UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2024

SUNSHINE BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Colorado | 001-41282 | 20-5566275 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer ID No.) |

1177 Avenue of the Americas, 5th Floor

New York , NY 10036

(Address of principal executive offices) (zip code)

(332) 216-1147

(Registrant’s telephone number, including area code)

________________________________________

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 | SBFM | The Nasdaq Stock Market LLC |

| Common Stock Purchase Warrants | SBFMW | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Effective April 17, 2024, Sunshine Biopharma, Inc. (the “Company”) filed a certificate of amendment to its articles of incorporation with the Secretary of State of Colorado to effect a 1-for-100 reverse split of the Company’s common stock.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 3.1 | ||

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL). |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: April 23, 2024 | SUNSHINE BIOPHARMA, INC. |

| By: /s/ Dr. Steve N. Slilaty | |

| Dr. Steve N. Slilaty, Chief Executive Officer |

|

|

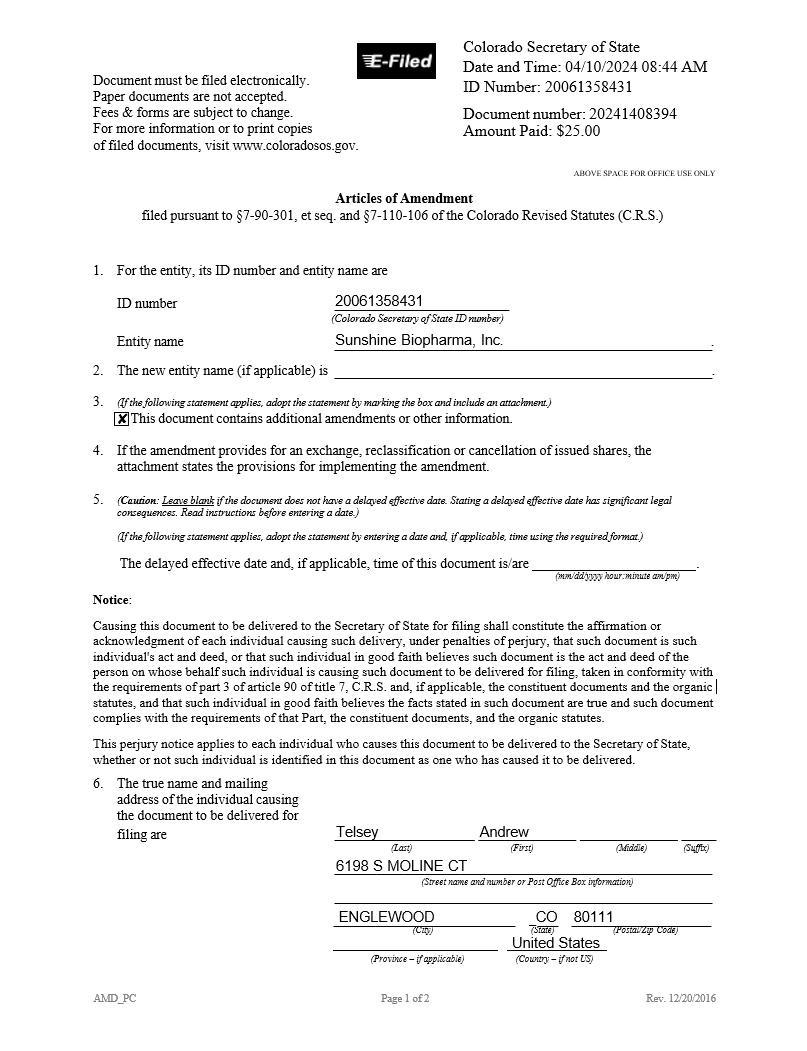

Exhibit 3.1

|

|

|

|

ARTICLES OF AMENDMENT

Relating to

STOCK SPLIT TRANSACTION

of

SUNSHINE BIOPHARMA, INC

Pursuant to CRS 7-106-105 of the Colorado Corporations and Associations Act

I, Dr. Steve N. Slilaty, President and Chief Executive Officer of Sunshine Biopharma, Inc., (the “Company”), a corporation organized and existing under the Colorado Corporation and Association Act (the “Act”), in accordance with the provisions of Section 7-106-105 thereof, DO HEREBY CERTIFY:

1. That, on March 4, 2024, in accordance with CRS 7-108-202 of the Act, the Board of Directors of the Company adopted a resolution authorizing a reverse stock split. On April 4, 2024, the Board of Directors adopted the ratio of the reverse stock split to be one (1) share of Common Stock for every one hundred (100) shares of Common Stock previously issued and outstanding.

2. That, on December 7, 2023, at the Company’s annual shareholder meeting, the Company’s stockholders approved a reverse stock split of the Company’s Common Stock by a ratio of not less than 1-for-2 and not more than 1-for-40 at any time prior to the one year anniversary of filing a definitive information statement with respect to the reverse split, with the Company’s Board of Directors having the discretion as to whether or not the reverse split is to be effected, with the exact ratio of any reverse split to be set at a whole number within the above range as determined by the Board in its discretion. On March 4, 2024, pursuant to CRS 7-107-104 of the Act, the requisite majority of the shareholders of the Company entitled to vote approved the amendment to the Company’s Articles of Incorporation and corresponding resolution adopted by the Board of Directors authorizing the previously approved maximum reverse split ratio of up to 1-for-40 to be increased to up to 1-for-200 with the exact ratio to be determined by the Board in its sole discretion (the “Reverse Stock Split”).

3. That said resolution of the Board of Directors of the Company authorizing the Reverse Stock Split of the Company’s Common Stock, provides that Article II of the Company’s Articles of Incorporation, as amended, shall not be amended as a result of the Reverse Stock Split, but shall remain as stated herein below. Effective on April 17, 2024, at market open (the “Effective Time”), the filing of this Amendment shall effect a reverse stock split pursuant to which each one hundred (100) shares of Common Stock issued and outstanding shall be combined into one (1) validly issued, fully paid and nonassessable share of Common Stock. The number of authorized shares and the par value of the Common Stock and Preferred Stock shall not be affected by the Reverse Stock Split. The Company shall not issue fractional shares to shareholders holding less than one (1) share of Common Stock as a result of the Reverse Stock Split. Rather, all fractional shares held by shareholders holding less than one (1) share of Common Stock will be rounded up.

And the first paragraph of Section 1 of the Article thereof numbered “II” of Attachment 1 to the Articles of Incorporation shall remain as stated, including the following:

“Section 1. Number: The amount of the total authorized capital stock of the corporation shall be three billion thirty million (3,030,000,000) shares consisting of Three Billion (3,000,000,000) shares of Common Stock, $0.001 par value per share, and Thirty Million (30,000,000) shares of Preferred Stock, par value $0.10 per share, consisting of Twenty Nine Million (29,000,000) undesignated shares of Preferred Stock, $0.10 par value per share and One Million (1,000,000) shares of Series “B” Preferred Stock, par value $0. IO per share, the designations, preferences, limitations and relative rights of the shares of each such class are as follows:"

(Balance to remain as previously stated)

4. That in accordance with the Colorado Corporations and Associations Act these Articles of Amendment shall be effective on April 17, 2024, at market open.

|

|

IN WITNESS WHEREOF, I have executed and subscribed these Articles of Amendment on behalf of the Company and do affirm the foregoing as true this 17th day of April 2024.

| By: /s/ Dr. Steve N. Slilaty | |

| President and Chief Executive Officer. | |

|

|