UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 24, 2024

ENGlobal Corporation |

(Exact name of registrant as specified in its charter) |

Nevada |

001-14217 |

88-0322261 |

||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

11740 Katy Fwy – Energy Tower III, 11th floor Houston, TX |

|

77079 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 281-878-1000

______________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value |

ENG |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

Amended and Restated Credit Agreement

On April 24, 2024 (the “Closing Date”), ENGlobal Corporation, a Nevada corporation (the “Company”), entered into an Amended and Restated Credit Agreement (the “Credit Agreement”) with Alliance 2000, Ltd., a Texas limited partnership (“Lender”), pursuant to which the parties amended and restated the Credit Agreement dated June 15, 2023 (the “Original Credit Agreement”), between the Company and the Lender to, among other things, (i) modify the existing term loans in the aggregate original principal amount of $1,200,000 (the “Term Loans”) to (a) extend the maturity date to July 2, 2025, and (b) reduce the applicable interest rate from 8.5% to 8.0% per annum, and (ii) provide a revolving credit facility (the “Line of Credit”) of up to the lesser of (a) the Borrowing Base (as defined below) and (b) $1,000,000. In connection with entering into the Original Credit Agreement, (i) the Company and its subsidiaries, ENGlobal U.S., Inc., a Texas corporation, ENGlobal Government Services, Inc., a Texas corporation, and ENGlobal Technologies, LLC, a Texas limited liability company (collectively, the “Guarantors”), previously entered into a Security Agreement (the “Security Agreement”) granting a security interest in favor of Lender on substantially all of the Company’s and Guarantors’ assets to secure all of the indebtedness and other obligations owed to Lender under the Credit Agreement and (ii) the Guarantors previously entered into a Continuing Guaranty (the “Guaranty”) pursuant to which the Guarantors guaranteed the payment of all indebtedness owed to Lender.

The Lender is the beneficial owner of more than 22% of the Company’s issued and outstanding common stock and is under the direct and indirect control of William A. Coskey, P.E., the Company’s Chairman and Chief Executive Officer. In accordance with the charter of the Company’s Audit Committee and the Company’s policy on related party transactions, the transactions contemplated by the Loan Documents (as defined below) were reviewed and approved by the Company’s Audit Committee and determined in good faith to be on terms no less favorable to the Company than could be obtained from unrelated third parties and fair to the Company and the Guarantors from a financial point of view, and were approved by all of the disinterested members of the Company’s Board of Directors.

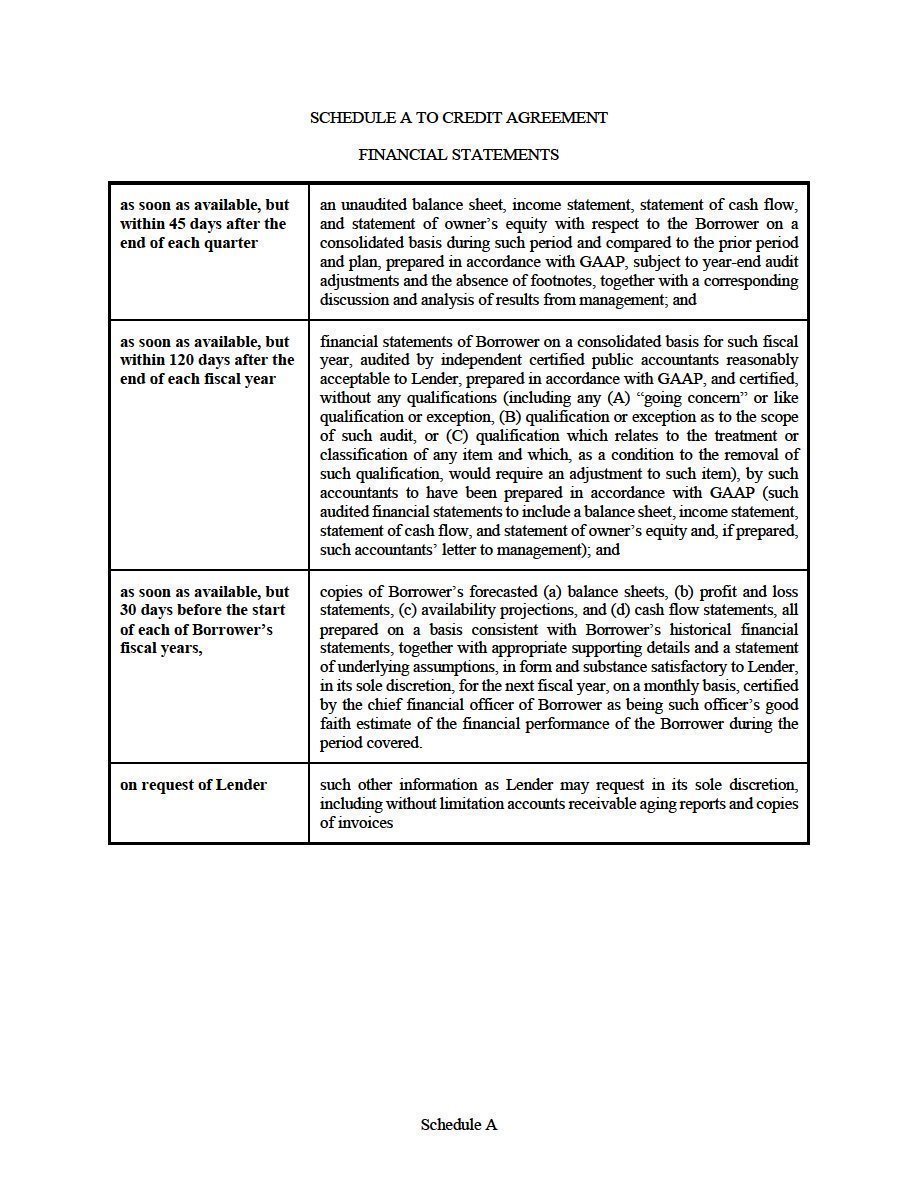

Set forth below are certain material terms of the Amended and Restated Credit Agreement, the Security Agreement and the Guaranty (collectively, the “Loan Documents”):

Term Loans: The first Term Loan was made on June 15, 2023 in an aggregate principal amount equal to $1,000,000 in a single loan which, when paid or prepaid, may not be re-borrowed. An additional Term Loan was made on January 30, 2024 in an aggregate principal amount equal to $200,000 in a single loan which, when paid or prepaid, may not be re-borrowed. On the Closing Date, accrued and unpaid interest of approximately $72 thousand under the Term Loans and origination fees of $6,000 in respect of the Term Loans were added to the principal balance thereof.

| 2 |

Line of Credit: The Lender will make advances to the Company from time to time in an aggregate principal amount that will not exceed the lesser of (i) the Borrowing Base, and (ii) $1,000,000 (such amount, the “Credit Limit”), the proceeds of which will be used for working capital and general corporate purposes. The borrowing base (the “Borrowing Base”) will be an amount equal to up to 95% of Eligible Receivables (as defined in the Credit Agreement) as determined by Lender from time to time, less any reserves established by Lender in its sole discretion from time to time. Lender will have the right, from time to time, in its credit judgment (i) to establish, modify or eliminate reserves against Eligible Receivables or the Borrowing Base, (ii) to decrease or increase the percentages in the definition of Borrowing Base, or (iii) to adjust any of the criteria set out in the definitions of “Eligible Receivables” or to establish new criteria. Amounts borrowed under the Line of Credit may be repaid in whole or in part and may be reborrowed, subject to the terms and conditions of the Credit Agreement.

Interest: The outstanding principal balance of the Term Loans will bear interest (computed on the basis of a 365/366-day year, as the case may be, actual days elapsed) at a per annum rate equal to 8.0%. The outstanding principal balance of the Line of Credit will bear interest (computed on the basis of a 365/366-day year, as the case may be, actual days elapsed) at a per annum rate equal to 12.0%. Interest under the Term Loans and the Line of Credit will be due and payable monthly in arrears on the last business day of each month, with any remaining accrued but unpaid interest payable at maturity.

Mandatory Prepayments: The Term Loans are required to be prepaid if the Company (i) issues any equity interests or (ii) incurs any additional indebtedness other than Permitted Indebtedness in which the aggregate capital amount raised pursuant to (i) and/or (ii) is greater than $2,000,000, then 100% of the Net Proceeds received will be paid to Lender. The Line of Credit is required to be repaid upon receipt of all or any portion of payment from an account debtor of each Eligible Receivable included in the Borrowing Base or if the amount borrowed under the Line of Credit exceeds the Credit Limit.

Negative Covenants: The Credit Agreement is subject to negative covenants that, among other things and subject to certain exceptions, limit the Company’s ability and the ability of the Guarantors to incur indebtedness, to merge, consolidate, transfer assets or undertake certain transactions outside of the ordinary course of business, to make guarantees; to make loans, advances and investments, to make dividends and distributions, to incur liens or encumbrances, to undertake affiliate transactions and to make certain organizational changes.

Maturity Date: The Term Loans and the Line of Credit mature on July 2, 2025.

Collateral: The Company and Guarantors have granted Lender, for the benefit of Lender, a continuing security interest in all of the Company and Guarantors’ now-owned and hereafter acquired property and assets of every kind.

Guaranty: Each of the Guarantors jointly and severally guarantee to Lender prompt payment of the obligations in full when due.

The foregoing description of the Loan Documents is included to provide you with information regarding their terms. It does not purport to be a complete description and is qualified in its entirety by reference to the full text of each of the Loan Documents, which are filed as Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3 hereto and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

| 3 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

Exhibit No. |

|

Description |

|

|

|

|

||

|

||

|

||

Exhibit 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| 4 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENGlobal Corporation |

|

|

|

(Registrant) |

|

|

|

|

|

April 25, 2024 |

|

/s/ Darren W. Spriggs |

|

(Date) |

|

Darren W. Spriggs, Chief Financial Officer, Treasurer and Corporate Secretary |

|

| 5 |