UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to

OR

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ____________________

Commission file number: 001-39152

FSD Pharma Inc. |

(Exact name of Registrant as specified in its charter) |

Ontario, Canada

(Jurisdiction of incorporation or organization)

199 Bay St., Suite 4000

Toronto, Ontario M5L 1A9, Canada

(Address of principal executive offices)

Zeeshan Saeed, Founder, Chief Executive Officer, President and Executive Co-Chairman of the Board

FSD Pharma Inc.

199 Bay St., Suite 4000

Toronto, Ontario M5L 1A9, Canada

Telephone: (416) 854-8884

Email: zsaeed@fsdpharma.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class B Subordinate Voting Shares, no par value |

|

HUGE |

|

The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Class A Multiple Voting Shares, no par value: 72 shares outstanding as of December 31, 2023

Class B Subordinate Voting Shares, no par value: 39,376,723 shares outstanding as of December 31, 2023

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Emerging growth company |

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

TABLE OF CONTENTS

6 |

||

|

|

|

6 |

||

|

|

|

9 |

||

|

|

|

10 |

||

|

|

|

|

11 |

|

|

|

|

11 |

||

|

|

|

11 |

||

|

|

|

11 |

||

|

|

|

11 |

||

11 |

||

11 |

||

11 |

||

|

|

|

29 |

||

|

|

|

29 |

||

34 |

||

46 |

||

48 |

||

|

|

|

48 |

||

|

|

|

48 |

||

|

|

|

48 |

||

48 |

||

48 |

||

48 |

||

48 |

||

|

|

|

48 |

||

|

|

|

48 |

||

51 |

||

59 |

||

65 |

||

65 |

||

| 3 |

| Table of Contents |

65 |

||

|

|

|

65 |

||

67 |

||

68 |

||

|

|

|

68 |

||

|

|

|

68 |

||

71 |

||

|

|

|

71 |

||

|

|

|

|

||

71 |

||

71 |

||

71 |

||

71 |

||

71 |

||

|

|

|

72 |

||

|

|

|

72 |

||

72 |

||

72 |

||

72 |

||

73 |

||

79 |

||

79 |

||

79 |

||

79 |

||

79 |

||

|

|

|

|

||

|

|

79 |

79 |

||

|

|

|

79 |

||

79 |

||

79 |

||

79 |

||

|

|

|

|

|

|

|

|

|

80 |

| 4 |

| Table of Contents |

Material Modifications to the Rights of Security Holders and Use of Proceeds. |

80 |

|

|

|

|

80 |

||

80 |

||

|

|

|

82 |

||

|

|

|

82 |

||

Management’s Annual Report on Internal Control over Financial Reporting |

82 |

|

82 |

||

82 |

||

|

|

|

82 |

||

|

|

|

82 |

||

|

|

|

83 |

||

|

|

|

83 |

||

|

|

|

83 |

||

|

|

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers. |

83 |

|

|

|

|

85 |

||

|

|

|

86 |

||

|

|

|

86 |

||

|

|

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

86 |

|

|

|

|

86 |

||

|

|

|

86 |

||

|

|

|

|

||

|

|

|

88 |

||

|

|

|

88 |

||

|

|

|

88 |

| 5 |

| Table of Contents |

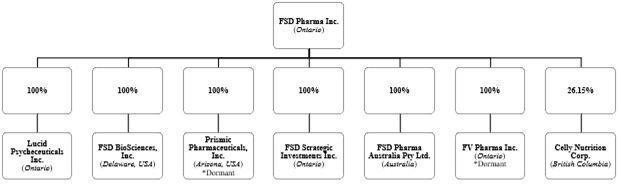

INTRODUCTION

Unless otherwise noted or the context otherwise requires, all references in this Annual Report on Form 20-F (this “Annual Report”), or this Annual Report, to “FSD,” “FSD Pharma,” “Company,” “Corporation,” “we,” “us” and “our” refer to FSD Pharma Inc., a corporation formed under the Business Corporations Act (Ontario) (the “OBCA”) and the direct or indirect subsidiary entities of FSD and any partnership interests held by FSD Pharma and its subsidiary entities, including Lucid Psycheceuticals Inc. (“Lucid”), FSD BioSciences Inc. (“FSD Biosciences”), FV Pharma Inc. (“FV Pharma”), Prismic Pharmaceuticals, Inc. (“Prismic”), FSD Strategic Investments Inc. (“FSD Strategic Investments”), FSD Pharma Australia Pty Ltd. (“FSD Australia”) and Celly Nutrition Corp. (“Celly Nu”).

Our fiscal year ends on December 31. This Annual Report includes our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023 and 2022, (the “2023 Annual Financial Statements”) which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. None of our financial statements were prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”).

Except where expressly indicated otherwise, our financial information is presented in U.S. dollars. All references in this Annual Report to “$” or “US$” mean United States of American (“U.S.” or “United States”) dollars, and all references in this Annual Report to “C$” mean Canadian dollars. For the convenience of the reader, in this Annual Report, unless otherwise indicated, translations from Canadian dollars into U.S. dollars were made at the rate of US$1.00 to C$1.3497, which is the average rate for the 2023 fiscal year, (2022 average rate: US$1.00=C$1.3013). Such U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars that could actually have been purchased upon exchange of Canadian dollars at the dates indicated.

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

This Annual Report includes registered and unregistered trademarks such as “Unbuzzd,” and “ALCOHOLDEATH,” which are protected under applicable intellectual property laws and are the property of the Company. Solely for convenience, our trademarks referred to in this Annual Report and in other publicly filed documents may appear without the ® or ™ symbol, but such references are not intended to indicate, in any way, that we will not assert our rights to the fullest extent under applicable law. All other trademarks used in this Annual Report are the property of their respective owners. For more information, please see “Item 4. Information on the Company. – B. Business Overview – Intellectual Property”.

We are incorporated under the laws of Ontario, Canada. Substantially all of our assets are located outside the United States. In addition, several of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such directors’ and officers’ assets may be located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or our officers or directors or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, investors should not assume that the courts of Canada (i) would enforce judgments of United States courts obtained in actions against us, our officers or directors, or other said persons, predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States or (ii) would enforce, in original actions, liabilities against us or such directors, officers or experts predicated upon the United States federal securities laws or any securities or other laws of any state or jurisdiction of the United States.

In addition, there is doubt as to the applicability of the civil liability provisions of the United States federal securities law to original actions instituted in Canada. It may be difficult for an investor, or any other person or entity, to assert United States securities laws claims in original actions instituted in Canada.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute forward-looking statements. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, business strategy, product candidates, product pipeline, ongoing and planned clinical studies, including those of our collaboration partners, regulatory approvals, research and development (“R&D”) costs, timing and likelihood of success, as well as plans and objectives of management for future operations, are forward-looking statements. Many of the forward-looking statements contained in this Annual Report are often, but not always, identified by words or phrases such as “hope”, “would”, “seek”, “anticipate”, “believe”, “expect”, “plan”, “continue”, “estimate”, “will”, “predict”, “intend”, “forecast”, “future”, “target”, “project”, “capacity”, “could”, “should”, “might”, “focus”, “proposed”, “scheduled”, “outlook”, “potential”, “may” or similar expressions and includes suggestions of future outcomes, including, but not limited to statements about:

|

· |

discussions concerning the Company’s exploration of near-term funding strategies; |

|

· |

the Company’s plans to advance the R&D of its Product Candidates (as defined herein) to commercialization through studies and clinical trials, including anticipated timing and associated costs; |

|

· |

the application and the costs associated with such planned trials, and the Company’s ability to obtain required funding and the terms and timing thereof; |

|

· |

the expansion of our product offering(s); |

|

· |

our business objectives and the expected impacts of previously announced acquisitions and developments; |

|

· |

the U.S. Food and Drug Administration (“FDA”) and Health Canada, or comparable regulatory authority, application process and any review thereof and its effects on our business objectives. |

| 6 |

| Table of Contents |

Readers are cautioned not to place undue reliance on Forward-Looking Statements as the Company’s actual results may differ materially and adversely from those expressed or implied.

The Corporation has made certain assumptions with respect to the Forward-Looking Statements regarding, among other things:

|

· |

the Corporation’s ability to generate sufficient cash flow from operations and obtain financing, if needed, on acceptable terms or at all; |

|

· |

the general economic, financial market, regulatory and political conditions in which the Corporation operates; |

|

· |

the interest of potential purchasers in the Product Candidates; |

|

· |

anticipated and unanticipated costs; the government regulation of the Corporation’s activities and Product Candidates; |

|

· |

the timely receipt of any required regulatory approvals; |

|

· |

the Corporation’s ability to obtain qualified staff, equipment and services in a timely and cost efficient manner; |

|

· |

the Corporation’s ability to conduct operations in a safe, efficient and effective manner; and |

|

· |

the Corporation’s expansion plans and timeframe for completion of such plans. |

Although the Corporation believes that the expectations and assumptions on which the Forward-Looking Statements are based are reasonable, undue reliance should not be placed on the Forward-Looking Statements, because no assurance can be given that such statements will prove to be correct.

Forward-looking statements appear in a number of places in this Annual Report and include, but are not limited to, statements regarding our intent, belief, or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions, and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under “Item 3. Key information - D. Risk Factors” in this Annual Report. These risks and uncertainties include multiple factors:

|

· |

the success of our clinical studies, our ability to obtain and maintain regulatory approval and to commercialize our Product Candidates, which include Lucid-21-302 (“Lucid-MS”), for the treatment of multiple sclerosis (“MS”) and our product for alcohol misuse in the healthcare area; |

|

· |

the ability of our licensing partner, Celly Nu to commercialize, sell and distribute Unbuzzd™, a functional beverage product that seeks to provide relief from inebriation and accelerate alcohol metabolism in the consumer market; |

|

· |

the ability of our competitors to discover, develop or commercialize competing products to Unbuzzd™, Lucid-MS or other product candidates before or more successfully than we do; |

|

· |

our plans to research, develop and commercialize our Product Candidates; |

|

· |

the identification of serious adverse, undesirable, or unacceptable side effects related to our Product Candidates; |

|

· |

our ability to maintain our current strategic relationships with Celly Nu, our licensing partner to commercialize Unbuzzd™; |

|

· |

our ability to protect and maintain our, and not infringe on third parties’, intellectual property rights throughout the world; |

|

· |

our ability to raise capital when needed in order to continue our product development programs and commercialization efforts; |

|

· |

our ability to attract and retain qualified employees and key personnel; |

|

· |

the acceptance by the FDA and applicable foreign regulatory authorities of data from studies for Lucid-MS that we and our collaboration partners conduct within and outside the U.S. now and in the future; |

|

· |

our foreign private issuer status, the loss of which would require us to comply with the Exchange Act of 1934’s, as amended (the “Exchange Act”) domestic reporting regime, and cause us to incur significant legal, accounting, and other expenses; |

|

· |

our incorporation in Ontario, the laws of which govern our corporate affairs and may differ from those applicable to companies incorporated in the U.S.; |

|

· |

the limited operating history of the Company and history of losses, and anticipated significant losses for the foreseeable future incurred to pursue commercialization of the Product Candidates; |

|

· |

the Company’s inability to file investigational new drug applications (“INDs”) or clinical trial application (“CTAs”) on timelines it reasonably anticipates, if at all; |

|

· |

the Company’s ability to identify, license or discover additional product candidates; |

|

· |

the Product Candidates being in the preclinical development stage; |

|

· |

the Company’s reliance on its Product Candidates; |

|

· |

the Company’s ability to successfully develop new commercialized products or find a market for their sale; |

|

· |

the impact of any future recall of the Company’s products; |

|

· |

the Company’s ability to promote and sustain its products, including any restrictions or constraints on marketing practices under the regulatory framework in which the Company operates; |

|

· |

failure to achieve the degree of market acceptance and demand for our products or Product Candidates by physicians, patients, healthcare payors, and others in the medical community which are necessary for commercial success, including due to the possibility that alternative, superior treatments may be available prior to the approval and commercialization of Product Candidates, should such approval be received at all; |

| 7 |

| Table of Contents |

|

· |

failure of clinical trials to demonstrate substantial evidence of the safety and/or effectiveness of Product Candidates, which could prevent, delay or limit the scope of regulatory approval and commercialization, including from difficulties encountered in enrolling patients in clinical trials, and reliance on third parties to conduct our clinical trials and some aspects of our research and preclinical testing, or results from future clinical testing which may demonstrate opposing evidence and draw negative conclusions regarding the effectiveness of any Product Candidate, including the effectiveness of Lucid-MS as a treatment for MS; |

|

· |

results of earlier studies or clinical trials not being predictive of future clinical trials and initial studies or clinical trials not establishing an adequate safety or efficacy profile for the Product Candidates to justify proceeding to advanced clinical trials or an application for regulatory approval; |

|

· |

potential side effects, adverse events or other properties or safety risks of the Product Candidates, which could delay or halt their clinical development, prevent their regulatory approval, cause suspension or discontinuance of clinical trials, abandonment of a Product Candidate, limit their commercial potential, if approved, or result in other negative consequences; |

|

· |

preliminary, interim data obtained from the Company’s clinical trials that it may announce or publish from time to time may not be indicative of future scientific observations or conclusions as more patient data becomes available, further analyses are conducted, and as the data becomes subject to subsequent audit and verification procedures; |

|

· |

inability to establish sales and marketing capabilities, or enter into agreements with third parties, to sell and market any Product Candidates that the Company may develop; |

|

· |

the ability to provide the capital required for research, product development, operations and marketing; |

|

· |

violations of laws and regulations resulting in repercussions; |

|

· |

risks inherent in an pharmaceutical business and the development and commercialization of pharmaceutical products, including the inability to accurately predict timing or amounts of expenses, requirements of regulatory authorities, and completion of clinical studies on anticipated timelines, which may encounter substantial delays or may not be able to be completed at all; |

|

· |

delays in clinical trials; |

|

· |

the Company’s inability to attain or maintain the regulatory approvals it needs in any jurisdiction to commercialize, distribute or sell any Product Candidate or other pharmaceutical products; |

|

· |

failure of counterparties to perform contractual obligations; |

|

· |

changes, whether anticipated or not, in laws, regulations and guidelines that may result in significant compliance costs for the Company, including in relation to restrictions on branding and advertising, regulation of distribution and excise taxes; |

|

· |

uncertainty associated with insurance coverage and reimbursement status for newly-approved pharmaceutical products, which could result in Product Candidates becoming subject to unfavorable pricing regulations, third-party coverage and reimbursement practices, or healthcare reform initiatives, including legislative measures aimed at reducing healthcare costs; |

|

· |

the effect that any public health crises, such as pandemics or epidemics may have on the Company’s business; |

|

· |

the price of our securities may be volatile due to a variety of factors, including volatility in the capital markets generally, geopolitical events, public health emergencies, macro economic pressures and natural disasters; |

|

· |

the inability to obtain required additional financing on terms favourable to the Corporation or at all; |

|

· | the Company’s anticipated negative cash flow from operations and non-profitability for the foreseeable future; |

|

· |

the issuances of equity securities and the conversion of outstanding securities to Class B subordinate voting shares in the capital of the Company (the “Class B Shares”); |

|

· |

the Company’s dual class share structure; |

|

· |

the market price of the Class B Shares possibly being subject to wide price fluctuations; |

|

· |

whether an active trading market for the Class B Shares is sustained; |

|

· |

the Company’s ability to maintain compliance with Nasdaq Stock Market LLC’s (“Nasdaq”) rules for continued listing on the Nasdaq; |

|

· |

the Company’s ability to identify and execute future acquisitions or dispositions effectively, including the ability to successfully manage the impacts of such transactions on its operations; |

|

· |

lack of dividends, and reinvestment of retained earnings, if any, into the Company’s business; |

|

· |

the Company’s reliance on management, key persons and skilled personnel; |

|

· |

reliance on contract manufacturing facilities; |

|

· |

manufacturing problems that could result in delay of the Company’s development or commercialization programs; |

|

· |

the Company’s expected minimal environmental impacts; insurance and uninsured risks; |

|

· |

claims from suppliers; conflicts of interest between the Company and its directors and officers; |

|

· |

the Company’s ability to manage its growth effectively; |

|

· |

the Company’s ability to realize production targets; |

|

· |

supply chain interruptions and the ability to maintain required supplies of, equipment, parts and components; |

|

· |

the Company’s ability to successfully implement and maintain adequate internal controls over financial reporting or disclosure controls and procedures; |

|

· |

results of litigation; |

|

· |

the dependence of the Company’s operations, in part, on the maintenance and protection of its information technology systems, and the information technology systems of its third-party research institution collaborators, contract research organizations (“CROs”) or other contractors or consultants, which could face cyber-attacks; |

|

· |

failure to execute definitive agreements with entities in which the Company has entered into letters of intent or memoranda of understanding; |

|

· |

unfavorable publicity or consumer perception towards the Product Candidates; |

| 8 |

| Table of Contents |

|

· |

reputational risks to third parties with whom the Company does business; failure to comply with laws and regulations; |

|

· |

the Company’s reliance on its own market research and forecasts; |

|

· |

competition from other technologies and pharmaceutical products, including from synthetic production, new manufacturing processes and new technologies, and expected significant competition from other companies with similar businesses, and significant competition in an environment of rapid technological and scientific change; |

|

· |

the Company’s ability to safely, securely, efficiently and cost-effectively transport our products to consumers; |

|

· |

liability arising from any fraudulent or illegal activity, or other misconduct or improper activities that the Company’s directors, officers, employees, contractors, consultants, commercial partners or vendors may engage in, including noncompliance with regulatory standards and requirements; |

|

· |

unforeseen claims made against the Company, including product liability claims or regulatory actions; |

|

· |

reliance on single-source suppliers, including single-source suppliers for the acquisition of the drug substance and drug product for any of the Product Candidates; |

|

· |

inability to obtain or maintain sufficient intellectual property protection for the Product Candidates; |

|

· |

third-party claims of intellectual property infringement; |

|

· |

patent terms being insufficient to protect competitive position on Product Candidates; |

|

· |

inability to obtain patent term extensions or non-patent exclusivity; |

|

· |

inability to protect the confidentiality of trade secrets; |

|

· |

inability to protect trademarks and trade names; |

|

· |

filing of claims challenging the inventorship of the Company’s patents and other intellectual property; |

|

· |

invalidity or unenforceability of patents, including legal challenges to patents covering any of the Product Candidates; |

|

· |

claims regarding wrongfully used or disclosed confidential information of third parties; |

|

· |

risks related to the Company’s investment in Celly Nu, including the ability of Celly Nu to commercialize the exclusive rights to the recreational applications for the Company’s alcohol misuse technology for rapid alcohol detoxification; |

|

· |

inability to protect property rights around the world; the impact of general economic conditions on the Company’s mortgage investment activities; |

|

· |

risks related to the Company’s status as a foreign private issuer; |

|

· |

the Company taking advantage of reduced disclosure requirements applicable to emerging growth companies; |

|

· |

the Company’s classification as a “passive foreign investment company”; |

|

· |

that the Company’s international business operations, including expansion to new jurisdictions, could expose it to regulatory risks or factors beyond our control such as currency exchange rates and changes in governmental policy; |

|

· |

risks related to expansion of international operations; |

|

· |

the Company’s ability to produce and sell products in, and export products to, other jurisdictions within and outside of Canada and the United States, which is dependent on compliance with additional regulatory or other requirements; |

|

· |

regulatory regimes of locations for clinical trials outside of Canada and the United States; |

|

· |

failure to obtain approval to commercialize Product Candidates outside of Canada and the United States; |

|

· |

if clinical trials are conducted for Product Candidates outside of Canada and the United States, FDA, Health Canada and comparable regulatory authorities may not accept data from such trials, or the scope of such approvals from regulatory authorities may be limited; |

|

· |

other factors beyond the Company’s control; |

|

· |

the other risk factors discussed under “Item 3. Key information - D. Risk Factors”. |

These forward-looking statements are applicable only as of the date of this Annual Report, and are subject to a number of risks, uncertainties and assumptions described under the sections in this Annual Report entitled “Item 3. Key information - D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

MARKET AND INDUSTRY DATA

This Annual Report includes market and industry data that has been obtained from third party sources, including industry publications. The Company believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Company has not independently verified any of the data from third party sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources.

| 9 |

| Table of Contents |

SUMMARY RISK FACTORS

Our business is subject to a number of risks and uncertainties, including those risks discussed at length in the section below titled “Risk Item 3. Key information - D. Risk Factors”. These risks include, among others, the following:

RISKS RELATED TO OUR PRODUCT CANDIDATES

|

· |

We have a limited operating history and funding, which may make it difficult to evaluate Lucid-MS, our products for alcohol misuse and their product development, product prospects and overall likelihood of success; |

|

· |

Our drug product candidate, Lucid-MS or our products relating to alcohol misuse, may not receive regulatory approval from Health Canada or the FDA, in a timely manner, if at all, or may receive regulatory approval on limiting terms; |

|

· |

We are relying on Celly Nu, our licensing partner, to develop and promote Unbuzzd™, an alcohol misuse product for the retail market; |

|

· |

The Company may be unable to raise the capital necessary for it to execute its strategy on favorable terms or at all; and |

|

· |

Drug development is a highly uncertain undertaking and involves a substantial degree of risk. |

RISKS RELATED TO THE PHARMACEUTICAL BUSINESS

|

· |

We rely on the UHN License (as defined herein) to use for pharmaceutical purposes certain patents and other intellectual property rights associated with Lucid-MS; |

|

· |

We rely on the Epitech License Agreement and the UHN License to use for pharmaceutical purposes certain patents and other intellectual property rights associated with FSD-PEA and Lucid-MS; |

|

· |

Even if Lucid-MS receives regulatory approval, we may nonetheless fail to achieve the degree of market acceptance of Lucid-MS by physicians, patients, healthcare payors, and others in the medical community necessary for commercial success; |

|

· |

We face significant competition for our Lucid-MS drug, and there is a possibility that our competitors may achieve regulatory approval for an effective treatment for MS before us or develop therapies that are safer, more advanced, or more effective than ours; |

|

· |

Psychedelic or psychedelic-inspired drugs may never be approved as medicines or other therapeutic applications, and violations of applicable laws and regulations, or changes in the regulatory or political discourse with respect to psychedelic or psychedelic-inspired drugs, could result in repercussions; |

|

· |

The loss of single-source suppliers, or their failure to supply us with the drug substance or drug product, could materially and adversely affect our business; |

|

· |

We currently rely on, and expect to continue to rely on, third parties to conduct drug trials and aspects of our research and preclinical testing for Lucid-MS, our products relating to alcohol misuse and other possible drug candidates; |

|

· |

We, our service providers, or any third-party manufacturers may fail to comply with regulatory requirements which could subject us to enforcement actions; and |

|

· |

The FDA, Health Canada or other comparable regulatory authorities may not accept data from trials conducted in foreign jurisdictions. |

RISKS RELATED TO OUR INTELLECTUAL PROPERTY

|

· |

We may be unable to obtain and maintain sufficient intellectual property protection for our Product Candidates; |

|

· |

Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts; and |

|

· |

If we are unable to adequately protect the confidentiality of our trade secrets, our trademarks or trade names, our business may be adversely affected. |

GENERAL CORPORATE RISKS

|

· |

Macroeconomic pressures in the markets in which we operate, including, but not limited to, the lasting effects of the COVID-19 pandemic, epidemic, or outbreak of an infectious disease, inflation, stagflation, supply chain and interest rate pressures, foreign currency exchange rate fluctuations, the ongoing conflict between Russia and Ukraine and political developments in Hong Kong and Taiwan, natural disasters and other macroeconomic and geopolitical events may materially and adversely affect our business and financial results and could cause a disruption to the development of our Product Candidates; |

|

· |

The Company operates in a highly regulated industry and is subject to a wide range of federal, state, and local laws, rules, and regulations, including FDA and Health Canada regulatory requirements and laws pertaining to fraud and abuse in healthcare, that affect nearly all aspects of our operations. Failure to comply with these laws, rules, and regulations, or to obtain and maintain required licenses, could subject the Company to enforcement actions, including substantial civil and criminal penalties, and might require us to recall or withdraw a product from the market or cease operations, which could materially and adversely affect our business, financial condition, and results of operations; |

|

· |

Any significant interruption in the supply chain for key inputs could materially impact the Company’s business; |

|

· |

Future sales or issuances of equity securities and the conversion of outstanding securities to Class B Shares could decrease the value of the Class B Shares and dilute investors’ voting power; |

|

· |

The Company’s dual class structure has the effect of concentrating voting control and the ability to influence corporate matters with a limited number of holders of Class A multiple voting shares in the capital of the Company (the “Class A Shares”); |

|

· |

A decline in general economic conditions may impact the viability and success of our mortgage investment activities; |

|

· |

We may lose our status as a foreign private issuer; |

|

· |

There can be no assurance that we will be able to comply with the continued listing standards of the Nasdaq and/or Canadian Securities Exchange (the “CSE”); |

|

· |

The Company is currently party to several legal proceedings and may become a party to potential future litigation; and |

|

· |

We are a passive foreign investment company for U.S. federal income tax purposes, which may result in adverse U.S. federal income tax consequences for U.S. Holders of our Class B Shares. |

| 10 |

| Table of Contents |

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in securities of the Company should only be made by persons who can afford a significant or total loss of their investment. We are exposed to a number of risks through the pursuit of our business objectives. The following risks and uncertainties identified below are those we believe may, individually or in combination with other risks and uncertainties, have a material impact on our business, but these are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or risks that we currently deem immaterial, may also impair our business operations. If any of the following risks, or any other risks and uncertainties that we have not yet identified or that we currently consider not to be material, actually occur, or become material risks, our business, financial condition, results of operations and cash flows, and consequently the price of the Class B Shares, could be materially and adversely affected.

The risks discussed below also include Forward-Looking Statements and our actual results may differ substantially from those discussed in these Forward-Looking Statements. See “Cautionary Note Regarding Forward-Looking Statements” in this Annual Report.

Risks relating to our Product Candidates

Drug development is highly uncertain undertaking and involves a substantial degree of risk. We have no product sales, which, together with our limited operating history, makes it difficult to evaluate our business and assess our future viability.

Pharmaceutical and biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. We are a biotechnology corporation with a limited operating history. We have no pharmaceutical products approved for commercial sale and have not generated any revenue from pharmaceutical product sales. We are currently focused on developing Lucid-MS, a patented new chemical entity targeting the treatment of MS. The effectiveness of Lucid-MS is not yet known. We continue to incur significant research and development and other expenses related to clinical trials and other operating expenses, ongoing operations and expect to incur losses for the foreseeable future. We anticipate these losses will increase and that we will not generate any revenue from product sales of Lucid-MS unless and until after we have successfully completed clinical development and received regulatory approval, for the commercial sale of this product.

We may never be able to develop or commercialize Lucid-MS or any other drug candidate or achieve profitability. Revenue from the sale of Lucid-MS, if regulatory approval is obtained, will be dependent, in part, upon the size of the markets in the territories for which we obtain regulatory approval, the accepted price for the product, the ability to obtain reimbursement at any price and whether we own the commercial rights for that territory, as well as the efficiency and availability of any comparable products. Our growth strategy depends on our ability to generate revenue. In addition, if the number of addressable patients is less than anticipated, the indication approved by regulatory authorities is narrower than expected, or the reasonably accepted population for treatment is narrowed by competition, physician choice or treatment guidelines, we may not generate significant revenue from sales of Lucid-MS or any other drug product, even if approved. Even if we are able to generate revenue from the sale of Lucid-MS, we may not become profitable and may need to obtain additional funding to continue operations. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to achieve sustained profitability would depress our value and could impair our ability to raise capital, expand our business, diversify our research and development pipeline, market Lucid-MS and any other product candidates that we may identify and pursue or continue our operations.

| 11 |

| Table of Contents |

Our future success is dependent on the regulatory approval and commercialization of our Product Candidates.

We do not have any products that have gained regulatory approval. As a result, our ability to finance our operations and generate revenue, are substantially dependent on our ability to obtain regulatory approval for, and, if approved, to successfully commercialize our product candidates in a timely manner. We cannot commercialize our other product candidates in Canada or the U.S. without first obtaining regulatory approval for each product from Health Canada or the FDA; similarly, we cannot commercialize any product candidates outside of the U.S. or Canada without obtaining regulatory approval from comparable foreign regulatory authorities, including the European Medicines Agency (the “EMA”). The FDA review process typically takes years to complete and approval is never guaranteed. Before obtaining regulatory approvals for the commercial sale of Lucid-MS or any of our potential product candidates for a target indication, we must demonstrate with substantial evidence gathered in preclinical and well-controlled clinical studies, with respect to approval in Canada and in the U.S. to the satisfaction of Health Canada and the FDA, and in Europe, to the satisfaction of the EMA, that the product candidate is safe and effective for use for that target indication; and that the manufacturing facilities, processes and controls are adequate. Obtaining regulatory approval for marketing of Lucid-MS or future product candidates in one country does not ensure we will be able to obtain regulatory approval in other countries. A failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in other countries.

Even if Lucid-MS or any of our other product candidates were to successfully obtain approval from Health Canada or the FDA or comparable foreign regulatory authorities, any approval might contain significant limitations related to use restrictions for specified age groups, warnings, precautions, or contraindications, or may be subject to burdensome post-approval studies or risk management requirements. If we are unable to obtain regulatory approval for our Product Candidates in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient funding or generate sufficient revenue to continue the development of any of our other Product Candidates that we are developing or may discover, in-license, develop or acquire in the future. Also, any regulatory approval of our Product Candidates, once obtained, may be withdrawn. Furthermore, even if we obtain regulatory approval for any of our Product Candidates, their commercial success will depend on a number of factors, including the following:

|

· |

development of a commercial organization within the Company or establishment of a commercial collaboration with a commercial infrastructure; |

|

· |

establishment of commercially viable pricing and obtaining approval for adequate reimbursement from third-party and government payers; |

|

· |

our ability to manufacture quantities of our Product Candidates using commercially satisfactory processes and at a scale sufficient to meet anticipated demand and enable us to reduce our cost of manufacturing; |

|

· |

our success in educating physicians and patients about the benefits, administration, and use of our Product Candidates; |

|

· |

the availability, perceived advantages, relative cost, relative safety, and relative efficacy of alternative and competing treatments; |

|

· |

the effectiveness of our own or our potential strategic collaborators’ marketing, sales and distribution strategy and operations; |

|

· |

acceptance as a safe and effective therapy by patients and the medical community; and |

|

· |

· a continued acceptable safety profile following approval. |

Many of these factors are beyond our control. If we are unable to successfully commercialize our Product Candidates, we may not be able to earn sufficient revenues to continue our business.

We our relying on Celly Nu, our licensing partner, to promote our Unbuzzd™ brand and if we fail to maintain a good relationship with Celly Nu our business, financial condition and results of operations could be adversely affected.

On July 31, 2023, we entered into the Celly Nu IP License Agreement (as defined herein). Pursuant to the Celly Nu IP License Agreement, we are relying on Celly Nu to promote, commercialize and distribute Unbuzzd™ to the consumer market. Although we can maintain control over Celly Nu’s products and content to a certain degree through contractual provisions in the licensing agreement, we have limited control over its marketing and commercialization strategy.

The viability of the Celly Nu IP License Agreement depends on our ability to establish and maintain good relationship with Celly Nu. The value of our Unbuzzd™ brand and the rapport that we maintain with Celly Nu is an important factor for the success of this relationship. If we are unable to maintain a good relationship with Celly Nu, it could have a material adverse effect on our results of operations. Our license agreements require us and Celly Nu to comply with operational and performance conditions that are subject to interpretation and could result in disagreements. At any given time, we could have a dispute with Celly Nu regarding the interpretation of a provision in the Celly Nu IP License Agreement. An adverse result in any such dispute could materially adversely impact our results of operations and business.

For more information, please see “Item 4. Information on the Company. - A. History and Development of the Company - Overview and History”.

| 12 |

| Table of Contents |

We rely on the UHN License to use for pharmaceutical purposes certain patents and other intellectual property rights associated with Lucid-MS.

One of our principal assets is the UHN License, which provides us with an exclusive, multi-jurisdictional license to use certain patents and other intellectual property rights associated with Lucid-MS, which is owned by the University Health Network (“UHN”). We are obligated to make milestone payments and royalties to UHN under the UHN License Agreement, which may limit our future profitability and our ability to enter into marketing partnership agreements. If we materially breach any of the terms of the UHN License Agreement (and fail to cure such breach with the specified time, to the extent a cure period is available for such breach), UHN, could terminate such agreement. If we were to lose or otherwise be unable to maintain the UHN License on acceptable terms, or find that it is necessary or appropriate to secure new licenses from other third parties, we may not be able to market Lucid-MS, and our current business model and plan would be impaired, which would have a material adverse effect on our business, operating results, and financial condition.

After receiving regulatory approvals, Lucid-MS may fail to achieve a sufficient degree of market acceptance by physicians, patients, healthcare payors, and others in the medical community.

The commercial success of Lucid-MS or other drug candidates that we develop, after receiving required regulatory approvals, will depend on their degree of market acceptance by physicians, patients, third-party payors, and others in the medical community. The degree of market acceptance of Lucid-MS will depend on a number of factors, including (i) the availability of alternative, superior treatments for a MS prior to the approval and commercialization Lucid-MS for such treatment; (ii) the efficacy and safety of Lucid-MS, including side effects or unexpected characteristics; (iii) the ability to offer Lucid-MS for sale at competitive prices; (iv) the ability to manufacture Lucid-MS in sufficient quantities and to offer appropriate patient access programs, such as co-pay assistance; (v) convenience and ease of dosing and administration compared to alternative treatments; (vi) the clinical indications for which Lucid-MS is approved by the FDA or Health Canada, if it approved at all, or comparable regulatory agencies; (vii) product labeling or product insert requirements of the FDA, Health Canada or other comparable regulatory authorities, including any limitations, contraindications or warnings contained in a product’s approved labeling; (viii) restrictions on how Lucid-MS is distributed; (ix) publicity concerning Lucid-MS or competing products and treatments; (x) the strength of marketing and distribution support; (xi) favorable third-party coverage and sufficient reimbursement; and (xii) the prevalence and severity of any side effects or adverse effects.

Sales of pharmaceutical products, such as Lucid-MS if and when it is approved by regulatory authorities, will depend on the willingness of physicians to prescribe the treatment, which is likely to be based on a determination by these physicians that the products are safe, therapeutically effective and cost effective. In addition, the inclusion or exclusion of products from treatment guidelines established by various physician groups and the viewpoints of influential physicians can affect the willingness of other physicians to prescribe the treatment. We cannot predict whether physicians, physicians’ organizations, hospitals, other healthcare providers, government agencies or private insurers will determine that Lucid-MS is safe, therapeutically effective and cost effective as compared with competing treatments. If Lucid-MS does not achieve adequate levels of acceptance, we may not generate significant product revenue, and we may not become profitable.

We face significant competition for our Lucid-MS drug and there is a possibility that our competitors may develop therapies that are safer, more advanced, or more effective than ours from MS.

The development and commercialization of new drug products is highly competitive. We face competition with respect to Lucid-MS for the treatment of MS from major pharmaceutical companies, specialty pharmaceutical companies, and biotechnology companies world-wide. Potential competitors also include academic institutions, government agencies, and other public and private research organizations that conduct research, seek patent protection, and establish collaborative arrangements for research, development, manufacturing, and commercialization. Even if we are successful in achieving regulatory approval to commercialize Lucid-MS ahead of our competitors, our future pharmaceutical products may face direct competition from generic and other follow-on drug products.

More established companies may have a competitive advantage over us due to their greater size, cash flows and institutional experience. Compared to us, many of our competitors may have significantly greater financial, technical and human resources. As a result of these factors, our competitors may obtain regulatory approval of their products before we do, which will limit our ability to develop or commercialize any of our Product Candidates. In addition, many companies are developing new therapeutics to supplant or expand upon the standard of care for a number of diseases, as a result, we cannot predict what the standard of care will be as our Product Candidates progress through clinical development.

Interim, “top-line,” and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data becomes available or as additional analyses are conducted, and as the data are subject to audit and verification procedures, that could result in material changes in the final data.

From time to time, we may publish interim, “top-line,” or preliminary data from our clinical studies. Interim data from clinical trials that we may complete are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available. Preliminary or “top-line” data also remain subject to audit and verification procedures that may result in the final data being materially different from the preliminary data we previously published. As a result, interim and preliminary data should be viewed with caution until the final data are available. Material adverse changes between preliminary, “top-line,” or interim data and final data could significantly harm our business prospects.

| 13 |

| Table of Contents |

We expect to rely on third parties to conduct product candidate drug trials and aspects of our research and preclinical testing.

We currently rely and expect to continue to rely on third parties, such as CROs, clinical data management organizations, medical institutions, and clinical investigators, to conduct some aspects of research and preclinical testing and clinical trials. Any of these third parties may terminate their engagements with us or be unable to fulfill their contractual obligations. If any of our relationships with these third parties terminate, we may not be able to enter into arrangements with alternative third parties on commercially reasonable terms, or at all. If we need to enter into alternative arrangements, it could delay our development activities.

Our reliance on these third parties for research and development activities reduces control over these activities but does not relieve us of our responsibilities. For example, we remain responsible for ensuring that product candidate drug trials are each conducted in accordance with the general investigational plan and protocols for each trial and applicable legal, regulatory, and scientific standards, and our reliance on third parties does not relieve us of our regulatory responsibilities. In addition, the FDA, Health Canada, and other comparable regulatory authorities require compliance with good clinical practices for conducting, recording, and reporting the results of clinical trials to assure that data and reported results are credible, reproducible and accurate and that the rights, integrity, and confidentiality of trial participants are protected. Regulatory authorities enforce these good clinical practices through periodic inspections of trial sponsors, principal investigators, and trial sites. If we or any of these third parties fail to comply with applicable good clinical practice regulations, some or all of the clinical data generated in any product candidate drug trials may be deemed unreliable and the FDA, Health Canada or other comparable regulatory authorities may reject our marketing applications or require us to perform additional nonclinical or clinical trials or to enroll additional patients before approving our marketing applications. We cannot be certain that, upon inspection, such regulatory authorities will determine that any product candidate drug trial complies with the good clinical practice regulations. For any violations of laws and regulations during the conduct of clinical trials, we could be subject to untitled and warning letters or enforcement action that may include civil penalties and criminal prosecution. We also are required to register ongoing clinical trials and post the results of completed clinical trials on a government-sponsored database within certain timeframes. Failure to do so can result in fines, adverse publicity, and civil and criminal sanctions.

If these third parties do not successfully carry out their contractual duties, meet expected deadlines, or conduct clinical trials in accordance with regulatory requirements or our stated protocols, we will not be able to obtain, or may be delayed in obtaining, marketing approvals for a product candidate and will not be able to, or may be delayed in our efforts to, successfully commercialize product candidates. Our failure or the failure of these third parties to comply applicable regulatory requirements or our stated protocols could also subject us to enforcement action.

We also expect to rely on other third parties to store and distribute drug supplies for product candidate drug trials. Any performance failure on the part of our distributors could delay clinical development or marketing approval of any product candidates we may develop or commercialization of our medicines or other therapeutic applications, producing additional losses and depriving us of potential product revenue.

Results of earlier studies or clinical trials may not be predictive of future clinical trial results and may not justify proceeding to advanced clinical trials or an application for regulatory approval.

Success in preclinical testing and early clinical trials does not ensure that later clinical trials will generate adequate data to demonstrate the efficacy and safety of an investigational drug. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in clinical trials, even after seeing promising results in earlier clinical trials. We do not know whether the clinical trials we are conducting, or may conduct, will demonstrate adequate efficacy and safety to result in regulatory approval to market any of our product candidates in any particular jurisdiction. Even if we believe that we have adequate data to support an application for regulatory approval to market our product candidates, the FDA or other comparable foreign regulatory authorities may not agree and could require us to conduct additional research studies, including late-stage clinical trials. If late-stage clinical trials do not produce favorable results, our ability to achieve regulatory approval for any of our product candidates may be adversely impacted.

Product candidates could be associated with side effects which could delay or halt clinical development, prevent regulatory approval, or result in other significant negative consequences.

As is the case with pharmaceuticals generally, it is likely that there may be side effects associated with Lucid-MS or our other drug product candidates. If Lucid-MS or our other drug product candidates are associated with undesirable side effects in preclinical studies or clinical trials or have characteristics that are unexpected, we may elect to abandon their development or limit their development to more narrow uses or subpopulations in which the undesirable side effects or other characteristics are less prevalent, less severe or more acceptable from a risk-benefit perspective, which may limit the commercial expectations for this product candidate if approved. We may also be required to modify or terminate our study plans based on findings in our preclinical studies or clinical trials.

Additionally, adverse developments in clinical trials of pharmaceutical and biopharmaceutical products conducted by others may cause the FDA, Health Canada, or other regulatory oversight bodies to suspend or terminate our clinical trials or to change the requirements for approval of Lucid-MS or our other drug product candidates.

Additionally, if we or others later identify undesirable side effects caused by Lucid-MS or our other drug product candidates once approved, several potentially significant negative consequences could result, including: (i) regulatory authorities may suspend or withdraw approvals of such product candidate; (ii) we may be required to change the way a product candidate is administered or conduct additional clinical trials; (iii) we may be required to include additional warnings on a product candidate’s labeling or the product candidate may be subject to restrictive distribution requirements; (iv) we could be sued and held liable for harm caused to patients; and (v) our reputation may suffer. Any of these occurrences may harm our business, financial condition, and prospects significantly.

In addition to side effects caused by the product candidate, the administration process or related procedures also can cause adverse side effects. If any such adverse events occur, our clinical trials could be suspended or terminated. If we are unable to demonstrate that any adverse events were caused by the administration process or related procedures, the FDA, Health Canada, or other regulatory authorities could order us to cease further development of, or deny approval of, a product candidate for any or all targeted indications. Even if we can demonstrate that all future serious adverse events are not product-related, such occurrences could affect patient recruitment or the ability of enrolled patients to complete the trial. Moreover, if we elect, or are required, to not initiate, delay, suspend or terminate any future clinical trial of Lucid-MS or any of our product candidates, the commercial prospects of Lucid-MS or such other product candidates may be harmed and our ability to generate product revenues from Lucid-MS or any of these other product candidates may be delayed or eliminated. Any of these occurrences may harm our ability to develop other product candidates, and may harm our business, financial condition, and prospects significantly.

| 14 |

| Table of Contents |

The Company may not be successful in its efforts to identify, license or discover additional product candidates.

Although a substantial amount of the Company’s effort will focus on the continued research and pre‐clinical and clinical testing, potential approval and commercialization of its Product Candidates, the success of its business also depends in part upon its ability to identify, license or discover additional product candidates. The Company’s research programs or licensing efforts may fail to yield additional product candidates for clinical development for a number of reasons, including but not limited to the following: (i) the Company’s research or business development methodology or search criteria and process may be unsuccessful in identifying potential product candidates; (ii) the Company may not be able or willing to assemble sufficient resources to acquire or discover additional product candidates; (iii) the Company’s product candidates may not succeed in pre‐clinical or clinical testing; (iv) the Company’s product candidates may be shown to have harmful side effects or may have other characteristics that may make the product candidates unmarketable or unlikely to receive marketing approval; (v) competitors may develop alternatives that render the Company’s product candidates obsolete or less attractive; (vi) product candidates the Company develops may be covered by third parties’ patents or other exclusive rights; (vii) the market for a product candidate may change during the Company’s program such that the further development of a product candidate may become undesirable; (viii) a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and (ix) a product candidate may not be accepted as safe and effective by patients, the medical community or third‐party payors.

If any of these events occurs, the Company may be forced to abandon its development efforts to identify, license or discover additional product candidates, which could have a material adverse effect on its business, prospects, results of operations and financial condition and could potentially cause the Company to cease operations. Research programs to identify new product candidates require substantial technical, financial, and human resources. The Company may focus its efforts and resources on potential programs or product candidates that ultimately prove to be unsuccessful.

The FDA, Health Canada or other comparable regulatory authorities may not accept data from trials conducted in foreign jurisdictions.

Obtaining regulatory approval in one country does not mean that regulatory approval will be obtained in any other country. We intend on submitting our initial regulatory approvals for Lucid-MS in the U.S. and Canada. Approval processes vary among countries and can involve additional product testing and validation and additional or different administrative review periods, including additional preclinical studies or clinical trials, as data from clinical trials conducted in one jurisdiction may not be accepted by regulatory authorities in other jurisdictions. In many jurisdictions outside the United States and Canada, a product candidate must be approved for reimbursement before it can be approved for sale in that jurisdiction. In some cases, the price that we intend to charge for our products is also subject to approval.

Non-U.S. and non-Canadian regulatory approval processes may include all of the risks associated with obtaining FDA or Health Canada approval, as well as additional risks. We do not have any product candidates approved for sale in any jurisdiction, including international markets, and we do not have experience in obtaining regulatory approval in international markets. If we fail to comply with regulatory requirements in international markets or to obtain and maintain required approvals, or if regulatory approval in international markets is delayed, our target market will be reduced and our ability to realize the full market potential of our Product Candidates will be harmed. In addition, if we conduct trials outside of the U.S. or Canada, the FDA or Health Canada, as applicable, may not accept the data from such trials and may require additional trials, which could be costly and time-consuming and delay aspects of our business plan.

Our suppliers could experience manufacturing problems that result in delays in our development or commercialization programs or otherwise harm our business.

Our contract manufacturing organization (“CMO”) must employ multiple steps to control the manufacturing process to assure that the process is reproducible and the product candidate is made strictly and consistently in compliance with the process. Problems with the manufacturing process, even minor deviations from the normal process, could result in product defects or manufacturing failures that result in lot failures, product recalls, product liability claims or insufficient inventory to conduct clinical trials or supply commercial markets. Furthermore, all entities involved in the preparation of product candidates for clinical trials or commercial sale, including our existing CMOs for all of our Product Candidates, are subject to extensive regulation. Components of a finished therapeutic products approved for commercial sale or used in certain clinical trials must be manufactured in accordance with good manufacturing practices (“GMP”), or similar regulatory requirements outside the United States and Canada. Our failure, or the failure of third-party manufacturers, to comply with applicable regulations could result in sanctions being imposed on us, including clinical holds, fines, injunctions, civil penalties, delays, suspension or withdrawal of approvals, license revocation, suspension of production, seizures or recalls of Product Candidates or marketed drugs, operating restrictions and criminal prosecutions, any of which could significantly and adversely affect clinical or commercial supplies of our Product Candidates and increase our costs. Consequently, there may be a material adverse effect on the business, results of operations, financial condition, and prospects of the Company.

In addition, the FDA, Health Canada, and other regulatory authorities may require us to submit samples of any lot of any approved Product Candidates together with the protocols showing the results of applicable tests at any time. Under some circumstances, the FDA, Health Canada, or other regulatory authorities may require that we not distribute a lot until the agency authorizes its release. Slight deviations in the manufacturing process, including those affecting quality attributes and stability, may result in unacceptable changes in the product that could result in lot failures or product recalls. Lot failures or product recalls could cause us to delay product launches or clinical trials, which could be costly to us and otherwise harm our business, results of operations, financial condition, and prospects.

| 15 |

| Table of Contents |

Our CMOs also may encounter problems hiring and retaining the experienced scientific, quality assurance, quality-control and manufacturing personnel needed to operate our manufacturing processes, which could result in delays in production or difficulties in maintaining compliance with applicable regulatory requirements.

Any problems in our CMOs’ manufacturing process or facilities could result in delays or cancellations of planned clinical trials, failures in satisfying ongoing regulatory obligations (before and after regulatory approval for a product candidate is obtained) and increased costs. Such problems could also make us a less attractive collaborator for potential partners, including larger biotechnology companies and academic research institutions, which could limit access to additional attractive development programs. Problems in our manufacturing process could restrict our ability to meet potential future market demand for products.

Lucid-MS, after it is approved, will be subject to extensive post-approval regulation.

After a product is approved, numerous post-approval requirements apply. Among other things, the holder of an approved NDA is subject to periodic and other FDA monitoring and reporting obligations, including obligations to monitor and report adverse events and instances of the failure of a product to meet the specifications in the NDA. Application holders must submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling, or manufacturing process. Application holders must also submit advertising and other promotional material to the FDA and report on ongoing clinical studies.

Depending on the circumstances, failure to meet these post-approval requirements can result in criminal prosecution, fines, injunctions, recall or seizure of products, total or partial suspension of production, denial or withdrawal of pre-marketing product approvals, or refusal to allow us to enter into supply contracts, including government contracts. In addition, even if we comply with FDA and other requirements, new information regarding the safety or effectiveness of a product could lead the FDA to modify or withdraw product approval. Similar laws in other jurisdictions would also apply.

After our Product Candidates are commercialized, they may be subject to recalls for a variety of reasons, which could require the Company to expend significant management and capital resources.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labeling disclosure. If any of the Company’s approved and commercialized Product Candidates are recalled due to an alleged product defect or for any other reason, the Company could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection with the recall. The Company may lose a significant amount of sales made on such products and may not be able to replace those sales at an acceptable margin or at all. In addition, a product recall may require significant management attention. Although the Company has detailed procedures in place for testing its products, there can be no assurance that any quality, potency, or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if one of the Company’s significant brands were subject to recall, the image of that brand and the Company could be harmed. A recall for any of the foregoing reasons could lead to decreased demand for the Company’s products and could have a material adverse effect on the results of the operations and financial condition of the Company. Additionally, product recalls may lead to increased scrutiny of the Company’s operations by the FDA, Health Canada or other regulatory agencies, requiring further management attention and potential legal fees and other expenses.

If approved, Lucid-MS may face competition from generic drugs approved through an abbreviated regulatory pathway.