UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 31, 2023

______________________________________

SOLITARIO RESOURCES CORP. |

(Exact name of registrant as specified in its charter) |

______________________________________

Colorado |

|

001-32978 |

|

84-1285791 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

4251 Kipling Street, Suite 390

Wheat Ridge, CO 80033

(Address of principal executive offices)

Registrant’s telephone number, including area code: (303) 534-1030 |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.01 par value |

|

XPL |

|

NYSE American |

Indicate by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement

On July 31, 2023, Solitario Resources Corp. (the “Company”) entered into a Stock Purchase Agreement (the “SPA”) with Newmont Overseas Exploration Ltd (“Newmont”). Pursuant to the SPA, Newmont agreed to purchase 4,166,667 shares of Company common stock for $2,500,000. Concurrently with the execution of the SPA the parties closed on the purchase and sale of the shares.

The Company made certain customary representations, warranties, and covenants in the SPA. The SPA is not intended to provide any other factual information about the Company. In addition, in the SPA, Newmont made various representations and warranties, including that Newmont purchased the shares for its own account and that Newmont is an accredited investor. The representations, warranties, and covenants contained in the SPA were made only for purposes of the SPA including the allocation of risk between the parties thereto, and as of specific dates, were solely for the benefit of the parties to the SPA, and may be subject to limitations agreed upon by the parties thereto.

Concurrently with the execution of the SPA, the Company and Newmont entered into an Investor Rights Agreement (the “Rights Agreement”). In the Rights Agreement: (i) subject to certain limitations and conditions, the Company granted Newmont the right to participate in certain equity offerings the Company may conduct from time to time, including with respect to certain sales of Company common stock that may be effected under the Company’s “At-the-Market” program when and if the Company were to sell 1.0 million or greater additional shares of its common stock under such a program; (ii) Newmont was granted a right of first offer with respect to certain transactions, such as a sale or joint venture, involving the Company’s Golden Crest Properties (as identified in the Rights Agreement); (iii) Newmont was granted a right of first refusal to participate in debt and non-equity financing transactions that involve the Golden Crest Properties; (iv) the Company agreed to provide Newmont certain information rights related to the Golden Crest Properties; and (v) Newmont was granted a one-time demand registration right with respect to the shares of Company common stock it purchased in the event that Newmont is deemed to beneficially own greater than 10% of the Company’s issued and outstanding shares of common stock. The Rights Agreement will terminate within 90 days of Newmont and its affiliates ceasing to own, in the aggregate, 8% or greater of the Company’s outstanding common stock.

Solitario expects to utilize the proceeds from the sale of the shares to Newmont to fund anticipated exploration activities at its Golden Crest, Lik and Florida Canyon projects as well as for general corporate purposes.

A copy of the SPA is filed with this report as Exhibit 10.1 and the summary of the SPA in this report is qualified by reference to that exhibit. A copy of the Rights Agreement is filed with this report as Exhibit 10.2 and the summary of the Rights Agreement in this report is qualified by reference to that exhibit.

Item 3.02 Unregistered Sales of Equity Securities

The shares of Company common stock sold to Newmont pursuant to the SPA as described in Item 1.01 above were sold in a private offering pursuant to the exemptions from registration of the Securities Act of 1933, as amended (the “Securities Act”) set forth in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder.

Item 7.01 Regulation FD Disclosure

On August 2, 2023, the Company issued a press release announcing the investment from Newmont. A copy of that press release is attached to this report as Exhibit 99.1.

The information furnished under this Item 7.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as shall be expressly set forth by reference to such filing.

| 2 |

Item 9.01 Financial Statements and Exhibits

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

104 |

|

Cover Page Interactive Data File (embedded with the Inline XBRL document) |

| 3 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

August 2, 2023

Solitario Resources Corp. |

|||

|

|

|

|

|

By: |

/s/ James R. Maronick |

|

|

|

James R. Maronick, Chief Financial Officer |

|

| 4 |

EXHIBIT 10.1

STOCK PURCHASE AGREEMENT

This STOCK PURCHASE AGREEMENT (this “Agreement”), is made as of July 31, 2023, by and between Solitario Resources Corp., a Colorado corporation (the “Company”), and Newmont Overseas Exploration Ltd., a Delaware corporation (the “Purchaser”).

In consideration of the mutual representations, warranties, covenants and agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows.

1. Purchase and Sale of Common Stock.

1.1 Sale and Issuance of Common Stock. Subject to the terms and conditions of this Agreement, the Purchaser hereby purchases, and the Company hereby sells and issues to the Purchaser, $2,500,000 in shares of the Company’s common stock, $0.01 par value (the “Common Stock”) for a per share price equal to the 90-day volume-weighted average price prior to the date of this Agreement, or 4,166,667 shares of Common Stock (the “Shares”).

1.2 Closing; Delivery. The purchase and sale of the Shares will take place remotely via the exchange of documents and signatures on the date of this Agreement (the “Closing”). At the Closing, (i) the Company will deliver to the Purchaser a certificate representing the Shares, or evidence of the book-entry issuance of the Shares, against payment by the Purchaser of the purchase price therefor by wire transfer to a bank account designated by the Company and (ii) each party will deliver the executed Investor Rights Agreement.

2. Defined Terms Used in this Agreement. In addition to the terms defined above and elsewhere in this Agreement, the following terms used in this Agreement will be construed to have the meanings set forth or referenced below.

“Action” has the meaning ascribed to such term in Section 3.13.

“Affiliate” means, with respect to any specified Person, any other Person who, directly or indirectly, controls, is controlled by, or is under common control with such Person.

“Annual Report” means the Company’s most recent Annual Report on Form 10-K filed with the SEC.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock Equivalent” has the meaning ascribed to such term in Section 3.7.

“Environmental Laws” has the meaning ascribed to such term in Section 3.33.

“Evaluation Date” has the meaning ascribed to such term in Section 3.21.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

| 1 |

“FCPA” means the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder.

“GAAP” means United States generally accepted accounting principles.

“Indebtedness” has the meaning ascribed to such term in Section 3.25.

“Intellectual Property Rights” has the meaning ascribed to such term in Section 3.18.

“Investor Rights Agreement” means that certain agreement, dated as of July [___], 2023, by and between the Company and the Purchaser.

“Liens” has the meaning ascribed to such term in Section 3.1.

“Material Adverse Effect” has the meaning ascribed to such term in Section 3.2.

“Material Permit” has the meaning ascribed to such term in Section 3.16.

“Money Laundering Laws” has the meaning ascribed to such term in Section 3.31.

“NYSE” means the New York American Stock Exchange.

“OFAC” means the Office of Foreign Assets Control of the U.S. Treasury Department.

“Person” means individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof).

“Proceeding” has the meaning ascribed to such term in Section 3.2.

“Required Approvals” has the meaning ascribed to such term in Section 3.5.

“SEC” means the United States Securities and Exchange Commission.

“SEC Reports” means the Annual Report and subsequent Quarterly Reports on Form 10‑Q filed by the Company with the SEC.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Subsidiary” means any significant subsidiary of the Company as defined in Rule 405 under the Securities Act.

“Transaction Agreements” means this Agreement and the Investor Rights Agreement and all respective ancillary documents thereto.

| 2 |

3. Representations and Warranties of the Company. The Company hereby represents and warrants to the Purchaser that the following is true and correct as of the date of the Closing, unless another date is specified:

3.1 Subsidiaries. All of the direct and indirect Subsidiaries of the Company are set forth on Exhibit 21.1 to the Company’s most recent Annual Report. The Company owns, directly or indirectly, all of the capital stock or other equity interests of each Subsidiary free and clear of any “Liens” (which for purposes of this Agreement will mean a lien, charge, security interest, encumbrance, right of first refusal, preemptive right or other restriction), and all the issued and outstanding shares of capital stock of each Subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities.

3.2 Organization and Qualification. The Company and each of the Subsidiaries is an entity duly incorporated or otherwise organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization (as applicable), with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. Neither the Company nor any Subsidiary is in violation or default of any of the provisions of its respective certificate or articles of incorporation, bylaws or other organizational or charter documents. Each of the Company and the Subsidiaries is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not reasonably be expected to result in (i) a material adverse effect on the legality, validity or enforceability of the Transaction Agreements, (ii) a material adverse change in the results of operations, assets, business, prospects or condition (financial or otherwise) of the Company and the Subsidiaries, taken as a whole, from that set forth in the SEC Reports, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under the Transaction Agreements (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no “Proceeding” (which for purposes of this Agreement will mean any action, claim, suit, investigation or proceeding (including, without limitation, an informal investigation or partial proceeding, such as a deposition), whether commenced or threatened) has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

3.3 Authorization and Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by the Transaction Agreements and otherwise to carry out its obligations under such agreements. The execution and delivery of the Transaction Agreements by the Company and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, the Board or its stockholders in connection herewith other than in connection with the Required Approvals. The Transaction Agreements have been duly executed and delivered by the Company and constitute the valid and binding obligations of the Company enforceable against the Company in accordance with their terms except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

| 3 |

3.4 No Conflicts. The execution, delivery and performance of the Transaction Agreements by the Company, the issuance and sale of the Shares and the consummation by the Company of the other transactions contemplated therein do not and will not (i) conflict with or violate any provision of the Company’s or any Subsidiary’s certificate or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company or any Subsidiary, or give to others any rights of termination, amendment, anti-dilution or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Company or Subsidiary debt or otherwise) or other understanding to which the Company or any Subsidiary is a party or by which any property or asset of the Company or any Subsidiary is bound or affected, or (iii) subject to the Required Approvals, conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company or a Subsidiary is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company or a Subsidiary is bound or affected, except in the case of each of clauses (ii) and (iii), such as could not reasonably be expected to be material.

3.5 Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other Person or other entity of any kind, including the NYSE, in connection with the execution, delivery and performance by the Company of the Transaction Agreements. other than (i) the filing with the Commission of a Form D and comparable notice fiilngs under applicable state blue sky laws and (ii) the filing of application(s) to and approval by the NYSE and the Toronto Stock Exchange for the listing of the Shares for trading thereon in the time and manner required thereby (collectively, the “Required Approvals”).

3.6 Issuance of Shares. The Shares are duly authorized and, when issued and paid for in accordance with this Agreement, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company. The Company has reserved from its duly authorized capital stock a sufficient number of shares of Common Stock issuable pursuant to this Agreement. The issuance by the Company of the Shares is being conducted pursuant to an exemption from registration under the Securities Act. Upon receipt of the Shares, the Purchaser will have good and marketable title to such Shares and the Shares will be tradable in compliance with Rule 144 of the Securities Act (or other applicable exemptions) or pursuant to a registration statement filed by the Company with the SEC, as provided in the Investor Rights Agreement.

| 4 |

3.7 Capitalization. The capitalization of the Company is as set forth in the SEC Reports. The Company has not issued any capital stock since its most recently filed periodic report under the Exchange Act, other than pursuant to the exercise of employee stock options under the Company’s stock option plans, the issuance of shares of Common Stock to employees pursuant to the Company’s employee stock purchase plan and pursuant to the conversion or exercise of securities exercisable, exchangeable or convertible into Common Stock (“Common Stock Equivalents”). No Person has any right of first refusal, preemptive right, right of participation, or any similar right to participate in the transactions contemplated by this Agreement. Except (i) pursuant to the Company’s stock option plan and (ii) pursuant to agreements or instruments filed as exhibits to the SEC Reports, there are no outstanding options, warrants, script rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exercisable or exchangeable for, or giving any Person any right to subscribe for or acquire, any shares of Common Stock, or contracts, commitments, understandings or arrangements by which the Company or any Subsidiary is or may become bound to issue additional shares of Common Stock or Common Stock Equivalents. The issuance and sale of the Shares will not obligate the Company to issue shares of Common Stock or other securities to any Person. There are no outstanding securities or instruments of the Company or any Subsidiary with any provision that adjusts the exercise, conversion, exchange or reset price of such security or instrument upon an issuance of securities by the Company or any Subsidiary. All of the outstanding shares of capital stock of the Company are validly issued, fully paid and nonassessable, have been issued in compliance with all federal and state securities laws, and none of such outstanding shares was issued in violation of any preemptive rights or similar rights to subscribe for or purchase securities. There are no stockholder agreements, investor rights agreements, voting agreements or other similar agreements with respect to the Company’s capital stock to which the Company is a party or, to the knowledge of the Company, between or among any of the Company’s stockholders.

3.8 Accuracy of SEC Reports. The SEC Reports, when they were filed with the SEC, conformed in all material respects to the requirements of the Exchange Act and the rules thereunder, and none of the SEC Reports, when they were filed with the SEC, contained any untrue statement of a material fact or omitted to state a material fact necessary to make the statements therein, in light of the circumstances under which they were made not misleading.

3.9 SEC Compliance. The Company has complied in all material respects with requirements to file all reports, schedules, forms, statements and other documents required to be filed by it under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof on a timely basis or has received a valid extension of such time of filing and has filed any such SEC Reports prior to the expiration of any such extension.

3.10 Financial Statements. The consolidated financial statements included in the SEC Reports comply in all material respects with applicable accounting requirements and the rules and regulations of the SEC with respect thereto as in effect at the time of filing or as amended or corrected in a subsequent filing. Such financial statements have been prepared in accordance with GAAP, except as may be otherwise specified in such financial statements or the notes thereto and except that unaudited financial statements may not contain all footnotes required by GAAP, and fairly present in all material respects the financial position of the Company and its consolidated subsidiaries as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, immaterial, year-end audit adjustments.

3.11 Accountants. The Company’s outside accountants are Plante & Moran, PLLC or otherwise as identified in the SEC Reports. To the knowledge of the Company, such accountants, which the Company expects would be able to express their opinion with respect to the financial statements to be included in the Company’s next Annual Report on Form 10-K, are a registered public accounting firm as required by the Securities Act.

| 5 |

3.12 Material Adverse Events. Since the date of the latest audited financial statements included within the SEC Reports, except as specifically disclosed in a subsequent SEC Report filed prior to the date hereof, (i) there has been no event, occurrence or development that has had or that could reasonably be expected to result in a Material Adverse Effect, (ii) the Company has not incurred any liabilities (contingent or otherwise) other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice and (B) liabilities reflected in the Company’s financial statements, (iii) the Company has not altered its method of accounting, (iv) the Company has not declared or made any dividend or distribution of cash or other property to its stockholders or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock and (v) the Company has not issued any equity securities to any officer, director or Affiliate, except pursuant to existing Company stock option plans. The Company does not have pending before the SEC any request for confidential treatment of information. No event, liability or development has occurred or exists with respect to the Company or its Subsidiaries or their respective business, properties, operations or financial condition, that would be required to be disclosed by the Company under applicable securities laws at the time this representation is deemed made that has not been publicly disclosed at least 1 Trading Day prior to the date that this representation is deemed made.

3.13 Litigation. There is no action, suit, inquiry, notice of violation, Proceeding or investigation pending or, to the knowledge of the Company, threatened against or affecting the Company, any Subsidiary or any of their respective properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign) (collectively, an “Action”) which (i) adversely affects or challenges the legality, validity or enforceability of the Transaction Agreements or the Shares or (ii) could, if there were an unfavorable decision, reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any Subsidiary, nor, to the knowledge of the Company, any director or officer thereof, is or has been the subject of any Action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and to the knowledge of the Company, there is not pending or contemplated, any investigation by the SEC involving the Company or any current or former director or officer of the Company. The SEC has not issued any stop order or other order suspending the effectiveness of any registration statement filed by the Company or any Subsidiary under the Exchange Act or the Securities Act.

3.14 Labor Relations. No material labor dispute exists or, to the knowledge of the Company, is imminent with respect to any of the employees of the Company which could reasonably be expected to result in a Material Adverse Effect. None of the Company’s or its Subsidiaries’ employees is a member of a union that relates to such employee’s relationship with the Company, and neither the Company nor any of its Subsidiaries is a party to a collective bargaining agreement, and the Company and its Subsidiaries believe that their relationships with their employees are good. No executive officer, to the knowledge of the Company, is, or is now expected to be, in violation of any material term of any employment contract, confidentiality, disclosure or proprietary information agreement or non-competition agreement, or any other contract or agreement or any restrictive covenant, and the continued employment of each such executive officer does not subject the Company or any of its Subsidiaries to any liability with respect to any of the foregoing matters. The Company and its Subsidiaries are in compliance with all U.S. federal, state, local and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to be in compliance could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

| 6 |

3.15 No Existing Defaults. Neither the Company nor any Subsidiary (i) is in default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a default by the Company or any Subsidiary under), nor has the Company or any Subsidiary received notice of a claim that it is in default under or that it is in violation of, any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound (whether or not such default or violation has been waived), (ii) is in violation of any order of any court, arbitrator or governmental body, or (iii) is or has been in violation of any statute, rule or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws relating to taxes, environmental protection, occupational health and safety, product quality and safety and employment and labor matters, except in each case as could not reasonably be expected to result in a Material Adverse Effect.

3.16 Regulatory Permits. The Company and the Subsidiaries possess all certificates, authorizations and permits issued by the appropriate federal, state, local or foreign regulatory authorities necessary to conduct their respective businesses as described in the SEC Reports, except where the failure to possess such permits could not reasonably be expected to result in a Material Adverse Effect (“Material Permits”), and neither the Company nor any Subsidiary has received any notice of proceedings relating to the revocation or modification of any Material Permit.

3.17 Title to Assets. The Company and the Subsidiaries have good and marketable title in fee simple to all real property owned by them that is material to the business of the Company and the Subsidiaries and good and marketable title in all personal property owned by them that is material to the business of the Company and the Subsidiaries, in each case free and clear of all Liens, except for Liens as do not materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property by the Company and the Subsidiaries and Liens for the payment of federal, state or other taxes, the payment of which is neither delinquent nor subject to penalties. Any real property and facilities held under lease by the Company and the Subsidiaries are held by them under valid, subsisting and enforceable leases of which the Company and the Subsidiaries are in material compliance. The Company has good and valid title (or leasehold interest) to the unpatented mining claims comprising the real property, subject only to the paramount title of the United States in the underlying minerals. The Company has not received any written notice of termination or cancellation of any unpatented mining claim. With respect to the unpatented mining claims: (A) all affidavits of assessment work, including fee payments required to maintain such unpatented mining claims in good standing through the most recent assessment year, have been properly and timely recorded, filed and paid with appropriate governmental agencies; (B) the Company is the sole owner and has the exclusive possession of the unpatented mining claims free and clear of all Liens, and subject to the paramount title of the United States; and (C) except for customary buffer and perimeter areas, there are no senior third-party unpatented mining claims that conflict with the unpatented mining claims.

| 7 |

3.18 Intellectual Property. The Company and the Subsidiaries have, or have rights to use, all patents, patent applications, trademarks, trademark applications, service marks, trade names, trade secrets, inventions, copyrights, licenses and other similar intellectual property rights necessary or material for use in connection with their respective businesses as described in the SEC Reports and which the failure to so have could reasonably be expected to have a Material Adverse Effect (collectively, the “Intellectual Property Rights”). Neither the Company nor any Subsidiary has received, since the date of the latest audited financial statements included within the SEC Reports, a notice (written or otherwise) that the Intellectual Property Rights violate or infringe upon the rights of any Person. All such Intellectual Property Rights are enforceable (other than patent and trademark applications) and to the knowledge of the Company there is no existing infringement by another Person of any of the Intellectual Property Rights. The Company and its Subsidiaries have taken reasonable security measures to protect the secrecy, confidentiality and value of all of their Intellectual Property Rights, except where failure to do so could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

3.19 Insurance. The Company and the Subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as the Company determines to be prudent and customary for companies of similar size as the Company in the businesses in which the Company and the Subsidiaries are engaged. To the knowledge of the Company, such insurance contracts and policies are accurate and complete. Neither the Company nor any Subsidiary has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business without a significant increase in cost.

3.20 Affiliate Transactions. Except as set forth in the SEC Reports, none of the officers or directors of the Company and, to the knowledge of the Company, none of the employees of the Company is presently a party to any transaction with the Company or any Subsidiary (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of the Company, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner, in each case in excess of $120,000, other than (i) for payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on behalf of the Company and (iii) for other employee benefits, including stock option agreements under any stock option plan of the Company.

3.21 Internal Controls. The Company and the Subsidiaries maintain a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. The Company has established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the Company and designed such disclosure controls and procedures to ensure that information required to be disclosed by the Company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. The Company’s certifying officers have evaluated the effectiveness of the Company’s disclosure controls and procedures as of the end of the period covered by the Company’s most recently filed periodic report under the Exchange Act (such date, the “Evaluation Date”). The Company presented in its most recently filed periodic report under the Exchange Act the conclusions of the certifying officers about the effectiveness of the disclosure controls and procedures based on their evaluations as of the Evaluation Date. Since the Evaluation Date, there have been no changes in the Company’s internal control over financial reporting (as such term is defined in the Exchange Act) that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

| 8 |

3.22 Finder’s Fees. No brokerage or finder’s fees or commissions are or will be payable by the Company to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other Person with respect to the transactions contemplated by this Agreement. The Purchaser will have no obligation with respect to any fees or with respect to any claims made by or on behalf of other Persons for fees of a type contemplated in this Section that may be due in connection with the transactions contemplated by this Agreement.

3.23 Listing and Maintenance Requirements. Subject to the submission and approval of an additional listing application with the NYSE, the issuance and sale of the Shares as contemplated in this Agreement does not contravene the rules and regulations of the NYSE. The Common Stock is registered pursuant to Section 12(b) or 12(g) of the Exchange Act, and the Company has taken no action designed to, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act nor has the Company received any notification that the SEC is contemplating terminating such registration. The Company has not, in the 12 months preceding the date hereof, received notice from the NYSE to the effect that the Company is not in compliance with the listing or maintenance requirements of the NYSE.

3.24 Application of Takeover Protections. Except as set forth in the SEC Reports, the Company and its Board have taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Company’s charter documents or the laws of its state of incorporation that is or could become applicable to the purchasers of the Shares.

3.25 Solvency. Based on the financial condition of the Company as of the date hereof, (i) the Company’s fair saleable value of its assets exceeds the amount that will be required to be paid on or in respect of the Company’s existing debts and other liabilities (including known contingent liabilities) as they mature, (ii) the Company’s assets do not constitute unreasonably small capital to carry on its business as now conducted and as proposed to be conducted including its capital needs taking into account the particular capital requirements of the business conducted by the Company, and projected capital requirements and capital availability thereof, and (iii) the current cash flow of the Company, together with the proceeds the Company would receive, were it to liquidate all of its assets, after taking into account all anticipated uses of the cash, would be sufficient to pay all amounts on or in respect of its debt when such amounts are required to be paid. The Company does not intend to incur debts beyond its ability to pay such debts as they mature (taking into account the timing and amounts of cash to be payable on or in respect of its debt) for the next 12 months. The SEC Reports set forth as of the dates thereof all outstanding secured and unsecured Indebtedness of the Company or any Subsidiary, or for which the Company or any Subsidiary has commitments. For the purposes of this Agreement, “Indebtedness” will mean (a) any liabilities for borrowed money or amounts owed in excess of $50,000 (other than accrued liabilities and trade accounts payable incurred in the ordinary course of business), (b) all guaranties, endorsements and other contingent obligations in respect of indebtedness of others, whether or not the same are or should be reflected in the Company’s balance sheet (or the notes thereto), except guaranties by endorsement of negotiable instruments for deposit or collection or similar transactions in the ordinary course of business; and (c) the present value of any lease payments in excess of $50,000 due under leases required to be capitalized in accordance with GAAP. Neither the Company nor any Subsidiary is in default with respect to any Indebtedness.

| 9 |

3.26 Tax Status. Except for matters that would not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect, the Company and each Subsidiary (i) have made or filed all necessary United States federal, and state income and all foreign income and franchise tax returns and have paid or accrued all taxes shown as due thereon, and the Company has no knowledge of a tax deficiency which has been asserted or threatened against the Company or any report and declaration required by any jurisdiction to which it is subject, (ii) have paid all taxes and other governmental assessments and charges that are material in amount, shown or determined to be due on such returns, reports and declarations and (iii) have set aside on its books provision reasonably adequate for the payment of all material taxes for periods subsequent to the periods to which such returns, reports or declarations apply. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company or of any Subsidiary know of no basis for any such claim.

3.27 Foreign Corrupt Practices. Neither the Company, nor to the knowledge of the Company, any agent or other person acting on behalf of the Company, has (i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by the Company (or made by any person acting on its behalf of which the Company is aware) which is in violation of law, or (iv) violated in any material respect any provision of the Foreign Corrupt Practices Act of 1977, as amended.

3.28 Office of Foreign Assets Control. Neither the Company nor any Subsidiary nor, to the Company's knowledge, any director, officer, agent, employee or affiliate of the Company or any Subsidiary is currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”).

3.29 U.S. Real Property Holding Corporation. The Company is not and has never been a U.S. real property holding corporation within the meaning of Section 897 of the Internal Revenue Code of 1986, as amended, and the Company will so certify upon the Purchaser’s request.

| 10 |

3.30 Bank Holding Company Act. Neither the Company nor any of its Subsidiaries or Affiliates is subject to the Bank Holding Company Act of 1956, as amended (the “BHCA”) and to regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Neither the Company nor any of its Subsidiaries or Affiliates owns or controls, directly or indirectly, five percent (5%) or more of the outstanding shares of any class of voting securities or twenty-five percent or more of the total equity of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve. Neither the Company nor any of its Subsidiaries or Affiliates exercises a controlling influence over the management or policies of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve.

3.31 Money Laundering. The operations of the Company and its Subsidiaries are and have been conducted at all times in compliance with applicable financial record-keeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, applicable money laundering statutes and applicable rules and regulations thereunder (collectively, the “Money Laundering Laws”), and no Action or Proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any Subsidiary with respect to the Money Laundering Laws is pending or, to the knowledge of the Company or any Subsidiary, threatened.

3.32 Liabilities. The Company and its Subsidiaries, on a consolidated basis, do not have any material liabilities or obligations, direct or contingent (including any off-balance sheet obligations or any “variable interest entities” within the meaning of the Financial Accounting Standards Board’s Accounting Standards Codification Topic 810), which are not disclosed in the SEC Reports.

3.33 Compliance with Environmental Laws. Except as disclosed in the SEC Reports, neither the Company nor any of its Subsidiaries is in violation of any statute, rule, regulation, decision or order of any governmental agency or body or any court, relating to the use, disposal or release of hazardous or toxic substances or relating to the protection or restoration of the environment or human exposure to hazardous or toxic substances (collectively, “Environmental Laws”), operates any real property contaminated with any substance that is subject to any Environmental Laws, is liable for any off-site disposal or contamination pursuant to any Environmental Laws, or is subject to any claim relating to any Environmental Laws, which violation, contamination, liability or claim would individually or in the aggregate reasonably be expected to have a Material Adverse Effect; and the Company is not aware of any pending investigation which might lead to such a claim.

3.34 Registration Rights. Except as provided in the Investor Rights Agreement and as described in the At the Market Offering Agreement dated February 2, 2021 between the Company and H.C. Wainwright & Co., LLC, the Company has not granted or agreed to grant, and is not under any obligation to provide, any rights to register under the Securities Act any of its presently outstanding securities or any of its securities that may be issued subsequently.

| 11 |

4. Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Company that the following is true and correct as of the date of the Closing:

4.1 Authorization. The Purchaser has full power and authority to enter into the Transaction Agreements. The Transaction Agreements, when executed and delivered by the Purchaser, will constitute valid and legally binding obligations of the Purchaser, enforceable against the Purchaser in accordance with their terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance and any other laws of general application affecting enforcement of creditors’ rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

4.2 Purchase Entirely for Own Account. This Agreement is made with the Purchaser in reliance upon the Purchaser’s representation to the Company, which, by the Purchaser’s execution of this Agreement, the Purchaser hereby confirms that the Shares to be acquired by the Purchaser will be acquired for investment for the Purchaser’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that the Purchaser has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, the Purchaser further represents that the Purchaser does not presently have any contract, undertaking, agreement or arrangement with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to any of the Shares. The Purchaser has not been formed for the specific purpose of acquiring the Shares.

4.3 Disclosure of Information. The Purchaser has had an opportunity to discuss the Company’s business, management, financial affairs and the terms and conditions of the offering of the Shares with the Company’s management and has had access to the SEC Reports to inform its decision to purchase the Shares. The foregoing, however, does not limit or modify the representations and warranties of the Company in this Agreement or the right of the Purchaser to rely thereon.

4.4 Restricted Securities. The Purchaser understands that the Shares have not been, and will not be, registered under the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act which depends on, among other things, the bona fide nature of the investment intent and the accuracy of the Purchaser’s representations as expressed herein. The Purchaser understands that the Shares are “restricted securities” under applicable U.S. federal and state securities laws and that, pursuant to these laws, the Purchaser must hold the Shares indefinitely unless they are registered with the SEC and qualified by state authorities, or an exemption from such registration and qualification requirements is available. The Purchaser acknowledges that, except as set forth in the Investor Rights Agreement, the Company has no obligation to register or qualify the Shares for resale. The Purchaser further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Shares, and on requirements relating to the Company which are outside of the Purchaser’s control, and which the Company is under no obligation to satisfy, except as set forth in the Investor Rights Agreement. The Purchaser represents that it is familiar with SEC Rule 144, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

| 12 |

4.5 Legends. The Purchaser understands that the Shares, may be notated with one or all of the following legends:

“THE SHARES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH TRANSFER MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN EXEMPTION FROM SUCH REGISTRATION REQUIREMENTS.” and

Any legend required by the securities laws of any state to the extent such laws are applicable to the Shares represented by the certificate, instrument, or book entry so legended.

4.6 Accredited Investor. The Purchaser is an “accredited investor” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act.

4.7 No General Solicitation. Neither the Purchaser, nor any of its officers, directors, employees, agents, stockholders or partners has either directly or indirectly, including, through a broker or finder (a) engaged in any general solicitation, or (b) published any advertisement in connection with the offer and sale of the Shares.

4.8 Principal Office. The principal office of the Purchaser is identified in the address of the Purchaser set forth in Section 5.5 below.

5. Miscellaneous.

5.1 Survival of Warranties; Indemnification. Unless otherwise set forth in this Agreement, the representations and warranties of the Company and the Purchaser contained in or made pursuant to this Agreement will survive the Closing and will in no way be affected by any investigation or knowledge of the subject matter thereof made by or on behalf of the Purchaser or the Company. From and after the Closing, each party will defend, indemnify, and hold harmless the other party and their respective Affiliates, directors, officers, employees, and agents from and against any and all liabilities, obligations, claims, contingencies, Taxes, fines, deficiencies, demands, assessments, losses (including diminution in value), damages (including incidental and consequential damages), costs and expenses, including, without limitation, all corrective and remedial actions, all court costs and reasonable attorneys’ fees, and all reasonable amounts paid in investigation, defense, or settlement of the foregoing) that constitute, or arise out of or in connection with such party’s: (i) breach of any representation or warranty provided in the Transaction Agreements, in each case without giving effect to any qualification as to materiality, Material Adverse Effect or words of similar import for purposes of determining whether there has been a breach or inaccuracy or the amount of any loss; or (ii) any default in the performance or observance of any covenant or agreement under the Transaction Agreements.

| 13 |

5.2 Successors and Assigns. The terms and conditions of this Agreement will inure to the benefit of and be binding upon the respective successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

5.3 Governing Law. This Agreement will be governed by the internal law of the State of Colorado, without regard to conflict of law principles that would result in the application of any law other than the law of the State of Colorado. The parties (a) hereby irrevocably and unconditionally submit to the jurisdiction of the state courts of Colorado and to the jurisdiction of the United States District Court for the District of Colorado for the purpose of any suit, action or other proceeding arising out of or based upon this Agreement, (b) agree not to commence any suit, action or other proceeding arising out of or based upon this Agreement except in the state courts of Colorado or the United States District Court for the District of Colorado, and (c) hereby waive, and agree not to assert, by way of motion, as a defense, or otherwise, in any such suit, action or proceeding, any claim that it is not subject personally to the jurisdiction of the above-named courts, that its property is exempt or immune from attachment or execution, that the suit, action or proceeding is brought in an inconvenient forum, that the venue of the suit, action or proceeding is improper or that this Agreement or the subject matter hereof may not be enforced in or by such court.

5.4 Counterparts. This Agreement may be executed in more than one counterpart, each of which will be deemed an original, but all of which together will constitute one and the same instrument. Counterparts may be delivered via electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes.

5.5 Notices. All notices and other communications given or made pursuant to this Agreement will be in writing and will be deemed effectively given upon the earlier of actual receipt, or (a) personal delivery to the party to be notified, (b) when sent, if sent by electronic mail during normal business hours of the recipient, and if not sent during normal business hours, then on the recipient’s next business day, (c) five (5) days after having been sent by registered or certified mail, return receipt requested, postage prepaid, or (d) one (1) business day after deposit with a nationally recognized overnight courier, freight prepaid, specifying next business day delivery, with written verification of receipt. All communications will be sent to the respective parties at their address as set forth below, or to such e-mail address, or address as subsequently modified by written notice given in accordance with this Section.

|

| if to the Company: |

| 4251 Kipling St., Suite 390 Wheat Ridge, Colorado 80033 |

|

|

|

| Attn: Christopher Herald E-mail: CHerald@solitariocorp.com

|

|

| with a copy to (which will not constitute notice): |

| Dykema Gossett PLLC 111 E. Kilbourn Ave., Suite 1050 Milwaukee, WI 53202 Attn: Peter F. Waltz, Esq. Email@Pwaltz@Dykema.com |

| 14 |

|

| if to the Purchaser: |

| c/o Newmont Corporation 6900 E. Layton Ave., Suite 700 Denver, Colorado 80237 Attn: Legal Department Email: Legalnotices@newmont.com |

|

|

with a copy to (which will not constitute notice): |

|

Holland & Hart LLP 555 17th Street, Suite 3200 Denver, CO 80202 Attention: Amy L. Bowler, Esq. Email: abowler@hollandhart.com |

5.6 Fees and Expenses. Each party will bear its own costs and expenses relating to the preparation and execution of this Agreement.

5.7 Attorneys’ Fees. If any action at law or in equity (including, arbitration) is necessary to enforce or interpret the terms of this Agreement, the prevailing party will be entitled to reasonable attorneys’ fees, costs and necessary disbursements in addition to any other relief to which such party may be entitled.

5.8 Amendments and Waivers. Any term of this Agreement may be amended, terminated or waived only with the written consent of the parties.

5.9 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction. Upon such determination that any term or other provision is invalid, illegal or unenforceable, the parties will negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in a mutually acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated to the greatest extent possible.

5.10 Delays or Omissions. No delay or omission to exercise any right, power or remedy accruing to any party under this Agreement, upon any breach or default of any other party under this Agreement, will impair any such right, power or remedy of such non-breaching or non-defaulting party nor will it be construed to be a waiver of any such breach or default, or an acquiescence therein, or of or in any similar breach or default thereafter occurring; nor will any waiver of any single breach or default be deemed a waiver of any other breach or default theretofore or thereafter occurring. Any waiver, permit, consent or approval of any kind or character on the part of any party of any breach or default under this Agreement, or any waiver on the part of any party of any provisions or conditions of this Agreement, must be in writing and will be effective only to the extent specifically set forth in such writing. All remedies, either under this Agreement or by law or otherwise afforded to any party, will be cumulative and not alternative.

5.11 Entire Agreement. This Agreement (including the exhibits hereto) and the Investor Rights Agreement constitute the full and entire understanding and agreement between the parties with respect to the subject matter hereof, and any other written or oral agreement relating to the subject matter hereof existing between the parties are expressly canceled.

5.12 No Commitment for Additional Financing. The Company acknowledges and agrees that the Purchaser has not made any representation, undertaking, commitment, or agreement to provide or assist the Company in obtaining any financing, investment, or other assistance, other than the purchase of the Shares as set forth herein and subject to the conditions set forth herein. The Purchaser will have the right, in its sole and absolute discretion, to refuse or decline to participate in any other financing of or investment in the Company, and will have no obligation to assist or cooperate with the Company in obtaining any financing, investment, or other assistance.

[Signature page follows]

| 15 |

IN WITNESS WHEREOF, the parties have executed this Stock Purchase Agreement as of the date first written above.

|

| COMPANY: |

|

|

|

|

|

|

|

|

| SOLITARIO RESOURCES CORP. |

|

|

|

|

|

|

|

|

| By: | /s/ Christopher E Herald |

|

|

| Name: | Chris Herald |

|

|

| Title: | Chief Executive Officer and President |

|

|

| PURCHASER: |

|

|

|

|

|

|

|

|

| NEWMONT OVERSEAS EXPLORATION LTD. |

|

|

|

|

|

|

|

|

| By: | /s/ Mark Ebel |

|

|

| Name: | Mark Ebel |

|

|

| Title: | Vice President |

|

[Signature Page to Stock Purchase Agreement]

| 16 |

EXHIBIT 10.2

INVESTOR RIGHTS AGREEMENT

This INVESTOR RIGHTS AGREEMENT (this “Agreement”) is made as of July 31, 2023 , by and between Solitario Resources Corp., a Colorado corporation (the “Company”), and Newmont Overseas Exploration Ltd., a Delaware corporation (the “Investor”).

RECITALS

WHEREAS, pursuant to a stock purchase agreement between the Company and the Investor, executed as of the same date as, and contingent on, this Agreement, the Investor is acquiring $2,500,000 in shares (the “Shares”) of Company’s common stock, $0.01 par value (the “Common Stock”).

WHEREAS, in consideration for its investment in the Shares, the Investor requires, and the Company is willing to provide, the investor rights described below.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

1. Preemptive Rights.

1.1 If the Company at any time, or from time-to-time, makes a private or public offering of equity securities (including Common Stock, preferred stock, or other equity securities), or any securities, options, warrants or debt that are convertible or exchangeable into equity securities or that include an equity component (including any derivative or hybrid security) for the purposes of raising capital in the form of cash proceeds to the Company (any such security, a “New Security”), the Investor has the right to acquire from the Company for the same price (net of underwriting discounts or sales commissions) and on the same terms as such securities are proposed to be offered to others, up to the amount of New Securities plus 1%, but in no case more than an amount that would result in the Investor owning more than 19.9% of the outstanding Common Stock of the Company; provided that such preemptive rights will not apply to (i) compensatory awards made under, or issuances pursuant to, the Company’s equity incentive plans approved by shareholders, or (ii) sales from time-to-time under the Company’s “At-the-Market” program (“ATM”) that is registered with the Securities and Exchange Commission (the “SEC”), including any extension of the existing ATM program or a replacement ATM program.

1.2 With respect to sales under the existing or any future ATM program :

(1) if the Company sells (or causes to be sold), in the aggregate, 1,000,000 or more shares of Common Stock, whether in a single transaction or series of transactions (the “ATM sale threshold”), the Investor will have the right, but not the obligation, to acquire from the Company up to that number of shares of Common Stock that would result in the Investor’s ownership being equal to 9.96%. After crossing the initial or subsequent ATM sale threshold, the measurement period for a new ATM sale threshold will commence. Any time the Company crosses a subsequent ATM sale threshold, the Investor will have the right, but not the obligation, to acquire additional shares as set forth in this Section 1.2.

(2) The Company will use reasonable best efforts to provide the Investor at least 30 days advanced notice that the Company is reasonably likely to cross an ATM sale threshold. Within 10 days after the ATM sale threshold has been crossed, the Company will provide a report (the “ATM Report”) to the Investor regarding the sale amounts and sale prices for all ATM sales that caused the applicable ATM sale threshold to be crossed, as well as the volume-weighted average price (“VWAP”) for all such sales. Within 15 days after receiving the ATM Report, the Investor will provide written notice regarding its intent (subject to approval by the Investor’s board of directors), if any, to acquire additional shares for the VWAP (the “Acquisition Notice”). To the extent the Investor exercises its right to acquire additional shares, the parties will promptly close the sale of additional shares to the Investor, but in any event, within no more than 30 days after the Investor provides the Acquisition Notice to the Company.

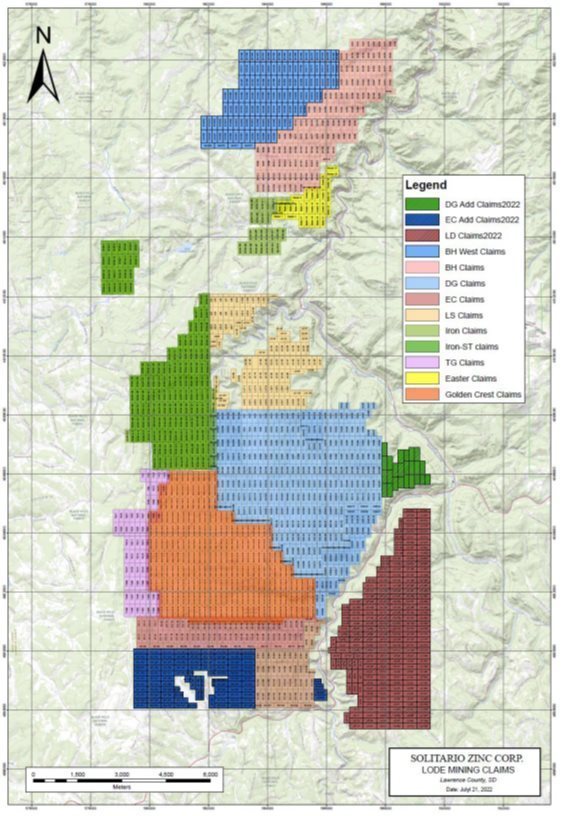

2. Right of First Offer – Property Transactions. Solely with respect to the “Golden Crest Properties” identified on Exhibit A hereto (or Company subsidiaries that own Golden Crest Properties), the Company will provide the Investor with the right of first offer with respect to any direct or indirect sale, option, lease, mortgage, joint-venture or other disposition of all or a portion of the Company’s interest in any of the Golden Crest Properties; provided that this right will not apply to any transaction that constitutes a change of greater than 50% of the voting control of the Company, a sale of substantially all of the Company’s assets, a sale of the Company as a whole, or a financing described in Section 3.

3. Right of First Refusal – Financing. Solely with respect to the Golden Crest Properties (or Company subsidiaries that own the Golden Crest Properties), the Investor will be granted a right of first refusal to provide or participate in any debt or non-equity financing, including but not limited to, tolling, any royalty in excess of 2.5%, or streaming transactions.

4. Exercise of Rights. With respect to the exercise by the Investor of its preemptive right (Section 1.1), right of first offer (Section 2), and right of first refusal (Section 3) described above:

4.1 The Company will use reasonable best efforts to provide the Investor at least 30 days advanced notice that an event that would be subject to the preemptive rights provisions of Section 1.1, the right of first offer provisions of Section 2, or the right of first refusal provisions of Section 3 (each a “Triggering Event”) is reasonably likely to occur and promptly provide to the Investor all information reasonably requested by the Investor to evaluate the Triggering Event.

4.2 Immediately upon determining that it intends to engage in a Triggering Event, the Company will provide to the Investor written notice of the anticipated Triggering Event and relevant information regarding the terms of the Triggering Event (the “Triggering Event Notice”). The Company will promptly provide to the Investor all information reasonably requested by the Investor to evaluate the Triggering Event. If the Investor declines to exercise its rights with respect to a Triggering Event, the Company may consummate the Triggering Event; provided that if the Triggering Event is not consummated within 90 days of the Triggering Event Notice, any subsequent actions with respect to such event will again be subject to this Agreement.

4.3 Within 30 days after receiving the Triggering Event Notice, the Investor will provide written notice regarding its intent (subject to approval by the Investor’s board of directors), if any, to exercise its rights hereunder (the “Investor Notice”). To the extent that the Investor exercises its rights with respect to any Triggering Event, the parties will promptly close the relevant transaction, but in any event, within no more than 45 days after the Investor provides the Investor Notice to the Company.

| 2 |

5. Additional Rights with Respect to the Gold Crest Properties.

5.1 The Company will use commercial best efforts to maintain the Golden Crest Properties in full force and effect and good standing, and refrain from doing anything, or omitting to do anything, which may subject the Golden Crest Properties to cancellation or recission, or otherwise restrict the ability of the Company or a successor to legally exploit any property or use rights associated with the Golden Crest Properties now or in the future. Nothing in this Section 5.1 shall serve to prohibit the Company from, in good faith, determining from time to time to abandon one or more claims that are a part of the Gold Crest Properties that the Company determines to have low mineral potential.

5.2 The Company will provide quarterly reports evidencing the financial condition of the Company and its subsidiaries that hold any of the Golden Crest Properties (with quarterly reports on Form 10-Q and annual reports on Form 10-K filed with the SEC being an acceptable means of conveying such information, to the extent such information is included in such reports).

5.3 The Company will promptly notify the Investor of any known breaches or violations of applicable laws, rules, regulations, tariffs, orders, material contracts, or directives with respect to the Golden Crest Properties and advise the Investor of any steps required or being taken to remedy such breach.

5.4 The Investor will have a right, at its expense, after providing the Company reasonable advance notice, to visit the Golden Crest Properties up to two times per year and perform reasonable due diligence with respect to such properties and operations.

5.5 The Company will produce and deliver to the Investor half-year reports detailing the exploration work performed on the Golden Crest Properties during such six-month period and the results of such work.

6. Confidentiality. Investor shall, and shall cause its directors, officers, managers, employees, agents, and third-party advisors with whom Investor shares confidential information of the Company (collectively, “Representatives”) to, keep confidential all, and shall not divulge to any other party any, (a) of the trade secrets or private or confidential information of the Company and the Gold Crest Properties it may receive or have access to under this Agreement including private, secret and confidential information relating to such matters as drilling results and analysis thereof, technical data, the finances, methods of operation and competition, strategies, equipment and operational requirements and information concerning personnel, customers and suppliers of or related to the Gold Crest Properties or the Company generally, unless such information is or becomes generally available to the public other than as a result of a disclosure by Investor or its Representatives.

| 3 |

7. Material Non-Public Information. The Investor acknowledges that the Company may provide the Investor with confidential information which may constitute “material non-public information” within the meaning of applicable U.S. federal securities laws (“MNPI”) in connection with this Agreement; provided that the Company will use reasonable efforts to identify MNPI as such prior to providing it to the Investor. In the event that the Investor wishes to trade in Common Stock, but is in possession of MNPI furnished in connection with this Agreement, the Investor will notify the Company and the Company will publicly disclose such MNPI reasonably promptly (but no later than the end of the next fiscal quarter) in order to allow the Investor to trade.

8. Partnership Against Corruption Initiative. The Investor, through its parent company, Newmont Corporation, is a member of the Partnership Against Corruption Initiative (“PACI”) of the World Economic Forum. The Investor has adopted an Anti-Corruption Standard consistent with the PACI principles. The Company agrees that the Investor may from time-to-time undertake reasonable due diligence in order to comply with its Anti-Corruption Standard and the Company will cooperate as reasonably requested by the Investor.

9. Registration Rights. So long as the Investor (together with its affiliates who hold any Common Stock) holds greater than 10% of the outstanding Common Stock or is otherwise regarded as an affiliate of the Company, the Investor will have the demand registration rights set forth below.

9.1 The Company, upon written demand (a “Demand Notice”) of the Investor or any of its affiliates holding Shares (each a “Registered Holder” and together the “Registered Holders”), agrees to register, on one occasion, all or any portion of the Common Stock held by the Registered Holders (the “Resale Shares”). On such occasion, the Company will file a registration statement with the SEC covering the resale of the Resale Shares within 60 days after receipt of a Demand Notice and use its commercially reasonable efforts to have the registration statement declared effective promptly thereafter, subject to compliance with review by the Securities and Exchange Commission. Notwithstanding the foregoing obligations, if the Company furnishes to the Registered Holders requesting a registration a certificate signed by the Company’s chief executive officer stating that, in the good faith judgment of the Board of Directors, it would be materially detrimental to the Company and its shareholders for such registration statement to either become effective or remain effective for as long as such registration statement otherwise would be required to remain effective, because such action would (i) materially interfere with a significant acquisition, corporate reorganization, or other similar transaction involving the Company; (ii) require premature disclosure of material information that the Company has a bona fide business purpose for preserving as confidential; or (iii) render the Company unable to comply with requirements under the Securities Act or Exchange Act, then the Company will have the right to defer taking action with respect to such filing, and any time periods with respect to filing or effectiveness thereof will be tolled correspondingly, for a period of not more than 90 days.

9.2 The Company will bear all fees and expenses attendant to the registration of the Resale Shares, but the Registered Holders will pay any and all underwriting commissions and the expenses of any legal counsel selected by the Registered Holders to represent them in connection with the sale of the Resale Shares. The Company agrees to use its commercially reasonable efforts to cause the registration statement to become effective promptly and to qualify or register the Resale Shares in such States as are reasonably requested by the Registered Holders; provided, however, that in no event will the Company be required to register the Resale Shares in a State in which such registration would cause: (i) the Company to be obligated to register or license to do business in such State or submit to general service of process in such State, or (ii) the principal shareholders of the Company to be obligated to escrow their shares of capital stock of the Company. The Company will cause any registration statement filed pursuant to the demand right granted hereunder to remain effective for a period of at least twelve (12) consecutive months after the date that the Registered Holders are first given the opportunity to sell all of the Resale Shares registered thereunder. The Registered Holders will only use the prospectuses provided by the Company to sell the shares covered by such registration statement, and will immediately cease to use any prospectus furnished by the Company if the Company advises the Registered Holders that such prospectus may no longer be used due to a material misstatement or omission.

| 4 |

10. Notices. All notices and other communications given or made pursuant to this Agreement will be in writing and will be deemed effectively given upon the earlier of actual receipt, or (a) personal delivery to the party to be notified, (b) when sent, if sent by electronic mail during normal business hours of the recipient, and if not sent during normal business hours, then on the recipient’s next business day, (c) five days after having been sent by registered or certified mail, return receipt requested, postage prepaid, or (d) one (1) business day after deposit with a nationally recognized overnight courier, freight prepaid, specifying next business day delivery, with written verification of receipt. All communications will be sent to the respective parties at their address as set forth below, or to such e-mail address, or address as subsequently modified by written notice given in accordance with this Section 10.

|

| if to the Company: |

| 4251 Kipling St., Suite 390 Wheat Ridge, Colorado 80033 |

|

|

|

| Attn: Christopher Herald E-mail: CHerald@solitariocorp.com |

|

|

with a copy to (which will not constitute notice): |

|

Dykema Gossett PLLC 111 E. Kilbourn Ave., Suite 1050 Milwaukee, WI 53202 Email: Pwaltz@Dykema.com |

|

|

if to the Purchaser: |

|

c/o Newmont Corporation 6900 E. Layton Ave. Denver, Colorado 80237 Attn: Legal Department Email: legalnotices@newmont.com |

|

|

with a copy to (which will not constitute notice): |

|

Holland & Hart LLP 555 17th Street, Suite 3200 Denver, CO 80202 Attention: Amy L. Bowler, Esq. Email: abowler@hollandhart.com |

| 5 |