dmc-pr20251117russell

Exhibit 99.1

|

|

Denison Mines

Corp.

1100 – 40

University Ave

Toronto, ON M5J

1T1

www.denisonmines.com

|

PRESS

RELEASE

Denison

Announces Agreements with Skyharbour Resources, Increasing

Denison’s Strategic Foothold Surrounding Wheeler

River

Toronto, ON – November

17, 2025. Denison Mines Corp. (“Denison” or the “Company”) (TSX: DML; NYSE American: DNN) is pleased

to announce that it has executed an agreement (the

“Agreement”) with Skyharbour Resources Ltd.

(“Skyharbour”) (TSX-V:SYH) (OTCQX: SYHBF),

(Frankfurt:SC1P) to acquire

initial interests in claims comprising Skyharbour’s Russell

Lake Uranium Project (“Russell”), which is located directly adjacent to

Denison’s flagship Wheeler River Project

(“Wheeler

River”).

The Russell property will be divided into four

property joint ventures that will be known as: Russell Lake

(“RL” or “Russell Lake”), Getty East, Wheeler North, and Wheeler

River Inliers, of which Denison will acquire initial ownership

interests of 20%, 30%, 49%, and 70%, respectively. In addition,

Denison and Skyharbour have agreed to enter into option agreements

(the “Earn-In Option

Agreements”), which will

allow Denison to increase its ownership interest in each of the new

Wheeler North and Getty East joint ventures to up to 70%

(collectively with the acquisition of initial interests, the

“Transaction”).

David Cates, President & CEO of Denison,

commented, “As

Denison nears receipt of final regulatory approvals for the Phoenix

In-Situ Recovery mine proposed for our flagship Wheeler River

property, we are also making measured investments in our project

pipeline – including our next development assets and

high-potential exploration properties. Given its proximity to

Wheeler River, Denison has had an interest in adding Russell to our

property portfolio for much of my nearly two decades with the

Company. This transaction achieves that objective by providing

Denison with the opportunity to lead and participate in exploration

efforts across four newly created joint ventures, which are

designed to drive collaboration between Denison and

Skyharbour’s technical teams. We are excited to build on our

long-standing relationship with Skyharbour and accelerate the

evaluation of this exceptional package of highly prospective

ground.”

Jordan Trimble,

President and CEO of Skyharbour, stated: “This is a

transformative transaction for Skyharbour and our shareholders as

it represents a major stamp of approval for Russell. We are very

pleased to expand upon our long-standing relationship with Denison

and to partner with their team to advance one of the more

prospective exploration projects in the Athabasca Basin proximal to

existing and developing mines. Denison’s success in

exploring, permitting, and developing the neighbouring world-class

Wheeler River Project will provide considerable insight and

experience as we jointly pursue success at Russell. Further, this

Transaction delivers on our belief that Russell should be treated

as multiple different projects due to the abundance of targets and

sheer scale of the land package in one of the most prolific uranium

exploration corridors in the world. The structure and terms of the

Agreement allow Skyharbour to continue exploring as operator at the

majority of the claims at Russell while retaining upside in future

success Denison may have at the Wheeler North, Getty East and

Wheeler River Inlier claims.”

Under the terms of the Agreement, Denison has

agreed to pay Skyharbour total consideration of $18.0 million

(“the

Consideration Payment”)

– consisting of a $2.0 million cash payment upon the

execution of the Agreement (“the Upfront

Payment”) and deferred

consideration of $16 million, payable in cash or common shares of

Denison in two tranches of $8.0 million (“the Deferred

Consideration”), before

December 31, 2025. Closing of the Transaction

(“Closing”) is expected to occur on or before

December 21, 2025.

Key Transaction Highlights:

●

Strengthens Denison’s

regional presence and establishes a strategic foothold immediately

east and north of the Company’s flagship Wheeler River

Property, with a high potential land package that stands to benefit

from its proximity to a property where the Phoenix and Gryphon

deposits are located.

●

Supports Denison’s

long-term growth objectives and exploration strategy by augmenting

its vast portfolio of exploration properties with key claims that

will benefit from the joint exploration expertise of Denison and

Skyharbour.

●

Promotes exploration activity

and increases the likelihood of exploration success near the

Wheeler River Project, meaningfully enhancing Denison’s

exposure to high potential and value-adding discovery

opportunities.

●

Gives Denison a pathway to

majority ownership through multi-phase earn-in options to increase

its ownership interests in Wheeler North and Getty East, allowing

for disciplined capital deployment tied to exploration

results.

Formation of Exploration Joint Ventures

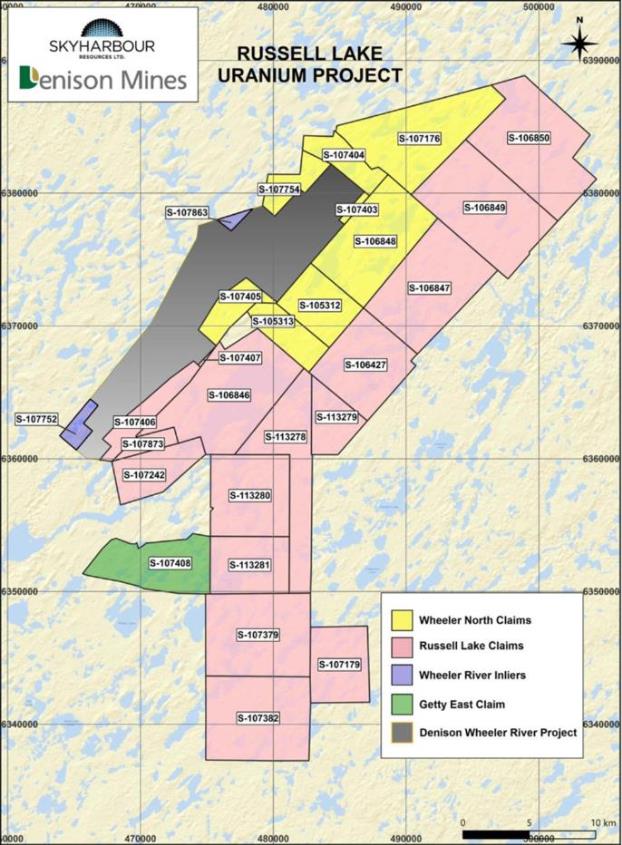

Upon closing of

the Transaction, Russell will be subdivided into four joint

ventures, (outlined in Figure

1), consisting of

Wheeler North, RL, Wheeler River Inliers, and Getty

East.

●

Wheeler North (49% DML, 51% SYH; subject to additional earn-in

options)

Represented by

the yellow claims in Figure

1, the Wheeler North claims are adjacent to the Northeast

boundary of Wheeler River. Comprised of 16,409 hectares over 8

claims. Upon closing of the Transaction, Denison will have the

option to increase its interest in Wheeler North to a 70% interest

in these claims and Denison will become the operator of Wheeler

North as described in more detail below.

Represented by

the pink claims in Figure 1,

the Russell Lake claims are adjacent and to the east of Wheeler

River and comprise 53,192 hectares over 16 claims. In order to

maintain its initial interest in RL, Denison has agreed to fund its

pro rata share of up to a maximum of C$10.0 million in total

project expenditures. Upon the closing of the Transaction,

Skyharbour will remain operator of RL.

●

Wheeler River Inliers (70% DML, 30% SYH)

Represented by

the blue claims in Figure 1,

the Wheeler River Inliers comprise a total of 608 inlaying hectares

within the boundaries of Wheeler River. Upon closing of the

Transaction, Denison will become operator of Wheeler River

Inliers.

●

Getty East (30% DML, 70% SYH; subject to additional earn-in

options)

Represented by

the green claim in Figure 1,

the Getty East claim of 3,105 hectares is located fewer than 10km

southeast of Wheeler River, and borders Cameco’s Cree Zimmer

property which holds its Key Lake operations to the south. Upon the

closing of the Transaction, Skyharbour will remain operator of

Getty East; however, Denison will have the option to become the

operator and acquire up to a 70% interest in this joint venture as

described in more detail below.

Figure 1: Russell Lake Uranium Property - Claim Map

Key Terms of the

Transaction:

Immediately

upon execution of the Agreement an upfront payment of $2.0 million

in cash will be payable to Skyharbour, with a deferred

consideration of $16.0 million payable prior to December 31,

2025. The Deferred Consideration will be comprised of two

tranches, each of which may be paid in cash or shares at

Denison’s election. This first deferred payment of $8.0

million in cash or shares, is payable on or before the fifth

business day prior to December 21, 2025. The second deferred

payment of $8.0 million in cash or shares, is payable within 10

days of December 21, 2025.

The Agreement grants Denison priority access to

excess capacity at Skyharbour’s existing Russell exploration

camp located near Highway 914 proximal to McGowan Lake (the

“Camp”), which Skyharbour will continue to

operate. Denison will pay Skyharbour a usage fee as well as a 7%

administrative fee to use the Camp.

The

Transaction is subject to customary approvals, including Skyharbour

obtaining TSX Venture exchange approval. The Transaction will be

considered a Reviewable Transaction under TSX Venture exchange

policies as David Cates, President, CEO & Director of Denison,

is also a director of Skyharbour.

Key Terms of the Earn-In Option Agreements:

The

Earn-In Option Agreements grant Denison an option to earn

additional interests in Wheeler North and Getty East.

Wheeler North Earn-In Option

Under

the terms of the Wheeler North Earn-In Option Agreement, Denison

may acquire up to a 70% interest in Wheeler North. The option

agreement contains two (2) phases, as summarized

below:

Phase

1: To earn an additional 11% interest in Wheeler North (increasing

Denison’s ownership to 60%), Denison must:

●

Incur $10.0

million in exploration expenditures at Wheeler North within 48

months of Closing, of which $2.5 million in exploration

expenditures must be completed within 24 months of Closing,

and

●

Make a cash

payment in the amount of $1.5 million to Skyharbour within 48

months of Closing.

Phase

2: To earn an additional 10% interest (increasing Denison’s

ownership to 70%) in Wheeler North, Denison must complete the

requirements of Phase 1, plus the following:

●

Incur an

additional $15.0 million in exploration expenditures at Wheeler

North within 7 years of Closing, and

●

Make a

further cash payment in the amount of $2.0 million to Skyharbour

within 7 years of Closing.

Getty East Earn-In Option Agreement

Under

the terms of the Getty East Option Agreement, Denison may acquire

up to a 70% interest in Getty East. The option agreement contains

two (2) phases, as summarized below.

Phase

1: To earn an additional 19% interest in Getty East (increasing

Denison’s ownership to 49%), Denison must incur $5.0 million

in exploration expenditures at Getty East within 48 months of

Closing, of which $1.5 million must be completed within the first

24 months of Closing.

Phase 2: To earn an additional 21% interest

in Getty East (increasing Denison’s ownership to 70%),

Denison must complete the requirements of Phase 1, plus incur an

additional $10 million in exploration expenditures within 7 years of Closing. Upon completion of the

Phase 2 earn-in option criteria, Denison will have the option to

become the operator in this joint venture.

About Denison

Denison is a leading uranium mining, development, and exploration

company with interests focused in the Athabasca Basin region of

northern Saskatchewan, Canada. Denison has an effective 95%

interest in its flagship Wheeler River Uranium Project, which is

the largest undeveloped uranium project in the infrastructure rich

eastern portion of the Athabasca Basin region of northern

Saskatchewan.

In mid-2023, the Phoenix feasibility study was completed for the

Phoenix deposit as an ISR mining operation, and an update to the

previously prepared 2018 Pre-Feasibility Study ('PFS') was

completed for Wheeler River's Gryphon deposit as a conventional

underground mining operation. Based on the respective studies, both

deposits have the potential to be competitive with the lowest cost

uranium mining operations in the world. Permitting efforts for the

planned Phoenix ISR operation commenced in 2019 and are nearing

completion with approval in July 2025 of the project's EA by the

Province of Saskatchewan and commencement in October 2025 of the

Canadian Nuclear Safety Commission Hearings for Federal approval of

the EA and project construction license. The Hearing is scheduled

to continue and be concluded during the week of December 8,

2025.

Denison's interests in Saskatchewan also include a 22.5% ownership

interest in the McClean Lake Joint Venture ('MLJV'), which includes

unmined uranium deposits (with mining at McClean North deposit via

the MLJV's SABRE mining method having commenced in July 2025 using

the MLJV's SABRE mining method) and the McClean Lake uranium mill

(currently utilizing a portion of its licensed capacity to process

the ore from the Cigar Lake mine under a toll milling agreement),

plus a 25.17% interest in the Midwest Joint Venture Midwest Main

and Midwest A deposits, and a 70.55% interest in the Tthe Heldeth

Túé ('THT') and Huskie deposits on the Waterbury Lake

Property. The Midwest Main, Midwest A, THT and Huskie deposits are

located within 20 kilometres of the McClean Lake mill. Taken

together, Denison has direct ownership interests in properties

covering ~384,000 hectares in the Athabasca Basin

region.

Additionally, through its 50% ownership of JCU (Canada) Exploration

Company, Limited ('JCU'), Denison holds interests in various

uranium project joint ventures in Canada, including the Millennium

project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118) and

Christie Lake (JCU, 34.4508%).

In 2024, Denison celebrated its 70th year in uranium mining,

exploration, and development, which began in 1954 with Denison's

first acquisition of mining claims in the Elliot Lake region of

northern Ontario.

For more information, please contact

David

Cates

(416) 979-1991 ext.

362

President and

Chief Executive Officer

Geoff

Smith

(416) 979-1991 ext.

358

Vice President

Corporate Development & Commercial

Follow Denison on

X (formerly Twitter) @DenisonMinesCo

About Skyharbour

Skyharbour holds an extensive portfolio of uranium exploration

projects in Canada's Athabasca Basin and is well positioned to

benefit from improving uranium market fundamentals with interest in

thirty-seven projects covering over 616,000 hectares (over 1.5

million acres) of land. Skyharbour has acquired from Denison Mines,

a large strategic shareholder of the Company, a 100% interest in

the Moore Uranium Project, which is located 15 kilometres east of

Denison's Wheeler River project and 39 kilometres south of Cameco's

McArthur River uranium mine. Moore is an advanced-stage uranium

exploration property with high-grade uranium mineralization in

several zones at the Maverick Corridor. Adjacent to the Moore

Project is the Russell Lake Uranium Project, which hosts widespread

uranium mineralization in drill intercepts over a large property

area with exploration upside potential. The Company is actively

advancing these projects through exploration and drilling

programs.

Skyharbour also has joint ventures with industry leaders Denison

Mines, Orano Canada Inc., Azincourt Energy, and Thunderbird

Resources at the Russell, Preston, East Preston, and Hook Lake

Projects, respectively. The Company also has several active earn-in

option partners, including CSE-listed Basin Uranium Corp. at the

Mann Lake Uranium Project; TSX-V listed North Shore Uranium at the

Falcon Project; UraEx Resources at the South Dufferin and Bolt

Projects; Hatchet Uranium at the Highway Project; CSE-listed

Mustang Energy at the 914W Project; and TSX-V listed Terra Clean

Energy at the South Falcon East Project.

Cautionary Statement Regarding Forward-Looking

Statements

Certain information contained in this news release constitutes

‘forward-looking information’, within the meaning of

the applicable United States and Canadian legislation, concerning

the business, operations and financial performance and condition of

Denison. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

‘potential’, ‘plans’,

‘expects’, ‘budget’,

‘scheduled’, ‘estimates’,

‘forecasts’, ‘intends’,

‘anticipates’, or ‘believes’, or the

negatives and/or variations of such words and phrases, or state

that certain actions, events or results ‘may’,

‘could’, ‘would’, ‘might’ or

‘will’ ‘be taken’, ‘occur’ or

‘be achieved’.

In particular, this news release contains forward-looking

information pertaining to Denison's current intentions and

objectives with respect to, and commitments set forth in, the

Agreement, Earn-In Option Agreements and ancillary agreements and

the expected benefits thereof; the assumption that the transactions

set forth in the agreements with Skyharbour will be completed as

described; the Company’s exploration, development and

expansion plans and objectives; and expectations regarding its

joint venture ownership interests and the continuity of its

agreements with its partners and third parties.

Forward looking statements are based on the opinions and estimates

of management as of the date such statements are made, and they are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of Denison to be materially different from those

expressed or implied by such forward-looking statements. For

example, the parties to the Option Agreement may not complete the

option phases as described and/or the exploration objective for the

Exploration Properties may not be achieved. In addition, Denison

may decide or otherwise be required to discontinue testing,

evaluation and other work on the Company’s other properties

if it is unable to maintain or otherwise secure the necessary

resources (such as testing facilities, capital funding, joint

venture approvals, regulatory approvals, etc.). Denison believes

that the expectations reflected in this forward-looking information

are reasonable but no assurance can be given that these

expectations will prove to be accurate and results may differ

materially from those anticipated in this forward-looking

information. For a discussion in respect of risks and other factors

that could influence forward-looking events, please refer to the

factors discussed in Denison’s Annual Information Form dated

March 28, 2025 under the heading ‘Risk Factors’ or in

subsequent quarterly financial reports. These factors are not, and

should not be construed as being, exhaustive.

Accordingly, readers should not place undue reliance on

forward-looking statements. The forward-looking information

contained in this news release is expressly qualified by this

cautionary statement. Any forward-looking information and the

assumptions made with respect thereto speaks only as of the date of

this news release. Denison does not undertake any obligation to

publicly update or revise any forward-looking information after the

date of this news release to conform such information to actual

results or to changes in Denison's expectations except as otherwise

required by applicable legislation.