|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

||||||

|

|

|||||||||||

(Address of principal executive offices)1

|

(Zip Code)1

|

||||||||||

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | |||||||

| COINBASE GLOBAL, INC. | ||||||||

| Dated: October 30, 2024 | By: | /s/ Alesia J. Haas | ||||||

| Alesia J. Haas | ||||||||

| Chief Financial Officer | ||||||||

Select Financial Metrics |

||||||||

FINANCIAL METRICS ($M) |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

|||

Net Revenue |

623 |

905 |

1,588 |

1,380 |

1,129 |

|||

Net Income (Loss) |

(2) |

273 |

1,176 |

36 |

75 |

|||

Adjusted EBITDA* |

178 |

324 |

1,014 |

596 |

449 |

|||

Q3’24 Coinbase Results vs. Outlook |

||||||||

METRIC |

COINBASE Q3 OUTLOOK (August 2024) |

Q3 ACTUALS |

||||||

Subscription and Services Revenue |

$530 – $600 million |

$556 million |

||||||

Transaction Expenses

as a percentage of net revenue

|

Mid teens as a % of net revenue

Dependent on revenue mix

|

15% |

||||||

Technology and Development +

General and Administrative Expenses

including stock-based compensation

|

$700 – $750 million

including ~$230 million in stock-based

compensation

|

$708 million

including $230 million in

stock-based compensation

|

||||||

Sales and Marketing Expenses

including stock-based compensation

|

$160 – $210 million

including ~$19 million in stock-based compensation

|

$165 million

including $19 million in

stock-based compensation

|

||||||

Total Revenue ($M) | |||||||

TOTAL REVENUE |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

||

Transaction Revenue |

|||||||

Consumer, net1

|

247.0 |

468.9 |

935.2 |

664.8 |

483.3 |

||

Institutional, net |

14.1 |

36.7 |

85.4 |

63.6 |

55.3 |

||

Other transaction revenue1

|

27.5 |

23.6 |

56.1 |

52.5 |

34.0 |

||

Total transaction revenue |

288.6 |

529.3 |

1,076.7 |

780.9 |

572.5 |

||

Subscription and Services revenue |

|||||||

Stablecoin revenue |

172.4 |

171.6 |

197.3 |

240.4 |

246.9 |

||

Blockchain rewards |

74.5 |

95.1 |

150.9 |

185.1 |

154.8 |

||

Interest and finance fee income2

|

42.5 |

48.9 |

66.7 |

69.4 |

64.0 |

||

Custodial fee revenue |

15.8 |

19.7 |

32.3 |

34.5 |

31.7 |

||

Other subscription and services revenue2

|

29.3 |

40.1 |

63.7 |

69.6 |

58.7 |

||

Total subscription and services revenue |

334.4 |

375.4 |

510.9 |

599.0 |

556.1 |

||

Net Revenue |

623.0 |

904.6 |

1,587.7 |

1,379.9 |

1,128.6 |

||

Corporate interest and other income |

51.1 |

49.2 |

49.9 |

69.7 |

76.6 |

||

Total Revenue |

674.1 |

953.8 |

1,637.6 |

1,449.6 |

1,205.2 |

||

TRADING VOLUME ($B) |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

||

Consumer |

11 |

29 |

56 |

37 |

34 |

||

Institutional |

65 |

125 |

256 |

189 |

151 |

||

Total |

76 |

154 |

312 |

226 |

185 |

||

TRADING VOLUME (% OF TOTAL) |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

||

Bitcoin |

38% |

31% |

33% |

35% |

37% |

||

Ethereum |

19% |

15% |

13% |

15% |

15% |

||

USDT |

15% |

13% |

11% |

10% |

15% |

||

Other crypto assets |

28% |

42% |

43% |

40% |

33% |

||

Total |

100% |

100% |

100% |

100% |

100% |

||

TRANSACTION REVENUE (% OF TOTAL) |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

||

Bitcoin |

37% |

29% |

30% |

31% |

35% |

||

Ethereum |

18% |

13% |

15% |

17% |

16% |

||

Solana |

* |

* |

* |

10% |

11% |

||

Other crypto assets |

46% |

57% |

55% |

42% |

38% |

||

Total |

100% |

100% |

100% |

100% |

100% |

||

Operating Expenses ($M) | |||||||

OPERATING EXPENSES |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

||

Transaction expense |

90.6 |

125.6 |

217.4 |

191.5 |

171.8 |

||

% of net revenue |

15% |

14% |

14% |

14% |

15% |

||

Technology and development |

322.8 |

323.1 |

357.9 |

364.3 |

377.4 |

||

Sales and marketing |

78.2 |

106.3 |

98.6 |

165.3 |

164.8 |

||

General and administrative1

|

252.6 |

313.9 |

287.2 |

320.1 |

330.4 |

||

(Gains) losses on crypto assets held for operations, net |

0.0 |

0.0 |

(86.4) |

31.0 |

(0.1) |

||

Crypto asset impairment, net |

7.2 |

(51.8) |

0.0 |

0.0 |

0.0 |

||

Restructuring |

(0.9) |

0.0 |

0.0 |

0.0 |

0.0 |

||

Other operating expenses (income), net1

|

3.5 |

21.1 |

2.4 |

34.4 |

(8.6) |

||

Total operating expenses |

754.0 |

838.2 |

877.1 |

1,106.5 |

1,035.7 |

||

Full-time employees (end of quarter) |

3,427 |

3,416 |

3,416 |

3,486 |

3,672 |

||

Coinbase Q4 2024 Outlook |

||||

METRIC |

OUTLOOK |

|||

Subscription and Services Revenue |

$505-$580 million |

|||

Transaction Expenses |

mid-teens as a percentage of net revenue

Dependent on revenue mix

|

|||

Technology & Development +

General & Administrative Expenses

|

$690-$730 million

Including ~$210 million in stock-based compensation

|

|||

Sales and Marketing Expenses |

$170-$220 million

Including ~$17 million in stock-based compensation

|

|||

September 30, |

December 31, |

||

2024 |

2023 |

||

Assets |

|||

Current assets: |

|||

Cash and cash equivalents .............................................................................................

|

$7,723,806 |

$5,139,351 |

|

Restricted cash and cash equivalents ..........................................................................

|

31,881 |

22,992 |

|

Customer custodial funds ...............................................................................................

|

4,035,045 |

4,570,845 |

|

Safeguarding customer crypto assets ...........................................................................

|

272,669,307 |

192,583,060 |

|

USDC .................................................................................................................................

|

871,425 |

576,028 |

|

Loan receivables ..............................................................................................................

|

398,239 |

193,425 |

|

Crypto assets borrowed ..................................................................................................

|

252,885 |

45,212 |

|

Accounts receivable, net .................................................................................................

|

187,004 |

168,290 |

|

Other current assets ........................................................................................................

|

255,975 |

286,643 |

|

Total current assets .....................................................................................................

|

286,425,567 |

203,585,846 |

|

Crypto assets held for investment .......................................................................................

|

1,260,718 |

330,610 |

|

Deferred tax assets ...............................................................................................................

|

1,032,959 |

1,272,233 |

|

Goodwill ...................................................................................................................................

|

1,139,670 |

1,139,670 |

|

Other non-current assets ......................................................................................................

|

699,694 |

654,594 |

|

Total assets .............................................................................................................

|

$290,558,608 |

$206,982,953 |

|

Liabilities and Stockholders’ Equity |

|||

Current liabilities: |

|||

Customer custodial cash liabilities .................................................................................

|

$4,035,045 |

$4,570,845 |

|

Safeguarding customer crypto liabilities .......................................................................

|

272,669,307 |

192,583,060 |

|

Crypto asset borrowings .................................................................................................

|

265,259 |

62,980 |

|

Obligation to return collateral .........................................................................................

|

118,224 |

1,063 |

|

Accrued expenses and other current liabilities ............................................................

|

500,603 |

496,183 |

|

Total current liabilities .................................................................................................

|

277,588,438 |

197,714,131 |

|

Long-term debt .......................................................................................................................

|

4,231,047 |

2,979,957 |

|

Other non-current liabilities ..................................................................................................

|

11,001 |

7,216 |

|

Total liabilities ...............................................................................................................

|

281,830,486 |

200,701,304 |

|

Commitments and contingencies |

|||

Stockholders’ equity: |

|||

Preferred stock, $0.00001 par value; 500,000 shares authorized and zero

shares issued and outstanding at each of September 30, 2024 and December

31, 2023 .............................................................................................................................

|

— |

— |

|

Class A common stock, $0.00001 par value; 10,000,000 shares authorized at

September 30, 2024 and December 31, 2023; 204,850 and 195,192 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively .......................................................................................................................

|

2 |

2 |

|

Class B common stock, $0.00001 par value; 500,000 shares authorized at

September 30, 2024 and December 31, 2023; 45,440 and 46,856 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively .......................................................................................................................

|

— |

— |

|

Additional paid-in capital .................................................................................................

|

5,087,238 |

4,491,571 |

|

Accumulated other comprehensive loss .......................................................................

|

(28,843) |

(30,270) |

|

Retained earnings ............................................................................................................

|

3,669,725 |

1,820,346 |

|

Total stockholders’ equity ...........................................................................................

|

8,728,122 |

6,281,649 |

|

Total liabilities and stockholders’ equity .............................................................

|

$290,558,608 |

$206,982,953 |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

2024 |

2023 |

2024 |

2023 |

||||

Revenue: |

|||||||

Net revenue .....................................................

|

$1,128,597 |

$623,004 |

$4,096,216 |

$2,021,902 |

|||

Other revenue .................................................

|

76,596 |

51,144 |

196,175 |

132,686 |

|||

Total revenue .............................................

|

1,205,193 |

674,148 |

4,292,391 |

2,154,588 |

|||

Operating expenses: |

|||||||

Transaction expense ......................................

|

171,781 |

90,577 |

580,665 |

295,146 |

|||

Technology and development .......................

|

377,440 |

322,756 |

1,099,561 |

1,001,454 |

|||

Sales and marketing ......................................

|

164,770 |

78,178 |

428,617 |

226,007 |

|||

General and administrative ...........................

|

330,387 |

252,630 |

937,738 |

760,379 |

|||

Gains on crypto assets held for

operations, net ................................................

|

(142) |

— |

(55,484) |

— |

|||

Crypto asset impairment, net .......................

|

— |

7,180 |

— |

17,089 |

|||

Restructuring ...................................................

|

— |

(860) |

— |

142,594 |

|||

Other operating (income) expense, net ......

|

(8,556) |

3,512 |

28,203 |

(10,806) |

|||

Total operating expenses .........................

|

1,035,680 |

753,973 |

3,019,300 |

2,431,863 |

|||

Operating income (loss) ...........................

|

169,513 |

(79,825) |

1,273,091 |

(277,275) |

|||

Interest expense ..................................................

|

20,530 |

20,821 |

60,108 |

64,029 |

|||

Losses (gains) on crypto assets held for

investment, net .....................................................

|

120,507 |

— |

(210,902) |

— |

|||

Other income, net ................................................

|

(40,105) |

(135,307) |

(21,883) |

(131,606) |

|||

Income (loss) before income taxes ........

|

68,581 |

34,661 |

1,445,768 |

(209,698) |

|||

(Benefit from) provision for income taxes ........

|

(6,914) |

36,926 |

157,878 |

(31,132) |

|||

Net income (loss) ......................................

|

$75,495 |

$(2,265) |

$1,287,890 |

$(178,566) |

|||

Net income (loss) attributable to common

stockholders:

|

|||||||

Basic .................................................................

|

$75,455 |

$(2,265) |

$1,287,106 |

$(178,566) |

|||

Diluted ..............................................................

|

$75,459 |

$(2,265) |

$1,296,949 |

$(178,566) |

|||

Net income (loss) per share: |

|||||||

Basic .................................................................

|

$0.30 |

$(0.01) |

$5.23 |

$(0.76) |

|||

Diluted ..............................................................

|

$0.28 |

$(0.01) |

$4.76 |

$(0.76) |

|||

Weighted-average shares of common stock

used to compute net income (loss) per share:

|

|||||||

Basic .................................................................

|

248,834 |

237,270 |

245,986 |

234,479 |

|||

Diluted ..............................................................

|

267,440 |

237,270 |

272,239 |

234,479 |

|||

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

2024 |

2023 |

2024 |

2023 |

||||

Technology and development ........................

|

$155,411 |

$130,776 |

$428,863 |

$376,941 |

|||

Sales and marketing .......................................

|

18,720 |

16,556 |

52,034 |

45,695 |

|||

General and administrative ............................

|

74,285 |

70,821 |

209,957 |

194,149 |

|||

Restructuring ....................................................

|

— |

— |

— |

84,042 |

|||

Total ..............................................................

|

$248,416 |

$218,153 |

$690,854 |

$700,827 |

|||

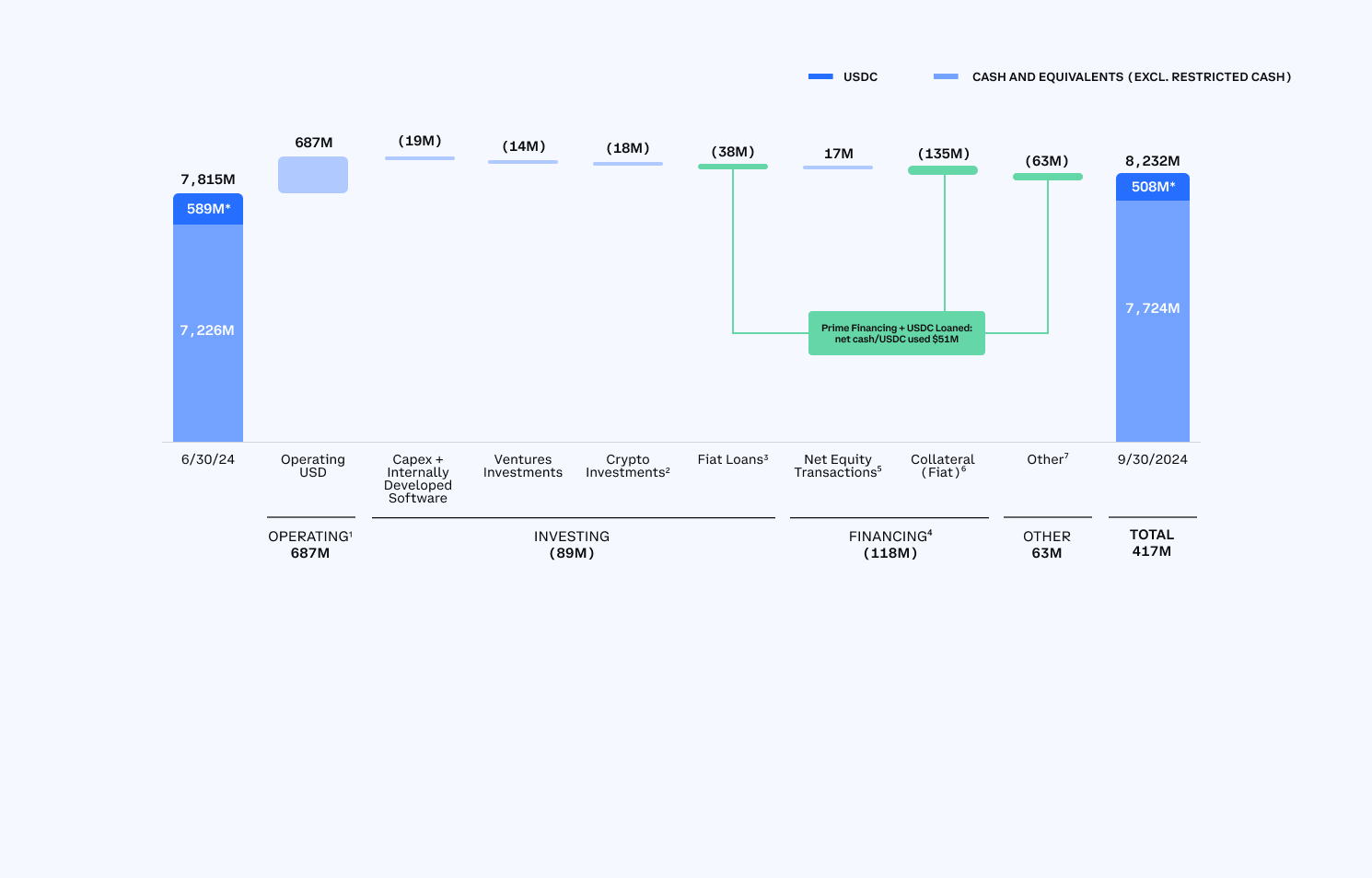

Nine Months Ended September 30, |

|||

2024 |

2023 |

||

Cash flows from operating activities |

|||

Net income (loss) ................................................................................................................

|

$1,287,890 |

$(178,566) |

|

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

|

|||

Depreciation and amortization .....................................................................................

|

94,523 |

110,157 |

|

Stock-based compensation expense .........................................................................

|

690,854 |

616,785 |

|

Deferred income taxes ..................................................................................................

|

61,075 |

(50,217) |

|

Non-cash lease expense ..............................................................................................

|

8,571 |

37,271 |

|

Gains on crypto assets held for operations, net .......................................................

|

(55,484) |

— |

|

Gains on crypto assets held for investment, net .......................................................

|

(210,902) |

— |

|

Gain on extinguishment of long-term debt, net .........................................................

|

— |

(99,446) |

|

Stock-based compensation expense recognized in relation to restructuring .......

|

— |

84,042 |

|

Realized loss on crypto futures contract ....................................................................

|

— |

43,339 |

|

Gains on crypto assets held, net (prior to ASU 2023-08) ........................................

|

— |

(110,610) |

|

Crypto asset impairment expense (prior to ASU 2023-08) .....................................

|

— |

77,151 |

|

Crypto assets received as revenue (prior to ASU 2023-08) ...................................

|

— |

(299,304) |

|

Crypto asset payments for expenses (prior to ASU 2023-08) ................................

|

— |

185,149 |

|

Other operating activities, net ......................................................................................

|

38,315 |

(2,164) |

|

Net changes in operating assets and liabilities .........................................................

|

(322,616) |

514,550 |

|

Net cash provided by operating activities ..........................................................................

|

1,592,226 |

928,137 |

|

Cash flows from investing activities |

|||

Fiat loans originated .........................................................................................................

|

(1,270,063) |

(348,252) |

|

Proceeds from repayment of fiat loans .........................................................................

|

1,075,000 |

242,384 |

|

Purchase of crypto assets held for investment ............................................................

|

(18,486) |

— |

|

Sale of crypto assets held for investment .....................................................................

|

52,586 |

— |

|

Settlement of crypto futures contract ............................................................................

|

— |

(43,339) |

|

Purchase of crypto assets held (prior to ASU 2023-08) .............................................

|

— |

(150,827) |

|

Sale of crypto assets held (prior to ASU 2023-08) ......................................................

|

— |

265,042 |

|

Other investing activities, net .........................................................................................

|

(72,006) |

(50,125) |

|

Net cash used in investing activities ...................................................................................

|

(232,969) |

(85,117) |

|

Cash flows from financing activities |

|||

Issuance of common stock upon exercise of stock options, net of repurchases ...

|

80,222 |

27,653 |

|

Taxes paid related to net share settlement of equity awards ....................................

|

(117,225) |

(183,962) |

|

Customer custodial cash liabilities .................................................................................

|

(550,776) |

(1,349,666) |

|

Issuance of convertible senior notes, net .....................................................................

|

1,246,025 |

— |

|

Purchases of capped calls ..............................................................................................

|

(104,110) |

— |

|

Repurchases of senior and convertible notes .............................................................

|

— |

(222,664) |

|

Fiat received as collateral ...............................................................................................

|

525,699 |

5,324 |

|

Fiat received as collateral returned ...............................................................................

|

(410,438) |

(4,585) |

|

Other financing activities, net .........................................................................................

|

13,266 |

(6,228) |

|

Net cash provided by (used in) financing activities ..........................................................

|

682,663 |

(1,734,128) |

|

Net increase (decrease) in cash, cash equivalents, and restricted cash and cash

equivalents ..............................................................................................................................

|

2,041,920 |

(891,108) |

|

Effect of exchange rates on cash, cash equivalents, and restricted cash and cash

equivalents ..............................................................................................................................

|

19,664 |

(27,353) |

|

Cash, cash equivalents, and restricted cash and cash equivalents, beginning of

period .......................................................................................................................................

|

9,555,429 |

9,429,646 |

|

Cash, cash equivalents, and restricted cash and cash equivalents, end of period ....

|

$11,617,013 |

$8,511,185 |

|

Supplemental disclosure of cash flow information |

|||

Cash paid during the period for interest .......................................................................

|

$33,424 |

$42,913 |

|

Cash paid during the period for Income taxes .............................................................

|

$113,107 |

$19,676 |

|

Nine Months Ended September 30, |

|||

2024 |

2023 |

||

USDC ..............................................................................................................................

|

$(294,104) |

$464,728 |

|

Accounts receivable, net ..............................................................................................

|

(37,759) |

81,317 |

|

Customer custodial funds in transit ............................................................................

|

4,039 |

(28,055) |

|

Income taxes, net ..........................................................................................................

|

(19,341) |

(157) |

|

Other current and non-current assets ........................................................................

|

(7,106) |

21,244 |

|

Other current and non-current liabilities ....................................................................

|

31,655 |

(24,527) |

|

Net changes in operating assets and liabilities ...................................................

|

$(322,616) |

$514,550 |

|

September 30, |

|||

2024 |

2023 |

||

Cash and cash equivalents .........................................................................................

|

$7,723,806 |

$5,100,799 |

|

Restricted cash and cash equivalents .......................................................................

|

31,881 |

26,319 |

|

Customer custodial cash and cash equivalents .......................................................

|

3,861,326 |

3,384,067 |

|

Total cash, cash equivalents, and restricted cash and cash equivalents .......

|

$11,617,013 |

$8,511,185 |

|

Nine Months Ended September 30, |

|||

2024 |

2023 |

||

Crypto asset loan receivables originated ..................................................................

|

$1,244,113 |

$409,027 |

|

Crypto asset loan receivables repaid .........................................................................

|

1,230,544 |

446,095 |

|

Cumulative-effect adjustment due to the adoption of ASU 2023-08 .....................

|

561,489 |

— |

|

Non-cash assets received as collateral returned .....................................................

|

495,574 |

237,681 |

|

Non-cash assets received as collateral .....................................................................

|

465,063 |

242,883 |

|

Crypto assets borrowed ...............................................................................................

|

353,325 |

399,460 |

|

Crypto assets borrowed repaid with crypto assets ..................................................

|

176,990 |

437,254 |

|

Non-cash assets pledged as collateral ......................................................................

|

75,893 |

128,587 |

|

Non-cash assets pledged as collateral returned ......................................................

|

69,245 |

140,818 |

|

Non-cash consideration paid for business combinations .......................................

|

— |

51,494 |

|

Crypto assets received on settlement of futures contract ......................................

|

— |

48,491 |

|

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

|

(in thousands) |

|||||

Net (loss) income ........................................................

|

$(2,265) |

$273,437 |

$1,176,245 |

$36,150 |

$75,495 |

Adjusted to exclude the following: |

|||||

Provision for (benefit from) income taxes ........

|

36,926 |

(140,584) |

261,179 |

(96,387) |

(6,914) |

Interest expense ..................................................

|

20,821 |

18,737 |

19,071 |

20,507 |

20,530 |

Depreciation and amortization ..........................

|

31,967 |

29,485 |

29,327 |

34,501 |

30,695 |

Stock-based compensation ...............................

|

218,153 |

163,883 |

224,504 |

217,934 |

248,416 |

(Gains) losses on crypto assets held for

investment, net (post-adoption of ASU

2023-08) ................................................................

|

— |

— |

(650,429) |

319,020 |

120,507 |

Other (income) expense, net(1) ..........................

|

(135,307) |

(35,977) |

(45,605) |

63,827 |

(40,105) |

Non-recurring accrued legal contingencies,

settlements, and related costs ..........................

|

— |

15,000 |

— |

— |

— |

Impairment on crypto assets still held, net

(pre-adoption of ASU 2023-08) .........................

|

8,897 |

— |

— |

— |

— |

Restructuring ........................................................

|

(860) |

— |

— |

— |

— |

Adjusted EBITDA ........................................................

|

$178,332 |

$323,981 |

$1,014,292 |

$595,552 |

$448,624 |

Revised definition no longer adjusts for: |

|||||

Crypto asset borrowing costs ............................

|

$706 |

$1,362 |

|||

Other impairment expense ................................

|

1,956 |

8,724 |

|||

Revised definition newly adjusts for: |

|||||

Additional other income, net(2) ...........................

|

(50) |

(28,961) |

|||

Adjusted EBITDA, previous definition ......................

|

$180,944 |

$305,106 |

|||