UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2025

Commission File Number: 000-56292

| Vox Royalty Corp. |

| (Registrant) |

1499 WEST 120th AVENUE, SUITE 110

WESTMINSTER, CO 80234

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibits 99.1 to 99.5 to this report on Form 6-K of Vox Royalty Corp. are hereby incorporated by reference herein and are hereby incorporated by reference into and as an exhibit to the Company’s Registration Statement on Form F-10 (File No. 333-284746) and Form S-8 (File No. 333-275418) under the U.S. Securities Act of 1933, as amended, to the extent not superseded by documents or reports subsequently filed or furnished by the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| Vox Royalty Corp. |

|

|

|

|

|

|

|

| Date: May 15, 2025 | By: | /s/ Kyle Floyd |

|

|

|

| Chief Executive Officer |

|

| 2 |

EXHIBIT INDEX

| 3 |

EXHIBIT 99.1

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(Expressed in United States Dollars)

VOX ROYALTY CORP.

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(Expressed in United States Dollars)

INDEX

| Unaudited Condensed Interim Consolidated Statements of Financial Position |

| 1 |

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statements of Loss and Comprehensive Loss |

| 2 |

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statements of Changes in Equity |

| 3 |

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statements of Cash Flows |

| 4 |

|

|

|

|

|

|

| Notes to the Unaudited Condensed Interim Consolidated Financial Statements |

| 5-14 |

|

| Vox Royalty Corp. Unaudited Condensed Interim Consolidated Statements of Financial Position (Expressed in United States Dollars) |

|

|

|

|

| As at |

|

|||||||

|

|

| Note |

|

| March 31, 2025 |

|

| December 31, 2024 |

|

|||

|

|

|

|

| $ |

|

| $ |

|

||||

| Assets |

|

|

|

|

|

|

|

|

|

|||

| Current assets |

|

|

|

|

|

|

|

|

|

|||

| Cash and cash equivalents |

|

|

|

|

| 9,145,867 |

|

|

| 8,754,391 |

|

|

| Accounts receivable |

|

| 4 |

|

|

| 2,906,224 |

|

|

| 2,917,680 |

|

| Prepaid expenses |

|

|

|

|

|

| 582,284 |

|

|

| 456,943 |

|

| Total current assets |

|

|

|

|

|

| 12,634,375 |

|

|

| 12,129,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Royalty interests |

|

| 5 |

|

|

| 37,199,066 |

|

|

| 37,984,188 |

|

| Other assets |

|

| 6 |

|

|

| 215,197 |

|

|

| 279,491 |

|

| Intangible assets |

|

| 7 |

|

|

| 942,746 |

|

|

| 988,631 |

|

| Deferred royalty acquisitions |

|

| 5 |

|

|

| 15,495 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

|

|

|

| 51,006,879 |

|

|

| 51,381,324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

| 8 |

|

|

| 992,167 |

|

|

| 1,390,507 |

|

| Dividends payable |

|

| 9 |

|

|

| 634,429 |

|

|

| 607,905 |

|

| Income taxes payable |

|

|

|

|

|

| 1,354,285 |

|

|

| 896,263 |

|

| Total current liabilities |

|

|

|

|

|

| 2,980,881 |

|

|

| 2,894,675 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred tax liabilities |

|

|

|

|

|

| 5,373,490 |

|

|

| 5,426,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

|

|

|

| 8,354,371 |

|

|

| 8,321,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

| 9 |

|

|

| 69,750,937 |

|

|

| 69,528,762 |

|

| Equity reserves |

|

| 10 |

|

|

| 5,086,479 |

|

|

| 4,722,776 |

|

| Deficit |

|

|

|

|

|

| (32,184,908 | ) |

|

| (31,191,339 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

|

|

|

| 42,652,508 |

|

|

| 43,060,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

|

|

|

| 51,006,879 |

|

|

| 51,381,324 |

|

Commitments and contingencies (Note 14)

Subsequent events (Note 19)

Approved by the Board of Directors on May 15, 2025

| Signed “Kyle Floyd” , Director |

| Signed “Robert Sckalor” , Director |

See accompanying notes to the unaudited condensed interim consolidated financial statements

|

|

| 1 |

| Vox Royalty Corp. Unaudited Condensed Interim Consolidated Statements of Loss and Comprehensive Loss (Expressed in United States Dollars) |

|

|

| Note |

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

|||

|

|

|

|

| $ |

|

| $ |

|

||||

| Revenue |

|

|

|

|

|

|

|

|

|

|||

| Royalty revenue |

|

|

|

|

| 2,680,194 |

|

|

| 2,882,512 |

|

|

| Total revenue |

|

| 16 |

|

|

| 2,680,194 |

|

|

| 2,882,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

| Depletion |

|

| 5 |

|

|

| (785,122 | ) |

|

| (468,373 | ) |

| Gross profit |

|

|

|

|

|

| 1,895,072 |

|

|

| 2,414,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| General and administration |

|

| 11,13 |

|

|

| (1,134,538 | ) |

|

| (1,110,134 | ) |

| Share-based compensation |

|

| 10,13 |

|

|

| (584,334 | ) |

|

| (655,271 | ) |

| Project evaluation expenses |

|

| 5 |

|

|

| (72,669 | ) |

|

| (38,220 | ) |

| Total operating expenses |

|

|

|

|

|

| (1,791,541 | ) |

|

| (1,803,625 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

|

|

|

| 103,531 |

|

|

| 610,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and finance expenses |

|

| 6 |

|

|

| (85,388 | ) |

|

| (73,705 | ) |

| Other income (expenses) |

|

| 12 |

|

|

| 73,733 |

|

|

| (36,094 | ) |

| Income before income taxes |

|

|

|

|

|

| 91,876 |

|

|

| 500,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

| 17 |

|

|

| (451,016 | ) |

|

| (742,102 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and comprehensive loss |

|

|

|

|

|

| (359,140 | ) |

|

| (241,387 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

|

| 50,729,613 |

|

|

| 50,082,651 |

|

| Diluted |

|

|

|

|

|

| 50,729,613 |

|

|

| 50,082,651 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

|

| (0.01 | ) |

|

| (0.00 | ) |

| Diluted |

|

|

|

|

|

| (0.01 | ) |

|

| (0.00 | ) |

See accompanying notes to the unaudited condensed interim consolidated financial statements

|

|

| 2 |

| Vox Royalty Corp. Unaudited Condensed Interim Consolidated Statements of Changes in Equity (Expressed in United States Dollars) |

|

|

| Note |

|

| Number of Shares |

|

| Share Capital |

|

| Equity Reserves |

|

| Deficit |

|

| Total Equity |

|

||||||

|

|

|

|

|

| # |

|

| $ |

|

| $ |

|

| $ |

|

| $ |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

| Balance, January 1, 2024 |

|

|

|

|

| 49,985,102 |

|

|

| 67,889,465 |

|

|

| 4,157,153 |

|

|

| (27,122,948 | ) |

|

| 44,923,670 |

|

|

| Share issue costs |

|

|

|

|

| - |

|

|

| (23,599 | ) |

|

| - |

|

|

| - |

|

|

| (23,599 | ) | |

| Dividends declared |

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (601,462 | ) |

|

| (601,462 | ) | |

| Settlement of RSUs |

|

|

|

|

| 136,748 |

|

|

| 364,759 |

|

|

| (364,759 | ) |

|

| - |

|

|

| - |

|

|

| Share-based compensation |

|

|

|

|

| - |

|

|

| - |

|

|

| 655,271 |

|

|

| - |

|

|

| 655,271 |

|

|

| Net loss and comprehensive loss |

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (241,387 | ) |

|

| (241,387 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, March 31, 2024 |

|

|

|

|

| 50,121,850 |

|

|

| 68,230,625 |

|

|

| 4,447,665 |

|

|

| (27,965,797 | ) |

|

| 44,712,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2025 |

|

|

|

|

| 50,658,776 |

|

|

| 69,528,762 |

|

|

| 4,722,776 |

|

|

| (31,191,339 | ) |

|

| 43,060,199 |

|

|

| Share issue costs |

|

|

|

|

| - |

|

|

| (1,839 | ) |

|

| - |

|

|

| - |

|

|

| (1,839 | ) | |

| Dividends declared |

|

| 9 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (634,429 | ) |

|

| (634,429 | ) |

| Shares issued – dividends reinvestment plan |

|

| 9 |

|

|

| 1,507 |

|

|

| 3,383 |

|

|

| - |

|

|

| - |

|

|

| 3,383 |

|

| Settlement of RSUs |

|

| 10 |

|

|

| 93,855 |

|

|

| 220,631 |

|

|

| (220,631 | ) |

|

| - |

|

|

| - |

|

| Share-based compensation |

|

| 10 |

|

|

| - |

|

|

| - |

|

|

| 584,334 |

|

|

| - |

|

|

| 584,334 |

|

| Net loss and comprehensive loss |

|

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (359,140 | ) |

|

| (359,140 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, March 31, 2025 |

|

|

|

|

|

| 50,754,138 |

|

|

| 69,750,937 |

|

|

| 5,086,479 |

|

|

| (32,184,908 | ) |

|

| 42,652,508 |

|

See accompanying notes to the unaudited condensed interim consolidated financial statements

|

|

| 3 |

| Vox Royalty Corp. Unaudited Condensed Interim Consolidated Statements of Cash Flows (Expressed in United States Dollars) |

|

|

| Note |

|

| Three months ended March 31, 2025 |

|

| Three months Ended March 31, 2024 |

|

|||

|

|

|

|

| $ |

|

| $ |

|

||||

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|||

| Net loss for the period |

|

|

|

|

| (359,140 | ) |

|

| (241,387 | ) | |

| Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred tax expense (recovery) |

|

| 17 |

|

|

| (52,960 | ) |

|

| 150,951 |

|

| Foreign exchange gain on cash and cash equivalents |

|

|

|

|

|

| 16,799 |

|

|

| 9,259 |

|

| Share-based compensation |

|

| 10,13 |

|

|

| 584,334 |

|

|

| 655,271 |

|

| Interest and finance expenses |

|

| 6 |

|

|

| 85,388 |

|

|

| 73,705 |

|

| Amortization |

|

| 7 |

|

|

| 45,885 |

|

|

| 45,885 |

|

| Depletion |

|

| 5 |

|

|

| 785,122 |

|

|

| 468,373 |

|

|

|

|

|

|

|

|

| 1,105,428 |

|

|

| 1,162,057 |

|

| Changes in non-cash working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

|

|

|

| 11,456 |

|

|

| 232,958 |

|

| Prepaid expenses |

|

|

|

|

|

| (125,341 | ) |

|

| 92,974 |

|

| Accounts payable and accrued liabilities |

|

|

|

|

|

| (410,751 | ) |

|

| (541,081 | ) |

| Income taxes payable |

|

|

|

|

|

| 458,022 |

|

|

| 265,246 |

|

| Net cash flows from operating activities |

|

|

|

|

|

| 1,038,814 |

|

|

| 1,212,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of royalties |

|

| 5 |

|

|

| - |

|

|

| (31,142 | ) |

| Restricted cash |

|

|

|

|

|

| - |

|

|

| 34,255 |

|

| Net cash flows from investing activities |

|

|

|

|

|

| - |

|

|

| 3,113 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows used in financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Share issue costs |

|

|

|

|

|

| (1,839 | ) |

|

| - |

|

| Transaction costs related to credit facility |

|

| 6 |

|

|

| (2,615 | ) |

|

| (433,823 | ) |

| Payments of interest on credit facility |

|

| 6 |

|

|

| (21,563 | ) |

|

| - |

|

| Dividends paid |

|

| 9 |

|

|

| (604,522 | ) |

|

| (549,836 | ) |

| Net cash flows used in financing activities |

|

|

|

|

|

| (630,539 | ) |

|

| (983,659 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in cash and cash equivalents |

|

|

|

|

|

| 408,275 |

|

|

| 231,608 |

|

| Impact of foreign exchange on cash and cash equivalents |

|

|

|

|

|

| (16,799 | ) |

|

| (9,259 | ) |

| Cash and cash equivalents, beginning of the period |

|

|

|

|

|

| 8,754,391 |

|

|

| 9,342,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of the period |

|

|

|

|

|

| 9,145,867 |

|

|

| 9,565,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental cash flow information (Note 15) |

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited condensed interim consolidated financial statements.

|

|

| 4 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

1. Nature of operations

Vox Royalty Corp. (“Vox” or the “Company”) was incorporated under the Business Corporations Act (Ontario). The Company’s head office is located at 1499 West 120th Ave, Suite 110, Westminster, CO, 80234, USA. The Company’s registered office is 100 King Street West, Suite 5700, Toronto, ON, M5X 1C7, Canada. The Company’s common shares trade on the Toronto Stock Exchange (“TSX”) and on the Nasdaq Stock Market LLC (“Nasdaq”), under the ticker symbol “VOXR”.

Vox is a mining royalty company focused on growing the size of its royalty asset portfolio through accretive acquisitions. Approximately 85% of the Company’s royalty assets by royalty count are located in Australia, Canada and the United States. In the near and medium-term, the Company is prioritizing acquiring royalties on producing or near-term producing assets (i.e. ranging from six months to three years from first production) to complement its existing portfolio of producing, development and exploration stage royalties.

2. Basis of preparation

(a) Statement of compliance

These unaudited condensed interim consolidated financial statements are prepared in accordance with International Accounting Standards 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”) and apply the same material accounting policy information and application as disclosed in the annual financial statements for the year ended December 31, 2024. They do not include all of the information and disclosures required by International Financial Reporting Standards (“IFRS”) for annual statements. In the opinion of management, all adjustments considered necessary for fair presentation have been included in these unaudited condensed interim consolidated financial statements. Operating results for the period ended March 31, 2025 are not necessarily indicative of the results that may be expected for the full year ended December 31, 2025. For further information, see the Company’s annual financial statements including the notes thereto for the year ended December 31, 2024.

These unaudited condensed interim consolidated financial statements were reviewed, approved, and authorized for issue by the Company’s Board of Directors on May 15, 2025.

(b) Basis of presentation

These unaudited condensed interim consolidated financial statements have been prepared on a historical cost basis, except for financial instruments, which have been measured at fair value. These unaudited condensed interim consolidated financial statements are presented in United States dollars (“$”), which is also the functional currency of the Company and its four wholly-owned subsidiaries.

(c) Principles of consolidation

These unaudited condensed interim consolidated financial statements incorporate the accounts of the Company and its wholly-owned subsidiaries: SilverStream SEZC (Cayman Islands), which in turn owns all of the shares of Vox Royalty Australia Pty Ltd. (Australia) and Vox Royalty Canada Ltd. (Ontario, Canada); and Vox Royalty USA Ltd. (Delaware, USA).

Subsidiaries are fully consolidated from the date the Company obtains control and continue to be consolidated until the date that control ceases. Control is achieved when the Company is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. All intercompany balances, transactions, revenues and expenses have been eliminated on consolidation.

(d) Recent accounting pronouncements

Certain new accounting standards and interpretations have been published that are not mandatory for the current period and have not been early adopted. The amendments have an effective date of later than December 31, 2025, with earlier application permitted.

IFRS 18 – Presentation and Disclosure in Financial Statements

In April 2024, IFRS 18 was issued to achieve comparability of the financial performance of similar entities. The standard, which replaces IAS 1, impacts the presentation of primary financial statements and notes, including the statement of earnings where companies will be required to present separate categories of income and expense for operating, investing, and financing activities with prescribed subtotals for each new category. The standard will also require management-defined performance measures to be explained and included in a separate note within the consolidated financial statements. The standard is effective for reporting periods beginning on or after January 1, 2027, including interim financial statements, and requires retrospective application. The Company is currently assessing the impact of the new standard.

3. Significant judgments, estimates and assumptions

The preparation of the Company’s unaudited condensed interim consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities and contingent liabilities at the date of the unaudited condensed interim consolidated financial statements and reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes can differ from these estimates. The unaudited condensed interim consolidated financial statements include estimates, which, by their nature, are uncertain. The impact of such estimates are pervasive throughout the unaudited condensed interim consolidated financial statements and may require accounting adjustments based on future occurrences.

|

|

| 5 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

The estimates and underlying assumptions are reviewed on a regular basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised and in any future periods affected. The areas involving a higher degree of judgment or complexity, or areas where the assumptions and estimates are significant to the consolidated financial statements were the same as those applied to the Company’s annual financial statements for the year ended December 31, 2024.

4. Accounts receivable

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Royalties receivable |

|

| 2,880,531 |

|

|

| 2,897,870 |

|

| Sales tax recoverable |

|

| 25,693 |

|

|

| 19,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2,906,224 |

|

|

| 2,917,680 |

|

Royalties receivable represents amounts that are generally collected within 45 days of quarter-end.

5. Royalty interests

As at and for the three months ended March 31, 2025:

|

|

| Cost | Accumulated Depletion |

|

|||||

| Royalty |

Country |

Opening |

Additions | (Impairment) reversal |

Ending |

Opening |

Depletion |

Ending | Carrying Amount |

|

|

| $ | $ | $ | $ | $ | $ | $ | $ |

| Wonmunna | Australia | 15,211,023 | - | - | 15,211,023 | (4,594,445) | (459,519) | (5,053,964) | 10,157,059 |

| Royalty portfolio | Australia | 5,205,731 | - | - | 5,205,731 | - | - | - | 5,205,731 |

| Janet Ivy | Australia | 4,457,600 | - | - | 4,457,600 | (582,117) | (110,742) | (692,859) | 3,764,741 |

| Castle Hill portfolio | Australia | 3,139,531 | - | - | 3,139,531 | (47,292) | (135,297) | (182,589) | 2,956,942 |

| Koolyanobbing | Australia | 2,649,738 | - | - | 2,649,738 | (1,922,675) | - | (1,922,675) | 727,063 |

| South Railroad | USA | 2,316,757 | - | - | 2,316,757 | (167,999) | (5,878) | (173,877) | 2,142,880 |

| Limpopo | South Africa | 1,150,828 | - | - | 1,150,828 | - | - | - | 1,150,828 |

| Bowdens | Australia | 1,130,068 | - | - | 1,130,068 | - | - | - | 1,130,068 |

| Bullabulling | Australia | 953,349 | - | - | 953,349 | - | - | - | 953,349 |

| Goldlund | Canada | 1,258,810 | - | - | 1,258,810 | - | - | - | 1,258,810 |

| Brits | South Africa | 764,016 | - | - | 764,016 | - | - | - | 764,016 |

| Otto Bore | Australia | 583,612 | - | - | 583,612 | (10,155) | (33,826) | (43,981) | 539,631 |

| Lynn Lake (MacLellan) |

Canada |

873,088 |

- |

- |

873,088 |

- |

- |

- |

873,088 |

| Bulong | Australia | 544,957 | - | - | 544,957 | (16,222) | (31,178) | (47,400) | 497,557 |

| Dry Creek | Australia | 475,723 | - | - | 475,723 | (114,392) | - | (114,392) | 361,331 |

| Sulfur Springs/ Kangaroo Caves |

Australia |

467,983 |

- |

- |

467,983 |

- |

- |

- |

467,983 |

| Pedra Branca | Brazil | 450,131 | - | - | 450,131 | - | - | - | 450,131 |

| Ashburton | Australia | 355,940 | - | - | 355,940 | - | - | - | 355,940 |

| Anthiby Well | Australia | 311,742 | - | - | 311,742 | - | - | - | 311,742 |

| Cardinia | Australia | 302,850 | - | - | 302,850 | - | - | - | 302,850 |

| Brauna | Brazil | 262,328 | - | - | 262,328 | (108,152) | (8,682) | (116,834) | 145,494 |

| Montanore | USA | 61,572 | - | - | 61,572 | - | - | - | 61,572 |

| Mt Ida | Australia | 210,701 | - | - | 210,701 | - | - | - | 210,701 |

| Other | Australia | 1,768,873 | - | - | 1,768,873 | (29,842) | - | (29,842) | 1,739,031 |

| Other | Canada | 624,919 | - | - | 624,919 | - | - | - | 624,919 |

| Other | Peru | 45,609 | - | - | 45,609 | - | - | - | 45,609 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

| 45,577,479 | - | - | 45,577,479 | (7,593,291) | (785,122) | (8,378,413) | 37,199,066 |

|

|

| 6 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

Total royalty interests include carrying amounts in the following countries:

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Australia |

|

| 29,681,719 |

|

|

| 30,452,281 |

|

| Canada |

|

| 2,756,817 |

|

|

| 2,756,817 |

|

| USA |

|

| 2,204,452 |

|

|

| 2,210,330 |

|

| South Africa |

|

| 1,914,844 |

|

|

| 1,914,844 |

|

| Brazil |

|

| 595,625 |

|

|

| 604,307 |

|

| Peru |

|

| 45,609 |

|

|

| 45,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 37,199,066 |

|

|

| 37,984,188 |

|

Deferred royalty acquisitions

Deferred royalty acquisitions as at March 31, 2025 of $15,495 (December 31, 2024 - $Nil) relates to costs incurred prior to the execution and closing of a royalty acquisition. Deferred royalty acquisition costs are reallocated to royalty interests upon signing of a definitive agreement. If management determines not to proceed with a proposed acquisition, the deferred costs are expensed as project evaluation expenses.

6. Credit facility

Facility terms

On January 16, 2024, the Company entered into a definitive credit agreement with the Bank of Montreal (“BMO”) providing for a $15,000,000 secured revolving credit facility (the “Facility”). The Facility includes an accordion feature which provides for an additional $10,000,000 of availability, subject to certain conditions. The Facility, secured against the assets of the Company, is available for general corporate purposes, acquisitions, and investments, subject to certain limitations. At the Company’s election, amounts drawn on the Facility bear interest at either (i) a rate determined by reference to the U.S. dollar base rate plus a margin of 1.5% to 2.5% per annum, or (ii) the secured overnight financing rate plus a margin of 2.60% to 3.60% per annum. The undrawn portion of the Facility is subject to a standby fee of 0.5625% to 0.7875% per annum, all of which is dependent on the Company’s leverage ratio (as defined in the credit agreement with BMO dated January 16, 2024). The Facility has a maturity date of December 31, 2026 and is extendable one-year at a time through mutual agreement between Vox and BMO. The Facility includes covenants that require the Company to maintain certain financial ratios, including the Company’s leverage ratios and meet certain non-financial requirements. As at March 31, 2025, Vox was in compliance with all such covenants.

As at March 31, 205, there were no outstanding amounts under the Facility. See Note 19 for subsequent draw down on Facility.

Other assets (Facility transaction costs)

The following summarizes the change in other assets as at March 31, 2025 and December 31, 2024:

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Balance, beginning of period |

|

| 279,491 |

|

|

| 271,029 |

|

| Facility transaction costs incurred during the period |

|

| - |

|

|

| 234,470 |

|

| Amortization expense of Facility transaction costs |

|

| (64,294 | ) |

|

| (226,008 | ) |

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

|

| 215,197 |

|

|

| 279,491 |

|

Interest and finance expenses

The following summarizes the interest and finance expenses for the three months ended March 31, 2025 and 2024:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Amortization expense of Facility transaction costs |

|

| 64,294 |

|

|

| 48,767 |

|

| Interest expense on Facility |

|

| 21,094 |

|

|

| 24,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 85,388 |

|

|

| 73,705 |

|

Interest expense on the Facility relates to the standby fee, as there were no amounts drawn on the Facility during the three months ended March 31, 2025 and 2024.

|

|

| 7 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

7. Intangible assets

Intangible assets are comprised of the Mineral Royalties Online (“MRO”) royalty database.

|

|

| Database |

|

|

|

|

| $ |

|

|

| Cost at: |

|

|

|

|

| December 31, 2024 |

|

| 1,837,500 |

|

| March 31, 2025 |

|

| 1,837,500 |

|

|

|

|

|

|

|

| Accumulated amortization at: |

|

|

|

|

| December 31, 2024 |

|

| 848,869 |

|

| Amortization |

|

| 45,885 |

|

| March 31, 2025 |

|

| 894,754 |

|

|

|

|

|

|

|

| Net book value at: |

|

|

|

|

| December 31, 2024 |

|

| 988,631 |

|

| March 31, 2025 |

|

| 942,746 |

|

8. Accounts payable and accrued liabilities

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Trade payables |

|

| 200,223 |

|

|

| 118,481 |

|

| Sales tax payable |

|

| 499,159 |

|

|

| 487,901 |

|

| Accrued liabilities |

|

| 292,785 |

|

|

| 784,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 992,167 |

|

|

| 1,390,507 |

|

9. Share capital

Authorized

The authorized share capital of the Company is an unlimited number of common shares without par value.

The number of common shares issued and outstanding as at March 31, 2025 and at December 31, 2024 is as follows:

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Issued and outstanding: 50,754,138 (December 31, 2024: 50,658,776) common shares |

|

| 69,750,937 |

|

|

| 69,528,762 |

|

Share repurchase program

On March 12, 2025, the Board of Directors of the Company approved the renewal of a Share Repurchase Program (“SRP”) for the repurchase of up to $1,500,000 of its common shares. The SRP is structured to comply with Rule 10b-18 under the Securities Exchange Act of 1934, as amended. The SRP is administered through an independent broker.

Repurchases under the SRP may be made at times and in amounts as the Company deems appropriate and may be made through open market transactions at prevailing market prices, privately negotiated transactions or by other means in accordance with securities laws in the United States. The actual timing, number and value of repurchases under the SRP will be determined by management in its discretion and will depend on a number of factors, including market conditions, stock price and other factors. The SRP may be suspended or discontinued at any time. Open market repurchases will only be made outside of Canada through the facilities of the Nasdaq or any alternative open market in the United States, as applicable.

The Company did not repurchase any shares under the SRP during the three months ended March 31, 2025.

Loss per share (“LPS”)

For the years three months ended March 31, 2025 and 2024, no stock options, warrants and RSUs were excluded in the computation of diluted LPS due to being anti-dilutive.

|

|

| 8 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

Dividends

The following table provides details on the dividends declared for the three months ended March 31, 2025.

| Declaration date |

| Dividend per common share |

|

| Record date |

| Payment date |

| Dividends payable |

|

||

|

|

| $ |

|

|

|

|

|

| $ |

|

||

| February 20, 2025 |

|

| 0.0125 |

|

| March 31, 2025 |

| April 14, 2025 |

|

| 634,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.0125 |

|

|

|

|

|

|

| 634,429 |

|

On March 18, 2024, the Company adopted a Dividend Reinvestment Plan (“DRIP”). The DRIP provides eligible shareholders of Vox with the opportunity to have all, or a portion of any cash dividends declared on common shares by the Company automatically reinvested into additional common shares, without paying brokerage commissions. Based on the current terms of the DRIP, the common shares are issued under the DRIP at a 5% discount to the average market price, as defined in the DRIP.

Total dividends paid for the three months ended March 31, 2025, included $3,383 paid in shares through the dividend reinvestment program, being 1,507 common shares issued at a discount rate of 5%.

10. Equity reserves

Options

The Company maintains an omnibus long-term incentive plan (the “Plan”) whereby certain key employees, officers, directors and consultants may be granted options to acquire common shares of the Company. The exercise price, expiry date, and vesting terms are determined by the Board of Directors. The Plan permits the issuance of options which, together with the Company’s other share compensation arrangements, may not exceed 10% of the Company’s issued common shares as at the date of grant.

The following summarizes the stock option activity for the three months ended March 31, 2025 and 2024:

|

|

| March 31, 2025 |

|

| March 31, 2024 |

|

||||||||||

|

|

| Number |

|

| Weighted average exercise price |

|

| Number |

|

| Weighted average exercise price |

|

||||

|

|

| # |

|

| C$ |

|

| # |

|

| C$ |

|

||||

| Outstanding, beginning and end of period |

|

| 1,346,838 |

|

|

| 3.70 |

|

|

| 1,347,398 |

|

|

| 3.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercisable, end of period |

|

| 1,346,838 |

|

|

| 3.70 |

|

|

| 1,347,398 |

|

|

| 3.70 |

|

The following table summarizes information of stock options outstanding as at March 31, 2025:

|

|

|

|

| Options Outstanding |

|

| Options Exercisable |

|

||||||||||||

| Expiry date |

| Exercise price |

|

| Number of options outstanding |

|

| Weighted average remaining contractual life |

|

| Number of options exercisable |

|

| Weighted average remaining contractual life |

|

|||||

|

|

| C$ |

|

| # |

|

| Years |

|

| # |

|

| Years |

|

|||||

| June 30, 2026 |

|

| 3.25 |

|

|

| 680,703 |

|

|

| 1.25 |

|

|

| 680,703 |

|

|

| 1.25 |

|

| March 9, 2027 |

|

| 4.16 |

|

|

| 666,135 |

|

|

| 1.94 |

|

|

| 666,135 |

|

|

| 1.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,346,838 |

|

|

| 1.59 |

|

|

| 1,346,838 |

|

|

| 1.59 |

|

Restricted Share Unit Plan

The Plans provide that the Board of Directors may, at its discretion, grant directors, officers, employees and consultants non-transferable RSUs based on the value of the Company’s share price at the date of grant. The Board of Directors has the discretion to settle vested RSUs in cash or equity. All RSU agreements entered into by the Board of Directors from the date of incorporation through March 31, 2025, do not give the Company or the holder the option to settle in cash and can only be equity settled. As the Company does not have a present obligation to settle the issued RSUs in cash, the RSUs issued have been treated as equity-settled instruments and measured at the grant date fair value.

During the three months ended March 31, 2025, 829,915 RSUs were granted to directors, officers and employees. The RSUs granted vest in 25% increments on each of July 2, 2025, January 2, 2026, July 2, 2026, and January 2, 2027.

The share-based compensation expense related to RSU grants is recorded over the vesting period.

|

|

| 9 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

The following summarizes the RSU activity for the three months ended March 31, 2025 and 2024:

|

|

| March 31, 2025 |

|

| March 31, 2024 |

|

||||||||||

|

|

| Number |

|

| Weighted average fair value |

|

| Number |

|

| Weighted average fair value |

|

||||

|

|

| # |

|

| $ |

|

| # |

|

| $ |

|

||||

| Outstanding, beginning of period |

|

| 1,309,061 |

|

|

| 2.23 |

|

|

| 952,018 |

|

|

| 2.62 |

|

| Granted |

|

| 829,915 |

|

|

| 2.26 |

|

|

| 964,564 |

|

|

| 2.00 |

|

| Exercised |

|

| (93,855 | ) |

|

| 2.35 |

|

|

| (136,748 | ) |

|

| 2.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding, end of period |

|

| 2,045,121 |

|

|

| 2.23 |

|

|

| 1,779,834 |

|

|

| 2.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Vested, end of period |

|

| 713,376 |

|

|

| 2.36 |

|

|

| 436,098 |

|

|

| 2.66 |

|

Warrants

During the three months ended March 31, 2024, 6,407,883 warrants expired, unexercised.

11.General and administration

The Company’s general and administration expenses incurred for the three months ended March 31, 2025 and 2024 are as follows:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Corporate administration |

|

| 254,441 |

|

|

| 268,477 |

|

| Professional fees |

|

| 117,101 |

|

|

| 103,652 |

|

| Salaries and benefits |

|

| 676,981 |

|

|

| 662,141 |

|

| Director fees |

|

| 40,130 |

|

|

| 29,979 |

|

| Amortization |

|

| 45,885 |

|

|

| 45,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,134,538 |

|

|

| 1,110,134 |

|

12. Other income (expenses)

The Company’s other expenses for the three months ended March 31, 2025 and 2024 are as follows:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Interest income |

|

| 92,284 |

|

|

| 121,651 |

|

| Foreign exchange expense |

|

| (18,551 | ) |

|

| (157,745 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 73,733 |

|

|

| (36,094 | ) |

13. Related party transactions

Related parties include the Company’s Board of Directors and management, as well as close family and enterprises that are controlled by these individuals and certain persons performing similar functions. Other than indicated below, the Company entered into no related party transactions during the three months ended March 31, 2025 and 2024.

Key management personnel compensation

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, and also comprise the directors of the Company. Key management personnel include the Company’s Chief Executive Officer, Chief Financial Officer, Chief Investment Officer, and former EVP – Australia.

|

|

| 10 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

The remuneration of directors and other members of key management personnel during the three months ended March 31, 2025 and 2024 are as follows:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Short-term employee benefits |

|

| 572,018 |

|

|

| 538,337 |

|

| Share-based compensation |

|

| 529,844 |

|

|

| 595,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,101,862 |

|

|

| 1,133,701 |

|

14. Commitments and contingencies

The Company is, from time to time, involved in legal proceedings of a nature considered normal to its business. Other than as noted below, the Company believes that none of the litigation in which it is currently involved or have been involved with during the period ended March 31, 2025, individually or in the aggregate, is material to its consolidated financial condition or results of operations.

Litigation matter

Titan

During the year ended December 31, 2023, the Company and SilverStream became aware that the operator of the Jaw, Phoebe, Cart and Colossus exploration projects did not renew all or substantially all of the relevant mining concessions and therefore the Peruvian Ministry of Energy and Mining extinguished the mining concessions. As a result, the Company fully impaired the four royalties as of December 31, 2023, and the carrying value of the investment of $1,000,000 was reduced to $nil. The Company has filed a statement of claim in the Supreme Court of Western Australia, as discussed below, against the operator of the Jaw, Phoebe, Cart and Colossus exploration projects. Pursuant to the original agreement signed with the operator on July 15, 2021, if any of the four exploration projects became relinquished within three years of signing the original agreement, the operator must promptly provide Vox with a replacement royalty for each relinquished royalty and with each replacement royalty having a value of at least $250,000. To the extent Vox is granted one or more replacement royalties, the Company expects to reverse up to $1,000,000 of the 2023 impairment charge, which would increase net income by the equivalent amount. During the three months ended March 31, 2025, no replacement royalties have been granted.

SilverStream filed a writ and statement of claim in the Supreme Court of Western Australia against Titan Minerals Limited (“Titan”) on February 23, 2024, along with an amended writ and statement of claim on March 28, 2024, in respect of the Jaw, Phoebe, Cart and Colossus exploration projects. SilverStream is seeking to enforce its rights to be issued replacement royalties and/or damages in respect of Titan’s failure to maintain certain mining concessions in Peru in accordance with various royalty deeds entered into between Titan and SilverStream in 2021. As at March 31, 2025, the proceeding is ongoing.

Aurenne

Vox Australia filed a writ and statement of claim in the Supreme Court of Western Australia against Aurenne MIT Pty Ltd (“Aurenne”) on November 8, 2024, in respect of the Mt Ida royalty asset. Vox Australia is seeking a court declaration regarding the unreasonable withholding of consent by Aurenne to certain transaction and assignment documentation. As at March 31, 2025, the proceeding is ongoing.

Commitments

The Company or affiliates of the Company are committed to minimum annual lease payments for its premises and certain consulting agreements, as follows:

|

|

| April 1, 2025 to March 31, 2026 |

|

|

|

|

| $ |

|

|

| Leases |

|

| 3,872 |

|

| Consulting agreements |

|

| 49,493 |

|

|

|

|

|

|

|

|

|

|

| 53,365 |

|

|

|

| 11 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

Contingencies

The Company or affiliates of the Company are responsible for making certain milestone payments in connection with royalty acquisitions, which become payable on certain royalty revenue or cumulative production thresholds being achieved, as follows:

| Royalty |

| $ |

|

|

| Limpopo(1)(3) |

|

| 6,190,874 |

|

| Brits(1)(4) |

|

| 1,250,000 |

|

| Bullabulling(2)(5) |

|

| 624,026 |

|

| Koolyanobbing(6) |

|

| 312,013 |

|

| El Molino(7) |

|

| 450,000 |

|

| Uley(1)(8) |

|

| 137,286 |

|

| Other(9) |

|

| 86,950 |

|

|

|

|

|

|

|

|

|

|

| 9,051,149 |

|

| (1) | The milestone payments may be settled in either cash or common shares of the Company, at the Company’s election. |

| (2) | The milestone payments may be settled in cash or ½ cash and ½ common shares of the Company, at the Company’s election |

| (3) | Milestone payments include: (i) C$1,500,000 upon cumulative royalty receipts from Limpopo exceeding C$500,000; (ii) C$400,000 upon cumulative royalty receipts from Limpopo exceeding C$1,000,000; and (iii) C$7,000,000 upon cumulative royalty receipts from Limpopo exceeding C$50,000,000. |

| (4) | Milestone payments include: (i) $1,000,000 once 210,000t have been mined over a continuous six-month period, and (ii) a further $250,000 once 1,500,000t have been mined over a rolling 3-year time horizon. |

| (5) | Milestone payments include: (i) A$500,000 upon the Operator receiving approval of a mining proposal from the West Australian Department of Mines, Industry Regulation and Safety; and (ii) A$500,000 upon the Company receiving first royalty revenue receipt from the Bullabulling project. |

| (6) | Milestone payment due upon achievement of cumulative 5Mdmt of ore processed. |

| (7) | Milestone payment due upon registration of the El Molino royalty rights on the applicable mining title in Peru and the satisfaction of other customary completion conditions. |

| (8) | Milestone payment due upon commencement of commercial production. |

| (9) | Milestone payment due upon (i) the exercise of a separate third-party option agreement, (ii) the issuance of the royalty to the previous royalty owner, and (iii) the assignment of the royalty to Vox. |

15. Supplemental cash flow information

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Change in accrued other assets |

|

| (2,615 | ) |

|

| (246,436 | ) |

| Change in accrued deferred royalty acquisitions |

|

| 15,495 |

|

|

| 12,930 |

|

| Change in accrued interest expense on Facility |

|

| 469 |

|

|

| - |

|

16. Segment information

For the three months ended March 31, 2025 and 2024, the Company operated in one reportable segment being the acquisition of royalty interests.

For the three months ended March 31, 2025 and 2024, revenues generated from each geographic location is as follows:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Australia |

|

| 2,647,509 |

|

|

| 2,862,195 |

|

| Brazil |

|

| 17,180 |

|

|

| 4,812 |

|

| USA |

|

| 15,505 |

|

|

| 15,505 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

| 2,680,194 |

|

|

| 2,882,512 |

|

|

|

| 12 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

The Company has the following non-current assets in seven geographic locations:

|

|

| March 31, 2025 |

|

| December 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Australia |

|

| 29,691,719 |

|

|

| 30,452,281 |

|

| Canada |

|

| 2,977,509 |

|

|

| 3,036,308 |

|

| USA |

|

| 2,204,452 |

|

|

| 2,210,330 |

|

| South Africa |

|

| 1,914,844 |

|

|

| 1,914,844 |

|

| Cayman Islands |

|

| 942,746 |

|

|

| 988,631 |

|

| Brazil |

|

| 595,625 |

|

|

| 604,307 |

|

| Peru |

|

| 45,609 |

|

|

| 45,609 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

| 38,372,504 |

|

|

| 39,252,310 |

|

17. Income taxes

For the three months ended March 31, 2025 and 2024, income tax recognized in net loss and comprehensive loss is comprised of the following:

|

|

| Three months ended March 31, 2025 |

|

| Three months ended March 31, 2024 |

|

||

|

|

| $ |

|

| $ |

|

||

| Current tax expense |

|

| 503,976 |

|

|

| 591,151 |

|

| Deferred tax expense (recovery) |

|

| (52,960 | ) |

|

| 150,951 |

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

| 451,016 |

|

|

| 742,102 |

|

18. Financial instruments

The Company’s risk exposures and the impact on the financial instruments are summarized below. There have been no material changes to the risks, objectives, policies and procedures during the three months ended March 31, 2025, and the year ended December 31, 2024.

Credit risk

Credit risk is the risk of potential loss to the Company if the counterparty to a financial instrument fails to meet its contractual obligations. The Company’s credit risk is primarily attributable to its liquid financial assets including cash and cash equivalents and royalty receivables in the ordinary course of business. In order to mitigate its exposure to credit risk, the Company maintains its cash in high quality financial institutions and closely monitors its royalty receivable balances. The Company’s royalty receivables are subject to the credit risk of the counterparties who own and operate the mines underlying Vox’s royalty portfolio.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they come due. The Company’s approach to managing liquidity is to ensure it will have sufficient liquidity to meet liabilities when due. In managing liquidity risk, the Company takes into account the anticipated cash flows from operations and holding of cash and cash equivalents. As at March 31, 2025, the Company had cash and cash equivalents of $9,145,867 (December 31, 2024 - $8,754,391) and working capital of $9,653,494 (December 31, 2024 - $9,234,339).

Currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. Financial instruments that impact the Company’s net loss due to currency fluctuations include cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities and income taxes payable denominated in Canadian and Australian dollars. Based on the Company’s Canadian and Australian-denominated monetary assets and liabilities at March 31, 2025, a 10% increase (decrease) of the value of the Canadian and Australian dollar relative to the United States dollar would increase (decrease) net loss and other comprehensive loss by $452,000.

Interest rate risk

The Company is exposed to interest rate risk due to the Facility being subject to floating interest rates. The Company monitors its exposure to interest rates. During the period ended March 31, 2025, a 1% increase (decrease) in nominal interest rates would have increased (decreased) net loss and other comprehensive loss by approximately $37,500.

|

|

| 13 |

| Vox Royalty Corp. Notes to the Unaudited Condensed Interim Consolidated Financial Statements For the three months ended March 31, 2025 and 2024 (Expressed in United States Dollars) |

The Company has cash balances with rates that fluctuate with the prevailing market rate. The Company’s current policy is to invest excess cash in cash accounts or short-term interest-bearing securities issued by chartered banks. The Company periodically monitors the investments it makes and is satisfied with the credit ratings of its banks. The Company does not use any derivative instrument to reduce its exposure to interest rate risk.

Commodity and share price risk

The Company’s royalties are subject to fluctuations from changes in market prices of the underlying commodities. The market prices of precious and base metals are the primary drivers of the Company’s profitability and ability to generate free cash flow. All of the Company’s future revenue is not hedged in order to provide shareholders with full exposure to changes in the market prices of these commodities.

The Company’s financial results may be significantly affected by a decline in the price of precious, base and/or ferrous metals. The price of precious, base and ferrous metals can fluctuate widely, and is affected by numerous factors beyond the Company’s control.

Fair value of financial instruments

The carrying amounts for cash and cash equivalents, accounts receivables, accounts payable and accrued liabilities, and income taxes payable on the unaudited condensed interim consolidated statements of financial position approximate fair value because of the limited term of these instruments.

The Company classifies fair value measurements using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy has the following levels:

|

| - | Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities; |

|

| - | Level 2 - Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); and |

|

| - | Level 3 - Inputs for the asset or liability that are not based on observable market data (unobservable inputs). |

As at March 31, 2025 and December 31, 2024, the Company does not have any financial instruments measured at fair value after initial recognition.

Capital management

The Company’s primary objective when managing capital is to maximize returns for its shareholders by growing its asset base through accretive acquisitions of royalty interests, while optimizing its capital structure by balancing debt and equity. Management regularly reviews cash flow forecasts to determine whether the Company has sufficient cash reserves to meet future working capital requirements and discretionary business development opportunities. As at March 31, 2025, the capital structure of the Company consists of $42,652,508 (December 31, 2024 - $43,060,199) of total equity, comprising of share capital, equity reserves, and deficit.

The Company is not subject to any externally imposed capital requirements other than as disclosed for the Facility.

19. Subsequent events

On May 14, 2025, the Company initiated a draw down of $11.7 million under the BMO Facility. The proceeds of the draw down were allocated to the purchase of the Kanmantoo royalty acquisition.

On May 15, 2025, the Company completed the acquisition of the producing Kanmantoo copper-gold royalty for total cash consideration of $11.7 million.

On May 15, 2025, the Board of Directors of the Company declared a quarterly dividend of $0.0125 per common share payable on July 14, 2025, to shareholders of record as of the close of business on June 30, 2025.

|

|

| 14 |

EXHIBIT 99.2

MANAGEMENT DISCUSSION & ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2025

| Vox Royalty Corp. Management Discussion & Analysis For the three months ended March 31, 2025 |

Effective Date

This Management’s Discussion and Analysis (“MD&A”), prepared as of May 15, 2025, is intended to help the reader understand the significant factors that have affected the performance of Vox Royalty Corp. and its subsidiaries (collectively “Vox”, the “Company, or “our”) and such factors that may affect its future performance. This MD&A should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements and related notes as at and for the three months ended March 31, 2025 (the “Consolidated Financial Statements”). The Consolidated Financial Statements and this MD&A are presented in U.S. dollars and the financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), applicable to preparation of interim financial statements including International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board (“IASB”). Readers are encouraged to consult the Company’s audited consolidated financial statements for the year ended December 31, 2024 and related notes thereto, and the 2024 annual MD&A, which are available on our website at www.voxroyalty.com, on SEDAR+ at www.sedarplus.ca and on Form 6-K filed with the United States Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

Readers are cautioned that the MD&A contains forward-looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the “Forward-Looking Statements” at the end of this MD&A and to consult Vox’s Consolidated Financial Statements which are available on our website at www.voxroyalty.com, on SEDAR+ at www.sedarplus.ca and on Form 6-K filed with the SEC on the SEC’s website at www.sec.gov.

Additional information, including the primary risk factors affecting Vox, are included in the Company’s Annual Information Form dated March 21, 2025 (“AIF”) and Annual Report on Form 40-F dated March 26, 2025, available on SEDAR+ at www.sedarplus.ca and on the SEC’s website at www.sec.gov, respectively. These documents contain descriptions of certain of Vox’s royalties, as well as a description of risk factors affecting the Company. For additional information, please see our website at www.voxroyalty.com.

Table of Contents

| Effective Date |

| 2 |

|

| Table of Contents |

| 2 |

|

| Overview |

| 2 |

|

| Highlights and Key Accomplishments |

| 3 |

|

| Royalty Portfolio Updates |

| 5 |

|

| Outlook |

| 8 |

|

| Asset Portfolio |

| 9 |

|

| Summary of Quarterly Results |

| 12 |

|

| Liquidity and Capital Resources |

| 14 |

|

| Off-Balance Sheet Arrangements |

| 15 |

|

| Commitments and Contingencies |

| 15 |

|

| Related Party Transactions |

| 16 |

|

| Recent Accounting Pronouncements |

| 16 |

|

| Outstanding Share Data |

| 17 |

|

| Critical Accounting Judgements and Estimates |

| 17 |

|

| Financial Instruments |

| 17 |

|

| Disclosure Controls and Procedures and Internal Control Over Financial Reporting |

| 18 |

|

| Forward-Looking Information |

| 19 |

|

| Third-Party Market and Technical Information |

| 20 |

|

Abbreviations Used in This Report

| Abbreviated Definitions |

||||

| Periods Under Review | Interest Types | Currencies |

||

| Q1 2025 The three-month period ended March 31, 2025 | “NSR” | Net smelter return royalty | “$” United States dollars |

|

| Q4 2024 The three-month period ended December 31, 2024 | “GRR” | Gross revenue royalty | “A$” Australian dollars |

|

| Q3 2024 The three-month period ended September 30, 2024 | “FC” | Free carry | “C$” Canadian dollars |

|

| Q2 2024 The three-month period ended June 30, 2024 | “PR” | Production royalty | ||

| Q1 2024 The three-month period ended March 31, 2024 | “GPR” | Gross proceeds royalty | ||

| Q4 2023 The three-month period ended December 31, 2023 | “GSR” | Gross sales royalty | ||

| Q3 2023 The three-month period ended September 30, 2023 | “FOB” | Free on board | ||

| Q2 2023 The three-month period ended June 30, 2023 | “RR” | Revenue royalty | ||

Overview

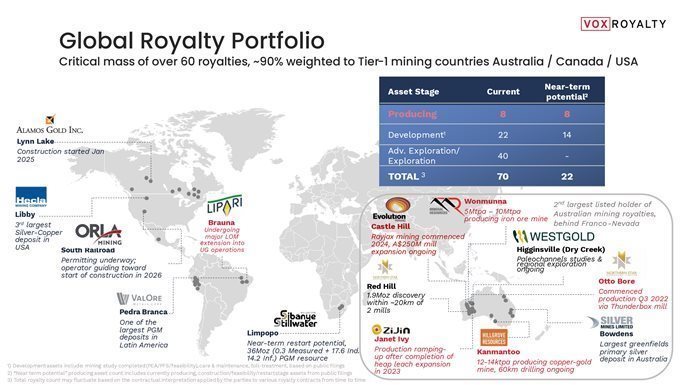

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions (Australia, Canada, the United States, Brazil, Peru, and South Africa). The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network that has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

| 2 |

| Vox Royalty Corp. Management Discussion & Analysis For the three months ended March 31, 2025 |

Vox operates a unique business model within the royalty space, which it believes offers it competitive advantages. Of these advantages, some are inherent to the Company’s business model, such as the diverse approach to finding global royalties providing it with a broader pipeline of opportunities to act on. Other competitive advantages have been strategically built since the Company’s formation, including its 2020 acquisition of Mineral Royalties Partnership Ltd.’s proprietary royalty database of over 8,500 royalties globally (“MRO”). The MRO database is not commercially available to the Company’s competitors. The MRO database vertically integrates global mining royalties with mineral deposits and mining claims, which provides the Company with the first-mover advantage to execute bilateral, non-brokered royalty acquisition transactions, which make up the majority of the historical acquisitions of the Company, in addition to brokered royalty acquisition opportunities available to other mining royalty companies. The Company also has an experienced technical team that consists of mining engineers and geologists who can objectively review the quality of assets and all transaction opportunities, in light of the cyclical nature of mineral prices.

Vox’s business model is focused on managing and growing its portfolio of royalties. The Company’s long-term goal is to provide its shareholders with a model which provides: (i) exposure to precious and industrial metals price optionality, (ii) a discovery option over large areas of geologically prospective lands, (iii) limited exposure to many of the risks associated with operating mining companies, (iv) a business model that can generate cash through the entire commodity cycle, and (v) a diversified business in which a large number of assets can be managed with scalability. Vox has a long-term investment outlook and recognizes the cyclical nature of the industry.

The Company is focused on growing the size of its royalty asset portfolio through accretive acquisitions. As at the date of this MD&A, approximately 85% of the Company’s royalty assets by royalty count are located in Australia, Canada and the United States. Specifically, the Company’s portfolio currently includes eight producing assets and twenty‑two development assets that are in the PEA/PFS/feasibility stage, or that have potential to be toll‑treated via a nearby mill or that may restart production operations after care and maintenance.

In the near and medium-term, the Company is prioritizing acquiring royalties on producing or near‑term producing assets (i.e. ranging from six months to three years from first production) to complement its existing portfolio of producing, development and exploration stage royalties. Historically, and subject to a number of commercial factors (including, but not limited to royalty percentage and ore-body coverage; royalty payment terms and deductions; royalty buy-back rights; the commodity type, location and operator of a particular mining project; project information rights; and security or guarantees relating to the payment of royalties), producing and near-term producing royalty assets tend to transact at deal sizes larger than the Company’s average purchase price for its acquisitions to date. Therefore, while the Company continues to target accretive acquisition opportunities at all stages of project development, the Company’s average deal size is expected to increase over time as part of the Company’s broader growth plans.