Document

INDEX TO FINANCIAL STATEMENTS

|

|

|

|

|

|

| Unaudited Consolidated Financial Statements |

Page |

Consolidated Balance Sheets (unaudited) as of March 31, 2024 and December 31, 2023 |

|

Consolidated Statements of Operations (unaudited) for the Three Months Ended March 31, 2024 and 2023 |

|

Consolidated Statements of Comprehensive Income (unaudited) for the Three Months Ended March 31, 2024 and 2023 |

|

Consolidated Statements of Changes in Shareholders’ Equity (unaudited) for the Three Months Ended March 31, 2024 and 2023 |

|

Consolidated Statements of Cash Flows (unaudited) for the Three Months Ended March 31, 2024 and 2023 |

|

| Notes to the Consolidated Financial Statements (unaudited) |

|

The Bank of N.T. Butterfield & Son Limited

Consolidated Balance Sheets (unaudited)

(In thousands of US dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

As at |

|

March 31, 2024 |

December 31, 2023 |

| Assets |

|

|

| Cash and demand deposits with banks - Non-interest bearing |

90,231 |

|

91,826 |

|

| Demand deposits with banks - Interest bearing |

151,609 |

|

151,104 |

|

| Cash equivalents - Interest bearing |

1,504,381 |

|

1,403,718 |

|

| Cash and cash equivalents |

1,746,221 |

|

1,646,648 |

|

| Securities purchased under agreements to resell |

134,928 |

|

187,274 |

|

| Short-term investments |

1,344,747 |

|

1,038,037 |

|

| Investment in securities |

|

|

|

|

|

| Available-for-sale at fair value (amortized cost: $1,944,820 (2023: $1,995,050)) |

1,766,631 |

|

1,831,129 |

|

| Held-to-maturity (fair value: $2,848,545 (2023: $2,976,709)) |

3,401,472 |

|

3,461,097 |

|

| Total investment in securities |

5,168,103 |

|

5,292,226 |

|

| Loans |

|

|

| Loans |

4,668,892 |

|

4,771,608 |

|

| Allowance for credit losses |

(24,780) |

|

(25,759) |

|

| Loans, net of allowance for credit losses |

4,644,112 |

|

4,745,849 |

|

| Premises, equipment and computer software, net |

150,285 |

|

154,362 |

|

|

|

|

| Goodwill |

23,827 |

|

24,107 |

|

| Other intangible assets, net |

72,477 |

|

74,800 |

|

| Equity method investments |

6,434 |

|

7,063 |

|

| Other real estate owned, net |

525 |

|

450 |

|

|

|

|

| Accrued interest and other assets |

236,413 |

|

203,204 |

|

|

|

|

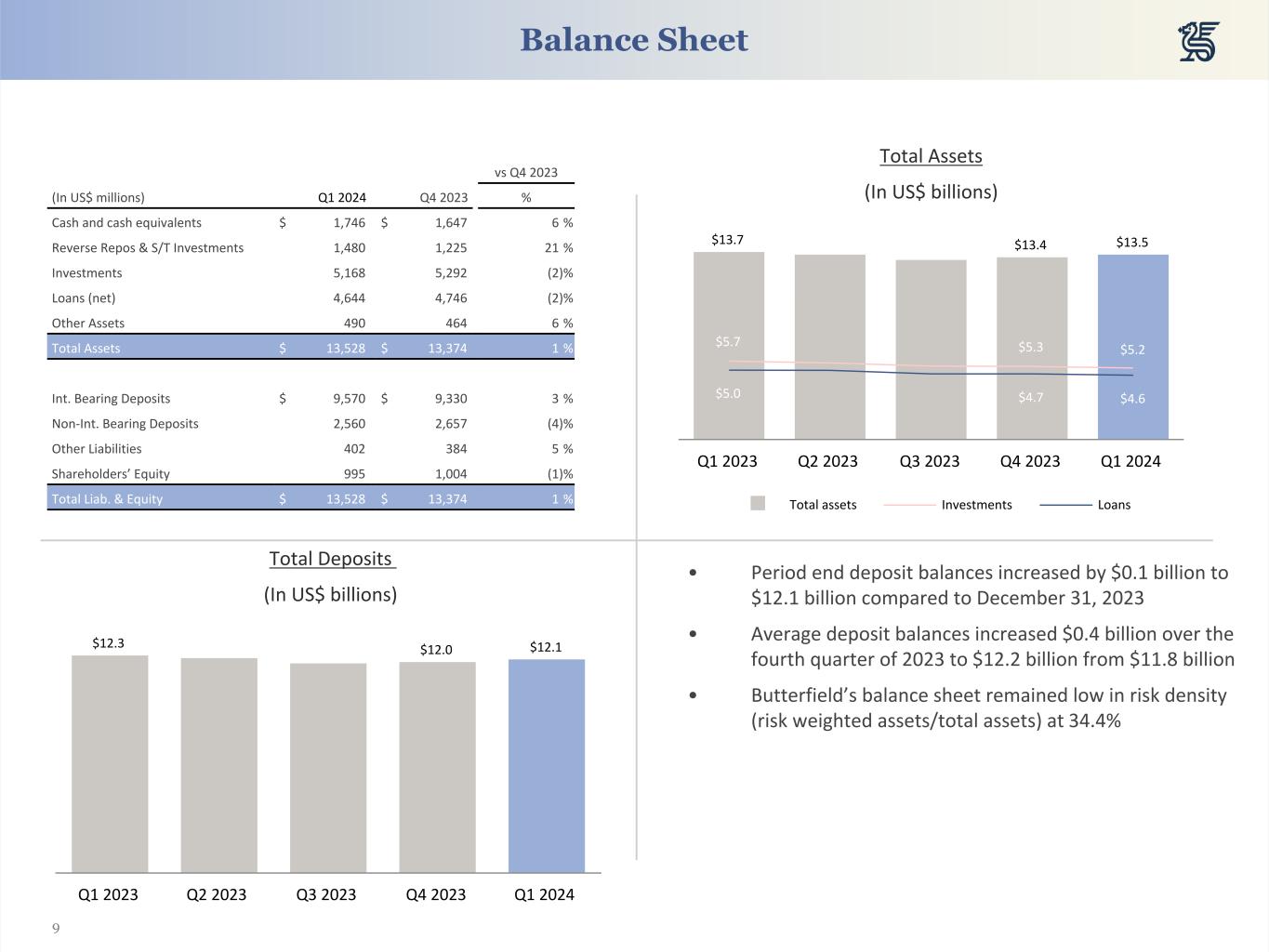

| Total assets |

13,528,072 |

|

13,374,020 |

|

|

|

|

| Liabilities |

|

|

| Deposits |

|

|

| Non-interest bearing |

2,560,430 |

|

2,656,659 |

|

| Interest bearing |

9,570,421 |

|

9,330,049 |

|

| Total deposits |

12,130,851 |

|

11,986,708 |

|

|

|

|

| Employee benefit plans |

88,937 |

|

88,694 |

|

|

|

|

|

|

|

|

|

|

| Accrued interest and other liabilities |

214,623 |

|

196,531 |

|

|

|

|

| Total other liabilities |

303,560 |

|

285,225 |

|

| Long-term debt |

98,549 |

|

98,490 |

|

| Total liabilities |

12,532,960 |

|

12,370,423 |

|

| Commitments, contingencies and guarantees (Note 10) |

|

|

|

|

|

| Shareholders' equity |

|

|

|

|

|

|

Common share capital (BMD 0.01 par; authorized voting ordinary shares 2,000,000,000 and

non-voting ordinary shares 6,000,000,000) issued and outstanding: 46,840,139 (2023: 47,529,045)

|

468 |

|

475 |

|

|

|

|

| Additional paid-in capital |

969,670 |

|

988,904 |

|

| Retained earnings |

364,921 |

|

342,520 |

|

| Less: treasury common shares, at cost: 619,212 (2023: 619,212) |

(18,660) |

|

(18,104) |

|

| Accumulated other comprehensive income (loss) |

(321,287) |

|

(310,198) |

|

| Total shareholders’ equity |

995,112 |

|

1,003,597 |

|

| Total liabilities and shareholders’ equity |

13,528,072 |

|

13,374,020 |

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Operations (unaudited)

(In thousands of US dollars, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

March 31, 2024 |

March 31, 2023 |

|

|

| Non-interest income |

|

|

|

|

| Asset management |

8,842 |

|

7,938 |

|

|

|

| Banking |

14,259 |

|

13,600 |

|

|

|

| Foreign exchange revenue |

13,192 |

|

10,712 |

|

|

|

| Trust |

15,044 |

|

12,838 |

|

|

|

| Custody and other administration services |

3,314 |

|

3,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-interest income |

442 |

|

1,761 |

|

|

|

| Total non-interest income |

55,093 |

|

50,185 |

|

|

|

| Interest income |

|

|

|

|

| Interest and fees on loans |

76,986 |

|

77,488 |

|

|

|

| Investments (none of the investment securities are intrinsically tax-exempt) |

|

|

|

|

|

|

|

|

|

| Available-for-sale |

9,573 |

|

8,908 |

|

|

|

| Held-to-maturity |

19,325 |

|

20,921 |

|

|

|

| Cash and cash equivalents, securities purchased under agreements to resell and short-term investments |

36,828 |

|

27,138 |

|

|

|

| Total interest income |

142,712 |

|

134,455 |

|

|

|

| Interest expense |

|

|

|

|

| Deposits |

54,209 |

|

34,696 |

|

|

|

| Long-term debt |

1,371 |

|

2,400 |

|

|

|

| Securities sold under agreement to repurchase |

54 |

|

4 |

|

|

|

| Total interest expense |

55,634 |

|

37,100 |

|

|

|

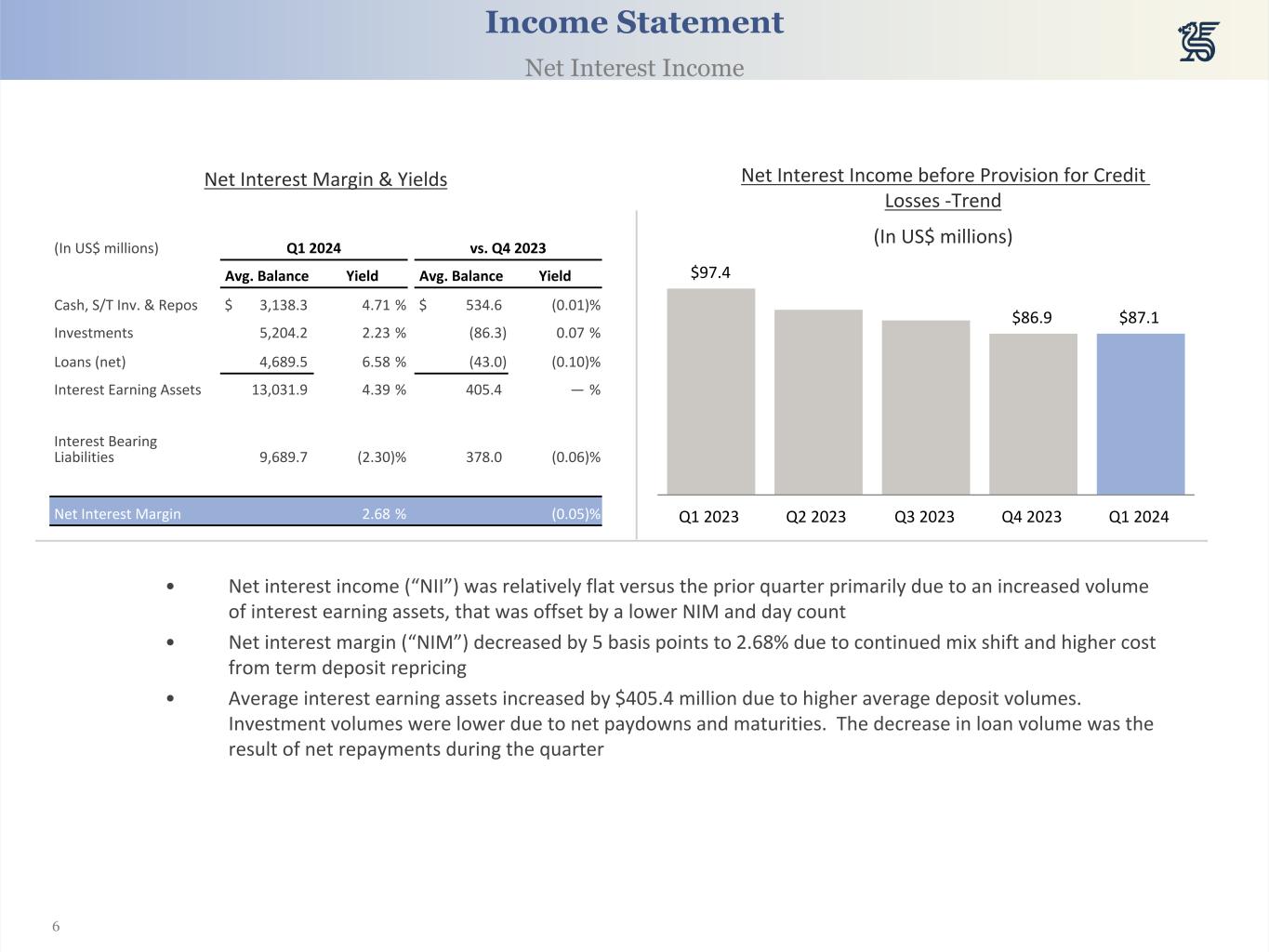

| Net interest income before provision for credit losses |

87,078 |

|

97,355 |

|

|

|

| Provision for credit (losses) recoveries |

409 |

|

(671) |

|

|

|

| Net interest income after provision for credit losses |

87,487 |

|

96,684 |

|

|

|

| Net gains (losses) on equity securities |

— |

|

50 |

|

|

|

| Net realized gains (losses) on available-for-sale investments |

— |

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net gains (losses) on other real estate owned |

(12) |

|

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net other gains (losses) |

249 |

|

9 |

|

|

|

| Total other gains (losses) |

237 |

|

110 |

|

|

|

| Total net revenue |

142,817 |

|

146,979 |

|

|

|

| Non-interest expense |

|

|

|

|

| Salaries and other employee benefits |

42,773 |

|

42,331 |

|

|

|

| Technology and communications |

16,127 |

|

13,929 |

|

|

|

| Professional and outside services |

5,513 |

|

5,033 |

|

|

|

| Property |

8,723 |

|

7,436 |

|

|

|

| Indirect taxes |

6,304 |

|

5,747 |

|

|

|

| Non-service employee benefits expense |

982 |

|

1,398 |

|

|

|

| Marketing |

1,302 |

|

1,503 |

|

|

|

| Amortization of intangible assets |

1,931 |

|

1,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expenses |

4,877 |

|

5,311 |

|

|

|

| Total non-interest expense |

88,532 |

|

84,106 |

|

|

|

| Net income before income taxes |

54,285 |

|

62,873 |

|

|

|

| Income tax benefit (expense) |

(854) |

|

(669) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

53,431 |

|

62,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share |

|

|

|

|

| Basic earnings per share |

1.15 |

|

1.25 |

|

|

|

| Diluted earnings per share |

1.13 |

|

1.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Comprehensive Income (unaudited)

(In thousands of US dollars)

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

March 31, 2024 |

March 31, 2023 |

|

|

|

|

|

|

|

| Net income |

53,431 |

|

62,204 |

|

|

|

|

|

|

|

|

| Other comprehensive income (loss), net of taxes |

|

|

|

|

Unrealized net gains (losses) on translation of net investment in foreign operations |

(63) |

|

(44) |

|

|

|

Net changes on investments transferred to held-to-maturity |

2,001 |

|

2,027 |

|

|

|

| Unrealized net gains (losses) on available-for-sale investments |

(14,277) |

|

29,816 |

|

|

|

| Employee benefit plans adjustments |

1,250 |

|

318 |

|

|

|

| Other comprehensive income (loss), net of taxes |

(11,089) |

|

32,117 |

|

|

|

|

|

|

|

|

| Total comprehensive income (loss) |

42,342 |

|

94,321 |

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Changes in Shareholders' Equity (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

March 31, 2023 |

|

|

|

Number of shares |

In thousands of

US dollars |

Number of shares |

In thousands of

US dollars |

|

|

|

|

| Common share capital issued and outstanding |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

47,529,045 |

|

475 |

|

50,277,466 |

|

503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retirement of shares |

(1,155,790) |

|

(11) |

|

(144,929) |

|

(2) |

|

|

|

|

|

| Issuance of common shares |

466,884 |

|

4 |

|

315,460 |

|

3 |

|

|

|

|

|

| Balance at end of period |

46,840,139 |

|

468 |

|

50,447,997 |

|

504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additional paid-in capital |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

|

988,904 |

|

|

1,032,632 |

|

|

|

|

|

| Share-based compensation |

|

4,796 |

|

|

4,493 |

|

|

|

|

|

| Share-based settlements |

|

22 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retirement of shares |

|

(24,048) |

|

|

(2,051) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common shares, net of underwriting discounts and commissions |

|

(4) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at end of period |

|

969,670 |

|

|

1,035,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retained earnings |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

|

342,520 |

|

|

229,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income for the period |

|

53,431 |

|

|

62,204 |

|

|

|

|

|

Common share cash dividends declared and paid, $0.44 per share (2023: $0.44 per share) |

|

(20,506) |

|

|

(21,975) |

|

|

|

|

|

| Retirement of shares |

|

(10,524) |

|

|

(2,792) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at end of period |

|

364,921 |

|

|

267,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Treasury common shares |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

619,212 |

|

(18,104) |

|

619,212 |

|

(20,600) |

|

|

|

|

|

| Purchase of treasury common shares |

1,155,790 |

|

(35,139) |

|

144,929 |

|

(4,756) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retirement of shares |

(1,155,790) |

|

34,583 |

|

(144,929) |

|

4,845 |

|

|

|

|

|

| Balance at end of period |

619,212 |

|

(18,660) |

|

619,212 |

|

(20,511) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accumulated other comprehensive income (loss) |

|

|

|

|

|

|

|

|

| Balance at beginning of period |

|

(310,198) |

|

|

(377,452) |

|

|

|

|

|

Other comprehensive income (loss), net of taxes |

|

(11,089) |

|

|

32,117 |

|

|

|

|

|

| Balance at end of period |

|

(321,287) |

|

|

(345,335) |

|

|

|

|

|

| Total shareholders' equity |

|

995,112 |

|

|

936,901 |

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Consolidated Statements of Cash Flows (unaudited)

(In thousands of US dollars)

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

March 31, 2024 |

March 31, 2023 |

|

| Cash flows from operating activities |

|

|

|

| Net income |

53,431 |

|

62,204 |

|

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile net income to operating cash flows |

|

|

|

| Depreciation and amortization |

(5,878) |

|

8,279 |

|

|

| Provision for credit losses (recoveries) |

(409) |

|

671 |

|

|

| Share-based payments and settlements |

4,818 |

|

4,496 |

|

|

|

|

|

|

| Net change in equity securities at fair value |

— |

|

(50) |

|

|

| Net realized (gains) losses on available-for-sale investments |

— |

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (gains) losses on other real estate owned |

12 |

|

(59) |

|

|

| (Increase) decrease in carrying value of equity method investments |

584 |

|

(398) |

|

|

| Dividends received from equity method investments |

45 |

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net other non-cash movements |

— |

|

1,089 |

|

|

| Changes in operating assets and liabilities |

|

|

|

| (Increase) decrease in accrued interest receivable and other assets |

(20,106) |

|

5,974 |

|

|

| Increase (decrease) in employee benefit plans, accrued interest payable and other liabilities |

(4,234) |

|

(5,100) |

|

|

| Cash provided by (used in) operating activities |

28,263 |

|

77,159 |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

| (Increase) decrease in securities purchased under agreements to resell |

52,346 |

|

(111,459) |

|

|

| Short-term investments other than restricted cash: proceeds from maturities and sales |

636,158 |

|

434,281 |

|

|

| Short-term investments other than restricted cash: purchases |

(917,859) |

|

(617,650) |

|

|

| Available-for-sale investments: proceeds from sale |

— |

|

2,993 |

|

|

| Available-for-sale investments: proceeds from maturities and pay downs |

184,993 |

|

27,086 |

|

|

| Available-for-sale investments: purchases |

(151,505) |

|

— |

|

|

| Held-to-maturity investments: proceeds from maturities and pay downs |

59,142 |

|

61,228 |

|

|

|

|

|

|

| Net (increase) decrease in loans |

84,593 |

|

118,460 |

|

|

| Additions to premises, equipment and computer software |

(1,620) |

|

(7,077) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of intangible assets |

(477) |

|

— |

|

|

|

|

|

|

| Cash provided by (used in) investing activities |

(54,229) |

|

(92,138) |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

| Net increase (decrease) in deposits |

187,822 |

|

(713,634) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares repurchased |

(35,139) |

|

(4,756) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends paid on common shares |

(20,506) |

|

(21,975) |

|

|

|

|

|

|

|

|

|

|

| Cash provided by (used in) financing activities |

132,177 |

|

(740,365) |

|

|

| Net effect of exchange rates on cash, cash equivalents and restricted cash |

(4,228) |

|

5,813 |

|

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

101,983 |

|

(749,531) |

|

|

| Cash, cash equivalents and restricted cash: beginning of period |

1,672,260 |

|

2,116,546 |

|

|

| Cash, cash equivalents and restricted cash: end of period |

1,774,243 |

|

1,367,015 |

|

|

|

|

|

|

| Components of cash, cash equivalents and restricted cash at end of period |

|

|

|

| Cash and cash equivalents |

1,746,221 |

|

1,344,800 |

|

|

| Restricted cash included in short-term investments on the consolidated balance sheets |

28,022 |

|

22,215 |

|

|

| Total cash, cash equivalents and restricted cash at end of period |

1,774,243 |

|

1,367,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure of non-cash items |

|

|

|

| Transfer to (out of) other real estate owned |

87 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited)

(In thousands of US dollars, unless otherwise stated)

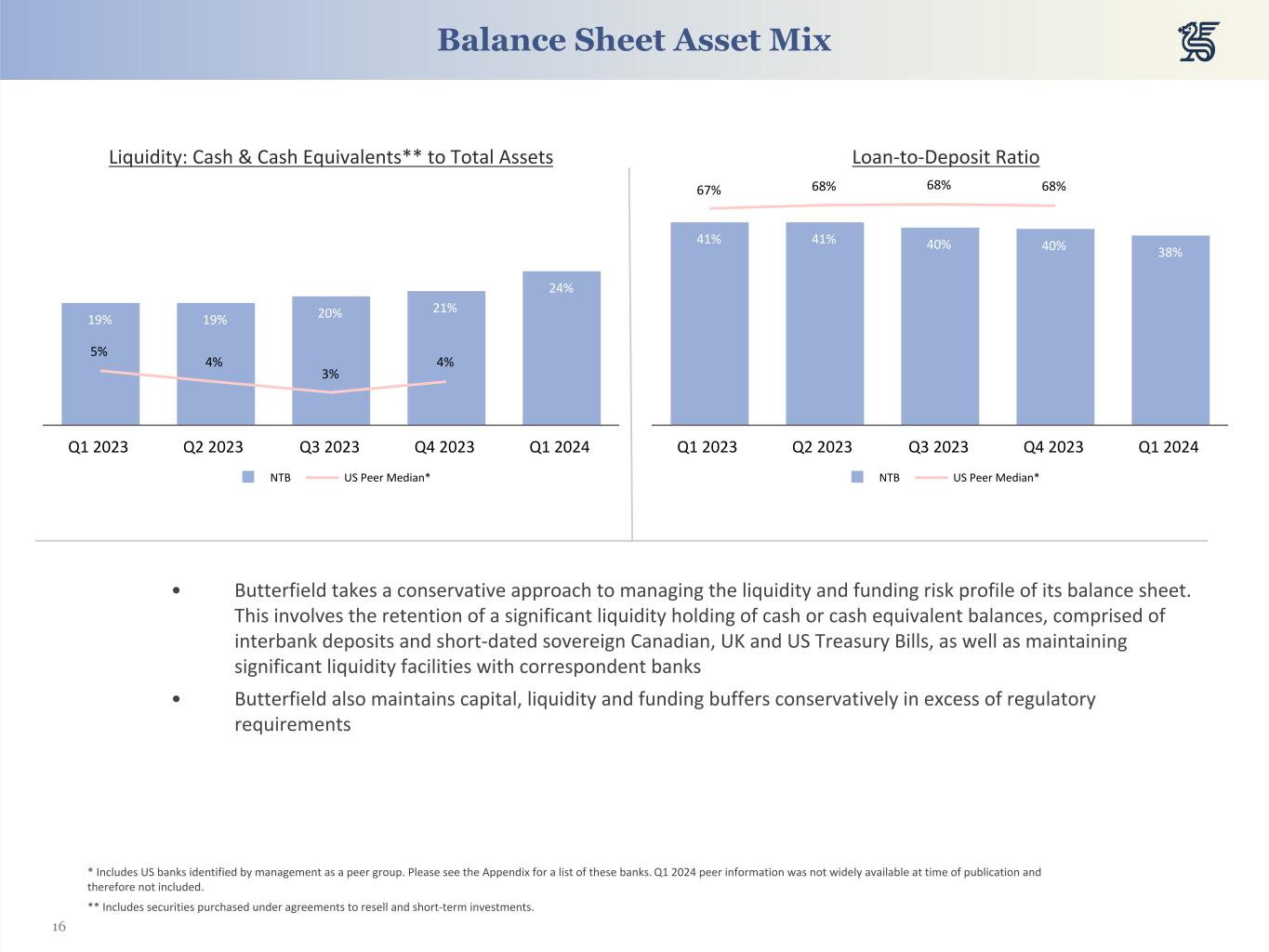

Note 1: Nature of business

The Bank of N.T. Butterfield & Son Limited (“Butterfield”, the “Bank” or the “Company”) is incorporated under the laws of Bermuda and has a banking license under the Banks and Deposit Companies Act, 1999 (“the Act”). Butterfield is regulated by the Bermuda Monetary Authority (“BMA”), which operates in accordance with Basel principles.

Butterfield is a full service bank and wealth manager headquartered in Hamilton, Bermuda. The Bank operates its business through three geographic segments: Bermuda, Cayman, and the Channel Islands and the United Kingdom ("UK"), where its principal banking operations are located and where it offers specialized financial services. Butterfield offers banking services, comprised of retail and corporate banking, and wealth management, which consists of trust, private banking, and asset management. In the Bermuda, Cayman, and Channel Islands and the UK segments, Butterfield offers both banking and wealth management services. Butterfield also has operations in the jurisdictions of The Bahamas, Canada, Mauritius, Singapore and Switzerland, which are included in our Other segment.

The Bank's common shares trade on the New York Stock Exchange under the symbol "NTB" and on the Bermuda Stock Exchange ("BSX") under the symbol "NTB.BH".

Note 2: Significant accounting policies

The accompanying unaudited interim consolidated financial statements of the Bank have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and should be read in conjunction with the Bank’s audited financial statements for the year ended December 31, 2023.

In the opinion of Management, these unaudited interim consolidated financial statements reflect all adjustments (consisting primarily of normal recurring accruals) considered necessary for a fair statement of the Bank’s financial position and results of operations as at the end of and for the periods presented. The Bank’s results for interim periods are not necessarily indicative of results for the full year.

The preparation of financial statements in conformity with GAAP requires Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited consolidated financial statements and the reported amounts of revenues and expenses during the reporting period, and actual results could differ from those estimates. Management believes that the most critical accounting estimates upon which the financial condition depends, and which involve the most complex or subjective decisions or assessments, are as follows:

•Allowance for credit losses

•Fair value of financial instruments

•Impairment of goodwill

•Employee benefit plans

•Share-based compensation

New Accounting Pronouncements

There were no accounting developments issued during the three months ended March 31, 2024 or accounting standards pending adoption which impacted the Bank.

Note 3: Cash and cash equivalents

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

December 31, 2023 |

|

|

|

| Non-interest bearing |

|

|

| Cash and demand deposits with banks |

90,231 |

|

91,826 |

|

|

|

|

| Interest bearing |

|

|

| Demand deposits with banks |

151,609 |

|

151,104 |

|

| Cash equivalents |

1,504,381 |

|

1,403,718 |

|

| Sub-total - Interest bearing |

1,655,990 |

|

1,554,822 |

|

|

|

|

| Total cash and cash equivalents |

1,746,221 |

|

1,646,648 |

|

Note 4: Short-term investments

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

December 31, 2023 |

|

|

|

| Unrestricted |

|

|

| Maturing within three months |

856,084 |

|

639,133 |

|

| Maturing between three to six months |

460,641 |

|

321,850 |

|

| Maturing between six to twelve months |

— |

|

51,442 |

|

| Total unrestricted short-term investments |

1,316,725 |

|

1,012,425 |

|

|

|

|

| Affected by drawing restrictions related to minimum reserve and derivative margin requirements |

|

|

|

|

| Interest earning demand and term deposits |

28,022 |

|

25,612 |

|

| Total restricted short-term investments |

28,022 |

|

25,612 |

|

|

|

|

| Total short-term investments |

1,344,747 |

|

1,038,037 |

|

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Note 5: Investment in securities

Amortized Cost, Carrying Amount and Fair Value

On the consolidated balance sheets, available-for-sale ("AFS") investments are carried at fair value and held-to-maturity ('HTM') investments are carried at amortized cost.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

December 31, 2023 |

|

Amortized

cost |

Gross

unrealized

gains |

Gross

unrealized

losses |

Fair value |

Amortized

cost |

Gross

unrealized

gains |

Gross

unrealized

losses |

Fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available-for-sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US government and federal agencies |

1,831,869 |

|

1,079 |

|

(174,191) |

|

1,658,757 |

|

1,721,278 |

|

1,382 |

|

(158,875) |

|

1,563,785 |

|

| Non-US governments debt securities |

94,410 |

|

— |

|

(3,121) |

|

91,289 |

|

254,532 |

|

— |

|

(4,355) |

|

250,177 |

|

|

|

|

|

|

|

|

|

|

| Asset-backed securities - Student loans |

40 |

|

— |

|

— |

|

40 |

|

40 |

|

— |

|

— |

|

40 |

|

|

|

|

|

|

|

|

|

|

| Residential mortgage-backed securities |

18,501 |

|

— |

|

(1,956) |

|

16,545 |

|

19,200 |

|

— |

|

(2,073) |

|

17,127 |

|

|

|

|

|

|

|

|

|

|

| Total available-for-sale |

1,944,820 |

|

1,079 |

|

(179,268) |

|

1,766,631 |

|

1,995,050 |

|

1,382 |

|

(165,303) |

|

1,831,129 |

|

|

|

|

|

|

|

|

|

|

| Held-to-maturity¹ |

|

|

|

|

|

|

|

|

| US government and federal agencies |

3,401,472 |

|

— |

|

(552,927) |

|

2,848,545 |

|

3,461,097 |

|

— |

|

(484,388) |

|

2,976,709 |

|

| Total held-to-maturity |

3,401,472 |

|

— |

|

(552,927) |

|

2,848,545 |

|

3,461,097 |

|

— |

|

(484,388) |

|

2,976,709 |

|

¹For the three months ended March 31, 2024 and March 31, 2023, impairments recognized in other comprehensive income for HTM investments were nil.

Investments with Unrealized Loss Positions

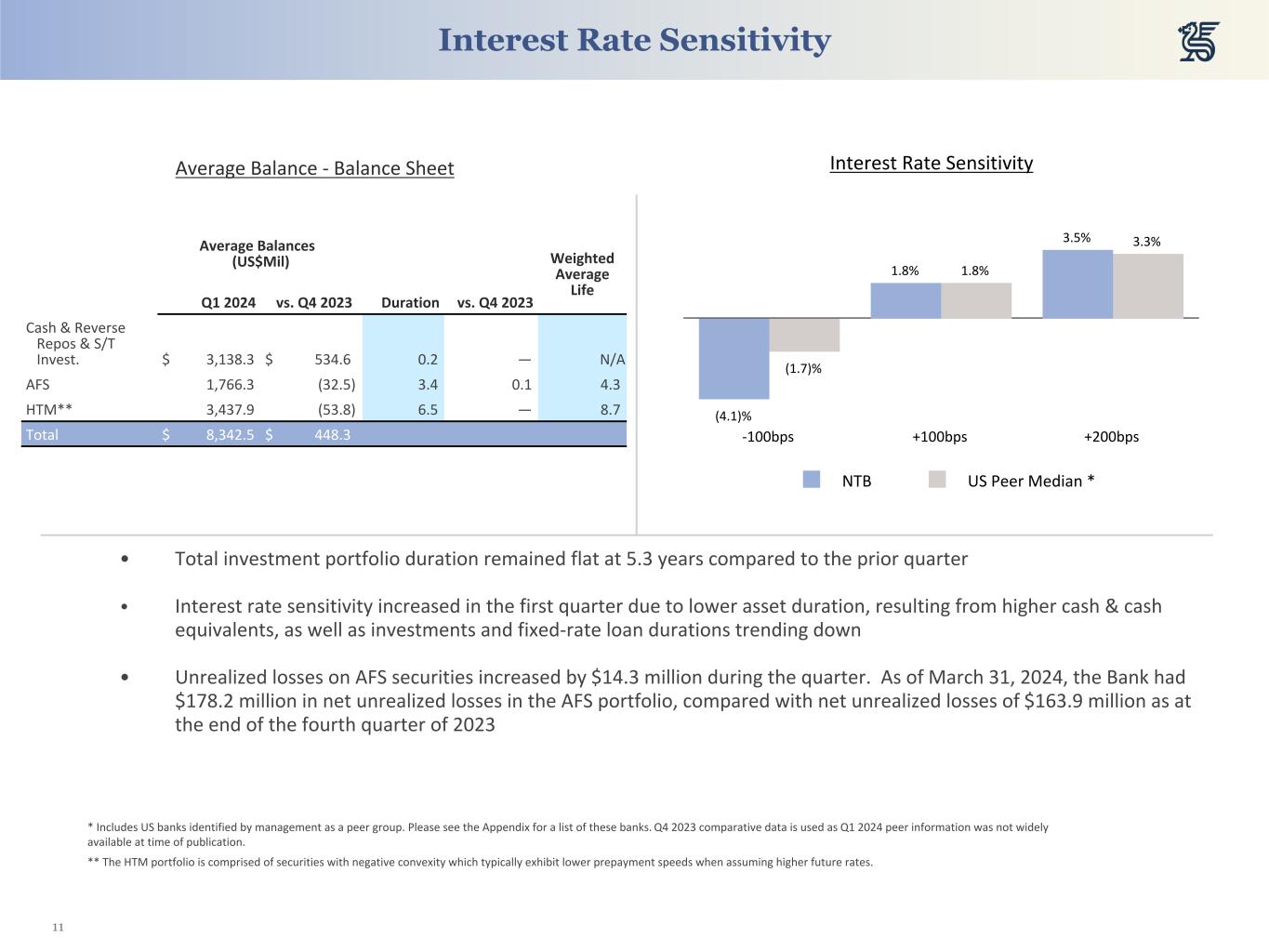

The Bank does not believe that the AFS debt securities that were in an unrealized loss position as of March 31, 2024, comprising 165 securities representing 94.2% of the AFS portfolios' carrying value (December 31, 2023: 163 and 96.2%), represent credit losses. Total gross unrealized AFS losses were 10.8% of the fair value of the affected securities (December 31, 2023: 9.4%).

The Bank’s HTM debt securities are comprised of US government and federal agencies securities and have a zero credit loss assumption under the CECL model. HTM debt securities that were in an unrealized loss position as of March 31, 2024, were comprised of 219 securities representing 100% of the HTM portfolios’ carrying value (December 31, 2023: 219 and 100%). Total gross unrealized HTM losses were 19.4% of the fair value of affected securities (December 31, 2023: 16.3%).

Management does not intend to sell and it is likely that management will not be required to sell the securities prior to the anticipated recovery of the cost of these securities. Unrealized losses were attributable primarily to changes in market interest rates, relative to when the investment securities were purchased, and not due to a decrease in the credit quality of the investment securities. The issuers continue to make timely principal and interest payments on the securities. The following describes the processes for identifying credit impairment in security types with the most significant unrealized losses as shown in the preceding tables.

Management believes that all the US government and federal agencies securities do not have any credit losses, given the explicit and implicit guarantees provided by the US federal government.

Management believes that all the Non-US governments debt securities do not have any credit losses, given the explicit guarantee provided by the issuing government.

Investments in Asset-backed securities - Student loans are composed primarily of securities collateralized by Federal Family Education Loan Program loans (“FFELP loans”). FFELP loans benefit from a US federal government guarantee of at least 97% of defaulted principal and accrued interest, with additional credit support provided in the form of over-collateralization, subordination and excess spread, which collectively total in excess of 100%. Accordingly, the vast majority of FFELP loan-backed securities are not exposed to traditional consumer credit risk.

Investments in Residential mortgage-backed securities relate to 13 securities (December 31, 2023: 13) which are rated AAA and possess similar significant credit enhancement as described above. No credit losses were recognized on these securities as the weighted average credit support and the weighted average loan-to-value ratios range from 15.6% - 49.5% and 45.0% - 53.8%, respectively. Current credit support is significantly greater than any delinquencies experienced on the underlying mortgages.

In the following tables, debt securities with unrealized losses that are not deemed to be credit impaired and for which an allowance for credit losses has not been recorded are categorized as being in a loss position for "less than 12 months" or "12 months or more" based on the point in time that the fair value most recently declined below the amortized

cost basis.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than 12 months |

12 months or more |

|

|

| March 31, 2024 |

Fair

value |

Gross

unrealized

losses |

Fair

value |

Gross

unrealized

losses |

Total

fair value |

Total gross

unrealized

losses |

| Available-for-sale securities with unrealized losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| US government and federal agencies |

122,311 |

|

(531) |

|

1,434,017 |

|

(173,660) |

|

1,556,328 |

|

(174,191) |

|

| Non-US governments debt securities |

— |

|

— |

|

91,289 |

|

(3,121) |

|

91,289 |

|

(3,121) |

|

|

|

|

|

|

|

|

| Asset-backed securities - Student loans |

— |

|

— |

|

40 |

|

— |

|

40 |

|

— |

|

|

|

|

|

|

|

|

| Residential mortgage-backed securities |

— |

|

— |

|

16,545 |

|

(1,956) |

|

16,545 |

|

(1,956) |

|

| Total available-for-sale securities with unrealized losses |

122,311 |

|

(531) |

|

1,541,891 |

|

(178,737) |

|

1,664,202 |

|

(179,268) |

|

|

|

|

|

|

|

|

| Held-to-maturity securities with unrealized losses |

|

|

|

|

|

|

| US government and federal agencies |

— |

|

— |

|

2,848,545 |

|

(552,927) |

|

2,848,545 |

|

(552,927) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less than 12 months |

12 months or more |

|

|

| December 31, 2023 |

Fair

value |

Gross

unrealized

losses |

Fair

value |

Gross

unrealized

losses |

Total

fair value |

Total gross

unrealized

losses |

| Available-for-sale securities with unrealized losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| US government and federal agencies |

7,855 |

|

(137) |

|

1,486,104 |

|

(158,738) |

|

1,493,959 |

|

(158,875) |

|

| Non-US governments debt securities |

— |

|

— |

|

250,177 |

|

(4,355) |

|

250,177 |

|

(4,355) |

|

|

|

|

|

|

|

|

| Asset-backed securities - Student loans |

— |

|

— |

|

40 |

|

— |

|

40 |

|

— |

|

|

|

|

|

|

|

|

| Residential mortgage-backed securities |

— |

|

— |

|

17,127 |

|

(2,073) |

|

17,127 |

|

(2,073) |

|

| Total available-for-sale securities with unrealized losses |

7,855 |

|

(137) |

|

1,753,448 |

|

(165,166) |

|

1,761,303 |

|

(165,303) |

|

|

|

|

|

|

|

|

| Held-to-maturity securities with unrealized losses |

|

|

|

|

|

|

| US government and federal agencies |

— |

|

— |

|

2,976,709 |

|

(484,388) |

|

2,976,709 |

|

(484,388) |

|

|

|

|

|

|

|

|

Investment Maturities

The following table presents the remaining term to contractual maturity of the Bank’s securities. The actual maturities may differ as certain securities offer prepayment options to the borrowers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remaining term to maturity |

|

|

| March 31, 2024 |

Within

3 months |

3 to 12

months |

1 to 5

years |

5 to 10

years |

Over

10 years |

No specific or single

maturity |

Carrying

amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available-for-sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US government and federal agencies |

44,737 |

|

147,267 |

|

587,580 |

|

— |

|

— |

|

879,173 |

|

1,658,757 |

|

| Non-US governments debt securities |

— |

|

91,289 |

|

— |

|

— |

|

— |

|

— |

|

91,289 |

|

|

|

|

|

|

|

|

|

| Asset-backed securities - Student loans |

— |

|

— |

|

— |

|

— |

|

— |

|

40 |

|

40 |

|

|

|

|

|

|

|

|

|

| Residential mortgage-backed securities |

— |

|

— |

|

— |

|

— |

|

— |

|

16,545 |

|

16,545 |

|

|

|

|

|

|

|

|

|

| Total available-for-sale |

44,737 |

|

238,556 |

|

587,580 |

|

— |

|

— |

|

895,758 |

|

1,766,631 |

|

|

|

|

|

|

|

|

|

| Held-to-maturity |

|

|

|

|

|

|

|

| US government and federal agencies |

— |

|

— |

|

— |

|

— |

|

— |

|

3,401,472 |

|

3,401,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pledged Investments

The Bank pledges certain US government and federal agencies investment securities to further secure the Bank's issued customer deposit products. The secured party does not have the right to sell or repledge the collateral.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

December 31, 2023 |

| Pledged Investments |

Amortized

cost |

Fair

value |

Amortized

cost |

Fair

value |

| Available-for-sale |

26,330 |

|

24,310 |

|

27,459 |

|

25,785 |

|

| Held-to-maturity |

94,987 |

|

84,392 |

|

96,952 |

|

88,399 |

|

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Sale Proceeds and Realized Gains and Losses of AFS Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

Sale proceeds |

Gross realized gains |

Gross realized

(losses) |

|

Sale

proceeds |

Gross realized

gains |

Gross realized

(losses) |

|

| Asset-backed securities - Student loans |

— |

|

— |

|

— |

|

|

2,993 |

|

— |

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

| Total |

— |

|

— |

|

— |

|

|

2,993 |

|

— |

|

(8) |

|

|

Taxability of Interest Income

None of the investments' interest income have received a specific preferential income tax treatment in any of the jurisdictions in which the Bank owns investments.

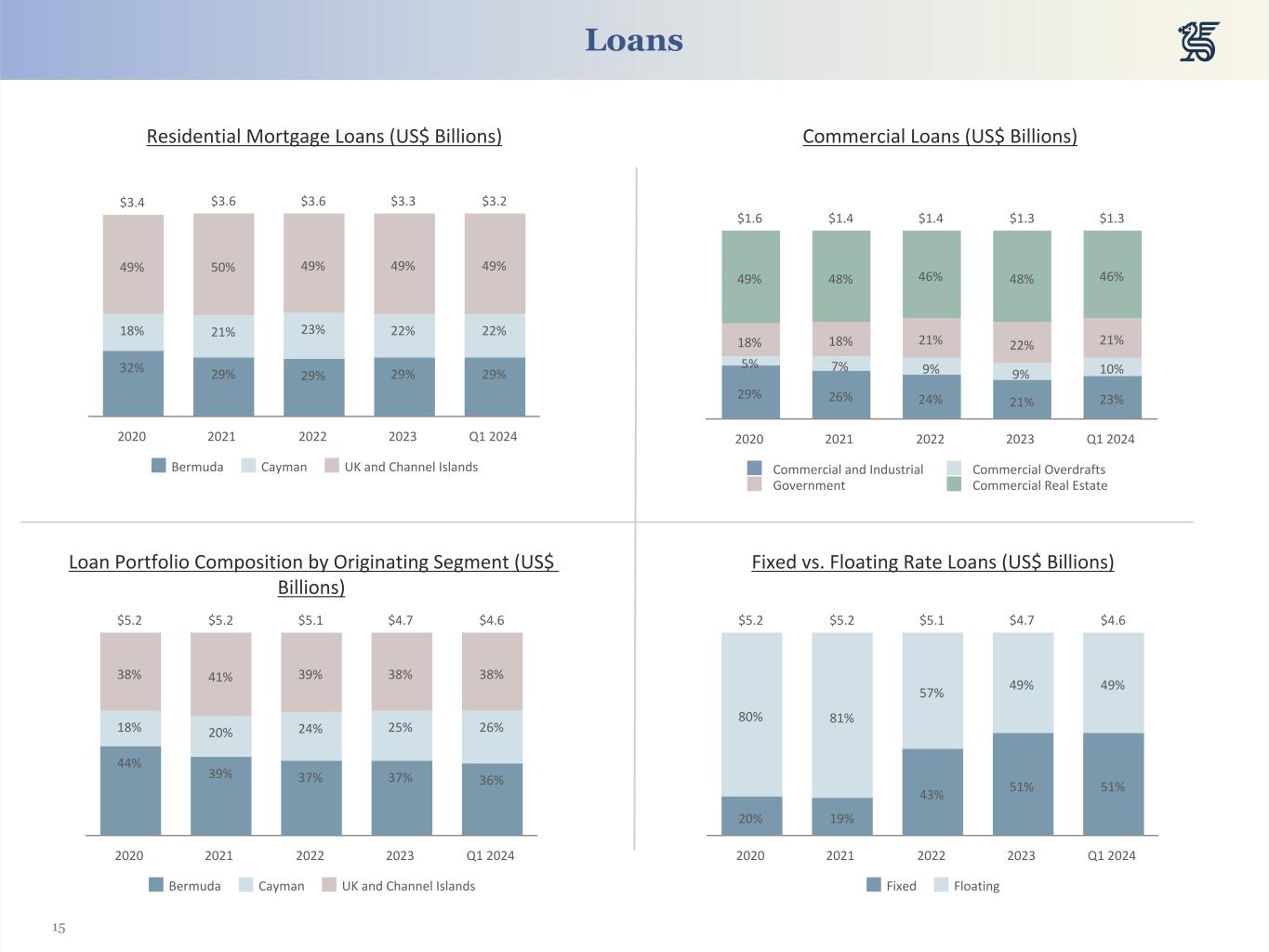

Note 6: Loans

The principal means of securing residential mortgages, personal, credit card and business loans are entitlements over assets and guarantees. Mortgage loans are generally repayable over periods of up to thirty years and personal and business loans are generally repayable over a period of five to ten years, depending on the purpose. Government loans are repayable over a variety of terms which are individually negotiated. Amounts owing on credit cards are revolving and typically a minimum amount is due within 30 days from billing. The credit card portfolio is managed as a single portfolio and includes consumer and business cards. The effective yield on total loans as at March 31, 2024 is 6.48% (December 31, 2023: 6.46%). The interest receivable on total loans as at March 31, 2024 is $23.3 million (December 31, 2023: $23.1 million). The interest receivable is included in Accrued interest and other assets on the consolidated balance sheets and is excluded from all loan amounts disclosed in this note.

Loans' Credit Quality

The four credit quality classifications set out in the following tables are defined below and describe the credit quality of the Bank's lending portfolio. These classifications each encompass a range of more granular internal credit rating grades. Loans' internal credit ratings are assigned by the Bank's customer relationship managers as well as members of the Bank's jurisdictional and Group Credit Committees. The borrowers' financial condition is documented at loan origination and maintained periodically thereafter at a frequency which can be up to monthly for certain loans. The loans' performing status, as well as current economic trends, are continuously monitored. The Bank's jurisdictional and Group Credit Committees meet on a monthly basis. The Bank also has a Group Provisions and Impairments Committee which is responsible for approving significant provisions and other impairment charges.

A pass loan shall mean a loan that is expected to be repaid as agreed. A loan is classified as pass where the Bank is not expected to face repayment difficulties because the present and projected cash flows are sufficient to repay the debt and the repayment schedule as established by the agreement is being followed. Loans in this category are reviewed by the Bank’s management on at least an annual basis.

A special mention loan shall mean a loan under close monitoring by the Bank’s management on at least a quarterly basis. Loans in this category are currently still performing, but are potentially weak and present an undue credit risk exposure, but not to the point of justifying a classification of substandard.

A substandard loan shall mean a loan whose evident unreliability makes repayment doubtful and there is a threat of loss to the Bank unless the unreliability is averted. Loans in this category are under close monitoring by the Bank’s management on at least a quarterly basis.

A non-accrual loan shall mean either management is of the opinion full payment of principal or interest is in doubt or that the principal or interest is 90 days past due unless it is a residential mortgage loan which is well secured and collection efforts are reasonably expected to result in amounts due. Loans in this category are under close monitoring by the Bank’s management on at least a quarterly basis.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

The amortized cost of loans by credit quality classification and allowance for expected credit losses by class of loans is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| March 31, 2024 |

|

|

Pass |

Special

mention |

Substandard |

Non-accrual |

Total amortized cost |

Allowance for expected credit losses |

Total net loans |

| Commercial loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government |

|

|

269,482 |

|

— |

|

— |

|

— |

|

269,482 |

|

(800) |

|

268,682 |

|

| Commercial and industrial |

|

|

267,727 |

|

553 |

|

835 |

|

18,369 |

|

287,484 |

|

(10,569) |

|

276,915 |

|

| Commercial overdrafts |

|

|

122,456 |

|

1,472 |

|

255 |

|

112 |

|

124,295 |

|

(131) |

|

124,164 |

|

| Total commercial loans |

|

|

659,665 |

|

2,025 |

|

1,090 |

|

18,481 |

|

681,261 |

|

(11,500) |

|

669,761 |

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate loans |

|

|

|

|

|

|

|

|

|

| Commercial mortgage |

|

|

573,033 |

|

1,584 |

|

2,485 |

|

3,034 |

|

580,136 |

|

(1,356) |

|

578,780 |

|

| Construction |

|

|

10,700 |

|

— |

|

— |

|

— |

|

10,700 |

|

— |

|

10,700 |

|

| Total commercial real estate loans |

|

|

583,733 |

|

1,584 |

|

2,485 |

|

3,034 |

|

590,836 |

|

(1,356) |

|

589,480 |

|

|

|

|

|

|

|

|

|

|

|

| Consumer loans |

|

|

|

|

|

|

|

|

|

| Automobile financing |

|

|

18,168 |

|

— |

|

— |

|

159 |

|

18,327 |

|

(53) |

|

18,274 |

|

| Credit card |

|

|

85,663 |

|

— |

|

317 |

|

— |

|

85,980 |

|

(1,718) |

|

84,262 |

|

| Overdrafts |

|

|

40,374 |

|

— |

|

— |

|

42 |

|

40,416 |

|

(477) |

|

39,939 |

|

Other consumer1 |

|

|

40,711 |

|

— |

|

1,666 |

|

751 |

|

43,128 |

|

(837) |

|

42,291 |

|

| Total consumer loans |

|

|

184,916 |

|

— |

|

1,983 |

|

952 |

|

187,851 |

|

(3,085) |

|

184,766 |

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgage loans |

|

|

2,991,028 |

|

20,414 |

|

160,903 |

|

36,599 |

|

3,208,944 |

|

(8,839) |

|

3,200,105 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

4,419,342 |

|

24,023 |

|

166,461 |

|

59,066 |

|

4,668,892 |

|

(24,780) |

|

4,644,112 |

|

1 Other consumer loans’ amortized cost includes $9 million of cash and portfolio secured lending and $27 million of lending secured by buildings in construction or other collateral.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2023 |

|

|

Pass |

Special

mention |

Substandard |

Non-accrual |

Total amortized cost |

Allowance for expected credit losses |

Total net loans |

| Commercial loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government |

|

|

274,854 |

|

— |

|

— |

|

— |

|

274,854 |

|

(848) |

|

274,006 |

|

| Commercial and industrial |

|

|

258,325 |

|

626 |

|

853 |

|

18,392 |

|

278,196 |

|

(10,133) |

|

268,063 |

|

| Commercial overdrafts |

|

|

116,859 |

|

1,689 |

|

159 |

|

87 |

|

118,794 |

|

(267) |

|

118,527 |

|

| Total commercial loans |

|

|

650,038 |

|

2,315 |

|

1,012 |

|

18,479 |

|

671,844 |

|

(11,248) |

|

660,596 |

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate loans |

|

|

|

|

|

|

|

|

|

| Commercial mortgage |

|

|

590,276 |

|

1,484 |

|

1,842 |

|

3,133 |

|

596,735 |

|

(1,441) |

|

595,294 |

|

| Construction |

|

|

10,981 |

|

— |

|

— |

|

— |

|

10,981 |

|

— |

|

10,981 |

|

| Total commercial real estate loans |

|

|

601,257 |

|

1,484 |

|

1,842 |

|

3,133 |

|

607,716 |

|

(1,441) |

|

606,275 |

|

|

|

|

|

|

|

|

|

|

|

| Consumer loans |

|

|

|

|

|

|

|

|

|

| Automobile financing |

|

|

18,823 |

|

— |

|

— |

|

139 |

|

18,962 |

|

(59) |

|

18,903 |

|

| Credit card |

|

|

85,242 |

|

— |

|

392 |

|

— |

|

85,634 |

|

(1,744) |

|

83,890 |

|

| Overdrafts |

|

|

42,673 |

|

— |

|

— |

|

42 |

|

42,715 |

|

(379) |

|

42,336 |

|

Other consumer1 |

|

|

41,901 |

|

— |

|

1,682 |

|

839 |

|

44,422 |

|

(914) |

|

43,508 |

|

| Total consumer loans |

|

|

188,639 |

|

— |

|

2,074 |

|

1,020 |

|

191,733 |

|

(3,096) |

|

188,637 |

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgage loans |

|

|

3,105,085 |

|

16,084 |

|

140,761 |

|

38,385 |

|

3,300,315 |

|

(9,974) |

|

3,290,341 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

4,545,019 |

|

19,883 |

|

145,689 |

|

61,017 |

|

4,771,608 |

|

(25,759) |

|

4,745,849 |

|

1 Other consumer loans’ amortized cost includes $8 million of cash and portfolio secured lending and $27 million of lending secured by buildings in construction or other collateral.

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

Based on the most recent analysis performed, the amortized cost of loans by year of origination and credit quality classification is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| March 31, 2024 |

Pass |

Special

mention |

Substandard |

Non-accrual |

Total amortized cost |

| Loans by origination year |

|

|

|

|

|

| 2024 |

99,730 |

|

— |

|

— |

|

— |

|

99,730 |

|

| 2023 |

418,099 |

|

— |

|

— |

|

— |

|

418,099 |

|

| 2022 |

823,557 |

|

134 |

|

— |

|

984 |

|

824,675 |

|

| 2021 |

499,405 |

|

134 |

|

— |

|

— |

|

499,539 |

|

| 2020 |

344,714 |

|

441 |

|

29,879 |

|

22 |

|

375,056 |

|

| Prior |

1,980,054 |

|

21,639 |

|

136,010 |

|

57,906 |

|

2,195,609 |

|

| Overdrafts and credit cards |

253,783 |

|

1,675 |

|

572 |

|

154 |

|

256,184 |

|

| Total amortized cost |

4,419,342 |

|

24,023 |

|

166,461 |

|

59,066 |

|

4,668,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2023 |

Pass |

Special

mention |

Substandard |

Non-accrual |

Total amortized cost |

| Loans by origination year |

|

|

|

|

|

| 2023 |

446,889 |

|

— |

|

— |

|

— |

|

446,889 |

|

| 2022 |

868,598 |

|

141 |

|

— |

|

1,024 |

|

869,763 |

|

| 2021 |

522,169 |

|

146 |

|

— |

|

— |

|

522,315 |

|

| 2020 |

364,225 |

|

457 |

|

25,534 |

|

12 |

|

390,228 |

|

| 2019 |

526,356 |

|

339 |

|

272 |

|

8,979 |

|

535,946 |

|

| Prior |

1,559,264 |

|

17,110 |

|

119,332 |

|

50,872 |

|

1,746,578 |

|

| Overdrafts and credit cards |

257,518 |

|

1,690 |

|

551 |

|

130 |

|

259,889 |

|

| Total amortized cost |

4,545,019 |

|

19,883 |

|

145,689 |

|

61,017 |

|

4,771,608 |

|

Age Analysis of Past Due Loans (Including Non-Accrual Loans)

The following tables summarize the past due status of the loans. The aging of past due amounts are determined based on the contractual delinquency status of payments under the loan and this aging may be affected by the timing of the last business day at period end. Loans less than 30 days past due are included in current loans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| March 31, 2024 |

30 - 59

days |

60 - 89

days |

90 days or more |

Total past

due loans |

Total

current |

Total

amortized cost |

|

| Commercial loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government |

— |

|

— |

|

— |

|

— |

|

269,482 |

|

269,482 |

|

|

| Commercial and industrial |

— |

|

— |

|

18,369 |

|

18,369 |

|

269,115 |

|

287,484 |

|

|

| Commercial overdrafts |

— |

|

— |

|

112 |

|

112 |

|

124,183 |

|

124,295 |

|

|

| Total commercial loans |

— |

|

— |

|

18,481 |

|

18,481 |

|

662,780 |

|

681,261 |

|

|

|

|

|

|

|

|

|

|

| Commercial real estate loans |

|

|

|

|

|

|

|

| Commercial mortgage |

351 |

|

472 |

|

3,034 |

|

3,857 |

|

576,279 |

|

580,136 |

|

|

| Construction |

— |

|

— |

|

— |

|

— |

|

10,700 |

|

10,700 |

|

|

| Total commercial real estate loans |

351 |

|

472 |

|

3,034 |

|

3,857 |

|

586,979 |

|

590,836 |

|

|

|

|

|

|

|

|

|

|

| Consumer loans |

|

|

|

|

|

|

|

| Automobile financing |

23 |

|

1 |

|

125 |

|

149 |

|

18,178 |

|

18,327 |

|

|

| Credit card |

559 |

|

343 |

|

317 |

|

1,219 |

|

84,761 |

|

85,980 |

|

|

| Overdrafts |

— |

|

— |

|

42 |

|

42 |

|

40,374 |

|

40,416 |

|

|

| Other consumer |

296 |

|

68 |

|

2,241 |

|

2,605 |

|

40,523 |

|

43,128 |

|

|

| Total consumer loans |

878 |

|

412 |

|

2,725 |

|

4,015 |

|

183,836 |

|

187,851 |

|

|

|

|

|

|

|

|

|

|

| Residential mortgage loans |

20,219 |

|

16,941 |

|

128,446 |

|

165,606 |

|

3,043,338 |

|

3,208,944 |

|

|

|

|

|

|

|

|

|

|

| Total amortized cost |

21,448 |

|

17,825 |

|

152,686 |

|

191,959 |

|

4,476,933 |

|

4,668,892 |

|

|

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, 2023 |

30 - 59

days |

60 - 89

days |

90 days or more |

Total past

due loans |

Total

current |

Total

amortized

cost |

| Commercial loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government |

— |

|

— |

|

— |

|

— |

|

274,854 |

|

274,854 |

|

| Commercial and industrial |

— |

|

— |

|

18,392 |

|

18,392 |

|

259,804 |

|

278,196 |

|

| Commercial overdrafts |

— |

|

— |

|

87 |

|

87 |

|

118,707 |

|

118,794 |

|

| Total commercial loans |

— |

|

— |

|

18,479 |

|

18,479 |

|

653,365 |

|

671,844 |

|

|

|

|

|

|

|

|

| Commercial real estate loans |

|

|

|

|

|

|

| Commercial mortgage |

— |

|

355 |

|

3,133 |

|

3,488 |

|

593,247 |

|

596,735 |

|

| Construction |

— |

|

— |

|

— |

|

— |

|

10,981 |

|

10,981 |

|

| Total commercial real estate loans |

— |

|

355 |

|

3,133 |

|

3,488 |

|

604,228 |

|

607,716 |

|

|

|

|

|

|

|

|

| Consumer loans |

|

|

|

|

|

|

| Automobile financing |

124 |

|

42 |

|

112 |

|

278 |

|

18,684 |

|

18,962 |

|

| Credit card |

902 |

|

255 |

|

392 |

|

1,549 |

|

84,085 |

|

85,634 |

|

| Overdrafts |

— |

|

— |

|

42 |

|

42 |

|

42,673 |

|

42,715 |

|

| Other consumer |

— |

|

89 |

|

2,296 |

|

2,385 |

|

42,037 |

|

44,422 |

|

| Total consumer loans |

1,026 |

|

386 |

|

2,842 |

|

4,254 |

|

187,479 |

|

191,733 |

|

|

|

|

|

|

|

|

| Residential mortgage loans |

23,483 |

|

17,559 |

|

102,224 |

|

143,266 |

|

3,157,049 |

|

3,300,315 |

|

|

|

|

|

|

|

|

| Total amortized cost |

24,509 |

|

18,300 |

|

126,678 |

|

169,487 |

|

4,602,121 |

|

4,771,608 |

|

Changes in Allowances For Credit Losses

The decrease in the allowance for expected credit losses during the three months ended March 31, 2024 was primarily attributable to repayment of two residential mortgage properties following the sale of the underlying collateral and reduced delinquencies in Bermuda. As disclosed in Note 2 of the December 31, 2023 Audited Consolidated Financial Statements, the Bank continuously collects and maintains attributes related to financial instruments within the scope of CECL, including current conditions, and reasonable and supportable assumptions about future economic conditions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2024 |

|

Commercial |

Commercial

real estate |

Consumer |

Residential

mortgage |

Total |

| Balance at the beginning of period |

11,248 |

|

1,441 |

|

3,096 |

|

9,974 |

|

25,759 |

|

| Provision increase (decrease) |

423 |

|

(85) |

|

154 |

|

(917) |

|

(425) |

|

| Recoveries of previous charge-offs |

— |

|

— |

|

284 |

|

108 |

|

392 |

|

| Charge-offs, by origination year |

|

|

|

|

|

| 2024 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2023 |

— |

|

— |

|

(2) |

|

— |

|

(2) |

|

| 2022 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2021 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2020 |

— |

|

— |

|

— |

|

— |

|

— |

|

| Prior |

(170) |

|

— |

|

— |

|

(323) |

|

(493) |

|

| Overdrafts and credit cards |

(1) |

|

— |

|

(446) |

|

— |

|

(447) |

|

| Other |

— |

|

— |

|

(1) |

|

(3) |

|

(4) |

|

| Allowances for expected credit losses at end of period |

11,500 |

|

1,356 |

|

3,085 |

|

8,839 |

|

24,780 |

|

The Bank of N.T. Butterfield & Son Limited

Notes to the Consolidated Financial Statements (unaudited) (continued)

(In thousands of US dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2023 |

|

Commercial |

Commercial

real estate |

Consumer |

Residential

mortgage |

Total |

Balance at the beginning of period |

12,143 |

|

884 |

|

2,696 |

|

9,238 |

|

24,961 |

|

| Provision increase (decrease) |

(243) |

|

(41) |

|

679 |

|

276 |

|

671 |

|

| Recoveries of previous charge-offs |

67 |

|

— |

|

343 |

|

262 |

|

672 |

|

| Charge-offs, by origination year |

|

|

|

|

|

| 2023 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2022 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2021 |

— |

|

— |

|

(16) |

|

— |

|

(16) |

|

| 2020 |

— |

|

— |

|

— |

|

— |

|

— |

|

| 2019 |

— |

|

— |

|

— |

|

— |

|

— |

|

| Prior |

(66) |

|

— |

|

(121) |

|

(474) |

|

(661) |

|