|

|

|

|

|

|

|

|

|

|

|

|

|

DENISON MINES

CORP.

|

||

|

|

|

|

||||

|

|

|

|

|

/s/ Amanda Willett

|

||

|

Date: August 8,

2025

|

|

|

|

Amanda

Willett

|

||

|

|

|

|

|

Vice

President Legal and Corporate Secretary

|

||

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

99.3

|

|

|

|

99.4

|

|

|

|

99.5

|

|

|

|

|

|

|

|

Exhibit 99.1

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

(Unaudited -

Expressed in thousands of Canadian dollars (“CAD”)

except for share amounts)

|

||||||

|

|

|

|

|

At June

30

2025

|

|

At December

31

2024

|

|

ASSETS

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Cash and cash

equivalents (note 4)

|

|

|

$

|

54,533

|

$

|

$108,518

|

|

Trade and other

receivables

|

|

|

|

4,115

|

|

3,075

|

|

Inventories

|

|

|

|

4,102

|

|

3,746

|

|

Investments-equity

instruments (note 5)

|

|

|

|

7,563

|

|

6,292

|

|

Investments-uranium

(note 7)

|

|

|

|

32,128

|

|

-

|

|

Prepaid expenses

and other

|

|

|

|

2,984

|

|

2,093

|

|

|

|

|

|

105,425

|

|

123,724

|

|

Non-Current

|

|

|

|

|

|

|

|

Inventories-ore

in stockpiles

|

|

|

|

2,098

|

|

2,098

|

|

Investments-equity

instruments (note 5)

|

|

|

|

5,075

|

|

1,755

|

|

Investments-uranium

(note 5)

|

|

|

|

203,487

|

|

231,088

|

|

Investments-convertible

debentures (note 5)

|

|

|

|

12,492

|

|

13,000

|

|

Investments-joint

venture (note 6)

|

|

|

|

19,726

|

|

20,663

|

|

Restricted cash

and investments

|

|

|

12,145

|

|

11,624

|

|

|

Property, plant

and equipment (note 7)

|

|

|

|

265,419

|

|

259,661

|

|

Other long-term

assets

|

|

|

|

1,016

|

|

-

|

|

Total

assets

|

|

|

$

|

626,883

|

$

|

663,613

|

|

LIABILITIES

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Accounts payable

and accrued liabilities (note 8)

|

|

|

$

|

20,073

|

$

|

21,333

|

|

Current portion

of long-term liabilities:

|

|

|

|

|

|

|

|

Deferred revenue

(note 9)

|

|

|

|

4,517

|

|

4,501

|

|

Reclamation

obligations (note 10)

|

|

|

|

1,569

|

|

1,713

|

|

Other

liabilities

|

|

|

|

567

|

|

6,344

|

|

|

|

|

|

26,726

|

|

33,891

|

|

Non-Current

|

|

|

|

|

|

|

|

Deferred revenue

(note 9)

|

|

|

|

28,222

|

|

29,492

|

|

Reclamation

obligations (note 10)

|

|

|

|

31,145

|

|

30,601

|

|

Other

liabilities

|

|

|

|

2,821

|

|

2,936

|

|

Deferred income

tax liability

|

|

|

|

2,114

|

|

2,371

|

|

Total

liabilities

|

|

|

|

91,028

|

|

99,291

|

|

EQUITY

|

|

|

|

|

|

|

|

Share capital

(note 11)

|

|

|

|

1,666,474

|

|

1,665,189

|

|

Contributed

surplus

|

|

|

|

74,785

|

|

73,311

|

|

Deficit

|

|

|

|

(1,207,036)

|

|

(1,176,000)

|

|

Accumulated other

comprehensive income

|

|

|

|

1,632

|

|

1,822

|

|

Total

equity

|

|

|

|

535,855

|

|

564,322

|

|

Total

liabilities and equity

|

|

|

$

|

626,883

|

$

|

663,613

|

|

Issued and

outstanding common shares (note 11)

|

|

|

|

896,422,542

|

|

895,713,101

|

|

Commitments

and contingencies (note 18)

|

|

|

|

|

|

|

|

The accompanying

notes are an integral part of the condensed interim consolidated

financial statements

|

||||||

|

|

||||||

|

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED

STATEMENTS OF INCOME (LOSS) AND COMPREHENSIVE INCOME

(LOSS)

(Unaudited -

Expressed in thousands of CAD dollars except for share and per

share amounts)

|

||||||||

|

|

|

Three

Months Ended

June

30

|

|

Six

Months Ended

June

30

|

||||

|

|

|

2025

|

|

2024

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES (note 14)

|

$

|

1,276

|

$

|

1,326

|

$

|

2,651

|

$

|

2,158

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

Operating

expenses (note 14)

|

|

(1,386)

|

|

(1,367)

|

|

(2,609)

|

|

(2,587)

|

|

Exploration (note

14)

|

|

(2,510)

|

|

(1,755)

|

|

(10,564)

|

|

(7,168)

|

|

Evaluation (note

14)

|

|

(11,106)

|

|

(6,708)

|

|

(20,136)

|

|

(12,409)

|

|

General and

administrative (note 14)

|

|

(4,603)

|

|

(3,741)

|

|

(9,346)

|

|

(7,325)

|

|

Other income

(expense) (note 13)

|

|

32,822

|

|

(4,596)

|

|

5,415

|

|

(9,678)

|

|

|

|

13,217

|

|

(18,167)

|

|

(37,240)

|

|

(39,167)

|

|

Income

(loss) before net finance expense, equity accounting

|

|

14,493

|

|

(16,841)

|

|

(34,589)

|

|

(37,009)

|

|

|

|

|

|

|

|

|

|

|

|

Finance (expense)

income, net (note 13)

|

|

(293)

|

|

902

|

|

(118)

|

|

1,743

|

|

Equity pick

up-investment in associates (note 5)

|

|

(1,359)

|

|

-

|

|

(1,499)

|

|

-

|

|

Equity pick

up-joint venture (note 6)

|

|

(426)

|

|

(547)

|

|

(937)

|

|

(1,128)

|

|

Income (loss)

before taxes

|

|

12,415

|

|

(16,486)

|

|

(37,143)

|

|

(36,394)

|

|

Deferred Income

tax recovery

|

|

83

|

|

45

|

|

6,107

|

|

73

|

|

Net income (loss)

from continuing operations

|

|

12,498

|

|

(16,441)

|

|

(31,036)

|

|

(36,321)

|

|

Net income from

discontinued operations,

net

of taxes (note 14)

|

|

-

|

|

471

|

|

-

|

|

471

|

|

Net income (loss)

for the period

|

$

|

12,498

|

$

|

(15,970)

|

$

|

(31,036)

|

$

|

(35,850)

|

|

|

|

|

|

|

|

|

|

|

|

Other

comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

Items that are or

may be subsequently reclassified to income (loss):

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation change

|

|

(188)

|

|

(18)

|

|

(190)

|

|

(67)

|

|

Comprehensive

income (loss) for the period

|

$

|

12,310

|

$

|

(15,988)

|

$

|

(31,226)

|

$

|

(35,917)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing

operations net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

0.01

|

$

|

(0.02)

|

$

|

(0.03)

|

$

|

(0.04)

|

|

Diluted

|

$

|

0.01

|

$

|

(0.02)

|

$

|

(0.03)

|

$

|

(0.04)

|

|

|

|

|

|

|

|

|

||

|

Discontinued

operations net income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

-

|

$

|

0.00

|

$

|

-

|

$

|

0.00

|

|

Diluted

|

$

|

-

|

$

|

0.00

|

$

|

-

|

$

|

0.00

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

Weighted-average

number of shares outstanding

(in

thousands):

|

|

|

|

|

|

|

|

|

|

Basic

|

|

896,322

|

|

892,230

|

|

896,049

|

|

891,727

|

|

Diluted

|

|

903,172

|

|

892,230

|

|

896,049

|

|

891,727

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying

notes are an integral part of the condensed interim consolidated

financial statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

(Unaudited -

Expressed in thousands of CAD dollars)

|

||||||||

|

|

|

|

|

Six

Months Ended

June

30

|

||||

|

|

|

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Share capital (note 11)

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

1,665,189

|

$

|

1,655,024

|

|

Other shares

issued, net of issue costs

|

|

|

|

|

|

108

|

|

95

|

|

Share options

exercised-cash

|

|

|

|

|

|

165

|

|

1,082

|

|

Share options

exercised-transfer from contributed surplus

|

|

|

|

84

|

|

509

|

||

|

Share units

exercised-transfer from contributed surplus

|

|

|

|

928

|

|

379

|

||

|

Balance-end of

period

|

|

|

|

|

|

1,666,474

|

|

1,657,089

|

|

|

|

|

|

|

|

|

|

|

|

Contributed surplus

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

73,311

|

|

69,823

|

|

Share-based

compensation expense (note 12)

|

|

|

|

|

|

2,486

|

|

2,212

|

|

Share options

exercised-transfer to share capital

|

|

|

|

|

|

(84)

|

|

(509)

|

|

Share units

exercised-transfer to share capital

|

|

|

|

|

|

(928)

|

|

(379)

|

|

Balance-end of

period

|

|

|

|

|

|

74,785

|

|

71,147

|

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

(1,176,000)

|

|

(1,084,881)

|

|

Net

loss

|

|

|

|

|

|

(31,036)

|

|

(35,850)

|

|

Balance-end of

period

|

|

|

|

|

|

(1,207,036)

|

|

(1,120,731)

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

other comprehensive income (note 13)

|

|

|

|

|

|

|

||

|

Balance-beginning

of period

|

|

|

|

|

|

1,822

|

|

1,818

|

|

Foreign currency

translation

|

|

|

|

|

|

(190)

|

|

(67)

|

|

Balance-end of

period

|

|

|

|

|

|

1,632

|

|

1,751

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

564,322

|

$

|

641,784

|

|

Balance-end of

period

|

|

|

|

|

$

|

535,855

|

$

|

609,256

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying

notes are an integral part of the condensed interim consolidated

financial statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited -

Expressed in thousands of CAD dollars)

|

||||||||

|

|

|

|

|

Six

Months Ended

June

30

|

||||

|

|

|

|

|

2025

|

|

2024

|

||

|

CASH PROVIDED BY (USED IN):

|

|

|

|

|

|

|

||

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

||

|

Net loss for the

period

|

|

|

$

|

(31,036)

|

$

|

(35,850)

|

||

|

Adjustments and

items not affecting cash and cash equivalents:

|

|

|

|

|

|

|

||

|

Depletion,

depreciation, amortization and accretion

|

|

|

|

5,232

|

|

5,219

|

||

|

Fair value change

(gains) losses:

|

|

|

|

|

|

|

||

|

Investments-equity

instruments (notes 5 and 13)

|

|

|

|

(2,101)

|

|

3,424

|

||

|

Investments-uranium

(note 5 and 13)

|

|

|

|

(4,527)

|

|

5,757

|

||

|

Investments-convertible

debentures (notes 5 and 13)

|

|

|

|

508

|

|

1,435

|

||

|

Deferred

consideration (notes 5 and 13)

|

|

|

|

(115)

|

|

-

|

||

|

Investment in

associate-equity pick up (note 5)

|

|

|

|

1,499

|

|

-

|

||

|

Joint

venture-equity pick up (note 6)

|

|

|

|

937

|

|

1,128

|

||

|

Recognition of

deferred revenue (note 9)

|

|

|

|

(2,651)

|

|

(2,158)

|

||

|

Gain on property,

plant and equipment disposals

|

|

|

|

-

|

|

(130)

|

||

|

Post-employment

benefit payments

|

|

|

|

(29)

|

|

(65)

|

||

|

Reclamation

obligation expenditures (note 10)

|

|

|

|

(522)

|

|

(1,216)

|

||

|

Share-based

compensation (note 12)

|

|

|

|

2,486

|

|

2,212

|

||

|

Foreign exchange

loss (gain) (note 13)

|

|

|

|

1,127

|

|

(1,111)

|

||

|

Deferred income

tax recovery

|

|

|

|

(6,107)

|

|

(73)

|

||

|

Change in

non-cash operating working capital items (note 13)

|

|

|

|

(4,545)

|

|

1,450

|

||

|

Net

cash used in operating activities

|

|

|

|

(39,844)

|

|

(19,978)

|

||

|

|

|

|

|

|

|

|

||

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

||

|

Additions of

property, plant and equipment (note 7)

|

|

|

|

(11,319)

|

|

(3,046)

|

||

|

Increase in

restricted cash and investments

|

|

|

|

(521)

|

|

(830)

|

||

|

Purchase of

equity investments (note 5)

|

|

|

|

(632)

|

|

-

|

||

|

Purchase of

investment in joint venture (note 6)

|

|

|

|

-

|

|

(1,949)

|

||

|

Proceeds on

disposal of investments – uranium (note 5)

|

|

|

|

-

|

|

13,598

|

||

|

Proceeds on

disposal of property, plant and equipment

|

|

|

|

-

|

|

207

|

||

|

Net

cash (used in) provided by investing activities

|

|

|

|

(12,472)

|

|

7,980

|

||

|

|

|

|

|

|

|

|

||

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

||

|

Proceeds

from share options exercised (note 12)

|

|

|

|

165

|

|

1,082

|

||

|

Repayment

of debt obligations

|

|

|

|

(242)

|

|

(119)

|

||

|

Payment

of issue costs

|

|

|

|

(252)

|

|

-

|

||

|

Net

cash (used in) provided by financing activities

|

|

|

|

(329)

|

|

963

|

||

|

|

|

|

|

|

|

|

||

|

Decrease

in cash and cash equivalents

|

|

|

|

(52,645)

|

|

(11,035)

|

||

|

Foreign

exchange effect on cash and cash equivalents

|

|

|

|

(1,340)

|

|

1,048

|

||

|

Cash

and cash equivalents, beginning of period

|

|

|

|

108,518

|

|

131,054

|

||

|

Cash

and cash equivalents, end of period

|

|

|

$

|

54,533

|

$

|

121,067

|

||

|

|

||||||||

|

The accompanying

notes are an integral part of the condensed interim consolidated

financial statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2025

|

|

|

(Unaudited -

Expressed in CAD dollars except for shares and per share

amounts)

|

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

$

|

1,456

|

$

|

1,113

|

|

Cash in MLJV and

MWJV

|

|

|

|

3,341

|

|

2,969

|

|

Cash

equivalents

|

|

|

|

49,736

|

|

104,436

|

|

|

|

|

$

|

54,533

|

$

|

108,518

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Equity

instruments

|

|

|

|

|

|

|

|

Shares

|

|

|

$

|

7,555

|

$

|

6,280

|

|

Warrants

|

|

|

|

1,433

|

|

280

|

|

Investment in

Associates

|

|

|

|

3,650

|

|

1,487

|

|

Convertible

Debentures

|

|

|

|

12,492

|

|

13,000

|

|

Physical

Uranium

|

|

|

|

235,615

|

|

231,088

|

|

|

|

|

$

|

260,745

|

$

|

252,135

|

|

|

|

|

|

|

|

|

|

Investments-by

balance sheet presentation:

|

|

|

|

|

|

|

|

Current

|

|

|

$

|

39,691

|

$

|

6,292

|

|

Long-term

|

|

|

|

221,054

|

|

245,843

|

|

|

|

|

$

|

260,745

|

$

|

252,135

|

|

(in

thousands)

|

|

Equity

Instruments

|

|

Investment in

Associates

|

|

Convertible

Debentures

|

|

Physical

Uranium

|

|

Total

Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

$

|

6,560

|

$

|

1,487

|

$

|

13,000

|

$

|

231,088

|

$

|

252,135

|

|

Acquisition of

investments

|

|

327

|

|

3,662

|

|

-

|

|

-

|

|

3,989

|

|

Change in fair

value (note 13)

|

|

2,101

|

|

-

|

|

(508)

|

|

4,527

|

|

6,120

|

|

Equity pick up of

associates

|

|

-

|

|

(1,499)

|

|

-

|

|

-

|

|

(1,499)

|

|

Balance-June 30,

2025

|

$

|

8,988

|

$

|

3,650

|

$

|

12,492

|

$

|

235,615

|

$

|

260,745

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Investment in

joint venture:

|

|

|

|

|

|

|

|

JCU

|

|

|

$

|

19,726

|

$

|

20,663

|

|

|

|

|

$

|

19,726

|

$

|

20,663

|

|

(in

thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

|

|

|

|

$

|

20,663

|

|

Investment at

cost:

|

|

|

|

|

|

|

|

Equity

share of loss

|

|

|

|

|

|

(937)

|

|

Balance-June 30,

2025

|

|

|

|

|

$

|

19,726

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Total current

assets(1)

|

|

|

$

|

1,143

|

$

|

3,226

|

|

|

Total non-current

assets

|

|

|

|

39,250

|

|

38,838

|

|

|

Total current

liabilities

|

|

|

|

(401)

|

|

(544)

|

|

|

Total non-current

liabilities

|

|

|

|

(542)

|

|

(194)

|

|

|

Total net

assets

|

|

|

$

|

39,450

|

$

|

41,326

|

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months

Ended

|

|

|

|

|

|

|

|

|

May 31,

2025(2)

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

$

|

-

|

|

|

Net

loss

|

|

|

|

|

|

(1,874)

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of

JCU net assets to Denison investment carrying value:

|

|

|

|||||

|

Adjusted net assets of

JCU–at December 31, 2024

|

|

|

$

|

41,326

|

|||

|

Net

loss

|

|

|

|

|

|

(1,874)

|

|

|

Net assets of

JCU-at May 31, 2025

|

|

|

|

|

$

|

39,452

|

|

|

Denison ownership

interest

|

|

|

|

|

|

50.00%

|

|

|

Investment in

JCU

|

|

|

|

|

$

|

19,726

|

|

|

|

|

Plant

and Equipment

|

|

Mineral

|

|

Total

|

||

|

(in

thousands)

|

|

Owned

|

|

Right-of-Use

|

|

Properties

|

|

PP&E

|

|

|

|

|

|

|

|

|

|

|

|

Cost:

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

$

|

116,512

|

$

|

2,055

|

$

|

184,158

|

$

|

302,725

|

|

Additions (note

14)

|

|

10,253

|

|

129

|

|

2,687

|

|

13,069

|

|

Disposal related

to Cosa Transaction (note 5)

|

|

-

|

|

-

|

|

(4,485)

|

|

(4,485)

|

|

Balance-June 30,

2025

|

$

|

126,765

|

$

|

2,184

|

$

|

182,360

|

$

|

311,309

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

amortization, depreciation:

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

$

|

(42,748)

|

$

|

(316)

|

$

|

-

|

$

|

(43,064)

|

|

Amortization

|

|

(277)

|

|

-

|

|

-

|

|

(277)

|

|

Depreciation

|

|

(2,407)

|

|

(142)

|

|

-

|

|

(2,549)

|

|

Balance- June 30,

2025

|

$

|

(45,432)

|

$

|

(458)

|

$

|

-

|

$

|

(45,890)

|

|

|

|

|

|

|

|

|

|

|

|

Carrying

value:

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

$

|

73,764

|

$

|

1,739

|

$

|

184,158

|

$

|

259,661

|

|

Balance- June 30,

2025

|

$

|

81,333

|

$

|

1,726

|

$

|

182,360

|

$

|

265,419

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Trade

payables

|

|

|

$

|

9,934

|

$

|

13,289

|

|

|

Payables in MLJV

and MWJV

|

|

|

|

8,236

|

|

7,007

|

|

|

Other

payables

|

|

|

|

1,903

|

|

1,037

|

|

|

|

|

|

$

|

20,073

|

$

|

21,333

|

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Deferred

revenue-pre-sold toll milling:

|

|

|

|

|

|

|

|

CLJV Toll

Milling-Ecora

|

|

|

$

|

32,739

|

$

|

33,993

|

|

|

|

|

$

|

32,739

|

$

|

33,993

|

|

Deferred

revenue-by balance sheet presentation:

|

|

|

|

|

||

|

Current

|

|

|

$

|

4,517

|

$

|

4,501

|

|

Non-current

|

|

|

|

28,222

|

|

29,492

|

|

|

|

|

$

|

32,739

|

$

|

33,993

|

|

(in

thousands)

|

|

|

|

|

|

|

Deferred

Revenue

|

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

|

|

|

|

$

|

33,993

|

|

|

Revenue

recognized during the period (note 14)

|

|

|

|

|

|

(2,651)

|

|

|

Accretion (note

13)

|

|

|

|

|

|

1,397

|

|

|

Balance-June 30,

2025

|

|

|

|

|

$

|

32,739

|

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Reclamation

obligations-by item:

|

|

|

|

|

|

|

|

Elliot

Lake

|

|

|

$

|

18,089

|

$

|

18,071

|

|

MLJV and

MWJV

|

|

|

|

12,400

|

|

12,057

|

|

Wheeler River and

other

|

|

|

|

2,225

|

|

2,186

|

|

|

|

|

$

|

32,714

|

$

|

32,314

|

|

|

|

|

|

|

|

|

|

Reclamation

obligations-by balance sheet presentation:

|

|

|

|

|

||

|

Current

|

|

|

$

|

1,569

|

$

|

1,713

|

|

Non-current

|

|

|

|

31,145

|

|

30,601

|

|

|

|

|

$

|

32,714

|

$

|

32,314

|

|

(in

thousands)

|

|

|

|

|

|

Reclamation

Obligations

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

|

|

|

|

$

|

32,314

|

|

Accretion (note

13)

|

|

|

|

|

|

922

|

|

Expenditures

incurred

|

|

|

|

|

|

(522)

|

|

Balance-June 30,

2025

|

|

|

|

|

$

|

32,714

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

Number

of

|

|

|

|

|

|

Common

|

|

Share

|

|

|

(in thousands

except share amounts)

|

Shares

|

|

Capital

|

|

|

|

|

|

|

|

|

Balance-December

31, 2024

|

895,713,101

|

$

|

1,665,189

|

|

|

Issued for

cash:

|

|

|

|

|

|

Share option

exercises

|

125,001

|

|

165

|

|

|

Share option

exercises-transfer from contributed surplus

|

-

|

|

84

|

|

|

Share unit

exercises-transfer from contributed surplus

|

538,998

|

|

928

|

|

|

Other share

issues proceeds-net of transaction costs

|

45,442

|

|

108

|

|

|

|

709,441

|

|

1,285

|

|

|

Balance-June 30,

2025

|

896,422,542

|

$

|

1,666,474

|

|

|

|

|

Three

Months Ended

June

30

|

|

Six

Months Ended

June

30

|

||||

|

(in

thousands)

|

|

2025

|

|

2024

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Share based

compensation expense for:

|

|

|

|

|

|

|

|

|

|

Share

options

|

$

|

(336)

|

$

|

(368)

|

$

|

(822)

|

$

|

(745)

|

|

RSUs

|

|

(764)

|

|

(925)

|

|

(1,664)

|

|

(1,467)

|

|

Share

based compensation expense

|

$

|

(1,100)

|

$

|

(1,293)

|

$

|

(2,486)

|

$

|

(2,212)

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

2025

|

||||

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

|

|

Average

|

|

|

|

|

|

|

|

|

|

Exercise

|

|

|

|

|

|

|

|

Number

of

Common

|

|

Price

per

Share

|

|

|

|

|

|

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

Share options

outstanding-December 31, 2024

|

|

|

|

|

|

5,649,167

|

$

|

1.85

|

|

Grants

|

|

|

|

|

|

1,671,000

|

|

1.99

|

|

Exercises

(1)

|

|

|

|

|

|

(125,001)

|

|

1.32

|

|

Forfeitures

|

|

|

|

|

|

(111,333)

|

|

2.33

|

|

Share options

outstanding-June 30, 2025

|

|

|

|

|

|

7,083,833

|

$

|

1.89

|

|

Share options exercisable- June

30, 2025

|

|

|

|

|

|

3,828,504

|

$

|

1.70

|

|

|

|

|

|

|

Weighted

|

|

|

|

Weighted-

|

|

|

|

|

|

|

Average

|

|

|

|

Average

|

|

|

|

|

|

|

Remaining

|

|

|

|

Exercise

|

|

Range of

Exercise

|

|

|

|

|

Contractual

|

|

Number

of

|

|

Price

per

|

|

Prices per

Share

|

|

|

|

|

Life

|

|

Common

|

|

Share

|

|

(CAD)

|

|

|

|

|

(Years)

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

|

Share options

outstanding

|

|

|

|

|

|

|

|||

|

$ 1.00 to $

1.50

|

|

|

|

|

1.76

|

|

2,558,499

|

|

1.40

|

|

$ 1.51 to $

2.00

|

|

|

|

|

3.45

|

|

2,769,334

|

|

1.93

|

|

$ 2.01 to $

2.50

|

|

|

|

|

3.38

|

|

288,000

|

|

2.18

|

|

$ 2.51 to $

3.00

|

|

|

|

|

3.68

|

|

1,468,000

|

|

2.62

|

|

Share options

outstanding-June 30, 2025

|

|

2.88

|

|

7,083,833

|

$

|

1.89

|

|||

|

|

|

|

|

Six Months

Ended

|

|

|

|

|

|

|

June 30,

2025

|

|

|

|

|

|

|

|

|

|

Risk-free

interest rate

|

|

|

|

2.64% -

2.75%

|

|

|

Expected stock

price volatility

|

|

|

|

56.68% -

57.43%

|

|

|

Expected

life

|

|

|

|

3.40

years

|

|

|

Expected dividend

yield

|

|

|

|

-

|

|

|

Fair value

per options granted

|

|

|

$0.86 to

$0.91

|

||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

RSUs

|

|

PSUs

|

||||

|

|

|

|

|

Weighted

|

|

|

|

Weighted

|

|

|

|

|

|

Average

|

|

|

|

Average

|

|

|

|

Number

of

|

|

Fair

Value

|

|

Number

of

|

|

Fair

Value

|

|

|

|

Common

|

|

Per

RSU

|

|

Common

|

|

Per

PSU

|

|

|

|

Shares

|

|

(CAD)

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

Units

outstanding–December 31, 2024

|

|

6,944,751

|

$

|

1.56

|

|

260,000

|

$

|

0.98

|

|

Grants

|

|

1,640,000

|

|

2.11

|

|

-

|

|

-

|

|

Exercises

(1)

|

|

(538,998)

|

|

1.72

|

|

-

|

|

-

|

|

Forfeitures

|

|

(107,667)

|

|

2.06

|

|

-

|

|

-

|

|

Units

outstanding–June 30, 2025

|

|

7,938,086

|

$

|

1.66

|

|

260,000

|

$

|

0.98

|

|

Units

vested–June 30, 2025

|

|

4,797,752

|

$

|

1.29

|

|

260,000

|

$

|

0.98

|

|

|

|

|

|

At June

30

|

|

At December

31

|

|

(in

thousands)

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

Cumulative

foreign currency translation

|

|

|

$

|

270

|

$

|

460

|

|

Experience

gains-post employment liability

|

|

|

|

|

||

|

Gross

|

|

|

|

1,847

|

|

1,847

|

|

Tax

effect

|

|

|

|

(485)

|

|

(485)

|

|

|

|

|

$

|

1,632

|

$

|

1,822

|

|

|

|

Three

Months Ended

June

30

|

|

Six

Months Ended

June

30

|

||||

|

(in

thousands)

|

|

2025

|

|

2024

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Gains (losses)

on:

|

|

|

|

|

|

|

|

|

|

Foreign

exchange

|

$

|

(1,110)

|

$

|

477

|

$

|

(1,127)

|

$

|

1,111

|

|

Fair value

changes (note 5):

|

|

|

|

|

|

|

|

|

|

Investments-equity

instruments

|

|

1,620

|

|

(2,628)

|

|

2,101

|

|

(3,424)

|

|

Investments-uranium

|

|

31,776

|

|

(80)

|

|

4,527

|

|

(5,757)

|

|

Investments-convertible

debentures

|

|

270

|

|

(2,074)

|

|

(508)

|

|

(1,435)

|

|

Gain

on recognition of proceeds–UI

Repayment Agreement

|

|

415

|

|

-

|

|

846

|

|

396

|

|

Uranium

investment carrying charges

|

|

(176)

|

|

(215)

|

|

(408)

|

|

(426)

|

|

Other

|

|

27

|

|

(76)

|

|

(16)

|

|

(143)

|

|

Other

income (expense)

|

$

|

32,822

|

$

|

(4,596)

|

$

|

5,415

|

$

|

(9,678)

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

Three

Months Ended

June

30

|

|

Six

Months Ended

June

30

|

||||

|

(in

thousands)

|

|

2025

|

|

2024

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Interest

income

|

$

|

941

|

$

|

2,144

|

$

|

2,301

|

$

|

4,282

|

|

Interest

expense

|

|

(1)

|

|

(2)

|

|

(2)

|

|

(3)

|

|

Accretion

expense

|

|

|

|

|

|

|

|

|

|

Deferred

revenue (note 9)

|

|

(719)

|

|

(749)

|

|

(1,397)

|

|

(1,561)

|

|

Reclamation

obligations (note 10)

|

|

(461)

|

|

(473)

|

|

(922)

|

|

(946)

|

|

Other

|

|

(53)

|

|

(18)

|

|

(98)

|

|

(29)

|

|

Finance

income (expense)

|

$

|

(293)

|

$

|

902

|

$

|

(118)

|

$

|

1,743

|

|

|

|

|

|

Six

Months Ended

June

30

|

||||

|

(in

thousands)

|

|

|

|

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Change in

non-cash working capital items:

|

|

|

|

|

|

|

|

|

|

Trade and other

receivables

|

|

|

|

|

$

|

(1,263)

|

$

|

(509)

|

|

Inventories

|

|

|

|

|

|

(356)

|

|

375

|

|

Prepaid expenses

and other assets

|

|

|

|

|

|

(428)

|

|

311

|

|

Accounts payable

and accrued liabilities

|

|

|

|

|

|

(2,498)

|

|

1,273

|

|

Change

in non-cash working capital items

|

|

|

|

|

$

|

(4,545)

|

$

|

1,450

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

(in

thousands)

|

|

|

Mining

|

Corporate

and

Other

|

Total

|

|

|

|

|

|

|

|

|

Statement of Operations:

|

|

|

|

|

|

|

Revenues

|

|

$

|

2,651

|

-

|

2,651

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

Operating

expenses

|

|

|

(2,609)

|

-

|

(2,609)

|

|

Exploration

|

|

|

(10,564)

|

-

|

(10,564)

|

|

Evaluation

|

|

|

(20,136)

|

-

|

(20,136)

|

|

General and

administrative

|

|

|

-

|

(9,346)

|

(9,346)

|

|

|

|

|

(33,309)

|

(9,346)

|

(42,655)

|

|

Segment

loss

|

|

$

|

(30,658)

|

(9,346)

|

(40,004)

|

|

|

|

|

|

|

|

|

Revenues-supplemental:

|

|

|

|

|

|

|

Toll milling

services-deferred revenue (note 9)

|

|

2,651

|

-

|

2,651

|

|

|

|

|

$

|

2,651

|

-

|

2,651

|

|

|

|

|

|

|

|

|

Capital additions:

|

|

|

|

|

|

|

Property,

plant and equipment (note 7)

|

$

|

11,933

|

1,136

|

13,069

|

|

|

|

|

|

|

|

|

|

Long-lived assets:

|

|

|

|

|

|

|

Plant and

equipment

|

|

|

|

|

|

|

Cost

|

|

$

|

120,732

|

8,217

|

128,949

|

|

Accumulated

depreciation

|

|

|

(45,281)

|

(609)

|

(45,890)

|

|

Mineral

properties

|

|

|

182,360

|

-

|

182,360

|

|

|

|

$

|

257,811

|

7,608

|

265,419

|

|

(in

thousands)

|

|

|

Mining

|

Corporate

and

Other

|

Total

|

|

|

|

|

|

|

|

|

Statement of Operations:

|

|

|

|

|

|

|

Revenues

|

|

$

|

1,276

|

-

|

1,276

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

Operating

expenses

|

|

|

(1,386)

|

-

|

(1,386)

|

|

Exploration

|

|

|

(2,510)

|

-

|

(2,510)

|

|

Evaluation

|

|

|

(11,106)

|

-

|

(11,106)

|

|

General and

administrative

|

|

|

-

|

(4,603)

|

(4,603)

|

|

|

|

|

(15,002)

|

(4,603)

|

(19,605)

|

|

Segment

loss

|

|

$

|

(13,726)

|

(4,603)

|

(18,329)

|

|

|

|

|

|

|

|

|

Revenues-supplemental:

|

|

|

|

|

|

|

Toll milling

services-deferred revenue (note 9)

|

|

1,276

|

-

|

1,276

|

|

|

|

|

$

|

1,276

|

-

|

1,276

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

(in

thousands)

|

|

|

Mining

|

Corporate

and

Other

|

Total

|

|

|

|

|

|

|

|

|

Statement of Operations:

|

|

|

|

|

|

|

Revenues

|

|

$

|

2,158

|

-

|

2,158

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

Operating

expenses

|

|

|

(2,587)

|

-

|

(2,587)

|

|

Exploration

|

|

|

(7,168)

|

-

|

(7,168)

|

|

Evaluation

|

|

|

(12,409)

|

-

|

(12,409)

|

|

General and

administrative

|

|

|

(19)

|

(7,306)

|

(7,325)

|

|

|

|

|

(22,183)

|

(7,306)

|

(29,489)

|

|

Segment

loss

|

|

$

|

(20,025)

|

(7,306)

|

(27,331)

|

|

|

|

|

|

|

|

|

Revenues-supplemental:

|

|

|

|

|

|

|

Toll milling

services-deferred revenue (note 9)

|

|

2,158

|

-

|

2,158

|

|

|

|

|

$

|

2,158

|

-

|

2,158

|

|

|

|

|

|

|

|

|

Capital additions:

|

|

|

|

|

|

|

Property,

plant and equipment (note 7)

|

$

|

4,136

|

106

|

4,242

|

|

|

|

|

|

|

|

|

|

Long-lived assets:

|

|

|

|

|

|

|

Plant and

equipment

|

|

|

|

|

|

|

Cost

|

|

$

|

109,348

|

6,648

|

115,996

|

|

Accumulated

depreciation

|

|

|

(40,041)

|

(1,459)

|

(41,500)

|

|

Mineral

properties

|

|

|

181,942

|

-

|

181,942

|

|

|

|

$

|

251,249

|

5,189

|

256,438

|

|

(in

thousands)

|

|

|

Mining

|

Corporate

and

Other

|

Total

|

|

|

|

|

|

|

|

|

Statement of Operations:

|

|

|

|

|

|

|

Revenues

|

|

$

|

1,326

|

-

|

1,326

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

Operating

expenses

|

|

|

(1,367)

|

-

|

(1,367)

|

|

Exploration

|

|

|

(1,755)

|

-

|

(1,755)

|

|

Evaluation

|

|

|

(6,708)

|

-

|

(6,708)

|

|

General and

administrative

|

|

|

-

|

(3,741)

|

(3,741)

|

|

|

|

|

(9,830)

|

(3,741)

|

(13,571)

|

|

Segment

loss

|

|

$

|

(8,504)

|

(3,741)

|

(12,245)

|

|

|

|

|

|

|

|

|

Revenues-supplemental:

|

|

|

|

|

|

|

Toll milling

services-deferred revenue (note 9)

|

|

1,326

|

-

|

1,326

|

|

|

|

|

$

|

1,326

|

-

|

1,326

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

Three

Months Ended

June

30

|

|

Six

Months Ended

June

30

|

||||

|

(in

thousands)

|

|

2025

|

|

2024

|

|

2025

|

|

2024

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and

short-term employee benefits

|

$

|

(883)

|

$

|

(913)

|

$

|

(3,820)

|

$

|

(2,608)

|

|

Share-based

compensation

|

|

(668)

|

|

(900)

|

|

(1,612)

|

|

(1,653)

|

|

Key

management personnel compensation

|

$

|

(1,551)

|

$

|

(1,813)

|

$

|

(5,432)

|

$

|

(4,261)

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

Financial

|

|

Fair

|

|

June

30,

|

|

December

31,

|

|

|

|

Instrument

|

|

Value

|

|

2025

|

|

2024

|

|

(in

thousands)

|

|

Category(1)

|

|

Hierarchy

|

|

Fair

Value

|

|

Fair

Value

|

|

|

|

|

|

|

|

|

|

|

|

Financial

Assets:

|

|

|

|

|

|

|

|

|

|

Cash and

equivalents

|

|

Category

B

|

|

|

$

|

54,533

|

$

|

108,518

|

|

Trade and other

receivables

|

|

Category

B

|

|

|

|

4,115

|

|

3,075

|

|

Investments

|

|

|

|

|

|

|

|

|

|

Equity

instruments-shares

|

|

Category

A

|

|

Level

1

|

|

7,555

|

|

6,280

|

|

Equity

instruments-warrants

|

|

Category

A

|

|

Level

2

|

|

1,433

|

|

280

|

|

Convertible

Debentures

|

|

Category

A

|

|

Level

3

|

|

12,492

|

|

13,000

|

|

Restricted

cash and equivalents

|

|

|

|

|

|

|

|

|

|

Elliot Lake

Reclamation Trust

|

|

Category

B

|

|

|

|

4,172

|

|

3,652

|

|

Credit

facility pledged assets

|

|

Category

B

|

|

|

|

7,972

|

|

7,972

|

|

|

|

|

|

|

$

|

92,272

|

$

|

142,777

|

|

|

|

|

|

|

|

|

|

|

|

Financial

Liabilities:

|

|

|

|

|

|

|

|

|

|

Account

payable and accrued liabilities

|

|

Category

C

|

|

|

|

20,073

|

|

21,333

|

|

Debt

obligations

|

|

Category

C

|

|

|

|

2,391

|

|

2,414

|

|

|

|

|

|

|

$

|

22,464

|

$

|

23,747

|

|

Exhibit

99.2

|

|

TABLE OF

CONTENTS

|

|

|

Q2 2025 PERFORMANCE

HIGHLIGHTS

|

2

|

|

ABOUT DENISON

|

3

|

|

RESULTS OF CONTINUING

OPERATIONS

|

5

|

|

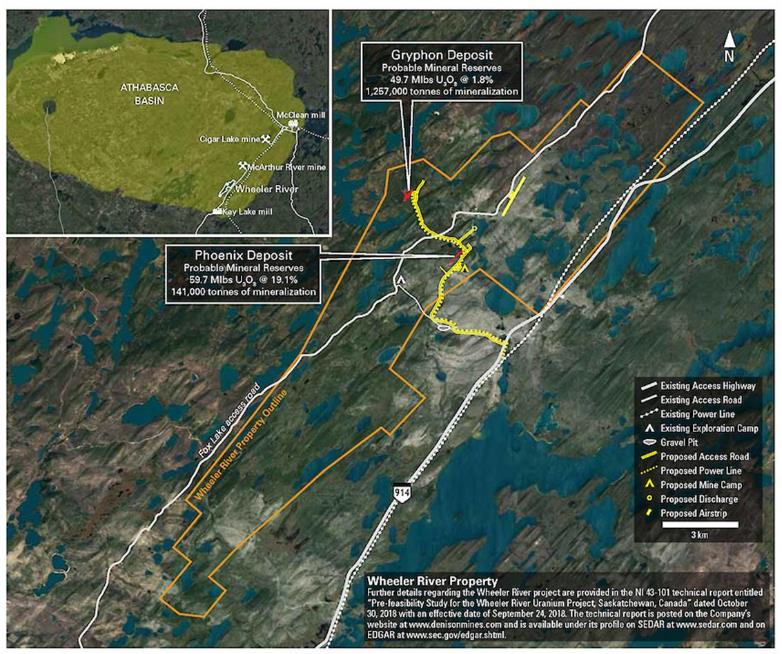

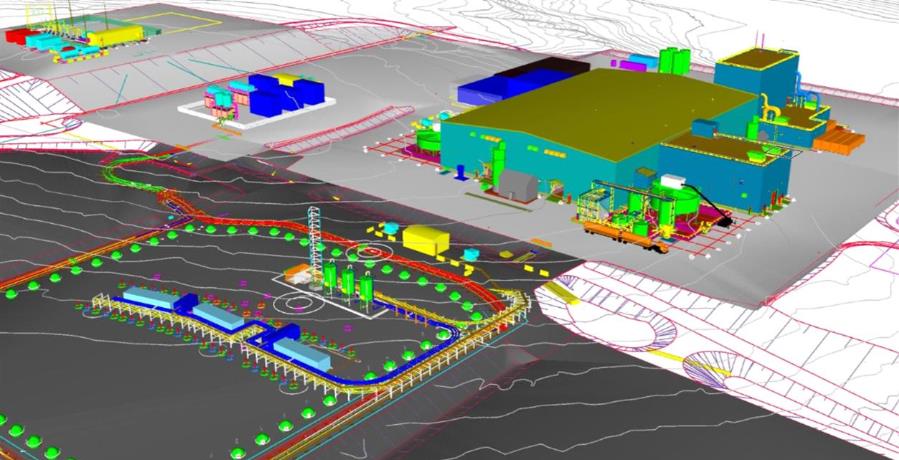

Wheeler River Uranium

Project

|

6

|

|

Evaluation Pipeline

Properties

|

12

|

|

LIQUIDITY AND CAPITAL

RESOURCES

|

24

|

|

DISCONTINUED OPERATIONS

|

26

|

|

OUTLOOK FOR 2025

|

26

|

|

ADDITIONAL INFORMATION

|

26

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

|

27

|

|

|

|

|

|

|

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

(in

thousands)

|

|

As at

June 30,

2025

|

|

As at

December 31,

2024

|

|

|

|

|

|

|

|

Financial Position:

|

|

|

|

|

|

Cash and cash

equivalents

|

$

|

54,533

|

$

|

108,518

|

|

Working

capital(1)

|

$

|

83,216

|

$

|

94,334

|

|

Investments in

uranium

|

$

|

235,615

|

$

|

231,088

|

|

Property, plant

and equipment

|

$

|

265,419

|

$

|

259,661

|

|

Total

assets

|

$

|

626,883

|

$

|

663,613

|

|

Total long-term

liabilities(2)

|

$

|

64,302

|

$

|

65,400

|

|

|

|

|

|

2025

|

|

2025

|

|

2024

|

|

2024

|

|

(in

thousands, except for per share amounts)

|

|

Q2

|

|

Q1

|

|

Q4

|

|

Q3

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Operations:

|

|

|

|

|

|

|

|

|

|

|

|

Total

revenues

|

$

|

1,276

|

$

|

1,375

|

$

|

1,170

|

$

|

695

|

||

|

Net earnings

(loss)

|

$

|

12,498

|

$

|

(43,534)

|

$

|

(29,502)

|

$

|

(25,767)

|

||

|

Basic and diluted

earnings (loss) per share

|

$

|

0.01

|

$

|

(0.05)

|

$

|

(0.03)

|

$

|

(0.03)

|

||

|

|

|

|

|

|

|

|

|

|

||

|

Discontinued Operations:

|

|

|

|

|

|

|

|

|

||

|

Net

earnings

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||

|

Basic and diluted

earnings per share

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||

|

|

|

|

|

2024

|

|

2024

|

|

2023

|

|

2023

|

|

(in

thousands, except for per share amounts)

|

|

Q2

|

|

Q1

|

|

Q4

|

|

Q3

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Operations:

|

|

|

|

|

|

|

|

|

||

|

Total

revenues

|

$

|

1,326

|

$

|

832

|

$

|

1,092

|

$

|

777

|

||

|

Net (loss)

earnings

|

$

|

(16,441)

|

$

|

(19,880)

|

$

|

34,627

|

$

|

57,916

|

||

|

Basic and diluted

(loss) earnings per share

|

$

|

(0.02)

|

$

|

(0.02)

|

$

|

0.04

|

$

|

0.07

|

||

|

|

|

|

|

|

|

|

|

|

||

|

Discontinued Operations:

|

|

|

|

|

|

|

|

|

||

|

Net (loss)

earnings

|

$

|

471

|

$

|

-

|

$

|

(150)

|

$

|

321

|

||

|

Basic and diluted

(loss) earnings per share

|

$

|

0.00

|

$

|

-

|

$

|

(0.00)

|

$

|

0.00

|

||

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

PROJECT EVALUATION ACTIVITIES

|

|||

|

Property

|

Denison’s ownership

|

Evaluation activities

|

|

|

Wheeler

River

|

95%(1)

|

Engineering,

detailed design, metallurgical testing, Feasibility Field Test

(‘FFT’) monitoring, 2025 Gryphon field program

activities, 2025 Phoenix field activities, environmental and

sustainability activities.

|

|

|

Waterbury

Lake

|

70.55%(2)

|

2025 field

activities and progression of a PFS for the THT

deposit.

|

|

|

Midwest

|

25.17%

|

2025 field

programs and progression of a PEA for Midwest Main

deposit.

|

|

|

Kindersley

Lithium Project (‘KLP’)

|

Earn-in(3)

|

Progression

of a PFS for the KLP.

|

|

|

|

|

|

|

|

MANAGEMENT’S DISCUSSION & ANALYSIS

|

|

Summary of Economic Results (100% Basis) – Base

Case

|

|

|

Uranium selling

price

|

UxC Spot Price(1)

(~US$66 to

US$70/lb U3O8)

|

|

Exchange Rate

(US$:CAD$)

|

1.35

|

|

Discount

Rate

|

8%

|

|

Operating profit

margin(2)

|

90.9%

|

|

|

|

|

Pre-tax

NPV8%(3) (Change from 2018 PFS)(4)

|