| BXP, Inc. | Delaware | 1-13087 |

04-2473675 | ||||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|||||||||

| Boston Properties Limited Partnership | Delaware | 0-50209 |

04-3372948 | ||||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|||||||||

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||||||||||||||||

| BXP, Inc. | Common Stock, par value $0.01 per share | BXP | New York Stock Exchange | |||||||||||||||||

| Exhibit No. | Description | |||||||

| *99.1 | ||||||||

| *99.2 | ||||||||

| *101.SCH | Inline XBRL Taxonomy Extension Schema Document. | |||||||

| *101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | |||||||

| *101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | |||||||

| *101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | |||||||

| *104 | Cover Page Interactive Data File (formatted as Inline XBRL with applicable taxonomy extension information contained in Exhibits 101.*). | |||||||

| BXP, INC. | |||||||||||

| By: | /s/ MICHAEL E. LABELLE | ||||||||||

Michael E. LaBelle |

|||||||||||

Executive Vice President, Chief Financial Officer |

|||||||||||

and Treasurer |

|||||||||||

BOSTON PROPERTIES LIMITED PARTNERSHIP |

|||||||||||

| By: BXP, Inc., its General Partner | |||||||||||

| By: | /s/ MICHAEL E. LABELLE | ||||||||||

Michael E. LaBelle |

|||||||||||

Executive Vice President, Chief Financial Officer |

|||||||||||

and Treasurer |

|||||||||||

| Corporate Headquarters | Trading Symbol | Investor Relations | Inquiries | ||||||||

| 800 Boylston Street | BXP | BXP, Inc. | Inquiries should be directed to | ||||||||

| Suite 1900 | 800 Boylston Street, Suite 1900 | Helen Han | |||||||||

| Boston, MA 02199 | Stock Exchange Listing | Boston, MA 02199 | Vice President, Investor Relations | ||||||||

| www.bxp.com | New York Stock Exchange | investors.bxp.com | at 617.236.3429 or | ||||||||

| (t) 617.236.3300 | investorrelations@bxp.com | hhan@bxp.com | |||||||||

| (t) 617.236.3429 | |||||||||||

| Michael E. LaBelle | |||||||||||

| Executive Vice President, Chief Financial Officer | |||||||||||

| at 617.236.3352 or | |||||||||||

| mlabelle@bxp.com | |||||||||||

|

Q2 2025 | ||||

| Table of contents | |||||

| Page | |||||

| OVERVIEW | |||||

| Company Profile | |||||

| Guidance and assumptions | |||||

| FINANCIAL INFORMATION | |||||

| Financial Highlights | |||||

| Consolidated Balance Sheets | |||||

| Consolidated Income Statements | |||||

| Funds From Operations (FFO) | |||||

| Funds Available for Distribution (FAD) | |||||

| Net Operating Income (NOI) | |||||

| Same Property Net Operating Income (NOI) by Reportable Segment | |||||

| Capital Expenditures, Tenant Improvement Costs and Leasing Commissions | |||||

| Acquisitions and Dispositions | |||||

| DEVELOPMENT ACTIVITY | |||||

| Construction in Progress | |||||

| Land Parcels and Purchase Options | |||||

| LEASING ACTIVITY | |||||

| Leasing Activity | |||||

| PROPERTY STATISTICS | |||||

| Portfolio Overview | |||||

| Residential and Hotel Performance | |||||

| In-Service Property Listing | |||||

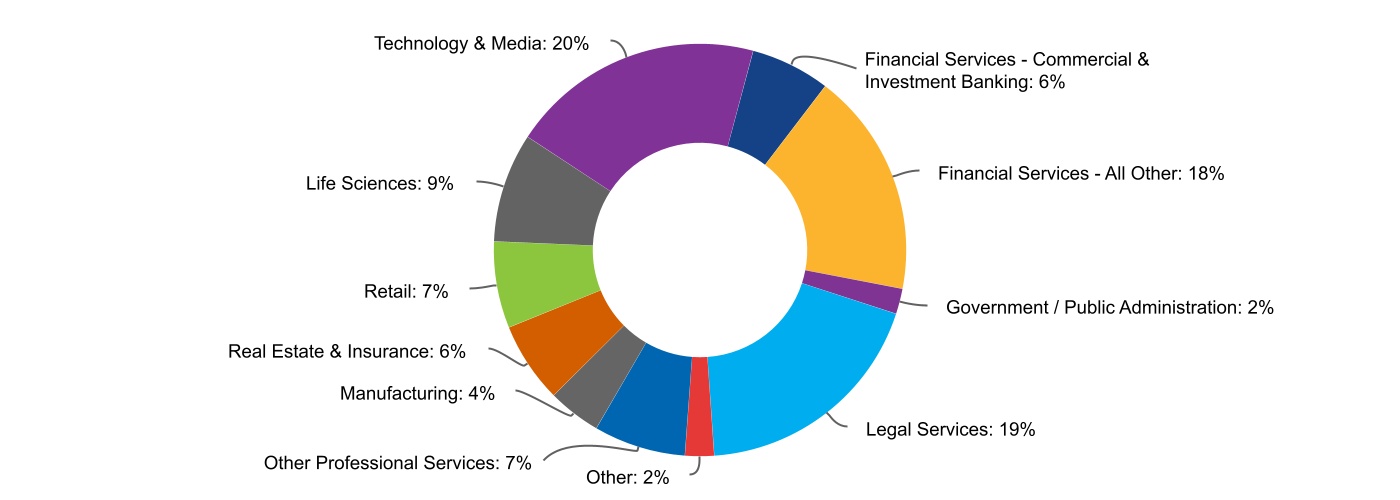

| Top 20 Clients Listing and Portfolio Client Diversification | |||||

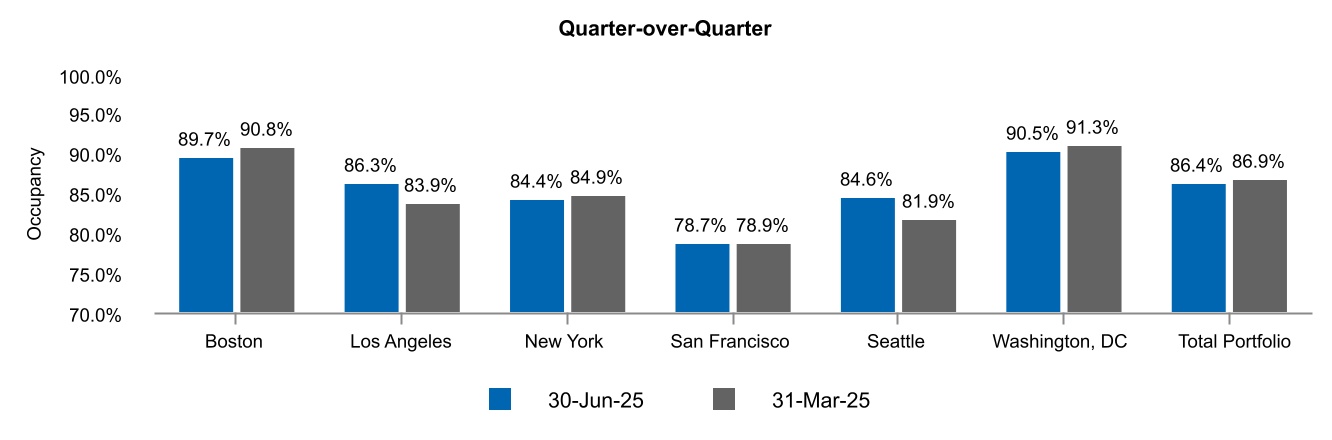

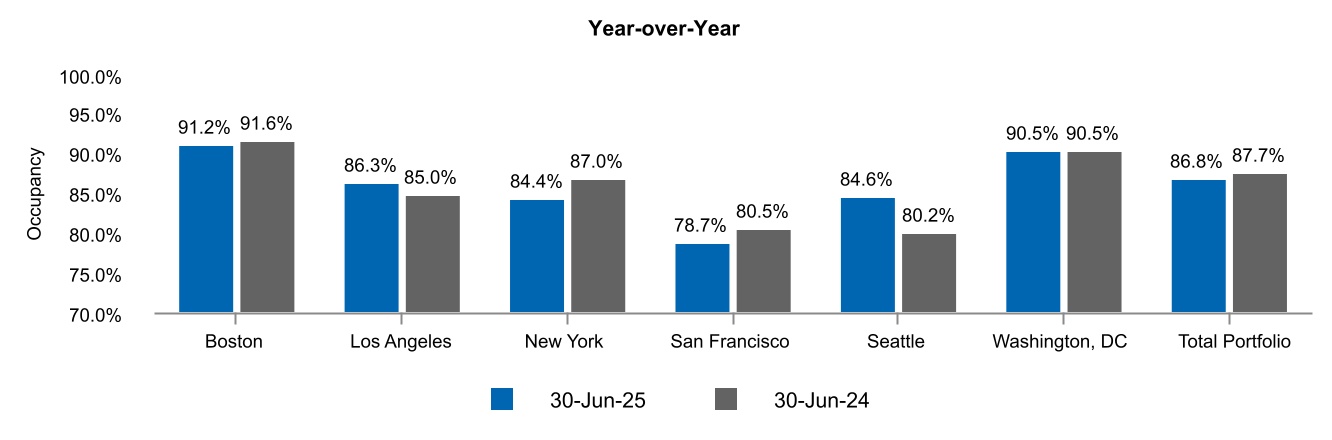

| Occupancy by Location | |||||

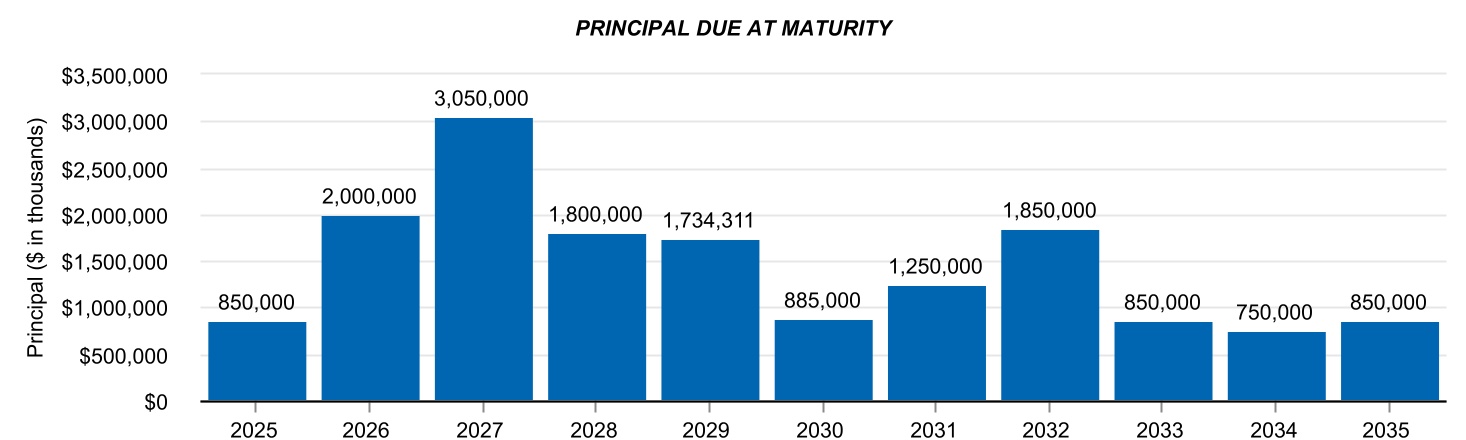

| DEBT AND CAPITALIZATION | |||||

| Capital Structure | |||||

| Debt Analysis | |||||

| Senior Unsecured Debt Covenant Compliance Ratios | |||||

Net Debt to EBITDAre |

|||||

| Debt Ratios | |||||

| JOINT VENTURES | |||||

| Consolidated Joint Ventures | |||||

| Unconsolidated Joint Ventures | |||||

| LEASE EXPIRATION ROLL-OUT | |||||

| Total In-Service Properties | |||||

| Boston | |||||

| Los Angeles | |||||

| New York | |||||

| San Francisco | |||||

| Seattle | |||||

| Washington, DC | |||||

| CBD | |||||

| Suburban | |||||

| RESEARCH COVERAGE, DEFINITIONS AND RECONCILIATIONS | |||||

| Research Coverage | |||||

| Definitions | |||||

| Reconciliations | |||||

| Consolidated Income Statement - Prior Year | |||||

|

Q2 2025 | ||||

| Company profile | |||||

| Fiscal Year-End | December 31 | ||||

| Total Properties (includes unconsolidated joint ventures and properties under development/redevelopment) | 186 | ||||

| Total Square Feet (includes unconsolidated joint ventures and properties under development/redevelopment) | 53.7 million | ||||

Common shares outstanding, plus common units and LTIP units (other than unearned Multi-Year Long-Term Incentive Program (MYLTIP) Units) on an as-converted basis 1, 2 |

176.8 million | ||||

| Closing Price, at the end of the quarter | $67.47 per share | ||||

| Dividend - Quarter/Annualized | $0.98/$3.92 per share | ||||

| Dividend Yield | 5.8% | ||||

Consolidated Market Capitalization 2 |

$27.7 billion | ||||

BXP’s Share of Market Capitalization 2, 3 |

$27.8 billion | ||||

| Unsecured Senior Debt Ratings | BBB (S&P); Baa2 (Moody’s) | ||||

| Board of Directors | ||||||||||||||

| Owen D. Thomas | Chairman of the Board | Owen D. Thomas | Chief Executive Officer | |||||||||||

| Douglas T. Linde | Douglas T. Linde | President | ||||||||||||

| Joel I. Klein | Lead Independent Director | Raymond A. Ritchey | Senior Executive Vice President | |||||||||||

| Bruce W. Duncan | Chair of Audit Committee | Michael E. LaBelle | Executive Vice President, Chief Financial Officer and Treasurer | |||||||||||

| Diane J. Hoskins | Chair of Sustainability Committee | Rodney C. Diehl |

Executive Vice President, West Coast Regions | |||||||||||

| Mary E. Kipp | Donna D. Garesche | Executive Vice President, Chief Human Resources Officer | ||||||||||||

| Matthew J. Lustig | Chair of Nominating & Corporate | Bryan J. Koop | Executive Vice President, Boston Region | |||||||||||

| Governance Committee | Peter V. Otteni | Executive Vice President, Co-Head of the Washington, DC | ||||||||||||

Timothy J. Naughton |

Chair of Compensation Committee | Region | ||||||||||||

| Julie G. Richardson | Hilary J. Spann | Executive Vice President, New York Region | ||||||||||||

| William H. Walton, III | John J. Stroman | Executive Vice President, Co-Head of the Washington, DC | ||||||||||||

| Derek A. (Tony) West | Region | |||||||||||||

| Colin D. Joynt | Senior Vice President, Chief Information Officer |

|||||||||||||

| Eric G. Kevorkian | Senior Vice President, Chief Legal Officer and Secretary | |||||||||||||

| Michael R. Walsh | Senior Vice President, Chief Accounting Officer | |||||||||||||

| James J. Whalen | Senior Vice President, Chief Technology Officer |

|||||||||||||

|

Q2 2025 | ||||

| Guidance and assumptions | |||||

| Third Quarter 2025 | Full Year 2025 | |||||||||||||||||||||||||||||||

| Low | High | Low | High | |||||||||||||||||||||||||||||

| Projected EPS (diluted) | $ | 0.41 | $ | 0.43 | $ | 1.74 | $ | 1.82 | ||||||||||||||||||||||||

| Add: | ||||||||||||||||||||||||||||||||

| Projected Company share of real estate depreciation and amortization | 1.28 | 1.28 | 5.20 | 5.20 | ||||||||||||||||||||||||||||

| Projected Company share of (gains)/losses on sales of real estate, gain on investment from unconsolidated joint venture and impairments | — | — | (0.10) | (0.10) | ||||||||||||||||||||||||||||

| Projected FFO per share (diluted) | $ | 1.69 | $ | 1.71 | $ | 6.84 | $ | 6.92 | ||||||||||||||||||||||||

| Full Year 2025 | |||||||||||||||||

| Low | High | ||||||||||||||||

| Operating property activity: | |||||||||||||||||

Average In-service portfolio occupancy 1 |

86.50 | % | 88.00 | % | |||||||||||||

| Change in BXP’s Share of Same Property net operating income (excluding termination income) | — | % | 0.50 | % | |||||||||||||

| Change in BXP’s Share of Same Property net operating income - cash (excluding termination income) | 1.00 | % | 1.50 | % | |||||||||||||

BXP’s Share of Non Same Properties’ incremental contribution to net operating income over prior year (excluding asset sales) |

$ | 22,000 | $ | 24,000 | |||||||||||||

| Taking Buildings Out-of-Service | $ | (17,000) | $ | (16,000) | |||||||||||||

BXP’s Share of incremental net operating income related to asset sales over prior year |

$ | — | $ | — | |||||||||||||

BXP’s Share of straight-line rent and fair value lease revenue (non-cash revenue) |

$ | 100,000 | $ | 115,000 | |||||||||||||

| Termination income | $ | 4,000 | $ | 8,000 | |||||||||||||

| Other revenue (expense): | |||||||||||||||||

| Development, management services and other revenue | $ | 33,000 | $ | 37,000 | |||||||||||||

General and administrative expense 2 |

$ | (161,000) | $ | (158,000) | |||||||||||||

| Consolidated net interest expense | $ | (625,000) | $ | (620,000) | |||||||||||||

| Unconsolidated joint venture interest expense | $ | (78,000) | $ | (75,000) | |||||||||||||

| Noncontrolling interest: | |||||||||||||||||

| Noncontrolling interest in property partnerships’ share of FFO | $ | (168,000) | $ | (160,000) | |||||||||||||

|

Q2 2025 | ||||

| Financial highlights | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 61,177 | ||||||||||

| Net income attributable to BXP, Inc. per share - diluted | $ | 0.56 | $ | 0.39 | ||||||||||

FFO attributable to BXP, Inc. 1 |

$ | 271,652 | $ | 260,591 | ||||||||||

Diluted FFO per share 1 |

$ | 1.71 | $ | 1.64 | ||||||||||

| Dividends per common share | $ | 0.98 | $ | 0.98 | ||||||||||

Funds available for distribution to common shareholders and common unitholders (FAD) 2 |

$ | 203,592 | $ | 213,885 | ||||||||||

| Selected items: | ||||||||||||||

| Revenue | $ | 868,457 | $ | 865,215 | ||||||||||

| Recoveries from clients | $ | 141,725 | $ | 143,778 | ||||||||||

| Service income from clients | $ | 2,848 | $ | 2,195 | ||||||||||

BXP’s Share of revenue 3 |

$ | 835,667 | $ | 836,192 | ||||||||||

BXP’s Share of straight-line rent 3 |

$ | 20,535 | $ | 26,687 | ||||||||||

BXP’s Share of fair value lease revenue 3, 4 |

$ | 3,029 | $ | 2,876 | ||||||||||

BXP’s Share of termination income 3 |

$ | 763 | $ | 446 | ||||||||||

| Ground rent expense | $ | 3,612 | $ | 3,653 | ||||||||||

| Capitalized interest | $ | 12,148 | $ | 10,317 | ||||||||||

| Capitalized wages | $ | 4,733 | $ | 4,443 | ||||||||||

| Loss from unconsolidated joint ventures | $ | (3,324) | $ | (2,139) | ||||||||||

BXP’s share of FFO from unconsolidated joint ventures 5 |

$ | 13,350 | $ | 15,188 | ||||||||||

| Net income attributable to noncontrolling interests in property partnerships | $ | 20,100 | $ | 18,749 | ||||||||||

FFO attributable to noncontrolling interests in property partnerships 6 |

$ | 41,045 | $ | 39,213 | ||||||||||

| Balance Sheet items: | ||||||||||||||

| Above-market rents (included within Prepaid Expenses and Other Assets) | $ | 6,214 | $ | 6,801 | ||||||||||

| Below-market rents (included within Other Liabilities) | $ | 23,792 | $ | 26,294 | ||||||||||

| Accrued rental income liability (included within Other Liabilities) | $ | 108,834 | $ | 113,053 | ||||||||||

| Ratios: | ||||||||||||||

Interest Coverage Ratio (excluding capitalized interest) 7 |

2.85 | 2.83 | ||||||||||||

Interest Coverage Ratio (including capitalized interest) 7 |

2.62 | 2.63 | ||||||||||||

Fixed Charge Coverage Ratio 7 |

2.23 | 2.38 | ||||||||||||

BXP’s Share of Net Debt to BXP’s Share of EBITDAre (Annualized) 8 |

8.18 | 8.33 | ||||||||||||

Change in BXP’s Share of Same Property Net Operating Income (NOI) (excluding termination income) 9 |

(0.2) | % | (0.6) | % | ||||||||||

Change in BXP’s Share of Same Property NOI (excluding termination income) - cash 9 |

1.7 | % | 1.8 | % | ||||||||||

FAD Payout Ratio 2 |

85.15 | % | 81.03 | % | ||||||||||

| Operating Margins [(rental revenue - rental expense)/rental revenue] | 60.5 | % | 60.6 | % | ||||||||||

Occupancy % of In-Service Properties 10 |

86.4 | % | 86.9 | % | ||||||||||

Leased % of In-Service Properties 11 |

89.1 | % | 89.4 | % | ||||||||||

| Capitalization: | ||||||||||||||

| Consolidated Debt | $ | 15,811,005 | $ | 15,671,692 | ||||||||||

BXP’s Share of Debt 12 |

$ | 15,833,687 | $ | 15,694,371 | ||||||||||

| Consolidated Market Capitalization | $ | 27,739,296 | $ | 27,546,987 | ||||||||||

| Consolidated Debt/Consolidated Market Capitalization | 57.00 | % | 56.89 | % | ||||||||||

BXP’s Share of Market Capitalization 12 |

$ | 27,761,978 | $ | 27,569,666 | ||||||||||

BXP’s Share of Debt/BXP’s Share of Market Capitalization 12 |

57.03 | % | 56.93 | % | ||||||||||

|

Q2 2025 | ||||

| Financial highlights (continued) | |||||

|

Q2 2025 | ||||

| Consolidated Balance Sheets | |||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| ASSETS | ||||||||||||||

| Real estate | $ | 26,632,189 | $ | 26,476,490 | ||||||||||

| Construction in progress | 1,047,687 | 907,989 | ||||||||||||

| Land held for future development | 748,198 | 730,944 | ||||||||||||

| Right of use assets - finance leases | 372,839 | 372,845 | ||||||||||||

| Right of use assets - operating leases | 325,670 | 330,129 | ||||||||||||

| Less accumulated depreciation | (7,863,743) | (7,699,234) | ||||||||||||

| Total real estate | 21,262,840 | 21,119,163 | ||||||||||||

| Cash and cash equivalents | 446,953 | 398,126 | ||||||||||||

| Cash held in escrows | 80,888 | 81,081 | ||||||||||||

| Investments in securities | 41,062 | 38,310 | ||||||||||||

| Tenant and other receivables, net | 109,683 | 117,353 | ||||||||||||

| Note receivable, net | 6,711 | 5,535 | ||||||||||||

| Related party note receivables, net | 88,825 | 88,816 | ||||||||||||

| Sales-type lease receivable, net | 15,188 | 14,958 | ||||||||||||

| Accrued rental income, net | 1,509,347 | 1,490,522 | ||||||||||||

| Deferred charges, net | 809,033 | 806,057 | ||||||||||||

| Prepaid expenses and other assets | 89,624 | 138,868 | ||||||||||||

| Investments in unconsolidated joint ventures | 1,161,036 | 1,137,732 | ||||||||||||

| Total assets | $ | 25,621,190 | $ | 25,436,521 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Liabilities: | ||||||||||||||

| Mortgage notes payable, net | $ | 4,278,788 | $ | 4,277,710 | ||||||||||

| Unsecured senior notes, net | 9,800,577 | 9,797,824 | ||||||||||||

| Unsecured line of credit | 185,000 | 300,000 | ||||||||||||

| Unsecured term loans, net | 796,640 | 796,158 | ||||||||||||

| Unsecured commercial paper | 750,000 | 500,000 | ||||||||||||

| Lease liabilities - finance leases | 365,897 | 368,379 | ||||||||||||

| Lease liabilities - operating leases | 399,174 | 395,638 | ||||||||||||

| Accounts payable and accrued expenses | 480,158 | 398,760 | ||||||||||||

| Dividends and distributions payable | 172,732 | 172,674 | ||||||||||||

| Accrued interest payable | 120,975 | 120,432 | ||||||||||||

| Other liabilities | 416,838 | 450,165 | ||||||||||||

| Total liabilities | 17,766,779 | 17,577,740 | ||||||||||||

| Commitments and contingencies | — | — | ||||||||||||

| Redeemable deferred stock units | 6,981 | 8,940 | ||||||||||||

| Equity: | ||||||||||||||

| Stockholders’ equity attributable to BXP, Inc.: | ||||||||||||||

| Excess stock, $0.01 par value, 150,000,000 shares authorized, none issued or outstanding | — | — | ||||||||||||

Common stock, $0.01 par value, 250,000,000 shares authorized, 158,445,177 and 158,402,227 issued and 158,366,277 and 158,323,327 outstanding at June 30, 2025 and March 31, 2025, respectively |

1,584 | 1,583 | ||||||||||||

| Additional paid-in capital | 6,854,753 | 6,846,015 | ||||||||||||

| Dividends in excess of earnings | (1,579,770) | (1,513,555) | ||||||||||||

Treasury common stock at cost, 78,900 shares at June 30, 2025 and March 31, 2025 |

(2,722) | (2,722) | ||||||||||||

| Accumulated other comprehensive loss | (15,059) | (11,379) | ||||||||||||

| Total stockholders’ equity attributable to BXP, Inc. | 5,258,786 | 5,319,942 | ||||||||||||

| Noncontrolling interests: | ||||||||||||||

| Common units of the Operating Partnership | 584,651 | 591,555 | ||||||||||||

| Property partnerships | 2,003,993 | 1,938,344 | ||||||||||||

| Total equity | 7,847,430 | 7,849,841 | ||||||||||||

| Total liabilities and equity | $ | 25,621,190 | $ | 25,436,521 | ||||||||||

|

Q2 2025 | ||||

| Consolidated Income Statements | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Revenue | ||||||||||||||

| Lease | $ | 805,935 | $ | 811,102 | ||||||||||

| Parking and other | 34,709 | 30,146 | ||||||||||||

| Insurance proceeds | 90 | 96 | ||||||||||||

| Hotel revenue | 14,773 | 9,597 | ||||||||||||

| Development and management services | 8,846 | 9,775 | ||||||||||||

| Direct reimbursements of payroll and related costs from management services contracts | 4,104 | 4,499 | ||||||||||||

| Total revenue | 868,457 | 865,215 | ||||||||||||

| Expenses | ||||||||||||||

| Operating | 184,942 | 183,076 | ||||||||||||

| Real estate taxes | 146,272 | 148,429 | ||||||||||||

| Restoration expenses related to insurance claims | 848 | 73 | ||||||||||||

| Hotel operating | 9,365 | 7,565 | ||||||||||||

General and administrative 1 |

42,516 | 52,284 | ||||||||||||

| Payroll and related costs from management services contracts | 4,104 | 4,499 | ||||||||||||

| Transaction costs | 357 | 768 | ||||||||||||

| Depreciation and amortization | 223,819 | 220,107 | ||||||||||||

| Total expenses | 612,223 | 616,801 | ||||||||||||

| Other income (expense) | ||||||||||||||

| Loss from unconsolidated joint ventures | (3,324) | (2,139) | ||||||||||||

| Gain on sale of real estate | 18,390 | — | ||||||||||||

Loss on sales-type lease 2 |

— | (2,490) | ||||||||||||

Gains (losses) from investments in securities 1 |

2,600 | (365) | ||||||||||||

| Unrealized loss on non-real estate investment | (39) | (483) | ||||||||||||

| Interest and other income (loss) | 8,063 | 7,750 | ||||||||||||

| Loss from early extinguishment of debt | — | (338) | ||||||||||||

| Interest expense | (162,783) | (163,444) | ||||||||||||

| Net income | 119,141 | 86,905 | ||||||||||||

| Net income attributable to noncontrolling interests | ||||||||||||||

| Noncontrolling interest in property partnerships | (20,100) | (18,749) | ||||||||||||

Noncontrolling interest - common units of the Operating Partnership 3 |

(10,064) | (6,979) | ||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 61,177 | ||||||||||

| INCOME PER SHARE OF COMMON STOCK (EPS) | ||||||||||||||

| Net income attributable to BXP, Inc. per share - basic | $ | 0.56 | $ | 0.39 | ||||||||||

| Net income attributable to BXP, Inc. per share - diluted | $ | 0.56 | $ | 0.39 | ||||||||||

|

Q2 2025 | ||||

Funds from operations (FFO) 1 | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 61,177 | ||||||||||

| Add: | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership | 10,064 | 6,979 | ||||||||||||

| Noncontrolling interests in property partnerships | 20,100 | 18,749 | ||||||||||||

| Net income | 119,141 | 86,905 | ||||||||||||

| Add: | ||||||||||||||

| Depreciation and amortization expense | 223,819 | 220,107 | ||||||||||||

Noncontrolling interests in property partnerships' share of depreciation and amortization 2 |

(20,945) | (20,464) | ||||||||||||

BXP's share of depreciation and amortization from unconsolidated joint ventures 3 |

16,674 | 17,327 | ||||||||||||

| Corporate-related depreciation and amortization | (600) | (716) | ||||||||||||

| Non-real estate related amortization | 2,131 | 2,130 | ||||||||||||

| Loss on sales-type lease | — | 2,490 | ||||||||||||

| Less: | ||||||||||||||

| Gain on sales of real estate | 18,390 | — | ||||||||||||

| Unrealized loss on non-real estate investment | (39) | (483) | ||||||||||||

| Noncontrolling interests in property partnerships | 20,100 | 18,749 | ||||||||||||

| FFO attributable to the Operating Partnership (including BXP, Inc.) (Basic FFO) | 301,769 | 289,513 | ||||||||||||

| Less: | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership’s share of FFO | 30,117 | 28,922 | ||||||||||||

| FFO attributable to BXP, Inc. | $ | 271,652 | $ | 260,591 | ||||||||||

| BXP, Inc.’s percentage share of Basic FFO | 90.02 | % | 90.01 | % | ||||||||||

| Noncontrolling interest’s - common unitholders percentage share of Basic FFO | 9.98 | % | 9.99 | % | ||||||||||

| Basic FFO per share | $ | 1.72 | $ | 1.65 | ||||||||||

| Weighted average shares outstanding - basic | 158,312 | 158,202 | ||||||||||||

| Diluted FFO per share | $ | 1.71 | $ | 1.64 | ||||||||||

| Weighted average shares outstanding - diluted | 158,795 | 158,632 | ||||||||||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Basic FFO | $ | 301,769 | $ | 289,513 | ||||||||||

| Add: | ||||||||||||||

| Effect of dilutive securities - stock-based compensation | — | — | ||||||||||||

| Diluted FFO | 301,769 | 289,513 | ||||||||||||

| Less: | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership’s share of diluted FFO | 30,056 | 28,835 | ||||||||||||

| BXP, Inc.’s share of Diluted FFO | $ | 271,713 | $ | 260,678 | ||||||||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Shares/units for Basic FFO | 175,871 | 175,752 | ||||||||||||

| Add: | ||||||||||||||

| Effect of dilutive securities - stock-based compensation (shares/units) | 483 | 430 | ||||||||||||

| Shares/units for Diluted FFO | 176,354 | 176,182 | ||||||||||||

| Less: | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership’s share of Diluted FFO (shares/units) | 17,559 | 17,550 | ||||||||||||

| BXP, Inc.’s share of shares/units for Diluted FFO | 158,795 | 158,632 | ||||||||||||

| BXP, Inc.’s percentage share of Diluted FFO | 90.04 | % | 90.04 | % | ||||||||||

|

Q2 2025 | ||||

Funds available for distributions (FAD) 1 | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 61,177 | ||||||||||

| Add: | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership | 10,064 | 6,979 | ||||||||||||

| Noncontrolling interests in property partnerships | 20,100 | 18,749 | ||||||||||||

| Net income | 119,141 | 86,905 | ||||||||||||

| Add: | ||||||||||||||

| Depreciation and amortization expense | 223,819 | 220,107 | ||||||||||||

Noncontrolling interests in property partnerships’ share of depreciation and amortization 2 |

(20,945) | (20,464) | ||||||||||||

BXP’s share of depreciation and amortization from unconsolidated joint ventures 3 |

16,674 | 17,327 | ||||||||||||

| Corporate-related depreciation and amortization | (600) | (716) | ||||||||||||

| Non-real estate related amortization | 2,131 | 2,130 | ||||||||||||

| Loss on sales-type lease | — | 2,490 | ||||||||||||

| Less: | ||||||||||||||

| Gain on sales of real estate | 18,390 | — | ||||||||||||

| Unrealized loss on non-real estate investment | (39) | (483) | ||||||||||||

| Noncontrolling interests in property partnerships | 20,100 | 18,749 | ||||||||||||

| Basic FFO | 301,769 | 289,513 | ||||||||||||

| Add: | ||||||||||||||

BXP’s Share of lease transaction costs that qualify as rent inducements 1, 4 |

3,482 | 4,301 | ||||||||||||

BXP’s Share of hedge amortization, net of costs 1 |

1,808 | 1,804 | ||||||||||||

BXP’s Share of fair value interest adjustment 1 |

1,217 | 2,608 | ||||||||||||

BXP’s Share of straight-line ground rent expense adjustment 1, 5 |

584 | 177 | ||||||||||||

| Stock-based compensation | 11,612 | 23,018 | ||||||||||||

| Non-real estate depreciation and amortization | (1,531) | (1,414) | ||||||||||||

Unearned portion of capitalized fees from consolidated joint ventures 6 |

969 | 825 | ||||||||||||

| Non-cash loss from early extinguishments of debt | — | 338 | ||||||||||||

| Less: | ||||||||||||||

BXP’s Share of straight-line rent 1 |

20,535 | 26,687 | ||||||||||||

BXP’s Share of fair value lease revenue 1, 7 |

3,029 | 2,876 | ||||||||||||

BXP’s Share of 2nd generation tenant improvements and leasing commissions 1 |

61,423 | 58,947 | ||||||||||||

BXP’s Share of maintenance capital expenditures 1, 8 |

30,211 | 18,307 | ||||||||||||

BXP’s Share of amortization and accretion related to sales type lease 1 |

261 | 309 | ||||||||||||

| Hotel improvements, equipment upgrades and replacements | 859 | 159 | ||||||||||||

Funds available for distribution to common shareholders and common unitholders (FAD) (A) |

$ | 203,592 | $ | 213,885 | ||||||||||

Distributions to common shareholders and unitholders (excluding any special distributions) (B) |

173,357 | 173,306 | ||||||||||||

FAD Payout Ratio1 (B÷A) |

85.15 | % | 81.03 | % | ||||||||||

|

Q2 2025 | ||||

| Reconciliation of net income attributable to BXP, Inc. to BXP’s Share of same property net operating income (NOI) | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 30-Jun-24 | |||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 79,615 | ||||||||||

| Net income attributable to noncontrolling interests | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership | 10,064 | 9,509 | ||||||||||||

| Noncontrolling interest in property partnerships | 20,100 | 17,825 | ||||||||||||

| Net income | 119,141 | 106,949 | ||||||||||||

| Add: | ||||||||||||||

| Interest expense | 162,783 | 149,642 | ||||||||||||

| Loss from unconsolidated joint ventures | 3,324 | 5,799 | ||||||||||||

| Depreciation and amortization expense | 223,819 | 219,542 | ||||||||||||

| Transaction costs | 357 | 189 | ||||||||||||

| Payroll and related costs from management services contracts | 4,104 | 4,148 | ||||||||||||

| General and administrative expense | 42,516 | 44,109 | ||||||||||||

| Less: | ||||||||||||||

| Interest and other income (loss) | 8,063 | 10,788 | ||||||||||||

| Unrealized gain (loss) on non-real estate investment | (39) | 58 | ||||||||||||

| Gains from investments in securities | 2,600 | 315 | ||||||||||||

| Gain on sale of real estate | 18,390 | — | ||||||||||||

| Direct reimbursements of payroll and related costs from management services contracts | 4,104 | 4,148 | ||||||||||||

| Development and management services revenue | 8,846 | 6,352 | ||||||||||||

| Net Operating Income (NOI) | 514,080 | 508,717 | ||||||||||||

| Add: | ||||||||||||||

BXP’s share of NOI from unconsolidated joint ventures 1 |

31,029 | 31,587 | ||||||||||||

| Less: | ||||||||||||||

Partners’ share of NOI from consolidated joint ventures (after income allocation to private REIT shareholders) 2 |

51,562 | 47,391 | ||||||||||||

| BXP’s Share of NOI | 493,547 | 492,913 | ||||||||||||

| Less: | ||||||||||||||

| Termination income | 909 | 841 | ||||||||||||

BXP’s share of termination income from unconsolidated joint ventures 1 |

(146) | — | ||||||||||||

| Add: | ||||||||||||||

Partners’ share of termination income from consolidated joint ventures 2 |

— | 40 | ||||||||||||

| BXP’s Share of NOI (excluding termination income) | $ | 492,784 | $ | 492,112 | ||||||||||

| Net Operating Income (NOI) | $ | 514,080 | $ | 508,717 | ||||||||||

| Less: | ||||||||||||||

| Termination income | 909 | 841 | ||||||||||||

NOI from non Same Properties (excluding termination income) 3 |

13,196 | 7,201 | ||||||||||||

| Same Property NOI (excluding termination income) | 499,975 | 500,675 | ||||||||||||

| Less: | ||||||||||||||

Partners’ share of NOI from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 2 |

51,562 | 47,351 | ||||||||||||

| Add: | ||||||||||||||

Partners’ share of NOI from non Same Properties from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 3 |

4,469 | — | ||||||||||||

BXP’s share of NOI from unconsolidated joint ventures (excluding termination income) 1 |

31,175 | 31,587 | ||||||||||||

| Less: | ||||||||||||||

BXP’s share of NOI from non Same Properties from unconsolidated joint ventures (excluding termination income) 3 |

(132) | (212) | ||||||||||||

| BXP’s Share of Same Property NOI (excluding termination income) | $ | 484,189 | $ | 485,123 | ||||||||||

|

Q2 2025 | ||||

| Reconciliation of net income attributable to BXP, Inc. to BXP’s Share of same property net operating income (NOI) - cash | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 30-Jun-24 | |||||||||||||

| Net income attributable to BXP, Inc. | $ | 88,977 | $ | 79,615 | ||||||||||

| Net income attributable to noncontrolling interests | ||||||||||||||

| Noncontrolling interest - common units of the Operating Partnership | 10,064 | 9,509 | ||||||||||||

| Noncontrolling interest in property partnerships | 20,100 | 17,825 | ||||||||||||

| Net income | 119,141 | 106,949 | ||||||||||||

| Add: | ||||||||||||||

| Interest expense | 162,783 | 149,642 | ||||||||||||

| Loss from unconsolidated joint ventures | 3,324 | 5,799 | ||||||||||||

| Depreciation and amortization expense | 223,819 | 219,542 | ||||||||||||

| Transaction costs | 357 | 189 | ||||||||||||

| Payroll and related costs from management services contracts | 4,104 | 4,148 | ||||||||||||

| General and administrative expense | 42,516 | 44,109 | ||||||||||||

| Less: | ||||||||||||||

| Interest and other income (loss) | 8,063 | 10,788 | ||||||||||||

| Unrealized gain (loss) on non-real estate investment | (39) | 58 | ||||||||||||

| Gains from investments in securities | 2,600 | 315 | ||||||||||||

| Gain on sale of real estate | 18,390 | — | ||||||||||||

| Direct reimbursements of payroll and related costs from management services contracts | 4,104 | 4,148 | ||||||||||||

| Development and management services revenue | 8,846 | 6,352 | ||||||||||||

| Net Operating Income (NOI) | 514,080 | 508,717 | ||||||||||||

| Less: | ||||||||||||||

| Straight-line rent | 24,533 | 16,094 | ||||||||||||

| Fair value lease revenue | 1,915 | 1,363 | ||||||||||||

| Amortization and accretion related to sales type lease | 232 | 246 | ||||||||||||

| Termination income | 909 | 841 | ||||||||||||

| Add: | ||||||||||||||

Straight-line ground rent expense adjustment 1 |

531 | 585 | ||||||||||||

Lease transaction costs that qualify as rent inducements 2 |

4,427 | 3,471 | ||||||||||||

| NOI - cash (excluding termination income) | 491,449 | 494,229 | ||||||||||||

| Less: | ||||||||||||||

NOI - cash from non Same Properties (excluding termination income) 3 |

10,276 | 17,006 | ||||||||||||

| Same Property NOI - cash (excluding termination income) | 481,173 | 477,223 | ||||||||||||

| Less: | ||||||||||||||

Partners’ share of NOI - cash from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 4 |

46,250 | 45,068 | ||||||||||||

| Add: | ||||||||||||||

Partners’ share of NOI - cash from non Same Properties from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 3 |

3,321 | — | ||||||||||||

BXP’s share of NOI - cash from unconsolidated joint ventures (excluding termination income) 5 |

27,909 | 27,473 | ||||||||||||

| Less: | ||||||||||||||

BXP’s share of NOI - cash from non Same Properties from unconsolidated joint ventures (excluding termination income) 3 |

(1,774) | (300) | ||||||||||||

| BXP’s Share of Same Property NOI - cash (excluding termination income) | $ | 467,927 | $ | 459,928 | ||||||||||

|

Q2 2025 | ||||

| Same property net operating income (NOI) by reportable segment | |||||

Office 1 |

Hotel & Residential | ||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | $ | % | Three Months Ended | $ | % | ||||||||||||||||||||||||||||||||||||||||||

| 30-Jun-25 | 30-Jun-24 | Change | Change | 30-Jun-25 | 30-Jun-24 | Change | Change | ||||||||||||||||||||||||||||||||||||||||

Rental Revenue 2 |

$ | 807,601 | $ | 799,437 | $ | 27,305 | $ | 27,038 | |||||||||||||||||||||||||||||||||||||||

| Less: Termination income | 909 | 736 | — | — | |||||||||||||||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

806,692 | 798,701 | $ | 7,991 | 1.0 | % | 27,305 | 27,038 | $ | 267 | 1.0 | % | |||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 318,079 | 309,486 | 8,593 | 2.8 | % | 15,943 | 15,578 | 365 | 2.3 | % | |||||||||||||||||||||||||||||||||||||

NOI (excluding termination income) 2, 3 |

$ | 488,613 | $ | 489,215 | $ | (602) | (0.1) | % | $ | 11,362 | $ | 11,460 | $ | (98) | (0.9) | % | |||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

$ | 806,692 | $ | 798,701 | $ | 7,991 | 1.0 | % | $ | 27,305 | $ | 27,038 | $ | 267 | 1.0 | % | |||||||||||||||||||||||||||||||

| Less: Straight-line rent and fair value lease revenue and amortization and accretion from sales-type lease | 23,619 | 27,359 | (3,740) | (13.7) | % | 140 | 150 | (10) | (6.7) | % | |||||||||||||||||||||||||||||||||||||

Add: Lease transaction costs that qualify as rent inducements 4 |

4,277 | 3,432 | 845 | 24.6 | % | 149 | 40 | 109 | 272.5 | % | |||||||||||||||||||||||||||||||||||||

| Subtotal | 787,350 | 774,774 | 12,576 | 1.6 | % | 27,314 | 26,928 | 386 | 1.4 | % | |||||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 318,079 | 309,486 | 8,593 | 2.8 | % | 15,943 | 15,578 | 365 | 2.3 | % | |||||||||||||||||||||||||||||||||||||

Add: Straight-line ground rent expense 5 |

531 | 585 | (54) | (9.2) | % | — | — | — | — | % | |||||||||||||||||||||||||||||||||||||

NOI - cash (excluding termination income) 2, 3 |

$ | 469,802 | $ | 465,873 | $ | 3,929 | 0.8 | % | $ | 11,371 | $ | 11,350 | $ | 21 | 0.2 | % | |||||||||||||||||||||||||||||||

Consolidated Total 1 (A) |

BXP’s share of Unconsolidated Joint Ventures (B) | ||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | $ | % | Three Months Ended | $ | % | ||||||||||||||||||||||||||||||||||||||||||

| 30-Jun-25 | 30-Jun-24 | Change | Change | 30-Jun-25 | 30-Jun-24 | Change | Change | ||||||||||||||||||||||||||||||||||||||||

Rental Revenue 2 |

$ | 834,906 | $ | 826,475 | $ | 51,685 | $ | 50,638 | |||||||||||||||||||||||||||||||||||||||

| Less: Termination income | 909 | 736 | (146) | — | |||||||||||||||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

833,997 | 825,739 | $ | 8,258 | 1.0 | % | 51,831 | 50,638 | $ | 1,193 | 2.4 | % | |||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 334,022 | 325,064 | 8,958 | 2.8 | % | 20,524 | 18,839 | 1,685 | 8.9 | % | |||||||||||||||||||||||||||||||||||||

NOI (excluding termination income) 2, 3 |

$ | 499,975 | $ | 500,675 | $ | (700) | (0.1) | % | $ | 31,307 | $ | 31,799 | $ | (492) | (1.5) | % | |||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

$ | 833,997 | $ | 825,739 | $ | 8,258 | 1.0 | % | $ | 51,831 | $ | 50,638 | $ | 1,193 | 2.4 | % | |||||||||||||||||||||||||||||||

| Less: Straight-line rent and fair value lease revenue and amortization and accretion from sales-type lease | 23,759 | 27,509 | (3,750) | (13.6) | % | 1,739 | 4,165 | (2,426) | (58.2) | % | |||||||||||||||||||||||||||||||||||||

Add: Lease transaction costs that qualify as rent inducements 4 |

4,426 | 3,472 | 954 | 27.5 | % | (21) | — | (21) | (100.0) | % | |||||||||||||||||||||||||||||||||||||

| Subtotal | 814,664 | 801,702 | 12,962 | 1.6 | % | 50,071 | 46,473 | 3,598 | 7.7 | % | |||||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 334,022 | 325,064 | 8,958 | 2.8 | % | 20,524 | 18,839 | 1,685 | 8.9 | % | |||||||||||||||||||||||||||||||||||||

Add: Straight-line ground rent expense 5 |

531 | 585 | (54) | (9.2) | % | 136 | 139 | (3) | (2.2) | % | |||||||||||||||||||||||||||||||||||||

NOI - cash (excluding termination income) 2, 3 |

$ | 481,173 | $ | 477,223 | $ | 3,950 | 0.8 | % | $ | 29,683 | $ | 27,773 | $ | 1,910 | 6.9 | % | |||||||||||||||||||||||||||||||

Partners’ share of Consolidated Joint Ventures (C) |

BXP’s Share 2, 6 |

||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | $ | % | Three Months Ended | $ | % | ||||||||||||||||||||||||||||||||||||||||||

| 30-Jun-25 | 30-Jun-24 | Change | Change | 30-Jun-25 | 30-Jun-24 | Change | Change | ||||||||||||||||||||||||||||||||||||||||

Rental Revenue 2 |

$ | 83,126 | $ | 81,125 | $ | 803,465 | $ | 795,988 | |||||||||||||||||||||||||||||||||||||||

| Less: Termination income | — | 40 | 763 | 696 | |||||||||||||||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

83,126 | 81,085 | $ | 2,041 | 2.5 | % | 802,702 | 795,292 | $ | 7,410 | 0.9 | % | |||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 36,033 | 33,734 | 2,299 | 6.8 | % | 318,513 | 310,169 | 8,344 | 2.7 | % | |||||||||||||||||||||||||||||||||||||

NOI (excluding termination income) 2, 3 |

$ | 47,093 | $ | 47,351 | $ | (258) | (0.5) | % | $ | 484,189 | $ | 485,123 | $ | (934) | (0.2) | % | |||||||||||||||||||||||||||||||

Rental revenue (excluding termination income) 2 |

$ | 83,126 | $ | 81,085 | $ | 2,041 | 2.5 | % | $ | 802,702 | $ | 795,292 | $ | 7,410 | 0.9 | % | |||||||||||||||||||||||||||||||

| Less: Straight-line rent and fair value lease revenue and amortization and accretion from sales-type lease | 5,088 | 2,538 | 2,550 | 100.5 | % | 20,410 | 29,136 | (8,726) | (29.9) | % | |||||||||||||||||||||||||||||||||||||

Add: Lease transaction costs that qualify as rent inducements 4 |

924 | 255 | 669 | 262.4 | % | 3,481 | 3,217 | 264 | 8.2 | % | |||||||||||||||||||||||||||||||||||||

| Subtotal | 78,962 | 78,802 | 160 | 0.2 | % | 785,773 | 769,373 | 16,400 | 2.1 | % | |||||||||||||||||||||||||||||||||||||

| Less: Operating expenses and real estate taxes | 36,033 | 33,734 | 2,299 | 6.8 | % | 318,513 | 310,169 | 8,344 | 2.7 | % | |||||||||||||||||||||||||||||||||||||

Add: Straight-line ground rent expense 5 |

— | — | — | — | % | 667 | 724 | (57) | (7.9) | % | |||||||||||||||||||||||||||||||||||||

NOI - cash (excluding termination income) 2, 3 |

$ | 42,929 | $ | 45,068 | $ | (2,139) | (4.7) | % | $ | 467,927 | $ | 459,928 | $ | 7,999 | 1.7 | % | |||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| Same property net operating income (NOI) by reportable segment (continued) | |||||

|

Q2 2025 | ||||

| Capital expenditures, tenant improvement costs and leasing commissions | |||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Maintenance capital expenditures | $ | 32,934 | $ | 20,186 | ||||||||||

| Planned capital expenditures associated with acquisition properties | 5,977 | 1,349 | ||||||||||||

| Repositioning capital expenditures | 13,150 | 19,495 | ||||||||||||

| Hotel improvements, equipment upgrades and replacements | 859 | 159 | ||||||||||||

| Subtotal | 52,920 | 41,189 | ||||||||||||

| Add: | ||||||||||||||

| BXP’s share of maintenance capital expenditures from unconsolidated joint ventures (JVs) | 703 | 95 | ||||||||||||

| BXP’s share of planned capital expenditures associated with acquisition properties from unconsolidated JVs | (85) | 146 | ||||||||||||

| BXP’s share of repositioning capital expenditures from unconsolidated JVs | — | — | ||||||||||||

| Less: | ||||||||||||||

| Partners’ share of maintenance capital expenditures from consolidated JVs | 3,426 | 1,974 | ||||||||||||

| Partners’ share of planned capital expenditures associated with acquisition properties from consolidated JVs | — | — | ||||||||||||

| Partners’ share of repositioning capital expenditures from consolidated JVs | 23 | (38) | ||||||||||||

BXP’s Share of Capital Expenditures 1 |

$ | 50,089 | $ | 39,494 | ||||||||||

| Three Months Ended | ||||||||||||||

| 30-Jun-25 | 31-Mar-25 | |||||||||||||

| Square feet | 852,284 | 916,029 | ||||||||||||

| Tenant improvements and lease commissions PSF | $ | 85.84 | $ | 74.01 | ||||||||||

|

Q2 2025 | ||||

| Acquisitions and dispositions | |||||

| Investment | |||||||||||||||||||||||||||||||||||||||||||||||

| Property | Location | Date Acquired | Square Feet | Initial | Anticipated Future | Total | In-service Leased (%) | ||||||||||||||||||||||||||||||||||||||||

290 Coles Street (670 Units) (19.46% ownership) 1 |

Jersey City, NJ | March 5, 2025 | 560,000 | $ | 20,000 | $ | 68,700 | $ | 88,700 | N/A | |||||||||||||||||||||||||||||||||||||

| Total Acquisitions | 560,000 | $ | 20,000 | $ | 68,700 | $ | 88,700 | — | % | ||||||||||||||||||||||||||||||||||||||

| Property | Location | Date Disposed | Square Feet | Gross Sales Price | Net Cash Proceeds | Book Gain (Loss) | ||||||||||||||||||||||||||||||||||||||

17 Hartwell Avenue 2 |

Lexington, MA | June 27, 2025 | 30,000 | $ | 21,840 | $ | 21,840 | $ | 18,390 | |||||||||||||||||||||||||||||||||||

| Total Dispositions | 30,000 | $ | 21,840 | $ | 21,840 | $ | 18,390 | |||||||||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| Construction in progress | |||||

| Actual/Estimated | BXP’s share | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Initial Occupancy | Stabilization Date | Square Feet | Investment to Date 2 |

Estimated Total Investment 2 |

Total Financing | Amount Drawn | Estimated Future Equity Requirement 2 |

Percentage | Percentage placed in-service 4 |

Net Operating Income (Loss) 5 (BXP’s share) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Leased 3 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Office | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 360 Park Avenue South (71% ownership) | Q4 2024 | Q4 2026 | New York, NY | 450,000 | $ | 377,847 | $ | 418,300 | $ | 156,470 | $ | 156,470 | $ | 40,453 | 28 | % | 30 | % | $ | 353 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reston Next Office Phase II | Q1 2025 | Q1 2027 | Reston, VA | 87,000 | 50,626 | 61,000 | — | — | 10,374 | 95 | % | 6 | % | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1050 Winter Street | Q2 2025 | Q3 2025 | Waltham, MA | 162,000 | 7,355 | 38,700 | — | — | 31,345 | 100 | % | 34 | % | 43 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 725 12th Street | Q1 2029 | Q4 2030 | Washington, DC | 320,000 | 71,335 | 349,600 | — | — | 278,265 | 87 | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Office Properties under Construction | 1,019,000 | 507,163 | 867,600 | 156,470 | 156,470 | 360,437 | 64 | % | 19 | % | 402 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lab/Life Sciences | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

290 Binney Street (55% ownership) 6 |

Q2 2026 | Q2 2026 | Cambridge, MA | 573,000 | 306,743 | 508,000 | — | — | 201,257 | 100 | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

651 Gateway (50% ownership) 7 |

Q1 2024 | Q3 2027 | South San Francisco, CA | 327,000 | 134,490 | 167,100 | — | — | 32,610 | 21 | % | 27 | % | 81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Lab/Life Sciences Properties under Construction | 900,000 | 441,233 | 675,100 | — | — | 233,867 | 71 | % | 10 | % | 81 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 Hartwell Avenue (312 units) (20% ownership) | Q2 2027 | Q2 2028 | Lexington, MA | 288,000 | 6,095 | 35,900 | 19,747 | — | 10,058 | — | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 Hartwell Avenue - Retail | 2,100 | — | — | — | — | — | — | % | — | % | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 121 Broadway Street (439 units) | Q3 2027 | Q2 2029 | Cambridge, MA | 492,000 | 173,279 | 597,800 | — | — | 424,521 | — | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

290 Coles Street (670 units) (19.46% ownership) 8 |

Q2 2028 | Q3 2029 | Jersey City, NJ | 547,000 | 20,294 | 88,700 | 56,400 | — | 12,006 | — | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 290 Coles Street - Retail | 13,000 | — | — | — | — | — | — | % | — | % | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Residential Properties under Construction | 1,342,100 | 199,668 | 722,400 | 76,147 | — | 446,585 | — | % | — | % | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reston Next Retail | Q4 2025 | Q4 2025 | Reston, VA | 30,000 | 25,863 | 26,600 | — | — | 737 | 45 | % | — | % | (16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Retail Property under Construction | 30,000 | 25,863 | 26,600 | — | — | 737 | 45 | % | — | % | (16) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Properties Under Construction at June 30, 2025 (A) | 3,291,100 | $ | 1,173,927 | $ | 2,291,700 | $ | 232,617 | $ | 156,470 | $ | 1,041,626 | 67 | % | 9 |

14 | % | $ | 467 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CONSTRUCTION COMMENCED AFTER JUNE 30, 2025 1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Office | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

343 Madison Avenue 10 |

Q3 2029 | Q2 2031 | New York, NY | 930,000 | $ | 67,618 | $ | 1,971,000 | $ | — | $ | — | $ | 1,903,382 | — | % | — | % | N/A | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Properties Commenced Construction after June 30, 2025 (B) | 930,000 | $ | 67,618 | $ | 1,971,000 | $ | — | $ | — | $ | 1,903,382 | — | % | — | % | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Properties Under Construction (A) + (B) | 4,221,100 | $ | 1,241,545 | $ | 4,262,700 | $ | 232,617 | $ | 156,470 | $ | 2,945,008 | 45 | % | 9 |

10 | % | $ | 467 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| Construction in progress (continued) | |||||

|

Q2 2025 | ||||

| Land parcels and purchase options | |||||

| Location | Approximate Developable Square Feet 2 |

|||||||

San Jose, CA 3 |

2,830,000 | |||||||

| Reston, VA | 2,490,000 | |||||||

| New York, NY (25% ownership) | 2,000,000 | |||||||

| Princeton, NJ | 1,723,000 | |||||||

| San Jose, CA (55% ownership) | 1,088,000 | |||||||

| Waltham, MA | 899,000 | |||||||

New York, NY (55% ownership) 4 |

895,000 | |||||||

| San Francisco, CA | 850,000 | |||||||

| Santa Clara, CA | 632,000 | |||||||

| Springfield, VA | 576,000 | |||||||

| Washington, DC (50% ownership) | 520,000 | |||||||

| South San Francisco, CA (50% ownership) | 451,000 | |||||||

| Rockville, MD | 435,000 | |||||||

| Lexington, MA | 420,000 | |||||||

| Herndon, VA (50% ownership) | 350,000 | |||||||

| El Segundo, CA (50% ownership) | 275,000 | |||||||

| Dulles, VA | 150,000 | |||||||

| Total | 16,584,000 | |||||||

| Location | Approximate Developable Square Feet 2 |

|||||||

| Boston, MA | 1,300,000 | |||||||

Waltham, MA 5 |

1,200,000 | |||||||

| Cambridge, MA | 573,000 | |||||||

| Total | 3,073,000 | |||||||

|

Q2 2025 | ||||

| Leasing activity | |||||

| Net (increase)/decrease in available space (SF) | Total | ||||

| Vacant space available at the beginning of the period | 6,348,177 | ||||

| Add: | |||||

Properties placed (and partially placed) in-service 1 |

55,604 | ||||

| Leases expiring or terminated during the period | 1,079,592 | ||||

| Total space available for lease | 7,483,373 | ||||

| 1st generation leases | 71,334 | ||||

| 2nd generation leases with new clients | 648,974 | ||||

| 2nd generation lease renewals | 203,310 | ||||

| Total leases commenced during the period | 923,618 | ||||

| Vacant space available for lease at the end of the period | 6,559,755 | ||||

| Net (increase)/decrease in available space | (211,578) | ||||

Second generation leasing information: 2 |

|||||

| Leases commencing during the period (SF) | 852,284 | ||||

| Weighted average lease term (months) | 80 | ||||

| Weighted average free rent period (days) | 160 | ||||

Total transaction costs per square foot 3 |

$85.84 | ||||

Increase (decrease) in gross rents 4 |

(9.67) | % | |||

Increase (decrease) in net rents 5 |

(14.27) | % | |||

| All leases commencing occupancy (SF) | Incr (decr) in 2nd generation cash rents | Total square feet of leases executed in the quarter 7 |

|||||||||||||||||||||||||||||||||

| 1st generation | 2nd generation | total 6 |

gross 4,6 |

net 5,6 |

|||||||||||||||||||||||||||||||

| Boston | 71,334 | 318,409 | 389,743 | (0.01) | % | (0.13) | % | 235,824 | |||||||||||||||||||||||||||

| Los Angeles | — | 59,736 | 59,736 | (33.56) | % | (48.64) | % | 7,322 | |||||||||||||||||||||||||||

| New York | — | 182,473 | 182,473 | (9.45) | % | (15.18) | % | 344,170 | |||||||||||||||||||||||||||

| San Francisco | — | 157,520 | 157,520 | (13.54) | % | (18.71) | % | 159,599 | |||||||||||||||||||||||||||

| Seattle | — | 60,884 | 60,884 | — | % | — | % | 18,556 | |||||||||||||||||||||||||||

| Washington, DC | — | 73,262 | 73,262 | (10.63) | % | (14.51) | % | 356,350 | |||||||||||||||||||||||||||

| Total / Weighted Average | 71,334 | 852,284 | 923,618 | (9.67) | % | (14.27) | % | 1,121,821 | |||||||||||||||||||||||||||

|

Q2 2025 | ||||

| Portfolio overview | |||||

| Office | Retail | Residential | Hotel | Total | ||||||||||||||||||||||||||||

| Boston | 14,481,370 | 1,145,814 | 550,114 | 330,000 | 16,507,298 | |||||||||||||||||||||||||||

| Los Angeles | 2,183,588 | 123,534 | — | — | 2,307,122 | |||||||||||||||||||||||||||

| New York | 12,111,055 | 477,517 | — | — | 12,588,572 | |||||||||||||||||||||||||||

| San Francisco | 7,239,924 | 349,525 | 318,171 | — | 7,907,620 | |||||||||||||||||||||||||||

| Seattle | 1,503,925 | 13,171 | — | — | 1,517,096 | |||||||||||||||||||||||||||

| Washington, DC | 8,047,670 | 623,475 | 910,277 | — | 9,581,422 | |||||||||||||||||||||||||||

| Total | 45,567,532 | 2,733,036 | 1,778,562 | 330,000 | 50,409,130 | |||||||||||||||||||||||||||

| % of Total | 90.40 | % | 5.42 | % | 3.53 | % | 0.65 | % | 100.00 | % | ||||||||||||||||||||||

| Total | |||||

Rentable square feet of in-service properties 2 |

50,409,130 | ||||

| Less: | |||||

Rentable square feet from residential and hotel properties 2 |

2,174,332 | ||||

Partners’ share of rentable square feet from unconsolidated joint venture properties, excluding residential properties 4 |

3,851,491 | ||||

Partners’ share of rentable square feet from consolidated joint venture properties 5 |

3,117,732 | ||||

BXP’s Share of rentable square feet, excluding residential and hotel properties 1 |

41,265,575 | ||||

| Office | Retail | Residential | Hotel 6 |

Total | ||||||||||||||||||||||||||||

| Consolidated | $ | 764,989 | $ | 64,015 | $ | 11,832 | $ | 14,671 | $ | 855,507 | ||||||||||||||||||||||

Less: |

||||||||||||||||||||||||||||||||

Partners’ share from consolidated joint ventures 7 |

78,233 | 10,038 | — | — | 88,271 | |||||||||||||||||||||||||||

Add: |

||||||||||||||||||||||||||||||||

BXP’s share from unconsolidated joint ventures 8 |

48,918 | 2,792 | 3,506 | — | 55,216 | |||||||||||||||||||||||||||

BXP’s Share of Rental revenue 1 |

$ | 735,674 | $ | 56,769 | $ | 15,338 | $ | 14,671 | $ | 822,452 | ||||||||||||||||||||||

| % of Total | 89.46 | % | 6.90 | % | 1.86 | % | 1.78 | % | 100.00 | % | ||||||||||||||||||||||

| CBD | Suburban | Total | |||||||||||||||

| Boston | 33.27 | % | 6.11 | % | 39.38 | % | |||||||||||

| Los Angeles | 3.60 | % | — | % | 3.60 | % | |||||||||||

| New York | 21.86 | % | 1.57 | % | 23.43 | % | |||||||||||

| San Francisco | 14.57 | % | 1.65 | % | 16.22 | % | |||||||||||

| Seattle | 2.31 | % | — | % | 2.31 | % | |||||||||||

| Washington, DC | 14.93 | % | 0.13 | % | 15.06 | % | |||||||||||

| Total | 90.54 | % | 9.46 | % | 100.00 | % | |||||||||||

|

Q2 2025 | ||||

| Residential and hotel performance | |||||

Residential 1 |

Hotel | ||||||||||||||||||||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| 30-Jun-25 | 31-Mar-25 | 30-Jun-25 | 31-Mar-25 | ||||||||||||||||||||

Rental Revenue 2 |

$ | 12,532 | $ | 12,348 | $ | 14,773 | $ | 9,597 | |||||||||||||||

| Less: Operating expenses and real estate taxes | 6,578 | 5,897 | 9,365 | 7,565 | |||||||||||||||||||

Net Operating Income (NOI) 2 |

5,954 | 6,451 | 5,408 | 2,032 | |||||||||||||||||||

| Add: BXP’s share of NOI from unconsolidated joint ventures | 2,148 | 1,986 | N/A | N/A | |||||||||||||||||||

BXP’s Share of NOI 2 |

$ | 8,102 | $ | 8,437 | $ | 5,408 | $ | 2,032 | |||||||||||||||

Rental Revenue 2 |

$ | 12,532 | $ | 12,348 | $ | 14,773 | $ | 9,597 | |||||||||||||||

| Less: Straight line rent and fair value lease revenue | 142 | 143 | (2) | (2) | |||||||||||||||||||

| Add: Lease transaction costs that qualify as rent inducements | 149 | 149 | — | — | |||||||||||||||||||

| Subtotal | 12,539 | 12,354 | 14,775 | 9,599 | |||||||||||||||||||

| Less: Operating expenses and real estate taxes | 6,578 | 5,897 | 9,365 | 7,565 | |||||||||||||||||||

NOI - cash basis 2 |

5,961 | 6,457 | 5,410 | 2,034 | |||||||||||||||||||

| Add: BXP’s share of NOI-cash from unconsolidated joint ventures | 2,148 | 1,986 | N/A | N/A | |||||||||||||||||||

BXP’s Share of NOI - cash basis 2 |

$ | 8,109 | $ | 8,443 | $ | 5,410 | $ | 2,034 | |||||||||||||||

| Residential Units | Three Months Ended | Percent Change | |||||||||||||||||||||

| 30-Jun-25 | 30-Jun-24 | ||||||||||||||||||||||

| Boston | 806 | ||||||||||||||||||||||

| Average Monthly Rental Rate | $ | 4,066 | $ | 3,939 | 3.22 | % | |||||||||||||||||

| Average Rental Rate Per Occupied Square Foot | $ | 5.93 | $ | 5.78 | 2.60 | % | |||||||||||||||||

| Average Physical Occupancy | 96.15 | % | 95.04 | % | 1.17 | % | |||||||||||||||||

| Average Economic Occupancy | 96.23 | % | 94.72 | % | 1.59 | % | |||||||||||||||||

| San Francisco | 402 | ||||||||||||||||||||||

| Average Monthly Rental Rate | $ | 2,996 | $ | 3,061 | (2.12) | % | |||||||||||||||||

| Average Rental Rate Per Occupied Square Foot | $ | 3.76 | $ | 3.86 | (2.59) | % | |||||||||||||||||

| Average Physical Occupancy | 89.64 | % | 87.06 | % | 2.96 | % | |||||||||||||||||

| Average Economic Occupancy | 87.86 | % | 85.28 | % | 3.03 | % | |||||||||||||||||

Washington, DC 4 |

1,016 | ||||||||||||||||||||||

| Average Monthly Rental Rate | $ | 2,875 | $ | 2,822 | 1.88 | % | |||||||||||||||||

| Average Rental Rate Per Occupied Square Foot | $ | 3.23 | $ | 2.90 | 11.38 | % | |||||||||||||||||

| Average Physical Occupancy | 83.01 | % | 96.00 | % | (13.53) | % | |||||||||||||||||

| Average Economic Occupancy | 80.19 | % | 96.06 | % | (16.52) | % | |||||||||||||||||

| Total residential units | 2,224 | ||||||||||||||||||||||

| Hotel Rooms | Three Months Ended | Percent Change | |||||||||||||||||||||

| 30-Jun-25 | 30-Jun-24 | ||||||||||||||||||||||

| Boston Marriott Cambridge | 437 | ||||||||||||||||||||||

| Average Occupancy | 82.80 | % | 80.60 | % | 2.73 | % | |||||||||||||||||

| Average Daily Rate | $ | 373.26 | $ | 372.29 | 0.26 | % | |||||||||||||||||

| Revenue Per Available Room | $ | 308.90 | $ | 299.94 | 2.99 | % | |||||||||||||||||

|

Q2 2025 | ||||

| In-service property listing | |||||

| as of June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Sub Market | Number of Buildings | Square Feet | Occupied % 1 |

Leased % 2 |

Annualized Rental Obligations Per Occupied SF 3 |

||||||||||||||||||||||||||||||||||||||||||

| CBD | |||||||||||||||||||||||||||||||||||||||||||||||

| BOSTON | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| 200 Clarendon Street | CBD Boston MA | 1 | 1,725,721 | 99.9 | % | 99.9 | % | $ | 87.14 | ||||||||||||||||||||||||||||||||||||||

| 800 Boylston Street - The Prudential Center | CBD Boston MA | 1 | 1,274,927 | 97.4 | % | 97.7 | % | 73.36 | |||||||||||||||||||||||||||||||||||||||

| 100 Federal Street (55% ownership) | CBD Boston MA | 1 | 1,233,546 | 91.4 | % | 97.1 | % | 77.78 | |||||||||||||||||||||||||||||||||||||||

| 111 Huntington Avenue - The Prudential Center | CBD Boston MA | 1 | 860,446 | 99.5 | % | 100.0 | % | 81.35 | |||||||||||||||||||||||||||||||||||||||

| Atlantic Wharf Office (55% ownership) | CBD Boston MA | 1 | 793,024 | 96.8 | % | 100.0 | % | 88.56 | |||||||||||||||||||||||||||||||||||||||

100 Causeway Street (50% ownership) 4 |

CBD Boston MA | 1 | 633,818 | 98.9 | % | 100.0 | % | 75.71 | |||||||||||||||||||||||||||||||||||||||

Prudential Center (retail shops) 5, 6 |

CBD Boston MA | 1 | 601,552 | 89.8 | % | 95.0 | % | 96.95 | |||||||||||||||||||||||||||||||||||||||

| 101 Huntington Avenue - The Prudential Center | CBD Boston MA | 1 | 506,476 | 100.0 | % | 100.0 | % | 62.95 | |||||||||||||||||||||||||||||||||||||||

The Hub on Causeway - Podium (50% ownership) 4 |

CBD Boston MA | 1 | 382,988 | 94.8 | % | 94.8 | % | 65.79 | |||||||||||||||||||||||||||||||||||||||

| 888 Boylston Street - The Prudential Center | CBD Boston MA | 1 | 363,320 | 100.0 | % | 100.0 | % | 84.24 | |||||||||||||||||||||||||||||||||||||||

Star Market at the Prudential Center 5 |

CBD Boston MA | 1 | 60,015 | 100.0 | % | 100.0 | % | 64.51 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 11 | 8,435,833 | 96.9 | % | 98.6 | % | $ | 80.42 | |||||||||||||||||||||||||||||||||||||||

| 145 Broadway | East Cambridge MA | 1 | 490,086 | 99.6 | % | 99.6 | % | $ | 93.42 | ||||||||||||||||||||||||||||||||||||||

| 325 Main Street | East Cambridge MA | 1 | 415,512 | 91.2 | % | 97.2 | % | 119.26 | |||||||||||||||||||||||||||||||||||||||

125 Broadway 7 |

East Cambridge MA | 1 | 271,000 | 100.0 | % | 100.0 | % | 148.82 | |||||||||||||||||||||||||||||||||||||||

| 355 Main Street | East Cambridge MA | 1 | 256,966 | 100.0 | % | 100.0 | % | 86.33 | |||||||||||||||||||||||||||||||||||||||

300 Binney Street (55% ownership) 7, 8 |

East Cambridge MA | 1 | 239,908 | 100.0 | % | 100.0 | % | 159.03 | |||||||||||||||||||||||||||||||||||||||

| 90 Broadway | East Cambridge MA | 1 | 223,771 | 100.0 | % | 100.0 | % | 80.99 | |||||||||||||||||||||||||||||||||||||||

| 255 Main Street | East Cambridge MA | 1 | 215,394 | 82.5 | % | 82.5 | % | 91.34 | |||||||||||||||||||||||||||||||||||||||

| 150 Broadway | East Cambridge MA | 1 | 177,226 | 100.0 | % | 100.0 | % | 101.94 | |||||||||||||||||||||||||||||||||||||||

| 105 Broadway | East Cambridge MA | 1 | 152,664 | 100.0 | % | 100.0 | % | 77.35 | |||||||||||||||||||||||||||||||||||||||

250 Binney Street 7 |

East Cambridge MA | 1 | 67,362 | 100.0 | % | 100.0 | % | 82.23 | |||||||||||||||||||||||||||||||||||||||

| University Place | Mid-Cambridge MA | 1 | 195,282 | 100.0 | % | 100.0 | % | 61.08 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 11 | 2,705,171 | 97.2 | % | 98.1 | % | $ | 103.95 | |||||||||||||||||||||||||||||||||||||||

| Subtotal Boston CBD | 22 | 11,141,004 | 97.0 | % | 98.5 | % | $ | 86.20 | |||||||||||||||||||||||||||||||||||||||

| Residential | |||||||||||||||||||||||||||||||||||||||||||||||

Hub50House (440 units) (50% ownership) 4 |

CBD Boston MA | 1 | 320,444 | ||||||||||||||||||||||||||||||||||||||||||||

| The Lofts at Atlantic Wharf (86 units) | CBD Boston MA | 1 | 87,096 | ||||||||||||||||||||||||||||||||||||||||||||

| Proto Kendall Square (280 units) | East Cambridge MA | 1 | 166,717 | ||||||||||||||||||||||||||||||||||||||||||||

| Subtotal | 3 | 574,257 | |||||||||||||||||||||||||||||||||||||||||||||

| Hotel | |||||||||||||||||||||||||||||||||||||||||||||||

| Boston Marriott Cambridge (437 rooms) | East Cambridge MA | 1 | 334,260 | ||||||||||||||||||||||||||||||||||||||||||||

| Subtotal | 1 | 334,260 | |||||||||||||||||||||||||||||||||||||||||||||

| LOS ANGELES | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

Colorado Center (50% ownership) 4 |

West Los Angeles CA | 6 | 1,130,066 | 89.6 | % | 90.3 | % | $ | 77.68 | ||||||||||||||||||||||||||||||||||||||

| Santa Monica Business Park | West Los Angeles CA | 14 | 1,104,050 | 83.4 | % | 83.4 | % | 72.77 | |||||||||||||||||||||||||||||||||||||||

Santa Monica Business Park Retail 5 |

West Los Angeles CA | 7 | 73,006 | 79.4 | % | 86.8 | % | 79.05 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 27 | 2,307,122 | 86.3 | % | 86.9 | % | $ | 75.46 | |||||||||||||||||||||||||||||||||||||||

| NEW YORK | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| 767 Fifth Avenue (The GM Building) (60% ownership) | Plaza District NY | 1 | 1,970,335 | 92.3 | % | 98.5 | % | $ | 169.42 | ||||||||||||||||||||||||||||||||||||||

| 601 Lexington Avenue (55% ownership) | Park Avenue NY | 1 | 1,671,682 | 99.4 | % | 99.4 | % | 99.93 | |||||||||||||||||||||||||||||||||||||||

| 399 Park Avenue | Park Avenue NY | 1 | 1,567,470 | 100.0 | % | 100.0 | % | 104.78 | |||||||||||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| In-service property listing (continued) | |||||

| as of June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Sub Market | Number of Buildings | Square Feet | Occupied % 1 |

Leased % 2 |

Annualized Rental Obligations Per Occupied SF 3 |

||||||||||||||||||||||||||||||||||||||||||

| 599 Lexington Avenue | Park Avenue NY | 1 | 1,106,336 | 87.8 | % | 96.9 | % | 87.96 | |||||||||||||||||||||||||||||||||||||||

| 7 Times Square (formerly Times Square Tower) (55% ownership) | Times Square NY | 1 | 1,238,724 | 82.0 | % | 86.5 | % | 76.61 | |||||||||||||||||||||||||||||||||||||||

| 250 West 55th Street | Times Square / West Side NY | 1 | 966,976 | 99.8 | % | 99.8 | % | 99.82 | |||||||||||||||||||||||||||||||||||||||

200 Fifth Avenue (26.69% ownership) 4 |

Flatiron District NY | 1 | 853,312 | 58.5 | % | 91.0 | % | 98.54 | |||||||||||||||||||||||||||||||||||||||

Dock 72 (50% ownership) 4 |

Brooklyn NY | 1 | 668,521 | 42.7 | % | 42.7 | % | 37.34 | |||||||||||||||||||||||||||||||||||||||

| 510 Madison Avenue | Fifth/Madison Avenue NY | 1 | 352,589 | 80.6 | % | 93.4 | % | 122.63 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 9 | 10,395,945 | 87.2 | % | 93.0 | % | $ | 109.51 | |||||||||||||||||||||||||||||||||||||||

| SAN FRANCISCO | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| Salesforce Tower | CBD San Francisco CA | 1 | 1,420,682 | 98.0 | % | 98.0 | % | $ | 114.38 | ||||||||||||||||||||||||||||||||||||||

| Embarcadero Center Four | CBD San Francisco CA | 1 | 945,405 | 88.5 | % | 93.5 | % | 105.53 | |||||||||||||||||||||||||||||||||||||||

| Embarcadero Center One | CBD San Francisco CA | 1 | 837,810 | 71.6 | % | 72.2 | % | 96.39 | |||||||||||||||||||||||||||||||||||||||

| Embarcadero Center Two | CBD San Francisco CA | 1 | 801,668 | 81.6 | % | 82.7 | % | 83.66 | |||||||||||||||||||||||||||||||||||||||

| Embarcadero Center Three | CBD San Francisco CA | 1 | 786,411 | 74.7 | % | 78.0 | % | 93.29 | |||||||||||||||||||||||||||||||||||||||

| 680 Folsom Street | CBD San Francisco CA | 2 | 522,406 | 59.2 | % | 59.2 | % | 84.38 | |||||||||||||||||||||||||||||||||||||||

| 535 Mission Street | CBD San Francisco CA | 1 | 307,205 | 69.9 | % | 78.5 | % | 82.31 | |||||||||||||||||||||||||||||||||||||||

| 690 Folsom Street | CBD San Francisco CA | 1 | 26,080 | 100.0 | % | 100.0 | % | 74.77 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 9 | 5,647,667 | 81.8 | % | 83.8 | % | $ | 99.79 | |||||||||||||||||||||||||||||||||||||||

| Residential | |||||||||||||||||||||||||||||||||||||||||||||||

| The Skylyne (402 units) | CBD Oakland CA | 1 | 330,996 | ||||||||||||||||||||||||||||||||||||||||||||

| Subtotal | 1 | 330,996 | |||||||||||||||||||||||||||||||||||||||||||||

| SEATTLE | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

Safeco Plaza (33.67% ownership) 4 |

CBD Seattle WA | 1 | 762,634 | 83.8 | % | 83.9 | % | $ | 49.31 | ||||||||||||||||||||||||||||||||||||||

| Madison Centre | CBD Seattle WA | 1 | 754,462 | 85.4 | % | 87.9 | % | 59.17 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 2 | 1,517,096 | 84.6 | % | 85.9 | % | $ | 54.25 | |||||||||||||||||||||||||||||||||||||||

| WASHINGTON, DC | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| 901 New York Avenue | East End Washington DC | 1 | 508,130 | 80.5 | % | 80.5 | % | $ | 68.79 | ||||||||||||||||||||||||||||||||||||||

Market Square North (50% ownership) 4 |

East End Washington DC | 1 | 417,298 | 76.2 | % | 76.2 | % | 75.54 | |||||||||||||||||||||||||||||||||||||||

| 2100 Pennsylvania Avenue | CBD Washington DC | 1 | 475,849 | 95.0 | % | 95.0 | % | 81.16 | |||||||||||||||||||||||||||||||||||||||

| 2200 Pennsylvania Avenue | CBD Washington DC | 1 | 459,811 | 94.9 | % | 97.5 | % | 94.70 | |||||||||||||||||||||||||||||||||||||||

| 1330 Connecticut Avenue | CBD Washington DC | 1 | 252,413 | 92.7 | % | 95.5 | % | 71.54 | |||||||||||||||||||||||||||||||||||||||

| Sumner Square | CBD Washington DC | 1 | 208,797 | 94.0 | % | 94.0 | % | 50.26 | |||||||||||||||||||||||||||||||||||||||

500 North Capitol Street, N.W. (30% ownership) 4 |

Capitol Hill Washington DC | 1 | 230,900 | 96.8 | % | 96.8 | % | 86.27 | |||||||||||||||||||||||||||||||||||||||

| Capital Gallery | Southwest Washington DC | 1 | 176,824 | 80.8 | % | 92.7 | % | 57.74 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 8 | 2,730,022 | 88.3 | % | 89.8 | % | $ | 76.23 | |||||||||||||||||||||||||||||||||||||||

| Reston Next | Reston VA | 2 | 1,063,284 | 92.1 | % | 99.6 | % | $ | 61.95 | ||||||||||||||||||||||||||||||||||||||

| South of Market | Reston VA | 3 | 624,387 | 91.8 | % | 91.8 | % | 57.28 | |||||||||||||||||||||||||||||||||||||||

| Fountain Square | Reston VA | 2 | 524,307 | 94.2 | % | 96.3 | % | 53.45 | |||||||||||||||||||||||||||||||||||||||

| One Freedom Square | Reston VA | 1 | 427,646 | 87.8 | % | 87.8 | % | 54.70 | |||||||||||||||||||||||||||||||||||||||

| Two Freedom Square | Reston VA | 1 | 423,222 | 100.0 | % | 100.0 | % | 55.65 | |||||||||||||||||||||||||||||||||||||||

| One and Two Discovery Square | Reston VA | 2 | 366,989 | 89.7 | % | 89.7 | % | 53.65 | |||||||||||||||||||||||||||||||||||||||

| One Reston Overlook | Reston VA | 1 | 319,519 | 100.0 | % | 100.0 | % | 49.82 | |||||||||||||||||||||||||||||||||||||||

| 17Fifty Presidents Street | Reston VA | 1 | 275,809 | 100.0 | % | 100.0 | % | 74.81 | |||||||||||||||||||||||||||||||||||||||

| Democracy Tower | Reston VA | 1 | 259,441 | 99.3 | % | 99.3 | % | 69.25 | |||||||||||||||||||||||||||||||||||||||

Fountain Square Retail 5 |

Reston VA | 1 | 196,421 | 90.4 | % | 90.8 | % | 56.09 | |||||||||||||||||||||||||||||||||||||||

| Two Reston Overlook | Reston VA | 1 | 134,615 | 100.0 | % | 100.0 | % | 56.54 | |||||||||||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| In-service property listing (continued) | |||||

| as of June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Sub Market | Number of Buildings | Square Feet | Occupied % 1 |

Leased % 2 |

Annualized Rental Obligations Per Occupied SF 3 |

||||||||||||||||||||||||||||||||||||||||||

Avant Retail 5 |

Reston VA | 1 | 26,179 | 100.0 | % | 100.0 | % | 66.39 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 17 | 4,641,819 | 94.0 | % | 96.0 | % | $ | 58.50 | |||||||||||||||||||||||||||||||||||||||

7750 Wisconsin Avenue (50% ownership) 4 |

Bethesda/Chevy Chase MD | 1 | 735,573 | 100.0 | % | 100.0 | % | $ | 38.99 | ||||||||||||||||||||||||||||||||||||||

| Wisconsin Place Office | Montgomery County MD | 1 | 294,665 | 48.9 | % | 49.7 | % | 54.03 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 2 | 1,030,238 | 85.4 | % | 85.6 | % | $ | 41.88 | |||||||||||||||||||||||||||||||||||||||

| Subtotal Washington, DC CBD | 27 | 8,402,079 | 91.1 | % | 92.7 | % | $ | 62.14 | |||||||||||||||||||||||||||||||||||||||

| Residential | |||||||||||||||||||||||||||||||||||||||||||||||

| Signature at Reston (508 units) | Reston VA | 1 | 517,783 | ||||||||||||||||||||||||||||||||||||||||||||

Skymark (508 units) (20% ownership) 4, 8 |

Reston VA | 1 | 417,036 | ||||||||||||||||||||||||||||||||||||||||||||

| Subtotal | 2 | 934,819 | |||||||||||||||||||||||||||||||||||||||||||||

| CBD Total | 103 | 41,585,245 | 89.9 | % | 9 |

92.5 | % | 9 |

$ | 86.98 | 9 |

||||||||||||||||||||||||||||||||||||

| BXP’s Share of CBD | 90.6 | % | 9 |

92.8 | % | 9 |

|||||||||||||||||||||||||||||||||||||||||

| SUBURBAN | |||||||||||||||||||||||||||||||||||||||||||||||

| BOSTON | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| Bay Colony Corporate Center | Route 128 Mass Turnpike MA | 2 | 546,248 | 73.0 | % | 73.0 | % | $ | 52.66 | ||||||||||||||||||||||||||||||||||||||

| 140 Kendrick Street | Route 128 Mass Turnpike MA | 3 | 409,197 | 76.3 | % | 78.0 | % | 60.27 | |||||||||||||||||||||||||||||||||||||||

| Weston Corporate Center | Route 128 Mass Turnpike MA | 1 | 357,579 | 12.5 | % | 12.5 | % | 47.00 | |||||||||||||||||||||||||||||||||||||||

180 CityPoint 7, 8 |

Route 128 Mass Turnpike MA | 1 | 329,195 | 43.2 | % | 55.2 | % | 101.02 | |||||||||||||||||||||||||||||||||||||||

| Waltham Weston Corporate Center | Route 128 Mass Turnpike MA | 1 | 301,611 | 69.8 | % | 71.4 | % | 45.83 | |||||||||||||||||||||||||||||||||||||||

| 230 CityPoint | Route 128 Mass Turnpike MA | 1 | 296,720 | 97.7 | % | 97.7 | % | 48.97 | |||||||||||||||||||||||||||||||||||||||

200 West Street 7 |

Route 128 Mass Turnpike MA | 1 | 273,361 | 86.1 | % | 86.1 | % | 91.37 | |||||||||||||||||||||||||||||||||||||||

880 Winter Street 7 |

Route 128 Mass Turnpike MA | 1 | 243,614 | 100.0 | % | 100.0 | % | 103.67 | |||||||||||||||||||||||||||||||||||||||

| 10 CityPoint | Route 128 Mass Turnpike MA | 1 | 236,570 | 97.1 | % | 98.6 | % | 60.11 | |||||||||||||||||||||||||||||||||||||||

| 20 CityPoint | Route 128 Mass Turnpike MA | 1 | 211,476 | 98.1 | % | 98.1 | % | 60.83 | |||||||||||||||||||||||||||||||||||||||

| 77 CityPoint | Route 128 Mass Turnpike MA | 1 | 209,382 | 86.3 | % | 86.3 | % | 57.46 | |||||||||||||||||||||||||||||||||||||||

| 890 Winter Street | Route 128 Mass Turnpike MA | 1 | 180,155 | 93.1 | % | 93.1 | % | 44.61 | |||||||||||||||||||||||||||||||||||||||

Reservoir Place 10 |

Route 128 Mass Turnpike MA | 1 | 164,994 | 35.0 | % | 35.0 | % | 44.00 | |||||||||||||||||||||||||||||||||||||||

153 & 211 Second Avenue 11 |

Route 128 Mass Turnpike MA | 2 | 137,545 | 18.5 | % | 18.5 | % | 115.26 | |||||||||||||||||||||||||||||||||||||||

1265 Main Street (50% ownership) 4 |

Route 128 Mass Turnpike MA | 1 | 120,681 | 100.0 | % | 100.0 | % | 57.36 | |||||||||||||||||||||||||||||||||||||||

103 CityPoint 8 |

Route 128 Mass Turnpike MA | 1 | 112,841 | — | % | — | % | — | |||||||||||||||||||||||||||||||||||||||

| Reservoir Place North | Route 128 Mass Turnpike MA | 1 | 73,258 | 100.0 | % | 100.0 | % | 52.12 | |||||||||||||||||||||||||||||||||||||||

The Point 5 |

Route 128 Mass Turnpike MA | 1 | 16,300 | 100.0 | % | 100.0 | % | 62.85 | |||||||||||||||||||||||||||||||||||||||

33 Hayden Avenue 7 |

Route 128 Northwest MA | 1 | 80,872 | 100.0 | % | 100.0 | % | 79.72 | |||||||||||||||||||||||||||||||||||||||

| 32 Hartwell Avenue | Route 128 Northwest MA | 1 | 69,154 | 100.0 | % | 100.0 | % | 27.49 | |||||||||||||||||||||||||||||||||||||||

100 Hayden Avenue 7 |

Route 128 Northwest MA | 1 | 55,924 | 100.0 | % | 100.0 | % | 64.60 | |||||||||||||||||||||||||||||||||||||||

| 92 Hayden Avenue | Route 128 Northwest MA | 1 | 31,100 | 100.0 | % | 100.0 | % | 46.70 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 26 | 4,457,777 | 71.6 | % | 72.9 | % | $ | 63.25 | |||||||||||||||||||||||||||||||||||||||

| NEW YORK | |||||||||||||||||||||||||||||||||||||||||||||||

| Office | |||||||||||||||||||||||||||||||||||||||||||||||

| 510 Carnegie Center | Princeton NJ | 1 | 234,160 | 72.4 | % | 72.4 | % | $ | 40.13 | ||||||||||||||||||||||||||||||||||||||

| 206 Carnegie Center | Princeton NJ | 1 | 161,763 | — | % | — | % | — | |||||||||||||||||||||||||||||||||||||||

| 210 Carnegie Center | Princeton NJ | 1 | 159,468 | 33.2 | % | 66.3 | % | 39.82 | |||||||||||||||||||||||||||||||||||||||

| 212 Carnegie Center | Princeton NJ | 1 | 148,942 | 82.4 | % | 82.4 | % | 37.44 | |||||||||||||||||||||||||||||||||||||||

| 214 Carnegie Center | Princeton NJ | 1 | 146,799 | 62.8 | % | 62.8 | % | 38.25 | |||||||||||||||||||||||||||||||||||||||

| 506 Carnegie Center | Princeton NJ | 1 | 139,050 | 77.2 | % | 95.1 | % | 41.68 | |||||||||||||||||||||||||||||||||||||||

| 508 Carnegie Center | Princeton NJ | 1 | 134,433 | 100.0 | % | 100.0 | % | 43.84 | |||||||||||||||||||||||||||||||||||||||

| 202 Carnegie Center | Princeton NJ | 1 | 134,068 | 71.9 | % | 80.0 | % | 39.27 | |||||||||||||||||||||||||||||||||||||||

|

Q2 2025 | ||||

| In-service property listing (continued) | |||||

| as of June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Sub Market | Number of Buildings | Square Feet | Occupied % 1 |

Leased % 2 |

Annualized Rental Obligations Per Occupied SF 3 |

||||||||||||||||||||||||||||||||||||||||||

| 804 Carnegie Center | Princeton NJ | 1 | 130,000 | 100.0 | % | 100.0 | % | 42.13 | |||||||||||||||||||||||||||||||||||||||

| 101 Carnegie Center | Princeton NJ | 1 | 122,791 | 99.5 | % | 100.0 | % | 40.25 | |||||||||||||||||||||||||||||||||||||||

| 504 Carnegie Center | Princeton NJ | 1 | 121,990 | 100.0 | % | 100.0 | % | 36.83 | |||||||||||||||||||||||||||||||||||||||