00016800622023False--12-31Q2P3Y21061727500016800622023-01-012023-06-300001680062us-gaap:CommonClassAMember2023-08-04xbrli:shares0001680062us-gaap:CommonClassBMember2023-08-0400016800622023-06-30iso4217:USD00016800622022-12-310001680062us-gaap:NonrelatedPartyMember2023-06-300001680062us-gaap:NonrelatedPartyMember2022-12-310001680062us-gaap:RelatedPartyMember2023-06-300001680062us-gaap:RelatedPartyMember2022-12-310001680062us-gaap:CommonClassAMember2023-06-300001680062us-gaap:CommonClassAMember2022-12-310001680062us-gaap:CommonClassBMember2023-06-300001680062us-gaap:CommonClassBMember2022-12-3100016800622023-04-012023-06-3000016800622022-04-012022-06-3000016800622022-01-012022-06-30iso4217:USDxbrli:shares0001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001680062us-gaap:AdditionalPaidInCapitalMember2021-12-310001680062us-gaap:RetainedEarningsMember2021-12-310001680062us-gaap:RetainedEarningsAppropriatedMember2021-12-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001680062us-gaap:NoncontrollingInterestMember2021-12-3100016800622021-12-310001680062us-gaap:RetainedEarningsMember2022-01-012022-06-300001680062us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-06-300001680062us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-01-012022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-06-300001680062us-gaap:AdditionalPaidInCapitalMember2022-06-300001680062us-gaap:RetainedEarningsMember2022-06-300001680062us-gaap:RetainedEarningsAppropriatedMember2022-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001680062us-gaap:NoncontrollingInterestMember2022-06-3000016800622022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001680062us-gaap:AdditionalPaidInCapitalMember2022-12-310001680062us-gaap:RetainedEarningsMember2022-12-310001680062us-gaap:RetainedEarningsAppropriatedMember2022-12-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001680062us-gaap:NoncontrollingInterestMember2022-12-310001680062us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001680062srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001680062us-gaap:RetainedEarningsMember2023-01-012023-06-300001680062us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-06-300001680062us-gaap:RetainedEarningsMember2023-06-300001680062us-gaap:RetainedEarningsAppropriatedMember2023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001680062us-gaap:NoncontrollingInterestMember2023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-03-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-03-310001680062us-gaap:AdditionalPaidInCapitalMember2022-03-310001680062us-gaap:RetainedEarningsMember2022-03-310001680062us-gaap:RetainedEarningsAppropriatedMember2022-03-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001680062us-gaap:NoncontrollingInterestMember2022-03-3100016800622022-03-310001680062us-gaap:RetainedEarningsMember2022-04-012022-06-300001680062us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-012022-06-300001680062us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001680062us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001680062us-gaap:AdditionalPaidInCapitalMember2023-03-310001680062us-gaap:RetainedEarningsMember2023-03-310001680062us-gaap:RetainedEarningsAppropriatedMember2023-03-310001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001680062us-gaap:NoncontrollingInterestMember2023-03-3100016800622023-03-310001680062us-gaap:RetainedEarningsMember2023-04-012023-06-300001680062us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001680062us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001680062us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-012023-06-300001680062us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001680062acmr:ACMResearchShanghaiIncMember2017-08-31xbrli:pure0001680062acmr:ACMResearchShanghaiIncMember2017-11-080001680062acmr:ACMResearchShanghaiIncMember2020-09-300001680062acmr:ShengweiResearchShanghaiIncMember2020-09-300001680062acmr:CleanChipTechnologiesLimitedMember2020-12-012020-12-310001680062acmr:ACMResearchShanghaiIncMemberus-gaap:IPOMember2021-11-302021-11-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:IPOMember2021-11-30iso4217:CNYxbrli:shares0001680062acmr:ACMResearchShanghaiIncMember2023-05-012023-05-310001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-05-012023-05-310001680062us-gaap:CommonClassAMember2022-03-012022-03-310001680062us-gaap:CommonClassAMember2022-03-160001680062us-gaap:CommonClassBMember2022-03-160001680062acmr:ACMResearchShanghaiIncMember2023-01-012023-06-300001680062acmr:ACMResearchShanghaiIncMember2023-06-300001680062acmr:ACMResearchShanghaiIncMember2022-12-310001680062acmr:ACMResearchWuxiIncMember2023-01-012023-06-300001680062acmr:ACMResearchWuxiIncMember2023-06-300001680062acmr:ACMResearchWuxiIncMember2022-12-310001680062acmr:CleanChipTechnologiesLimitedMember2023-01-012023-06-300001680062acmr:CleanChipTechnologiesLimitedMember2023-06-300001680062acmr:CleanChipTechnologiesLimitedMember2022-12-310001680062acmr:ACMResearchKoreaCOLTDMember2023-01-012023-06-300001680062acmr:ACMResearchKoreaCOLTDMember2023-06-300001680062acmr:ACMResearchKoreaCOLTDMember2022-12-310001680062acmr:ShengweiResearchShanghaiIncMember2023-01-012023-06-300001680062acmr:ShengweiResearchShanghaiIncMember2023-06-300001680062acmr:ShengweiResearchShanghaiIncMember2022-12-310001680062acmr:ACMResearchCAIncMember2023-01-012023-06-300001680062acmr:ACMResearchCAIncMember2023-06-300001680062acmr:ACMResearchCAIncMember2022-12-310001680062acmr:ACMResearchCaymanIncMember2023-01-012023-06-300001680062acmr:ACMResearchCaymanIncMember2023-06-300001680062acmr:ACMResearchCaymanIncMember2022-12-310001680062acmr:ACMResearchSingaporePTELTDMember2023-01-012023-06-300001680062acmr:ACMResearchSingaporePTELTDMember2023-06-300001680062acmr:ACMResearchSingaporePTELTDMember2022-12-310001680062acmr:ACMResearchBeijingIncMember2023-01-012023-06-300001680062acmr:ACMResearchBeijingIncMember2023-06-300001680062acmr:ACMResearchBeijingIncMember2022-12-310001680062acmr:HangukACMCOLTDMember2023-01-012023-06-300001680062acmr:HangukACMCOLTDMember2023-06-300001680062acmr:HangukACMCOLTDMember2022-12-310001680062acmr:YushengMicroSemiconductorShanghaiCoLtdMember2023-01-012023-06-300001680062acmr:YushengMicroSemiconductorShanghaiCoLtdMember2023-06-300001680062acmr:YushengMicroSemiconductorShanghaiCoLtdMember2022-12-310001680062acmr:ACMWooliMicroelectronicsShanghaiCoLtdMember2023-01-012023-06-300001680062acmr:ACMWooliMicroelectronicsShanghaiCoLtdMember2023-06-300001680062acmr:ACMWooliMicroelectronicsShanghaiCoLtdMember2022-12-310001680062us-gaap:CustomerConcentrationRiskMemberacmr:TheHualiHuahongGroupMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001680062us-gaap:CustomerConcentrationRiskMemberacmr:SemiconductorManufacturingInternationalCorpMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001680062us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberacmr:YangtzeMemoryTechnologiesMember2022-01-012022-12-310001680062us-gaap:CustomerConcentrationRiskMemberacmr:TheHualiHuahongGroupMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001680062us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberacmr:YangtzeMemoryTechnologiesMember2021-01-012021-12-310001680062srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-012023-06-300001680062srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-06-300001680062country:US2023-06-300001680062country:US2022-12-310001680062country:CN2023-06-300001680062country:CN2022-12-310001680062country:HK2023-06-300001680062country:HK2022-12-310001680062country:KR2023-06-300001680062country:KR2022-12-310001680062country:SG2023-06-300001680062country:SG2022-12-310001680062acmr:ACMShanghaiMember2023-04-012023-06-300001680062acmr:ACMShanghaiMember2023-01-012023-06-300001680062acmr:ACMShanghaiMember2022-04-012022-06-300001680062acmr:ACMShanghaiMember2022-01-012022-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2023-01-012023-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2023-06-300001680062acmr:ChinaMerchantBankDepositsMaturingOnJanuary292023Member2022-12-310001680062acmr:ChinaEverbrightBankDepositMaturingOnJanuary292023Member2023-01-012023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingOnJanuary292023Member2023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingOnJanuary292023Member2022-12-310001680062acmr:ChinaEverbrightBankDepositMaturingMay222023Member2023-01-012023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingMay222023Member2023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingMay222023Member2022-12-310001680062acmr:ChinaIndustrialBankDepositMaturingOnJanuary302023Member2023-01-012023-06-300001680062acmr:ChinaIndustrialBankDepositMaturingOnJanuary302023Member2023-06-300001680062acmr:ChinaIndustrialBankDepositMaturingOnJanuary302023Member2022-12-310001680062acmr:ChinaMerchantBankDepositMaturingJanuary292024Member2023-01-012023-06-300001680062acmr:ChinaMerchantBankDepositMaturingJanuary292024Member2023-06-300001680062acmr:ChinaMerchantBankDepositMaturingJanuary292024Member2022-12-310001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2023-01-012023-06-300001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2023-06-300001680062acmr:BankOfNingboDepositMaturingOnFebruary172024Member2022-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2023-01-012023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingOctober202025Member2022-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2023-01-012023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingNovember142025Member2022-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2023-01-012023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember82025Member2022-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember152025Member2023-01-012023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember152025Member2023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember152025Member2022-12-310001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2023-01-012023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2023-06-300001680062acmr:ShanghaiPudongDevelopmentBankDepositMaturingDecember302025Member2022-12-310001680062acmr:ChinaEverbrightBankDepositMaturingJuly42023Member2023-01-012023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingJuly42023Member2023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingJuly42023Member2022-12-310001680062acmr:ChinaEverbrightBankDepositMaturingNovember222023Member2023-01-012023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingNovember222023Member2023-06-300001680062acmr:ChinaEverbrightBankDepositMaturingNovember222023Member2022-12-310001680062acmr:ChinaMerchantBankDepositMaturingJanuary302026Member2023-01-012023-06-300001680062acmr:ChinaMerchantBankDepositMaturingJanuary302026Member2023-06-300001680062acmr:ChinaMerchantBankDepositMaturingJanuary302026Member2022-12-310001680062us-gaap:FairValueInputsLevel1Member2023-06-300001680062us-gaap:FairValueInputsLevel2Member2022-12-310001680062us-gaap:FairValueInputsLevel3Member2023-06-300001680062us-gaap:FairValueInputsLevel2Member2023-06-300001680062us-gaap:FairValueInputsLevel1Member2022-12-310001680062us-gaap:FairValueInputsLevel3Member2022-12-310001680062acmr:ThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-30acmr:Customer0001680062us-gaap:AccountsReceivableMemberacmr:ThreeCustomersMemberus-gaap:CustomerConcentrationRiskMember2023-04-012023-06-300001680062acmr:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001680062acmr:FourCustomersMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-04-012022-06-300001680062us-gaap:CustomerConcentrationRiskMemberacmr:OneCustomerMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001680062us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberacmr:OneCustomerMember2023-01-012023-06-300001680062acmr:FourCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001680062acmr:FourCustomersMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-06-300001680062us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberacmr:TwoCustomersMember2023-01-012023-06-300001680062us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberacmr:TwoCustomersMember2022-01-012022-12-310001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2023-04-012023-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2022-04-012022-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2023-01-012023-06-300001680062acmr:TotalSingleWaferAndSemiCriticalCleaningEquipmentMember2022-01-012022-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2023-04-012023-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2022-04-012022-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2023-01-012023-06-300001680062acmr:ECPFrontEndAndPackagingFurnaceAndOtherTechnologiesMember2022-01-012022-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2023-04-012023-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2022-04-012022-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2023-01-012023-06-300001680062acmr:AdvancedPackagingExcludeECPServicesSparesMember2022-01-012022-06-300001680062acmr:WetCleaningAndOtherFrontEndProcessingToolsMember2023-04-012023-06-300001680062acmr:WetCleaningAndOtherFrontEndProcessingToolsMember2022-04-012022-06-300001680062acmr:WetCleaningAndOtherFrontEndProcessingToolsMember2023-01-012023-06-300001680062acmr:WetCleaningAndOtherFrontEndProcessingToolsMember2022-01-012022-06-300001680062acmr:AdvancedPackagingOtherProcessingServicesAndSparesMember2023-04-012023-06-300001680062acmr:AdvancedPackagingOtherProcessingServicesAndSparesMember2022-04-012022-06-300001680062acmr:AdvancedPackagingOtherProcessingServicesAndSparesMember2023-01-012023-06-300001680062acmr:AdvancedPackagingOtherProcessingServicesAndSparesMember2022-01-012022-06-300001680062country:CN2023-04-012023-06-300001680062country:CN2022-04-012022-06-300001680062country:CN2023-01-012023-06-300001680062country:CN2022-01-012022-06-300001680062acmr:OherRegionsMember2023-04-012023-06-300001680062acmr:OherRegionsMember2022-04-012022-06-300001680062acmr:OherRegionsMember2023-01-012023-06-300001680062acmr:OherRegionsMember2022-01-012022-06-300001680062acmr:FirstToolsMember2023-01-012023-06-300001680062acmr:FirstToolsMember2023-06-300001680062acmr:FirstToolsMember2022-12-310001680062acmr:BuildingsAndPlantsMember2023-06-300001680062acmr:BuildingsAndPlantsMember2022-12-310001680062us-gaap:EquipmentMember2023-06-300001680062us-gaap:EquipmentMember2022-12-310001680062us-gaap:OfficeEquipmentMember2023-06-300001680062us-gaap:OfficeEquipmentMember2022-12-310001680062us-gaap:TransportationEquipmentMember2023-06-300001680062us-gaap:TransportationEquipmentMember2022-12-310001680062us-gaap:LeaseholdImprovementsMember2023-06-300001680062us-gaap:LeaseholdImprovementsMember2022-12-310001680062acmr:ACMLingangMemberacmr:BuildingsAndPlantsMember2022-01-310001680062acmr:ACMLingangMemberacmr:BuildingsAndPlantsMember2023-06-300001680062acmr:ACMLingangMemberacmr:BuildingsAndPlantsMember2023-02-280001680062acmr:ShengweiResearchShanghaiIncMember2020-01-012020-12-310001680062acmr:ShengweiResearchShanghaiIncMember2020-07-31utr:sqft0001680062acmr:BuildingsAndPlantsMemberacmr:ShengweiResearchShanghaiIncMember2023-02-280001680062acmr:LineOfCreditUpToRMB150000FromChinaEverbrightBankMember2023-06-30iso4217:CNY0001680062acmr:LineOfCreditUpToRMB150000FromChinaEverbrightBankMember2022-12-310001680062acmr:LineOfCreditDueOnAugust172023WithAnAnnualInterestRateOf340Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust172023WithAnAnnualInterestRateOf340Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust172023WithAnAnnualInterestRateOf340Member2023-06-300001680062acmr:LineOfCreditDueOnAugust172023WithAnAnnualInterestRateOf340Member2022-12-310001680062acmr:LineOfCreditDueOnSeptember12023WithAnAnnualInterestRateOf360Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnSeptember12023WithAnAnnualInterestRateOf360Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnSeptember12023WithAnAnnualInterestRateOf360Member2023-06-300001680062acmr:LineOfCreditDueOnSeptember12023WithAnAnnualInterestRateOf360Member2022-12-310001680062acmr:LineOfCreditDueOnDecember162023WithAnAnnualInterestRateOf300Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnDecember162023WithAnAnnualInterestRateOf300Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnDecember162023WithAnAnnualInterestRateOf300Member2023-06-300001680062acmr:LineOfCreditDueOnDecember162023WithAnAnnualInterestRateOf300Member2022-12-310001680062acmr:LineOfCreditUpToRMB100000FromBankOfCommunicationsMember2023-06-300001680062acmr:LineOfCreditUpToRMB100000FromBankOfCommunicationsMember2022-12-310001680062acmr:LineOfCreditDueOnAugust112023WithAnAnnualInterestRateOf360Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust112023WithAnAnnualInterestRateOf360Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust112023WithAnAnnualInterestRateOf360Member2023-06-300001680062acmr:LineOfCreditDueOnAugust112023WithAnAnnualInterestRateOf360Member2022-12-310001680062acmr:LineOfCreditDueOnSeptember52023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnSeptember52023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnSeptember52023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnSeptember52023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditUpToRMB40000FromBankOfChinaMember2023-06-300001680062acmr:LineOfCreditUpToRMB40000FromBankOfChinaMember2022-12-310001680062acmr:LineOfCreditDueOnAugust262023WithAnAnnualInterestRateOf315Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust262023WithAnAnnualInterestRateOf315Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust262023WithAnAnnualInterestRateOf315Member2023-06-300001680062acmr:LineOfCreditDueOnAugust262023WithAnAnnualInterestRateOf315Member2022-12-310001680062acmr:LineOfCreditUpToRMB100000FromChinaMerchantsBankMember2023-06-300001680062acmr:LineOfCreditUpToRMB100000FromChinaMerchantsBankMember2022-12-310001680062acmr:LineOfCreditDueOnJuly212023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnJuly212023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnJuly212023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnJuly212023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnJuly272023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnJuly272023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnJuly272023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnJuly272023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust12023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust12023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust12023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust12023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust32023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust32023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust32023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust32023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust72023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust72023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust72023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust72023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust142023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust142023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust142023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust142023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust152023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust152023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust152023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust152023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust212023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust212023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust212023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust212023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnAugust282023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnAugust282023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnAugust282023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnAugust282023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnSeptember132023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnSeptember132023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnSeptember132023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnSeptember132023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnSeptember202023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnSeptember202023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnSeptember202023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnSeptember202023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:LineOfCreditDueOnSeptember292023WithAnAnnualInterestRateOf350Member2023-01-012023-06-300001680062acmr:LineOfCreditDueOnSeptember292023WithAnAnnualInterestRateOf350Member2022-01-012022-12-310001680062acmr:LineOfCreditDueOnSeptember292023WithAnAnnualInterestRateOf350Member2023-06-300001680062acmr:LineOfCreditDueOnSeptember292023WithAnAnnualInterestRateOf350Member2022-12-310001680062acmr:ChinaMerchantsBankMember2023-06-300001680062acmr:ChinaMerchantsBankMember2022-12-310001680062acmr:BankOfChinaMember2023-06-300001680062acmr:BankOfChinaMember2022-12-310001680062acmr:ChinaMerchantsBankMember2023-01-012023-06-30acmr:Intallment0001680062acmr:SubsidiesToStressFreePolishingProjectMember2023-06-300001680062acmr:SubsidiesToStressFreePolishingProjectMember2022-12-310001680062acmr:SubsidiesToElectroCopperPlatingProjectMember2023-06-300001680062acmr:SubsidiesToElectroCopperPlatingProjectMember2022-12-310001680062acmr:SubsidiesToOtherCleaningToolsCommencedIn2020Member2023-06-300001680062acmr:SubsidiesToOtherCleaningToolsCommencedIn2020Member2022-12-310001680062acmr:SubsidiesToSWLingangRDDevelopmentIn2021Member2023-06-300001680062acmr:SubsidiesToSWLingangRDDevelopmentIn2021Member2022-12-310001680062acmr:SubsidiesToCO2TechnologyMember2023-06-300001680062acmr:SubsidiesToCO2TechnologyMember2022-12-310001680062acmr:OtherMember2023-06-300001680062acmr:OtherMember2022-12-310001680062acmr:NinebellCompanyLimitedMemberacmr:EquityInvestmentMemberus-gaap:CommonClassAMember2023-06-300001680062acmr:NinebellCompanyLimitedMemberacmr:EquityInvestmentMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:WooilFluconCompanyLimitedMemberus-gaap:CommonClassAMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:WooilFluconCompanyLimitedMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:ShengyiSemiconductorTechnologyCompanyLimitedMemberus-gaap:CommonClassAMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:ShengyiSemiconductorTechnologyCompanyLimitedMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMemberus-gaap:CommonClassAMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMember2023-06-300001680062acmr:EquityInvestmentMemberus-gaap:CommonClassAMemberacmr:WaferworksCompanyLimitedMember2023-06-300001680062acmr:EquityInvestmentMemberacmr:WaferworksCompanyLimitedMember2023-06-300001680062acmr:InvestmentExcludingOtherMemberacmr:NinebellCompanyLimitedMember2023-06-300001680062acmr:InvestmentExcludingOtherMemberacmr:NinebellCompanyLimitedMember2022-12-310001680062acmr:InvestmentExcludingOtherMemberacmr:WooilFluconCompanyLimitedMember2023-06-300001680062acmr:InvestmentExcludingOtherMemberacmr:WooilFluconCompanyLimitedMember2022-12-310001680062acmr:InvestmentExcludingOtherMemberacmr:ShengyiSemiconductorTechnologyCompanyLimitedMember2023-06-300001680062acmr:InvestmentExcludingOtherMemberacmr:ShengyiSemiconductorTechnologyCompanyLimitedMember2022-12-310001680062acmr:InvestmentExcludingOtherMemberacmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMember2023-06-300001680062acmr:InvestmentExcludingOtherMemberacmr:HefeiShixiChanhengIntegratedCircuitIndustryVentureCapitalFundPartnershipMember2022-12-310001680062acmr:InvestmentExcludingOtherMember2023-06-300001680062acmr:InvestmentExcludingOtherMember2022-12-310001680062us-gaap:OtherLongTermInvestmentsMemberacmr:WaferworksCompanyLimitedMember2023-06-300001680062us-gaap:OtherLongTermInvestmentsMemberacmr:WaferworksCompanyLimitedMember2022-12-310001680062us-gaap:OtherLongTermInvestmentsMemberacmr:TDSHFundMember2023-06-300001680062us-gaap:OtherLongTermInvestmentsMemberacmr:TDSHFundMember2022-12-310001680062acmr:NuodeAssetManagementCompanyLimitedMember2022-09-1900016800622022-09-190001680062acmr:SemiconductorManufacturingInternationalCorporationMember2023-04-012023-06-300001680062acmr:SemiconductorManufacturingInternationalCorporationMember2023-01-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:NinebellCoLtdMember2023-06-300001680062us-gaap:RelatedPartyMemberacmr:NinebellCoLtdMember2022-12-310001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2022-12-310001680062acmr:NinebellCoLtdMember2023-04-012023-06-300001680062acmr:NinebellCoLtdMember2022-04-012022-06-300001680062acmr:NinebellCoLtdMember2023-01-012023-06-300001680062acmr:NinebellCoLtdMember2022-01-012022-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2023-04-012023-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2022-04-012022-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2023-01-012023-06-300001680062acmr:ShengyiSemiconductorTechnologyCoLtdMember2022-01-012022-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-04-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2021-04-012021-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2023-01-012023-06-300001680062us-gaap:RelatedPartyMemberacmr:ShengyiSemiconductorTechnologyCoLtdMember2022-01-012022-06-30acmr:Vote0001680062us-gaap:CommonClassBMember2023-01-012023-06-300001680062us-gaap:CostOfSalesMember2023-04-012023-06-300001680062us-gaap:CostOfSalesMember2022-04-012022-06-300001680062us-gaap:CostOfSalesMember2023-01-012023-06-300001680062us-gaap:CostOfSalesMember2022-01-012022-06-300001680062us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001680062us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001680062us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001680062us-gaap:SellingAndMarketingExpenseMember2022-01-012022-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001680062us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001680062us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300001680062us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001680062us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001680062us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001680062us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-04-012023-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-04-012022-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-01-012023-06-300001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-01-012022-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-04-012023-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2022-04-012022-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-01-012023-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001680062us-gaap:EmployeeStockOptionMember2022-12-310001680062us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001680062us-gaap:EmployeeStockOptionMember2023-06-300001680062us-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2023-06-300001680062us-gaap:EmployeeStockOptionMembersrt:MinimumMemberacmr:ServicePeriodBasedApproachMember2022-12-310001680062srt:MaximumMemberus-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2022-12-310001680062us-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2023-01-012023-06-300001680062us-gaap:EmployeeStockOptionMembersrt:MinimumMemberacmr:ServicePeriodBasedApproachMember2022-01-012022-12-310001680062srt:MaximumMemberus-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2022-01-012022-12-310001680062us-gaap:EmployeeStockOptionMemberacmr:ServicePeriodBasedApproachMember2022-01-012022-12-310001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-12-310001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-01-012022-12-310001680062acmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2022-12-310001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001680062acmr:ACMResearchShanghaiIncMemberus-gaap:EmployeeStockOptionMember2023-06-300001680062acmr:ACMResearchShanghaiIncMember2023-04-012023-06-300001680062acmr:ACMResearchShanghaiIncMember2022-04-012022-06-300001680062acmr:ACMResearchShanghaiIncMember2022-01-012022-06-300001680062acmr:ACMResearchShanghaiIncMemberacmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-06-300001680062acmr:ACMResearchShanghaiIncMemberacmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-12-310001680062acmr:ACMResearchShanghaiIncMemberacmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2023-01-012023-06-300001680062acmr:ACMResearchShanghaiIncMemberacmr:ShareBasedPaymentArrangementNonEmployeeStockOptionMember2022-01-012022-06-300001680062us-gaap:ForeignCountryMembersrt:MinimumMember2023-01-012023-06-300001680062srt:MaximumMemberus-gaap:ForeignCountryMember2023-01-012023-06-30acmr:Subsidiary0001680062acmr:ACMResearchShanghaiIncMemberus-gaap:ForeignCountryMembersrt:MinimumMember2023-01-012023-06-300001680062us-gaap:ForeignCountryMemberacmr:ACMResearchWuxiIncMember2023-01-012023-06-300001680062us-gaap:ForeignCountryMemberacmr:ACMResearchBeijingIncMember2023-01-012023-06-300001680062us-gaap:ForeignCountryMemberacmr:ShengweiResearchShanghaiIncMember2023-01-012023-06-300001680062us-gaap:ForeignCountryMember2023-01-012023-06-300001680062acmr:ACMResearchShanghaiIncMemberus-gaap:ForeignCountryMember2020-01-012022-12-31acmr:LegalProceedingacmr:Segment0001680062us-gaap:SubsequentEventMemberacmr:LoanContractDueOnDecember212022Member2023-07-250001680062us-gaap:SubsequentEventMemberacmr:LoanContractDueOnDecember212022Memberacmr:NationalInterbankFundingCenterOneYearLoanMarketQuotationRateMember2023-07-252023-07-250001680062acmr:FupingChenMember2023-01-012023-06-300001680062acmr:FupingChenMember2023-04-012023-06-300001680062acmr:FupingChenMember2023-06-300001680062acmr:HaipingDunMember2023-01-012023-06-300001680062acmr:HaipingDunMember2023-04-012023-06-300001680062acmr:HaipingDunMember2023-06-300001680062acmr:DavidWangMember2023-01-012023-06-300001680062acmr:DavidWangMember2023-04-012023-06-300001680062acmr:DavidWangMember2023-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

|

|

|

| þ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _____________

Commission file number: 001-38273

ACM Research, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

| Delaware |

94-3290283 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

42307 Osgood Road, Suite I

Fremont, California

|

94539 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (510) 445-3700

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on which Registered |

| Class A Common Stock, $0.0001 par value |

|

ACMR |

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

þ |

|

Accelerated filer |

o |

|

Non-accelerated filer |

o |

|

Smaller reporting company |

o |

|

|

|

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

|

|

|

|

|

|

|

|

| Class |

|

Number of Shares Outstanding |

| Class A Common Stock, $0.0001 par value |

|

55,000,705 shares outstanding as of August 4, 2023 |

| Class B Common Stock, $0.0001 par value |

|

5,021,811 shares outstanding as of August 4, 2023 |

TABLE OF CONTENTS

ACM Research, Inc., or ACM Research, is a Delaware corporation founded in California in 1998 to supply capital equipment developed for the global semiconductor industry. Since 2005, ACM Research has conducted its business operations principally through its subsidiary ACM Research (Shanghai), Inc., or ACM Shanghai, a limited liability corporation formed by ACM Research in the People’s Republic of China, or the PRC, in 2005. Unless the context requires otherwise, references in this report to “our company,” “our,” “us,” “we” and similar terms refer to ACM Research, Inc. and its subsidiaries, including ACM Shanghai, collectively.

We conduct a substantial majority of our product development, manufacturing, support and services in the PRC through ACM Shanghai. We are not a PRC operating company, and we do not conduct our operations in the PRC through the use of a variable interest entity or any other structure designed for the purpose of avoiding PRC legal restrictions on direct foreign investments in PRC-based companies. For a description of certain matters relating to our operations in the PRC, including our corporate structure, the movement of cash throughout our organization, certain audit and regulatory matters, and risks associated therewith, please see “Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report, the disclosure at the forefront of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and the Risk Factors included therein, as updated by the disclosure included in “Part II. Item 1A—Risk Factors” in this report.

For purposes of this report, certain amounts in Renminbi, or RMB, have been translated into U.S. dollars solely for the convenience of the reader. The translations have been made based on the conversion rates published by the State Administration of Foreign Exchange of the People’s Republic of China.

SAPS, TEBO, ULTRA C and ULTRA FURNACE are trademarks of ACM Research. For convenience, these trademarks appear in this report without ™ symbols, but that practice does not mean that ACM Research will not assert, to the fullest extent under applicable law, ACM Research’s rights to the trademarks. This report also contains other companies’ trademarks, registered marks and trade names, which are the property of those companies.

FORWARD-LOOKING STATEMENTS AND STATISTICAL DATA

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties and other factors, including uncertainties surrounding the COVID‑19 pandemic (including effects of related PRC restrictions) and other factors described or incorporated by reference in “Item 1A. Risk Factors” of Part II of this report, that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

The information included under the heading “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview,” of Part I of this report contains statistical data and estimates, including forecasts, that are based on information provided by Gartner, Inc., or Gartner, in “Forecast: Semiconductor Wafer Fab Equipment, Worldwide, 4Q22 Update” (December 2022), or the Gartner Report. The Gartner Report represents research opinions or viewpoints that are published, as part of a syndicated subscription service, by Gartner and are not representations of fact. The Gartner Report speaks as of its original publication date (and not as of the date of this report), and the opinions expressed in the Gartner Report are subject to change without notice. While we are not aware of any misstatements regarding any of the data presented from the Gartner Report, estimates, and in particular forecasts, involve numerous assumptions and are subject to risks and uncertainties, as well as change based on various factors, that could cause results to differ materially from those expressed in the data presented below.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Except as required by law, we assume no obligation to update these statements publicly or to update the reasons actual results could differ materially from those anticipated in these statements, even if new information becomes available in the future.

You should read this report, and the documents that we reference in this report and have filed as exhibits to this report, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

ACM RESEARCH, INC.

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2023 |

|

December 31,

2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

257,420 |

|

|

$ |

247,951 |

|

| Restricted cash |

582 |

|

|

500 |

|

| Short-term time deposits (note 2) |

6,000 |

|

|

70,492 |

|

| Trading securities (note 15) |

6,375 |

|

|

20,209 |

|

| Accounts receivable (note 4) |

200,745 |

|

|

182,936 |

|

| Other receivables |

34,491 |

|

|

29,617 |

|

| Inventories (note 5) |

471,094 |

|

|

393,172 |

|

| Advances to related party (note 16) |

1,155 |

|

|

3,322 |

|

| Prepaid expenses |

18,970 |

|

|

15,607 |

|

| Total current assets |

996,832 |

|

|

963,806 |

|

| Property, plant and equipment, net (note 6) |

159,013 |

|

|

82,875 |

|

| Land use right, net (note 7) |

8,290 |

|

|

8,692 |

|

| Operating lease right-of-use assets, net (note 11) |

7,809 |

|

|

2,489 |

|

| Intangible assets, net |

2,107 |

|

|

1,255 |

|

| Long-term time deposits (note 2) |

112,104 |

|

|

101,956 |

|

| Deferred tax assets (note 19) |

11,249 |

|

|

6,703 |

|

| Long-term investments (note 14) |

16,122 |

|

|

17,459 |

|

| Other long-term assets (note 8) |

3,388 |

|

|

50,265 |

|

| Total assets |

$ |

1,316,914 |

|

|

$ |

1,235,500 |

|

| Liabilities and Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

106,861 |

|

|

$ |

101,735 |

|

| Other payables and accrued expenses (note 10) |

59,997 |

|

|

52,201 |

|

| Advances from customers |

195,485 |

|

|

153,773 |

|

| Current portion of operating lease liability (note 11) |

3,042 |

|

|

1,382 |

|

| Deferred revenue |

5,050 |

|

|

4,174 |

|

| Short-term borrowings (note 9) |

53,976 |

|

|

56,004 |

|

| Current portion of long-term borrowings (note 12) |

3,239 |

|

|

2,322 |

|

| Income taxes payable (note 19) |

10,324 |

|

|

3,469 |

|

| FIN-48 payable (note 19) |

6,446 |

|

|

6,686 |

|

| Related party accounts payable (note 16) |

11,879 |

|

|

14,468 |

|

| Total current liabilities |

456,299 |

|

|

396,214 |

|

| Long-term borrowings (note 12) |

15,899 |

|

|

18,687 |

|

| Long-term operating lease liability (note 11) |

4,767 |

|

|

1,107 |

|

| Other long-term liabilities (note 13) |

6,566 |

|

|

7,321 |

|

| Total liabilities |

483,531 |

|

|

423,329 |

|

| Commitments and contingencies (note 20) |

|

|

|

| Equity: |

|

|

|

| Stockholders’ equity: |

|

|

|

| Class A Common stock (note 17) |

5 |

|

|

5 |

|

| Class B Common stock (note 17) |

1 |

|

|

1 |

|

| Additional paid-in capital |

612,699 |

|

|

604,089 |

|

| Retained earnings |

124,284 |

|

|

94,426 |

|

| Statutory surplus reserve (note 22) |

16,881 |

|

|

16,881 |

|

| Accumulated other comprehensive loss |

(61,916) |

|

|

(40,546) |

|

| Total ACM Research, Inc. stockholders’ equity |

691,954 |

|

|

674,856 |

|

| Non-controlling interests |

141,429 |

|

|

137,315 |

|

| Total equity |

833,383 |

|

|

812,171 |

|

| Total liabilities and equity |

$ |

1,316,914 |

|

|

$ |

1,235,500 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, 2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenue (note 3) |

$ |

144,577 |

|

|

$ |

104,395 |

|

|

$ |

218,833 |

|

|

$ |

146,581 |

|

| Cost of revenue |

75,938 |

|

|

60,238 |

|

|

110,208 |

|

|

82,738 |

|

| Gross profit |

68,639 |

|

|

44,157 |

|

|

108,625 |

|

|

63,843 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Sales and marketing |

11,439 |

|

|

7,664 |

|

|

20,776 |

|

|

14,361 |

|

| Research and development |

20,064 |

|

|

11,367 |

|

|

34,093 |

|

|

28,713 |

|

| General and administrative |

6,706 |

|

|

5,091 |

|

|

14,464 |

|

|

10,040 |

|

| Total operating expenses |

38,209 |

|

|

24,122 |

|

|

69,333 |

|

|

53,114 |

|

| Income from operations |

30,430 |

|

|

20,035 |

|

|

39,292 |

|

|

10,729 |

|

| Interest income |

2,346 |

|

|

2,144 |

|

|

4,131 |

|

|

3,949 |

|

| Interest expense |

(649) |

|

|

(306) |

|

|

(1,344) |

|

|

(567) |

|

| Realized gain from sale of trading securities |

3,919 |

|

|

- |

|

|

7,913 |

|

|

- |

|

| Unrealized loss on trading securities |

(2,455) |

|

|

(423) |

|

|

(3,109) |

|

|

(4,281) |

|

| Other income, net |

3,724 |

|

|

2,505 |

|

|

2,306 |

|

|

2,742 |

|

| Equity income in net income of affiliates |

3,920 |

|

|

472 |

|

|

3,888 |

|

|

401 |

|

| Income before income taxes |

41,235 |

|

|

24,427 |

|

|

53,077 |

|

|

12,973 |

|

| Income tax expense (note 19) |

(7,638) |

|

|

(7,679) |

|

|

(10,517) |

|

|

(3,668) |

|

| Net income |

33,597 |

|

|

16,748 |

|

|

42,560 |

|

|

9,305 |

|

| Less: Net income attributable to non-controlling interests |

6,772 |

|

|

4,512 |

|

|

8,590 |

|

|

2,855 |

|

| Net income attributable to ACM Research, Inc. |

$ |

26,825 |

|

|

$ |

12,236 |

|

|

$ |

33,970 |

|

|

$ |

6,450 |

|

| Less: Dilutive effect arising from stock-based awards by ACM Shanghai |

(303) |

|

|

(230) |

|

|

(395) |

|

|

(147) |

|

| Net income available to common stockholders, diluted |

$ |

26,522 |

|

|

$ |

12,006 |

|

|

$ |

33,575 |

|

|

$ |

6,303 |

|

|

|

|

|

|

|

|

|

| Comprehensive income (loss): |

|

|

|

|

|

|

|

| Net income |

33,597 |

|

|

16,748 |

|

|

42,560 |

|

|

9,305 |

|

| Foreign currency translation adjustment, net of tax |

(35,269) |

|

|

(40,372) |

|

|

(25,846) |

|

|

(37,918) |

|

| Comprehensive income (loss) |

(1,672) |

|

|

(23,624) |

|

|

16,714 |

|

|

(28,613) |

|

| Less: Comprehensive income (loss) attributable to non-controlling interests |

652 |

|

|

(2,248) |

|

|

4,114 |

|

|

(3,321) |

|

| Comprehensive income (loss) attributable to ACM Research, Inc. |

$ |

(2,324) |

|

|

$ |

(21,376) |

|

|

$ |

12,600 |

|

|

$ |

(25,292) |

|

|

|

|

|

|

|

|

|

| Net income attributable to ACM Research, Inc. per share of common stock (note 2): |

|

|

|

|

|

|

|

| Basic |

$ |

0.45 |

|

|

$ |

0.21 |

|

|

$ |

0.57 |

|

|

$ |

0.11 |

|

| Diluted |

$ |

0.41 |

|

|

$ |

0.18 |

|

|

$ |

0.52 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

| Weighted average shares of common stock outstanding used in computing per share amounts (note 2): |

|

|

|

|

|

|

|

| Basic |

59,898,149 |

|

59,177,643 |

|

59,817,903 |

|

59,003,484 |

| Diluted |

64,929,638 |

|

65,478,677 |

|

64,968,900 |

|

65,772,973 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Changes in Equity

For the Six Months Ended June 30, 2023 and 2022

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock Class A |

|

Common

Stock Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Additional Paid-

in Capital |

|

Retained

earnings |

|

Statutory

Surplus

Reserve |

|

Accumulated

Other

Comprehensive

Income |

|

Non-controlling

interests |

|

Total

Equity |

| Balance at December 31, 2021 |

53,608,929 |

|

$ |

5 |

|

|

5,087,814 |

|

$ |

1 |

|

|

$ |

595,045 |

|

|

$ |

63,732 |

|

|

$ |

8,312 |

|

|

$ |

9,109 |

|

|

$ |

135,461 |

|

|

$ |

811,665 |

|

| Net income |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

6,450 |

|

|

- |

|

|

- |

|

|

2,855 |

|

|

9,305 |

|

| Foreign currency translation adjustment |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(31,742) |

|

|

(6,176) |

|

|

(37,918) |

|

| Exercise of stock options |

531,874 |

|

- |

|

|

- |

|

- |

|

|

750 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

750 |

|

| Stock-based compensation |

- |

|

- |

|

|

- |

|

- |

|

|

3,343 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

3,343 |

|

| Conversion of Class B common stock to Class A common stock |

1,002 |

|

- |

|

|

(1,002) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Balance at June 30, 2022 |

54,141,805 |

|

$ |

5 |

|

|

5,086,812 |

|

$ |

1 |

|

|

$ |

599,138 |

|

|

$ |

70,182 |

|

|

$ |

8,312 |

|

|

$ |

(22,633) |

|

|

$ |

132,140 |

|

|

$ |

787,145 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock Class A |

Common

Stock Class B |

|

|

|

|

|

|

|

Shares |

Amount |

Shares |

Amount |

Additional Paid-

in Capital |

Retained

earnings |

Statutory Surplus

Reserve |

Accumulated

Other

Comprehensive

Income (Loss) |

Non-controlling

interests |

Total

Equity |

| Balance at December 31, 2022 |

54,655,286 |

$ |

5 |

|

5,021,811 |

$ |

1 |

|

$ |

604,089 |

|

$ |

96,034 |

|

$ |

16,881 |

|

$ |

(40,546) |

|

$ |

137,315 |

|

$ |

813,779 |

|

| Cumulative effect of change in accounting principle under ASU 2016-13 |

|

|

|

|

|

(1,769) |

|

|

|

|

(1,769) |

|

| Net income |

- |

- |

|

- |

- |

|

- |

|

33,970 |

|

- |

|

- |

|

8,590 |

|

42,560 |

|

| Foreign currency translation adjustment |

- |

- |

|

- |

- |

|

- |

|

- |

|

- |

|

(21,370) |

|

(4,476) |

|

(25,846) |

|

| Exercise of stock options |

296,204 |

- |

|

- |

- |

|

4,525 |

|

- |

|

- |

|

- |

|

- |

|

4,525 |

|

| Shanghai dividend accrual |

|

|

|

|

|

(3,951) |

|

|

|

|

(3,951) |

|

| Stock-based compensation |

- |

- |

|

- |

- |

|

4,085 |

|

- |

|

- |

|

- |

|

- |

|

4,085 |

|

| Balance at June 30, 2023 |

54,951,490 |

$ |

5 |

|

5,021,811 |

$ |

1 |

|

$ |

612,699 |

|

$ |

124,284 |

|

$ |

16,881 |

|

$ |

(61,916) |

|

$ |

141,429 |

|

$ |

833,383 |

|

ACM RESEARCH, INC.

Condensed Consolidated Statements of Changes in Equity

For the Three Months Ended June 30, 2023 and 2022

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock Class A |

|

Common

Stock Class B |

|

Additional Paid-

in Capital |

|

Retained

earnings |

|

Statutory

Surplus

Reserve |

|

Accumulated

Other

Comprehensive

Income |

|

Non-controlling

interests |

|

Total

Equity |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

| Balance at April 1, 2022 |

54,035,280 |

|

$ |

5 |

|

|

5,086,812 |

|

$ |

1 |

|

|

$ |

597,143 |

|

|

$ |

57,946 |

|

|

$ |

8,312 |

|

|

$ |

10,979 |

|

|

$ |

134,388 |

|

|

$ |

808,774 |

|

| Net income |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

12,236 |

|

|

- |

|

|

- |

|

|

4,512 |

|

|

16,748 |

|

| Foreign currency translation adjustment |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(33,612) |

|

|

(6,760) |

|

|

(40,372) |

|

| Exercise of stock options |

106,525 |

|

- |

|

|

- |

|

- |

|

|

26 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

26 |

|

| Stock-based compensation |

- |

|

- |

|

|

- |

|

- |

|

|

1,969 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,969 |

|

| Balance at June 30, 2022 |

54,141,805 |

|

$ |

5 |

|

|

5,086,812 |

|

$ |

1 |

|

|

$ |

599,138 |

|

|

$ |

70,182 |

|

|

$ |

8,312 |

|

|

$ |

(22,633) |

|

|

$ |

132,140 |

|

|

$ |

787,145 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Stock Class A |

|

Common

Stock Class B |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Additional Paid-

in Capital |

|

Retained

earnings |

|

Statutory Surplus

Reserve |

|

Accumulated

Other

Comprehensive

Income (Loss) |

|

Non-controlling

interests |

|

Total

Equity |

| Balance at April 1, 2023 |

54,818,355 |

|

$ |

5 |

|

|

5,021,811 |

|

$ |

1 |

|

|

$ |

606,398 |

|

|

$ |

101,410 |

|

|

$ |

16,881 |

|

|

$ |

(32,768) |

|

|

$ |

140,778 |

|

|

$ |

832,705 |

|

| Net income |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

26,825 |

|

|

- |

|

|

- |

|

|

6,772 |

|

|

33,597 |

|

| Foreign currency translation adjustment |

- |

|

- |

|

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(29,148) |

|

|

(6,121) |

|

|

(35,269) |

|

| Exercise of stock options |

133,135 |

|

- |

|

|

- |

|

- |

|

|

4,284 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

4,284 |

|

| Shanghai dividend accrual |

|

|

|

|

|

|

|

|

|

|

(3,951) |

|

|

|

|

|

|

|

|

(3,951) |

|

| Stock-based compensation |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

2,017 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

2,017 |

|

| Balance at June 30, 2023 |

54,951,490 |

|

$ |

5 |

|

|

5,021,811 |

|

$ |

1 |

|

$ |

— |

|

$ |

612,699 |

|

$ |

— |

|

$ |

124,284 |

|

$ |

— |

|

$ |

16,881 |

|

$ |

— |

|

$ |

(61,916) |

|

$ |

— |

|

$ |

141,429 |

|

$ |

— |

|

$ |

833,383 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

2023 |

|

2022 |

| Cash flows from operating activities: |

|

|

|

| Net income |

$ |

42,560 |

|

|

$ |

9,305 |

|

| Adjustments to reconcile net income from operations to net cash used in operating activities |

|

|

|

| Depreciation and amortization |

3,955 |

|

|

2,555 |

|

Loss on disposals of property, plant and equipment |

(1) |

|

|

— |

|

| Realized gain on trading securities |

(7,913) |

|

|

— |

|

| Equity income in net income of affiliates |

(3,888) |

|

|

(401) |

|

| Unrealized loss on trading securities |

3,109 |

|

|

4,281 |

|

| Bad debt expense |

496 |

|

|

- |

|

| Deferred income taxes |

(4,711) |

|

|

1,642 |

|

| Stock-based compensation |

4,085 |

|

|

3,343 |

|

| Net changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(28,630) |

|

|

(55,919) |

|

| Other receivables |

(8,252) |

|

|

(676) |

|

| Inventories |

(96,739) |

|

|

(80,862) |

|

| Advances to related party (note 16) |

2,167 |

|

|

(690) |

|

| Prepaid expenses |

(4,749) |

|

|

(5,996) |

|

| Other long-term assets |

— |

|

|

910 |

|

| Related party accounts payable (note 16) |

(2,589) |

|

|

1,163 |

|

| Accounts payable |

9,963 |

|

|

5,950 |

|

| Advances from customers |

46,611 |

|

|

44,069 |

|

| Deferred revenue |

4,056 |

|

|

2,950 |

|

| Income taxes payable |

8,629 |

|

|

1,791 |

|

| FIN-48 payable |

(240) |

|

|

(111) |

|

| Other payables and accrued expenses |

10,004 |

|

|

6,862 |

|

| Other long-term liabilities |

(2,163) |

|

|

(1,463) |

|

| Net cash flow used in operating activities |

(24,240) |

|

|

(61,297) |

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

| Purchase of property and equipment |

(21,633) |

|

|

(5,256) |

|

| Purchase of intangible assets |

(1,285) |

|

|

(453) |

|

| Purchase of long-term investment (Note 14) |

(1,453) |

|

|

— |

|

| (Increase) decrease of time deposits |

48,208 |

|

|

(144,530) |

|

Proceeds from selling trading securities |

17,709 |

|

|

— |

|

| Dividends from unconsolidated affiliates |

5,095 |

|

|

— |

|

| Net cash (used in) provided by investing activities |

46,641 |

|

|

(150,239) |

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

| Repayments of short-term borrowings |

— |

|

|

(4,921) |

|

| Repayments of long-term borrowings |

(1,111) |

|

|

(800) |

|

| Proceeds from exercise of stock options |

4,525 |

|

|

750 |

|

| Net cash (used in) provided by financing activities |

3,414 |

|

|

(4,971) |

|

|

|

|

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

$ |

(16,264) |

|

|

$ |

(22,216) |

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

$ |

9,551 |

|

|

$ |

(238,723) |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at beginning of period |

248,451 |

|

|

563,067 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

258,002 |

|

|

$ |

324,344 |

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

| Interest paid, net of capitalized interest |

$ |

1,344 |

|

|

$ |

567 |

|

| Cash paid for income taxes |

$ |

7,243 |

|

|

$ |

119 |

|

|

|

|

|

| Reconciliation of cash, cash equivalents and restricted cash in condensed consolidated statements of cash flows: |

|

|

|

| Cash and cash equivalents |

257,420 |

|

|

324,344 |

|

| Restricted cash |

582 |

|

|

— |

|

| Cash, cash equivalents and restricted cash |

$ |

258,002 |

|

|

$ |

324,344 |

|

|

|

|

|

| Non-cash financing activities: |

|

|

|

| Conversion of Class B common stock to Class A common stock |

$ |

— |

|

|

$ |

1,002 |

|

| Cashless exercise of stock options |

$ |

79 |

|

|

$ |

68 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

ACM RESEARCH, INC.

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share, percentage and per share data)

NOTE 1 – DESCRIPTION OF BUSINESS

ACM Research, Inc. (“ACM”) and its subsidiaries (collectively with ACM, the “Company”) develop, manufacture and sell single-wafer wet-cleaning equipment used to improve the manufacturing process and yield for advanced integrated chips. The Company markets and sells its single-wafer wet-cleaning equipment, under the brand name "Ultra C," which are based on the Company’s proprietary Space Alternated Phase Shift (“SAPS”) and Timely Energized Bubble Oscillation (“TEBO”) technologies. These tools are designed to remove random defects from a wafer surface efficiently, without damaging the wafer or its features, even at increasingly advanced process nodes.

ACM was incorporated in California in 1998, and it initially focused on developing tools for manufacturing process steps involving the integration of ultra low-K materials and copper. The Company’s early efforts focused on stress-free copper-polishing technology, and it sold tools based on that technology in the early 2000s.

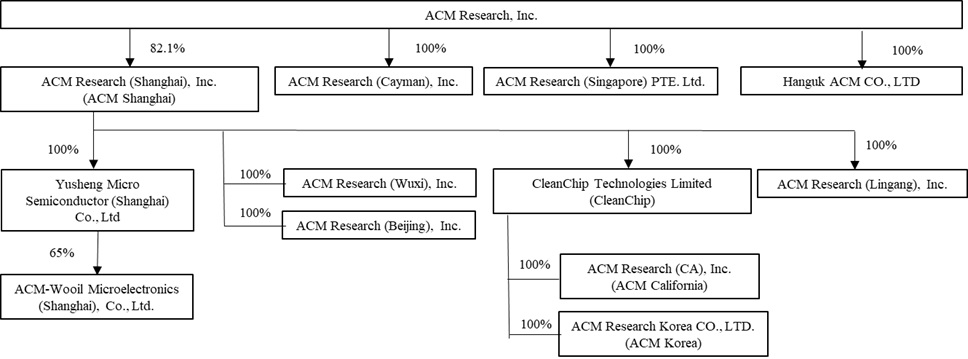

In 2006, the Company established its operational center in Shanghai in the People’s Republic of China (the “PRC”), where it operates through ACM’s subsidiary, ACM Research (Shanghai), Inc. (“ACM Shanghai”). ACM Shanghai was formed to help establish and build relationships with integrated circuit manufacturers in the PRC, and the Company initially financed its Shanghai operations in part through sales of non-controlling equity interests in ACM Shanghai.