Form 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May 2025

Commission File Number 001-31522

| Eldorado Gold Corporation |

| (Translation of registrant’s name into English) |

| 11th Floor-550 Burrard Street Bentall 5 Vancouver, B.C. Canada V6C 2B5 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

|

| Form 20-F | ☐ |

| Form 40-F | ☒ |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| ELDORADO GOLD CORPORATION |

|

| By: | /s/ Karen Aram |

|

|

|

| Karen Aram, Corporate Secretary |

|

Date: May 30, 2025

| 2 |

Exhibits

| Exhibit No. |

| Description |

|

| ||

|

|

| 3 |

EXHIBIT 99.1

|

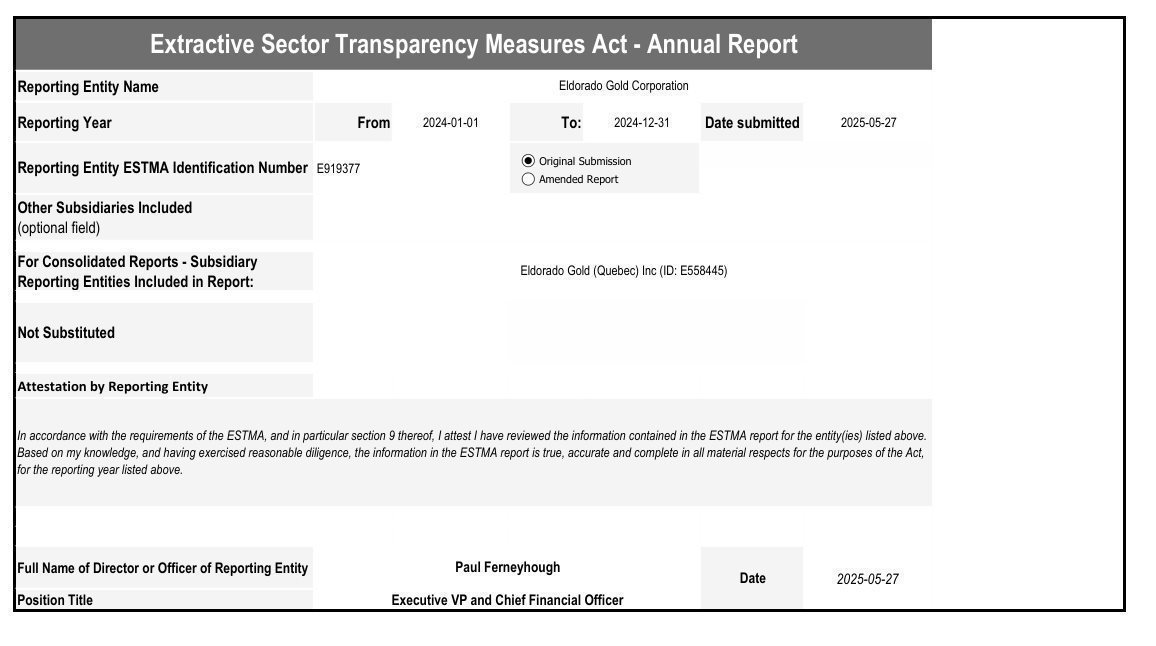

Extractive Sector Transparency Measures Act - Annual Report

|

|||||||||||

| Reporting Year | From: | 2024-01-01 | To: | 2024-12-31 |

|

|

|

|

|

||

| Reporting Entity Name | Eldorado Gold Corporation | Currency of the Report | USD |

|

|||||||

| Reporting Entity ESTMA Identification Number | E919377 |

|

|

||||||||

| Subsidiary Reporting Entities (if necessary) | Eldorado Gold (Quebec) Inc (ID: E558445) |

|

|

|

|

|

|||||

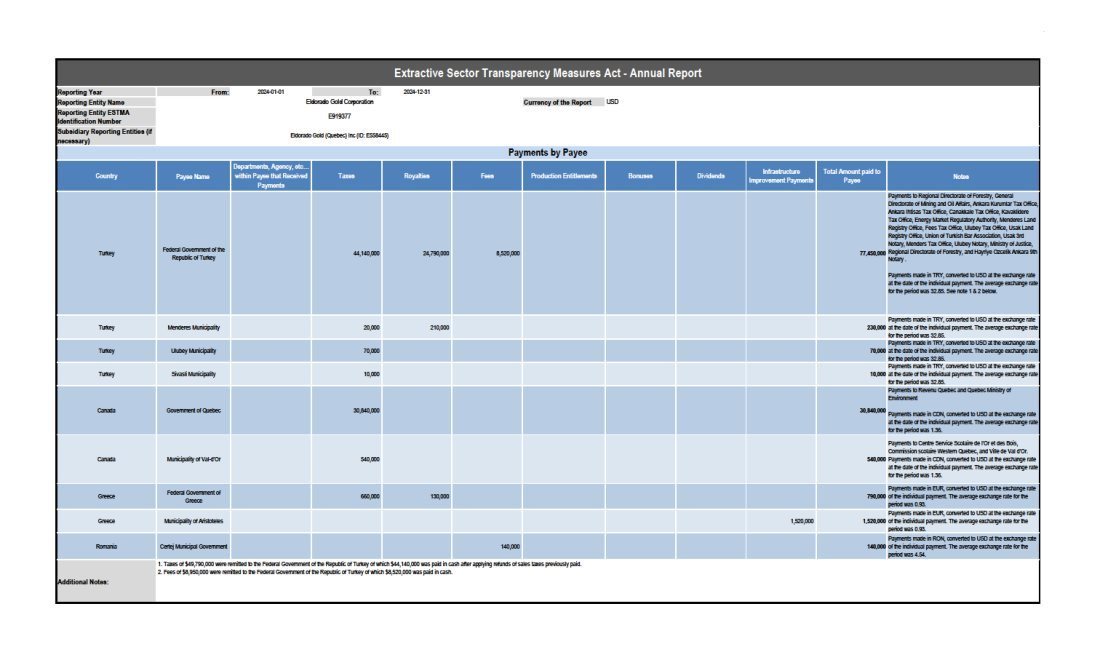

| Payments by Payee |

|||||||||||

| Country | Payee Name1 | Departments, Agency, etc… within Payee that Received Payments2 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid to Payee | Notes34 |

| Turkey | Federal Government of the Republic of Turkey |

| 44,140,000 | 24,790,000 | 8,520,000 |

|

|

|

| 77,450,000 | Payments to Regional Directorate of Forestry, General Directorate of Mining and Oil Affairs, Ankara Kurumlar Tax Office, Ankara Ihtisas Tax Office, Canakkale Tax Office, Kavaklidere Tax Office, Energy Market Regulatory Authority, Menderes Land Registry Office, Fees Tax Office, Ulubey Tax Office, Usak Land Registry Office, Union of Turkish Bar Association, Usak 3rd Notary, Menders Tax Office, Ulubey Notary, Ministry of Justice, Regional Directorate of Forestry, and Hayriye Ozcelik Ankara 9th Notary .

Payments made in TRY, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 32.85. See note 1 & 2 below. |

| Turkey | Menderes Municipality |

| 20,000 | 210,000 |

|

|

|

|

| 230,000 | Payments made in TRY, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 32.85. |

| Turkey | Ulubey Municipality |

| 70,000 |

|

|

|

|

|

| 70,000 | Payments made in TRY, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 32.85. |

| Turkey | Sivasli Municipality |

| 10,000 |

|

|

|

|

|

| 10,000 | Payments made in TRY, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 32.85. |

| Canada | Government of Quebec |

| 30,840,000 |

|

|

|

|

|

| 30,840,000 | Payments to Revenu Quebec and Quebec Ministry of Environment

Payments made in CDN, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 1.36. |

| Canada | Municipality of Val-d'Or |

| 540,000 |

|

|

|

|

|

| 540,000 | Payments to Centre Service Scolaire de l'Or et des Bois, Commission scolaire Western Quebec, and Ville de Val d'Or.

Payments made in CDN, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 1.36. |

| Greece | Federal Government of Greece |

| 660,000 | 130,000 |

|

|

|

|

| 790,000 | Payments made in EUR, converted to USD at the exchange rate of the individual payment. The average exchange rate for the period was 0.93. |

| Greece | Municipality of Aristoteles |

|

|

|

|

|

|

| 1,520,000 | 1,520,000 | Payments made in EUR, converted to USD at the exchange rate of the individual payment. The average exchange rate for the period was 0.93. |

| Romania | Certej Municipal Government |

|

|

| 140,000 |

|

|

|

| 140,000 | Payments made in RON, converted to USD at the exchange rate of the individual payment. The average exchange rate for the period was 4.54. |

| Additional Notes: | 1. Taxes of $49,790,000 were remitted to the Federal Government of the Republic of Turkey of which $44,140,000 was paid in cash after applying refunds of sales taxes previously paid. 2. Fees of $8,950,000 were remitted to the Federal Government of the Republic of Turkey of which $8,520,000 was paid in cash. |

||||||||||

|

Extractive Sector Transparency Measures Act - Annual Report

|

||||||||||

| Reporting Year | From: | 2024-01-01 | To: | 2024-12-31 |

|

|

|

|

||

| Reporting Entity Name | Eldorado Gold Corporation | Currency of the Report | USD |

|

|

|||||

| Reporting Entity ESTMA Identification Number | E919377 |

|

|

|

|

|||||

| Subsidiary Reporting Entities (if necessary) | Eldorado Gold (Quebec) Inc (ID: E558445) |

|

|

|

|

|||||

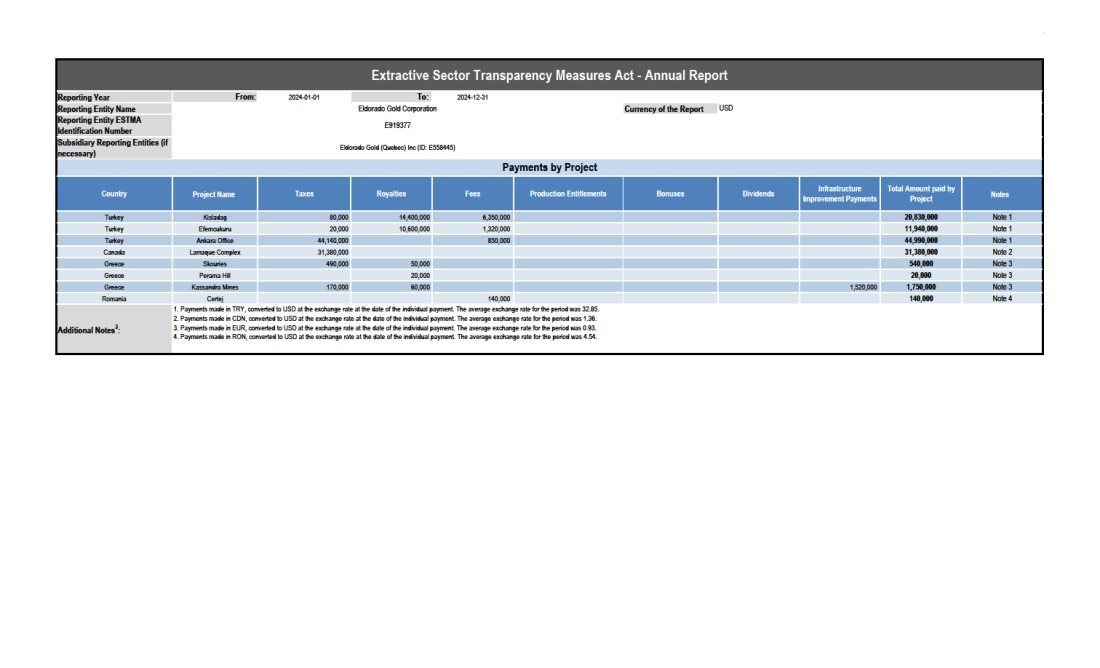

| Payments by Project |

||||||||||

| Country | Project Name1 | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure Improvement Payments | Total Amount paid by Project | Notes23 |

| Turkey | Kisladag | 80,000 | 14,400,000 | 6,350,000 |

|

|

|

| 20,830,000 | Note 1 |

| Turkey | Efemcukuru | 20,000 | 10,600,000 | 1,320,000 |

|

|

|

| 11,940,000 | Note 1 |

| Turkey | Ankara Office | 44,140,000 |

| 850,000 |

|

|

|

| 44,990,000 | Note 1 |

| Canada | Lamaque Complex | 31,380,000 |

|

|

|

|

|

| 31,380,000 | Note 2 |

| Greece | Skouries | 490,000 | 50,000 |

|

|

|

|

| 540,000 | Note 3 |

| Greece | Perama Hill |

| 20,000 |

|

|

|

|

| 20,000 | Note 3 |

| Greece | Kassandra Mines | 170,000 | 60,000 |

|

|

|

| 1,520,000 | 1,750,000 | Note 3 |

| Romania | Certej |

|

| 140,000 |

|

|

|

| 140,000 | Note 4 |

| Additional Notes3: | 1. Payments made in TRY, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 32.85. 2. Payments made in CDN, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 1.36. 3. Payments made in EUR, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 0.93. 4. Payments made in RON, converted to USD at the exchange rate at the date of the individual payment. The average exchange rate for the period was 4.54. |

|||||||||

Reporting Principles

| 1. | Basis of Accounting |

|

|

|

|

| The Schedule of Payments by Payee and the Schedule of Payments by Project (collectively, the “Schedules") prepared by Eldorado Gold Corporation (the “Company”) for the year ended December 31, 2024 has been prepared in accordance with the financial reporting provisions in Section 9 of the Extractive Sector Transparency Measures Act, Section 2 of the Extractive Sector Transparency Measures Act – Technical Reporting Specifications and Section 3 of the Extractive Sector Transparency Measures Act – Guidance Version 2.1 (collectively the “financial reporting framework”). |

|

|

|

|

| The Schedules are prepared to provide information to the Board of Directors of Eldorado Gold Corporation and the Minister of Natural Resources Canada to assist in meeting the requirements of the Extractive Sector Transparency Measures Act. As a result, the Schedules may not be suitable for another purpose. |

|

|

|

| 2. | Basis of Presentation |

|

|

|

|

| The Schedules have been prepared using the cash basis of accounting, as required by the financial reporting framework, and therefore exclude any accruals related to payments due to governments. |

|

|

|

|

| The Schedules include all cash payments made, without inclusion of cash inflows from a government. Where the Company makes a payment to a government that is net of credits from that government, the net payment amount has been presented. |

|

|

|

| 3. | Reporting Currency |

|

|

|

|

| All payments are reported in U.S. dollars which is the reporting currency of the Company. When the Company has made payments in currencies other than its reporting currency, it translates the payments using the exchange rate on the date of the individual payment. |

|

|

|

| 4. | Rounding |

|

|

|

|

| All figures have been rounded to the nearest $10,000 U.S. dollars. |

|

|

|

| 5. | Control |

|

|

|

|

| As required by the financial reporting framework, the Company has reported payments made by entities controlled by the Company. The Company has determined whether it controls an entity in accordance with International Financial Reporting Standards. |

EXHIBIT 99.2