Investor Presentation March 2024

Delek Tech 2 Forward Looking Statement Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral or written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; cost reductions; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; competitive conditions in the markets where our refineries are located; the performance of our joint venture investments, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; long-term value creation from capital allocation; targeted internal rates of return on capital expenditures; execution of strategic initiatives and the benefits therefrom, including cash flow stability from business model transition and approach to renewable diesel; and access to crude oil and the benefits therefrom. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; risks and uncertainties related to the integration by Delek Logistics of the Delaware Gathering business following its acquisition; Delek US’ ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, gathering, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the possibility of litigation challenging renewable fuel standard waivers; the ability to grow the Midland Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. To reflect events or circumstances that occur, or which Delek US becomes aware of, after the date hereof, except as required by applicable law or regulation.

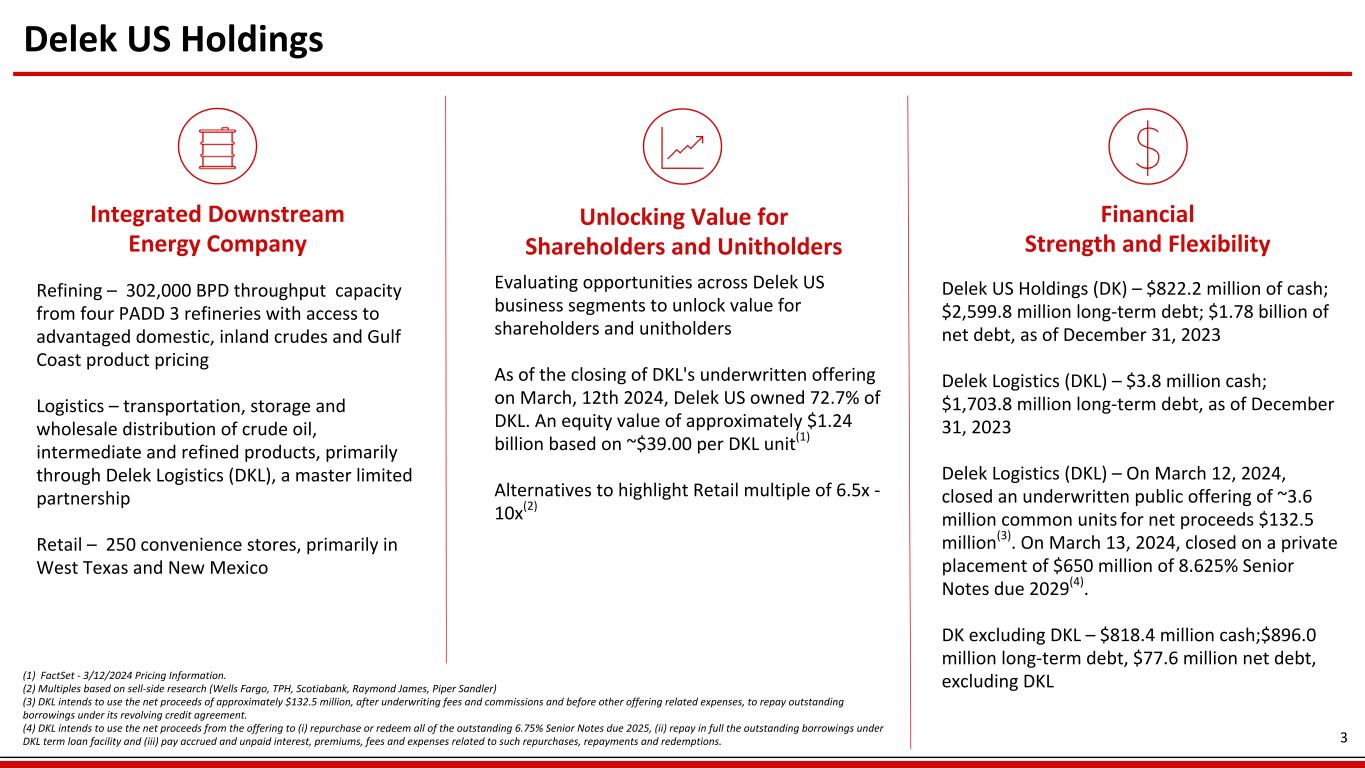

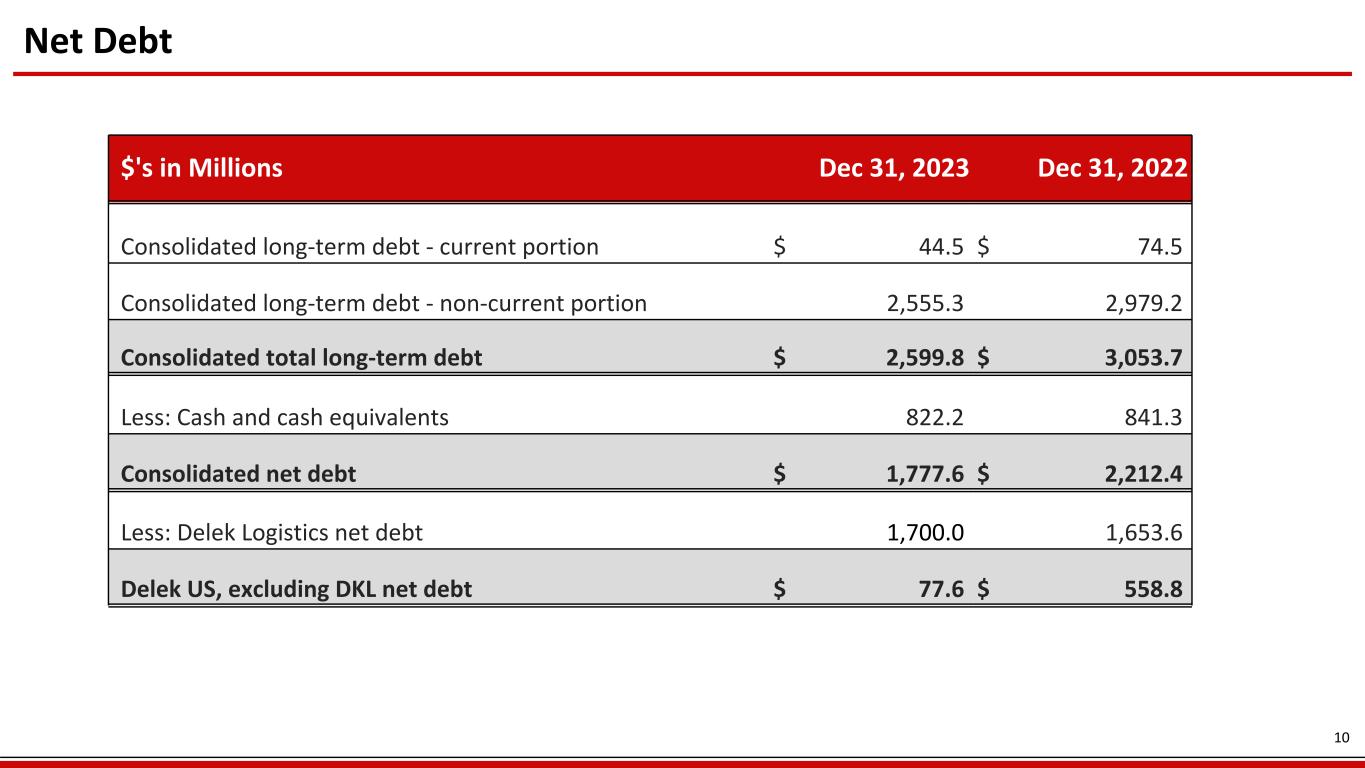

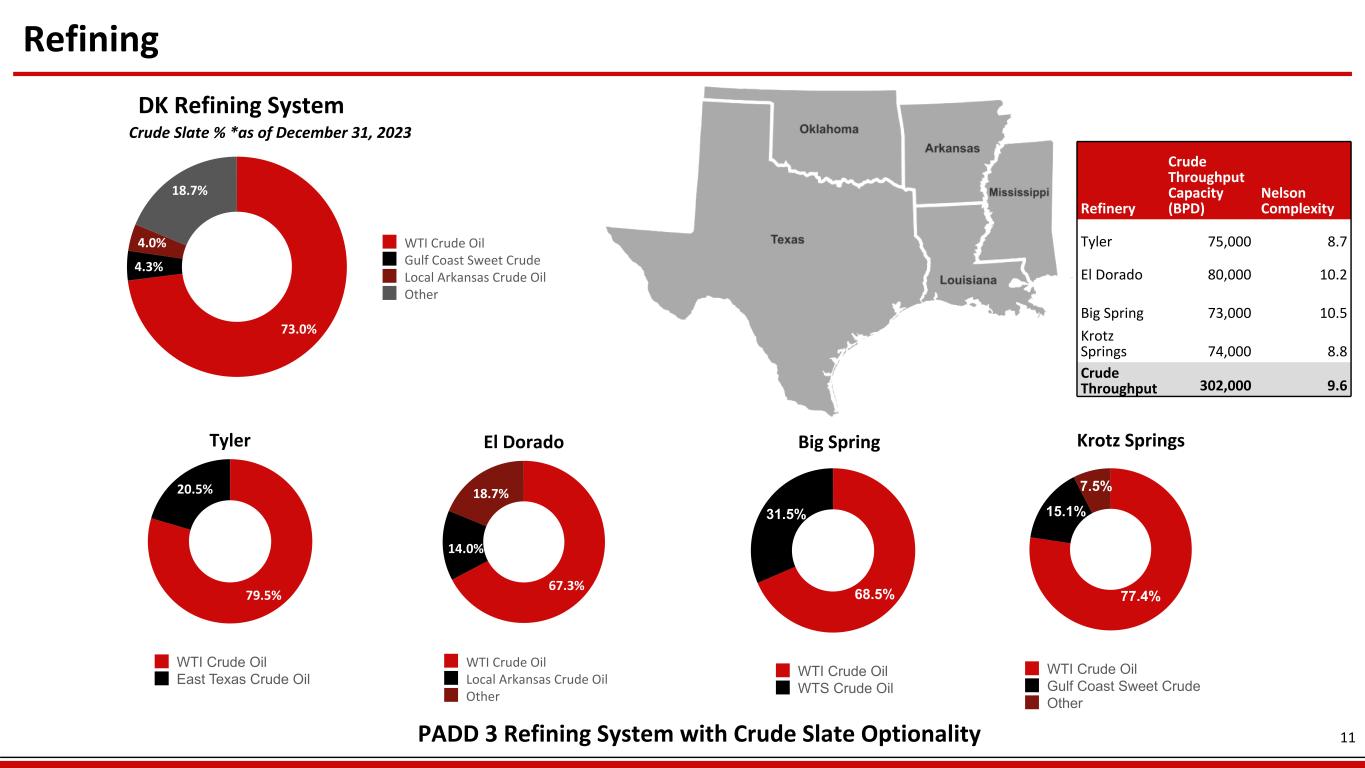

Delek Tech 3 Delek US Holdings Unlocking Value for Shareholders and Unitholders Financial Strength and Flexibility Integrated Downstream Energy Company (1) FactSet - 3/12/2024 Pricing Information. (2) Multiples based on sell-side research (Wells Fargo, TPH, Scotiabank, Raymond James, Piper Sandler) (3) DKL intends to use the net proceeds of approximately $132.5 million, after underwriting fees and commissions and before other offering related expenses, to repay outstanding borrowings under its revolving credit agreement. (4) DKL intends to use the net proceeds from the offering to (i) repurchase or redeem all of the outstanding 6.75% Senior Notes due 2025, (ii) repay in full the outstanding borrowings under DKL term loan facility and (iii) pay accrued and unpaid interest, premiums, fees and expenses related to such repurchases, repayments and redemptions. Delek US Holdings (DK) – $822.2 million of cash; $2,599.8 million long-term debt; $1.78 billion of net debt, as of December 31, 2023 Delek Logistics (DKL) – $3.8 million cash; $1,703.8 million long-term debt, as of December 31, 2023 Delek Logistics (DKL) – On March 12, 2024, closed an underwritten public offering of ~3.6 million common units for net proceeds $132.5 million(3). On March 13, 2024, closed on a private placement of $650 million of 8.625% Senior Notes due 2029(4). DK excluding DKL – $818.4 million cash;$896.0 million long-term debt, $77.6 million net debt, excluding DKL Refining – 302,000 BPD throughput capacity from four PADD 3 refineries with access to advantaged domestic, inland crudes and Gulf Coast product pricing Logistics – transportation, storage and wholesale distribution of crude oil, intermediate and refined products, primarily through Delek Logistics (DKL), a master limited partnership Retail – 250 convenience stores, primarily in West Texas and New Mexico Evaluating opportunities across Delek US business segments to unlock value for shareholders and unitholders As of the closing of DKL's underwritten offering on March, 12th 2024, Delek US owned 72.7% of DKL. An equity value of approximately $1.24 billion based on ~$39.00 per DKL unit(1) Alternatives to highlight Retail multiple of 6.5x - 10x(2)

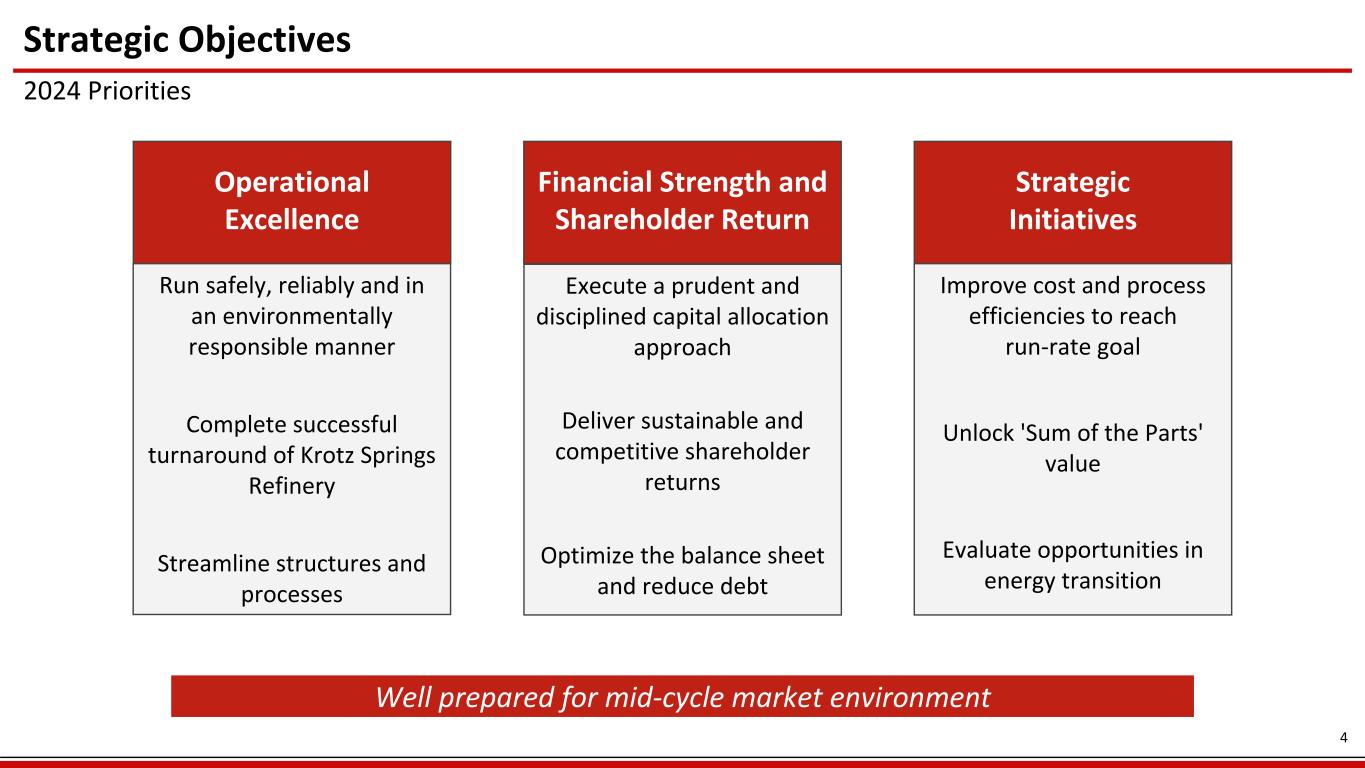

Well prepared for mid-cycle market environment Strategic Objectives 2024 Priorities Run safely, reliably and in an environmentally responsible manner Complete successful turnaround of Krotz Springs Refinery Streamline structures and processes Execute a prudent and disciplined capital allocation approach Deliver sustainable and competitive shareholder returns Optimize the balance sheet and reduce debt Improve cost and process efficiencies to reach run-rate goal Unlock 'Sum of the Parts' value Evaluate opportunities in energy transition Financial Strength and Shareholder Return Operational Excellence Strategic Initiatives 4

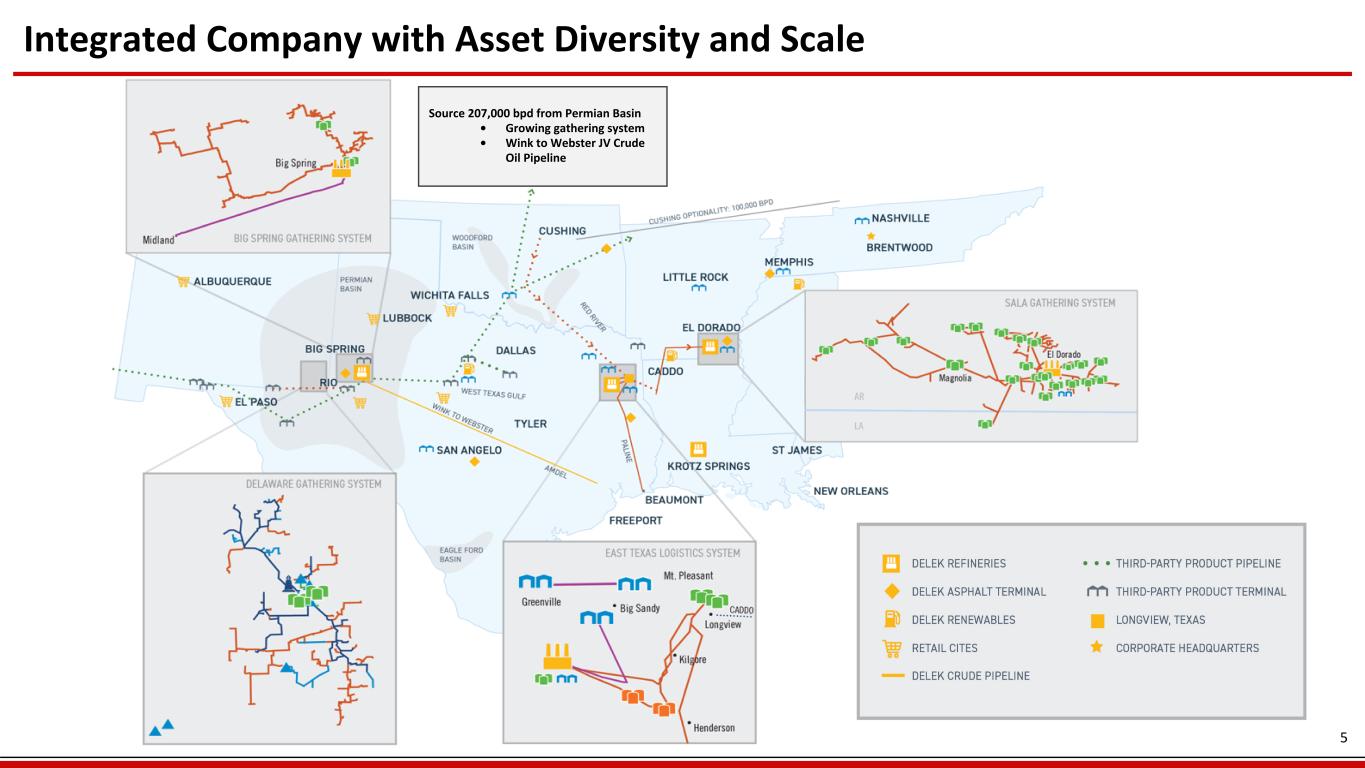

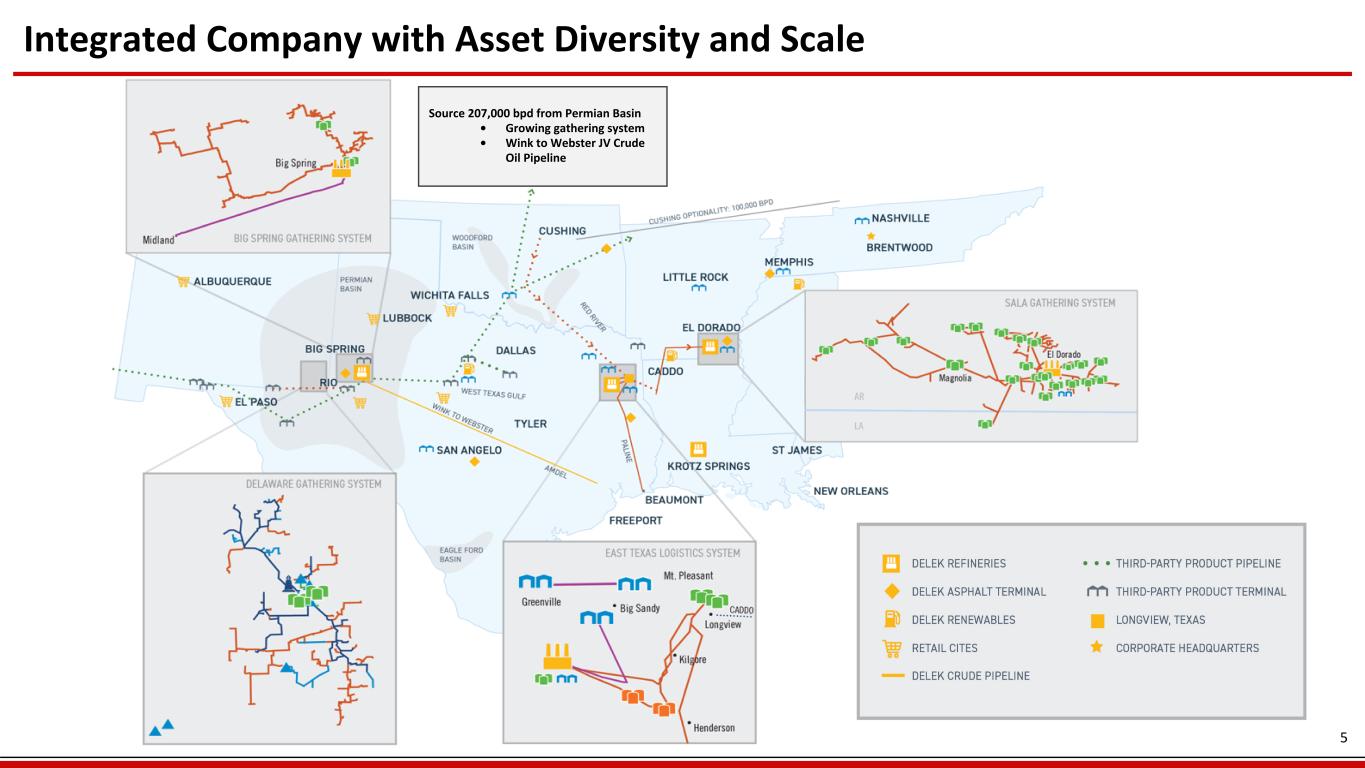

Delek Tech 5 Integrated Company with Asset Diversity and Scale Source 207,000 bpd from Permian Basin • Growing gathering system • Wink to Webster JV Crude Oil Pipeline RIO

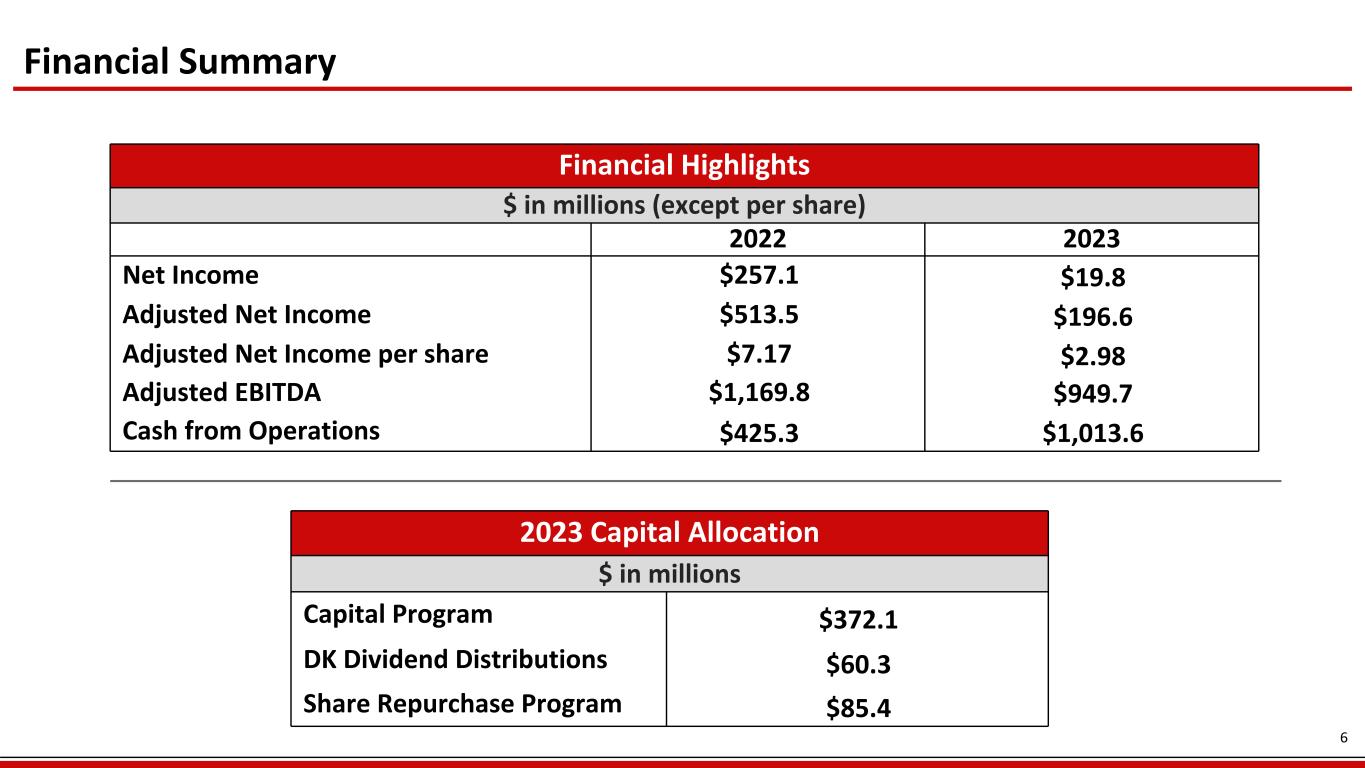

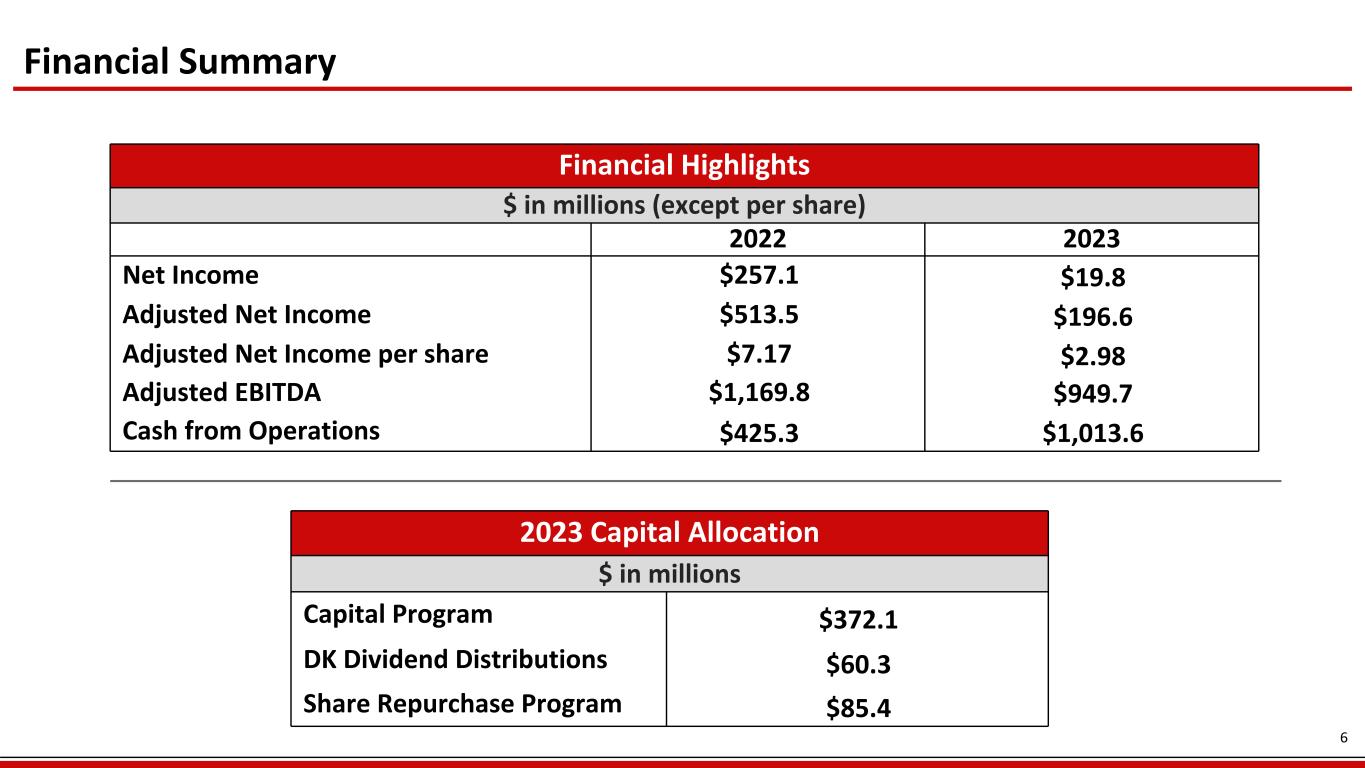

Financial Summary Financial Highlights $ in millions (except per share) 2022 2023 Net Income $257.1 $19.8 Adjusted Net Income $513.5 $196.6 Adjusted Net Income per share $7.17 $2.98 Adjusted EBITDA $1,169.8 $949.7 Cash from Operations $425.3 $1,013.6 2023 Capital Allocation $ in millions Capital Program $372.1 DK Dividend Distributions $60.3 Share Repurchase Program $85.4 6

Adjusted EBITDA 2023 vs 2022 ($MM's) 2023 Adjusted EBITDA Results by Segment Refining Logistics Retail Corporate $706.4 $378.2 $46.9 $(181.8) $1,169.8 $(322.8) $62.9 $2.8 $37.0 $949.7 2022 Refining Logistics Retail Corporate 2023 7

2023 Consolidated Cash Flow ($MM's) *includes cash and cash equivalents $841.3 $1,013.6 $(408.0) $(624.7) $822.2 12/31/2022 Cash Balance* Operating Activities Investing Activities Financing Activities 12/31/2023 Cash Balance* 8

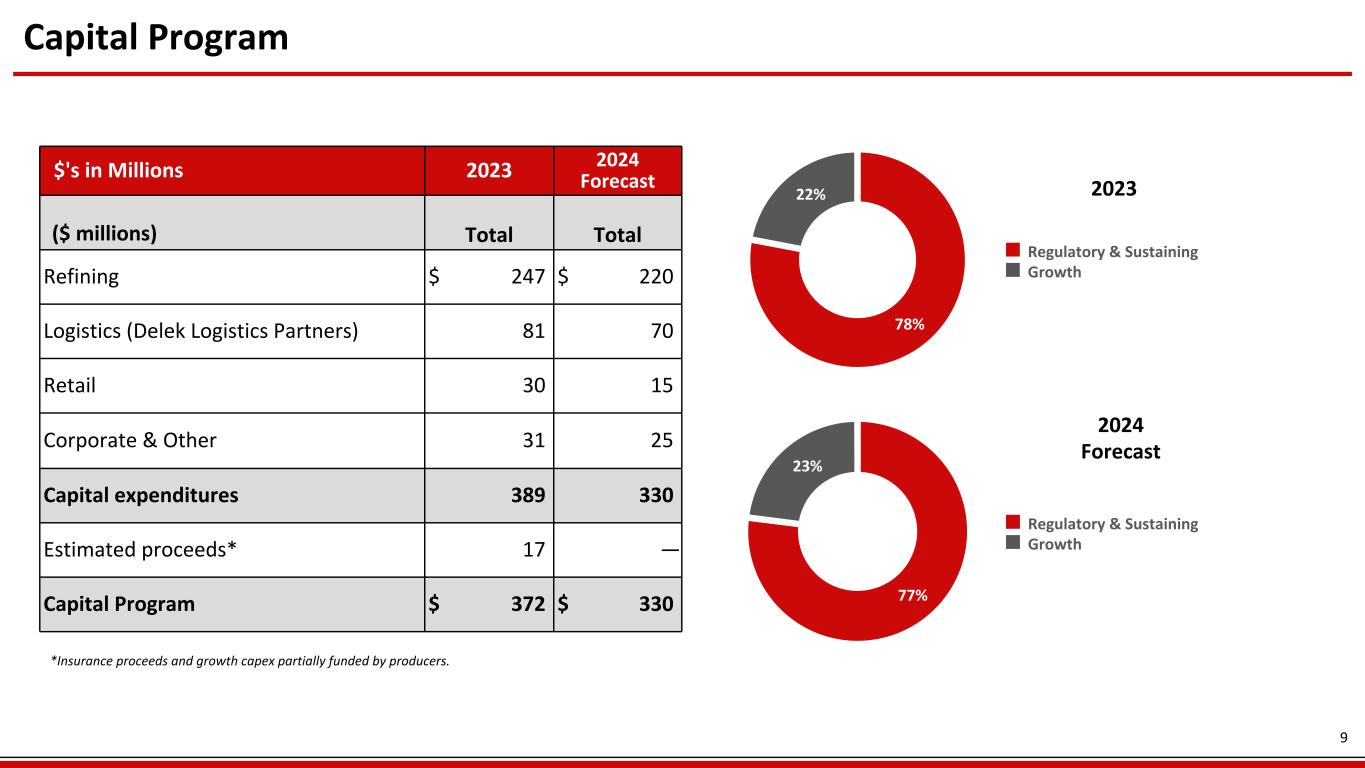

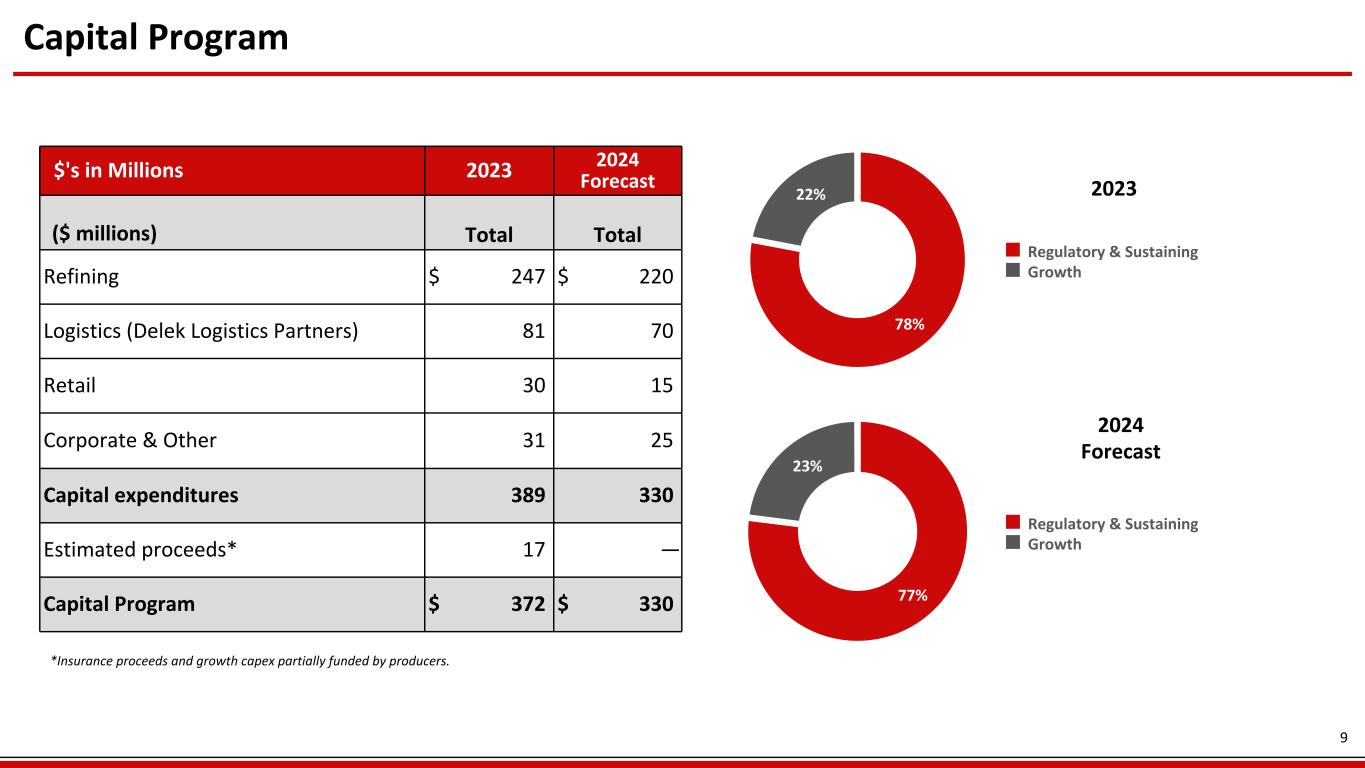

Capital Program $'s in Millions 2023 2024 Forecast ($ millions) Total Total Refining $ 247 $ 220 Logistics (Delek Logistics Partners) 81 70 Retail 30 15 Corporate & Other 31 25 Capital expenditures 389 330 Estimated proceeds* 17 — Capital Program $ 372 $ 330 2023 77% 23% Regulatory & Sustaining Growth 2024 Forecast 78% 22% Regulatory & Sustaining Growth *Insurance proceeds and growth capex partially funded by producers. 9

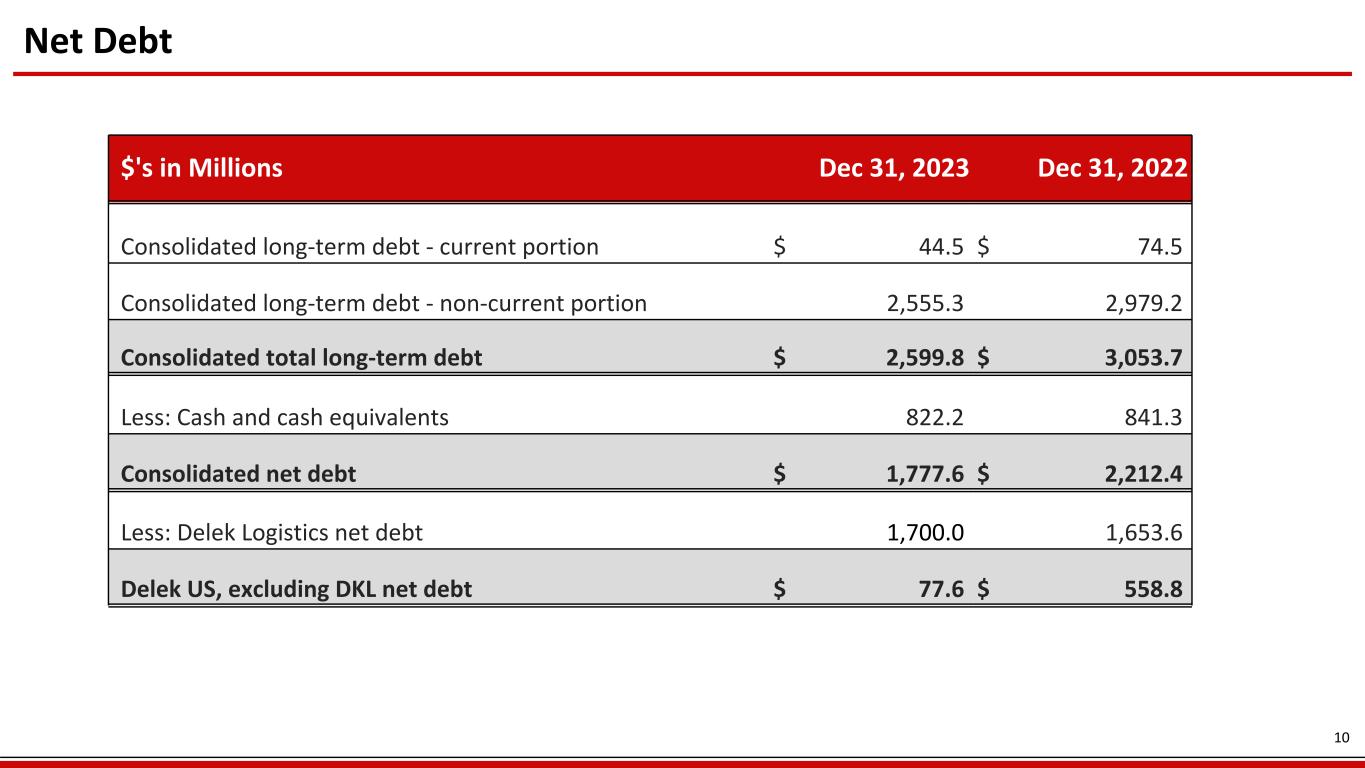

Net Debt $'s in Millions Dec 31, 2023 Dec 31, 2022 Consolidated long-term debt - current portion $ 44.5 $ 74.5 Consolidated long-term debt - non-current portion 2,555.3 2,979.2 Consolidated total long-term debt $ 2,599.8 $ 3,053.7 Less: Cash and cash equivalents 822.2 841.3 Consolidated net debt $ 1,777.6 $ 2,212.4 Less: Delek Logistics net debt 1,700.0 1,653.6 Delek US, excluding DKL net debt $ 77.6 $ 558.8 10

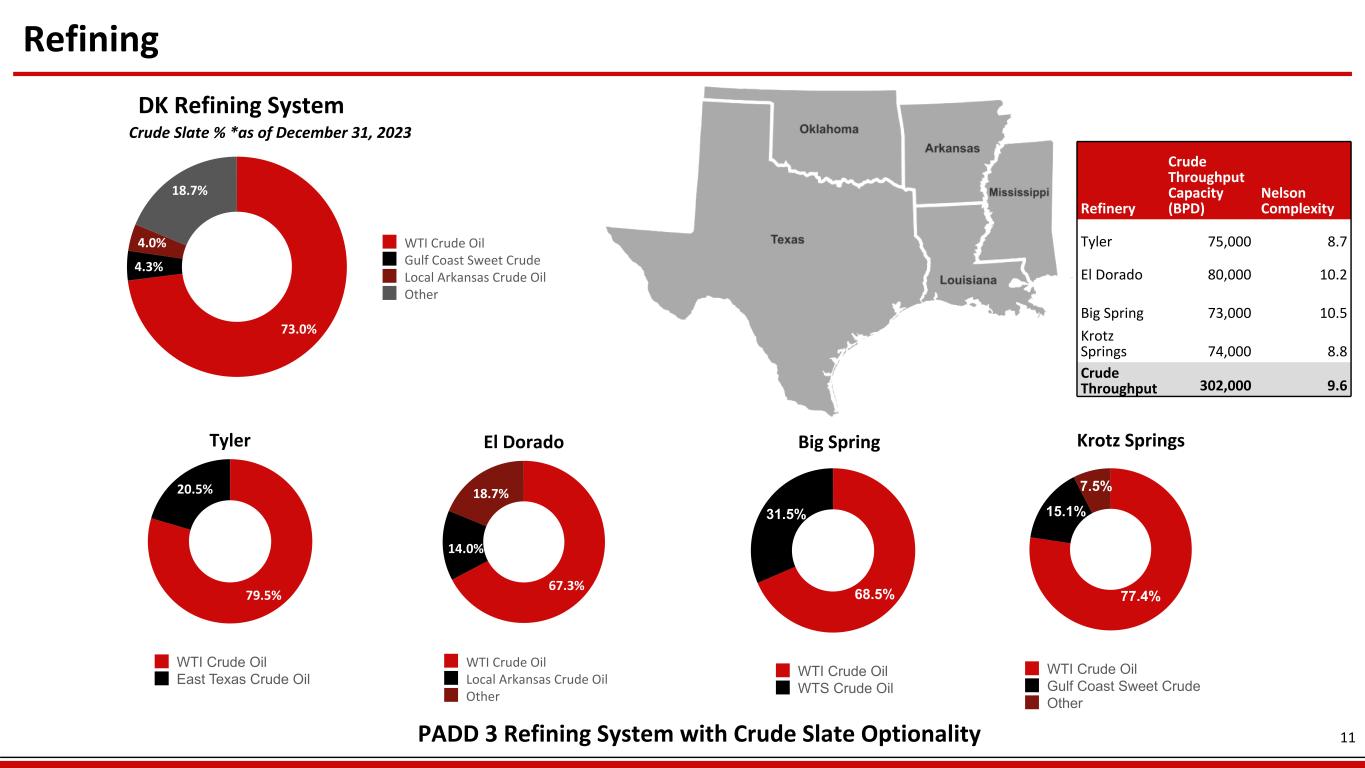

Delek Tech 11 Refining DK Refining System Tyler El Dorado Big Spring Krotz Springs PADD 3 Refining System with Crude Slate Optionality Crude Slate % *as of December 31, 2023 73.0% 4.3% 4.0% 18.7% WTI Crude Oil Gulf Coast Sweet Crude Local Arkansas Crude Oil Other 79.5% 20.5% WTI Crude Oil East Texas Crude Oil 67.3% 14.0% 18.7% WTI Crude Oil Local Arkansas Crude Oil Other 68.5% 31.5% WTI Crude Oil WTS Crude Oil 77.4% 15.1% 7.5% WTI Crude Oil Gulf Coast Sweet Crude Other Refinery Crude Throughput Capacity (BPD) Nelson Complexity Tyler 75,000 8.7 El Dorado 80,000 10.2 Big Spring 73,000 10.5 Krotz Springs 74,000 8.8 Crude Throughput 302,000 9.6

Inconsistent operational reliability Commercial optimization realized Refining Improvement Plan Path to refinery optimization O pe ra ti on al E xc el le nc e Commercial Optimization El Dorado TylerKrotz Springs Big Spring Tyler Refinery Commercially optimized with reliable operations El Dorado Refinery Opportunities to advance commercial optionality Big Spring Refinery Niche location, executing on reliability improvements Krotz Refinery Opportunities to advance commercial optionality Inconsistent operational reliability Commercial optimization opportunities Sustainable operational reliability Commercial optimization opportunities Sustainable operational reliability Commercial optimization realized Current State Future State Past State 12

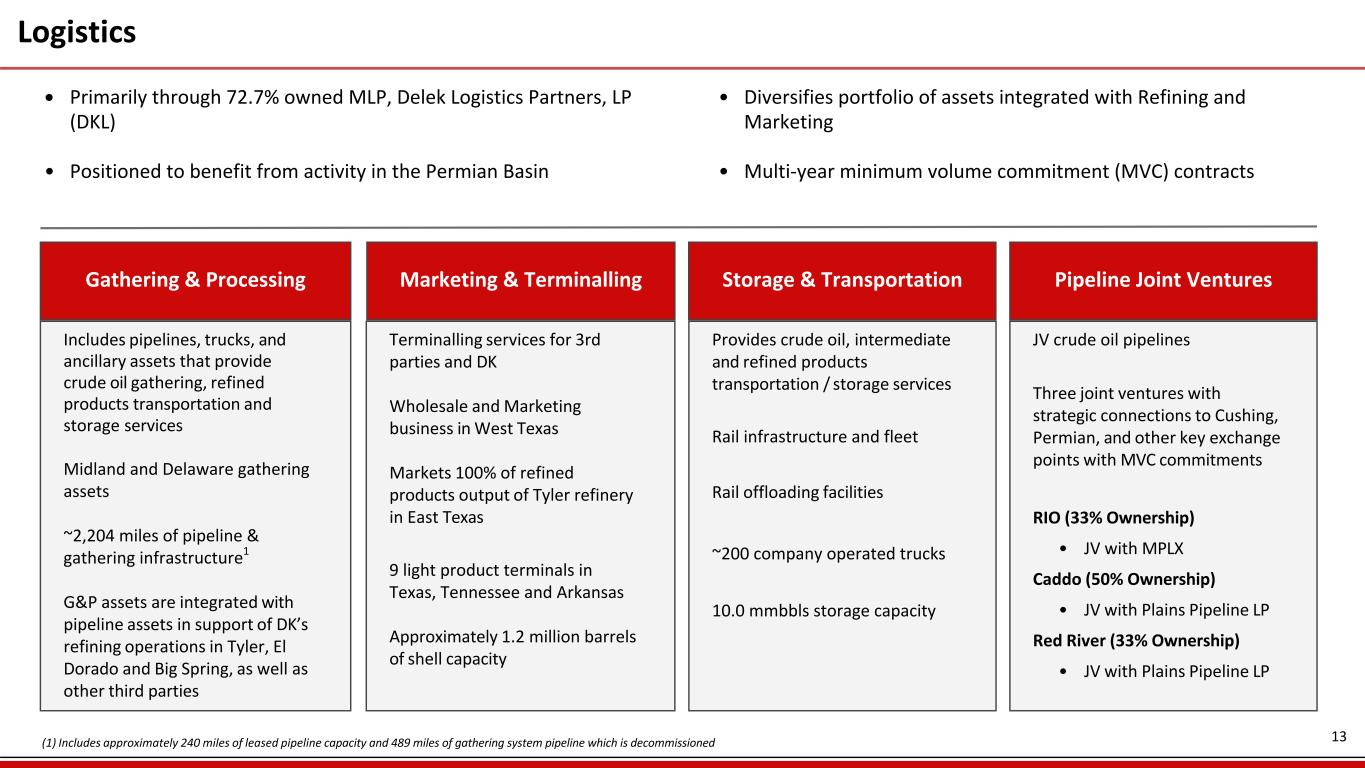

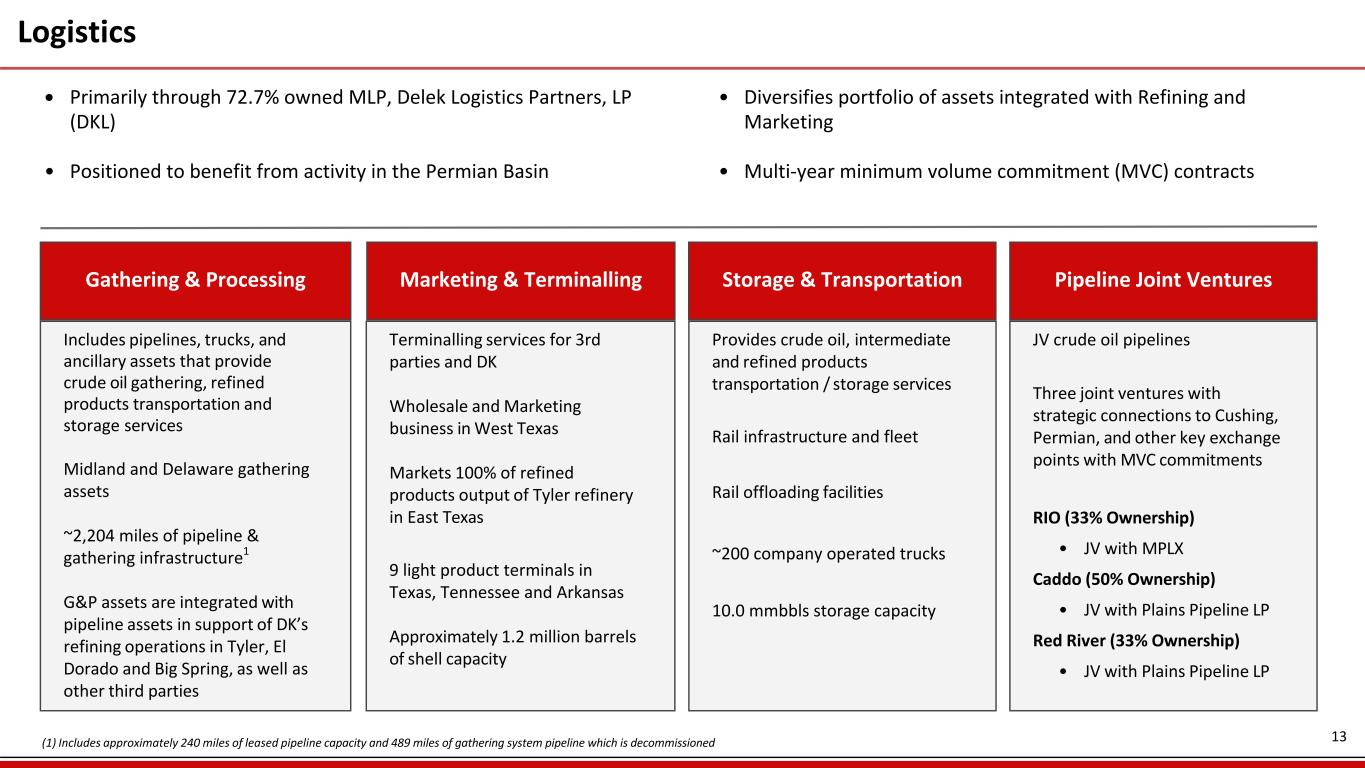

Gathering & Processing Marketing & Terminalling Storage & Transportation Pipeline Joint Ventures Includes pipelines, trucks, and ancillary assets that provide crude oil gathering, refined products transportation and storage services Midland and Delaware gathering assets ~2,204 miles of pipeline & gathering infrastructure1 G&P assets are integrated with pipeline assets in support of DK’s refining operations in Tyler, El Dorado and Big Spring, as well as other third parties Terminalling services for 3rd parties and DK Wholesale and Marketing business in West Texas Markets 100% of refined products output of Tyler refinery in East Texas 9 light product terminals in Texas, Tennessee and Arkansas Approximately 1.2 million barrels of shell capacity Provides crude oil, intermediate and refined products transportation / storage services Rail infrastructure and fleet Rail offloading facilities ~200 company operated trucks 10.0 mmbbls storage capacity JV crude oil pipelines Three joint ventures with strategic connections to Cushing, Permian, and other key exchange points with MVC commitments RIO (33% Ownership) • JV with MPLX Caddo (50% Ownership) • JV with Plains Pipeline LP Red River (33% Ownership) • JV with Plains Pipeline LP Logistics 13 • Primarily through 72.7% owned MLP, Delek Logistics Partners, LP (DKL) • Positioned to benefit from activity in the Permian Basin • Diversifies portfolio of assets integrated with Refining and Marketing • Multi-year minimum volume commitment (MVC) contracts (1) Includes approximately 240 miles of leased pipeline capacity and 489 miles of gathering system pipeline which is decommissioned

14 Retail ~80% integration with existing downstream operations offering synergies and competitive advantage Operate 250 C-stores in West Texas and New Mexico 704 thousand of gallons in fuel sales (per site) per quarter Implement interior rebranding/ re-imaging

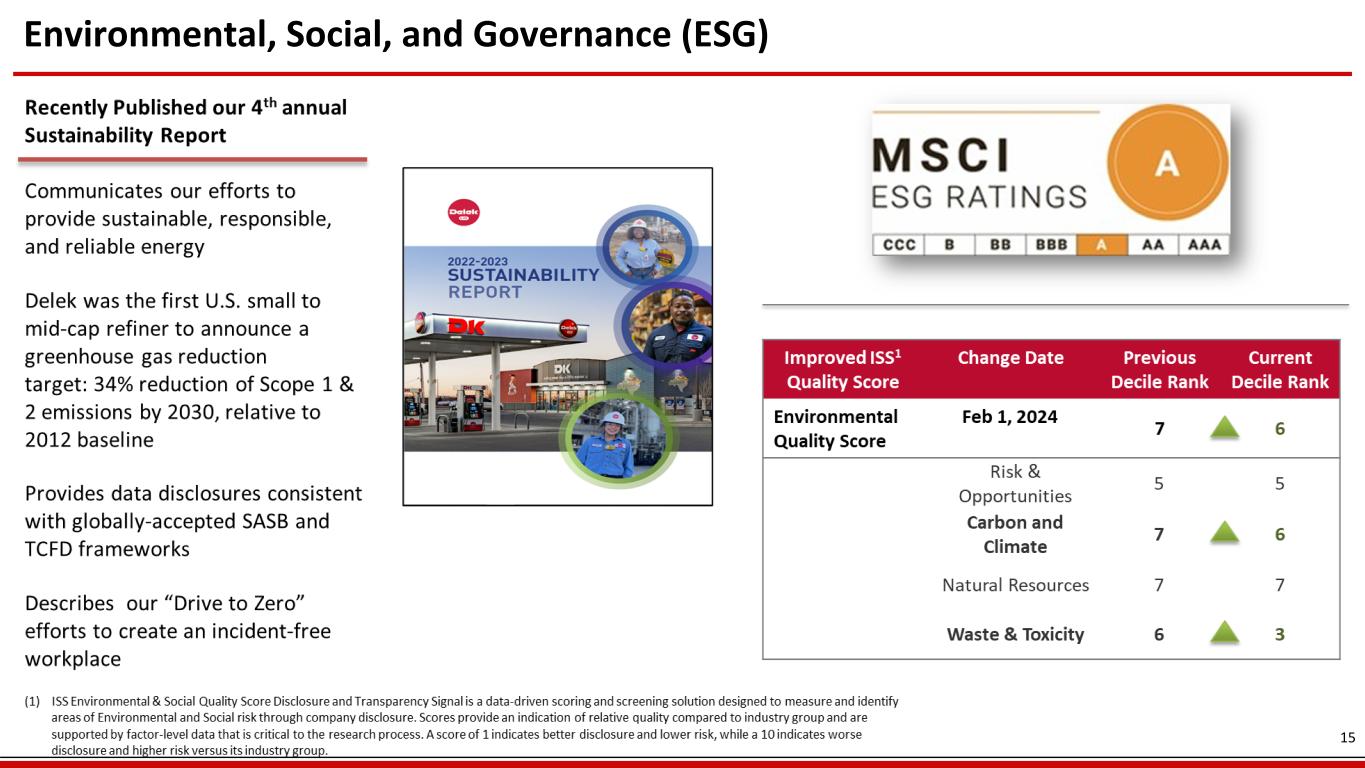

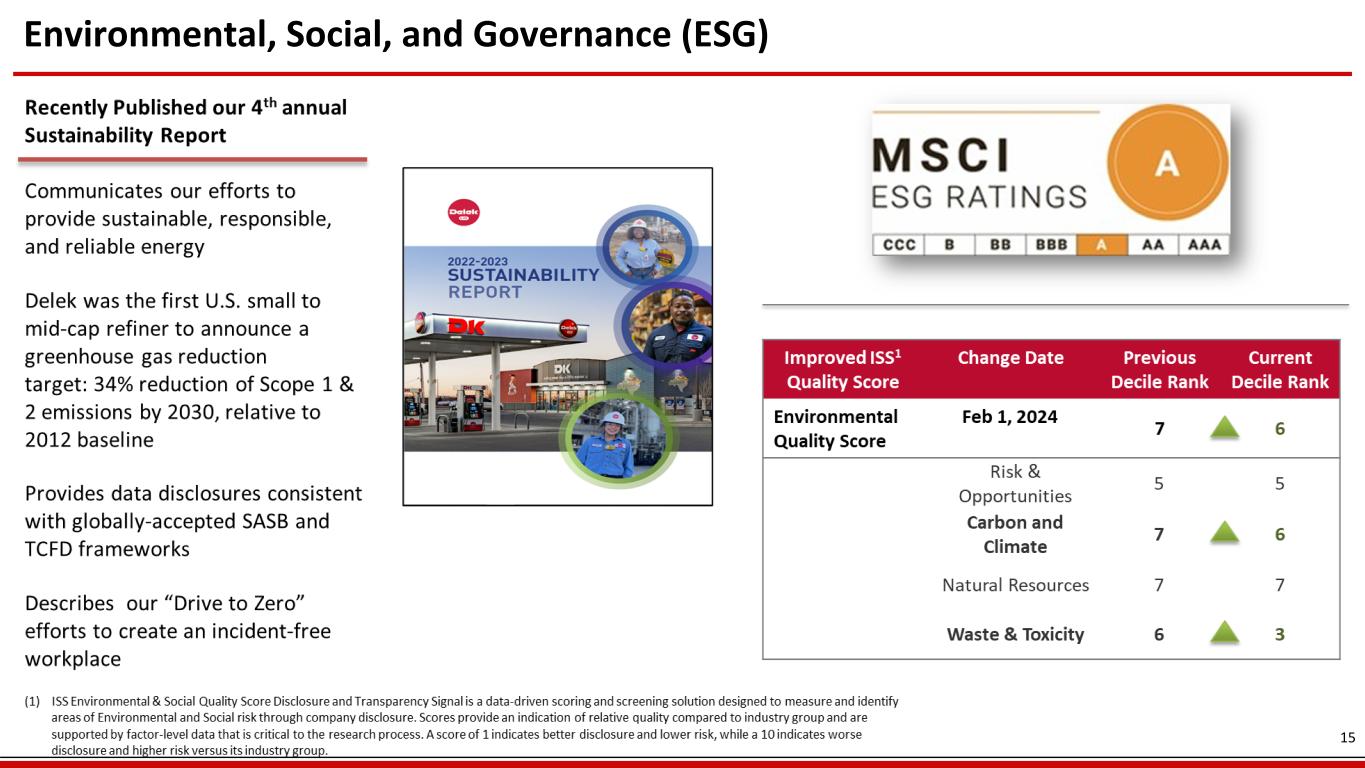

Environmental, Social, and Governance (ESG) 15

Guidance 1st Quarter 2024 $'s in Millions Low High Operating Expenses $215 $225 General and Administrative Expenses $60 $65 Depreciation and Amortization $90 $95 Net Interest Expense $80 $85 Barrels per day (bpd) Low High Total Crude Throughput 269,000 281,000 Total Throughput 289,000 301,000 Total Throughput by Refinery: Tyler, TX 71,000 74,000 El Dorado, AR 82,000 85,000 Big Spring, TX 63,000 66,000 Krotz Spring, LA 73,000 76,000 16

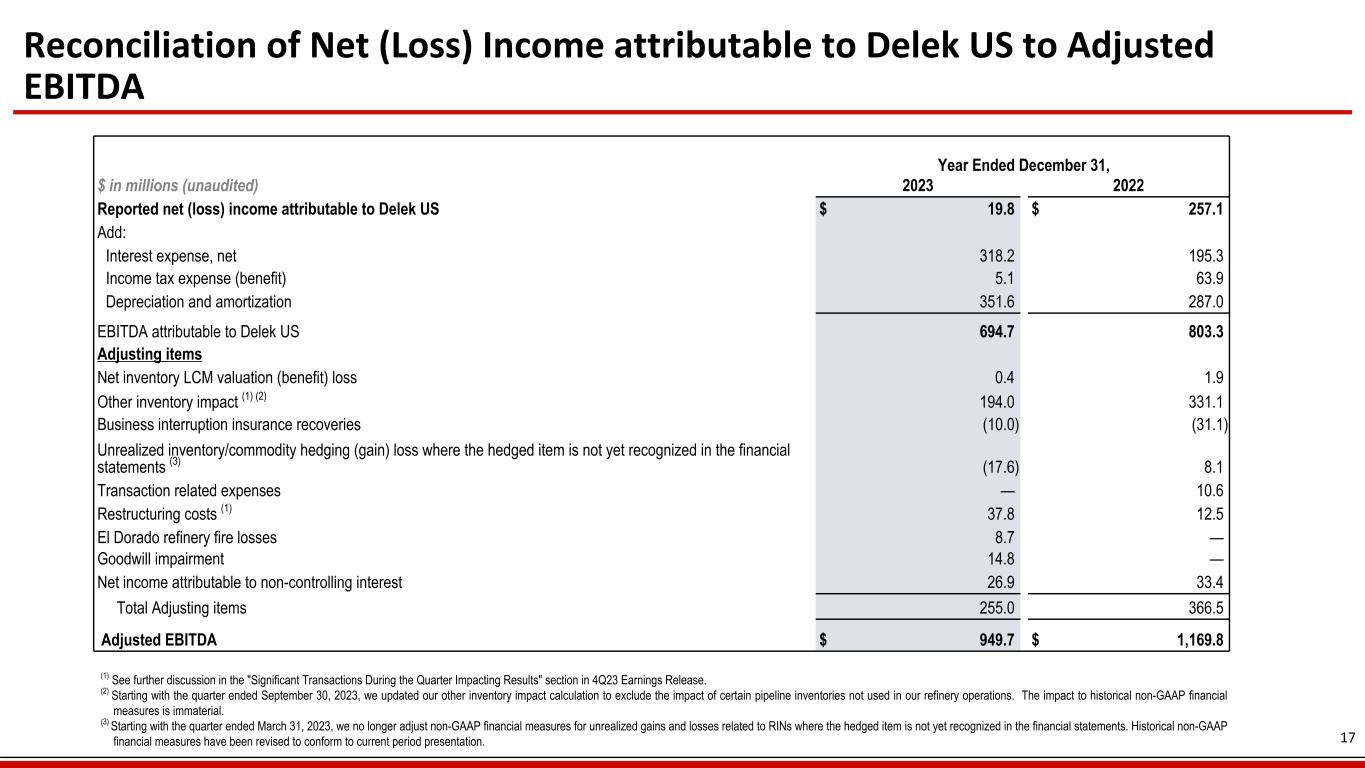

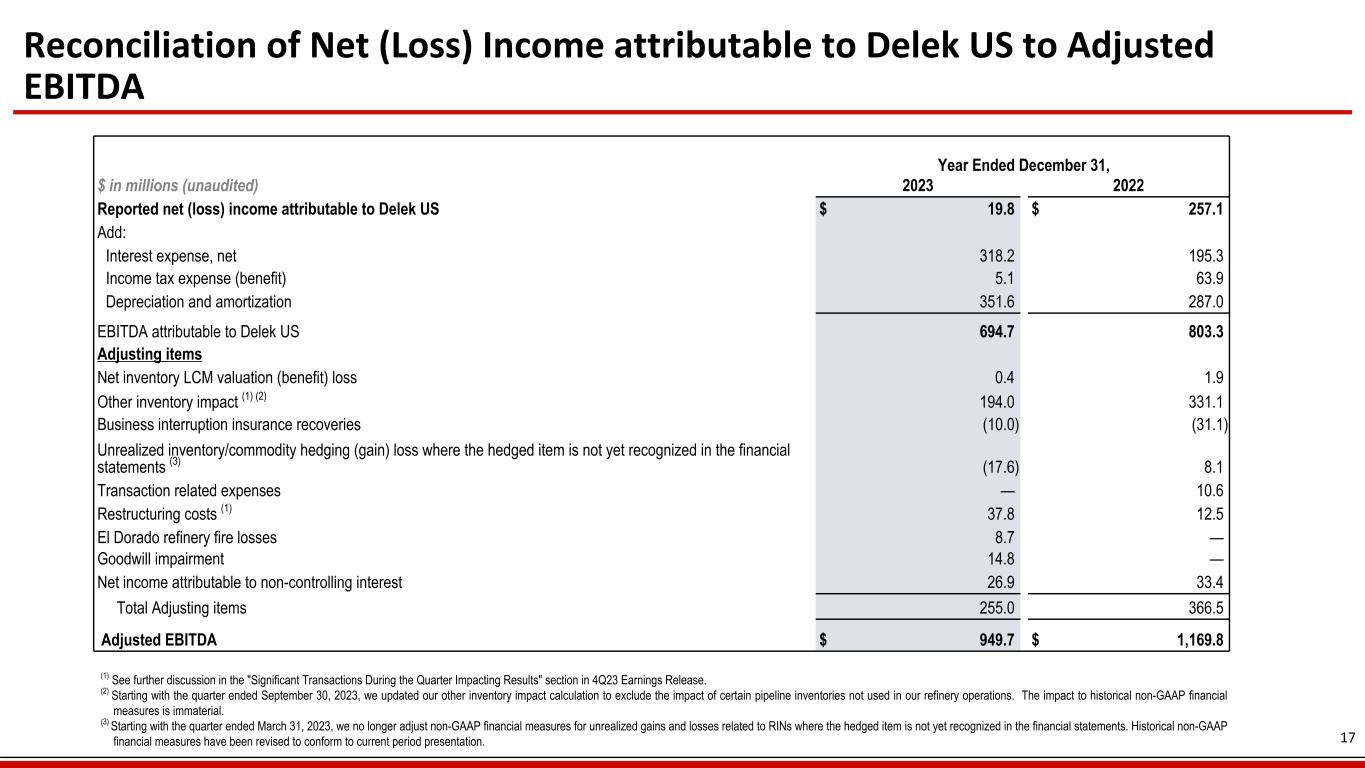

Reconciliation of Net (Loss) Income attributable to Delek US to Adjusted EBITDA Year Ended December 31, $ in millions (unaudited) 2023 2022 Reported net (loss) income attributable to Delek US $ 19.8 $ 257.1 Add: Interest expense, net 318.2 195.3 Income tax expense (benefit) 5.1 63.9 Depreciation and amortization 351.6 287.0 EBITDA attributable to Delek US 694.7 803.3 Adjusting items Net inventory LCM valuation (benefit) loss 0.4 1.9 Other inventory impact (1) (2) 194.0 331.1 Business interruption insurance recoveries (10.0) (31.1) Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) (17.6) 8.1 Transaction related expenses — 10.6 Restructuring costs (1) 37.8 12.5 El Dorado refinery fire losses 8.7 — Goodwill impairment 14.8 — Net income attributable to non-controlling interest 26.9 33.4 Total Adjusting items 255.0 366.5 Adjusted EBITDA $ 949.7 $ 1,169.8 (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation. 17

Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation. Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA Year Ended December 31, 2023 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ 529.4 $ 363.0 $ 46.9 $ (244.6) $ 694.7 Adjusting items Net inventory LCM valuation (benefit) loss 0.4 — — — 0.4 Other inventory impact (1) (2) 194.0 — — — 194.0 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) (17.6) — — — (17.6) Restructuring costs 1.5 0.4 — 35.9 37.8 Business Interruption insurance recoveries (10.0) — — — (10.0) El Dorado refinery fire losses 8.7 — — — 8.7 Goodwill impairment — 14.8 — — 14.8 Net income attributable to non-controlling interest — — — 26.9 26.9 Total Adjusting items 177.0 15.2 — 62.8 255.0 Adjusted Segment EBITDA $ 706.4 $ 378.2 $ 46.9 $ (181.8) $ 949.7 Year Ended December 31, 2022 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek $ 719.1 $ 304.8 $ 44.1 $ (264.7) $ 803.3 Adjusting items Net inventory LCM valuation (benefit) loss 2.0 (0.1) — — 1.9 Other inventory impact (1) (2) 331.1 — — — 331.1 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) 8.1 — — — 8.1 Restructuring costs — — — 12.5 12.5 Transaction related expenses — 10.6 — — 10.6 Business Interruption insurance recoveries (31.1) — — — (31.1) Net income attributable to non-controlling interest — — — 33.4 33.4 Total Adjusting items 310.1 10.5 — 45.9 366.5 Adjusted Segment EBITDA $ 1,029.2 $ 315.3 $ 44.1 $ (218.8) $ 1,169.8 18