UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 20, 2025

FOCUS UNIVERSAL INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 001-34780 | 46-3355876 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

2311 East Locust Street Ontario, California |

91761 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (626) 272-3883

Registrant’s Fax Number, Including Area Code: (917) 791-8877

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | FCUV |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐.

|

|

| Item 1.01 | Entry into a Material Definitive Agreement. |

The information set forth in Item 3.02 of this Current Report on Form 8-K is incorporated into this Item 1.01 by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

On October 27, 2025, Focus Universal Inc. (the “Company”) issued a press release announcing the closing of $10,000,000 in preferred equity.

Private Placement of Series A Preferred Stock

On or about October 20, 2025, the Company committed the sale of 750,000 shares of Series A Convertible Preferred Stock (the “Series A Preferred Stock”) in a private placement to Edward Lee, the Chairman of the Company’s Board of Directors, as the lead investor and other accredited investors for an aggregate purchase price of $3,000,000, or $4.00 per share (the “Series A Private Placement”).

In connection with the Series A Private Placement, on or about October 15, 2025, the Company entered into a subscription agreement with each investor, the form of which is included hereto as Exhibit 10.1, is incorporated by reference into this Item 3.02.

The Series A Preferred Stock were offered and sold in a private placement to certain eligible investors pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The Series A Preferred Stock have not been registered under the Securities Act, or the securities laws of any other jurisdiction, and may not be offered or sold in the United States absent registration under or an applicable exemption from such registration requirements. This Current Report on Form 8-K does not constitute an offer to sell, or a solicitation of an offer to purchase, the Series A Preferred Stock in any jurisdiction in which such offer or solicitation would be unlawful.

Private Placement of Series B Preferred Stock

On or about October 21, 2025, the Company entered into a securities purchase agreement (the “Series B Agreement”) with private accredited investors (the “Investors”) the form of which is included hereto as Exhibit 10.2, is incorporated by reference into this Item 3.02. Pursuant to the terms and conditions of the Series B Agreement, the Investors committed to purchase up to $7,000,000 or 8,236 shares (the “Commitment Amount”) of the Company’s Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”) at a price per share of $850.00 (the “Series B Private Placement”), which represents a 15% original issuance discount. There will be three Closings: (i) $3,000,000 for the purchase of the Series B Preferred Stock funded at the Initial Closing; (ii) $1,000,000 for the purchase of the Series B Preferred Stock funded on the date the Company files, (a) the Registration Statement on Form S-1 required by and pursuant to the Registration Rights Agreement and (b) the Information Statement with the SEC; and (iii) $3,000,000 for the purchase of the Series B Preferred Stock funded within two (2) Business Days after (a) such Registration Statement is declared effective by the SEC and (b) the Information Statement has become effective under Rule 14c-2 (including expiration of any applicable waiting period).

In connection with the Series B Private Placement, the Company and the Investors entered into a Registration Rights Agreement, the form of which is included hereto as Exhibit 10.3 and is incorporated by reference into this Item 3.02. The Company also entered into a Placement Agent Agreement with Spartan Capital Securities, LLC, the form of which is included hereto as Exhibit 10.4 and is incorporated by reference into this Item 3.02.

In connection with the Series B Private Placement, the Company’s executive officers and 5% shareholders entered into a Lock-Up Agreement effective October 21, 2025, and until December 29, 2025, the form of which is included hereto as Exhibit 10.5 and is incorporated by reference into this Item 3.02.

The Series B Preferred Stock were offered and sold in a private placement to certain eligible investors pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The Series B Preferred Stock have not been registered under the Securities Act, or the securities laws of any other jurisdiction, and may not be offered or sold in the United States absent registration under or an applicable exemption from such registration requirements. This Current Report on Form 8-K does not constitute an offer to sell, or a solicitation of an offer to purchase, the Series B Preferred Stock in any jurisdiction in which such offer or solicitation would be unlawful.

|

|

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws. |

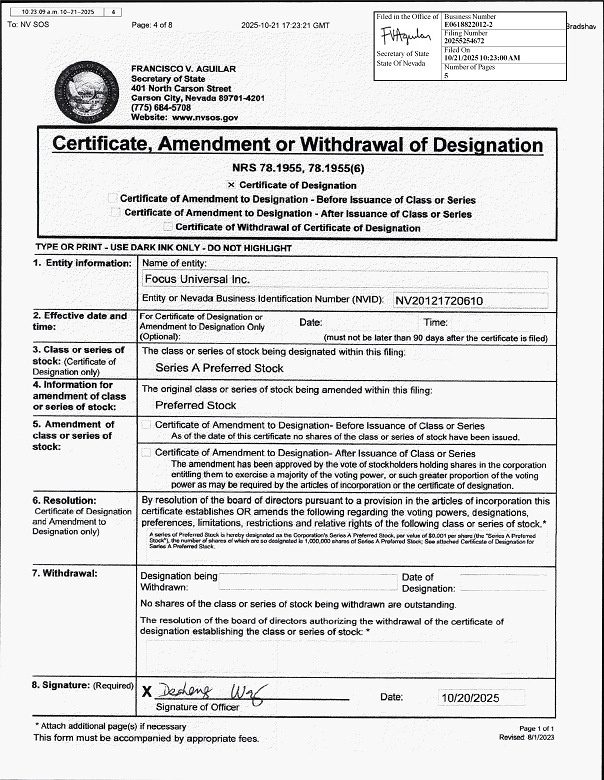

Certificate of Designation of Series A Preferred Stock

On October 21, 2025, the Company filed a Certificate of Designation of Series A Preferred Stock (“Series A Designation”) that had the effect of designating 1,000,000 shares of its 5,000,000 authorized shares of preferred stock as Series A Preferred Stock (“Series A Preferred Stock”). The Series A Designation as filed with the Secretary of State of Nevada, which is included hereto as Exhibit 3.1, is incorporated by reference into this Item 5.03.

Dividends

Each share of Series A Preferred Stock will be entitled to receive dividends paid on and equal to the Company’s common stock, par value $0.001 per share (“Common Stock”) when and if declared by the Board of Directors.

Voting Rights

The holders of Series A Preferred Stock have the voting rights as though the shares of Series A Preferred Stock have converted into Common Stock. In addition, as long as any shares of Series A Preferred Stock remain outstanding, the Series A Designation provides that the Company shall not, without the affirmative vote of holders of eighty percent (80%) of the then outstanding shares of Series A Preferred Stock, (a) amend, alter or repeal any provision of the Articles of Incorporation or the Bylaws as to adversely the designations, preferences, limitations, and relative rights of the Series A Preferred Stock or (b) effect any reclassification of the Series A Preferred Stock. Furthermore, the Company shall not amend, alter or repeal the Series A Designation without the affirmative vote of the holders of at least a majority of all outstanding shares of the Series A Preferred Stock, unless the Company needs to make a technical, corrective, administrative change that does not adversely affect the rights or preferences.

Liquidation Rights; Rank

Each share of Series A Preferred Stock ranks senior to the Company’s Common Stock in liquidation.

Conversion Rights

Each share of Series A Preferred Stock is convertible into 1.1 shares of restricted Common Stock at the option of the holder, at any time.

Redemption Rights

The shares of Series A Preferred Stock will not have any redemption rights.

Certificate of Designation of Series B Preferred Stock

On October 20, 2025, the Company filed a Certificate of Designation of Series B Preferred Stock (“Series B Designation”) that had the effect of designating 15,000 shares of its 5,000,000 authorized shares of preferred stock as Series B Convertible Preferred Stock (“Series B Preferred Stock”). The Series B Designation as filed with the Secretary of State of Nevada, which is included hereto as Exhibit 3.2, is incorporated by reference into this Item 5.03.

|

|

Dividends

If the Company pays a dividend or distribution (other than one payable in Common Stock shares or its equivalents) on shares of Common Stock, the holders of shares of outstanding Series B Preferred Stock will be entitled to receive dividends paid on and equal to the Company’s Common Stock, as if each share of Series B Preferred Stock is converted into shares of Common Stock, when and if declared by the Board of Directors.

Voting Rights

The holders of Series B Preferred Stock have no voting rights.

As long as any shares of Series B Preferred Stock remain outstanding, the Series B Designation provides that the Company shall not, without the affirmative vote of holders of at least 50.1% of the then outstanding shares of Series B Preferred Stock, (a) amend or repeal, or add any provision to its charter documents if such action would alter or change adversely the preferences, rights, privileges or powers, or restrictions provided for the benefit, of the Series B Preferred Stock.

Liquidation Rights; Rank

Each share of Series B Preferred Stock ranks senior to the Company’s Common Stock.

Conversion Rights

Each share of Series B Preferred Stock is convertible as follows:

| (a) | Voluntary conversion. The holder of any shares of Series B Preferred Stock shall have the right, at its option at any time following the initial issuance date, to convert any such shares into Common Stock at the Conversion Rate, which is determined by dividing the number of shares Series B Preferred Stock to be converted by the Conversion Price (i.e., 85% of the lowest daily volume weighted average price of the Common Stock for any ten (10) Trading Days immediately prior to the date of conversion, subject to adjustment). |

| (b) | Triggering Event Conversion. At any time during the period between the date of a Triggering Event and ending on the date of the cure of such Triggering Event, the holder of any shares of Series B Preferred Stock shall have the right, at its option, to convert at the Triggering Event Conversion Price, which is the lesser of the Conversion Price and 75% of the lowest daily volume weighted average price of the Common Stock for any ten (10) Trading Days immediately prior to the date of conversion |

Purchase Rights

If the Company grants, issues, or sells any options, convertible securities, or rights to purchase stock, warrants, securities, or other property pro rata to the Common Stock shareholders (the “Purchase Rights”), then each holder of Series B Preferred Stock will be entitled to the same.

Conversion Price Protection

If the Company issues or sells any securities (including Options or Convertible Securities) except any Exempt Issuance at an effective price (or exercise or conversion price) of less than the Conversion Price, then upon such issuance or sale, the Conversion Price shall be reduced to the sale price or exercise or conversion price of the securities issued or sold.

|

|

Participation Rights

Until the six (6) month anniversary of the issuance of the Series B Preferred Stock to the holder, upon the Company’s issuance of Common Stock (or its equivalents) for cash consideration intended to be exempt from registration (“Subsequent Financing”), the holders of outstanding shares of Series B Preferred Stock shall have the right to participate in an amount equal to an aggregate 30% of the Subsequent Financing on the same terms.

Beneficial Ownership Limitation

The Company shall not effect a conversion of the Series B Preferred Stock, and the holder of any shares of Series B Preferred Stock shall not have the right to voluntarily convert its shares of Series B Preferred Stock, to the extent that after giving effect to such exercise, such Person (together with such Person’s Affiliates) would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the shares of Common Stock outstanding immediately after giving effect to such conversion.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 27, 2025 |

| FOCUS UNIVERSAL, INC. | ||

| By: | /s/ Desheng Wang | |

| Name: | Desheng Wang | |

| Title: | Chief Executive Officer | |

|

|

Exhibit 3.1

Business Number E0618822012 - 2 Filed in the Office of Filing Number 20255254672 Secretary of State State Of Nevada Filed On 10/21/2025 10:23:00 AM Number of Pages 5 [ - 10 : 23 : 09 a . m . 10 - 2 1 - 2025 [ TJ To : NV SOS Page : 5 of 8 2025 - 10 - 21 17 :2 3 : 21 GMT Docusign Envelope ID : 40791247 - F735 - 4EDE - AE64 - 762AADBD8DD5 From : Gilbert Bradshav CERTIFICATE OF DESIGNATION OF FOCUS UNIVERSAL INC. ESTABLISHING THE DESIGNATIONS, PREFERENCES, LIMITATIONS AND RELATIVE RIGHTS OF ITS SERIES A PREFERRED STOCK Pursuant to Section 78 . 1 955 of the Nevada Revised Statutes (the " NRS ") , Focus Universal Inc . , a corporation organized and existing under the NRS ( the " Company ") , DOES HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors (" Board " ) by the Articles of Incorporation, as amended, of the Company, and pursuant to Section 78 . 1955 of the NRS, the Board, by unanimous written consent of aU members of the Board effective on October 15 , 2025 , duly adopted a resolution providing for the issuance of a series of Series i \ Preferred Stock, which resolution is and reads as follows : RESOLVED, that pursuant to the authority expressly grante d to and invested in the Board of the Company b y the provisions of the Articles of Incorporation of the Company, as amended, a series of the preferred stock, par va lu e $ 0 . 001 p er share, of the Company be, and it h ereby is, established ; and it is further RESOLVED, that the series of preferred stock of the Company be, and it hereby is, given the distinctive designation of " Series A Preferred Stock " ; and it is further RESOLVED, that the Series i \ Preferred Stock shall consist of one million ( 1 , 000 , 000 ) shares ; and it is further RESOLVED, that the Series A Preferred Stock shall have the powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon set forth below ( the " Designation " or " Certificate of Designations " ) : SECTION 1 . DESIGNATION OF SERIES . The shares of such series shall be designated as the " Series A Preferred Stock " (the " Series A Preferred Stock" ) and the number of shares in . itiaUy constituting such series shall be up to one million ( 1 , 000 , 000 ) shares which shall only be issued to and held by the purchasers as of the date of this D esignation . SECTION 2 . DIVIDENDS . The holders of the Series A Preferred Stock shall be equall y entitled to receive dividends paid on the Common Stock . SECTION 3 . LIQUIDATION PREFERENCE . The holders of the Series A Preferr ed Stock sha ll have a liquidation preference senior to all common stockholders . SECTION 4. VOTING . 1. Voting Rights. The holders of the Series A Preferred Stock will have the voting rights as though they had converted into Common Stock or as required by Nevada l aw. 2. Amendments to Articles and Bylaws .

So long as the Series A Preferred Stock is 1 0 : 23 : 09 a . m . 1 0 - 2 1 - 2 0 25 I TJ 2 To : NV SOS Page : 6 of 8 20 25 - 10 - 2 1 17 : 23 :2 1 GM T D ocusign Envelope I D : 40791247 - F735 - 4 ED E - AE 64 - 76 2 AA DBD 8 DD 5 F r om : G i lbert Brad s ha � outstanding, the Company shall not, without the affirmative vote of the ho l ders of at least 80 ( 1 /<i of a ll outstanding shares of Series A Preferred Stock, voting separately as a class (i) amend, alter or repeal any provision of the Articles of Incorporation or the By l aws of the Company so as to adversely affect the designations, preferences, limitations and relative rights of the Series A Preferred Stock or (i i ) effect any reclassification of the Ser i es A Preferred Stock . 4 . 3 Am e ndm e nt of Ri g hts o f S e ri es A Pr e f er r e d S t o ck The Company shall not, without the affirmative vo te of the holders of at least a majority of all outstanding shares of the Series A Preferred Stock, amend, alter or repeal any provision of this Statement of Designations, PROVI D ED, HO \ Y 'E VER, that the Company may, by any means authorized by la,v and without any vote of the holders of shares of the Series A Preferred Stock, make technical, corrective, administrative or similar changes in this Statement of Designations that do not, individually or in the aggregate, adversely affect the rights or preferences of the holders of shares of the Preferred Stock . SECTION 5 . CONVERSION RIGHTS . The shares of the Series A Preferred Stock shall be convertib l e into restricted Common Stock of the Company voluntarily, at any time at the option of the Holder . Each share of Series A Preferred Stock shall convert into 1 . 1 shares of Common Stock . SECTION 6 . R E DEMPTION RIGHTS . The shares of the Serie s A Preferred Stock shall have no redemption rights . S E CTION 7 . PROCEDURES OF CONVERSION . ln order to effectuate a conversion of shares of Series A Preferred Stock a holder shall (a) subrnit a written election to the Corporation that such holder elect s to convert Shares, the number of Shares elected to be converted ; and (b) surrender, along with such written election, to the Corporation the certificate or certificates representing the Shares being converted, duly assigned or endorsed for transfer to the Corporatio n (o r accompanied by du l y executed stock powers relating t h e reto ) or, in the event the certificate or certificates are l ost, sto l en, or missing, accompanied by an affidavi t of l oss exec u ted by the ho l der . The conversion of such Shares hereunder shal l be deemed effecLive as of th e date of surrender of such Series A Preferred Stock certificate or certificate s or delivery of such affidavit ofloss . Upon the receipt b y the Corporation of a written dection and the surrender of such certificate(s ) and accompanying materials, the Corporation shalJ as promptly as practicable (but in any event within ten ( 10 ) days thereafter) deliver to the relevant ho l der (a) a certificate in such holder's name (o r the name of such ho l der's designee as stated in the written election ) for the number of shares of Common Stock to which such holder shal l be entitled upon conversion of the applicable Shares as calculated pursuant to Section 7 and, if applicable (b ) a certificate in such holder's ( or the name of such holder's designee as slated in the written election) for th e number of Shares of Series A Preferred SLOck represente d b y the certificate or certificates delivered to the Corporation for conversion but otherwise not elected to be converted pursuant to the written election . All shares of capita l stock issued hereunder by the Corporation shall be duly and validly issued, fully paid, and nonassessable, free and clear of all taxes, liens, charges, and encumbrances with respect to the issuance thereof . All Shares of Series A Preferred Stock converted as provided in this Section 7 shal l no longer be deemed outstanding as of the effective tim e of the applicable conversion and all rig h ts with respect to such Shares shall immediately cease and terminate as of such time, other than the rig h t of the holder to receive shares of Common Stock and payment in lieu of any fraction of a Share in exchange therefor .

The Corporation shal l al all times when any Shares of Series A Preferred Stock are outstandin g reserve and keep available out of its 10 : 23 : 09a . m . 10 - 21 :=wio ?] 3 To: NV SOS Page: 7 of 8 2025 - 10 - 21 17 : 23:21 GMT Docusig n Envelope ID : 4079124 7 - F735 - 4EOE - AE64 - 762AADBD8OD5 From: Gilbert Bradsha � authorized but unissued shares of capital stock, solely for the purpose of issuance upon the conversion of the Series A Preferred Stock, such number of shares of Common Stock issuab l e upon the conversion of a ll o ut standing Series A Preferred Stock pursuant to this Section 7 , taking into account any adjustment to such number of shares so issuable . The Corporation shall take all such actions as may be necessary to assure that all such shares of Common Stock may be so issued without violation of any applicab l e law or governmental regulation or any reguirements of any domestic securities ex ch ange upon which shares of Common Stock may be li sted ( except for official notice of issuance which shaU be immediately delivered by the Corporation upon each such issuance ) . The Corporation shall not close its books against the transfer of any of its capital stock in any manner which would prevent the timely conversio n of the Shares of Series A Preferred Stock . SECTION 8 . TRANSFER RIGHTS . The Series A Preferred Stock shaU be freely transferable at the Holder's request, s ub ject to Nevada State Law or applicable securities l aws . SECTION 9 . NOTICES . 1 \ ny notice required hereby to be hriven to the holders of shares of the Series A Preferred Stock shall be deemed given if deposited in the United States mail, postage prepaid, and addressed to each holder of record at his address appeari n g on the books of the Company . SECTION 10. PROTECTIVE PROVISIONS. Subject to the rights of series of Pr eferred Stock which may from time to time come into existence, so long as any shares of Series J \ Preferred Stock are outstanding, this Com pan y shall not without first obtaining the approval (by written consent, as provided by l aw) of the holders of at least 80 % of the then outstanding shares of Series A Preferred Stock, voting together as a class, except as othern r ise provided for in this D esignation : (a) Increase or decrease ( other than by redemption or conversion ) the total number of authorized shares of Series r \ Preferred Stock ; (b) Effect an exchange, reclassification, or cancellation of all or a part of the Series A Preferred Stock, e x cluding a reverse stock split or forward stock split ; (c) Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series A Preferred Stock ; or (d) Alter or change the rights, preferences or privileges of the shares of Series A Pr eferred Stock so as to affect adverse l y the shares of such series, including the rights set forth in this Designation . PROVIDED, HOWEVER , that the Company may, by any means authorized by l aw and without any vote of the holders of shares of the Series A Pr eferred Stock, make technical, corrective, adm ini strative or simi l ar changes in this Statement of Designations that do not, individuaUy or i n the aggregate, adversely affect the rights or preferences of the holders of shares of the Series A Preferred Stock . SECTION 11. MISCELLANEOUS.

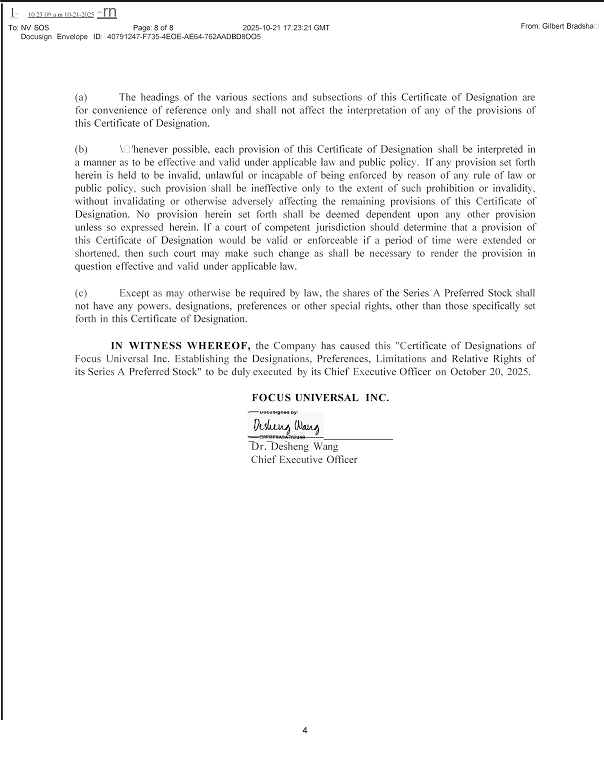

1 - 1 0 : 23 : 09 a . m . 10 - 21 - 2 0 25 - rn 4 To : NV SO S Pa g e : 8 o f 8 2 0 25 - 1 0 - 21 17 : 23:21 GMT D ocusign E nvelope I D : 40791247 - F735 - 4 EO E - A E 64 - 762AAD BD 8 OO 5 Fr om : G il b ert B r ad sha � (a) The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall not affect the interpretation of any of the provisions of this Certificate of Designation . (b) \ � ' henever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under applicable l aw and public polic y . If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public polic y, such provision shall be ineffective only to the extent of such prohibition or invalidit y, without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation . No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein . If a court of competent jurisdiction should determin e that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened, then such court ma y make such change as shall be n e c ess ary to render the provision in question effective and valid under app l icab l e law . (c) Ex cept as m ay otherwise be required b y law, the shares of the Series A Preferred Stock shall not have any power s, designations, preferences or other special rights, other than those specifically set forth in this Certificate of Designation . IN WITN E SS W HEREOF, the Company has cau se d this "Ce rtificate of Designation s of Focus Universal Inc . Establishing the Des i gnations, Preferences, Limitations a nd Relative Rights of its Seri es A Preferr e d Stock" to b e du l y executed b y its Chief Exe cutive Officer on October 20 , 2025 . F OCUS UNIVERSAL INC . Dr . Desheng Wang Chief Executive Officer

Exhibit 3.2

Business Number E0618822012 - 2 Filed in the Office of Filing Number 20255253183 Secretary of State State Of Nevada Filed On 10/20/2025 3:10:00 PM Number of Pages 29 1 03 ,o 20 pm 10 - 20 - 202s I 4 I To : NV SOS Page : 04 of 31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID . 636B7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From ; G il bert Bradshav CERTIFICATE OF O F:S I GNAT I ONS , PREFERF. CF:S AND RIGHTS OF THE SERIES B CO VERTIDLE PREFERRED STOCK OF FOCUS UNIVERSAL INC. PURSUANT TO RS 78 . 1955 OF TH E NEVADA REVISED STATUTES The under s igt1 ed. De s h eng Wang. th e Chief Executive Officer of Focus Universal Jn c. (the " Co rpo rotio n " ') . a Nevada corporation, hereby doe s certify : Th ar pursuant 10 the authority expressly conferred upon the Board of Directors of the Corporat i on (Lilt : " Board of Directors") by th e Co rporatiu 11 ·s Arti 1 .: lt : s of lo co q ,oratiuu, as aint : n<le<l (the - ' - Ar ticl es of Incorpor at ion ''), the Board of Directors on October 15 , 2025 , adopted the following resolution determining it desirable a nd in the best int erests of the Corporation and its shareholders for the Corporation to creote a series of 15 , 000 s h ares of preferred stoc k designated as "Series B Convert ibl e Preferred Stock : · (each , a · ' Se rie s B S hare ", or co llectiv e l y, the " Series B S h ares '·) RE S OLV E D . that the Board of Directors designates the Series B Convertible Pr eferred Stock and th e number of sha r es constituting s uch s erie s, and fixe s the ri ghts, powers , pr eferences, privileges and restrictions relatin g to suc h se r ies in addi ti on to a ny set forth in the A 1 1 ic l es or I ncorporation as follow s : TERMS OF SERI.ESB CONVERTIBLE PREFERRED STOCK I. Certain Defined Terms. Por purposes of thi s Certificate of Designation. the following t erms shall have the following meanings: (a) " 1 934 Act'" means the Secur iti es Exchange Act of 1934 , as amended, and tJ 1 e rules and regulations thereunder . (b) " 19 .99% Ownership Limitation .. shall ha ve the meaning given to it in Sec1io n 5 hereto. (c) ·' A ffi l i ate· ' means . with respect t o any Person , any other Person that directly or indirectly controls, is controlled by, o r is under common control with, such Person , it be in g understood for purposes o f this detinition that ··control"' of a Per son mean s the p ower directly or indirectly eit h er to vote I 0 % or rnore of the stock having ordinary vo tin g pow e r for the e le c ti on of directors of such Person or direct or cause the direction of the management and policies of s u ch Per on whether hy contract or otherwise . (d) '' A uthori ze d Failure Shares" sha ll have th e meanin g g i ven to it in Section 1 2 hereto. (e) hereto. (f) " Authori zed Share A llocati o n " shall have th e meaning given to it in Sect i o n 12 ·'A uth orized Share fail ur e '· shn ll have the meani n g given to it in Section 12 hereto. (g) -- Busi11ess Da y" means any day except a11y Saturday, any Sunday.

any day which is a federal legal holiday in the U n ited States or any day on which banking institutions in th e State I 03 : 10 20p m 10 - 20 - 202S I S ! To : NV SOS Page : 05 of 31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID. 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradshav of New York are authorized or required by law or o t her gove mm e nt a l action to close. (h) · ' Bu y - In Pric e.. s hall have the meaning given to it in Section 5 hereto. (i) ··ce rtificat e of Designation '' means this Certificate of Designations, P references and Right s of the Series B Convertib le Pref erred Stock of the Corporation . U) " Closing Sale Price ' · means , for any sec urity on any Trading Day , (i) the offic i a l closing pric e for suc h secu r ity on the P r in cipal Market, as r epo rt ed b y Blo omberg or, if n o t ava ilabl e, as reported by OTC Markets Group I nc . (or any successor) . o r (ii) if no such trade price is available for that Trad ing Day, the fair market va lue of such secur ity as determ i ned in good faith by the Board of Directors of the Corporation . (k) ·'Co mmon Stock ' ' means (i) the Corpo r ation ' s s har es of common stock, $ 0 . 001 par va lue per share, and (ii) any cap it a l stock in to wh i ch suc h common stock sha ll have been changed or any s hare capital resulting from a r ec l assi tication of such common stock . (I) "Co mmon Stock E qui v al e nts .. means any securit i es of the Company or the Suhsiclia ri es which would entitle the hokier thereof to acqui r e Common S t ock at ilny r . ime , including, wit hout l imi t at i on, any debt, pr eferred s t ock, ri g ht . opt i on, warrant or other instTUment that is at any time convertible into or exercisable or exchangeable for , or otherwise ent it les the holder thereof to receive , Common Stock . (m) "Conve r s ion Amount " slrn ll have the meaning given to it in Section 5 hereto . (n) " Conversion Date .. s hall have the meaning g i ve n to it in Section 5 hereto. (o) " Co nversion Failure· ' shall ha ve th e meaning given to it in Section 5 hereto. (p) "C onversion Notice .. sha ll have the rneauing g i veu toil in Section 5 hereto. (q} ' ' Co n vers ion Price " sha ll have the meaning given to it in Sect i on 5 hereto. (r) ·'C onv ers ion R ate'· s hall have the mean in g given to it in Section 5 hereto . (s) ' 'C onv erti ble Sec uriti es' ' m eans any stoc k or other security (othe r than Options) that i s at any time and under any circumstances, direct l y or indirectly, convertib l e int o, exercisab l e or excha n geable for . or which othenvise en titles the holder thereof t o acquire , any shares of Commo n Stock . "C orporate Eve nf ' shal l have the meaning given to i i in Sect ion 7 hereto. "'Co rpo ration " sha ll h ave the meaning given to it in the preamble hereto. " Disput e S ubmission D e adlin e" sha ll have th e meaning given to i t in Section 22 (t) (u) (v) hereto . (w) (x) " Distributions " s h a ll have the meaning given to il in Section 14 hereto. " DT C' s h a ll have the meaning given to it in Section 5 hereto. 2 1 03 ,o 20 p . m 1 0 - 20 - 2025 I 6 I To: NV SOS Page : 06 of 31 2025 - 10 - 20 22 : 10:34 GMT Docusign Envelope ID . 63BB7822 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradshav (y) ' 'Excess Shares .. s h all have th e meaning give n to it in Section 5 hereto . (z) '' Floor Price " means 20 % of the Nasdaq minimum price . as s uch tennis defined by the rules of the Nasdaq Stock Market (Rule 5635 (d)( I )(A)) . subject t o proportional adjustment for any s tock s p l its, dividend s , combinations , r ecapita li zat ions , or similar events (o r s uch lower amount as p e rmitt ed , from time to time, by th e Principal M a r ket , subject 10 downward adjustments for share sp l its . share dividends , s hare co mbinations , recapitalizations or other s imil ar eve nts (fo r the avoidance of doubt . s hare splits . s hare dividends . share combinations, recapitalizations or other s imil ar events s h all not cause an adjustment to increa se the floor price) . (aa) " Fundamenta] Transaction" shall have the meaning given to it in Section 7 . (bb) "Holder"' or "Holders·· mean s a holder of Series B S h ares. (cc) Holder hereof. " Initi a l Issuance Date " m eans th e date the first s hare of Se rie s B is i ss ued to any (dd) ''Junior S to ck " shall have the meanin g given to it in Sectjon 3 hereto. (ee) '' Liquidation Event" mean s , whether in a s in gle transaction or series of transactions, the voluntary or in vo luntary liquidation, dis so l ution or winding up of the Corporation o r s u< .: h Subsiuiarics th< .: assets ufwbich < .: onslilutc : all or s ubslanlially all urlhe assets of the business of the Corporation and it s Subsidiaries, taken as a whole . (ff) "Liquidation .Fu nds " shall have the meaning given to it m Section J 3 hereto. (gg) " Max i mum Percentage " s hall have th e meaning given to it in Section 5 hereto. (hh) "NRS" means Nevada Revised Statutes . (ii) · ' Options '' means any rights, warrants o r options to s ub scribe for or pur c has e s hare s of Common Srock or Conve 11 ible Securities . (jj) " . Parity Stock'" shall have the meaning given t o it in Section 3 heret o . (kk) "Person" means an indi vidua l , a l im it e d liability company, a partner s hip , a joint vent ure , a corporation . a rru st, an unincorporated organization, any other entity or a government or any department or agency thereof . (II) " Principal Market " means the primary market on which the Common Stock is then listed or quoted for trading , including, without limitation , The New York Stock Exchange . tbe NYSE American . the Nasdaq Global Select Market , the Nasdaq Global Market , the Nasdaq Capital Market , OTCPink . OTCQR or OTCQX and any successor markets th ereto . (mm ) ·'Purchase Rights ' · s hall have the meaning given to it in Sect . ion 7 hereto . (nn) ' · Register " shall have the meaning given to it in Section 5 her e to .

o3 : w20 p . m . ,o - 20 - 202s I 1 I 4 To : NV SOS Page : 07 of 31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID . 63BB7B22 • 7C12•4B93 - 9DC7 - - 474F0F38SEE3 (oo) " R eg ist e red Series B " s hall ha ve the meaning given ro it in Sect i on 5 h ereto. (pp) " R e ported Outstanding Share Number" shall have the . meaning given to it in Section 5 hereto. {qq) '' R e quired Dispute Do c um e ntatio n " sha ll have tJ1e meaning given to it in Section 22 hereto . (rr) hereto. From : Gilbert Bradsha � " R e quir e d Reserve Amounf· s haU have the meaning given to it in Section 12 (ss) • ' SEC ' means th e Securities and Exchange Commission or the successor theret o. (tt) " Sec uriti es Purchase Agreements" mean s those ce r tain Securities P UTchas e Agreements by and among the Corporation and the holders of Series B , effective as of the Initial I ss uance Date , as may be amended from time in accordance with the tenns thereof . (uu) " Sc ri � s 8 ' " shall have Lht: meaning givt:n tu it in S � <.:Liun 2 ht:rt:L � >. (vv) preamble. · · ser i es 8 S ha r e ' ' o r Se r i e s B S hare s " sha ll ha ve the meaning give n to it in the (ww) " Se ri e s B Ce rtifi c at es " shall have t he mt:a11i n g given tu it i n St:cliun 5 h t:n:tu. (xx) "S h a r e Delivery Deadline·· s hall have the meaning given to it in Section 5 hereto . (yy) " S ha re h o l d e r Approval" means s uch approval as i s r equired by the appl i cable rules and regulations of the Nasdaq Stack Market (or any successor entity) from the shareholde r s of the Company wi t h respect to the issuance of a ll of the s hares o f Common Stock issuable or potentially issuable in the futur e upon conversion of the Series B . (zz) "St ated Va l u e'· s hall mean $ 1 , 000 per s hare of Ser i es B , subject to adju s tment for stock s plits , stock dividend s, recapi 1 al ization s, reorganizations, reclassification s, combinations, suhdivisions or othe r simi l ar events occurring after the Initial I ssuance Dat e with respect to the Serit : s D (including any adjustment for a T r iggering Event} . (aaa) ' ' S ub s idiar y" when used w i th respect to any Per so n , m eans any corporation or other organization, whether incorporated or unincorporated . of which (A}at least a majority of the securit i es or other interests havin g by their terms ord i nary vot i n g power to elect a majority of the board of dire ctors or others performing similar functio n s with respect to such corporation o r othe r organ i zat i on i s direc t ly or indirectly owned or co n trolled by such Person (through ownership of sec urit i es, by contrac t or otherwise) or ( 8 ) such P erson or any s ub s idiary of s uch Person i s a ge n era l partner of any ge n eral pa 11 ner s h i p or a manager of any limited liability company . (bbb) " Tra din g Day .. mean s any day on which the Co mmon Stock i s eligible to be traded on the Principal Market o r sec urities market on which the Common Stock is then traded .

(ccc) ··T r a n s a c tion Documents" means the Securities Purchase Agreements and th i s Certificate of D esigna tion , and each of the other agreements and instnuuents entered into or delivered by Lhe Corporation in co 1111 ection with the transactions contemplated by t h e Securities I 03 , 10 : 2op . m ,o . - 20 - 202s I s I 5 To : NV SOS Page:08 of31 2025 - 1 0 - 20 22 : 10 : 34 GMT Docusign Envelope ID . 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradsha � Pur chase Agreements, all as may be amended from time to rime in accordance wi th the terms thereof. (ddd) ' 'Tra n sfer Age n t '· means Vstock Transfer . (eee) ·'T riggering Eve nt " sha ll have the meaning give n t o it in Section 6 hereto. (fff) " T ri gge ,;ng Event Conversion Pric e " s hall have the meaning given to it in Section 6 hereto. 2. Designation and Number of Shares . There shall hereby be created and estab li s hed a series of preferred s tock of th e Co rp orntion d es ignated as "Series B Convertible PrefeiT e d Stock"' (the ··Ser ie s B" ') . Th e a ulh urizeu numbc : r of Series B shares s hall be 15 , 000 ) sharc : s . Eat : 11 sliare uf Series B sha ll ha vt : a par va lu e of $ 0 . 00 I and Stated Value equal to $ 1 , 000 . subject to adjustme nt as set forth herein . 3. Ranking . The Ser i es B shall rank (i) senior r . o all of the Common Stock ; (ii) se nior to any cla< ; s or se ries of carital stock of th e C : orro r ation hereaft er created s pecifi cally rankin g hy its terms junio r to any Ser i es B (' ' . Jun i or Sec uriti es ' ') ; a nd (iii) with any c l ass or se ries of cap ital stoc k of the Corpora ti on expressly designated (with Series B Holder approval as required by Section I 5 (a)) to rank on parity with the Series B (" Pari ty Sec uritie s'" ) . Subject to any superior liquidation rights of the hold e r s of any Senior Seculities of the Corporation and the rigbrs of the Corpo r ation·s existing and futw·e creditors . upon any liquidation , dissolution or winding - up of the Corpo r ation, whether voluntary or involuntary (a '' Liquidation "') , each I I older shall be ent itl ed to be p aid o ut of the assets of the Corporation legally available for distribution to stockholders, prior and in preference to any di s tribution of any of t be assets or s urplus funds of the Corpora ti on to the holder s of th e Common Stock and Junior Secur iti es and pari pass 11 wit h any distribution to the holders of Parity Secu riti es, an amount equal to the Stated Value tor each share of Series B h e ld by suc h H olde r and a n amount equal ro any accmed and unpaid dividend s thereon , and th e r eafte r the Holders shall be ent i tled to r eceive out of the assets, whether capital or sw - plus, of t h e Corporation th e sa me amount that a holder of Common Stock woul d receive if the Series B were fu l ly converted (disregarding for s uch purpo ses any conversion limitation s hereunder) to Common Stock w hi ch amounts s hall be paid pari passu with all ho l der s of Co mmon Stock . Th e Co rporation shall mail w ritt en notice of any suc h Liquidation , not Jes s than s ixty ( 60 ) days prior to the paym e nt date s tated there i n . to eac h H older . 4. Dividends and Conversio n . (a) [Reserved] (b) Participating Di videntls . If the Corpora t ion, al any Lime whilt : any sh are s or Series B are outstanding . pays a d i vidend or distribution (o ther than one payable in shares of Common Stock or in Common S to c k Equivalents) on shares ofConm 10 n Stock, Holder s as of the record dat e for s uch dividend or di str ibution on Common Stock s hall b e entitled to recei ve at th e sa me lime as s u ch payment o n Common Stock, and the Corporation shall pay , a dividend or distribution on each share of Series B equal to th e per - share amow 1 t of the divide nd or di stribution on Commo n Stock multiplied by the trnn 1 ber of s hares of Co mmon Stock into which s uch s hare of Series B was (on s uch record date) convert i ble {without regard to any limitation s on conversion . including without limitation t h e Beneficial Ownership Limitation) . Such di v idend or distribution on Series B shall be paid in th e s ame form as the dividend o r distribution on Common Stock . The Ser i es B s hall not otherwise have any right s to dividends .

The fair market va l ue of any dividend or distribution to which a share of Series B has become entitled pursuant to this Sec tion 4 (b) but which has not yet been paid sha ll , until such dividend o r distribution has been paid on s uch share of Series 13 , be I 03 : 10 20 p . m 10 - 20 - 202s I 9 1 6 To : NV SOS Page: 09 of 31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID . 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 added to the Stated Value of such share of Series B . 5. Conversion . Each share of Series B shall be convel 1 ibl e immediately upon issuance . at tl 1 e option of the Holder, at any time and from time to time . into validly issued, fully paid and non - assessable shares of Common Stock in accordance with this Section 5 ; provided, however, that unless and until the Corporation obtains Stockholder Approval, t 11 e Holder shall not be entitled to convert a n y shares of Series B to the extent that , after giving effect 10 such conversion, the H o ld e r (together with its affiliates and any other persons whose beneficial ownership would be aggregated for purposes of Nasdaq Listing Rule 5635 (d)or any similar rule of any other Principal Market on which the Common Stock js then listed or quoted fortrading) would beneficially own in excess of 19 . 99 % of the outstanding shares of Common Stock (t h e " 19 . 99 % Ownership Limitation .. ) . (a) H older ' s Conversion Right. Subject to the provisions of Section S(d) and if Shareholder Approval is required by the rules and regulations of the PriJ1cipal Trading Market, following receipt uf such Shareholder Approval , al any tin1e ur limes on or afler the Initia l lssuam;e Date, each Holder shall be ent itl ed to conve11 a n y portion of the outstanding Series B held by such Holder into validly issued, fully paid and non - assessable s har es of Common Stock in accordance with Section S(c) at the Conversion Rate. The Corporation s h a ll not issue any fraction of a share of Common Stock upon any co n ve r s i on. Jr lhe issuance would result in the issuance of a fraction of a share of Common Slol:k., the Corporation shall, in its suit: disaelion , round such frat.:Liun ofa share of Common Stock up to the nearest whole share or pay to the Holder a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion Price. The Corporation shall pay any and all transfer , stamp, issuance and simtlar taxes, costs and expenses (including fees and expenses of the Transfer Agent that may be payable with respect to the issuance and delivery of Common Stock upon co n ve r s i o n of any Conversion Amount; provided that the Corporation shall not he required to pay any tax !'hat may be payable in re.<;pect of any transfer in volved in the issuance and delivery of any such conversion shares upon conversion in a name other than that of the H o ld e r or such shares of Series B and the Corpora ti on sha ll nol be required to issue or deliver such conversion shares to such transferee unless or until the Person or Persons requesting the issuance thereof s h a ll have paid to the Corporation the amoum of such tax or s hall have established to the satisfaction of the Corporation that such tax ha s been paid . (b) Conv � rniQn R � . The number of shares of Common Stock issuable upon co n ve r sio n of any share of Series B pursuant to Section 5(a) shall be determined by dividing (x) the Conversion Amount of such share of Series B by (y) the Conversion Price (the ··conversion Rat e .. ) ; (i) " Conversio n Amount'' means . with respect t o eac h share of Series B . as of the applicable <late of determination, the sum of the Stated Value at issue . (ii) " Conversion Price " means, with respect to each share of Series B, as of any Conversion Date or other date of determination . 85 % of the lowest daily vo lum e weighted average price of the Common Stock for any of the ten ( 10 ) Trading Days immediately prior to the s ubje c t Conversion Date or other date of determination, subject to adjustment os provided herein, but in no event shall the Conversion Price be less than the Floor Price . (c) Mechanics of Conversiou. Th e conversion of each share of Series B shall be conducted in the following manner: (i) ( 1) Optional Conversion.

To convert a share of Series B into shares of From : Gilbert Bradsha � I o3 · 10 . 2op m 10 - 20 - 202s I ,o I To : NVSOS Page : 10of31 2025 - 10 - 2022 : 10 : 34GMT Docusign Envelope ID . 638B7B22•7C12 - 4B93 - 9DC7 - 474F0F385EE3 7 From : Gilbert Bradsha11 Common Stock at any tim e and from time to time from and after the Initial I ssuance Date (a "Co nv e rsi o n D ate'') , a H older shall deliver . via electron i c mail or otherwise , fo r receipt o n or prior to 11 :59 p.m. , Eastern time , on such date, a copy of an executed notice of conve r sion of the sha r e(s) of Series B subject to such conve r sion in the form attached hereto as Ex hibit I (the " Conversion Notice ' ') to the Corpora ti on . If required by Section 5( c)(iii), within three Trading Days following a conversion of any suc h Ser i es B as aforesaid, such Holder shall surrender to a nationally r ecogn i zed overnight delivery se r vice for d e livery to the Corporation the original certificates representing the Series B ( th e · ' Series 8 Ce rtific ates") so converted as aforesaid (or an indemnification undertaking with respect to th e Series B in the case of its l oss, theft or de s truction as contemplated by Sect i on 1 6). On o r before the first Trading Day follow in g the date of receipt of a Conversion No ti ce, the Corporation shall transmit by electro nic mail an ack no w l edgment of confinnation. in the form attached h e reto as Ex hibit IL of receipt of such Conven,iou Nolit:e Lu s ud1 H okie r anti the Curpuratiun ' s Transfer Agent, whid1 cunfinnaLion sha ll constitute an instruction to the Transfer Agent to process such Conve r s ion Notice in acco rdan ce with the te rm s herein. On or before the second Trncling Day following the date of receipt of a Conversion Notice (or s u ch earlier date as required pursuant to the I 934 Ac t o r o ther applicable la w, rule, or regulation, inclu<ling the rule s of the Principal Market or other customary appli<.:able polit:y fort.he si::ttlt:ment ora lrade initialeu on lhe applit:abk Conversion Date of suc h shares of Common Stock issuable pursuant to such Co n version Notice ) (the "S har e Delivery Deadline "), the Co rp orut ion s hall ( I) provided that the Transfer Agent is participating in The Depository Trust Corporation 's ("' OTC '" ) Fast Automated Securities Transfer Program , credit such aggrega t e numb er of shares of Common Stock to w hi ch such Holder sha ll be e ntitled to such Holder 's or its designee·s balance account wilh DTC through its Deposit / Withdrawal at Custodian system. or (2) if the Transfer Agent is not participating in the DTC Fast Automated Securities Transfer Pr ogram, issue and deliver ( via reputable overnight co uri er) to th e address as specified in suc h Conve r sio n Notice, a certificate, registered in t he name of s uch H older or i ts designee , for the number of shares of Common Stock to whic h s u ch H older sha ll be emitled . J f the number of Series B represented by th e Series B Certificate(s) suhmi11ed for conversion pursuant 10 Sect i on S(c)(i) is greater than the number of Series D being converted , then the Corporation shall , as soon as practicable and i n no event later than two Tradin g Oa ys after receipt of the Series 13 Certificate(s) and at its own expense, i ss ue an<l deliver to s uch H older (or its de s ignee) a new Series B Certificate (in accordance with Sec1ion 1 6( d )) represeming the number of Se ri es B not convened. Th e Person or Persons entit l ed to receive the shares of Common Stock issuahle upon a conversion of Ser i es B s h all be treated for all purposes as the r ecord holder or holders of such s hares of Common Stock on the Conversion Date. (ii) Corporatio n 's Failure ro Timely Convert . lfth e Corporation shall fail, for a n y reason or for no rea so n , on or prior to 1 he llpplicable Share D el i very n eadline , to i ss u e t n such H older a certificate for the number of shares of Couunon Stock to wh i ch s u c h Holder is entitled and register such s hares of Com mon Stock on the Corporation's s har e register or to credit s uch H older ' s or it s designee 's balance account with OTC fo r s uch numb er of s hares of Common Stock to which suc h Holder i s entit l ed upon such Holder·s conver s ion of any Conversion Amount (as the case may be) (a "C( mversion Failure " ) . then , in addition to all other remedies available to sucb H o ld er . (X) the Corporatio n shaJ I pay in cash, as pa 1 tial li quid ated damages and not as a p enalty . to suc h Holder on each day after the S h are D e liv ery Deadline a nd during s uch Convers i on Fai .

lur e an amount equal to J 20 % of the product of (A) the s um of the number of shares of Common Srock not issued to such Holder o n o r prior to the Share Delivery Deadline and t o which such Holder i s entitled , multiplied by (B) the c lo sing price of 1 h e Common Slock on th e applicable Conversion Date and ending on the applicab l e Share Del ivery Deadline, and (Y) such Holder , upon written notic e to the Corporation, may ! 03 : 1D : 2Dp . m 10 - 20 - 2025 I 11 ! To : NV SOS Page : 11 of31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID . 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradsha � void its Co nversion Notice with respect to , and retain or have returned, as rhe case may be. all. or any portion. of s 11 cb Series 8 that ha s not been co nverted p11rswmt to s u ch C onve r sion Notice; provided that the voiding of a Conversion Notice sha ll not affect the Corporation's obligarions to make any payments which have accrued prior to th e date of suc h notice pursuant to thi s Section S(c)(ii) or otherwise. In addition to the foregoing, if on or prior to the Share Delivery Deadline the Transfer Agent is not participating in the OTC Fast Automated Securities Tran s fer Program , the Corporation s h all fail to issue and deli ve r to suc h Holder (or its designee) a cert ificate and register such s har es of Common Stock on the Corporation ' s share register or. if the Transfer Agent is pa11icipating in the OTC Fast Automated Securities Transfer Program. the Transfer / \ gent s hall fail t o credit the balance account of s uch Holder or such Holder's d es ignee with OTC for the number of s h ares of Co mmon Stock to which suc h Holder is e ntitl ed upon such Holder·s exercise h ereun d e r or pursuant to the Cor p oration ' s obligation pursuant lu claust: (II) bdow and if uu or after such Share Delivery Dea<lline s ud1 Hokier purchases (in an open market transaction or otherwise) sha res of Common Stock to d el iver in satisfaction of a s ale by s uch Holder of nil or any portion of the number of s hare s of Common Stock, or a sa le of a nwnber of shares of Co m mon Srock equal to all or any p ort ion of the number of shares of Common Stock , is s u able upon such conversion that s u c h Holder so i s entitle<.! to ret:ei vt: from the Corporation, then , inaddition Lu all olht:r rt:medit:s available to s u t:h Holder, the Corporation shall. withfo two) Trading Days after receipt of suc h H olde r ' s request and in su ch Holder 's discretion, either: (I) puy ca s h to s uch H older in an amount equal to s uch Holder" s total purchas e pr i ce (including brokerage coinmissions and other out - of - pocket expe n ses . if any) for the s hares of Common Stock so r,urcha sed (inclucling by any other Person in r es pect , or on behalf, of suc h Holder) (the · ' Buy - Jn Pric e "). at which point the Corporarion ·s obligation to so i ssu e and deliver such certificate o r cre dit s uch Holder 's balance account with OTC for the number of s har es of Co mmon Stock to which s uch Holder is e nti t l ed upon s u ch Hold er ' s conversion her e u nder (a s the case may be) (and to issue such shares of Co mmon Stock ) s hall tenninate , or ( II ) promptly honor it s obligation to so issue and deli ve r to such Holder a certificate or ce rtificate s repre se nting such s hares of Common Stock or credit s uch Holder 's balance account with OTC for th e numher of s har es of Common Stock t.o which s uch llolder i s entitled upon s uch lloldcr's conversion hereunder (as the case may be) and pay cash to s u ch Holder in an amoun t equal to the excess (if any) of the Huy - In Price over the product of (x) s uch number of shares of Common Stock to w h ich such Holder is entitled multiplied by (y) the lowest Closing Sale Pri ce of th e Common Stock on any Trading Day during the period co mmen c in g on the date of the ar, plicahle Conversion Notice and endi n g on th e date of such issuance and payment under thi s clause (ii). (iii) Regi st ration ; Book - E ntry . The Corporation shall maintain a register (the " R egiste r ") for the recordation of the names and addresses of the Holders of each s hare of Series B and the Stated V :: i lue of the Series R (the " R eg ister e d Series R ") . Th e e ntri es in th e Regi s t e r sha ll be co n c lu s i ve and bindiJ 1 g for all purpo ses absent manifest error . The Corporation and each Holder of the Series B s hall treat each Person whose name is recorded in the R eg i ste r as the owner of a share of Series B for nil purposes (including th e right to receive payments and dividend s hereunder) notwith s tanding notice to the comra 1 y . A registered share of Series B may be assigned, transf e rred or so ld only by reg is tration of s uch assignmen t or sa le oo the Register . Upon its receipt of a written request to assign, tran sfer or se ll one or more Regi ste red Se r ies B by s u ch H o ld er thereof . the Co rporati o n s hall rec o rd the information contnined therein in the Regi ste r nnd i ss ue one or more ne w shnres of Series B in the sa m e aggregate Stated Va l ue as the Stated Value of the surrendered Series B to the de s ignated assignee or transferee pursuant to Section J 7 .

pro v id e d that if the Corporation doe s not so record an assignment, transfer or sa le (as the case ma y b e) of such Series B shares within t wo Trading Days of such a r equest then the Register shall be automaticaUy deemed updated to I 03 . 10 : 20 pm . 10 - 20 - 202S ! 12 I 9 To: NV SOS Page : 12 of 31 2025 - 10 - 20 22:10 : 34 GMT Docusign Envelope ID . 63887822 - 7C12 - 4893 - 9DC7 - 474F0F385EE3 From : Gilbert Bradsha � reflect such assigmnent, transfer or sa l e (as the case may be) . Not \ . vithstanding anything to the contrnry set forth in this Section , following conversion of any Series B in accordance with the teims hereof, the applicable II older shall not be required to physically sun - ende r such Series B Certificate to the Corporation unless (A) t · h e full or remaining number of Series 8 shares represented by the applicable Series B Certificate are being converted (in which event such certificate(s) shall be delivered to the Corporation as contemplated by this Section 5 (c)(iii)) or (B) such Holder has provided the Corporation with prior written notice (wh i ch notice may be included in a Conversion Notice) requesting reissuance of Series B upon physical suiTender of the applicable Series 8 Certificate . Each Holder and the Corporation shall maintain records showing the Stated Value ood dividends converted and/or paid (as the case may be) and the dates of such conversions and / or payments tas the case may be) or shall use suc h other m e thod , reasonably satisfactory to suc h Holder and the Corporation, so as nor to require physical surrem . ler of a Serit : s B C 1 :: r 1 ificate upu 11 cunvt : rsiuu . If l h e Corporation does nut update the Register to record sucb Stated Value and dividends converted and/or paid (as the case may be) and lhe dates of such conversions and / or payments (as the case may be) within two Trading Days of s u c h occurrence, then the R egiste r shall be automatically deemed updated to reflect such occu 1 Tence . 1 n the event of any dispute or discrepancy, such records of suc h Holder es t ablishing lht : number of Series B to which the n : 1 .: onl hokier is entitlt : d shall be 1 .: unlrolling and determinative in the absence of manifest error . A Holder and any transferee or assignee, by acceptance of a certificate, acknowledge and agree that, by reason of the provisions of this paragraph , following conversion of any Series B, the number of Series B represented by such certificate may be less than the number of Series B stated on the face thereof . Each Series B Certificate shall bear the following legend : ANY TRANSFEREE OR ASSIGNEE OF THJS CERTIFICATE SHOULD CARE F ULLY REVIEW THE TERMS OF THE CORPORATION'S CE RT IFlCATE OF DESIGNATIONS RELATING TO TH £ SHARES OF SERIES B CONVERTIBLE PREFERRED STOCK REPRESENTED BY THIS CER Tlfl CATE . TJIG NUM 0 ER or - SIJARES or - SERIES I 3 CONVERTll 3 LE PR . crbRRED STOCK R . EPRl ::: SENTJ ::: D BY THIS CERTIFICATE MAY BE LESS THAN THE NUMBER OF SHARES OF SERIES B CONVERTIBLE PREFERRED STOCK STATED ON THF . FACE HF . RF . OF (iv) Pro Raia Conversion : Disputes . In the event that the Corporation receives a Conversion Notice from more than one 1 : - - lolder for the same Conversion Date and the Corporation can co n ve rt some, but not all, of such Series B submined for conversion, the Corporation shall converr· from each Holder e l ecting to have Series R converted on such date a pro rata amount of such H older ' s Series B submitted for conversion on such date based on the number of Se 1 ies B submitted for conversion on such date by such Holder relative to the aggregate number of Series B submitted for conversion on s u ch date . ln the event of a dispute as to the number of shares of Common Stock issuable to a Holder in connection with a conversion of Series B , the Corporation shall issue to such Holder the number of shares of Common Stock not in dispute and resolve such dispute in accordance with Section 22 . (d) Limitation on Beneficial Ownership .

The Corporation s hall not effect the conversion of any of the Series B held by a H older , and such Holder shall not have the right to convert any of the Series B held by such Holder pursuant to the terms and condit i ons of this Ce 1 tificate of Designation and any such conversion shall be uull and void and treated as if never made , to th e extent that after giving effect to such conversion, such Holder (together with s u ch I 03 : 10 . 2op m . 10 - 20 - 202s I n I 10 To : NV SOS Page : 13 of 31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Envelope ID. 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F365EE3 From : Gilbert Bradshav Hold er·s Affiliates) would beneficially own in excess of 4 . 99 % (the ··Maxim um Percentage '') of the sha r es of Common Stoc k outstandi n g immediately after g i ving effec t to such co n vers i on (which provision may be increased to a maximum of 9 . 99 % by suc h H o ld er by wrirten notice from . s u ch H o ld er to the Corporation, which notice s h all be effective 61 calendar days after the date of such notice) . For purposes of the foregoing sentence, the aggregate number of s har es o f Com m on Stock beneficially owned by such H older sha ll include the number of s hare s of Co mm on Stock h e ld by such Holder plus th e numb e r of shares of Common Stock issuable upon convers i on of the Series B with respect t o which th e detennination of such sente n ce is being made, but sha ll exclude shares of Common Stock which would be issuable upon (A) conversion of the remain in g, nonconve 1 ted Series B beneficially owned by suc h Holder and (B) exercise or co n version of the unexerci se d or nonconverted portion of any other securities of the Corporation (including a n y Convertib l e Secu 1 ities and Options) beneficially owned by such H older subject to a limitation on conversion or exercis 1 : analogous Lo tb � limit at i on wnla im : d in this Se 1 .: Liou 5 (u) . Fur pmposes of this Sect i on S(d), beneficial ownership shall be calcu l ated in accordance with Section 13 ( d) of the I 934 Act and the rules t h e(eunder . F or purpose s of determining the numb er of outstan din g shares of Co mm on Stock a Hold er may acqu ir e upon the conversion of suc h Series B without exceed in g the Maximum Percentage , such H older may rely on the number of outstanding shares of Common Stock as rt : Ot : cle<l in (x . ) th � Cor p oratioo·s most n :: 1 .: enl Annual R epon on Funn 1 0 - K , Quarterly R eport on Form I 0 - Q , C urrent Report on Form 8 - K or other pub l ic filing with the SEC, as the case m ay b e, (y) a more recent public announcement by the Corporation or (z) any other written notice by the Corpo r ation or the Transfer Agen t , if a n y, setting forth the number of shares of Common Stock outs t anding (the " Reported Outstanding S h are N umber "). Notw i thstanding the preceding , the H o ld er may r ely on the Transfer Agent·s records if the Reported Oursranding Share Nw1 1b er is different than what the Cor p oration rep orts. I f the Corpora ti on r eceives a Convers i on Notice from a H older at a time when the actual number of o ut sta ndin g s h ares of Common Stock is le ss than the Reported Outstanding Share N umb e r , the Co rpora tion shall notify such H ol der in writing of the number of shares of Co mm on Stock then outsta ndin g and. to the extent that such Conve r s i on Notice wou ld ot h e1wise cause suc h H older·s beneficial ownership, as derermined pursuant to this Section 5(d), to exceed the Maximum P ercentage, s u ch Holder must notify the Co rporation of a r e duced number of shares of Commo n Stock to be purchased pursuant to such Conve r sion Notice. for any reason at a n y time , upon the w rit ten or oral reque st of any H ol d er, the Corporation shall wit hin one Trading Day confirm o raJl y and in writing or by electronic mail to such H older the number of shares of Common Stock t h en outstanding. ln any case, the number of outstanding s hares of Common Stock sha ll he d eter mined after giving effect to the convers i on or exe rcise of securities of the Corpo rati on, including s u ch Series B, by such H o ld er since the date as of whic h the Reported Outstand ing S har e Number was r eported. In the event that the issuance of shares of Common Stock to a H o ld er upon conve r s ion of s uch Series B result s in s uch H older being deemed l o beneficially own, in the aggrega t e, more than the Maximum Percentage of the number of outsta ndin g shares of Common Stock (as determined under Section I 3(d) of the 1934 Act) , lh e number of shares so i ssued by which such Hold er ' s beneficial ownership exceeds the Maximum P ercentage (the " Excess S har es ") shall be deemed null and vo id and sha ll be ca ncelled ab initio, and such Holder shal l not ha ve the power to vote or to transfer tbe Excess Shares. For purpo ses of clarity, the shares of Common Stock issuable to a Holder pmsuant to the terms of thi s Ce rtificat e of Designation in excess of the Maximum P ercentage sha ll not be deemed to be benefic i ally owned by suc h Holder for any purpose including for p urpo ses of Section 1 3(d) or Ruic I 6a - J (a) ( I) of the I 934 Act. No prior inability t o convert such Serie s B pursuant to this pa ragraph s hall have any effect on the appl i cabili t y of the provi s ion s of th is paragraph with respect t o any subsequent determination of convertibi lit y.

The provisions of this paragraph shal l be co n strued and imp l emented in a manner otherwise than in s tri ct confor mit y wi th the term s of this Sect i on S(d) to th e extent nec ess ary to correct this paragraph ( or a n y portion of !h i s p aragraph) which may be defective or inconsistent wit h the intend e d b eneficial ow n ership l imitation contained in this Section S(d) or to make changes 03 10 : 20 p . m . l 0 - 20 - 2025 I 14 I To : NV SOS Page : 14 of31 2025 - 10 - 20 22 : 10 : 34 GMT Docusign Enveloµe ID . 63BB7822 - 7C12 - 4893 - 9DC7 - 474FOF385EE3 From : Gilbert Bradshav or supplements necessary or desirable to properly give effect to such limitation . The provisions of this Section S(d) shall be of no further force or effect if tbe Holder participates in a subsequent transaction with the Corporation which results in the Holder beneficially owning in excess of 4 . 99 ¾ of the number of shares of the Common Stock outstanding which shall include securities co n ve rt i bl e into Common Stock which do not contain a beneficial ownership limitation . To ensure compliance with this restriction, each Holder wiJI be deemed to represent to the Corporation each time it delivers a Conversion Notice that such Conversion Notice has not violated the restrictions set forth i n this Section 5 (d) and the Corporation shaJI h a ve no obligation t . o verify or confim 1 the accuracy of such determ i n at i o n . The limitations contained in this Section 5 (d) s hall apply to a successor holder of Series 8 . (e) Triggering Event C onv e r sion . Subject to Section S(d), at any time during the periu<l commern ; i ng on the date of Lite 01 .: cwTen 1 .: e of a Triggering Event amt en<ling on the date of the cure of such Triggering Event, a Holder may . at such Holder 's option . by delivery of a Conversion Notice to the Corporation to convert all, or any number of Series B into shares of Common Stock at the Triggering Event Conversion Price ... Triggering Event Conversion Pr i ce " means, the l esse r of (i) the Conversion Price, and (ii) 75 % of the lowest daily volume weighted averagt : price of lhe Common Stock for a n y of the Len Tra<ling Day : s prior to Jate of Lhe Conve :: rsion Notice ; provided that the Triggering Event Conversion Price under this Section 5 (e)(ii) shall be subject to Shareholder Approval and in no event may be lower than the Floor Price . (t) Shareholder Approval . A H ol d er s h all not convert any Series B Shares into shares of Common Swck which would resulr in the Holder beneficially owning in excess of 19 . 99 % of the issued and outstanding shares of Common Stock of the Company until the Company has obtained the Shareholder Approval to the issuance of t h e Conversion Amount due to the aggregate number of shares of Common Stock issued after giving effect to the issuance of the Conversion Amount issuable upon conversion of the Series B exceeding 1 9 . 99 % of all shares of Common Stock issued and outstanding on the initial Issuance Dare, subject to pro r ata adjustment in connection with any stock splits, stock dividends, or similar changes to the Co mp any ' s ca p it a li zat i o n after the Initial I ss uan ce Date . 6. Triggering Eve n t s . (a) Evc n f ' : Triggering Event. F.ach of the following event<. i; h al l constitute a ·· Tri gge ri ng (i) the Corporation does not meet the current public informat i on requirements under R uJe 144 in respect of the shares of Common Stock issuable upon conversion of the Series R ; ( ii) of the 1934 Act: the Corporation ceases to be s ubj ect to the periodic reporting pro v i sio n s (iii) the s u s p e n sio n from trading or failure of the Common Stock to be trading or listed (as applicable) on a Principal Market for a period of IO consecutive Trading Days, provided, however . that this clause (iii) shall only apply following the Corporation's receipt of formal approval for listing on a Principal Market and after the Common Stock hos commenced trading on such Principal Market for at least one ( 1 ) Trading Day ; (iv) the Corpora t i on 's written notice to any holder of Series B , i . ncluding, without limitation , by way of public announcement or through any of its agents . at any time .

I I 1 o3 10 : 2 0 p . m . 10 - 2 0 - 202s I ,s I 1 2 To: NV SOS Page : 15 of31 2025 - 10 - 20 22 : 10 : 34 GMT Docuslgn Envelope ID . 63B87822 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradshav of its intention not to comply . as r eq uir ed, wi th a request for conversion of any Series B inro shares of Common S to c k that is requested i . n accordance with the provisions of this Certificate of D es ign a ti o n , other than pursuant to Section 5 ( d) hereof : (v) at a n y time following the I 0 th consecutive day that a H o lder 's Authorized Share Allocation is less than 200 % of the number of shares of Common Stock that s u c h Holder would b e entitled to receive upon a conversio n , in full , of a ll of the Series B th e n held by uch Holder (without r ega rd t o any limitations on conversion set forth in this Ce r tificate of Designation) : (vi) the Corporation's failure to pay to aoy H o lder any dividend on a Dividend Payment Date or any other amount when and as due under this Certificate of Desig 11 ation . or any other Tran � adiun Dm .: u 111 en 1 , except . in the cGtse of a failure tu pay dividemh u 11 the Dividend Payment Date, only if such failure remains uncured for a period of at least 10 consecutive Trading Days ; (vii) the Corporation either (A) fai l s to cure a Conversion Failure by delivery uf the requirt!d number of shares of Commun Stm .: k within lwu Trading O 1 : 1 ys after Lhe applicable Conversion Date on two or more occasions or (B) fails to remove any restrictive legend on any certificate or any shares of Common Stock issued to s u c h Holder upon conversion of aoy Series B or as and when required by this Certificate of Desigriation unless otherwise then prohibited by applicable federal securities law s , and any such failure 10 remove the legend remains uncured for at least ten consecutive Trading Days ; (viii) bankruptcy, insolvency, reorganization or l i quidation proceedings or other proceedings for the relief of debtors shall be instituted by or against the Corporation or any Subsidiary which s h a ll not be di s mi sse d within 60 days of their injti a ti o n ; (ix) the commencement by the Corporation or any Subsidiary of a voluntary case or proceeding under any applicable federal , state or foreign bankruptcy . insolvency . reorganization or other similar law or of any other case or proceeding to be adjudicated a bankntpt or in so l ve nt , or the consent by it to the entry of a decree, order, judgment or other similar document in respect of the Co r poration or any Subsidiary in an involumary case or proceeding uncler any applicable fede r a l , state or foreign hanknrptcy, i n solvency , reorganization or other s imi l ar l aw or to the commencement of any bankruptcy or insolvency case or proceeding against it, or the filing by 1 l of a petition or answer or consent seeking reorganization or relief under any applicable federal, s t a t e or foreign law, or the consent by it to the filing of such petition or to the appoinrment of or taking possession by a custodian, receiv e r , liquid a tor , a ss ign ee , tru s tee , sequesl'rator or other similar official of the Corporation or any Subsidiary or of any substantial pat 1 of its property, or the making by it of an assignment for the benefit of creditors, or the execution of a composition of debts, or the occu r rence of any other sirrrilar federal, state or foreign proceeding . the taking of corporate action by the Corporatjon or any Subsidiary in furtherance of any such action or the taking of any action by any Person to commence a Uniform Commercial Code foreclosure sale or any other similar action under federal . state or foreign law ; (x) the entry by a court of (i) a decree . order, judgment o r other s imil a r document in respect of the Corporation or any Subsidiary of an involuntary case or proceeding under a n y applicable federal , state or foreig 11 bankruptcy, in so l ve ncy , r eo r ga ni za ti o n or other silllilar law or (ii) a decree .

order, judgment or other s imil ar document adjudging the Co rporati o n or any Subsidiary as bankrupt or insolvent, or approving as properly filed a petition I 03 · 1 0 : 2op m 10 - 20 - 2025 i 16 I 11 To: NV SOS Page : 16 of 31 2025 - 10 - 20 22 ; 10 : 34 GMT Docusign Envelope ID . 63BB7B22 - 7C12 - 4B93 - 9DC7 - 474F0F385EE3 From : Gilbert Bradshav seeking li quidation , re org anization , arrangement, adjustment or composition of or in respect of the Corporation o r any Subsidiary under any applicable federal, sti : ite or fore i gn law or (iii) a decree, order,judgment (but only such judgments in an amount of $ 1 , 000 , 000 or more) or other similar document appointing a c u s t odian, receiver, liqt 1 idator , ass i gnee, trustee, sequestrator or other similar official of the Corporation or any Subsidiary or of any s ub s tantial part of its property, or orde rin g the winding up or l iquid at ion of its affairs : (x_i) a final judgmen t or judgments for the payment of money in excess of $ l . 000 , 000 are rendered against the Co 1 vorat i on and/or any of its S u b si diari es a n d which judgments are not , wiU 1 in IO days after the entry thereof, bonded, di sc harg ed, settled or stayed pending appeal, or are not discharged w i thin thirty 30 days after the ex p i r at i o n of such stay ; (xii) other than as spt : cifo .: ally st : l forth in anolher clau : st : or Section 6 (a), tht : Corporation or any Subsidiary breaches any representation or war r anty in any material respect (other than r e pre se nt a ti o n s or warranties subject to material adverse effect or materiality, which may not be breached in any respect) or any covenant or other term or condition of any Transaction D oc um e nt , except, in the case of a breach of a covenant or other term or condition that is curable . only if such bn : a 1 : h remains um ; un : d for a period ur five cunserntive Trading Days : (xiii) faili n g to comply in any material respect with the reporting requirements of the 1934 Act (including, but not limited to, becoming d elinq u e nt in its filings); (xiv) prov i din g material non - public infonnation lo a Holder o f Series B without their prior writte n consent; (xv) any change in t h e Corporation's Transfer Agent without providing at least ten (I 0) days prior notice to rhe Holder of Series B: (xvi) a false or inaccurate certification (including a false or inaccurate deemed certification) by t h e Corporation as to whet h e r any Triggering Event has occurred; or (xvii) the Corporation fails to obtain Shareholder Approval on or before the date that is ninety (90) calendar days after the I niti a l l s1; u a n ce D ate . (b) Notice of a Triggering Event . Upon the occt 11 Tence of a Triggering Even t , the Corporation s ha ll within three Trad i n g Days deliver written notice thereof via facsimile . electronic mail or overnight courier (with next day delivery spec i fi ed) to each Holder . 7. Rights Upon rssuance of Purchase Rights and Other Corporate Events. (a) Pu . rchase Rights . l n ad d i tion to any adjm,tments pursuant to Sect i o n s 8 and 9 below, if at any time the Corporation grants, issues or sells any Options, Convertible Securities or rights to pur c h ase stock . wammts , secu riti es or other property pro rata to all or substantially all of the record holders of a n y class of Common Stock (the " Pu rc h a s e Right s "), then each Holder will be entitled to acquire . upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which such Holder could have acquired if such Holder had held the number of shares of Common Stock acquirable upon co mp l ete conversion of all the Se r i es B (w i thout taking i nt o account any limitations or restrictions on the convertibility of the Series B) held by s u c h Holder i mm e diat e ly prior 10 the date on which a record is taken for the grant .