UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-32210

| NORTHERN DYNASTY MINERALS LTD. |

| (Translation of registrant’s name into English) |

14th Floor - 1040 W Georgia St., Vancouver, BC, V6E 4H1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☐ Form 20-F ☒ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUBMITTED HEREWITH

| Exhibits |

| Description |

| 2 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| Northern Dynasty Minerals Ltd. |

|

|

|

| (Registrant) |

|

|

|

|

|

|

|

| Date: September 21, 2023 | By: | /s/ Trevor Thomas |

|

|

| By: | Trevor Thomas |

|

|

| Title: | Secretary and General Counsel |

|

| 3 |

EXHIBIT 99.1

|

|

|

|

|

|

|

|

|

|

| Pebble Project

NI 43-101 Technical Report Update and Preliminary Economic Assessment

Alaska, United States of America

Effective Date: August 21, 2023 Amended & Restated Report Date: September 18, 2023

Prepared for: Northern Dynasty Minerals Ltd.

1040 W Georgia St. Vancouver, BC, V6E 4H1, Canada

Prepared by: Ausenco Engineering Canada Inc.

1050 West Pender, Suite 1200 Vancouver, BC, Canada

List of Qualified Persons: Robin Kalanchey, P.Eng., Ausenco Engineering Canada Inc. Scott Weston, P. Geo., Ausenco Sustainability Inc. Graeme Roper, P. Geo., Tetra Tech Canada Inc. Greg Z. Mosher, P. Geo., Tetra Tech Canada Inc. Hassan Ghaffari, P.Eng., Tetra Tech Canada Inc. Sabry Abdel Hafez, PhD, P.Eng., Worley Canada Services Ltd. Les Galbraith, P.Eng., P.E., Knight Piésold Ltd. Stuart J. Parks, P.E., NANA Worley James Wescott Bott, P.E., HDR Alaska Inc. Steven R. Rowland, P.E., RECON LLC |

|||

|

|

|||

CERTIFICATE OF QUALIFIED PERSON

Robin Kalanchey, P.Eng.

I, Robin Kalanchey, P.Eng., do hereby certify that:

| 1. | I am a Professional Engineer, employed as Vice President, Asset Optimization with Ausenco Engineering Canada Inc., with an office at 4515 Central Boulevard, Burnaby, BC, Canada. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I am a graduate of University of British Columbia with a Bachelor of Applied Science degree in Metals and Materials Engineering,1996. |

|

|

|

| 4. | I am a Professional Engineer registered with Engineers and Geoscientists British Columbia, registrant identification 223314. |

|

|

|

| 5. | I have practiced my profession continuously since 1996 and as a metallurgical engineer have been involved multiple projects for the recovery of base and precious metals, in numerous countries and jurisdictions including the United States of America. I have recognized expertise in mineral processing and metallurgical testing, process plant design and engineering, and mining project evaluation for copper, gold, silver, and bulk metal sulphide deposits. I have specific experience in the design, start up and initial operation of mineral processing plants in northern climates, including for Sherritt, Kazakhmys and China Western Mining, amongst others. As part of a consulting design team, I have led or contributed to the design and commercialization of several projects with similar metallurgy and processing schemes to that identified for Pebble including the Arctic Project in Alaska, the Skouries Project in Greece, the Eva Project in Australia and the Josemaria Project in Argentina. In a previous role, as Vice President of Ausenco’s Transportation and Logistics group, I oversaw the design and estimation of a number of bulk terminals and transshipping facilities such as that included in the Pebble Project. |

|

|

|

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

|

|

|

| 7. | I have not made a site visit to the Pebble Project as of the Effective Date of the Technical Report. |

|

|

|

| 8. | I am responsible for sections 1.1-1.4, 1.13, 1.14, 1.16-1.19, 1.20.1.3, 1.20.1.7, 1.20.2.3, 1.21.1, 1.21.5, 2.1, 2.2, 2.4, 2.5, 3.3, 4.1, 4.7, 12.1, 17, 18.1, 18.3, 18.7.2.2-18.7.2.5, 18.7.3-18.7.7, 18.9, 18.10, 19, 21.1, 21.2.1-21.2.3, 21.2.5, 21.2.7.1, 21.2.7.3, 21.2.8.2, 21.2.8.3, 21.2.9-21.2.11, 21.2.12.1, 21.2.13.1, 21.3.1, 21.3.2, 21.3.5, 21.3.8, 21.3.9, 22, 24, 25.1, 25.8, 25.9, 25.11-25.14, 25.15.1.3, 25.15.1.7, 25.15.2.3, 26.1, 26.5.1, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of the Issuer as defined in Section 1.5 of NI 43-101. |

|

|

|

| 10. | I have had prior involvement with the subject property as a QP for the report “Preliminary Economic Assessment NI 43-101 Technical Report, Pebble Project, Alaska, USA”, effective date September 9, 2021” and QP of the report “Preliminary Economic Assessment NI 43-101 Technical Report Update, Pebble Project, Alaska USA, effective date October 1, 2022”. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

|

|

|

Dated: September 18, 2023.

“Signed and sealed”

Robin Kalanchey, P. Eng.

Permit to Practice No. 1001905, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Scott Weston, P. Geo.

I, Scott Weston, P. Geo., certify that:

| 1. | I am currently employed as Vice President, Business Development and Strategy of Ausenco Sustainability Inc., with an office at 4515 Central Boulevard, Burnaby, BC, Canada. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from University of British Columbia, Vancouver, BC, Canada in 1995 with a BSC. in Physical Geography, and from Royal Roads University, Victoria, BC, Canada, in 2003 with a Master of Science, Environmental and Management. |

|

|

|

| 4. | I am a professional Geoscientist of Engineers and Geoscientists, British Columbia (license no.124888). |

|

|

|

| 5. | I worked as a geoscientist continuously for 25 years, leading or working on teams advancing multidisciplinary environmental projects related to natural resource development. Examples of projects I’ve been involved with include Wasamac Project FS, Eskay Creek Mine PFS, Las Chispas Mine FS, and Casino Project FS. |

|

|

|

| 6. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 7. | I have not made a site visit to the Pebble Project as of the Effective Date of the Technical Report. |

|

|

|

| 8. | I am responsible for Sections 1.15.1, 1.15.3, 1.20.1.6, 1.20.2.5, 3.2, 4.5, 4.7, 12.2, 20, 25.10, 25.15.1.6, 25.15.2.5, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 10. | I have had no previous involvement with the Pebble Project. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Scott Weston, P. Geo.

Permit to Practice No. 1003471, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Graeme Roper, P. Geo.

I, Graeme Roper, P. Geo., certify that:

| 1. | I am employed as Senior Resource Geologist with Tetra Tech, with an office address of 1000-10th FL 885 Dunsmuir St, Vancouver, British Columbia, Canada, V6C 1N5. |

|

|

|

| 2. | This certificate applies to the technical report “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from The University of Guelph in 2009 with a Bachelor of Science in Earth Surface Science. |

|

|

|

| 4. | I am a member in good standing of Engineers and Geoscientists British Columbia, License no.# 45027. |

|

|

|

| 5. | I have practiced my profession for 15 years. I have a relevant 10.5 years of experience with respect evaluation of porphyry deposits in exploration, resource estimation and mine production settings working as a senior geologist which included reviewing exploration data and resource estimates. This experience is drawn from and applied to the work completed on the Pebble Project. |

|

|

|

| 6. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 7. | I visited the Pebble Project on February 2, 2023, to complete data verification checks on the drill core and review core storage facilities. |

|

|

|

| 8. | I am responsible for Sections 1.5, 2.3.1, 3.1, 4.2-4.4, 4.6, 5, 6, 11, 12.10, 23, 25.2-25.4, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 10. | I have had no previous involvement with the Pebble Project. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Graeme Roper, P. Geo.

Permit to Practice No. 1001972, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Greg Z. Mosher, P. Geo.

I, Greg Z Mosher, P. Geo., certify that:

| 1. | I am employed as Senior Geologist with Tetra Tech Canada, with an office address of 1000 – 885 Dunsmuir Street, Vancouver, BC, V6C 1N5. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I am a graduate of Dalhousie University (B.Sc. Hons., 1970) and McGill University (M.Sc. Applied, 1973). I am a member in good standing of the Engineers and Geoscientists BC, License #19267. |

|

|

|

| 4. | My relevant experience with respect to exploration for porphyry deposits includes over 30 years of exploration for and evaluation of such deposits. Additionally, I have been conducting mineral resource estimates of porphyry deposits since 2005. |

|

|

|

| 5. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 6. | I conducted an audit of the mineral resource estimate for the Pebble Project for this Technical Report but did not make a site visit. |

|

|

|

| 7. | I am responsible for Sections 1.6-1.9, 1.11, 1.20.1.1, 1.20.2.1, 1.22.3, 2.3.2, 7, 8, 9, 10, 12.9, 14, 25.6, 25.15.1.1, 25.15.2.1, 26.3, and 27 of the Technical Report. |

|

|

|

| 8. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 9. | In 2013 I conducted an audit of a mineral resource estimate for the Pebble Project and a site visit in December 2013. |

|

|

|

| 10. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Greg Z Mosher, P. Geo.

Permit to Practice No. 1001972, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Hassan Ghaffari, P.Eng., M.A.Sc.

I, Hassan Ghaffari, P.Eng., M.A.Sc., certify that:

| 1. | I am employed as a Director of Metallurgy with Tetra Tech Canada Inc., with an office address of 1000 – 885 Dunsmuir Street, Vancouver, BC, V6C 1N5. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I am a graduate of the University of Tehran (M.A.Sc., Mining Engineering, 1990) and the University of British Columbia (M.A.Sc., Mineral Process Engineering, 2004). |

|

|

|

| 4. | I am a member in good standing of the Engineers and Geoscientists BC, License no. #30408. |

|

|

|

| 5. | My relevant experience includes 30 years of experience in mining and mineral processing plant operation, engineering, project studies and management of various types of mineral processing, including hydrometallurgy, mineral processing particularly for large porphyry copper deposits such as Copper Fox Schaft Creek, Seabridge KSM, KGHM Ajax, Mount Milligan and Pebble. |

|

|

|

| 6. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 7. | I visited the Pebble Project on September 1 and 2, 2010 to conduct a personal inspection of the Pebble property. |

|

|

|

| 8. | I am responsible for Sections 1.10, 1.21.2, 2.3.3, 12.3, 13, 25.5, 26.2, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 10. | I have had previous involvement with the Pebble property that is the subject of the Technical Report, in acting as a Qualified Person for the “Preliminary Assessment of the Pebble Project, Southwest Alaska” with an effective date of February 15, 2011, and 2021 Technical Report on the Pebble Project, Southwest Alaska, USA, with an effective date of February 24, 2021. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Hassan Ghaffari, P.Eng., M.A.Sc

Permit to Practice No. 1001972, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Sabry Abdel Hafez, PhD, P.Eng.

I, Sabry Abdel Hafez, PhD, P.Eng., certify that:

| 1. | I am employed as Principal Mining Engineer with NANA Worley, LLC’s parent company Worley Canada Services Ltd., with an office address of 49 Quarry Park Blvd SE Calgary, Alberta T2C 5H9 Canada. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from Assiut University (B.Sc. Mining Engineering, 1991; M.Sc. in Mining Engineering, 1996; Ph.D. in Mineral Economics, 2000). |

|

|

|

| 4. | I am a member in good standing of Association of Professional Engineers and Geoscientists of Alberta (APEGA), License no.# 251988. |

|

|

|

| 5. | I have practiced my profession for 25 years. My relevant experience includes evaluation of mining projects, advanced financial analysis, and mine planning and optimization. I have been involved in the technical studies of several base metals, gold, silver, and aggregate mining projects in Canada and abroad such as Arctic project copper/lead/zinc/gold/silver PEA, KSM project copper/gold/moly PFS and Schaft Creek project copper/gold/moly PEA and FS. |

|

|

|

| 6. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 7. | I visited the Pebble Project on December 10, 2013. |

|

|

|

| 8. | I am responsible for Sections 1.12, 1.20.1.2, 1.20.2.2, 1.21.4, 2.3.4, 12.4, 15, 16, 18.7.1, 18.7.2.1, 21.2.4, 21.2.12.2, 21.3.4, 25.7, 25.15.1.2, 25.15.2.2, 26.4, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 10. | I have had prior involvement with the Pebble property that is the subject of the Technical Report in multiple internal studies since 2012, and as QP for the report “Preliminary Economic Assessment NI 43-101 Technical Report, Pebble Project, Alaska, USA”, effective date September 9, 2021, and the report “Preliminary Economic Assessment NI 43-101 Technical Report Update, Pebble Project, Alaska, USA”, effective date October 1, 2022. All involvements prior to the 2023 work happened when I was employed by Tetra Tech Canada Inc. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Sabry Abdel Hafez, PhD, P.Eng.

Permit to Practice No. P725, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Les Galbraith, P.Eng., P.E.

I, Les Galbraith, P.Eng., P.E., of Vancouver, British Columbia certify that:

| 1. | I am a Specialist Engineer | Associate with Knight Piésold Ltd. with a business address at Suite 1400 – 750 West Pender Street, Vancouver. B.C. V6C 2T8. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from the University of British Columbia in 1995 with a B.A.Sc. (Civil Engineering). I am a member in good standing of the Engineers and Geoscientists of British Columbia (license no. #25493) and the State of Alaska Board of Registration for Architects, Engineers and Land Surveyors (license no. #129941). |

|

|

|

| 4. | I have practiced my profession continuously since graduation. I have over 27 years of relevant experience in providing waste and water management engineering support to mining projects, primarily in British Columbia and Alaska. My experience includes geotechnical investigations, tailings dam design (from PEA studies to detailed design), and construction supervision of tailings embankments. I am the Engineer of Record for six tailings dams in British Columbia. |

|

|

|

| 5. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 6. | I visited the Pebble Project in June 2013. |

|

|

|

| 7. | I am responsible for Sections 1.15.2, 1.20.1.4, 1.21.6, 2.3.5, 12.5, 18.4, 18.5.1.1-18.5.1.6, 18.5.2, 21.2.6, 21.2.12.3, 21.2.13.2, 21.2.13.3, 21.3.6, 25.15.1.4, 26.6, and 27 of the Technical Report. |

|

|

|

| 8. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 9. | I have been involved with the Pebble Project since 2004, most recently as co-QP of the “Preliminary Economic Assessment NI 43-101 Technical Report, Pebble Project, Alaska, USA”, effective date October 1, 2022.I have read the NI 43-101, and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. |

|

|

|

| 10. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Les Galbraith, P.Eng., P.E.

Permit to Practice No. 1001011, Engineers and Geoscientists British Columbia.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Stuart J. Parks, P.E.

I, Stuart J. Parks, P.E., certify that:

| 1. | I am employed as a Vice President of Operations with NANA Worley, LLC, with an office address of 3700 Centerpoint Drive, 7th Floor, Anchorage, Alaska 99503. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from New Mexico State University (B.S., Electrical Engineering, 1985) and Arizona State University M.S., Civil Engineering, 1995). I am a member in good standing of Alaska State Board of Registration for Architects, Engineers, and Land Surveyors, as a Professional Engineer in Electrical Engineering (license no. #AELE10174) and of Montana State Board of Professional Engineers and Land Surveyors, as a Professional Engineer in Electrical Engineer (PEL-PE-LIC-17650). |

|

|

|

| 4. | I have practiced my profession for over 35 years. I have relevant experience in electrical, power, and control system engineering and project management for many projects in remote areas of Alaska. This experience spans a wide range of brownfield and greenfield projects for the hydrocarbons, power, mining and telecommunication industries, from front-end studies and conceptual designs to detailed design and construction support. |

|

|

|

| 5. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 6. | I have not made a site visit to the Pebble Project as of the Effective Date of the Technical Report. |

|

|

|

| 7. | I am responsible for Sections 1.20.1.5, 12.6, 18.8, 21.2.8.1, 21.3.3, 25.15.1.5, and 27 of the Technical Report. |

|

|

|

| 8. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 9. | I have had previous involvement with the Pebble Project, specifically with the power generation and natural gas pipeline components of the project. This scoping level engineering work has been performed by NANA Worley and our parent company affiliate offices since 2007, specifically under my staff’s and my oversight. |

|

|

|

| 10. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Stuart J. Parks, P.E.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

James Wescott Bott, P.E.

I, James Wescott Bott, P.E., certify that:

| 1. | I am employed as Civil Engineer | Associate Vice President with HDR Alaska, Inc., with an office address of 582 E 36th Avenue, Suite 500, Anchorage, Alaska 99503-4169. |

|

|

|

| 2. | This certificate applies to the technical report “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from Virginia Military Institute in 1999 with a Bachelor of Science degree in Civil & Environmental Engineering and I graduated from Virginia Tech in 2005 with a Master of Science degree in Civil Engineering. I am a member in good standing of the Alaska State Board of Registration for Architects, Engineers, and Land Surveyors, as a Professional Engineer in both Civil Engineering (license no. #AELC11521) and Environmental Engineering (license no. #AELV14371). |

|

|

|

| 4. | I have practiced my profession for 19 years. I have relevant experience in water and wastewater engineering in Alaska for seven mining (or proposed mine) projects. My experience includes mine water management, mine water disposal permitting, and mine water treatment system planning, design, and operational support. |

|

|

|

| 5. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 6. | I visited the Pebble Project in December 2006 for a duration of approximately 6 days. |

|

|

|

| 7. | I am responsible for Sections 1.20.2.4, 2.3.6, 12.7, 18.5.1.7, 18.6, 21.2.7.2, 21.2.13.4, 21.3.7, 25.15.2.4, and 27 of the Technical Report. |

|

|

|

| 8. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 9. | I have had previous involvement with the Pebble Project. I was involved with environmental baseline data collection in 2006, preliminary engineering of water treatment systems from 2011 to 2013, preliminary engineering of mine access road bridges and culverts from 2017 to 2018, and preliminary engineering of water treatment systems from 2017 to present. |

|

|

|

| 10. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

James Wescott Bott, P.E.

|

|

|

|

CERTIFICATE OF QUALIFIED PERSON

Steven R. Rowland, P.E.

I, Steven R. Rowland, P.E. certify that:

| 1. | I am employed as Principal Engineer with RECON LLC, with an office address of 565 W Recon Cir., Palmer, Alaska 99645. |

|

|

|

| 2. | This certificate applies to the technical report titled “Pebble Project, NI 43-101 Technical Report Update Preliminary Economic Assessment, Alaska, USA” (the “Technical Report”), prepared for Northern Dynasty Minerals Ltd. (the “Issuer”), that has an effective date of August 21, 2023 (the “Effective Date”), and an amended and restated report date of September 18, 2023. |

|

|

|

| 3. | I graduated from the University of Alaska in 1980 with a B.Sc. Geological Engineering]. I am duly qualified and registered as a Professional Engineer and entitled to practice Civil Engineering in the State of Alaska. |

|

|

|

| 4. | I am a member in good standing of American Society of Civil Engineers. |

|

|

|

| 5. | I have practiced my profession for 43 years. I have provided engineering consulting services to numerous resource exploration, development, and mining companies with projects in Alaska. The range of services provided includes access infrastructure route selection, geotechnical investigations, road and airfield design, mine site development recommendations, cost estimates and construction management. |

|

|

|

| 6. | I have read the definition of “Qualified Person” set out in the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and certify that by virtue of my education, affiliation to a professional association and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for those sections of the Technical Report that I am responsible for preparing. |

|

|

|

| 7. | I worked at the Pebble Project location on numerous occasions beginning with an initial reconnaissance trip in 2005. Subsequent site work has included on the ground traverse of the proposed access road routes, pipeline routes and numerous alternative routes. Proposed port sites have been visited and all identified material sources have been visited and mapped. |

|

|

|

| 8. | I am responsible for Sections 2.3.7, 12.8, 18.2, 21.2.8.4, 21.2.12.4, 21.3.10, 26.5.2, and 27 of the Technical Report. |

|

|

|

| 9. | I am independent of Northern Dynasty Minerals Ltd. as independence is described by Section 1.5 of the NI 43-101. |

|

|

|

| 10. | I have had prior involvement with the project as the engineer responsible for providing access road alignments, material source locations, and construction cost estimates that have been used in permit applications and prior Prefeasibility Studies. |

|

|

|

| 11. | I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument. As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading. |

Dated: September 18, 2023.

“Signed and sealed”

Steven R. Rowland, P.E.

|

|

|

|

|

|

|

|

Important Notice

This report was prepared as National Instrument 43-101 Technical Report for Northern Dynasty Minerals Ltd. (NDM) by Ausenco Engineering Canada Inc. and Ausenco Sustainability Inc. (collectively, Ausenco), Tetra Tech Canada Inc. (Tetra Tech), NANA Worley Inc. (NANA Worley), Worley Canada Services Ltd. (Worley Canada), Knight Piésold Ltd. (Knight Piésold) and RECON LLC (RECON), and HDR Alaska Inc. (HDR), collectively the “Report Authors.” The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in the Report Authors’ services, based on i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by NDM subject to the terms and conditions of its contracts with each of the Report Authors. Except for the purposes legislated under Canadian provincial and territorial securities law, any other uses of this report by any third party are at that party’s sole risk.

Notice to Reader:

This report replaces the “Pebble Project NI 43-101 Technical Report and Preliminary Economic Assessment” filed on September 05, 2023, and reflects certain housekeeping and clarifying amendments along with conforming changes to the certificates of the qualified professionals who have authored the report.

|

|

|

|

Table of Contents

| 1 | SUMMARY |

| 1 |

|

|

| 1.1 | Introduction |

| 1 |

|

|

| 1.2 | Project Location |

| 2 |

|

|

| 1.3 | Property Description |

| 2 |

|

|

| 1.4 | Project Description |

| 3 |

|

|

| 1.5 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements |

| 6 |

|

|

| 1.6 | Geological Setting and Mineralization |

| 7 |

|

|

| 1.7 | History |

| 8 |

|

|

| 1.8 | Exploration |

| 10 |

|

|

| 1.9 | Drilling and Sampling |

| 11 |

|

|

| 1.10 | Metallurgical Testwork |

| 11 |

|

|

| 1.11 | Mineral Resource Estimation |

| 13 |

|

|

| 1.12 | Mining Methods |

| 13 |

|

|

| 1.13 | Recovery Methods |

| 14 |

|

|

| 1.14 | Project Infrastructure |

| 17 |

|

|

| 1.15 | Environmental, Permitting and Social Considerations |

| 17 |

|

|

|

| 1.15.1 | Environmental Considerations |

| 17 |

|

|

| 1.15.2 | Closure and Reclamation Considerations |

| 19 |

|

|

| 1.15.3 | Permitting Considerations |

| 19 |

|

| 1.16 | Forward-Looking Information |

| 23 |

|

|

| 1.17 | Capital and Operating Cost Estimates |

| 24 |

|

|

|

| 1.17.1 | Capital Cost Estimates |

| 24 |

|

|

| 1.17.2 | Operating Cost Estimates |

| 25 |

|

| 1.18 | Economic Analysis |

| 26 |

|

|

|

| 1.18.1 | Economic Analysis |

| 26 |

|

|

| 1.18.2 | Sensitivity Analysis |

| 28 |

|

| 1.19 | Conclusion and Interpretation |

| 32 |

|

|

| 1.20 | Risks and Opportunities |

| 32 |

|

|

|

| 1.20.1 | Risks |

| 32 |

|

|

| 1.20.2 | Opportunities |

| 35 |

|

| 1.21 | Recommendations |

| 36 |

|

|

|

| 1.21.1 | Introduction |

| 36 |

|

|

| 1.21.2 | Metallurgical Testwork |

| 37 |

|

|

| 1.21.3 | Mineral Resource Estimate |

| 37 |

|

|

| 1.21.4 | Mining Methods |

| 38 |

|

|

| 1.21.5 | Process and Infrastructure Engineering |

| 38 |

|

|

| 1.21.6 | Tailings and Waste Management |

| 39 |

|

| Pebble Project | Page i |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 2 | INTRODUCTION |

| 41 |

|

|

| 2.1 | Terms of Reference |

| 41 |

|

|

| 2.2 | Qualified Persons |

| 42 |

|

|

| 2.3 | Site Visits and Scope of Personal Inspection |

| 43 |

|

|

|

| 2.3.1 | Site inspection by Graeme Roper, P. Geo. |

| 43 |

|

|

| 2.3.2 | Site inspection by Greg Mosher, P. Eng. |

| 43 |

|

|

| 2.3.3 | Site inspection by Hassan Ghaffari, P.Eng. |

| 43 |

|

|

| 2.3.4 | Site inspection by Sabry Abdel Hafez, P. Eng. |

| 44 |

|

|

| 2.3.5 | Site inspection by Les Galbraith, P.Eng. P.E. |

| 44 |

|

|

| 2.3.6 | Site inspection by James Wescott Bott, P.E. |

| 44 |

|

|

| 2.3.7 | Site inspection by Steven Rowland, P.E. |

| 44 |

|

| 2.4 | Effective Dates |

| 44 |

|

|

| 2.5 | Sources of Information and Data |

| 44 |

|

|

|

| 2.5.1 | Definitions |

| 45 |

|

| 3 | RELIANCE ON OTHER EXPERTS |

| 51 |

|

|

| 3.1 | Mineral Tenure |

| 51 |

|

|

| 3.2 | Environmental, Permitting, Closure, and Social and Community Impacts |

| 51 |

|

|

| 3.3 | Taxation |

| 51 |

|

|

| 4 | PROPERTY DESCRIPTION AND LOCATION |

| 52 |

|

|

| 4.1 | Property Location |

| 52 |

|

|

| 4.2 | Mineral Tenure |

| 53 |

|

|

| 4.3 | Royalty and Other Agreements |

| 53 |

|

|

| 4.4 | Surface Rights |

| 55 |

|

|

| 4.5 | Environmental Liabilities |

| 55 |

|

|

| 4.6 | Permits |

| 55 |

|

|

| 4.7 | Comments |

| 55 |

|

|

| 5 | ACESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

| 57 |

|

|

| 5.1 | Accessibility |

| 57 |

|

|

| 5.2 | Climate |

| 58 |

|

|

| 5.3 | Infrastructure |

| 58 |

|

|

| 5.4 | Local Resources |

| 59 |

|

|

| 5.5 | Physiography |

| 59 |

|

|

| 6 | HISTORY |

| 60 |

|

|

| 6.1 | Overview |

| 60 |

|

|

| 6.2 | Historical Sample Preparation and Analysis |

| 62 |

|

|

|

| 6.2.1 | Sample Preparation |

| 62 |

|

|

| 6.2.2 | Sample Analysis |

| 62 |

|

| 6.3 | Historical Resource Estimates |

| 63 |

|

|

| 6.4 | Study History |

| 63 |

|

|

|

| 6.4.1 | Property Ownership |

| 64 |

|

| Pebble Project | Page ii |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 6.5 | Historical Production |

| 65 |

|

|

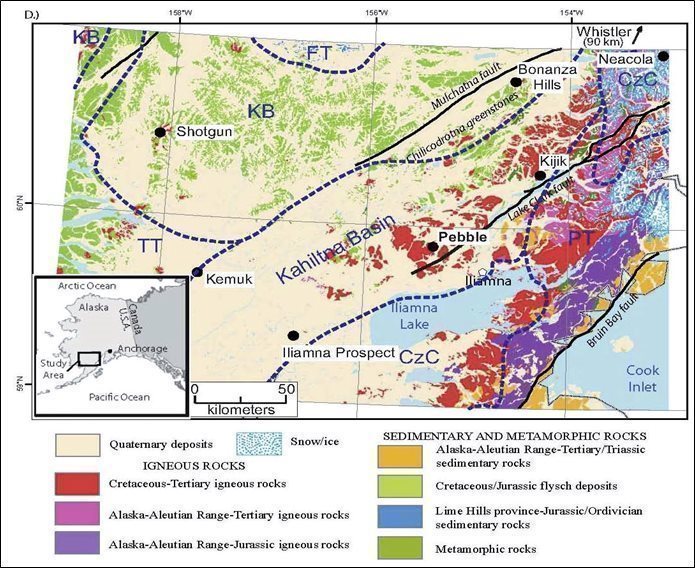

| 7 | GEOLOGICAL SETTING AND MINERALIZATION |

| 66 |

|

|

| 7.1 | Introduction |

| 66 |

|

|

| 7.2 | Regional Geology |

| 66 |

|

|

| 7.3 | Project Geology |

| 69 |

|

|

|

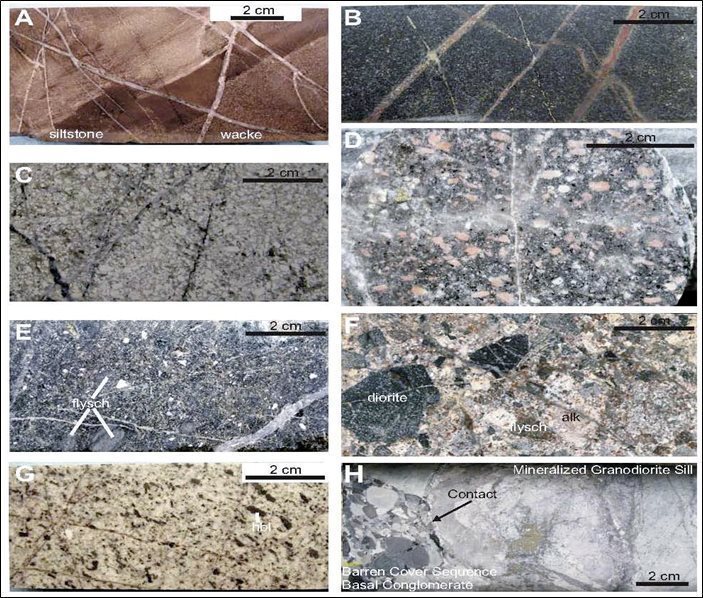

| 7.3.1 | Kahiltna Flysch |

| 69 |

|

| 7.3.2 | Diorite and Granodiorite Sills |

| 69 |

|

|

| 7.3.3 | Alkalic Intrusions and Associated Breccias |

| 69 |

|

|

| 7.3.4 | Hornblende Granodiorite Intrusions |

| 70 |

|

|

| 7.3.5 | Volcanic Sedimentary cover Sequence |

| 70 |

|

|

| 7.3.6 | Hornblende Monzonite Porphyry Intrusions |

| 70 |

|

|

| 7.3.7 | Eocene Volcanic Rocks and Intrusions |

| 70 |

|

|

| 7.3.8 | Glacial Sediments |

| 71 |

|

|

| 7.3.9 | District Structure |

| 71 |

|

|

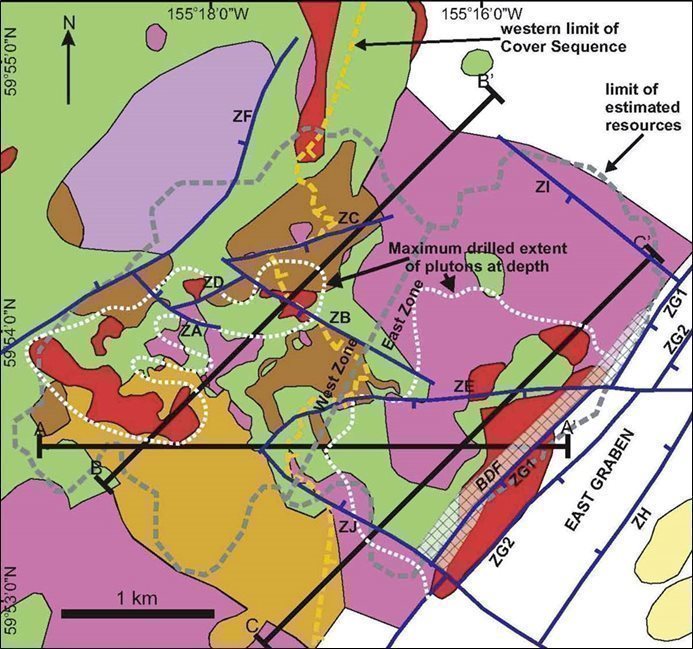

| 7.4 | Deposit Geology |

| 71 |

|

|

| 7.4.1 | Rock Types |

| 75 |

|

|

| 7.4.2 | Structure |

| 75 |

|

|

| 7.4.3 | Deposit Alteration Styles |

| 76 |

|

|

| 7.4.4 | Mineralization Styles |

| 81 |

|

|

| 8 | DEPOSIT TYPES |

| 85 |

|

|

| 9 | EXPLORATION |

| 86 |

|

|

| 9.1 | Introduction |

| 86 |

|

|

| 9.2 | Overview |

| 86 |

|

|

| 9.3 | Geological Mapping |

| 86 |

|

|

| 9.4 | Geophysical Surveys |

| 86 |

|

|

| 9.5 | Geochemical Surveys |

| 87 |

|

|

| 10 | DRILLING |

| 88 |

|

|

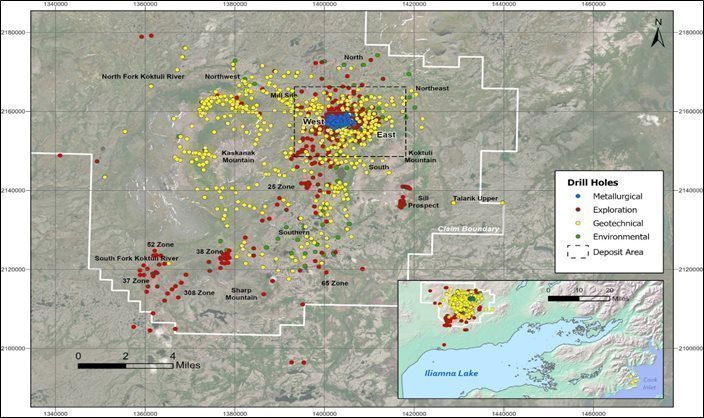

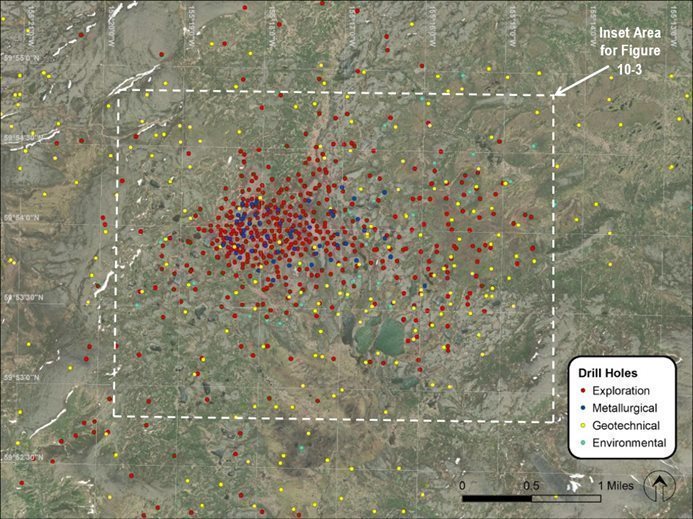

| 10.1 | Introduction |

| 88 |

|

|

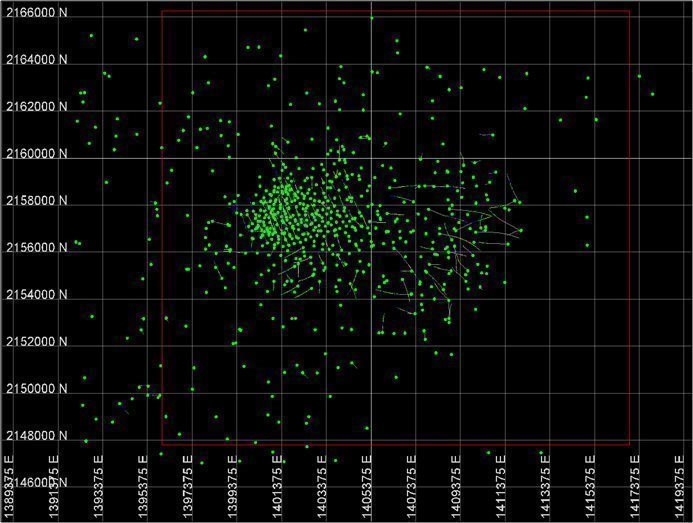

| 10.2 | Drill Hole Locations |

| 88 |

|

|

| 10.3 | Summary of Drilling, 2001–2019 |

| 89 |

|

|

| 10.3.1 | Northern Dynasty Drilling, 2002–2006 |

| 94 |

|

|

| 10.3.2 | Northern Dynasty and Pebble Partnership Drilling, 2007 |

| 94 |

|

|

| 10.3.3 | Pebble Partnership Drilling, 2008–2014 |

| 94 |

|

|

| 10.3.4 | Pebble Partnership Drilling, 2018–2019 |

| 95 |

|

|

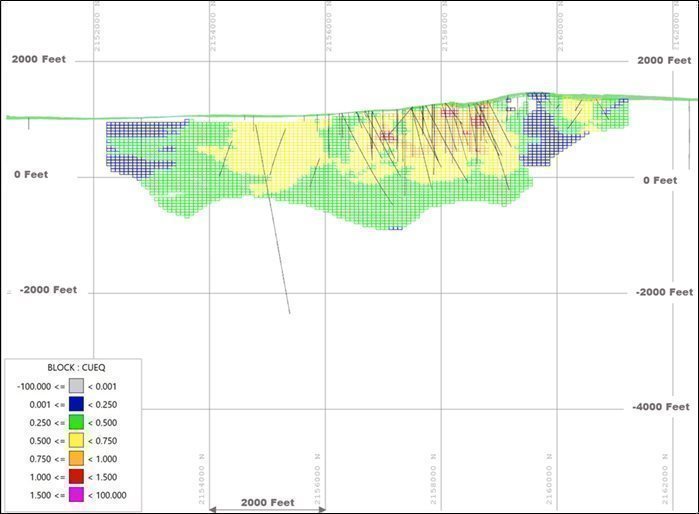

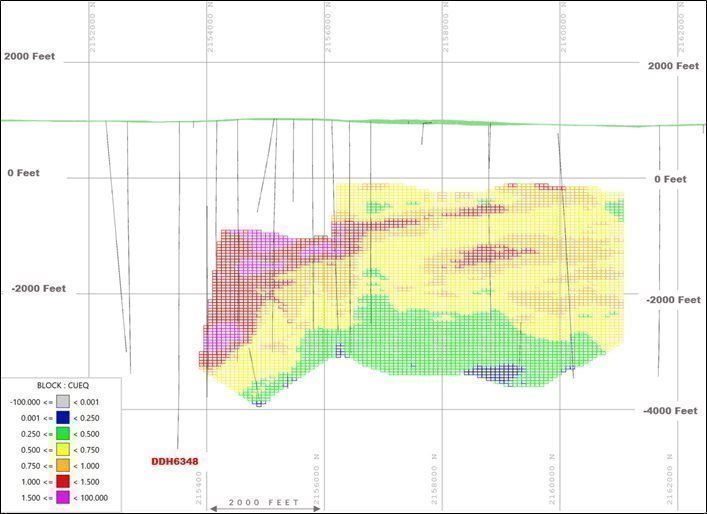

| 10.4 | Drill Sections |

| 95 |

|

|

| 10.5 | Bulk Density Results |

| 100 |

|

|

| 10.6 | Conclusions |

| 100 |

|

|

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY |

| 101 |

|

|

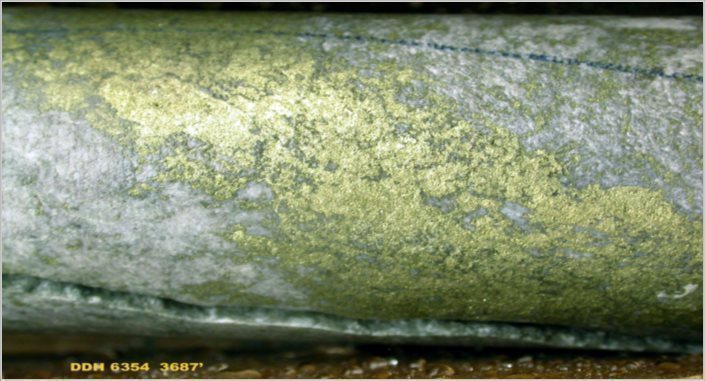

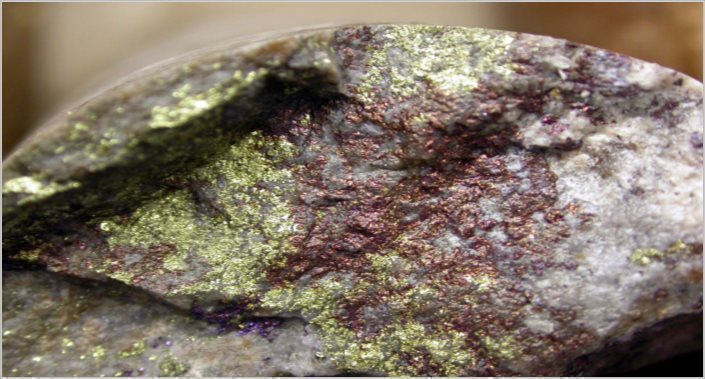

| 11.1 | Sampling Method and Approach |

| 101 |

|

|

| 11.1.1 | Northern Dynasty Sampling, 2002–2006 |

| 101 |

|

|

| Pebble Project | Page iii |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

|

| 11.1.2 | Northern Dynasty and Pebble Partnership Sampling, 2007 |

| 102 |

|

|

| 11.1.3 | Pebble Partnership Sampling, 2008–2014 |

| 102 |

|

| 11.2 | Sample Preparation |

| 103 |

|

|

|

| 11.2.1 | Northern Dynasty Sample Preparation, 2002 |

| 103 |

|

|

| 11.2.2 | Northern Dynasty Sample Preparation, 2003 |

| 103 |

|

|

| 11.2.3 | Northern Dynasty and Pebble Partnership Sample Preparation, 2004–2013 and 2018 |

| 103 |

|

| 11.3 | Sample Analysis |

| 103 |

|

|

|

| 11.3.1 | Northern Dynasty Sample Analysis, 2002 |

| 103 |

|

|

| 11.3.2 | Bulk Density Determinations |

| 111 |

|

| 11.4 | Quality Control/Quality Assurance |

| 111 |

|

|

|

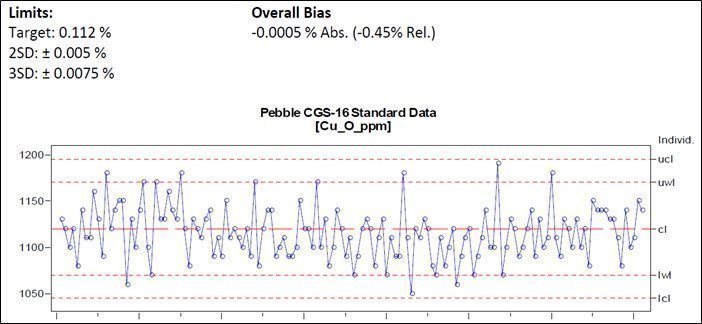

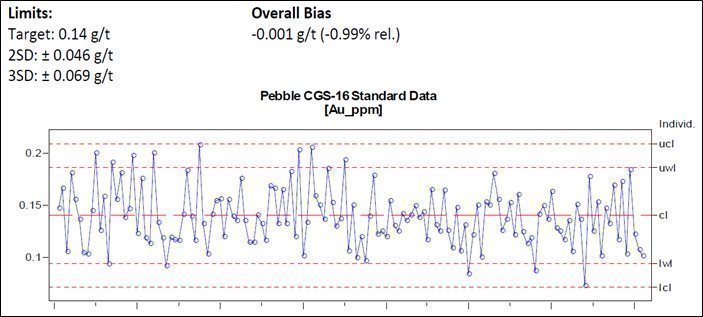

| 11.4.1 | Quality Assurance and Quality Control |

| 111 |

|

|

| 11.4.2 | Standards |

| 113 |

|

|

| 11.4.3 | Duplicates |

| 113 |

|

|

| 11.4.4 | Blanks |

| 114 |

|

|

| 11.4.5 | QA/QC on Other Elements |

| 115 |

|

|

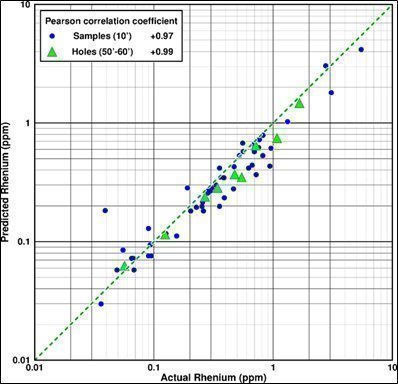

| 11.4.6 | Rhenium Study |

| 115 |

|

| 11.5 | Bulk Density Validation |

| 118 |

|

|

| 11.6 | Survey Validation |

| 118 |

|

|

| 11.7 | Data Environment |

| 119 |

|

|

|

| 11.7.1 | Error Detection Processes |

| 119 |

|

|

| 11.7.2 | Analysis Hierarchies |

| 120 |

|

|

| 11.7.3 | Wedges |

| 120 |

|

| 11.8 | Verification of Drilling Data |

| 120 |

|

|

| 11.9 | Conclusions |

| 122 |

|

|

| 12 | DATA VERIFICATION |

| 123 |

|

|

| 12.1 | Data Verification by Robin Kalanchey |

| 123 |

|

|

| 12.2 | Data Verification by Scott Weston |

| 123 |

|

|

| 12.3 | Data Verification by Hassan Ghaffari |

| 123 |

|

|

| 12.4 | Data Verification by Sabry Abdel Hafez |

| 124 |

|

|

| 12.5 | Data Verification by Les Galbraith |

| 124 |

|

|

| 12.6 | Data Verification by Stuart Parks |

| 124 |

|

|

| 12.7 | Data Verification by James Wescott Bott |

| 124 |

|

|

| 12.8 | Data Verification by Steven Rowland |

| 124 |

|

|

| 12.9 | Data Verification by Greg Mosher |

| 125 |

|

|

| 12.10 | Data Verification by Graeme Roper |

| 125 |

|

|

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING |

| 129 |

|

|

| 13.1 | Test Programs Summary |

| 129 |

|

|

|

| 13.1.1 | 2003 to 2005 Testwork |

| 129 |

|

|

| 13.1.2 | 2006 to 2010 Testwork |

| 129 |

|

|

| 13.1.3 | 2011 to 2014 Testwork |

| 131 |

|

| 13.2 | Comminution Tests |

| 132 |

|

|

| Pebble Project | Page iv |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 13.2.1 | Bond Grindability Tests |

| 132 |

|

|

| 13.2.2 | Bond Low Energy Impact Tests |

| 133 |

|

|

| 13.2.3 | SMC Tests |

| 134 |

|

|

| 13.2.4 | MacPherson Autogenous Grindability Tests |

| 134 |

|

|

| 13.3 | Flotation Concentration Tests |

| 135 |

|

|

| 13.3.1 | Recovery of Bulk Flotation Concentrate |

| 135 |

|

|

| 13.3.2 | Separation of Molybdenum and Copper |

| 140 |

|

|

| 13.3.3 | Rhenium Recovery into Molybdenum Concentrate |

| 144 |

|

|

| 13.3.4 | Pyrite Flotation |

| 145 |

|

|

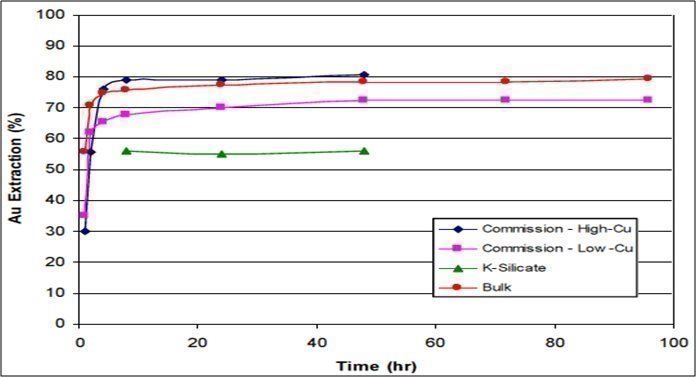

| 13.4 | Gold Recovery Tests |

| 146 |

|

|

| 13.4.1 | Gravity Recoverable Gold Tests |

| 146 |

|

|

| 13.4.2 | Gold Recovered from Leaching |

| 147 |

|

|

| 13.5 | SART Process (Sulphidization, Acidification, Recycling, Thickening) |

| 148 |

|

|

| 13.6 | Cyanide Destruction |

| 148 |

|

|

| 13.7 | Auxiliary Tests – Concentrate Filtration |

| 149 |

|

|

| 13.8 | Quality of Concentrates |

| 149 |

|

|

| 13.9 | Geometallurgy |

| 150 |

|

|

| 13.9.1 | Introduction |

| 150 |

|

|

| 13.9.2 | Description of Geometallurgical Domains |

| 151 |

|

|

| 13.10 | Metal Recovery Projection |

| 153 |

|

|

| 13.10.1 | Metal Projections of Copper, Gold Silver, and Molybdenum, 2014 and 2018 |

| 153 |

|

|

| 13.10.2 | Metal Recovery Projection Results |

| 158 |

|

|

| 14 | MINERAL RESOURCE ESTIMATES |

| 159 |

|

|

| 14.1 | Introduction |

| 159 |

|

|

| 14.2 | Summary |

| 159 |

|

|

| 14.3 | Geological Interpretation for Estimation |

| 160 |

|

|

| 14.4 | Inclusion of Rhenium in the Project Database |

| 162 |

|

|

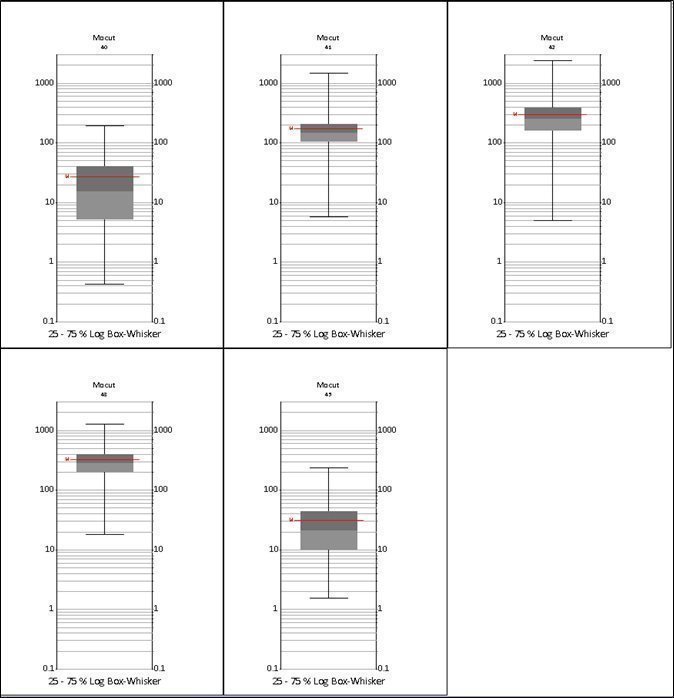

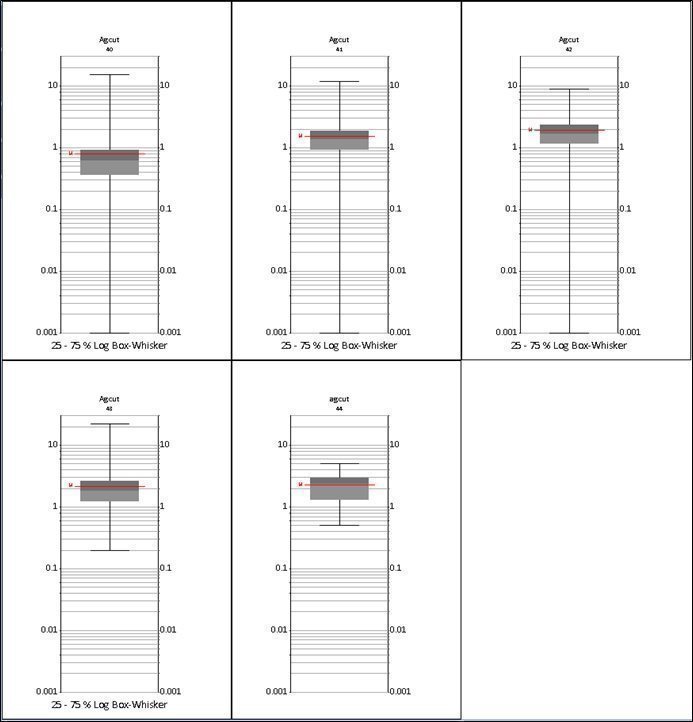

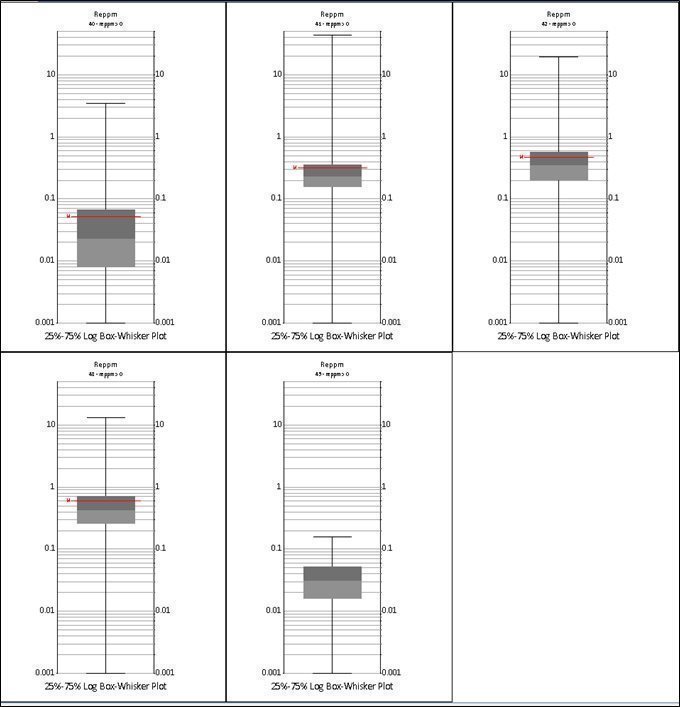

| 14.4.1 | Grade Capping/Outlier Restrictions |

| 163 |

|

|

| 14.4.2 | Data Used to Develop the Regression Equation |

| 164 |

|

|

| 14.4.3 | Data Analysis |

| 165 |

|

|

| 14.4.4 | Validation |

| 166 |

|

|

| 14.5 | Exploratory Data Analysis |

| 168 |

|

|

| 14.5.1 | Assays |

| 168 |

|

|

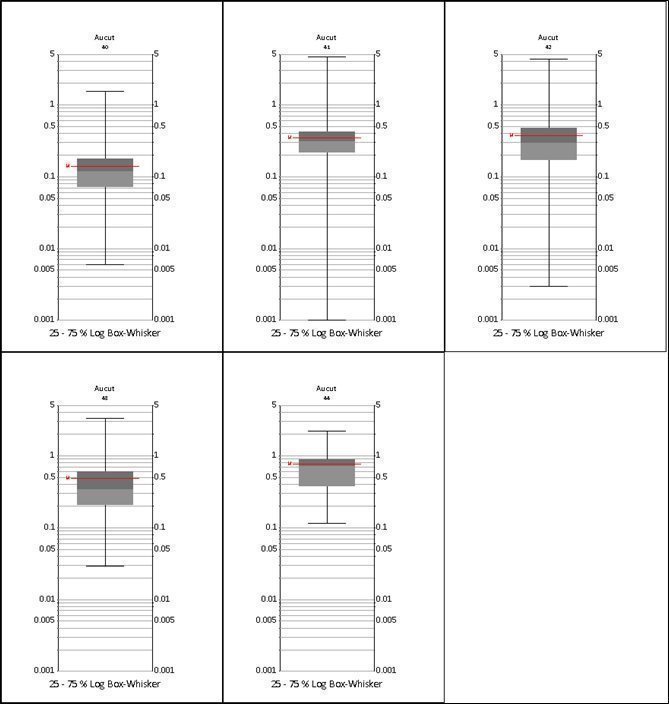

| 14.5.2 | Capping |

| 176 |

|

|

| 14.5.3 | Composites |

| 177 |

|

|

| 14.6 | Bulk Density |

| 177 |

|

|

| 14.7 | Spatial Analysis |

| 178 |

|

|

| 14.8 | Resource Block Model |

| 179 |

|

|

| 14.9 | Interpolation Plan |

| 180 |

|

|

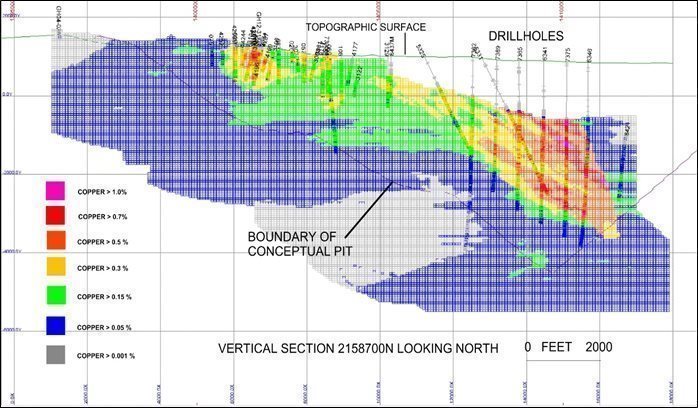

| 14.10 | Reasonable Prospects of Eventual Economic Extraction |

| 181 |

|

|

| 14.11 | Mineral Resource Classification |

| 182 |

|

|

| 14.12 | Copper Equivalency |

| 182 |

|

|

| Pebble Project | Page v |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 14.13 | Cutoff Grade |

| 184 |

|

|

| 14.14 | Block Model Validation |

| 184 |

|

|

| 14.15 | Factors That May Affect the Mineral Resource Estimates |

| 188 |

|

|

| 15 | MINERAL RESERVE ESTIMATES |

| 189 |

|

|

| 16 | MINING METHODS |

| 190 |

|

|

| 16.1 | Introduction |

| 190 |

|

|

| 16.2 | Mine Plan Inputs |

| 190 |

|

|

|

| 16.2.1 | Block Model |

| 190 |

|

|

| 16.2.2 | Pit Slope Angle |

| 190 |

|

|

| 16.2.3 | Surface Topography |

| 190 |

|

|

| 16.2.4 | Pit Optimization parameters |

| 190 |

|

| 16.3 | Mine Design |

| 193 |

|

|

| 16.4 | Minimum Working Area |

| 195 |

|

|

|

| 16.4.1 | Haul Road |

| 196 |

|

|

| 16.4.2 | Pit Hydrology/Dewatering |

| 196 |

|

|

| 16.4.3 | Pit Design Results |

| 196 |

|

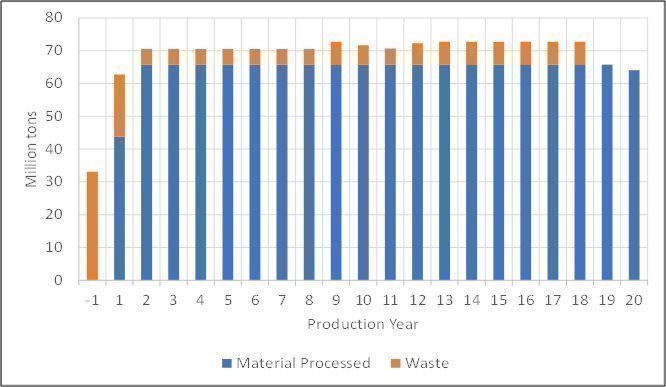

| 16.5 | Mine Plan |

| 197 |

|

|

| 16.6 | Blasting |

| 200 |

|

|

| 16.7 | Mine Waste Rock Management |

| 200 |

|

|

| 16.8 | Mining Equipment |

| 201 |

|

|

|

| 16.8.1 | Mine Equipment Fleet |

| 201 |

|

|

| 16.8.2 | Operating Hours |

| 201 |

|

|

| 16.8.3 | Primary Equipment |

| 202 |

|

|

| 16.8.4 | Support and Ancillary Equipment |

| 203 |

|

| 16.9 | Mining Labour |

| 204 |

|

|

| 17 | RECOVERY METHODS |

| 206 |

|

|

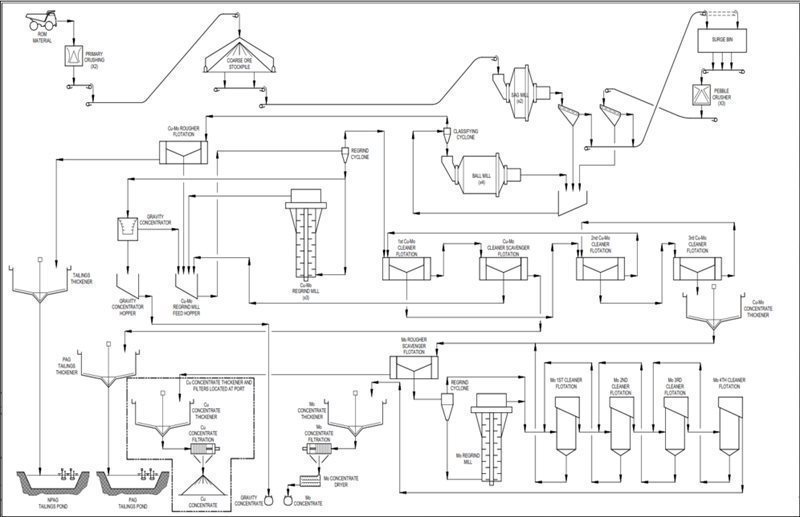

| 17.1 | Summary |

| 206 |

|

|

| 17.2 | Simplified Process Flowsheet |

| 206 |

|

|

| 17.3 | Process Design Criteria |

| 208 |

|

|

| 17.4 | Process Plant Description |

| 209 |

|

|

|

| 17.4.1 | Primary Crushing |

| 209 |

|

|

| 17.4.2 | Stockpile |

| 209 |

|

|

| 17.4.3 | Primary Grinding |

| 210 |

|

|

| 17.4.4 | Secondary Grinding |

| 210 |

|

|

| 17.4.5 | Bulk Rougher Flotation |

| 210 |

|

|

| 17.4.6 | Bulk Concentrate Re-grind |

| 210 |

|

|

| 17.4.7 | Bulk Concentrate-Cleaner Flotation |

| 211 |

|

|

| 17.4.8 | Molybdenum Flotation |

| 211 |

|

|

| 17.4.9 | Concentrate Dewatering and Filtration |

| 212 |

|

|

| 17.4.10 | Tailings Management |

| 212 |

|

|

| 17.4.11 | Reagents Handling and Storage |

| 212 |

|

| Pebble Project | Page vi |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

|

| 17.4.12 | Assay and Metallurgical Laboratories |

| 213 |

|

|

| 17.4.13 | Power Supply |

| 213 |

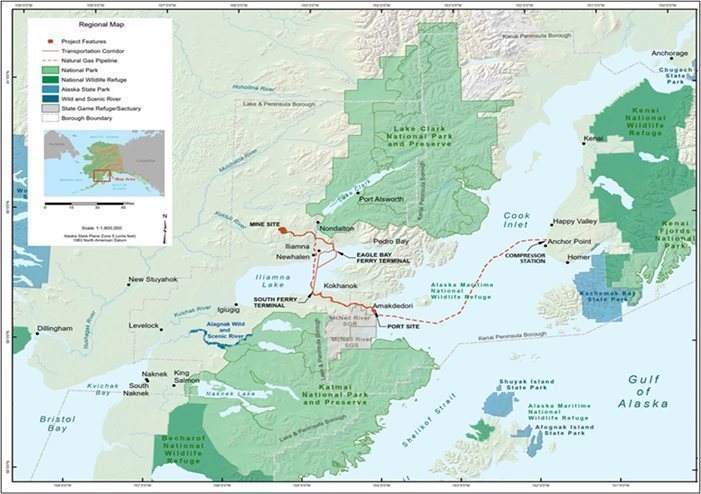

|

|

| 17.4.14 | Water Supply |

| 213 |

|

|

| 17.4.15 | Air Supply |

| 214 |

|

| 17.5 | Process Control Philosophy |

| 214 |

|

|

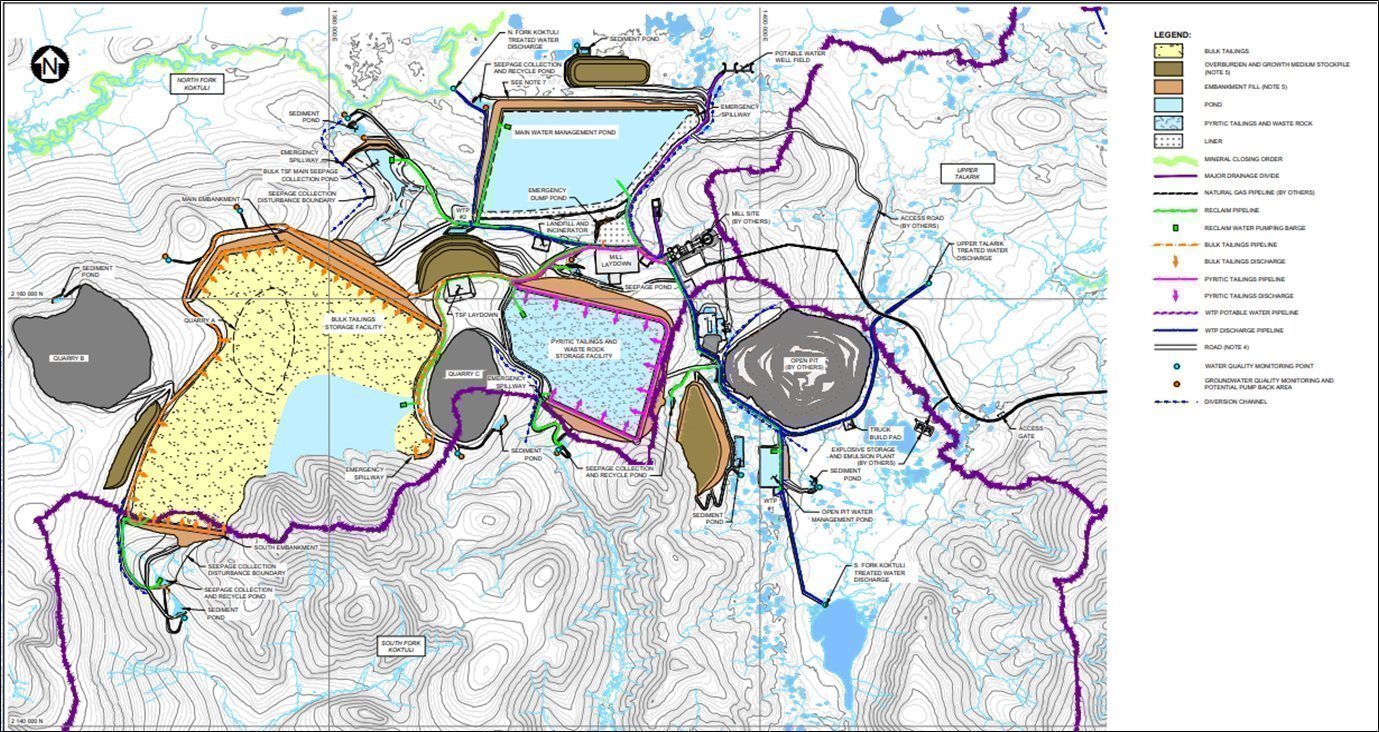

| 18 | PROJECT INFRASTRUCTURE |

| 215 |

|

|

| 18.1 | Introduction |

| 215 |

|

|

| 18.2 | Access Road |

| 217 |

|

|

| 18.2.1 | Main Access Road |

| 218 |

|

|

| 18.3 | Site Roads |

| 222 |

|

|

| 18.3.1 | Haul Roads |

| 222 |

|

|

| 18.3.2 | Service Roads |

| 222 |

|

|

| 18.4 | Tailings Storage Facilities |

| 223 |

|

|

| 18.4.1 | Introduction |

| 223 |

|

|

|

| 18.4.2 | Tailings Overview |

| 223 |

|

|

| 18.4.3 | Site Selection |

| 223 |

|

|

| 18.4.4 | Design Criteria |

| 224 |

|

|

| 18.4.5 | Tailings Storage Facility Design |

| 225 |

|

| 18.5 | Water Management |

| 227 |

|

|

|

| 18.5.1 | Water Management Systems |

| 227 |

|

|

| 18.5.2 | Site-Wide Water Balance |

| 228 |

|

| 18.6 | Water Treatment |

| 230 |

|

|

|

| 18.6.1 | Influent Stream Characteristics |

| 231 |

|

|

| 18.6.2 | WTP Processes |

| 232 |

|

|

| 18.6.3 | WTP Buildings and Appurtenances |

| 233 |

|

| 18.7 | Mine Site Facilities |

| 234 |

|

|

| 18.7.1 | Mine Site Conditions and Design Criteria |

| 234 |

|

|

| 18.7.2 | Mine Service Facilities |

| 235 |

|

|

| 18.7.3 | Water Systems |

| 236 |

|

|

| 18.7.4 | Medical and First Aid |

| 237 |

|

|

| 18.7.5 | Camp |

| 237 |

|

|

| 18.7.6 | Cold Storage Building |

| 237 |

|

|

| 18.7.7 | Utilities and Services |

| 238 |

|

|

| 18.8 | Natural Gas Line and Power Supply |

| 239 |

|

|

| 18.8.1 | Power Supply |

| 239 |

|

|

| 18.8.2 | Natural Gas Supply |

| 241 |

|

|

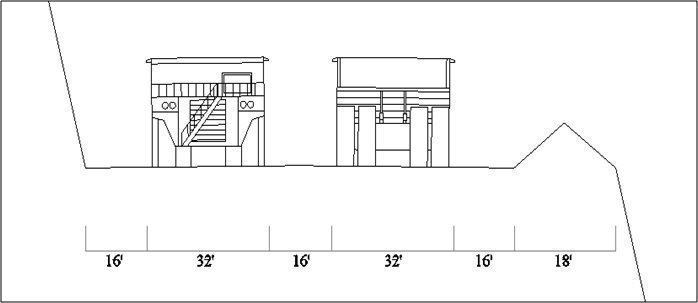

| 18.9 | Marine Infrastructure |

| 243 |

|

|

| 18.9.1 | Marine Barge Handling Facility |

| 245 |

|

|

| 18.9.2 | Onshore Terminal Facilities – Amakdedori Port, North and South Ferry Terminals |

| 247 |

|

|

| 18.9.3 | Fuel Supply |

| 249 |

|

|

| 18.10 | Ferry |

| 249 |

|

|

| Pebble Project | Page vii |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 19 | MARKET STUDIES AND CONTRACTS |

| 252 |

|

|

| 19.1 | Introduction |

| 252 |

|

|

| 19.2 | Metal Prices |

| 252 |

|

|

| 19.3 | Smelter Terms |

| 253 |

|

|

| 19.4 | Concentrate Logistics |

| 255 |

|

|

| 19.5 | Contracts |

| 256 |

|

|

|

| 19.5.1 | Existing Contracts |

| 256 |

|

|

| 19.5.2 | Royalties |

| 256 |

|

| 20 | ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT |

| 257 |

|

|

| 20.1 | Project Setting |

| 257 |

|

|

| 20.1.1 | Jurisdictional Setting |

| 257 |

|

|

| 20.1.2 | Environmental and Social Setting |

| 257 |

|

|

| 20.2 | Baseline Studies – Existing Environment |

| 259 |

|

|

| 20.2.1 | Climate and Meteorology |

| 260 |

|

|

| 20.2.2 | Surface Water Hydrology and Quality |

| 261 |

|

|

| 20.2.3 | Groundwater Hydrology and Quality |

| 263 |

|

|

| 20.2.4 | Geochemical Characterization |

| 264 |

|

|

| 20.2.5 | Wetlands |

| 265 |

|

|

| 20.2.6 | Fish, Fish Habitat and Aquatic Invertebrates |

| 265 |

|

|

| 20.2.7 | Marine Habitats |

| 266 |

|

|

| 20.3 | Marine Mammals |

| 267 |

|

|

| 20.4 | Economy and Social Conditions |

| 267 |

|

|

| 20.5 | Community Consultation and Stakeholder Relations |

| 269 |

|

|

| 20.6 | Permitting |

| 270 |

|

|

| 20.6.1 | Clean Water Act Section 404 |

| 270 |

|

|

| 20.6.2 | Other Federal and State Permits and Approvals |

| 273 |

|

|

| 20.7 | Closure |

| 276 |

|

|

| 21 | CAPITAL AND OPERATING COSTS |

| 278 |

|

|

| 21.1 | Introduction |

| 278 |

|

|

| 21.2 | Capital Cost Estimate |

| 278 |

|

|

| 21.2.1 | Estimate Responsibility |

| 278 |

|

|

| 21.2.2 | Capital Cost Summary |

| 278 |

|

|

| 21.2.3 | Direct Costs |

| 279 |

|

|

| 21.2.4 | Area 1000 – Mine Capital Cost |

| 280 |

|

|

| 21.2.5 | Area 2000 – Process Capital Costs |

| 280 |

|

|

| 21.2.6 | Area 3000 – Tailings and Water Management |

| 281 |

|

|

| 21.2.7 | Area 4000 – On-Site Infrastructure |

| 281 |

|

|

| 21.2.8 | Area 5000 – Off-Site Infrastructure |

| 283 |

|

|

| 21.2.9 | Area 6000 – Indirect Costs |

| 285 |

|

|

| 21.2.10 | Area 7000 – Owners Costs |

| 286 |

|

|

| 21.2.11 | Area 8000 – Contingency |

| 286 |

|

|

| Pebble Project | Page viii |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

|

| 21.2.12 | Sustaining Costs |

| 286 |

|

|

| 21.2.13 | Closure Costs |

| 287 |

|

| 21.3 | Operating Costs |

| 290 |

|

|

| 21.3.1 | Summary |

| 290 |

|

|

| 21.3.2 | General & Administrative |

| 290 |

|

|

| 21.3.3 | Power Supply Costs |

| 291 |

|

|

| 21.3.4 | Open Pit Mining |

| 291 |

|

|

| 21.3.5 | Processing Costs |

| 292 |

|

|

| 21.3.6 | Tailings Operation & Maintenance |

| 293 |

|

|

| 21.3.7 | Water Treatment Plants |

| 293 |

|

|

| 21.3.8 | Marine Terminal Facilities |

| 294 |

|

|

| 21.3.9 | Ferry |

| 294 |

|

|

| 21.3.10 | Access Roads |

| 295 |

|

|

| 22 | ECONOMIC ANALYSIS |

| 296 |

|

|

| 22.1 | Forward-Looking Information |

| 296 |

|

|

| 22.2 | Summary |

| 297 |

|

|

| 22.3 | Methodology |

| 299 |

|

|

| 22.4 | Inputs to the Cash Flow Models |

| 299 |

|

|

| 22.5 | Pre-Tax Financial Evaluation |

| 308 |

|

|

| 22.5.1 | Pre-Tax Evaluation Basis |

| 308 |

|

|

| 22.5.2 | Pre-Tax Financial Results |

| 308 |

|

|

| 22.6 | Post-Tax Financial Analysis |

| 310 |

|

|

| 22.6.1 | Overview |

| 310 |

|

|

| 22.6.2 | U.S. Federal and Alaska State Corporate Income Tax |

| 310 |

|

|

| 22.6.3 | Lake and Peninsula Borough Severance Tax |

| 310 |

|

|

| 22.6.4 | Alaska State Royalty Tax |

| 311 |

|

|

| 22.6.5 | Alaska Mining License Tax |

| 311 |

|

|

| 22.6.6 | Post-Tax Financial Results |

| 311 |

|

|

| 22.7 | Cash Flow |

| 311 |

|

|

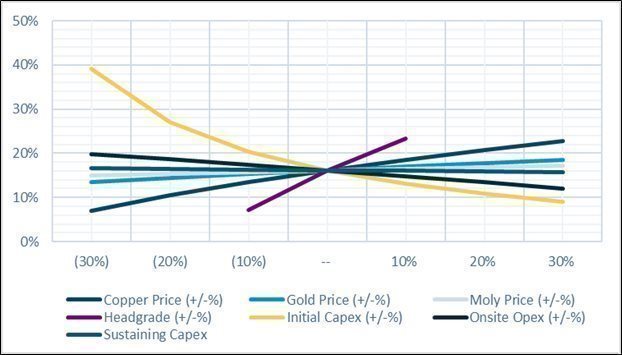

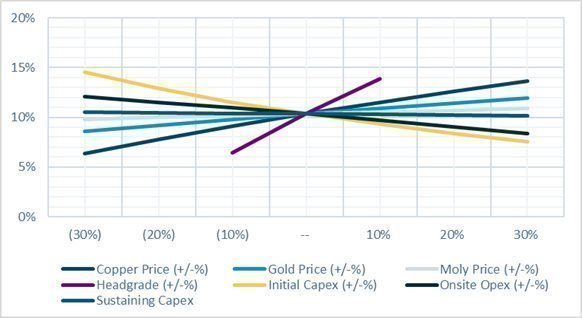

| 22.8 | Sensitivity Analysis |

| 313 |

|

|

| 22.8.1 | Copper and Gold Price Sensitivity Analysis |

| 315 |

|

|

| 22.8.2 | Sensitivity Analysis to Changes in Capital Costs |

| 315 |

|

|

| 22.8.3 | Potential Expansions |

| 318 |

|

|

| 23 | ADJACENT PROPERTIES |

| 323 |

|

|

| 24 | OTHER RELEVANT DATA AND INFORMATION |

| 324 |

|

|

| 25 | INTERPRETATION AND CONCLUSIONS |

| 325 |

|

|

| 25.1 | Introduction |

| 325 |

|

|

| 25.2 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements |

| 325 |

|

|

| 25.3 | Geology and Mineralization |

| 326 |

|

|

| 25.4 | Exploration, Drilling, and Analytical Data Collection in Support of Mineral Resource Estimation |

| 326 |

|

|

| Pebble Project | Page ix |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| 25.5 | Metallurgical Testwork |

| 327 |

|

|

| 25.6 | Mineral Resource Estimates |

| 327 |

|

|

| 25.7 | Mining Methods |

| 328 |

|

|

| 25.8 | Recovery Methods |

| 328 |

|

|

| 25.9 | Infrastructure |

| 329 |

|

|

| 25.10 | Environmental, Permitting, Closure and Social |

| 329 |

|

|

| 25.11 | Markets and Contracts |

| 331 |

|

|

| 25.12 | Capital and Operating Costs |

| 332 |

|

|

| 25.13 | Economic Analysis |

| 332 |

|

|

| 25.14 | Potential Expansions |

| 332 |

|

|

| 25.15 | Risks and Opportunities |

| 333 |

|

|

| 25.15.1 | Risks |

| 333 |

|

|

| 25.15.2 | Opportunities |

| 335 |

|

|

| 26 | RECOMMENDATIONS |

| 337 |

|

|

| 26.1 | Introduction |

| 337 |

|

|

| 26.2 | Metallurgical Testwork |

| 337 |

|

|

| 26.2.1 | Metallurgy Testwork |

| 337 |

|

|

| 26.2.2 | Grinding Circuit SAG Mill Size |

| 337 |

|

|

| 26.2.3 | Flotation Circuit Optimization |

| 337 |

|

|

| 26.2.4 | Estimated Metallurgical Program Cost |

| 338 |

|

|

| 26.3 | Mineral Resource Estimate |

| 338 |

|

|

| 26.3.1 | Update of Inferred Resource |

| 338 |

|

|

| 26.3.2 | Block Model Update |

| 338 |

|

|

| 26.3.3 | Additional Metals |

| 338 |

|

|

| 26.3.4 | Estimated Resource Update Cost |

| 338 |

|

|

| 26.4 | Mining Methods |

| 338 |

|

|

| 26.5 | Process and Infrastructure Engineering |

| 339 |

|

|

| 26.5.1 | Process Plant and Infrastructure |

| 339 |

|

|

| 26.5.2 | Access Road |

| 339 |

|

|

| 26.6 | Tailings and Waste Management |

| 340 |

|

|

| 27 | REFERENCES |

| 341 |

|

|

List of Tables

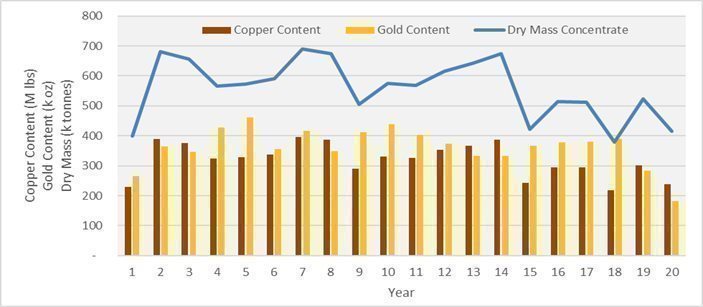

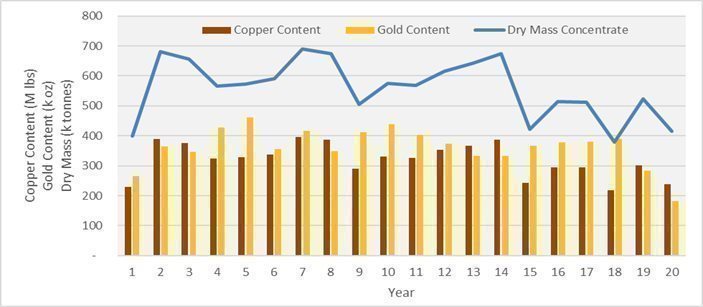

| Table 1‑1: | Projected Metallurgical Recoveries |

| 12 |

|

| Table 1‑2: | Pebble Deposit Mineral Resource Estimate at 0.3% Copper Equivalent Cut-off June 1, 2023 |

| 13 |

|

| Table 1‑3: | Proposed Project Production Summary |

| 16 |

|

| Table 1‑4: | Pebble Proposed Project – Capital Cost Estimate |

| 25 |

|

| Pebble Project | Page x |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

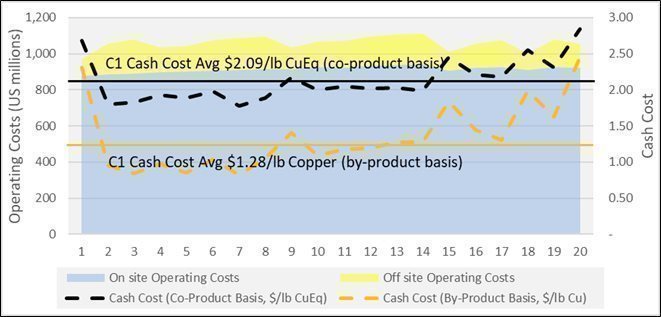

| Table 1‑5: | Summary of Annual Operating Cost Estimate |

| 26 |

|

| Table 1‑6: | Forecast Metal Price |

| 27 |

|

| Table 1‑7: | Proposed Project Cost and Tax Summary |

| 27 |

|

| Table 1‑8: | Forecast Financial Results for the Proposed Project - Base Case (Post Tax) |

| 28 |

|

| Table 1‑9: | Proposed Project Full Capital Case Financial Results |

| 29 |

|

| Table 1‑10: | Potential Expansions Metrics Information |

| 30 |

|

| Table 1‑11: | Potential Expansions Financial Results1 |

| 31 |

|

| Table 1‑12: | Summary Sensitivities of Adding a Gold Plant in Year 5 to Proposed Expansions |

| 31 |

|

| Table 1‑13: | Gold Plant Expansions Financial Results |

| 32 |

|

| Table 1‑14: | Cost Summary for the Recommended Future Work |

| 36 |

|

| Table 2‑1: | Report Contributors |

| 42 |

|

| Table 2‑2: | Units and Abbreviations |

| 45 |

|

| Table 2‑3: | Unit Abbreviations |

| 48 |

|

| Table 6‑1: | Teck Drilling on the Sill Prospect to the End of 1997 |

| 61 |

|

| Table 6‑2: | Teck Drilling on the Pebble Deposit to the End of 1997 |

| 61 |

|

| Table 6‑3: | Total Teck Drilling on the Property to the End of 1997 |

| 61 |

|

| Table 6‑4: | Teck Resource Estimates |

| 63 |

|

| Table 10‑1: | Summary of Drilling to December 2019 |

| 90 |

|

| Table 10‑2: | Summary of All Bulk Density (g/cm3) Results |

| 100 |

|

| Table 11‑1: | ALS Aqua Regia Digestion Multi-Element Analytical Method ME-ICP41 |

| 104 |

|

| Table 11‑2: | ALS Additional Analytical Procedures |

| 104 |

|

| Table 11‑3: | ALS Precious Metal Fire Assay Analytical Methods |

| 105 |

|

| Table 11‑4: | SGS Copper Analytical Method ICAY50 |

| 105 |

|

| Table 11‑5: | SGS Gold Fire Assay Analytical Methods |

| 105 |

|

| Table 11‑6: | SGS Aqua Regia Digestion Multi-Element Analytical Method ICP70 |

| 106 |

|

| Table 11‑7: | ALS Four Acid Digestion Multi-Element Analytical Method ME-ICP61a |

| 107 |

|

| Table 11‑8: | ALS Four Acid Digestion Multi-Element Analytical Method ME-MS61 |

| 108 |

|

| Table 11‑9: | ALS Mercury Aqua Regia Digestion Analytical Methods |

| 108 |

|

| Table 11‑10: | ALS Copper Speciation Analytical Methods |

| 109 |

|

| Table 11‑11: | BVCCL Four Acid Digestion Multi-Element Analytical Method MA270 |

| 109 |

|

| Table 11‑12: | BVCCL Precious Metal Fire Assay Analytical Method |

| 110 |

|

| Table 11‑13: | QA/QC Sample Types Used |

| 111 |

|

| Table 12‑1: | Holes Inspected for Spot Checks Against Core Logging and Assay Intervals |

| 125 |

|

| Table 13‑1: | Testwork Programs and Reports 2006 to 2010 |

| 130 |

|

| Table 13‑2: | Subsequent Testwork Programs and Reports, 2011 to 2014 |

| 132 |

|

| Table 13‑3: | Pebble West Rod Mill Data Comparison, SGS January 20122 |

| 133 |

|

| Table 13‑4: | Pebble West Ball Mill Data Comparison, SGS January 20122 |

| 133 |

|

| Table 13‑5: | Bond Low-Energy Impact Test Results, SGS January 2012 |

| 133 |

|

| Table 13‑6: | Major SMC Data Comparison on Pebble West Samples |

| 134 |

|

| Table 13‑7: | Major SMC Data Comparison on Pebble East Samples |

| 134 |

|

| Table 13‑8: | MacPherson Autogenous Grindability Test Results, SGS, January 2012 |

| 135 |

|

| Table 13‑9: | Summary of Locked-Cycle Test Variability Test Results |

| 138 |

|

| Pebble Project | Page xi |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| Table 13‑10: | Locked-Cycle Test Results on Pebble Variability Samples, SGS Lakefield, 2014 |

| 138 |

|

| Table 13‑11: | Locked-Cycle Test Results of Bulk Samples, SGS Lakefield, 2012 |

| 139 |

|

| Table 13‑12: | Locked-Cycle Test Results of Molybdenum Flotation |

| 143 |

|

| Table 13‑13: | Molybdenum Recovery |

| 143 |

|

| Table 13‑14: | Open Cycle Cleaner Flotation Test Results (Mo-F13, SGS Lakefield, 2012) |

| 144 |

|

| Table 13‑15: | LCT Cu-Mo Concentrate Major Elements Analysis Results – SGS Lakefield, 2014 |

| 149 |

|

| Table 13‑16: | LCT Cu Concentrate Major Elements Analysis Results – SGS Lakefield, 2014 |

| 149 |

|

| Table 13‑17: | LCT Mo Concentrate Major Elements Analysis Results – SGS 2014 |

| 150 |

|

| Table 13‑18: | Summary of Batch Recovery Change per 10 µm Primary Grind Size Reduction |

| 157 |

|

| Table 13‑19: | Change in Metal Recovery for 101µm Primary Grind Size Reduction, P80 150 µm to 300 µm |

| 157 |

|

| Table 13‑20: | Projected Metallurgical Recoveries Tetra Tech, 2021 |

| 158 |

|

| Table 14‑1: | Pebble Deposit Mineral Resource Estimate at 0.3% Copper Equivalent Cut-off June 1, 2023 |

| 160 |

|

| Table 14‑2: | Pebble Deposit Metal Domains |

| 161 |

|

| Table 14‑3: | Correlation Coefficients Between Rhenium and Other Elements |

| 165 |

|

| Table 14‑4: | Predicted and Actual Rhenium for 50 Withheld Validation Samples, at 10 ft Scale and at 50 ft Scale |

| 167 |

|

| Table 14‑5: | Pebble Deposit Assay Database Descriptive Global Statistics |

| 169 |

|

| Table 14‑6: | Pebble Deposit Capping Values |

| 176 |

|

| Table 14‑7: | Pebble Deposit Composite Mean Values |

| 177 |

|

| Table 14‑8: | Pebble Deposit Variogram Parameters |

| 178 |

|

| Table 14‑9: | Pebble Deposit Search Ellipse Parameters |

| 179 |

|

| Table 14‑10: | Pebble Deposit 2020 Block Model Parameters |

| 180 |

|

| Table 14‑11: | Pebble Deposit Domain Interpolation Data Sources |

| 180 |

|

| Table 14‑12: | Pebble Deposit Conceptual Pit Parameters |

| 182 |

|

| Table 16‑1: | Pit Optimization Parameters |

| 192 |

|

| Table 16‑2: | Haul Road Width |

| 196 |

|

| Table 16‑3: | Open Pit Design Results |

| 197 |

|

| Table 16‑4: | Mined Material – Preproduction Phase |

| 198 |

|

| Table 16‑5: | Mined Material – Production Phase |

| 198 |

|

| Table 16‑6: | Production Forecast |

| 198 |

|

| Table 16‑7: | Overburden and Waste Rock Mined Over the LOM |

| 200 |

|

| Table 16‑8: | Operational Delays per Shift |

| 202 |

|

| Table 16‑9: | Primary Equipment Requirements |

| 202 |

|

| Table 16‑10: | Support Equipment Requirements |

| 203 |

|

| Table 16‑11: | Ancillary Equipment Requirements |

| 204 |

|

| Table 16‑12: | Operator and Maintenance Staff on Payroll |

| 204 |

|

| Table 16‑13: | Maximum Number of Employees over the Life of Mine |

| 205 |

|

| Table 17‑1: | Major Process Design Criteria |

| 208 |

|

| Table 17‑2: | Reagent and Comminution Consumables Consumptions |

| 212 |

|

| Table 18‑1: | Overview of Pebble WTPs during Operations, Closure, and Post-Closure |

| 231 |

|

| Table 18‑2: | Site Parameters and Design Operating Conditions for Proposed Project Power Plant |

| 240 |

|

| Table 19‑1: | Metal Prices |

| 252 |

|

| Table 19‑2: | Average Metal Prices (Data from S&P Market Intelligence, July 2023) |

| 252 |

|

| Pebble Project | Page xii |

| NI 43-101 Technical Report Update and Preliminary Economic Assessment | August 21, 2023 |

|

|

|

|

| Table 19‑3: | Smelter and Refinery Terms |

| 254 |

|

| Table 20‑1: | Permits Required for the Pebble Project |

| 274 |

|

| Table 21‑1: | Summary of Capital Cost Estimate |

| 279 |

|

| Table 21‑2: | Mining Direct Capital Cost Estimate |

| 280 |

|

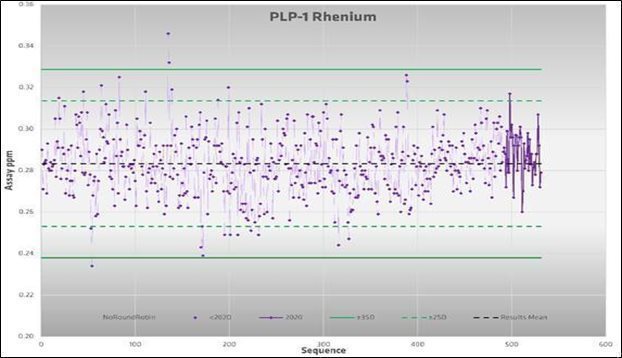

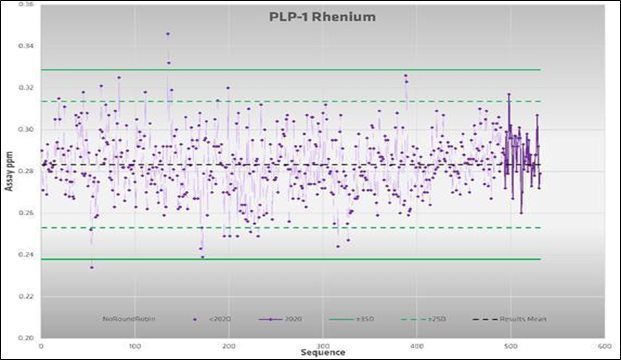

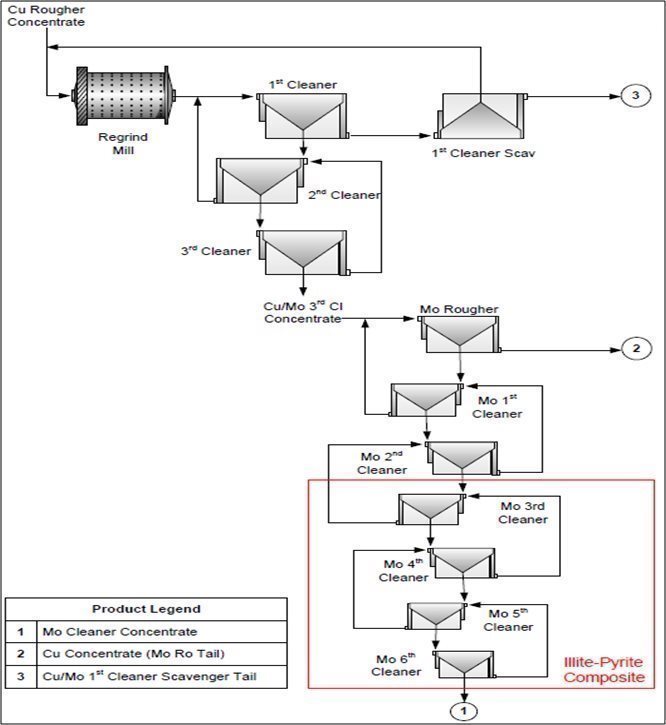

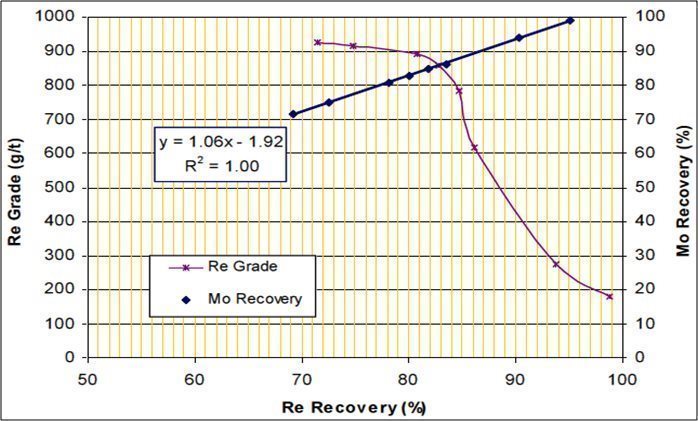

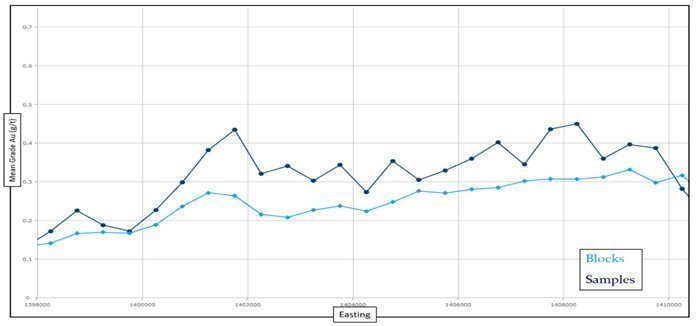

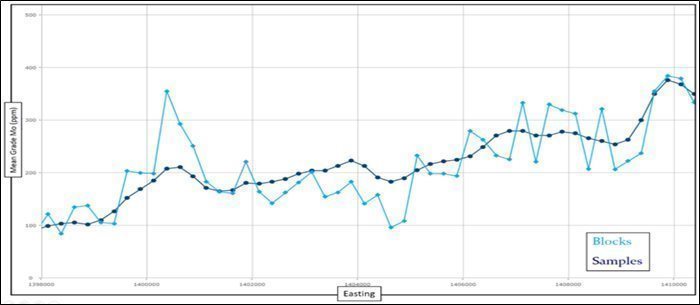

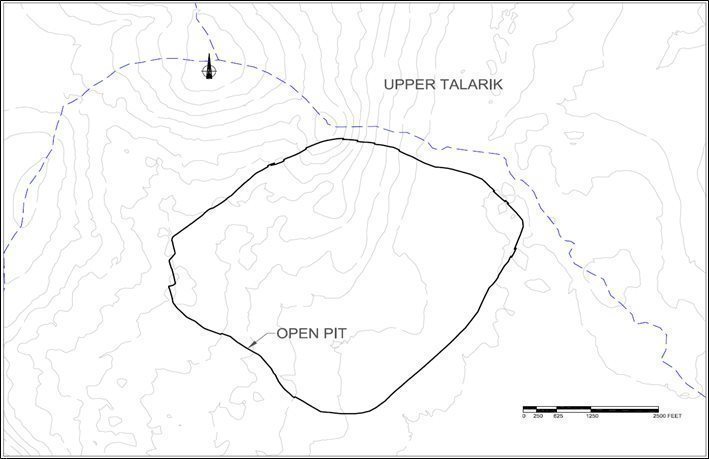

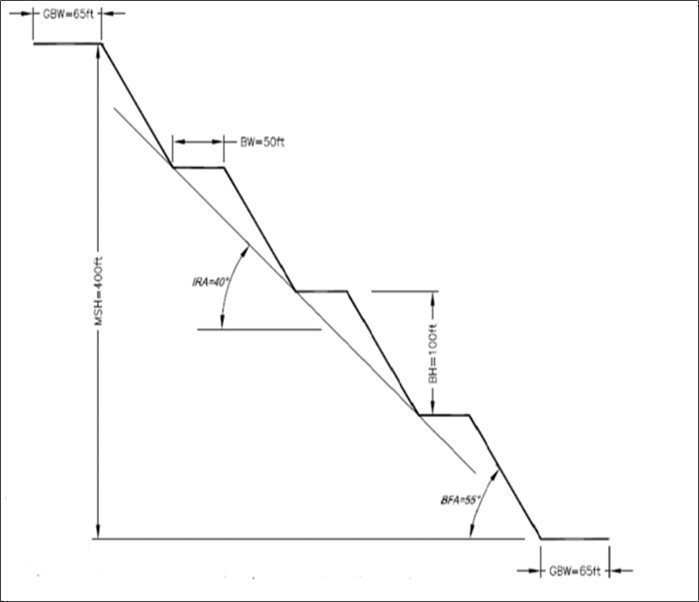

| Table 21‑3: | Feed Material Handling and Process Plant Capital Cost Summary |