| DIGITALBRIDGE GROUP, INC. | ||||||||

| (Exact Name of Registrant as Specified in Its Charter) | ||||||||

| Maryland | 001-37980 | 46-4591526 | ||||||||||||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

| Class A Common Stock, $0.01 par value | DBRG | New York Stock Exchange | ||||||||||||

| Preferred Stock, 7.125% Series H Cumulative Redeemable, $0.01 par value | DBRG.PRH | New York Stock Exchange | ||||||||||||

| Preferred Stock, 7.15% Series I Cumulative Redeemable, $0.01 par value | DBRG.PRI | New York Stock Exchange | ||||||||||||

| Preferred Stock, 7.125% Series J Cumulative Redeemable, $0.01 par value | DBRG.PRJ | New York Stock Exchange | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |||||||||||

Emerging growth company |

☐ | ||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||

| Exhibit No. | Description | |||||||

| Press Release dated August 4, 2022 | ||||||||

| Supplemental Financial Disclosure Presentation for the quarter ended June 30, 2022 | ||||||||

| Earnings Presentation dated August 4, 2022 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

Date: |

August 4, 2022 | DIGITALBRIDGE GROUP, INC. |

|||||||||

| By: | /s/ Jacky Wu |

||||||||||

| Jacky Wu | |||||||||||

| Executive Vice President, Chief Financial Officer and Treasurer | |||||||||||

|

||||||||

|

||||||||

|

||||||||

| June 30, 2022 | December 31, 2021 | |||||||||||||

| (unaudited) | ||||||||||||||

Assets |

||||||||||||||

Cash and cash equivalents |

$ | 337,150 | $ | 1,602,102 | ||||||||||

Restricted cash |

108,686 | 99,121 | ||||||||||||

Real estate, net |

6,047,928 | 4,972,284 | ||||||||||||

| Loans receivable | 514,163 | 173,921 | ||||||||||||

| Equity and debt investments | 1,080,261 | 935,153 | ||||||||||||

Goodwill |

761,368 | 761,368 | ||||||||||||

Deferred leasing costs and intangible assets, net |

1,827,960 | 1,187,627 | ||||||||||||

| Assets held for disposition | 156,672 | 3,676,615 | ||||||||||||

| Other assets | 991,382 | 740,395 | ||||||||||||

Due from affiliates |

51,718 | 49,230 | ||||||||||||

Total assets |

$ | 11,877,288 | $ | 14,197,816 | ||||||||||

Liabilities |

||||||||||||||

| Debt, net | $ | 5,539,732 | $ | 4,860,402 | ||||||||||

| Accrued and other liabilities | 1,624,708 | 928,042 | ||||||||||||

Intangible liabilities, net |

32,840 | 33,301 | ||||||||||||

| Liabilities related to assets held for disposition | 719 | 3,088,699 | ||||||||||||

Dividends and distributions payable |

15,759 | 15,759 | ||||||||||||

Total liabilities |

7,213,758 | 8,926,203 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

Redeemable noncontrolling interests |

102,011 | 359,223 | ||||||||||||

Equity |

||||||||||||||

Stockholders’ equity: |

||||||||||||||

| Preferred stock, $0.01 par value per share; $883,500 liquidation preference; 250,000 shares authorized; 35,340 shares issued and outstanding | 854,232 | 854,232 | ||||||||||||

| Common stock, $0.01 par value per share | ||||||||||||||

| Class A, 949,000 shares authorized; 655,750 and 568,577 shares issued and outstanding | 6,557 | 5,685 | ||||||||||||

| Class B, 1,000 shares authorized; 666 shares issued and outstanding | 7 | 7 | ||||||||||||

Additional paid-in capital |

7,646,852 | 7,820,807 | ||||||||||||

Accumulated deficit |

(6,875,817) | (6,576,180) | ||||||||||||

Accumulated other comprehensive income |

1,455 | 42,383 | ||||||||||||

| Total stockholders’ equity | 1,633,286 | 2,146,934 | ||||||||||||

Noncontrolling interests in investment entities |

2,870,528 | 2,653,173 | ||||||||||||

Noncontrolling interests in Operating Company |

57,705 | 112,283 | ||||||||||||

Total equity |

4,561,519 | 4,912,390 | ||||||||||||

Total liabilities, redeemable noncontrolling interests and equity |

$ | 11,877,288 | $ | 14,197,816 | ||||||||||

|

||||||||

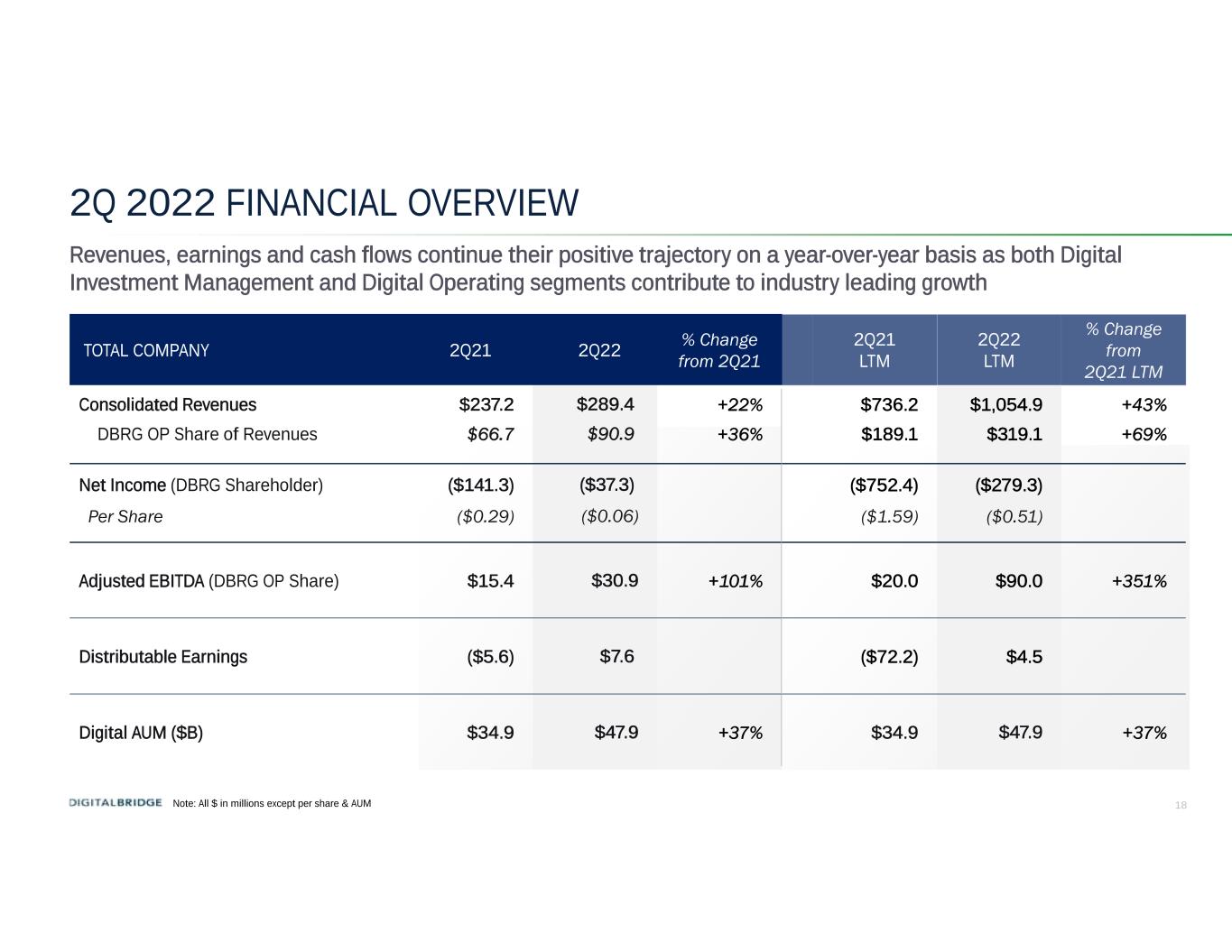

| Three Months Ended June 30, | |||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Revenues | |||||||||||||||||

| Property operating income | $ | 234,251 | $ | 188,985 | |||||||||||||

| Interest income | 8,499 | 1,319 | |||||||||||||||

| Fee income | 44,318 | 45,157 | |||||||||||||||

| Other income | 2,341 | 1,726 | |||||||||||||||

| Total revenues | 289,409 | 237,187 | |||||||||||||||

| Expenses | |||||||||||||||||

| Property operating expense | 97,290 | 77,140 | |||||||||||||||

| Interest expense | 46,388 | 37,938 | |||||||||||||||

| Investment expense | 7,187 | 5,871 | |||||||||||||||

| Transaction-related costs | 2,756 | 64 | |||||||||||||||

| Depreciation and amortization | 155,352 | 138,229 | |||||||||||||||

| Compensation expense | |||||||||||||||||

| Cash and equity-based compensation | 52,792 | 48,199 | |||||||||||||||

| Carried interest and incentive fee compensation | 49,069 | 8,266 | |||||||||||||||

| Administrative expenses | 26,353 | 28,505 | |||||||||||||||

| Total expenses | 437,187 | 344,212 | |||||||||||||||

| Other income (loss) | |||||||||||||||||

| Other gain (loss), net | (46,256) | (27,041) | |||||||||||||||

| Equity method earnings (losses) | 27,427 | 51,481 | |||||||||||||||

| Equity method earnings (losses) - carried interest | 110,779 | 11,169 | |||||||||||||||

| Income (loss) before income taxes | (55,828) | (71,416) | |||||||||||||||

| Income tax benefit (expense) | 2,518 | 75,239 | |||||||||||||||

| Income (loss) from continuing operations | (53,310) | 3,823 | |||||||||||||||

| Income (loss) from discontinued operations | (14,771) | (98,906) | |||||||||||||||

| Net income (loss) | (68,081) | (95,083) | |||||||||||||||

| Net income (loss) attributable to noncontrolling interests: | |||||||||||||||||

| Redeemable noncontrolling interests | (14,327) | 6,025 | |||||||||||||||

| Investment entities | (29,102) | 36,616 | |||||||||||||||

| Operating Company | (3,090) | (14,980) | |||||||||||||||

| Net income (loss) attributable to DigitalBridge Group, Inc. | (21,562) | (122,744) | |||||||||||||||

| Preferred stock dividends | 15,759 | 18,516 | |||||||||||||||

| Net income (loss) attributable to common stockholders | $ | (37,321) | $ | (141,260) | |||||||||||||

| Loss per share—basic | |||||||||||||||||

| Loss from continuing operations per share—basic | $ | (0.04) | $ | (0.02) | |||||||||||||

| Net loss attributable to common stockholders per share—basic | $ | (0.06) | $ | (0.29) | |||||||||||||

| Loss per share—diluted | |||||||||||||||||

| Loss from continuing operations per share—diluted | $ | (0.04) | $ | (0.02) | |||||||||||||

| Net loss attributable to common stockholders per share—diluted | $ | (0.06) | $ | (0.29) | |||||||||||||

| Weighted average number of shares | |||||||||||||||||

| Basic | 615,932 | 479,643 | |||||||||||||||

| Diluted | 615,932 | 479,643 | |||||||||||||||

|

||||||||

| Three Months Ended | ||||||||||||||

| June 30, 2022 | June 30, 2021 | |||||||||||||

| Net income (loss) attributable to common stockholders | $ | (37,321) | $ | (141,260) | ||||||||||

| Net income (loss) attributable to noncontrolling common interests in Operating Company | (3,090) | (14,980) | ||||||||||||

| Net income (loss) attributable to common interests in Operating Company and common stockholders | (40,411) | (156,240) | ||||||||||||

| Adjustments for Distributable Earnings (DE): | ||||||||||||||

Transaction-related and restructuring charges(1) |

29,300 | 5,174 | ||||||||||||

| Non-real estate (gains) losses, excluding realized gains or losses of digital assets within the Corporate and Other segment | (58,775) | (6,485) | ||||||||||||

| Net unrealized carried interest | 13,433 | (151,773) | ||||||||||||

| Equity-based compensation expense | 9,344 | 11,642 | ||||||||||||

| Depreciation and amortization | 155,909 | 170,454 | ||||||||||||

| Straight-line rent revenue and expense | (2,956) | (2,309) | ||||||||||||

| Amortization of acquired above- and below-market lease values, net | (10) | (1,498) | ||||||||||||

| Impairment loss | 12,184 | 242,903 | ||||||||||||

| Gain from sales of real estate | — | (2,969) | ||||||||||||

| Non-revenue enhancing capital expenditures | (13,377) | (764) | ||||||||||||

| Debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts | 5,238 | 10,196 | ||||||||||||

| Adjustment to reflect BRSP cash dividend declared | (4,660) | (40,165) | ||||||||||||

| Income tax effect on certain of the foregoing adjustments | — | (42,536) | ||||||||||||

| Adjustments attributable to noncontrolling interests in investment entities | (91,676) | (15,334) | ||||||||||||

| DE from discontinued operations | (5,958) | (25,874) | ||||||||||||

| After-tax DE | $ | 7,585 | $ | (5,578) | ||||||||||

DE per common share / common OP unit(2) |

$ | 0.01 | $ | (0.01) | ||||||||||

DE per common share / common OP unit—diluted(2)(3) |

$ | 0.01 | $ | (0.01) | ||||||||||

Weighted average number of common OP units outstanding used for DE per common share and OP unit(2) |

674,573 | 539,287 | ||||||||||||

Weighted average number of common OP units outstanding used for DE per common share and OP unit—diluted (2)(3) |

691,046 | 539,287 | ||||||||||||

|

||||||||

| Cautionary Statement Regarding Forward-Looking Statements | ||

DigitalBridge | Supplemental Financial Report |

||||||||

| Important Note Regarding Non-GAAP Financial Measures | ||

DigitalBridge | Supplemental Financial Report |

||||||||

| Note Regarding DBRG Reportable Segments / Consolidated and OP Share of Consolidated Amounts | ||

DigitalBridge | Supplemental Financial Report |

||||||||

| Table of Contents | ||

Page |

|||||||||||

| I. | Financial Overview |

||||||||||

a. |

6 | ||||||||||

| II. | Financial Results |

||||||||||

a. |

Balance Sheet Consolidated & Noncontrolling Interests’ Share |

7 | |||||||||

b. |

8 | ||||||||||

c. |

9 | ||||||||||

d. |

Segment Reconciliation of Net Income to DE and Adjusted EBITDA |

10-11 | |||||||||

| III. | Capitalization |

||||||||||

a. |

Debt Summary |

12 | |||||||||

b. |

Secured Fund Fee Revenue Notes and Variable Funding Notes |

13 | |||||||||

c. |

Convertible/Exchangeable Notes & Perpetual Preferred Stock |

14 | |||||||||

d. |

Organization Structure |

15 | |||||||||

| IV. | Assets Under Management |

16 | |||||||||

| V. | Digital Investment Management |

17 | |||||||||

| VI. | Digital Operating |

18-20 | |||||||||

| VII. | Other |

21 | |||||||||

| VIII. | Cash G&A Expense |

22 | |||||||||

| Appendices | |||||||||||

| Reconciliations of Digital IM FRE and Digital Operating Adjusted EBITDA to Net Income (Loss) | 24 | ||||||||||

| Reconciliations of DE and Adjusted EBITDA and to Net Income (Loss) | 25-26 | ||||||||||

| Definitions | 27 | ||||||||||

DigitalBridge | Supplemental Financial Report |

5 |

||||||||||

| Ia. Summary Financial Metrics | ||

| ($ and shares in thousands, except per share data and as noted) (Unaudited) | ||||||||||||||||||||||||||

| 6/30/2022 - 2Q22 | 3/31/2022 - 1Q22 | 12/31/2021 - 4Q21 | 9/30/2021 - 3Q21 | 6/30/2021 - 2Q21 | 3/31/2021 - 1Q21 | 12/31/2020 - 4Q20 | 9/30/2020- 3Q20 | |||||||||||||||||||

| Financial Data | ||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | (37,321) | $ | (262,316) | $ | (20,686) | $ | 41,036 | $ | (141,260) | $ | (264,806) | $ | (140,575) | $ | (205,784) | ||||||||||

| Net income (loss) attributable to common stockholders per basic share | (0.06) | (0.46) | (0.04) | 0.08 | (0.29) | (0.56) | (0.30) | (0.44) | ||||||||||||||||||

| Distributable Earnings ("DE") | 7,585 | 1,569 | (5,352) | 700 | (5,578) | (10,213) | (25,373) | (31,010) | ||||||||||||||||||

| DE per basic share | 0.01 | — | (0.01) | — | (0.01) | (0.02) | (0.05) | (0.06) | ||||||||||||||||||

| Adjusted EBITDA | 30,928 | 20,494 | 20,957 | 17,622 | 15,377 | 12,538 | (2,444) | (5,519) | ||||||||||||||||||

| Balance Sheet, Capitalization and Trading Statistics | ||||||||||||||||||||||||||

| Total consolidated assets | $ | 11,877,288 | $ | 11,232,157 | $ | 14,197,816 | $ | 15,442,981 | $ | 15,921,346 | $ | 16,625,250 | $ | 20,200,560 | $ | 19,043,050 | ||||||||||

| DBRG OP share of consolidated assets | 4,177,806 | 3,561,501 | 6,233,158 | 6,086,259 | 6,929,390 | 7,324,784 | 10,119,834 | 10,087,808 | ||||||||||||||||||

Total consolidated debt(1) |

5,612,274 | 5,187,597 | 4,922,722 | 4,621,240 | 3,919,255 | 7,023,226 | 7,931,458 | 7,165,859 | ||||||||||||||||||

DBRG OP share of consolidated debt(1) |

1,746,365 | 1,458,886 | 1,366,528 | 1,391,943 | 1,073,609 | 3,392,620 | 3,853,642 | 3,683,660 | ||||||||||||||||||

Basic shares and OP units outstanding(2) |

707,718 | 649,845 | 620,553 | 547,162 | 545,815 | 538,908 | 535,217 | 535,473 | ||||||||||||||||||

| Liquidation preference of perpetual preferred equity | 883,500 | 883,500 | 883,500 | 947,500 | 1,033,750 | 1,033,750 | 1,033,750 | 1,033,750 | ||||||||||||||||||

| Insider ownership of shares and OP units | 3.3% | 3.6% | 3.5% | 4.0% | 4.0% | 9.4% | 9.4% | 10.0% | ||||||||||||||||||

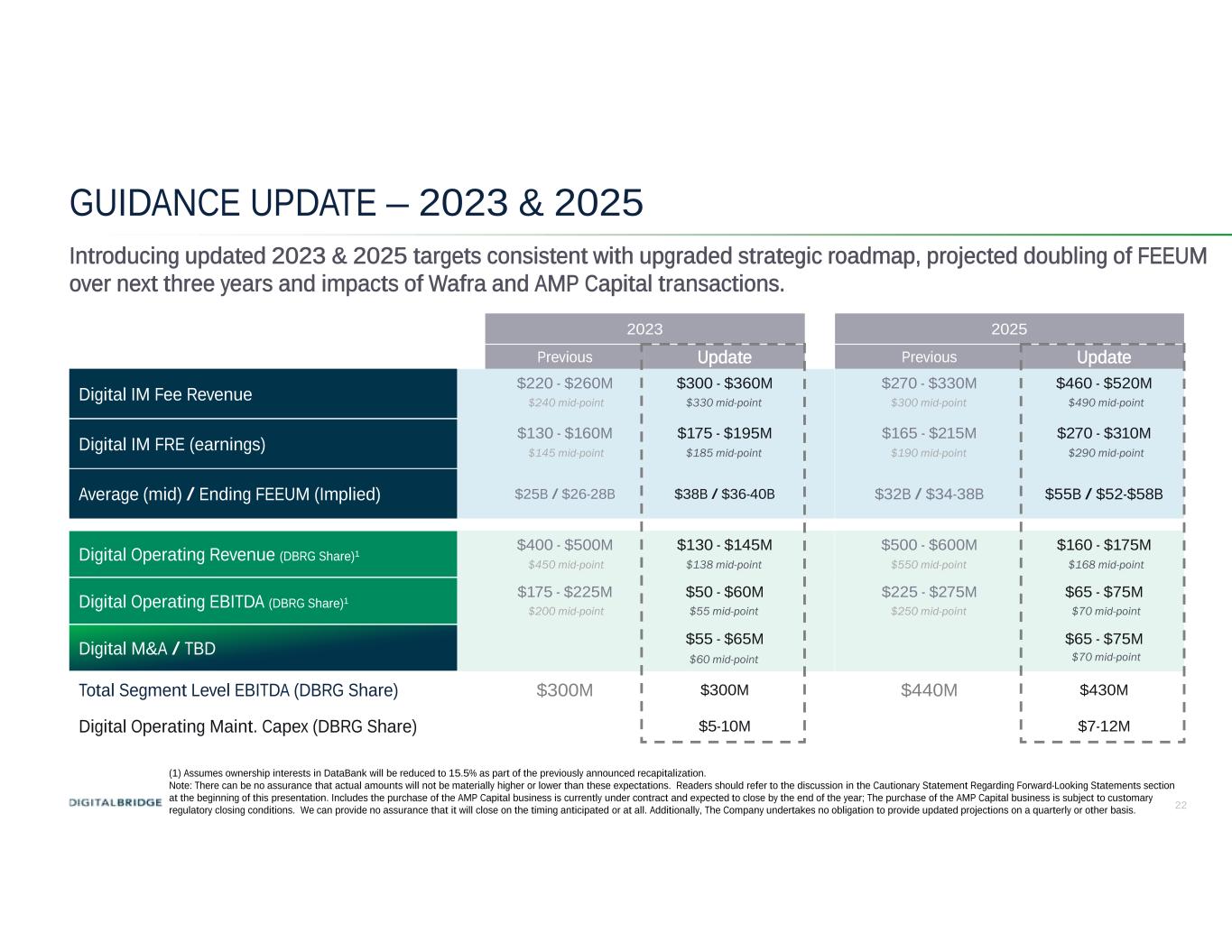

| Digital Assets Under Management ("AUM") (in billions) | $ | 47.9 | $ | 46.6 | $ | 45.3 | $ | 37.8 | $ | 34.9 | $ | 32.0 | $ | 30.0 | $ | 23.3 | ||||||||||

| Digital Fee Earning Equity Under Management ("FEEUM") (in billions) | $ | 19.0 | $ | 18.8 | $ | 18.3 | $ | 16.5 | $ | 14.5 | $ | 12.9 | $ | 12.8 | $ | 8.6 | ||||||||||

| Digital Key Metrics | ||||||||||||||||||||||||||

| Digital IM FRE | 25,459 | 24,604 | 34,790 | 33,659 | 27,680 | 20,138 | 6,415 | 10,731 | ||||||||||||||||||

| Digital IM FRE - DBRG OP share | 20,759 | 16,989 | 23,757 | 22,922 | 19,470 | 13,583 | 3,893 | 8,148 | ||||||||||||||||||

| Digital Operating Adjusted EBITDA | 101,233 | 88,659 | 84,529 | 80,886 | 81,995 | 82,287 | 59,716 | 45,177 | ||||||||||||||||||

| Digital Operating Adjusted EBITDA - DBRG OP share | 17,643 | 15,497 | 14,200 | 13,636 | 13,776 | 13,948 | 9,620 | 6,914 | ||||||||||||||||||

| Digital and Corporate Debt | 5,612,274 | 5,187,597 | 4,856,222 | 4,617,240 | 3,919,255 | 3,869,338 | 3,758,345 | 3,077,861 | ||||||||||||||||||

| Digital and Corporate Debt - DBRG OP share | 1,746,365 | 1,458,886 | 1,300,028 | 1,387,943 | 1,073,609 | 1,027,520 | 1,059,881 | 886,765 | ||||||||||||||||||

| Other digital net carrying value | 1,190,358 | 672,130 | 532,969 | 503,106 | 424,345 | 353,776 | 353,194 | 256,451 | ||||||||||||||||||

| Other digital net carrying value - DBRG OP share | 808,570 | 495,825 | 358,178 | 339,634 | 269,488 | 243,726 | 254,718 | 210,396 | ||||||||||||||||||

| Number of BRSP shares owned by DigitalBridge | 34,991 | 34,991 | 34,991 | 34,991 | 44,478 | 44,474 | 44,474 | 44,473 | ||||||||||||||||||

| Digital and Corporate net assets & other non-digital assets net carrying value - DBRG OP share | 269,580 | 1,053,640 | 1,085,397 | 654,576 | 439,747 | 283,133 | 493,388 | 330,965 | ||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

6 |

||||||||||

| IIa. Financial Results - Balance Sheet | ||

| ($ in thousands, except per share data) (unaudited) | As of June 30, 2022 | |||||||||||||

| Consolidated | Noncontrolling Interests' Share | |||||||||||||

| Assets | ||||||||||||||

| Cash and cash equivalents | $ | 337,150 | $ | 175,818 | ||||||||||

| Restricted cash | 108,686 | 83,851 | ||||||||||||

| Real estate, net | 6,047,928 | 4,878,537 | ||||||||||||

| Loans receivable | 514,163 | 3,945 | ||||||||||||

| Equity and debt investments | 1,080,261 | 421,001 | ||||||||||||

| Goodwill | 761,368 | 354,982 | ||||||||||||

| Deferred leasing costs and intangible assets, net | 1,827,960 | 1,186,035 | ||||||||||||

| Assets held for disposition | 156,672 | — | ||||||||||||

| Other assets | 991,382 | 595,313 | ||||||||||||

| Due from affiliates | 51,718 | — | ||||||||||||

| Total assets | $ | 11,877,288 | $ | 7,699,482 | ||||||||||

| Liabilities | ||||||||||||||

| Debt, net | $ | 5,539,732 | $ | 3,820,638 | ||||||||||

| Accrued and other liabilities | 1,624,708 | 878,656 | ||||||||||||

| Intangible liabilities, net | 32,840 | 27,649 | ||||||||||||

| Liabilities related to assets held for disposition | 719 | — | ||||||||||||

| Dividends and distributions payable | 15,759 | — | ||||||||||||

| Total liabilities | 7,213,758 | 4,726,943 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

| Redeemable noncontrolling interests | 102,011 | 102,011 | ||||||||||||

| Equity | ||||||||||||||

| Stockholders’ equity: | ||||||||||||||

| Preferred stock, $0.01 par value per share; $883,500 liquidation preference; 250,000 shares authorized; 35,340 shares issued and outstanding | 854,232 | — | ||||||||||||

| Common stock, $0.01 par value per share | 0 | |||||||||||||

| Class A, 949,000 shares authorized; 655,750 shares issued and outstanding | 6,557 | — | ||||||||||||

| Class B, 1,000 shares authorized; 666 shares issued and outstanding | 7 | — | ||||||||||||

| Additional paid-in capital | 7,646,852 | — | ||||||||||||

| Accumulated deficit | (6,875,817) | — | ||||||||||||

| Accumulated other comprehensive income | 1,455 | — | ||||||||||||

| Total stockholders’ equity | 1,633,286 | — | ||||||||||||

| Noncontrolling interests in investment entities | 2,870,528 | 2,870,528 | ||||||||||||

| Noncontrolling interests in Operating Company | 57,705 | — | ||||||||||||

| Total equity | 4,561,519 | 2,870,528 | ||||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | 11,877,288 | $ | 7,699,482 | ||||||||||

DigitalBridge | Supplemental Financial Report |

7 |

||||||||||

| IIb. Financial Results - Consolidated Segment Operating Results | ||

| Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||

| ($ in thousands) (unaudited) | Digital Investment Management | Digital Operating | Corporate and Other | Discontinued Operations | Total | ||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Property operating income | $ | — | $ | 227,646 | $ | 6,605 | $ | — | $ | 234,251 | |||||||||||||||||||

| Interest income | 15 | 7 | 8,477 | — | 8,499 | ||||||||||||||||||||||||

| Fee income | 45,113 | — | (795) | — | 44,318 | ||||||||||||||||||||||||

| Other income | 987 | 34 | 1,320 | — | 2,341 | ||||||||||||||||||||||||

| Total revenues | 46,115 | 227,687 | 15,607 | — | 289,409 | ||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||

| Property operating expense | — | 94,744 | 2,546 | — | 97,290 | ||||||||||||||||||||||||

| Interest expense | 2,785 | 37,233 | 6,370 | — | 46,388 | ||||||||||||||||||||||||

| Investment expense | 259 | 5,487 | 1,441 | — | 7,187 | ||||||||||||||||||||||||

| Transaction-related costs | 1,898 | — | 858 | — | 2,756 | ||||||||||||||||||||||||

| Depreciation and amortization | 5,375 | 145,817 | 4,160 | — | 155,352 | ||||||||||||||||||||||||

| Compensation expense | |||||||||||||||||||||||||||||

| Cash and equity-based compensation | 23,230 | 20,229 | 9,333 | — | 52,792 | ||||||||||||||||||||||||

| Carried interest and incentive fee compensation | 49,069 | — | — | — | 49,069 | ||||||||||||||||||||||||

| Administrative expenses | 4,869 | 8,910 | 12,574 | — | 26,353 | ||||||||||||||||||||||||

| Total expenses | 87,485 | 312,420 | 37,282 | — | 437,187 | ||||||||||||||||||||||||

| Other income (loss) | |||||||||||||||||||||||||||||

| Other gain (loss), net | (424) | (534) | (45,298) | — | (46,256) | ||||||||||||||||||||||||

| Equity method earnings (loss) | 1,016 | — | 26,411 | — | 27,427 | ||||||||||||||||||||||||

| Equity method earnings (loss) - carried interest | 110,779 | — | — | — | 110,779 | ||||||||||||||||||||||||

| Income (loss) before income taxes | 70,001 | (85,267) | (40,562) | — | (55,828) | ||||||||||||||||||||||||

| Income tax benefit (expense) | (2,006) | (161) | 4,685 | — | 2,518 | ||||||||||||||||||||||||

| Income (loss) from continuing operations | 67,995 | (85,428) | (35,877) | — | (53,310) | ||||||||||||||||||||||||

| Income (loss) from discontinued operations | — | — | — | (14,771) | (14,771) | ||||||||||||||||||||||||

| Net income (loss) | 67,995 | (85,428) | (35,877) | (14,771) | (68,081) | ||||||||||||||||||||||||

| Net income (loss) attributable to noncontrolling interests: | |||||||||||||||||||||||||||||

| Redeemable noncontrolling interests | 47 | — | (14,374) | — | (14,327) | ||||||||||||||||||||||||

| Investment entities | 44,931 | (69,414) | (5,005) | 386 | (29,102) | ||||||||||||||||||||||||

| Operating Company | 1,748 | (1,207) | (2,489) | (1,142) | (3,090) | ||||||||||||||||||||||||

| Net income (loss) attributable to DigitalBridge Group, Inc. | 21,269 | (14,807) | (14,009) | (14,015) | (21,562) | ||||||||||||||||||||||||

| Preferred stock dividends | — | — | 15,759 | — | 15,759 | ||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 21,269 | $ | (14,807) | $ | (29,768) | $ | (14,015) | $ | (37,321) | |||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

8 |

||||||||||

| IIc. Financial Results - Noncontrolling Interests’ Share Segment Operating Results | ||

| Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||

| ($ in thousands) (unaudited) | Digital Investment Management | Digital Operating | Corporate and Other | Discontinued Operations | Total | ||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Property operating income | $ | — | $ | 186,828 | $ | 2,871 | $ | — | $ | 189,699 | |||||||||||||||||||

| Interest income | — | 3 | 42 | — | 45 | ||||||||||||||||||||||||

| Fee income | 13 | — | — | — | 13 | ||||||||||||||||||||||||

| Other income | 4 | 27 | 811 | — | 842 | ||||||||||||||||||||||||

| Total revenues | 17 | 186,858 | 3,724 | — | 190,599 | ||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||

| Property operating expense | — | 77,584 | 1,107 | — | 78,691 | ||||||||||||||||||||||||

| Interest expense | — | 29,876 | 541 | — | 30,417 | ||||||||||||||||||||||||

| Investment expense | — | 4,689 | 224 | — | 4,913 | ||||||||||||||||||||||||

| Depreciation and amortization | — | 120,645 | 1,273 | — | 121,918 | ||||||||||||||||||||||||

| Compensation expense | |||||||||||||||||||||||||||||

| Cash and equity-based compensation | — | 15,271 | — | — | 15,271 | ||||||||||||||||||||||||

| Carried interest and incentive fee compensation | 45,190 | — | — | — | 45,190 | ||||||||||||||||||||||||

| Administrative expenses | 25 | 6,895 | 325 | — | 7,245 | ||||||||||||||||||||||||

| Total expenses | 45,215 | 254,960 | 3,470 | — | 303,645 | ||||||||||||||||||||||||

| Other income (loss) | |||||||||||||||||||||||||||||

| Other gain (loss), net | (80) | (463) | (24,747) | — | (25,290) | ||||||||||||||||||||||||

| Equity method earnings (loss) | 642 | — | 5,233 | — | 5,875 | ||||||||||||||||||||||||

| Equity method earnings (loss) - carried interest | 86,720 | — | — | — | 86,720 | ||||||||||||||||||||||||

| Income (loss) before income taxes | 42,084 | (68,565) | (19,260) | — | (45,741) | ||||||||||||||||||||||||

| Income tax benefit (expense) | — | (128) | — | — | (128) | ||||||||||||||||||||||||

| Net income (loss) | 42,084 | (68,693) | (19,260) | — | (45,869) | ||||||||||||||||||||||||

| Income (loss) from discontinued operations | — | — | — | — | — | ||||||||||||||||||||||||

| Non-pro rata allocation of income (loss) to noncontrolling interests | 2,894 | (721) | 267 | — | 2,440 | ||||||||||||||||||||||||

| Net income (loss) attributable to noncontrolling interests | $ | 44,978 | $ | (69,414) | $ | (18,993) | $ | — | $ | (43,429) | |||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

9 |

||||||||||

IId. Financial Results - Segment Reconciliation of Net Income to DE and Adjusted EBITDA | ||

| OP pro rata share by segment | Amounts attributable to noncontrolling interests |

DBRG consolidated as reported | |||||||||||||||||||||||||||||||||||||||

| ($ in thousands; for the three months ended June 30, 2022; and unaudited) | Digital IM | Digital Operating | Corporate and Other | Discontinued Operations | Total OP pro rata share | ||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 21,269 | $ | (14,807) | $ | (29,768) | $ | (14,015) | $ | (37,321) | $ | — | $ | (37,321) | |||||||||||||||||||||||||||

| Net income (loss) attributable to noncontrolling common interests in Operating Company | 1,748 | (1,207) | (2,489) | (1,142) | (3,090) | — | (3,090) | ||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to common interests in Operating Company and common stockholders | 23,017 | (16,014) | (32,257) | (15,157) | (40,411) | — | (40,411) | ||||||||||||||||||||||||||||||||||

| Adjustments for Distributable Earnings (DE): | |||||||||||||||||||||||||||||||||||||||||

Transaction-related and restructuring charges(1) |

5,050 | — | 3,539 | 20,358 | 28,947 | 353 | 29,300 | ||||||||||||||||||||||||||||||||||

| Non-real estate (gains) losses, excluding realized gains or losses of digital assets within the Corporate and Other segment | 13 | 71 | 9,826 | (11,666) | (1,756) | 15,189 | 13,433 | ||||||||||||||||||||||||||||||||||

| Net unrealized carried interest | (17,246) | — | — | — | (17,246) | (41,529) | (58,775) | ||||||||||||||||||||||||||||||||||

| Equity-based compensation expense | 2,883 | 212 | 4,840 | 36 | 7,971 | 1,373 | 9,344 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 160 | 25,172 | 5,248 | 265 | 30,845 | 125,064 | 155,909 | ||||||||||||||||||||||||||||||||||

| Straight-line rent revenue and expense | 61 | 224 | (1,697) | (78) | (1,490) | (1,466) | (2,956) | ||||||||||||||||||||||||||||||||||

| Amortization of acquired above- and below-market lease values, net | — | (27) | — | — | (27) | 17 | (10) | ||||||||||||||||||||||||||||||||||

| Impairment loss | — | — | — | 12,184 | 12,184 | — | 12,184 | ||||||||||||||||||||||||||||||||||

| Non-revenue enhancing capital expenditures | — | (2,571) | — | — | (2,571) | (10,806) | (13,377) | ||||||||||||||||||||||||||||||||||

| Debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts | 353 | 940 | 448 | 16 | 1,757 | 3,481 | 5,238 | ||||||||||||||||||||||||||||||||||

| Adjustment to reflect BRSP cash dividend declared | — | — | (4,660) | — | (4,660) | — | (4,660) | ||||||||||||||||||||||||||||||||||

| Adjustments attributable to noncontrolling interests in investment entities | — | — | — | — | — | (91,676) | (91,676) | ||||||||||||||||||||||||||||||||||

| DE from discontinued operations | — | — | — | (5,958) | (5,958) | — | (5,958) | ||||||||||||||||||||||||||||||||||

| After-tax DE | $ | 14,291 | $ | 8,007 | $ | (14,713) | $ | — | $ | 7,585 | $ | — | $ | 7,585 | |||||||||||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

10 |

||||||||||

IId. Financial Results - Segment Reconciliation of Net Income to DE and Adjusted EBITDA | ||

| OP pro rata share by segment | ||||||||||||||||||||||||||||||||

| ($ in thousands; for the three months ended June 30, 2022; and unaudited) | Digital IM | Digital Operating | Corporate and Other | Discontinued Operations | Total OP pro rata share | |||||||||||||||||||||||||||

| After-tax DE | $ | 14,291 | $ | 8,007 | $ | (14,713) | $ | — | $ | 7,585 | ||||||||||||||||||||||

| Interest expense included in DE | 2,433 | 6,327 | 5,382 | — | 14,142 | |||||||||||||||||||||||||||

| Income tax expense (benefit) included in DE | 1,991 | 32 | (4,685) | — | (2,662) | |||||||||||||||||||||||||||

| Preferred dividends | — | — | 15,759 | — | 15,759 | |||||||||||||||||||||||||||

| Earnings of equity method investments | — | — | (6,982) | — | (6,982) | |||||||||||||||||||||||||||

| Investment costs and non-revenue enhancing capital expenditures in DE | (201) | 3,287 | — | — | 3,086 | |||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 18,514 | $ | 17,653 | $ | (5,239) | $ | — | $ | 30,928 | ||||||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

11 |

||||||||||

| IIIa. Capitalization - Debt Summary | ||

| ($ in thousands; as of June 30, 2022) | ||||||||||||||||||||||||||||||||||||||||||||

| Consolidated debt | Payments due by period(1) |

|||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2023 | 2024 | 2025 | 2026 and after | Total | |||||||||||||||||||||||||||||||||||||||

| Investment-level debt: | ||||||||||||||||||||||||||||||||||||||||||||

| Digital Operating - Fixed | $ | 3,116 | $ | 219,792 | $ | 600,753 | $ | 700,000 | $ | 2,119,690 | $ | 3,643,351 | ||||||||||||||||||||||||||||||||

| Digital Operating - Variable | 9,000 | 278,250 | 446,517 | 100,000 | $ | 833,767 | ||||||||||||||||||||||||||||||||||||||

| Total Digital Operating | 3,116 | 228,792 | 879,003 | 1,146,517 | 2,219,690 | 4,477,118 | ||||||||||||||||||||||||||||||||||||||

| Corporate and Other debt: | ||||||||||||||||||||||||||||||||||||||||||||

| 2021-1, A-1 Variable Funding Notes | — | — | — | — | 70,000 | 70,000 | ||||||||||||||||||||||||||||||||||||||

| 2021-1, Class A-2 Term Notes | — | — | — | — | 300,000 | 300,000 | ||||||||||||||||||||||||||||||||||||||

Other - Variable (2) |

— | 136,500 | 31,500 | — | 224,681 | 392,681 | ||||||||||||||||||||||||||||||||||||||

Other - Fixed (2) |

— | — | — | — | 94,053 | 94,053 | ||||||||||||||||||||||||||||||||||||||

| Convertible/exchangeable senior notes | — | 200,000 | — | 78,422 | — | 278,422 | ||||||||||||||||||||||||||||||||||||||

Total consolidated debt (3) |

$ | 3,116 | $ | 565,292 | $ | 910,503 | $ | 1,224,939 | $ | 2,908,424 | $ | 5,612,274 | ||||||||||||||||||||||||||||||||

| Fixed/Variable | WA Interest Rate | WA Remaining Term | ||||||||||||||||||||||||||||||||||||||||||

| DBRG OP share of debt | Payments due by period(1) |

|||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2023 | 2024 | 2025 | 2026 and after | Total | |||||||||||||||||||||||||||||||||||||||

| Investment-level debt: | ||||||||||||||||||||||||||||||||||||||||||||

| Digital Operating - Fixed | $ | 409 | $ | 28,859 | $ | 78,879 | $ | 91,910 | $ | 379,462 | $ | 579,519 | Fixed | 2.4% | 3.6 | |||||||||||||||||||||||||||||

| Digital Operating - Variable | — | 1,799 | 59,192 | 89,259 | 19,990 | $ | 170,240 | Variable | 6.0% | 2.9 | ||||||||||||||||||||||||||||||||||

| Total Digital Operating | 409 | 30,658 | 138,071 | 181,169 | 399,452 | 749,759 | 3.2% | 3.4 | ||||||||||||||||||||||||||||||||||||

| Corporate and Other debt: | ||||||||||||||||||||||||||||||||||||||||||||

| 2021-1, A-1 Variable Funding Notes | — | — | — | — | 70,000 | 70,000 | Variable | 4.8% | 4.2 | |||||||||||||||||||||||||||||||||||

| 2021-1, Class A-2 Term Notes | — | — | — | — | 300,000 | 300,000 | Fixed | 3.9% | 4.2 | |||||||||||||||||||||||||||||||||||

Other - Variable (2) |

— | 136,500 | 31,500 | — | 127,015 | 295,015 | Variable | 3.1% | 3.7 | |||||||||||||||||||||||||||||||||||

Other - Fixed (2) |

— | — | — | — | 53,169 | 53,169 | Fixed | 6.5% | 6.9 | |||||||||||||||||||||||||||||||||||

| Convertible/exchangeable senior notes | — | 200,000 | — | 78,422 | — | 278,422 | Fixed | 5.2% | 1.4 | |||||||||||||||||||||||||||||||||||

Total DBRG share of debt (3) |

$ | 409 | $ | 367,158 | $ | 169,571 | $ | 259,591 | $ | 949,636 | $ | 1,746,365 | ||||||||||||||||||||||||||||||||

| Digital and Corporate Net Assets | Consolidated amount | DBRG OP share of consolidated amount |

||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents, restricted cash and other assets | $ | 1,091,322 | $ | 375,661 | ||||||||||||||||||||||||||||||||||||||||

| Accrued and other liabilities and dividends payable | 896,543 | 320,033 | ||||||||||||||||||||||||||||||||||||||||||

| Net assets | $ | 194,779 | $ | 55,628 | ||||||||||||||||||||||||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

12 |

||||||||||

| IIIb. Capitalization - DBRG Series 2021-1 | ||

| ($ in thousands, as of June 30, 2022) | |||||||||||

| Class A-2 Term Notes | |||||||||||

| Amount outstanding | $ | 300,000 | |||||||||

| Interest rate | 3.933 | % | |||||||||

| Anticipated Repayment Date (ARD) | September 25, 2026 | ||||||||||

| Kroll Rating | BBB | ||||||||||

| Class A-1 Variable Funding Notes | |||||||||||

| Maximum Available | $ | 300,000 | (1) |

||||||||

| Amount outstanding | $ | 70,000 | |||||||||

| Interest Rate | 1M Term SOFR + 3.00% | (1) |

|||||||||

Fully extended Anticipated Repayment Date (ARD)(2) |

September 25, 2026 | ||||||||||

| Financial covenants: | Covenant level | ||||||||||

Debt Service Coverage Ratio(3) |

Minimum 1.75x | ||||||||||

Loan to Value Ratio(4) |

Less than 35.0% | ||||||||||

Investment Management Expense Ratio(5) |

Less than 60.0% | ||||||||||

| Company status: As of August 3, 2022, DBRG is meeting all required covenant threshold levels. | |||||||||||

DigitalBridge | Supplemental Financial Report |

13 |

||||||||||

| IIIc. Capitalization - Convertible/Exchangeable Notes & Perpetual Preferred Stock | ||

| ($ in thousands; except per share data; as of June 30, 2022) | ||||||||||||||||||||||||||||||||||||||

| Convertible/exchangeable debt | ||||||||||||||||||||||||||||||||||||||

| Description | Outstanding principal | Final due date(1) |

Interest rate | Conversion price (per share of common stock) | Conversion ratio | Conversion shares | ||||||||||||||||||||||||||||||||

| 5.75% Exchangeable senior notes | $ | 78,422 | July 15, 2025 | 5.75% fixed | $ | 2.30 | 434.7826 | 34,097 | ||||||||||||||||||||||||||||||

| 5.0% Convertible senior notes | 200,000 | April 15, 2023 | 5.00% fixed | 15.76 | 63.4700 | 12,694 | ||||||||||||||||||||||||||||||||

| Total convertible debt | $ | 278,422 | ||||||||||||||||||||||||||||||||||||

| Perpetual preferred stock | ||||||||||||||||||||

| Description | Liquidation preference |

Shares outstanding (In thousands) | Callable period | |||||||||||||||||

| Series H 7.125% cumulative redeemable perpetual preferred stock | 223,500 | 8,940 | Callable | |||||||||||||||||

| Series I 7.15% cumulative redeemable perpetual preferred stock | 345,000 | 13,800 | Callable | |||||||||||||||||

| Series J 7.125% cumulative redeemable perpetual preferred stock | 315,000 | 12,600 | On or after September 22, 2022 | |||||||||||||||||

| Total preferred stock | $ | 883,500 | 35,340 | |||||||||||||||||

DigitalBridge | Supplemental Financial Report |

14 |

||||||||||

| IIId. Capitalization - Organization Structure | ||

DigitalBridge | Supplemental Financial Report |

15 |

||||||||||

| IV. Assets Under Management | ||

| ($ in millions) | DBRG OP Share | ||||||||||||||||||||||||||||

| Segment | 6/30/22 | 3/31/22 | 12/31/21 | 9/30/21 | 6/30/21 | 3/31/21 | 12/31/20 | 9/30/20 | |||||||||||||||||||||

| Digital Investment Management | $ | 45,296 | $ | 44,517 | $ | 43,619 | $ | 36,337 | $ | 33,551 | $ | 30,711 | $ | 28,577 | $ | 22,237 | |||||||||||||

| Digital Operating | 1,466 | 1,460 | 1,233 | 1,157 | 1,093 | 1,073 | 1,087 | 724 | |||||||||||||||||||||

Other (1) |

2,348 | 1,848 | 6,427 | 11,880 | 13,790 | 14,397 | 22,300 | 23,853 | |||||||||||||||||||||

| Total AUM | $ | 49,110 | $ | 47,825 | $ | 51,279 | $ | 49,374 | $ | 48,434 | $ | 46,181 | $ | 51,964 | $ | 46,814 | |||||||||||||

DigitalBridge | Supplemental Financial Report |

16 |

||||||||||

| V. Digital Investment Management | ||

| ($ in millions) | ||||||||||||||||||||||||||||||||

| AUM DBRG OP Share | 6/30/22 | 3/31/22 | 12/31/21 | 9/30/21 | 6/30/21 | 3/31/21 | 12/31/20 | 9/30/20 | ||||||||||||||||||||||||

| DigitalBridge Partners I | $ | 5,988 | $ | 5,766 | $ | 6,180 | $ | 6,180 | $ | 6,003 | $ | 5,931 | $ | 6,089 | $ | 5,686 | ||||||||||||||||

| DigitalBridge Partners II | 10,739 | 10,687 | 10,430 | 8,005 | 6,431 | 4,775 | 3,241 | — | ||||||||||||||||||||||||

| Separately Capitalized Portfolio Companies | 7,402 | 7,111 | 6,882 | 10,147 | 10,254 | 9,893 | 8,947 | 8,273 | ||||||||||||||||||||||||

| Co-Investment (Sidecar) Capital | 20,200 | 19,907 | 19,311 | 11,417 | 10,273 | 9,591 | 9,857 | 8,181 | ||||||||||||||||||||||||

| Liquid and Other Strategies | 967 | 1,046 | 816 | 588 | 590 | 521 | 443 | 97 | ||||||||||||||||||||||||

| Digital IM AUM | $ | 45,296 | $ | 44,517 | $ | 43,619 | $ | 36,337 | $ | 33,551 | $ | 30,711 | $ | 28,577 | $ | 22,237 | ||||||||||||||||

| FEEUM DBRG OP Share | 6/30/22 Annual IM Fee Rate | 6/30/22 | 3/31/22 | 12/31/21 | 9/30/21 | 6/30/21 | 3/31/21 | 12/31/20 | 9/30/20 | |||||||||||||||||||||||

| DigitalBridge Partners I | 1.10% | $ | 3,048 | $ | 3,034 | $ | 3,215 | $ | 3,040 | $ | 3,081 | $ | 3,179 | $ | 3,756 | $ | 3,756 | |||||||||||||||

| DigitalBridge Partners II | 1.18% | 7,996 | 7,996 | 8,001 | 7,146 | 5,519 | 3,964 | 3,217 | — | |||||||||||||||||||||||

| Separately Capitalized Portfolio Companies | 0.81% | 2,401 | 2,372 | 2,148 | 2,576 | 2,576 | 2,534 | 2,777 | 2,603 | |||||||||||||||||||||||

| Co-Investment (Sidecar) Capital | 0.53% | 4,651 | 4,370 | 4,105 | 3,184 | 2,817 | 2,744 | 2,655 | 2,042 | |||||||||||||||||||||||

| Liquid and Other Strategies | 0.42% | 933 | 1,013 | 786 | 510 | 512 | 432 | 437 | 153 | |||||||||||||||||||||||

| Digital IM FEEUM | 0.92% | $ | 19,029 | $ | 18,785 | $ | 18,255 | $ | 16,456 | $ | 14,505 | $ | 12,853 | $ | 12,842 | $ | 8,554 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||||||||

| Digital IM FRE | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | ||||||||||||||||||||||||

| Fee income | $ | 44,758 | $ | 43,155 | $ | 43,145 | $ | 37,751 | $ | 33,304 | $ | 28,917 | $ | 24,191 | $ | 19,172 | ||||||||||||||||

Fee income, other (1) |

355 | 523 | 8,787 | 12,809 | 8,996 | 2,148 | 862 | 876 | ||||||||||||||||||||||||

| Other income | 530 | 251 | 273 | 483 | 84 | 54 | 183 | 87 | ||||||||||||||||||||||||

| Compensation expense—cash | (17,725) | (17,675) | (16,275) | (16,933) | (14,426) | (10,852) | (18,353) | (9,414) | ||||||||||||||||||||||||

| Administrative expenses | (4,794) | (4,012) | (3,446) | (2,675) | (2,337) | (2,067) | (2,310) | (1,832) | ||||||||||||||||||||||||

| Exclude: Start-up FRE of certain new strategies | 2,335 | 2,362 | 2,306 | 2,224 | 2,059 | 1,938 | 1,842 | 1,842 | ||||||||||||||||||||||||

Digital IM FRE (2) |

$ | 25,459 | $ | 24,604 | $ | 34,790 | $ | 33,659 | $ | 27,680 | $ | 20,138 | $ | 6,415 | $ | 10,731 | ||||||||||||||||

DBRG OP share of Digital IM FRE(3) |

$ | 20,759 | $ | 16,989 | $ | 23,757 | $ | 22,922 | $ | 19,470 | $ | 13,583 | $ | 3,893 | $ | 8,148 | ||||||||||||||||

DigitalBridge | Supplemental Financial Report |

17 |

||||||||||

| VI. Digital Operating | ||

| ($ in millions, unless otherwise noted) | |||||||||||||||||||||||||||||

| Portfolio Overview | 6/30/22 | 3/31/22 | 12/31/21 | 9/30/21 | 6/30/21 | 3/31/21 | 12/31/20 | 9/30/20 | |||||||||||||||||||||

| Consolidated amount | |||||||||||||||||||||||||||||

Asset(1) |

$ | 8,429 | $ | 8,397 | $ | 7,624 | $ | 7,211 | $ | 6,736 | $ | 6,633 | $ | 6,248 | $ | 4,925 | |||||||||||||

Debt(2)(3) |

(4,477) | (4,479) | (4,217) | (3,817) | (3,374) | (3,369) | (3,227) | (2,546) | |||||||||||||||||||||

| Net Carrying Value - Consolidated | $ | 3,952 | $ | 3,918 | $ | 3,407 | $ | 3,394 | $ | 3,362 | $ | 3,264 | $ | 3,021 | $ | 2,379 | |||||||||||||

| DBRG OP share of consolidated amount | |||||||||||||||||||||||||||||

Asset(1) |

$ | 1,466 | $ | 1,460 | $ | 1,233 | $ | 1,157 | $ | 1,093 | $ | 1,073 | $ | 1,087 | $ | 724 | |||||||||||||

Debt(2)(3) |

(746) | (746) | (661) | (588) | (529) | (528) | (536) | (355) | |||||||||||||||||||||

| Net Carrying Value - DBRG OP share | $ | 720 | $ | 714 | $ | 572 | $ | 569 | $ | 564 | $ | 545 | $ | 551 | $ | 369 | |||||||||||||

| DBRG net carrying value % interest | 18 | % | 18 | % | 17 | % | 17 | % | 17 | % | 17 | % | 18 | % | 16 | % | |||||||||||||

| ($ in millions, unless otherwise noted) | |||||||||||||||||||||||||||||

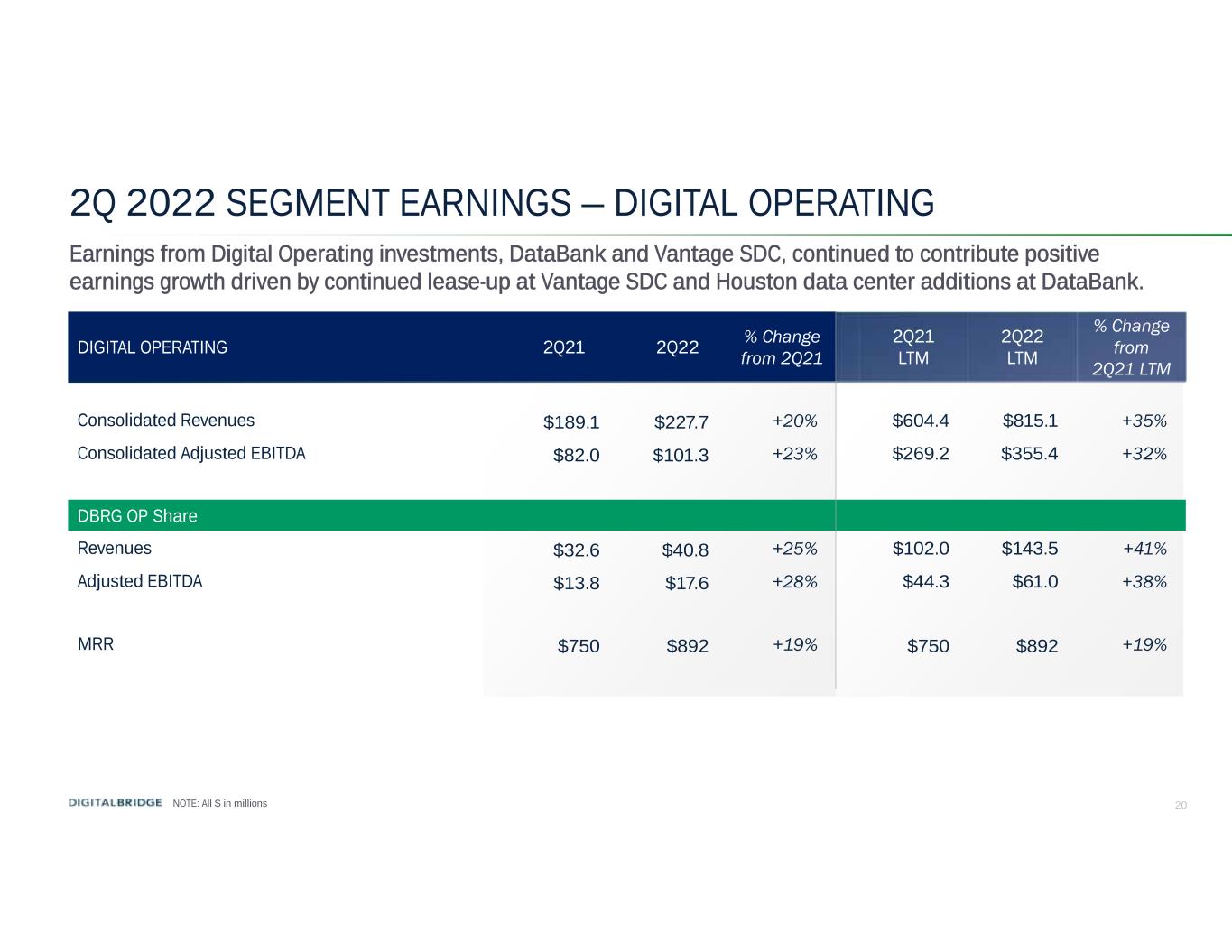

Operating Metrics (4) |

6/30/2022 2Q22 | 3/31/2022 - 1Q22 | 12/31/2021 - 4Q21 | 9/30/2021 - 3Q21 | 6/30/2021 - 2Q21 | 3/31/2021 - 1Q21 | 12/31/2020 - 4Q20 | 9/30/2020- 3Q20 | |||||||||||||||||||||

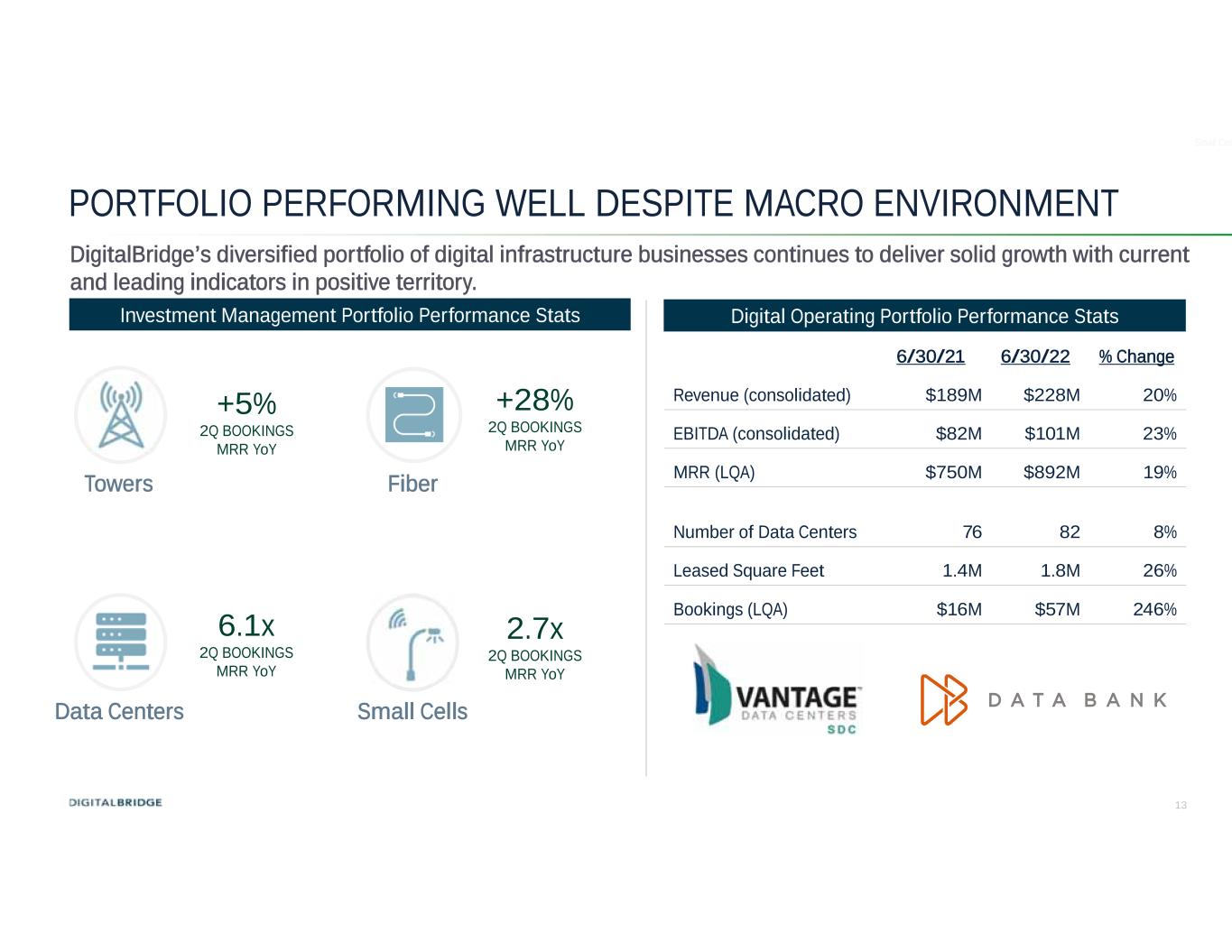

| Number of Data Centers | 82 | 78 | 78 | 76 | 76 | 76 | 32 | 32 | |||||||||||||||||||||

| Max Critical I.T. Square Feet | 2,317,827 | 1,980,317 | 1,949,144 | 1,819,946 | 1,809,943 | 1,791,781 | 1,138,048 | 1,137,866 | |||||||||||||||||||||

| Leased Square Feet | 1,817,101 | 1,608,378 | 1,552,517 | 1,467,420 | 1,439,291 | 1,423,322 | 967,879 | 945,640 | |||||||||||||||||||||

| % Utilization Rate | 78.4% | 81.2% | 79.7% | 80.6% | 79.5% | 79.4% | 85.0% | 83.1% | |||||||||||||||||||||

| MRR (Annualized) | $ | 892.0 | $ | 812.3 | $ | 790.4 | $ | 773.1 | $ | 750.2 | $ | 743.0 | $ | 442.0 | $ | 374.0 | |||||||||||||

| Bookings (Annualized) | $ | 56.5 | $ | 14.2 | $ | 15.3 | $ | 16.6 | $ | 16.4 | $ | 23.0 | $ | 6.0 | $ | 9.4 | |||||||||||||

| Quarterly Churn (% of Prior Quarter MRR) | 1.7% | .9% | 1.9% | 1.3% | 1.3% | 1.3% | .8% | .8% | |||||||||||||||||||||

DigitalBridge | Supplemental Financial Report |

18 |

||||||||||

| VI. Digital Operating | ||

| ($ in thousands) | |||||||||||||||||||||||||||||

| Digital Operating Adjusted EBITDA | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

| Consolidated amount | |||||||||||||||||||||||||||||

| Total revenues | $ | 227,687 | $ | 202,522 | $ | 189,938 | $ | 194,966 | $ | 189,093 | $ | 189,202 | $ | 127,546 | $ | 98,549 | |||||||||||||

| Property operating expenses | (94,744) | (84,003) | (78,950) | (80,226) | (77,140) | (79,862) | (47,224) | (37,544) | |||||||||||||||||||||

| Compensation and administrative expenses | (29,139) | (26,855) | (28,879) | (29,766) | (28,488) | (25,947) | (16,982) | (11,863) | |||||||||||||||||||||

| Investment expenses | (5,487) | (8,016) | (5,153) | (4,862) | (5,255) | (6,565) | (3,329) | (2,362) | |||||||||||||||||||||

| Straight-line rent expenses and amortization of above- and below-market lease intangibles | (236) | (377) | 370 | 482 | (98) | (399) | (2,607) | (2,106) | |||||||||||||||||||||

| Compensation expense—equity-based | 752 | 752 | 1,918 | 308 | 308 | 308 | 728 | 148 | |||||||||||||||||||||

| Installation services | — | — | 2,097 | (4,058) | 576 | 880 | 429 | (65) | |||||||||||||||||||||

| Transaction-related and restructuring charges | 2,400 | 4,636 | 3,188 | 4,042 | 2,999 | 4,670 | 1,155 | 420 | |||||||||||||||||||||

Digital Operating Adjusted EBITDA - Consolidated (1) |

$ | 101,233 | $ | 88,659 | $ | 84,529 | $ | 80,886 | $ | 81,995 | $ | 82,287 | $ | 59,716 | $ | 45,177 | |||||||||||||

| DBRG OP share of consolidated amount | |||||||||||||||||||||||||||||

| Total revenues | $ | 41,448 | $ | 36,882 | $ | 32,464 | $ | 33,771 | $ | 32,624 | $ | 32,741 | $ | 21,013 | $ | 15,600 | |||||||||||||

| Property operating expenses | (17,649) | (15,614) | (13,740) | (14,115) | (13,690) | (14,165) | (7,911) | (6,026) | |||||||||||||||||||||

| Compensation and administrative expenses | (6,246) | (5,752) | (5,457) | (5,615) | (5,350) | (4,888) | (3,276) | (2,310) | |||||||||||||||||||||

| Investment expenses | (793) | (1,169) | (732) | (709) | (819) | (1,090) | (433) | (290) | |||||||||||||||||||||

| Straight-line rent expenses and amortization of above- and below-market lease intangibles | 246 | 195 | 244 | 295 | 247 | 192 | (250) | (154) | |||||||||||||||||||||

| Compensation expense—equity-based | 164 | 164 | 384 | 62 | 62 | 62 | 146 | 30 | |||||||||||||||||||||

| Installation services | — | — | 419 | (812) | 115 | 176 | 86 | (13) | |||||||||||||||||||||

| Transaction-related and restructuring charges | 473 | 791 | 618 | 759 | 587 | 920 | 245 | 77 | |||||||||||||||||||||

| Digital Operating Adjusted EBITDA - DBRG OP share | $ | 17,643 | $ | 15,497 | $ | 14,200 | $ | 13,636 | $ | 13,776 | $ | 13,948 | $ | 9,620 | $ | 6,914 | |||||||||||||

DigitalBridge | Supplemental Financial Report |

19 |

||||||||||

| VI. Digital Operating | ||

| ($ in thousands) | |||||||||||||||||||||||||||||

| Capital Expenditures | |||||||||||||||||||||||||||||

| Consolidated amount | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

| Non-revenue enhancing capital expenditures | $ | 13,377 | $ | 7,418 | $ | 6,410 | $ | 7,387 | $ | 4,423 | $ | 1,220 | $ | 1,416 | $ | 1,551 | |||||||||||||

| Revenue enhancing capital expenditures | 101,100 | 84,668 | 94,018 | 42,841 | 40,460 | 34,652 | 37,534 | 20,423 | |||||||||||||||||||||

| Total capital expenditures | $ | 114,477 | $ | 92,086 | $ | 100,428 | $ | 50,228 | $ | 44,883 | $ | 35,872 | $ | 38,950 | $ | 21,974 | |||||||||||||

| Leasing Commissions | $ | 2,660 | $ | 1,266 | $ | 1,535 | $ | 1,233 | $ | 5,024 | $ | 775 | $ | 545 | $ | 539 | |||||||||||||

| DBRG OP share of consolidated amount | |||||||||||||||||||||||||||||

| Non-revenue enhancing capital expenditures | $ | 2,571 | $ | 1,372 | $ | 1,097 | $ | 1,349 | $ | 764 | $ | 226 | $ | 233 | $ | 300 | |||||||||||||

| Revenue enhancing capital expenditures | 21,249 | 17,578 | 18,090 | 8,315 | 7,538 | 6,532 | 6,770 | 3,702 | |||||||||||||||||||||

| Total capital expenditures | $ | 23,820 | $ | 18,950 | $ | 19,187 | $ | 9,664 | $ | 8,302 | $ | 6,758 | $ | 7,003 | $ | 4,002 | |||||||||||||

| Leasing Commissions | $ | 489 | $ | 308 | $ | 307 | $ | 213 | $ | 756 | $ | 155 | $ | 109 | $ | 108 | |||||||||||||

DigitalBridge | Supplemental Financial Report |

20 |

||||||||||

| VII. Other | ||

| ($ in thousands) | |||||||||||||||||||||||||||||

| Consolidated amount | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

| DBRG's GP Co-investment in DBP I and II Investments | $ | 284,282 | $ | 248,663 | $ | 242,856 | $ | 230,972 | $ | 225,411 | $ | 173,831 | $ | 171,204 | $ | 184,829 | |||||||||||||

Equity interests in digital investment vehicles, warehouse / seed investments and CLOs (1) |

906,076 | 423,467 | 290,113 | $ | 272,134 | $ | 198,934 | $ | 179,945 | $ | 181,990 | $ | 71,622 | ||||||||||||||||

| Other - digital assets net carrying value | $ | 1,190,358 | $ | 672,130 | $ | 532,969 | $ | 503,106 | $ | 424,345 | $ | 353,776 | $ | 353,194 | $ | 256,451 | |||||||||||||

| DBRG OP share of consolidated amount | |||||||||||||||||||||||||||||

| DBRG's GP Co-investment in DBP I and II Investments | $ | 217,504 | $ | 187,247 | $ | 183,612 | $ | 173,732 | $ | 171,012 | $ | 160,342 | $ | 157,610 | $ | 176,329 | |||||||||||||

Equity interests in digital investment vehicles, warehouse / seed investments and CLOs (1) |

591,066 | 308,578 | 174,566 | $ | 165,902 | $ | 98,476 | $ | 83,384 | $ | 97,108 | $ | 34,067 | ||||||||||||||||

| Other - digital assets net carrying value | $ | 808,570 | $ | 495,825 | $ | 358,178 | $ | 339,634 | $ | 269,488 | $ | 243,726 | $ | 254,718 | $ | 210,396 | |||||||||||||

DigitalBridge | Supplemental Financial Report |

21 |

||||||||||

| VIII. Cash G&A Expense | ||

| ($ in thousands) | |||||||||||||||||||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | ||||||||||||||||||||||

| Digital Investment Management Cash G&A | |||||||||||||||||||||||||||||

| Cash and equity-based compensation | $ | 23,230 | $ | 24,808 | $ | 20,802 | $ | 21,606 | $ | 16,262 | $ | 12,385 | $ | 19,007 | $ | 9,603 | |||||||||||||

| Administrative expenses | 4,869 | 4,171 | 4,387 | 5,820 | 9,345 | 2,131 | 3,511 | 1,847 | |||||||||||||||||||||

| Compensation expense—equity-based | (3,361) | (3,190) | (2,011) | (2,046) | (1,785) | (1,533) | (649) | (189) | |||||||||||||||||||||

| Administrative expenses—straight-line rent | (76) | (159) | (75) | (74) | (50) | (5) | 1 | (15) | |||||||||||||||||||||

| Administrative expenses—placement agent fee | — | — | (880) | (3,069) | (6,959) | (59) | (1,202) | — | |||||||||||||||||||||

| Transaction-related and restructuring charges | (2,143) | (3,943) | (2,502) | (2,629) | (50) | — | (5) | — | |||||||||||||||||||||

| Digital Investment Management Cash G&A | 22,519 | 21,687 | 19,721 | 19,608 | 16,763 | 12,919 | 20,663 | 11,246 | |||||||||||||||||||||

| Corporate & Other Cash G&A | |||||||||||||||||||||||||||||

| Cash and equity-based compensation | 9,333 | 20,778 | 12,084 | 15,200 | 13,061 | 48,372 | 26,738 | 18,099 | |||||||||||||||||||||

| Administrative expenses | 12,574 | 16,815 | 21,171 | 12,474 | 9,548 | 7,747 | 12,468 | 11,539 | |||||||||||||||||||||

| Compensation expense—equity-based | (4,840) | (5,878) | (3,837) | (4,651) | (5,721) | (14,065) | (5,058) | (4,659) | |||||||||||||||||||||

| Administrative expenses—straight-line rent | 741 | 856 | 1,195 | 602 | 375 | 591 | 353 | 224 | |||||||||||||||||||||

| Administrative expenses—noncontrolling interests | (327) | (302) | (377) | (332) | (255) | (248) | (234) | (96) | |||||||||||||||||||||

| Transaction-related and restructuring charges | (2,828) | (14,352) | (14,229) | (5,027) | (1,399) | (29,626) | (18,971) | (4,565) | |||||||||||||||||||||

| Corporate & Other Cash G&A | 14,653 | 17,917 | 16,007 | 18,266 | 15,609 | 12,771 | 15,296 | 20,542 | |||||||||||||||||||||

| DBRG Cash G&A excluding Portfolio Company G&A | $ | 37,172 | $ | 39,604 | $ | 35,728 | $ | 37,874 | $ | 32,372 | $ | 25,690 | $ | 35,959 | $ | 31,788 | |||||||||||||

| Corporate & Other EBITDA | |||||||||||||||||||||||||||||

| EBITDA, excluding Cash G&A | $ | 9,414 | $ | 8,162 | $ | 1,273 | $ | 1,515 | $ | (239) | $ | (284) | $ | 1,181 | $ | 1,803 | |||||||||||||

| Cash G&A | (14,653) | (17,917) | (16,007) | (18,266) | (15,609) | (12,771) | (15,296) | (20,542) | |||||||||||||||||||||

| Corporate & Other EBITDA | $ | (5,239) | $ | (9,755) | $ | (14,734) | $ | (16,751) | $ | (15,848) | $ | (13,055) | $ | (14,115) | $ | (18,739) | |||||||||||||

DigitalBridge | Supplemental Financial Report |

22 |

||||||||||

DigitalBridge | Supplemental Financial Report |

23 |

||||||||||

| Reconciliations of Digital IM FRE and Digital Operating Adjusted EBITDA to Net Income (Loss) | ||

| ($ in thousands) | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

| Digital IM net income (loss) | 67,995 | (9,143) | 28,194 | 39,272 | 15,786 | 7,663 | 2,702 | 3,799 | |||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Interest expense (income) | 2,771 | 2,500 | 2,499 | 2,250 | — | (1) | (1) | (2) | |||||||||||||||||||||

| Investment expense, net of reimbursement | (200) | 138 | (12) | — | — | 32 | 204 | — | |||||||||||||||||||||

| Depreciation and amortization | 5,375 | 5,276 | 5,928 | 8,242 | 6,298 | 8,912 | 6,421 | 10,259 | |||||||||||||||||||||

| Compensation expense—equity-based | 3,361 | 3,191 | 2,011 | 2,046 | 1,786 | 1,533 | 655 | 189 | |||||||||||||||||||||

| Compensation expense—carried interest and incentive | 49,069 | (20,352) | 25,921 | 31,736 | 8,266 | (33) | 994 | 912 | |||||||||||||||||||||

| Administrative expenses—straight-line rent | 76 | 159 | 75 | 74 | 50 | (2) | (1) | 14 | |||||||||||||||||||||

| Administrative expenses—placement agent fee | — | — | 880 | 3,069 | 6,959 | 59 | 1,202 | — | |||||||||||||||||||||

| Transaction-related and restructuring charges | 4,042 | 3,942 | 2,516 | 2,627 | 51 | — | — | — | |||||||||||||||||||||

| Incentive/performance fee income | (110,779) | 40 | (5,720) | (1,313) | (4,489) | — | — | — | |||||||||||||||||||||

| Equity method (earnings) losses | (1,016) | 31,062 | (31,608) | (59,196) | (11,203) | 195 | (6,744) | (6,394) | |||||||||||||||||||||

| Other (gain) loss, net | 424 | 3,055 | (52) | (461) | (119) | (165) | (102) | (32) | |||||||||||||||||||||

| Income tax (benefit) expense | 2,006 | 2,374 | 1,852 | 3,089 | 2,236 | 7 | (757) | 144 | |||||||||||||||||||||

| Digital IM Adjusted EBITDA | $ | 23,124 | $ | 22,242 | $ | 32,484 | $ | 31,435 | $ | 25,621 | $ | 18,200 | $ | 4,573 | $ | 8,889 | |||||||||||||

| Exclude: Start-up FRE of certain new strategies | 2,335 | 2,362 | 2,306 | 2,224 | 2,059 | 1,938 | 1,842 | 1,842 | |||||||||||||||||||||

| Digital IM FRE | $ | 25,459 | $ | 24,604 | $ | 34,790 | $ | 33,659 | $ | 27,680 | $ | 20,138 | $ | 6,415 | $ | 10,731 | |||||||||||||

| Wafra’s 31.5% ownership | (4,700) | (7,615) | (11,033) | (10,737) | (8,210) | (6,555) | (2,522) | (2,583) | |||||||||||||||||||||

| DBRG OP share of Digital IM FRE | $ | 20,759 | $ | 16,989 | $ | 23,757 | $ | 22,922 | $ | 19,470 | $ | 13,583 | $ | 3,893 | $ | 8,148 | |||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | ||||||||||||||||||||||

| Digital Operating net income (loss) from continuing operations | (85,428) | (74,141) | (83,909) | (71,822) | (10,850) | (64,260) | (53,591) | (38,795) | |||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Interest expense | 37,233 | 36,184 | 35,144 | 29,839 | 29,272 | 31,132 | 41,815 | 18,589 | |||||||||||||||||||||

| Income tax (benefit) expense | 161 | (330) | (1,941) | 1,922 | (66,788) | (12,268) | (6,967) | (6,091) | |||||||||||||||||||||

| Depreciation and amortization | 145,817 | 122,891 | 126,436 | 120,458 | 126,227 | 122,221 | 78,554 | 73,032 | |||||||||||||||||||||

| Straight-line rent expenses and amortization of above- and below-market lease intangibles | (236) | (377) | 370 | 482 | (98) | (399) | (2,607) | (2,106) | |||||||||||||||||||||

| Compensation expense—equity-based | 752 | 752 | 1,918 | 308 | 308 | 308 | 728 | 148 | |||||||||||||||||||||

| Installation services | — | — | 2,097 | (4,058) | 576 | 880 | 429 | (65) | |||||||||||||||||||||

| Transaction-related and restructuring charges | 2,400 | 4,636 | 3,188 | 4,042 | 2,999 | 4,670 | 1,155 | 420 | |||||||||||||||||||||

| Other gain/loss, net | 534 | (956) | 1,226 | (285) | 349 | 3 | 200 | 45 | |||||||||||||||||||||

| Digital Operating Adjusted EBITDA | $ | 101,233 | $ | 88,659 | $ | 84,529 | $ | 80,886 | $ | 81,995 | $ | 82,287 | $ | 59,716 | $ | 45,177 | |||||||||||||

DigitalBridge | Supplemental Financial Report |

24 |

||||||||||

| Reconciliations of DE and Adjusted EBITDA to Net Income (Loss) | ||

| ($ in thousands) | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

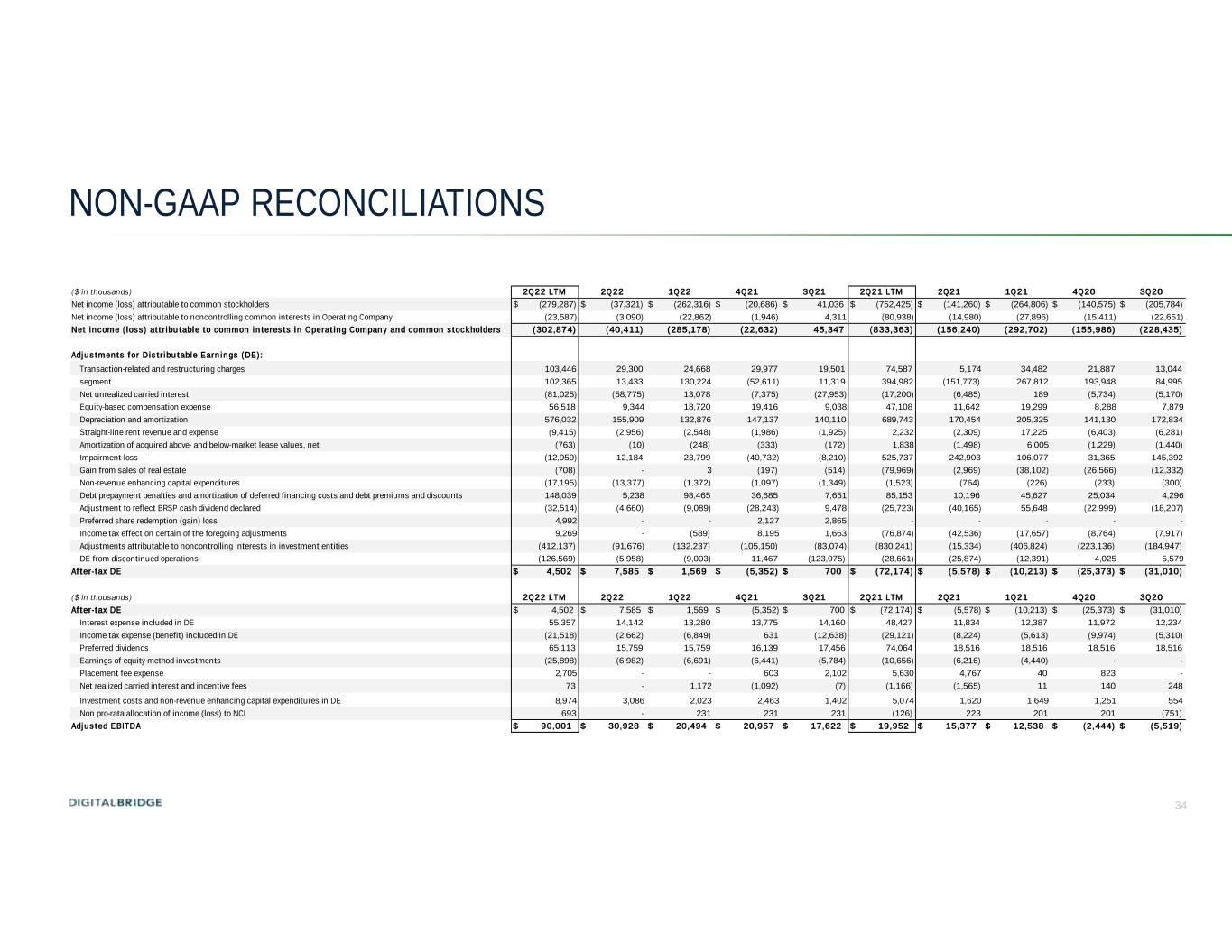

| Net income (loss) attributable to common stockholders | $ | (37,321) | $ | (262,316) | $ | (20,686) | $ | 41,036 | $ | (141,260) | $ | (264,806) | $ | (140,575) | $ | (205,784) | |||||||||||||

| Net income (loss) attributable to noncontrolling common interests in Operating Company | (3,090) | (22,862) | (1,946) | 4,311 | (14,980) | (27,896) | (15,411) | (22,651) | |||||||||||||||||||||

| Net income (loss) attributable to common interests in Operating Company and common stockholders | (40,411) | (285,178) | (22,632) | 45,347 | (156,240) | (292,702) | (155,986) | (228,435) | |||||||||||||||||||||

| Adjustments for Distributable Earnings (DE): | |||||||||||||||||||||||||||||

| Transaction-related and restructuring charges | 29,300 | 24,668 | 29,977 | 19,501 | 5,174 | 34,482 | 21,887 | 13,044 | |||||||||||||||||||||

| Non-real estate (gains) losses, excluding realized gains or losses of digital assets within the Corporate and Other segment | 13,433 | 130,224 | (52,611) | 11,319 | (151,773) | 267,812 | 193,948 | 84,995 | |||||||||||||||||||||

| Net unrealized carried interest | (58,775) | 13,078 | (7,375) | (27,953) | (6,485) | 189 | (5,734) | (5,170) | |||||||||||||||||||||

| Equity-based compensation expense | 9,344 | 18,720 | 19,416 | 9,038 | 11,642 | 19,299 | 8,288 | 7,879 | |||||||||||||||||||||

| Depreciation and amortization | 155,909 | 132,876 | 147,137 | 140,110 | 170,454 | 205,325 | 141,130 | 172,834 | |||||||||||||||||||||

| Straight-line rent revenue and expense | (2,956) | (2,548) | (1,986) | (1,925) | (2,309) | 17,225 | (6,403) | (6,281) | |||||||||||||||||||||

| Amortization of acquired above- and below-market lease values, net | (10) | (248) | (333) | (172) | (1,498) | 6,005 | (1,229) | (1,440) | |||||||||||||||||||||

| Impairment loss | 12,184 | 23,799 | (40,732) | (8,210) | 242,903 | 106,077 | 31,365 | 145,392 | |||||||||||||||||||||

| Gain from sales of real estate | — | 3 | (197) | (514) | (2,969) | (38,102) | (26,566) | (12,332) | |||||||||||||||||||||

| Non-revenue enhancing capital expenditures | (13,377) | (1,372) | (1,097) | (1,349) | (764) | (226) | (233) | (300) | |||||||||||||||||||||

| Debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts | 5,238 | 98,465 | 36,685 | 7,651 | 10,196 | 45,627 | 25,034 | 4,296 | |||||||||||||||||||||

| Adjustment to reflect BRSP cash dividend declared | (4,660) | (9,089) | (28,243) | 9,478 | (40,165) | 55,648 | (22,999) | (18,207) | |||||||||||||||||||||

| Preferred share redemption (gain) loss | — | — | 2,127 | 2,865 | — | — | — | — | |||||||||||||||||||||

| Income tax effect on certain of the foregoing adjustments | — | (589) | 8,195 | 1,663 | (42,536) | (17,657) | (8,764) | (7,917) | |||||||||||||||||||||

| Adjustments attributable to noncontrolling interests in investment entities | (91,676) | (132,237) | (105,150) | (83,074) | (15,334) | (406,824) | (223,136) | (184,947) | |||||||||||||||||||||

| DE from discontinued operations | (5,958) | (9,003) | 11,467 | (123,075) | (25,874) | (12,391) | 4,025 | 5,579 | |||||||||||||||||||||

| After-tax DE | $ | 7,585 | $ | 1,569 | $ | (5,352) | $ | 700 | $ | (5,578) | $ | (10,213) | $ | (25,373) | $ | (31,010) | |||||||||||||

DigitalBridge | Supplemental Financial Report |

25 |

||||||||||

| Reconciliations of DE and Adjusted EBITDA to Net Income (Loss) | ||

| ($ in thousands) | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | |||||||||||||||||||||

| After-tax DE | $ | 7,585 | $ | 1,569 | $ | (5,352) | $ | 700 | $ | (5,578) | $ | (10,213) | $ | (25,373) | $ | (31,010) | |||||||||||||

| Interest expense included in DE | 14,142 | 13,280 | 13,775 | 14,160 | 11,834 | 12,387 | 11,972 | 12,234 | |||||||||||||||||||||

| Income tax expense (benefit) included in DE | (2,662) | (6,849) | 631 | (12,638) | (8,224) | (5,613) | (9,974) | (5,310) | |||||||||||||||||||||

| Preferred dividends | 15,759 | 15,759 | 16,139 | 17,456 | 18,516 | 18,516 | 18,516 | 18,516 | |||||||||||||||||||||

| Earnings of equity method investments | (6,982) | (6,691) | (6,441) | (5,784) | (6,216) | (4,440) | — | — | |||||||||||||||||||||

| Placement fee expense | — | — | 603 | 2,102 | 4,767 | 40 | 823 | — | |||||||||||||||||||||

| Net realized carried interest and incentive fees | — | 1,172 | (1,092) | (7) | (1,565) | 11 | 140 | 248 | |||||||||||||||||||||

| Investment costs and non-revenue enhancing capital expenditures in DE | 3,086 | 2,023 | 2,463 | 1,402 | 1,620 | 1,649 | 1,251 | 554 | |||||||||||||||||||||

| Non pro-rata allocation of income (loss) to noncontrolling interests | — | 231 | 231 | 231 | 223 | 201 | 201 | (751) | |||||||||||||||||||||

| Adjusted EBITDA | $ | 30,928 | $ | 20,494 | $ | 20,957 | $ | 17,622 | $ | 15,377 | $ | 12,538 | $ | (2,444) | $ | (5,519) | |||||||||||||

DigitalBridge | Supplemental Financial Report |

26 |

||||||||||

| Definitions | ||

DigitalBridge | Supplemental Financial Report |

27 |

||||||||||