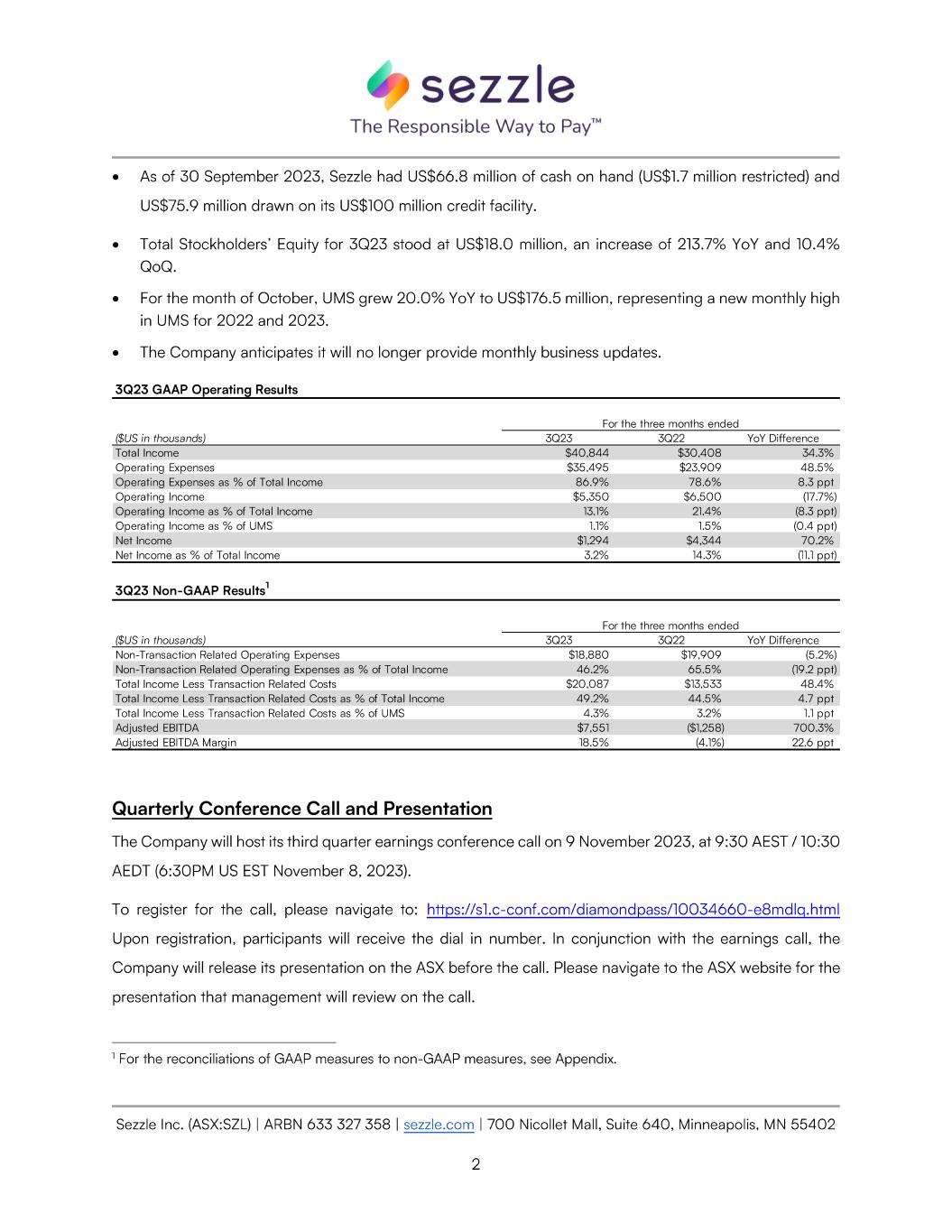

• • •

• • • •

•

• • • • •

• • • • • • • •

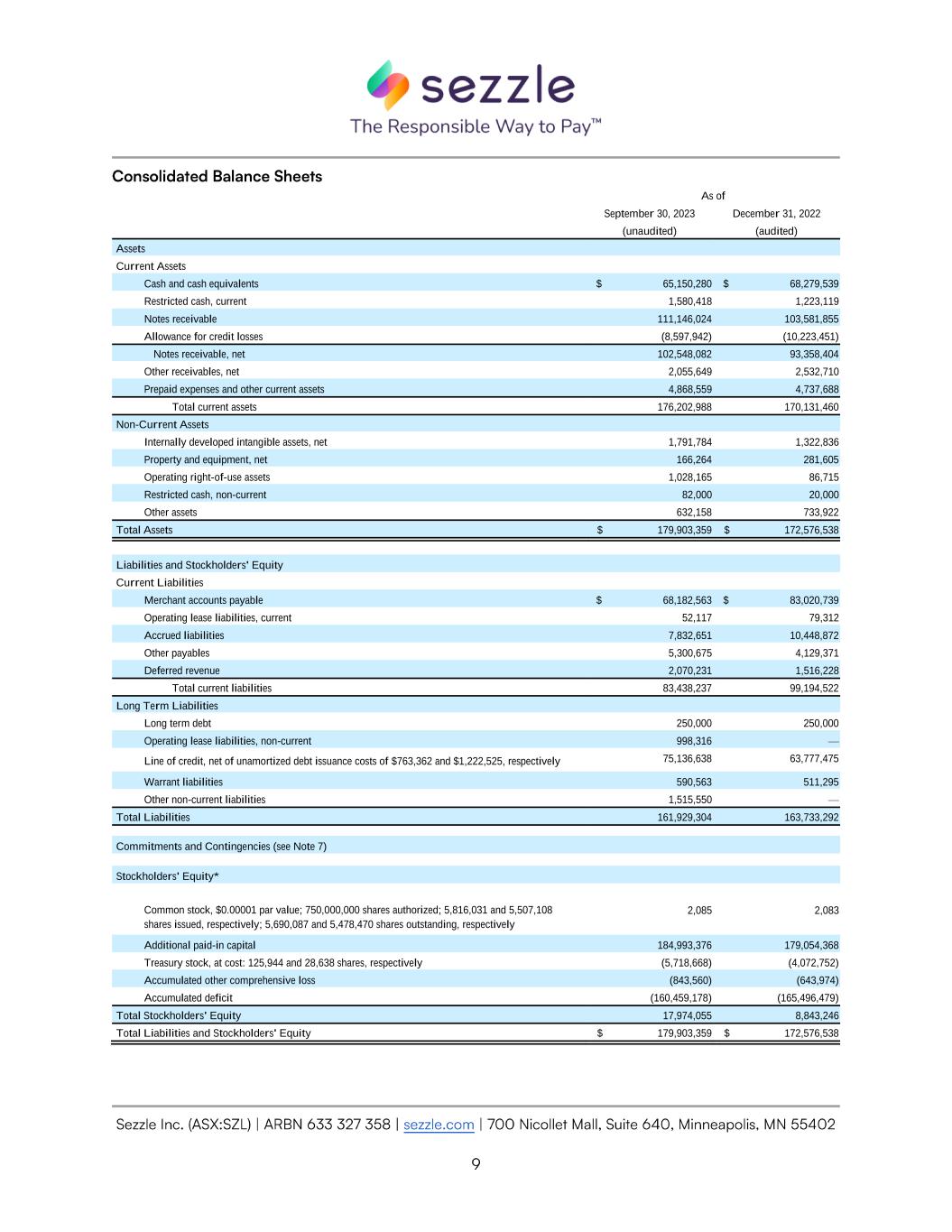

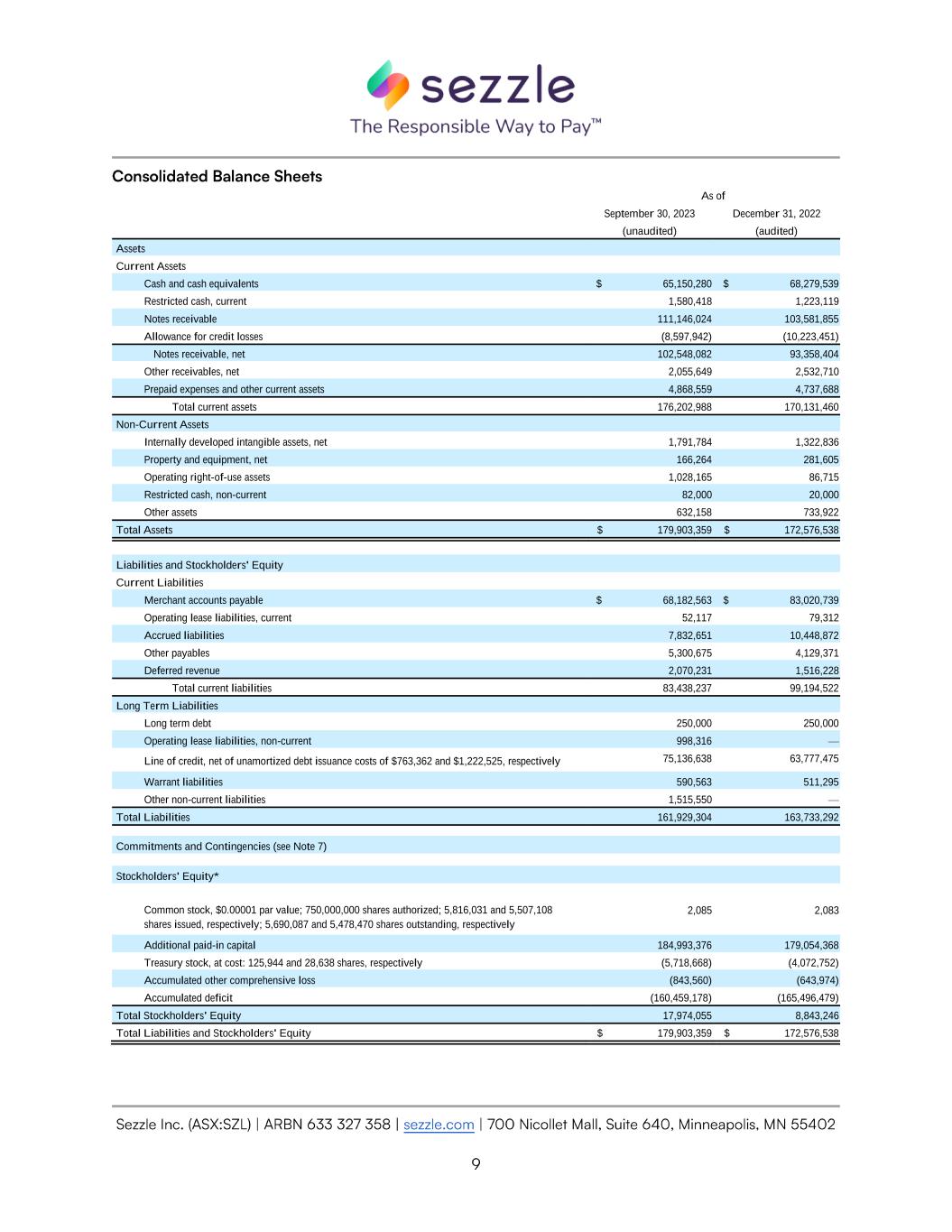

As of September 30, 2023 December 31, 2022 (unaudited) (audited) Assets Current Assets Cash and cash equivalents $ 65,150,280 $ 68,279,539 Restricted cash, current 1,580,418 1,223,119 Notes receivable 111,146,024 103,581,855 Allowance for credit losses (8,597,942) (10,223,451) Notes receivable, net 102,548,082 93,358,404 Other receivables, net 2,055,649 2,532,710 Prepaid expenses and other current assets 4,868,559 4,737,688 Total current assets 176,202,988 170,131,460 Non-Current Assets Internally developed intangible assets, net 1,791,784 1,322,836 Property and equipment, net 166,264 281,605 Operating right-of-use assets 1,028,165 86,715 Restricted cash, non-current 82,000 20,000 Other assets 632,158 733,922 Total Assets $ 179,903,359 $ 172,576,538 Liabilities and Stockholders' Equity Current Liabilities Merchant accounts payable $ 68,182,563 $ 83,020,739 Operating lease liabilities, current 52,117 79,312 Accrued liabilities 7,832,651 10,448,872 Other payables 5,300,675 4,129,371 Deferred revenue 2,070,231 1,516,228 Total current liabilities 83,438,237 99,194,522 Long Term Liabilities Long term debt 250,000 250,000 Operating lease liabilities, non-current 998,316 — Line of credit, net of unamortized debt issuance costs of $763,362 and $1,222,525, respectively 75,136,638 63,777,475 Warrant liabilities 590,563 511,295 Other non-current liabilities 1,515,550 — Total Liabilities 161,929,304 163,733,292 Commitments and Contingencies (see Note 7) Stockholders' Equity* Common stock, $0.00001 par value; 750,000,000 shares authorized; 5,816,031 and 5,507,108 shares issued, respectively; 5,690,087 and 5,478,470 shares outstanding, respectively 2,085 2,083 Additional paid-in capital 184,993,376 179,054,368 Treasury stock, at cost: 125,944 and 28,638 shares, respectively (5,718,668) (4,072,752) Accumulated other comprehensive loss (843,560) (643,974) Accumulated deficit (160,459,178) (165,496,479) Total Stockholders' Equity 17,974,055 8,843,246 Total Liabilities and Stockholders' Equity $ 179,903,359 $ 172,576,538

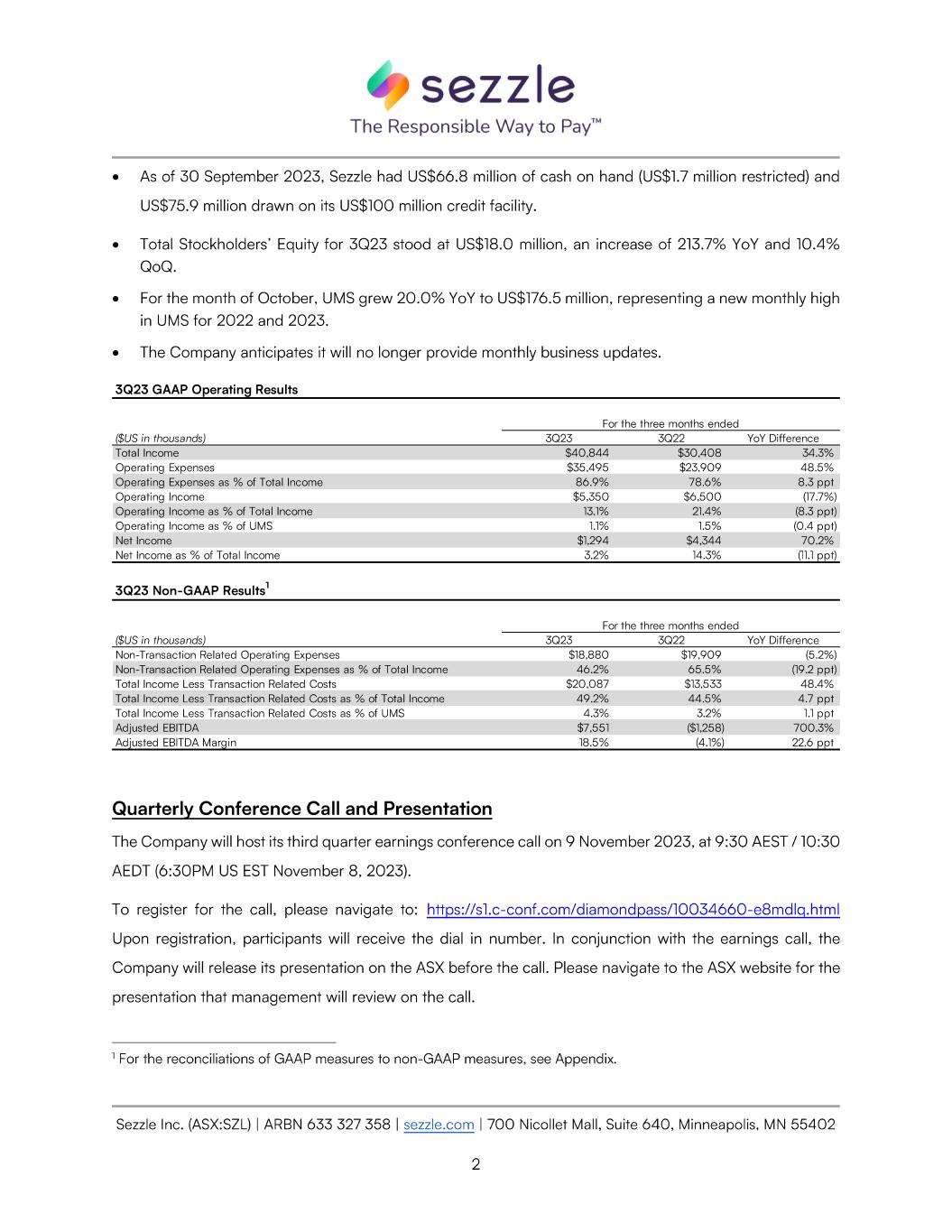

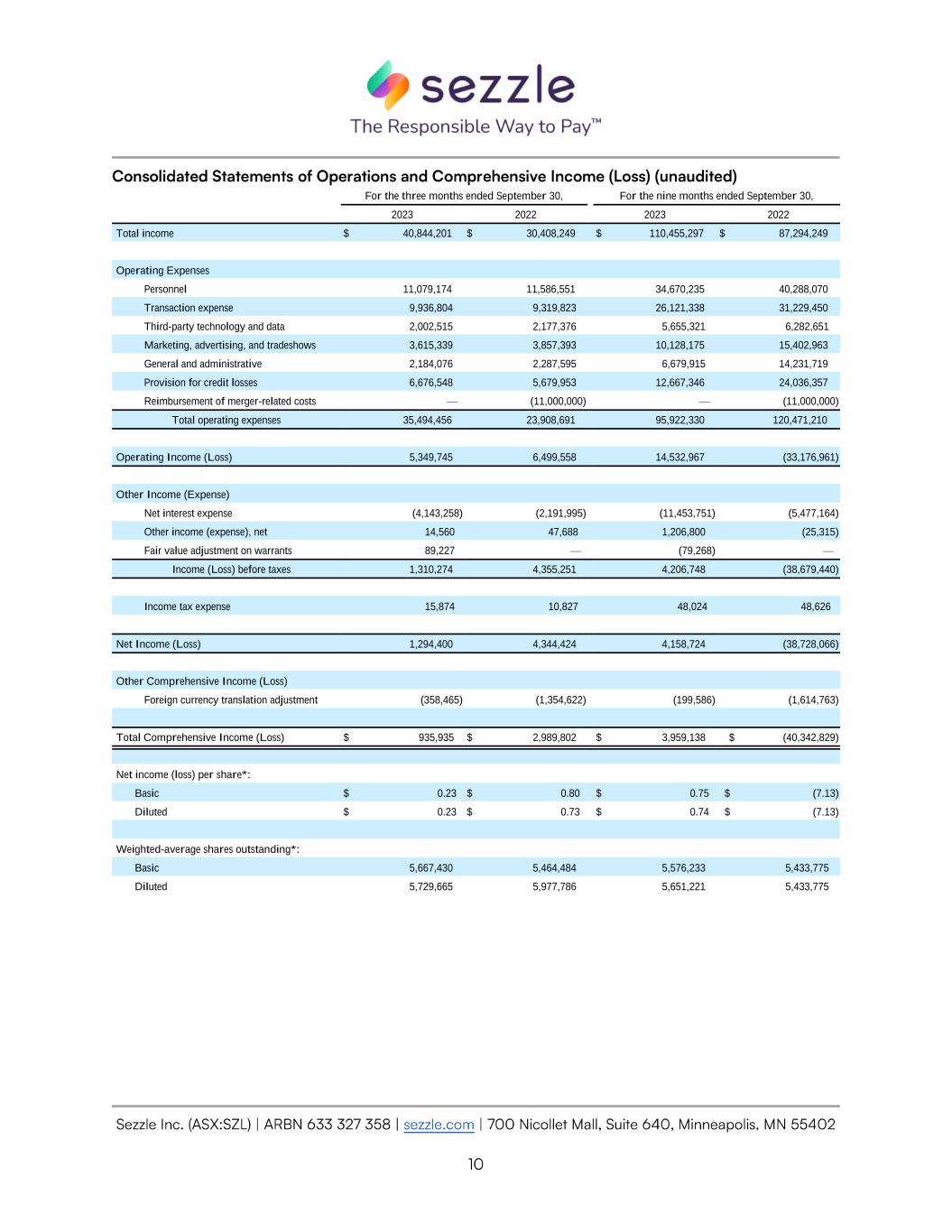

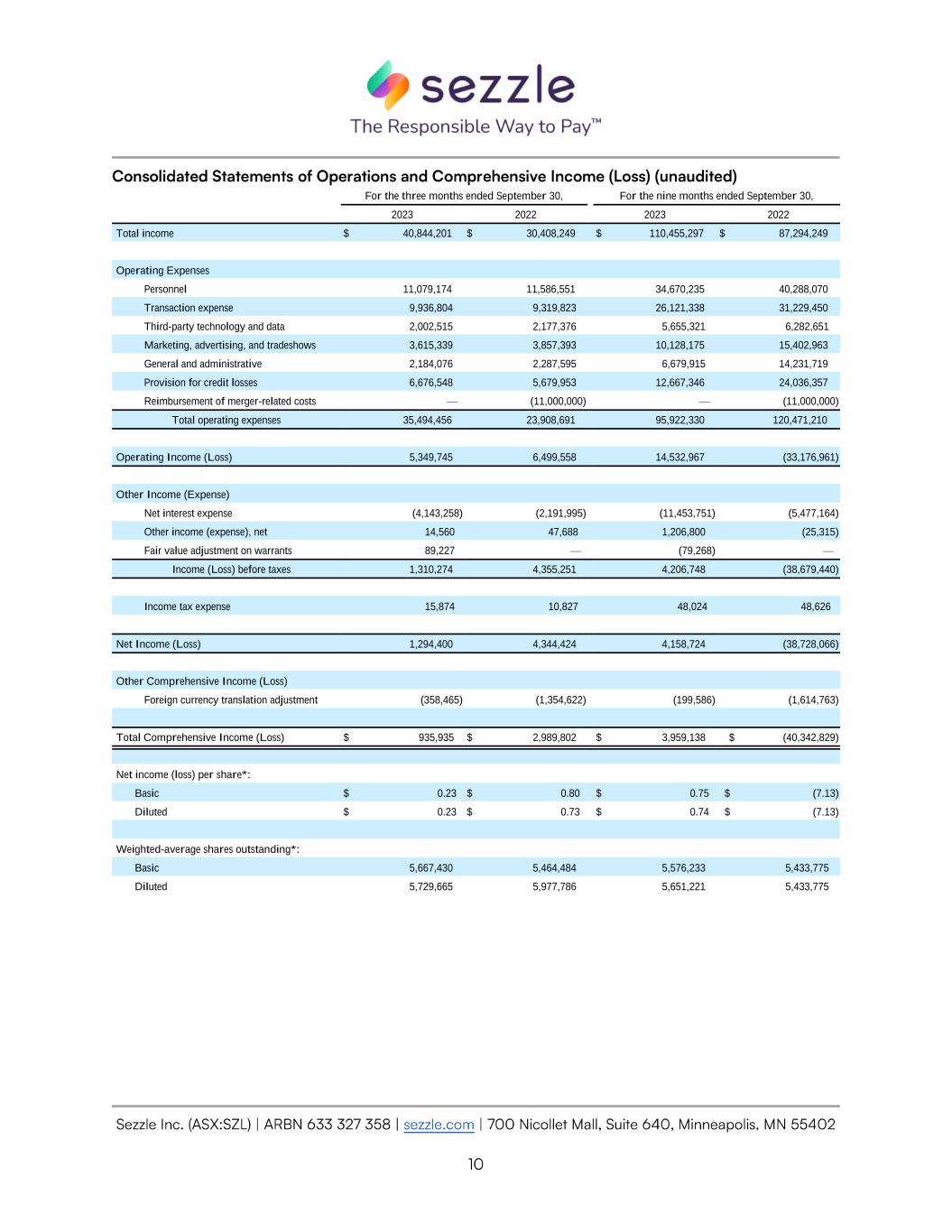

For the three months ended September 30, For the nine months ended September 30, 2023 2022 2023 2022 Total income $ 40,844,201 $ 30,408,249 $ 110,455,297 $ 87,294,249 Operating Expenses Personnel 11,079,174 11,586,551 34,670,235 40,288,070 Transaction expense 9,936,804 9,319,823 26,121,338 31,229,450 Third-party technology and data 2,002,515 2,177,376 5,655,321 6,282,651 Marketing, advertising, and tradeshows 3,615,339 3,857,393 10,128,175 15,402,963 General and administrative 2,184,076 2,287,595 6,679,915 14,231,719 Provision for credit losses 6,676,548 5,679,953 12,667,346 24,036,357 Reimbursement of merger-related costs — (11,000,000) — (11,000,000) Total operating expenses 35,494,456 23,908,691 95,922,330 120,471,210 Operating Income (Loss) 5,349,745 6,499,558 14,532,967 (33,176,961) Other Income (Expense) Net interest expense (4,143,258) (2,191,995) (11,453,751) (5,477,164) Other income (expense), net 14,560 47,688 1,206,800 (25,315) Fair value adjustment on warrants 89,227 — (79,268) — Income (Loss) before taxes 1,310,274 4,355,251 4,206,748 (38,679,440) Income tax expense 15,874 10,827 48,024 48,626 Net Income (Loss) 1,294,400 4,344,424 4,158,724 (38,728,066) Other Comprehensive Income (Loss) Foreign currency translation adjustment (358,465) (1,354,622) (199,586) (1,614,763) Total Comprehensive Income (Loss) $ 935,935 $ 2,989,802 $ 3,959,138 $ (40,342,829) Net income (loss) per share*: Basic $ 0.23 $ 0.80 $ 0.75 $ (7.13) Diluted $ 0.23 $ 0.73 $ 0.74 $ (7.13) Weighted-average shares outstanding*: Basic 5,667,430 5,464,484 5,576,233 5,433,775 Diluted 5,729,665 5,977,786 5,651,221 5,433,775

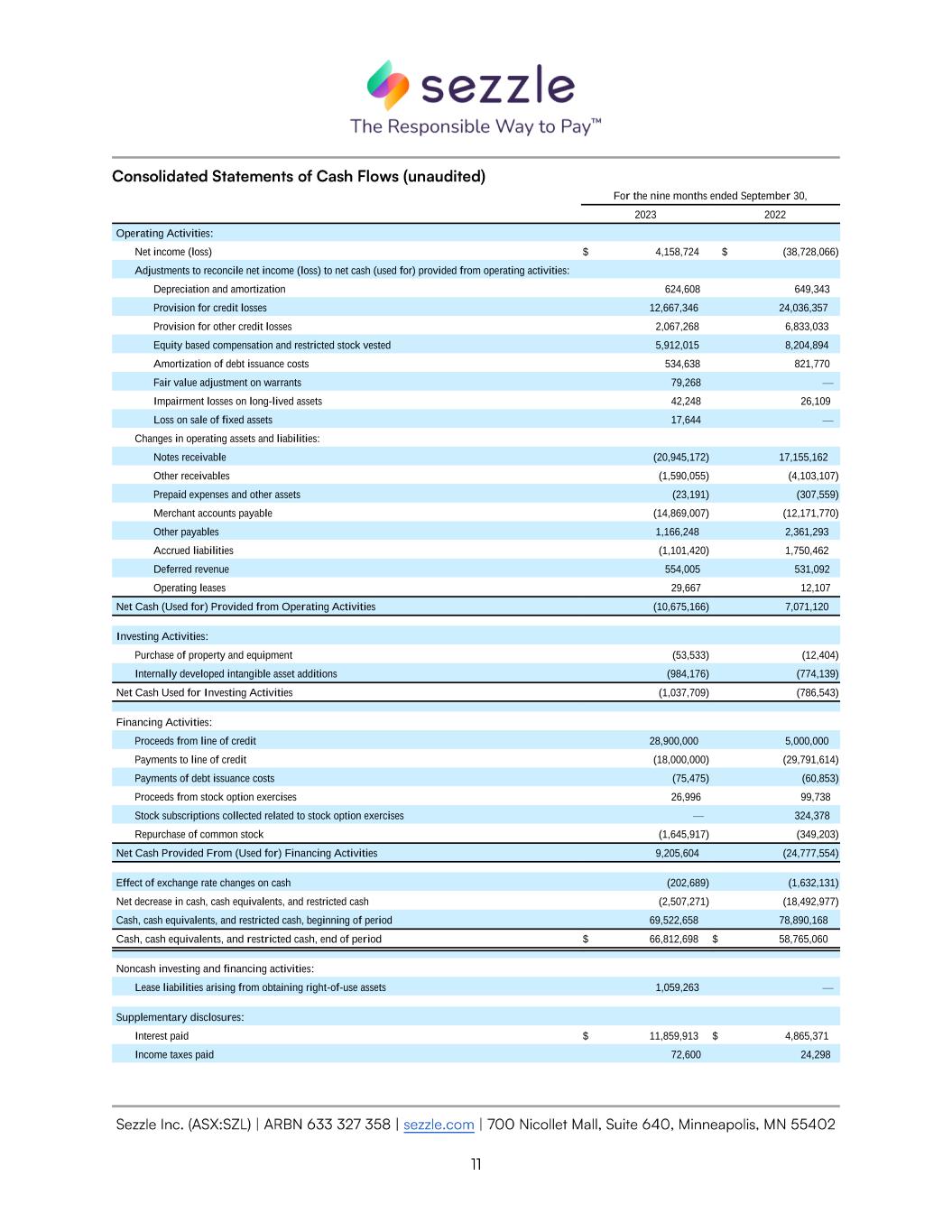

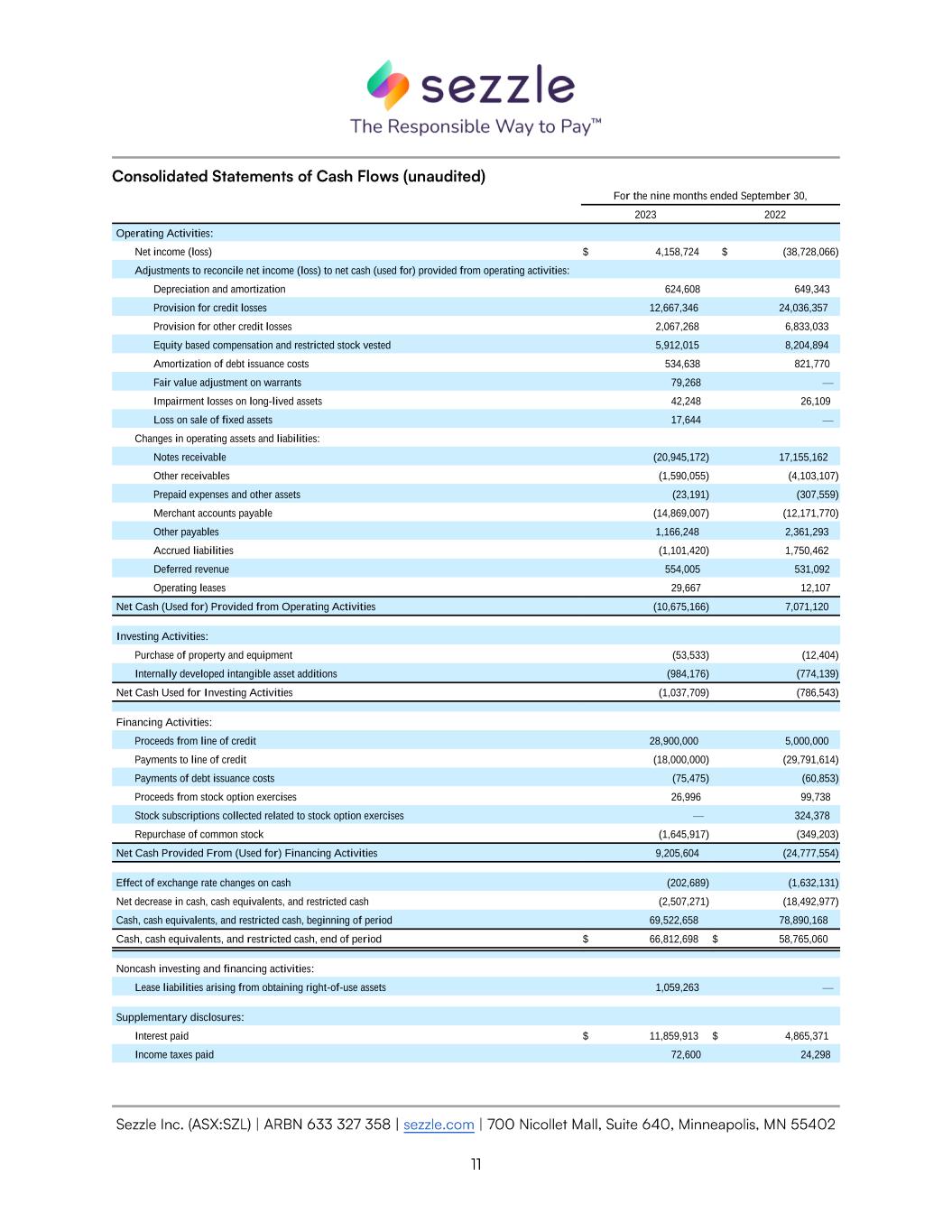

For the nine months ended September 30, 2023 2022 Operating Activities: Net income (loss) $ 4,158,724 $ (38,728,066) Adjustments to reconcile net income (loss) to net cash (used for) provided from operating activities: Depreciation and amortization 624,608 649,343 Provision for credit losses 12,667,346 24,036,357 Provision for other credit losses 2,067,268 6,833,033 Equity based compensation and restricted stock vested 5,912,015 8,204,894 Amortization of debt issuance costs 534,638 821,770 Fair value adjustment on warrants 79,268 — Impairment losses on long-lived assets 42,248 26,109 Loss on sale of fixed assets 17,644 — Changes in operating assets and liabilities: Notes receivable (20,945,172) 17,155,162 Other receivables (1,590,055) (4,103,107) Prepaid expenses and other assets (23,191) (307,559) Merchant accounts payable (14,869,007) (12,171,770) Other payables 1,166,248 2,361,293 Accrued liabilities (1,101,420) 1,750,462 Deferred revenue 554,005 531,092 Operating leases 29,667 12,107 Net Cash (Used for) Provided from Operating Activities (10,675,166) 7,071,120 Investing Activities: Purchase of property and equipment (53,533) (12,404) Internally developed intangible asset additions (984,176) (774,139) Net Cash Used for Investing Activities (1,037,709) (786,543) Financing Activities: Proceeds from line of credit 28,900,000 5,000,000 Payments to line of credit (18,000,000) (29,791,614) Payments of debt issuance costs (75,475) (60,853) Proceeds from stock option exercises 26,996 99,738 Stock subscriptions collected related to stock option exercises — 324,378 Repurchase of common stock (1,645,917) (349,203) Net Cash Provided From (Used for) Financing Activities 9,205,604 (24,777,554) Effect of exchange rate changes on cash (202,689) (1,632,131) Net decrease in cash, cash equivalents, and restricted cash (2,507,271) (18,492,977) Cash, cash equivalents, and restricted cash, beginning of period 69,522,658 78,890,168 Cash, cash equivalents, and restricted cash, end of period $ 66,812,698 $ 58,765,060 Noncash investing and financing activities: Lease liabilities arising from obtaining right-of-use assets 1,059,263 — Supplementary disclosures: Interest paid $ 11,859,913 $ 4,865,371 Income taxes paid 72,600 24,298