NOTICE OF ANNUAL GENERAL MEETING TO THE SHAREHOLDERS OF THE BANK OF N.T. BUTTERFIELD & SON LIMITED The 2024 Annual General Meeting of The Bank of N.T. Butterfield & Son Limited (the “Bank”) will be held at 10:00 a.m. Bermuda time on May 8, 2024. The meeting is a virtual shareholder meeting and will be held via a live webcast with telephone access. There will be no physical meeting. Shareholders will be able to access the virtual Annual General Meeting, vote their shares and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/NTB2024. Shareholders may also access the meeting by telephone at 1 (888) 560-5639 (toll-free U.S. and Canada) or 1 (929) 207-7651 (international). Shareholders must enter the control number included in their proxy materials in order to attend the meeting through the website or by telephone. If attending by telephone, shareholders should ask to be joined into “The Bank of N.T. Butterfield & Son Limited” call. Additional instructions regarding voting by the internet and telephone are listed on the proxy card. At the meeting, in addition to transacting such other business as may properly come before the meeting including any adjournments and postponements thereof, the shareholders of the Bank will consider and vote on the following proposals: 1. To appoint PricewaterhouseCoopers Ltd. as the independent auditor of the Bank for the year ending December 31, 2024, and to authorize the Board of Directors of the Bank, acting through the Audit Committee, to set their remuneration. 2. To elect each of the following individuals as a Director, to hold office until the close of the 2025 Annual General Meeting, or until his or her successor is duly elected or appointed: Michael Collins Alastair Barbour Sonia Baxendale Mark Lynch Ingrid Pierce Jana Schreuder Michael Schrum John Wright 3. To generally and unconditionally authorize the Board of Directors to dispose of or transfer all or any treasury shares, and to allot, issue or grant (i) shares; (ii) securities convertible into shares; or (iii) options, warrants or similar rights to subscribe for any shares or such convertible securities, where the shares in question are of a class that is listed on the Bermuda Stock Exchange (“BSX shares”), provided that the BSX shares allotted and issued pursuant hereto are in aggregate less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting, to such person(s), at such times, for such consideration and upon such terms and conditions as the Board of Directors may determine.

2 In addition, the audited financial statements for the Bank for the year ended December 31, 2023 and the independent auditor’s report thereon will be laid before the shareholders at the 2024 Annual General Meeting. Only shareholders of record, as shown on the register of shareholders of the Bank, as of the close of business on February 21, 2024 are entitled to notice of and to vote at the 2024 Annual General Meeting. Changes to our bye-laws permit us to provide shareholder documents (including proxy materials) to our shareholders via electronic delivery, unless they request printed copies of such materials. Electronic delivery allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials. On or about March 13, 2024, we will begin mailing or otherwise distributing a notice regarding the availability of proxy materials to shareholders informing them that our proxy statement, 2023 Annual Report on Form 20-F and voting instructions are available on the internet as of such date. Instructions will be provided about how to access the materials and vote. We will provide a printed or emailed copy of our proxy materials to those shareholders who request delivery by such methods. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF PROPOSAL NUMBERS 1, 2, AND 3. PLEASE VOTE BY INTERNET, TELEPHONE, OR MAIL AS PROMPTLY AS POSSIBLE IF YOU DO NOT PLAN TO ATTEND THE MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ENCLOSED PROXY STATEMENT. By Order of the Board of Directors, Mr. Michael W. Collins Chairman & Chief Executive Officer March 13, 2024 Hamilton, Bermuda

3 THE BANK OF N.T. BUTTERFIELD & SON LIMITED 65 Front Street Hamilton HM 12 Bermuda 2024 Annual General Meeting May 8, 2024 PROXY STATEMENT The Board of Directors (the “Board”) of The Bank of N.T. Butterfield & Son Limited (the “Bank”) is soliciting the accompanying proxy form to be voted at the 2024 Annual General Meeting of the Bank to be held at 10:00 a.m. Bermuda time on May 8, 2024 (the “Meeting”), including any adjournments or postponements thereof. The Meeting is virtual and will be held via a live webcast with telephone access. There will be no physical meeting. Shareholders will be able to access the virtual Meeting, vote their shares and submit questions during the Meeting by visiting www.virtualshareholdermeeting.com/NTB2024. Shareholders may also access the Meeting by telephone by dialing 1 (888) 560-5639 (toll-free U.S. and Canada) or 1 (929) 207-7651 (international). Shareholders must enter the control number included in their proxy materials in order to attend the Meeting through the website or by telephone. Please see “Attending and Participating in the Virtual Annual General Meeting” below for additional information. Only holders of the voting ordinary shares, par value BD$0.01 per share, of the Bank (the “Common Shares”) of record as of the close of business on February 21, 2024 (the “Record Date”) will be entitled to vote at or participate in the Meeting. As of the close of business on the Record Date, there were issued 47,563,072 Common Shares, of which 46,943,860 shares were outstanding and entitled to vote at the meeting and 619,212 were held as treasury shares. Each Common Share entitles the holder of record on such date to one vote. Any shareholder wishing to vote by giving a proxy prior to the Meeting must vote online, by phone or by mail. To use the internet to transmit voting instructions, shareholders must access the website www.proxyvote.com. Shareholders may alternatively use any touchtone phone to transmit voting instructions by dialing 1 (800) 690- 6903. Shareholders who vote online or by phone must vote by 11:59 pm ET on May 7, 2024. For voting by mail, shareholders must deliver a completed proxy to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, USA. Completed proxy cards delivered by mail must be postmarked on or before May 1, 2024 in order to be processed. When a proxy is properly executed and returned, the Common Shares to which it relates will, subject to any direction to the contrary, be voted in the manner indicated on the proxy with respect to the proposals specified in the Notice of Annual General Meeting attached hereto and, in the absence of voting instructions, will be voted in favor of each of the proposals. Any shareholder who has given a proxy may revoke it prior to its exercise by providing Broadridge at the address listed above with written notice of revocation (provided such notice is given in sufficient time to permit the necessary examination and tabulation of the revocation before the vote is taken), by voting at the Meeting or by executing a later-dated proxy (provided such later-dated proxy is submitted or postmarked within the voting deadlines for internet, telephone or mail voting, as applicable). The affirmative vote of a majority of the votes cast by holders of issued and outstanding Common Shares present in person or by proxy at the Meeting is required for approval of the proposals specified in the Notice of Annual General Meeting accompanying this Proxy Statement; provided that a quorum is present consisting of two or more persons present in person and representing in person or by proxy in excess of 25% of the total issued and outstanding shares entitled to vote at the meeting. Holders of Common Shares who are present in person or by proxy but who abstain from voting will be counted towards the quorum but will not be considered as voting. A notice informing shareholders where they can access this Proxy Statement, the accompanying Notice of Annual General Meeting, the proxy form and the Bank’s Annual Report on Form 20-F for the year ending December 31, 2023 is first being mailed or otherwise distributed to shareholders on or about March 13, 2024. Please see

4 “Electronic Delivery of Proxy Materials” below for additional information. It is important that your shares be represented and voted at the Meeting. Regardless of whether you plan to virtually attend and participate in the Meeting, we encourage you to vote in advance. The Board knows of no specific matter to be brought before the Meeting which is not referred to in the accompanying Notice of Annual General Meeting.

5 BACKGROUND OF THE PROPOSED DIRECTORS In relation to Proposal 2, the election of Directors, biographical information is provided for each person proposed: Michael Collins, Alastair Barbour, Sonia Baxendale, Mark Lynch, Ingrid Pierce, Jana Schreuder, Michael Schrum, and John Wright. With the exceptions of Mr. Collins, who serves as the Bank’s Chairman and Chief Executive Officer, and Mr. Schrum, who serves as the Bank’s President and Group Chief Risk Officer, the remaining Directors are independent Directors. Michael Collins joined the Board in 2015 when he was named Chief Executive Officer of the Bank. He was named Chairman in July of 2017. Prior to this appointment, Mr. Collins was Senior Executive Vice President with responsibility for all of the Bank's client businesses in Bermuda, including Corporate, Private and Retail Banking, as well as the Operations, Custody and Marketing functions in Bermuda and the Cayman Islands. Mr. Collins has more than 40 years of experience in financial services, having held progressively senior positions, at Morgan Guaranty Trust Company in New York and later at Bank of Bermuda and HSBC in Bermuda. Before joining the Bank in 2009, Mr. Collins was Chief Operating Officer at HSBC Bank Bermuda. Mr. Collins holds a BA in Economics from Brown University. Alastair Barbour joined the Board in 2012 and was appointed Lead Independent Director in October 2021. He is a Chartered Accountant with more than 25 years of experience providing auditing and advisory services to publicly traded companies, primarily in the financial services industry. Mr. Barbour was employed with KPMG from 1978 until his retirement in 2011. During his time there, he held various positions both locally and overseas. In 1985, he was named Partner at KPMG (Bermuda). Mr. Barbour's most recent position was head of KPMG's Financial Services Group in Scotland. Currently, Mr. Barbour serves as Non-Executive Chairman of Liontrust Asset Management plc. Mr. Barbour trained with Peat, Marwick, Mitchell & Co. in London and holds a Bachelor of Science from the University of Edinburgh. He is a Fellow of the Institute of Chartered Accountants in England & Wales. Sonia Baxendale joined the Board in 2020. She is currently the President and CEO of the Global Risk Institute, a government, industry and academic partnership. From 1992 to 2011, Ms. Baxendale held senior leadership roles within Canadian Imperial Bank of Commerce (“CIBC”), including six years as Senior Executive Vice President and President of Retail Banking and Wealth Management. Prior to joining CIBC, Ms. Baxendale held progressively senior positions with Saatchi & Saatchi and American Express Canada. Ms. Baxendale serves on the Boards of several public and private companies, including Foresters Financial and Laurentian Bank of Canada. Ms. Baxendale also serves as Chair of the Board of Directors of the Hospital for SickKids Foundation and on the Board of Trustees for Toronto’s Hospital for Sick Children. She holds a Bachelor of Arts in Political Science and Economics from Victoria College, University of Toronto. Mark Lynch joined the Board in 2019. Until June 30, 2019, he was a partner of Boston-based Wellington Management Co., where he served as the firm’s senior financial services analyst since 1994 and a partner since 1996. He was also a portfolio manager of mutual funds, hedge funds, and institutional portfolios over that period. Prior to joining Wellington, Mr. Lynch was a US regional bank analyst with Lehman Brothers and Bear Stearns. He holds a degree in European History from Harvard College. Ingrid Pierce joined the Board in December 2022. She is the Global Managing Partner of Walkers, a leading international law firm that provides legal, corporate, fiduciary and compliance services to global corporations, financial institutions, capital markets participants and investment fund managers. Recognized as one of the world's leading investment funds lawyers, she acts for major institutions, asset managers, insurers, reinsurers, trustees and other fiduciaries. Ms. Pierce was made a partner of Walkers in 2008 having joined the firm in 2002. She practiced in the Insolvency and Dispute Resolution Group, Trusts Group and Investment Funds Group, where she became head of the Cayman Islands practice. Prior to Walkers, Ms. Pierce spent nearly a decade working as a Barrister in London in the commercial chancery field. Ms. Pierce serves as a member of the Board of Directors of Lex Mundi, the world's leading network of independent law firms, and is a member of the Society of Trust and

6 Estate Practitioners (STEP). She holds a Bachelor of Laws from University College London (UCL) and was admitted to the Bar of England and Wales (1992) (not practicing), the Cayman Islands (2002) and the British Virgin Islands (2002). Jana Schreuder joined the Board in 2020. She is an experienced executive who most recently served as Executive Vice President and Chief Operating Officer of Northern Trust Corporation, a role from which she retired in 2018. Ms. Schreuder joined Northern Trust in 1980 and during her tenure held multiple roles as a member of the executive management team, including: the President of Wealth Management from 2011 through 2014; President of Operations & Technology from 2007 through 2010; and Chief Risk Officer from 2005 through 2006. Ms. Schreuder currently serves as a Director and Chair of the Compensation Committees of Kyndryl Holdings Inc. and, until December 2023, Avantax Inc. (formerly Blucora, Inc.). Since 2008, Ms. Schreuder has served as a Director and is currently Chair of the Compensation Committee for Entrust Corporation. From 2016 to 2018, Ms. Schreuder was a member of the Board of Directors of LifePoint Health. Ms. Schreuder received her Bachelor of Business Administration degree from Southern Methodist University and a Master’s degree in finance and marketing management from Northwestern University's Kellogg Graduate School of Management. Ms. Schreuder is a member of the New York Chapter of Women Corporate Directors and the National Association of Corporate Directors, from which she has received the NACD Directorship Certification. Michael Schrum joined the Board in 2020. He was appointed President and Group Chief Risk Officer in May 2022 and served as Group Chief Financial Officer from 2015. He was previously Chief Financial Officer at HSBC Bank Bermuda. Mr. Schrum has more than 25 years of financial services experience in London, New York and Bermuda, mainly in banking, insurance and tax. He joined HSBC in Bermuda in 2001 and held progressively more senior positions within the bank’s Commercial Banking, Strategy, and Finance divisions. He is a CFA Charterholder (CFA Institute), and a Fellow Chartered Accountant (Institute of Chartered Accountants in England and Wales). Mr. Schrum holds a Master’s (University of London) and Bachelor’s (Southern Denmark Business School) degree in Economics. John Wright joined the Board in 2002. Mr. Wright retired as chief executive of Clydesdale & Yorkshire Banks in 2001. Mr. Wright’s career in commercial banking spans over 43 years and includes assignments in the UK, India, Sri Lanka, West Africa, Canada, Hong Kong and the United States. He is a visiting Professor at Heriot-Watt University Business School, a past President of the Irish Institute of Bankers and a past Vice President of the Chartered Institute of Bankers in Scotland. Mr. Wright was educated at Daniel Stewart's College Edinburgh.

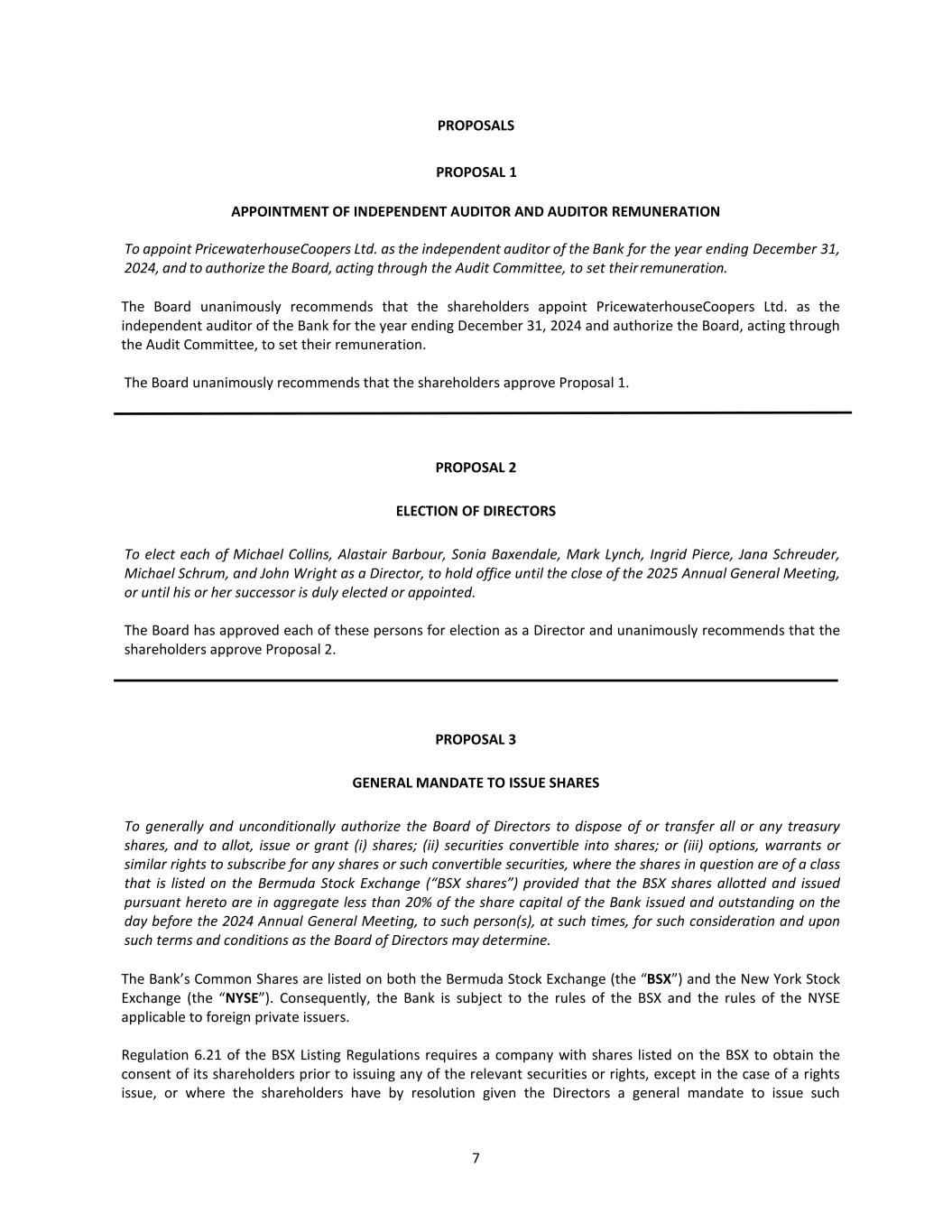

7 PROPOSALS PROPOSAL 1 APPOINTMENT OF INDEPENDENT AUDITOR AND AUDITOR REMUNERATION To appoint PricewaterhouseCoopers Ltd. as the independent auditor of the Bank for the year ending December 31, 2024, and to authorize the Board, acting through the Audit Committee, to set their remuneration. The Board unanimously recommends that the shareholders appoint PricewaterhouseCoopers Ltd. as the independent auditor of the Bank for the year ending December 31, 2024 and authorize the Board, acting through the Audit Committee, to set their remuneration. The Board unanimously recommends that the shareholders approve Proposal 1. PROPOSAL 2 ELECTION OF DIRECTORS To elect each of Michael Collins, Alastair Barbour, Sonia Baxendale, Mark Lynch, Ingrid Pierce, Jana Schreuder, Michael Schrum, and John Wright as a Director, to hold office until the close of the 2025 Annual General Meeting, or until his or her successor is duly elected or appointed. The Board has approved each of these persons for election as a Director and unanimously recommends that the shareholders approve Proposal 2. PROPOSAL 3 GENERAL MANDATE TO ISSUE SHARES To generally and unconditionally authorize the Board of Directors to dispose of or transfer all or any treasury shares, and to allot, issue or grant (i) shares; (ii) securities convertible into shares; or (iii) options, warrants or similar rights to subscribe for any shares or such convertible securities, where the shares in question are of a class that is listed on the Bermuda Stock Exchange (“BSX shares”) provided that the BSX shares allotted and issued pursuant hereto are in aggregate less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting, to such person(s), at such times, for such consideration and upon such terms and conditions as the Board of Directors may determine. The Bank’s Common Shares are listed on both the Bermuda Stock Exchange (the “BSX”) and the New York Stock Exchange (the “NYSE”). Consequently, the Bank is subject to the rules of the BSX and the rules of the NYSE applicable to foreign private issuers. Regulation 6.21 of the BSX Listing Regulations requires a company with shares listed on the BSX to obtain the consent of its shareholders prior to issuing any of the relevant securities or rights, except in the case of a rights issue, or where the shareholders have by resolution given the Directors a general mandate to issue such

8 securities or rights. Regulation 6.21 applies to any issuance of such securities or rights by a BSX listed company and provides no de minimis exception that would allow a company to issue a small number of such securities or rights without seeking express shareholder approval. This Proposal 3 requests shareholder approval for share issuances as described above so that the Board’s authority is consistent with and parallel to the requirement under NYSE Rule 312.03, which requires shareholder approval for certain Common Share issuances by the Bank. The scope of the general mandate is limited, so that the securities allotted and issued pursuant thereto are less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting. As noted above, under applicable rules of the BSX, absent the mandate the Board may only take these actions if authorized to do so by shareholders. Pursuant to this Proposal 3, the Board will be permitted to exercise its power to dispose of or transfer treasury shares, and to allot, issue or grant (i) BSX shares; (ii) securities convertible into BSX shares; or (iii) options, warrants or similar rights to subscribe for any BSX shares or such convertible securities, provided that the BSX shares allotted and issued are in aggregate less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting. The Board’s authority will only be valid until the conclusion of the Annual General Meeting in 2025. The grant of the general mandate will allow the Bank to issue, amongst other things, Common Shares pursuant to its employee share incentive plans, employee share purchase plan and to issue Common Shares in connection with the exercise of any outstanding options previously granted by the Bank. The general mandate would also allow the Bank to engage in any corporate transaction consistent with its strategic growth strategy, subject to the limitation on the amount of shares that can be allotted and issued pursuant to the general mandate. In 2023, the general mandate was used to issue Common Shares under the Bank’s employee share incentive plans, the employee share purchase plan, and the Board’s Director remuneration plan. Other than the allotment of Common Shares for the purposes of fulfilling the Bank’s obligations under certain of its share plans and in connection with the exercise of options or in connection with any corporate transaction consistent with its strategic growth strategy, the Directors have no present intention to exercise this authority. The authority is, however, sought to ensure that the Bank has maximum flexibility in managing the group’s capital resources and the Board considers it prudent to acquire the flexibility that this authority provides. The Bank’s Directors intend to seek renewal of this authority annually. The Board unanimously recommends that the shareholders approve this Proposal 3. VOTE REQUIRED The affirmative vote of a majority of the votes cast by holders of issued and outstanding Common Shares present in person or by proxy at the Meeting is required for approval of the proposals specified in the Notice of Annual General Meeting accompanying this Proxy Statement; provided that a quorum is present consisting of two or more persons present in person and representing in person or by proxy in excess of 25% of the total issued and outstanding shares entitled to vote at the meeting. If the Proposals are approved by the shareholders, they will become effective immediately. ATTENDING AND PARTICIPATING IN THE VIRTUAL ANNUAL GENERAL MEETING The Meeting will be accessible only through the internet or by telephone. You will not be able to attend the Meeting in person. You are entitled to virtually attend and participate in the Meeting only if you were a shareholder as of February 21, 2024, the Record Date, or if you hold a valid proxy for the Meeting.

9 To virtually attend and participate in the Meeting you must access the website at www.virtualshareholdermeeting.com/NTB2024. You may also attend by telephone at 1 (888) 560-5639 (toll-free U.S. and Canada) or 1 (929) 207-7651 (international). Shareholders must enter the control number found on their proxy materials in order to attend via the website or telephone. If attending by telephone, shareholders should ask to be joined into “The Bank of N.T. Butterfield & Son Limited” call. Additional instructions regarding voting by the internet and telephone are listed on the proxy card. We encourage you to access the Meeting prior to the start time. Please allow ample time for check-in, which will begin at 9:45 am Bermuda time. It is important that your shares be represented and voted at the Meeting. Regardless of whether you plan to virtually attend and participate in the Meeting, we encourage you to vote in advance. We welcome questions from shareholders. If you wish to submit a question, you may do so during the Meeting by telephone or the website. Questions pertinent to Meeting matters will be answered during the Meeting, subject to time constraints. Questions not complying with our Meeting rules of conduct will not be answered. Any questions pertinent to Meeting matters that cannot be answered during the Meeting due to time constraints will be posted online and answered at www.butterfieldgroup.com. Additional information regarding the rules and procedures for participating in the Meeting will be set forth in our meeting rules of conduct, which shareholders can view during the Meeting at the website noted above and at www.butterfieldgroup.com. Shareholders can also access copies of this Proxy Statement and our Annual Report on Form 20-F for the year ending December 31, 2023 at the Meeting website and at www.butterfieldgroup.com. ELECTRONIC DELIVERY OF PROXY MATERIALS Our bye-laws permit us to provide shareholder documents (including proxy materials) to our shareholders via electronic delivery, unless they request printed copies of such materials. Electronic delivery allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials. On or about March 13, 2024, we will begin mailing or otherwise distributing a notice regarding the availability of proxy materials to shareholders informing them that our proxy statement, Annual Report on Form 20-F for the year ending December 31, 2023 and voting instructions are available on the internet as of such date. Instructions will be provided about how to access the materials and vote, as well as request copies of the materials. We will provide a printed or emailed copy of our proxy materials free of charge to those shareholders who request delivery by such methods. Requests for printed copies of proxy materials must be received by April 17, 2024. RECOMMENDATION BY THE BOARD OF DIRECTORS THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NUMBERS 1, 2, AND 3. *********

[This page intentionally left blank]

[This page intentionally left blank]

BRG0772R-0224-NPS

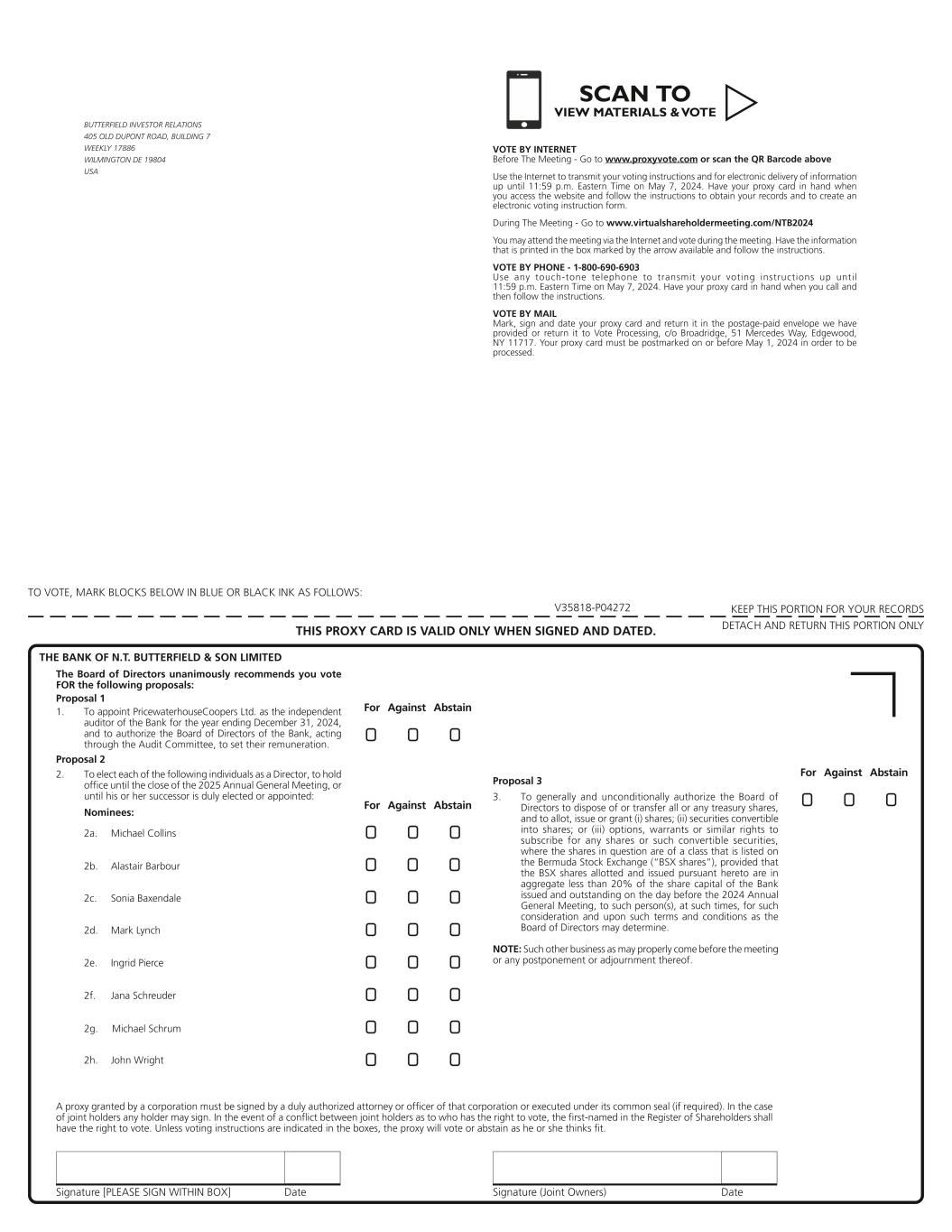

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V35818-P04272 For Against Abstain ! !! ! !! ! !! ! !! ! !! ! !! ! !! ! !! ! !! BUTTERFIELD INVESTOR RELATIONS 405 OLD DUPONT ROAD, BUILDING 7 WEEKLY 17886 WILMINGTON DE 19804 USA THE BANK OF N.T. BUTTERFIELD & SON LIMITED 2g. Michael Schrum 1. To appoint PricewaterhouseCoopers Ltd. as the independent auditor of the Bank for the year ending December 31, 2024, and to authorize the Board of Directors of the Bank, acting through the Audit Committee, to set their remuneration. 2a. Michael Collins 2b. Alastair Barbour 2e. Ingrid Pierce 2c. Sonia Baxendale 2d. Mark Lynch 2f. Jana Schreuder 2. To elect each of the following individuals as a Director, to hold office until the close of the 2025 Annual General Meeting, or until his or her successor is duly elected or appointed: Nominees: The Board of Directors unanimously recommends you vote FOR the following proposals: 3. To generally and unconditionally authorize the Board of Directors to dispose of or transfer all or any treasury shares, and to allot, issue or grant (i) shares; (ii) securities convertible into shares; or (iii) options, warrants or similar rights to subscribe for any shares or such convertible securities, where the shares in question are of a class that is listed on the Bermuda Stock Exchange (“BSX shares”), provided that the BSX shares allotted and issued pursuant hereto are in aggregate less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting, to such person(s), at such times, for such consideration and upon such terms and conditions as the Board of Directors may determine. 2h. John Wright Proposal 3 NOTE: Such other business as may properly come before the meeting or any postponement or adjournment thereof. A proxy granted by a corporation must be signed by a duly authorized attorney or officer of that corporation or executed under its common seal (if required). In the case of joint holders any holder may sign. In the event of a conflict between joint holders as to who has the right to vote, the first-named in the Register of Shareholders shall have the right to vote. Unless voting instructions are indicated in the boxes, the proxy will vote or abstain as he or she thinks fit. Proposal 1 Proposal 2 For Against Abstain For Against Abstain ! !! SCAN TO VIEW MATERIALS & VOTEw VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on May 7, 2024. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/NTB2024 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 7, 2024. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Your proxy card must be postmarked on or before May 1, 2024 in order to be processed.

V35819-P04272 Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting: The Proxy Statement and Annual Report/Form 20F are available at www.proxyvote.com. THE BANK OF N.T. BUTTERFIELD & SON LIMITED Annual General Meeting of Shareholders May 8, 2024 10:00 a.m. Bermuda Time This proxy is solicited by the Board of Directors I /we being (a) Shareholder(s) of the Bank hereby appoint the Chairman of the Meeting, fai l ing whom, _______________________________________ of _______________________________________ as my/our proxy to vote for me/us and on my/our behalf at the 2024 Annual General Meeting of The Bank of N.T. Butterfield & Son Limited to be held virtually at 10:00 a.m. Bermuda Time on Wednesday, May 8, 2024, accessible at www.virtualshareholdermeeting.com/NTB2024 and at 1(888) 560-5639 or 1(929) 207-7651, and at any postponement or adjournment thereof. In respect of the Proposals referred to in the Notice of Annual General Meeting, I/we desire my/our proxy to vote as indicated (or in the absence of any such indication, in favor of such Proposal(s)) and to vote in his or her discretion in respect of any other matters properly brought before the 2024 Annual General Meeting including any postponement or adjournment thereof. The undersigned shareholder hereby revokes any proxy heretofore given with respect to the 2024 Annual General Meeting. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side

Your Vote Counts! 2024 Virtual Annual General Meeting Vote by May 7, 2024 11:59 PM ET You invested in THE BANK OF N.T. BUTTERFIELD & SON LIMITED and it’s time to vote! You have the right to vote on proposals being presented at the Annual General Meeting. This is an important notice regarding the availability of proxy material for the virtual shareholder meeting to be held on May 8, 2024. Vote Virtually at the Meeting* May 8, 2024 10:00 a.m. Bermuda Time Virtually at: www.virtualshareholdermeeting.com/NTB2024 *Please check the meeting materials for any special requirements for meeting attendance. Smartphone users Point your camera here and vote without entering a control number For complete information and to vote, visit www.ProxyVote.com Control # V35828-P04272 THE BANK OF N.T. BUTTERFIELD & SON LIMITED BUTTERFIELD INVESTOR RELATIONS 405 OLD DUPONT ROAD, BUILDING 7 WEEKLY 17886 WILMINGTON DE 19804 USA Get informed before you vote View the Proxy Statement and Annual Report/Form 20F online OR you can receive a free paper or email copy of the material(s) by requesting prior to April 17, 2024. If you would like to request a copy of the material(s) for this and/or future shareholder meetings, you may (1) visit www.ProxyVote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com. If sending an email, please include your control number (indicated below) in the subject line. Unless requested, you will not otherwise receive a paper or email copy.

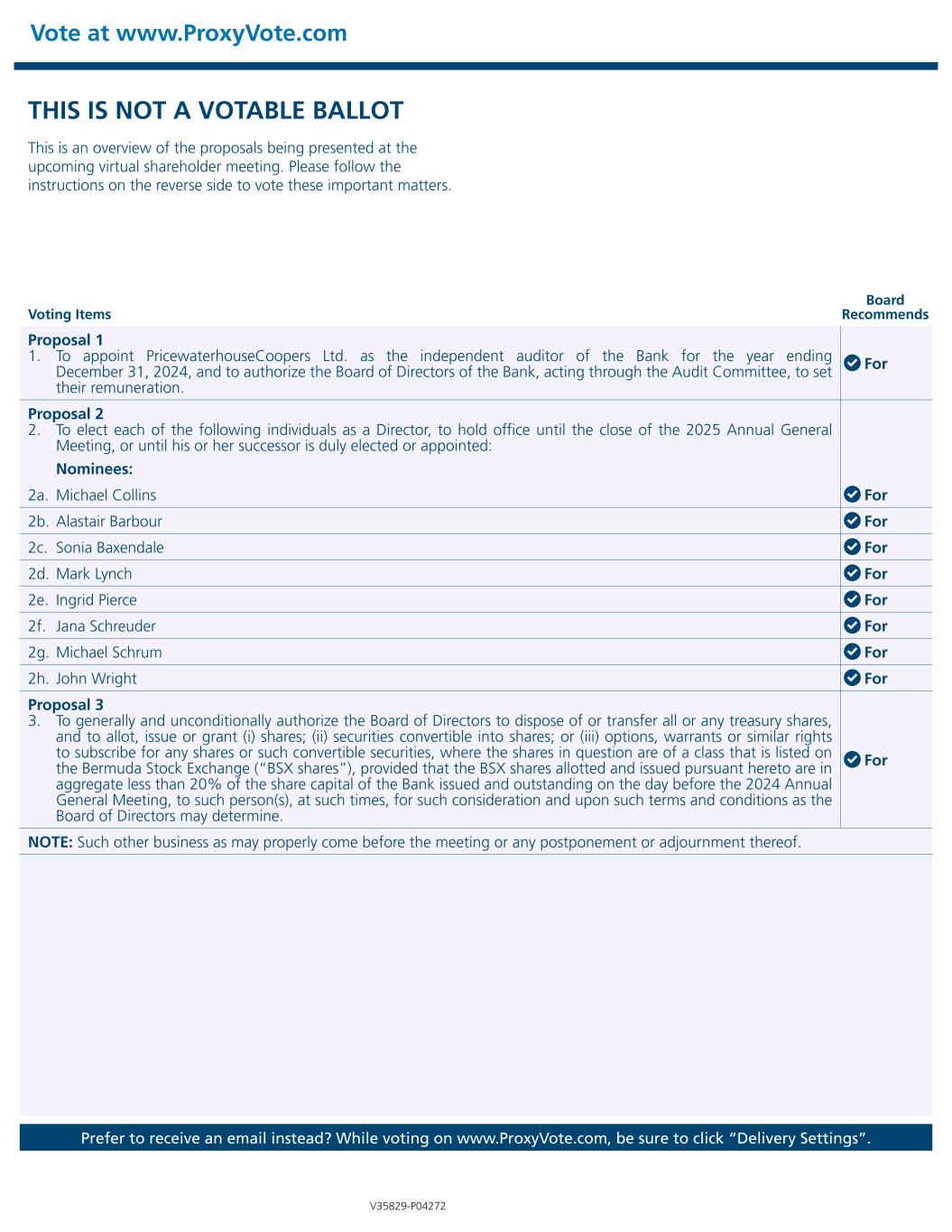

THIS IS NOT A VOTABLE BALLOT This is an overview of the proposals being presented at the upcoming virtual shareholder meeting. Please follow the instructions on the reverse side to vote these important matters. Vote at www.ProxyVote.com Prefer to receive an email instead? While voting on www.ProxyVote.com, be sure to click “Delivery Settings”. Voting Items Board Recommends V35829-P04272 Proposal 1 1. To appoint PricewaterhouseCoopers Ltd. as the independent auditor of the Bank for the year ending December 31, 2024, and to authorize the Board of Directors of the Bank, acting through the Audit Committee, to set their remuneration. For Proposal 2 2. To elect each of the following individuals as a Director, to hold office until the close of the 2025 Annual General Meeting, or until his or her successor is duly elected or appointed: Nominees: 2a. Michael Collins For 2b. Alastair Barbour For 2c. Sonia Baxendale For 2d. Mark Lynch For 2e. Ingrid Pierce For 2f. Jana Schreuder For 2g. Michael Schrum For 2h. John Wright For Proposal 3 3. To generally and unconditionally authorize the Board of Directors to dispose of or transfer all or any treasury shares, and to allot, issue or grant (i) shares; (ii) securities convertible into shares; or (iii) options, warrants or similar rights to subscribe for any shares or such convertible securities, where the shares in question are of a class that is listed on the Bermuda Stock Exchange (“BSX shares”), provided that the BSX shares allotted and issued pursuant hereto are in aggregate less than 20% of the share capital of the Bank issued and outstanding on the day before the 2024 Annual General Meeting, to such person(s), at such times, for such consideration and upon such terms and conditions as the Board of Directors may determine. For NOTE: Such other business as may properly come before the meeting or any postponement or adjournment thereof.