0001653558falseFY2024P3YP2Yhttp://fasb.org/us-gaap/2024#DepreciationAndAmortization http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpenseP3Yhttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesprth:stateprth:territoryprth:subsidiaryxbrli:pureprth:voteprth:hourprth:segment00016535582024-01-012024-12-3100016535582024-06-3000016535582025-02-2800016535582024-12-3100016535582023-12-3100016535582023-01-012023-12-3100016535582022-01-012022-12-310001653558us-gaap:CommonStockMember2021-12-310001653558us-gaap:TreasuryStockCommonMember2021-12-310001653558us-gaap:AdditionalPaidInCapitalMember2021-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001653558us-gaap:RetainedEarningsMember2021-12-310001653558us-gaap:ParentMember2021-12-310001653558us-gaap:NoncontrollingInterestMember2021-12-3100016535582021-12-310001653558us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001653558us-gaap:ParentMember2022-01-012022-12-310001653558us-gaap:CommonStockMember2022-01-012022-12-310001653558us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001653558us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001653558us-gaap:RetainedEarningsMember2022-01-012022-12-310001653558us-gaap:CommonStockMember2022-12-310001653558us-gaap:TreasuryStockCommonMember2022-12-310001653558us-gaap:AdditionalPaidInCapitalMember2022-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001653558us-gaap:RetainedEarningsMember2022-12-310001653558us-gaap:ParentMember2022-12-310001653558us-gaap:NoncontrollingInterestMember2022-12-3100016535582022-12-310001653558us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001653558us-gaap:ParentMember2023-01-012023-12-310001653558us-gaap:CommonStockMember2023-01-012023-12-310001653558us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001653558us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001653558us-gaap:RetainedEarningsMember2023-01-012023-12-310001653558us-gaap:CommonStockMember2023-12-310001653558us-gaap:TreasuryStockCommonMember2023-12-310001653558us-gaap:AdditionalPaidInCapitalMember2023-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001653558us-gaap:RetainedEarningsMember2023-12-310001653558us-gaap:ParentMember2023-12-310001653558us-gaap:NoncontrollingInterestMember2023-12-310001653558us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001653558us-gaap:ParentMember2024-01-012024-12-310001653558us-gaap:CommonStockMember2024-01-012024-12-310001653558us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001653558us-gaap:RetainedEarningsMember2024-01-012024-12-310001653558us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001653558us-gaap:CommonStockMember2024-12-310001653558us-gaap:TreasuryStockCommonMember2024-12-310001653558us-gaap:AdditionalPaidInCapitalMember2024-12-310001653558us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001653558us-gaap:RetainedEarningsMember2024-12-310001653558us-gaap:ParentMember2024-12-310001653558us-gaap:NoncontrollingInterestMember2024-12-310001653558country:US2024-12-310001653558country:UM2024-12-310001653558srt:MinimumMember2024-12-310001653558srt:MaximumMember2024-12-310001653558us-gaap:TradeAccountsReceivableMember2023-12-310001653558prth:SettlementAssetsMember2023-12-310001653558us-gaap:TradeAccountsReceivableMember2024-01-012024-12-310001653558prth:SettlementAssetsMember2024-01-012024-12-310001653558us-gaap:TradeAccountsReceivableMember2024-12-310001653558prth:SettlementAssetsMember2024-12-310001653558srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001653558srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001653558srt:MinimumMemberus-gaap:EquipmentMember2024-12-310001653558srt:MaximumMemberus-gaap:EquipmentMember2024-12-310001653558srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001653558srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001653558srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2024-12-310001653558srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2024-12-310001653558prth:ISOAndReferralPartnerRelationshipsMembersrt:MinimumMember2024-12-310001653558prth:ISOAndReferralPartnerRelationshipsMembersrt:MaximumMember2024-12-310001653558prth:ResidualBuyoutsMembersrt:MinimumMember2024-12-310001653558prth:ResidualBuyoutsMembersrt:MaximumMember2024-12-310001653558us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-12-310001653558us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-12-310001653558prth:MerchantPortfolioMembersrt:MinimumMember2024-12-310001653558prth:MerchantPortfolioMembersrt:MaximumMember2024-12-310001653558us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2024-12-310001653558us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2024-12-310001653558prth:TradeNamesAndNonCompeteAgreementsMembersrt:MinimumMember2024-12-310001653558prth:TradeNamesAndNonCompeteAgreementsMembersrt:MaximumMember2024-12-310001653558srt:MinimumMember2024-01-012024-12-310001653558srt:MaximumMember2024-01-012024-12-310001653558us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001653558us-gaap:RevenueFromRightsConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:RevenueFromRightsConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:RevenueFromRightsConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558prth:CustomerAccountBalancesMember2024-12-310001653558prth:PlastiqMember2023-07-312023-07-310001653558prth:PlastiqMember2023-07-310001653558prth:PlastiqMemberus-gaap:CustomerRelationshipsMember2023-07-312023-07-310001653558prth:PlastiqMemberprth:ReferralPartnerRelationshipsMember2023-07-312023-07-310001653558prth:PlastiqMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-07-312023-07-310001653558prth:PlastiqMemberus-gaap:TradeNamesMember2023-07-312023-07-310001653558us-gaap:CreditCardMerchantDiscountMember2024-01-012024-12-310001653558us-gaap:CreditCardMerchantDiscountMember2023-01-012023-12-310001653558us-gaap:CreditCardMerchantDiscountMember2022-01-012022-12-310001653558prth:MoneyTransmissionsServicesMember2024-01-012024-12-310001653558prth:MoneyTransmissionsServicesMember2023-01-012023-12-310001653558prth:MoneyTransmissionsServicesMember2022-01-012022-12-310001653558prth:OutsourcedServicesAndOtherServicesMember2024-01-012024-12-310001653558prth:OutsourcedServicesAndOtherServicesMember2023-01-012023-12-310001653558prth:OutsourcedServicesAndOtherServicesMember2022-01-012022-12-310001653558us-gaap:ProductMember2024-01-012024-12-310001653558us-gaap:ProductMember2023-01-012023-12-310001653558us-gaap:ProductMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:CreditCardMerchantDiscountMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberprth:MoneyTransmissionsServicesMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberprth:OutsourcedServicesAndOtherServicesMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:ProductMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:CreditCardMerchantDiscountMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberprth:MoneyTransmissionsServicesMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberprth:OutsourcedServicesAndOtherServicesMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:ProductMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:CreditCardMerchantDiscountMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:MoneyTransmissionsServicesMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:OutsourcedServicesAndOtherServicesMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberus-gaap:ProductMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:OperatingSegmentsMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:CreditCardMerchantDiscountMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberprth:MoneyTransmissionsServicesMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberprth:OutsourcedServicesAndOtherServicesMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberus-gaap:ProductMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMember2022-01-012022-12-3100016535582025-01-012024-12-310001653558prth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558prth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558prth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558prth:BankMemberprth:DueToACHPayeesMemberprth:B2BPaymentsSegmentMember2024-12-310001653558prth:BankMemberprth:DueToACHPayeesMemberprth:B2BPaymentsSegmentMember2023-12-310001653558prth:DueToACHPayeesMemberprth:B2BPaymentsSegmentMember2024-12-310001653558prth:DueToACHPayeesMemberprth:B2BPaymentsSegmentMember2023-12-310001653558prth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558prth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558prth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558prth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558prth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558prth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558prth:EnterprisePaymentsSegmentMember2024-12-310001653558prth:EnterprisePaymentsSegmentMember2023-12-310001653558prth:CardSettlementsDueFromProcessorsMember2024-12-310001653558prth:CardSettlementsDueFromProcessorsMember2023-12-310001653558prth:CardSettlementsDueFromNetworksMember2024-12-310001653558prth:CardSettlementsDueFromNetworksMember2023-12-310001653558prth:OtherSettlementAssetsMember2024-12-310001653558prth:OtherSettlementAssetsMember2023-12-310001653558prth:CardSettlementsDueFromMerchantsMember2024-12-310001653558prth:CardSettlementsDueFromMerchantsMember2023-12-310001653558prth:CustomerAccountObligationsMember2024-12-310001653558prth:CustomerAccountObligationsMember2023-12-310001653558prth:SubscriberAccountObligationsMember2024-12-310001653558prth:SubscriberAccountObligationsMember2023-12-310001653558prth:CustomerAndSubscriberAccountObligationsMember2024-12-310001653558prth:CustomerAndSubscriberAccountObligationsMember2023-12-310001653558prth:DueToCustomerPayeesMember2024-12-310001653558prth:DueToCustomerPayeesMember2023-12-310001653558us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001653558us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001653558us-gaap:EquipmentMember2024-12-310001653558us-gaap:EquipmentMember2023-12-310001653558us-gaap:LeaseholdImprovementsMember2024-12-310001653558us-gaap:LeaseholdImprovementsMember2023-12-310001653558us-gaap:FurnitureAndFixturesMember2024-12-310001653558us-gaap:FurnitureAndFixturesMember2023-12-310001653558prth:DepreciablePropertyPlantAndEquipmentMember2024-12-310001653558prth:DepreciablePropertyPlantAndEquipmentMember2023-12-310001653558prth:CapitalWorkInProgressMember2024-12-310001653558prth:CapitalWorkInProgressMember2023-12-310001653558prth:SMBPaymentsSegmentMember2024-12-310001653558prth:SMBPaymentsSegmentMember2023-12-310001653558prth:B2BPaymentsSegmentMember2024-12-310001653558prth:B2BPaymentsSegmentMember2023-12-310001653558prth:ISOAndReferralPartnerRelationshipsMember2024-12-310001653558prth:ResidualBuyoutsMember2024-12-310001653558us-gaap:CustomerRelationshipsMember2024-12-310001653558us-gaap:ServiceAgreementsMember2024-12-310001653558us-gaap:DevelopedTechnologyRightsMember2024-12-310001653558us-gaap:NoncompeteAgreementsMember2024-12-310001653558us-gaap:TradeNamesMember2024-12-310001653558us-gaap:LicenseMember2024-12-310001653558prth:ISOAndReferralPartnerRelationshipsMember2023-12-310001653558prth:ResidualBuyoutsMember2023-12-310001653558us-gaap:CustomerRelationshipsMember2023-12-310001653558us-gaap:ServiceAgreementsMember2023-12-310001653558us-gaap:DevelopedTechnologyRightsMember2023-12-310001653558us-gaap:NoncompeteAgreementsMember2023-12-310001653558us-gaap:TradeNamesMember2023-12-310001653558us-gaap:LicenseMember2023-12-310001653558prth:A2024CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:A2024CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-12-310001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001653558prth:A2021CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-12-310001653558prth:A2021CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001653558prth:A2024CreditAgreementMemberus-gaap:SecuredDebtMember2024-05-160001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-05-1600016535582024-05-162024-05-160001653558prth:A2024CreditAgreementMemberus-gaap:SecuredDebtMember2024-05-162024-05-160001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-12-310001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-11-212024-11-210001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-11-210001653558prth:A2024CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-11-202024-11-200001653558prth:A2021CreditAgreementMemberus-gaap:SecuredDebtMember2021-04-270001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-270001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-09-172021-09-170001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-09-170001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-06-290001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-06-300001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-022023-10-020001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-012023-10-010001653558prth:A2021CreditAgreementMember2021-04-272021-04-270001653558prth:A2021CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-04-272021-04-2700016535582021-04-2700016535582021-04-272021-04-270001653558prth:IssuanceUponAcquisitionClosingMember2021-04-272021-04-270001653558prth:IssuanceUponSatisfactionOfClosingConditionsMember2021-04-272021-04-270001653558us-gaap:AdditionalPaidInCapitalMember2021-04-272021-04-2700016535582021-09-172021-09-1700016535582024-11-212024-11-210001653558srt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrMember2023-06-302023-06-3000016535582023-06-302023-06-300001653558us-gaap:SecuredOvernightFinancingRateSofrMember2023-06-302023-06-300001653558us-gaap:BaseRateMember2023-06-302023-06-300001653558us-gaap:StateAndLocalJurisdictionMember2024-12-310001653558us-gaap:StateAndLocalJurisdictionMember2023-12-3100016535582022-06-300001653558prth:A2018EquityIncentivePlanMember2018-07-310001653558prth:A2018EquityIncentivePlanMember2022-03-172022-03-170001653558prth:A2018EquityIncentivePlanMember2022-03-170001653558us-gaap:RestrictedStockUnitsRSUMemberprth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558us-gaap:RestrictedStockUnitsRSUMemberprth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558us-gaap:RestrictedStockUnitsRSUMemberprth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558us-gaap:EmployeeStockOptionMemberprth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558us-gaap:EmployeeStockOptionMemberprth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558us-gaap:EmployeeStockOptionMemberprth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558prth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558prth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558prth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558us-gaap:EmployeeStockMember2024-01-012024-12-310001653558us-gaap:EmployeeStockMember2023-01-012023-12-310001653558us-gaap:EmployeeStockMember2022-01-012022-12-310001653558prth:EquityIncentiveUnitsMember2024-01-012024-12-310001653558prth:EquityIncentiveUnitsMember2023-01-012023-12-310001653558prth:EquityIncentiveUnitsMember2022-01-012022-12-310001653558prth:A2018EquityIncentivePlanMember2021-12-310001653558us-gaap:PerformanceSharesMemberprth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558prth:A2018EquityIncentivePlanMember2022-12-310001653558us-gaap:PerformanceSharesMemberprth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558prth:A2018EquityIncentivePlanMember2023-12-310001653558us-gaap:PerformanceSharesMemberprth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558prth:A2018EquityIncentivePlanMember2024-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2021-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2022-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2023-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558prth:RestrictedStockUnitsRSUsServiceBasedMemberprth:A2018EquityIncentivePlanMember2024-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2021-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2022-01-012022-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2022-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2023-01-012023-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2023-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2024-01-012024-12-310001653558prth:RestrictedStockUnitsRSUsPerformanceBasedWithMarketConditionMemberprth:A2018EquityIncentivePlanMember2024-12-310001653558prth:A2018EquityIncentivePlanMemberprth:RestrictedStockUnitsRSUsServiceBasedMemberprth:NonEmployeeBoardOfDirectorsMember2024-01-012024-12-310001653558prth:A2018EquityIncentivePlanMemberprth:RestrictedStockUnitsRSUsServiceBasedMemberprth:NonEmployeeBoardOfDirectorsMember2023-01-012023-12-310001653558prth:A2018EquityIncentivePlanMemberprth:RestrictedStockUnitsRSUsServiceBasedMemberprth:NonEmployeeBoardOfDirectorsMember2022-01-012022-12-310001653558us-gaap:EmployeeStockMember2021-04-1600016535582021-04-162021-04-160001653558us-gaap:EmployeeStockMember2021-04-162021-04-160001653558us-gaap:EmployeeStockMember2024-12-310001653558prth:ChiefExecutiveOfficerAndChairmanMember2019-01-312019-01-310001653558prth:ChiefExecutiveOfficerAndChairmanMember2019-02-280001653558prth:ChiefExecutiveOfficerAndChairmanMember2019-02-012019-02-280001653558prth:ChiefExecutiveOfficerAndChairmanMember2021-05-012021-05-310001653558srt:SubsidiariesMember2020-11-300001653558srt:SubsidiariesMemberprth:ShareExchangeMember2020-11-122020-11-120001653558srt:SubsidiariesMemberprth:ShareExchangeMember2020-11-120001653558srt:SubsidiariesMemberprth:ShareExchangeMember2021-05-012021-05-310001653558prth:ChiefExecutiveOfficerAndChairmanMemberprth:ShareExchangeMember2021-05-012021-05-310001653558srt:ChiefOperatingOfficerMemberprth:ShareExchangeMember2021-05-012021-05-310001653558srt:ChiefOperatingOfficerMember2021-05-012021-05-310001653558srt:SubsidiariesMember2024-05-300001653558srt:SubsidiariesMemberprth:ShareExchangeMember2024-04-012024-06-300001653558srt:ChiefOperatingOfficerMemberprth:ShareExchangeMember2024-07-012024-09-300001653558prth:OtherHoldersMemberprth:ShareExchangeMember2024-07-012024-09-300001653558prth:ThirdPartyProcessingFeesMember2024-12-310001653558prth:CapitalCommitmentsMember2024-12-310001653558prth:CapitalCommitmentsMember2023-12-310001653558prth:CapitalCommitmentsMember2024-01-012024-12-310001653558prth:CapitalCommitmentsMember2023-01-012023-12-310001653558us-gaap:NotesReceivableMember2024-12-310001653558us-gaap:NotesReceivableMember2023-12-310001653558us-gaap:NotesReceivableMember2024-01-012024-12-310001653558us-gaap:NotesReceivableMember2023-01-012023-12-310001653558prth:WholesalePaymentsInc.ResidualPortfolioRightsMember2023-01-012023-12-310001653558prth:CHFinancialServicesMember2023-01-012023-12-3100016535582024-10-012024-10-310001653558us-gaap:FairValueInputsLevel3Member2024-12-310001653558us-gaap:FairValueInputsLevel3Member2023-12-310001653558us-gaap:OperatingSegmentsMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberprth:SMBPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberprth:B2BPaymentsSegmentMember2024-01-012024-12-310001653558us-gaap:IntersegmentEliminationMemberprth:EnterprisePaymentsSegmentMember2024-01-012024-12-310001653558prth:CorporateReconcilingItemsAndEliminationsMember2024-01-012024-12-310001653558us-gaap:CorporateNonSegmentMember2024-01-012024-12-310001653558us-gaap:OperatingSegmentsMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberprth:SMBPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberprth:B2BPaymentsSegmentMember2023-01-012023-12-310001653558us-gaap:IntersegmentEliminationMemberprth:EnterprisePaymentsSegmentMember2023-01-012023-12-310001653558prth:CorporateReconcilingItemsAndEliminationsMember2023-01-012023-12-310001653558us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001653558us-gaap:OperatingSegmentsMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberprth:SMBPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberprth:B2BPaymentsSegmentMember2022-01-012022-12-310001653558us-gaap:IntersegmentEliminationMemberprth:EnterprisePaymentsSegmentMember2022-01-012022-12-310001653558prth:CorporateReconcilingItemsAndEliminationsMember2022-01-012022-12-310001653558us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001653558us-gaap:WarrantMember2024-01-012024-12-310001653558us-gaap:WarrantMember2023-01-012023-12-310001653558us-gaap:WarrantMember2022-01-012022-12-310001653558prth:OptionsAndWarrantsMember2024-01-012024-12-310001653558prth:OptionsAndWarrantsMember2023-01-012023-12-310001653558prth:OptionsAndWarrantsMember2022-01-012022-12-310001653558us-gaap:RestrictedStockMember2024-01-012024-12-310001653558us-gaap:RestrictedStockMember2023-01-012023-12-310001653558us-gaap:RestrictedStockMember2022-01-012022-12-310001653558us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001653558us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001653558us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001653558us-gaap:WarrantMember2024-12-310001653558prth:WarrantsIssuedToAdvisorMember2024-12-310001653558prth:LetusBusinessMemberus-gaap:SubsequentEventMember2025-01-212025-01-210001653558prth:LetusBusinessMemberus-gaap:SubsequentEventMember2025-01-2100016535582024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to __________

Commission file number: 001-37872

Priority Technology Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

47-4257046 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

| 2001 Westside Parkway |

|

|

| Suite 155 |

|

|

| Alpharetta, |

Georgia |

|

30004 |

| (Address of principal executive offices) |

|

|

(Zip Code) |

Registrant's telephone number, including area code: (404) 952-2107

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

PRTH |

|

Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," ''accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Securities Exchange Act of 1934, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financials statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2024, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's Common Stock held by non-affiliates of the registrant was approximately $93.1 million (based upon the closing sale price of the Common Stock on that date on The Nasdaq Capital Market).

As of February 28, 2025, the number of the registrant's Common Stock outstanding was 79,519,234.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A relating to the Annual Meeting of shareholders of Priority Technology Holdings, Inc., scheduled to be held on May 21, 2025, will be incorporated by reference in Part III of this Form 10-K. Priority Technology Holdings, Inc. intends to file such proxy statement with the Securities and Exchange Commission no later than 120 days after its fiscal year ended December 31, 2024.

Table of Contents

Cautionary Note Regarding Forward-looking Statements

Some of the statements made in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of the federal securities laws. Such forward-looking statements include, but are not limited to, statements regarding our management's expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, such as statements about our future financial performance, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "future," "goal," "intend," "likely," "may," "might," "plan," "possible," "potential," "predict," "project," "seek," "should," "would," "will," "approximately," "shall" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•negative economic and political conditions that adversely affect the general economy, consumer confidence and consumer and commercial spending habits, which may, among other things, negatively impact our business, financial condition and results of operations;

•competition in the payment processing industry;

•the use of distribution partners;

•any unauthorized disclosures of merchant or cardholder data, whether through breach of our computer systems, computer viruses or otherwise;

•any breakdowns in our processing systems;

•government regulation, including regulation of consumer information;

•the use of third-party vendors;

•any changes in card association and debit network fees or products;

•any changes in interest rates by the Federal Reserve

•any failure to comply with the rules established by payment networks or standards established by third-party processors;

•any proposed acquisitions or dispositions or any risks associated with completed acquisitions or dispositions; and

•other risks and uncertainties set forth in the "

Item 1A - Risk Factors" section of this Annual Report on Form 10-K.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

The forward-looking statements contained in this Annual Report on Form 10-K are based on our current expectations and beliefs concerning future developments and their potential effects on us. You should not place undue reliance on these forward-looking statements in deciding whether to invest in our securities. We cannot assure you that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions, including the risk factors set forth in the "

Item 1A - Risk Factors" section of this Annual Report on Form 10-K, that may cause our actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

You should read this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Forward-looking statements speak only as of the date they were made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Terms Used in this Annual Report on Form 10-K

As used in this Annual Report on Form 10-K, unless the context otherwise requires, references to the terms "Company," "Priority," "we," "us" and "our" refer to Priority Technology Holdings, Inc. and its consolidated subsidiaries.

Commonly Used or Defined Terms

|

|

|

|

|

|

|

|

|

| Term |

|

Definition |

| 2018 Plan |

|

Priority Technology Holdings, Inc. 2018 Equity Incentive Plan |

| 2021 Stock Purchase Plan |

|

Priority Technology Holdings, Inc. 2021 Employee Stock Purchase Plan |

| 2021 Share Repurchase Program |

|

Priority Technology Holdings, Inc. 2021 Share Repurchase Program |

| ACH |

|

Automated clearing house |

| AML |

|

Anti-money laundering |

| AOCI |

|

Accumulated other comprehensive income |

| AP |

|

Accounts payable |

| API |

|

Application program interface |

| APIC |

|

Additional paid-in capital |

| ASC |

|

Accounting Standards Codification |

| ASU |

|

Accounting Standards Update |

| ATI |

|

Adjusted taxable income |

| B2B |

|

Business-to-business |

| B2C |

|

Business-to-consumer |

| BaaS |

|

Banking as a service |

| BSA |

|

Bank Secrecy Act of 1970, as amended by the USA Patriot Act of 2001 |

| CARES Act |

|

Coronavirus Aid, Relief, and Economic Security Act |

| CCPA |

|

California Consumer Protection Act |

| CEO |

|

The Company's Chairman and Chief Executive Officer |

| CFO |

|

The Company's Chief Financial Officer |

| CFPB |

|

U.S. Consumer Financial Protection Bureau |

| Common Stock |

|

The Company's Common Stock, par value $.001 per share |

| Company |

|

Priority Technology Holdings, Inc., a Delaware corporation, and its direct and indirect subsidiaries |

| 2024 Credit Agreement |

|

Credit and Guaranty Agreement with Truist Bank dated as of May 16, 2024 (as amended) |

| 2021 Credit Agreement |

|

Credit and Guaranty Agreement with Truist Bank dated as of April 27, 2021 (as amended) |

| CRM |

|

Customer relationship management |

| Delayed Draw Term Loan |

|

Delayed draw term loan facility under the credit agreement |

| Dodd-Frank Act |

|

Dodd Frank Wall Street Reform and Consumer Protection Act of 2010 |

| EBITDA |

|

Earnings before interest, taxes, depreciation, and amortization |

| Electronic Payments |

|

Payments with credit, debit, prepaid cards, ACH and wire |

| EPS |

|

Earnings (loss) per share |

| ESPP |

|

Employee stock purchase plan |

| Exchange Act |

|

Securities Exchange Act of 1934 |

| FASB |

|

Financial Accounting Standards Board |

| FBO |

|

For the benefit of |

| FCRA |

|

Fair Credit Reporting Act |

| Federal Reserve Board |

|

Governors of the Federal Reserve System |

| FDIC |

|

Federal Deposit Insurance Corporation |

|

|

|

|

|

|

|

|

|

| FFIEC |

|

Federal Financial Institutions Examination Council |

| FI |

|

Financial institution |

| FIFO |

|

First in, first out |

| FinCEN |

|

Financial Crimes Enforcement Network |

| Finxera |

|

Finxera Holdings, Inc. |

| FSOC |

|

Financial Stability Oversight Council |

| GAAP |

|

United States Generally Accepted Accounting Principles |

| Initial Term Loan |

|

A senior secured first lien term loan facility in an aggregate principal amount of $300,000,000 |

| IRA |

|

Inflation Reduction Act |

| ISO |

|

Independent sales organization |

| ISV |

|

Independent software vendors |

| IT |

|

Information technology |

| LIBOR |

|

London Interbank Offered Rate |

| LIFO |

|

Last in, first out |

| LLC |

|

Limited Liability Company |

| Nasdaq |

|

National Association of Securities Dealers Automated Quotations |

| NCI |

|

Non-controlling interests |

| OFAC |

|

Office of Foreign Assets Control |

| Passport |

|

Priority Passport |

PHOT |

|

Priority Hospitality Technology, LLC a Delaware limited liability company |

| Plastiq |

|

Acquisition of Plastiq, Inc. and certain affiliates |

| 2024 Revolving Facility |

|

$70.0 million line issued under 2024 Credit Agreement |

| 2021 Revolving Facility |

|

$65.0 million line issued under 2021 Credit Agreement |

| PIK |

|

Payment-in-kind |

| POS |

|

Point-of-sale |

| PRET |

|

Priority Real Estate Technology, LLC, a Delaware limited liability company |

| PRTH |

|

The Company's Nasdaq Capital Market trading symbol |

| PSU |

|

Restricted stock unit (performance-based) |

| Redeemable NCI's |

|

Redeemable non-controlling preferred equity interests |

| ROU Asset |

|

Right of use asset |

| RSU |

|

Restricted stock unit (service-based) |

| SaaS |

|

Software as a Service |

| SAR |

|

Stock appreciation rights |

| SEC |

|

United States Securities and Exchange Commission |

| SMB |

|

Small and medium-sized businesses |

| SMS |

|

Short message service |

| SOFR |

|

Secured Overnight Financing Rate |

| Tax Act |

|

The Housing Assistance Tax Act of 2008 |

| TCPA |

|

Federal Telephone Consumer Protection Act of 1991 |

| Term Facility |

|

Term loan facility issued under the 2024 Credit Agreement |

|

|

|

|

|

|

|

|

|

| Total Net Leverage Ratio |

|

The ratio of consolidated total debt to the Consolidated Adjusted EBITDA (as defined in the Credit Agreement). |

| Truist |

|

Truist Bank |

| TSP |

|

Technology service provider |

| U.S. |

|

United States of America |

| VARs |

|

Value-added resellers |

PART I.

Item 1. Business

Overview of the Company

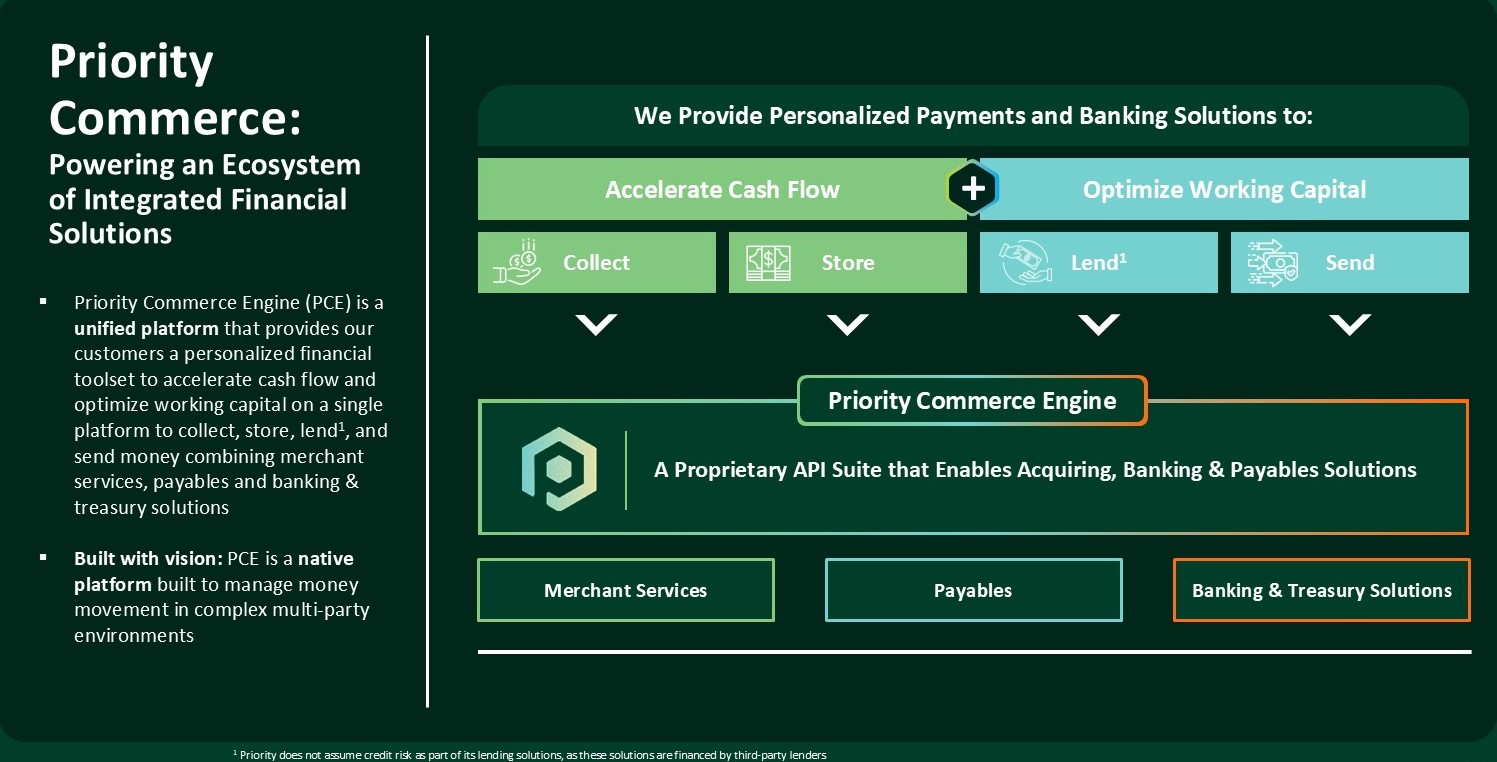

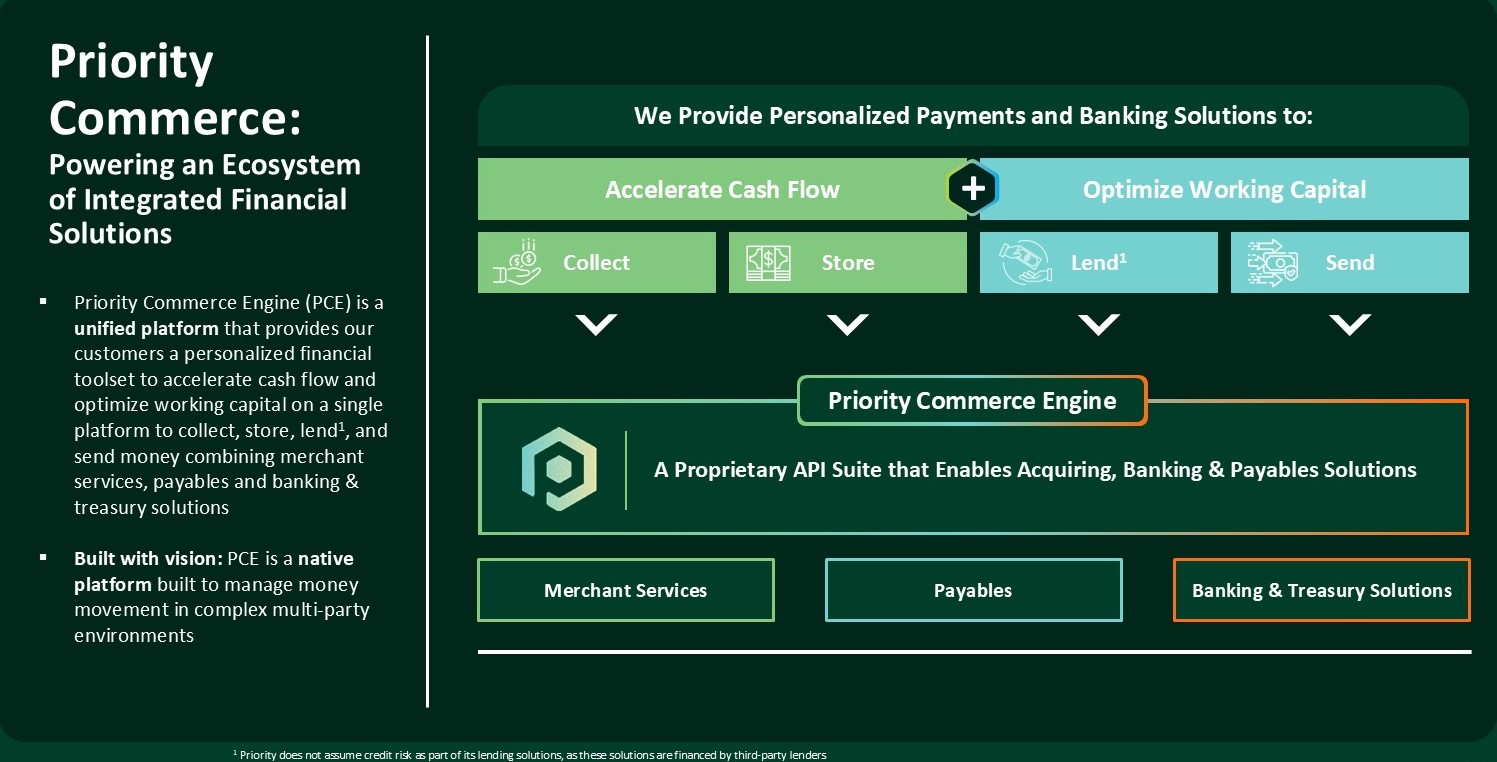

Priority is a payments and banking fintech that streamlines collecting, storing, lending and sending money through its innovative commerce engine (the “Priority Commerce Engine” or “PCE”) to unlock revenue opportunities and generate operational success for businesses. Our mission is to provide a personalized financial toolset to accelerate cashflow and optimize working capital for our customers by providing merchant services, payables and banking & treasury solutions. Priority operates at scale across three primary business segments: SMB Acquiring, B2B Payables and Enterprise Payments and is presently serving approximately 1.2 million customer accounts processing over $130.0 billion in annual transaction activity while administering approximately $1.2 billion dollars in account balances. The Priority Commerce Engine serves enterprise grade independent software vendors (ISV's), as well as discrete institutional and SMB customers across all major sectors of the U.S. economy including Retail, Hospitality, Healthcare, Real Estate, Government, Utility, Education, Non-Profit, Business-to-Business, Professional Services and Financial Institutions. Priority builds with intention, utilizing market research and stakeholder feedback to drive growth activity. The result is an end-to-end solution that customers leverage across their financial lifecycle, engineered to accelerate cash flow and optimize working capital. Trust is paramount in partnerships with customers, which is why Priority works with multiple, proven partners, to ensure our customers experience the security and peace of mind that comes with diversification, while enjoying the cost and time-saving benefits of consolidation. Priority centralizes all money movement activity within a single, integrated platform, empowering users to seamlessly collect, store, lend, and send money. Highly configurable and easy to use, the Priority Commerce Engine enables financial agility and operational stability for today’s fastest-growing enterprises.

Priority was established in 2005 and has grown from a founder-financed technology startup with a mission to build an institutional caliber enterprise to advance the convergence of software and payments to become the 6th largest non-bank merchant acquirer in the U.S. by volume, according to the Nilson Report issued in March 2024. Since inception, we have built a native technology platform that provides all forms of payments (card acquiring and issuing, ACH, check and wire) and embedded finance solutions that serve customers of any size. Priority maintains a global business platform with 1,019 employees operating from its headquarters in Alpharetta, GA and regional offices in other locations, including New York, NY; Hicksville, NY; Nashville,TN; Chattanooga, TN; Raleigh, NC; Houston, TX; Dallas, TX; San Francisco, CA; and Chandigarh, India.

Priority delivers value to its partners by leveraging its payments and embedded finance technology to deliver solutions that power modern commerce for SMBs and enterprise software and business partners. We handle the complexities of payments and embedded finance to allow partners to focus on their core business objectives. Priority's solutions are offered via API or proprietary applications with nationwide money transmission licenses, providing end-to-end operational support including automated risk management and underwriting, full compliance and industry leading customer service.

Our growth has been underpinned by three key strengths: 1) market leading proprietary product platforms in SMB, B2B and Enterprise Payments verticals; 2) focused distribution engines dedicated to helping partners monetize their merchant payment networks; and 3) a cost-efficient, agile payment and business processing infrastructure, purpose-built to support our partners’ operations.

Priority's solutions are delivered via internally developed payment applications and services to customers in the following business segments:

•SMB Payments: Provides full-service acquiring and payment-enabled solutions for B2C transactions, leveraging Priority's proprietary software platform, distributed through ISO, direct sales and vertically focused ISV channels.

•B2B Payments: Provides market-leading AP automation solutions to corporations, software partners and industry leading FIs (including Citibank, Visa and Mastercard) in addition to improving cash flows by providing instant access to working capital.

•Enterprise Payments: Provides embedded finance and BaaS solutions to customers to modernize legacy platforms and accelerate software partners' strategies to monetize payments.

The MX product suite provides technology-enabled payment acceptance and business management capabilities to merchants, enterprises and our distribution partners. The MX product suite includes MX Connect and MX Merchant products, which together provide resellers and merchant clients a flexible and customizable set of business applications that help better manage critical business work functions and revenue performance using core payment processing as our leverage point. MX Connect provides our SMB payments reselling partners with automated tools that support low friction merchant on-boarding, underwriting and risk management, client service, and commission processing through a single mobile-enabled, web-based interface. The result is a smooth merchant activation onto our flagship consumer payments offering, MX Merchant, which provides core processing and business solutions to SMB clients. In addition to payment processing, the MX Merchant product suite encompasses a variety of proprietary and third-party product applications that merchants can adopt such as MX Insights, MX Storefront, MX Retail, MX Invoice, MX B2B and ACH.com, among others. This comprehensive suite of solutions enables merchants to 1) identify key consumer trends in their businesses; 2) quickly implement e-commerce or retail POS solutions; and 3) handle ACH payments. By empowering resellers to adopt a consultative selling approach and embedding our technology into the critical day-to-day workflows and operations of both merchants and resellers, we believe that we have established and maintained "sticky" relationships. We believe that our strong retention, coupled with consistent merchant onboarding, have resulted in strong processing volume and revenue growth.

In addition to our SMB offering, we have diversified our source of revenues through our growing presence in the B2B market. We provide automated AP offerings to our enterprise clients and financial institutions through our CPX platform. Our CPX platform offers clients a seamless bridge for buyer-to-supplier (payor-to-provider) payments by integrating directly to a buyer's payment instruction file and parsing it for payment to suppliers via virtual card, purchase card, ACH +, dynamic discounting or check. Successful implementation of our AP automation solutions provides: 1) suppliers with the benefits of cash acceleration; 2) buyers with valuable rebate/discount revenue: and 3) the Company with stable sources of payment processing and other revenue. Additionally, we provide a suite of integrated AP automation solutions businesses to FIs and card networks such as Citibank, Mastercard and Visa, among others.

Alongside CPX as part of the AP suite, Priority acquired the assets of Plastiq Inc. through its subsidiary Plastiq, Powered by Priority, LLC, a leading B2B payments company, in the third fiscal quarter of 2023, and has helped tens of thousands of businesses improve cash flow with instant access to working capital, while automating and enabling control over all aspects of accounts payable and receivable.

The flagship product, Plastiq Pay, pioneered a way for businesses to pay suppliers by credit card regardless of acceptance as an alternative to expensive, scarce bank loan options. Plastiq Accept offers an alternative to expensive merchant services, enabling businesses to accept credit cards with no merchant fees and get paid across any customer touch point, including a website, invoice, checkout process, and in person via QR code. The Plastiq Connect API suite enables platforms, marketplaces, and ERPs, to expand B2B payment options for payables and receivables in their native customer experience while outsourcing payment execution, risk, and compliance.

Our Enterprise Payments segment provides embedded finance and BaaS solutions to customers that modernize legacy platforms and accelerate modern software partners looking to monetize payment components. We provide solutions for ISVs, third-party integrators, and merchants that allow for the leveraging of our core payments engine, our automated payables platform or our account ledgering capabilities all via API resources.

We generate revenue primarily from payment processing transactions, and from monthly services and other solutions provided to customers and interest income from the permissible investments of the account balances we hold. Payment processing fees are generated from the ongoing sales to our customers and are governed by multi-year contracts. As a result, payment processing fees are highly recurring in nature.

For the year ended December 31, 2024, we generated revenue of $879.7 million, net loss attributable to common shareholders of $24.0 million and operating income of $133.4 million, compared to revenue of $755.6 million, net loss attributable to common shareholders of $49.1 million and operating income of $81.5 million for the year ended December 31, 2023.

Industry Overview

The payment processing industry provides businesses with credit, debit, gift, loyalty card and other payment processing services, along with related value-added solutions and information services. The industry continues to grow, driven by wider acceptance, increased use of Electronic Payments, advances in payment technology and the disruption in banking by fintech providers. The proliferation of bankcards and the use of other payment technologies has made the acceptance of Electronic Payments through multiple channels a virtual necessity for many businesses to remain competitive. The increased use and acceptance of bankcards and the availability of more sophisticated products and services has resulted in a highly competitive, specialized industry.

Services to the SMB merchant market have been historically characterized by basic payment processing without ready access to more sophisticated technology, value-added solutions, or customer service that are typically offered to large merchants. To keep up with the changing demands of how consumers wish to pay for goods and services, we believe SMB merchants and enterprise customers increasingly recognize the need for value-added services wrapped around omni-channel payment solutions that are tailored to their specific business needs.

Key Industry Trends

The following are key trends we believe are impacting the fintech and payments processing industry:

•Trend Toward Electronic Transactions – We believe the continued shift from cash/paper payments toward electronic/card payments will drive growth for merchant acquirers and processors as volume continues to grow correspondingly. We believe this migration and overall market growth will continue to provide tailwinds to the Electronic Payments industry. B2B payments is the largest payment market in the U.S. by volume and presents a significant opportunity for payment providers to capitalize on the conversion of check and paper-based payments to Electronic Payments, including card-based acceptance. As businesses have increasingly looked to improve efficiency and reduce costs, the electronification of B2B payments has gained momentum.

•Convergence of Payments and Embedded Finance Solutions – As consumer behavior shifted during the COVID-19 pandemic, the scale of disruption grew dramatically and we believe the speed of change will continue to rise. The appetite of both merchants and consumers for new alternatives to traditional payment options remains top of mind and big tech companies, fintechs, challenger banks and other non-bank entrants are driving market disruption by offering customers better user experiences at lower prices. The continued displacement of cash and checks over the next several years, helped along by customers' adoption of digital shopping and fueled by their desire to avoid contact with physical infrastructure and objects, continues to create even more opportunities for disruption in payments.

•Mobile Payments – Historically, e-commerce was conducted on a computer via a web browser; however, as mobile technologies continue to proliferate, consumers are making more purchases through mobile browsers and native mobile applications. We believe this shift represents a significant opportunity given the high growth rates of mobile payments volume, higher fees for card-not-present and cross-border processing and potential for the in-app economy to stimulate and/or alter consumer spending behavior.

B2B Payments is the largest payment market in the U.S. by volume and presents a significant opportunity for payment providers to capitalize on the conversion of check and paper-based payments to Electronic Payments, including card-based acceptance. As businesses have increasingly looked to improve efficiency and reduce costs, the electronification of B2B Payments has gained momentum.

Enterprise Payments and BaaS is the integration of financial services, like payments, lending, or banking services, into non-financial offerings. This embedded finance capability allows customers to access financial services seamlessly through applications they already utilize. The market is large and growing rapidly as customers demand a digital, frictionless and integrated approach to meeting the needs of their end consumer.

Competitive Strengths

We possess certain attributes that we believe differentiate us as a leading provider of merchant services, payables and banking & treasury solutions in the U.S. Our key competitive strengths include:

•Diverse Reseller Community – We maintain strong reseller relationships with approximately 1,100 partners, including ISOs, FIs, ISVs, VARs and other referral partners. MX Connect enables resellers to efficiently market merchant acquiring solutions to a broad base of merchants through a one-to-many distribution model. We believe that our ability to service our reseller partners through a comprehensive offering provides a competitive advantage that has allowed the Company to build a large, diverse merchant base characterized by high retention. The strengths of our technology offering are manifested in the fact that we maintain ownership of merchant contracts, with most reseller contracts including strong non-solicit and portability restrictions.

•Comprehensive Suite of Payment Solutions – We offer a comprehensive and differentiated suite of traditional and emerging payment products and services that enables SMBs to address their payment needs through one provider. Our purpose-built proprietary technology provides technology-enabled payment acceptance and business management solutions to merchants, enterprises and ISVs. We provide a payment processing platform that allows merchants to accept Electronic Payments (e.g., credit cards, debit cards, and ACH) at the POS, online, and via mobile payment technologies. We deliver innovative business management products and add-on features that meet the needs of SMBs across different vertical markets. Additionally, with our embedded finance offerings and money transmissions licenses in forty six U.S. states, the District of Columbia and two U.S. territories, we are uniquely positioned to collect, store, lend and send money on behalf of our customers. As a result, we believe we are well-positioned to capitalize on the trend towards integrated payments solutions, new technology adoption and value-add service utilization that is underway in the SMB market. We believe our solutions facilitate a superior merchant experience that results in increased customer lifetime value.

•Highly Scalable Business Model with Operating Leverage – As a result of thoughtful investments in our technology, we have developed robust and differentiated infrastructure that has enabled us to scale in a cost-efficient manner. Our operating efficiency supports a low capital expenditure environment to develop product enhancements that drive organic growth across our SMB, B2B and Enterprise payment ecosystems, as well as attract both reselling partners and enterprise clients looking for best-in-class solutions. By creating a cost-efficient environment that facilitates the combination of ongoing product innovation to drive organic growth and stable cash flow to fund acquisitions, we anticipate ongoing economies of scale and increased margins over time.

•Experienced Management Team Led by Industry Veterans – Our executive management team has a record of execution in the merchant acquiring and technology-enabled payments industry. Our team has continued to develop and enhance our proprietary and innovative technology platforms that differentiate us in the payments industry. We invest to attract and retain executive leadership that align with the opportunities in the market and our strategic focus.

Growth Strategies

We intend to continue to execute a multi-pronged growth strategy, with diverse organic initiatives supplemented by acquisitions. Growth strategies include:

Organic Growth in our Reseller Network and Merchant Base

We expect to grow through our existing reseller network and merchant base by capitalizing on the organic growth of existing merchant volume and reseller merchant portfolios. By providing resellers with agile tools to manage their sales businesses and grow their merchant portfolio, we have established a solid base from which to generate new merchant adoption and retain existing merchants. By engaging in a consultative partnership approach, we maintain strong relationships with our reseller partners and continue to exhibit strong merchant adoption and volume growth trends. Through our resellers, we provide merchants with full-service acquiring solutions, as well as value-added services and tools to streamline their business processes and enable them to focus on driving same store sales growth.

Deploy our Embedded Finance Solution to Enterprise Customers

Our Enterprise Payments segment, enables software partners and business platform customers to embed our banking and treasury solutions into their core operating and business systems that deliver a fully automated and digital experience to collect, store, lend and send money for their customers. Priority delivers a fully embedded finance solution to customers that manages the inflows and outflows, and reconciliation, of all forms of payments (ACH, wire, check, credit and debit) for any number of clients from a single account. The platform today manages over 930,000 active accounts and, through its money transmission licenses in forty six U.S. states, the District of Columbia and two U.S. territories, handles over $945.0 million in deposits across a growing number of banking partners. This segment is quickly growing as marketplaces, gig economy platforms, software partners, and legacy business platforms are incorporating features of payment processing and embedded finance services into their customer experience and enhance their offering.

Expand our Network of Distribution Partners

We have established and maintained a strong position within the reseller community with approximately 1,100 partners. We intend to continue to expand our distribution network to reach new partners, particularly with ISVs and VARs to expand technology and integrated partnerships. We believe that our technology offering enables us to attract and retain high-quality resellers focused on growth.

Deploy Industry Specific Payment Technology

We intend to continue to enhance and deploy our technology-enabled payment solutions and our capabilities to collect, store, lend and send money into industry-specific verticals. We continue to identify and evaluate new, attractive industries where we can deliver differentiated technology-enabled payment solutions that meet merchants' industry-specific needs.

Expand Electronic Payments Share of B2B Transactions with CPX and Plastiq

We have a growing presence in the commercial payments market where we provide curated managed services and AP automation solutions to businesses, FIs and card networks such as Citibank, Mastercard and Visa. The commercial payments market is the largest and one of the fastest growing payments markets in the U.S. by volume. We are well positioned to capitalize on the shift from check to Electronic Payments, which currently lags the consumer payments market, by eliminating the friction between buyers and suppliers through our industry leading offerings of CPX and Plastiq. We believe this will drive strong growth and profitability.

Accretive Acquisitions

With a consistent, long-term goal of maximizing shareholder value, we intend to selectively pursue strategic and tactical acquisitions that meet our established criteria. We actively seek potential acquisition candidates that exhibit certain attractive attributes including predictable and recurring revenue, a scalable operating model, low capital intensity, complementary technology offerings and a strong cultural fit. Our operating infrastructure is purpose-built to rapidly and seamlessly consolidate complementary businesses into our ecosystem all while optimizing revenue and cost synergies.

Sales and Distribution

We reach our SMB segment through three primary sales channels: 1) ISOs (Retail and Wholesale) and Agents; 2) FIs; and 3) ISVs and VARs. Our cloud-based solution, MX Connect, allows our partners and resellers to engage merchants for processing services and a host of value-added features designed to enhance their customer relationships. Our merchants utilize our cloud-based MX Merchant product suite to manage their businesses and process transactions. This separate solution increases our ability to retain the merchant if the ISO were to leave the Company.

Our B2B segment obtains its partner clients through: 1) direct sales initiatives; 2) ISVs and business partnerships; 3) the card networks (Mastercard, Visa and American Express); 4) large U.S. banking institutions and 5) other card issuer referral partners. We support a direct vendor sales model that provides turn-key merchant development, product sales and supplier enablement programs. By establishing a seamless bridge for buyer-to-supplier (payor-to-provider) payments that is integrated directly to a buyer's payment instruction file to facilitate payments to vendors via all payment types (virtual card, purchase card, ACH +, dynamic discounting), we have established ourselves as a top solutions provider in commercial payments. Our Plastiq offerings consist of all payment types including wires and checks to the vendors of our customers.

Our Enterprise segment goes to market through integrations with software partners and business platform customers by enabling them to embed our payments and treasury solutions into their core operating and business systems. Priority's offering provides those partners with a fully automated, scalable and integrated financial tool to collect, store, lend and send money for their customers.

Our market strategy has resulted in a merchant base that we believe is diversified across both industries and geographies resulting in, what we believe, is more stable average profitability per merchant. Only one reseller relationship contributes more than 10% of total bankcard processing volume, and such relationship represents approximately 10.6% of our total bankcard processing volume for the fiscal year ending December 31, 2024.

Third-party Processors and Sponsor Banks

We partner with various vendors in the payments value chain, most notably processors and sponsor banks which sit between us (the merchant acquirer) and the card networks, to assist us in providing payment processing services to merchant clients. Processing is a scale-driven business in which many acquirers outsource the processing function to a small number of large processors. In these partnerships, we serve as a merchant acquirer and enter into processing agreements with payment processors, such as Fiserv or Global Payments, to assist us in providing front-end and back-end transaction processing services for our merchants. These third parties are compensated for their services. These processors in turn have agreements with card networks such as Visa and Mastercard, through which the transaction information is routed in exchange for network fees.

To provide processing services, merchant acquirers like Priority must be registered with the card networks (e.g., Visa, Mastercard, American Express, Discover, etc.). To register with a card network in the U.S., acquirers must maintain relationships with banks willing to sponsor the merchant acquirer's adherence to the rules and standards of the card networks, or a sponsor bank. We maintain sponsor bank relationships with Wells Fargo, Synovus Bank, Pueblo Bank and Georgia Banking Company ("GBC"). We maintain a card issuing relationship with Sutton Bank. For ACH payments, the Company's ACH network (ACH.com) is sponsored by South State Bank. Sponsor bank relationships enable us to route transactions under the sponsor bank's control and identification number (referred to as a BIN for Visa and ICA for Mastercard) across the card networks (or ACH network) to authorize and clear transactions.

We offer banking and money transmission services to our customers through our partner banks including Wells Fargo and Axos Bank. Our proprietary ledgering technology enables us to store customer funds in uniquely identifiable accounts in order to position customer deposits for pass through FDIC insurance eligibility. Customer deposits may placed throughout our banking partner portfolio to maximize pass through FDIC insurance coverage.

Risk Management

Our thoughtful customer and reseller underwriting policies combined with our forward-looking transaction monitoring capabilities have enabled us to maintain low credit loss performance. Our risk management strategies are informed by a team with experience managing payments and banking risk operations that are augmented by our rules-based modern systems designed to manage risk at the transaction level.

Initial Underwriting – Central to our risk management process are our front-line underwriting policies that vet all resellers and customers prior to their contractual arrangements with us. Our automated risk systems access: 1) guarantor information; 2) corporate ownership details; 3) anti-money laundering information; and, 4) OFAC and FinCEN information from a variety of integrated databases. The collected information is delivered to a team of underwriters who conduct necessary industry checks, financial performance analysis or owner background checks, as applicable and consistent with our policies. Based upon these results, the underwriting department rejects or approves the customer or reseller and sets appropriate reserve requirements which are held by our bank sponsors on our behalf. Resellers may be subject to quarterly and/or annual assessments for financial strength in compliance with our policies and adjustments to reserve levels. The results of our initial customer underwriting process inform the transaction-level risk limits for volume, average ticket, transaction types and authorization codes that are captured by our CYRIS risk module - a proprietary risk system that monitors and reports transaction risk activity to our risk team. This transaction-level risk module, housed within MX Connect, forms the foundational risk management framework that enables the Company to optimize transaction activity and processing scale while preserving a modest aggregate risk profile that has resulted in historically low losses.

Real-Time Risk Monitoring – Customer transactions are monitored on a transactional basis to proactively enforce risk controls. Our risk systems provide automated evaluation of customer transaction activity against initial underwriting settings. Transactions that are outside underwriting parameters are queued for further investigation. Also, resellers whose customer portfolio represents a concentration of investigated merchants are evaluated for risk action (i.e., increased reserves or contract termination).

Risk Audit – Transactions flagged by our risk monitoring systems or that demonstrate suspicious activity traits that have been flagged for review can result in funds being held in addition to other risk mitigation actions. The risk mitigation actions can include: 1) non-authorization of the transaction; 2) debit of reserves; or 3) termination of the processing or services agreement. Customers are periodically reviewed to assess any risk adjustments based upon their overall financial health and compliance with network standards. Customer transaction activity is investigated for instances of business activity changes or credit impairment (and improvement).

Loss Mitigation – In instances where transactions and/or individual merchants are flagged for fraud, or in instances where the transaction activity is resulting in excessive charge-backs, several loss mitigation actions may be taken. These include: 1) charge-back dispute resolution; 2) merchant and reseller funds (reserves or processed batches) withheld; 3) inclusion on Network Match List to notify the industry of a "bad actor"; and/or 4) legal action.

Investments - We use our primary portfolio to provide for the investment of excess funds at acceptable risk levels as permitted. Our portfolio consists primarily of money market accounts at FDIC insured institutions. Concentration in any one particular financial institution could create operational disruption or put customer funds in excess of FDIC insured limits at risk.

Competition

The U.S. acquiring industry is highly competitive, with several large processors accounting for the majority of processing volume. When excluding banks, we ranked 6th among U.S. non-bank merchant acquirers, according to the March 2024 Nilson Report.

The concentration at the top of the industry is partly a result of consolidation. We believe that consolidation has also resulted in many large processors maintaining multiple, inflexible legacy IT systems that are not well-equipped to adjust to changing market requirements. We believe that the large merchant acquirers whose innovation has been hindered by these redundant legacy systems risk losing market share to acquirers with more agile and dynamic IT systems.

Pricing has historically been the key factor influencing the selection of a merchant acquirer. Providers with more advanced tech-enabled services (primarily online and integrated offerings), have an advantage over providers who are operating legacy technology and offering undifferentiated services that have come under pricing pressure from higher levels of competition. High quality customer service further differentiates providers as this helps to reduce attrition. Other competitive factors that set acquirers apart include: 1) price; 2) breadth of product offerings; 3) partnerships with FIs; 4) servicing capability; 5) data security; and 6) functionality. Leading acquirers are expected to continue to add additional services to expand cross-selling opportunities, primarily in omni-channel payment solutions, POS software, payments security, customer loyalty and other payments-related offerings.