- Fall 2023 -

Forward-Looking Statements; Non-GAAP Information This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements of goals, intentions, and expectations as to future trends, plans, events or results of FVCB’s operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in FVCB’s market, interest rates and interest rate policy, competitive factors, and other conditions which by their nature, are not susceptible to accurate forecasts and are subject to significant uncertainty. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. These forward-looking statements are based on current beliefs that involve significant risks, uncertainties, and assumptions. Factors that could cause FVCB’s actual results to differ materially from those indicated in these forward-looking statements, include, but are not limited to: general business and economic conditions nationally or in the markets that FVCB serves; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rate, market and monetary fluctuations; changes in FVCB’s liquidity requirements could be adversely affected by changes in assets and liabilities; changes in the assumptions underlying the establishment of reserves for possible loan losses; FVCB’s management of risks inherent in its real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of FVCB’s collateral and the ability to sell collateral upon any foreclosure; credit risk, market risk, and liquidity risk affecting FVCB’s securities portfolio, as well as changes in the estimates used to value the securities in the portfolio; changes in the level of FVCB’s nonperforming assets and charge-offs; geopolitical conditions, including acts or threats of terrorism, or actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; the impact of the COVID-19 pandemic and associated efforts to limit the spread of the virus; the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; technological changes, including potential exposure to fraud, negligence, computer theft and cyber-crime; and the risk factors and other cautionary language included in FVCB’s Annual Report on Form 10-K for the year ended December 31, 2022 and in other periodic and current reports filed with the Securities and Exchange Commission. Because of these uncertainties and the assumptions on which the forward-looking statements are based, actual operations and results in the future may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. FVCB’s past results are not necessarily indicative of future performance. Use of Non-GAAP Financial Measures This presentation includes certain financial information that is calculated and presented on the basis of methodologies that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). These non-GAAP financial measures include pre-tax pre-provision return on average assets, pre-tax pre-provision return on average equity, tangible book value, tangible common equity, tangible assets and efficiency ratio. The non-GAAP financial measures included in this presentation do not replace the presentation of FVCB’s GAAP financial results, should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled measures of other companies. These measurements provide supplemental information to assist management, as well as certain investors, in analyzing FVCB’s core business, capital position and results of operations. FVCB has chosen to provide this additional information to investors because it believes that these measures are meaningful in assisting investors to evaluate FVCB’s core ongoing operations, results and financial condition. Reconciliations of the non-GAAP financial measures provided in this presentation to the most directly comparable GAAP measures can be found in the appendix of this presentation. 2

(1) Consolidated financial data as of the quarter ended June 30, 2023, unless otherwise noted. (2) Nonperforming assets defined as nonaccruals, loans past-due 90 days or more, and other real estate owned. (3) Non-GAAP financial measure. See the reconciliation included in the appendix to this presentation. FVCB Company Snapshot 3 Address City, State Deposits 6/30/2023 ($000) 5-Year CAGR (%) 1 11325 Random Hills Rd Fairfax, VA $1,204,338 19.47% 2 7900 Sudley Rd Manassas, VA $294,666 10.13% 3 11260 Roger Bacon Dr Reston, VA $308,143 11.67% 4 2500 Wilson Blvd Arlington, VA $107,295 -1.14% 5 6975 Springfield Blvd Springfield, VA $47,428 1.76% 6 224 Albemarle St Baltimore, MD $36,923 12.69% 7 6929 Arlington Rd Bethesda, MD $26,877 8.58% 8 1600 E Gude Dr Rockville, MD $27,876 -6.60% 9 1301 9th St NW Washington, DC $35,142 -11.43% LPO 100 West Road Towson, MD N/A N/A Dollar values in thousands, except per share data. Financial Highlights ¹ Total Assets $2,344,372 Total Loans, Net of Fees $1,903,814 Total Deposits $2,088,042 Tangible Common Equity 3 $203,368 TCE / TA (Bank) 3 9.22% ROAA 0.73% MRQ Pre-tax pre-provision ROAA 3 1.05% ROAE 8.17% MRQ Pre-tax pre-provision ROAE 3 11.72% MRQ Net Interest Margin 2.60% MRQ Operating Efficiency Ratio 3 60.23% NPAs2 / Assets 0.06% Capitalization Detail ¹ Shares issued and outstanding 17,783,305 Options Outstanding 1,178,103 Average Weighted Strike Price of Options $7.15 Restricted Stock Units (Exluded from share count) 204,929 Basic Tangible Book Value per Share $11.44 MRQ EPS Annualized $0.92

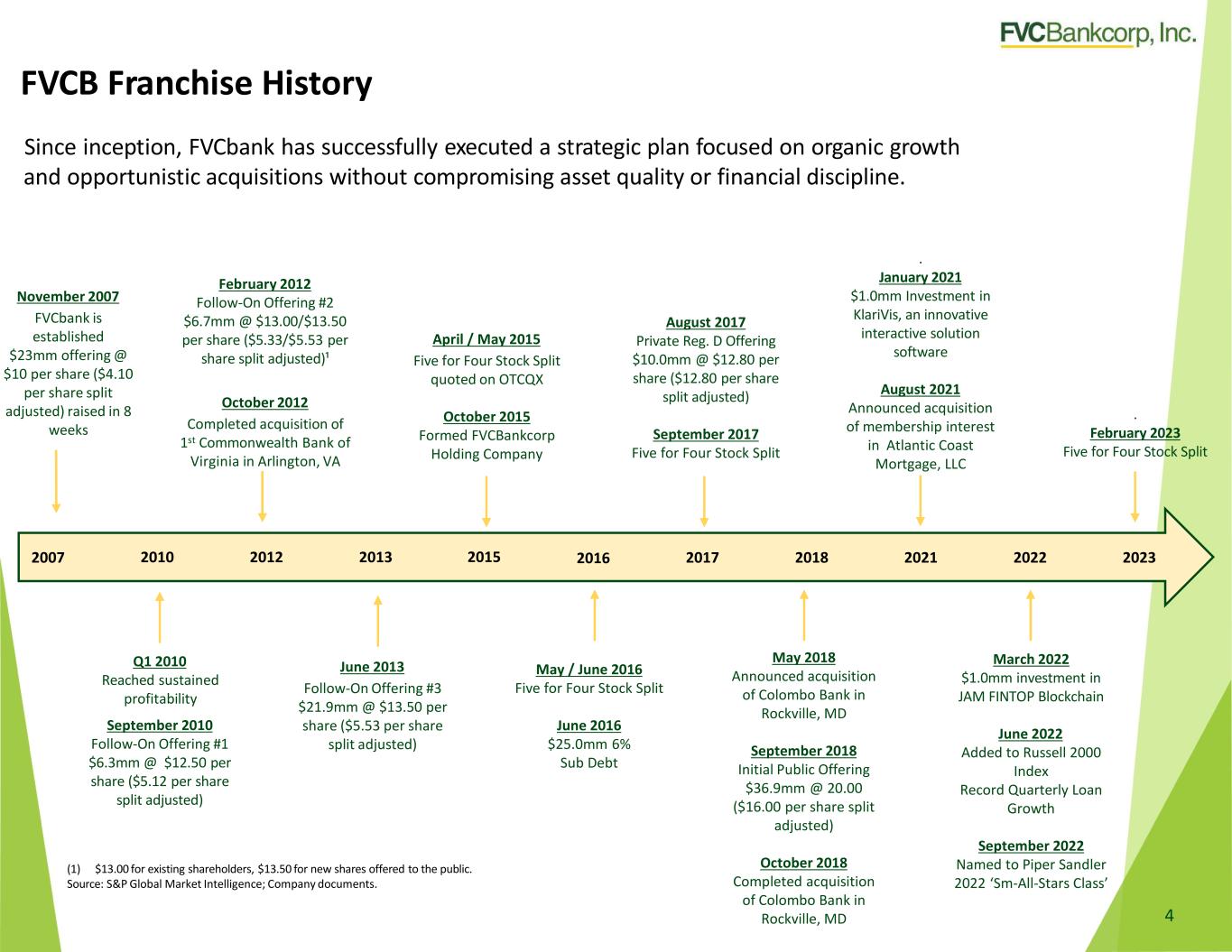

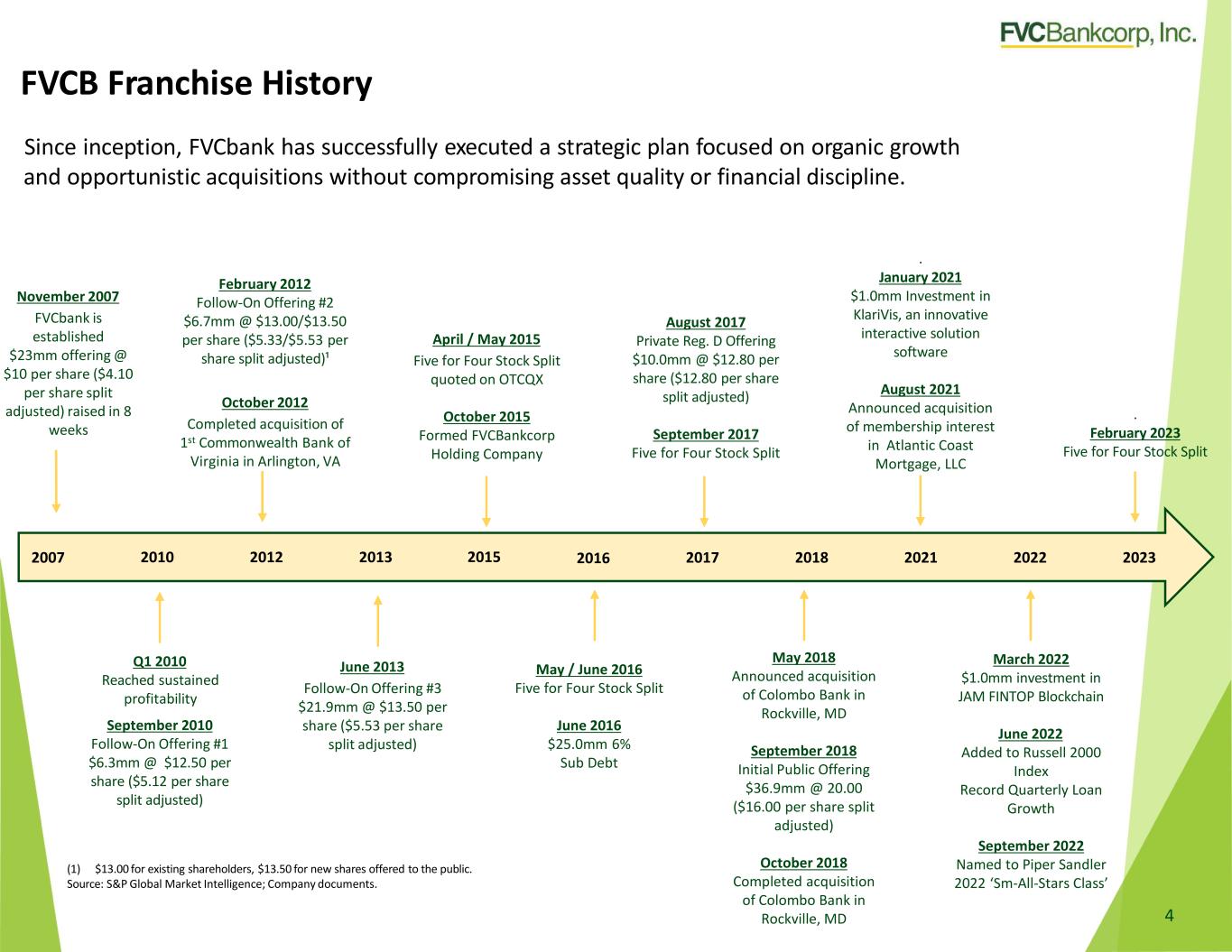

4 FVCB Franchise History Since inception, FVCbank has successfully executed a strategic plan focused on organic growth and opportunistic acquisitions without compromising asset quality or financial discipline. (1) $13.00 for existing shareholders, $13.50 for new shares offered to the public. Source: S&P Global Market Intelligence; Company documents. June 2013 Follow-On Offering #3 $21.9mm @ $13.50 per share ($5.53 per share split adjusted) Q1 2010 Reached sustained profitability September 2010 Follow-On Offering #1 $6.3mm @ $12.50 per share ($5.12 per share split adjusted) 2010 2013 2015 2016 20172012 2018 May / June 2016 Five for Four Stock Split June 2016 $25.0mm 6% Sub Debt February 2012 Follow-On Offering #2 $6.7mm @ $13.00/$13.50 per share ($5.33/$5.53 per share split adjusted)¹ October 2012 Completed acquisition of 1st Commonwealth Bank of Virginia in Arlington, VA April / May 2015 Five for Four Stock Split quoted on OTCQX October 2015 Formed FVCBankcorp Holding Company May 2018 Announced acquisition of Colombo Bank in Rockville, MD September 2018 Initial Public Offering $36.9mm @ 20.00 ($16.00 per share split adjusted) October 2018 Completed acquisition of Colombo Bank in Rockville, MD 2007 November 2007 FVCbank is established $23mm offering @ $10 per share ($4.10 per share split adjusted) raised in 8 weeks August 2017 Private Reg. D Offering $10.0mm @ $12.80 per share ($12.80 per share split adjusted) September 2017 Five for Four Stock Split 2021 . January 2021 $1.0mm Investment in KlariVis, an innovative interactive solution software August 2021 Announced acquisition of membership interest in Atlantic Coast Mortgage, LLC 2022 March 2022 $1.0mm investment in JAM FINTOP Blockchain June 2022 Added to Russell 2000 Index Record Quarterly Loan Growth September 2022 Named to Piper Sandler 2022 ‘Sm-All-Stars Class’ 2023 . February 2023 Five for Four Stock Split

Technology Deployment Driving Top-Tier Performance *FVCbankcorp, Inc. has invested in KlariVis and JAM FINTOP Blockchain (the Fund). Strategically Aligned Solutions 5 Lending • Loan origination platform provides paperless workflow solution and automates approval process and tickler tracking. • Automated borrowing base certification process (Accounts Receivable Financing) streamlines process for government contracting customers and lender. • Automated warehouse lending platform allows timely response with limited resources. • Automated construction loan functionality for lender, borrower, title insurance and inspector. • Lightning Lending provides digital lending experience for small businesses • Online deposit account opening for consumers. • Zelle for customers who use peer-to-peer digital payment processing. • Q2 Digital Platform delivers online banking solutions and treasury management services with maximum flexibility Treasury and Payments Enterprise-Wide • Data analytics functionality (KlariVis)* which provides: • Immediate access to better communicate and respond to customers. • Dashboards to easily analyze activity for all areas of the Bank. • Board reports without requiring preparation. • Robotic process automation have reduced risk of error and reduced processing time from hours to minutes. Collectively hundreds of hours have been saved on daily, weekly, monthly and periodic repetitive manual processes. • FinTech investment in cutting-edge (JAM FINTOP)* Blockchain Fund.

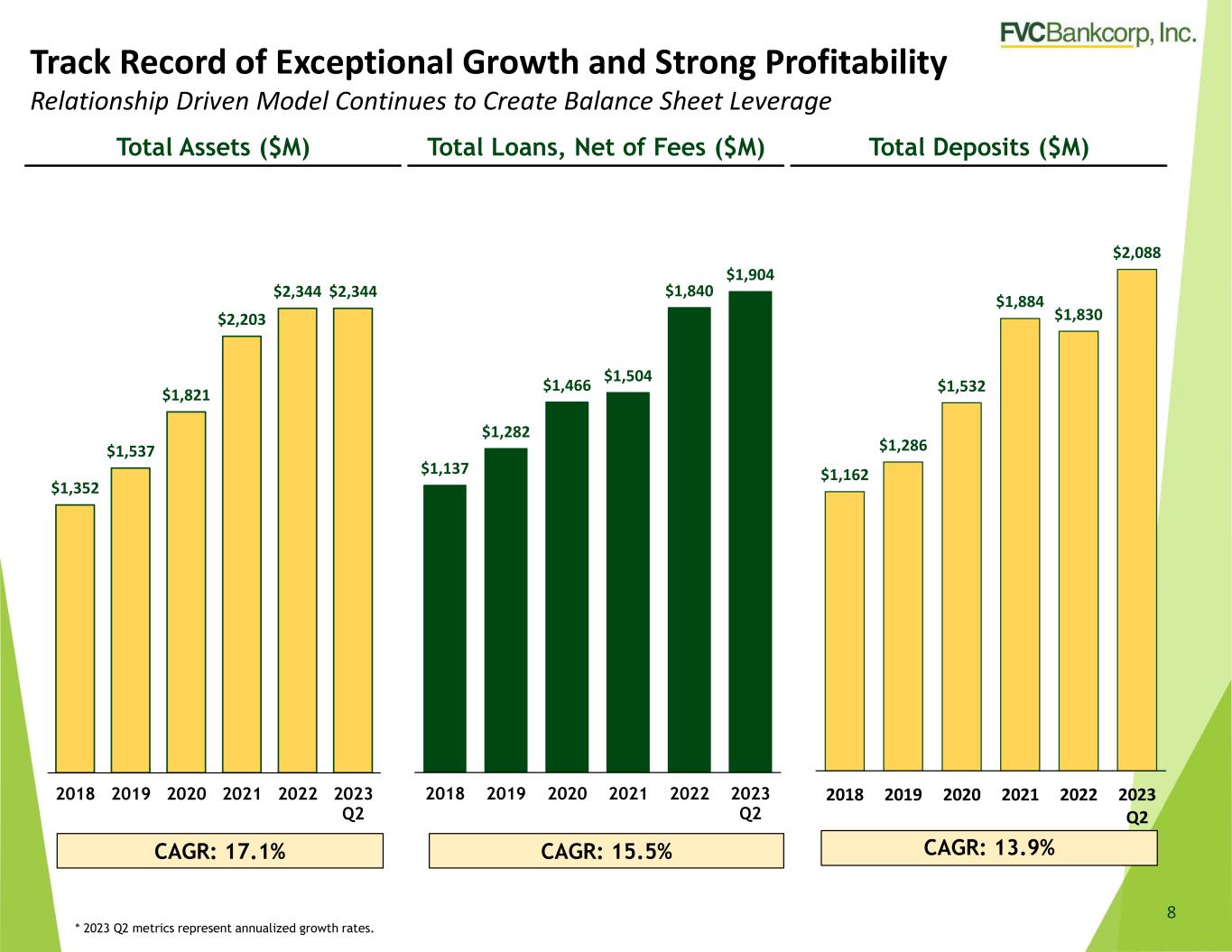

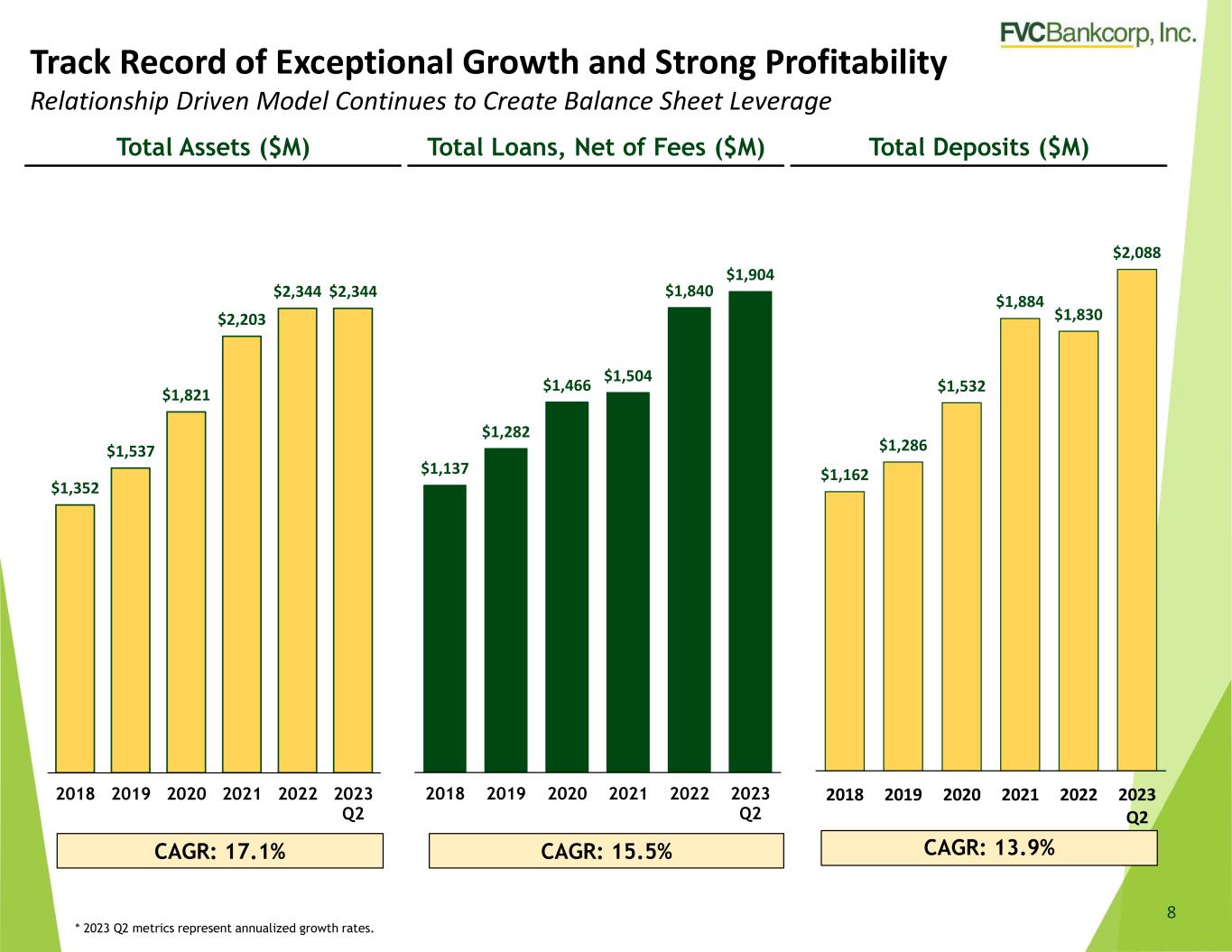

An Attractive Investment Opportunity in the DC and Baltimore MSAs •Sixth largest MSA with favorable demographics, economic trends and business investments. •Recent consolidation in local markets has created growth opportunities for remaining banks. •Organic CAGRs1 of 17% for assets, 16% for loans, and 14% for deposits since 2018. •MRQ NII increased over 3% compared to the prior quarter. •Commercial focused lending portfolio comprised of strong loans with medium average loan balances that further mitigates risk. •Emphasis on credit administration and risk management that embraces comprehensive policies and procedures enabling the maintenance of strong asset quality. •Over 15-year history, cumulative commercial net charge-offs totaling $6.2 million comprised of 102 loans. •Strategy of full-service relationship banking helps support FVCB’s margin. •Treasury management tools allow FVCB to compete against larger competitors and attract sophisticated commercial and government customers. •21% of the deposit base is non interest-bearing deposits •Hands on management team with extensive knowledge of its clients, loans, and the markets it serves. •Proven track record of quality growth. Well positioned in one of the most attractive banking markets in the U.S. Track record of exceptional growth and strong profitability Disciplined, low risk commercial balance sheet Strong core deposit base Experienced leadership team 6 1 CAGR is calculated based on annualized earnings for the current year compared to 2018

Well Positioned In One of the Most Attractive Markets in the U.S. Top 10 MSAs By Population Vibrant Economy • Washington D.C. and Baltimore MSAs contain 30 and 7 Fortune 1000 companies, respectively. • Over 3.3 million private sector employees and nearly 1 million public sector employees in the Washington D.C. and Baltimore MSAs. • Virginia was ranked the best state for business in 2021 by CNBC. • Both states have large workforce populations spanning several generational demographic cohorts. • 9 of the top 30 wealthiest counties in the nation are located in Washington DC and Baltimore MSAs. • Numerous Government Contracting entities support government functions. • With over 30 banks acquired in these markets over the past five years, there are limited opportunities to invest in community banks in this market. Source: S&P Global Market Intelligence; FDIC, Proximityone.com, DC Department of Employment Services, Maryland Department of Labor, Licensing and Regulation, US News and World Report. Market Name Population 2027 Projected Population Median Household Income ($) 2027 Projected Median Household Income ($) New York-Newark-Jersey City 20,006,203 21,045,615 92,717 104,070 Los Angeles-Long Beach-Anaheim 13,207,559 13,343,788 86,804 98,253 Chicago-Naperville-Elgin 9,535,847 9,657,030 83,335 93,568 Dallas-Fort Worth-Arlington 7,826,862 8,291,685 81,205 90,829 Houston-The Woodlands-Sugar Land 7,273,204 7,711,294 74,859 82,549 Washington-Arlington-Alexandria 6,441,102 6,702,073 115,601 125,882 Philadelphia-Camden-Wilmington 6,265,252 6,486,448 81,746 90,787 Miami-Fort Lauderdale-Pompano Beach 6,227,541 6,474,537 67,696 77,065 Atlanta-Sandy Springs-Alpharetta 6,206,533 6,540,650 79,388 88,792 Boston-Cambridge-Newton, MA-NH 5,011,582 5,238,768 103,847 116,543 7

Total Assets ($M) Total Loans, Net of Fees ($M) Total Deposits ($M) CAGR: 17.1% CAGR: 15.5% CAGR: 13.9% Track Record of Exceptional Growth and Strong Profitability Relationship Driven Model Continues to Create Balance Sheet Leverage * 2023 Q2 metrics represent annualized growth rates. 8 $1,352 $1,537 $1,821 $2,203 $2,344 $2,344 2018 2019 2020 2021 2022 2023 Q2 $1,137 $1,282 $1,466 $1,504 $1,840 $1,904 2018 2019 2020 2021 2022 2023 Q2 $1,162 $1,286 $1,532 $1,884 $1,830 $2,088 2018 2019 2020 2021 2022 2023 Q2

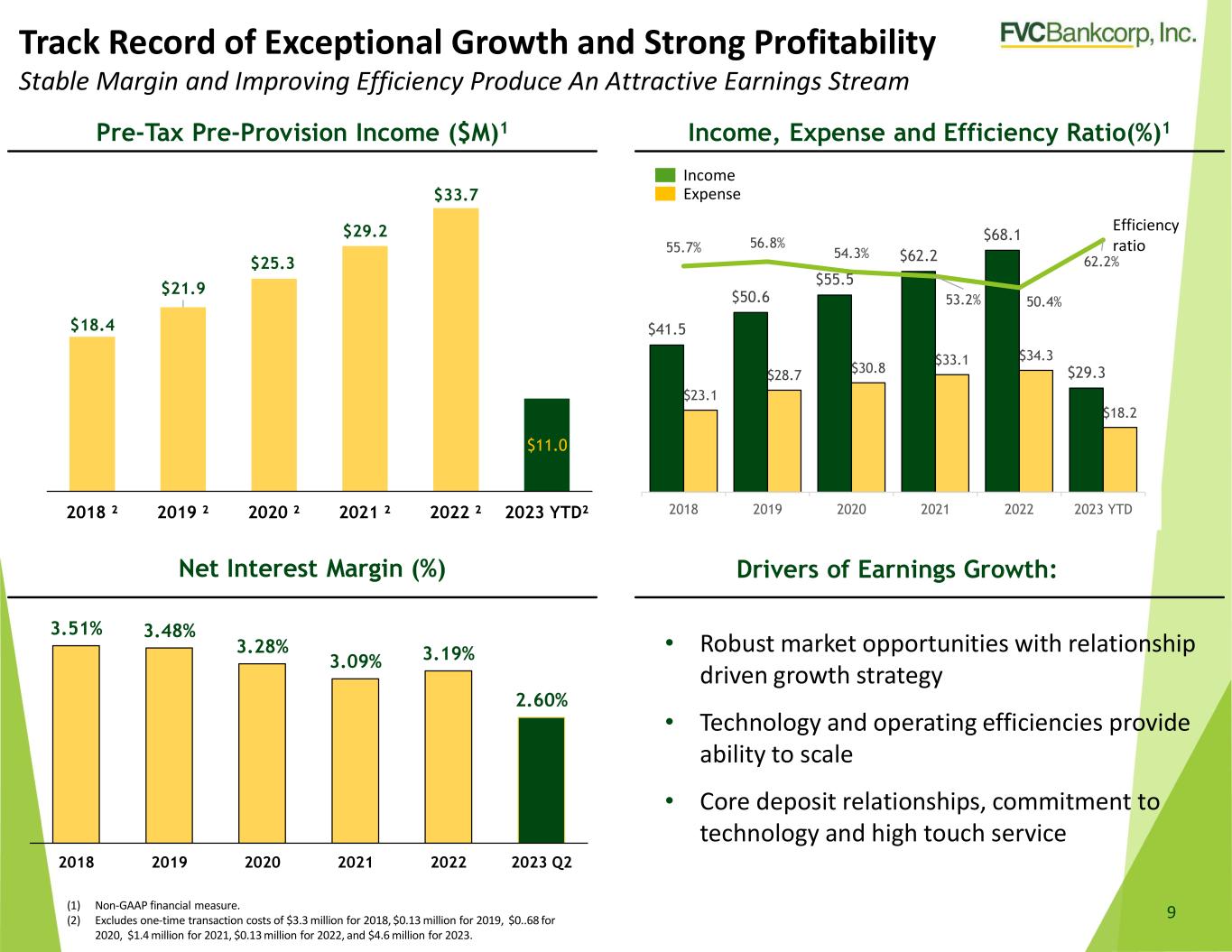

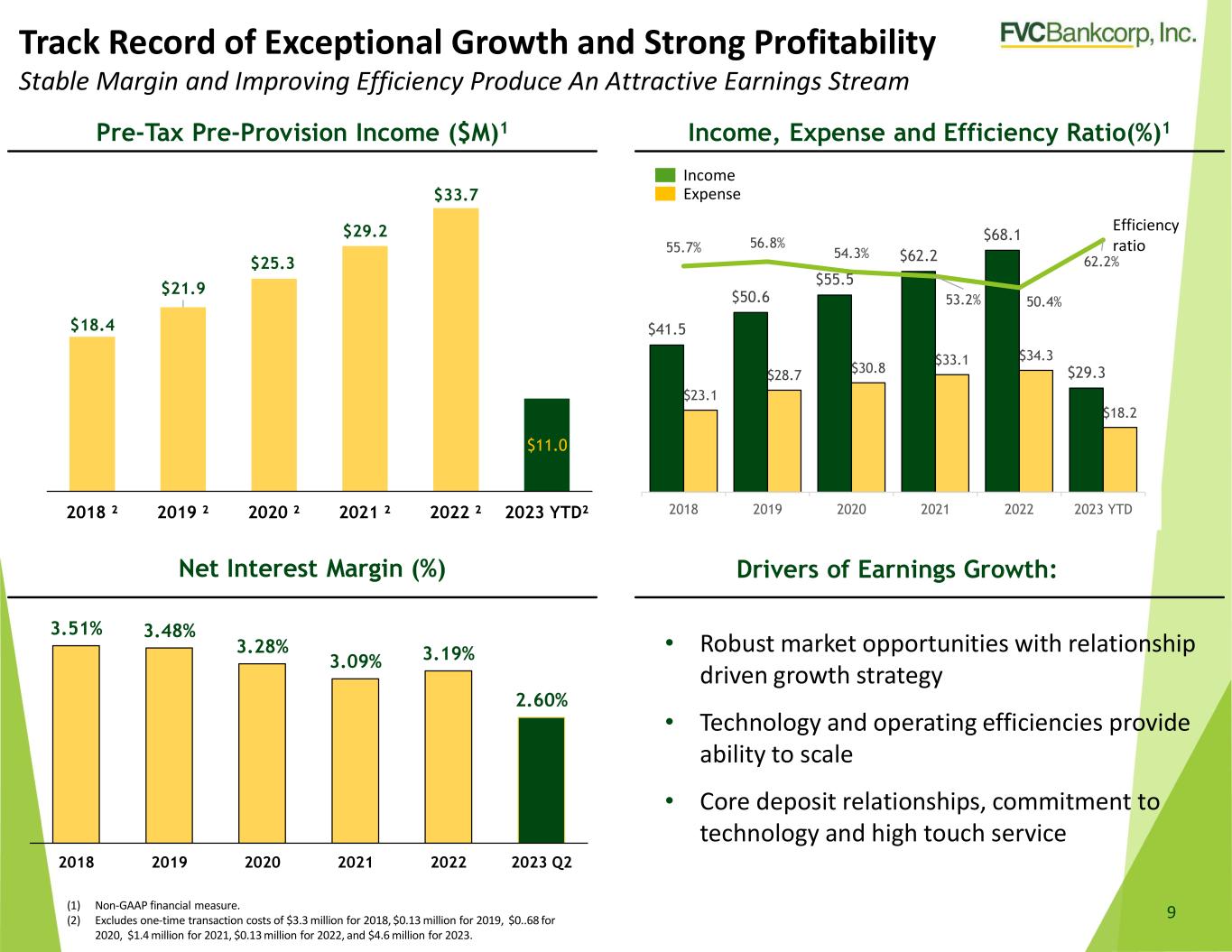

$18.4 $21.9 $25.3 $29.2 $33.7 $11.0 2018 ² 2019 ² 2020 ² 2021 ² 2022 ² 2023 YTD² 3.51% 3.48% 3.28% 3.09% 3.19% 2.60% 2018 2019 2020 2021 2022 2023 Q2 $41.5 $50.6 $55.5 $62.2 $68.1 $29.3 $23.1 $28.7 $30.8 $33.1 $34.3 $18.2 55.7% 56.8% 54.3% 53.2% 50.4% 62.2% 2018 2019 2020 2021 2022 2023 YTD (1) Non-GAAP financial measure. (2) Excludes one-time transaction costs of $3.3 million for 2018, $0.13 million for 2019, $0..68 for 2020, $1.4 million for 2021, $0.13 million for 2022, and $4.6 million for 2023. Pre-Tax Pre-Provision Income ($M)1 Income, Expense and Efficiency Ratio(%)1 Net Interest Margin (%) Track Record of Exceptional Growth and Strong Profitability Stable Margin and Improving Efficiency Produce An Attractive Earnings Stream 9 Drivers of Earnings Growth: • Robust market opportunities with relationship driven growth strategy • Technology and operating efficiencies provide ability to scale • Core deposit relationships, commitment to technology and high touch service Efficiency ratio Income Expense

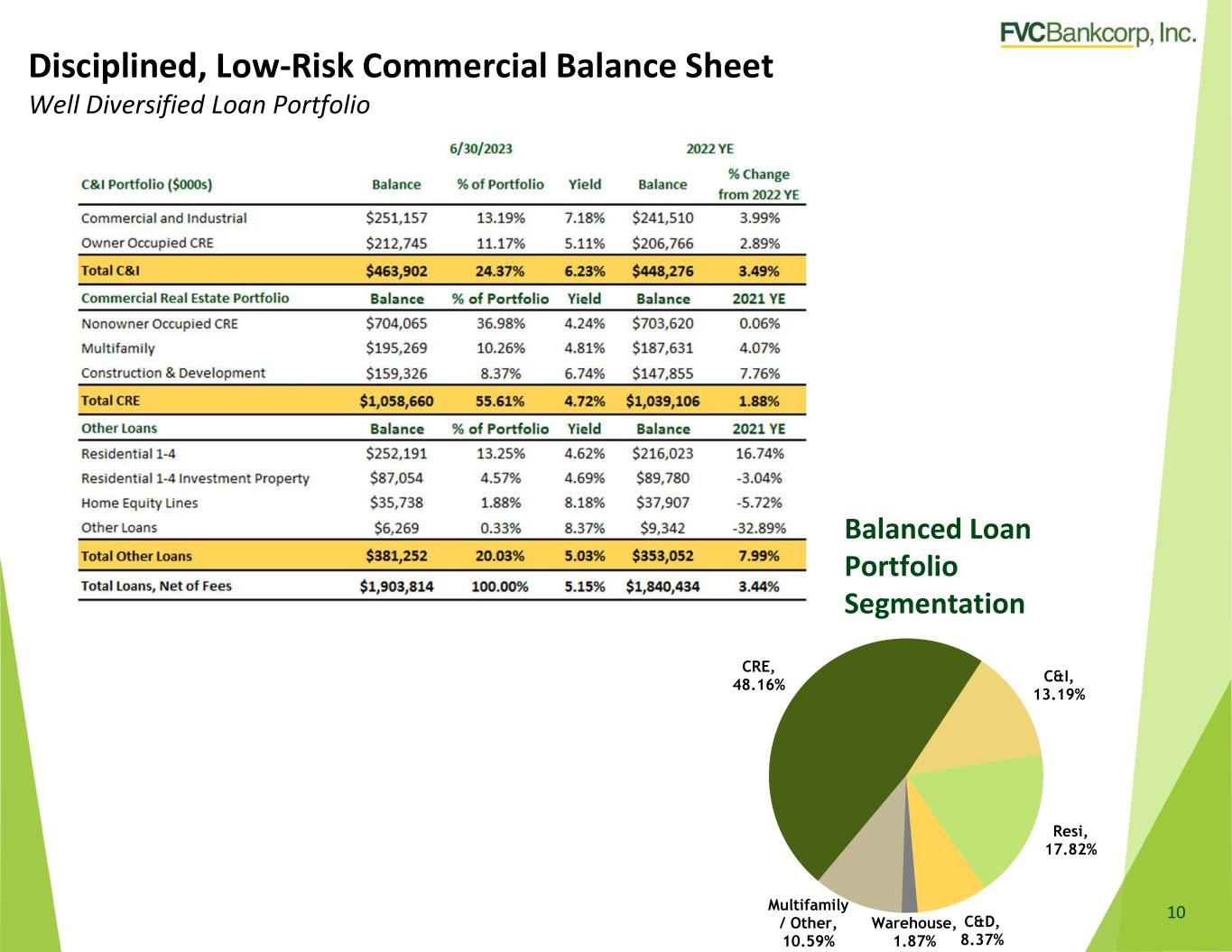

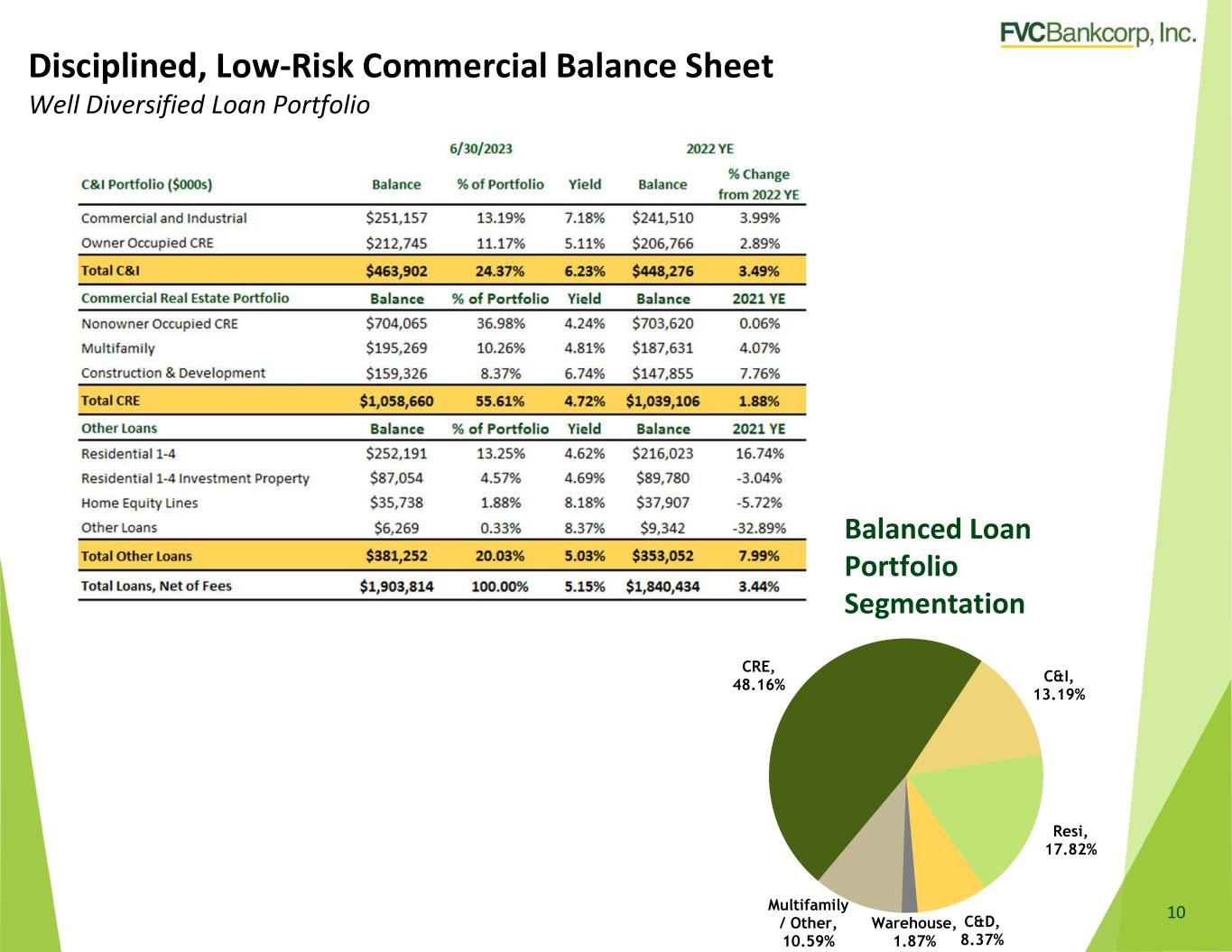

Disciplined, Low-Risk Commercial Balance Sheet Well Diversified Loan Portfolio 10 Balanced Loan Portfolio Segmentation CRE, 48.16% C&I, 13.19% Resi, 17.82% C&D, 8.37% Warehouse, 1.87% Multifamily / Other, 10.59%

• 12 loan officers with deep connections to the markets; average experience of over 21 years. • Focused effort on commercial, real estate and small business, including government contracting. • Expanded focus on government contracting provides large source of growth potential. • Small average loan balance helps mitigate risk. ‒ Average Loan Size ‒ C&I Portfolio: $484,966 ‒ CRE Portfolio: $1,904,021 Disciplined, Low-Risk Commercial Balance Sheet Positioned for future Growth 11(1) Represents gross loan balance for each category and excludes fees, costs, and valuation adjustments (if any). (2) Represents values as a percentage of Total Bank Loans. Asset Class Number of Total Loans Bank Owned Principal (1) Number of Total Loans Bank Owned Principal (1) Number of Total Loans Bank Owned Principal (1) Total Bank Owned Principal (1) % of Total Loans (2) Multifamily - -$ 100 180,772$ - -$ 180,772$ 9.50% Retail 15 12,409 90 245,506 - - 257,915 13.55% Office 61 30,354 48 93,197 - - 123,551 6.49% Hotel - - 8 49,803 - - 49,803 2.62% Construction - - - - 66 116,063 116,063 6.10% AD&C - - - - 3 2,968 2,968 0.16% Land - - - - 22 40,215 40,215 2.11% Industrial 44 66,518 38 134,174 - - 200,692 10.54% Mixed Use 11 7,022 37 63,284 - - 70,306 3.69% Special Use 29 42,112 10 27,840 - - 69,952 3.67% Other 53 56,527 37 107,058 11 118 163,703 8.60% Subtotal 213 214,941$ 368 901,635$ 102 159,365$ 1,275,941$ 67.02% Data as of June 30, 2023 (1) Bank-owned principal is not adjusted for deferred fees and costs. (2) Values represented as a percantage of total bank loans. Owner Occupied Commercial Real Estate Non-Owner Occupied Commercial Real Estate Construction

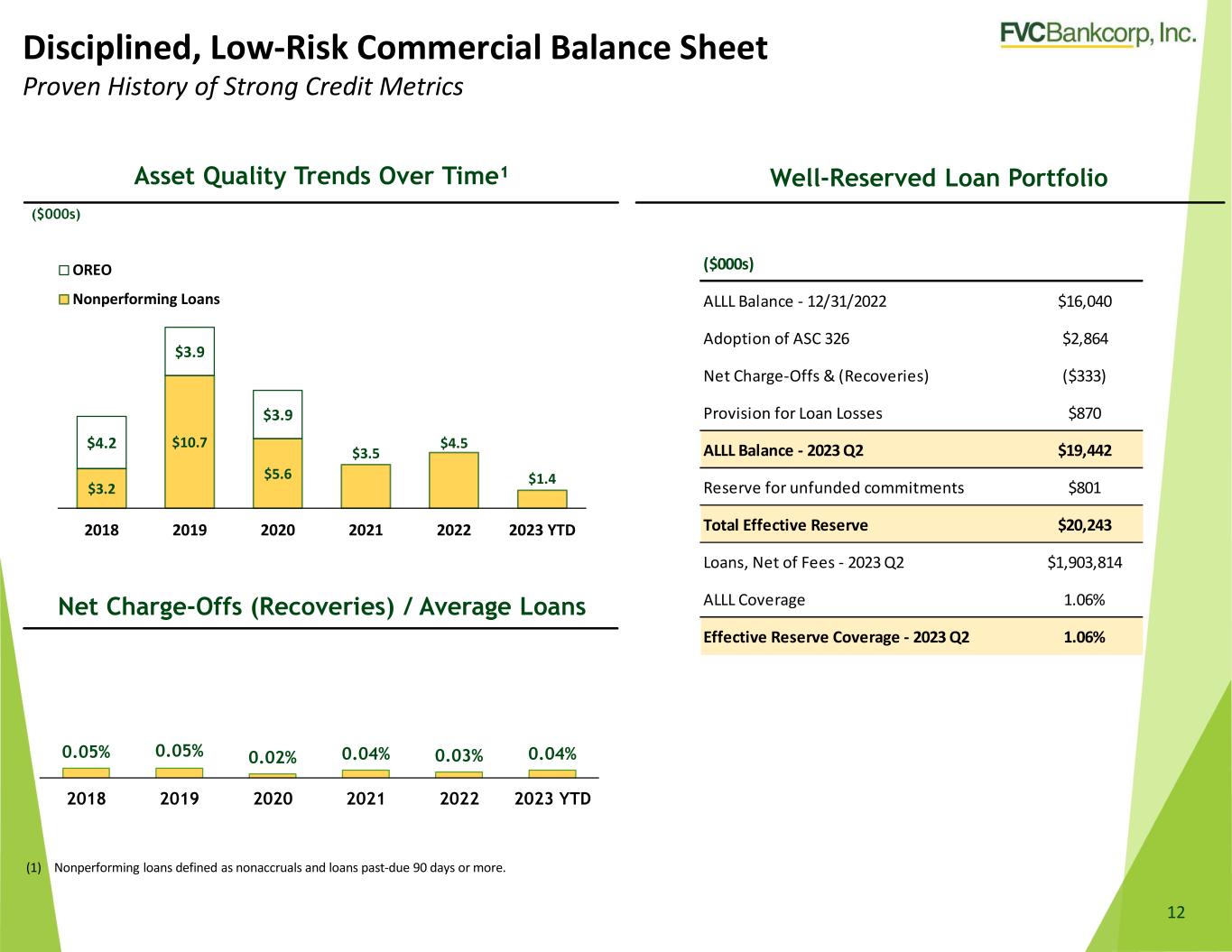

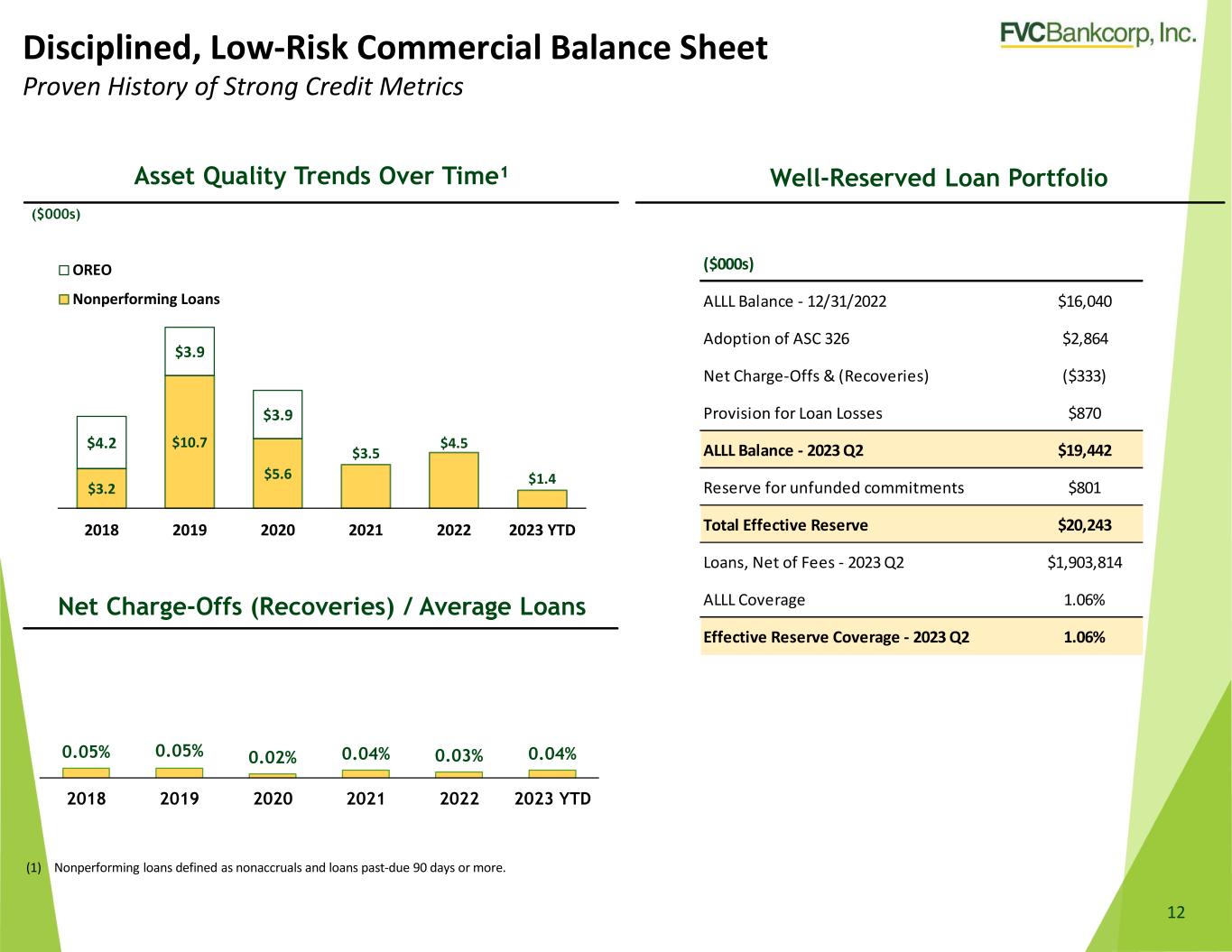

0.05% 0.05% 0.02% 0.04% 0.03% 0.04% 2018 2019 2020 2021 2022 2023 YTD Net Charge-Offs (Recoveries) / Average Loans Asset Quality Trends Over Time¹ Well-Reserved Loan Portfolio (1) Nonperforming loans defined as nonaccruals and loans past-due 90 days or more. ($000s) Disciplined, Low-Risk Commercial Balance Sheet Proven History of Strong Credit Metrics 12 $3.2 $10.7 $5.6 $3.5 $4.5 $1.4 $4.2 $3.9 $3.9 2018 2019 2020 2021 2022 2023 YTD OREO Nonperforming Loans ($000s) ALLL Balance - 12/31/2022 $16,040 Adoption of ASC 326 $2,864 Net Charge-Offs & (Recoveries) ($333) Provision for Loan Losses $870 ALLL Balance - 2023 Q2 $19,442 Reserve for unfunded commitments $801 Total Effective Reserve $20,243 Loans, Net of Fees - 2023 Q2 $1,903,814 ALLL Coverage 1.06% Effective Reserve Coverage - 2023 Q2 1.06%

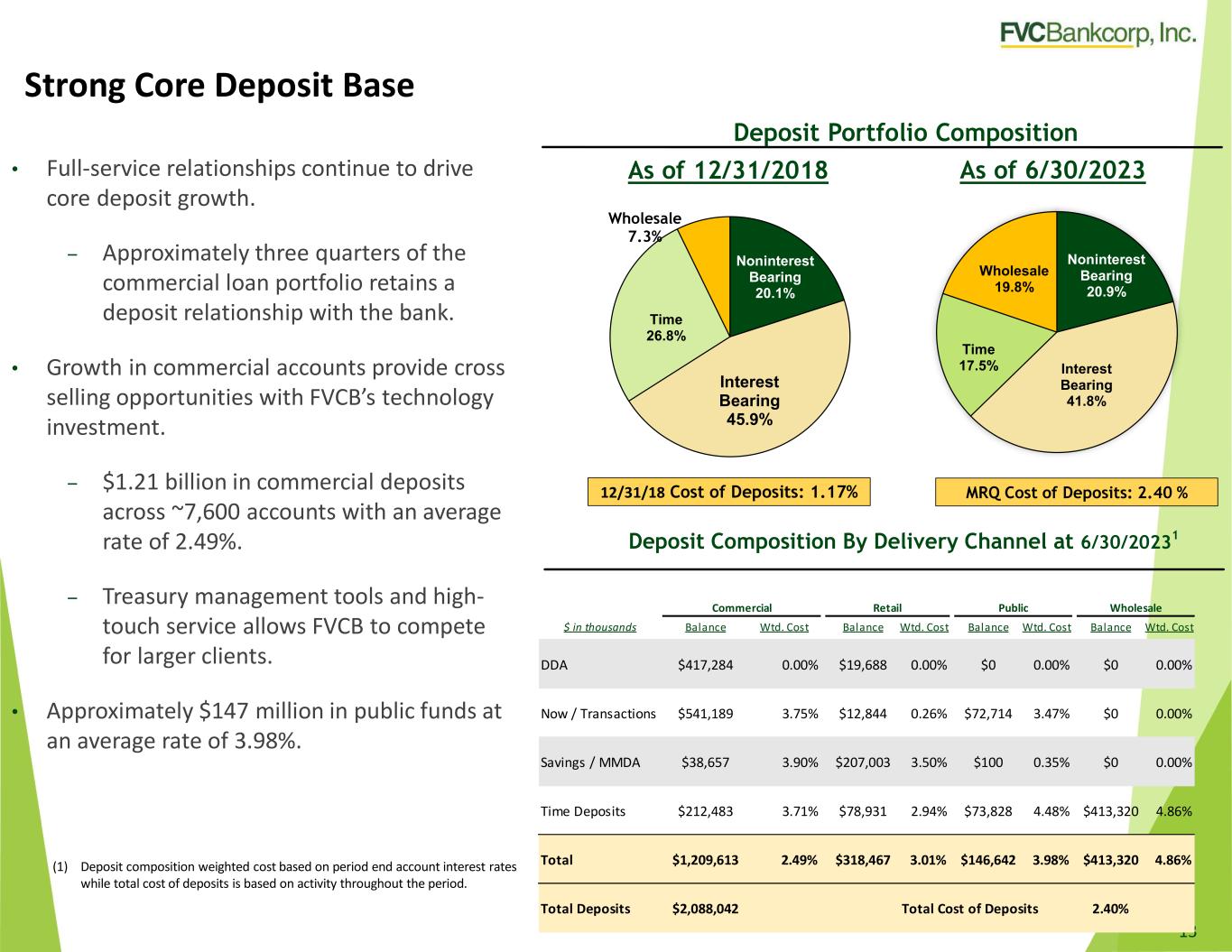

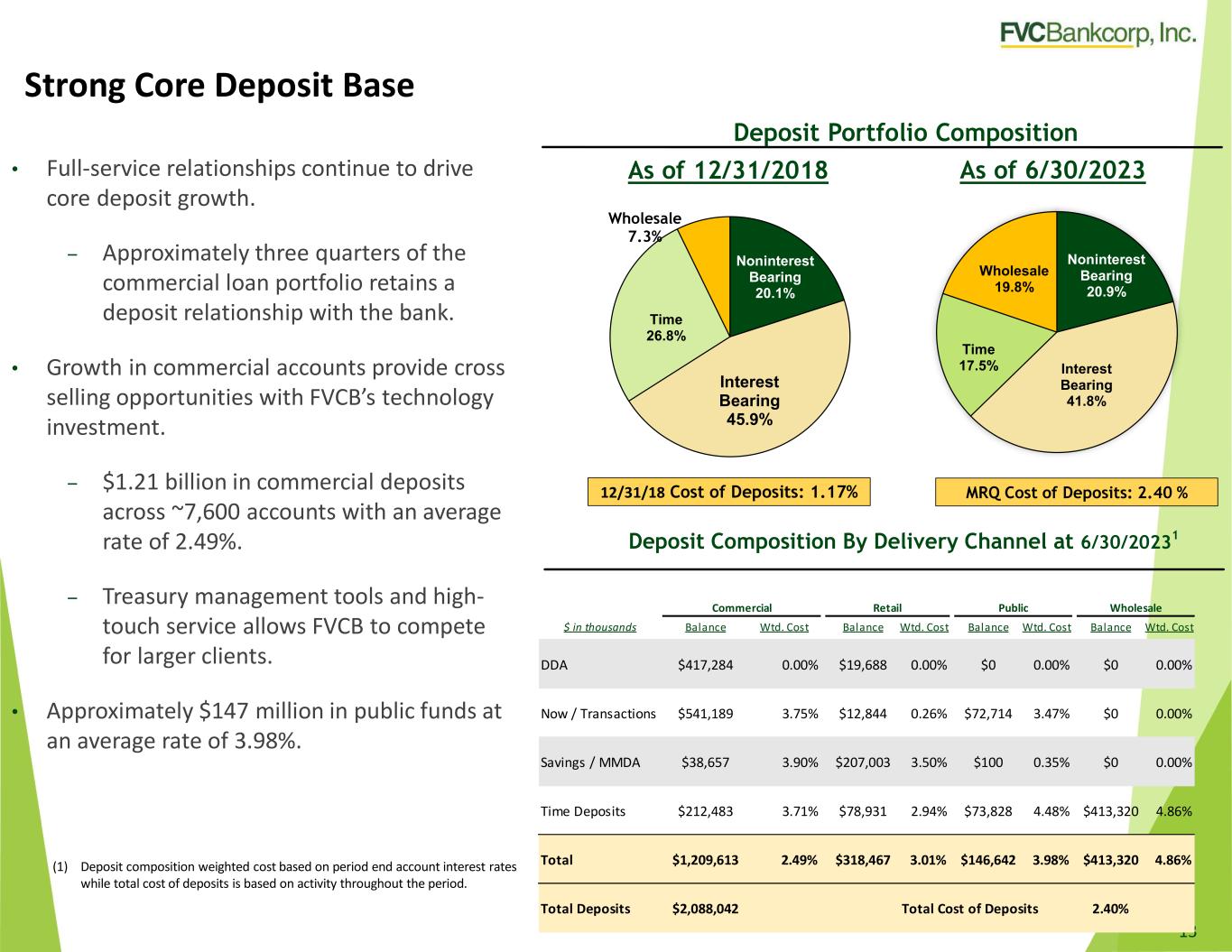

Strong Core Deposit Base • Full-service relationships continue to drive core deposit growth. ‒ Approximately three quarters of the commercial loan portfolio retains a deposit relationship with the bank. • Growth in commercial accounts provide cross selling opportunities with FVCB’s technology investment. ‒ $1.21 billion in commercial deposits across ~7,600 accounts with an average rate of 2.49%. ‒ Treasury management tools and high- touch service allows FVCB to compete for larger clients. • Approximately $147 million in public funds at an average rate of 3.98%. Deposit Portfolio Composition As of 12/31/2018 As of 6/30/2023 12/31/18 Cost of Deposits: 1.17% Deposit Composition By Delivery Channel at 6/30/20231 MRQ Cost of Deposits: 2.40 % 13 (1) Deposit composition weighted cost based on period end account interest rates while total cost of deposits is based on activity throughout the period. Noninterest Bearing 20.1% Interest Bearing 45.9% Time 26.8% Wholesale 7.3% Noninterest Bearing 20.9% Interest Bearing 41.8% Time 17.5% Wholesale 19.8% Commercial Retail Public Wholesale $ in thousands Balance Wtd. Cost Balance Wtd. Cost Balance Wtd. Cost Balance Wtd. Cost DDA $417,284 0.00% $19,688 0.00% $0 0.00% $0 0.00% Now / Transactions $541,189 3.75% $12,844 0.26% $72,714 3.47% $0 0.00% Savings / MMDA $38,657 3.90% $207,003 3.50% $100 0.35% $0 0.00% Time Deposits $212,483 3.71% $78,931 2.94% $73,828 4.48% $413,320 4.86% Total $1,209,613 2.49% $318,467 3.01% $146,642 3.98% $413,320 4.86% Total Deposits $2,088,042 Total Cost of Deposits 2.40%

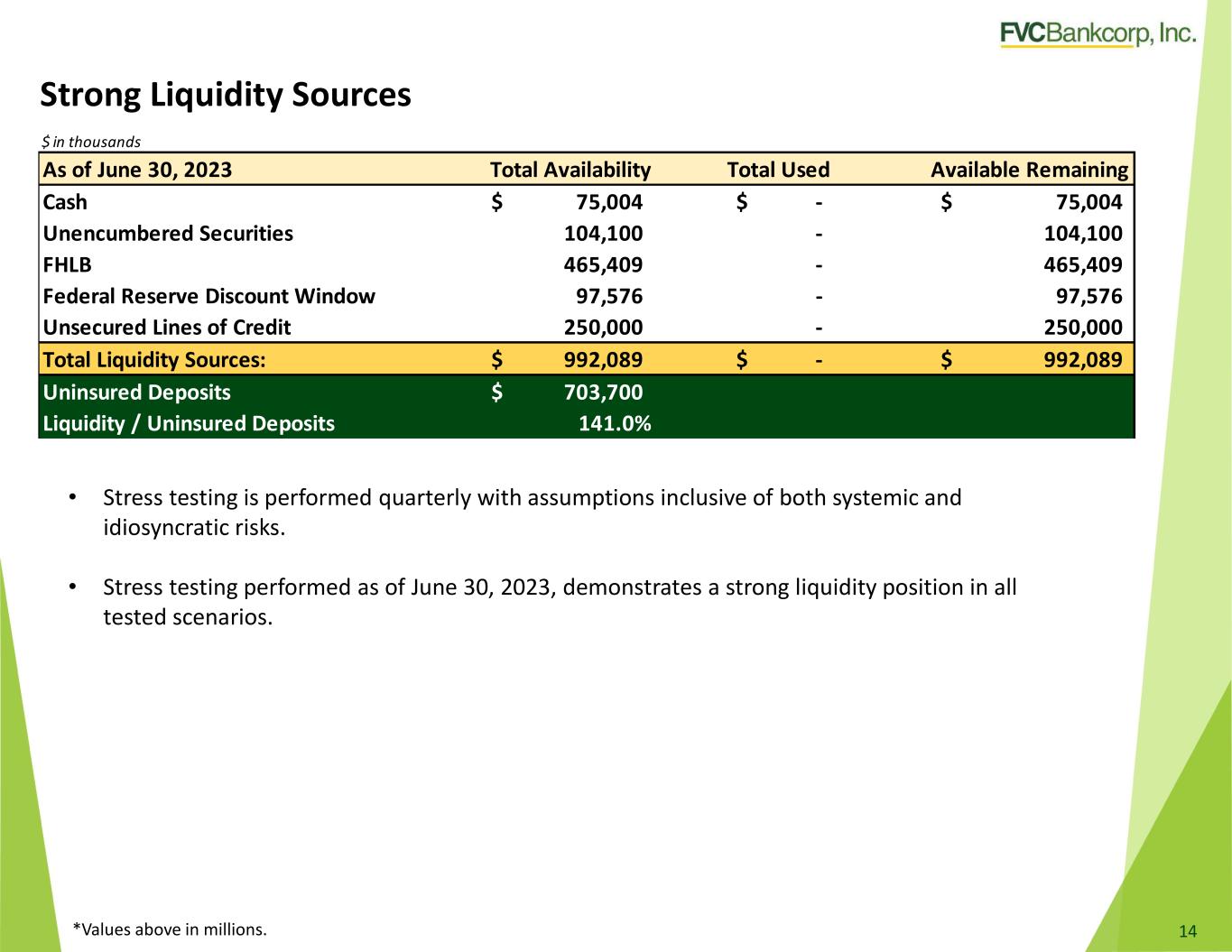

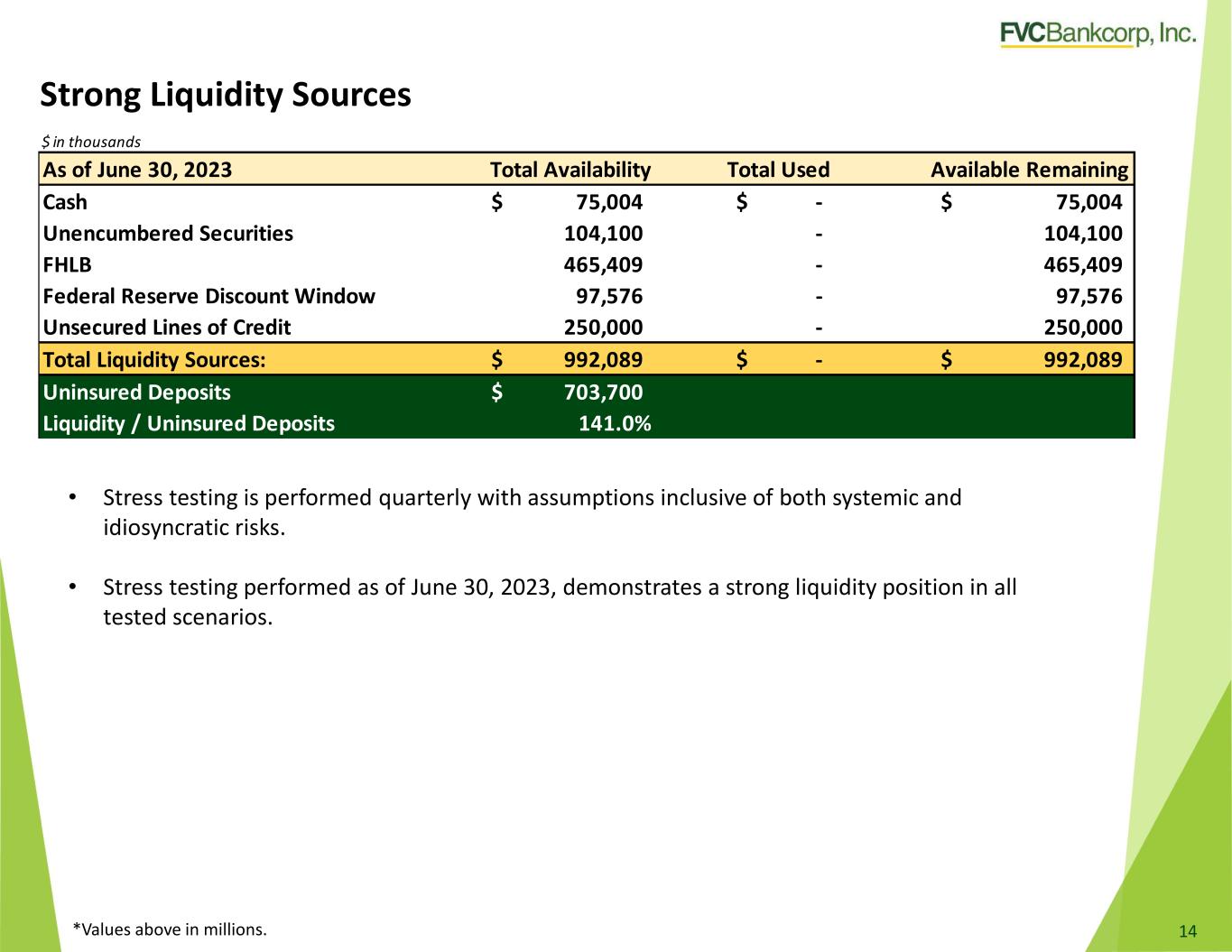

Strong Liquidity Sources 14*Values above in millions. • Stress testing is performed quarterly with assumptions inclusive of both systemic and idiosyncratic risks. • Stress testing performed as of June 30, 2023, demonstrates a strong liquidity position in all tested scenarios. $ in thousands As of June 30, 2023 Total Availability Total Used Available Remaining Cash 75,004$ -$ 75,004$ Unencumbered Securities 104,100 - 104,100 FHLB 465,409 - 465,409 Federal Reserve Discount Window 97,576 - 97,576 Unsecured Lines of Credit 250,000 - 250,000 Total Liquidity Sources: 992,089$ -$ 992,089$ Uninsured Deposits 703,700$ Liquidity / Uninsured Deposits 141.0%

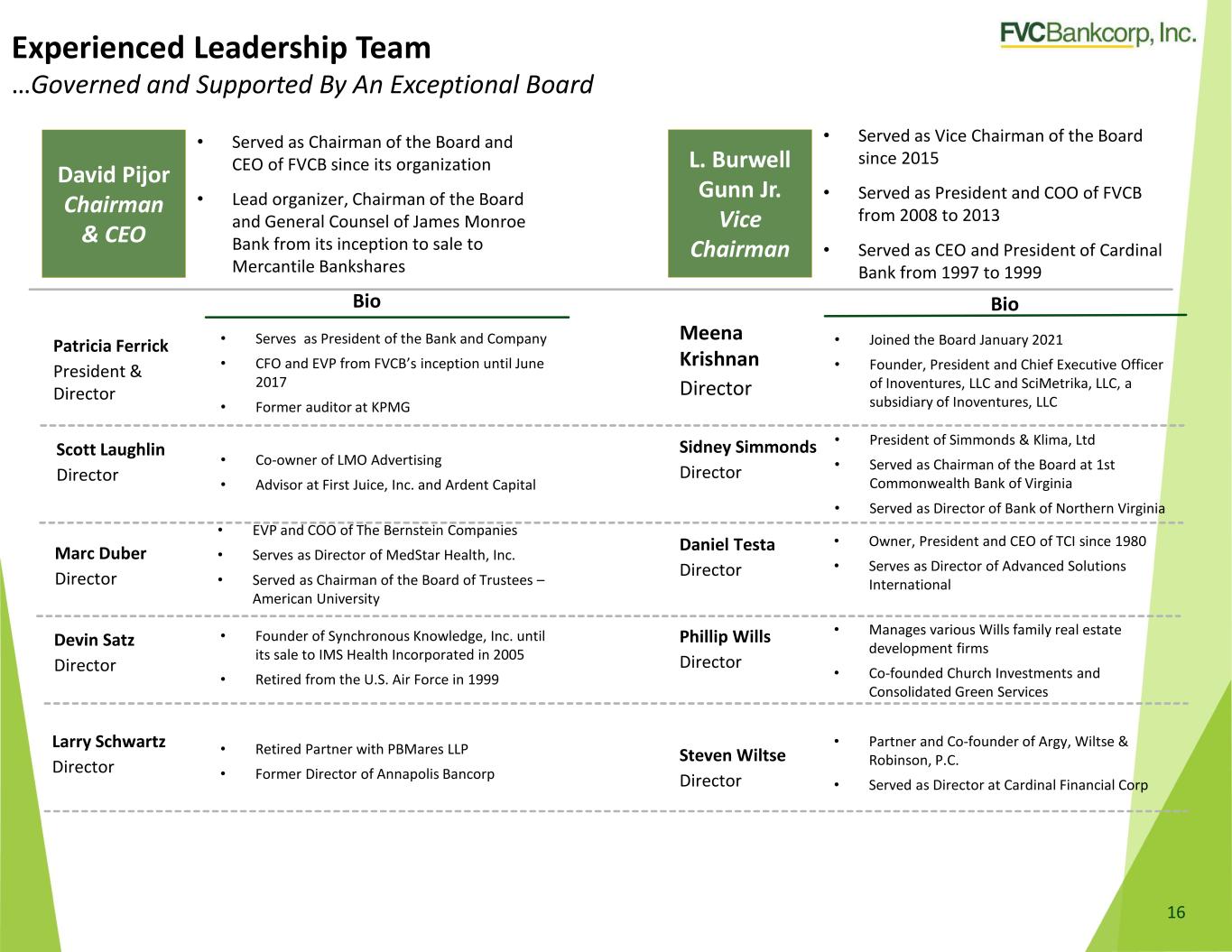

Experienced Leadership Team Management Team With Strong Ties to The Market… FVCB’s executive management team consists of seven officers with over 217 years of combined experience in the Washington, D.C. metropolitan area. • David Pijor was the founding Chairman of the Board of James Monroe Bancorp, which opened in June 1998 in Arlington, VA, and he was instrumental in the growth and strategic direction of the bank until its sale to Mercantile Bankshares Corporation in 2006 for $143.8 million. Name Current Position Prior Community Bank Experience Years Years at FVCBExperience David W. Pijor Chairman & CEO, Company and Bank James Monroe Bancorp 24 16 Patricia A. Ferrick President, Company and Bank Southern Financial Bancorp, Potomac Bank of Virginia 36 16 B. Todd Dempsey EVP and Chief Operating Officer, Company and Bank United Bank 42 16 William G. Byers EVP and Chief Lending Officer, Company and Bank Middleburg Bank, Century National Bank 29 12 Michael G. Nassy EVP and Chief Credit Officer, Company and Bank City First Bank of DC, National Cooperative Bank 23 11 Sharon L. Jackson EVP and Chief Banking Officer, Company and Bank MainStreet Bank 37 7 Jennifer L. Deacon EVP and Chief Financial Officer, Company and Bank Cardinal Financial Corp. 26 6 15

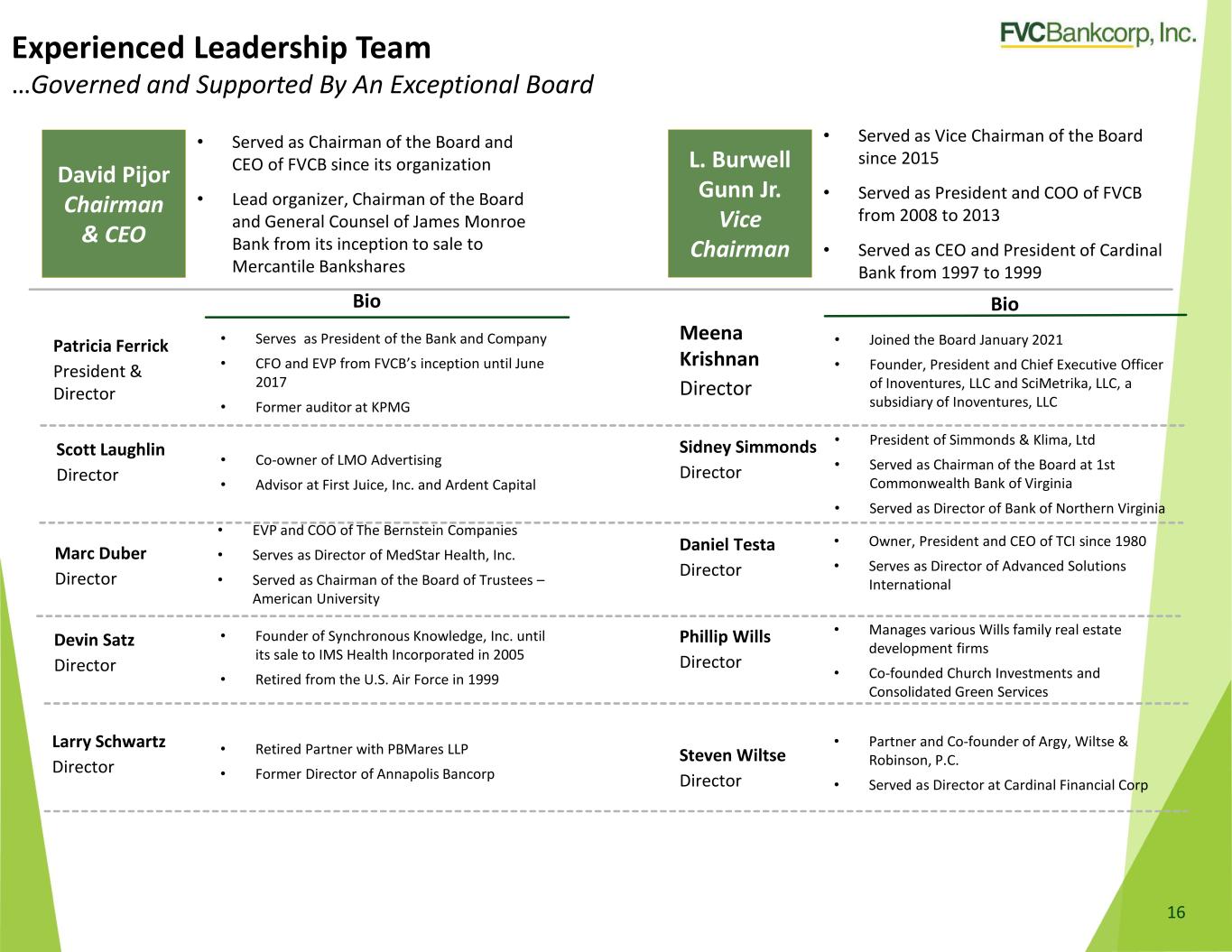

David Pijor Chairman & CEO • Served as Chairman of the Board and CEO of FVCB since its organization • Lead organizer, Chairman of the Board and General Counsel of James Monroe Bank from its inception to sale to Mercantile Bankshares L. Burwell Gunn Jr. Vice Chairman • Served as Vice Chairman of the Board since 2015 • Served as President and COO of FVCB from 2008 to 2013 • Served as CEO and President of Cardinal Bank from 1997 to 1999 • Joined the Board January 2021 • Founder, President and Chief Executive Officer of Inoventures, LLC and SciMetrika, LLC, a subsidiary of Inoventures, LLC Bio Bio Patricia Ferrick President & Director Scott Laughlin Director Devin Satz Director Larry Schwartz Director Meena Krishnan Director Sidney Simmonds Director Daniel Testa Director Phillip Wills Director Steven Wiltse Director • Manages various Wills family real estate development firms • Co-founded Church Investments and Consolidated Green Services • President of Simmonds & Klima, Ltd • Served as Chairman of the Board at 1st Commonwealth Bank of Virginia • Served as Director of Bank of Northern Virginia • Owner, President and CEO of TCI since 1980 • Serves as Director of Advanced Solutions International • Partner and Co-founder of Argy, Wiltse & Robinson, P.C. • Served as Director at Cardinal Financial Corp • Serves as President of the Bank and Company • CFO and EVP from FVCB’s inception until June 2017 • Former auditor at KPMG • Founder of Synchronous Knowledge, Inc. until its sale to IMS Health Incorporated in 2005 • Retired from the U.S. Air Force in 1999 • Co-owner of LMO Advertising • Advisor at First Juice, Inc. and Ardent Capital • Retired Partner with PBMares LLP • Former Director of Annapolis Bancorp Experienced Leadership Team …Governed and Supported By An Exceptional Board 16 Marc Duber Director • EVP and COO of The Bernstein Companies • Serves as Director of MedStar Health, Inc. • Served as Chairman of the Board of Trustees – American University

17 Appendix: Additional Materials

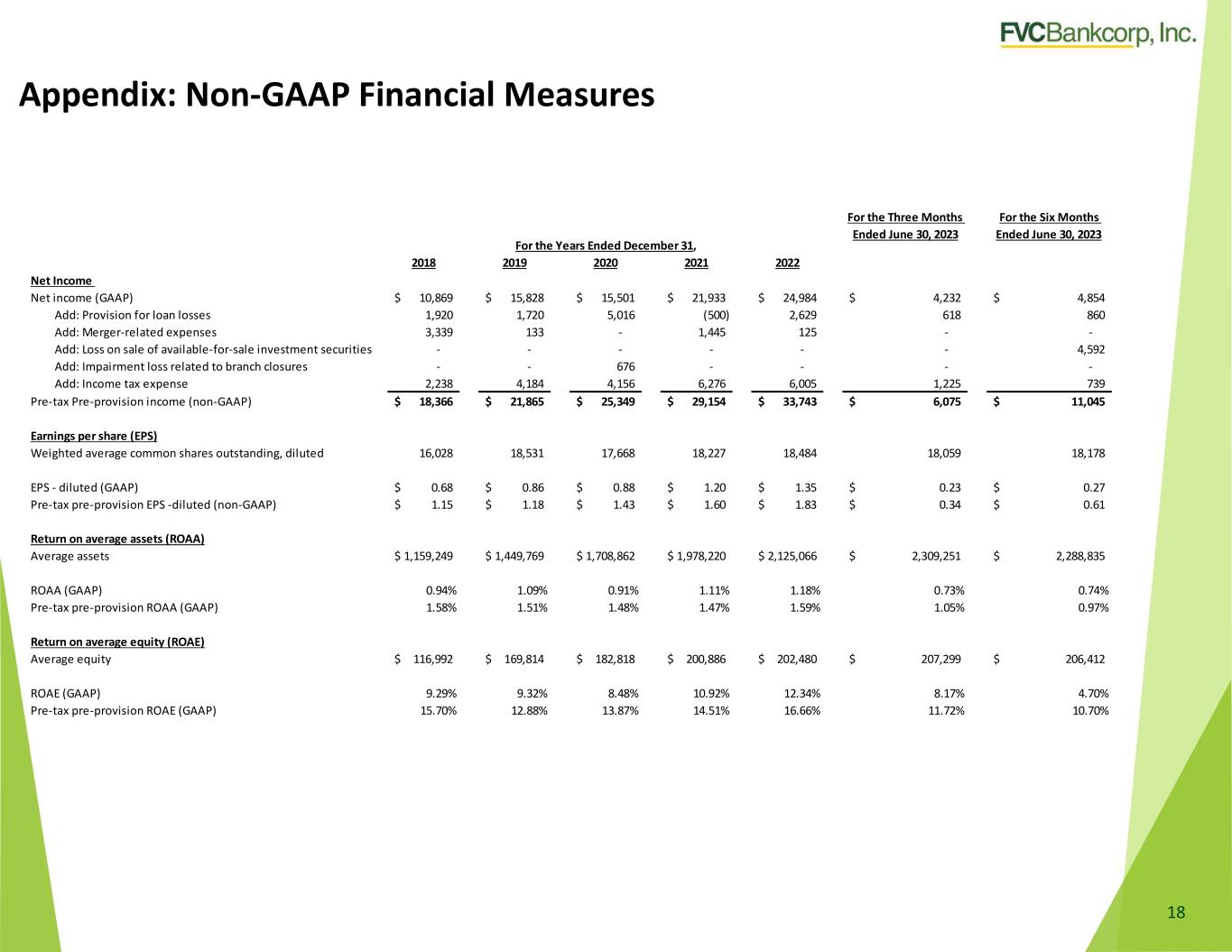

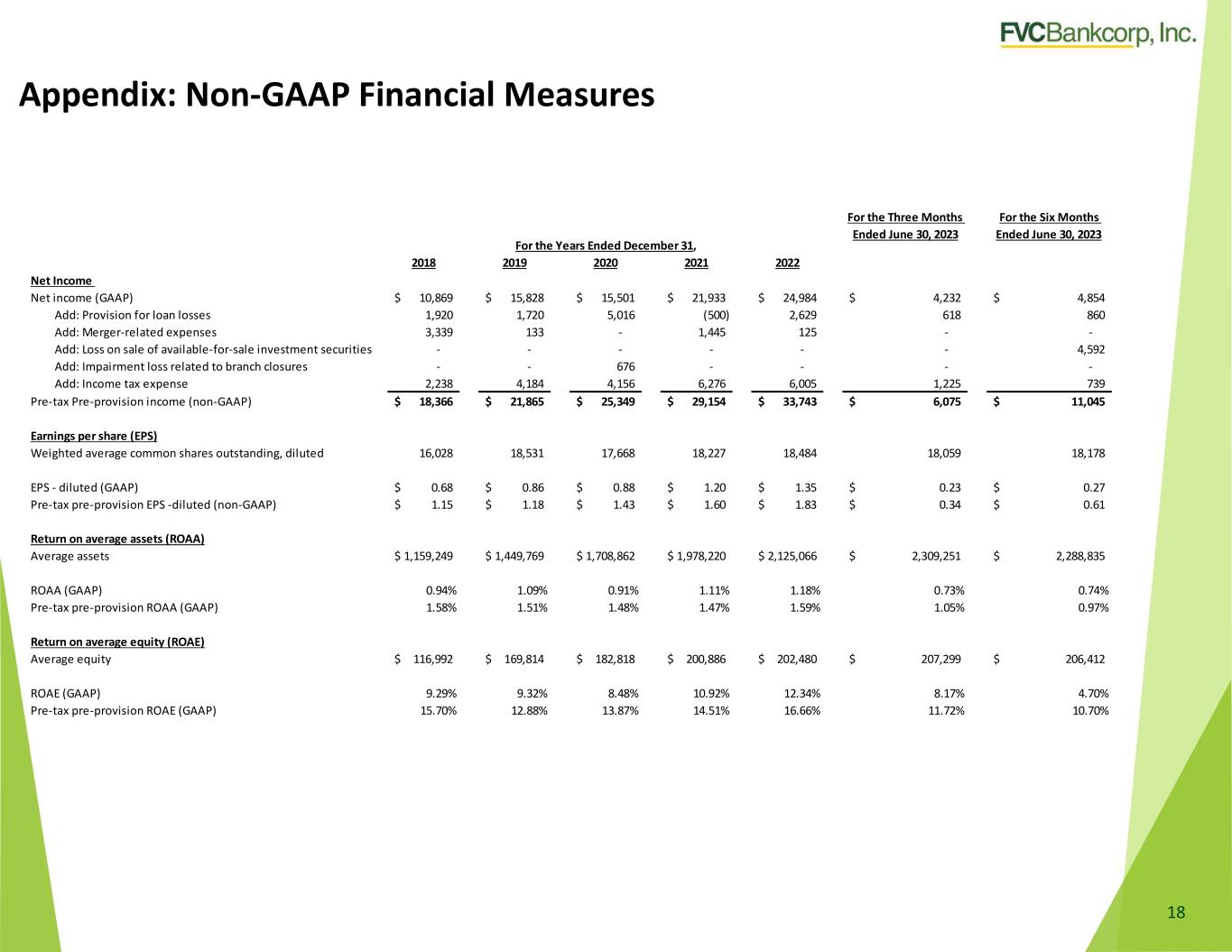

Appendix: Non-GAAP Financial Measures 18 For the Three Months Ended June 30, 2023 For the Six Months Ended June 30, 2023 2018 2019 2020 2021 2022 Net Income Net income (GAAP) 10,869$ 15,828$ 15,501$ 21,933$ 24,984$ 4,232$ 4,854$ Add: Provision for loan losses 1,920 1,720 5,016 (500) 2,629 618 860 Add: Merger-related expenses 3,339 133 - 1,445 125 - - Add: Loss on sale of available-for-sale investment securities - - - - - - 4,592 Add: Impairment loss related to branch closures - - 676 - - - - Add: Income tax expense 2,238 4,184 4,156 6,276 6,005 1,225 739 Pre-tax Pre-provision income (non-GAAP) 18,366$ 21,865$ 25,349$ 29,154$ 33,743$ 6,075$ 11,045$ Earnings per share (EPS) Weighted average common shares outstanding, diluted 16,028 18,531 17,668 18,227 18,484 18,059 18,178 EPS - diluted (GAAP) 0.68$ 0.86$ 0.88$ 1.20$ 1.35$ 0.23$ 0.27$ Pre-tax pre-provision EPS -diluted (non-GAAP) 1.15$ 1.18$ 1.43$ 1.60$ 1.83$ 0.34$ 0.61$ Return on average assets (ROAA) Average assets 1,159,249$ 1,449,769$ 1,708,862$ 1,978,220$ 2,125,066$ 2,309,251$ 2,288,835$ ROAA (GAAP) 0.94% 1.09% 0.91% 1.11% 1.18% 0.73% 0.74% Pre-tax pre-provision ROAA (GAAP) 1.58% 1.51% 1.48% 1.47% 1.59% 1.05% 0.97% Return on average equity (ROAE) Average equity 116,992$ 169,814$ 182,818$ 200,886$ 202,480$ 207,299$ 206,412$ ROAE (GAAP) 9.29% 9.32% 8.48% 10.92% 12.34% 8.17% 4.70% Pre-tax pre-provision ROAE (GAAP) 15.70% 12.88% 13.87% 14.51% 16.66% 11.72% 10.70% For the Years Ended December 31,

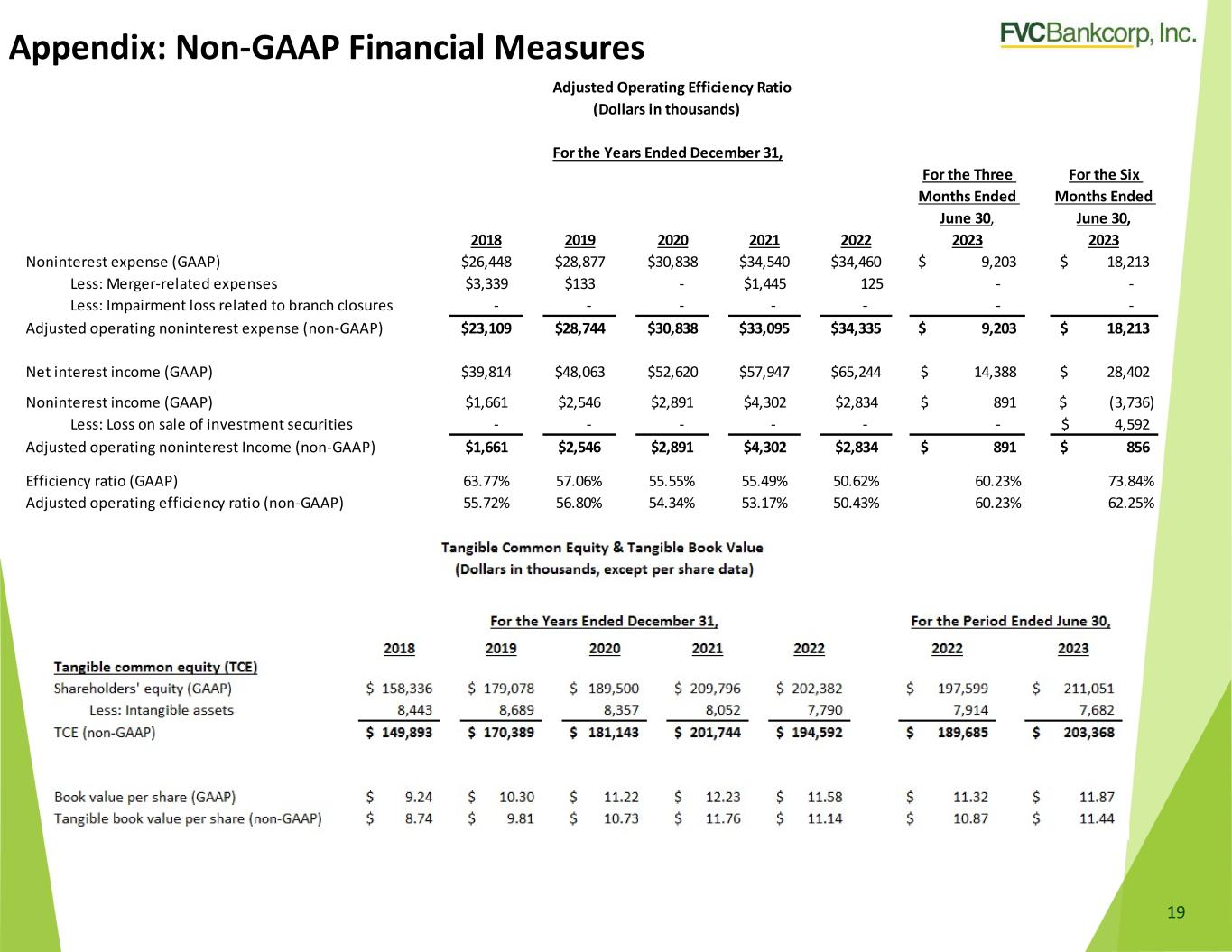

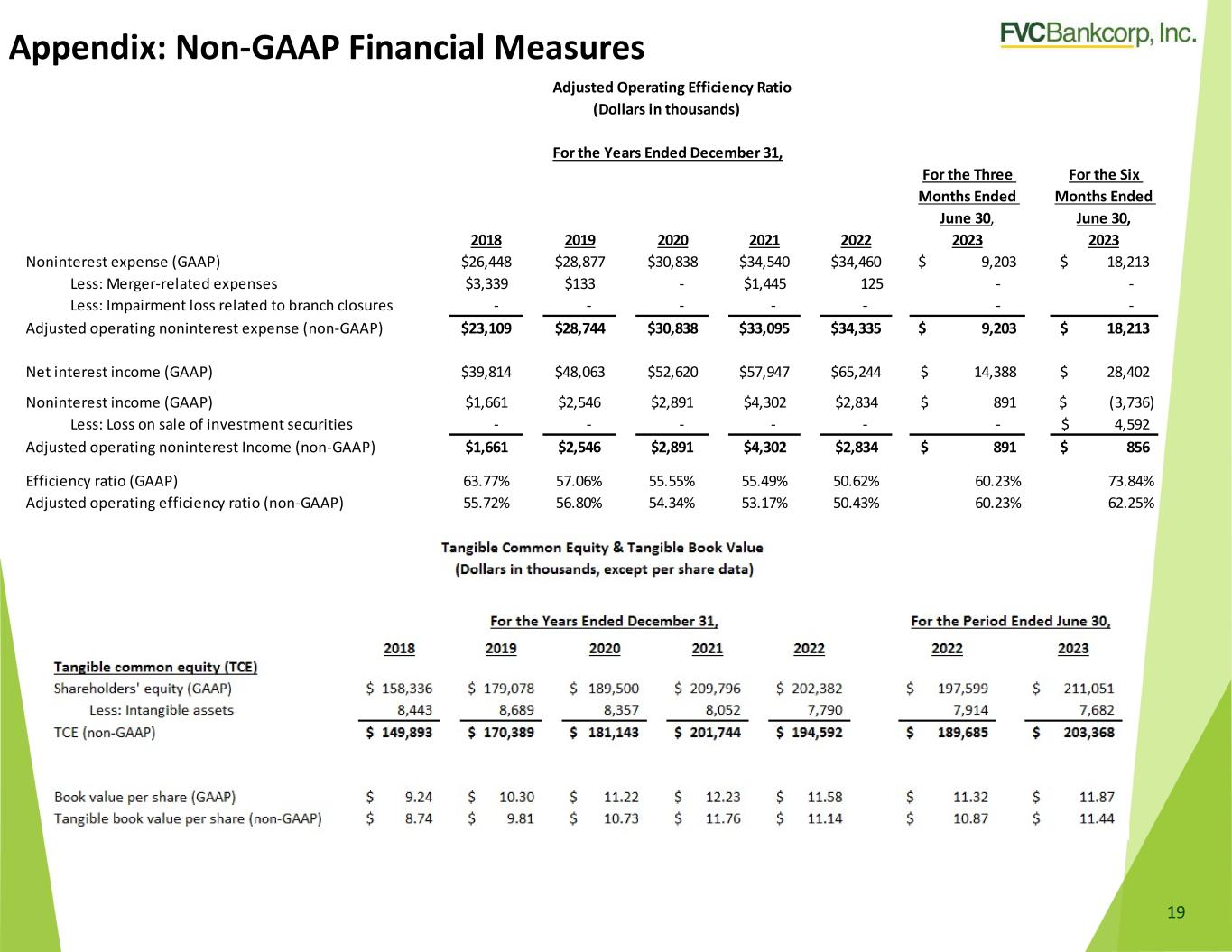

Appendix: Non-GAAP Financial Measures 19 Adjusted Operating Efficiency Ratio (Dollars in thousands) For the Years Ended December 31, 2018 2019 2020 2021 2022 For the Three Months Ended June 30, 2023 For the Six Months Ended June 30, 2023 Noninterest expense (GAAP) $26,448 $28,877 $30,838 $34,540 $34,460 9,203$ 18,213$ Less: Merger-related expenses $3,339 $133 - $1,445 125 - - Less: Impairment loss related to branch closures - - - - - - - Adjusted operating noninterest expense (non-GAAP) $23,109 $28,744 $30,838 $33,095 $34,335 9,203$ 18,213$ Net interest income (GAAP) $39,814 $48,063 $52,620 $57,947 $65,244 14,388$ 28,402$ Noninterest income (GAAP) $1,661 $2,546 $2,891 $4,302 $2,834 891$ (3,736)$ Less: Loss on sale of investment securities - - - - - - 4,592$ Adjusted operating noninterest Income (non-GAAP) $1,661 $2,546 $2,891 $4,302 $2,834 891$ 856$ Efficiency ratio (GAAP) 63.77% 57.06% 55.55% 55.49% 50.62% 60.23% 73.84% Adjusted operating efficiency ratio (non-GAAP) 55.72% 56.80% 54.34% 53.17% 50.43% 60.23% 62.25%

Appendix: Financial Highlights (1) Performance ratios presented are calculated using annualized GAAP net income. (2) Non-GAAP financial measures excludes one-time transaction costs of $3.3 million for 2018, $0.13 million for 2019, $0..68 for 2020, $1.4 million for 2021, $0.13 million for 2022, and $4.6 million for 2023. (3) Nonperforming assets defined as nonaccruals, loans past-due 90 days or more, and other real estate owned. (4) Nonperforming loans defined as nonaccruals and 90+ days past due. (5) Financial Data as of 06/30/23. 20 Financial Data as of 06/30/23 Dollars in Millions, Except Per Share Amounts 2018 2019 2020 2021 2022 2023 Q25 Total Assets $1,352 $1,537 $1,821 $2,203 $2,344 $2,344 Total Loans, Net of Fees $1,137 $1,282 $1,466 $1,504 $1,840 $1,904 Total Deposits $1,162 $1,286 $1,532 $1,884 $1,830 $2,088 Total Equity $158 $179 $190 $210 $202 $211 Net Interest Income $39.8 $48.1 $52.6 $57.9 $65.2 $28.4 Non Interest Income $1.7 $2.5 $2.9 $4.3 $2.8 ($3.7) Non Interest Expense $26.4 $28.9 $30.8 $34.5 $34.5 $18.2 Net Income $10.9 $15.8 $15.5 $21.9 $25.0 $4.9 Earnings Per Share $0.68 $0.86 $0.88 $1.20 $1.35 $0.27 ROAA 1 0.94% 1.09% 0.91% 1.11% 1.18% 0.42% ROAE 1 9.29% 9.32% 8.48% 10.92% 12.34% 4.70% Efficiency Ratio 2 55.7% 57.1% 54.3% 55.5% 50.6% 62.25% Net Interest Margin 3.51% 3.48% 3.28% 3.09% 3.19% 2.60% NPAs 3 / Assets 0.57% 0.95% 0.52% 0.16% 0.19% 0.06% Reserves / Loans 0.81% 0.81% 1.02% 0.92% 0.87% 1.06% NPLs 4 / Total Assets 0.57% 0.70% 0.31% 0.16% 0.19% 0.06% NCO Ratio 0.05% 0.05% 0.02% 0.04% 0.03% 0.08% Tier 1 Leverage Ratio 11.79% 12.15% 11.65% 10.55% 10.75% 10.41% Income Statement Performance Asset Quality Bank Level Capital Ratios Balance Sheet

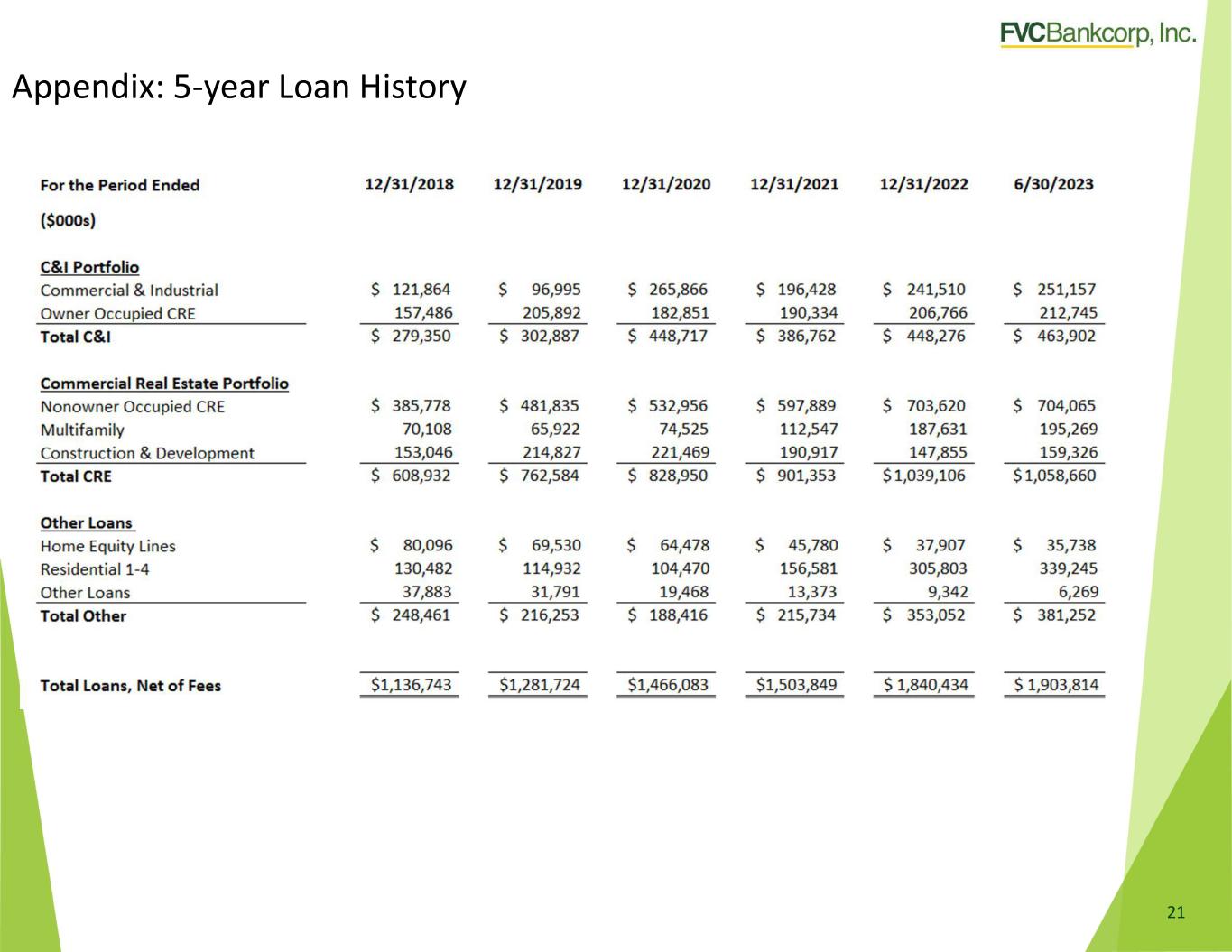

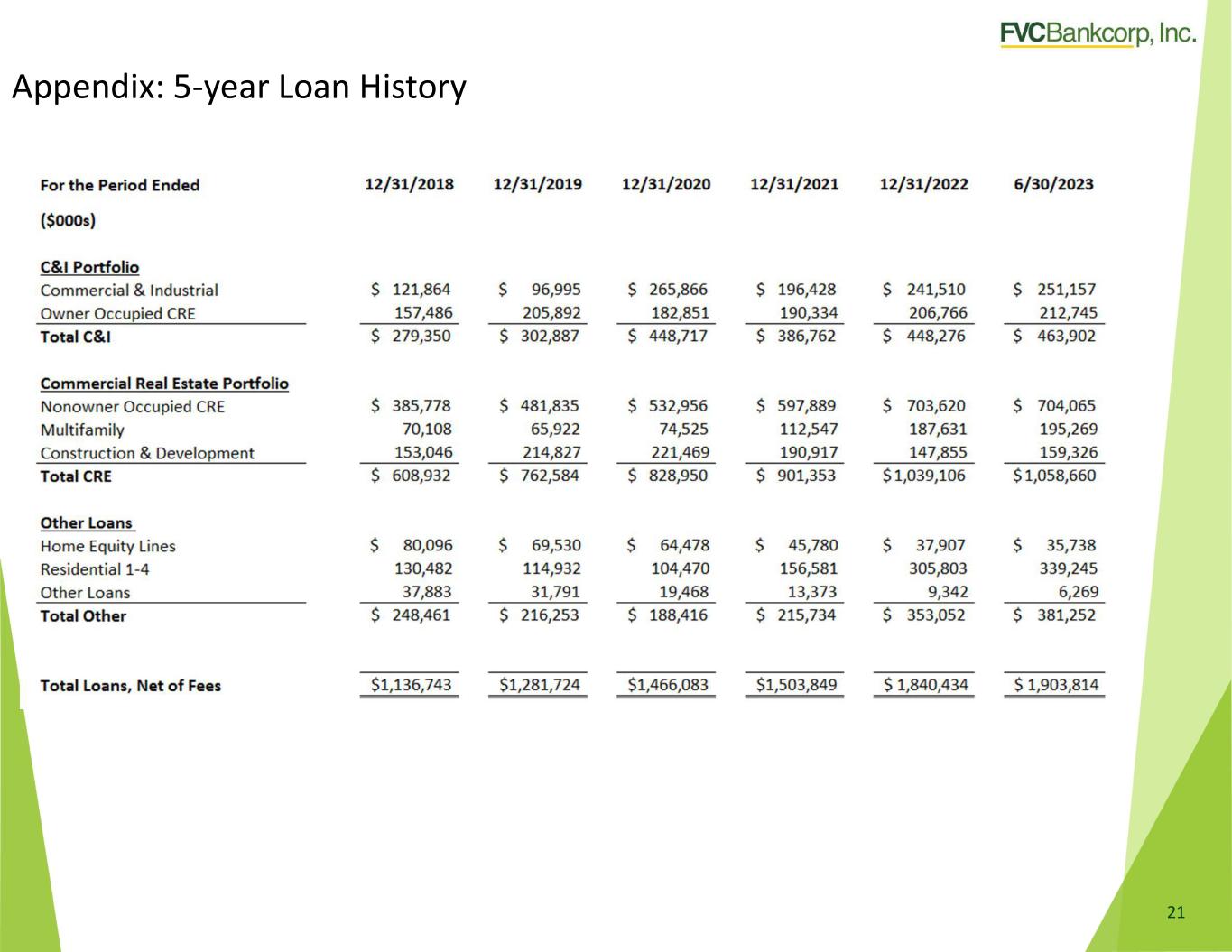

Appendix: 5-year Loan History 21

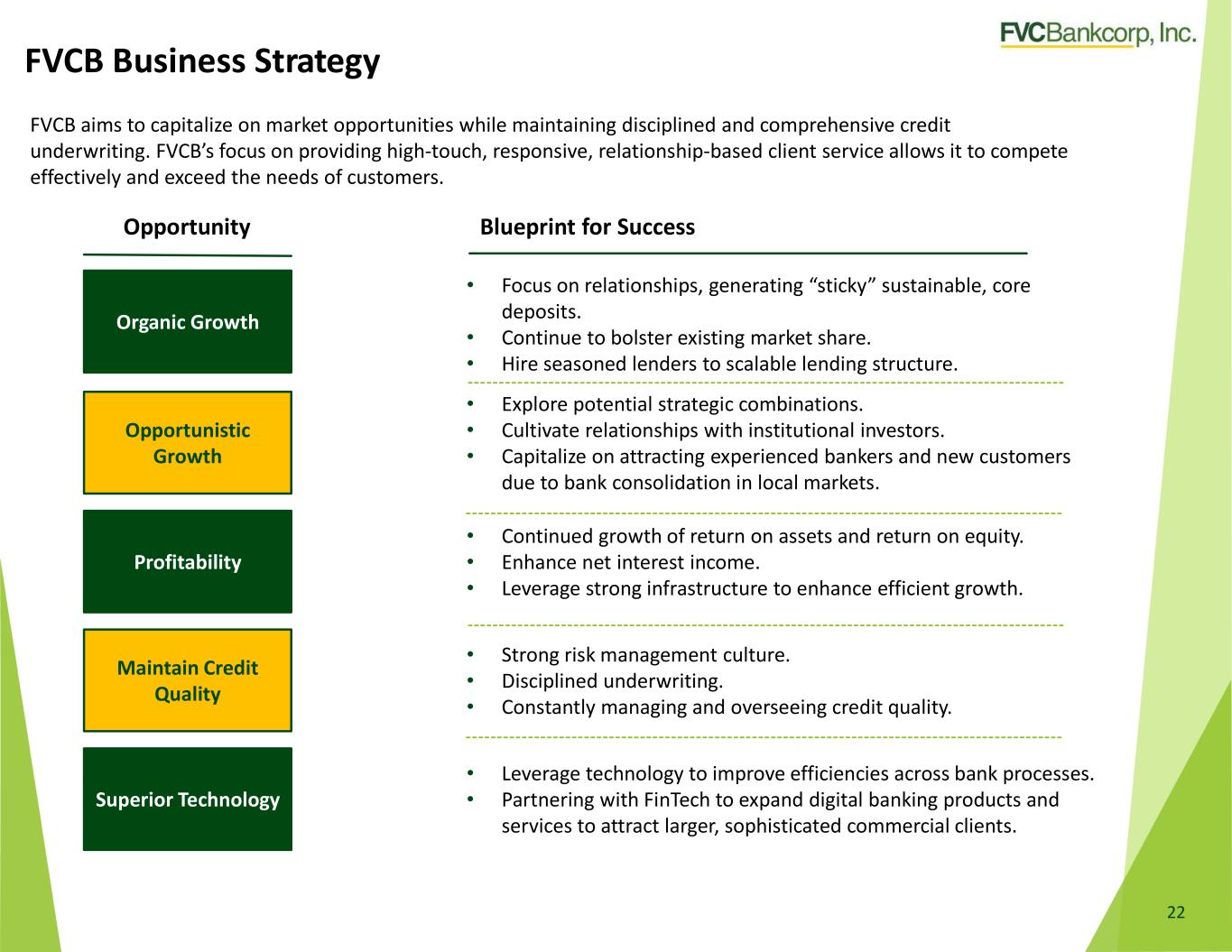

FVCB Business Strategy FVCB aims to capitalize on market opportunities while maintaining disciplined and comprehensive credit underwriting. FVCB’s focus on providing high-touch, responsive, relationship-based client service allows it to compete effectively and exceed the needs of customers. Opportunity Blueprint for Success Organic Growth • Focus on relationships, generating “sticky” sustainable, core deposits. • Continue to bolster existing market share. • Hire seasoned lenders to scalable lending structure. Opportunistic Growth • Explore potential strategic combinations. • Cultivate relationships with institutional investors. • Capitalize on attracting experienced bankers and new customers due to bank consolidation in local markets. Maintain Credit Quality • Strong risk management culture. • Disciplined underwriting. • Constantly managing and overseeing credit quality. Superior Technology • Leverage technology to improve efficiencies across bank processes. • Partnering with FinTech to expand digital banking products and services to attract larger, sophisticated commercial clients. Profitability • Continued growth of return on assets and return on equity. • Enhance net interest income. • Leverage strong infrastructure to enhance efficient growth. 22