false2023FY0001674910P7YP5YP7Yhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrentP1YP1Y9200016749102022-10-012023-09-3000016749102023-03-31iso4217:USD00016749102023-11-15xbrli:shares00016749102021-10-012022-09-3000016749102020-10-012021-09-30iso4217:USDxbrli:shares00016749102023-09-3000016749102022-09-3000016749102021-09-3000016749102020-09-300001674910us-gaap:CommonStockMember2020-09-300001674910us-gaap:AdditionalPaidInCapitalMember2020-09-300001674910us-gaap:RetainedEarningsMember2020-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001674910us-gaap:RetainedEarningsMember2020-10-012021-09-300001674910us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300001674910us-gaap:CommonStockMember2020-10-012021-09-300001674910us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-09-300001674910srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-012021-09-300001674910us-gaap:CommonStockMember2021-09-300001674910us-gaap:AdditionalPaidInCapitalMember2021-09-300001674910us-gaap:RetainedEarningsMember2021-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001674910us-gaap:RetainedEarningsMember2021-10-012022-09-300001674910us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001674910us-gaap:CommonStockMember2021-10-012022-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300001674910us-gaap:CommonStockMember2022-09-300001674910us-gaap:AdditionalPaidInCapitalMember2022-09-300001674910us-gaap:RetainedEarningsMember2022-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001674910us-gaap:RetainedEarningsMember2022-10-012023-09-300001674910us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001674910us-gaap:CommonStockMember2022-10-012023-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001674910us-gaap:CommonStockMember2023-09-300001674910us-gaap:AdditionalPaidInCapitalMember2023-09-300001674910us-gaap:RetainedEarningsMember2023-09-300001674910us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30vvv:stores0001674910vvv:ExpressCareMember2023-09-300001674910us-gaap:BuildingMembersrt:MinimumMember2023-09-300001674910us-gaap:BuildingMembersrt:MaximumMember2023-09-300001674910srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-09-300001674910srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-09-300001674910srt:MinimumMember2022-10-012023-09-300001674910srt:MaximumMember2022-10-012023-09-30vvv:reporting_unitvvv:numberOfPrincipalActivities0001674910us-gaap:TransferredAtPointInTimeMember2022-10-012023-09-30xbrli:pure0001674910us-gaap:TransferredAtPointInTimeMember2021-10-012022-09-300001674910us-gaap:TransferredAtPointInTimeMember2020-10-012021-09-300001674910us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2022-10-012023-09-300001674910us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2021-10-012022-09-300001674910us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2020-10-012021-09-300001674910srt:MinimumMember2023-09-300001674910srt:MaximumMember2023-09-300001674910vvv:OilChangesMember2022-10-012023-09-300001674910vvv:OilChangesMember2021-10-012022-09-300001674910vvv:OilChangesMember2020-10-012021-09-300001674910vvv:NonOilChangesMember2022-10-012023-09-300001674910vvv:NonOilChangesMember2021-10-012022-09-300001674910vvv:NonOilChangesMember2020-10-012021-09-300001674910us-gaap:FranchiseMember2022-10-012023-09-300001674910us-gaap:FranchiseMember2021-10-012022-09-300001674910us-gaap:FranchiseMember2020-10-012021-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:FranchiseMember2022-10-012023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:FranchiseMember2021-10-012022-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:FranchiseMember2020-10-012021-09-300001674910country:US2022-10-012023-09-300001674910country:US2021-10-012022-09-300001674910country:US2020-10-012021-09-300001674910vvv:InternationalMember2022-10-012023-09-300001674910vvv:InternationalMember2021-10-012022-09-300001674910vvv:InternationalMember2020-10-012021-09-300001674910us-gaap:CommonStockMember2023-01-012023-09-300001674910us-gaap:RetainedEarningsMember2023-01-012023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2023-03-012023-03-010001674910us-gaap:DiscontinuedOperationsHeldforsaleMember2022-10-012023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMember2021-10-012022-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMember2020-10-012021-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2022-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2022-10-012023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2021-10-012022-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2020-10-012021-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:GlobalProductsMember2023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:FormerGlobalProductsBusinessMember2022-10-012023-09-300001674910us-gaap:DiscontinuedOperationsHeldforsaleMembervvv:FormerGlobalProductsBusinessMember2023-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2023-09-300001674910us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2022-09-300001674910us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001674910us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:InterestRateSwapMember2022-10-012023-09-300001674910us-gaap:InterestRateSwapMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-09-300001674910vvv:SeniorUnsecuredNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMembervvv:SeniorUnsecuredNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2023-09-300001674910vvv:SeniorUnsecuredNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMembervvv:SeniorUnsecuredNotesDue2030Memberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2022-09-300001674910us-gaap:FairValueInputsLevel2Membervvv:SeniorUnsecuredNotesDue2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membervvv:SeniorUnsecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-300001674910us-gaap:FairValueInputsLevel2Membervvv:SeniorUnsecuredNotesDue2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membervvv:SeniorUnsecuredNotesDue2031Memberus-gaap:SeniorNotesMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-09-300001674910us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-09-30vvv:service_center_storevvv:numberOfFormerFranchiseCenters0001674910vvv:ExpressCareMember2021-10-012022-09-300001674910vvv:KentLubricationCentersLtdMember2020-10-012020-10-010001674910vvv:WestcoLubeIncMember2020-10-152020-10-150001674910vvv:LFEnterprisesMember2020-10-302020-10-300001674910vvv:CarWashPartnersIncMember2020-12-112020-12-11vvv:States00016749102021-04-302021-04-300001674910vvv:ExpressCareMember2020-10-012021-09-300001674910us-gaap:FranchiseRightsMember2023-09-300001674910us-gaap:FranchiseRightsMember2022-09-300001674910us-gaap:FranchiseRightsMember2021-09-300001674910us-gaap:CustomerRelationshipsMember2023-09-300001674910us-gaap:CustomerRelationshipsMember2022-09-300001674910us-gaap:CustomerRelationshipsMember2021-09-300001674910us-gaap:OtherIntangibleAssetsMember2023-09-300001674910us-gaap:OtherIntangibleAssetsMember2022-09-300001674910us-gaap:OtherIntangibleAssetsMember2021-09-300001674910us-gaap:AssetsHeldUnderCapitalLeasesMember2023-09-300001674910us-gaap:AssetsHeldUnderCapitalLeasesMember2022-09-300001674910us-gaap:AssetsHeldUnderCapitalLeasesMember2021-09-300001674910us-gaap:CapitalLeaseObligationsMember2023-09-300001674910us-gaap:CapitalLeaseObligationsMember2022-09-300001674910us-gaap:CapitalLeaseObligationsMember2021-09-300001674910us-gaap:FranchiseRightsMember2022-10-012023-09-300001674910us-gaap:FranchiseRightsMember2020-10-012021-09-300001674910us-gaap:FranchiseRightsMember2021-10-012022-09-300001674910us-gaap:TrademarksAndTradeNamesMember2023-09-300001674910us-gaap:TrademarksAndTradeNamesMember2022-09-300001674910vvv:SeniorUnsecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-300001674910vvv:SeniorUnsecuredNotesDue2031Memberus-gaap:SeniorNotesMember2022-09-300001674910us-gaap:SeniorNotesMembervvv:SeniorUnsecuredNotesDue2030Domain2023-09-300001674910us-gaap:SeniorNotesMembervvv:SeniorUnsecuredNotesDue2030Domain2022-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:TermLoansMember2023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:TermLoansMember2022-09-300001674910us-gaap:RevolvingCreditFacilityMemberus-gaap:TradeAccountsReceivableMember2023-09-300001674910us-gaap:RevolvingCreditFacilityMemberus-gaap:TradeAccountsReceivableMember2022-09-300001674910vvv:SeniorUnsecuredNotesDue2031Memberus-gaap:SeniorNotesMember2021-01-012021-01-310001674910vvv:SeniorUnsecuredNotesDue2025Memberus-gaap:SeniorNotesMember2021-01-310001674910vvv:SeniorUnsecuredNotesDue2025Member2021-01-012021-01-310001674910vvv:SeniorUnsecuredNotesDue2025Member2020-10-012021-09-300001674910us-gaap:SeniorNotesMembervvv:SeniorUnsecuredNotesDue2030Domain2020-02-012020-02-290001674910vvv:SeniorUnsecuredNotesDue2025Memberus-gaap:SeniorNotesMember2020-02-290001674910vvv:SeniorUnsecuredNotesDue2024Memberus-gaap:SeniorNotesMember2020-02-290001674910vvv:SeniorUnsecuredNotesDue2024Member2020-02-012020-02-290001674910vvv:SeniorUnsecuredNotesDue2024Member2019-10-012020-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:TermLoansMember2020-02-012020-02-290001674910vvv:A2022CreditFacilitiesMember2023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:A2022TermLoansMember2022-12-012022-12-310001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:A2022TermLoansMember2023-09-300001674910us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembervvv:A2022RevolverMember2022-12-012022-12-310001674910us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembervvv:A2022RevolverMember2023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:A2022TermLoansMember2022-10-012023-09-300001674910vvv:A2022CreditFacilitiesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2022-10-012023-09-300001674910vvv:A2022CreditFacilitiesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2022-10-012023-09-300001674910us-gaap:BaseRateMembervvv:A2022CreditFacilitiesMembersrt:MinimumMember2022-10-012023-09-300001674910us-gaap:BaseRateMembervvv:A2022CreditFacilitiesMembersrt:MaximumMember2022-10-012023-09-300001674910us-gaap:RevolvingCreditFacilityMembervvv:A2019TermLoansMemberus-gaap:LineOfCreditMember2022-10-012023-09-300001674910us-gaap:RevolvingCreditFacilityMembervvv:A2019CreditFacilitiesMemberus-gaap:LineOfCreditMember2022-10-012023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2022-10-012023-09-300001674910us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2021-10-012022-09-300001674910us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembervvv:TermLoansMember2023-09-300001674910vvv:TradeReceivablesFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-03-012023-03-010001674910vvv:TradeReceivablesFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2022-10-012023-09-300001674910vvv:TradeReceivablesFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMembervvv:FinancingSubsidiaryMember2022-09-300001674910vvv:A2022CreditFacilitiesMemberus-gaap:LineOfCreditMember2023-09-300001674910vvv:ExpirationYears2039Through2042Memberus-gaap:ForeignCountryMember2023-09-300001674910us-gaap:StateAndLocalJurisdictionMembervvv:ExpirationYears2023Through2034Member2023-09-300001674910us-gaap:MajorityShareholderMember2016-09-280001674910vvv:TaxMattersAgreementMember2021-09-300001674910vvv:TaxMattersAgreementMember2020-10-012021-09-300001674910vvv:TaxMattersAgreementMembersrt:AffiliatedEntityMembervvv:AshlandGlobalHoldingsInc.Member2023-09-300001674910vvv:TaxMattersAgreementMembersrt:AffiliatedEntityMembervvv:AshlandGlobalHoldingsInc.Member2022-09-300001674910us-gaap:TaxYear2023Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2022-10-012023-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2021-10-012022-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2020-10-012021-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-012023-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-012022-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-10-012021-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2021-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-09-300001674910us-gaap:PensionPlansDefinedBenefitMember2023-09-300001674910us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-09-300001674910us-gaap:LiabilityMemberus-gaap:PensionPlansDefinedBenefitMember2023-09-300001674910us-gaap:LiabilityMemberus-gaap:PensionPlansDefinedBenefitMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherInvestmentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-09-300001674910us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001674910vvv:HedgeFundsRelativeValueMember2023-09-300001674910us-gaap:HedgeFundsEventDrivenMember2023-09-300001674910vvv:CommonCollectiveTrustsDailyRedemptionMember2023-09-300001674910vvv:CommonCollectiveTrustsDailyRedemptionMember2022-10-012023-09-300001674910us-gaap:PrivateEquityFundsMember2023-09-300001674910us-gaap:DefinedBenefitPlanDebtSecurityMember2023-09-300001674910us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-09-300001674910us-gaap:DefinedBenefitPlanEquitySecuritiesMembersrt:MinimumMember2023-09-300001674910us-gaap:DefinedBenefitPlanEquitySecuritiesMembersrt:MaximumMember2023-09-300001674910us-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-09-300001674910srt:MinimumMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-09-300001674910srt:MaximumMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2023-09-300001674910us-gaap:DefinedBenefitPlanDebtSecurityMember2022-09-300001674910us-gaap:OtherInvestmentsMembersrt:MinimumMember2023-09-300001674910us-gaap:OtherInvestmentsMembersrt:MaximumMember2023-09-300001674910us-gaap:OtherInvestmentsMember2023-09-300001674910us-gaap:OtherInvestmentsMember2022-09-300001674910us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-09-300001674910us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-09-300001674910us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-09-300001674910vvv:ValvolineInc.IncentivePlanMember2023-09-300001674910us-gaap:StockAppreciationRightsSARSMember2022-10-012023-09-300001674910us-gaap:StockAppreciationRightsSARSMember2021-10-012022-09-300001674910us-gaap:StockAppreciationRightsSARSMember2020-10-012021-09-300001674910vvv:NonvestedStockUnitsMember2022-10-012023-09-300001674910vvv:NonvestedStockUnitsMember2021-10-012022-09-300001674910vvv:NonvestedStockUnitsMember2020-10-012021-09-300001674910us-gaap:StockAppreciationRightsSARSMembersrt:MinimumMember2022-10-012023-09-300001674910us-gaap:StockAppreciationRightsSARSMembersrt:MaximumMember2022-10-012023-09-300001674910srt:MinimumMembervvv:NonvestedStockUnitsMember2022-10-012023-09-300001674910srt:MaximumMembervvv:NonvestedStockUnitsMember2022-10-012023-09-300001674910vvv:NonvestedStockUnitsPerformanceBasedMember2022-10-012023-09-300001674910vvv:NonvestedStockUnitsMember2022-09-300001674910vvv:NonvestedStockUnitsMember2023-09-300001674910vvv:NonvestedStockUnitsPerformanceBasedMember2021-10-012022-09-300001674910vvv:NonvestedStockUnitsPerformanceBasedMember2020-10-012021-09-300001674910vvv:TenderOfferMemberus-gaap:CommonStockMember2023-05-310001674910vvv:TenderOfferMember2023-06-012023-06-300001674910us-gaap:CommonStockMember2022-11-150001674910us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-09-300001674910us-gaap:AccumulatedTranslationAdjustmentMember2021-09-300001674910us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-09-300001674910us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-10-012022-09-300001674910us-gaap:AccumulatedTranslationAdjustmentMember2021-10-012022-09-300001674910us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-10-012022-09-300001674910us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-09-300001674910us-gaap:AccumulatedTranslationAdjustmentMember2022-09-300001674910us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-09-300001674910us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-10-012023-09-300001674910us-gaap:AccumulatedTranslationAdjustmentMember2022-10-012023-09-300001674910us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-012023-09-300001674910us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-300001674910us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300001674910us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-09-300001674910us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001674910us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300001674910us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-10-012021-09-300001674910us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-09-300001674910us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-09-300001674910us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-09-300001674910us-gaap:LandMember2023-09-300001674910us-gaap:LandMember2022-09-300001674910us-gaap:BuildingMember2023-09-300001674910us-gaap:BuildingMember2022-09-300001674910us-gaap:MachineryAndEquipmentMember2023-09-300001674910us-gaap:MachineryAndEquipmentMember2022-09-300001674910us-gaap:ConstructionInProgressMember2023-09-300001674910us-gaap:ConstructionInProgressMember2022-09-300001674910country:US2023-09-300001674910country:US2022-09-300001674910country:CA2023-09-300001674910country:CA2022-09-300001674910us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2023-10-012023-11-150001674910us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2023-11-1500016749102023-07-012023-09-300001674910vvv:MrSamuelJMitchellJrMember2022-10-012023-09-300001674910vvv:MrSamuelJMitchellJrMember2023-07-012023-09-300001674910vvv:MrSamuelJMitchellJrMember2023-09-300001674910us-gaap:AllowanceForCreditLossMember2022-09-300001674910us-gaap:AllowanceForCreditLossMember2022-10-012023-09-300001674910us-gaap:AllowanceForCreditLossMember2023-09-300001674910us-gaap:AllowanceForCreditLossMember2021-09-300001674910us-gaap:AllowanceForCreditLossMember2021-10-012022-09-300001674910us-gaap:AllowanceForCreditLossMember2020-09-300001674910us-gaap:AllowanceForCreditLossMember2020-10-012021-09-300001674910us-gaap:AllowanceForNotesReceivableMember2022-09-300001674910us-gaap:AllowanceForNotesReceivableMember2022-10-012023-09-300001674910us-gaap:AllowanceForNotesReceivableMember2023-09-300001674910us-gaap:AllowanceForNotesReceivableMember2021-09-300001674910us-gaap:AllowanceForNotesReceivableMember2021-10-012022-09-300001674910us-gaap:AllowanceForNotesReceivableMember2020-09-300001674910us-gaap:AllowanceForNotesReceivableMember2020-10-012021-09-300001674910us-gaap:InventoryValuationReserveMember2022-09-300001674910us-gaap:InventoryValuationReserveMember2022-10-012023-09-300001674910us-gaap:InventoryValuationReserveMember2023-09-300001674910us-gaap:InventoryValuationReserveMember2021-09-300001674910us-gaap:InventoryValuationReserveMember2021-10-012022-09-300001674910us-gaap:InventoryValuationReserveMember2020-09-300001674910us-gaap:InventoryValuationReserveMember2020-10-012021-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-012023-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-10-012022-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-09-300001674910us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-10-012021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

|

| ☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ___________

Commission file number 001-37884

VALVOLINE INC.

|

|

|

|

|

|

| Kentucky |

30-0939371 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

100 Valvoline Way, Suite 100

Lexington, Kentucky 40509

Telephone Number (859) 357-7777

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

VVV |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☑ |

Accelerated filer |

☐

|

Non-accelerated filer |

☐

|

Smaller reporting company |

☐

|

|

|

Emerging growth company |

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of voting common stock held by non-affiliates at March 31, 2023 was approximately $5.9 billion. At November 15, 2023, there were 130,650,040 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2024 Annual Meeting of Shareholders (the “Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K and will be filed within 120 days of the registrant’s fiscal year end.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page |

| PART I |

|

|

|

Item 1. |

|

|

|

Item 1A. |

|

|

|

Item 1B. |

|

|

|

Item 2. |

|

|

|

Item 3. |

|

|

|

Item 4. |

|

|

|

|

|

|

| PART II |

|

|

|

Item 5. |

|

|

|

Item 6. |

|

|

|

Item 7. |

|

|

|

Item 7A. |

|

|

|

Item 8. |

|

|

|

Item 9. |

|

|

|

Item 9A. |

|

|

|

Item 9B. |

|

|

|

|

|

|

| PART III |

|

|

|

Item 10. |

|

|

|

Item 11. |

|

|

|

Item 12. |

|

|

|

Item 13. |

|

|

|

Item 14. |

|

|

|

|

|

|

| PART IV |

|

|

|

Item 15. |

|

|

|

Item 16. |

|

|

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, executing on its growth strategy to create shareholder value by driving the full potential in the Company’s core business, accelerating network growth and innovating to meet the needs of customers and the evolving car parc; realizing the benefits from the sale of Global Products; and future opportunities for the remaining stand-alone retail business; and any other statements regarding Valvoline's future operations, financial or operating results, capital allocation, debt leverage ratio, anticipated business levels, dividend policy, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods. Valvoline has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “may,” “will,” “should,” and “intends,” and the negative of these words or other comparable terminology. These forward-looking statements are based on Valvoline’s current expectations, estimates, projections, and assumptions as of the date such statements are made and are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed under the headings “Risk Factors” in Item 1A of Part I of this Annual Report on Form 10-K, “Management’s Discussion and Analysis of Financial Condition and Results of Operation” in Item 7 of Part II of this Annual Report on Form 10-K and “Quantitative and Qualitative Disclosures about Market Risk” in Item 7A of Part II of this Annual Report on Form 10-K. Valvoline assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future, unless required by law.

PART I

ITEM 1. BUSINESS

Overview

Valvoline Inc. is a leader in automotive preventive maintenance delivering convenient and trusted services in its retail stores throughout the United States (“U.S.”) and Canada. The terms “Valvoline,” the “Company,” “we,” “us,” “management,” and “our” as used herein refer to Valvoline Inc., its predecessors and its consolidated subsidiaries, except where the context indicates otherwise.

As the quick, easy, trusted leader in automotive preventive maintenance, Valvoline is creating shareholder value by driving the full potential of its core business, accelerating network growth and innovating to meet the needs of customers and the evolving car parc. With average customer ratings that indicate high levels of service satisfaction, Valvoline and the Company’s franchise partners keep customers moving with 15-minute stay-in-your-car oil changes; battery, bulb and wiper replacements; tire rotations; and other manufacturer recommended maintenance services. The Company operates and franchises more than 1,850 service center locations through its Valvoline Instant Oil ChangeSM (“VIOC”) and Valvoline Great Canadian Oil Change (“GCOC”) retail locations and supports nearly 300 locations through its Express CareTM platform. For over 15 decades, Valvoline has consistently adapted to address changing technologies and customer needs and is well positioned to service evolving vehicle maintenance needs with its growing network of stores.

Company background

Established in 1866, Valvoline has a history of innovation spanning more than 155 years when Dr. John Ellis founded Valvoline by discovering the lubricating properties of distilled crude oil and formulated the world's first petroleum-based lubricant. Valvoline was trademarked seven years later in 1873, making it the first trademarked motor oil brand in the U.S. Soon thereafter, as vehicle ownership rapidly grew, Valvoline became widely known in the automotive world through racing victories and as a recommended oil for the iconic Ford Model T, while expanding its product offerings and global reach through its innovative automotive maintenance and heavy-duty engine applications.

Valvoline was acquired by Ashland (currently doing business as Ashland Inc., and together with its predecessors and consolidated subsidiaries, referred to herein as “Ashland”), in 1950 and continued accelerating through the development of all-climate and racing motor oils, in addition to supporting notable automobile racing victories by some of the biggest legends of the sport. By the late 1980s, Valvoline began operating and franchising VIOC service center stores, expanding into consumer-focused automotive preventive maintenance and quick lube services. Valvoline maintained its focus on innovating for evolving vehicle technologies and the needs of customers through the late 1990s and early 2000s by introducing synthetic and high-mileage motor oils.

Valvoline was incorporated in May 2016 as a subsidiary of Ashland, followed by the transfer of the Valvoline business and certain other legacy Ashland assets and liabilities from Ashland to Valvoline. Valvoline completed its initial public offering of common stock in September 2016, and Ashland distributed its remaining ownership interest in Valvoline in May 2017 (the “Distribution”). Today, Valvoline operates as an independent corporation that trades on the New York Stock Exchange (“NYSE”) under the symbol “VVV,” as a pure play automotive retail services provider focused on delivering quick and convenient vehicle maintenance services to further accelerate its growth.

Discontinued operations

On March 1, 2023, Valvoline completed the sale of its former Global Products reportable segment (“Global Products”) to Aramco Overseas Company B.V. (“Aramco” or the “Buyer”) (the “Transaction”). Refer to Note 3 included within the Notes to Consolidated Financial Statements included in Item 8 of Part II of this Annual Report on Form 10-K for additional information regarding the Global Products business, including the assets and liabilities divested and income from discontinued operations.

Valvoline’s retail services

Valvoline operates and franchises more than 1,850 service center locations through its VIOC and GCOC retail locations and supports nearly 300 locations through its Express Care platform. The Company has built a reputation as the quick, easy, trusted name in automotive preventive maintenance and continues to build its market share by leveraging its stay-in-your-car service model and providing each customer with service that can be seen by experts they can trust. Valvoline technicians utilize the Company’s proprietary SuperProTM system to deliver a superior customer experience and make timely service recommendations based upon vehicle service history and original equipment manufacturer (“OEM”) recommendations. The SuperPro system is utilized in both company-operated and franchised service center locations, creating a consistent service experience for customers.

The following summarizes the primary services Valvoline offers at its retail service center stores:

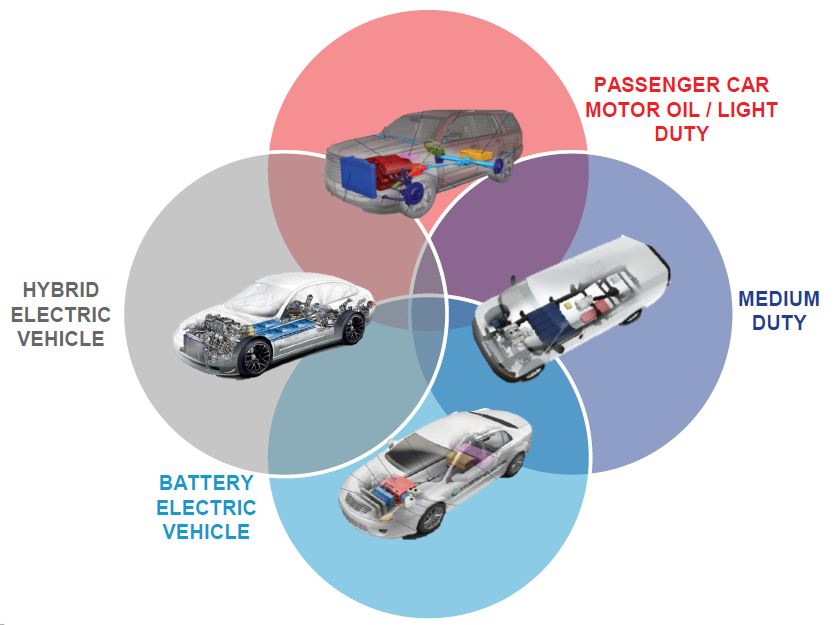

Valvoline’s services are offered to a wide range of vehicle types, including fleets, as shown below:

Industry overview

Demand for automotive aftermarket services benefits from the growing number and age of vehicles in operation as well as increasing vehicle complexity and ongoing increases in miles driven. In addition, the resilient North American automotive aftermarket services market is highly fragmented, which creates a significant opportunity for consolidation.

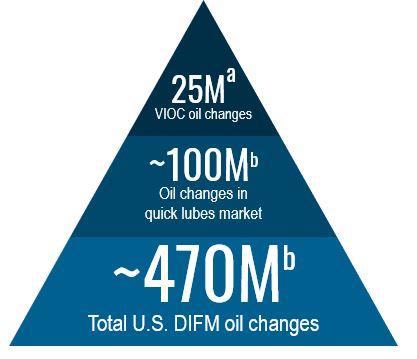

Based on industry surveys and management estimates, the U.S. Do It For Me (“DIFM”) total addressable market depicted below demonstrates the magnitude of the opportunity in the U.S. for Valvoline:

|

|

|

|

|

|

| (a) |

VIOC oil changes in fiscal year 2023 (U.S. company and franchised stores) |

| (b) |

Management estimates developed utilizing internal and industry data for U.S. passenger car and light truck quick lube and DIFM oil changes |

Business and growth strategies

As a pure play automotive retail services provider and the trusted leader in preventive automotive maintenance, Valvoline is well positioned to create long-term shareholder value through executing the Company’s strategic initiatives, which include:

•Driving the full potential of the core business through increasing market share and non-oil change revenue growth in existing stores by building on Valvoline’s strong foundation in marketing, technology, and data.

•Aggressively growing the retail footprint with company-operated store growth and an increased emphasis on franchisee store growth; and

•Developing capabilities to capture new customers through services expansion focused on fleet manager needs and needs of the evolving car parc.

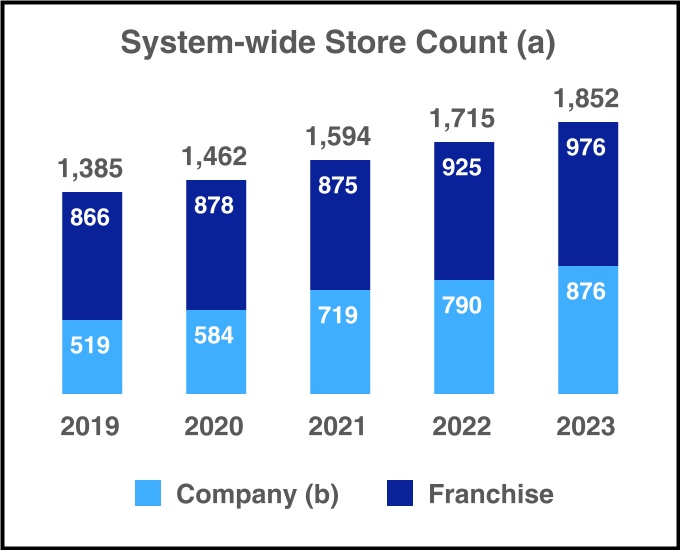

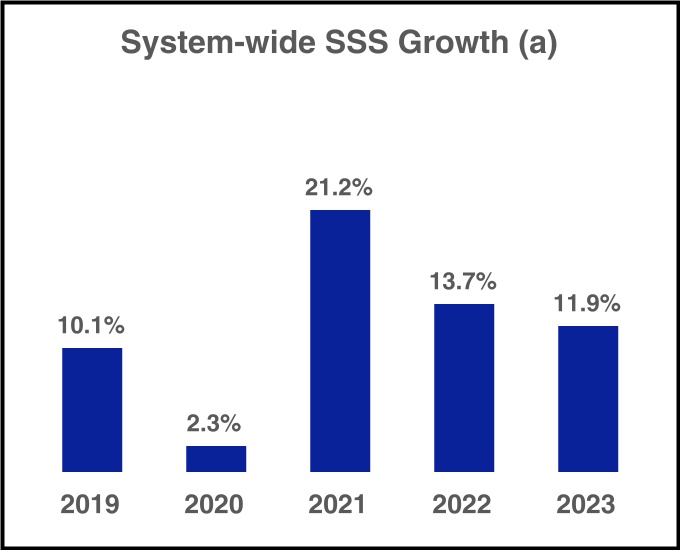

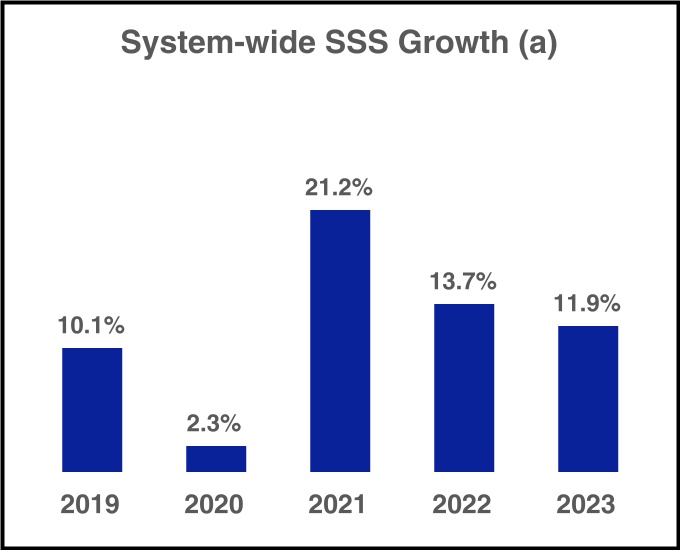

Retail store development

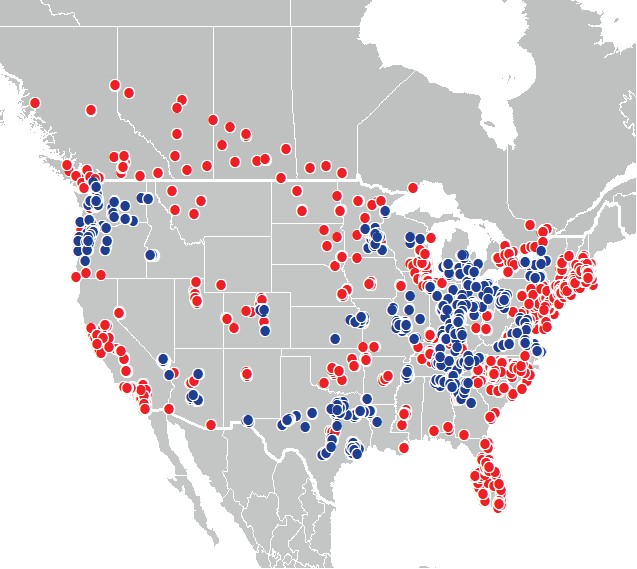

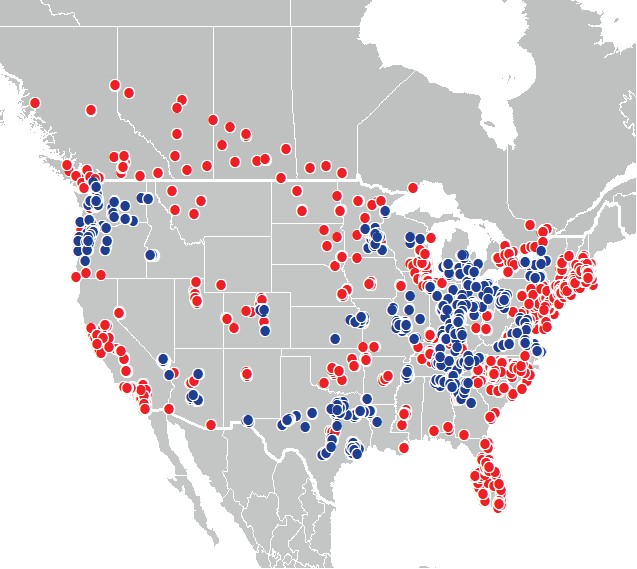

Valvoline’s network of retail service centers delivered its 17th consecutive year of system-wide same-store sales (“SSS”) growth in fiscal 2023, demonstrating the system's operational excellence. As shown below, Valvoline operates, either directly or through its franchisees, 1,852 service center stores across the U.S. and Canada as of September 30, 2023:

|

|

|

|

|

|

| l |

Company-operated |

| l |

Franchised |

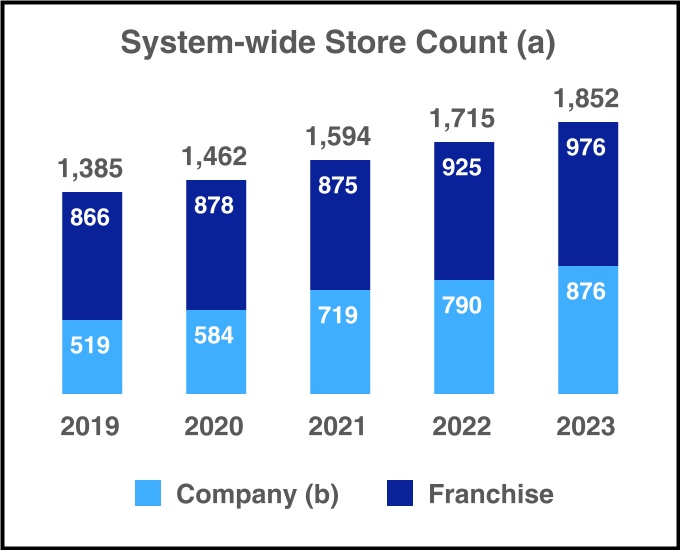

Valvoline utilizes a three-pronged approach to grow its retail network through 1) franchisee store expansion 2) opportunistic acquisitions, and 3) new store development. This approach drove system-wide store growth of more than 30% over the last five years. During this period, Valvoline added 467 net new stores to the system and expanded its service centers internationally into Canada. The retail services store network and its same-store sales growth in each of the last five years is summarized below:

|

|

|

|

|

|

| (a) |

Refer to "Key Business Measures" in Item 7 of Part II of this Annual Report on Form 10-K for a description of management's use and determination of key metrics, including store counts and SSS. Measures include franchisees, which are distinct independent legal entities and Valvoline does not consolidate the results of operations of its franchisees. |

| (b) |

As of September 30, 2020, one franchised service center store included in the store count was temporarily closed at the discretion of the respective independent operator due to the impacts of COVID-19. |

Competition

The automotive aftermarket service industry is highly fragmented and Valvoline faces competition across its service categories and subcategories. Competition is based on several key criteria, including brand recognition, product selection, quality of service, price, convenience, speed, location, and customer experience, in addition to the ability to deliver innovative services to meet evolving customer needs. Valvoline competes for customers with automotive dealerships, automotive repair and maintenance centers, as well as other regional and independent quick lube operators.

Additionally, Valvoline’s retail stores compete for consumers and franchisees with other major franchised brands that offer a turn-key operations management system, such as Jiffy Lube, Grease Monkey, Take 5 Oil Change, Express Oil Change, and Mr. Lube in Canada. Valvoline competes with other franchisors in automotive services and across other industries on the basis of the expected return on investment and the value propositions offered to franchisees.

Valvoline also competes for Express Care operators and customers with national branded companies that offer an independent quick lube platform with a professional signage program and limited business model support.

Marketing and customer experience

Valvoline places a high priority on delivering an in-store customer experience that is quick, easy, and trusted. To both acquire and retain customers, marketing plays an important role in demonstrating the differentiated experience that Valvoline offers customers, as well as providing information on locations, pricing and services offered. Techniques utilized by the Company are intended to build awareness of and create demand for its automotive preventive maintenance services. Valvoline markets through search and direct response channels and invests in advertising through social and digital media. The Company’s digital modeling marketing strategies are efficient and yield strong rates of return.

Valvoline leverages its digital tools to obtain customer feedback across the retail network of stores. Customer feedback is frequently measured and monitored to ensure that any service issues are quickly addressed to maintain high levels of customer satisfaction. Valvoline also utilizes its digital infrastructure and technology to more efficiently interact with customers, driving customer engagement, acquisition and retention, and consistency. The Company's strengths in digital marketing and data analytics are leveraged to attract new and retain existing customers, including tailored marketing campaigns directed to specific customers when their next service is estimated to be due.

Intellectual property

Valvoline holds approximately 260 trademarks in more than 60 countries across the world, including the Valvoline and “V” brand logo trademarks. These trademarks have a perpetual life, are generally subject to renewal every ten years, and are among Valvoline's most protected and valuable assets. With the completion of the sale of Global Products, Valvoline owns the Valvoline brand for all global retail services, excluding China and certain countries in the Middle East and North Africa, while Global Products owns the Valvoline brand for all products uses globally. Valvoline partners with Global Products to ensure that Valvoline's iconic brand is managed in a consistent and holistic manner.

Valvoline trade names and service marks used in its business include ValvolineTM and Valvoline Instant Oil ChangeSM, among others. Valvoline is also party to arrangements that license its intellectual property to others in return for revenues. Valvoline owns approximately 700 domain names that are used to promote Valvoline services and provide information about the Company.

Product supply and price

The products used in Valvoline’s retail service delivery are principally sourced from Global Products. In connection with the sale of its former reportable segment, Valvoline entered into a long-term supply agreement for the purchase of substantially all lubricant and certain ancillary products for its stores from Global Products (the “Supply Agreement”).

Valvoline is able to leverage its scale, as well as the scale of its suppliers, for favorable terms in the arrangement of product supply for its store operations across the network. This benefit enhances the value proposition to new and existing independent store operators as well as to the profits of Valvoline’s company store operations. Valvoline’s arrangement of product supply for its independent operators provides recurring fees and margins that benefit ongoing results. As Valvoline continues to grow organically and through acquisitions, the business is well-positioned to continue driving increased benefits to the overall system of retail stores.

Valvoline works diligently to preserve margins by adjusting its pricing in response to changes in costs. The Company’s customer value proposition focuses on convenience and quality service which provides the ability to leverage pricing power to raise prices while maintaining customer loyalty. Pricing adjustments to products sold to Valvoline's independent operators are made pursuant to their contracts and are generally based on movements in published base oil indices.

Seasonality

Valvoline’s business is moderately impacted by seasonality. Transaction volumes follow driving patterns of customers, which generally trend with the length of daylight hours, North American holidays, and vacation timing. Weather conditions can modestly affect transaction volumes, and geographic variation typically limits weather impacts to specific regions. As a result, the second half of the fiscal year ordinarily is more robust as miles driven tends to be higher.

Regulatory and environmental matters

Valvoline operates to maintain compliance with various federal, provincial, state, and local laws and governmental regulations relating to the operation of its business, including those regarding employment and labor practices; workplace safety; building and zoning requirements; the handling, storage and disposal of hazardous substances contained in the products used in service, including used motor oil and lead-acid batteries; and the ownership, construction and operation of real property, among others. Valvoline maintains policies and procedures to control risks and monitor compliance with applicable laws and regulations. These laws and regulations require Valvoline to obtain and comply with permits, registrations or other authorizations issued by governmental authorities. These authorities can modify or revoke the Company’s permits, registrations or other authorizations and can enforce compliance through fines, sanctions and injunctions. The Company is also subject to regulation by various U.S. federal regulatory agencies and by the applicable regulatory authorities in locations in which Valvoline’s services are offered. Such regulations principally relate to the operation of its service centers, advertising and marketing of Valvoline’s services.

Valvoline stores lubricating and vehicle maintenance products and handles used automotive oils and filters. Accordingly, Valvoline is subject to numerous federal, provincial, state, and local environmental laws including the Comprehensive Environmental Response Compensation and Liability Act. In addition, the U.S. Environmental Protection Agency under the Resource Conservation and Recovery Act, as well as various state and local environmental protection agencies, regulate the handling and disposal of certain waste products and other materials.

As a franchisor, Valvoline is subject to various state and provincial laws, and the Federal Trade Commission (the “FTC”) regulates franchising activities in the U.S. The FTC requires that franchisors make extensive disclosure to prospective franchisees before the execution of a franchise agreement. Certain jurisdictions require registration or specific disclosure in connection with franchise offers and sales, or have laws that limit franchisor rights with regard to the termination, renewal or transfer of franchise agreements.

Valvoline is subject to laws relating to information security, privacy, cashless payments and customer credit, protection and fraud. An increasing number of governments and industry groups have established data privacy laws and standards for the protection of personal information, including financial information (e.g., credit card numbers), social security numbers, and health information. The Company is also subject to labor and employment laws, including regulations established by the U.S. Department of Labor and other local regulatory agencies, which sets laws governing working conditions, paid leave, workplace safety, wage and hour standards, and hiring and employment practices.

Human capital management

"It all starts with our people" is one of Valvoline's core values, and the Company endeavors to create an environment that promotes safety, fosters diversity, encourages creativity, rewards performance, and emphasizes culture and purpose. To recruit and retain the most qualified team members, Valvoline focuses on treating team members well by paying competitive wages, offering an attractive benefit package, and providing robust training and career development opportunities. Valvoline is committed to actively creating an environment where each team member is empowered to learn, grow, and maximize their personal contribution.

As of September 30, 2023, Valvoline had more than 10,000 employees (excluding contract employees) in the U.S. and Canada, including approximately 9,600 full-time employees. Valvoline operates 876 company-owned retail service center stores throughout the U.S. and Canada and supports its network of over 1,850 stores through centralized teams.

The table below provides the Company's approximate distribution of employees, which includes its company-operated service center stores, central supporting teams, and excludes independent contractors:

|

|

|

|

|

|

|

Number of employees |

| Technicians |

8,600 |

|

| Store management |

1,100 |

|

| Customer service |

200 |

|

| Total company-operated store employees |

9,900 |

|

| Area and regional operations |

400 |

|

| Total retail services operations |

10,300 |

|

Headquarter and remote corporate team members |

600 |

|

| Total employee headcount |

10,900 |

|

Valvoline seeks to attract, develop, and retain highly qualified talent as summarized further below.

Employee communication and feedback

In an ongoing effort to understand employees’ needs and deliver on the Company’s values of trust, accountability and collaboration, Valvoline remains focused on transparency and employee feedback. The Company regularly hosts company-wide town halls in which Valvoline’s Chief Executive Officer and other members of senior management inform employees about performance, strategic initiatives, activities, and policies along with providing opportunities for them to ask questions. In addition, Valvoline management is focused on listening understand what is on the minds of employees by regularly surveying team members to gather real-time feedback as well as identifying opportunities for continuous improvement. During fiscal 2023, the Company also surveyed employees to solicit feedback and address questions regarding the Transaction and maintained an intranet page dedicated to communicating and establishing transparency throughout the separation process. Valvoline believes employee survey results are important to evaluate areas for improved communication and are meaningful to recruit and retain top talent, believing satisfied employees are more likely to have a positive impact in the workplace and deliver great customer service.

Diversity, equity and inclusion (“DEI”)

Valvoline is committed to creating an inclusive and welcoming environment for its employees and customers by fostering a strong sense of belonging, where diverse backgrounds are represented, engaged and empowered to inspire innovative ideas and decisions. To help further promote an inclusive culture and to better serve customers, the Company is focused on:

•Promoting a culture of diversity and inclusion that leverages the talents of all employees,

•Implementing practices that attract, recruit and retain diverse top talent.and

•Demonstrating an investment in diversity and inclusion through diverse supplier spend, depositing cash in federally-insured minority depository institutions ("MDIs") and through the Company's charitable giving efforts.

As part of the Company's commitment to deposit cash in MDIs, Valvoline has invested $2.5 million of its cash equivalents as of September 30, 2023 with MDIs.

In connection with the focus on equity, inclusion and belonging, Valvoline supports employee-led networking groups (Employee Resource Groups or “ERGs”), which are open to all employees and include the Women’s, LGBTQ+, African American/Black, and Veteran’s Networks. These ERGs provide a forum to communicate and exchange ideas, build a network of relationships across the Company, and pursue personal and professional development. Each ERG has four purpose pillars which include Engage, Educate, Development, and Impact.

The Company also actively sponsors events that promote diversity and utilizes its DEI Council, a working committee to help steer diversity and inclusion efforts across the business and its operations. In fiscal 2023, Valvoline established the Environmental, Social and Governance (“ESG”) and Equality Council (the “Council”), comprised of senior leaders from the Company and a member of the Valvoline Board of Directors (the “Board”), to support continued progress on ESG initiatives. The Council is overseen by and reports to the Board’s Governance and Nominating Committee and works closely with Valvoline’s employee-driven DEI Council to focus on strengthening Valvoline’s commitment to diversity, equity and inclusion. The Council works to further Valvoline’s efforts to integrate sustainability into the Company’s business operations.

Talent acquisition

Valvoline strives to foster a workplace culture that attracts and retains top, diverse talent at every level. Valvoline's talent acquisition is based on qualifications and experiences of target employees, including "building block" traits and capabilities that support strong development early in an employee's career with the Company. In fiscal 2023, Valvoline invested heavily in the talent acquisition team to ensure the Company has the right skill set to attract and recruit exceptional diverse talent along with supporting technology to increase efficiency in staffing stores. Valvoline utilizes innovative technology and structured processes intended to attract qualified candidates, including engaging job descriptions designed to reach a larger audience, a quick and mobile-friendly application process, online chat features to proactively address applicant questions, and video storytelling that offers a view of Valvoline's culture through the lens of its own employees. These tools have been created to convey what makes Valvoline unique as an employer to better attract diverse and ideal candidates, and these strong branding and sourcing efforts allow Valvoline to select among the very best.

The Company’s focus on aggressive growth, including the addition of 137 net new system-wide stores in fiscal 2023, creates a critical need for talent to operate those stores. Valvoline utilizes its tools and processes to attract qualified candidates, including providing support to franchise sourcing efforts. Franchisees collaborate through periodic sharing of hiring experiences and best practices to ensure company-operated and franchised locations attract and hire the best candidates to deliver consistent and superior service to Valvoline’s customers.

Training and development

The opportunity to develop and advance, regardless of job role or location, is critical to the success of Valvoline. A key component of the Company’s talent development approach is to provide each team member with the necessary tools and training opportunities to develop within their area of subject matter knowledge. The Company follows a three-step process to career development planning, along with several resources designed to aid employees in assessing competencies and designing a development plan specific to their goals.

Across the organization, including within the VIOC and GCOC systems of company-operated and franchised service center stores, employees are provided voluntary and compulsory regulatory, safety, compliance, customer service, and product training opportunities. Training is based on job role and function, delivered via virtual or in-person classes and e-learning. This includes management and leadership programs with approximately 20 hours of live training and development for its new managers. In addition, an internal management system for executing Valvoline's retail services provides a structured and detailed early learning training plan supported by a proprietary digital learning platform. This plan provides new VIOC employees 270 hours of training that is generally completed within the first 60 days of employment leading to their first certification and another 240 hours of training in the next 140 days that supports promotability.

Throughout the year, Valvoline provides an Introduction to Management program within its VIOC stores where assistant managers who qualify as potential store managers meet for three days to interact with leadership team members and peers from other stores to learn about Valvoline's culture, share best practices, and receive management training to prepare them for career advancement. The combination of these efforts enable Valvoline to continue a promote-from-within strategy which has led to a majority of service center managers, area managers, and market manager promotions in the last year being earned by team members who started in hourly positions at VIOC.

Valvoline also offers and has many partnerships to deliver quality development opportunities, including those with leading universities, research organizations and companies. Employees have opportunities to attend seminars and training programs provided by industry trade and professional organizations. Valvoline provides tuition assistance for employees enrolled in higher education programs directed at improving their performance or helping them prepare for a future role within the Company. By engaging team members early, Valvoline provides them with the necessary tools to learn and acquire new skills which increases their value as an employee and, most importantly, affords them the opportunity to advance their careers.

Valvoline has been presented with Training magazine’s Training APEX Award 11 times, which ranks companies that are unsurpassed in harnessing human capital and reflects the winners’ journey to attain peak performance in employee training and development and organizational success. Additionally, the Company is a ten-time recipient of the BEST Award from The Association for Talent Development, that recognizes organizations that are Building talent, Enterprise-wide and Strategically driving a Talent development culture that delivers results.

Total rewards

Taking care of the whole person is a guiding principle of Valvoline’s total rewards philosophy. The Company offers competitive comprehensive compensation and benefits packages designed to care for the physical, emotional, and financial well-being of its employees as well as to attract, retain and recognize its employees and is committed to aligning rewards to performance. By compensating employees fairly and consistently based on their role, location, and performance, Valvoline can ensure that employees are not paid based on factors like gender, race, or ethnicity. The Company’s Compensation Committee of the Board is actively involved in determining competitive compensation strategies to help Valvoline continually improve in attracting, developing and retaining top talent.

The Company provides a wide variety of benefits to eligible full-time and part-time employees. Valvoline’s strategy is to provide competitive benefit programs which align to the changing business environment and meet the needs of employees through all stages of life, which includes:

•Affordable healthcare plans (medical, prescription, dental, vision, maternity, fertility, adoption and telehealth)

•Life, disability, and accident insurance coverage

•Health savings account (HSA) with company contributions

•401(k) retirement savings plans with generous company basic and matching contributions

•Personalized well-being programs (physical, mental and financial) to support taking care of the whole employee and family

•Tuition reimbursement

•Paid time off, plus holiday pay, paid disability, paid maternity and family leave, and other leave programs.

Health and safety

Valvoline is committed to a zero-incident culture for its employees, vendors, and customers. The Company designs, builds and operates its facilities to promote and protect the health and safety of its team members, known as its "Vamily." Valvoline strives to create workplaces and practices in all environments that team members work in to help foster a safe and secure environment for every employee and customer, which includes a sense of belonging that enables them to deliver V-class service to customers. In order to help reduce the number of incidents at the Company, Valvoline employs safety-specific education as part of its training programs. Employees will begin this training on day one to instill safety precautions and best practices. As part of the broader training course, team members are required to successfully complete execution reports confirming a strong understanding of Valvoline safety measures.

In response to the COVID-19 pandemic, the Company implemented additional personal safety measures in all its offices and facilities by offering expanded employee assistance, telehealth services, well-being plans, and a remote/hybrid work policy. The Company continues to follow and communicate guidance provided by national, state and local public and occupational health authorities.

Citizenship

Valvoline’s citizenship efforts support social and educational needs within the communities the Company serves. Throughout the year, Valvoline supports its employees in volunteering their time and talents to give back to their communities. Valvoline employees support the United Way, Red Cross, Children’s Miracle Network, Habitat for Humanity, Big Brothers Big Sisters, and many more national and local organizations.

Valvoline's Charitable Giving Program encourages its team members to support the communities in which they live and in which the Company operates, through hands-on service, focused generosity and the continuous pursuit of innovative and sustainable solutions. A major focus of Valvoline’s charitable giving programs is the annual employee giving campaign where employees are encouraged to donate to the charity of their choice. Valvoline’s matching program will match the donations given to the organizations that align with at least one of the Company’s giving pillars: (1) disadvantaged families and children, (2) education, (3) environment, (4) health care, and/or (5) diversity, equity and inclusion. In fiscal 2023, the Company offered participation within the Valvoline Grant Program which offered non-profits the opportunity to submit proposals for specific needs within their organization. Valvoline’s Charitable Giving Committee awards the grants based on the Company’s giving pillars.

Additionally, Valvoline employees support a program that assists company employees during times of personal hardship by providing short-term financial assistance to eligible service center and corporate employees in immediate financial need because of an accident, illness, injury, death, natural disaster, or other catastrophic or emergency event.

Available information

More information about Valvoline is available on the Company’s website at http://investors.valvoline.com. On this website, Valvoline makes available, free of charge, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports, as well as any beneficial ownership reports of officers and directors filed on Forms 3, 4 and 5. All such reports are available as soon as reasonably practicable after they are electronically filed with, or electronically furnished to, the U.S. Securities and Exchange Commission (the “SEC"). Valvoline also makes available, free of charge on its website, its Amended and Restated Articles of Incorporation, By-Laws, Corporate Governance Guidelines, Board Committee Charters, Director Independence Standards and the Global Standards of Business Conduct that apply to Valvoline’s directors, officers and employees. These documents are also available in print to any shareholder who requests them. The information contained on Valvoline’s website is not part of this Annual Report on Form 10-K and is not incorporated by reference in this document. References to website addresses are provided as inactive textual references only. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and other information and statements regarding issuers, including Valvoline, that file electronically with the SEC.

Executive officers of Valvoline

The following table sets forth information concerning Valvoline's executive officers as of November 15, 2023:

|

|

|

|

|

|

|

|

|

| Name |

Age |

Title |

| Lori A. Flees |

53 |

President and Chief Executive Officer and Director |

| Mary E. Meixelsperger |

63 |

Chief Financial Officer |

| Julie M. O’Daniel |

56 |

Senior Vice President, Chief Legal Officer and Corporate Secretary |

| Jonathan L. Caldwell |

46 |

Senior Vice President and Chief People Officer |

R. Travis Dobbins |

51 |

Senior Vice President and Chief Technology Officer |

| Linne R. Fulcher |

52 |

Senior Vice President and Chief Operating Officer |

| Dione R. Sturgeon |

46 |

Chief Accounting Officer and Controller |

Lori A. Flees has served as a director and President and Chief Executive Officer of Valvoline since October 2023. Ms. Flees served as President, Retail Services of Valvoline from April 2022 to September 2023. Prior to joining Valvoline, Ms. Flees held leadership positions at Walmart Inc., serving as Senior Vice President and Chief Operating Officer of Health & Wellness from August 2020 to March 2022; Senior Vice President and General Merchandising Manager, Sam’s Club Health & Wellness from June 2018 to August 2020; and Senior Vice President, Next Generation Retail and Principal Store No.8 from September 2017 to June 2019.

Mary E. Meixelsperger has served as Valvoline's Chief Financial Officer since June 2016. Prior to joining Valvoline, Ms. Meixelsperger was Senior Vice President and Chief Financial Officer of DSW Inc. from April 2014 to June 2016.

Julie M. O’Daniel has served as Senior Vice President, Chief Legal Officer and Corporate Secretary of Valvoline since January 2017. Ms. O’Daniel served as General Counsel and Corporate Secretary of Valvoline from September 2016 to January 2017 and as Lead Commercial Counsel of Valvoline from April 2014 to September 2016.

Jonathan L. Caldwell has served as Valvoline's Senior Vice President and Chief People Officer since April 2020. Mr. Caldwell served as Senior Director, Human Resources of Valvoline from March 2018 to April 2020 and as Senior Director, Global Talent Management of Valvoline from October 2016 to March 2018.