UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): February 5, 2024

AMERICAN RESOURCES CORPORATION |

(Exact name of registrant as specified in its charter) |

Florida |

|

000-55456 |

|

46-3914127 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

12115 Visionary Way, Suite 174, Fishers Indiana, 46038

(Address of principal executive offices)

(317) 855-9926

(Registrant’s telephone number, including area code)

________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See: General Instruction A.2. below):

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

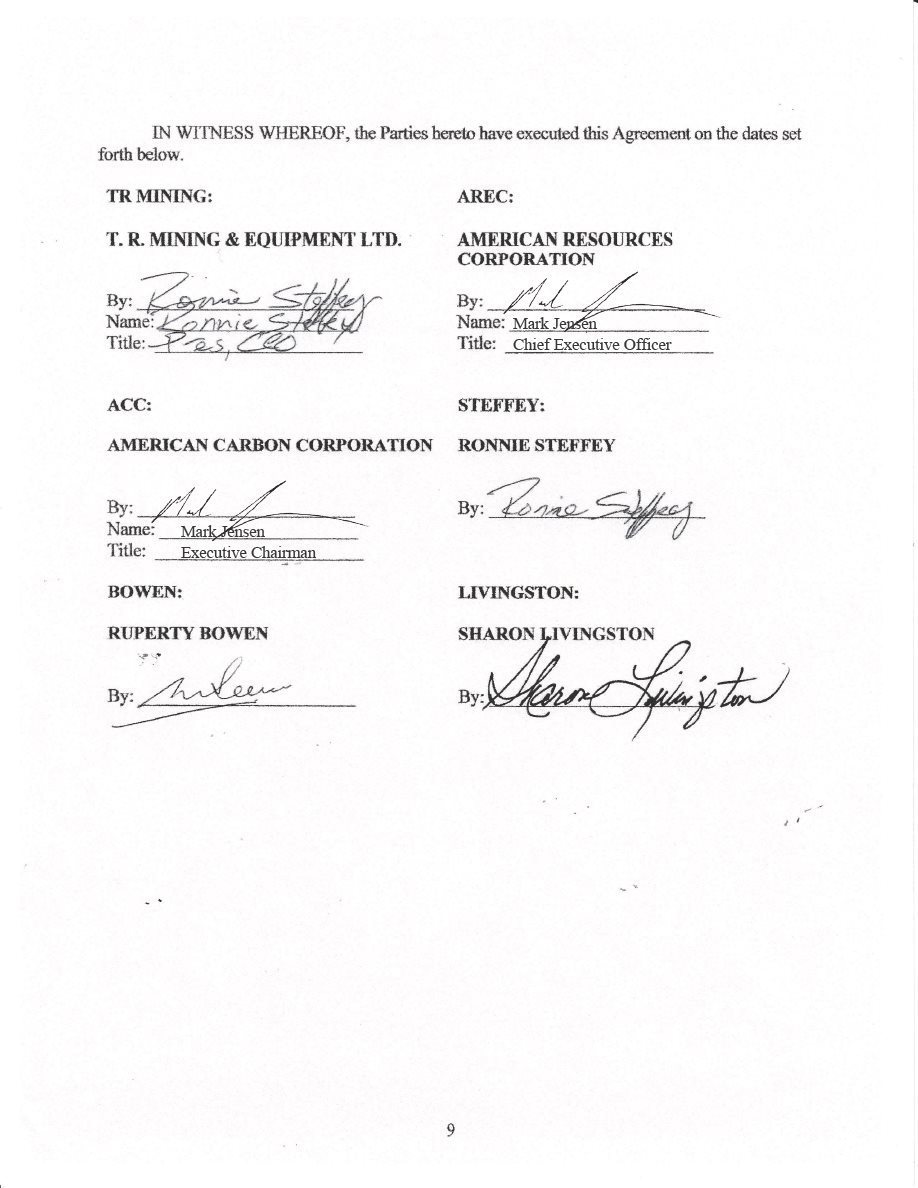

On February 5, 2024, American Resources Corporation (“American Resources” or the “Company”) and its wholly owned subsidiary, American Carbon Corporation (“ACC”) entered into a Share Purchase Agreement (“Purchase Agreement”) with T.R. Mining & Equipment Ltd. (“TR Mining”), to where ACC has purchased 51% of the fully diluted shares outstanding of TR Mining in exchange for approximately 6% of the primary shares outstanding of ACC. The assets of TR Mining include a diversified mineral deposit with a focus on iron ore, titanium and vanadium with an initial estimated deposit of 212,925,000 tons of raw feedstock with an estimated 106,462,500 tons of ore body, based on an average of 50% magnetic material.

The Purchase Agreement was fully executed and closed on February 5, 2024.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text, which is filed as an Exhibit hereto.

Item 8.01 Other Events.

On February 7, 2024 American Resources issued a press release announcing the completion of the strategic acquisition of the 51% interest in TR Mining including the equipment, leases, and permits and the exclusive offtake rights of the mineral feedstock.

The information presented in Item 8.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are attached hereto and filed herewith.

|

Exhibit No. |

|

Description |

|

||

|

| 2 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

American Resources Corporation |

|

|

|

|

|

|

Date: February 9, 2024 |

By |

/s/ Mark C. Jensen |

|

|

|

Mark C. Jensen |

|

|

|

Chief Executive Officer |

|

| 3 |

EXHIBIT 1.1

EXHIBIT 99.1

American Resources Corporation’s American Carbon Corporation Completes Strategic Acquisition of 51% Interest in Iron Ore and Titanium Assets

Jamaican-based resource deposit further establishes American Carbon’s foothold in the steelmaking supply chain for infrastructure development and expansion

Acquisition of mineral deposit and exclusive offtake rights for six percent of American Carbon establishes an acquisition value of approximately $19.3 million

Initial reserve analysis represents over 212.9 million tons of total feedstock deposits

February 7, 2024 | Source: American Resources Corporation

FISHERS, INDIANA / ACCESSWIRE / February 7, 2024 / American Resources Corporation’s (NASDAQ:AREC) (“American Resources” or the “Company”) subsidiary American Carbon Corporation (“American Carbon”), an owner and operator of low-cost, high-quality metallurgical and specialty carbon assets, has acquired a 51% ownership interest in a diversified mineral asset with a focus on iron ore, titanium and vanadium with an initial estimated deposit of 212,925,000 tons of raw feedstock with an estimated 106,462,500 tons of ore body, based on an average of 50% magnetic material.

Tarlis Thompson, Chief Executive Officer of American Carbon Corporation, emphasized the importance and expansion into the broader supply chain for infrastructure and steel inputs stated, "This project is a diversified and high-quality asset that our team and colleagues have worked on for over a year to evaluate the market need and importance for high value assets in the iron ore and titanium markets. We believe the initial reserve analysis that has been completed and the assays of the material potentially make this a world class asset for iron ore, titanium as well as the potential for other critical and strategic elements. We are excited to work with our local partners as we further expand the reserve evaluation, mine plan, permitting and operational game plan to work with the local community utilizing low cost, highly environmentally sensitive technologies for mineral concentration and processing in the future."

Mark Jensen, CEO of American Resources Corporation added, “We currently sit at a very strategic and unique position within the global supply chain of high value raw materials and refined, technical-grade minerals. Our unique asset base, operational expertise, entrepreneurial foresight and nimble, low cost structure has enabled us to provide, what we think are, the most efficient and meaningful solutions in a highly-competitive, and geopolitical mineral supply chain for commercial and national security applications. Our innovative solutions position us to bring attractive and sought after value for stakeholders, our shareholders and partners alike. We will continue to aggressively work to deploy our value-added solutions and broaden our resource base along the way.”

| 1 |

American Carbon Corporation acquired its 51% ownership stake of TR Mining and Equipment Limited (“TR Mining”) (including equipment, leases, permits etc.) with 100% offtake rights to mineral feedstock located within the Special Exclusive Prospecting License No. 611, or any successor permit. The total consideration for the 51% ownership interest and offtake rights is the issuance of approximately 6% of the equity of American Carbon Corporation to the owners of TR Mining equating to a total equity consideration of approximately $19.305 million.

The initial assessment and laboratory results from the magnetite and titanomagnetite indicate the black sand resource typically range from 9% to 57% in surface iron content. The asset base contains both onshore and offshore reserves off the southern shore of Jamacia outside of any residential regions of the island. The minerals identified though the initial assessment included titanomagnetite, magnetite, hematite, ilmenite, plagioclase, quartz, epidote, olivine, augite, hornblende, apatite, calcite, garnet, hypersthene, rutile, zircon, etc. Third-party analysis and reserve report evaluation were conducted by the Geological and Geographical Solutions field team, Ja-GeoS, and commissioned by T.R. Mining and Equipment Limited.

About American Carbon Corporation

American Carbon Corporation is a raw material supplier to the infrastructure marketplace with a focus on metallurgical carbon, iron ore and titanium. Current operations are primarily focused on the extraction, processing, transportation, and distribution of coal for a variety of industries, with a primary focus on metallurgical quality coal to the steel industry. We have six coal mining and processing operating subsidiaries in the metallurgical carbon industry located in Eastern Kentucky and West Virginia along with a substantial iron ore and titanium asset base in the mining region of Jamaica. For more information visit americancarboncorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

About American Resources Corporation

American Resources Corporation (NASDAQ: AREC) is a next-generation, environmentally and socially responsible supplier of high-quality raw materials to the new infrastructure market. The Company is focused on the extraction and processing of metallurgical carbon, an essential ingredient used in steelmaking, critical and rare earth minerals for the electrification market, and reprocessed metal to be recycled. American Resources has a growing portfolio of operations located in the Central Appalachian basin of eastern Kentucky and southern West Virginia where premium quality metallurgical carbon and rare earth mineral deposits are concentrated.

American Resources has established a nimble, low-cost business model centered on growth, which provides a significant opportunity to scale its portfolio of assets to meet the growing global infrastructure and electrification markets while also continuing to acquire operations and significantly reduce their legacy industry risks. Its streamlined and efficient operations are able to maximize margins while reducing costs. For more information visit americanresourcescorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

| 2 |

Special Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause the Company’s actual results, performance, or achievements or industry results to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. These statements are subject to a number of risks and uncertainties, many of which are beyond American Resources Corporation’s control. The words “believes”, “may”, “will”, “should”, “would”, “could”, “continue”, “seeks”, “anticipates”, “plans”, “expects”, “intends”, “estimates”, or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Any forward-looking statements included in this press release are made only as of the date of this release. The Company does not undertake any obligation to update or supplement any forward-looking statements to reflect subsequent events or circumstances. The Company cannot assure you that the projected results or events will be achieved.

Investor Contact:

JTC Team, LLC

Jenene Thomas

833-475-8247

arec@jtcir.com

RedChip Companies Inc.

Robert Foley

1-800-RED-CHIP (733-2447)

Info@redchip.com

Company Contact:

Mark LaVerghetta

Vice President of Corporate Finance and Communications

317-855-9926 ext. 0

investor@americanresourcescorp.com

| 3 |