income (Loss) per share | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| $ per share (unaudited) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

| Reported diluted (loss) income per share | $ | (1.20) | $ | 1.97 | $ | (2.29) | $ | 2.78 | ||||||||||||||||||

Adjusting items, after tax (per share) (1) (2) |

||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | — | 0.04 | (0.13) | (0.07) | ||||||||||||||||||||||

Other inventory impact (3) |

0.31 | (0.33) | 0.47 | 1.70 | ||||||||||||||||||||||

| Business interruption insurance and settlement recoveries | — | — | (0.13) | (0.12) | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (0.10) | 0.21 | 0.01 | (0.09) | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (4) |

(0.03) | — | 0.05 | — | ||||||||||||||||||||||

Transaction related expenses (3) |

0.25 | — | 0.25 | — | ||||||||||||||||||||||

Restructuring costs (3) |

0.41 | 0.04 | 0.73 | 0.08 | ||||||||||||||||||||||

| El Dorado refinery fire losses | — | 0.09 | — | 0.09 | ||||||||||||||||||||||

| Property settlement | — | — | (0.65) | — | ||||||||||||||||||||||

Gain on sale of Retail Stores (3) |

(1.09) | — | (1.09) | — | ||||||||||||||||||||||

Total adjusting items (1) |

(0.25) | 0.05 | (0.49) | 1.59 | ||||||||||||||||||||||

| Adjusted net (loss) income per share | $ | (1.45) | $ | 2.02 | $ | (2.78) | $ | 4.37 | ||||||||||||||||||

10 | |

|||||

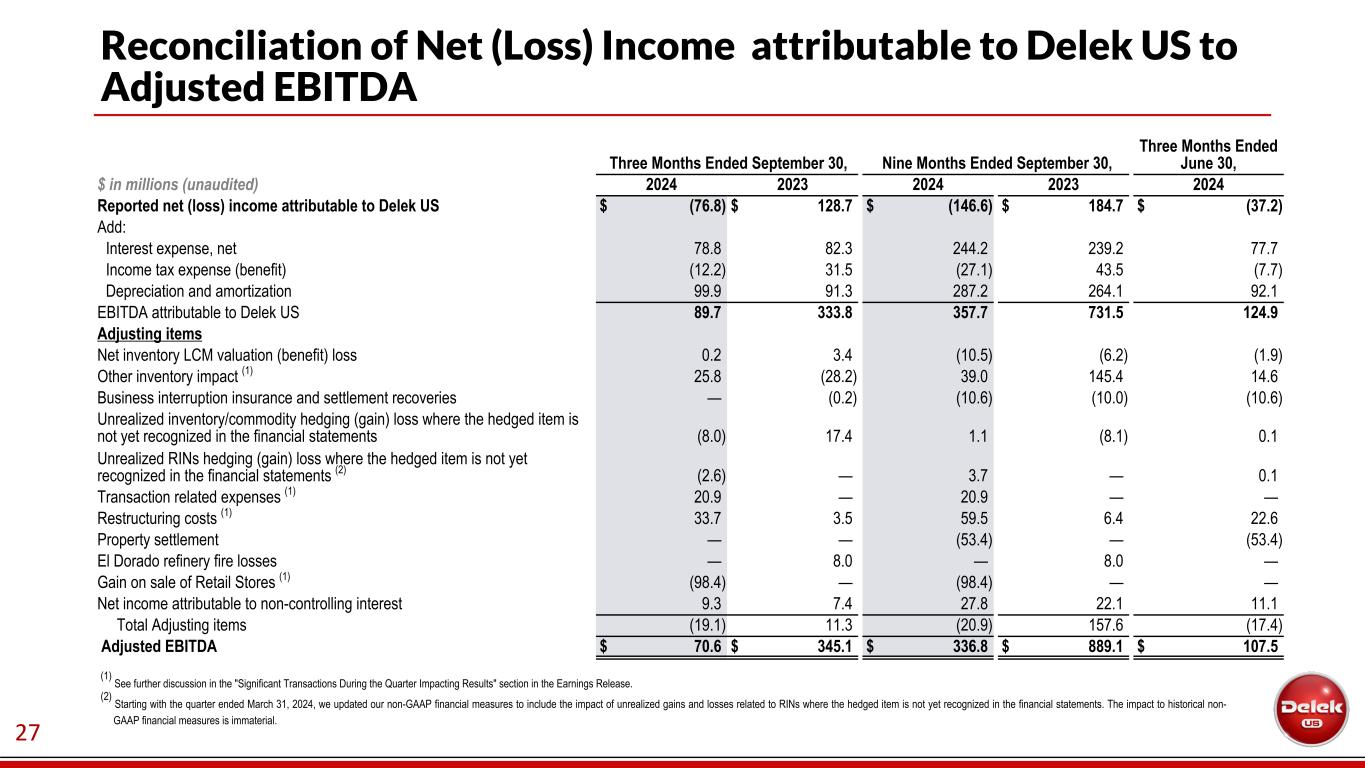

| Reconciliation of Net Income (Loss) attributable to Delek US to Adjusted EBITDA | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| $ in millions (unaudited) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

| Reported net (loss) income attributable to Delek US | $ | (76.8) | $ | 128.7 | $ | (146.6) | $ | 184.7 | ||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Interest expense, net | 78.8 | 82.3 | 244.2 | 239.2 | ||||||||||||||||||||||

| Income tax expense (benefit) | (12.2) | 31.5 | (27.1) | 43.5 | ||||||||||||||||||||||

| Depreciation and amortization | 99.9 | 91.3 | 287.2 | 264.1 | ||||||||||||||||||||||

| EBITDA attributable to Delek US | 89.7 | 333.8 | 357.7 | 731.5 | ||||||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | 0.2 | 3.4 | (10.5) | (6.2) | ||||||||||||||||||||||

Other inventory impact (1) |

25.8 | (28.2) | 39.0 | 145.4 | ||||||||||||||||||||||

| Business interruption insurance and settlement recoveries | — | (0.2) | (10.6) | (10.0) | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.0) | 17.4 | 1.1 | (8.1) | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (2) |

(2.6) | — | 3.7 | — | ||||||||||||||||||||||

Transaction related expenses (1) |

20.9 | — | 20.9 | — | ||||||||||||||||||||||

Restructuring costs (1) |

33.7 | 3.5 | 59.5 | 6.4 | ||||||||||||||||||||||

| El Dorado refinery fire losses | — | 8.0 | — | 8.0 | ||||||||||||||||||||||

| Property settlement | — | — | (53.4) | — | ||||||||||||||||||||||

Gain on sale of Retail Stores (1) |

(98.4) | — | (98.4) | — | ||||||||||||||||||||||

| Net income attributable to non-controlling interest | 9.3 | 7.4 | 27.8 | 22.1 | ||||||||||||||||||||||

| Total Adjusting items | (19.1) | 11.3 | (20.9) | 157.6 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 70.6 | $ | 345.1 | $ | 336.8 | $ | 889.1 | ||||||||||||||||||

11 | |

|||||

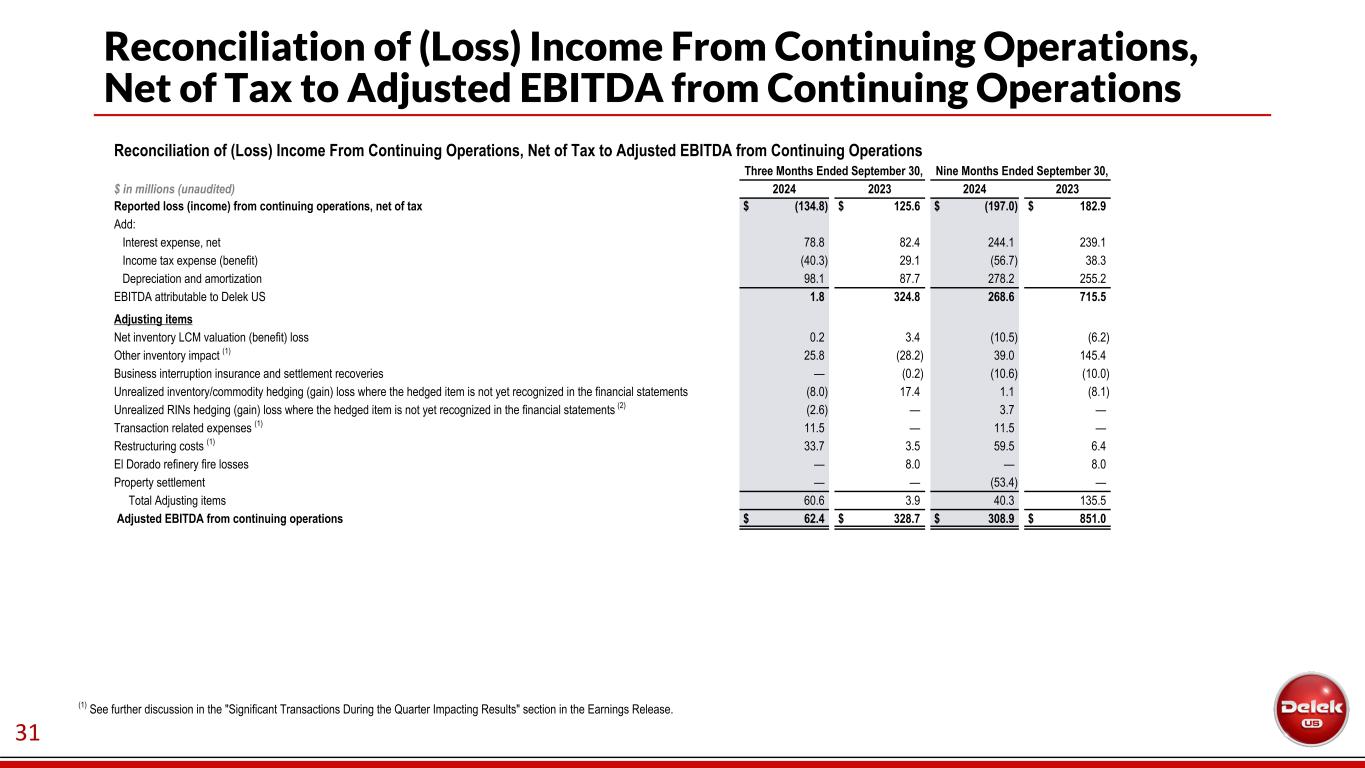

| Reconciliation of (Loss) Income From Continuing Operations, Net of Tax to Adjusted EBITDA from Continuing Operations | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| $ in millions (unaudited) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

| Reported loss (income) from continuing operations, net of tax | $ | (134.8) | $ | 125.6 | $ | (197.0) | $ | 182.9 | ||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Interest expense, net | 78.8 | 82.4 | 244.1 | 239.1 | ||||||||||||||||||||||

| Income tax expense (benefit) | (40.3) | 29.1 | (56.7) | 38.3 | ||||||||||||||||||||||

| Depreciation and amortization | 98.1 | 87.7 | 278.2 | 255.2 | ||||||||||||||||||||||

| EBITDA attributable to Delek US | 1.8 | 324.8 | 268.6 | 715.5 | ||||||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | 0.2 | 3.4 | (10.5) | (6.2) | ||||||||||||||||||||||

Other inventory impact (1) |

25.8 | (28.2) | 39.0 | 145.4 | ||||||||||||||||||||||

| Business interruption insurance and settlement recoveries | — | (0.2) | (10.6) | (10.0) | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.0) | 17.4 | 1.1 | (8.1) | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (2) |

(2.6) | — | 3.7 | — | ||||||||||||||||||||||

Transaction related expenses (1) |

11.5 | — | 11.5 | — | ||||||||||||||||||||||

Restructuring costs (1) |

33.7 | 3.5 | 59.5 | 6.4 | ||||||||||||||||||||||

| El Dorado refinery fire losses | — | 8.0 | — | 8.0 | ||||||||||||||||||||||

| Property settlement | — | — | (53.4) | — | ||||||||||||||||||||||

| Total Adjusting items | 60.6 | 3.9 | 40.3 | 135.5 | ||||||||||||||||||||||

| Adjusted EBITDA from continuing operations | $ | 62.4 | $ | 328.7 | $ | 308.9 | $ | 851.0 | ||||||||||||||||||

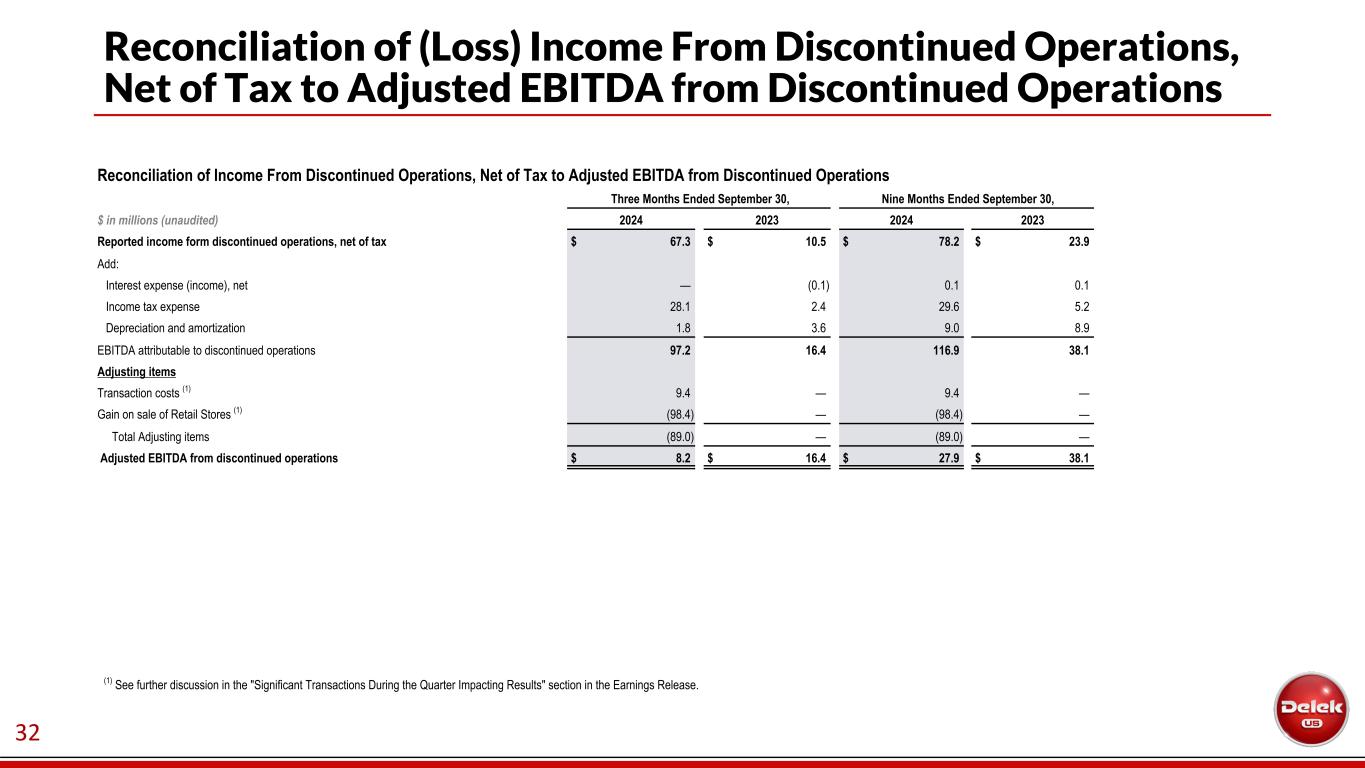

| Reconciliation of Income From Discontinued Operations, Net of Tax to Adjusted EBITDA from Discontinued Operations | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| $ in millions (unaudited) | 2024 | 2023 |

2024 | 2023 |

||||||||||||||||||||||

| Reported income from discontinued operations, net of tax | $ | 67.3 | $ | 10.5 | $ | 78.2 | $ | 23.9 | ||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Interest expense (income), net | — | (0.1) | 0.1 | 0.1 | ||||||||||||||||||||||

| Income tax expense | 28.1 | 2.4 | 29.6 | 5.2 | ||||||||||||||||||||||

| Depreciation and amortization | 1.8 | 3.6 | 9.0 | 8.9 | ||||||||||||||||||||||

| EBITDA attributable to discontinued operations | 97.2 | 16.4 | 116.9 | 38.1 | ||||||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

Transaction costs (1) |

9.4 | — | 9.4 | — | ||||||||||||||||||||||

Gain on sale of Retail Stores (1) |

(98.4) | — | (98.4) | — | ||||||||||||||||||||||

| Total Adjusting items | (89.0) | — | (89.0) | — | ||||||||||||||||||||||

| Adjusted EBITDA from discontinued operations | $ | 8.2 | $ | 16.4 | $ | 27.9 | $ | 38.1 | ||||||||||||||||||

12 | |

|||||

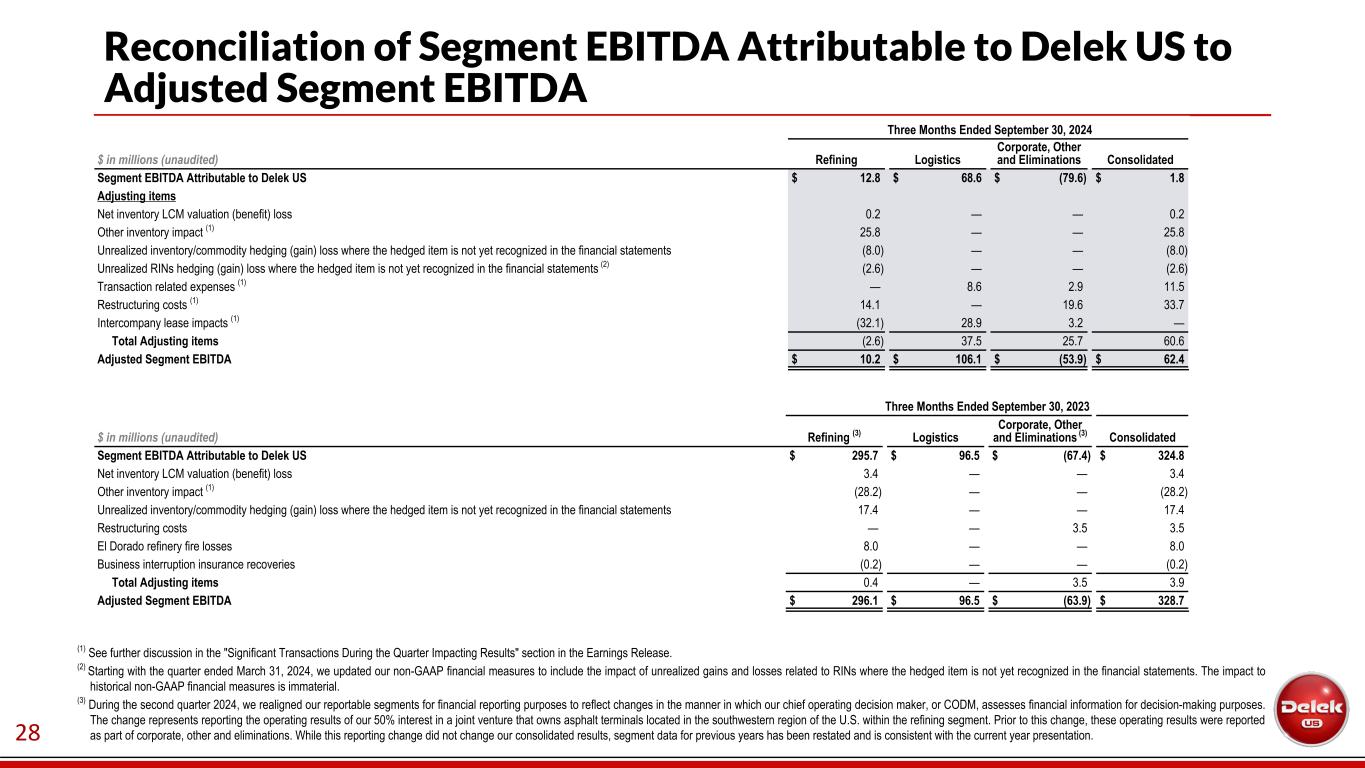

| Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA | ||||||||||||||||||||||||||

| Three Months Ended September 30, 2024 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining | Logistics | Corporate, Other and Eliminations | Consolidated | ||||||||||||||||||||||

| Segment EBITDA Attributable to Delek US | $ | 12.8 | $ | 68.6 | $ | (79.6) | $ | 1.8 | ||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | 0.2 | — | — | 0.2 | ||||||||||||||||||||||

Other inventory impact (1) |

25.8 | — | — | 25.8 | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.0) | — | — | (8.0) | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (2) |

(2.6) | — | — | (2.6) | ||||||||||||||||||||||

Transaction related expenses (1) |

— | 8.6 | 2.9 | 11.5 | ||||||||||||||||||||||

Restructuring costs (1) |

14.1 | — | 19.6 | 33.7 | ||||||||||||||||||||||

Intercompany lease impacts (1) |

(32.1) | 28.9 | 3.2 | — | ||||||||||||||||||||||

| Total Adjusting items | (2.6) | 37.5 | 25.7 | 60.6 | ||||||||||||||||||||||

| Adjusted Segment EBITDA | $ | 10.2 | $ | 106.1 | $ | (53.9) | $ | 62.4 | ||||||||||||||||||

Three Months Ended September 30, 2023 |

||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining (3) |

Logistics | Corporate, Other and Eliminations (3) |

Consolidated | ||||||||||||||||||||||

| Segment EBITDA Attributable to Delek US | $ | 295.7 | $ | 96.5 | $ | (67.4) | $ | 324.8 | ||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | 3.4 | — | — | 3.4 | ||||||||||||||||||||||

Other inventory impact (1) |

(28.2) | — | — | (28.2) | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | 17.4 | — | — | 17.4 | ||||||||||||||||||||||

| Restructuring costs | — | — | 3.5 | 3.5 | ||||||||||||||||||||||

| Business interruption insurance recoveries | (0.2) | — | — | (0.2) | ||||||||||||||||||||||

| El Dorado refinery fire losses | 8.0 | — | — | 8.0 | ||||||||||||||||||||||

| Total Adjusting items | 0.4 | — | 3.5 | 3.9 | ||||||||||||||||||||||

| Adjusted Segment EBITDA | $ | 296.1 | $ | 96.5 | $ | (63.9) | $ | 328.7 | ||||||||||||||||||

13 | |

|||||

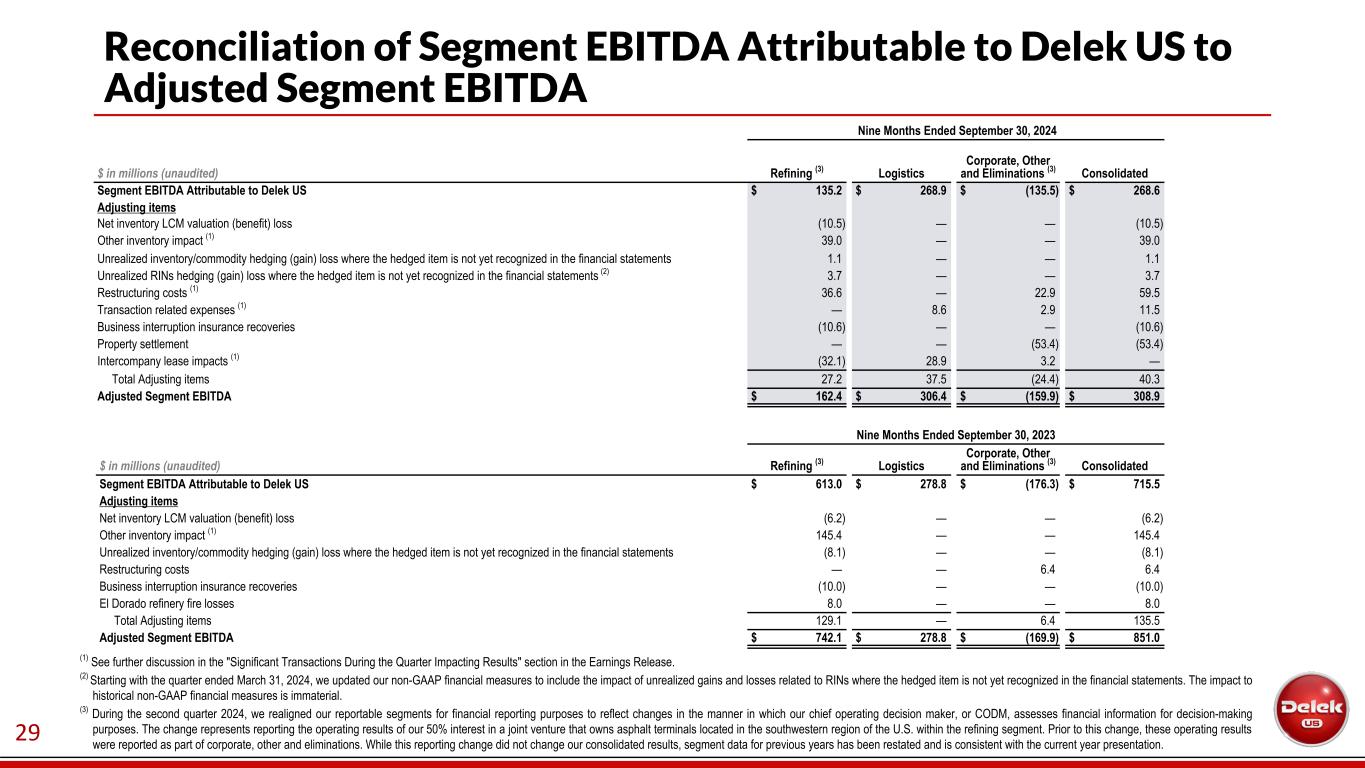

| Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA | ||||||||||||||||||||||||||

| Nine Months Ended September 30, 2024 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining (3) |

Logistics | Corporate, Other and Eliminations (3) |

Consolidated | ||||||||||||||||||||||

| Segment EBITDA Attributable to Delek US | $ | 135.2 | $ | 268.9 | $ | (135.5) | $ | 268.6 | ||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | (10.5) | — | — | (10.5) | ||||||||||||||||||||||

Other inventory impact (1) |

39.0 | — | — | 39.0 | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | 1.1 | — | — | 1.1 | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (2) |

3.7 | — | — | 3.7 | ||||||||||||||||||||||

Restructuring costs (1) |

36.6 | — | 22.9 | 59.5 | ||||||||||||||||||||||

Transaction related expenses (1) |

— | 8.6 | 2.9 | 11.5 | ||||||||||||||||||||||

| Business interruption settlement recoveries | (10.6) | — | — | (10.6) | ||||||||||||||||||||||

| Property settlement | — | — | (53.4) | (53.4) | ||||||||||||||||||||||

Intercompany lease impacts (1) |

(32.1) | 28.9 | 3.2 | — | ||||||||||||||||||||||

| Total Adjusting items | 27.2 | 37.5 | (24.4) | 40.3 | ||||||||||||||||||||||

| Adjusted Segment EBITDA | $ | 162.4 | $ | 306.4 | $ | (159.9) | $ | 308.9 | ||||||||||||||||||

| Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining (3) |

Logistics | Corporate, Other and Eliminations (3) |

Consolidated | ||||||||||||||||||||||

| Segment EBITDA Attributable to Delek US | $ | 613.0 | $ | 278.8 | $ | (176.3) | $ | 715.5 | ||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation (benefit) loss | (6.2) | — | — | (6.2) | ||||||||||||||||||||||

Other inventory impact (1) |

145.4 | — | — | 145.4 | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.1) | — | — | (8.1) | ||||||||||||||||||||||

| Restructuring costs | — | — | 6.4 | 6.4 | ||||||||||||||||||||||

| Business interruption insurance recoveries | (10.0) | — | — | (10.0) | ||||||||||||||||||||||

| El Dorado refinery fire losses | 8.0 | — | — | 8.0 | ||||||||||||||||||||||

| Total Adjusting items | 129.1 | — | 6.4 | 135.5 | ||||||||||||||||||||||

| Adjusted Segment EBITDA | $ | 742.1 | $ | 278.8 | $ | (169.9) | $ | 851.0 | ||||||||||||||||||

14 | |

|||||

| Refining Segment Selected Financial Information | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Total Refining Segment | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||

| Days in period | 92 | 92 | 274 | 273 | ||||||||||||||||||||||

Total sales volume - refined product (average barrels per day ("bpd")) (1) |

309,175 | 307,626 | 312,075 | 295,141 | ||||||||||||||||||||||

| Total production (average bpd) | 303,882 | 303,399 | 302,858 | 287,375 | ||||||||||||||||||||||

| Crude oil | 295,350 | 294,726 | 291,042 | 275,310 | ||||||||||||||||||||||

| Other feedstocks | 12,245 | 11,222 | 15,727 | 14,815 | ||||||||||||||||||||||

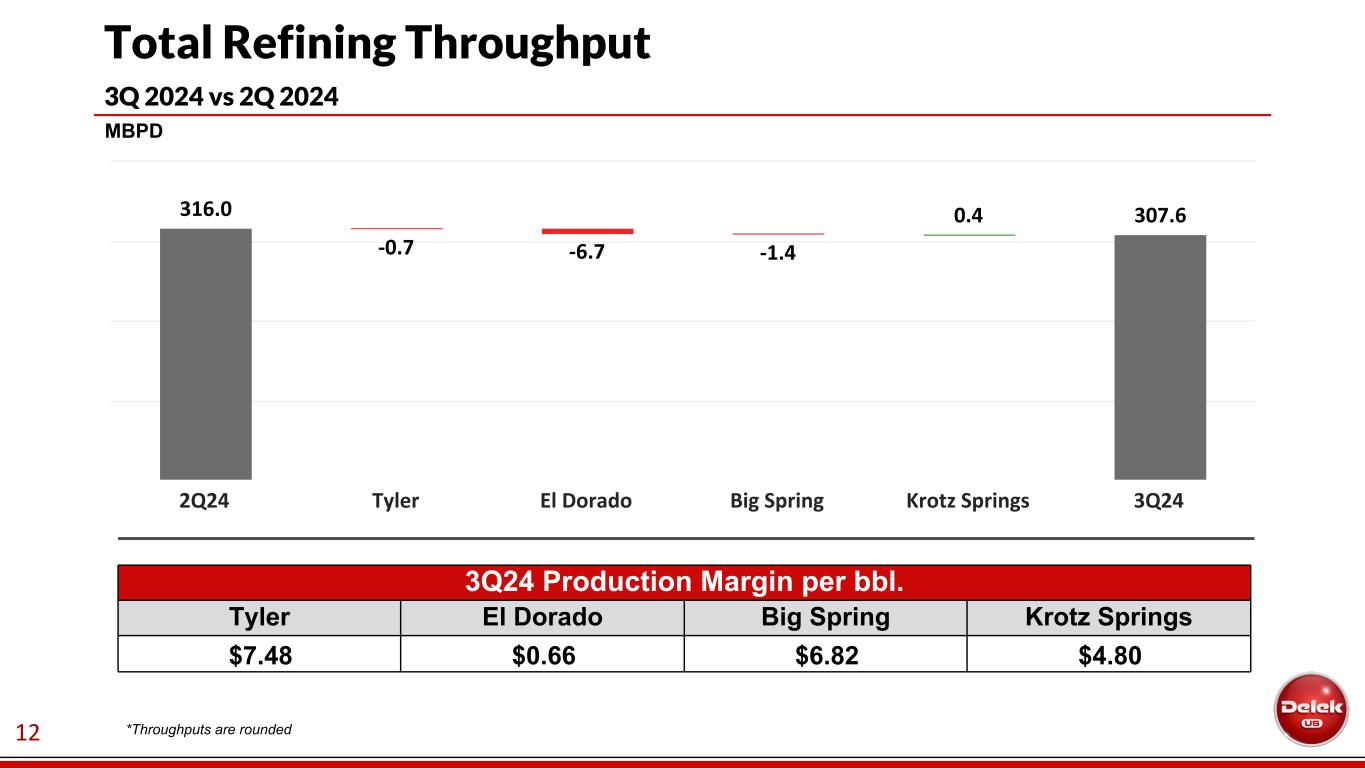

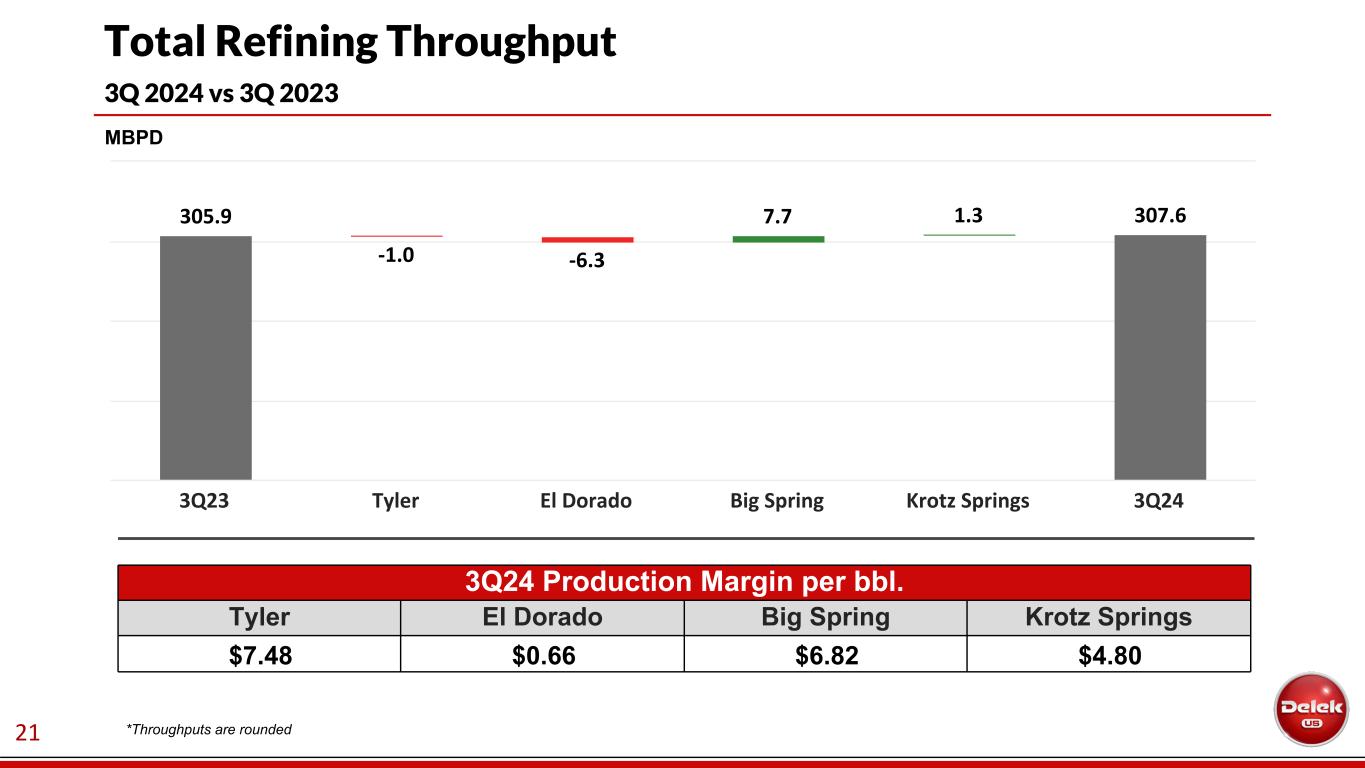

| Total throughput (average bpd) | 307,595 | 305,948 | 306,769 | 290,125 | ||||||||||||||||||||||

| Total refining production margin per bbl total throughput | $ | 4.88 | $ | 16.01 | $ | 8.09 | $ | 13.86 | ||||||||||||||||||

| Total refining operating expenses per bbl total throughput | $ | 5.12 | $ | 5.47 | $ | 5.34 | $ | 5.50 | ||||||||||||||||||

| Total refining production margin ($ in millions) | $ | 138.1 | $ | 450.5 | $ | 680.3 | $ | 1,097.7 | ||||||||||||||||||

Supply, marketing and other ($ millions) (2) |

10.7 | (1.2) | (88.4) | 95.0 | ||||||||||||||||||||||

| Total adjusted refining margin ($ in millions) | $ | 148.8 | $ | 449.3 | $ | 591.9 | $ | 1,192.7 | ||||||||||||||||||

| Total crude slate details | ||||||||||||||||||||||||||

| Total crude slate: (% based on amount received in period) | ||||||||||||||||||||||||||

| WTI crude oil | 69.4 | % | 73.4 | % | 70.9 | % | 73.3 | % | ||||||||||||||||||

| Gulf Coast Sweet crude | 8.8 | % | 3.3 | % | 7.5 | % | 4.0 | % | ||||||||||||||||||

| Local Arkansas crude oil | 3.2 | % | 4.0 | % | 3.3 | % | 4.1 | % | ||||||||||||||||||

| Other | 18.6 | % | 19.3 | % | 18.3 | % | 18.6 | % | ||||||||||||||||||

Crude utilization (% based on nameplate capacity) (4) |

97.8 | % | 97.6 | % | 96.4 | % | 91.2 | % | ||||||||||||||||||

| Tyler, TX Refinery | ||||||||||||||||||||||||||

| Days in period | 92 | 92 | 274 | 273 | ||||||||||||||||||||||

| Products manufactured (average bpd): | ||||||||||||||||||||||||||

| Gasoline | 35,962 | 35,615 | 36,620 | 30,750 | ||||||||||||||||||||||

| Diesel/Jet | 33,647 | 34,620 | 32,490 | 26,976 | ||||||||||||||||||||||

| Petrochemicals, LPG, NGLs | 3,429 | 3,429 | 2,432 | 2,409 | ||||||||||||||||||||||

| Other | 93 | 1,959 | 991 | 1,856 | ||||||||||||||||||||||

| Total production | 73,131 | 75,623 | 72,533 | 61,991 | ||||||||||||||||||||||

| Throughput (average bpd): | ||||||||||||||||||||||||||

| Crude oil | 73,385 | 74,877 | 71,671 | 59,379 | ||||||||||||||||||||||

| Other feedstocks | 1,613 | 1,118 | 2,641 | 3,243 | ||||||||||||||||||||||

| Total throughput | 74,998 | 75,995 | 74,312 | 62,622 | ||||||||||||||||||||||

| Tyler refining production margin ($ in millions) | $ | 51.6 | $ | 165.4 | $ | 224.6 | $ | 329.7 | ||||||||||||||||||

| Per barrel of throughput: | ||||||||||||||||||||||||||

| Tyler refining production margin | $ | 7.48 | $ | 23.66 | $ | 11.03 | $ | 19.29 | ||||||||||||||||||

| Operating expenses | $ | 4.61 | $ | 4.74 | $ | 4.90 | $ | 5.06 | ||||||||||||||||||

| Crude Slate: (% based on amount received in period) | ||||||||||||||||||||||||||

| WTI crude oil | 79.2 | % | 76.8 | % | 80.6 | % | 78.1 | % | ||||||||||||||||||

| East Texas crude oil | 19.6 | % | 23.2 | % | 19.0 | % | 21.9 | % | ||||||||||||||||||

| Other | 1.2 | % | — | % | 0.4 | % | — | % | ||||||||||||||||||

Capture rate (3) |

47.8 | % | 73.0 | % | 58.4 | % | 64.0 | % | ||||||||||||||||||

| El Dorado, AR Refinery | ||||||||||||||||||||||||||

Days in period |

92 | 92 | 274 | 273 | ||||||||||||||||||||||

| Products manufactured (average bpd): | ||||||||||||||||||||||||||

| Gasoline | 34,887 | 39,361 | 38,350 | 37,213 | ||||||||||||||||||||||

| Diesel | 29,854 | 31,927 | 30,587 | 29,211 | ||||||||||||||||||||||

| Petrochemicals, LPG, NGLs | 1,317 | 1,875 | 1,301 | 1,564 | ||||||||||||||||||||||

| Asphalt | 9,046 | 7,893 | 8,849 | 7,418 | ||||||||||||||||||||||

| Other | 993 | 1,168 | 1,291 | 1,034 | ||||||||||||||||||||||

| Total production | 76,097 | 82,224 | 80,378 | 76,440 | ||||||||||||||||||||||

| Throughput (average bpd): | ||||||||||||||||||||||||||

| Crude oil | 75,344 | 81,671 | 79,597 | 75,286 | ||||||||||||||||||||||

| Other feedstocks | 2,674 | 2,611 | 2,500 | 3,053 | ||||||||||||||||||||||

| Total throughput | 78,018 | 84,282 | 82,097 | 78,339 | ||||||||||||||||||||||

15 | |

|||||

| Refining Segment Selected Financial Information (continued) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| El Dorado refining production margin ($ in millions) | $ | 4.7 | $ | 97.5 | $ | 97.0 | $ | 231.0 | ||||||||||||||||||

| Per barrel of throughput: | ||||||||||||||||||||||||||

| El Dorado refining production margin | $ | 0.66 | $ | 12.57 | $ | 4.31 | $ | 10.80 | ||||||||||||||||||

| Operating expenses | $ | 5.01 | $ | 4.36 | $ | 4.61 | $ | 4.60 | ||||||||||||||||||

| Crude Slate: (% based on amount received in period) | ||||||||||||||||||||||||||

| WTI crude oil | 68.3 | % | 71.9 | % | 67.0 | % | 67.6 | % | ||||||||||||||||||

| Local Arkansas crude oil | 12.4 | % | 13.4 | % | 11.9 | % | 14.8 | % | ||||||||||||||||||

| Other | 19.3 | % | 14.7 | % | 21.1 | % | 17.6 | % | ||||||||||||||||||

Capture rate (3) |

4.2 | % | 38.8 | % | 22.8 | % | 35.8 | % | ||||||||||||||||||

| Big Spring, TX Refinery | ||||||||||||||||||||||||||

Days in period |

92 | 92 | 274 | 273 | ||||||||||||||||||||||

| Products manufactured (average bpd): | ||||||||||||||||||||||||||

| Gasoline | 34,510 | 29,274 | 32,925 | 33,755 | ||||||||||||||||||||||

| Diesel/Jet | 26,303 | 23,607 | 25,282 | 23,333 | ||||||||||||||||||||||

| Petrochemicals, LPG, NGLs | 5,160 | 3,723 | 4,630 | 3,299 | ||||||||||||||||||||||

| Asphalt | 3,176 | 2,220 | 2,703 | 1,833 | ||||||||||||||||||||||

| Other | 3,290 | 5,272 | 4,290 | 3,283 | ||||||||||||||||||||||

| Total production | 72,439 | 64,096 | 69,830 | 65,503 | ||||||||||||||||||||||

| Throughput (average bpd): | ||||||||||||||||||||||||||

| Crude oil | 68,746 | 61,046 | 65,856 | 62,733 | ||||||||||||||||||||||

| Other feedstocks | 3,817 | 3,865 | 4,638 | 3,834 | ||||||||||||||||||||||

| Total throughput | 72,563 | 64,911 | 70,494 | 66,567 | ||||||||||||||||||||||

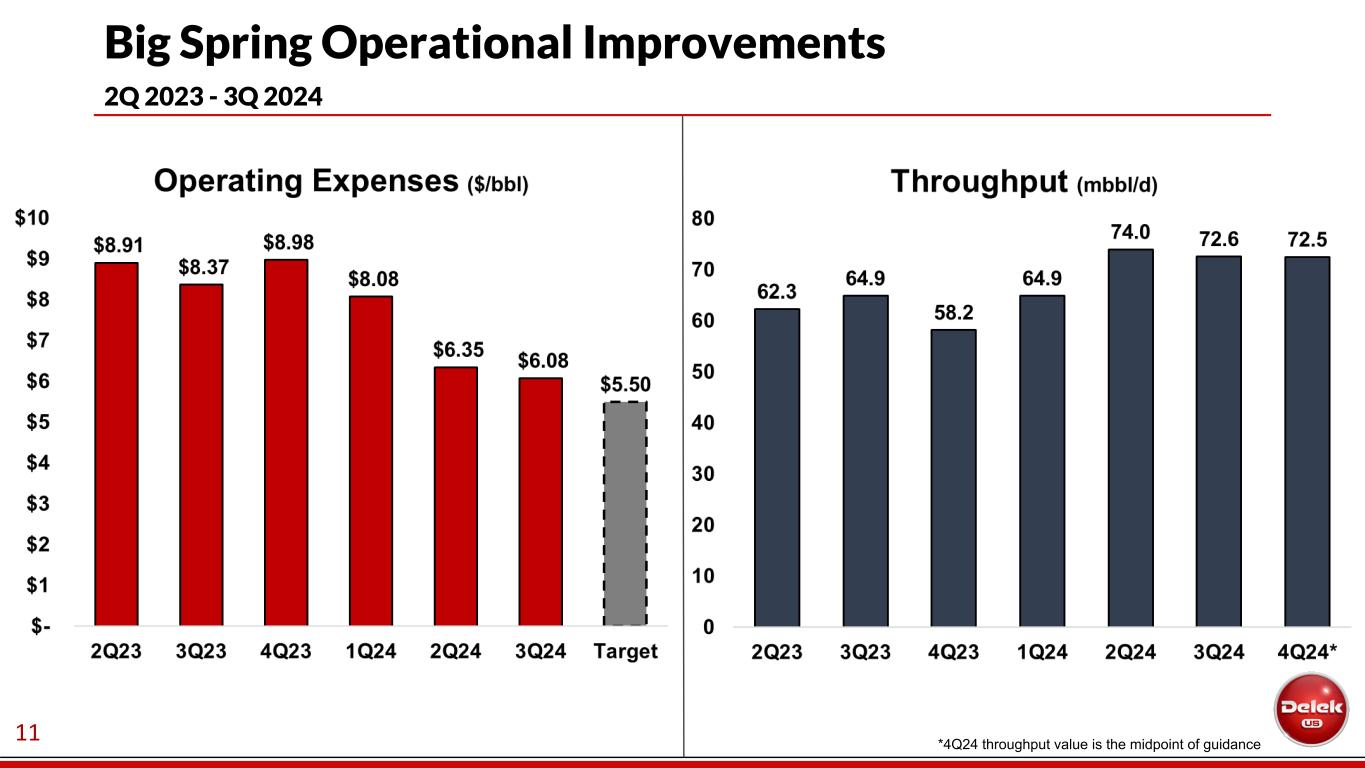

| Big Spring refining production margin ($ in millions) | $ | 45.6 | $ | 95.1 | $ | 181.6 | $ | 280.3 | ||||||||||||||||||

| Per barrel of throughput: | ||||||||||||||||||||||||||

| Big Spring refining production margin | $ | 6.82 | $ | 15.92 | $ | 9.40 | $ | 15.43 | ||||||||||||||||||

| Operating expenses | $ | 6.08 | $ | 8.37 | $ | 6.78 | $ | 7.61 | ||||||||||||||||||

| Crude Slate: (% based on amount received in period) | ||||||||||||||||||||||||||

| WTI crude oil | 68.9 | % | 64.3 | % | 70.5 | % | 68.8 | % | ||||||||||||||||||

| WTS crude oil | 31.1 | % | 35.7 | % | 29.5 | % | 31.2 | % | ||||||||||||||||||

Capture rate (3) |

44.7 | % | 50.9 | % | 51.5 | % | 52.6 | % | ||||||||||||||||||

| Krotz Springs, LA Refinery | ||||||||||||||||||||||||||

Days in period |

92 | 92 | 274 | 273 | ||||||||||||||||||||||

| Products manufactured (average bpd): | ||||||||||||||||||||||||||

| Gasoline | 40,842 | 38,361 | 39,557 | 40,454 | ||||||||||||||||||||||

| Diesel/Jet | 32,879 | 30,653 | 31,203 | 31,794 | ||||||||||||||||||||||

| Heavy oils | 1,559 | 5,461 | 1,773 | 4,239 | ||||||||||||||||||||||

| Petrochemicals, LPG, NGLs | 6,332 | 6,079 | 5,665 | 6,510 | ||||||||||||||||||||||

| Other | 602 | 902 | 1,919 | 446 | ||||||||||||||||||||||

| Total production | 82,214 | 81,456 | 80,117 | 83,443 | ||||||||||||||||||||||

| Throughput (average bpd): | ||||||||||||||||||||||||||

| Crude oil | 77,875 | 77,132 | 73,918 | 77,912 | ||||||||||||||||||||||

| Other feedstocks | 4,141 | 3,628 | 5,948 | 4,686 | ||||||||||||||||||||||

| Total throughput | 82,016 | 80,760 | 79,866 | 82,598 | ||||||||||||||||||||||

| Krotz Springs refining production margin ($ in millions) | $ | 36.2 | $ | 92.5 | $ | 177.1 | $ | 256.6 | ||||||||||||||||||

| Per barrel of throughput: | ||||||||||||||||||||||||||

| Krotz Springs refining production margin | $ | 4.80 | $ | 12.45 | $ | 8.09 | $ | 11.38 | ||||||||||||||||||

| Operating expenses | $ | 4.82 | $ | 5.00 | $ | 5.22 | $ | 5.00 | ||||||||||||||||||

| Crude Slate: (% based on amount received in period) | ||||||||||||||||||||||||||

| WTI Crude | 61.6 | % | 79.8 | % | 66.1 | % | 79.0 | % | ||||||||||||||||||

| Gulf Coast Sweet Crude | 32.8 | % | 11.2 | % | 28.6 | % | 13.5 | % | ||||||||||||||||||

| Other | 5.6 | % | 9.0 | % | 5.3 | % | 7.5 | % | ||||||||||||||||||

Capture rate (3) |

42.0 | % | 63.9 | % | 55.3 | % | 68.4 | % | ||||||||||||||||||

16 | |

|||||

| Logistics Segment Selected Information | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||||

| Gathering & Processing: (average bpd) | ||||||||||||||||||||||||||

| Lion Pipeline System: | ||||||||||||||||||||||||||

| Crude pipelines (non-gathered) | 68,430 | 70,153 | 71,576 | 64,835 | ||||||||||||||||||||||

| Refined products pipelines | 55,283 | 63,991 | 59,681 | 54,686 | ||||||||||||||||||||||

| SALA Gathering System | 13,886 | 14,774 | 12,113 | 13,935 | ||||||||||||||||||||||

| East Texas Crude Logistics System | 35,891 | 36,298 | 26,319 | 29,928 | ||||||||||||||||||||||

| Midland Gathering Assets | 185,179 | 248,443 | 201,796 | 230,907 | ||||||||||||||||||||||

| Plains Connection System | 188,421 | 250,550 | 218,323 | 248,763 | ||||||||||||||||||||||

| Delaware Gathering Assets: | ||||||||||||||||||||||||||

Natural gas gathering and processing (Mcfd) (1) |

75,719 | 69,737 | 76,092 | 72,569 | ||||||||||||||||||||||

| Crude oil gathering (average bpd) | 125,123 | 111,973 | 124,190 | 110,935 | ||||||||||||||||||||||

| Water disposal and recycling (average bpd) | 123,856 | 99,158 | 120,360 | 104,920 | ||||||||||||||||||||||

Midland Water Gathering System: (2) |

||||||||||||||||||||||||||

| Water disposal and recycling (average bpd) | 100,335 | — | 100,335 | — | ||||||||||||||||||||||

| Wholesale Marketing & Terminalling: | ||||||||||||||||||||||||||

East Texas - Tyler Refinery sales volumes (average bpd) (3) |

70,172 | 69,178 | 69,246 | 57,894 | ||||||||||||||||||||||

| Big Spring wholesale marketing throughputs (average bpd) | 22,700 | 81,617 | 60,109 | 78,399 | ||||||||||||||||||||||

| West Texas wholesale marketing throughputs (average bpd) | 6,552 | 10,692 | 5,276 | 9,871 | ||||||||||||||||||||||

| West Texas wholesale marketing margin per barrel | $ | 3.38 | $ | 9.64 | $ | 2.85 | $ | 8.76 | ||||||||||||||||||

Terminalling throughputs (average bpd) (4) |

160,849 | 121,430 | 152,272 | 116,455 | ||||||||||||||||||||||

17 | |

|||||

| Supplemental Information | ||||||||||||||||||||

| Schedule of Selected Segment Financial Data, Pricing Statistics Impacting our Refining Segment, and Other Reconciliations of Amounts Reported Under U.S. GAAP | ||||||||||||||||||||

| Selected Segment Financial Data | Three Months Ended September 30, 2024 | |||||||||||||||||||||||||

| $ in millions (unaudited) | Refining | Logistics | Corporate, Other and Eliminations |

Consolidated | ||||||||||||||||||||||

| Net revenues (excluding intercompany fees and revenues) | $ | 2,852.6 | $ | 99.2 | $ | — | $ | 2,951.8 | ||||||||||||||||||

Inter-segment fees and revenues (1) |

175.2 | 114.9 | (199.5) | 90.6 | ||||||||||||||||||||||

| Total revenues | $ | 3,027.8 | $ | 214.1 | $ | (199.5) | $ | 3,042.4 | ||||||||||||||||||

| Cost of sales | 3,083.3 | 168.3 | (189.0) | 3,062.6 | ||||||||||||||||||||||

| Gross margin | $ | (55.5) | $ | 45.8 | $ | (10.5) | $ | (20.2) | ||||||||||||||||||

| Three Months Ended September 30, 2023 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining | Logistics | Corporate, Other and Eliminations |

Consolidated | ||||||||||||||||||||||

| Net revenues (excluding intercompany fees and revenues) | $ | 4,392.4 | $ | 119.5 | $ | — | $ | 4,511.9 | ||||||||||||||||||

Inter-segment fees and revenues (1) |

232.1 | 156.4 | (271.6) | 116.9 | ||||||||||||||||||||||

| Total revenues | $ | 4,624.5 | $ | 275.9 | $ | (271.6) | $ | 4,628.8 | ||||||||||||||||||

| Cost of sales | 4,394.4 | 206.5 | (250.1) | 4,350.8 | ||||||||||||||||||||||

| Gross margin | $ | 230.1 | $ | 69.4 | $ | (21.5) | $ | 278.0 | ||||||||||||||||||

| Nine Months Ended September 30, 2024 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining | Logistics | Corporate, Other and Eliminations |

Consolidated | ||||||||||||||||||||||

| Net revenues (excluding intercompany fees and revenues) | $ | 8,872.1 | $ | 319.4 | $ | — | $ | 9,191.5 | ||||||||||||||||||

Inter-segment fees and revenues (1) |

571.2 | 411.4 | (695.6) | 287.0 | ||||||||||||||||||||||

| Total revenues | $ | 9,443.3 | $ | 730.8 | $ | (695.6) | $ | 9,478.5 | ||||||||||||||||||

| Cost of sales | 9,506.8 | 539.1 | (658.9) | 9,387.0 | ||||||||||||||||||||||

| Gross margin | $ | (63.5) | $ | 191.7 | $ | (36.7) | $ | 91.5 | ||||||||||||||||||

| Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||

| $ in millions (unaudited) | Refining | Logistics | Corporate, Other and Eliminations |

Consolidated | ||||||||||||||||||||||

| Net revenues (excluding intercompany fees and revenues) | $ | 11,842.2 | $ | 351.9 | $ | — | $ | 12,194.1 | ||||||||||||||||||

Inter-segment fees and revenues (1) |

629.3 | 414.4 | (712.7) | 331.0 | ||||||||||||||||||||||

| Total revenues | $ | 12,471.5 | $ | 766.3 | $ | (712.7) | $ | 12,525.1 | ||||||||||||||||||

| Cost of sales | 12,045.8 | 555.6 | (669.9) | 11,931.5 | ||||||||||||||||||||||

| Gross margin | $ | 425.7 | $ | 210.7 | $ | (42.8) | $ | 593.6 | ||||||||||||||||||

18 | |

|||||

| Pricing Statistics | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||

| (average for the period presented) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| WTI — Cushing crude oil (per barrel) | $ | 75.28 | $ | 82.51 | $ | 77.72 | $ | 77.37 | ||||||||||||||||||

| WTI — Midland crude oil (per barrel) | $ | 75.96 | $ | 83.85 | $ | 78.75 | $ | 78.63 | ||||||||||||||||||

| WTS — Midland crude oil (per barrel) | $ | 75.25 | $ | 83.01 | $ | 77.91 | $ | 77.34 | ||||||||||||||||||

| LLS (per barrel) | $ | 77.28 | $ | 84.88 | $ | 80.23 | $ | 79.82 | ||||||||||||||||||

| Brent (per barrel) | $ | 78.71 | $ | 85.92 | $ | 81.81 | $ | 81.96 | ||||||||||||||||||

U.S. Gulf Coast 5-3-2 crack spread (per barrel) (1) |

$ | 15.64 | $ | 32.39 | $ | 18.89 | $ | 30.15 | ||||||||||||||||||

U.S. Gulf Coast 3-2-1 crack spread (per barrel) (1) |

$ | 15.27 | $ | 31.30 | $ | 18.26 | $ | 29.30 | ||||||||||||||||||

U.S. Gulf Coast 2-1-1 crack spread (per barrel) (1) |

$ | 11.42 | $ | 19.48 | $ | 14.63 | $ | 16.64 | ||||||||||||||||||

| U.S. Gulf Coast Unleaded Gasoline (per gallon) | $ | 2.11 | $ | 2.58 | $ | 2.21 | $ | 2.44 | ||||||||||||||||||

| Gulf Coast Ultra-low sulfur diesel (per gallon) | $ | 2.24 | $ | 2.97 | $ | 2.43 | $ | 2.74 | ||||||||||||||||||

| U.S. Gulf Coast high sulfur diesel (per gallon) | $ | 2.08 | $ | 2.04 | $ | 1.97 | $ | 1.80 | ||||||||||||||||||

| Natural gas (per MMBTU) | $ | 2.23 | $ | 2.66 | $ | 2.23 | $ | 2.57 | ||||||||||||||||||

19 | |

|||||

| Other Reconciliations of Amounts Reported Under U.S. GAAP | ||||||||||||||||||||||||||

| $ in millions (unaudited) | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| Reconciliation of gross margin to Refining margin to Adjusted refining margin | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Gross margin | $ | (55.5) | $ | 230.1 | $ | (63.5) | $ | 425.7 | ||||||||||||||||||

| Add back (items included in cost of sales): | ||||||||||||||||||||||||||

| Operating expenses (excluding depreciation and amortization) | 145.0 | 166.5 | 459.4 | 459.4 | ||||||||||||||||||||||

| Depreciation and amortization | 76.0 | 60.1 | 194.8 | 176.5 | ||||||||||||||||||||||

| Refining margin | $ | 165.5 | $ | 456.7 | $ | 590.7 | $ | 1,061.6 | ||||||||||||||||||

| Adjusting items | ||||||||||||||||||||||||||

| Net inventory LCM valuation loss (benefit) | 0.2 | 3.4 | (10.5) | (6.2) | ||||||||||||||||||||||

Other inventory impact (1) |

25.8 | (28.2) | 39.0 | 145.4 | ||||||||||||||||||||||

| Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements | (8.0) | 17.4 | 1.1 | (8.1) | ||||||||||||||||||||||

Unrealized RINs hedging (gain) loss where the hedged item is not yet recognized in the financial statements (2) |

(2.6) | — | 3.7 | — | ||||||||||||||||||||||

Intercompany lease impacts (1) |

(32.1) | — | (32.1) | — | ||||||||||||||||||||||

| Total adjusting items | (16.7) | (7.4) | 1.2 | 131.1 | ||||||||||||||||||||||

| Adjusted refining margin | $ | 148.8 | $ | 449.3 | $ | 591.9 | $ | 1,192.7 | ||||||||||||||||||

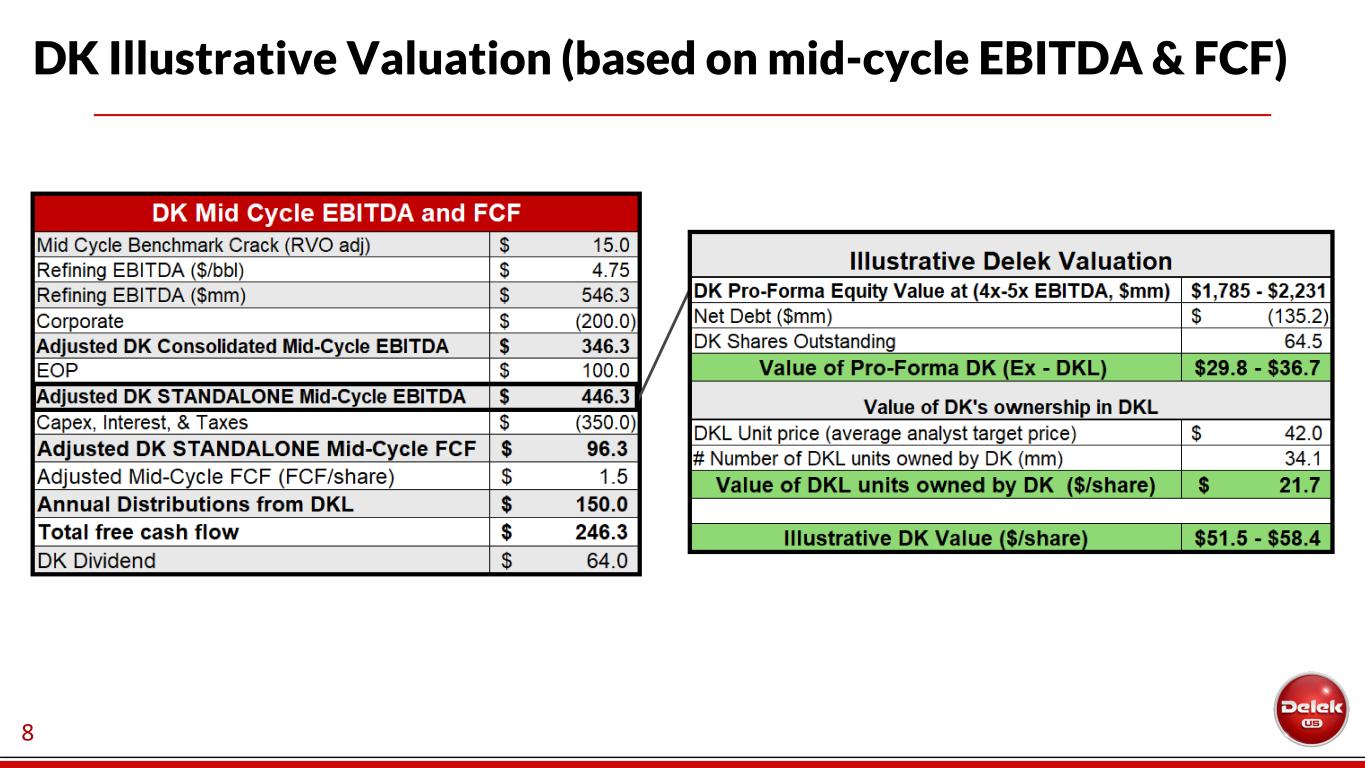

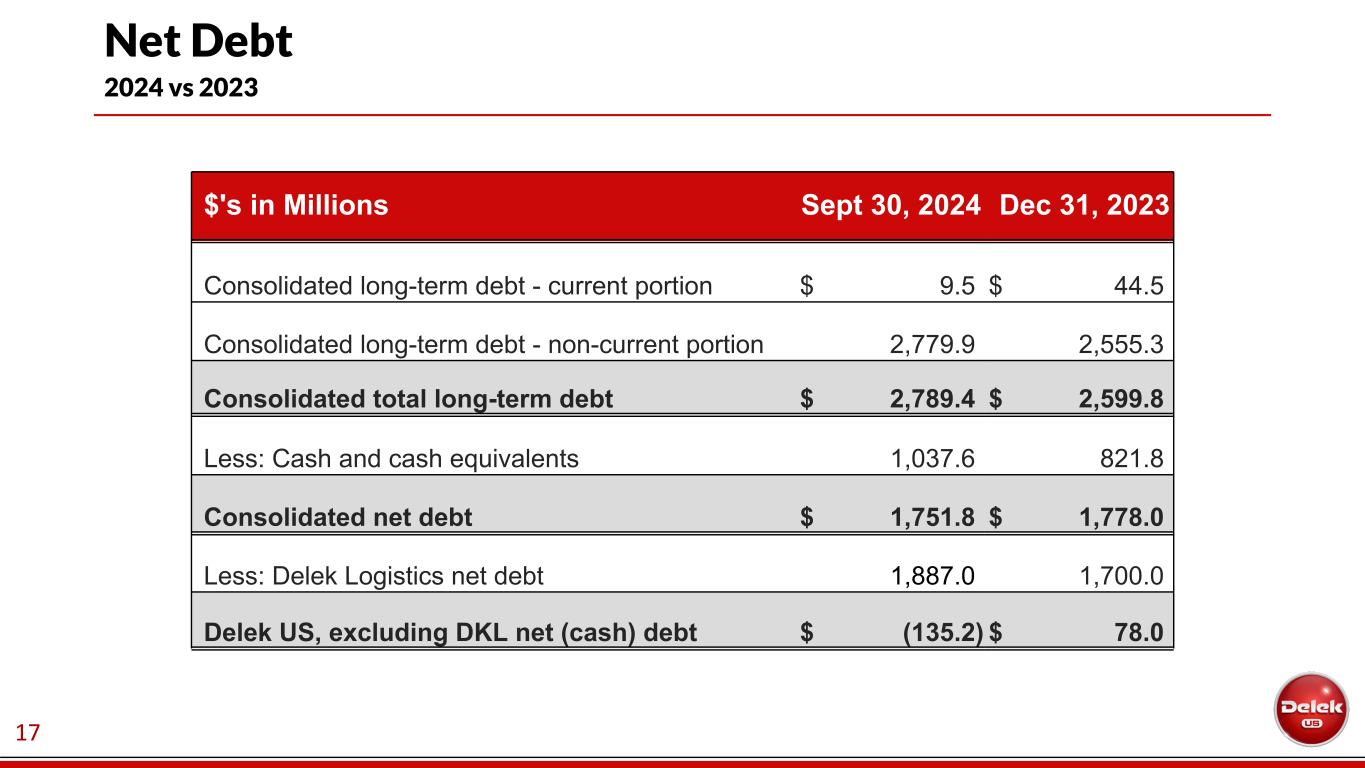

| Calculation of Net (Cash) Debt | September 30, 2024 | December 31, 2023 | ||||||||||||

| Long-term debt - current portion | $ | 9.5 | $ | 44.5 | ||||||||||

| Long-term debt - non-current portion | 2,779.9 | 2,555.3 | ||||||||||||

| Total long-term debt | 2,789.4 | 2,599.8 | ||||||||||||

| Less: Cash and cash equivalents | 1,037.6 | 821.8 | ||||||||||||

| Net debt - consolidated | 1,751.8 | 1,778.0 | ||||||||||||

| Less: DKL net debt | 1,887.0 | 1,700.0 | ||||||||||||

| Net (cash) debt, excluding DKL | $ | (135.2) | $ | 78.0 | ||||||||||

20 | |

|||||