Document

Notice of Annual General Meeting and Information Circular

With respect to the Annual General Meeting of Shareholders to be held on June 12, 2024

Dated as of April 18, 2024

SILVERCREST METALS INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on June 12, 2024

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the “Meeting”) of shareholders of SilverCrest Metals Inc. (the “Company”) will be held at 10:00 a.m. (Vancouver time) at Suite 501, 570 Granville Street, Vancouver, British Columbia on Wednesday, June 12, 2024 for the following purposes:

1.to receive the consolidated financial statements of the Company for the financial year ended December 31, 2023 and the report of the auditor on those statements;

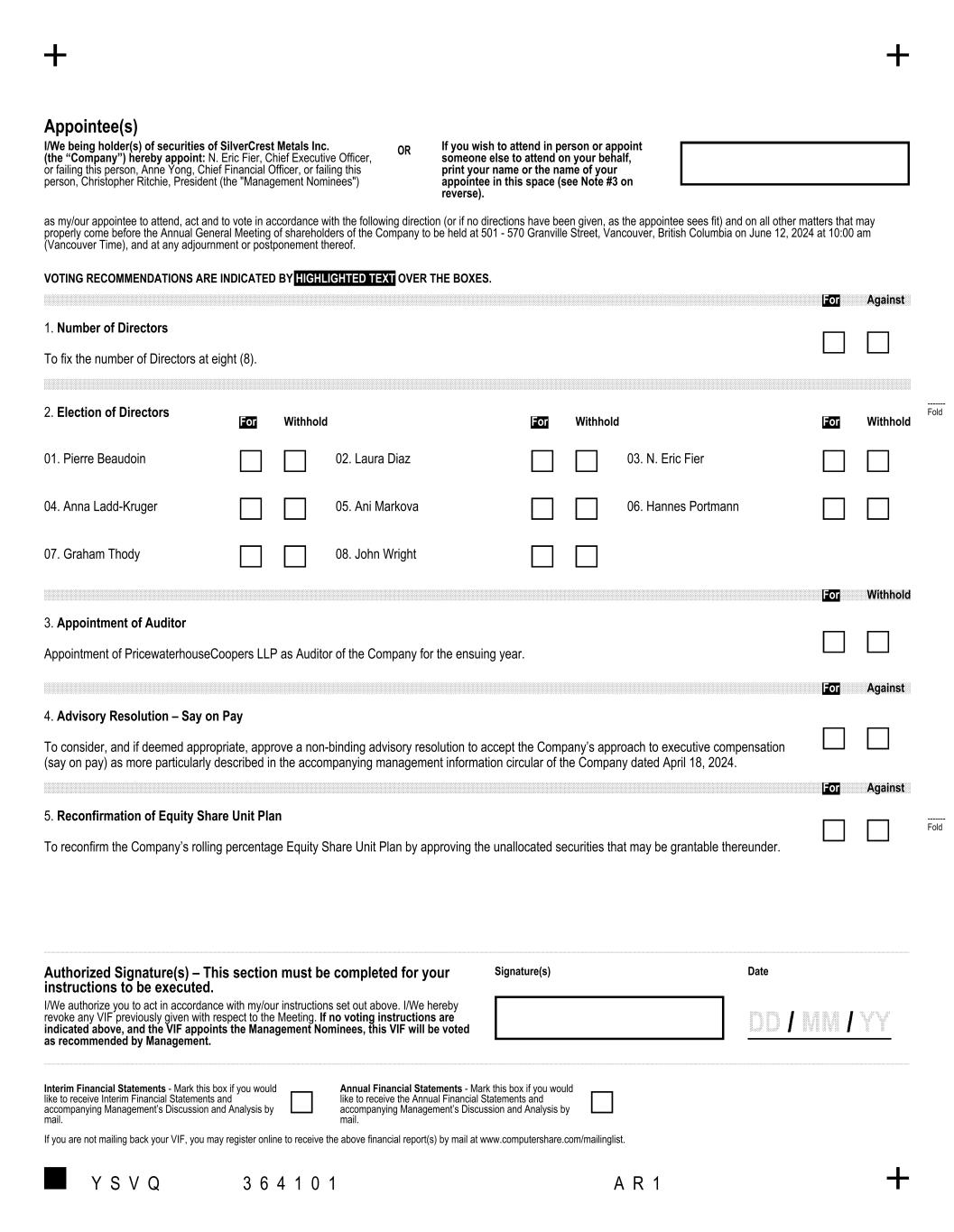

2.to fix the number of directors at eight (8) and to elect eight (8) directors of the Company to hold office until the close of the next annual general meeting;

3.to appoint an auditor of the Company to serve until the close of the next annual general meeting;

4.to consider, and if deemed appropriate, approve a non-binding advisory resolution to accept the Company’s approach to executive compensation (say on pay) as more particularly described in the management information circular in connection with the Meeting;

5.to reconfirm the Company’s rolling percentage Equity Share Unit Plan by approving the unallocated securities that may be grantable thereunder; and

6.to transact such other business as may properly come before the Meeting or any adjournments thereof.

All matters set forth above for consideration at the Meeting are more particularly described in the accompanying Information Circular.

The Company is using the notice and access provisions (“Notice and Access”) under the Canadian Securities Administrators’ National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer for the delivery of its Information Circular to its shareholders for the Meeting. Under Notice and Access, instead of receiving paper copies of the Information Circular, shareholders will be receiving a Notice and Access notification with information on how they may obtain a copy of the Information Circular electronically or request a paper copy. Registered shareholders will still receive a Proxy form enabling them to vote at the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company’s printing and mailing costs. The Company will arrange to mail paper copies of the Information Circular to those registered shareholders who have existing instructions on their account to receive paper copies of the Company’s meeting materials.

The Information Circular and other Meeting materials will be available on the Company’s website at http://www.silvercrestmetals.com/investors/agm/ as of May 1, 2024 and will remain on the website for one full year thereafter. Meeting materials are also available upon request, without charge, by email at info@silvercrestmetals.com or by calling toll free at 1-866-691-1730 (Canada and U.S.A.) or at +1-604-694-1730, or can be accessed online on SEDAR+ at www.sedarplus.ca, as of May 1, 2024.

Only shareholders of record at the close of business on April 18, 2024 will be entitled to receive notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders who are unable to or who do not wish to attend the Meeting in person are requested to date and sign the enclosed Proxy form promptly and return it in the self-addressed envelope enclosed for that purpose or by any of the other methods indicated in the Proxy form. To be used at the Meeting, proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 10:00 a.m. (Vancouver time) on June 12, 2024 or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened. Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy from. If a registered shareholder receives more than one Proxy form because such shareholder owns shares registered in different names or addresses, each Proxy form should be completed and returned.

Dated as of the 18th day of April, 2024.

BY ORDER OF THE BOARD

“N. Eric Fier”

N. ERIC FIER, CHIEF EXECUTIVE OFFICER

|

|

|

|

|

|

| SILVERCREST METALS INC. |

2 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

SILVERCREST METALS INC.

ANNUAL GENERAL MEETING OF SHAREHOLDERS

INFORMATION CIRCULAR

GENERAL INFORMATION

This management information circular (“Information Circular”) is furnished to the holders (“shareholders”) of common shares (“Common Shares”) of SilverCrest Metals Inc. (the “Company”) by management of the Company in connection with the solicitation of proxies to be voted at the annual general meeting (the “Meeting”) of the shareholders to be held at the Company’s Head Office located at Suite 501, 570 Granville Street, Vancouver, British Columbia on Thursday, June 12, 2024, at 10:00 a.m. (Vancouver time) and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting. The purposes are:

1.to receive the consolidated financial statements of the Company for the financial year ended December 31, 2023 and the report of the auditor on those statements;

2.to fix the number of directors at eight (8) and to elect eight (8) directors of the Company to hold office until the close of the next annual general meeting;

3.to appoint an auditor of the Company to serve until the close of the next annual general meeting;

4.to consider, and if deemed appropriate, approve a non-binding advisory resolution to accept the Company’s approach to executive compensation (say on pay) as more particularly described in the Information Circular in connection with the Meeting;

5.to reconfirm the Company’s rolling percentage Equity Share Unit Plan by approving the unallocated securities that may be grantable thereunder (being up to 1.5% of the issued and outstanding Common Shares of the Company at any time and from time to time); and

6.to transact such other business as may properly come before the Meeting or any adjournments thereof.

Except as otherwise indicated, the information contained in this Information Circular is stated as of April 18, 2024. All dollar amounts referenced herein, unless otherwise indicated, are expressed in Canadian dollars.

PROXIES

Solicitation of Proxies

The enclosed Proxy form is solicited by and on behalf of management of the Company. The persons named in the enclosed Proxy form are management-designated proxyholders. A registered shareholder desiring to appoint some other person (who need not be a shareholder) to represent the shareholder at the Meeting may do so either by inserting such other person’s name in the blank space provided in the Proxy form or by completing another form of proxy. To be used at the Meeting, proxies must be received by Computershare Investor Services Inc. (“Computershare”), Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 10:00 a.m. (Vancouver time) on June 12, 2024, or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened. Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy from. Solicitation will be primarily by mail, but some proxies may be solicited personally or by telephone by regular employees or directors of the Company at a nominal cost. The cost of solicitation by management of the Company will be borne by the Company.

Notice and Access Process

The Company has decided to take advantage of the notice-and-access provisions (“Notice and Access”) under the Canadian Securities Administrators’ National Instrument 54‑101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54‑101”) for the delivery of the Information Circular to its shareholders for the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company’s printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Information Circular, shareholders receive a notice (“Notice and Access Notification”) with information on the Meeting date, location and purpose, as well as information on how they may access the Information Circular electronically or request a paper copy. The Company will arrange to mail paper copies of the Information Circular to those registered and beneficial shareholders who have existing instructions on their account to receive paper copies of the Company’s proxy related materials.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

3 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

Non-Registered Holders

Only registered holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

a.in the name of an Intermediary (an “Intermediary”) with which the Non-Registered Holder deals in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or

b.in the name of a clearing agency (such as The Canadian Depository for Securities Limited (CDS)) of which the Intermediary is a participant.

Non-Registered Holders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are referred to as “NOBOs”. Those Non-Registered Holders who have objected to their Intermediary disclosing ownership information about themselves to the Company are referred to as “OBOs”.

In accordance with the requirements of NI 54-101, the Company has elected to send the Notice and Access Notification in connection with the Meeting directly to the NOBOs and indirectly through Intermediaries to the OBOs.

The Intermediaries (or their service companies) are responsible for forwarding the Notice and Access Notification to each OBO, unless the OBO has waived the right to receive proxy-related materials from the Company. Intermediaries will frequently use service companies to forward proxy-related materials to the OBOs. Generally, an OBO who has not waived the right to receive proxy-related materials will either:

a.be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the OBO and must be completed, but not signed, by the OBO and deposited with Computershare; or

b.more typically, be given a voting instruction form (“VIF”) which is not signed by the Intermediary, and which, when properly completed and signed by the OBO and returned to the Intermediary or its service company, will constitute voting instructions which the Intermediary must follow.

The Company will not be paying for Intermediaries to deliver to OBOs (who have not otherwise waived their right to receive proxy-related materials) copies of proxy-related materials and related documents (including the Notice and Access Notification). Accordingly, an OBO will not receive copies of proxy-related materials and related documents unless the OBO’s Intermediary assumes the costs of delivery.

Applicable proxy-related materials are being sent to both registered shareholders of the Company and Non-Registered Holders. If you are a Non-Registered Holder, and the Company or its agent has sent the applicable proxy-related materials to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf. By choosing to send these materials to you directly, the Company (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

The Notice and Access Notification and any proxy-related materials sent to NOBOs who have not waived the right to receive proxy-related materials are accompanied by a VIF, instead of a proxy form. By returning the VIF in accordance with the instructions noted on it, a NOBO is able to instruct the voting of the Common Shares owned by the NOBO.

VIFs, whether provided by the Company or by an Intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF. The purpose of this procedure is to permit Non-Registered Holders to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder who receives a VIF wish to attend the Meeting or have someone else attend on the Non-Registered Holder’s behalf, the Non-Registered Holder may request a legal proxy as set forth in the VIF, which will grant the Non-Registered Holder, or the Non-Registered Holder’s nominee, the right to attend and vote at the Meeting.

Non-Registered Holders should return their voting instructions as specified in the VIF sent to them. Non-Registered Holders should carefully follow the instructions set out in the VIF, including those regarding when and where the VIF is to be delivered.

Although Non-Registered Holders may not be recognized directly at the Meeting for the purpose of voting Common Shares registered in the name of their broker, agent or nominee, a Non-Registered Holder may attend the Meeting as a proxyholder for a registered shareholder and vote Common Shares in that capacity. Non-Registered Holders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered shareholder should contact their broker, agent or nominee well in advance of the Meeting to determine the steps necessary to permit them to indirectly vote their Common Shares as a proxyholder.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

4 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

Revocability of Proxies

A registered shareholder who has given a Proxy may revoke it by an instrument in writing that is:

a.executed by the shareholder giving same or by the shareholder’s attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation; and

b.delivered either to the registered office of the Company (19th Floor, 885 West Georgia Street, Vancouver, British Columbia V6C 3H4) at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, or to the chair of the Meeting on the day of the Meeting or any adjournment thereof before any vote in respect of which the Proxy is to be used shall have been taken, or in any other manner provided by law.

NOBOs who wish to revoke their voting instructions should contact Computershare at telephone number 1‑800‑564‑6253. OBOs who wish to revoke a voting instruction form or a waiver of the right to receive proxy-related materials should contact their Intermediaries for instruction.

Voting of Proxies

Common Shares represented by a shareholder’s Proxy form will be voted or withheld from voting in accordance with the shareholder’s instructions on any ballot that may be called for at the Meeting and, if the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of any instructions, the management-designated proxyholder named on the Proxy form will cast the shareholder’s votes in favour of the passage of the resolutions set forth herein and in the Notice of Meeting.

The enclosed Proxy form confers discretionary authority upon the persons named therein with respect to: (a) amendments or variations to matters identified in the Notice of Meeting; and (b) other matters which may properly come before the Meeting or any adjournment thereof. At the time of printing of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

Only Common Shares carry voting rights at the Meeting, with each Common Share carrying the right to one vote. The board of directors of the Company (“Board of Directors” or “Board”) has fixed April 18, 2024, as the record date (“Record Date”) for the determination of shareholders entitled to receive notice of and to vote at the Meeting and at any adjournment thereof, and only shareholders of record at the close of business on that date are entitled to such notice and to vote at the Meeting. As of the Record Date, 147,260,572 Common Shares were issued and outstanding as fully paid and non-assessable.

To the knowledge of the directors and executive officers of the Company, as at the Record Date, no person beneficially owned, or controlled or directed, directly or indirectly, shares carrying 10% or more of the voting rights attached to the Company’s issued and outstanding Common Shares.

VOTES NECESSARY TO PASS RESOLUTIONS AT THE MEETING

Under the Company’s Articles, the quorum for the transaction of business at the Meeting consists of two shareholders entitled to vote at the Meeting, whether present in person or represented by proxy, holding in the aggregate at least 5% of the issued shares entitled to be voted at the meeting. Under the Business Corporations Act (British Columbia) and the Company’s Articles, a simple majority of the votes cast at the Meeting (in person or by proxy) is required to pass the resolutions referred to in the accompanying Notice of Meeting.

DETAILS OF MATTERS TO BE ACTED UPON AT THE MEETING

Financial Statements

The shareholders will receive and consider the audited consolidated financial statements of the Company for the year ended December 31, 2023, together with the auditors’ report thereon. No vote by the Company’s shareholders is required with respect to this matter. These documents are available upon request, or they can be found under the Company’s SEDAR+ profile on www.sedarplus.ca or on the Company’s website at www.silvercrestmetals.com.

Election of Directors

The number of directors of the Company was last fixed by the shareholders at seven. As permitted by the Articles of the Company, the Board appointed Pierre Beaudoin as an additional director on February 1, 2024 and, accordingly, the Company currently has eight directors. At the Meeting, shareholders will be asked to fix the number of directors at eight and elect eight directors.

The persons named below are the eight nominees of management for election as directors, all of whom are current directors of the Company. Each nominee elected will hold office as a director until the next annual general meeting or until the director’s

|

|

|

|

|

|

| SILVERCREST METALS INC. |

5 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

successor is elected or appointed, unless the director’s office is earlier vacated under any of the relevant provisions of the Articles of the Company or the Business Corporations Act (British Columbia). It is the intention of the persons named by management as proxyholders in the enclosed proxy form to vote for the election to the Board of Directors of those persons hereinafter designated as nominees for election as directors. The Board of Directors does not contemplate that any of such nominees will be unable to serve as a director; however, if for any reason any of the proposed nominees do not stand for election or are unable to serve as such, proxies in favour of management designees will be voted for another nominee in their discretion unless the shareholder has specified in the shareholder’s proxy form that the shareholder’s shares are to be withheld from voting in the election of directors.

The following tables set out the name of each of the persons proposed to be nominated for election as a director (listed in alphabetical order); all positions and offices in the Company presently held by them; their principal occupation, business or employment; the period during which they each served as a director; and the number and value of securities of the Company that they each have advised are beneficially owned, or controlled or directed, directly or indirectly, as at the Record Date and as at the last two financial year ends.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

6 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| PIERRE BEAUDOIN |

|

Age: 60

Gender Identity: Male

Visible Minority: No

Ontario, Canada

Non-Independent Director Since: February 1, 2024

Principal Occupation: Corporate Director

|

Mr. Beaudoin joined the SilverCrest board in June 2018 and subsequently became the Chief Operating Officer in November 2018. During his five years in the role he successfully lead the technical studies, build and ramp-up of the Las Chispas Operation. He retired from this role in early 2024 and rejoined the SilverCrest board.

Prior to SilverCrest he joined Detour Gold in 2010 as Senior Vice President of Capital Projects and led the design and construction of the Detour Lake Mine. In 2013, he was appointed Chief Operating Officer of Detour Gold where he retired in 2017. Prior, Mr. Beaudoin spent the previous 16 years with Barrick Gold. During his last 6 years with Barrick, he worked in the Capital Projects Group, where he led the study teams for Buzwagi in Tanzania (commissioned in 2009), Donlin Creek in Alaska and Cerro Casale in Chile. From 1996 to 2004, Mr. Beaudoin held management positions at the processing plants of Barrick operations in Canada (Ontario and Quebec) and in Western Australia (KCGM). Before he joined Barrick Gold, he worked for Lac Minerals Ltd. and Noranda Minerals.

|

|

Areas of Expertise: Mining Operations / Metallurgy, Environmental, Safety and Sustainability, Social, Risk Management, Human Resources and Compensation

Mr. Beaudoin is a mineral processing professional with 40 years of international operating and project development experience.

|

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership(1) |

2023 Attendance |

| Board |

N/A |

N/A |

Safety Environmental and Social Sustainability Committee (“SESS Committee”) |

N/A |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

N/A |

N/A |

| 2022 |

N/A |

N/A |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Radisson Mining Resources Inc. (since September 2021)

•Health, Safety, Environment and Community Committee

|

TSX-V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

RSUs |

PSUs |

Total Value of Common Shares, DSUs, RSUs and PSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

115,950 |

353,500 |

16,500 |

13,000 |

15,000 |

$1,668,680 |

Yes |

| December 31, 2023 |

240,950 |

403,500 |

— |

21,000 |

37,500 |

$2,602,221 |

Yes |

| December 31, 2022 |

283,950 |

503,500 |

— |

21,000 |

50,000 |

$2,875,095 |

Yes |

(1)Mr. Beaudoin was appointed to the Board and the SESS Committee on February 1, 2024.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

7 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| LAURA DIAZ |

|

|

Age: 56

Gender Identity: Female

Visible Minority: Yes

Mexico City, Mexico

Independent Director Since: November 11, 2020

Principal Occupation: Partner of DBR Abogados SC, a law firm in Mexico, since July 2020

|

Ms. Diaz has worked in the mining industry for over 25 years as Legal Counsel or independent director to Canadian and U.S. public mining companies. Ms. Diaz more recently held the position of General Director of Mines with the Ministry of Economy in Mexico from December 2018 to June 2019. After leaving this position, Ms. Diaz was self-employed and then returned in July 2020 to the practice of law as a partner of DBR Abogados SC (law firm based in Mexico) where she had been a partner from July 2012 to November 2018.

Ms. Diaz is an active member of the Association of Mining Engineers, Metallurgists and Geologists of Mexico (AIMMGM), Women in Mining (WIM) Mexico, and Prospector & Developers Association of Canada (PDAC), Canada. She also holds a Master’s in Social Responsibility and Diploma in Sustainable Law from the University of Anahuac, Law Degree from University of Femenina de Mexico, and Diploma in Contracts, Diploma in American Law and European Union Law from the University of Iberoamericana.

|

|

Areas of Expertise: Regulatory, Legal, Environmental, and Social Governance (ESG).

Ms. Diaz is a partner at a law firm based in Mexico City and serves as a Mining Project Advisor in areas of mineral exploration, development and production.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

2023 Attendance |

| Board |

7 of 7 |

100% |

Corporate Governance & Nominating Committee Chair(1) |

3 of 3 |

100% |

SESS Committee |

4 of 4 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

97.09% |

2.91% |

| 2022 |

99.58% |

0.42% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

| No other public company directorships |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

NIL |

25,000 |

56,000 |

$582,400 |

Yes |

| December 31, 2023 |

NIL |

25,000 |

39,500 |

$343,255 |

Yes |

| December 31, 2022 |

NIL |

25,000 |

39,500 |

$319,950 |

Yes |

(1)Ms. Diaz was appointed to Chair of the Corporate Governance & Nominating Committee Chair on June 15, 2023.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

8 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| N. ERIC FIER |

|

|

Age: 62

Gender Identity: Male

Visible Minority: No

British Columbia, Canada

Non-independent

Director Since: June 23, 2015

Principal Occupation: Founder, Chief Executive Officer and Director of the Company

|

Mr. Fier is a Certified Professional Geologist (USA) and Engineer (Canada) with over 35 years of experience in the international mining industry including exploration, acquisition, development and production of numerous mining projects in Guyana, Chile, Brazil, Central America, Mexico and Peru. He has in-depth knowledge of project evaluation and management, reserve estimation and economic analysis, construction, as well as operations management.

Mr. Fier previously worked as Chief Geologist with Pegasus Gold Corp., Senior Engineer & Manager with Newmont Mining Corp. and Project Manager with Eldorado Gold Corp. and is also currently the Executive Chairman of Goldsource Mines Inc.

Prior to the formation of the Company, he was a co-founder, President and Chief Operating Officer of SilverCrest Mines Inc., which was acquired by First Majestic Silver Corp in October, 2015. He was largely responsible for the successful implementation of a systematic and responsible “phased approach” business model, that built the Santa Elena project into a successful and profitable mine.

|

Areas of Expertise: Mining Industry, Environmental, Social, Governance, Finance, Human Resources and Compensation. |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

2023 Attendance |

| Board |

7 of 7 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

99.56% |

0.44% |

| 2022 |

99.68% |

0.32% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Goldsource Mines Inc. (since June 2010)

•Executive Chairman

|

TSX-V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

RSUs |

PSUs |

Total Value of Common Shares, RSUs and PSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

2,010,075 |

624,500 |

81,119 |

54,850 |

$22,318,858 |

Yes |

| December 31, 2023 |

4,010,075 |

559,000 |

35,583 |

34,625 |

$35,457,659 |

Yes |

| December 31, 2022 |

4,010,075 |

834,000 |

35,583 |

37,750 |

$33,075,605 |

Yes |

|

|

|

|

|

|

| SILVERCREST METALS INC. |

9 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| ANNA LADD-KRUGER |

|

Age: 54

Gender Identity: Female

Visible Minority: Yes

British Columbia, Canada

Independent Director Since: July 11, 2022

Principal Occupation: Corporate Director & Chartered Professional Accountant

|

Ms. Ladd-Kruger is Chartered Professional Accountant (CPA, CMA), and holds a Master’s in Economics from Queen's University, a Bachelor of Commerce from the University of British Columbia and the Canadian Institute of Corporate Directors designation.

She has over 20 years of experience in the mining industry and was previously a mining executive at McEwen Mining Inc. and Trevali Mining Corporation. Her experience includes serving as the CFO and VP Corporate Development for several mining companies and began her career working at Vale S.A.'s Thompson and Sudbury Canadian operations before joining Kinross Gold Corporation as their North American Group Controller.

|

Areas of Expertise: Finance, Accounting, Capital Markets, Systems Integration, Enterprise Risk Management, Corporate Governance and Compensation, and ESG. |

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership |

2023 Attendance |

| Board |

7 of 7 |

100% |

Audit Committee Chair(1) |

4 of 4 |

100% |

Corporate Governance & Nominating Committee(2) |

1 of 1 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

99.45% |

0.55% |

| 2022 |

N/A |

N/A |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Integra Resources Corp. (Since December 2018)

•Audit Committee Chair

•Technical & Safety Committee

•Environment, Social & Governance Committee

|

TSX-V |

|

Sherritt International Corp. (Since February 2023)

•Audit Committee Member

|

TSX |

|

Nevada Copper Corp. (since November 2023)

•Audit Committee Chair

•Sustainability Committee

|

TSX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met(3) |

| April 18, 2024 |

NIL |

25,000 |

39,500 |

$410,800 |

Yes |

| December 31, 2023 |

NIL |

25,000 |

23,000 |

$199,870 |

N/A |

| December 31, 2022 |

NIL |

25,000 |

23,000 |

$186,300 |

N/A |

(1)Ms. Ladd-Kruger was appointed to Chair of the Audit Committee on May 26, 2023.

(2)Ms. Ladd-Kruger was appointed to the Corporate Governance & Nominating Committee on May 26, 2023 and her attendance reflects the meetings held during that period.

(3)Ms. Ladd-Kruger is required to meet the share ownership guideline by July 2027, being five years from her appointment to the Board.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

10 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| ANI MARKOVA |

|

Age: 54

Gender Identity: Female

Visible Minority: No

Ontario, Canada

Independent Director Since: May 30, 2019

Principal Occupation: Founder and CEO of Investor View Advisory; Chartered Financial Analyst; and Corporate Director.

|

Ms. Markova holds an MBA from George Washington University in Washington DC, Chartered Financial Analyst, Canadian Investment Management, Corporate Board International (CDI.D) designations ESG Competent Boards Certificate and Designation (GCB.D) and Climate and Biodiversity Designation (CCB.D).

Ms. Markova has over 25 years of capital markets involvement and extensive experience in qualitative and quantitative financial analysis, capital allocation, equity financings and valuations, as well as governance and sustainability reporting. She has managed up to $2 billion of mutual fund assets and has spent more than 15 years investing in the global mining sector and commodity markets. Ms. Markova was Vice President and Portfolio Manager with AGF Investments Inc. from August 2003 to January 2019.

Ms. Markova is actively engaged with public companies on ESG topics and provides guidance on ESG integration in enterprise risk management as a CEO of Investor View Advisory and a co-founder of Onyen Corporation, which provides technology based ESG reporting solutions to public and private companies.

|

|

Areas of Expertise: Environmental, Social and Governance (ESG), Climate Competency, Capital Markets, Finance and Accounting

|

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership |

2023 Attendance |

| Board |

7 of 7 |

100% |

| Audit Committee |

4 of 4 |

100% |

| Compensation Committee |

5 of 5 |

100% |

| SESS Committee Chair |

4 of 4 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

94.70% |

5.30% |

| 2022 |

97.27% |

2.73% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Critical Elements Lithium Corporation (since September 2021)

•Audit Committee

•Governance and Nominating Committee

•Environmental and Social Responsibility Committee Chair

|

TSX-V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

9,400 |

|

37,500 |

|

55,000 |

|

$669,760 |

Yes |

| December 31, 2023 |

9,400 |

|

117,500 |

|

38,500 |

|

$416,251 |

Yes |

| December 31, 2022 |

9,400 |

|

137,500 |

|

38,500 |

|

$387,990 |

Yes |

|

|

|

|

|

|

| SILVERCREST METALS INC. |

11 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| HANNES PORTMANN |

|

Age: 44

Gender Identity: Male

Visible Minority: No

Ontario, Canada

Independent Director Since: October 31, 2018

Principal Occupation: Chief Financial Officer of Cabot Management Company Limited since February 2022.

|

Mr. Portmann was the Chief Financial Officer and Business Development of Marathon Gold Corporation from October 2019 to January 2022. Previously, Mr. Portmann spent 10 years with New Gold Inc. (and predecessor companies) where he moved into progressively more senior roles, ultimately serving as President and Chief Executive Officer of the intermediate gold producer from January 2017 through May 2018. As Executive Vice President, Business Development of New Gold, Mr. Portmann’s primary areas of responsibility were corporate development, investor relations, human resources and exploration. Prior to New Gold, he was a member of the Merrill Lynch investment banking mining group and the assurance and advisory practices of PricewaterhouseCoopers LLP.

Mr. Portmann is a Chartered Professional Accountant and holds a Bachelor of Science in Mining Engineering from Queen’s University and a Masters of Management and Professional Accounting from the Rotman School of Management, University of Toronto.

|

|

Areas of Expertise: Finance, Accounting, Capital Markets, Human Resources and Compensation

Mr. Portmann is the Chief Financial Officer of Cabot Management Company Limited since February 2022. He has previous experience as a mining executive at Marathon Gold Corporation and New Gold Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

2023 Attendance |

| Board |

7 of 7 |

100% |

| Audit Committee |

4 of 4 |

100% |

| Compensation Committee Chair |

5 of 5 |

100% |

| SESS Committee |

4 of 4 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

96.93% |

3.07% |

| 2022 |

98.80% |

1.20% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

| No other public company directorships |

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

40,000 |

|

37,500 |

|

55,000 |

|

$988,000 |

Yes |

| December 31, 2023 |

40,000 |

|

37,500 |

|

38,500 |

|

$682,165 |

Yes |

| December 31, 2022 |

40,000 |

|

75,000 |

|

38,500 |

|

$635,850 |

Yes |

|

|

|

|

|

|

| SILVERCREST METALS INC. |

12 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| GRAHAM THODY |

|

Age: 73

Gender Identity: Male

Visible Minority: No

British Columbia, Canada

Independent Director Since: August 6, 2015

Principal Occupation: Retired Chartered Professional Accountant; and Corporate Director

|

Mr. Thody is a retired Chartered Professional Accountant and the former Board Chair of the Company between October 2015 and June 2023.

He was President and CEO of UEX Corporation from November 2009 until his retirement in January 2014. Mr. Thody served as the Chair of the Board at UEX Corporation until August 2022.

He has also served as a director of several reporting companies which are involved in mineral exploration and development throughout North, Central and South America.

|

Areas of Expertise: Accounting, Audit and Tax, Finance Corporate Governance and Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

Board/Committee Membership |

2023 Attendance |

Board(1) |

7 of 7 |

100% |

Audit Committee(2) |

4 of 4 |

100% |

| Corporate Governance & Nominating Committee |

3 of 3 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

96.47% |

3.53% |

| 2022 |

98.49% |

1.51% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Goldsource Mines Inc. (since December 2003)

•Lead Director

•Audit Committee Chair

•Corporate Governance and Compensation Committee

|

TSX-V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

30,000 |

|

— |

|

66,500 |

|

$1,003,600 |

Yes |

| December 31, 2023 |

75,000 |

|

50,000 |

|

50,000 |

|

$1,086,250 |

Yes |

| December 31, 2022 |

158,571 |

|

150,000 |

|

50,000 |

|

$1,689,425 |

Yes |

(1) Mr. Thody stepped down from the Company’s Board Chair Position on June 15, 2023.

(2) Mr. Thody stepped down from the Company’s Audit Committee Chair Position on May 26, 2023.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

13 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

| JOHN WRIGHT |

|

Age: 71

Gender Identity: Male

Visible Minority: No

British Columbia, Canada

Independent Director Since: January 1, 2017

Principal Occupation: Corporate Director and Professional Engineer

|

Mr. Wright is a Metallurgical Engineer and Honours graduate of Queens University in Ontario and the Board Chair of the Company.

Mr. Wright was a founder, director and former President and Chief Operating Officer of Pan American Silver Corp. and was also a director of Lumina Copper Corp., Northern Peru Copper Corp., Regalito Copper Corp. and Capstone Mining Corp. He spent the first 10 years of his career with Teck Cominco where he worked at the Trail Smelter operations and later participated in the management of feasibility studies, marketing and mine construction at the Afton, Highmont, Bull Moose and David Bell mines.

Mr. Wright has a P.Eng. (retired) designation from the Association of Professional Engineers and Geoscientists of British Columbia.

|

Areas of Expertise: Mining Operations / Metallurgy, Exploration / Geology, Capital Markets, Risk Management, Governance, Environmental, Safety and Sustainability, and International Business |

|

|

|

|

|

|

|

|

|

|

|

|

| Board/Committee Membership |

2023 Attendance |

Board Chair(1) |

7 of 7 |

100% |

Corporate Governance & Nominating Committee(2) |

3 of 3 |

100% |

| Compensation Committee |

5 of 5 |

100% |

SESS Committee(3) |

4 of 4 |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

| Historical Proxy Voting Results |

For |

Withheld |

| 2023 |

97.23% |

2.77% |

| 2022 |

98.58% |

1.42% |

|

|

|

|

|

|

| Other Directorships |

Exchange |

|

Ero Copper Corp (Since October 2017)

•Audit Committee

•Lead Director

•HSES Committee

|

TSX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities Held |

Common Shares |

Options |

DSUs |

Total Value of Common Shares and DSUs |

Share Ownership Requirement Met |

| April 18, 2024 |

300,000 |

|

37,500 |

|

58,300 |

|

$3,726,320 |

Yes |

| December 31, 2023 |

325,000 |

|

37,500 |

|

38,500 |

|

$3,158,815 |

Yes |

| December 31, 2022 |

297,000 |

|

112,500 |

|

38,500 |

|

$2,717,550 |

Yes |

(1) Mr. Wright was appointed to as Board Chair on June 15, 2023.

(2) Mr. Wright stepped down from the Company’s Corporate Governance & Nominating Committee Chair Position on June 15, 2023.

(3) Mr. Wright stepped down from the SESS Committee on February 1, 2024.

Advance Notice Policy

Pursuant to the Advance Notice Policy of the Company adopted by the Board of Directors on May 9, 2016, subject to shareholder approval, which was obtained on June 22, 2016, any additional director nominations for the Meeting must be received by the

|

|

|

|

|

|

| SILVERCREST METALS INC. |

14 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

Company in compliance with the Advance Notice Policy by May 13, 2024. The Company will publish details of any such additional director nominations through a public announcement in accordance with the Advance Notice Policy.

The Company’s Advance Notice Policy is available on the Company’s website: https://www.silvercrestmetals.com/sustainability/policies-and-guidelines/.

Majority Voting Policy

The Board of Directors has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under the Majority Voting Policy, if a nominee does not receive the affirmative vote of at least the majority of votes cast, the director shall promptly tender a resignation for consideration by the Corporate Governance and Nominating Committee and the Board. The Corporate Governance and Nominating Committee shall consider the resignation and recommend to the Board the action to be taken with respect to such offered resignation, which may include: accepting the resignation, maintaining the director, but addressing what the Corporate Governance and Nominating Committee believes to be the underlying cause of the withheld votes, resolving that the director will not be re nominated in the future for election, or rejecting the resignation and explaining the basis for such determination. Further to the rules of the Toronto Stock Exchange (“TSX”), the Board shall accept such director’s resignation absent exceptional circumstances.

The Corporate Governance and Nominating Committee in making its recommendation, and the Board in making its decision, may consider any factors or other information they consider appropriate and relevant. Any director who tenders a resignation pursuant to the Majority Voting Policy may not participate in the recommendation of the Corporate Governance and Nominating Committee or the decision of the Board with respect to the resignation. The Board will act on the recommendation of the Corporate Governance and Nominating Committee within 90 days after the shareholder meeting at which the election of directors occurred. Following the Board’s decision, the Company will promptly issue a press release disclosing the Board’s determination (and, if applicable, the reasons for rejecting the resignation) and will provide a copy of such press release to TSX.

If the Board accepts any tendered resignation in accordance with the Majority Voting Policy, then the Board may (i) proceed to fill the vacancy through the appointment of a new director, or (ii) determine not to fill the vacancy and instead decrease the size of the Board. If a director’s resignation is not accepted by the Board, such director will continue to serve until the next annual meeting and until the director’s successor is duly elected, or the director’s earlier resignation or removal; alternatively, the director shall otherwise serve for such shorter time and under such other conditions as determined by the Board, considering all of the relevant facts and circumstances.

The Company’s Majority Voting Policy is available on the Company’s website: https://www.silvercrestmetals.com/sustainability/policies-and-guidelines/.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

To the knowledge of Management of the Company, none of the proposed directors is, as at the date of this Information Circular, or has been, within the ten years preceding the date of this Information Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that:

a.was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (collectively, an “Order”), when such Order was issued while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company; or

b.was subject to an Order that was issued after such person ceased to be a director, chief executive officer or chief financial officer of the relevant company, and which resulted from an event that occurred while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company.

Other than as disclosed below, no proposed director is, as at the date of this Information Circular, or has been, within the ten years preceding the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

On March 3, 2023, Laura Díaz was a director of Magna Gold Corp. (“Magna”), when Magna filed a Notice of Intention to Make a Proposal under the Bankruptcy and Insolvency Act (Canada) which provides creditor protection while corporations seek to restructure their affairs. As a result of the foregoing, the TSX-V transferred trading of Magna’s common shares to the NEX Board of the TSX-V effective at the opening of market on March 8, 2023. On March 27, 2023, Magna was granted an order (the "Order")

|

|

|

|

|

|

| SILVERCREST METALS INC. |

15 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

pursuant to the Companies' Creditors Arrangement Act (the "CCAA") by the Ontario Superior Court of Justice (Commercial List) (the "Court") on application by Magna seeking court protection from its creditors to allow it to restructure its business and property as a going concern. The Order, among other things, provided a stay of proceedings (the "Stay of Proceedings") barring all creditors from taking action to recover debts owed by Magna during the stay period. As a result of the foregoing, the TSX-V suspended trading of Magna’s common shares on the NEX Board. The Stay of Proceedings was granted until April 6, 2023 and extended by the Court until November 15, 2023. Magna was unable to finalize a plan of compromise or arrangement with its creditors by November 15, 2023. Accordingly, on November 21, 2023 pursuant to a further order of the Court, the CCAA protections and proceedings, as they applied to Magna, were terminated. Ms. Diaz resigned as a director of Magna on February 29, 2024.

On August 31, 2015, Pierre Beaudoin was the Chief Operating Officer of Detour Gold Corporation ("Detour Gold") when Detour Gold was advised that the Ontario Provincial Police would be investigating the circumstances surrounding the death of an employee that occurred at the Detour Lake mine site on June 3, 2015. On April 21, 2016, Detour Gold was charged with one count of criminal negligence causing death under the Criminal Code as a result of the June 2015 fatality. On August 30, 2017, Detour Gold pleaded guilty to the one count of criminal negligence. A sentencing hearing was held on August 30 and 31, 2017. Detour Gold was ordered to pay a fine of $1.4 million plus the 30% victim surcharge provided for under the Criminal Code. In addition, the court, as requested by Detour Gold, ordered a restitution payment for the family of the deceased worker for lost income through to retirement which was considered when determining the fine amount.

On May 13, 2014, Pierre Beaudoin was the Chief Operating Officer of Detour Gold when a proposed securities class action claiming, among other things, special and general damages in the amount of $80 million, was commenced against Detour Gold and its former President and Chief Executive Officer in relation to Detour Gold's secondary market public disclosure concerning the Detour Lake Mine operations between April 9, 2013 and November 7, 2013 (the "Class Action Claim"). On July 10, 2014, the plaintiff issued an Amended Statement of Claim incorporating allegations in respect of Detour Gold's primary market disclosure, specifically in respect of Detour Gold's final short form prospectus dated June 2, 2013. On November 29, 2016, the parties agreed to settle the Class Action Claim for $6 million and dismiss the action without any admission of liability subject to court approval which was subsequently obtained on June 27, 2017.

No proposed director has, within the ten years preceding the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

No proposed director has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director.

APPOINTMENT OF AUDITOR

PricewaterhouseCoopers LLP, Chartered Professional Accountants, is the auditor of the Company and has been since December 20, 2019.

At the Company’s 2023 annual general meeting of shareholders held on June 15, 2023, proxy votes by shareholders were 99.37% in favour of the appointment of PricewaterhouseCoopers LLP as auditor of the Company.

The Board recommends that shareholders vote FOR the re-appointment of PricewaterhouseCoopers LLP as auditor of the Company. Unless directed otherwise in the Proxy form, the management-designated proxyholders named in the enclosed Proxy form intend to vote FOR the appointment of PricewaterhouseCoopers LLP as the auditor of the Company to hold office until the next annual general meeting of shareholders, or until a successor is appointed.

CORPORATE GOVERNANCE DISCLOSURE

The Board recognizes the significance of corporate governance for effective management of the Company and for the best interest of all its stakeholders. As the Company grows, the Board continues to add corporate governance policies designed to effectively manage the organization and protect shareholder value.

The Canadian Securities Administrators have adopted National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”) which requires issuers to disclose on an annual basis their corporate governance practices in accordance with NI 58-101. Corporate governance disclosure of the Company is set out below.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

16 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

The Board of Directors

A copy of the mandate of the Board of Directors (“Board Mandate”) can be viewed on the Company’s website at www.silvercrestmetals.com and is incorporated by reference herein. The following is a summary of the Board Mandate.

The Board of Directors is responsible for overseeing the business and affairs of the Company and, in doing so, must act honestly and in good faith with a view to the best interests of the Company. The Board’s fundamental objectives are to enhance and preserve long-term shareholder value, ensuring that the Company meets its obligations on an ongoing basis and that the Company operates in a reliable and safe manner. In performing its functions, the Board should also consider the legitimate interests of its other stakeholders, such as employees, debtholders, communities and environment in which it operates. In overseeing the conduct of the business, the Board, through the Chief Executive Officer, shall set the standards of conduct for the organization. The Board agrees with and confirms its responsibility for overseeing management's performance in the following areas:

•the strategic planning process of the Company;

•identification and management of the principal risks associated with the business of the Company;

•ensuring adequate plans are in place for management development and succession;

•the Company's policies regarding communications with its shareholders and others; and

•assessing the integrity of the internal controls and management information systems of the Company.

Certain of the above matters are also dealt with or covered by the Company’s existing formal committees, being the Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and SESS Committee, which are governed by their respective charters available on the Company’s website. In carrying out the Board Mandate, the Board relies primarily on management to provide it with regular detailed reports on the operations of the Company and its financial position. The Board reviews and assesses these reports and other information provided to it at meetings of the full Board and of its committees. N. Eric Fier (CEO) is a member of the Board, which has given the Board direct access to information on their areas of responsibility. Other management personnel regularly attend Board meetings to provide information and answer questions. Directors also consult from time to time with management and have, on occasion, visited the properties of the Company. The reports and information provided to the Board include details concerning the monitoring and management of the risks associated with the Company's activities, such as compliance with safety standards and legal requirements, environmental issues and the financial position and liquidity of the Company. At least annually, the Board reviews management's report on its business and strategic plan and any changes with respect to risk management and succession planning.

Meetings of the Board

The Board meets a minimum of five times per year, usually every quarter, and at year-end. Following each scheduled meeting of the Board, an “in-camera” session is held without any non-independent director or member of management in attendance. In addition, an in-camera session is held following each Audit Committee meeting with the Company’s auditor. Each committee of the Board generally meets once a year or more frequently as deemed necessary by the applicable committee. Since January 1, 2023 to the date hereof, there were a total of nine Board meetings and all directors were in attendance. The following table sets out the attendance record of current directors for Board meetings and for Board committee meetings for the mentioned periods.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Board of directors |

Audit Committee |

Corporate Governance & Nominating Committee |

Compensation Committee |

Safety Environment Social and Sustainability Committee |

Pierre Beaudoin(1) |

2 of 2 |

- |

- |

- |

- |

Laura Diaz |

9 of 9 |

- |

3 of 3 |

- |

4 of 4 |

| N. Eric Fier |

9 of 9 |

- |

- |

- |

- |

Anna Ladd-Kruger |

9 of 9 |

5 of 5 |

1 of 1 |

- |

- |

Ani Markova |

9 of 9 |

5 of 5 |

- |

6 of 6 |

4 of 4 |

| Hannes Portmann |

9 of 9 |

5 of 5 |

- |

6 of 6 |

4 of 4 |

Graham Thody |

9 of 9 |

5 of 5 |

3 of 3 |

- |

- |

| John Wright |

9 of 9 |

- |

3 of 3 |

6 of 6 |

4 of 4 |

(1) Pierre Beaudoin was appointed to the Board and SESS Committee on February 1, 2024.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

17 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

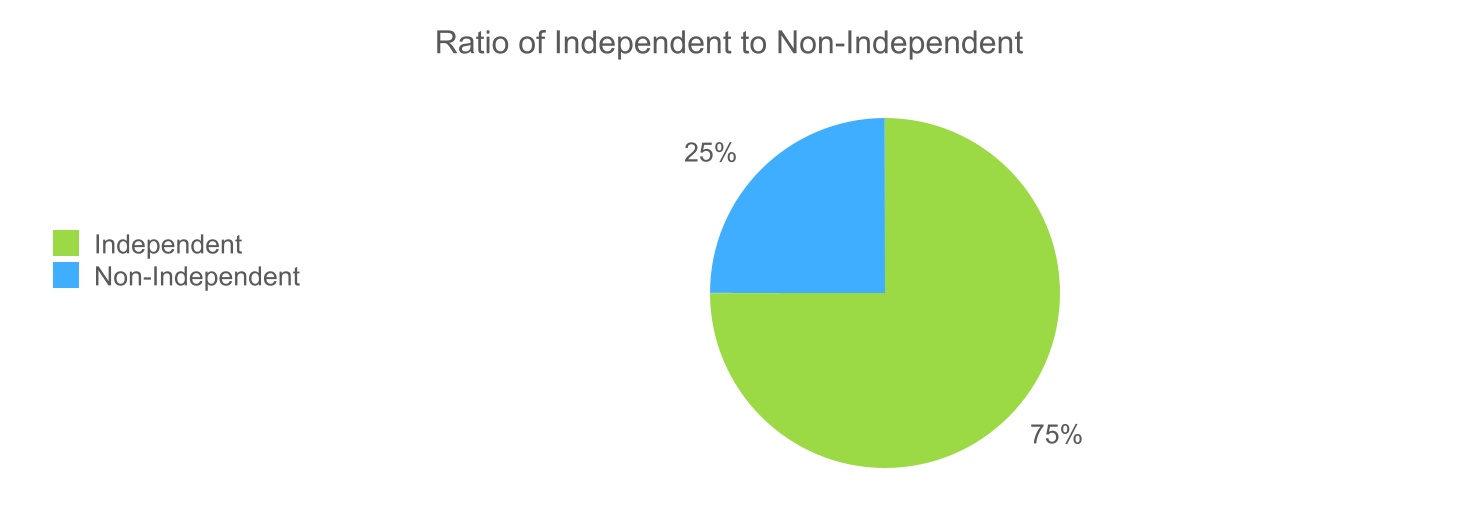

Independence of the Board

All of the directors of the Company are independent except for N. Eric Fier who is Chief Executive Officer of the Company and Pierre Beaudoin who held the title of Chief Operating Officer of the Company until January 31, 2024 and, therefore, are not independent. See “Election of Directors”.

The independent directors meet at least once a quarter, at mid-year, at year end, and as many times as may be necessary without any non-independent director or member of management in attendance. During 2023, the independent directors held seven (7) Board meetings without any non-independent director or member of management in attendance. These meetings were the in-camera sessions held following each scheduled Board meeting.

Separate Board Chair and Chief Executive Officer (CEO)

The Company has a separate Board Chair and CEO. Having an independent Board Chair enables non-management directors to raise issues and concern for Board consideration without immediately involving management. The Board Chair also serves as a liaison between the Board and senior management.

Chair of the Board

The Board is responsible for reviewing the Board Chair’s performance annually. During 2022, the Board has developed a written position description for the Chair of the Board. A copy of the position description for the Chair of the Board is available on the Company's website http://silvercrestmetals.com/about-us/governance/.

CEO

The Board is responsible for monitoring and reviewing the CEO’s performance annually and ensuring adequate plans are in place for development and succession. During 2022, together with the CEO of the Company, the Board has developed a written position description for the CEO. A copy of the position description for the CEO is available on the Company's website http://silvercrestmetals.com/about-us/governance/.

Board Committee Chairs

The Board has not developed written position descriptions for the chair of each Board Committee. The chair of each Board Committee is in charge of the particular respective committee and ensuring their designated responsibilities are effectively discharged. The Board Committee chairs are required to comply with the requirements of the policies governing the various committees. The chairs act as the liaison with the Board Chair and are responsible for reporting to the Board on matters under their purview.

Succession Planning

The Corporate Governance and Nominating Committee, comprised entirely of independent directors, is responsible for maintaining a CEO succession plan and a Board succession plan that are responsive to the needs of the Company and the interests of its shareholders. This Committee seeks to maintain a Board comprised of talented directors with a diverse mix of experience, expertise, skills, gender and backgrounds. On an annual basis, the Committee reviews with the CEO that adequate plans are in place for management development and succession and on a bi-annual basis assesses the Board composition in

|

|

|

|

|

|

| SILVERCREST METALS INC. |

18 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

order to assess any gaps between the desired set of competencies required to successfully govern the corporate strategy and development, taking pending retirements into account.

Other Reporting Issuer Directorship

The directors of the Company who currently hold directorships in other reporting issuers are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Issuer |

Term |

Exchange |

| Pierre Beaudoin |

Radisson Mining Resources Inc. |

Since September 2021 |

TSX-V |

| N. Eric Fier |

Goldsource Mines Inc. |

Since June 2010 |

TSX-V |

| Anna Ladd-Kruger |

Integra Resources Corp.

Sherritt International Corp.

Nevada Copper Corp.

|

Since December 2018

Since February 2023

Since November 2023

|

TSX-V

TSX

TSX

|

| Ani Markova |

Critical Elements Lithium Corporation |

Since September 2021 |

TSX-V |

| Graham Thody |

Goldsource Mines Inc. |

Since December 2003 |

TSX-V |

| John Wright |

Ero Copper Corp. |

Since October 2017 |

TSX |

Interlocking Directorships

The Board has not set a formal limit on the number of directors who may serve on the same board of directors of another issuer. The Corporate Governance and Nominating Committee considers interlocking directorships in the process of nominating individuals to serve on the Board. Currently, Mr. Fier and Mr. Thody are both directors of Goldsource Mines Inc. The Board expects that, as required by law, they and all other directors who serve as directors of other issuers will act honestly and in good faith with a view to the best interests of the Company. Conflicts, if any, will be subject to and governed by laws applicable to directors’ conflicts of interest.

Assessment of Board Performance

The Corporate Governance and Nominating Committee and the Board, as a whole, both assess the effectiveness of the Board, its committees and individual directors. The Board of Directors has adopted an annual formal assessment process with respect to performance of the Board, its committees and its individual directors. The Board, as a whole, considers the contributions and performance of each of the directors and the performance of the Board and each of its committees by conducting a performance review questionnaire. The Board uses an assessment tool to determine whether additional expertise is required to ensure that the Board is able to discharge its responsibilities and individuals with specific skill sets are identified.

The following demonstrates the overall skill set of the Board:

|

|

|

|

|

|

| SILVERCREST METALS INC. |

19 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Skills & Experience |

# of Board Members with Core Competency(1) |

# of Board Members with Ancillary Competency(2) |

| Regulatory |

Legal-corporate/Commercial/Litigation |

1 |

1 |

| Governance and Regulatory Compliance |

| Government Relations |

| Finance |

Capital Markets |

3 |

3 |

| International Business Experience |

| Risk Management |

| M&A Experience and Execution |

| Accounting and Tax |

Financial Literacy |

3 |

1 |

| Internal Control / Management Information Systems |

| Tax |

| Mine Development & Operations |

Exploration |

3 |

2 |

| Resources/Reserves/Engineering Studies |

| Mine and Plant Development/Construction |

| Mine and Plant Operations |

| Climate-related and environmental risk management |

Environment and Sustainability (including climate-related risk) |

3 |

3 |

| Social License |

| Health and Safety |

| Human Rights |

| Human Resources and Compensation |

Human Resources |

2 |

2 |

| Compensation |

| Strategic Leadership |

| Executive Management Skills |

(1)Core competency – a Board Member considered an expert in this area

(2)Ancillary competency – working knowledge and exposure to the area

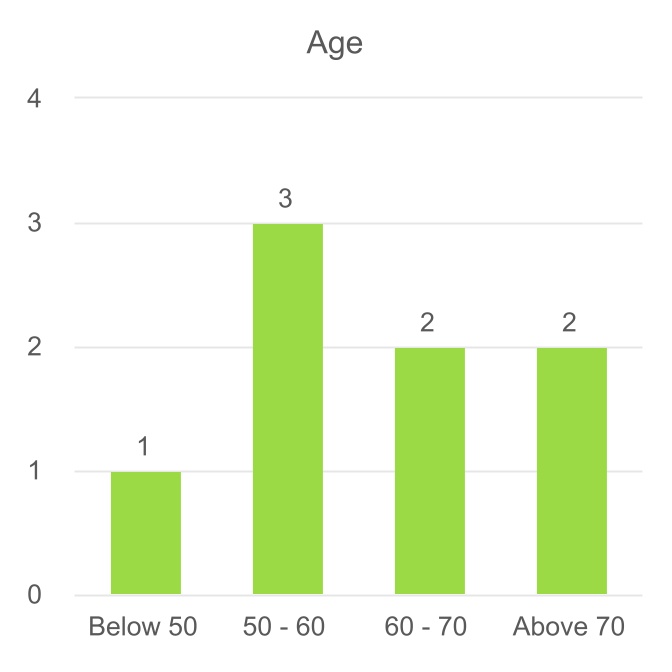

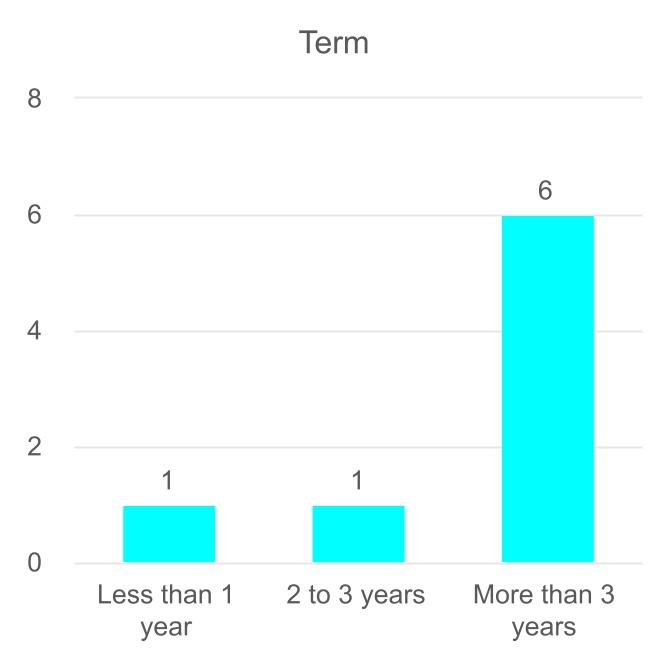

Director Term Limits and Other Mechanisms of Board Renewal

The Company has not adopted director term limits or other mechanisms of board renewal. The Company and Board have considered term limits and believes that:

•there is value in periodic renewals to the board members to maintain adequate independence from management;

•the imposition of director term limits on a board may discount the value of experience and continuity amongst board members and runs the risk of excluding experienced and potentially valuable board members; and

•regular evaluation of Board skills and experience, rather than arbitrary term limits, will result in better Board performance.

The Board of Directors will periodically consider whether term limits or other mechanisms of renewal for the Board of Directors should be adopted and will implement changes when deemed necessary.

As of April 18, 2024, the average term served by the nominees is 5 years and the average age of the nominees is 59 years.

|

|

|

|

|

|

| SILVERCREST METALS INC. |

20 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

Diversity and Gender Policy

The Company is committed to a merit-based system for the composition of its Board of Directors, senior management, and workforce within a diverse and inclusive culture that solicits multiple perspectives and views free of bias and discrimination. The Company recognizes the benefits of having diversity on the Board and in senior management. Diversity is important to ensure that members of the Board and senior management possess the necessary range of perspectives, experience and expertise required to achieve the Company’s objectives.

Diversity means all the varied characteristics that make individuals unique from one another. It includes, but is not limited to, characteristics such as gender, education, religion, ethnicity, race, nationality, culture, language, aboriginal status, age, disability and other characteristics.

The Company has a Diversity and Gender Policy (the “Diversity and Gender Policy”) which provides a basic framework within which the Company will consider the principles of diversity when recruiting, developing and appointing the senior management team and Board members, with the goal of having talented, knowledgeable persons with diverse experience, backgrounds and perspectives guiding the company. A copy of the Diversity and Gender Policy is available on the Company’s website: https://www.silvercrestmetals.com/sustainability/policies-and-guidelines/.

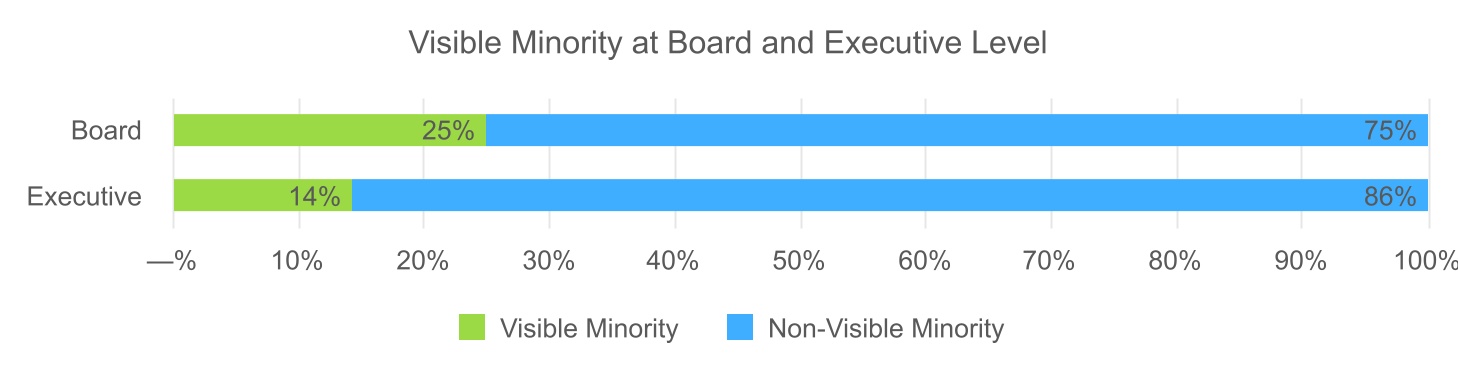

In order to promote and foster diversity, the Board adopted a target to have at least 30% of women throughout the organization. At the end of December 31, 2023, SilverCrest had 20% women throughout the organization. Three women directors have been nominated for election to the Board at the Meeting, representing 38% of the Board nominated for election at the Meeting. More than 30% of executive officer positions are currently filled by women.

In addition to gender diversity, the Company also considers other forms of diversity in terms of Designated Groups (as defined under the Employment Equity Act (Canada)) such as Indigenous peoples, persons with disabilities and members of visible minorities. As of the Record Date, the Board has two directors and one NEO (as defined herein) that are also members of a visible minority.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Women |

Person with disabilities |

Indigenous peoples |

Members of visible minorities |

Total |

Number of individuals who are members of more than one designated group |

| # |

% |

# |

% |

# |

% |

# |

% |

| Board |

3 |

38% |

0 |

—% |

0 |

—% |

2 |

25% |

5 |

2 |

| Executive |

3 |

43% |

0 |

—% |

1 |

14% |

1 |

14% |

5 |

1 |

|

|

|

|

|

|

| SILVERCREST METALS INC. |

21 |

|

|

|

|

|

|

|

2024 Annual General Meeting of Shareholders |

|

Orientation and Continuing Education

The Company has not adopted a formal orientation and education program for new directors, and all relevant information is communicated to new directors informally. The directors consider that the adoption of formal orientation and education programs for new directors is not presently warranted; however, the Board will reassess such needs on an ongoing basis as the Company continues to grow. Orientation and education of new Board members is conducted by meetings between any new Board member and the Board Chair and other long-standing Board members to assist any new director in learning about the Company’s key assets and about the business in which the Company is involved. New directors are provided with most recent Board meeting materials and annual budget. In addition, new directors are encouraged to visit and meet with management on a regular basis.

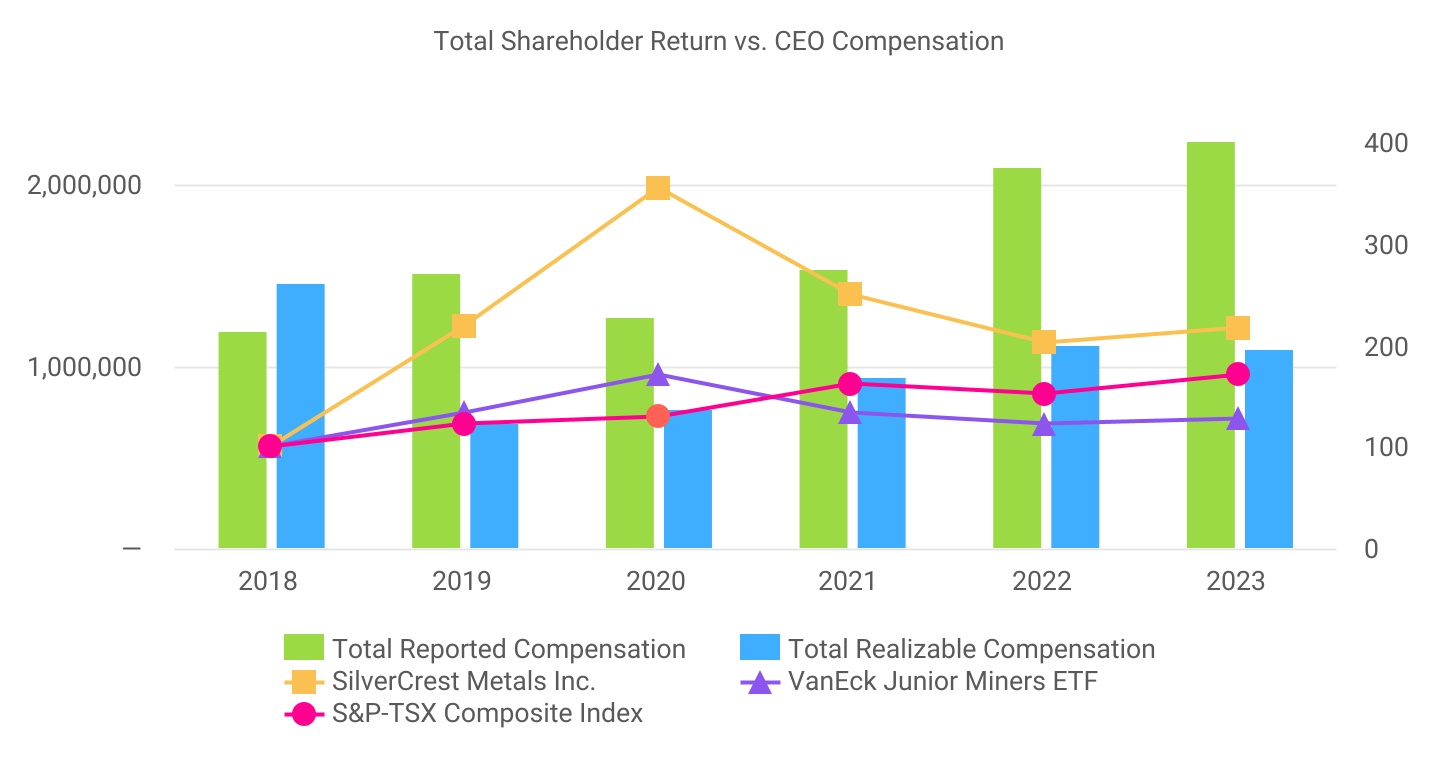

Given the size of the Company, there is no formal continuing education program in place. The Company relies on the in depth public company and professional experience of the members of the Board for their skills and knowledge necessary to meet their obligations as directors. Board members are entitled to attend, and do attend, seminars they determine necessary to keep themselves up-to-date with current issues relevant to their service as directors of the Company. Directors also visit, from time to time, the Company’s Las Chispas Property in Mexico.