EXECUTION VERSION The taking of (a) any of the Finance Documents (including this document) or (b) any certified copy thereof or (c) any document which constitutes substitute documentation thereof including written confirmations or references (the "Stamp Duty Sensitive Documents") into Austria may cause the imposition of Austrian stamp duty. The same, inter alia, applies to (i) the sending of Stamp Duty Sensitive Documents to an Austrian addressee by fax, (ii) the sending of any e-mail communication to which an electronic scan copy (e.g., pdf or tif) of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (iii) the sending of any e- mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. Accordingly, in particular, keep any Stamp Duty Sensitive Documents outside of Austria and avoid (A) sending Stamp Duty Sensitive Documents by fax to an Austrian addressee, (B) sending any e-mail communication to which an electronic scan copy of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (C) sending any e-mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. Amendment and restatement agreement Dated _________________2023 for NOMAD FOODS LIMITED as Listco and NOMAD FOODS EUROPE MIDCO LIMITED as Midco with CREDIT SUISSE AG, LONDON BRANCH acting as Agent and CREDIT SUISSE AG, LONDON BRANCH acting as Security Agent RELATING TO A SENIOR FACILITIES AGREEMENT ORIGINALLY DATED 3 JULY 2014 AS AMENDED AND/OR AMENDED AND RESTATED FROM TIME TO TIME Ref: L-296544 15 September

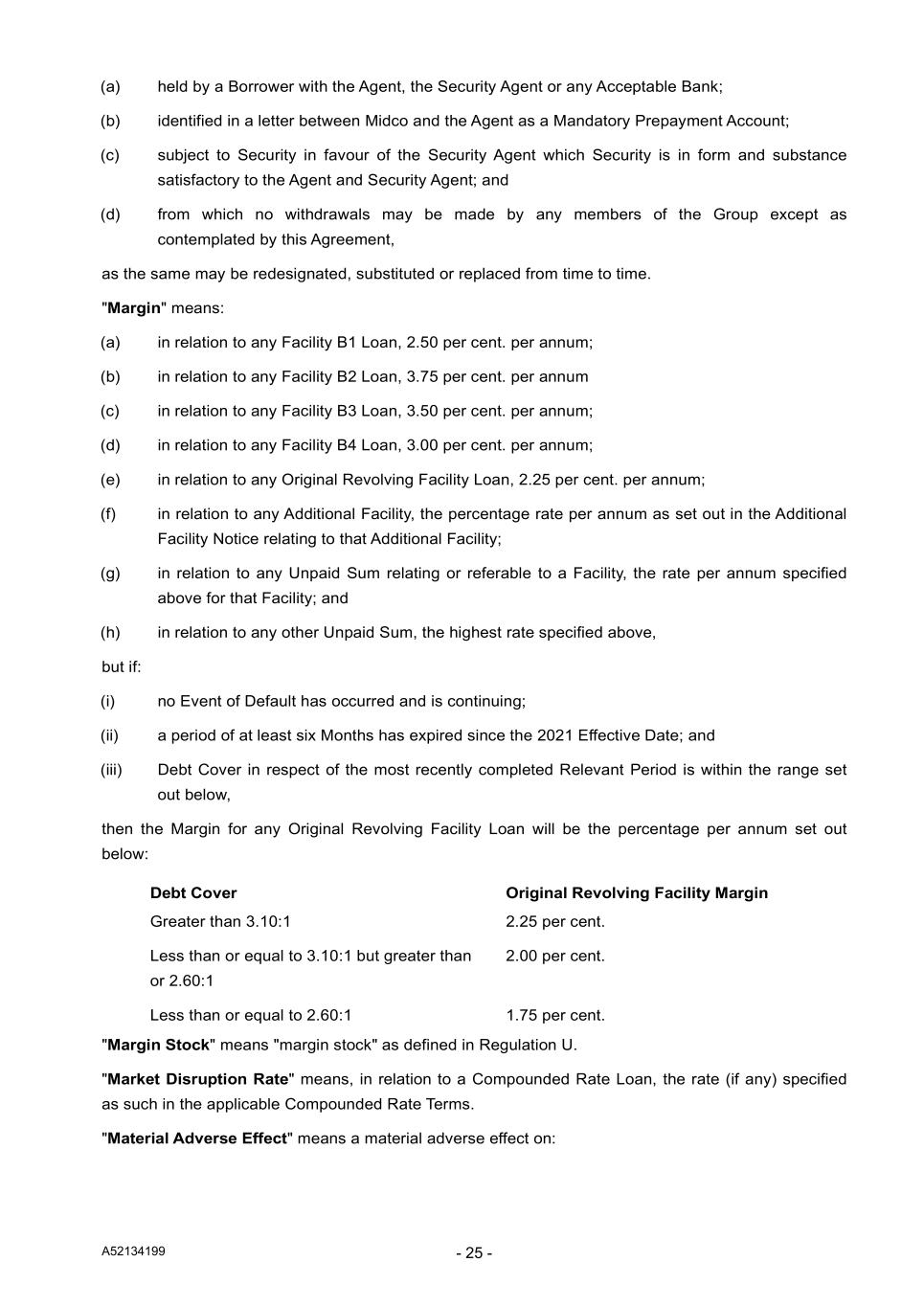

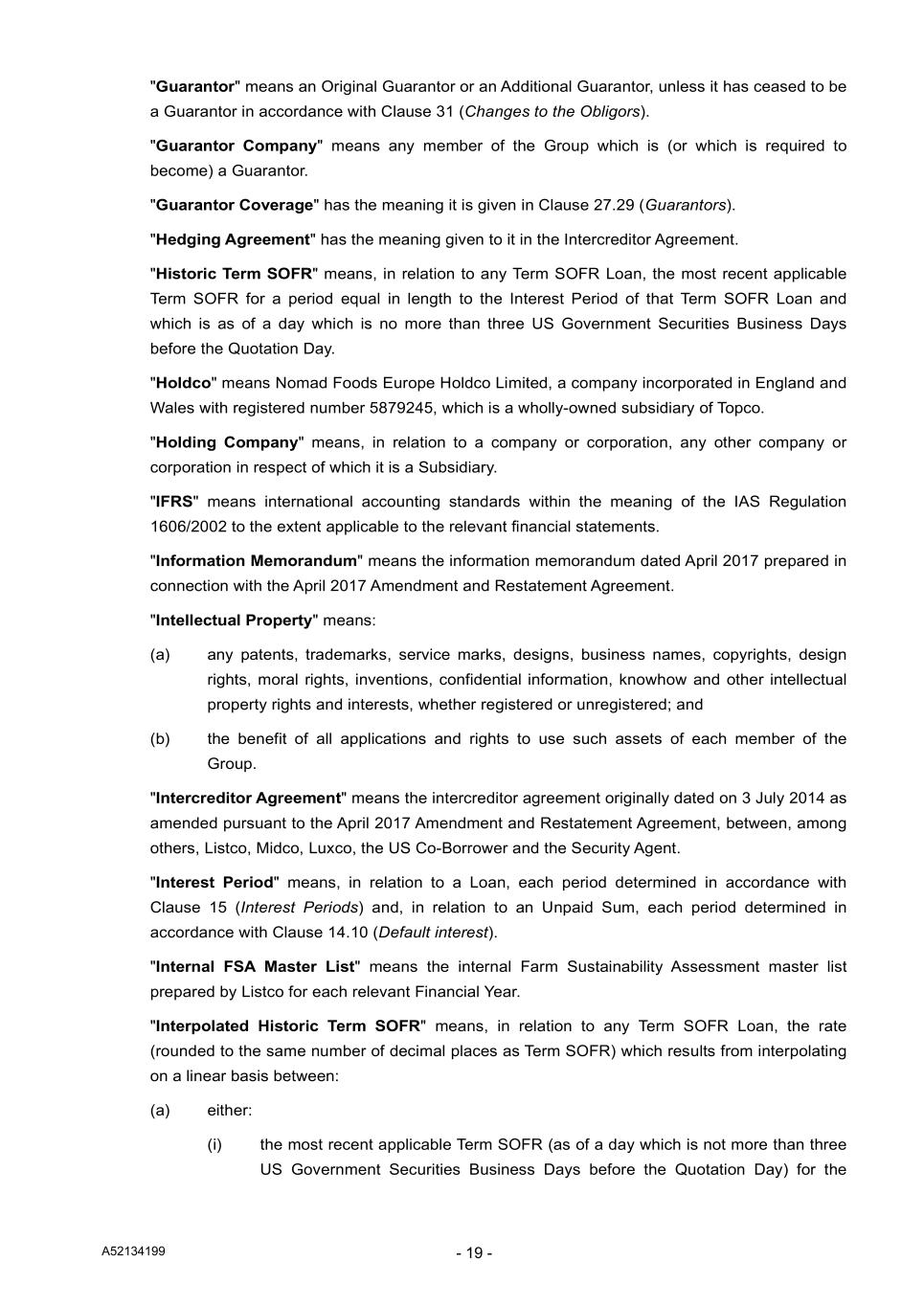

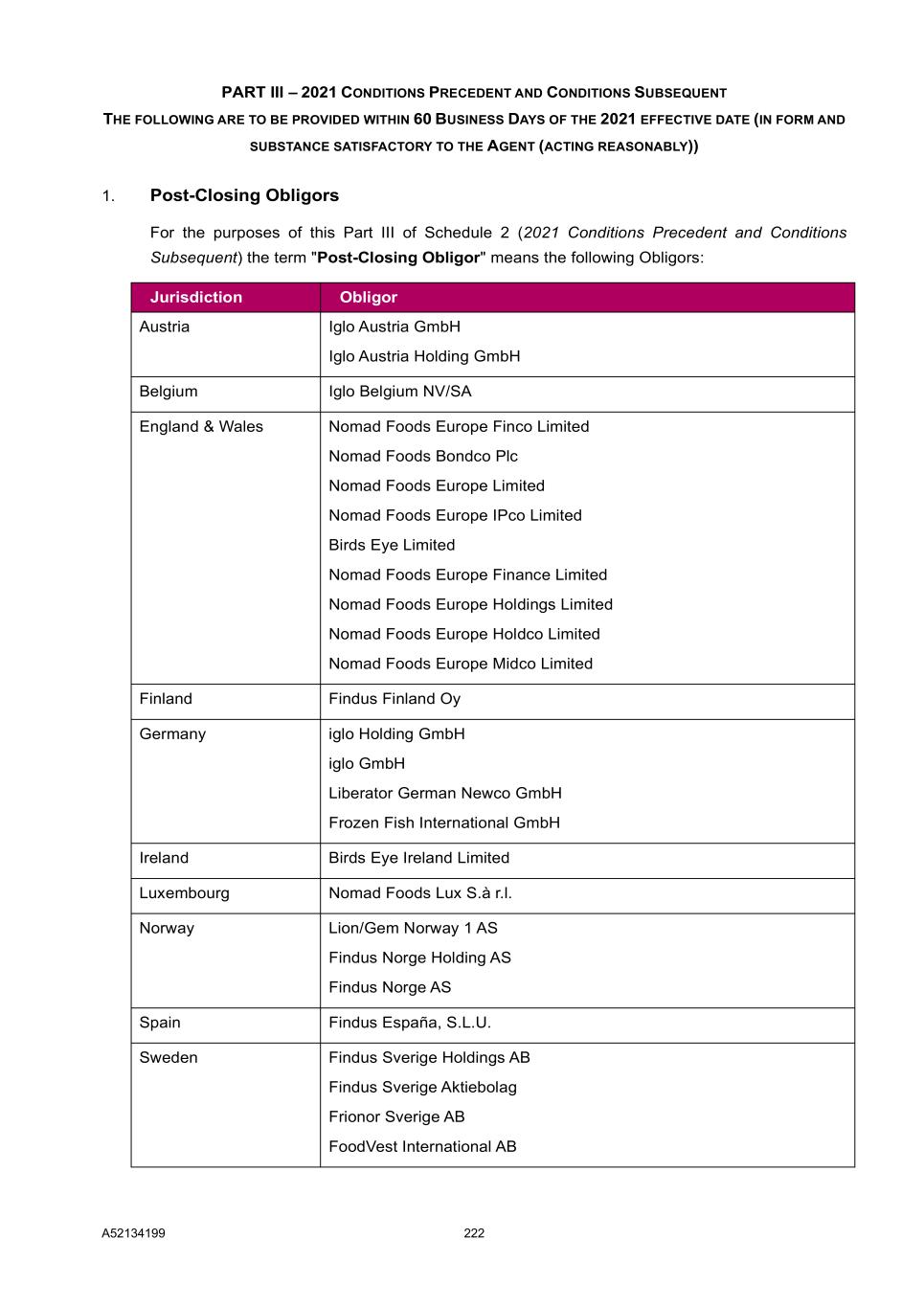

A52134198 CONTENTS CLAUSE PAGE 1. Definitions and interpretation .................................................................................................... 1 2. Establishment of Facility B4 as an Additional Facility .............................................................. 4 3. Accession of the Initial Term Facility Lenders .......................................................................... 5 4. Utilisation of Facility B4 ............................................................................................................ 6 5. Facility B4 OID Fees ................................................................................................................. 7 6. Voluntary prepayments ............................................................................................................. 7 7. Conditions precedent ................................................................................................................ 7 8. Amendment and restatement ................................................................................................... 8 9. Accession of New Arranger ...................................................................................................... 8 10. Confirmation ............................................................................................................................. 9 11. Reaffirmation of NY Law Security Agreements ...................................................................... 10 12. Agent's books and records, waiver of transfer fee .................................................................. 11 13. Further assurance .................................................................................................................... 11 14. Indemnity ................................................................................................................................. 11 15. Representations ...................................................................................................................... 12 16. Termination ............................................................................................................................. 12 17. Miscellaneous ......................................................................................................................... 12 18. Governing law ......................................................................................................................... 13 THE SCHEDULES SCHEDULE PAGE SCHEDULE 1 Conditions Precedent ...................................................................................................... 14 SCHEDULE 2 Amended Facilities Agreement ........................................................................................ 17

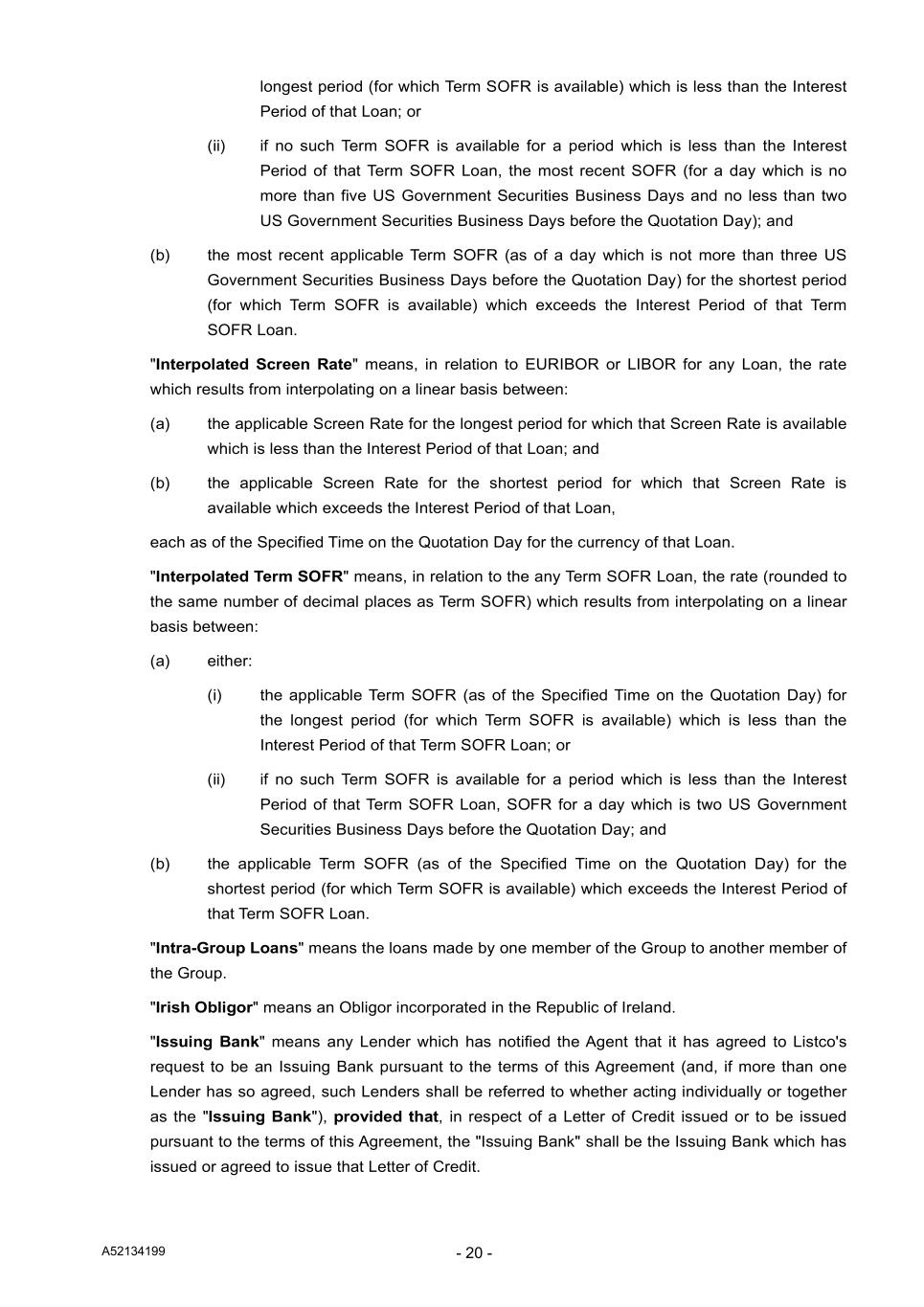

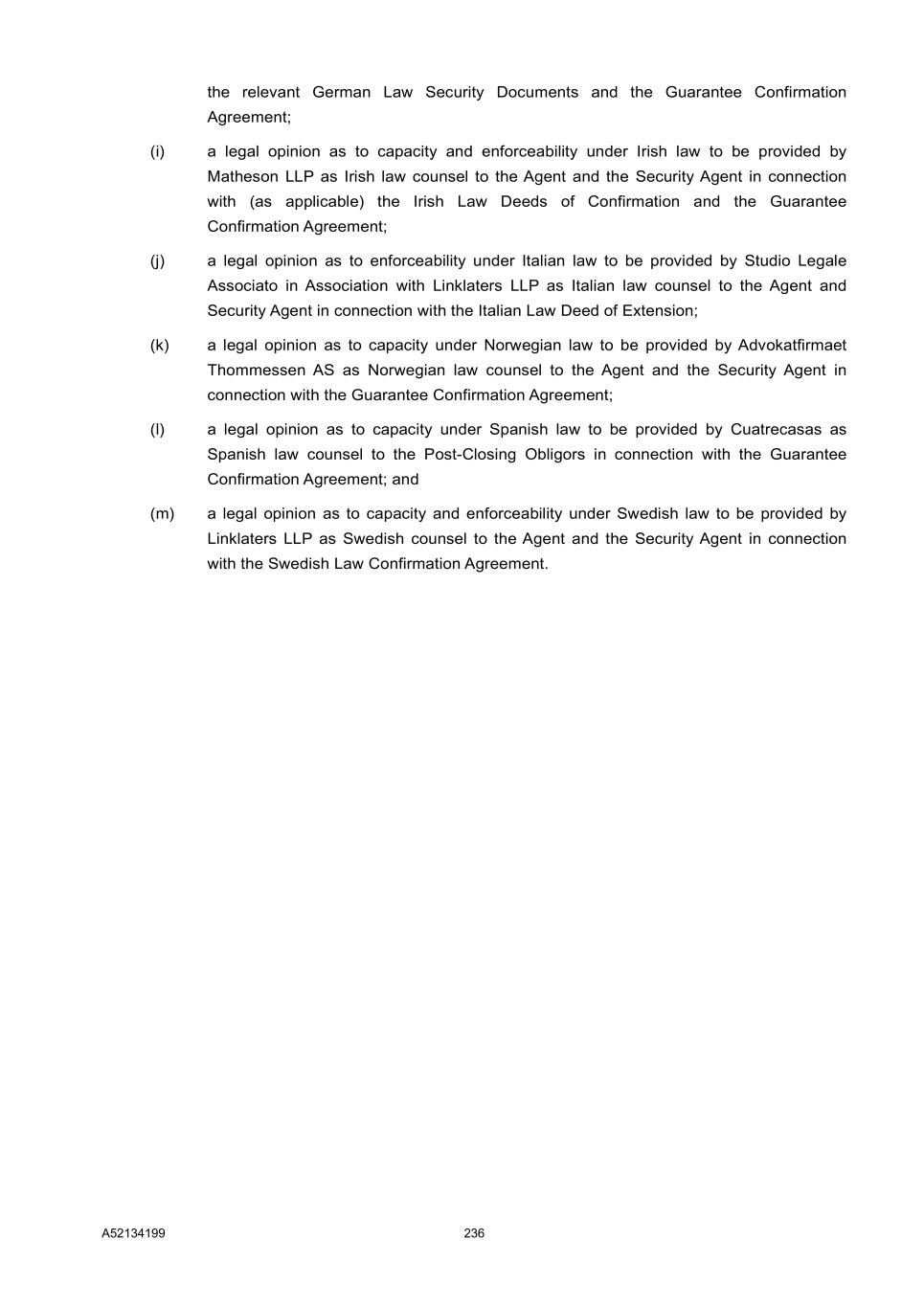

A52134198 THIS AGREEMENT is entered into on ____________2023 between: (1) NOMAD FOODS LIMITED, a public listed company incorporated in the British Virgin Islands with registered number 1818482, for itself and as Obligors' Agent under (and as defined in) the Original Facilities Agreement (as the context requires) ("Listco"); (2) NOMAD FOODS EUROPE MIDCO LIMITED, a company incorporated in England and Wales with registered number 5879252 ("Midco"); (3) NOMAD FOODS LUX S.À R.L., a private limited liability company (société à responsabilité limitée), with registered address at 9, rue de Bitbourg, L-1273 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies under number B214174 ("Luxco"); (4) NOMAD FOODS US LLC, a single member limited liability company organised in Delaware (the "US Co-Borrower"); (5) JEFFERIES FINANCE LLC (the "Fronting Facility B4 Lender"); (6) JEFFERIES FINANCE LLC, CITIBANK, N.A., LONDON BRANCH, J.P. MORGAN SE and BANCO SANTANDER, S.A., NEW YORK BRANCH as Arrangers (whether acting individually or together, the "New Arrangers"); (7) CREDIT SUISSE AG, LONDON BRANCH as agent of the other Finance Parties under (and as defined in) the Original Facilities Agreement (the "Agent"); and (8) CREDIT SUISSE AG, LONDON BRANCH, as security agent and trustee for the other Secured Parties under (and as defined in) the Intercreditor Agreement (the "Security Agent"). IT IS AGREED as follows: 1. Definitions and interpretation 1.1 Definitions In this Agreement: "Additional Facility Effective Time" means the applicable time on the Effective Date which falls immediately prior to the time at which the Agent gives notice pursuant to paragraph (c) of Clause 7 (Conditions precedent), provided that, for the avoidance of any doubt, the Additional Facility Effective Time shall not occur to the extent that no such notice is given by the Agent pursuant to paragraph (c) of Clause 7 (Conditions precedent)). "Allocations Table" means the allocations and commitments table held by the New Arrangers or, as the case may be, the Agent, specifying the Commitments of each of the Lenders under Facility B4 as at the Additional Facility Effective Time as set out in Part II of Schedule 1 (The Parties) of the Amended Facilities Agreement. "Amended Facilities Agreement" means the Original Facilities Agreement, as amended and restated in the form set out in Schedule 2 (Amended Facilities Agreement). "Effective Date" means the date of the notification by the Agent under paragraph (c) of Clause 7 (Conditions precedent). 15 September

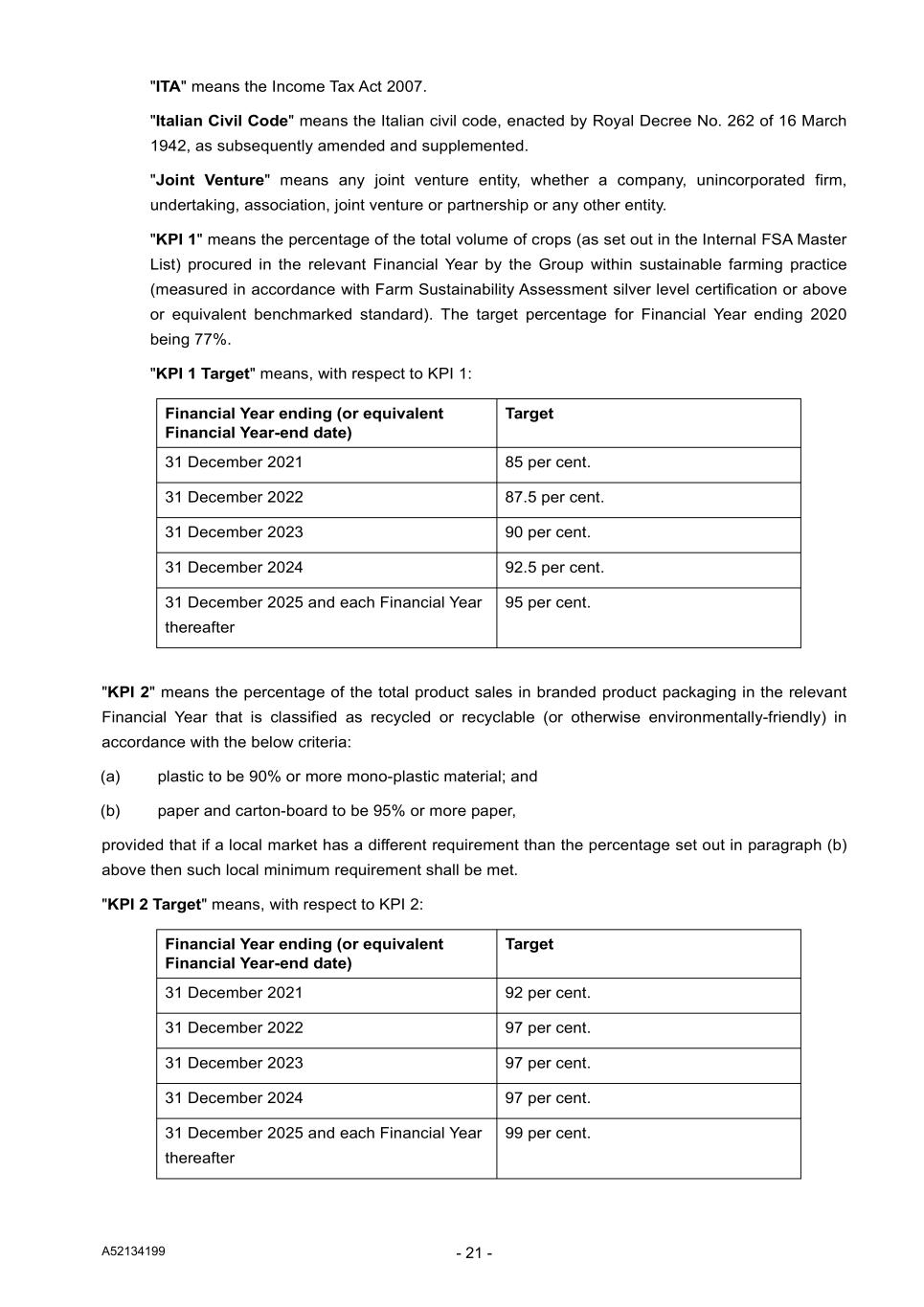

A52134198 2 "Fee Letters" means the fee letters, each dated on or around the date of this Agreement between Listco and each New Arranger (as applicable). "Initial Term Facility Lenders" means Jefferies Finance LLC in its capacity as Fronting Facility B4 Lender. "Intercreditor Agreement" means the Intercreditor Agreement originally dated on 3 July 2014 (as amended and/or amended and restated from time to time) between, among others, Midco and the Security Agent. "Long Stop Date" means 4 December 2023. "NY Law Security Agreements" mean: (i) a New York law-governed pledge agreement dated as of 3 May 2017 between Midco as grantor and the Security Agent as security agent in respect of Midco's equity interests in the US Co-Borrower; and (ii) a New York law-governed pledge and security agreement dated as of 3 May 2017 between the US Co-Borrower as grantor and the Security Agent as security agent in respect of substantially all the assets of the US Co-Borrower, (each a "NY Law Security Agreement"). "Original Facilities Agreement" means the Senior Facilities Agreement originally dated 3 July 2014 as amended and restated from time to time up to, but excluding, the Effective Date between, among others, Listco and the Agent. "Original Facility B4 Lender" means an Original Lender with a Facility B4 Commitment. "Party" means a party to this Agreement. "Redesignating Lender" means each Lender (if any) (as defined in the Original Facilities Agreement) under Facility B2 (as defined in the Original Facilities Agreement) which has accepted the Invitation set out in, and as defined in, the Term Facilities Invitation Letter. "Term Facilities Invitation Letter" means an invitation letter sent to one or more Lender (as defined in the Original Facilities Agreement) under Facility B2 (as defined in the Original Facilities Agreement) (as amended and/or supplemented from time to time) inviting such Lenders to roll all or part of their participations under Facility B2 on a cashless basis into Facility B4. 1.2 Incorporation of defined terms and interpretation (a) Unless a contrary indication appears, a term defined in the Amended Facilities Agreement has the same meaning in this Agreement (notwithstanding that the Effective Date may not have occurred), save that each capitalised term used in Clauses 2 (Establishment of Facility B4 as an Additional Facility) to 6 (Voluntary prepayments) (other than, for the avoidance of any doubt, the terms Facility B4, Facility B4 Commitment, and Facility B4 Loan) shall have the meaning given to those terms in the Original Facilities Agreement or (as the context requires) the Intercreditor Agreement (unless a contrary indication appears in any such Clause).

A52134198 3 (b) The principles of construction set out in the Amended Facilities Agreement shall have effect as if set out in this Agreement mutatis mutandis (notwithstanding that the Effective Date may not have occurred). (c) This Agreement shall be raised to the status of Spanish public document (escritura pública). 1.3 Clauses In this Agreement any reference to a "Clause" or a "Schedule" is, unless the context otherwise requires, a reference to a Clause in or a Schedule to this Agreement. 1.4 Third party rights (a) Unless otherwise provided in this Agreement, a person who is not a party to this Agreement has no right under the Contracts (Rights of Third Parties) Act 1999 to enforce or to enjoy the benefit of any term of this Agreement. (b) Each of the Secured Parties (as defined in the Intercreditor Agreement) may enforce and enjoy the benefit of any provision of this Agreement expressed to be in their favour or for their benefit (or, as the case may be, being a confirmation given in their favour or for their benefit), subject always to the terms of Clause 17 (Miscellaneous) and Clause 18 (Governing law) below. 1.5 Designation (a) In accordance with the Original Facilities Agreement, Listco and the Agent designate this Agreement as a Finance Document and as an Additional Facility Document (each as defined in the Original Facilities Agreement). (b) Paragraph (a) above shall be without prejudice to the operation of the Amended Facilities Agreement, pursuant to which, this Agreement shall become, on the Effective Date, a Finance Document. 1.6 Payments (a) All payments to be made by a member of the Group under, or in connection with, Clause 5 (Facility B4 OID Fees): (i) shall be paid in the currency of payment or invoice and in immediately available, freely transferable funds to such account(s) with such bank(s) as the recipient of that payment notifies to the relevant member of the Group and shall be non-refundable; (ii) shall be paid without any set-off or counterclaim and without any deduction or withholding for or on account of tax (a "Tax Deduction") unless a Tax Deduction is required by law. If a Tax Deduction is required by law to be made, the amount of the payment due shall be increased to an amount which (after making any Tax Deduction) leaves an amount equal to the payment which would have been due if no Tax Deduction had been required; and (iii) are exclusive of any value added tax or similar charge ("VAT"). If VAT is chargeable on any payment or amount to be reimbursed under this Agreement (including if any VAT is chargeable on services provided from legal counsel where the recipient is required to self- assess and account for VAT in their role as recipient of such services), the relevant payor

A52134198 4 shall also and at the same time pay to the recipient of the relevant payment an amount equal to the amount of the VAT. 2. Establishment of Facility B4 as an Additional Facility (a) The Agent and Listco acknowledge and agree that: (i) this Agreement shall be deemed to be, and shall take effect in accordance with its terms as, an Additional Facility Notice in respect of each of Facility B4 and shall be deemed to have been duly completed and delivered pursuant to clause 2.4 (Additional Facilities) of the Original Facilities Agreement; (ii) the Response Form (as defined in the Term Facilities Invitation Letter) or (as applicable) this Agreement shall: (A) satisfy the requirements of clause 2.4 (Additional Facilities) of the Original Facilities Agreement in so far as that clause requires each provider of Facility B4 to deliver to the Agent a duly completed Additional Facility Notice and Lender Accession Notice in respect of Facility B4; and (B) be deemed to be (for the purposes of paragraph (k) of clause 2.4 (Additional Facilities) of the Original Facilities Agreement) the agreement of each provider of Facility B4 as to the terms applicable to Facility B4 (with such terms being the applicable terms of the Amended Facilities Agreement, the Intercreditor Agreement and the other Finance Documents (as defined in the Amended Facilities Agreement) (notwithstanding that the Effective Date has not then occurred)); and (iii) Facility B4 shall, upon its establishment in accordance with the terms of this Agreement, be an Additional Term Facility, a US$ Denominated Facility and a Credit Facility (and, for the avoidance of any doubt, constitute Credit Facility Lender Liabilities for the purposes of the Intercreditor Agreement). (b) Listco confirms that, as at the Additional Facility Effective Time, the conditions and requirements set out in: (i) paragraph (d) of clause 2.4 (Additional Facilities) of the Original Facilities Agreement are satisfied in respect of the establishment (and, in the case of the conditions and requirements set out in paragraph (d)(x) of clause 2.4 (Additional Facilities) of the Original Facilities Agreement, utilisation) of Facility B4 as an Additional Facility under the Original Facilities Agreement; and (ii) paragraphs (a)(i) and (a)(ii) of clause 7.1 (New Debt Financing) of the Intercreditor Agreement are satisfied in respect of the establishment of Facility B4 as an Additional Facility under the Original Facilities Agreement. (c) The Agent acknowledges and agrees that, as at the Additional Facility Effective Time, the conditions and requirements set out in: (i) paragraph (d)(xi) of clause 2.4 (Additional Facilities) of the Original Facilities Agreement have been satisfied; and

A52134198 5 (ii) paragraph (e) of clause 2.4 (Additional Facilities) of the Original Facilities Agreement are satisfied by reference to the applicable terms of the Amended Facilities Agreement. (d) Upon the occurrence of the Additional Facility Effective Time Facility B4 will be established and incorporated into the Original Facilities Agreement, with the total Facility B4 Commitments allocated among, as a result of the operation of Clause 3 (Accession of the Initial Term Facility Lenders), or assumed by, as a result of the operation of Clause 4 (Utilisation of Facility B4) below, the relevant Lenders as set out in the Allocations Table. 3. Accession of the Initial Term Facility Lenders (a) The Agent and Listco acknowledge and agree that this Agreement shall, with respect to each Initial Term Facility Lender, be deemed to be a Lender Accession Notice for the purposes of the Original Facilities Agreement and a Creditor/Agent Accession Undertaking for the purposes of the Intercreditor Agreement. (b) Upon the occurrence of the Additional Facility Effective Time, each Initial Term Facility Lender agrees that it shall (to the extent that it is not already a party in that capacity) become party to the Original Facilities Agreement as a Lender and shall become party to the Intercreditor Agreement as a Credit Facility Lender, a Credit Facility Finance Party, a Senior Secured Facilities Lender and a Senior Secured Creditor and undertakes to perform all the obligations expressed in: (i) the Original Facilities Agreement to be assumed by a Lender and agrees that it shall be bound by all the provisions of the Original Facilities Agreement as if it had been an original party to the Original Facilities Agreement as a Lender; and (ii) the Intercreditor Agreement to be assumed by a Credit Facility Lender, a Credit Facility Finance Party, a Senior Secured Facilities Lender and a Senior Secured Creditor and agrees that it shall be bound by all the provisions of the Intercreditor Agreement as if it had been an original party to the Intercreditor Agreement as a Credit Facility Lender, a Credit Facility Finance Party, a Senior Secured Facilities Lender and a Senior Secured Creditor. (c) By signing this Agreement, upon the occurrence of the Additional Facility Effective Time: (i) the Fronting Facility B4 Lender agrees to become a Lender under Facility B4 and to be bound by the terms applicable in respect of Facility B4 as contemplated in this Agreement; (ii) the Fronting Facility B4 Lender confirms that it intends to incur liabilities under the Finance Documents in respect of Facility B4 with a Facility B4 Commitment in the amount set out in the Allocations Table as being the Facility B4 Commitment of the Fronting Facility B4 Lender; (iii) each Initial Term Facility Lender acknowledges and agrees to each of the matters set out in Clause 2 (Establishment of Facility B4 as an Additional Facility), clause 2.4 (Additional Facilities) and clause 29.10 (Lender Accession Notice) of the Original Facilities Agreement; (iv) each Initial Term Facility Lender confirms that it is not a member of the Group or a Listco Affiliate; and

A52134198 6 (v) each Initial Term Facility Lender confirms that it is a Qualifying Lender. (d) Upon the occurrence of the Additional Facility Effective Time, each Initial Term Facility Lender shall assume the same obligations to and acquire the same rights against each other party under the Original Facilities Agreement as a Lender and under the Intercreditor Agreement as a Credit Facility Lender, a Credit Facility Finance Party, a Senior Secured Facilities Lender and a Senior Secured Creditor as it would have assumed or acquired under each such agreement had it been an original party to those agreements in those capacities. (e) The administrative details of each Initial Term Facility Lender are as provided to the Agent prior to the Additional Facility Effective Time. 4. Utilisation of Facility B4 (a) Upon the occurrence of the Additional Facility Effective Time: (i) in relation to Facility B2: (A) an amount of the Facility B2 Commitment of each Redesignating Lender will be redesignated as a Facility B4 Commitment in the amount set out opposite the name of such Redesignating Lender in the Allocations Table, and the aggregate participations of such Redesignating Lender in Facility B2 Loans (which correspond to the Facility B2 Commitments redesignated pursuant to this paragraph (a)(i)(A)) will be redesignated as its participation in a new single Facility B4 Loan (denominated in USD) the principal amount of which is equal to (x) the aggregate amount of all such Redesignating Lenders' Facility B2 Loan and (y) the participation of the Fronting Facility B4 Lender in such Facility B4 Loan as a result of the operation of paragraphs (ii) and (iii) below; and (B) each Redesignating Lender shall be deemed to have made its participation in a Facility B4 Loan in the amount set out opposite the name of such Redesignating Lender in respect of Facility B4 in the Allocations Table (and Luxco and/or the US Co-Borrower (as applicable) shall be deemed to have utilised such Facility B4 Loan) on a cashless basis. (ii) the Fronting Facility B4 Lender shall make available its participation in the Facility B4 Loan through its Facility Office in an amount in USD equal to the Facility B4 Commitment assumed by it pursuant to paragraph (c)(i) of Clause 3 (Accession of the Initial Term Facility Lenders) and shall thereby have a participation in the Facility B4 Loan in the amount so made available; and (iii) paragraphs (i) and (ii) above shall be deemed to operate so as to give rise to a single Facility B4 Loan in which each Redesignating Lender and the Fronting Facility B4 Lender participate (with their respective participations as contemplated in paragraphs (i) and (ii) above. (b) The first Interest Period for the Facility B4 Loan referred to in paragraph (a)(iii) above shall be six Months (or such other period as the Arrangers and Listco or Luxco and the US Co-Borrower may

A52134198 7 agree prior to the Additional Facility Effective Time) as specified in the Amended Facilities Agreement (notwithstanding that the Effective Date shall not have occurred at that time). (c) The Term SOFR rate applicable to the first Interest Period for the Facility B4 Loan referred to in paragraph (a)(iii) above shall be the relevant rate notified to Listco by the Agent on or about the Additional Facility Effective Time. (d) For the avoidance of any doubt, the Margin applicable to the Facility B2 Loan referred to in paragraph (a)(iii) above shall be the Margin as specified (and as defined) in the Amended Facilities Agreement as being applicable to a Facility B4 Loan (notwithstanding that the Effective Date shall not have occurred at such time). (e) For the avoidance of any doubt, no Break Costs shall be payable in connection with any redesignation of Facility B2 Commitments and/or Facility B2 Loan participations effected pursuant to paragraph (a)(i) above. (f) For the avoidance of any doubt, the operation of paragraph (a)(iii) above shall be deemed to be a utilisation of Facility B4 (being the Additional Facility established pursuant to paragraph (d) of Clause 2 (Establishment of Facility B4 as an Additional Facility)) and notwithstanding the requirements of clause 5.1 (Delivery of a Utilisation Request) and clause 5.2 (Completion of a Utilisation Request for Loans) of the Original Facilities Agreement, the Agent may accept a Utilisation Request in respect of Facility B4 at such time and in such form as the Agent may agree with Listco or, as the case may be, another member of the Group (acting reasonably). 5. Facility B4 OID Fees No original issue discount fees in respect of Facility B4 will be payable by Listco to the Original Facility B4 Lender. 6. Voluntary prepayments Listco shall ensure that all Facility B2 Loans (as defined in the Original Facilities Agreement) will be voluntarily prepaid in full immediately after the Additional Facility Effective Time but prior to the Effective Date. 7. Conditions precedent (a) The Effective Date shall only occur if the requirements of paragraphs (b) and (c) below have then been satisfied. (b) Listco shall deliver, or shall procure are delivered, to the Agent and the Security Agent the conditions precedent documents listed in Schedule 1 (Conditions Precedent) in form and substance satisfactory to the Agent and the Security Agent (each acting reasonably). (c) The Agent and the Security Agent shall each notify Listco and the Arrangers upon the date that it has received all of the documents and other evidence listed in Schedule 1 (Conditions Precedent). (d) The Agent and the Security Agent shall not be liable for any damages, costs or losses whatsoever as a result of giving any such notification and neither the Agent nor Security Agent shall be liable

A52134198 8 for any damages, costs or losses whatsoever in connection with this Agreement (unless directly caused by its gross negligence or wilful misconduct). 8. Amendment and restatement On and with effect from the Effective Date, the Original Facilities Agreement shall be amended and restated in the form set out in Schedule 2 (Amended Facilities Agreement). 9. Accession of New Arranger (a) With effect from the Effective Date, each New Arranger shall become party to the Amended Facilities Agreement as an Arranger and a Finance Party and shall become party to the Intercreditor Agreement as a Credit Facility Finance Party, an Arranger and a Senior Secured Creditor. (b) By signing this Agreement, upon the occurrence of the Effective Date, each New Arranger: (i) confirms that it intends to be a party to the Amended Facilities Agreement as, and agrees to become, an Arranger and a Finance Party under the Amended Facilities Agreement and to be bound by the terms of the Amended Facilities Agreement as an Arranger and a Finance Party; (ii) undertakes to perform all the obligations expressed in the Amended Facilities Agreement to be assumed by an Arranger and a Finance Party and agrees that it shall be bound by all the provisions of the Amended Facilities Agreement as if it had been an original party to the Amended Facilities Agreement as an Arranger and a Finance Party; (iii) confirms that it intends to be a party to the Intercreditor Agreement as, and agrees to become, a Credit Facility Finance Party, an Arranger and a Senior Secured Creditor; (iv) undertakes to perform all the obligations expressed in the Intercreditor Agreement to be assumed by a Credit Facility Finance Party, an Arranger and a Senior Secured Creditor and agrees that it shall be bound by all the provisions of the Intercreditor Agreement as if it had been an original party to the Intercreditor Agreement as a Credit Facility Finance Party, an Arranger and a Senior Secured Creditor; and (v) shall, for the avoidance of any doubt, have conferred upon it each of the roles and titles (but only those roles and titles) which are specified alongside its name in the list of parties in the Amended Facilities Agreement. (c) Upon the occurrence of the Effective Date, each New Arranger shall assume the same obligations to and acquire the same rights against each other party under the Amended Facilities Agreement as an Arranger and a Finance Party and under the Intercreditor Agreement as a Credit Facility Finance Party, an Arranger and a Senior Secured Creditor as it would have assumed or acquired under each such agreement had it been an original party to those agreements in such capacity. (d) Each New Arranger confirms that its address for notices for the purposes of clause 37 (Notices) of the Amended Facilities Agreement and clause 24 (Notices) of the Intercreditor Agreement is that as notified to the Agent prior to the Effective Date.

A52134198 9 (e) Each Party agrees that each New Arranger (save to the extent that each New Arranger agrees in writing to the contrary in a Mandate Document) shall have no responsibility or liability (whether direct or indirect, in contract or tort or otherwise) for or in connection with this Agreement, the Amended Facilities Agreement, the Intercreditor Agreement and/or the Term Facilities Invitation Letter (or any transaction or matter referred to in any such agreement or document), in each case, whether prior to, or after, its accession as an Arranger pursuant to this Clause 9. (f) Notwithstanding any term to the contrary in this Clause 9 (if any), each New Arranger shall only assume obligations under the Amended Facilities Agreement and the Intercreditor Agreement which apply to an "Arranger" (or, as applicable, any other capacity therein which includes acting in the capacity as Arranger) (if any) on and from the Effective Date and shall not, for the avoidance of any doubt, have any responsibility or liability for any obligations (whether under the Amended Facilities Agreement, the Intercreditor Agreement or the Original Facilities Agreement) which apply or applied to an "Arranger" (or, as applicable, any other capacity therein which includes acting in the capacity as Arranger) prior to such date (nor any responsibility or liability for the non- performance (or otherwise) of any such obligations). 10. Confirmation (a) On and from the Effective Date, the provisions of the Original Facilities Agreement, the Intercreditor Agreement and the other Finance Documents (as defined in the Original Facilities Agreement) (including, without limitation, the guarantee and indemnity of each Obligor) shall, save as amended by this Agreement, continue in full force and effect. (b) Immediately prior to the Effective Date (but after the Additional Facility Effective Time): (i) Listco, for itself and for and on behalf of each Obligor, acknowledges and confirms its acceptance of this Agreement and (on and from the Effective Date) the Amended Facilities Agreement and agrees that it and each such Obligor (as defined in the Original Facilities Agreement) is bound, with effect from the Effective Date, as an Obligor by the terms of the Amended Facilities Agreement, and confirms, for the benefit of the Finance Parties, that the guarantees and indemnities set out in clause 23 (Guarantee and indemnity) of the Amended Facilities Agreement shall apply, on and from the Effective Date, in respect of all of the obligations of each Obligor under the Finance Documents and extend to all new obligations of any such Obligor under any such Finance Document (including any arising from this Agreement and/or each amendment and restatement (and any other transactions consequent thereon) referred to in Clause 8 (Amendment and restatement)); and (ii) Listco, for itself and for and on behalf of each Obligor, acknowledges and confirms its acceptance of this Agreement and (on and from the Effective Date) the Intercreditor Agreement and agrees that it and each such Debtor (as defined in the Intercreditor Agreement) is bound, with effect from the Effective Date, as a Debtor by the terms of the Intercreditor Agreement, and confirms, for the benefit of the Secured Parties, that the guarantees and indemnities set out in clause 28 (Guarantee and indemnity) of the Intercreditor Agreement shall apply, on and from the Effective Date, in respect of all of the obligations of each Debtor under the relevant Debt Documents and extend to all new

A52134198 10 obligations of any such Debtor under any such Debt Document (including any arising from this Agreement and/or each amendment and restatement (and any other transactions consequent thereon) referred to in Clause 8 (Amendment and restatement)). (c) Listco hereby confirms that each Obligor has irrevocably authorised it (and, to the extent legally possible, has relieved it from the restrictions pursuant to section 181 of the German Civil Code (Bürgerliches Gesetzbuch) and/or any similar restrictions applicable pursuant to any other applicable law) to sign on its behalf this Agreement and all other documents required to implement the transactions, confirmations, accessions, redesignations, utilisations (or other borrowings) and/or amendments and restatements effected or to be effected pursuant to this Agreement (including, without limitation, each amendment and restatement pursuant to Clause 8 (Amendment and restatement)). (d) For the avoidance of any doubt, no waiver is given by entering into this Agreement or the transactions contemplated by this Agreement. 11. Reaffirmation of NY Law Security Agreements 11.1 This Agreement shall be deemed to be a reaffirmation and confirmation of, and supplement to, the NY Law Security Agreements and shall not be construed in any way as a replacement therefor or novation thereof. 11.2 Each of Midco and the US Co-Borrower hereby acknowledges that it is a party to the Amended Facilities Agreement. 11.3 Each of Midco and the US Co-Borrower hereby acknowledges and agrees that, both before and after the Effective Date, the NY Law Security Agreement to which it is party, including, without limitation, all of the terms, provisions, obligations, guarantees, grants of security interest, agreements and schedules forming part of such NY Law Security Agreement, is and shall continue to be in full force and effect and is hereby ratified and confirmed in all respects. 11.4 Each of Midco and the US Co-Borrower hereby acknowledges and agrees that, before and after the Effective Date, the term "Secured Obligations" in the NY Law Security Agreement to which it is party includes, without limitation, all Secured Obligations of the Grantor under the Amended Facilities Agreement and the other Finance Documents. 11.5 Each of Midco and the US Co-Borrower acknowledges and agrees that, both before and after the Effective Date, all present and future Collateral continues to secure the present and future Secured Obligations (as extended, increased and otherwise amended pursuant to the Amended Facilities Agreement), under the NY Law Security Agreement to which it is party on a continuous basis, unimpaired, uninterrupted and undischarged, and having the same perfected status and priority as collateral security for the Secured Obligations as existed prior to the Effective Date. The term "Secured Obligations" as used in each NY Law Security Agreement includes all Unpaid Sums. In the event that the Amended Facilities Agreement hereafter is amended and/or restated after the Effective Date or the date of this letter, and without limiting the generality of the definition of the term "Amended Facilities Agreement", the term "Secured Obligations" as used in each NY Law Security Agreement shall include, without limitation, the "Unpaid Sums" as defined in the Amended Facilities Agreement as so amended and/or restated.

A52134198 11 11.6 Each of Midco and the US Co-Borrower hereby reaffirms, confirms and ratifies its obligations and liabilities under the NY Law Security Agreement to which it is party. 11.7 All references in each NY Law Security Agreement to such NY Law Security Agreement, and the words "hereto", "hereof", "hereunder" or words of like import referring to such NY Law Security Agreement shall mean such NY Law Security Agreement as reaffirmed and supplemented by this Agreement. 12. Agent's books and records, waiver of transfer fee (a) Upon the occurrence of each of the Additional Facility Effective Time and the Effective Date, the Agent shall (in each case) update the register of Lenders (as defined in the Original Facilities Agreement) to reflect the establishment of Facility B4 (and the Commitments of the Lenders (each such term as defined in the Original Facilities Agreement) under Facility B4 as set out in the Allocations Table), the redesignation (if any) of Facility B2 Commitments and Facility B2 Loan participations (each such term as defined in the Original Facilities Agreement) effected pursuant to paragraph (a)(i)(A) of Clause 4 (Utilisation of Facility B4), the utilisation of (or, as the case may be, deemed utilisation of) Facility B4 (and the relevant participations of the Lenders (as defined in the Original Facilities Agreement) thereunder), each voluntary prepayment referred to in Clause 6 (Voluntary prepayments), each accession and each resignation referred to in this Agreement and (to the extent applicable) each other transaction contemplated in this Agreement. (b) The Agent acknowledges and agrees that: (i) no fee shall be payable to it pursuant to clause 29.3 (Assignment or transfer fee) of the Original Facilities Agreement in connection with any redesignation (if any) of Facility B2 Commitments or Facility B2 Loan participations (each such term as defined in the Original Facilities Agreement) effected pursuant to paragraph (a)(i)(A) of Clause 4 (Utilisation of Facility B4); and (ii) no fee shall be payable to it pursuant to clause 29.3 (Assignment or transfer fee) of the Original Facilities Agreement and/or clause 29.3 (Assignment or transfer fee) of the Amended Facilities Agreement in connection with primary syndication of Facility B4 by the Arrangers (acting in any capacity) and/or the Initial Term Facility Lenders. 13. Further assurance Listco shall ensure that each member of the Group shall, at the request of the Agent (acting reasonably) and at Listco's own expense, do all such acts and things which are necessary or desirable to give effect to the transactions, confirmations, accessions, redesignations, utilisations (or other borrowings) and/or amendments and restatements effected or to be effected pursuant to this Agreement (including, without limitation, each amendment and restatement pursuant to Clause 8 (Amendment and restatement)). 14. Indemnity Listco shall promptly indemnify each Party and each Finance Party for any costs, expense, loss or liability incurred in connection with this Agreement and each other agreement referred to in this

A52134198 12 Agreement and/or as a result of any payments to be made by (or on behalf of or at the direction of) Listco or any other member of the Group pursuant to this Agreement or any other agreement referred to in this Agreement on or prior to the Effective Date (including as a result of any such payment not being made in whole or in part by the relevant member of the Group on the relevant due date for payment). 15. Representations Listco, on behalf of itself and each Obligor, makes each of the representations and warranties contained in clause 24 (Representations) of the Amended Facilities Agreement (by reference to the facts and circumstances then existing) on: (a) the date of this Agreement; and (b) the Effective Date, but as if: (i) references to "this Agreement", "Transaction Document", "Transaction Documents" and "Finance Document" in those representations and warranties (or any similar terms) were instead, on the date of this Agreement, references to this Agreement and to the Original Facilities Agreement and, on the Effective Date, to this Agreement and to the Amended Facilities Agreement; (ii) references to the "Closing Date" in those representations and warranties were instead, on the date of this Agreement, to the date of this Agreement and, on the Effective Date, to the Effective Date; and (iii) in the case of paragraph (a) above, the Effective Date had occurred on the date of this Agreement. 16. Termination If the Effective Date has not occurred on or prior to the Long Stop Date, this Agreement shall terminate and shall be of no further force or effect and the provisions of the Original Facilities Agreement and the other Finance Documents (including the guarantee and indemnity of each Guarantor (as defined in the Original Facilities Agreement) shall continue in full force and effect as if this Agreement had not been entered into. 17. Miscellaneous (a) The provisions of clause 22.1 (Transaction expenses), clause 37 (Notices), clause 39 (Partial invalidity) and clause 45 (Enforcement) of the Original Facilities Agreement shall be incorporated into this Agreement as if set out in full in this Agreement, mutatis mutandis, and as if references in those clauses to "this Agreement" or "the Finance Documents" (or any similar terms) are references to this Agreement. (b) This Agreement may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this Agreement.

A52134198 13 18. Governing law This Agreement and any non-contractual obligations arising out of or in connection with it are governed by English law. This Agreement has been entered into on the date stated at the beginning of this Agreement.

A52134198 14 SCHEDULE 1 CONDITIONS PRECEDENT 1.1 A copy of the constitutional documents of each of Listco, Midco, Luxco and the US Co-Borrower (or confirmation that the constitutional documents have not been amended, rescinded, supplemented or superseded since they were previously delivered to the Agent) and including: (a) in relation to Luxco, a copy of (i) its up to date articles of association (status coordonnés); (ii) an excerpt (extrait) from the Registre de Commerce et des Sociétés in Luxembourg (the "Luxembourg RCS") dated not more than two days prior to the Effective Date; and (iii) certificate of non-inscription of a judicial decision or of administrative dissolution without liquidation (certificate de non-inscription d’une décision judiciaire ou de dissolution administrative sans liquidation) issued by the Luxembourg RCS regarding the absence of judicial proceedings dated not more than two days prior to the Effective Date; and (b) in relation to the US Co-Borrower, (i) a certificate as to the existence and good standing of the US Co-Borrower from the Secretary of State of the State of Delaware, (ii) a copy of its Certificate of Formation certified by the Secretary of State of the State of Delaware and (iii) a copy of its Operating Agreement. 1.2 A copy of a resolution of the board of directors/managers of each of Listco, Midco, Luxco and the US Co-Borrower: (a) approving the terms of and the transactions contemplated by this Agreement (and the Amended Facilities Agreement) and the Finance Documents to which it is a party and resolving that it executes, delivers and performs this Agreement (and the Amended Facilities Agreement) and the Finance Documents; (b) authorising a specified person or persons to execute this Agreement (and the Amended Facilities Agreement) and the Finance Documents to which it is a party on its behalf and any other documents and notices to be signed by or on behalf of it under or in connection with this Agreement (and the Amended Facilities Agreement) and the Finance Documents; and (c) in respect of Listco only, confirming, on behalf of itself and each of the Obligors, each of the matters specified in Clause 10 (Confirmation) of this Agreement, including that the guarantee issued under and in accordance with clause 23 (Guarantee and indemnity) of the Original Facilities Agreement will be legal, valid and binding and in full force and effect notwithstanding the proposed amendments to the Original Facilities Agreement in the form set out in Schedule 2 (Amended Facilities Agreement). 1.3 A specimen of the signature of each person authorised by the resolutions referred to above in relation to this Agreement. 1.4 In relation to Listco: (a) a certificate from its registered agent, in form and substance satisfactory to the Security Agent, dated no earlier than three Business Days before the date of this Agreement (including copies of its registers of members and directors);

A52134198 15 (b) a certified copy of the register of charges maintained by it under the BVI Business Companies Act 2004; (c) a certificate of good standing issued by the BVI Registrar of Corporate Affairs dated no earlier than three Business Days before the date of this Agreement; and (d) (if applicable) a copy of any power of attorney under which any Finance Document is executed on behalf of Listco. 1.5 A certificate of a director/manager of each of Listco, Midco, Luxco and the US Co-Borrower certifying that: (a) each copy document relating to it is correct, complete and in full force and effect and has not been amended or superseded; (b) there has been no breach of guaranteeing, borrowing or similar restrictions by it or any Obligor as at the date of such certificate; and (c) borrowing or guaranteeing or securing, as appropriate, the Total Commitments would not cause any borrowing, guaranteeing, securing or similar limit binding on it or any other Obligor to be exceeded. 1.6 In relation to Luxco, a copy of a duly signed certificate of an authorised signatory of each person authorised by the resolution referred to in paragraph 1.2above, such certificate should certify that: (a) Luxco is not subject to bankruptcy (faillite), insolvency, voluntary or judicial liquidation (liquidation volontaire ou judiciaire), composition with creditors (concordat préventif de la faillite), reprieve from payment (sursis de paiement), controlled management (gestion contrôlée), administrative dissolution without liquidation (dissolution administrative sans liquidation) or, on the date hereof, in a state of cessation of payments (cessation de paiements) and has not lost its commercial creditworthiness (ébranlement de credit); (b) the managers of Luxco have not made any application, petition, order or resolution for the administration or winding up of the entity; (c) Luxco has not been served with an insolvency court's order regarding protective measures taken as a consequence of a creditor's application for the opening of insolvency proceedings with respect of its assets and has not otherwise been informed of such application; and (d) the managers of Luxco are not aware of any appointment of a receiver or administrator based on a filing for insolvency by a creditor of the entity. 2. Transaction Security Document 2.1 An English law debenture incorporating fixed and floating charges over all of the present and future assets of Listco and Midco (the "English Law Supplemental Debenture"). 2.2 A Luxembourg law governed security confirmation agreement to be entered into by Luxco and Midco (the "Luxembourg Law Confirmation Agreement") in relation to: (a) an account pledge agreement entered into by Luxco; (b) a receivables pledge over the receivables owed by Midco to Luxco; and

A52134198 16 (c) a share pledge agreement entered into by Midco. 2.3 In relation to each of Midco and the US Co-Borrower, UCC lien search reports. 2.4 Delivery of all share certificates, transfers, stock transfer forms, documents of title, notices and other deliverables, registrations and fillings (where required, executed and delivered by the relevant Obligor) in connection with the Transaction Security and any other documents delivered pursuant to this Schedule 1. 3. Legal opinions 3.1 A legal opinion as to capacity and enforceability under English law to be provided by Linklaters LLP as English law counsel to the Agent and the Security Agent in connection with this Agreement (and the Amended Facilities Agreement), the Luxembourg Law Confirmation Agreement, the English Law Supplemental Debenture and the Finance Documents to which Midco is party to. 3.2 A legal opinion as to capacity under Luxembourg law to be provided by Arendt & Medernach as Luxembourg law counsel to the Obligors in connection with the Luxembourg Law Confirmation Agreement. 3.3 A legal opinion as to enforceability under Luxembourg law to be provided by Linklaters LLP as Luxembourg law counsel to the Agent and the Security Agent in connection with the Luxembourg Law Confirmation Agreement. 3.4 A legal opinion as to capacity and continued validity and perfection of security interests under the laws of the State of Delaware to be provided by Greenberg Traurig as Delaware law counsel to the Obligors in connection with this Agreement and the Amended Facilities Agreement. 3.5 A legal opinion as to capacity under the laws of the British Virgin Islands to be provided by Mourant Ozannes as British Virgin Islands law counsel to the Agent and the Security Agent in connection with this Agreement (and the Amended Facilities Agreement), the English Law Supplemental Debenture, and the Finance Documents to which Listco is party to. 4. Other documents and evidence 4.1 The Fee Letters. 4.2 A copy of the structure chart of the Group. 4.3 Evidence that all fees, costs and expenses due to any of the Finance Parties have been paid or will be paid on or prior to the Effective Date. 4.4 Satisfaction of all "Know-your-customer" and other similar checks required by the Finance Parties.

A52134198 17 SCHEDULE 2 AMENDED FACILITIES AGREEMENT

EXECUTION VERSION The taking of (a) any of the Finance Documents (including this document) or (b) any certified copy thereof or (c) any document which constitutes substitute documentation thereof including written confirmations or references (the "Stamp Duty Sensitive Documents") into Austria may cause the imposition of Austrian stamp duty. The same, inter alia, applies to (i) the sending of Stamp Duty Sensitive Documents to an Austrian addressee by fax, (ii) the sending of any e-mail communication to which an electronic scan copy (e.g., pdf or tif) of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (iii) the sending of any e-mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. Accordingly, in particular, keep any Stamp Duty Sensitive Documents outside of Austria and avoid (A) sending Stamp Duty Sensitive Documents by fax to an Austrian addressee, (B) sending any e-mail communication to which an electronic scan copy of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (C) sending any e-mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. SENIOR FACILITIES AGREEMENT originally dated 3 July 2014 as amended and restated from time to time including pursuant to the 2023 Amendment and Restatement Agreement for NOMAD FOODS LIMITED as Listco with JEFFERIES FINANCE LLC as left lead bank in respect of Facility B4 with JEFFERIES FINANCE LLC as mandated lead arranger in respect of Facility B4 with JEFFERIES FINANCE LLC as physical bookrunner in respect of Facility B4 with JEFFERIES FINANCE LLC, CITIBANK, N.A., LONDON BRANCH, J.P. MORGAN SE AND BANCO SANTANDER, S.A., NEW YORK BRANCH as bookrunners in respect of Facility B4 with JEFFERIES FINANCE LLC as global co-ordinator in respect of Facility B4 with CREDIT SUISSE AG, LONDON BRANCH acting as Agent and CREDIT SUISSE AG, LONDON BRANCH acting as Security Agent Ref: L-296544

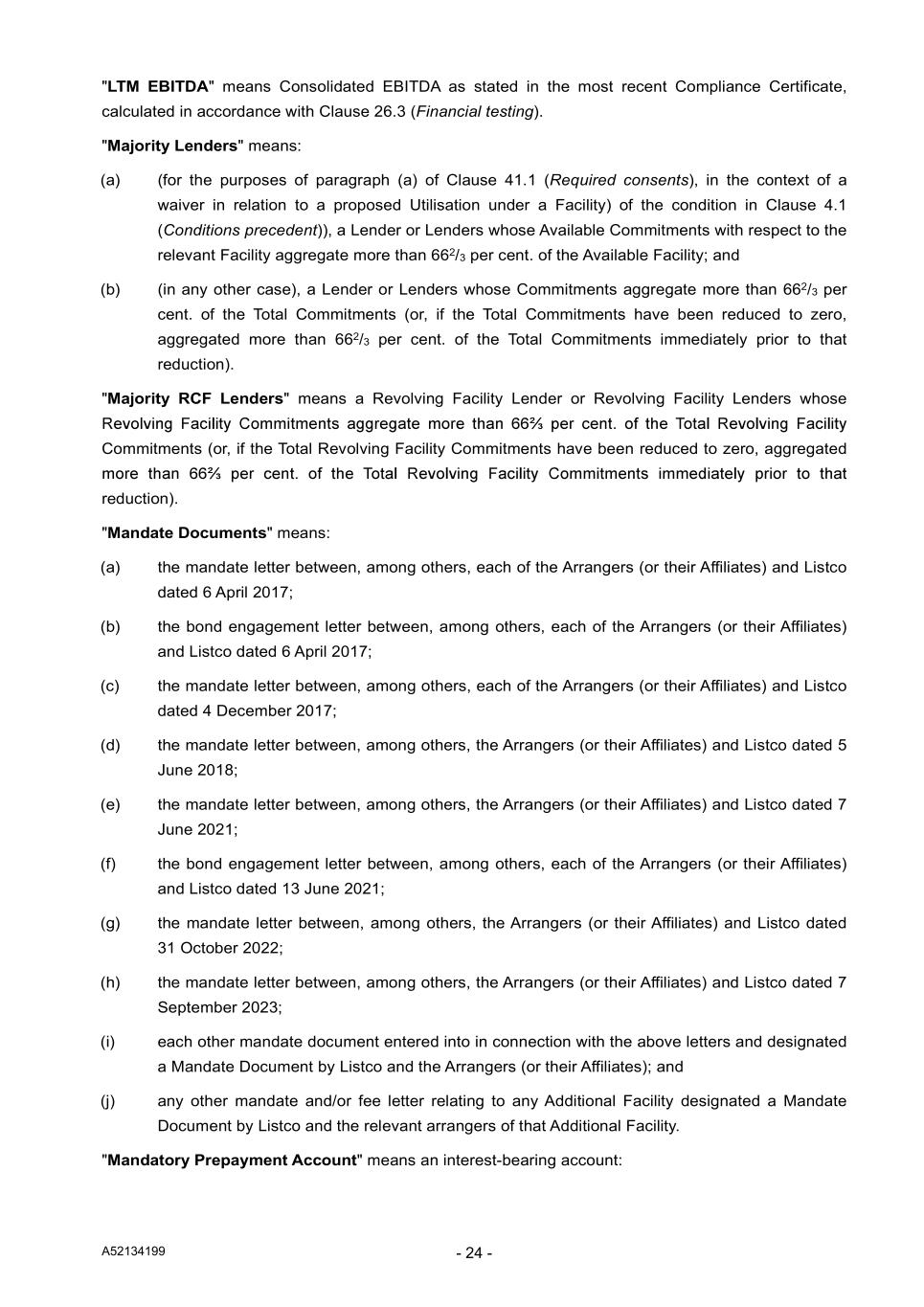

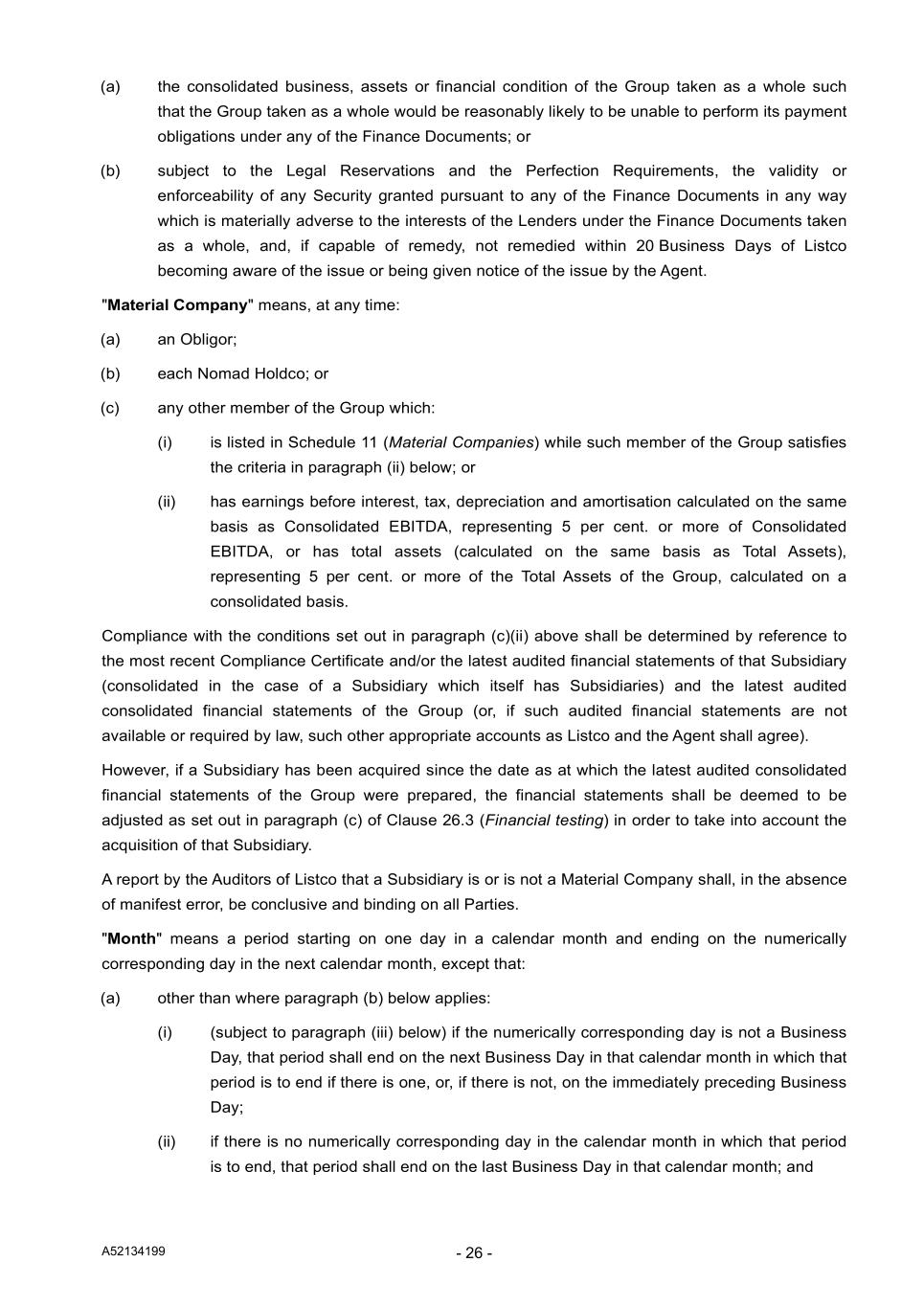

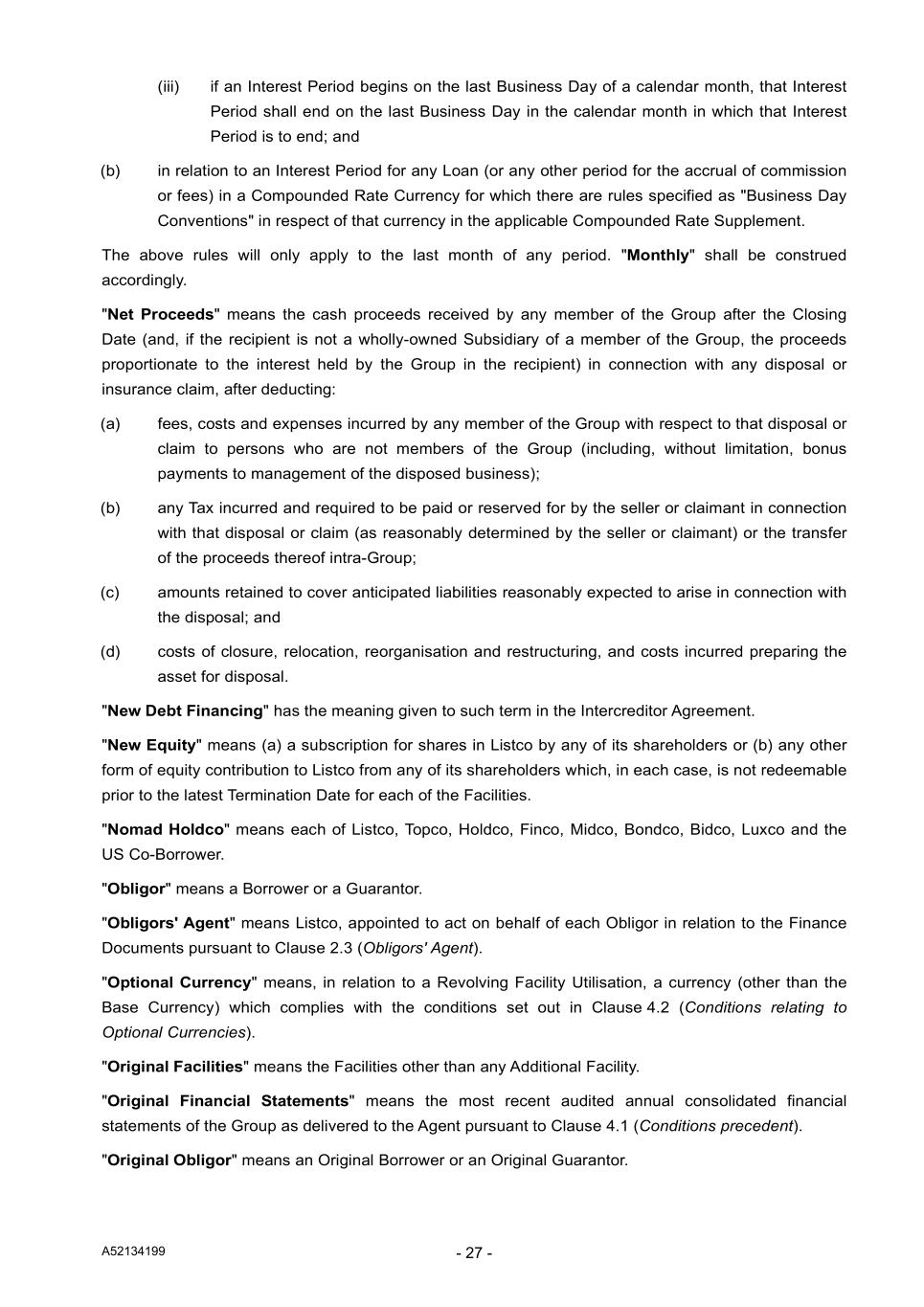

A52134199 - i - CONTENTS CLAUSE PAGE SECTION 1 INTERPRETATION 1. Definitions and interpretation ..................................................................................................... 2 SECTION 2 THE FACILITIES 2. The Facilities ............................................................................................................................ 58 3. Purpose ................................................................................................................................... 65 4. Conditions of Utilisation ........................................................................................................... 66 SECTION 3 UTILISATION 5. Utilisation – Loans ................................................................................................................... 68 6. Utilisation - Letters of Credit .................................................................................................... 69 7. Letters of Credit ....................................................................................................................... 72 8. Optional Currencies ................................................................................................................. 74 9. Ancillary Facilities .................................................................................................................... 74 SECTION 4 REPAYMENT, PREPAYMENT AND CANCELLATION 10. Repayment .............................................................................................................................. 79 11. Illegality, voluntary prepayment and cancellation .................................................................... 79 12. Mandatory prepayment............................................................................................................ 82 13. Restrictions .............................................................................................................................. 85 SECTION 5 COSTS OF UTILISATION 14. Interest ..................................................................................................................................... 87 15. Interest Periods ....................................................................................................................... 93 16. Changes to the calculation of interest ..................................................................................... 94 17. Fees ......................................................................................................................................... 97 SECTION 6 ADDITIONAL PAYMENT OBLIGATIONS 18. Tax gross-up and indemnities ................................................................................................ 100 19. Increased Costs ..................................................................................................................... 108 20. Other indemnities .................................................................................................................. 109 21. Mitigation by the Lenders ...................................................................................................... 111 22. Costs and expenses .............................................................................................................. 111 SECTION 7 GUARANTEE 23. Guarantee and indemnity ...................................................................................................... 113 SECTION 8 REPRESENTATIONS, UNDERTAKINGS AND EVENTS OF DEFAULT 24. Representations .................................................................................................................... 122 25. Information undertakings ....................................................................................................... 126 26. Financial covenant ................................................................................................................. 131 27. General undertakings ............................................................................................................ 141 28. Events of Default ................................................................................................................... 152

A52134199 - ii - SECTION 9 CHANGES TO PARTIES 29. Changes to the Lenders ........................................................................................................ 159 30. Debt Purchase Transactions ................................................................................................. 165 31. Changes to the Obligors ........................................................................................................ 168 SECTION 10 THE FINANCE PARTIES 32. Role of the Agent, the Arrangers, the Issuing Bank and others ............................................ 173 33. Conduct of business by the Finance Parties ......................................................................... 182 34. Sharing among the Finance Parties ...................................................................................... 183 SECTION 11 ADMINISTRATION 35. Payment mechanics .............................................................................................................. 185 36. Set-off .................................................................................................................................... 187 37. Notices ................................................................................................................................... 187 38. Calculations and certificates .................................................................................................. 191 39. Partial invalidity ...................................................................................................................... 191 40. Remedies and waivers .......................................................................................................... 192 41. Amendments and waivers ..................................................................................................... 192 42. Confidentiality ........................................................................................................................ 197 43. Confidentiality of Funding Rates ........................................................................................... 200 44. Counterparts .......................................................................................................................... 202 45. Bail-in ..................................................................................................................................... 202 46. Acknowledgment regarding any supported QFCs ................................................................ 203 SECTION 12 GOVERNING LAW AND ENFORCEMENT 47. Governing law ........................................................................................................................ 205 48. Enforcement .......................................................................................................................... 205 49. General Austrian limitation .................................................................................................... 207 THE SCHEDULES SCHEDULE PAGE SCHEDULE 1 The Parties ..................................................................................................................... 208 SCHEDULE 2 Conditions Precedent and Conditions Subsequent ....................................................... 212 SCHEDULE 3 Requests ........................................................................................................................ 248 SCHEDULE 4 Form of Transfer Certificate and Lender Accession Undertaking .................................. 253 SCHEDULE 5 Form of Accession Letter................................................................................................ 257 SCHEDULE 6 Form of Resignation Letter ............................................................................................. 259 SCHEDULE 7 Form of Compliance Certificate ...................................................................................... 261 SCHEDULE 8 LMA Form of Confidentiality Undertaking ...................................................................... 263 SCHEDULE 9 Timetables ...................................................................................................................... 268 SCHEDULE 10 Form of Letter of Credit ................................................................................................ 270 SCHEDULE 11 Material Companies ...................................................................................................... 274 SCHEDULE 12 Security Principles ........................................................................................................ 275 SCHEDULE 13 Form of Lender Accession Notice ................................................................................ 283 SCHEDULE 14 Form of Additional Facility Notice ................................................................................. 286 SCHEDULE 15 Forms of Notifiable Debt Purchase Transaction Notice ............................................... 288 SCHEDULE 16 Compounded Rate Terms ............................................................................................ 290

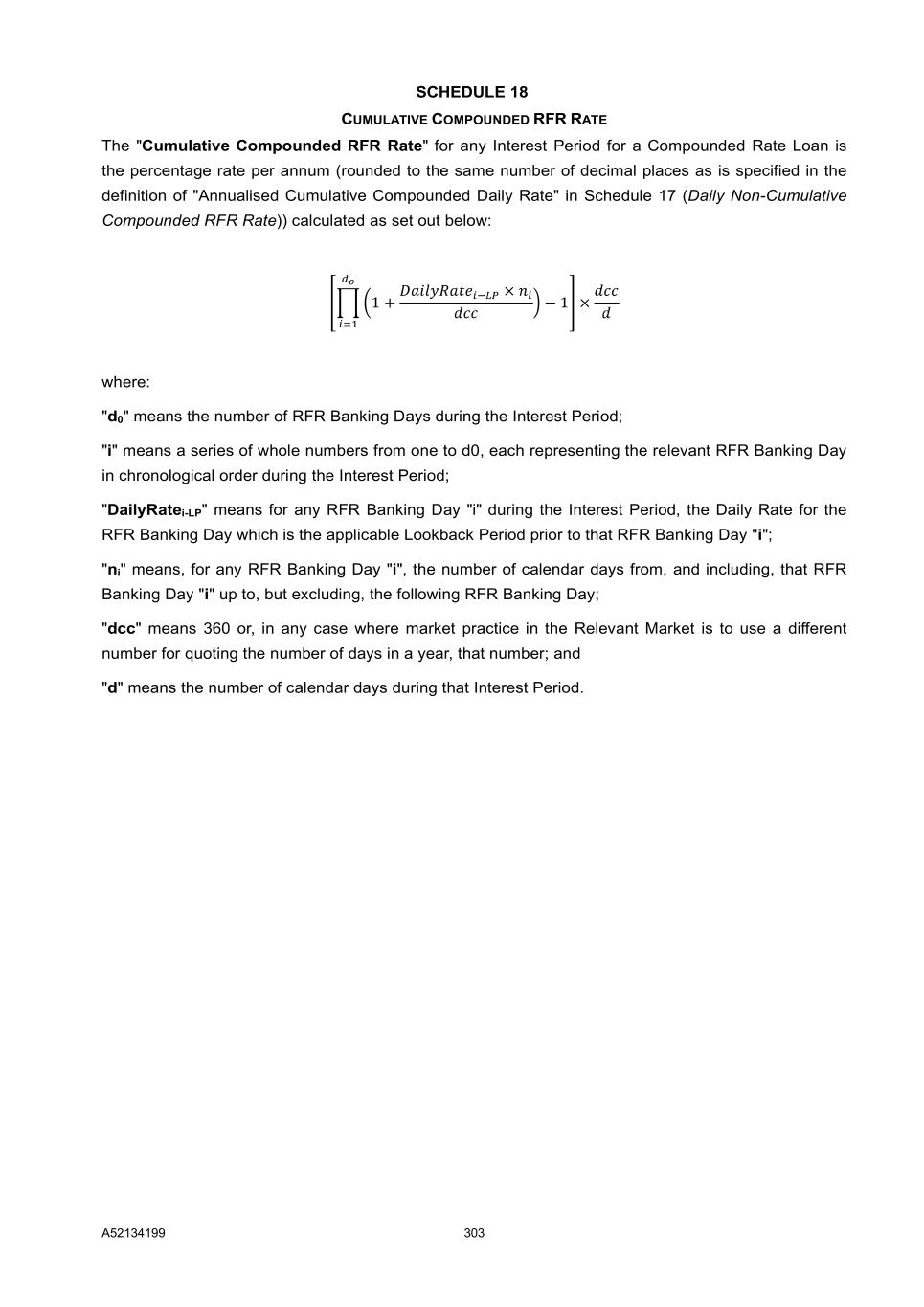

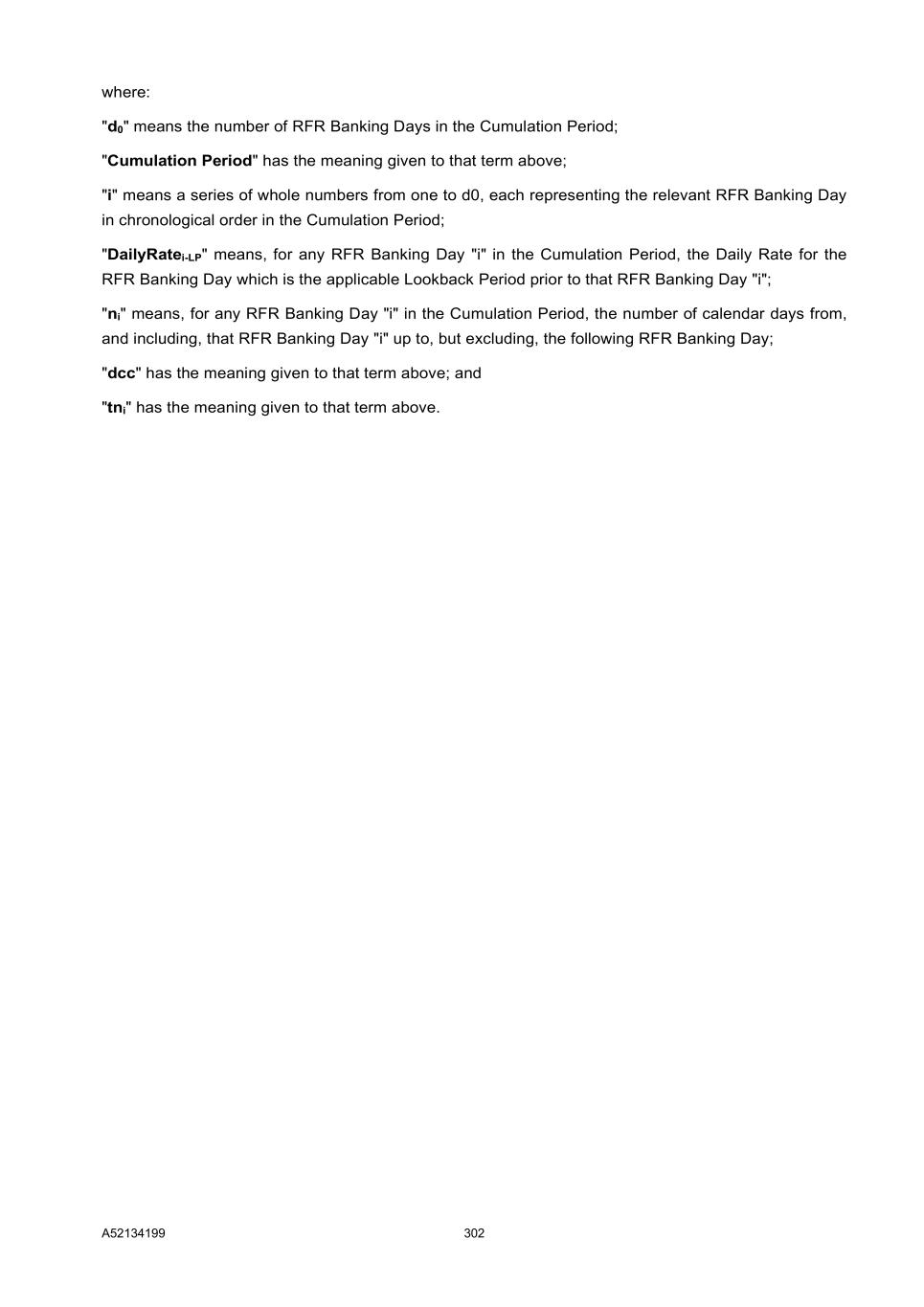

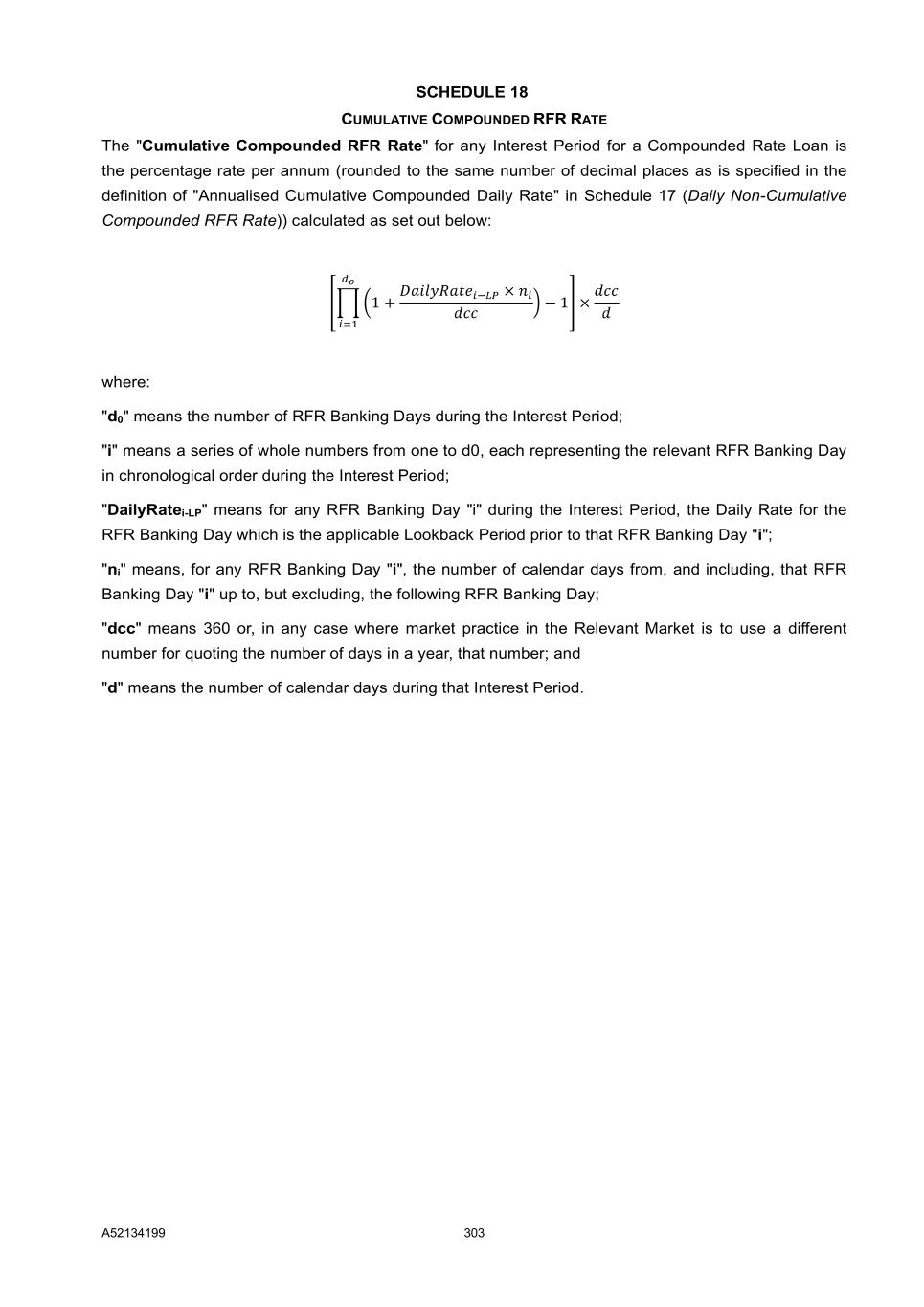

A52134199 - iii - SCHEDULE 17 Daily Non-Cumulative Compounded RFR Rate .......................................................... 301 SCHEDULE 18 Cumulative Compounded RFR Rate ........................................................................... 303

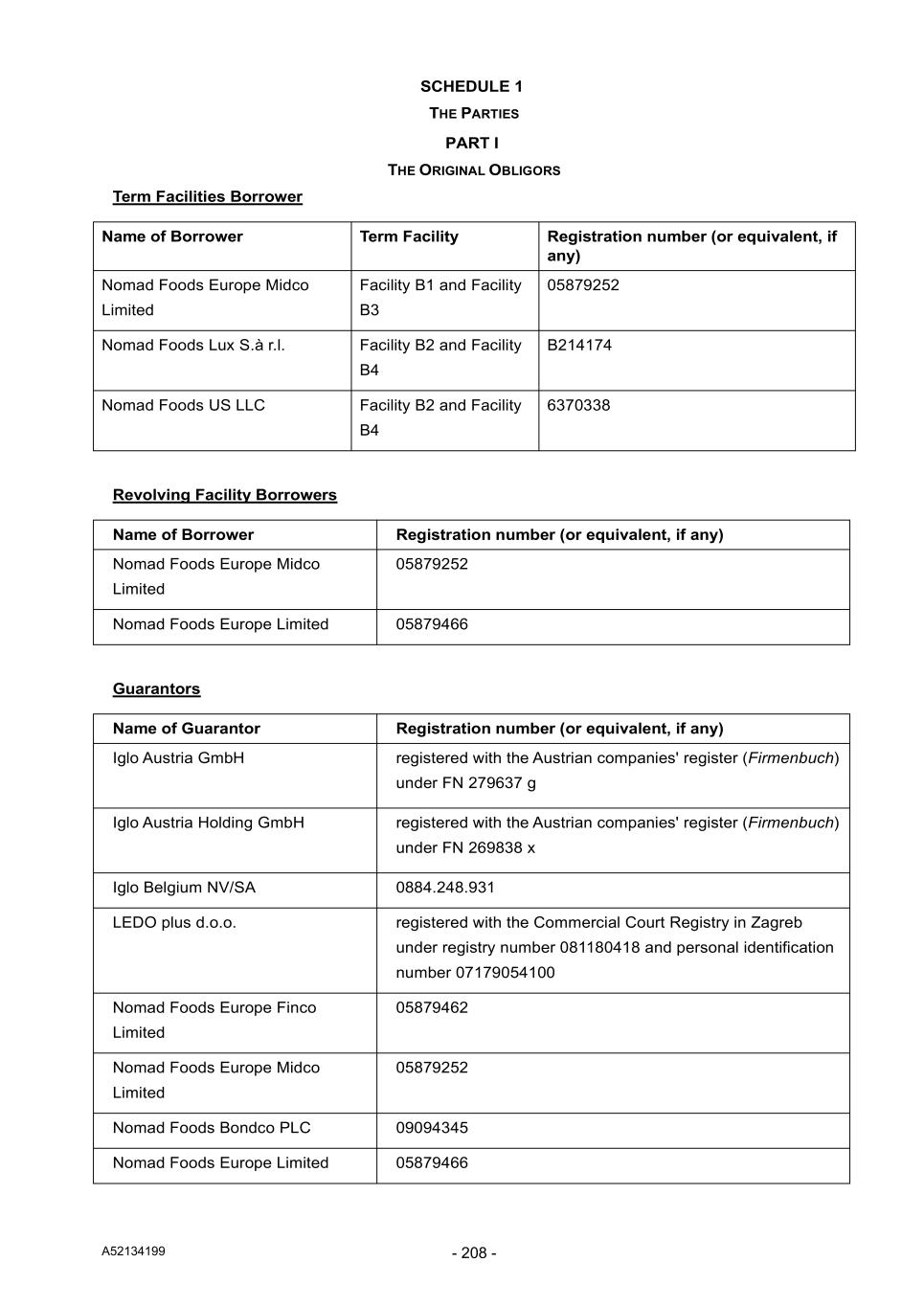

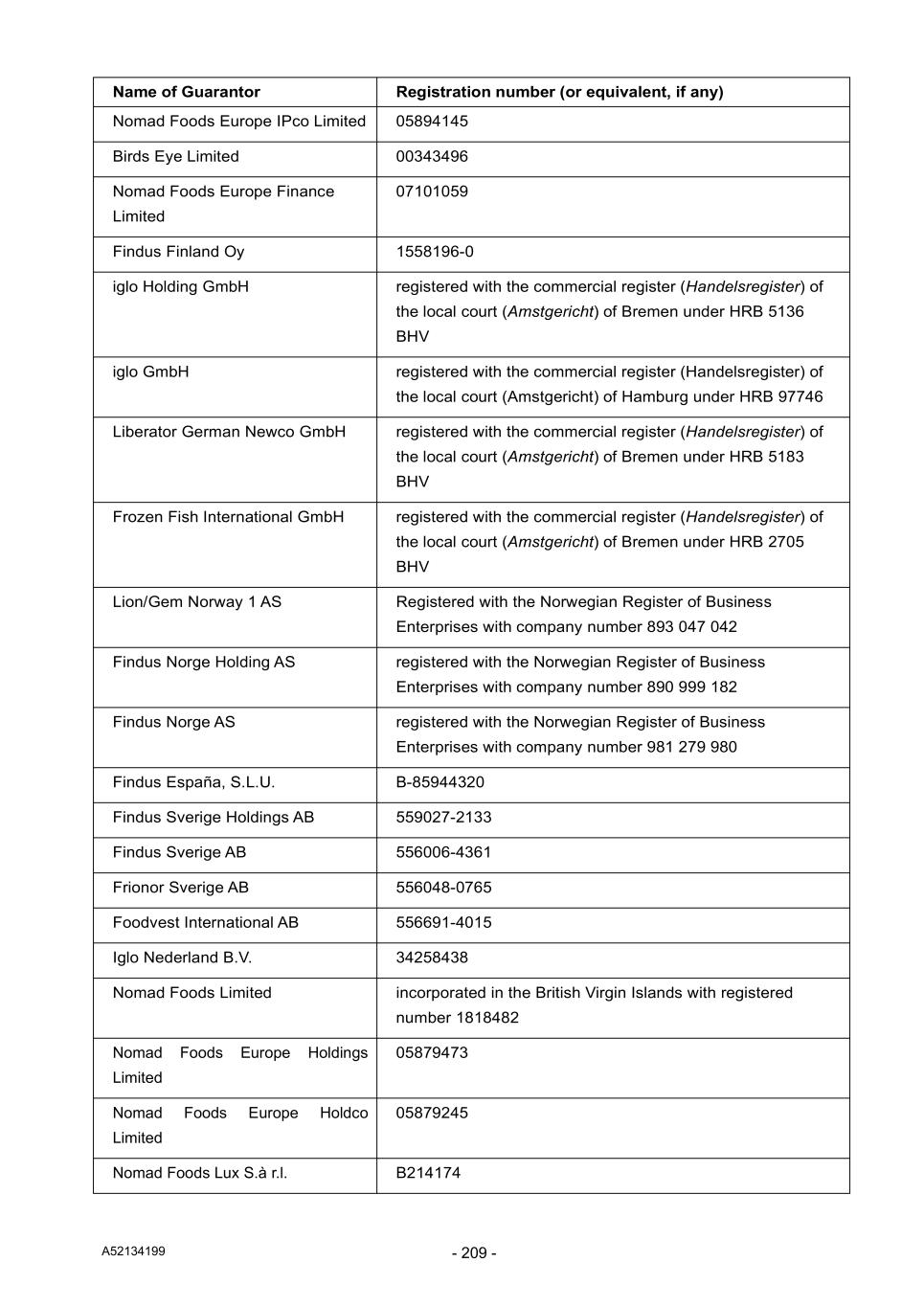

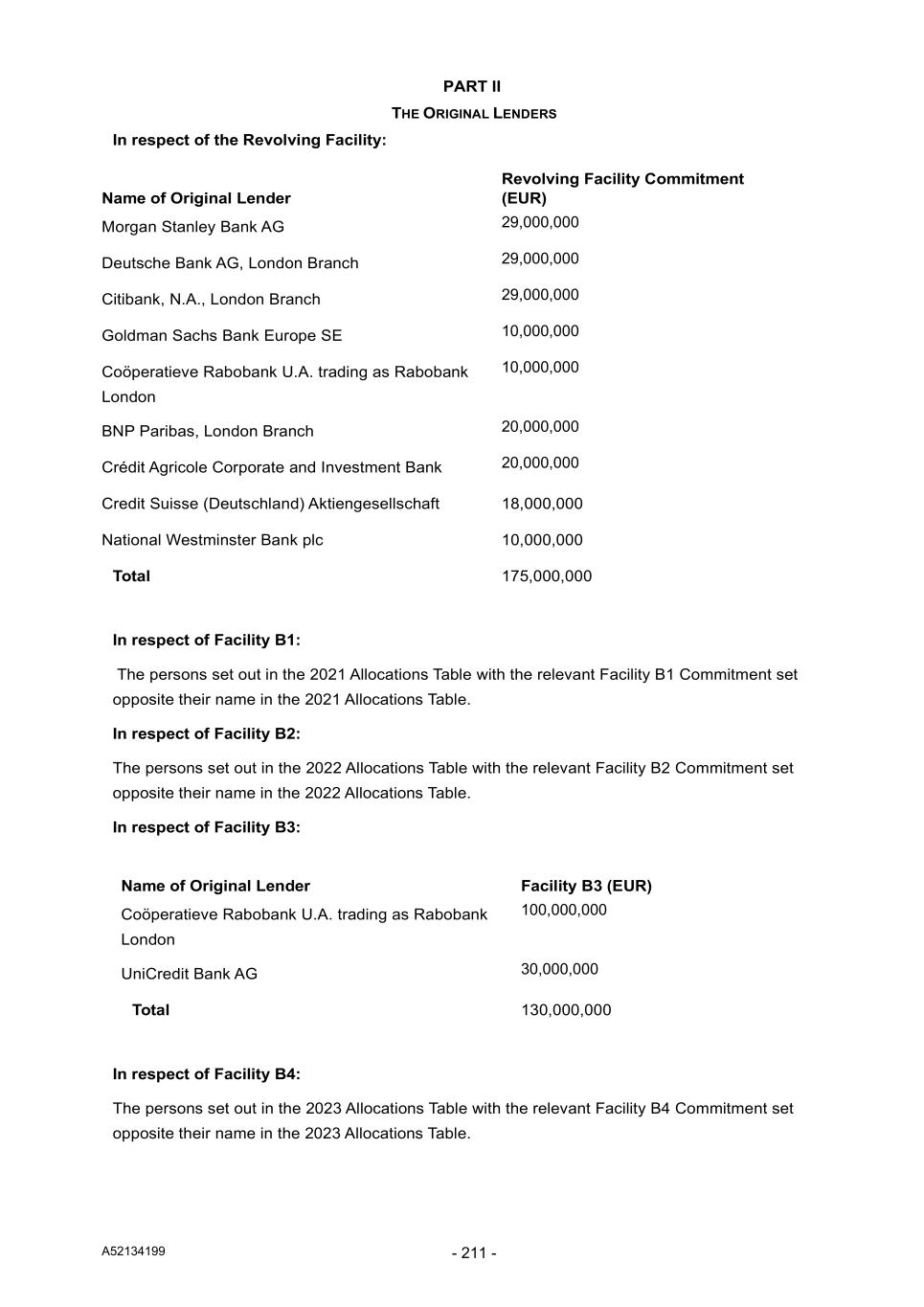

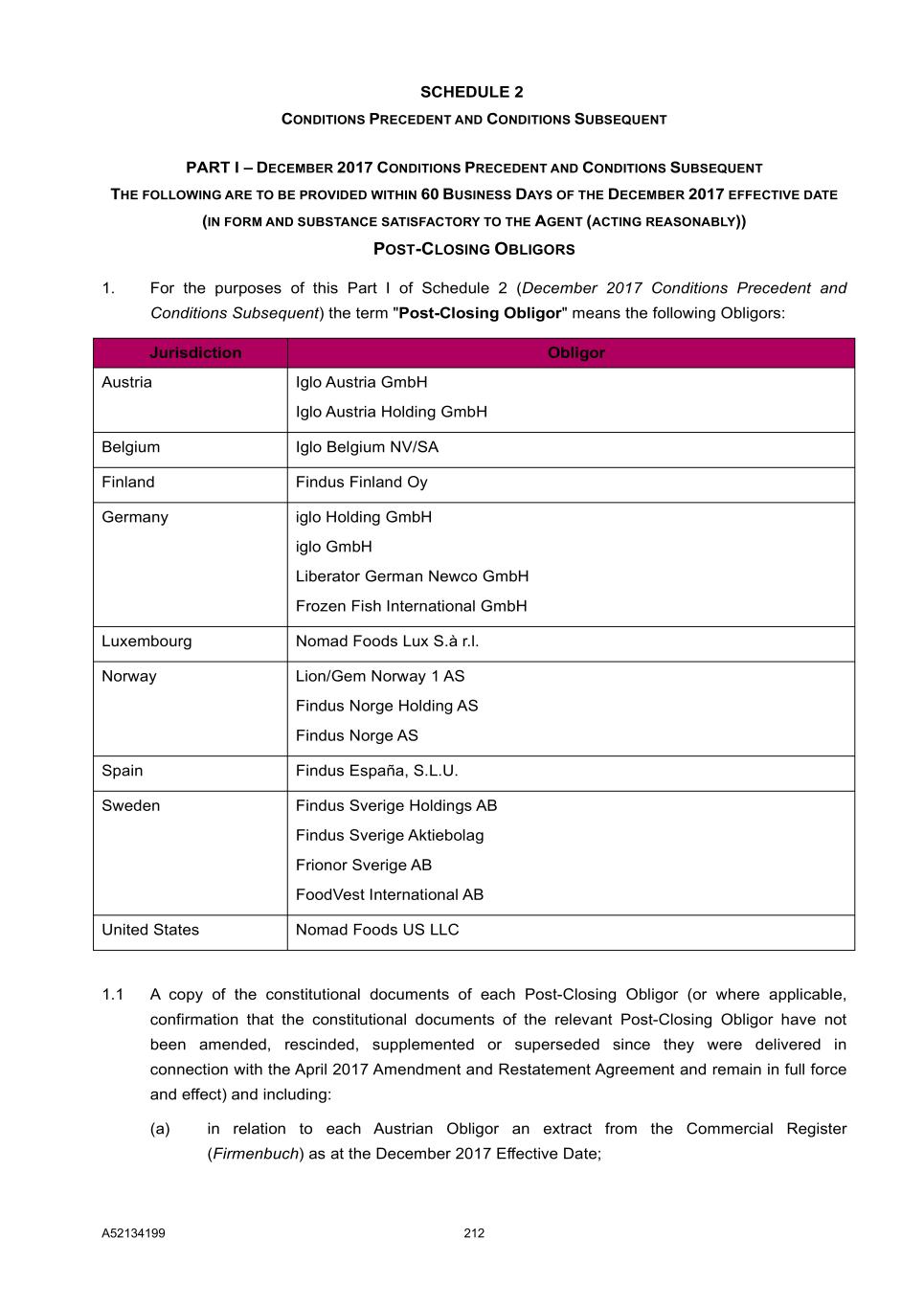

A52134199 - 1 - THIS AGREEMENT is dated 3 July 2014 as amended and restated from time to time, including on the 2023 Effective Date pursuant to the 2023 Amendment and Restatement Agreement, and made BETWEEN: (1) NOMAD FOODS LIMITED, a public listed company incorporated in the British Virgin Islands with registered number 1818482 ("Listco"); (2) NOMAD FOODS EUROPE MIDCO LIMITED, a company incorporated in England and Wales with registered number 5879252 ("Midco"); (3) NOMAD FOODS LUX S.À R.L., a private limited liability company (société à responsabilité limitée), having its registered office at 9, rue de Bitbourg, L-1273 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies (Registre de commerce et des sociétés, Luxembourg) under number B214174 ("Luxco"); (4) NOMAD FOODS US LLC, a single member limited liability company organised in Delaware, the US for the sole purpose of acting as co-borrower in respect of Facility B2 and Facility B4 (or any Additional Facility denominated in US$) ("US Co-Borrower"); (5) THE ENTITIES listed in Part I of Schedule 1 (The Parties) as borrowers (the "Original Borrowers"); (6) THE ENTITIES listed in Part I of Schedule 1 (The Parties) as guarantors (the "Original Guarantors"); (7) MORGAN STANLEY BANK AG, as left lead bank in respect of Facility B1 (the "Facility B1 Left Lead Bank"); (8) CITIBANK, N.A., LONDON BRANCH, as left lead bank in respect of Facility B2 and Facility B3 (the "Facilities B2 and B3 Left Lead Bank"); (9) JEFFERIES FINANCE LLC, as left lead bank in respect of Facility B4 (together with the Facility B1 Left Lead Bank and the Facilities B2 and B3 Left Lead Bank, the "Left Lead Banks"); (10) MORGAN STANLEY BANK AG and DEUTSCHE BANK AG, LONDON BRANCH as physical bookrunners of Facility B1, CITIBANK, N.A., LONDON BRANCH and MORGAN STANLEY BANK AG as physical bookrunners of Facility B2 and Facility B3 and JEFFERIES FINANCE LLC as physical bookrunner of Facility B4 (together, the "Physical Bookrunners"); (11) CITIBANK, N.A., LONDON BRANCH and MORGAN STANLEY BANK AG, as global co- ordinators of Facility B2 and Facility B3 and JEFFERIES FINANCE LLC as global co-ordinator of Facility B4 (the "Global Co-ordinators"); (12) MORGAN STANLEY BANK AG, CITIBANK, N.A., LONDON BRANCH, DEUTSCHE BANK AG, LONDON BRANCH, MORGAN STANLEY BANK AG, J.P. MORGAN SE, JEFFERIES FINANCE LLC, BNP PARIBAS, LONDON BRANCH, CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK, GOLDMAN SACHS BANK EUROPE SE and COÖPERATIEVE RABOBANK U.A. TRADING AS RABOBANK LONDON as bookrunners for Facility B1 and CITIBANK, N.A., LONDON BRANCH and MORGAN STANLEY BANK AG as mandated lead arrangers for Facility B2 and Facility B3 and CITIBANK, N.A., FINANCE LLC, DEUTSCHE BANK AG, LONDON BRANCH, and GOLDMAN SACHS BANK USA as bookrunners for Facility B2 and CITIBANK, N.A., LONDON BRANCH, MORGAN STANLEY BANK AG, J.P. MORGAN SE, JEFFERIES FINANCE LLC, DEUTSCHE BANK AG, LONDON BRANCH, GOLDMAN SACHS BANK USA and COÖPERATIEVE RABOBANK U.A. TRADING AS RABOBANK LONDON as bookrunners for Facility B3 and JEFFERIES FINANCE LLC, CITIBANK, N.A., LONDON BRANCH, J.P. MORGAN SE and BANCO SANTANDER, S.A.,

A52134199 - 2 - NEW YORK BRANCH as bookrunners for Facility B4 and JEFFERIES FINANCE LLC as mandated lead arranger for Facility B4 (in each case, whether acting individually or together, and together with the Left Lead Banks, the Physical Bookrunners and the Global Co-ordinators, the “Arrangers”); (13) THE FINANCIAL INSTITUTIONS referred to in Part II of Schedule 1 (The Parties) (the “Original Lenders”); (14) CREDIT SUISSE AG, LONDON BRANCH, as agent of the other Finance Parties (the “Agent”); and (15) CREDIT SUISSE AG, LONDON BRANCH, as security agent for the Secured Parties (the “Security Agent”). IT IS AGREED as follows SECTION 1 INTERPRETATION 1. DEFINITIONS AND INTERPRETATION 1.1 Definitions In this Agreement: “2018 Amendment and Restatement Agreement” means the amendment and restatement agreement, in relation to this Agreement, dated 15 June 2018 between, among others, Listco and the Agent. “2018 Effective Date” has the meaning given to the term “Effective Date” in the 2018 Amendment and Restatement Agreement. “2021 Additional Facility Effective Time” has the meaning given to the term “Additional Facility Effective Time” in the 2021 Amendment and Restatement Agreement. “2021 Allocations Table” has the meaning given to the term “Allocations Table” in the 2021 Amendment and Restatement Agreement. “2021 Amendment and Restatement Agreement” means the amendment and restatement agreement, in relation to this Agreement, dated 22 June 2021 between, among others, Listco and the Agent. “2021 Effective Date” has the meaning given to the term “Effective Date” in the 2021 Amendment and Restatement Agreement. “2022 Additional Facility Effective Time” has the meaning given to the term “Additional Facility Effective Time” in the 2022 Amendment and Restatement Agreement. “2022 Allocations Table” has the meaning given to the term “Allocations Table” in the 2022 Amendment and Restatement Agreement. “2022 Amendment and Restatement Agreement” means the amendment and restatement agreement, in relation to this Agreement, dated 8 November 2022 between, among others, Listco and the Agent. “2022 Effective Date” has the meaning given to the term “Effective Date” in the 2022 Amendment and Restatement Agreement.

A52134199 - 3 - “2023 Additional Facility Effective Time” has the meaning given to the term “Additional Facility Effective Time” in the 2023 Amendment and Restatement Agreement. “2023 Allocations Table” has the meaning given to the term “Allocations Table” in the 2023 Amendment and Restatement Agreement. “2023 Amendment and Restatement Agreement” means the amendment and restatement agreement, in relation to this Agreement, dated __________ 2023 between, among others, Listco and the Agent. “2023 Effective Date” has the meaning given to the term “Effective Date” in the 2023 Amendment and Restatement Agreement. “Acceptable Bank” means: (a) a Lender and, to the extent not a Lender, the list of banks with whom the Group has certain banking arrangements as at the Closing Date as agreed between Listco and the Arrangers prior to the Closing Date; (b) any bank or financial institution which has a rating for its long-term debt obligations of BBB- or higher by Standard & Poor’s Rating Services or Fitch Ratings Ltd or Baa3 or higher by Moody’s Investors Service Limited or a comparable rating from an internationally recognised credit rating agency; or (c) any other bank or financial institution approved by the Agent (acting reasonably). “Accession Letter” means a document substantially in the form set out in Schedule 5 (Form of Accession Letter) or any other form agreed by the Agent and Listco. “Accounting Principles” means generally accepted accounting principles in the jurisdiction of incorporation of the relevant member of the Group or International Accounting Standards. “Acquired Debt” has the meaning given to it in paragraph (e) of the definition of "Permitted Financial Indebtedness". "Acquired Group" means, in relation to Permitted Acquisition under paragraph (d) of the definition of "Permitted Acquisition", the entity (and its Subsidiaries) or business or undertaking (as the case may be) acquired by the Group pursuant to such Permitted Acquisition. "Acquisition Costs" means all non-periodic fees, costs and expenses, stamp, registration and other Taxes incurred or required to be paid by any member of the Group in connection with any Permitted Acquisition or the Transaction Documents. "Additional Borrower" means a company which becomes a Borrower in accordance with Clause 31 (Changes to the Obligors). "Additional Business Day" means any day specified as such in the applicable Compounded Rate Terms. "Additional Facility" has the meaning given to it in Clause 2.4 (Additional Facilities). "Additional Facility Commencement Date" means, in respect of an Additional Facility, the date specified as the "Commencement Date" in the Additional Facility Notice relating to that Additional Facility. 15 September

A52134199 - 4 - "Additional Facility Commitment" means, in respect of an Additional Facility Lender and an Additional Facility, the Base Currency Amount specified as its Lender Commitment in the Additional Facility Notice delivered by that Additional Facility Lender, to the extent not cancelled, reduced or transferred by such Additional Facility Lender under this Agreement. "Additional Facility Documents" means, in relation to any Additional Facility, the Additional Facility Debt Instrument, any fee letter entered into, under or in connection with the Additional Facility and any other document or instrument relating to that Additional Facility and designated as such by Listco and the relevant Additional Facility Lender. "Additional Facility Debt Instrument" means, in relation to any Additional Facility, the indenture, facility agreement, or other equivalent document by which that Additional Facility is issued or, as the case may be, made available. "Additional Facility Lender" has the meaning given to it in Clause 2.4 (Additional Facilities). "Additional Facility Loan" means an Additional Facility Revolving Loan and/or an Additional Facility Term Loan. "Additional Facility Notice" means a notice substantially in the form set out in Schedule 14 (Form of Additional Facility Notice) or any other form agreed by the Agent and Listco. "Additional Facility Revolving Loan" means loans made or to be made under an Additional Revolving Facility or the principal amount outstanding for the time being of those loans under an Additional Revolving Facility. "Additional Facility Term Loan" means loans made or to be made under an Additional Term Facility or the principal amount outstanding for the time being of those loans under an Additional Term Facility. "Additional Guarantor" means a company which becomes a Guarantor in accordance with Clause 31 (Changes to the Obligors). "Additional Obligor" means an Additional Borrower or an Additional Guarantor. "Additional Revolving Facility" means any revolving facility established by Listco as an Additional Facility under Clause 2.4 (Additional Facilities). "Additional Term Facility" means any term facility established by Listco as an Additional Facility under Clause 2.4 (Additional Facilities). "Affiliate" means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company. "Agent's Spot Rate of Exchange" means the Agent's spot rate of exchange for the purchase of the relevant currency with the Base Currency in the London foreign exchange market at or about 11:00 a.m. on a particular day. "Ancillary Commencement Date" means, in relation to an Ancillary Facility, the date on which that Ancillary Facility is first made available, which date shall (unless a contrary indication appears in the April 2017 Amendment and Restatement Agreement) be a Business Day within the Availability Period for the applicable Revolving Facility.

A52134199 - 5 - "Ancillary Commitment" means, in relation to an Ancillary Lender and an Ancillary Facility, the maximum Base Currency Amount which that Ancillary Lender has agreed (whether or not subject to satisfaction of conditions precedent) to make available from time to time under an Ancillary Facility and which has been authorised as such under Clause 9 (Ancillary Facilities), to the extent that amount is not cancelled or reduced under this Agreement or the Ancillary Documents relating to that Ancillary Facility. "Ancillary Document" means each document relating to or evidencing the terms of an Ancillary Facility. "Ancillary Facility" means any ancillary facility made available by an Ancillary Lender in accordance with Clause 9 (Ancillary Facilities). "Ancillary Lender" means each Lender (or Affiliate of a Lender) which makes available an Ancillary Facility in accordance with Clause 9 (Ancillary Facilities). "Ancillary Outstandings" means, at any time, in relation to an Ancillary Lender and an Ancillary Facility, the aggregate of the equivalents (as calculated by that Ancillary Lender) in the Base Currency of the following amounts outstanding under that Ancillary Facility then in force: (a) the principal amount under each overdraft facility and on demand short-term loan facility (net of any credit balances on any account of any Borrower of an Ancillary Facility with the Ancillary Lender making available that Ancillary Facility to the extent that such credit balance is freely available to be set off by that Ancillary Lender against liabilities owed to it by that Borrower under that Ancillary Facility) (ignoring, for this purpose, where agreed by the Ancillary Lender, any liability in respect of BACS facilities); (b) the face amount of each guarantee, bond and letter of credit under that Ancillary Facility (to the extent not repaid or prepaid); and (c) the amount fairly representing the aggregate exposure (excluding interest and similar charges) of that Ancillary Lender under each other type of accommodation provided under that Ancillary Facility, in each case, as determined by such Ancillary Lender in accordance with the relevant Ancillary Document or normal banking practice. "Anti-Corruption Laws" means the US Foreign Corrupt Practices Act 1977, the UK Bribery Act 2010, the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions and any other applicable anti-bribery or anti-corruption law or regulation. "Anti-Money Laundering Laws" means all applicable financial record keeping and reporting requirements and anti-money laundering statutes in all jurisdictions in which the member of the Group conducts its business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency. "April 2017 Amendment and Restatement Agreement" means the amendment and restatement agreement, in relation to this Agreement and the Intercreditor Agreement, dated 28 April 2017 between, among others, Listco, Midco, Luxco, the US Co-Borrower and the Agent. "April 2017 Effective Date" has the meaning given to the term "Effective Date" in the April 2017 Amendment and Restatement Agreement.

A52134199 - 6 - "Auditors" means any firm of independent accountants appointed by Listco as its auditors from time to time. "Austrian Capital Maintenance Rules" has the meaning given to it in Clause 23.12 (Limitations on obligations of Austrian Guarantors). "Austrian Guarantor" has the meaning given to it in Clause 23.5 (Guarantor intent). "Austrian Obligor" means an Obligor incorporated in the Republic of Austria. "Authorisation" means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation or registration. "Availability Period" means: (a) in relation to the Facility B1, the period from (and including) the 2021 Additional Facility Effective Time to (and including) 15 July 2021; (b) in relation to Facility B2, the period from (and including) the 2022 Additional Facility Effective Time to (and including) the earlier of (i) the first Utilisation of Facility B2 and (ii) 11:59 pm on 31 December 2022; (c) in relation to Facility B3, the period from (and including) the 2022 Additional Facility Effective Time to (and including) the earlier of (i) the first Utilisation of Facility B3 and (ii) 11:59 pm on the 31 December 2022; (d) in relation to Facility B4, the period from (and including) the 2023 Additional Facility Effective Time to (and including) the earlier of (i) the first Utilisation of Facility B4 and (ii) 11:59 pm on 4 December 2023; (e) in relation to the Original Revolving Facility, the period from (and including) the 2021 Effective Date to (and including) the date falling one Month prior to the Termination Date applicable to the Original Revolving Facility; and (f) in relation to any Additional Facility, the period specified in the Additional Facility Notice relating to that Additional Facility. "Available Amount" has the meaning ascribed to such term in Clause 26.4 (Baskets). "Available Commitment" means, in relation to a Facility, a Lender's Commitment under that Facility minus (subject to Clause 9.7 (Affiliates of Lenders as Ancillary Lenders) and as set out below): (a) the amount (or, in the case of a Revolving Facility only, the Base Currency Amount) of its participation in any outstanding Utilisations under that Facility and, in the case of a Revolving Facility only, the Base Currency Amount of the aggregate of its Ancillary Commitments; and (b) in relation to any proposed Utilisation amount (or, in the case of a Revolving Facility only, the Base Currency Amount), the amount of its participation in any other Utilisations that are due to be made under that Facility on or before the proposed Utilisation Date and, in the case of a Revolving Facility only, the Base Currency Amount of its Ancillary Commitment in relation to any new Ancillary Facility that is due to be made available on or before the proposed Utilisation Date.

A52134199 - 7 - For the purposes of calculating a Lender's Available Commitment in relation to any proposed Utilisation under a Revolving Facility only, the following amounts shall not be deducted from a Lender's Commitment under that Facility: (i) that Lender's participation in any Revolving Facility Utilisations that are due to be repaid or prepaid on or before the proposed Utilisation Date; and (ii) that Lender's (or its Affiliate's) Ancillary Commitments to the extent that they are due to be reduced or cancelled on or before the proposed Utilisation Date. "Available Facility" means, in relation to a Facility, the aggregate for the time being of each Lender's Available Commitment in respect of that Facility. "Backstop Rate Switch Date" has the meaning given to that term in Clause 14.5 (Rate switch definitions). "Base Currency" means: (a) for Facility B1, Facility B3 and the Original Revolving Facility, euro; (b) for Facility B2 and Facility B4, US Dollars; and (c) in relation to any Additional Facility, such currency as is agreed between Listco and the applicable Additional Facility Lenders. "Base Currency Amount" means: (a) in relation to a Utilisation, the amount specified in the Utilisation Request delivered by a Borrower for that Utilisation (or, in the case of a Utilisation under a Revolving Facility, if the amount requested is not denominated in the Base Currency, that amount converted into the Base Currency at the Agent's Spot Rate of Exchange on the date which is three Business Days before the Utilisation Date or, if later, on the date the Agent receives the Utilisation Request in accordance with the terms of this Agreement) and, in the case of a Letter of Credit, as adjusted under Clause 6.7 (Revaluation of Letters of Credit) at annual intervals; and (b) in relation to an Ancillary Commitment, the amount specified as such in the notice delivered to the Agent by Listco pursuant to Clause 9.2 (Availability) (or, if the amount specified is not denominated in the Base Currency, that amount converted into the Base Currency at the Agent's Spot Rate of Exchange on the date which is three Business Days before the Ancillary Commencement Date for that Ancillary Facility or, if later, the date the Agent receives the notice of the Ancillary Commitment in accordance with the terms of this Agreement), (c) as adjusted to reflect any repayment, prepayment, consolidation or division of a Utilisation, or (as the case may be) cancellation or reduction of an Ancillary Facility. "Belgian Additional Obligor" means an Additional Obligor incorporated in Belgium. "Belgian Companies Code" means the Belgian Companies Code of 7 May 1999, as amended from time to time. "Belgian Obligor" means an Obligor incorporated in Belgium.