February XX, 2024 Shareholder Letter Fourth Quarter and Full-Year 2023 February 15, 2024 Exhibit 99.1

Fourth Quarter and Full-Year 2023 1 Fellow

Shareholders, In 2023, we saw our operational rigor pay off. We achieved our financial goal, launched new innovative products, strengthened our competitive position, and doubled down on our efforts to create momentum for a workable regulatory framework for crypto in the US. For the full-year, we generated net income of $95 million and positive Adjusted EBITDA in all four quarters, totaling nearly $1 billion - consistent with our financial goal to generate positive Adjusted EBITDA in all market conditions. We diversified our full-year 2023 total revenue base of $3.1 billion by generating $1.4 billion in subscription and services revenue. Meanwhile, our balance sheet strengthened as we increased our total $USD resources to $5.7 billion while simultaneously reducing total debt by 12%. Beyond the numbers, we accelerated product velocity. We launched Coinbase International Exchange, eligible customers can now access derivative products through Coinbase Financial Markets, launched Base, and we acquired key licenses, registrations or launched operations in 6 new markets. We have improved our existing product suite and laid important foundations for future growth. In 2024 Coinbase will focus on three main priorities. First, driving revenue through improving our core trading and USDC. Second, driving utility in crypto with experiments in payments using USDC and Base. Lastly, we will continue to drive regulatory clarity for the industry. All told, Coinbase is a fundamentally stronger company today than a year ago, and we are in a strong financial position to capitalize on the opportunities ahead. Note: Figures have been rounded for presentation purposes only. [1] Adjusted EBITDA is a non- GAAP financial measure. [2] $USD resources is defined as cash and cash equivalents, USDC, and historically, custodial account overfunding. For additional financial information and a reconciliation between GAAP and non-GAAP results, please refer to our shareholder letter issued on February 15, 2024 and our FY 2023 Form 10-K filed with the SEC on February 15, 2024.

Fourth Quarter and Full-Year 2023 2 Chapter 1: Chapter 2: Chapter 3: Chapter 4: We are building a business for long-term growth; Coinbase is financially strong, demonstrated by our Q4’23 and full-year 2023 results. Q4 transaction revenue surged 83% Q/Q to $529 million, primarily driven by higher levels of volatility and crypto asset prices. Q4 subscription and services revenue grew 12% Q/Q to $375 million. 2023 total revenue was $3.1 billion, down 3% Y/Y. Subscription and services revenue grew 78% Y/Y to $1.4 billion in 2023. 2023 net income was $95 million and Adjusted EBITDA was $964 million, up from negative $371 million in 2022. Our balance sheet strengthened as we reduced debt by $413 million and grew our total $USD resources1 by $217 million Y/Y, ending 2023 at $5.7 billion. We are driving a strong future for crypto by building trusted products. In 2023, Coinbase paired operational excellence with product innovation to deliver a strong year of execution against our product roadmap. We made progress in derivatives by launching Coinbase International Exchange and US derivatives products from Coinbase Financial Markets (CFM). We expanded operations internationally by obtaining licenses or registrations or launching in key growth countries - including Bermuda, Brazil, Canada, France, Singapore, and Spain. On the institutional side, we grew our institutional financing product, launched Coinbase Asset Management, and more recently in January 2024, began playing a key role as custodian for 8 of the 11 Bitcoin ETFs. We reached an updated arrangement with Circle to help expand the utility of USDC. We launched Base, our layer 2 network, which aims to improve speed, lower cost, and integrate developers into the Coinbase ecosystem. Lastly, we updated Coinbase Wallet to make sending crypto as simple as sending a text. We are driving regulatory clarity and made significant progress in 2023. In 2023, we said regulatory clarity was one of our top priorities, and we are pleased with the progress. By year end, 83% of G20 members and major financial hubs made progress toward regulatory clarity. Yet in the US, we are still fighting for clarity. In Q4, we advanced advocacy by supporting the $85 million Fairshake Super PAC and its affiliates with the goal of electing pro-crypto candidates in the 2024 election and by supporting Stand With Crypto’s efforts to engage 1 million crypto advocates and help drive pro-crypto policies. Meanwhile, in January 2024, oral arguments were held for our motion to dismiss in our case with the SEC. While it is very hard for defendants to entirely dismiss a case at this stage, we are prepared for all outcomes, and view all next steps as a positive path forward. Our goal is regulatory clarity. Clarity is the win. Q1’24 Outlook. Through February 13, we generated approximately $320 million of transaction revenue and expect Q1 subscription and services revenue to be within a range of $410-480 million. We anticipate transaction expenses will be in the mid-teens as a percentage of net revenue. We expect technology & development and general & administrative expenses together will increase Q/ Q to $600-650 million, driven primarily by higher stock-based compensation due to an improvement in an operational process (discussed in detail in Chapter 4). We expect Q1 sales & marketing expenses to be $85-100 million, lower than Q4, driven by seasonally lower NBA spend. We remain focused on generating positive Adjusted EBITDA in all market conditions. For a reconciliation of net income (loss) to Adjusted EBITDA used in this shareholder letter, please refer to the reconciliation table in the section titled “Reconciliation of Net Income (Loss) to Adjusted EBITDA,” following the financial statements included at the end of this shareholder letter. 1 $USD resources is defined as our cash and cash equivalents, USDC, and historically custodial account overfunding. Q4’23 Coinbase Results vs. Outlook Metric Subscription and Services Revenue Technology and Development +

General and Administrative Expenses including stock-based compensation Sales and Marketing Expenses

including stock-based compensation Transaction Expenses

as a percentage of net revenue Coinbase Q4 Outlook (November 2023) $85 – $95 million including ~$14 million in stock-based compensation Approximately flat compared to Q3 $525 – $575 million including ~$150 million in stock-based compensation Mid teens as a % of net revenue Dependent on revenue mix $106 million including $13 million in

stock-based compensation $375 million $604 million including $151 million in

stock-based compensation 14% Q4 Actuals Select Financial Metrics Full-Year FINANCIAL METRICS ($M) Net Revenue Net Income (Loss) Adjusted EBITDA 663 (97) 194 Q2’23 623 (2) 181 Q3’23 905 273 305 Q4’23 (79) 736 284 Q1’23 605 (557) (124) Q4’22 3,149 (2,625) (371) 2022 2,927 95 964 2023

Stablecoin revenue1 Subscription and services revenue Total Revenue ($M) TOTAL REVENUE Tranaction Revenue Institutional, net Consumer, net Total transaction revenue Interest income2 Blockchain rewards Total Revenue Custodial fee revenue Corporate interest and other income Other subscription and services revenue Total subscription and services revenue Net Revenue Full-Year Q2’23 151.4 87.6 50.0 17.0 29.4 335.4 662.5 45.4 707.9 Q3’23 172.4 74.5 39.5 15.8 334.4 32.3 623.0 51.1 674.1 Q4’23 171.6 95.1 42.6 375.4 19.7 46.5 904.6 49.2 953.8 Q1’23 198.9 73.7 361.7 41.9 17.0 30.1 736.4 36.1 772.5 Q4’22 145.7 282.8 62.4 36.5 11.4 26.7 604.9 24.2 629.1 2022 90.2 792.6 245.7 275.5 81.2 79.8 110.3 3,148.8 45.4 3,194.2 2023 1,429.5 1,406.9 694.2 330.9 173.9 69.5 138.3 2,926.5 181.8 3,108.4 1,519.7 Fourth Quarter and Full-Year 2023 3 Chapter 1

We are building

a business for

long-term growth; Coinbase is financially strong, demonstrated by our Q4’23 and full-year 2023 results. 2023 was a year characterized by financial discipline and operational excellence for Coinbase. We were pleased with our ability to build and ship products to best position us for long-term growth and expand our international operations, while simultaneously reducing expenses and executing on our goal of generating positive Adjusted EBITDA in all market conditions. 2023 total revenue was $3.1 billion, down 3% Y/Y. Net revenue was $2.9 billion, down 7% Y/Y, and Other revenue was $182 million, up 301% Y/Y. Total operating expenses were $3.3 billion, down 45% Y/Y, while technology & development, sales & marketing, and general & administrative expenses were collectively $2.7 billion, down 39% Y/Y. Net income was $95 million and Adjusted EBITDA was $964 million. Our balance sheet strengthened as we reduced debt by $413 million or approximately 12%, and our total $USD resources grew $217 million Y/Y to $5.7 billion by the end of the year. In addition, the fair market value of our corporate crypto investment portfolio was $1.0 billion bringing our total liquid resources to $6.7 billion. Q4 total revenue was $954 million, up 41% Q/Q. Net revenue was $905 million, up 45% Q/Q, and Other revenue was $49 million, down 4% Q/Q. Total operating expenses were $838 million, up 11% Q/Q, while technology & development, sales & marketing, and general & administrative expenses were collectively $710 million, up 9% Q/Q. Net income was $273 million and Adjusted EBITDA was $305 million. Net Income benefited from a $121 million non-cash tax valuation allowance release and a $18 million gain from debt repurchase. 310.0 17.1 327.1 274.5 288.6 14.1 529.3 492.5 36.7 374.7 352.4 22.3 322.1 308.8 13.4 2,356.2 2,236.9 119.3 1 Stablecoin revenue is derived from our arrangement with the issuer of USDC. Prior to Q3'23, stablecoin revenue was included within interest income. 2 Interest income represents interest earned on customer custodial funds as well as loans. Note: Figures presented may not sum precisely due to rounding

Fourth Quarter and Full-Year 2023 4 Transaction Revenue

Consumer Transaction Revenue

Institutional Transaction Revenue

2023 transaction revenue was $1.5 billion, down 36% Y/Y. Total trading volume2 was $468 billion, down 44% Y/Y. Consumer trading volume was $75 billion, down 55% Y/Y, and institutional trading volume was $393 billion, down 41% Y/Y. The primary driver of these Y/Y declines was multi-year lows in crypto asset volatility3, particularly in Q2 and Q3. Over the course of 2023, we gained market share in spot trading through delivering trusted crypto products and benefiting from our long-term approach to compliance and regulation. In Q4, we saw a sharp increase in crypto asset volatility - which resembled Q1’23 levels - and crypto asset prices. We believe the increases were driven by a variety of factors, principally excitement around Bitcoin spot ETF approvals and broad expectations around improving macroeconomic conditions in 2024, which contributed broadly in the capital markets to ‘risk on’ activity. The Q/Q increase in both of these macro factors positively impacted our Q4 transaction revenue. Q4 consumer transaction revenue was $493 million, up 79% Q/Q. In addition to the aforementioned macroeconomic factors, we saw existing users trade significantly higher volumes Q/Q, and to a lesser extent, growth in the number of users actively trading. Q4 consumer trading volume was $29 billion, up 164% Q/Q, significantly better than the US spot market, which grew 90% Q/Q. In connection with the Q/Q increase in volatility, we saw a relatively higher mix of Advanced volume in Q4 compared to Q3. The mix of Advanced and Simple volume was similar to Q1 when we had similar levels of volatility. As a result, our blended average fee rate was similar to Q1. Q4 institutional transaction revenue was $37 million, up 161% Q/Q. Institutional trading volume increased 92% Q/Q, in-line with the US spot market. Our strong performance in Q4 was driven not just by improved broader market activity, but also by continued investment in our product offering. Q4 trading volume benefited from strong growth in both Markets - which largely consists of market maker activity - and Coinbase Prime. The growth in Coinbase Prime volume resulted in a higher blended average fee rate in Q4 compared to Q3. Strength in Prime volume was driven by stronger market conditions, including the anticipation of Bitcoin ETF approvals - coupled with our widening product portfolio. As of Q4, 33% of the 100 largest hedge funds in the world by reported AUM had chosen to onboard with Coinbase. Also in Q4, we continued to see elevated levels of client onboarding and strong levels of re-activation of large institutional clients across our product suite. We were pleased to see strong growth in clients leveraging our Prime Financing products - including trade financing and portfolio margin. 2 Trading volume represents the total U.S. dollar equivalent value of spot matched trades transacted between a buyer and seller through our platform during the period of measurement. 3 Crypto asset volatility represents our internal measure of crypto volatility in the market relative to

prior periods. The volatility is based on intraday returns of a volume-weighted basket of all assets listed on our trading platform. These returns are used to compute the basket’s intraday volatility which is then scaled to a daily window. These daily volatility values are then averaged over the applicable time period as needed.

Fourth Quarter and Full-Year 2023 5 Subscription and Services Revenue

2023 subscription and services revenue was $1.4 billion, up 78% Y/Y. Growth was largely driven by stablecoin revenue, interest income, and blockchain rewards, as these revenues benefited from higher interest rates and higher staked balances over the course of 2023. Additionally, on a Y/Y basis, our assets under custody inflows were $7 billion - and we ended the year with $101 billion in assets under custody. Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 100% 75% 50% 25% 0% Total Subscription & Services Revenue Total Transaction Revenue Net Revenue (% of total) Note: Figures presented may not sum precisely due to rounding Full-Year Trading Volume (% of total) Bitcoin Ethereum USDT 40% 23% * Q2’23 38% 19% 15% Q3’23 31% 15% 13% Q4’23 24% 32% * Q1’23 35% 33% * Q4’22 29% 25% * 2022 34% 20% 11% 2023 Full-Year Trading Volume ($B) Consumer Institutional 14 78 92 Q2’23 11 65 76 Q3’23 29 125 154 Q4’23 124 21 145 Q1’23 20 125 145 Q4’22 167 663 830 2022 75 393 468 2023 Total Total Other crypto assets 38% 100% 28% 100% 42% 100% 45% 100% 33% 100% 46% 100% 35% 100% Full-Year Transaction Revenue (% of total) Bitcoin Ethereum Other crypto assets 39% 21% 39% Q2’23 37% 18% 46% Q3’23 29% 13% 57% Q4’23 18% 36% 46% Q1’23 35% 19% 46% Q4’22 29% 22% 49% 2022 35% 17% 48% 2023 Total 100% 100% 100%100%100% 100% 100% * Below reporting threshold of 10%

Fourth Quarter and Full-Year 2023 6 Q4 subscription and services revenue was $375 million, up 12% Q/Q. The primary driver of the Q/Q growth was blockchain rewards, which was influenced by higher crypto asset prices. Stablecoin revenue was $172 million, essentially flat Q/Q, due to a full-quarter of our economics related to our updated arrangement with Circle that we announced in August 2023 and higher-on platform balances, offset by lower USDC market capitalization. We ended Q4 with $2.8 billion in on-platform USDC, up from $2.5 billion at the end of Q3. Blockchain rewards revenue was $95 million, up 28% Q/Q, primarily driven by higher crypto asset prices, as well as continued growth in staked balances. As of December 31, 2023, approximately $9.4 billion in assets were held on behalf of individual consumers staked through our platform, and over $7.4 billion in assets were staked by our institutional customers through Coinbase Prime. Interest income was $43 million, up 8% Q/Q. The Q/Q growth was primarily driven by higher average custodial fiat balances, particularly towards the latter half of the quarter. As a reminder, custodial fiat balances vary on a quarter to quarter basis and we do not manage our business to grow these balances. Custodial fee revenue was $20 million, up 24% Q/Q, primarily driven by higher crypto asset prices. We continue to customize pricing on the Coinbase Prime platform based on customer needs between trading, custody, financing, and other products. Accordingly, we anticipate that product specific fees will vary from quarter to quarter depending on the types of customers onboarded and using the Coinbase Prime suite of products in any particular period. Other subscription and services revenue was $46 million, up 44% Q/Q. Several new products are gaining traction, including Coinbase One, our Prime Financing products, Coinbase Cloud, and other infrastructure investments. Throughout 2023, to execute on our goal of generating positive Adjusted EBITDA in all market conditions, we doubled down on expense management and operating efficiently. As a result, 2023 total operating expenses declined 45% Y/Y to $3.3 billion - including a 39% collective decline in technology & development, general & administrative, and sales & marketing expenses. We ended 2023 with 3,416 full-time employees, down approximately 24% Y/Y, largely driven by our January 2023 workforce reduction. Further, we exited 2023 with total quarterly operating expense levels that are among the lowest we have incurred as a public company. Expenses

Total Operating Expenses ($M) Other Transaction ExpensesTechnology & Development, General & Administrative, and Sales & Marketing $2,000 $1,500 $1,000 $500 $0 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 Q1’23 Q2’23 Q4’23Q3’23

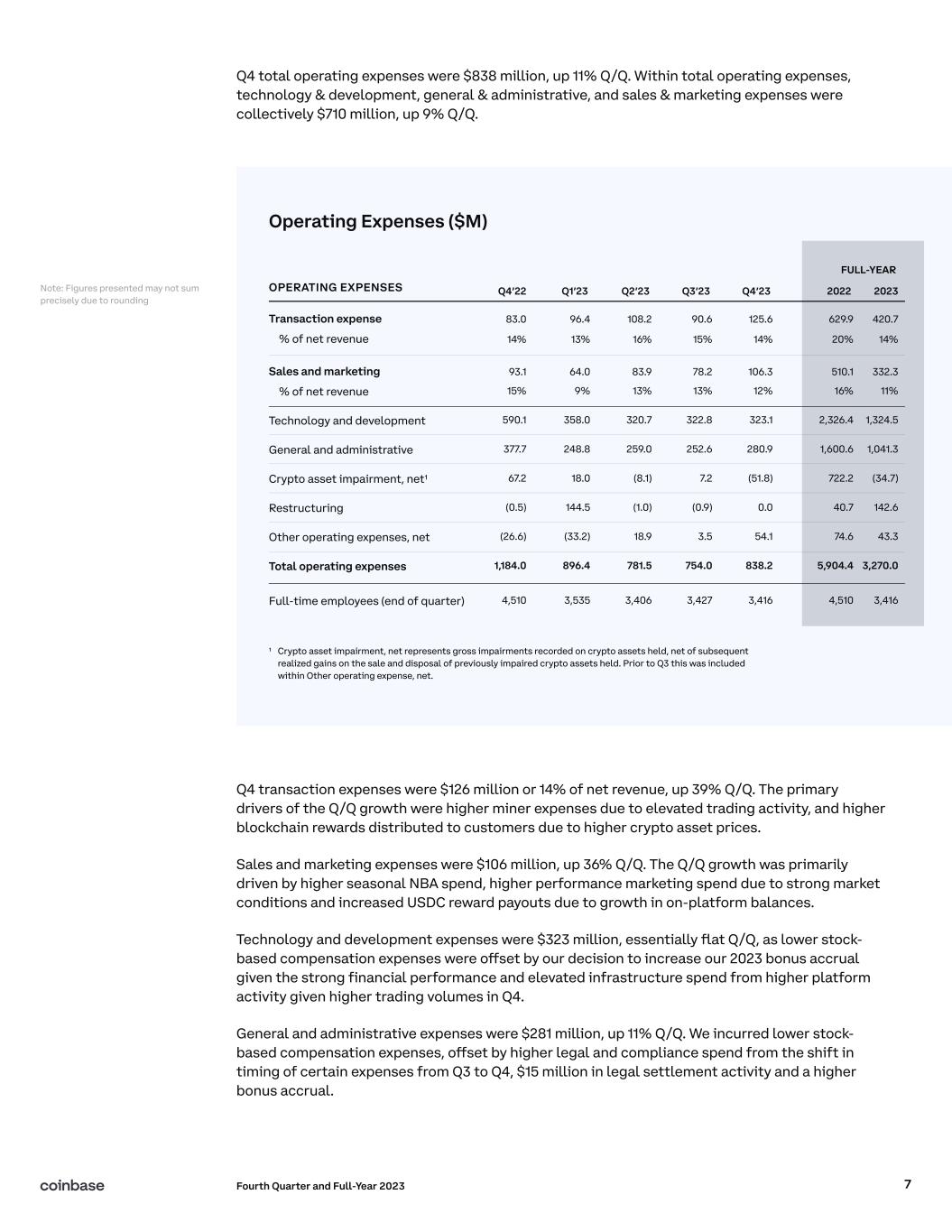

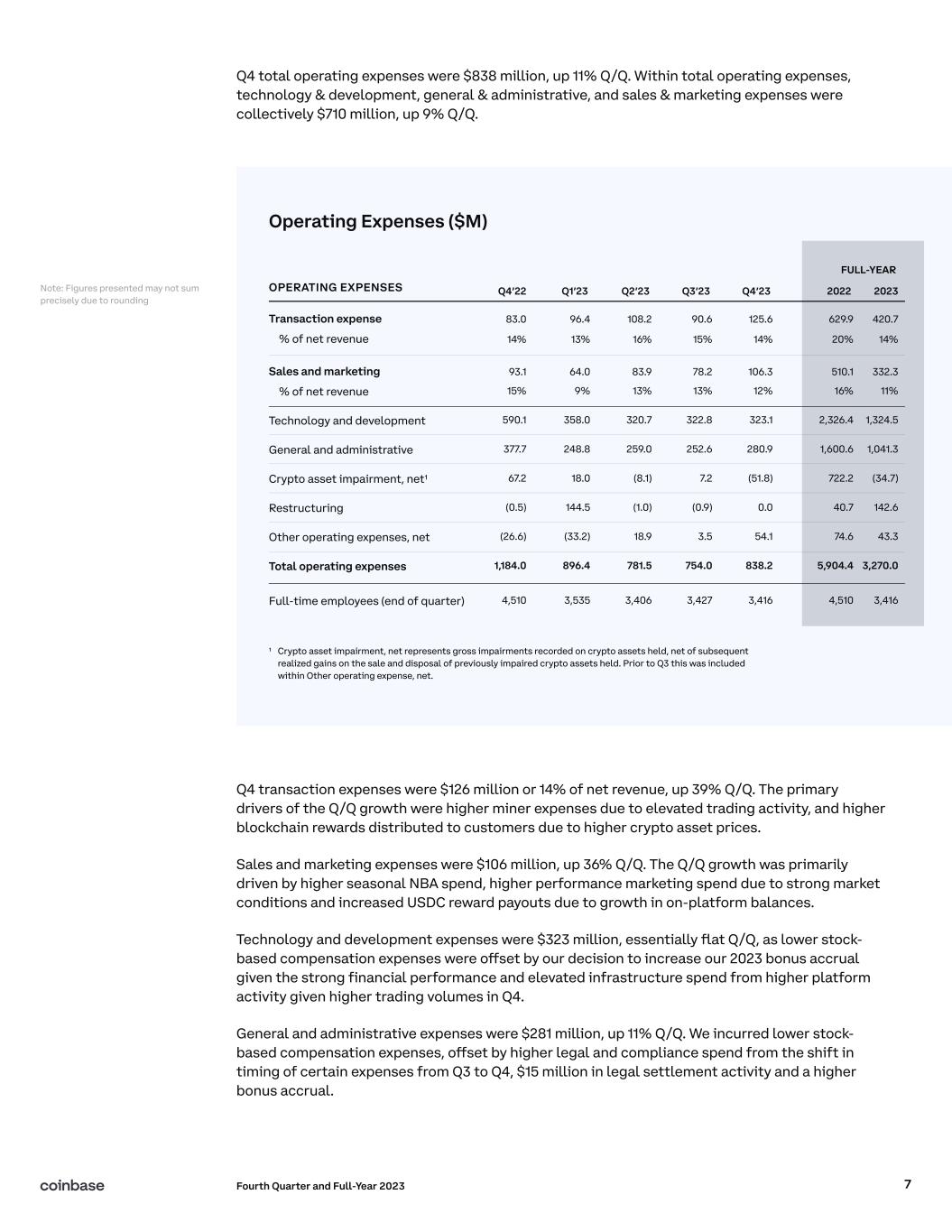

Fourth Quarter and Full-Year 2023 7 Q4 total operating expenses were $838 million, up 11% Q/Q. Within total operating expenses, technology & development, general & administrative, and sales & marketing expenses were collectively $710 million, up 9% Q/Q. Q4 transaction expenses were $126 million or 14% of net revenue, up 39% Q/Q. The primary drivers of the Q/Q growth were higher miner expenses due to elevated trading activity, and higher blockchain rewards distributed to customers due to higher crypto asset prices. Sales and marketing expenses were $106 million, up 36% Q/Q. The Q/Q growth was primarily driven by higher seasonal NBA spend, higher performance marketing spend due to strong market conditions and increased USDC reward payouts due to growth in on-platform balances. Technology and development expenses were $323 million, essentially flat Q/Q, as lower stock- based compensation expenses were offset by our decision to increase our 2023 bonus accrual given the strong financial performance and elevated infrastructure spend from higher platform activity given higher trading volumes in Q4. General and administrative expenses were $281 million, up 11% Q/Q. We incurred lower stock- based compensation expenses, offset by higher legal and compliance spend from the shift in timing of certain expenses from Q3 to Q4, $15 million in legal settlement activity and a higher bonus accrual. Note: Figures presented may not sum precisely due to rounding Full-Year 108.2 16% 83.9 13% 320.7 259.0 (8.1) (1.0) 18.9 781.5 3,406 Q2’23 15% 78.2 90.6 322.8 13% 252.6 7.2 (0.9) 754.0 3.5 3,427 14% Q3’23 106.3 125.6 323.1 13% 12% 280.9 (51.8) 838.2 0.0 54.1 3,416 64.0 Q4’23 358.0 14% 96.4 9% 248.8 896.4 18.0 144.5 (33.2) 3,535 93.1 20% Q1’23 510.1 590.1 83.0 14% 332.3 2,326.4 15% 1,184.0 377.7 67.2 (0.5) (26.6) 4,510 Q4’22 1,324.5 629.9 16% 1,600.6 722.2 40.7 74.6 5,904.4 4,510 2022 420.7 11% 1,041.3 (34.7) 142.6 3,270.0 43.3 3,416 2023 Operating Expenses ($M) Transaction expense % of net revenue Sales and marketing % of net revenue Restructuring Crypto asset impairment, net1 OPERATING EXPENSES General and administrative Technology and development Other operating expenses, net Full-time employees (end of quarter) Total operating expenses 1 Crypto asset impairment, net represents gross impairments recorded on crypto assets held, net of subsequent realized gains on the sale and disposal of previously impaired crypto assets held. Prior to Q3 this was included within Other operating expense, net.

Fourth Quarter and Full-Year 2023 8 Crypto asset impairment was a net $52 million gain. In Q4, as normal course of operations, we sold certain crypto assets used for operations which resulted in a gain In December 2023, the FASB issued Accounting Standards Update No. 2023-08 (“ASU 2023-08”), which represents a significant change in how we will account for changes in value for crypto assets we hold on our platform - both assets held for operations, and assets held as part of our corporate investment portfolio. Historically, we assessed for impairment within each quarter and only recorded a gain when we sold an asset above its impaired cost basis. Effective January 1, 2024, as a result of ASU 2023-08, we will measure the majority of our crypto assets held at fair value and to reflect changes in fair value (both gains and losses) in net income each reporting period. We will adjust Adjusted EBITDA for net unrealized and realized gains and losses recognized as a result of changes in the fair value of crypto assets held related to our corporate investment portfolio. Other operating expenses were $54 million, primarily driven by political contributions in support of driving regulatory clarity by electing pro-crypto candidates in the US elections this year. Stock-based compensation was $164 million. Other income was $36 million, primarily driven by unrealized gains related to fair market adjustments of certain financial instruments, as well as gains related to the extinguishment of $100 million of our 2026 Convertible Notes. Our Q4 effective tax rate was negative 106%. The Q4 effective tax rate is lower than the US statutory rate primarily due to a $121 million release of a valuation allowance on deferred tax assets on our capital losses as a result of the appreciation of crypto asset prices during the quarter. Q4 net income was $273 million. Our Q4 fully diluted share count was 279.7 million, down slightly Q/Q. This includes 242.0 million common shares and 37.7 million dilutive securities (including 3.4 million associated with our 2026 Convertible Notes which have a conversion price of $370.45). Full-year 2023 dilution was approximately 1.6%. We ended Q4 with $5.7 billion in $USD resources, an increase of $213 million Q/Q. We define $USD resources as cash and cash equivalents, USDC, and historically, custodial account overfunding. Share count

Capital and Liquidity

Fourth Quarter and Full-Year 2023 9 Total $USD Resources Corporate Cash Held

at Third Party Venues USDC Corporate Cash Money Market Funds $89M $576M $1,367M $3,683M Total $5,715M 5,502M 09/30/2023 Operating1

292M Investing

91M Financing4

(153M) Other

(17M) Adj. Op.

Cash Flow Capex + Internally Developed Software M&A + Ventures Crypto Investments,

Inventory

and Other2 Financing Products and Collateral3 Repurchase of Long- Term Debt Net Equity Transactions5 Financing Collateral (USDC)6 Other7 12/31/2023 5,101M 401M (12M) 292M (3M) 70M (81M) (72M) (38M) 21M36M Total

213M 12/31/2022 5,498M 4,425M 861M 212M 5,715M 5,139M 576M Customer Account Overfunding USDC Cash and Equivalents (Excl. Restricted Cash) Q4 $USD Resources Walk 1 Cash flows due to operating activities, excluding the net change in USDC and deposits in-transit 2 Crypto disposals and purchases across crypto inventory portfolio, operating purposes, and other business activities 3 Financing products and collateral includes Prime Financing and Retail Borrow plus fiat assets pledged as collateral 4 Excludes the net change in customer custodial cash liabilities 5 Net cash paid for taxes related to net share settlement of equity awards, offset by cash received for the issuance of common stock upon exercises of stock options, net of repurchases and proceeds for the employee stock purchase plan 6 Represents net inflows of USDC relating to financing collateral 7 Other includes the effect of FX on corporate cash offset by miscellaneous outflows of USDC Note: Figures presented may not sum precisely due to rounding

Fourth Quarter and Full-Year 2023 10 We also consider our crypto assets held as investments as other unencumbered resources to us. The fair market value of our crypto assets held as investments was $1.0 billion as of and had an impaired cost basis of $331 million at the end of Q4. When including our crypto investments, total available resources totaled $6.7 billion, up from $5.9 billion at the end of 2022. We maintained our longstanding commitment to operational and risk excellence throughout Q4. At the end of Q4, we had $546 million in total credit and counterparty risk (excluding banks), stemming from $399 million in loans to customers, $94 million held at third party venues (including $89 million in unrestricted cash), and $53 million in collateral posted. In Q4, we continued to see healthy adoption of our Prime Financing suite products, including secured lending, trade financing and portfolio margin. As a result, loans to institutional customers increased to $399 million at the end of Q4. Credit and Counterparty Risk

Fourth Quarter and Full-Year 2023 11 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC OCT Chose Ireland as EU hub AUG Updated arrangement with Circle AUG Launch in Canada AUG Base Mainnet and Onchain Summer SEP Obtain registration in Spain SEP Coinbase Prime launched Web3 Wallet MAR Launch in Brazil FEB Base Testnet MAY Launched Coinbase International Exchange APR Obtained license from Bermuda Monetary Authority AUG Supported Shapella upgrade; fueled Institutional staking JUN Series of Coinbase Advanced improvements, including 200+ new trading pairs and USDC <> USD order book unification Q2 Q4 Q3Q1 Down Markets are For Builders MAR One River Acquisition - now Coinbase Asset Management OCT Obtained Major Payment Institution license from the Monetary Authority of Singapore OCT Perpetual futures available to eligible non- US customers via Coinbase International Exchange NOV Coinbase Financial Markets begins offering regulated futures contracts DEC Obtain registration in France DEC Coinbase International Exchange launches spot trading Chapter 2

We are driving a strong future for crypto by building trusted products In 2023, Coinbase paired operational excellence with product innovation to deliver a strong year of execution against our product roadmap. We made good progress in derivatives by launching Coinbase International Exchange and US derivatives products from Coinbase Financial Markets. We expanded operations internationally by obtaining licenses or registrations or launching in key growth countries - including Bermuda, Brazil, Canada, France, Singapore, and Spain. On the institutional side, we grew our institutional financing product, launched Coinbase Asset Management, and more recently in January 2024, began playing a key role as custodian for 8 of the 10 Bitcoin ETFs. We reached an updated arrangement with Circle to help expand the utility of USDC. We launched our new layer 2 network, Base, which aims to improve speed, lower cost, and integrate developers into the Coinbase ecosystem. Lastly, we updated Coinbase Wallet to make sending crypto as simple as sending a text.

Fourth Quarter and Full-Year 2023 12 Crypto creates economic freedom by ensuring that people can participate fairly in the economy, and Coinbase is on a mission to increase economic freedom for more than 1 billion people. We are continually thinking about the next act for crypto and how we can integrate crypto into a larger portion of the global economy. Recognizing the limitations of the traditional financial system, Coinbase has introduced innovative solutions to usher in a more efficient, transparent, and accessible financial landscape. Crypto as an

update to the Financial System Our product strategy is mapped against the three pillars of crypto adoption. First, crypto as an asset class, which centers around the core trading and store of value use case. Second, crypto as an update to the financial system, which centers around stablecoins, staking services, and more. And lastly, crypto as an app platform, which centers around a wide variety of applications - from decentralized services to cloud services and commerce. Derivatives Through The Coinbase International Exchange and Coinbase Financial Markets

The derivatives market for crypto represented 75% of all trading volume in 2023, with the majority of this volume going through unregulated exchanges. We believe there is a large opportunity for a trusted, regulated player to provide a safe and secure way to engage with regulated derivatives products. We made great progress in pursuit of this market in 2023. In May, we launched the Coinbase International Exchange and began offering derivatives products to non-US institutional customers, and in October we began offering perpetual futures trading to non- US retail customers. In August, Coinbase Financial Markets (CFM) received approval to offer futures to eligible US customers by the National Futures Association and in November, CFM launched a derivatives offerings to eligible US retail traders. These futures contracts are designed to be more accessible for retail traders with smaller contract sizes for Bitcoin and Ethereum. CFM is the first crypto-native leader to offer access to regulated, leveraged, and cash-settled crypto futures. International Expansion

In the first three quarters of 2023, Coinbase made substantial progress towards our global expansion strategy. Key achievements included obtaining licenses in Singapore and Bermuda, launching operations in Canada and Brazil with local currency support, and expanding the reach of our product portfolio, including Coinbase One, staking, and USDC globally. Additionally, Coinbase improved product quality in a number of markets, and improved our onboarding experience which resulted in double the onboarding success rates. We also built new localization infrastructure including local new feeds, home pages, and improved translation services. In Q4, we continued to build on this momentum and continued to make progress against our goals for international expansion. In France and Spain, Coinbase received Virtual Asset Service Provider (VASP) registrations enabling operations and offering digital asset services in compliance with national regulations, enhancing our presence and catering to these countries’ growing crypto interest. And we chose Ireland as our EU MiCA hub, leveraging its supportive FinTech environment and regulatory framework. Coinbase was named as the Primary Custodian on 8 of 11 ETF Applications

In 2023 Coinbase was named as the trusted primary custodian on 8 of 11 ETF applications. ETFs provide a simplified way to invest in a fund that owns Bitcoin, opening up a regulated avenue for otherwise trapped capital to enter the crypto market and signaling the maturation of the crypto market. Most recently in January of 2024 Spot bitcoin ETFs were approved in the US, reaffirming that the future of money is here. The SEC’s ETF approval is a watershed moment for the expansion of the cryptoeconomy. Crypto as an

Asset Class

Fourth Quarter and Full-Year 2023 13 Stablecoins and USDC

Base

Expanding Coinbase Wallet Functionality

Stablecoins play a crucial role as a bridge towards more accessible and improved financial services, along with modernizing the financial infrastructure. Stablecoins bring together the advantages of cryptocurrency, such as immediate transactions, no geographic limits, universal access, and cost-free exchanges, all while eliminating concerns over fluctuating values. In Q3, we entered into an updated arrangement with Circle, which resulted in even greater strategic alignment on the long-term success of the stablecoin ecosystem. Pursuant to this arrangement, Coinbase will earn a pro rata portion of income earned on the USDC reserves based on the amount of USDC held on each respective party’s platform, and will now equally share in the income earned from the distribution and usage of USDC after certain expenses. Today, USDC is on over a dozen blockchains and the second largest stablecoin with a market cap of $28 billion. Blockchain is the core technology for decentralized apps, and Coinbase is advancing infrastructure to make development faster and more cost-effective. Removing limitations to increase onchain app creation is why we launched our secure Ethereum L2 solution Base. Base aims to transform L2 usage, improving speed, lowering costs, and integrating developers into the Coinbase ecosystem. While it is still very early days for Base we have seen great progress. As of Q4, Base is one of the largest & fastest growing ecosystems launched since 2020, and as of Q4 boasts over $600 million in assets on platform. We are encouraged by the early utility of Base and are optimistic about the role L2s will play not only for Coinbase but for the growth and development of the entire cryptoeconomy. In Q4, we updated Coinbase Wallet to make sending assets as simple as sending a text, enabling transactions via messaging apps and social media platforms. This update supports local fiat onramps in over 130 countries, promoting financial inclusion, especially in high-inflation regions with traditionally less access to stable currencies. Coinbase's commitment to reducing fees and expanding global access underlines our aim to facilitate easier, cheaper, and faster asset transfers worldwide, thus broadening participation in the cryptoeconomy. Crypto as an

App Platform

Fourth Quarter and Full-Year 2023 14 In 2023, we said regulatory clarity was one of our top priorities, and we have seen progress. 83% of G20 members and major financial hubs have made progress towards regulatory clarity for crypto. Yet in the US, we are still fighting for clarity. There are two bills going through Congress in the US with strong bipartisan support and we will continue to work to advance this legislation. To that end, Coinbase, along with other players in the crypto space, collectively contributed $85 million to a Super PAC designed to elect pro-crypto candidates in the US elections this year. Further, in August 2023, we were proud to help create Stand With Crypto, a grassroots movement for crypto advocates in the US. Their goal is to bring together 1 million advocates and help drive pro-crypto policies and crypto innovation worldwide. They are 30% of the way to that goal with over 300,000 members today. We are grateful that crypto remains bipartisan and we hope to see support of all candidates who support and will drive crypto legislation in the US. Another path to regulatory clarity we are pursuing is through the US court system. Our ongoing litigation with the SEC is part of this process. In January 2024, oral arguments on our motion to dismiss were held in our case with the SEC. While we are not in the business of making predictions on a motion to dismiss, and it is very hard for defendants to entirely dismiss a case at this stage, we are as optimistic as ever that whether the case goes to trial or is dismissed, we will get the clarity we have long sought. We are confident in the outcome–whether it comes later or comes sooner–because we strongly believe we are right on the facts and right on the law. We are also directly challenging in court the SEC’s decision not to engage in rulemaking for crypto. Anecdotally, our customers regularly thank us for our willingness to seek regulatory clarity in the courts. While we work through these cases, it is business as usual at Coinbase. We remain prepared for all outcomes, and view all next steps as a positive step forward to achieving our goal: regulatory clarity. Clarity is the win. Chapter 3

We are driving regulatory clarity and made significant progress in 2023 Litigation Stages Complaint Filed Motion

to Dismiss Discovery Motion for summary judgment Trial The case will likely proceed to discovery on the claims that have not been dismissed.The SEC will likely appeal. If the motion is granted in full: If the motion is granted in part but denied in part: If the motion is denied in full: There is no set timeline for the decision on the Motion to Dismiss. The case will proceed to discovery on all claims. Next steps

Fourth Quarter and Full-Year 2023 15 We remain confident the US will get this right, whether it comes from the courts creating new case law, Congress passing new legislation, or ultimately the 52 million Americans that own crypto electing candidates who represent their values. 52 million Americans

own crypto

Fourth Quarter and Full-Year 2023 16 Experience reminds us how quickly crypto markets can evolve (as evidenced in Q4) and we enter 2024, as always, prepared for a wide range of outcomes. Our 2023 goal was to generate positive Adjusted EBITDA in all market conditions and we plan to execute against that same goal in 2024. Beneath the surface, we expect total expenses to increase in 2024 in absolute dollars, primarily driven by higher stock-based compensation (see explanation below). In addition, we anticipate moderate headcount growth in 2024 to capitalize on the long-term opportunities we see ahead, although we expect these expenses to be offset by lower restructuring expenses on a Y/Y basis: The volatility of our stock price had an impact on our total stock-based compensation expense in 2023. Historically, we have had a gap between the dates when our equity awards to employees were approved and when those equity awards were recorded as an expense. That historical process introduced risk to our financials - upwards or downwards - depending on movement in our stock price. In 2023, our stock price happened to have declined between these days. As a result, our 2023 stock-based compensation expense was lower than the intended total value of equity awards issued to employees. In 2024, we have improved our process so that the timing of annual equity award grants and the associated expense recognition are aligned, which results in higher stock-based compensation on a total dollar basis compared to 2023. Turning to Q1, our outlook reflects the most predictable elements of our business, specifically subscription and services revenue and expenses, as outlined below: We have generated approximately $320 million of total transaction revenue through February 13, which is approximately halfway through Q1. We continue to urge caution in extrapolating these results. We expect Q1 subscription and services revenue to be within $410-480 million. Achieving the high vs. low end of this range will largely depend on how crypto asset prices trend for the remainder of Q1. Transaction Revenue

Subscription and Services Revenue

Coinbase Q1 2024 Outlook Metric Subscription and Services Revenue Transaction Expenses Technology and Development +

General and Administrative Expenses Sales and Marketing Expenses $410-480 million Mid teens as a % of net revenue Dependent on revenue mix $600 million - $650 million Including ~$215 million in stock-based compensation $85 million - $100 million Including ~$17 million in stock-based compensation OUTLOOK Chapter 4

Q1’24 Outlook

Fourth Quarter and Full-Year 2023 17 Expense Looking Ahead - 2024

Technology & development and general & administrative expenses are expected to increase modestly Q/Q. We expect stock-based compensation to grow Q/Q both due to the process improvement dynamic discussed above and from seasonally-higher expense recognition. This should be partially offset by lower legal spend and a normalized bonus accrual in Q1 (vs. our higher bonus accrual in Q4). We expect sales and marketing expenses to decline Q/Q, driven by seasonally lower NBA- related spend. In addition to our outlook, we wanted to provide a few notes on our 2024 financial statements We are adopting new accounting treatment for crypto assets and we will begin measuring our crypto assets at fair value starting in Q1. Additional details are included in Chapter 1 above We anticipate growth in our institutional financing product which will increase loans receivable and reduce cash on our balance sheet. These institutional loans are short-duration and fully collateralized. We have seen volatility in our 2023 effective tax rate which may continue in 2024. Our effective tax rate can fluctuate as a result of changes in the valuation of our deferred tax assets, the fair value of the crypto assets we hold, and the amount of tax credits we can claim.

Fourth Quarter and Full-Year 2023 18 Webcast Information

Forward Looking Statements

Non-GAAP Financial Measure

We will host a question and answer session to discuss the results for the fourth quarter and full- year 2023 on February 15, 2024 at 2:30 pm PT. The live webcast of the call will be available on the Investor Relations section of Coinbase’s website at https://investor.coinbase.com. A replay of the call as well as a transcript will be available on the same website. This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our future operating results and financial position, including for the first quarter and the full-year ending December 31, 2024, anticipated future expenses and investments; expectations relating to certain of our key financial and operating metrics; our business strategy and plans; expectations relating to legal and regulatory proceedings; expectations relating to our industry, the regulatory environment, market conditions, trends and growth; expectations relating to customer behaviors and preferences; our ability to fund our operations through periods of macroeconomic uncertainty and significant volatility in the cryptoeconomy; our market position; potential market opportunities; and our objectives for future operations. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management’s expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including, among others: our ability to successfully execute our business and growth strategy and generate future profitability; market acceptance of our products and services; our ability to further penetrate our existing customer base and expand our customer base; our ability to develop new products and services; our ability to expand internationally; the success of any acquisitions or investments that we make; the effects of increased competition in our markets; our ability to stay in compliance with applicable laws and regulations; stock price fluctuations; market conditions across the cryptoeconomy, including crypto asset price volatility; and general market, political and economic conditions, including interest rate fluctuations, inflation, instability in the global banking system, economic downturns, and other global events, including regional wars and conflicts and government shutdowns. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, our actual results could differ materially and adversely from those anticipated or implied in the forward- looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are, or will be included, in our filings we make with the Securities and Exchange Commission (SEC) from time to time, including our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 15, 2024. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward- looking statements. To supplement our consolidated financial statements, which are prepared and presented in accordance with US generally accepted accounting principles (GAAP), we use the following non- GAAP financial measure: Adjusted EBITDA. The presentation of this financial measure is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In addition, other companies, including companies in our industry, may calculate this non-GAAP measure differently or may use other measures to evaluate their performance, all of which could

Fourth Quarter and Full-Year 2023 19 reduce the usefulness of our disclosure of our non-GAAP financial measure as a tool for comparison. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure. We believe this non-GAAP financial measure provides investors with useful supplemental information about the financial performance of our business, enables comparison of financial results between periods where certain items may vary independent of business performance, and allows for greater transparency with respect to key metrics used by management in operating our business. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA may be helpful to investors because it provides consistency and comparability with past financial performance. There are a number of limitations related to Adjusted EBITDA rather than net income (loss), which is the nearest GAAP equivalent of Adjusted EBITDA. Some of these limitations are Adjusted EBITDA excludes benefit from income taxes interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us depreciation and intangible assets amortization expense and, although these are non-cash expenses, the assets being depreciated and amortized may have to be replaced in the future stock-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy other impairment expense, which represents impairment on property and equipment and intangible assets and is infrequent in nature and is a non-cash adjustment non-recurring accrued legal contingencies, settlements, and related costs, which reduces cash available to us non-recurring expenses related to our direct listing in April 2021 impairment on crypto assets still held, net, represents impairment on crypto assets still held and is a non-cash expense, which has been recurring, and may in the future recur, although the crypto assets impaired may be sold in the future at a price at or higher than the price the assets have been impaired to the impact of restructuring, which is infrequent and not related to normal operations but impacted our results in 2022 and 2023 the impact of fair value gain or loss on derivatives, a non-cash expense, which has been recurring, and may in the future recur the impact of crypto asset borrowing costs, a non-cash expense, which is similar in nature to interest expense on our crypto asset borrowings, which has been recurring, and may in the future recur gain on extinguishment of long-term debt due to repurchases prior to maturity, a non-cash adjustment, which has been recurring, and may in the future recur gain or loss on investments, which represents net gains on investments and impairment on investments, net, a non-cash expense, which has been recurring, and may in the future recur, although the impaired investments may be sold in the future at a price lower, at or higher than the price the assets have been impaired to the impact of unrealized foreign exchange gains or losses and fair value adjustments on foreign exchange derivatives for hedging activities, non-cash adjustments, which have been recurring, and may in the future recur; an a non-recurring fee and write-off related to an early lease termination, a non-recurring accrual for value-added tax related to our Irish operations, and non-cash unrealized gains or losses on contingent consideration, which we have consolidated into the line item “other adjustments, net” because they are not material individually. Adjusted EBITDA

Fourth Quarter and Full-Year 2023 20 We calculate Adjusted EBITDA as net loss or income, adjusted to exclude provision for or benefit from income taxes, interest expense, depreciation and amortization, stock-based compensation expense, other impairment expense, non-recurring accrued legal contingencies, settlements and related costs, non-recurring direct listing expenses, impairment on crypto assets still held, net, restructuring, fair value gain or loss on derivatives, crypto asset borrowing costs, gain on extinguishment of long-term debt, net, loss or gain on investments, net, unrealized foreign exchange gain or loss, and other adjustments, net. For more information on our non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures, please see the “Reconciliation of GAAP to Non-GAAP Results” table in this shareholder letter. We have not reconciled our Adjusted EBITDA outlook to GAAP net income (loss) because certain items that impact GAAP net income (loss) are uncertain or out of our control and cannot be reasonably predicted. For example, stock-based compensation is impacted by the future fair market value of our Class A common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of Adjusted EBITDA outlook to GAAP net income (loss) is not available without unreasonable effort.

December 31, December 31, 2023 2022 Assets Current assets: Cash and cash equivalents ............................................................................................. $ 5,139,351 $ 4,425,021 Restricted cash ................................................................................................................. 22,992 25,873 Customer custodial funds ............................................................................................... 4,570,845 5,041,119 Safeguarding customer crypto assets ........................................................................... 192,583,060 75,413,188 USDC ................................................................................................................................. 576,028 861,149 Accounts and loans receivable, net of allowance ....................................................... 361,715 404,376 Income tax receivable ...................................................................................................... 63,726 60,441 Prepaid expenses and other current assets ................................................................ 148,814 217,048 Total current assets ..................................................................................................... 203,466,531 86,448,215 Crypto assets held ................................................................................................................. 449,925 424,393 Deferred tax assets ............................................................................................................... 1,272,233 1,046,791 Lease right-of-use assets ..................................................................................................... 12,737 69,357 Property and equipment, net ............................................................................................... 192,550 171,853 Goodwill ................................................................................................................................... 1,139,670 1,073,906 Intangible assets, net ............................................................................................................ 86,422 135,429 Other non-current assets ...................................................................................................... 362,885 354,929 Total assets .................................................................................................................. $ 206,982,953 $ 89,724,873 Liabilities and Stockholders’ Equity Current liabilities: Customer custodial cash liabilities ................................................................................. $ 4,570,845 $ 4,829,587 Safeguarding customer crypto liabilities ....................................................................... 192,583,060 75,413,188 Accounts payable ............................................................................................................. 39,294 56,043 Accrued expenses and other current liabilities ............................................................ 447,050 331,236 Crypto asset borrowings ................................................................................................. 62,980 151,505 Lease liabilities, current ................................................................................................... 10,902 33,734 Total current liabilities ................................................................................................. 197,714,131 80,815,293 Lease liabilities, non-current ................................................................................................ 3,821 42,044 Long-term debt ....................................................................................................................... 2,979,957 3,393,448 Other non-current liabilities .................................................................................................. 3,395 19,531 Total liabilities ............................................................................................................... 200,701,304 84,270,316 Commitments and contingencies Preferred stock, $0.00001 par value; 500,000 shares authorized and zero shares issued and outstanding at December 31, 2023 and 2022, respectively ....................... — — Stockholders’ equity: Class A common stock, $0.00001 par value; 10,000,000 shares authorized at December 31, 2023 and 2022; 195,192 and 182,796 shares issued and outstanding at December 31, 2023 and 2022, respectively ...................................... 2 2 Class B common stock, $0.00001 par value; 500,000 shares authorized at December 31, 2023 and 2022; 46,856 and 48,070 shares issued and outstanding at December 31, 2023 and 2022, respectively ...................................... — — Additional paid-in capital ................................................................................................. 4,491,571 3,767,686 Accumulated other comprehensive loss ....................................................................... (30,270) (38,606) Retained earnings ............................................................................................................ 1,820,346 1,725,475 Total stockholders’ equity ........................................................................................... 6,281,649 5,454,557 Total liabilities and stockholders’ equity ............................................................. $ 206,982,953 $ 89,724,873 Coinbase Global, Inc. Consolidated Balance Sheets (In thousands, except par value data)

Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Revenue: Net revenue .................................................. $ 904,638 $ 604,946 $ 2,926,540 $ 3,148,815 Other revenue .............................................. 49,157 24,162 181,843 45,393 Total revenue ........................................... 953,795 629,108 3,108,383 3,194,208 Operating expenses: Transaction expense ................................... 125,559 82,991 420,705 629,880 Technology and development .................... 323,087 590,103 1,324,541 2,326,354 Sales and marketing ................................... 106,305 93,103 332,312 510,089 General and administrative ........................ 280,929 377,682 1,041,308 1,600,586 Crypto asset impairment, net ..................... (51,764) 67,249 (34,675) 722,211 Restructuring ................................................ — (518) 142,594 40,703 Other operating expense (income), net ... 54,066 (26,630) 43,260 74,593 Total operating expenses ...................... 838,182 1,183,980 3,270,045 5,904,416 Operating income (loss) ........................ 115,613 (554,872) (161,662) (2,710,208) Interest expense ................................................ 18,737 21,600 82,766 88,901 Other (income) expense, net ........................... (35,977) (5,594) (167,583) 265,473 Income (loss) before income taxes ..... 132,853 (570,878) (76,845) (3,064,582) Benefit from income taxes ............................... (140,584) (13,877) (171,716) (439,633) Net income (loss) ................................... $ 273,437 $ (557,001) $ 94,871 $ (2,624,949) Net income (loss) attributable to common stockholders: Basic ................................................................. $ 273,257 $ (557,001) $ 94,752 $ (2,624,949) Diluted .............................................................. $ 275,676 $ (557,853) $ 94,751 $ (2,631,179) Net income (loss) per share attributable to common stockholders: Basic ................................................................. $ 1.14 $ (2.46) $ 0.40 $ (11.81) Diluted .............................................................. $ 1.04 $ (2.46) $ 0.37 $ (11.83) Weighted-average shares of common stock used to compute net income (loss) per share attributable to common stockholders: Basic ................................................................. 239,706 226,758 235,796 222,314 Diluted .............................................................. 263,852 226,769 254,391 222,338 Stock-based Compensation Expense Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Technology and development ......................... $ 99,537 $ 300,410 $ 476,478 $ 1,093,983 Sales and marketing ........................................ 13,305 23,340 59,000 76,153 General and administrative ............................. 51,041 106,995 245,190 395,687 Restructuring ..................................................... — — 84,042 — Total ............................................................... $ 163,883 $ 430,745 $ 864,710 $ 1,565,823 Coinbase Global, Inc. Consolidated Statements of Operations (In thousands, except per share data) (unaudited)

Cash flows from operating activities Net income (loss) ............................................................................................................................................. $ 94,871 $ (2,624,949) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization ................................................................................................................. 139,642 154,069 Other impairment expense ....................................................................................................................... 18,793 26,518 Investment impairment expense ............................................................................................................. 29,375 101,445 Stock-based compensation expense ..................................................................................................... 780,668 1,565,823 Restructuring stock-based compensation expense ............................................................................. 84,042 — Provision for transaction losses and doubtful accounts ...................................................................... 11,059 (13,051) Deferred income taxes .............................................................................................................................. (216,334) (468,035) Unrealized loss on foreign exchange ..................................................................................................... 17,190 28,516 Non-cash lease expense .......................................................................................................................... 40,429 31,123 (Gain) loss on investments....................................................................................................................... (50,121) 3,056 Fair value (gain) loss on derivatives ....................................................................................................... (41,033) 7,410 Gain on extinguishment of long-term debt, net ..................................................................................... (117,383) — Crypto asset impairment expense .......................................................................................................... 96,783 757,257 Crypto assets received as revenue ........................................................................................................ (460,878) (470,591) Crypto asset payments for expenses ..................................................................................................... 298,255 383,221 Realized gain on crypto assets ............................................................................................................... (145,594) (36,666) Other operating activities, net .................................................................................................................. 16,981 883 Net changes in operating assets and liabilities ..................................................................................... 326,206 (1,031,448) Net cash provided by (used in) operating activities ....................................................................................... 922,951 (1,585,419) Cash flows from investing activities Capitalized internal-use software development costs ............................................................................ (63,202) (61,038) Business combinations, net of cash acquired .......................................................................................... (30,730) (186,150) Purchase of investments ............................................................................................................................. (11,822) (63,048) Loans originated ............................................................................................................................................ (586,691) (207,349) Proceeds from repayment of loans ............................................................................................................ 513,698 327,539 Assets pledged as collateral ....................................................................................................................... (27,899) (41,630) Assets pledged as collateral returned ....................................................................................................... 68,338 — Settlement of crypto futures contract ......................................................................................................... (43,339) — Purchase of crypto assets held .................................................................................................................. (277,367) (1,400,032) Disposal of crypto assets held .................................................................................................................... 461,325 969,185 Other investing activities, net ...................................................................................................................... 3,081 (1,299) Net cash provided by (used in) investing activities ........................................................................................ 5,392 (663,822) Cash flows from financing activities Issuance of common stock upon exercise of stock options, net of repurchases ............................... 47,944 51,497 Taxes paid related to net share settlement of equity awards ................................................................ (277,798) (351,867) Proceeds received under the ESPP .......................................................................................................... 16,297 20,848 Customer custodial cash liabilities ............................................................................................................. (274,822) (5,562,558) Repayment of long-term debt ..................................................................................................................... (303,533) — Assets received as collateral ...................................................................................................................... 66,014 — Assets received as collateral returned ...................................................................................................... (64,952) — Proceeds from short-term borrowings ....................................................................................................... 31,640 190,956 Repayments of short-term borrowings ...................................................................................................... (52,122) (191,073) Other financing activities ............................................................................................................................. — 3,679 Net cash used in financing activities ................................................................................................................ (811,332) (5,838,518) Net increase (decrease) in cash, cash equivalents, and restricted cash ................................................... 117,011 (8,087,759) Effect of exchange rates on cash, cash equivalents, and restricted cash ................................................. 8,772 (163,257) Cash, cash equivalents, and restricted cash, beginning of period .............................................................. 9,429,646 17,680,662 Cash, cash equivalents, and restricted cash, end of period ........................................................................ $ 9,555,429 $ 9,429,646 Supplemental disclosure of cash flow information Cash paid during the period for interest .................................................................................................... $ 76,142 $ 82,399 Cash paid during the period for income taxes ......................................................................................... 39,122 35,888 Operating cash outflows for amounts included in the measurement of operating lease liabilities .. 14,730 14,528 Year Ended December 31, 2023 2022 Coinbase Global, Inc. Consolidated Statements of Cash Flows (In thousands)

Supplemental Disclosures of Cash Flow Information Changes in operating assets and liabilities affecting cash were as follows (in thousands): Year Ended December 31, 2023 2022 USDC ........................................................................................................................... $ 254,571 $ (848,138) Accounts and loans receivable ................................................................................ 80,375 (141,023) Deposits in transit ....................................................................................................... (115,391) 28,952 Income taxes, net ....................................................................................................... 8,547 1,906 Other current and non-current assets ..................................................................... 28,033 19,237 Accounts payable ....................................................................................................... 954 18,612 Lease liabilities ........................................................................................................... (39,733) (10,223) Other current and non-current liabilities ................................................................. 108,850 (100,771) Net changes in operating assets and liabilities ........................................................ $ 326,206 $ (1,031,448) Reconciliation of cash, cash equivalents, and restricted cash (in thousands): Year Ended December 31, 2023 2022 Cash and cash equivalents ....................................................................................... $ 5,139,351 $ 4,425,021 Restricted cash ........................................................................................................... 22,992 25,873 Customer custodial cash ........................................................................................... 4,393,086 4,978,752 Total cash, cash equivalents, and restricted cash ................................................... $ 9,555,429 $ 9,429,646 Supplemental schedule of non-cash investing and financing activities were as follows (in thousands): Year Ended December 31, 2023 2022 Crypto assets borrowed .......................................................................................... $ 450,663 $ 920,379 Crypto assets borrowed repaid with crypto assets ............................................. 559,191 1,432,688 Crypto loans originated ........................................................................................... 396,981 — Crypto loans repaid ................................................................................................. 469,763 — Non-cash assets received as collateral ............................................................... 255,383 26,874 Non-cash assets received as collateral returned ............................................... 282,257 — Non-cash assets pledged as collateral ................................................................ 156,963 58,377 Non-cash assets pledged as collateral returned ................................................ 163,460 — Non-cash consideration paid for business combinations .................................. 51,494 324,925 Purchase of crypto assets and investments with non-cash consideration ..... 27,977 19,967 Realized gain on crypto assets held as investments ......................................... 48,491 — Disposal of crypto assets and investments for non-cash consideration ......... 42,551 617 Changes in right-of-use assets and operating lease obligations ..................... 17,530 3,059

Reconciliation of Net (Loss) Income to Adjusted EBITDA (unaudited) Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 FY’23 FY’22 (in thousands) Net (loss) income .................... $ (557,001) $ (78,896) $ (97,405) $ (2,265) $ 273,437 $ 94,871 $ (2,624,949) Adjusted to exclude the following: (Benefit from) provision for income taxes .............. (13,877) (86,780) 18,722 36,926 (140,584) (171,716) (439,633) Interest expense .............. 21,600 21,536 21,672 20,821 18,737 82,766 88,901 Depreciation and amortization ...................... 40,348 41,208 36,982 31,967 29,485 139,642 154,069 Stock-based compensation ................... 430,745 198,860 199,772 218,153 163,883 780,668 1,565,823 Other impairment expense(1) ......................... 17,446 5,527 2,586 1,956 8,724 18,793 26,518 Non-recurring accrued legal contingencies, settlements, and related costs .................................. 50,000 — — — 15,000 15,000 64,250 Impairment on crypto assets still held, net ......... 5,672 12,085 8,499 8,897 — 29,481 592,495 Restructuring .................... (518) 144,489 (1,035) (860) — 142,594 40,703 Fair value loss (gain) on derivatives ........................ 4,059 (3,199) (10,731) (402) (26,701) (41,033) 7,410 Fair value loss on foreign exchange derivatives ........................ 22,935 — — — — — — Crypto asset borrowing costs .................................. 2,728 1,520 1,218 706 1,362 4,807 6,675 Gain on extinguishment of long-term debt, net ...... — — (17,855) (81,591) (17,938) (117,383) — Loss (gain) on investments, net(2) ........... 30,579 5,008 3,172 (48,498) 19,493 (20,826) 101,445 Unrealized foreign exchange (gain) loss ....... (163,736) 8,428 8,008 878 (123) 17,190 28,516 Other adjustments, net ... (15,097) 13,866 20,347 (5,744) (39,669) (11,200) 16,379 Adjusted EBITDA .................... $ (124,117) $ 283,652 $ 193,952 $ 180,944 $ 305,106 $ 963,654 $ (371,398) __________________ Note: Figures presented above may not sum precisely due to rounding (1) Other impairment expense represents impairment on property and equipment and intangible assets. (2) Includes impairment and net gains on investments.