UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 27, 2023

ENGlobal Corporation |

(Exact name of registrant as specified in its charter) |

Nevada |

001-14217 |

88-0322261 |

||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

11740 Katy Fwy – Energy Tower III, 11th floor Houston, TX |

|

77079 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 281-878-1000

________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value |

ENG |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 27, 2023, ENGlobal Corporation (the “Company”) received written notice from The Nasdaq Stock Market Inc. (“Nasdaq”) notifying the Company that it is no longer in compliance with Nasdaq Listing Rule 5550(b)(1) for continued listing due to its failure to maintain a minimum of $2.5 million in stockholders' equity. In the Company's Form 10-Q for the period ended September 30, 2023, the Company reported stockholders' equity of approximately $2.1 million. Nasdaq also determined that the Company does not meet the alternatives of market value of listed securities or net income from continuing operations for continued listing. The notice has no immediate effect on the listing of the Company’s common stock, par value $0.001 per share (the “Common Stock”), and the Common Stock will continue to trade on The Nasdaq Stock Market under the symbol “ENG” at this time.

The Company may regain compliance with the minimum stockholders’ equity requirement by submitting a plan to regain compliance (a “Compliance Plan”) to Nasdaq by January 8, 2024. If the Compliance Plan is accepted, the Company may be granted an extension of up to 180 calendar days from November 27, 2023 to regain compliance. If the Compliance Plan is not accepted by Nasdaq, the Company will have an opportunity to appeal that decision to a Nasdaq Hearings Panel. During the pendency of the hearing process, the Common Stock would continue to be listed on Nasdaq.

The Company’s management is considering various options to regain compliance and maintain the Company’s listing on The Nasdaq Capital Market. The Company intends to submit the Compliance Plan as soon as practicable. There can be no assurance that the Compliance Plan will be accepted or that if it is, the Company will be able to regain compliance with the minimum stockholder’s equity requirement or will otherwise be in compliance with other Nasdaq listing criteria.

Item 3.03 Material Modification to Rights of Security Holders

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

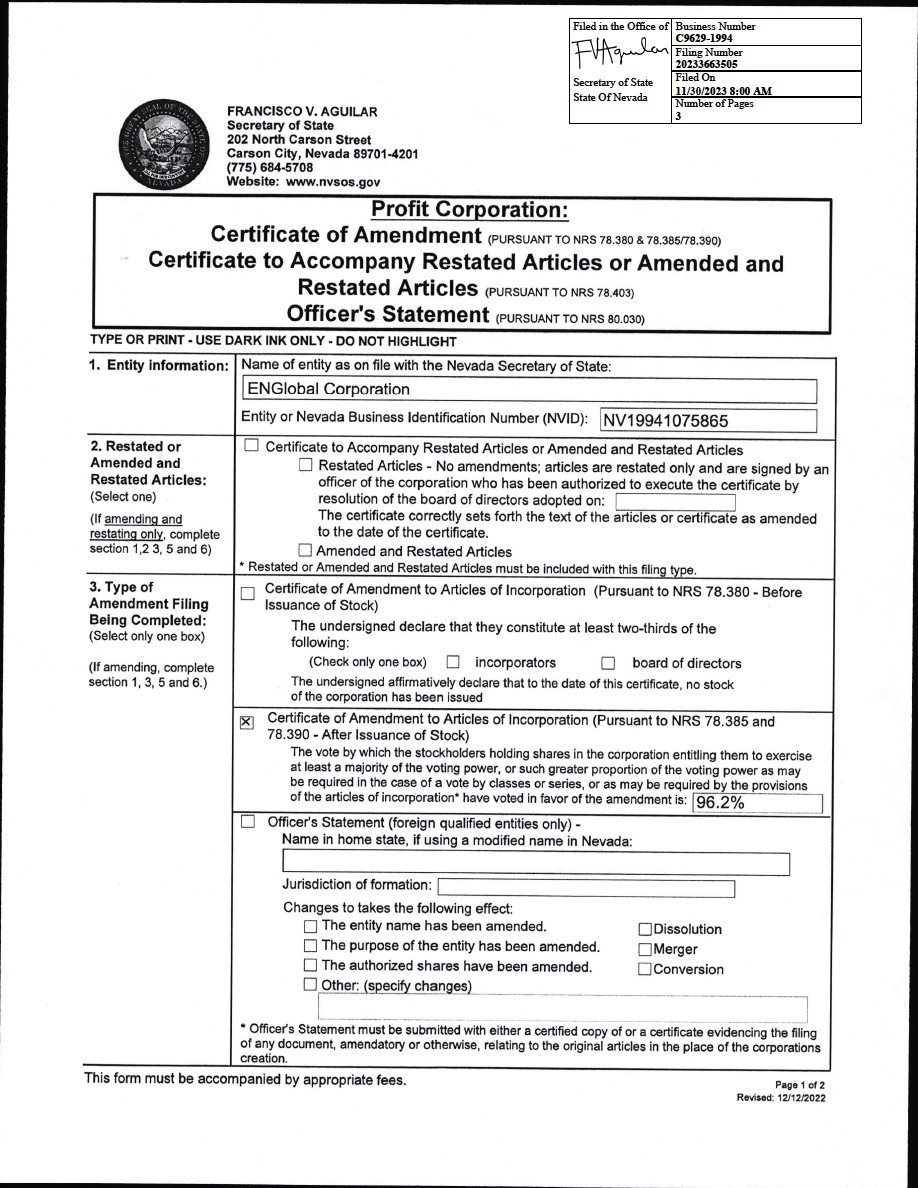

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On November 30, 2023, the Company filed a Certificate of Amendment to the Restated Articles of Incorporation of the Company with the Secretary of State of the State of Nevada (the “Certificate of Amendment”) to effect a 1-for-8 reverse stock split (the “reverse stock split”) of the shares of the Common Stock on November 30, 2023 at 11:59 PM Eastern time. The reverse stock split will affect all shareholders of the Company uniformly and will not affect any shareholder’s percentage ownership interests or proportionate voting power, except to the extent that the reverse stock split results in any shareholders owning a fractional share. No fractional shares will be issued in connection with the reverse stock split. To avoid the existence of fractional shares of the Common Stock, any fractional shares that would otherwise be issued as a result of the reverse stock split will be rounded up to the nearest whole share. The number of authorized shares of Common Stock will remain at 75,000,000 shares.

| 2 |

The Common Stock will begin trading on a reverse stock split-adjusted basis on The Nasdaq Capital Market with the opening of the markets on Friday, December 1, 2023. The trading symbol for the Common Stock will remain “ENG.” The Common Stock was assigned a new CUSIP number (293306 205) following the reverse stock split.

The foregoing description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosures

On November 29, 2023, the Company issued a press release announcing the reverse stock split and the notice received from Nasdaq, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01 (including the press release attached hereto as Exhibit 99.1 and incorporated by reference in this Item 7.01) is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be been incorporated by reference under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

Exhibit No. |

|

Description |

|

Certificate of Amendment to the Restated Articles of Incorporation of ENGlobal Corporation |

|

|

||

Exhibit 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| 3 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENGlobal Corporation |

|

|

|

(Registrant) |

|

|

|

|

|

December 1, 2023 |

|

/s/ Darren W. Spriggs |

|

(Date) |

|

Darren W. Spriggs, Chief Financial Officer, Treasurer and Corporate Secretary |

|

| 4 |

Exhibit Index

Exhibit No. |

|

Description |

Certificate of Amendment to the Restated Articles of Incorporation of ENGlobal Corporation |

||

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| 5 |

EXHIBIT 3.1

EXHIBIT 99.1

ENGLOBAL ANNOUNCES REVERSE STOCK SPLIT, NASDAQ COMMUNICATION

REGARDING STOCKHOLDERS' EQUITY

HOUSTON, TX / ACCESSWIRE / November 29, 2023 / ENGlobal Corporation (NASDAQ: ENG), a provider of innovative engineering project solutions focused on the energy industry, today announced that it will effect a one-for-eight reverse split of its common stock, effective at 11:59 pm, Eastern Standard Time, on November 30, 2023 (the “Effective Time”).

The reverse stock split is intended to increase the per share trading price of the Company's common stock to satisfy the minimum bid price requirement for continued listing on The Nasdaq Capital Market. As a result of the reverse stock split, every eight shares of the Company's common stock issued and outstanding at the Effective Time will be consolidated into one issued and outstanding share of common stock, with no change in the par value per share of $0.001. Any fractional shares that would otherwise be issued as a result of the reverse stock split will be rounded up to the nearest whole share. The Company’s number of authorized shares of common stock will remain at 75,000,000 shares.

Trading of the Company's common stock on The Nasdaq Capital Market will continue, on a split-adjusted basis, with the opening of the markets on Friday, December 1, 2023, under the symbol "ENG" and the new CUSIP number 293306205. Immediately after the reverse stock split, the Company expects that there will be approximately 5,125,000 shares of the Company's common stock issued and outstanding.

At the Company’s annual meeting of shareholders held on June 29, 2023, the Company's shareholders granted the Company's Board of Directors the discretion to effect a reverse stock split of the Company's common stock through an amendment to its Restated Articles of Incorporation, as amended, at a ratio of not less than one-for-two and not more than one-for-ten, with such ratio to be determined by the Company's Board of Directors.

The Company has retained its transfer agent, Computershare Trust Company, N.A. ("Computershare"), to act as its exchange agent for the reverse stock split. Computershare will provide shareholders of record as of the Effective Date with instructions for the exchange of their stock certificates. Shareholders holding their shares in book-entry form and/or owning shares via a broker or other nominee will have their positions automatically adjusted to reflect the reverse stock split, subject to their brokers' particular processes, and will not be required to take any action in connection with the reverse stock split.

The Company also announced that it received a notification letter dated November 27, 2023 (the "Deficiency Letter") from the Listing Qualifications Department of The Nasdaq Stock Market Inc. ("Nasdaq") notifying the Company that it is not currently in compliance with Nasdaq Listing Rule 5550(b)(1) for continued listing due to its failure to maintain a minimum of $2.5 million in stockholders' equity. In the Company's Form 10-Q for the period ended September 30, 2023, the Company reported stockholders' equity of approximately $2.1 million. Nasdaq also determined that the Company does not meet the alternatives of market value of listed securities or net income from continuing operations for continued listing.

The notice has no immediate effect on the listing of the Company’s common stock. The Company may regain compliance with the minimum stockholders’ equity requirement by submitting a plan to regain compliance (a “Compliance Plan”) to Nasdaq by January 8, 2024. If the Compliance Plan is accepted by Nasdaq, the Company may be granted a compliance period of up to 180 calendar days from the date of the Deficiency Letter to evidence compliance. If the Compliance Plan is not accepted by Nasdaq, the Company will have an opportunity to appeal that decision to a Nasdaq Hearings Panel. During the pendency of the hearing process, the Company’s common stock would continue to be listed on Nasdaq.

The Company's management is considering various options to regain compliance with the minimum stockholders’ equity requirement and maintain the Company’s listing on The Nasdaq Capital Market. The Company intends to submit the Compliance Plan as soon as practicable. There can be no assurance that the Compliance Plan will be accepted or that if it is, the Company will be able to regain compliance with the minimum stockholder’s equity requirement or will otherwise be in compliance with other Nasdaq listing criteria.

About ENGlobal

ENGlobal Corporation is a provider of innovative, delivered project solutions primarily to the energy industry. ENGlobal operates through two business segments: Commercial and Government Services. The Commercial segment provides engineering, design, fabrication, construction management and integration of automated control systems. The Government Services segment provides engineering, design, installation, operations, and maintenance of various government, public sector, and international facilities, specializing in turnkey automation and instrumentation systems for the U.S. Defense industry. Further information about the Company and its businesses is available at www.englobal.com.

For further information, please email ir@englobal.com.

Cautionary Note Regarding Forward Looking Statements

The statements above regarding the Company's expectations, including those relating to its future results, its future operations and certain other matters discussed in this press release may constitute forward-looking statements within the meaning of the federal securities laws and are subject to risks and uncertainties. For a discussion of risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ENGlobal's filings with the Securities and Exchange Commission, including the Company's most recent reports on Form 10-K and 10-Q, and other SEC filings.