| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the financial year ended March 31, 2025 |

Commission File Number: 001-38691 |

||||

British Columbia, Canada |

2833 | N/A | ||||||||||||

| (Province or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code) | (I.R.S. Employer Identification No.) |

||||||||||||

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

||||||

|

Common Shares, no par value

|

ACB | Nasdaq Capital Market |

||||||

| Rights to purchase Common Shares, without par value | ||||||||

☒ |

Annual Information Form |

☒ |

Audited Annual Financial Statements |

||||||||

| Yes | x | No | ¨ | |||||||||||

| Yes | x | No |

¨ | |||||||||||

| Document | Exhibit No. | ||||

Audited consolidated financial statements of the Company and notes thereto as at and for the financial year ended March 31, 2025, together with the reports thereon of the independent registered public accounting firm |

99.5 | ||||

Management’s Discussion and Analysis of the Company for the financial year ended March 31, 2025 (the “MD&A”) |

99.6 | ||||

Annual Information Form of the Company for the financial year ended March 31, 2025 (the “AIF”) |

99.7 | ||||

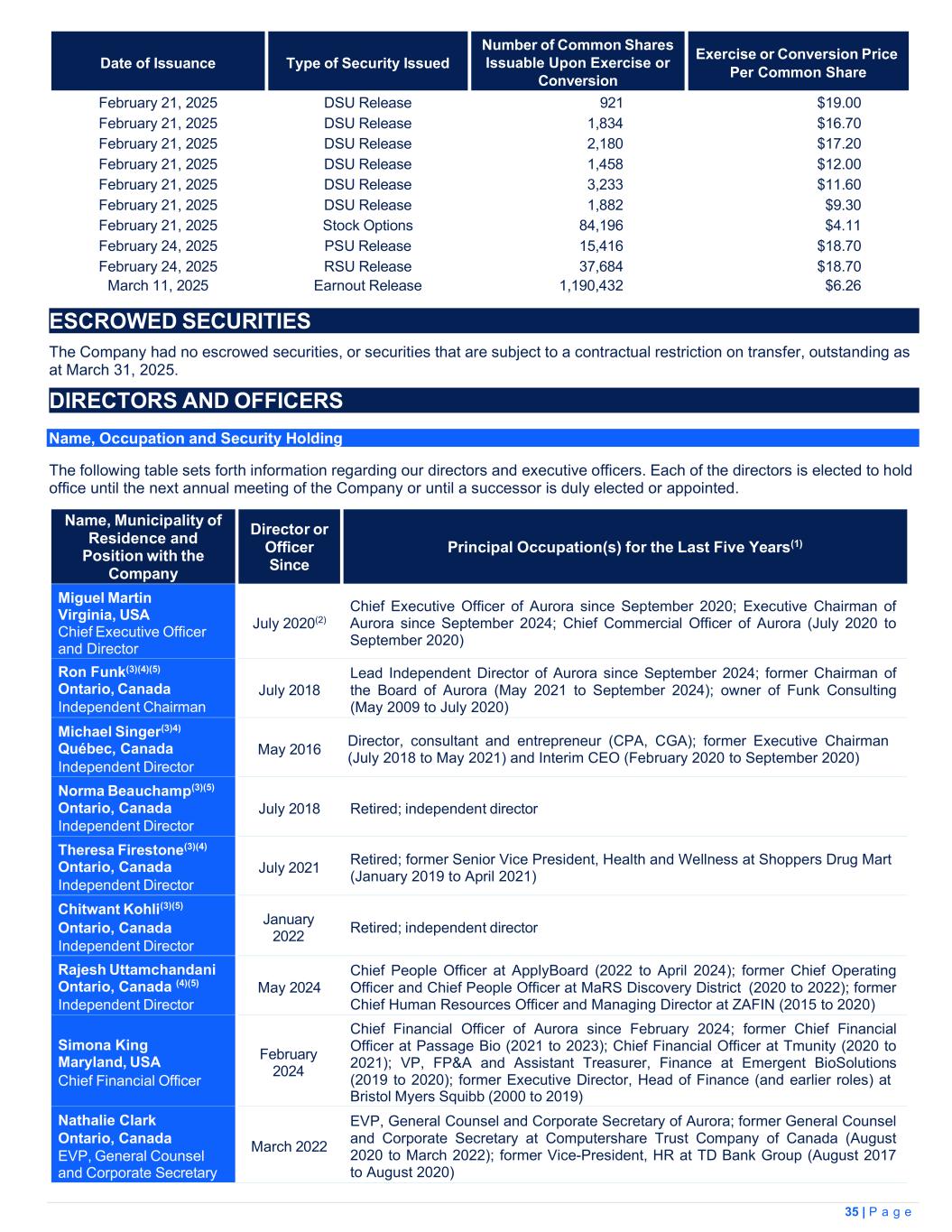

| Financial Period Ending |

Audit Fees

($)(1)

|

Audit Related Fees

($)(2)

|

Tax Fees

($)(3)

|

All Other Fees

($)(4)

|

||||||||||

March 31, 2025 |

$4,658,658 | — | 10,250 | — | ||||||||||

March 31, 2024 |

$3,629,767 | — | 271,887 | — | ||||||||||

Exhibit Number |

Exhibit Description | ||||

| Clawback Policy (incorporated by reference from Exhibit 97 to the Registrant’s Annual Report on Form 40-F, filed with the Commission on June 20, 2024) |

|||||

Certification of Chief Executive Officer pursuant to Rule 13a-14(a) of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|||||

| Certification of Chief Financial Officer pursuant to Rule 13a-14(a) of the Exchange Act, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |||||

| Certification of Chief Executive Officer pursuant to Rule 13a-14(b) of the Exchange Act and 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||||

| Certification of Chief Financial Officer pursuant to Rule 13a-14(b) of the Exchange Act and 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||||

Audited consolidated financial statements of the Company and notes thereto as at and for the financial year ended March 31, 2025, together with the report thereon of the independent auditor |

|||||

Management’s Discussion and Analysis for the financial year ended March 31, 2025 |

|||||

Annual Information Form of the Company for the financial year ended March 31, 2025 |

|||||

| Consent of Ernst & Young LLP | |||||

| Consent of KPMG LLP | |||||

| 101 | Interactive Data File (formatted as Inline XBRL) | ||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | ||||

| Date: June 18, 2025 | AURORA CANNABIS INC. |

||||||||||

By |

/s/ “Simona King” |

||||||||||

Simona King Chief Financial Officer |

|||||||||||

Consolidated Statements of Financial Position |

|||||

Consolidated Statements of Income (loss) and Comprehensive Income (loss) |

|||||

Consolidated Statements of Changes in Equity |

|||||

Consolidated Statements of Cash Flows |

|||||

Notes to the Consolidated Financial Statements |

|||||

| Note 1 | Nature of Operations | Note 14 | Share Capital | |||||||||||||||||

| Note 2 | Material Accounting Policies and Judgments | Note 15 | Share-Based Compensation | |||||||||||||||||

| Note 3 | Accounts Receivable | Note 16 | Income (Loss) Per Share | |||||||||||||||||

| Note 4 | Marketable Securities | Note 17 |

Other Gains (Losses) | |||||||||||||||||

| Note 5 | Biological Assets | Note 18 | Supplemental Cash Flow Information | |||||||||||||||||

| Note 6 | Inventory | Note 19 | Income Taxes | |||||||||||||||||

| Note 7 | Property, Plant and Equipment | Note 20 | Related Party Transactions | |||||||||||||||||

| Note 8 | Assets Held for Sale and Discontinued Operations | Note 21 | Commitments and Contingencies | |||||||||||||||||

| Note 9 | Business Combinations | Note 22 | Revenue | |||||||||||||||||

| Note 10 | Non-controlling Interests | Note 23 | Segmented Information | |||||||||||||||||

| Note 11 | Intangible Assets and Goodwill | Note 24 | Fair Value of Financial Instruments | |||||||||||||||||

| Note 12 | Loans and Borrowings | Note 25 | Financial Instruments Risk | |||||||||||||||||

| Note 13 | Lease Liabilities | Note 26 | Capital Management | |||||||||||||||||

| Note | March 31, 2025 | March 31, 2024 | |||||||||

| $ | $ | ||||||||||

| Assets | |||||||||||

| Current | |||||||||||

| Cash and cash equivalents | 2(j) |

137,921 | 136,095 | ||||||||

| Restricted cash | 18, 2(j) |

47,407 | 43,126 | ||||||||

| Accounts receivable | 3 | 42,470 | 45,411 | ||||||||

| Marketable securities | 4 | 554 | 4,036 | ||||||||

| Derivative asset | — | 760 | |||||||||

| Biological assets | 5 | 51,168 | 42,774 | ||||||||

| Inventory | 6 | 187,925 | 143,602 | ||||||||

| Prepaids and other current assets | 10,661 | 9,402 | |||||||||

| Assets held for sale | 8(a) | 222 | 1,399 | ||||||||

| 478,328 | 426,605 | ||||||||||

| Property, plant and equipment | 7 | 268,107 | 294,324 | ||||||||

| Deposits and other long-term assets | 7,722 | 12,028 | |||||||||

| Lease receivable | 5,256 | 6,343 | |||||||||

| Intangible assets | 11 | 45,163 | 40,850 | ||||||||

| Goodwill | 11 | 43,871 | 43,180 | ||||||||

| Deferred tax assets | 19 | 4,219 | 15,343 | ||||||||

| Total assets | 852,666 | 838,673 | |||||||||

| Liabilities | |||||||||||

| Current | |||||||||||

| Accounts payable and accrued liabilities | 25(b) |

73,605 | 58,563 | ||||||||

| Income taxes payable | 7,601 | 1,547 | |||||||||

| Deferred revenue | 1,074 | 1,687 | |||||||||

| Loans and borrowings | 12 | 21,513 | 52,361 | ||||||||

| Lease liabilities | 13 | 5,381 | 4,856 | ||||||||

| Provisions | 1,689 | 5,606 | |||||||||

| 110,863 | 124,620 | ||||||||||

| Loans and borrowings | 12 | 40,194 | 4,898 | ||||||||

| Lease liabilities | 13 | 37,495 | 42,676 | ||||||||

| Derivative liabilities | 14(c), 15(e), 24 |

5,531 | 2,309 | ||||||||

| Other long-term liability | 24 |

48,095 | 46,110 | ||||||||

| Deferred tax liability | 19 | 1,897 | 16,190 | ||||||||

| Total liabilities | 244,075 | 236,803 | |||||||||

| Shareholders’ equity | |||||||||||

| Share capital | 14 | 6,991,154 | 6,971,416 | ||||||||

| Reserves | 158,970 | 162,351 | |||||||||

| Accumulated other comprehensive loss | (215,208) | (206,058) | |||||||||

| Deficit | (6,367,745) | (6,367,936) | |||||||||

| Total equity attributable to Aurora Cannabis Inc. shareholders | 567,171 | 559,773 | |||||||||

| Non-controlling interests | 41,420 | 42,097 | |||||||||

| Total equity | 608,591 | 601,870 | |||||||||

| Total liabilities and equity | 852,666 | 838,673 | |||||||||

| Years ended March 31, | |||||||||||

| Note | 2025 | 2024(1) |

|||||||||

| $ | $ | ||||||||||

| Revenue | 22 | 374,240 | 299,180 | ||||||||

| Excise taxes | 22 | (30,947) | (29,543) | ||||||||

| Net revenue | 343,293 | 269,637 | |||||||||

| Cost of sales | 6 |

189,240 | 191,950 | ||||||||

| Gross profit before fair value adjustments | 154,053 | 77,687 | |||||||||

Changes in fair value of inventory and biological assets sold |

5, 6 |

141,807 | 80,546 | ||||||||

| Unrealized gain on changes in fair value of biological assets | 5 | (175,361) | (134,588) | ||||||||

| Gross profit | 187,607 | 131,729 | |||||||||

| Expense | |||||||||||

| General and administration | 97,257 | 91,325 | |||||||||

| Sales and marketing | 56,281 | 51,910 | |||||||||

| Business development costs | 3,435 | 5,326 | |||||||||

| Research and development | 3,676 | 3,572 | |||||||||

| Depreciation and amortization | 7, 11 |

9,080 | 11,980 | ||||||||

| Share-based compensation | 15 | 12,930 | 12,717 | ||||||||

| 182,659 | 176,830 | ||||||||||

Income (loss) from operations |

4,948 | (45,101) | |||||||||

| Other income (expenses) | |||||||||||

| Interest and other income | 11,505 | 12,820 | |||||||||

| Finance and other costs | (8,420) | (13,798) | |||||||||

| Foreign exchange gain (loss) | 11,441 | (415) | |||||||||

| Other gains | 17 | 1,604 | 27,263 | ||||||||

| Restructuring charges | — | (1,508) | |||||||||

| Impairment of property, plant and equipment | 7, 8(a) |

(696) | (4,042) | ||||||||

| Impairment of intangible assets and goodwill | 11 | — | (32,856) | ||||||||

| 15,434 | (12,536) | ||||||||||

| Income (loss) before taxes | 20,382 | (57,637) | |||||||||

| Income tax recovery (expense) | |||||||||||

| Current | 19 | (7,808) | (1,109) | ||||||||

| Deferred, net | 19 | 3,189 | 1,663 | ||||||||

| (4,619) | 554 | ||||||||||

| Net income (loss) from continuing operations | 15,763 | (57,083) | |||||||||

| Net loss from discontinued operations, net of tax | 8(b) | (14,172) | (12,243) | ||||||||

Net income (loss) |

1,591 | (69,326) | |||||||||

| Years ended March 31, | |||||||||||

| Note | 2025 | 2024(1) |

|||||||||

| $ | $ | ||||||||||

| Net income (loss) from continuing operations | 15,763 | (57,083) | |||||||||

| Net loss from discontinued operations, net of tax | 8(b) | (14,172) | (12,243) | ||||||||

| Net income (loss) | 1,591 | (69,326) | |||||||||

Other comprehensive income (loss) (“OCI”) that will not be reclassified to net income (loss) |

— | — | |||||||||

Other comprehensive income (loss) that may be reclassified to net income (loss) |

|||||||||||

| Realized gain on marketable securities | — | 4,733 | |||||||||

| Foreign currency translation gain (loss) | (9,150) | 1,574 | |||||||||

Total other comprehensive income (income (loss)) |

(9,150) | 6,307 | |||||||||

| Comprehensive income (loss) from continuing operations | 6,613 | (50,776) | |||||||||

| Comprehensive loss from discontinued operations | (14,172) | (12,243) | |||||||||

Comprehensive income (loss) |

(7,559) | (63,019) | |||||||||

| Net income (loss) from continuing operations attributable to: | |||||||||||

| Aurora Cannabis Inc. | 16,440 | (53,339) | |||||||||

| Non-controlling interests | 10 | (677) | (3,744) | ||||||||

| Net loss from discontinued operations attributable to: | |||||||||||

| Aurora Cannabis Inc. | 8(b) | (14,172) | (12,243) | ||||||||

| Non-controlling interests | — | — | |||||||||

| Comprehensive income (loss) attributable to: | |||||||||||

| Aurora Cannabis Inc. | (6,882) | (59,275) | |||||||||

| Non-controlling interests | (677) | (3,744) | |||||||||

| Income (loss) per share - basic | |||||||||||

| Continuing operations | 16 | $0.30 | ($1.23) | ||||||||

| Discontinued operations | 16 | ($0.26) | ($0.28) | ||||||||

| Total operations | 16 | $0.04 | ($1.52) | ||||||||

| Income (loss) per share - diluted | |||||||||||

| Continuing operations | 16 |

$0.30 | ($1.23) | ||||||||

| Discontinued operations | 16 | ($0.26) | ($0.28) | ||||||||

| Total operations | 16 | $0.04 | ($1.52) | ||||||||

| Share Capital | Reserves | Accumulated Other Comprehensive Income (Loss) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Note | Common Shares | Amount |

Share-Based

Compensation

|

Compensation Options/ Warrants/Shares Expired |

Change in Ownership Interest |

Obligation to Issue Shares | Total Reserves |

Fair Value |

Deferred Tax |

Foreign Currency Translation | Total AOCI |

Deficit | Non-Controlling Interests | Total | |||||||||||||||||||||||||||||||||||||||

| # | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 54,545,797 | 6,971,416 | 217,498 | 28,086 | (86,800) | 3,567 | 162,351 | (209,658) | 18,919 | (15,319) | (206,058) | (6,367,936) | 42,097 | 601,870 | |||||||||||||||||||||||||||||||||||||||

| Shares issued for business combinations | — | 3,177 | — | — | — | (3,567) | (3,567) | — | — | — | — | — | — | (390) | |||||||||||||||||||||||||||||||||||||||

| Shares released for earn out payment related to business combination |

14(b) |

1,190,432 | 7,452 | — | — | — | — | — | — | — | — | — | — | — | 7,452 | ||||||||||||||||||||||||||||||||||||||

| Share issuance costs | — | (461) | — | — | — | — | — | — | — | — | — | — | — | (461) | |||||||||||||||||||||||||||||||||||||||

| Exercise of stock options | 15(a) | 111,661 | 459 | (459) | — | — | — | (459) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Shares issued under share-based compensation plans | 15 | 386,341 | 9,111 | (8,290) | — | — | — | (8,290) | — | — | — | — | — | — | 821 | ||||||||||||||||||||||||||||||||||||||

| Share-based compensation | 15 | — | — | 8,935 | — | — | — | 8,935 | — | — | — | — | — | — | 8,935 | ||||||||||||||||||||||||||||||||||||||

| Put option liability | — | — | — | — | — | — | — | — | — | — | — | (2,077) | — | (2,077) | |||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | — | — | — | — | — | — | — | — | — | (9,150) | (9,150) | 2,268 | (677) | (7,559) | |||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2025 | 56,234,231 | 6,991,154 | 217,684 | 28,086 | (86,800) | — | 158,970 | (209,658) | 18,919 | (24,469) | (215,208) | (6,367,745) | 41,420 | 608,591 | |||||||||||||||||||||||||||||||||||||||

| Share Capital | Reserves | Accumulated Other Comprehensive Income (loss) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Note | Common Shares(1) |

Amount |

Share-Based

Compensation

|

Compensation Options/ Warrants/Shares Expired |

Change in Ownership Interest |

Obligation to issue shares | Total Reserves |

Fair Value |

Deferred Tax |

Foreign Currency Translation | Total AOCI |

Deficit | Non-Controlling Interests | Total | |||||||||||||||||||||||||||||||||||||||

| # | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

Balance, March 31, 2023 |

34,526,931 | 6,841,234 | 212,340 | 28,086 | (86,800) | 414 | 154,040 | (214,391) | 18,919 | (16,893) | (212,365) | (6,292,265) | 31,061 | 521,705 | |||||||||||||||||||||||||||||||||||||||

| Shares issued for business combination | 6,948,994 | 32,915 | — | — | — | 3,567 | 3,567 | — | — | — | — | — | — | 36,482 | |||||||||||||||||||||||||||||||||||||||

| Shares released for earn out payments | 14(b) | 57,008 | 353 | — | — | — | — | — | — | — | — | — | — | — | 353 | ||||||||||||||||||||||||||||||||||||||

| Shares issued for convertible debenture repurchases | 7,259,329 | 54,680 | — | — | — | — | — | — | — | — | — | — | — | 54,680 | |||||||||||||||||||||||||||||||||||||||

| Shares issued under equity financing | 5,576,785 | 41,098 | — | — | — | (414) | (414) | — | — | — | — | — | — | 40,684 | |||||||||||||||||||||||||||||||||||||||

| Share issuance costs | — | (3,215) | — | — | — | — | — | — | — | — | — | — | — | (3,215) | |||||||||||||||||||||||||||||||||||||||

| Deferred tax on share issuance costs | — | (1,278) | — | — | — | — | — | — | — | — | — | — | — | (1,278) | |||||||||||||||||||||||||||||||||||||||

| Shares issued under share-based compensation plans | 15 |

176,725 | 5,629 | (5,629) | — | — | — | (5,629) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Share-based compensation | 15 |

— | — | 10,787 | — | — | — | 10,787 | — | — | — | — | — | — | 10,787 | ||||||||||||||||||||||||||||||||||||||

| Put option liability | — | — | — | — | — | — | — | — | — | — | — | 2,119 | — | 2,119 | |||||||||||||||||||||||||||||||||||||||

| Change in ownership interests in subsidiaries | — | — | — | — | — | — | — | — | — | — | — | (12,208) | 14,780 | 2,572 | |||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | — | — | — | — | — | — | — | 4,733 | — | 1,574 | 6,307 | (65,582) | (3,744) | (63,019) | |||||||||||||||||||||||||||||||||||||||

| Other | 25 | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 54,545,797 | 6,971,416 | 217,498 | 28,086 | (86,800) | 3,567 | 162,351 | (209,658) | 18,919 | (15,319) | (206,058) | (6,367,936) | 42,097 | 601,870 | |||||||||||||||||||||||||||||||||||||||

| Years ended March 31, | |||||||||||

| Note | 2025 | 2024(1) |

|||||||||

| $ | $ | ||||||||||

| Operating activities | |||||||||||

| Net income (loss) from continuing operations | 15,763 | (57,083) | |||||||||

| Adjustments for non-cash items: | |||||||||||

| Unrealized gain on changes in fair value of biological assets | (175,361) | (134,588) | |||||||||

Changes in fair value of inventory and biological assets sold |

141,807 | 80,546 | |||||||||

| Depreciation of property, plant and equipment | 21,952 | 31,874 | |||||||||

| Amortization of intangible assets | 11 | 595 | 901 | ||||||||

| Share-based compensation | 15 |

11,524 | 12,717 | ||||||||

| Impairment of property, plant and equipment | 7 |

696 | 4,042 | ||||||||

| Impairment of intangible assets and goodwill | 11 | — | 32,856 | ||||||||

| Net interest accrual and accretion | 2,465 | 7,923 | |||||||||

| Interest and other income | — | (33) | |||||||||

| Deferred tax recovery | (3,190) | (1,667) | |||||||||

| Other gains | 17 | (607) | (29,091) | ||||||||

| Foreign exchange gain (loss) | (11,453) | 171 | |||||||||

| Deferred compensation amortization | 20 | 3,805 | 3,807 | ||||||||

| Cash provided by (used in) operating activities from continuing operations before changes in non-cash working capital | 7,996 | (47,625) | |||||||||

| Changes in non-cash working capital | 18 | 10,210 | (15,541) | ||||||||

| Net cash provided by (used in) operating activities from continuing operations | 18,206 | (63,166) | |||||||||

| Net cash used in operating activities from discontinued operations | (2,201) | (5,342) | |||||||||

| Net cash provided by (used in) operating activities | 16,005 | (68,508) | |||||||||

| Investing activities | |||||||||||

| Proceeds from derivative asset and marketable securities | 5,488 | 4,993 | |||||||||

| Purchase of property, plant and equipment and intangible assets | (18,859) | (16,834) | |||||||||

| Proceeds from disposal of property, plant and equipment and assets held for sale | 8(a) |

2,034 | 12,276 | ||||||||

| Changes in restricted cash | 2(j),18 | (4,282) | 2,124 | ||||||||

| Acquisition of businesses, net of cash acquired | — | (2,539) | |||||||||

| Payment of contingent consideration | — | (3,006) | |||||||||

| Cash used in investing activities from continuing operations | (15,619) | (2,986) | |||||||||

| Net cash provided by (used in) investing activities from discontinued operations | 1,292 | (377) | |||||||||

| Net cash used in investing activities | (14,327) | (3,363) | |||||||||

| Financing activities | |||||||||||

| Proceeds from loans and borrowings | 12 | 11,680 | 14,544 | ||||||||

| Repayment of loans and borrowings | 12 | (7,245) | (3,042) | ||||||||

| Repayment of convertible debenture | — | (91,635) | |||||||||

| Net principal payments of lease liabilities | (5,240) | (5,239) | |||||||||

| Shares issued for cash, net of issuance costs | — | 37,924 | |||||||||

| Proceeds from stock option exercise | 820 | — | |||||||||

| Cash used in financing activities from continuing operations | 15 | (47,448) | |||||||||

| Net cash used in financing activities from discontinued operations | (131) | (475) | |||||||||

| Net cash used in financing activities | (116) | (47,923) | |||||||||

| Effect of foreign exchange on cash and cash equivalents | 264 | 297 | |||||||||

| Increase (decrease) in cash and cash equivalents | 1,826 | (119,497) | |||||||||

| Cash and cash equivalents, beginning of period | 2(j) | 136,095 | 255,592 | ||||||||

| Cash and cash equivalents, end of period | 2(j) | 137,921 | 136,095 | ||||||||

| Major subsidiaries | Domicile | Principal Activity | Percentage Ownership | Functional Currency | ||||||||||

| Aurora Cannabis Enterprises Inc. | Canada | Corporate | 100% | Canadian Dollar | ||||||||||

| Aurora Deutschland GmbH (“Aurora Deutschland”) | Germany | Propagation and distribution | 100% | European Euro | ||||||||||

| TerraFarma Inc. | Canada | Propagation facility | 100% | Canadian Dollar | ||||||||||

| Whistler Medical Marijuana Corporation (“Whistler”) | Canada | Propagation facility | 100% | Canadian Dollar | ||||||||||

| Bevo Agtech Inc. (“Bevo”) | Canada | Plant propagation facilities and headquarters | 50.1% | Canadian Dollar | ||||||||||

| CannaHealth Therapeutics Inc. | Canada | Patient counselling | 100% | Canadian Dollar | ||||||||||

| ACB Captive Insurance Company Inc. | Canada | Insurance | 100% | Canadian Dollar | ||||||||||

| Indica Industries Pty Ltd. (“MedReleaf Australia”) | Australia | Distribution of cannabis | 100% | Australian Dollar | ||||||||||

| March 31, 2024 | Previously reported | Adjustments | Adjusted | ||||||||

Consolidated statement of financial position |

$ | $ | $ | ||||||||

| Assets | |||||||||||

| Cash and cash equivalents | 113,439 | 22,656 | 136,095 | ||||||||

| Restricted cash | 65,782 | (22,656) | 43,126 | ||||||||

| Total current assets | 426,605 | — | 426,605 | ||||||||

| Consolidated statements of cash flows - year ended | |||||||||||

| Investing activities | |||||||||||

| Restricted cash | — | 2,123 | 2,123 | ||||||||

| Net cash used in investing activities | (5,486) | 2,123 | (3,363) | ||||||||

| Decrease in cash and cash equivalents | (121,620) | 2,123 | (119,497) | ||||||||

| Increase in restricted cash | 118 | (118) | — | ||||||||

| Cash and cash equivalents, beginning of period | 234,942 | 20,650 | 255,592 | ||||||||

| Cash and cash equivalents, end of period | 113,439 | 22,656 | 136,095 | ||||||||

| June 30, 2024 - (Unaudited) | Previously reported | Adjustments | Adjusted | ||||||||

Consolidated statement of financial position |

$ | $ | $ | ||||||||

| Assets | |||||||||||

| Cash and cash equivalents | 115,487 | 22,723 | 138,210 | ||||||||

| Restricted cash | 66,680 | (22,723) | 43,957 | ||||||||

| Inventory | 165,754 | (1,629) | 164,125 | ||||||||

| Total current assets | 439,366 | (1,629) | 437,737 | ||||||||

| Property, plant and equipment | 283,729 | (261) | 283,468 | ||||||||

| Deferred tax assets | 14,679 | 489 | 15,168 | ||||||||

| Total assets | 838,689 | (1,401) | 837,288 | ||||||||

| Liabilities | |||||||||||

| Lease liabilities long term | 44,906 | 257 | 45,163 | ||||||||

| Deficit | (6,366,257) | (1,658) | (6,367,915) | ||||||||

| Total liabilities and equity | 838,689 | (1,401) | 837,288 | ||||||||

Consolidated statements of income (loss) and comprehensive income (loss) - three months ended |

|||||||||||

| Cost of sales | 53,310 | 1,629 | 54,939 | ||||||||

| Gross profit | 44,546 | (1,629) | 42,917 | ||||||||

| General and administration | 22,524 | 229 | 22,753 | ||||||||

| Income (loss) from operations | 877 | (1,858) | (981) | ||||||||

| Finance and other costs | (1,736) | (25) | (1,761) | ||||||||

| Income before taxes | 7,701 | (1,883) | 5,818 | ||||||||

| Deferred income tax recovery (expense) | (2,036) | 489 | (1,547) | ||||||||

| Net income | 5,148 | (1,394) | 3,754 | ||||||||

| Comprehensive income | 2,908 | (1,394) | 1,514 | ||||||||

| Income per share - basic and diluted | 0.13 | (0.03) | 0.10 | ||||||||

| Continuing operations | 0.12 | (0.03) | 0.09 | ||||||||

| Discontinued operations | 0.01 | — | 0.01 | ||||||||

| Consolidated statements of cash flows - three months ended | |||||||||||

| Investing activities | |||||||||||

| Restricted cash | — | (830) | (830) | ||||||||

| Net cash used in investing activities | 814 | (830) | (16) | ||||||||

| Increase in cash and cash equivalents | 2,946 | (830) | 2,116 | ||||||||

| Decrease in restricted cash | (898) | 898 | — | ||||||||

| Cash and cash equivalents, beginning of period | 113,439 | 22,656 | 136,095 | ||||||||

| Cash and cash equivalents, end of period | 115,487 | 22,723 | 138,210 | ||||||||

| September 30, 2024 - (Unaudited) | Previously reported | Adjustments | Adjusted | ||||||||

Consolidated statement of financial position |

$ | $ | $ | ||||||||

| Assets | |||||||||||

| Cash and cash equivalents | 84,921 | 22,648 | 107,569 | ||||||||

| Restricted cash | 66,678 | (22,648) | 44,030 | ||||||||

| Inventory | 170,986 | (1,604) | 169,382 | ||||||||

| Total current assets | 417,675 | (1,604) | 416,071 | ||||||||

| Property, plant and equipment | 276,482 | (261) | 276,221 | ||||||||

| Deferred tax assets | 14,621 | 482 | 15,103 | ||||||||

| Total assets | 808,774 | (1,383) | 807,391 | ||||||||

| Liabilities | |||||||||||

| Lease liabilities long term | 38,397 | 515 | 38,912 | ||||||||

| Deficit | (6,381,444) | (1,898) | (6,383,342) | ||||||||

| Total liabilities and equity | 808,774 | (1,383) | 807,391 | ||||||||

Consolidated statements of income (loss) and comprehensive income (loss) - six months ended |

|||||||||||

| Cost of sales | 95,239 | 1,604 | 96,843 | ||||||||

| Gross profit | 86,711 | (1,604) | 85,107 | ||||||||

| General and administration | 44,560 | 458 | 45,018 | ||||||||

| Loss from operations | (1,515) | (2,062) | (3,577) | ||||||||

| Finance and other costs | (3,872) | (54) | (3,926) | ||||||||

| Income before taxes | 8,304 | (2,116) | 6,188 | ||||||||

| Deferred income tax recovery (expense) | — | 482 | 482 | ||||||||

| Net loss | (7,817) | (1,634) | (9,451) | ||||||||

| Comprehensive loss | (16,046) | (1,634) | (17,680) | ||||||||

| Income (loss) per share - basic and diluted | (0.10) | (0.03) | (0.13) | ||||||||

| Continuing operations | 0.16 | (0.03) | 0.13 | ||||||||

| Discontinued operations | (0.26) | — | (0.26) | ||||||||

| Consolidated statements of cash flows - six months ended | |||||||||||

| Investing activities | |||||||||||

| Restricted cash | — | (903) | (903) | ||||||||

| Net cash used in investing activities | (2,824) | (903) | (3,727) | ||||||||

| Financing activities | |||||||||||

| Decrease in restricted cash | (898) | 898 | — | ||||||||

| Net cash used in financing activities | (3,242) | 898 | (2,344) | ||||||||

| Decrease in cash and cash equivalents | (28,518) | (5) | (28,523) | ||||||||

| Cash and cash equivalents, beginning of period | 113,439 | 22,656 | 136,095 | ||||||||

| Cash and cash equivalents, end of period | 84,921 | 22,648 | 107,569 | ||||||||

| December 31, 2024 - (Unaudited) | Previously reported | Adjustments | Adjusted | ||||||||

Consolidated statement of financial position |

$ | $ | $ | ||||||||

| Assets | |||||||||||

| Cash and cash equivalents | 108,711 | 23,914 | 132,625 | ||||||||

| Restricted cash | 71,467 | (23,914) | 47,553 | ||||||||

| Inventory | 192,385 | (5,663) | 186,722 | ||||||||

| Total current assets | 494,211 | (5,663) | 488,548 | ||||||||

| Property, plant and equipment | 270,660 | (261) | 270,399 | ||||||||

| Deferred tax assets | — | 1,700 | 1,700 | ||||||||

| Total assets | 866,521 | (4,224) | 862,297 | ||||||||

| Liabilities | |||||||||||

| Lease liabilities long term | 36,904 | 792 | 37,696 | ||||||||

| Deficit | (6,353,069) | (5,016) | (6,358,085) | ||||||||

| Total liabilities and equity | 866,521 | (4,224) | 862,297 | ||||||||

Consolidated statements of income (loss) and comprehensive income (loss) - nine months ended |

|||||||||||

| Cost of sales | 136,057 | 5,662 | 141,719 | ||||||||

| Gross profit | 165,706 | (5,662) | 160,044 | ||||||||

| General and administration | 68,003 | 702 | 68,705 | ||||||||

| Income from operations | 35,341 | (6,364) | 28,977 | ||||||||

| Finance and other costs | (5,814) | (88) | (5,902) | ||||||||

| Income before taxes | 40,373 | (6,452) | 33,921 | ||||||||

| Deferred income tax recovery (expense) | 4 | 1,700 | 1,704 | ||||||||

| Net income | 23,526 | (4,752) | 18,774 | ||||||||

| Comprehensive income | 15,042 | (4,752) | 10,290 | ||||||||

| Income (loss) per share - basic | 0.48 | (0.09) | 0.39 | ||||||||

| Continuing operations | 0.74 | (0.09) | 0.65 | ||||||||

| Discontinued operations | (0.26) | — | (0.26) | ||||||||

| Income (loss) per share - diluted | 0.47 | (0.09) | 0.38 | ||||||||

| Continuing operations | 0.73 | (0.09) | 0.64 | ||||||||

| Discontinued operations | (0.26) | — | (0.26) | ||||||||

| Consolidated statements of cash flows - nine months ended | |||||||||||

| Investing activities | |||||||||||

| Restricted cash | — | (4,426) | (4,426) | ||||||||

| Net cash used in investing activities | (6,036) | (4,426) | (10,462) | ||||||||

| Financing activities | |||||||||||

| Decrease in restricted cash | (5,687) | 5,687 | — | ||||||||

| Net cash used in financing activities | (8,686) | 5,687 | (2,999) | ||||||||

| Decrease in cash and cash equivalents | (4,728) | 1,261 | (3,467) | ||||||||

| Cash and cash equivalents, beginning of period | 113,439 | 22,656 | 136,095 | ||||||||

| Cash and cash equivalents, end of period | 108,711 | 23,914 | 132,625 | ||||||||

|

Accounting Policy

Accounts receivable are recognized initially at fair value and subsequently measured at amortized cost, less any provisions for impairment. Financial assets measured at amortized cost are assessed for impairment at the end of each reporting period. Impairment provisions are estimated using the expected credit loss impairment model where any expected future credit losses are provided for, irrespective of whether a loss event has occurred at the reporting date.

Estimates of expected credit losses take into account the Company’s collection history, deterioration of collection rates during the average credit period, as well as observable changes in and forecasts of future economic conditions that affect default risk. Where applicable, the carrying amount of a trade receivable is reduced for any expected credit losses. Changes in the allowance for expected credit losses are recognized in the consolidated statements of income (loss) and comprehensive income (loss). Accounts receivables are written off when they are deemed uncollectible.

| ||

| Notes | March 31, 2025 | March 31, 2024 | |||||||||

| $ | $ | ||||||||||

Trade receivables, net (1) |

25(a) | 35,018 | 40,542 | ||||||||

| Sales taxes receivable | 3,087 | 1,511 | |||||||||

| Lease receivable | 25(a) | 1,585 | 2,460 | ||||||||

Other receivables, net (1) |

2,780 | 898 | |||||||||

| 42,470 | 45,411 | ||||||||||

|

Accounting Policy

Marketable securities are initially measured at fair value and are subsequently measured at fair value through profit or loss (“FVTPL”) or are designated at fair value through other comprehensive income (loss) (“FVTOCI”), at the election of the Company. The designation of FVTOCI is made on an instrument by instrument basis and if elected, subsequent changes in fair value are recognized in other comprehensive income (loss) and not through profit or loss on disposition.

| ||

| Financial asset hierarchy level | Level 1 | ||||

| FVTPL | |||||

| $ | |||||

| Balance, March 31, 2023 | — | ||||

| Additions | 5,025 | ||||

| Disposals | (2,179) | ||||

| Unrealized gain on changes in fair value | 1,190 | ||||

| Balance, March 31, 2024 | 4,036 | ||||

| Additions | 554 | ||||

| Disposals | (4,700) | ||||

| Realized gain on disposal | 664 | ||||

Balance, March 31, 2025 |

554 | ||||

|

Accounting Policy

The Company defines biological assets as living plants up to the point of harvest. Biological assets are measured at fair value less costs to sell at the end of each reporting period in accordance with IAS 41 - Agriculture using the income approach. The Company utilizes an income approach to determine the fair value less cost to sell at a specific measurement date, based on the existing plants’ stage of completion up to the point of harvest. The Company cultivates cannabis and propagation plants biological assets. For cannabis plants, the stage of completion is determined based on the specific date of clipping the mother plant, the period-end reporting date, the average growth rate for the strain and facility environment and is calculated on a weighted average basis for the number of plants in the specific lot. Propagation plants are comprised solely of plants from the Bevo business, and are sold as living plants to customers and therefore not harvested into inventory. For propagation plants, the stage of completion is determined based on the propagation date, the promised date, and the period-end reporting date.

|

||||||||||||||

The following inputs and assumptions are all categorized within Level 3 on the fair value hierarchy and were used in determining the fair value of cannabis biological assets: |

||||||||||||||

Inputs and assumptions |

Description |

Correlation between inputs and fair value | ||||||||||||

| Average selling price per gram | Represents the average selling price per gram of dried cannabis net of excise taxes, where applicable, for the period for all strains of cannabis sold, which is expected to approximate future selling prices. | If the average selling price per gram were higher (lower), estimated fair value would increase (decrease). | ||||||||||||

| Weighted average yield per plant | Represents the weighted average number of grams of dried cannabis inventory expected to be harvested from each cannabis plant. | If the weighted average yield per plant was higher (lower), estimated fair value would increase (decrease). | ||||||||||||

| Cost per gram to complete production | Based on actual production costs incurred divided by the grams produced in the period. | If the cost per gram to complete production was lower (higher), estimated fair value would increase (decrease). | ||||||||||||

| Stage of completion in the production process | Calculated by taking the weighted average number of days in production over a total average grow cycle of approximately twelve weeks. | If the number of days in production was higher (lower), estimated fair value would increase (decrease). | ||||||||||||

| Production costs are capitalized to cannabis biological assets and include all direct and indirect costs relating to biological transformation. Costs include direct costs of production, such as labor, growing materials, as well as indirect costs such as indirect labor and benefits, quality control costs, depreciation on production equipment, and overhead expenses including rent and utilities. | ||||||||||||||

|

The following inputs and assumptions are all categorized within Level 3 on the fair value hierarchy and were used in determining the fair value of propagation plants biological assets:

|

||||||||||||||

Inputs and assumptions |

Description |

Correlation between inputs and fair value | ||||||||||||

| Selling price per plant | Represents selling price per plant, which is based on committed purchase plans or approximate future selling price. | If selling price per plant were higher (lower), estimated fair value would increase (decrease). | ||||||||||||

| Stage of completion in the production process | Calculated by taking the number of days in production over the promised date less the propagation date. | If the number of days in production was higher (lower), estimated fair value would increase (decrease). | ||||||||||||

| Production costs are capitalized to propagation plants biological assets based on a rolling gross margin rate and includes all direct and indirect costs relating to biological transformation. Costs include direct costs of production, such as labor, growing materials, as well as indirect costs such as indirect labor and benefits, quality control costs, depreciation on production equipment, and overhead expenses including rent and utilities. | ||||||||||||||

March 31, 2025 |

March 31, 2024 |

|||||||

| $ | $ | |||||||

| Indoor cannabis production facilities | 18,368 | 21,522 | ||||||

| Plant propagation production facilities | 32,800 | 21,252 | ||||||

| 51,168 | 42,774 | |||||||

March 31, 2025 |

March 31, 2024 |

|||||||

| $ | $ | |||||||

| Balance, beginning of period | 42,774 | 22,690 | ||||||

Production costs capitalized |

116,915 | 85,766 | ||||||

| Sale of biological assets | (58,038) | (39,218) | ||||||

| Change in inventory provision | (246) | (1,126) | ||||||

| Foreign currency translation | 29 | (3) | ||||||

Changes in fair value less cost to sell due to biological transformation |

175,361 | 134,588 | ||||||

Transferred to inventory upon harvest |

(225,627) | (159,923) | ||||||

| Balance, end of period | 51,168 | 42,774 | ||||||

Significant inputs & assumptions(1) |

Range of inputs | Sensitivity | Impact on fair value | ||||||||||||||

| March 31, 2025 |

March 31, 2024 | March 31, 2025 |

March 31, 2024 | ||||||||||||||

| Average selling price per gram | $6.61 | $4.88 | Increase or decrease of $1.00 per gram |

$3,401 | $5,490 | ||||||||||||

| Weighted average yield (grams per plant) | 73.46 | 68.61 | Increase or decrease by 5 grams per plant |

$1,823 | $1,538 | ||||||||||||

| Cost per gram to complete production | $1.40 | $0.99 | Increase or decrease of $1.00 per gram |

$3,466 | $5,619 | ||||||||||||

Significant inputs & assumptions(1) |

Range of inputs | Sensitivity | Impact on fair value | ||||||||||||||

| March 31, 2025 |

March 31, 2024 | March 31, 2025 |

March 31, 2024 | ||||||||||||||

| Average selling price per floral/bedding plant | $7.38 | $7.77 | Increase or decrease by 10% |

$2,963 | $2,360 | ||||||||||||

| Average stage of completion in the production process | 69 | % | 59 | % | Increase or decrease by 10% |

$1,894 | $3,464 | ||||||||||

|

Accounting Policy

The Company defines inventory as all cannabis products after the point of harvest (“Cannabis Inventory”), hemp products, purchased finished goods for resale, consumable supplies and accessories. Cannabis Inventory includes harvested cannabis, trim, cannabis oils, capsules, edibles and vaporizers.

Inventories of harvested cannabis are transferred from biological assets at fair value less costs to sell at the point of harvest, which becomes the deemed cost. By-products, such as trim, are measured at their net realizable value (“NRV”) at point of harvest which is deducted from the total deemed cost to give a net cost for the primary product. Any subsequent post-harvest costs are capitalized to Cannabis Inventory to the extent that the cost is less than NRV. NRV for work-in-process (“WIP”) and finished Cannabis Inventory is determined by deducting estimated remaining conversion/completion costs and selling costs from the estimated sale price achievable in the ordinary course of business. Conversion and selling costs are determined using average cost. In the period that Cannabis Inventory is sold, the fair value portion of the deemed cost is recorded within changes in fair value of inventory sold line, and the cost of such Cannabis Inventory, including direct and indirect costs, are recorded within the cost of sales line on the consolidated statements of income (loss) and comprehensive income (loss).

Products for resale, consumable supplies and accessories are initially recognized at cost and subsequently valued at the lower of cost and NRV. The Company reviews these types of inventory for obsolescence, redundancy and slow turnover to ensure that they are written-down and reflected at NRV. Inventory purchased from third parties are measured at weighted-average cost. Medreleaf Australia measures inventory at first-in first-out.

The Company uses judgment in determining the NRV of inventory. When assessing NRV, the Company considers the impact of the average selling price per gram, inventory spoilage, inventory excess, age and damage.

| ||

| March 31, 2025 | March 31, 2024 | |||||||||||||||||||

| Capitalized cost |

Fair value adjustment |

Carrying value |

Capitalized cost |

Fair value adjustment |

Carrying value |

|||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||

Harvested cannabis |

||||||||||||||||||||

Work-in-process |

40,369 | 52,740 | 93,109 | 25,977 | 32,519 | 58,496 | ||||||||||||||

Finished goods |

20,655 | 30,267 | 50,922 | 34,871 | 10,782 | 45,653 | ||||||||||||||

| 61,024 | 83,007 | 144,031 | 60,848 | 43,301 | 104,149 | |||||||||||||||

Extracted cannabis |

||||||||||||||||||||

Work-in-process |

10,980 | 4,917 | 15,897 | 8,674 | 4,428 | 13,102 | ||||||||||||||

Finished goods |

12,998 | 2,686 | 15,684 | 8,749 | 590 | 9,339 | ||||||||||||||

| 23,978 | 7,603 | 31,581 | 17,423 | 5,018 | 22,441 | |||||||||||||||

| Supplies and consumables | 11,402 | — | 11,402 | 14,987 | — | 14,987 | ||||||||||||||

| Merchandise and accessories | 911 | — | 911 | 2,025 | — | 2,025 | ||||||||||||||

| Ending balance | 97,315 | 90,610 | 187,925 | 95,283 | 48,319 | 143,602 | ||||||||||||||

|

Accounting Policy

Owned Assets

Property, plant and equipment is measured at cost, net of accumulated depreciation and any impairment losses.

Cost includes expenditures that are directly attributable to the asset acquisition. The cost of self-constructed assets includes the cost of materials, direct labor, other costs directly attributable to make the asset available for its intended use, as well as relevant borrowing costs on qualifying assets as further described below. During their construction, property, plant and equipment are classified as construction in progress (“CIP”) and are not subject to depreciation. When the asset is available for use, it is transferred from CIP to the relevant category of property, plant and equipment and depreciation commences.

Where particular parts of an asset are significant, discrete and have distinct useful lives, the Company may allocate the associated costs between the various components, which are then separately depreciated over the estimated useful lives of each respective component. Depreciation is calculated on a straight-line basis over the following estimated useful lives:

Computer software and equipment 3 - 5 years

Production equipment 5 - 10 years

Furniture and fixtures 5 years

Building and improvements 10 - 30 years

Residual values, useful lives and depreciation methods are reviewed annually and changes are accounted for prospectively.

Gains and losses on asset disposals are determined by deducting the carrying value from the sale proceeds and are recognized in profit or loss.

The Company capitalizes borrowing costs on qualifying capital construction projects. Upon the asset becoming available for use, capitalization of borrowing costs ceases and depreciation commences on a straight-line basis over the estimated useful life of the related asset.

Right-of-use leased assets

Right-of-use assets are measured at cost, which is calculated as the amount of the initial measurement of lease liability plus any lease payments made at or before the commencement date, any initial direct costs and related restoration costs. The right-of-use assets are depreciated on a straight-line basis over the shorter of the lease term and the useful life of the underlying asset. The depreciation is recognized from the commencement date of the lease.

If the right-of-use asset is subsequently leased to a third party (a “sublease”), the Company will assess the classification of the sublease as to whether it is a finance or operating lease. Subleases that are classified as an operating lease will recognize lease income while a finance lease will recognize a lease receivable and derecognize the carrying value of the right-of-use asset, with the difference recorded in profit of loss.

Impairment of property, plant and equipment

The Company assesses impairment of property, plant and equipment when an impairment indicator arises (e.g. change in use or discontinued use, obsolescence or physical damage). When the asset does not generate cash inflows that are largely independent of those from other assets or group of assets, the asset is tested at the cash generating unit (“CGU”) level. In assessing impairment, the Company compares the carrying amount of the asset or CGU to the recoverable amount, which is determined as the higher of the asset or CGU’s fair value less costs of disposal and its value-in-use. Value-in-use is assessed based on the estimated future cash flows, discounted to their present value using a pre-tax discount rate that reflects applicable market and economic conditions, the time value of money and the risks specific to the asset. An impairment loss is recognized whenever the carrying amount of the asset or CGU exceeds its recoverable amount and is recorded in the consolidated statements of income (loss) and comprehensive income (loss).

| ||

| March 31, 2025 | March 31, 2024 | |||||||||||||||||||||||||

| Cost | Accumulated depreciation | Impairment | Net book value | Cost | Accumulated depreciation | Impairment | Net book value | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Owned assets | ||||||||||||||||||||||||||

| Land | 43,937 | — | — | 43,937 | 43,914 | — | — | 43,914 | ||||||||||||||||||

| Buildings | 242,939 | (111,596) | — | 131,343 | 242,052 | (97,885) | (300) | 143,867 | ||||||||||||||||||

| Construction in progress | 27,153 | — | — | 27,153 | 26,330 | — | (645) | 25,685 | ||||||||||||||||||

Computer software & equipment |

31,963 | (30,767) | — | 1,196 | 31,333 | (30,135) | — | 1,198 | ||||||||||||||||||

| Furniture & fixtures | 7,614 | (6,619) | — | 995 | 7,900 | (6,444) | — | 1,456 | ||||||||||||||||||

| Production & other equipment | 152,406 | (116,087) | (129) | 36,190 | 154,042 | (106,370) | (202) | 47,470 | ||||||||||||||||||

| Total owned assets | 506,012 | (265,069) | (129) | 240,814 | 505,571 | (240,834) | (1,147) | 263,590 | ||||||||||||||||||

| Right-of-use leased assets | ||||||||||||||||||||||||||

| Land | 13,494 | (1,865) | — | 11,629 | 13,890 | (1,601) | — | 12,289 | ||||||||||||||||||

| Buildings | 34,801 | (18,846) | (567) | 15,388 | 37,252 | (16,640) | (2,512) | 18,100 | ||||||||||||||||||

| Production & other equipment | 5,466 | (5,190) | — | 276 | 5,290 | (4,945) | — | 345 | ||||||||||||||||||

| Total right-of-use lease assets | 53,761 | (25,901) | (567) | 27,293 | 56,432 | (23,186) | (2,512) | 30,734 | ||||||||||||||||||

| Total property, plant and equipment | 559,773 | (290,970) | (696) | 268,107 | 562,003 | (264,020) | (3,659) | 294,324 | ||||||||||||||||||

| Balance, March 31, 2024 | Additions | Disposals | Other (1) |

Depreciation | Impairment | Foreign currency translation | Balance, March 31, 2025 | |||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Owned assets | ||||||||||||||||||||||||||

| Land | 43,914 | — | — | — | — | — | 23 | 43,937 | ||||||||||||||||||

| Buildings | 143,867 | 1,093 | — | (789) | (12,622) | — | (206) | 131,343 | ||||||||||||||||||

| Construction in progress | 25,685 | 12,929 | — | (11,489) | — | — | 28 | 27,153 | ||||||||||||||||||

Computer software & equipment |

1,198 | 619 | — | (28) | (593) | — | — | 1,196 | ||||||||||||||||||

| Furniture & fixtures | 1,456 | 69 | (13) | (105) | (439) | — | 27 | 995 | ||||||||||||||||||

Production & other equipment |

47,470 | 960 | (323) | (1,406) | (10,495) | (129) | 113 | 36,190 | ||||||||||||||||||

| Total owned assets | 263,590 | 15,670 | (336) | (13,817) | (24,149) | (129) | (15) | 240,814 | ||||||||||||||||||

| Right-of-use leased assets | ||||||||||||||||||||||||||

| Land | 12,289 | — | — | (396) | (264) | — | — | 11,629 | ||||||||||||||||||

| Buildings | 18,100 | 7,406 | (562) | (6,475) | (2,773) | (567) | 259 | 15,388 | ||||||||||||||||||

Production & other equipment |

345 | 203 | — | (25) | (259) | — | 12 | 276 | ||||||||||||||||||

Total right-of-use lease assets |

30,734 | 7,609 | (562) | (6,896) | (3,296) | (567) | 271 | 27,293 | ||||||||||||||||||

Total property, plant and equipment |

294,324 | 23,279 | (898) | (20,713) | (27,445) | (696) | 256 | 268,107 | ||||||||||||||||||

| Balance, March 31, 2023 | Additions | Additions from business combinations | Disposals | Other (1) |

Depreciation | Impairment | Foreign currency translation | Balance, March 31, 2024 |

|||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Owned assets | |||||||||||||||||||||||||||||

| Land | 50,257 | — | 1,497 | — | (7,779) | — | — | (61) | 43,914 | ||||||||||||||||||||

| Real estate | 151,623 | 1,168 | — | (212) | 3,435 | (12,397) | (300) | 550 | 143,867 | ||||||||||||||||||||

| Construction in progress | 25,618 | 10,239 | — | (2,137) | (7,760) | (145) | (645) | 515 | 25,685 | ||||||||||||||||||||

Computer software & equipment |

1,723 | 313 | — | (26) | (12) | (797) | — | (3) | 1,198 | ||||||||||||||||||||

| Furniture & fixtures | 1,796 | 407 | — | (11) | 159 | (883) | — | (12) | 1,456 | ||||||||||||||||||||

Production & other equipment |

57,849 | 3,026 | — | (1,232) | 4,340 | (16,325) | (202) | 14 | 47,470 | ||||||||||||||||||||

| Total owned assets | 288,866 | 15,153 | 1,497 | (3,618) | (7,617) | (30,547) | (1,147) | 1,003 | 263,590 | ||||||||||||||||||||

| Right-of-use leased assets | |||||||||||||||||||||||||||||

| Land | 12,545 | — | — | — | — | (255) | — | (1) | 12,289 | ||||||||||||||||||||

| Real estate | 20,953 | 5,232 | 298 | (2,355) | (388) | (3,098) | (2,512) | (30) | 18,100 | ||||||||||||||||||||

Production & other equipment |

605 | 87 | — | (68) | — | (277) | — | (2) | 345 | ||||||||||||||||||||

Total right-of-use lease assets |

34,103 | 5,319 | 298 | (2,423) | (388) | (3,630) | (2,512) | (33) | 30,734 | ||||||||||||||||||||

Total property, plant and equipment |

322,969 | 20,472 | 1,795 | (6,041) | (8,005) | (34,177) | (3,659) | 970 | 294,324 | ||||||||||||||||||||

|

Accounting Policy

Non-current assets, or disposal groups comprising assets and liabilities, are classified as held-for-sale if it is highly probable that they will be recovered primarily through sale rather than through continued use. Such assets, or disposal groups, are generally measured at the lower of their carrying amount and the fair value less costs of disposal. Impairment losses recognized upon initial classification as held-for-sale and subsequent gains and losses on re-measurement are recognized in the consolidated statements of income (loss) and comprehensive income (loss). Once classified as held-for-sale, intangible assets and property, plant and equipment are no longer amortized or depreciated.

| ||

| Whistler Alpha Lake | European R&D Facility & Land |

Equipment | ICC | Total | |||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||

| Balance, March 31 2023 | 638 | — | — | — | 638 | ||||||||||||

| Additions | — | 8,919 | 1,800 | 199 | 10,918 | ||||||||||||

| Impairment | — | (585) | — | — | (585) | ||||||||||||

| Foreign exchange | — | (1) | — | — | (1) | ||||||||||||

| Proceeds from disposal | (2,270) | (8,333) | (600) | — | (11,203) | ||||||||||||

Gain on disposal (1) |

1,632 | — | — | — | 1,632 | ||||||||||||

| Balance, March 31, 2024 | — | — | 1,200 | 199 | 1,399 | ||||||||||||

| Additions | — | — | — | 14,089 | 14,089 | ||||||||||||

| Impairment | — | — | — | (11,643) | (11,643) | ||||||||||||

| Foreign exchange | — | — | — | 57 | 57 | ||||||||||||

| Proceeds from disposal | — | — | (1,200) | (1,199) | (2,399) | ||||||||||||

| Assignment of liabilities held for sale | — | — | — | (1,281) | (1,281) | ||||||||||||

| Balance, March 31, 2025 | — | — | — | 222 | 222 | ||||||||||||

Years ended March 31, |

||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Revenue | 347 | 1,069 | ||||||

| Cost of sales | 1,805 | 6,923 | ||||||

| Changes in fair value of inventory and biological assets sold | — | 5,644 | ||||||

| Unrealized gain on changes in fair value of biological assets | — | (4,411) | ||||||

| Gross loss | (1,458) | (7,087) | ||||||

| Operating expenses | 1,515 | 3,423 | ||||||

| Other income | (696) | (1,058) | ||||||

| Impairment of property, plant, and equipment | 11,870 | 287 | ||||||

| Loss on disposal of discontinued operations | — | 2,411 | ||||||

| Income taxes | 25 | 93 | ||||||

| 12,714 | 5,156 | |||||||

| Net loss from discontinued operations | (14,172) | (12,243) | ||||||

|

Accounting Policy

A business combination is a transaction or event in which an acquirer obtains control of one or more businesses and is accounted for using the acquisition method. The total consideration paid for the acquisition is the aggregate of the fair values of assets acquired, liabilities assumed, and equity instruments issued in exchange for control of the acquiree at the acquisition date. The acquisition date is the date when the Company obtains control of the acquiree. The identifiable assets acquired and liabilities assumed are recognized at their acquisition date fair values, except for deferred taxes and share-based payment awards where IFRS provides exceptions to recording the amounts at fair value. Goodwill represents the difference between the fair value of total consideration paid and the fair value of the net identifiable assets acquired. Acquisition costs incurred are expensed through the consolidated statements of income (loss) and comprehensive income (loss).

Contingent consideration is measured at its acquisition date fair value and is included as part of the consideration transferred in a business combination, subject to the applicable terms and conditions. Contingent consideration that is classified as equity is not remeasured at subsequent reporting dates and its subsequent settlement is accounted for within equity. Contingent consideration that is classified as an asset or a liability is remeasured at subsequent reporting dates in accordance with IFRS 9 Financial Instruments with the corresponding gain or loss recognized in profit or loss.

Based on the facts and circumstances that existed at the acquisition date, management will perform a valuation analysis to allocate the purchase price based on the fair values of the identifiable assets acquired and liabilities assumed on the acquisition date. Management has one year from the acquisition date to confirm and finalize the facts and circumstances that support the finalized fair value analysis and related purchase price allocation. Until such time, these values are provisionally reported and are subject to change. Changes to fair values and allocations are retrospectively adjusted in subsequent periods.

In determining the fair value of all identifiable assets acquired and liabilities assumed, the most significant estimates generally relate to contingent consideration, intangible assets and property, plant and equipment. Management exercises judgment in estimating the probability and timing of when earn-out milestones are expected to be achieved, which is used as the basis for estimating fair value. Identified intangible assets are fair valued using appropriate valuation techniques which are generally based on a forecast of the total expected future net cash flows of the acquiree. Valuations are highly dependent on the inputs used and assumptions made by management regarding the future performance of these assets and any changes in the discount rate applied. Property, plant and equipment are fair valued using a combination of the cost approach and sales comparison approach.

Acquisitions that do not meet the definition of a business combination are accounted for as asset acquisitions. Consideration paid for an asset acquisition is allocated to the individual identifiable assets acquired and liabilities assumed based on their relative fair values. Asset acquisitions do not give rise to goodwill.

| ||

| Allocation of consideration | ||||||||

| $ | ||||||||

| Cash paid | 8,249 | |||||||

| Common shares issued | 36,092 | |||||||

Total purchase price for remaining 90.43% interest |

44,341 | |||||||

| Fair value of existing ownership | 4,734 | |||||||

| Total fair value of consideration | 49,075 | |||||||

| Final fair value of net identifiable assets | ||||||||

| Cash | 5,710 | |||||||

| Accounts receivable | 4,785 | |||||||

| Inventory | 10,464 | |||||||

| Prepaid expenses and other current assets | 80 | |||||||

| Property, plant and equipment | 1,795 | |||||||

| Intangible assets: | ||||||||

| Licenses | 5,500 | |||||||

| Brand | 7,500 | |||||||

| 35,834 | ||||||||

| Accounts payable and accrued liabilities | 10,206 | |||||||

| Income taxes payable | 317 | |||||||

| Lease liability | 311 | |||||||

| 10,834 | ||||||||

| Final purchase price allocation | ||||||||

| Net identifiable assets acquired | 25,000 | |||||||

| Goodwill | 24,075 | |||||||

| 49,075 | ||||||||

| Net cash outflows | ||||||||

| Cash consideration paid | (8,249) | |||||||

| Cash acquired | 5,710 | |||||||

| (2,539) | ||||||||

|

Accounting Policy

Non-controlling interests (“NCI”) are initially recognized either at fair value or at the NCI’s proportionate share of the acquiree’s net assets, and subsequently adjusted for the proportionate share of earnings (loss). For each acquisition, the excess of the total consideration, the fair value of previously held equity interests held prior to obtaining control and the NCI in the acquiree, over the fair value of the identifiable net assets acquired, is recorded as goodwill.

| ||

| Bevo | Other | Total | |||||||||

| $ | $ | $ | |||||||||

Balance, March 31, 2023 |

32,904 | (1,843) | 31,061 | ||||||||

Discontinued operations (Note 8) |

— | 2,572 | 2,572 | ||||||||

| Change in ownership interests in net assets | 12,208 | — | 12,208 | ||||||||

| Share of loss for the period | (3,519) | (225) | (3,744) | ||||||||

Balance, March 31, 2024 |

41,593 | 504 | 42,097 | ||||||||

| Share of loss for the period | (677) | — | (677) | ||||||||

Balance, March 31, 2025 |

40,916 | 504 | 41,420 | ||||||||

| Summary of Statement of Financial Position | March 31, 2025 |

March 31, 2024 | ||||||

| $ | $ | |||||||

| Current assets | 46,522 | 35,813 | ||||||

| Non-current assets | 141,359 | 91,759 | ||||||

| Current liabilities | 38,242 | 62,323 | ||||||

| Non-current liabilities | 55,335 | 4,900 | ||||||

|

Accounting Policy

Intangible assets

Intangible assets are recorded at cost less accumulated amortization and any impairment losses. Intangible assets acquired in a business combination are measured at fair value at the acquisition date. Amortization of definite life intangibles is calculated on a straight-line basis over their estimated useful lives, which do not exceed the contractual period, if any, over the following terms:

| ||||||||

Customer relationships Health Canada licenses Other operating licenses Patents IP and know-how ERP software |

20 years Earlier of the license expiration date or Useful life of the facility 10 years 10 years 10 years 5 years |

|||||||

|

The estimated useful lives, residual values and amortization methods are reviewed annually and any changes in estimates are accounted for prospectively. Intangible assets with an indefinite life or not yet available for use are not subject to amortization. Indefinite life permits and licenses are predominantly held by the Company’s foreign subsidiaries. Given that these permits and licenses are connected to the subsidiary rather than a specific asset, there is no foreseeable limit to the period over which these assets are expected to generate future cash inflows for the Company.

Research costs are expensed as incurred. Development expenditures are capitalized only if development costs can be measured reliably, the product or process is technically and commercially feasible, future economic benefits are probable, and the Company intends to and has sufficient resources to complete development to use or sell the asset. Other development expenditures are recognized as research and development expenses on the consolidated statements of income (loss) and comprehensive income (loss) as incurred. Capitalized deferred development costs are internally generated intangible assets.

Goodwill

Goodwill represents the excess of the purchase price paid for the acquisition of an entity over the fair value of the net tangible and intangible assets acquired. Goodwill is allocated to the CGU or group of CGUs which are expected to benefit from the synergies of the combination. Goodwill is not subject to amortization.

Impairment of intangible assets and goodwill

Goodwill and intangible assets with an indefinite life or not yet available for use are tested for impairment annually and whenever events or circumstances that make it more likely than not that an impairment may have occurred, such as a significant adverse change in the business climate or a decision to sell or dispose all or a portion of a reporting unit. Finite life intangible assets are tested whenever there is an indication of impairment.

Goodwill and indefinite life intangible assets are tested annually as required for impairment by comparing the carrying value of each CGU containing the assets to its recoverable amount. Indefinite life intangible assets are tested for impairment by comparing the carrying value of each CGU containing the assets to its recoverable amount. Goodwill is tested for impairment based on the level at which it is monitored by management, and not at a level higher than an operating segment. The goodwill is allocated to the segment.

An impairment loss is recognized for the amount by which the operating segment or CGU’s carrying amount exceeds it recoverable amount. The recoverable amounts of the CGUs’ assets have been determined based on the higher of fair value less costs of disposal and value-in-use. There is a material degree of uncertainty with respect to the estimates of the recoverable amounts of the CGU, given the necessity of making key economic assumptions about the future. Impairment losses recognized in respect of a CGU are first allocated to the carrying value of goodwill and any excess is allocated to the carrying value of assets in the CGU. Any impairment is recorded in profit and loss in the period in which the impairment is identified. A reversal of an asset impairment loss is allocated to the assets of the CGU on a pro rata basis. In allocating a reversal of an impairment loss, the carrying amount of an asset shall not be increased above the lower of its recoverable amount and the carrying amount that would have been determined had no impairment loss been recognized for the asset in prior period. Impairment losses on goodwill are not subsequently reversed.

| ||||||||

| March 31, 2025 | March 31, 2024 | ||||||||||||||||||||||

| Cost | Accumulated amortization | Net book value | Cost | Accumulated amortization | Impairment | Net book value | |||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| Definite life intangible assets: | |||||||||||||||||||||||

| Customer relationships | 42,528 | (37,629) | 4,899 | 42,439 | (37,349) | — | 5,090 | ||||||||||||||||

| Permits and licenses | 54,065 | (53,996) | 69 | 54,002 | (43,305) | (10,652) | 45 | ||||||||||||||||

| Patents | 751 | (751) | — | 982 | (793) | — | 189 | ||||||||||||||||

| Intellectual property and know-how | 52,590 | (52,590) | — | 52,590 | (52,590) | — | — | ||||||||||||||||

| Software | 21,992 | (18,198) | 3,794 | 18,661 | (16,408) | (1,504) | 749 | ||||||||||||||||

| Indefinite life intangible assets: | |||||||||||||||||||||||

| Brand | 7,666 | — | 7,666 | 28,200 | — | (20,700) | 7,500 | ||||||||||||||||

| Permits and licenses | 28,735 | — | 28,735 | 27,277 | — | — | 27,277 | ||||||||||||||||

| Total intangible assets | 208,327 | (163,164) | 45,163 | 224,151 | (150,445) | (32,856) | 40,850 | ||||||||||||||||

| Goodwill | 43,871 | — | 43,871 | 43,180 | — | — | 43,180 | ||||||||||||||||

| Total | 252,198 | (163,164) | 89,034 | 267,331 | (150,445) | (32,856) | 84,030 | ||||||||||||||||

| Balance, March 31, 2024 |

Additions | Other | Amortization | Foreign currency translation | Balance, March 31, 2025 | |||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||

| Definite life intangible assets: | ||||||||||||||||||||

| Customer relationships | 5,090 | — | 90 | (281) | — | 4,899 | ||||||||||||||

| Permits and licenses | 45 | 48 | 8 | (43) | 11 | 69 | ||||||||||||||

| Patents | 189 | 6 | (197) | — | 2 | — | ||||||||||||||

| Software | 749 | 3,406 | (90) | (271) | — | 3,794 | ||||||||||||||

Indefinite life intangible assets: |

||||||||||||||||||||

| Brand | 7,500 | — | — | — | 166 | 7,666 | ||||||||||||||

| Permits and licenses | 27,277 | — | 59 | — | 1,399 | 28,735 | ||||||||||||||

| Total intangible assets | 40,850 | 3,460 | (130) | (595) | 1,578 | 45,163 | ||||||||||||||

| Goodwill | 43,180 | 354 | (390) | — | 727 | 43,871 | ||||||||||||||

| Total | 84,030 | 3,814 | (520) | (595) | 2,305 | 89,034 | ||||||||||||||

| Indefinite Life Intangible Impairment Testing |

Goodwill Impairment Testing | ||||||||||||||||||||||

| Canadian Cannabis CGU | Plant Propagation CGU | Australia Cannabis CGU | European Cannabis CGU | Cannabis Operating Segment | Plant Propagation | ||||||||||||||||||

January 1, 2025 |

|||||||||||||||||||||||

| Terminal value growth rate | 2.0% | 3.0% | 3.0% | 3.0% | 2.5% | 3.0% | |||||||||||||||||

| Discount rate | 17.8% | 11.0% | 10.3% | 13.3% | 15.3% | 11.0% | |||||||||||||||||

| Revenue growth rate | 1.0% | 7.0% | 6.4% | 13.1% | 6.4% | 7.0% | |||||||||||||||||

| Fair value less cost to dispose | $293,973 | $194,294 | $23,325 | $95,979 | $403,767 | $194,294 | |||||||||||||||||

| Carrying value | $211,713 | $185,156 | $14,338 | $40,869 | $341,777 | $185,156 | |||||||||||||||||

| Indefinite Life Intangible Impairment Testing |

Goodwill Impairment Testing | |||||||||||||||||||

| Canadian Cannabis CGU | Plant Propagation | European Cannabis CGU | Cannabis Operating Segment | Plant Propagation | ||||||||||||||||

January 1, 2024 |

||||||||||||||||||||

| Terminal value growth rate | 3.0% | 3.0% | 3.0% | 3.0% | 3.0% | |||||||||||||||

| Discount rate | 12.0% | 10.0% | 12.0% | 12.0% | 10.0% | |||||||||||||||

| Revenue growth rate | 4.6% | 10.6% | 17.4% | 4.6% | 10.6% | |||||||||||||||

| Fair value less cost to dispose | $74,175 | $192,729 | $48,143 | $138,395 | $192,729 | |||||||||||||||

| Carrying value | $266,399 | $172,475 | $46,904 | $333,721 | $172,475 | |||||||||||||||

| Significant inputs & key assumptions | Sensitivity | Decrease in fair value | ||||||

| Discount rate | Increase of 0.5% |

$9,186 | ||||||

| Total revenue | Decrease of 2% |

$12,842 | ||||||

| EBITDA margin | Decrease of 1% |

$7,549 | ||||||

| Significant inputs & key assumptions | Sensitivity | Decrease in fair value | ||||||

| Discount rate | Increase of 0.5% |

$6,208 | ||||||

| Total revenue | Decrease of 2% |

$22,921 | ||||||

| EBITDA margin | Decrease of 1% |

$13,607 | ||||||

| Significant inputs & key assumptions | Sensitivity | Decrease in fair value | ||||||

| Discount rate | Increase of 0.5% |

8,987 | ||||||

| Total revenue | Decrease of 2% |

$16,664 | ||||||

| EBITDA margin | Decrease of 1% |

$10,465 | ||||||

| Significant inputs & assumptions | Sensitivity | Decrease in fair value | ||||||

| Discount rate | Increase of 0.5% |

$10,735 | ||||||

| Total revenue | Decrease of 2% |

$15,688 | ||||||

| EBITDA margin | Decrease of 1% |

$7,834 | ||||||

|

Accounting Policy

Loans and Borrowings are initially recognized at fair value, net of transaction costs incurred. Loans are subsequently measured at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption amount is recognized in profit or loss

over the period of the borrowings using the effective interest method. Loans are derecognized from the consolidated statement of financial position when the obligation specified in the contract is discharged, cancelled, or expired. The difference between the carrying amount of a financial liability that has been extinguished or transferred to another party and the consideration paid, including any non-cash assets transferred or liabilities assumed, is recognized in profit or loss as finance costs. Loans are classified as current liabilities unless the Company has an unconditional right to defer settlement of the liability for at least 12 months after the reporting period.

| ||||||||

| Term Facilities | |||||

| $ | |||||

| Balance, March 31, 2023 | 38,224 | ||||

| Drawings | 2,751 | ||||

| Interest accretion | 23 | ||||

| Principal repayments | (2,749) | ||||

| Balance, March 31, 2024 | 38,249 | ||||

| Transfer from Revolver | 4,000 | ||||

| Drawings | 2,824 | ||||

| Interest accretion | 13 | ||||

| Debt issuance costs | (493) | ||||

| Principal repayments | (2,100) | ||||

Balance, March 31, 2025 |

42,493 | ||||

| Current portion | (2,299) | ||||

| Long-term portion | 40,194 | ||||

|

Accounting Policy

The Company assesses whether a contract is or contains a lease at inception of the contract. A lease is recognized as a right-of-use asset and corresponding liability at the commencement date. Each lease payment included in the lease liability is apportioned between the repayment of the liability and a finance cost. The finance cost is recognized in “finance and other costs” in the consolidated statements of income (loss) and comprehensive income (loss) over the lease period so as to produce a constant periodic rate of interest on the remaining balance of the liability. Lease liabilities represent the net present value of fixed lease payments (including in-substance fixed payments); variable lease payments based on an index, rate, or subject to a fair market value renewal condition; amounts expected to be payable by the lessee under residual value guarantees; the exercise price of a purchase option if the lessee is reasonably certain to exercise that option; and payments of penalties for terminating the lease, if it is probable that the lessee will exercise that option.

The Company’s lease liability is recognized net of lease incentives receivable. The lease payments are discounted using the interest rate implicit in the lease or, if that rate cannot be determined, the lessee’s incremental borrowing rate. The period over which the lease payments are discounted is the expected lease term, including renewal and termination options that the Company is reasonably certain to exercise.

Subsequently, if there is a change to the expected lease term within the control of the lessee, the lease liability will be remeasured using the updated term and revised discount rate on a prospective basis.

Payments associated with short-term leases and leases of low-value assets are recognized as an expense on a straight-line basis in general and administration and sales and marketing expense in the consolidated statements of income (loss) and comprehensive income (loss). Short-term leases are defined as leases with a lease term of 12 months or less. Variable lease payments that do not depend on an index, rate, or subject to a fair market value renewal condition are expensed as incurred and recognized in costs of goods sold, general and administration, or sales and marketing expense, as appropriate given how the underlying leased asset is used, in the consolidated statements of income (loss) and comprehensive income (loss).

If the right-of-use asset is subsequently leased to a third party (a “sublease”), the Company will assess the classification of the sublease as to whether it is a finance or operating lease. Subleases that are classified as an operating lease will recognize lease income, while a financing lease will recognize a lease receivable and derecognize the carrying value of the right-of-use asset, with the difference recorded in profit or loss.

| ||

| $ | ||||||||

Balance, March 31, 2023 |

49,217 | |||||||

| Lease additions | 5,618 | |||||||

| Disposal of leases | (635) | |||||||

| Lease payments | (8,446) | |||||||

| Lease reassessments | (1,402) | |||||||

| Foreign exchange | 28 | |||||||

| Interest accretion | 3,152 | |||||||

| Balance, March 31, 2024 | 47,532 | |||||||

| Current portion | (4,856) | |||||||

| Long-term portion | 42,676 | |||||||

| Balance, March 31, 2024 | 47,532 | |||||||

| Lease additions | 7,609 | |||||||

| Lease payments | (8,129) | |||||||

Lease liabilities assumed (Note 8(a)) |

(1,281) | |||||||

| Lease reassessments | (6,068) | |||||||

| Foreign exchange | 292 | |||||||

| Interest accretion | 2,921 | |||||||

| Balance, March 31, 2025 | 42,876 | |||||||

| Current portion | (5,381) | |||||||

| Long-term portion | 37,495 | |||||||

|

Accounting Policy

Share Purchase Warrants

Warrants issued in foreign currencies are classified as derivative liabilities. Upon exercise, in exchange for a fixed amount of common shares, the expected cash receivable is variable due to changes in foreign exchange rates. The Company measures derivative financial liabilities at fair value through profit or loss at initial recognition and in subsequent reporting periods. Fair value gains or losses are recognized in other gains (losses) on the statement of comprehensive income (loss). The fair value of foreign currency share purchase warrants is determined using the quoted market price on the valuation date, which is a Level 1 input. Transaction costs, which are directly attributable to the offering, are allocated to equity and classified as equity financing transaction costs.

| ||

Warrants(1) |

Weighted average exercise price |

|||||||

| # | $ | |||||||

Balance, March 31, 2023 |

8,912,479 | 70.90 | ||||||

| Expired | (1,838,131) | 1,124.60 | ||||||

| Balance, March 31, 2024 | 7,074,348 | 44.34 | ||||||

| Expired | (10,486) | 388.43 | ||||||

| Balance, March 31, 2025 | 7,063,862 | 46.22 | ||||||

| U.S.$ equivalent | |||||||||||

| June 2022 Offering |

June 2022 Offering |

||||||||||

| $ | $ | ||||||||||

Balance, March 31, 2023 |

9,514 | 7,041 | |||||||||

| Unrealized gain on derivative liability | (9,038) | (6,688) | |||||||||

Balance, March 31, 2024 |

476 | 353 | |||||||||

| Unrealized loss on derivative liability | 28 | — | |||||||||

Balance, March 31, 2025 |

504 | 353 | |||||||||

| Exercise Price ($) | Expiry Date | Warrants (#)(1) |

||||||

45.80 |

June 1, 2025 | 7,040,875 | ||||||

111.06 - 418.80 |

May 29, 2025 - November 30, 2025 | 22,987 | ||||||

| 7,063,862 | ||||||||

|

Accounting Policy

Stock Options

Stock options issued to employees are measured at fair value at the grant date and are recognized as an expense over the relevant vesting periods with a corresponding credit to share reserves.