November 6, 2025 Fourth Quarter 2025 Investor Presentation

1 Forward–looking statements Certain statements contained in this Presentation that are not historical in nature may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the Company’s future plans, results, strategies, and expectations, including expectations around changing economic markets and statements regarding the merger of Southern States Bancshares, Inc. (“Southern States”) with the Company (the “Merger”) and expectations with regard to the benefits of the Merger. These statements can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,” and other variations of such words and phrases and similar expressions. These forward-looking statements are not historical facts, and are based upon management’s current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain and beyond the Company’s control. The inclusion of these forward-looking statements should not be regarded as a representation by the Company or any other person that such expectations, estimates, and projections will be achieved. Accordingly, the Company cautions shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements including, without limitation, (1) current and future economic conditions, including the effects of inflation, interest rate fluctuations, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, and high unemployment rates in the local or regional economies in which the Company operates and/or the US economy generally, (2) changes or the lack of changes in government interest rate policies and the associated impact on the Company’s business, net interest margin, and mortgage operations, (3) increased competition for deposits, (4) changes in the quality or composition of the Company’s loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers or issuers of investment securities, or the impact of interest rates on the value of our investment securities portfolio, (5) any deterioration in commercial real estate market fundamentals, (6) risks associated with the Merger, including (a) the risk that the cost savings and any revenue synergies from the Merger is less than or different from expectations, (b) disruption from the Merger with customer, supplier, or employee relationships,(c) the possibility that the costs, fees, expenses and charges related to the Merger may be greater than anticipated, including as a result of unexpected or unknown factors, events, or liabilities, (d) the risks related to the integration of the combined businesses, including the risk that the integration will be materially delayed or will be more costly or difficult than expected, (e) the diversion of management time on merger-related issues, (f) the ability of the Company to effectively manage the larger and more complex operations of the combined company following the Merger, (g) the risk of expansion into new geographic or product markets, (h) reputational risk and the reaction of the parties’ customers to the Merger, (i) the Company’s ability to successfully execute its various business strategies, including its ability to execute on potential acquisition opportunities, and (j) the risk of potential litigation or regulatory action related to the Merger, (7) the Company’s ability to identify potential candidates for, consummate, and achieve synergies from, other potential future acquisitions, (8) the Company’s ability to manage any unexpected outflows of uninsured deposits and avoid selling investment securities or other assets at an unfavorable time or at a loss, (9) the Company’s ability to successfully execute its various business strategies, (10) changes in state and federal legislation, regulations or policies applicable to banks and other financial service providers, including legislative developments, (11) the effectiveness of the Company’s controls and procedures to detect, prevent, mitigate and otherwise manage the risk of fraud or misconduct by internal or external parties, including attempted physical-security and cybersecurity attacks, denial-of-service attacks, hacking, phishing, social-engineering attacks, malware intrusion, data-corruption attempts, system breaches, identity theft, ransomware attacks, environmental conditions, and intentional acts of destruction, (12) the Company’s dependence on information technology systems of third party service providers and the risk of systems failures, interruptions, or breaches of security, (13) the impact, extent and timing of technological changes, (14) concentrations of credit or deposit exposure, (15) the impact of natural disasters, pandemics, acts of war or terrorism, or other catastrophic events, (16) events giving rise to international or regional political instability, including the broader impacts of such events on financial markets and/or global macroeconomic environments, and/or (17) general competitive, economic, political, and market conditions. Further information regarding the Company and factors which could affect the forward-looking statements contained herein can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and in any of the Company’s subsequent filings with the SEC. Many of these factors are beyond the Company’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward- looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this Presentation, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

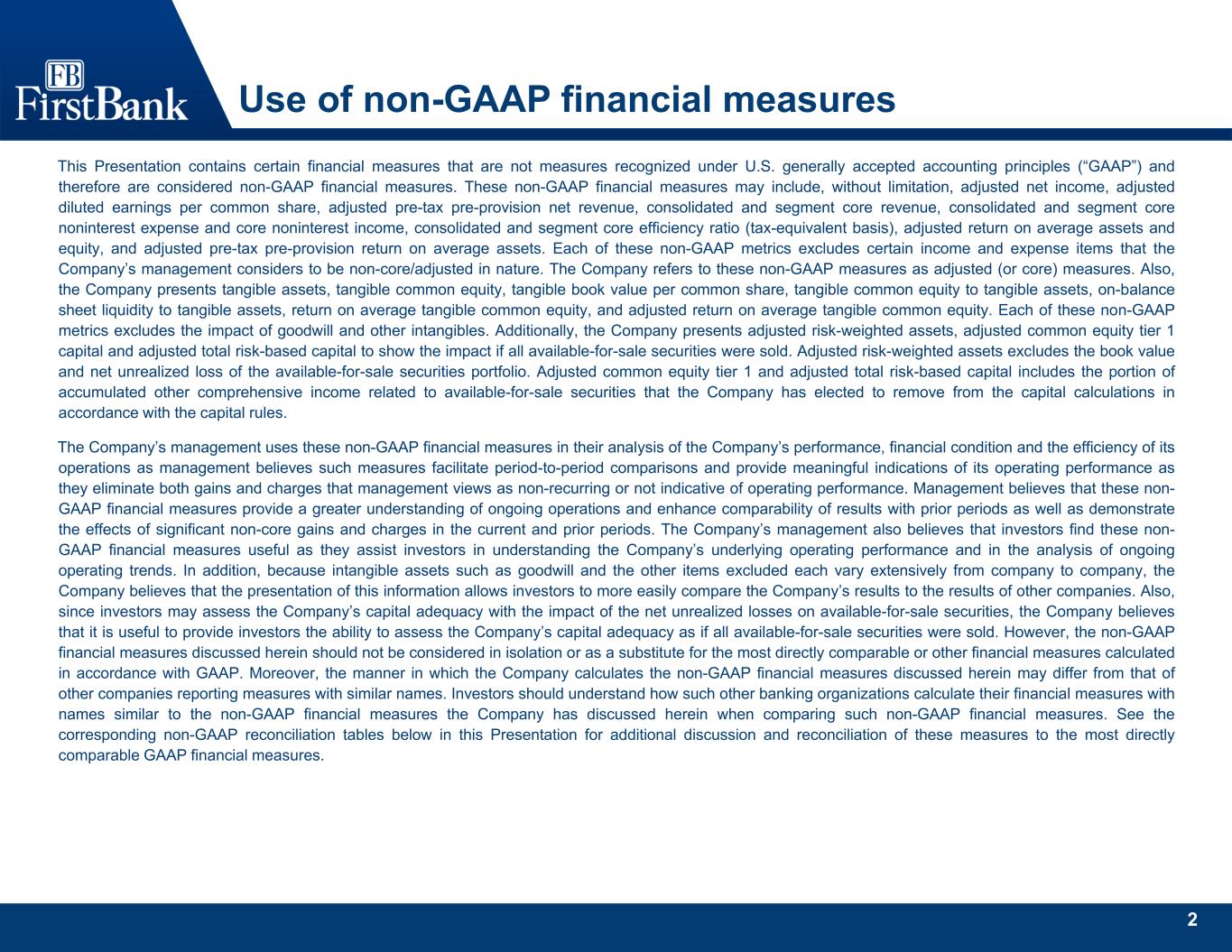

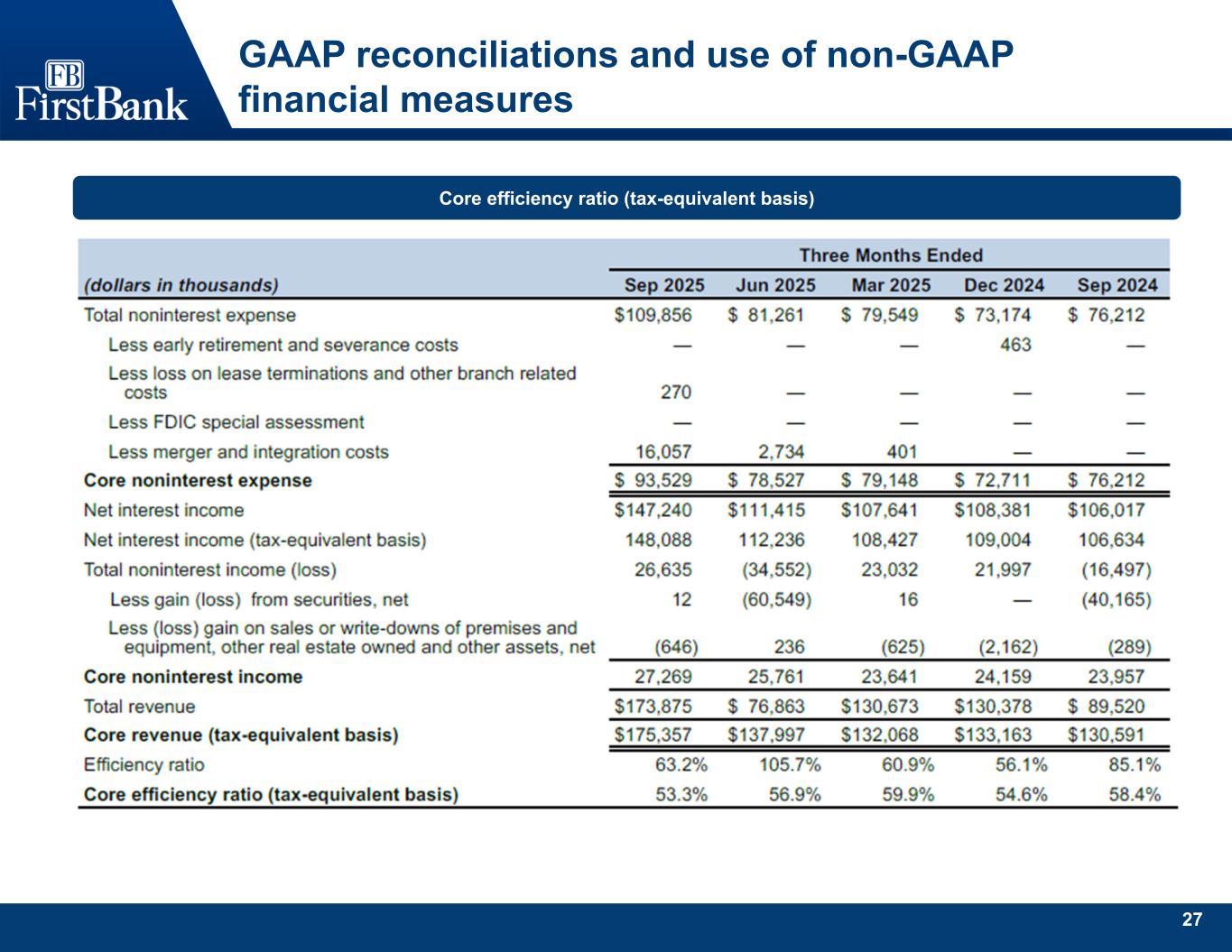

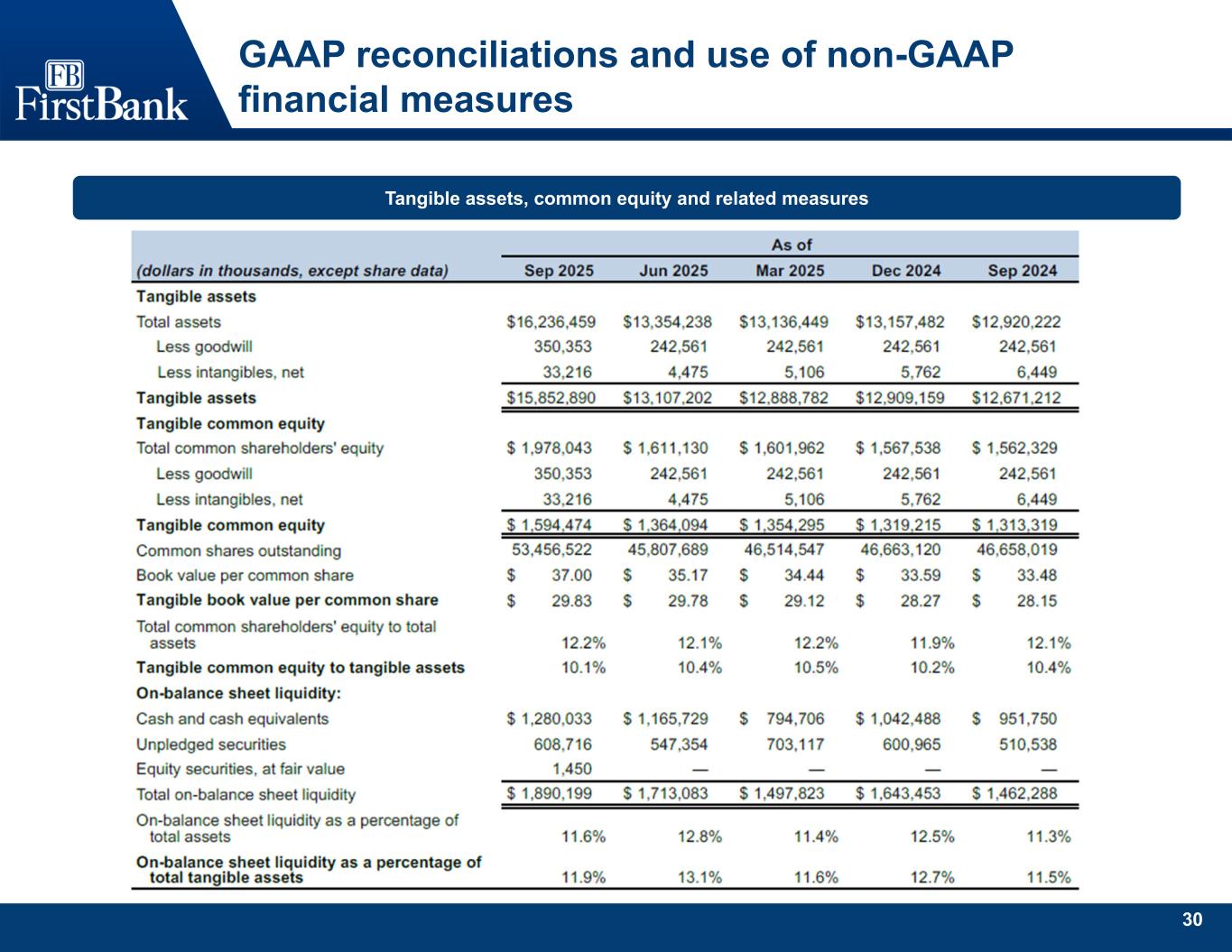

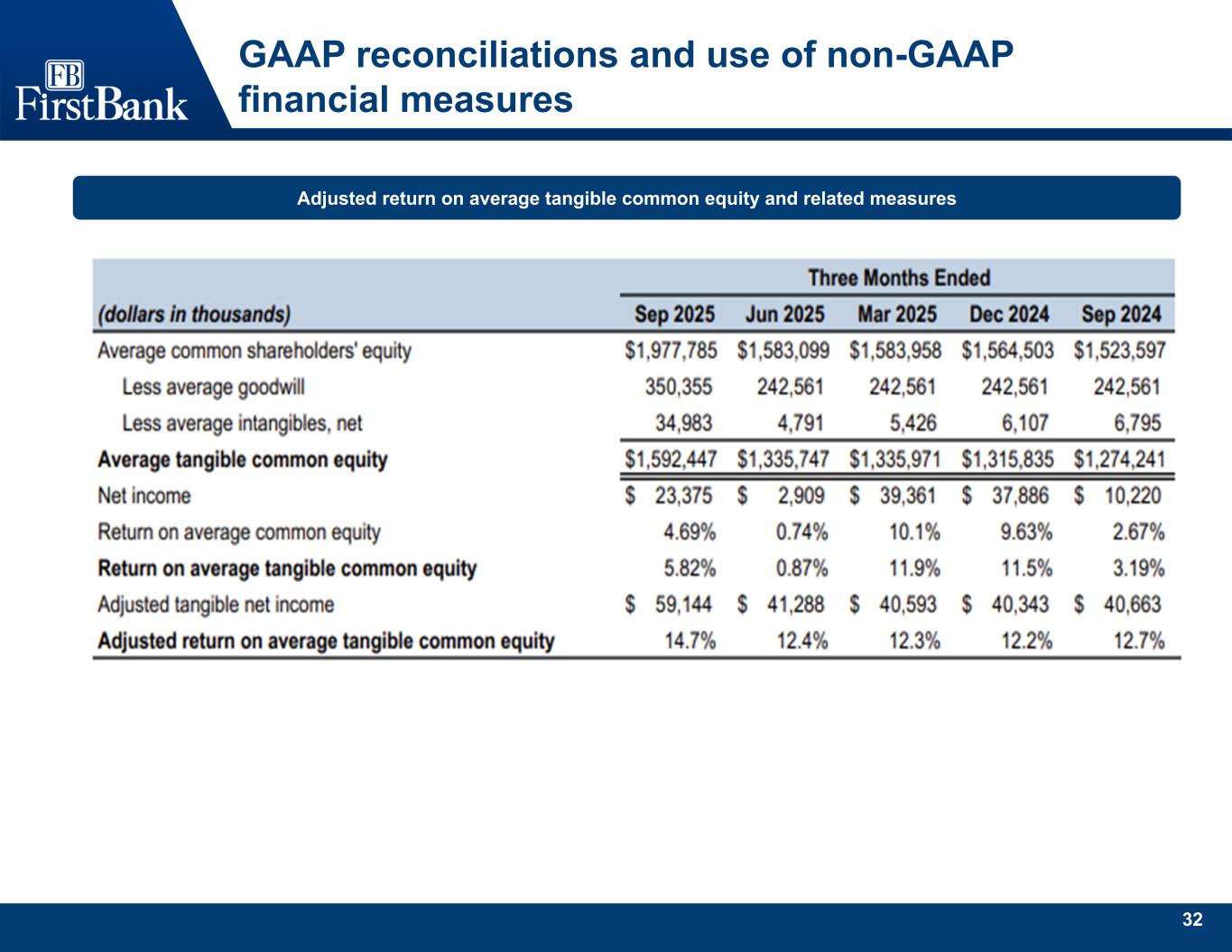

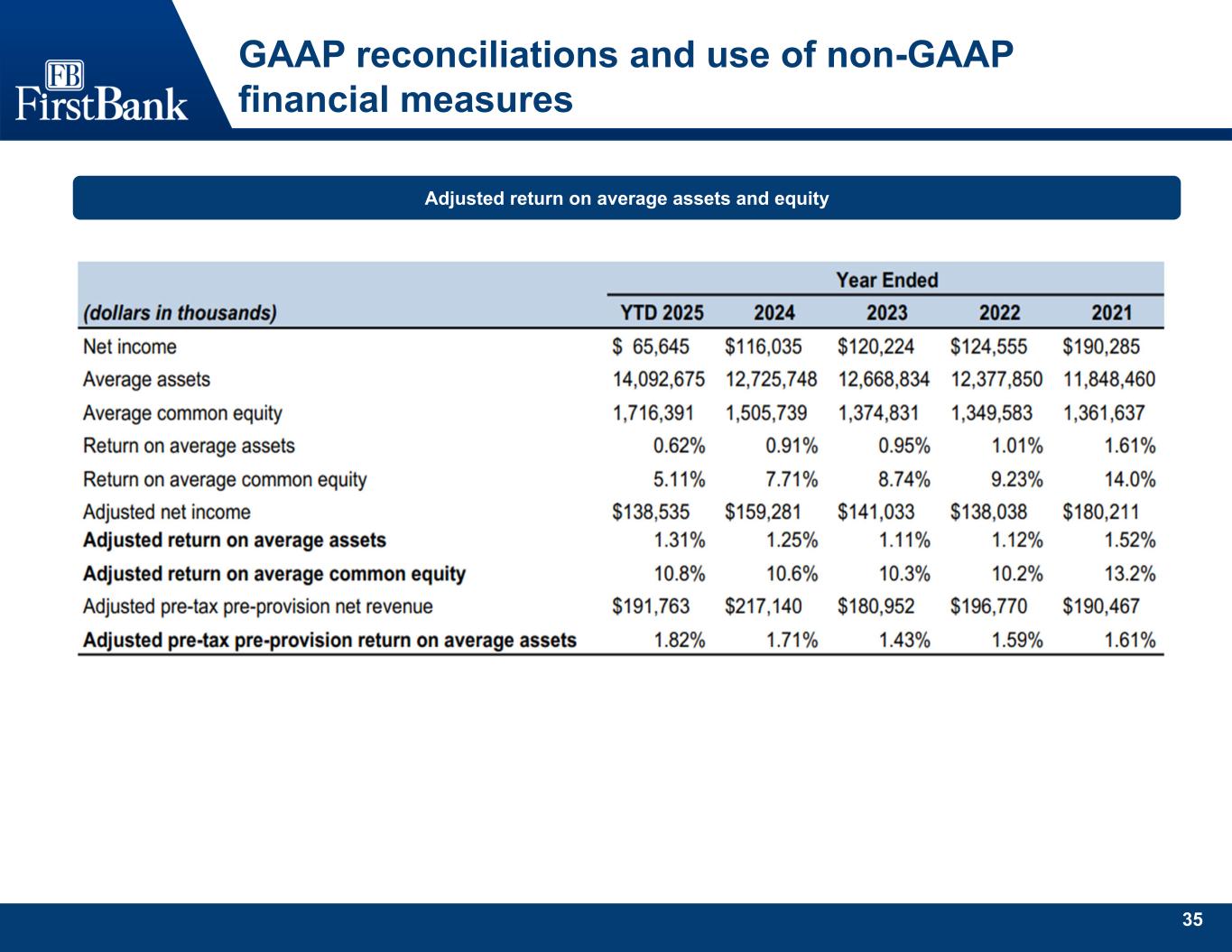

2 Use of non-GAAP financial measures This Presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non-GAAP financial measures may include, without limitation, adjusted net income, adjusted diluted earnings per common share, adjusted pre-tax pre-provision net revenue, consolidated and segment core revenue, consolidated and segment core noninterest expense and core noninterest income, consolidated and segment core efficiency ratio (tax-equivalent basis), adjusted return on average assets and equity, and adjusted pre-tax pre-provision return on average assets. Each of these non-GAAP metrics excludes certain income and expense items that the Company’s management considers to be non-core/adjusted in nature. The Company refers to these non-GAAP measures as adjusted (or core) measures. Also, the Company presents tangible assets, tangible common equity, tangible book value per common share, tangible common equity to tangible assets, on-balance sheet liquidity to tangible assets, return on average tangible common equity, and adjusted return on average tangible common equity. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles. Additionally, the Company presents adjusted risk-weighted assets, adjusted common equity tier 1 capital and adjusted total risk-based capital to show the impact if all available-for-sale securities were sold. Adjusted risk-weighted assets excludes the book value and net unrealized loss of the available-for-sale securities portfolio. Adjusted common equity tier 1 and adjusted total risk-based capital includes the portion of accumulated other comprehensive income related to available-for-sale securities that the Company has elected to remove from the capital calculations in accordance with the capital rules. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non- GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant non-core gains and charges in the current and prior periods. The Company’s management also believes that investors find these non- GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and the other items excluded each vary extensively from company to company, the Company believes that the presentation of this information allows investors to more easily compare the Company’s results to the results of other companies. Also, since investors may assess the Company’s capital adequacy with the impact of the net unrealized losses on available-for-sale securities, the Company believes that it is useful to provide investors the ability to assess the Company’s capital adequacy as if all available-for-sale securities were sold. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. Investors should understand how such other banking organizations calculate their financial measures with names similar to the non-GAAP financial measures the Company has discussed herein when comparing such non-GAAP financial measures. See the corresponding non-GAAP reconciliation tables below in this Presentation for additional discussion and reconciliation of these measures to the most directly comparable GAAP financial measures.

3 Snapshot of FB Financial today 1 Source: S&P Global. Market data is as of June 30, 2025 and is presented on a pro forma basis for announced acquisitions since June 30, 2025. 2 Non-GAAP financial measure; See "Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. 3 Presented on a tax-equivalent basis. Company Overview Community Bank Solid capital foundation Growth strategy Disciplined risk management Top-quartile performer • 11.7% CET1 (preliminary) & 10.1% TCE/TA2 • Continuous evaluation of capital deployment opportunities • 0.58% ROAA / 1.43% (adj.)2 • 5.82% ROATCE2 / 14.7% (adj.)2 • Completed merger with Southern States Bancshares, Inc. • Recent market expansions in Alabama and into North Carolina • 1.50% ACL coverage ratio • 0.94% NPLs / Total Loans HFI • Chartered in 1906, one of the longest continually operated banks in Tennessee • Local-decision making model deployed across our footprint Balance Sheet ($B) $16.2Total assets $12.5Total loans $13.8Total deposits $2.0Total equity Profitability (%) 1.43%Adj. ROAA2 14.7%Adj. ROATCE2 3.95%Net interest margin3 53.3%Core efficiency2,3 Strong market presence • Franchise spanning both Metro & Community markets across the Southeast • Number 6 market share in Nashville MSA; top 10 in 7 additional MSAs throughout our footprint1 Financial Snapshot (as of September 30, 2025 QTD) Franchise Map Not pictured: Mortgage Only Location in Fair Hope, Alabama.

4 Strategic drivers Highly Motivated Executive Management Team Great Place to Work Poised for Solid Performance Empowered Teams Across Attractive Metro & Community Markets Organic Focused Growth Proven Opportunistic Acquirer with Scalable Platforms and Technology

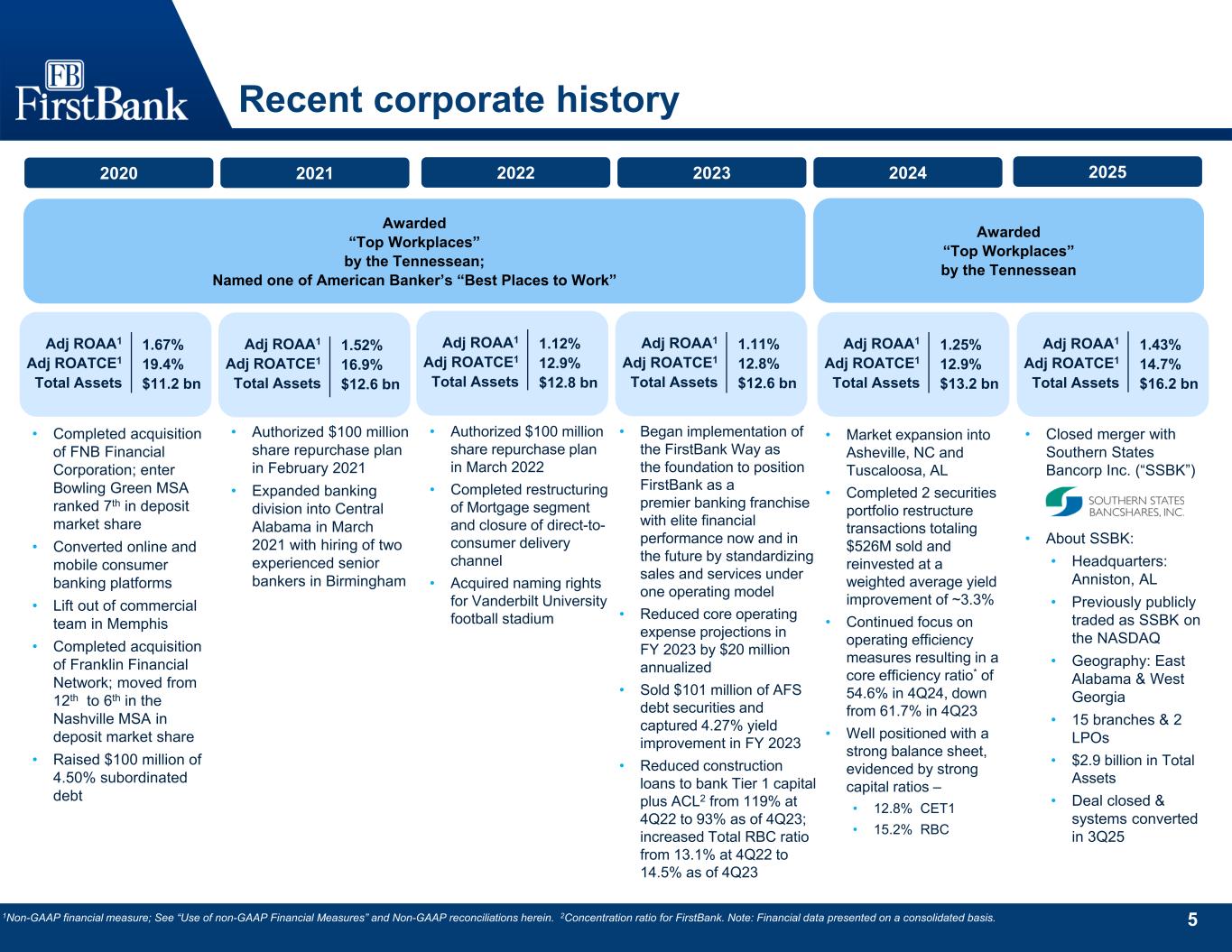

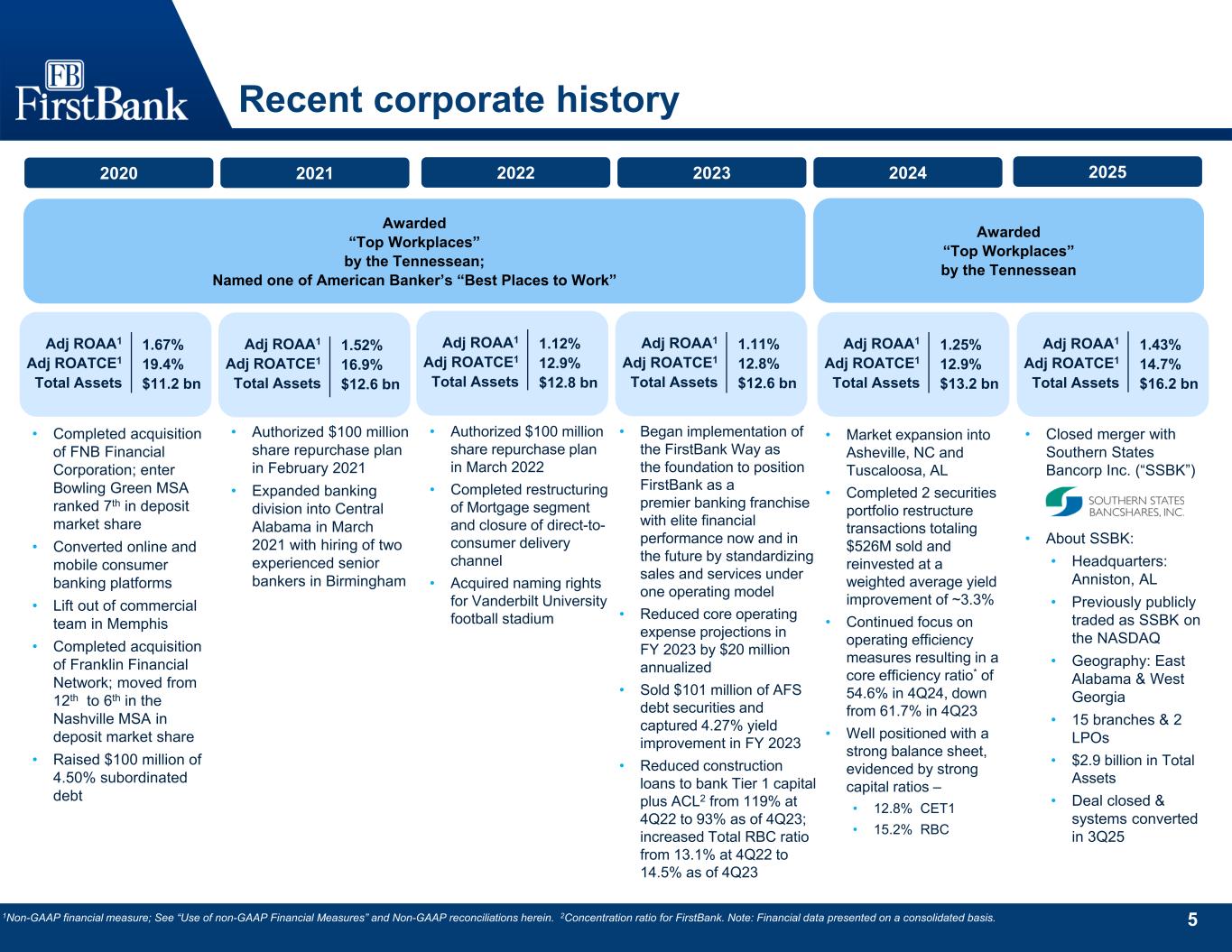

5 Recent corporate history 2021 Awarded “Top Workplaces” by the Tennessean; Named one of American Banker’s “Best Places to Work” 2020 • Completed acquisition of FNB Financial Corporation; enter Bowling Green MSA ranked 7th in deposit market share • Converted online and mobile consumer banking platforms • Lift out of commercial team in Memphis • Completed acquisition of Franklin Financial Network; moved from 12th to 6th in the Nashville MSA in deposit market share • Raised $100 million of 4.50% subordinated debt 2022 • Authorized $100 million share repurchase plan in February 2021 • Expanded banking division into Central Alabama in March 2021 with hiring of two experienced senior bankers in Birmingham 2023 • Authorized $100 million share repurchase plan in March 2022 • Completed restructuring of Mortgage segment and closure of direct-to- consumer delivery channel • Acquired naming rights for Vanderbilt University football stadium 2024 • Began implementation of the FirstBank Way as the foundation to position FirstBank as a premier banking franchise with elite financial performance now and in the future by standardizing sales and services under one operating model • Reduced core operating expense projections in FY 2023 by $20 million annualized • Sold $101 million of AFS debt securities and captured 4.27% yield improvement in FY 2023 • Reduced construction loans to bank Tier 1 capital plus ACL2 from 119% at 4Q22 to 93% as of 4Q23; increased Total RBC ratio from 13.1% at 4Q22 to 14.5% as of 4Q23 • Market expansion into Asheville, NC and Tuscaloosa, AL • Completed 2 securities portfolio restructure transactions totaling $526M sold and reinvested at a weighted average yield improvement of ~3.3% • Continued focus on operating efficiency measures resulting in a core efficiency ratio* of 54.6% in 4Q24, down from 61.7% in 4Q23 • Well positioned with a strong balance sheet, evidenced by strong capital ratios – • 12.8% CET1 • 15.2% RBC Awarded “Top Workplaces” by the Tennessean 2025 • Closed merger with Southern States Bancorp Inc. (“SSBK”) • About SSBK: • Headquarters: Anniston, AL • Previously publicly traded as SSBK on the NASDAQ • Geography: East Alabama & West Georgia • 15 branches & 2 LPOs • $2.9 billion in Total Assets • Deal closed & systems converted in 3Q25 1Non-GAAP financial measure; See “Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. 2Concentration ratio for FirstBank. Note: Financial data presented on a consolidated basis. Adj ROAA1 Adj ROATCE1 Total Assets 1.67% 19.4% $11.2 bn Adj ROAA1 Adj ROATCE1 Total Assets 1.11% 12.8% $12.6 bn Adj ROAA1 Adj ROATCE1 Total Assets 1.12% 12.9% $12.8 bn Adj ROAA1 Adj ROATCE1 Total Assets 1.52% 16.9% $12.6 bn Adj ROAA1 Adj ROATCE1 Total Assets 1.25% 12.9% $13.2 bn Adj ROAA1 Adj ROATCE1 Total Assets 1.43% 14.7% $16.2 bn

6 Well-positioned for organic growth in desirable markets Growing deposit franchise 1Source: S&P Global. Market data is as of June 30, 2024 and is presented on a pro forma basis for announced acquisitions since June 30, 2024. 2Source: S&P Global. Market data is as of June 30, 2025 and is presented on a pro forma basis for announced acquisitions since June 30, 2025. 3Source: S&P Global. FBK Footprint is based on weighted average demographics of MSAs and counties not located in MSAs with weightings based on deposits in each market as of June 30, 2025. (P) represents projected information. 3.6% 6.4% 9.0% U.S. FBK Footprint Nashville Population change3 2020 - 2026 2.6% 4.2% 5.7% U.S. FBK Footprint Nashville Population Change (P)3 2026 - 2031 11.3% 11.7% 14.7% U.S. FBK Footprint Nashville Household Income Change (P)3 2026 - 2031 91 full-service branches $13.8 billion deposits Previous1 6thNashville 5thChattanooga 9thKnoxville 3rdJackson, TN 7thBowling Green, KY 21stBirmingham, AL 21stHuntsville, AL 28thMemphis, TN 9thFlorence, AL Current2 6thNashville 5thChattanooga 9thKnoxville 3rdJackson, TN 5thAuburn/Opelika, AL 4th Columbus, GA 8thBowling Green 16thBirmingham, AL 16thHuntsville, AL 28thMemphis, TN 24thAtlanta, GA Green = change since previous market share reporting.

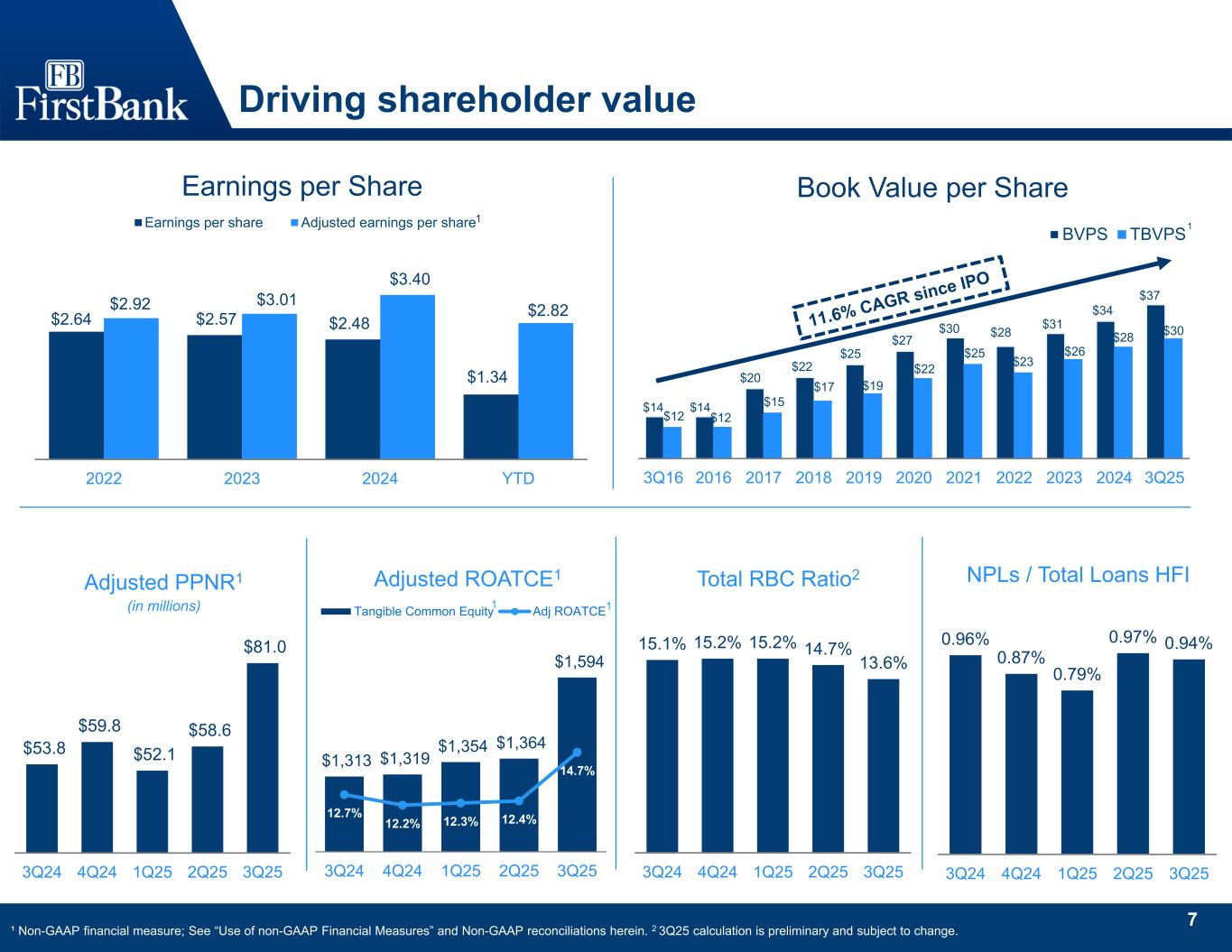

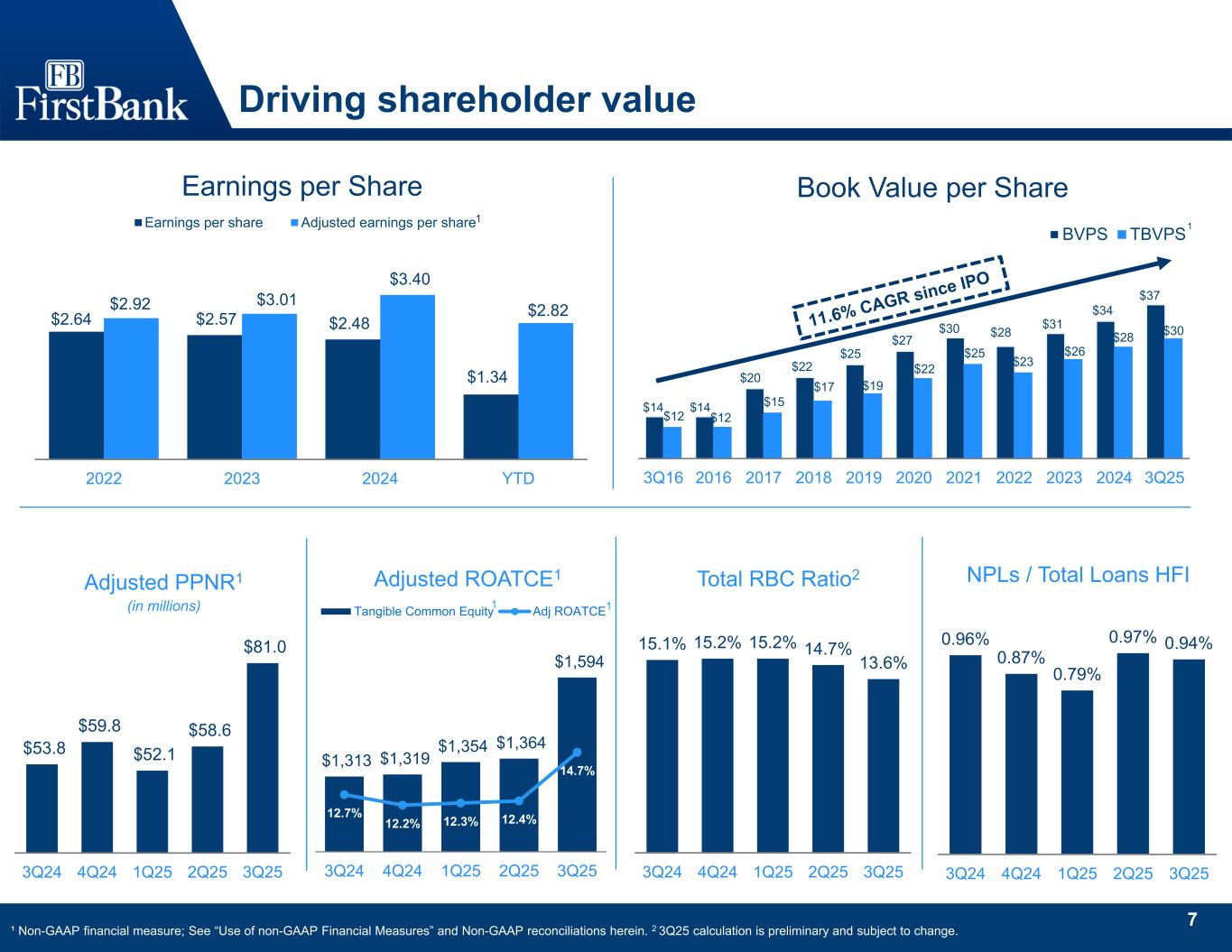

7 Driving shareholder value ¹ Non-GAAP financial measure; See “Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. 2 3Q25 calculation is preliminary and subject to change. $2.64 $2.57 $2.48 $1.34 $2.92 $3.01 $3.40 $2.82 2022 2023 2024 YTD Earnings per share Adjusted earnings per share Earnings per Share $14 $14 $20 $22 $25 $27 $30 $28 $31 $34 $37 $12 $12 $15 $17 $19 $22 $25 $23 $26 $28 $30 3Q16 2016 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 BVPS TBVPS 15.1% 15.2% 15.2% 14.7% 13.6% 3Q24 4Q24 1Q25 2Q25 3Q25 0.96% 0.87% 0.79% 0.97% 0.94% 3Q24 4Q24 1Q25 2Q25 3Q25 $53.8 $59.8 $52.1 $58.6 $81.0 3Q24 4Q24 1Q25 2Q25 3Q25 Book Value per Share Total RBC Ratio2 NPLs / Total Loans HFIAdjusted ROATCE1Adjusted PPNR1 (in millions) 1 1 $1,313 $1,319 $1,354 $1,364 $1,594 12.7% 12.2% 12.3% 12.4% 14.7% 3Q24 4Q24 1Q25 2Q25 3Q25 Tangible Common Equity Adj ROATCE11

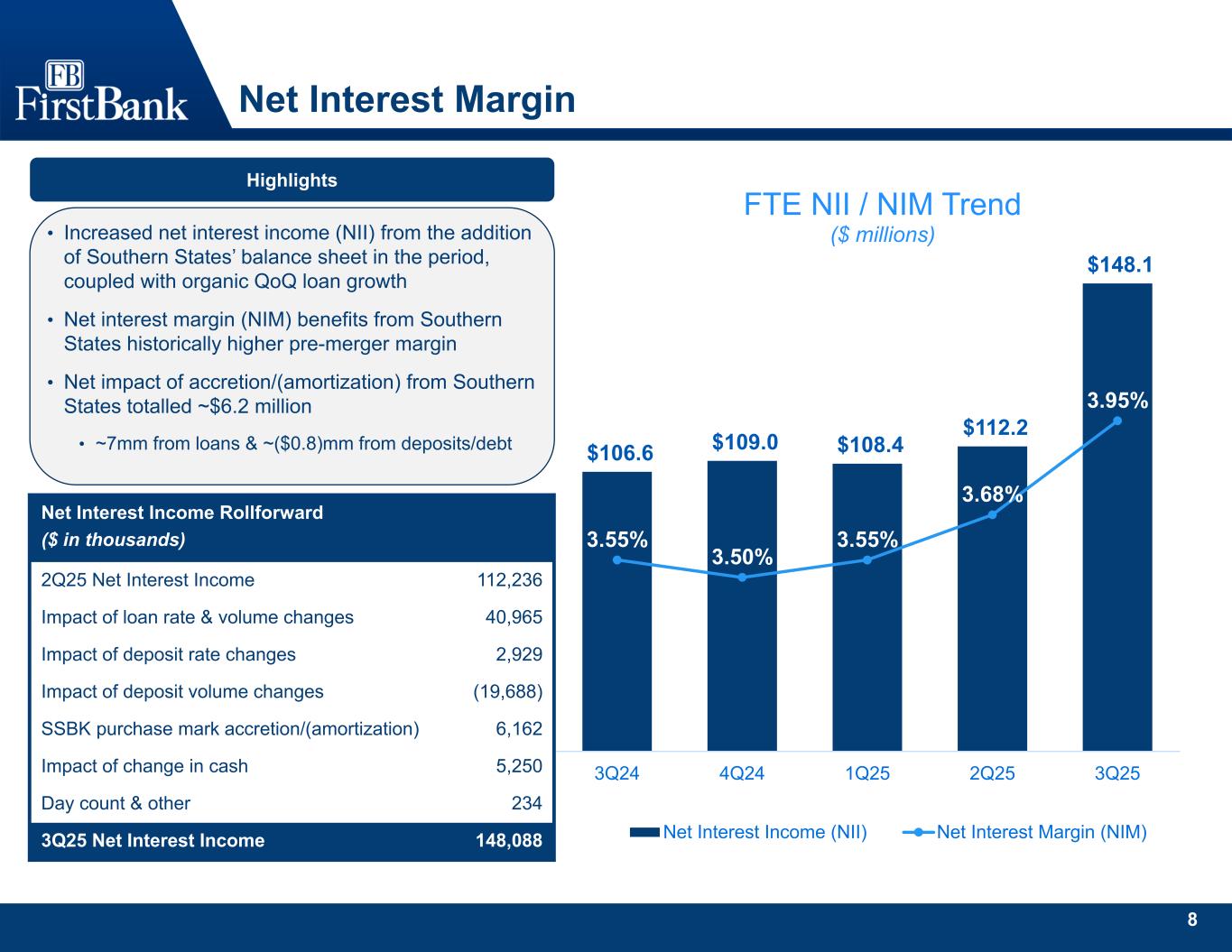

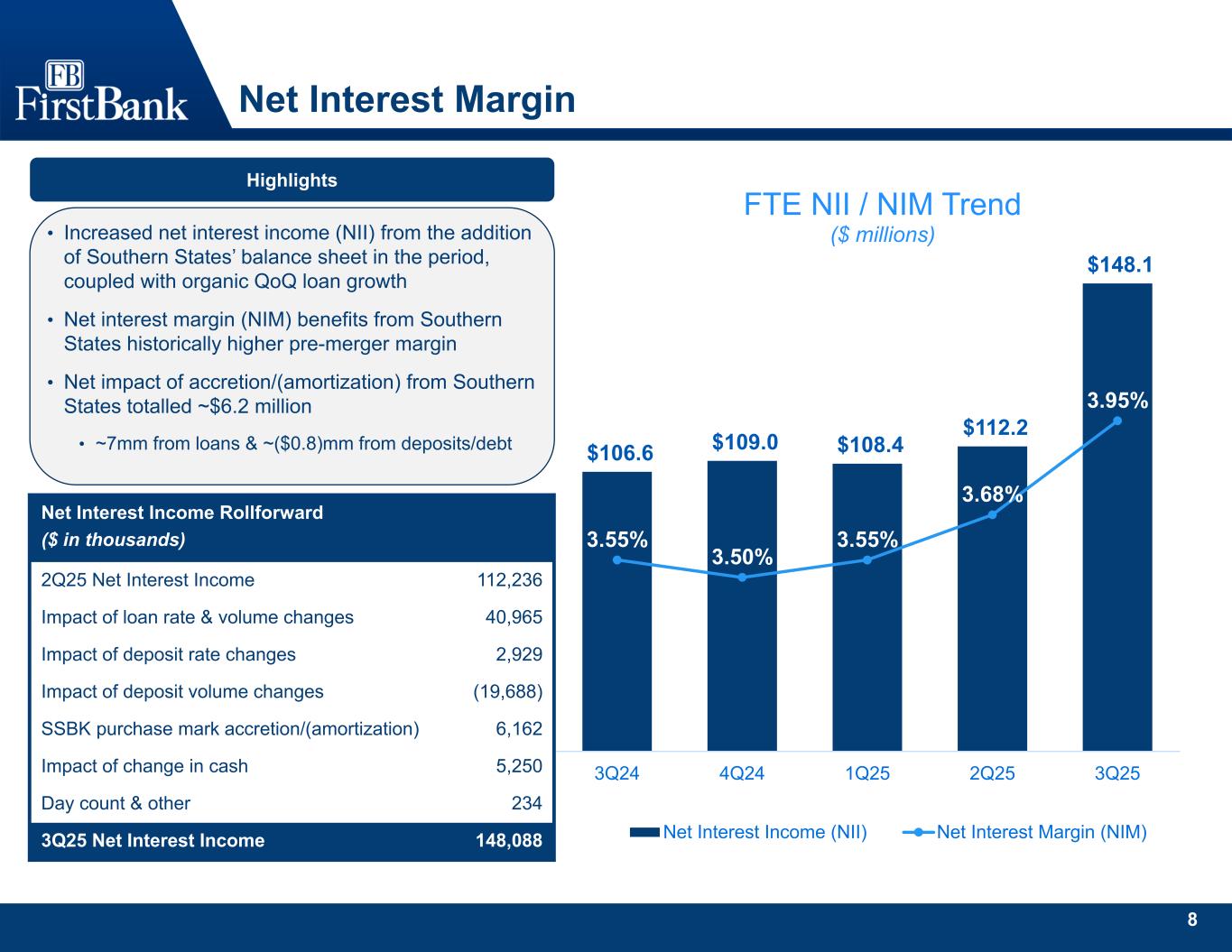

8 Net Interest Margin $106.6 $109.0 $108.4 $112.2 $148.1 3.55% 3.50% 3.55% 3.68% 3.95% 3Q24 4Q24 1Q25 2Q25 3Q25 FTE NII / NIM Trend ($ millions) Net Interest Income (NII) Net Interest Margin (NIM) Highlights Net Interest Income Rollforward ($ in thousands) 112,2362Q25 Net Interest Income 40,965Impact of loan rate & volume changes 2,929Impact of deposit rate changes (19,688)Impact of deposit volume changes 6,162SSBK purchase mark accretion/(amortization) 5,250Impact of change in cash 234Day count & other 148,0883Q25 Net Interest Income • Increased net interest income (NII) from the addition of Southern States’ balance sheet in the period, coupled with organic QoQ loan growth • Net interest margin (NIM) benefits from Southern States historically higher pre-merger margin • Net impact of accretion/(amortization) from Southern States totalled ~$6.2 million • ~7mm from loans & ~($0.8)mm from deposits/debt

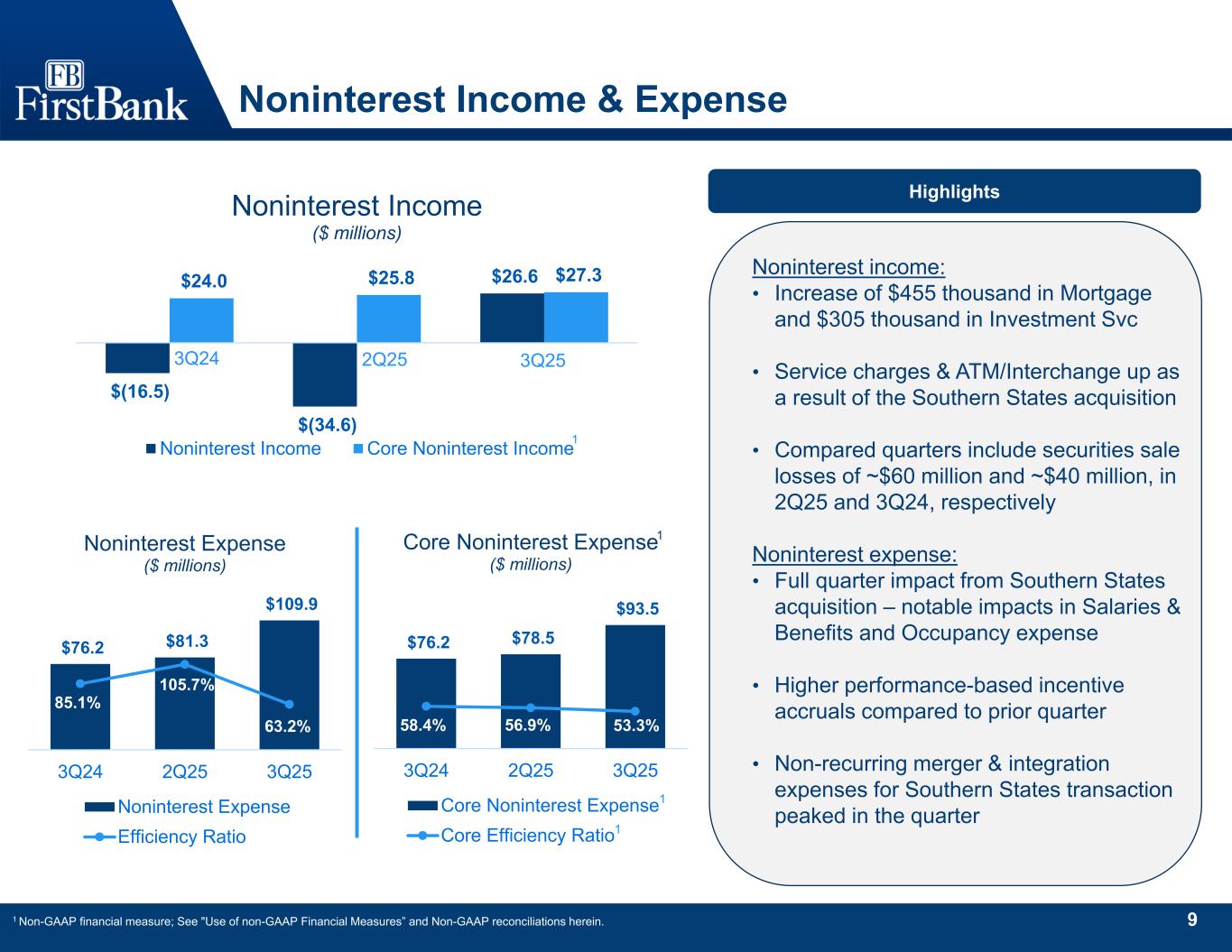

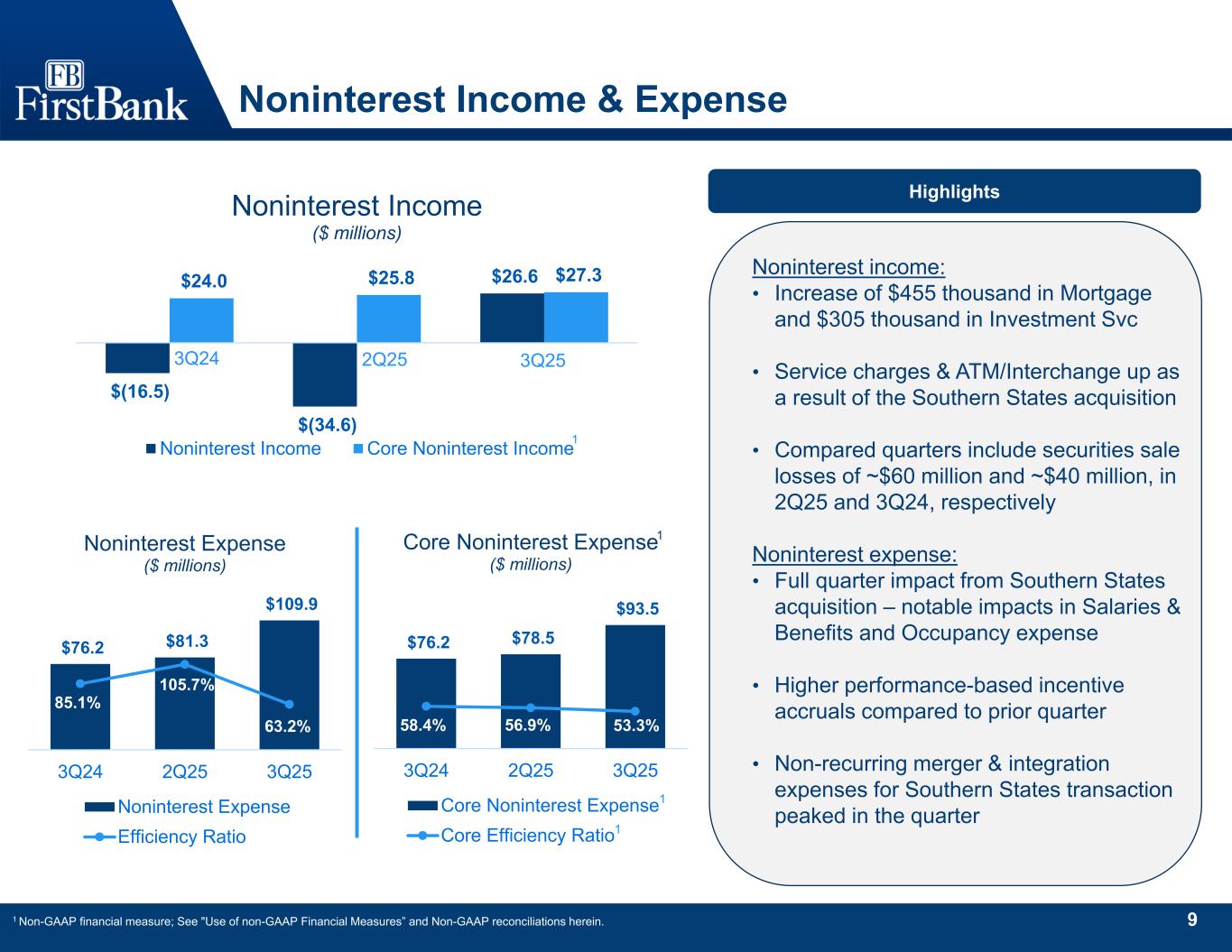

9 Noninterest Income & Expense $76.2 $81.3 $109.9 85.1% 105.7% 63.2% 3Q24 2Q25 3Q25 Noninterest Expense ($ millions) Noninterest Expense Efficiency Ratio $76.2 $78.5 $93.5 58.4% 56.9% 53.3% 3Q24 2Q25 3Q25 Core Noninterest Expense ($ millions) Core Noninterest Expense Core Efficiency Ratio $(16.5) $(34.6) $26.6 $24.0 $25.8 $27.3 Noninterest Income ($ millions) Noninterest Income Core Noninterest Income Highlights 1 1 Non-GAAP financial measure; See "Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. 1 1 1 Noninterest income: • Increase of $455 thousand in Mortgage and $305 thousand in Investment Svc • Service charges & ATM/Interchange up as a result of the Southern States acquisition • Compared quarters include securities sale losses of ~$60 million and ~$40 million, in 2Q25 and 3Q24, respectively Noninterest expense: • Full quarter impact from Southern States acquisition – notable impacts in Salaries & Benefits and Occupancy expense • Higher performance-based incentive accruals compared to prior quarter • Non-recurring merger & integration expenses for Southern States transaction peaked in the quarter 2Q253Q24 3Q25

10 Loans HFI $9.48 $9.60 $9.77 $9.87 $12.30 6.70% 6.51% 6.41% 6.44% 6.75% 3Q 24 4Q 24 1Q 25 2Q25 3Q25 Loans HFI / Total Yield ($ billions) Loans HFI Total Loan HFI Yield 1-4 family 15% 1-4 family HELOC 6% Multifamily 6% C&D 10% CRE 23% C&I 35% Other 5% Portfolio Mix $12.3 Billion 1 C&I includes owner-occupied CRE. 2 Excludes owner-occupied CRE. Note: Loan yield shown above includes a tax-equivalent adjustment using combined marginal tax rate of 26.06%. 1 2 • ~$2.3 billion in loan HFI balances acquired during the quarter due to the completion of the Southern States merger • Organic loan growth in the combined company loan portfolio of ~$156mm, or 5% annualized • Notable organic growth categories include – Residential real-estate, Owner-occupied commercial real estate, and Consumer & Other • Lift in loan yield attributable to historically higher yield on acquired Southern States portfolio, coupled with new loan origination activity coming on at rates higher than the portfolio average

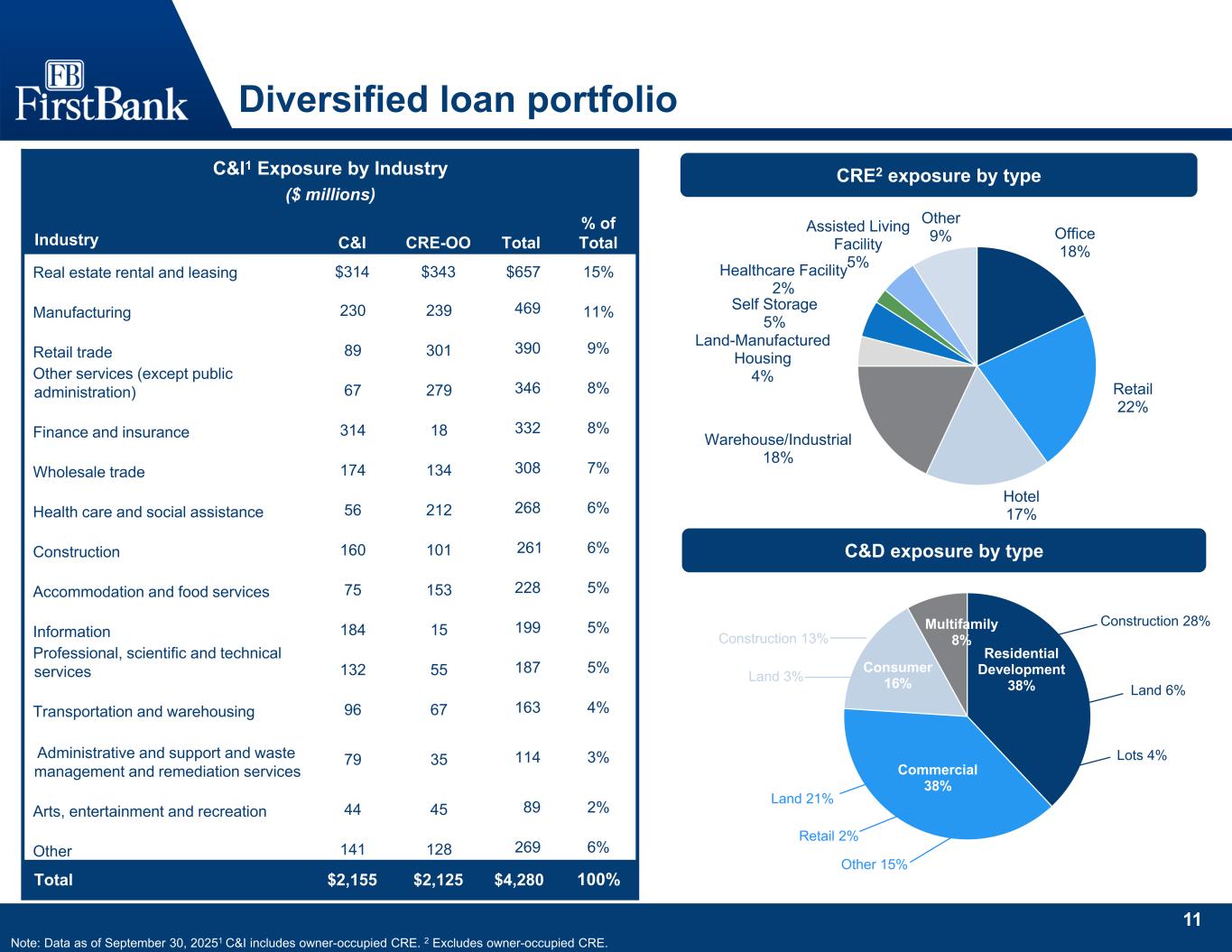

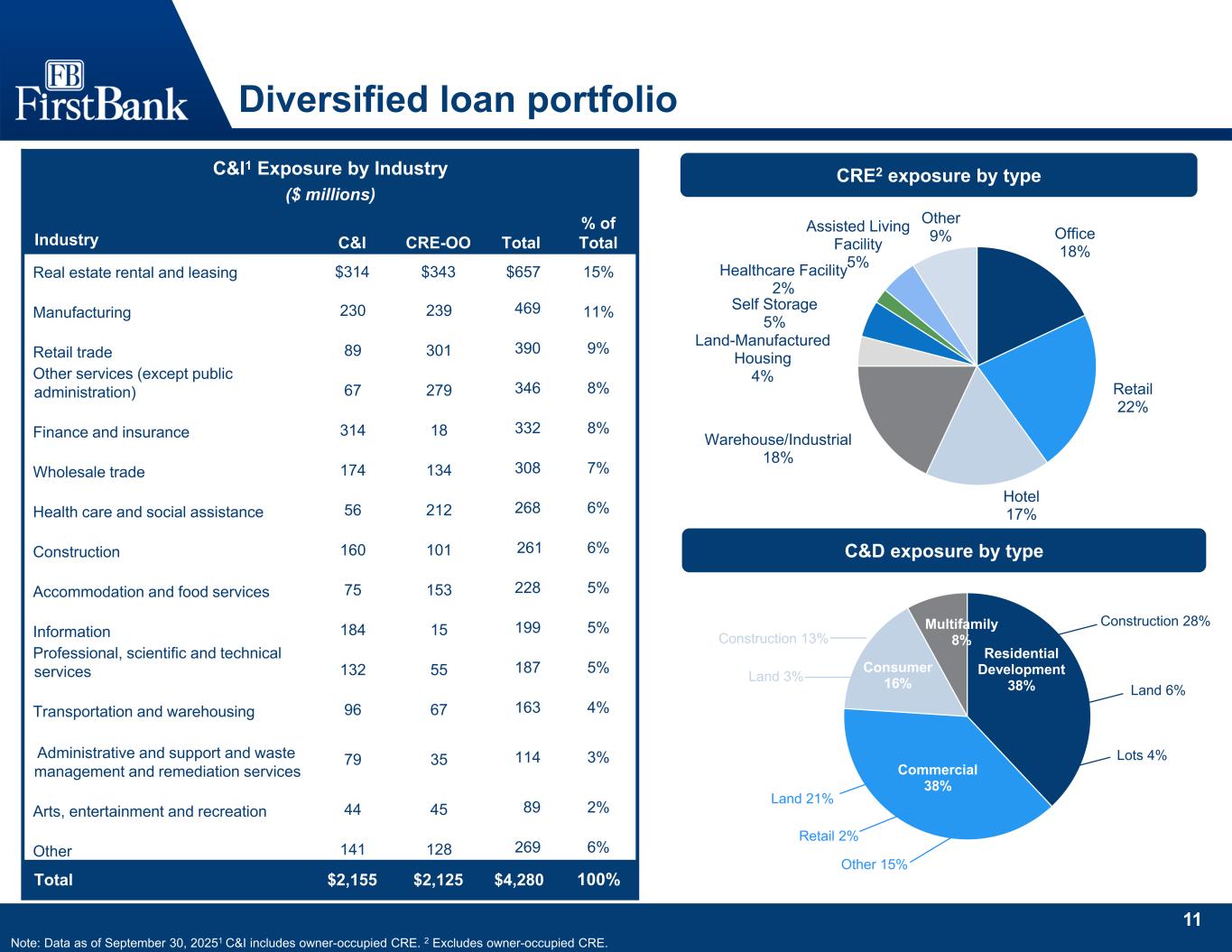

11 Residential Development 38% Commercial 38% Consumer 16% Multifamily 8% Construction 28% Land 6% Lots 4% Office 18% Retail 22% Hotel 17% Warehouse/Industrial 18% Land-Manufactured Housing 4% Self Storage 5% Healthcare Facility 2% Assisted Living Facility 5% Other 9% Diversified loan portfolio CRE2 exposure by type Note: Data as of September 30, 20251 C&I includes owner-occupied CRE. 2 Excludes owner-occupied CRE. C&D exposure by type C&I1 Exposure by Industry ($ millions) % of TotalTotalCRE-OOC&IIndustry 15%$657 $343 $314 Real estate rental and leasing 11%469 239 230 Manufacturing 9%390 301 89 Retail trade 8%346 279 67 Other services (except public administration) 8%332 18 314 Finance and insurance 7%308 134 174 Wholesale trade 6%268 212 56 Health care and social assistance 6%261 101 160 Construction 5%228 153 75 Accommodation and food services 5%199 15 184 Information 5%187 55 132 Professional, scientific and technical services 4%163 67 96 Transportation and warehousing 3%114 35 79 Administrative and support and waste management and remediation services 2%89 45 44 Arts, entertainment and recreation 6%269 128 141 Other 100%$4,280 $2,125 $2,155Total Land 21% Retail 2% Other 15% Construction 13% Land 3%

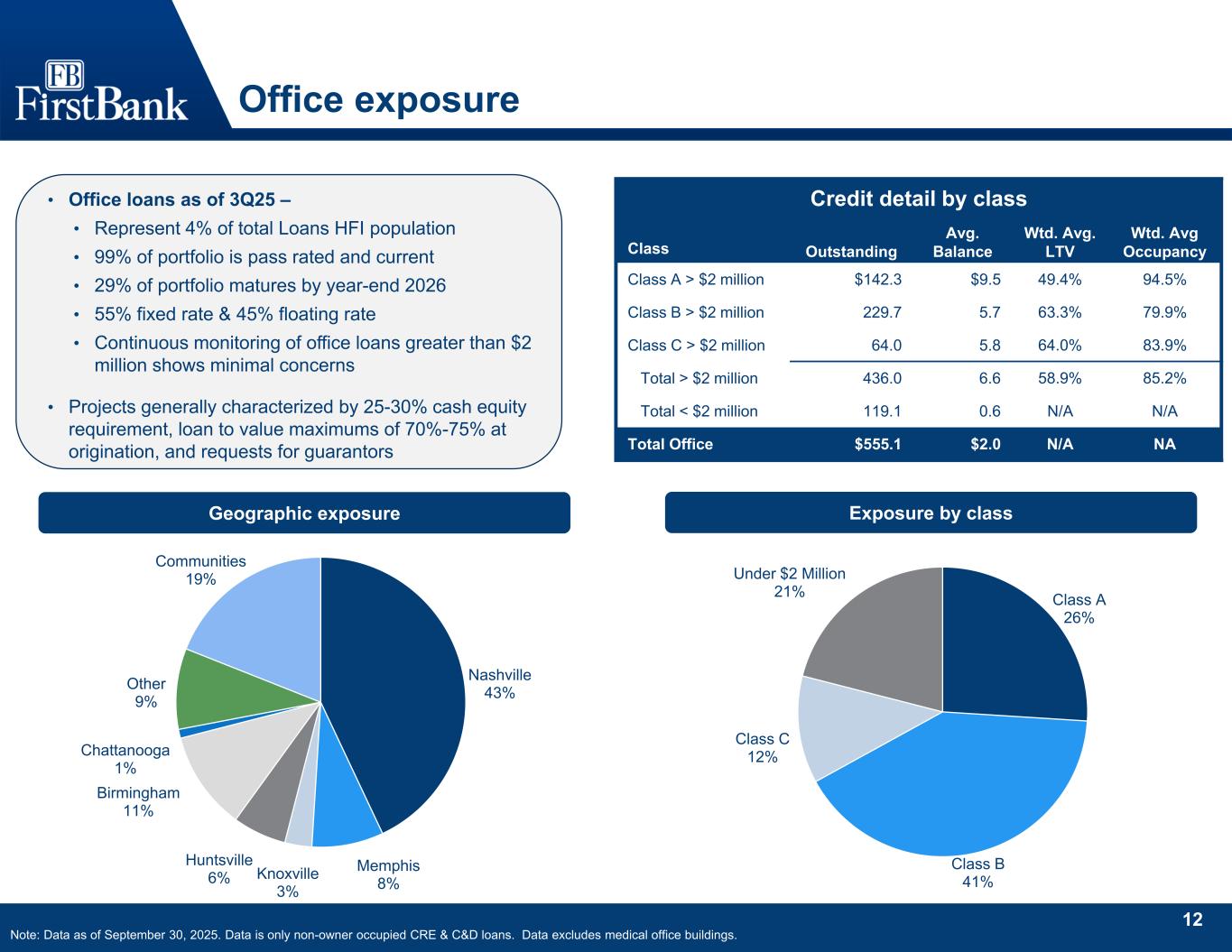

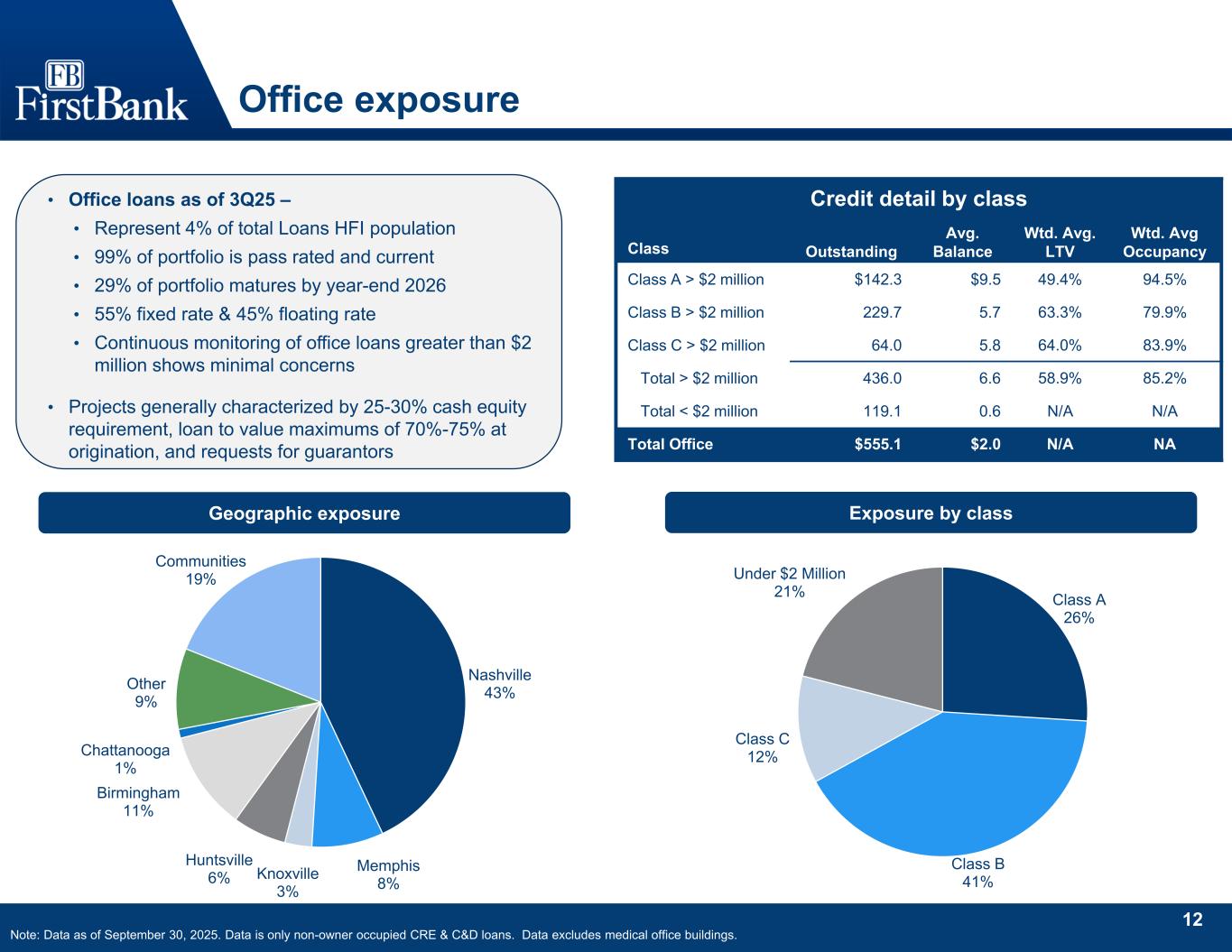

12 Nashville 43% Memphis 8%Knoxville 3% Huntsville 6% Birmingham 11% Chattanooga 1% Other 9% Communities 19% Class A 26% Class B 41% Class C 12% Under $2 Million 21% Office exposure • Office loans as of 3Q25 – • Represent 4% of total Loans HFI population • 99% of portfolio is pass rated and current • 29% of portfolio matures by year-end 2026 • 55% fixed rate & 45% floating rate • Continuous monitoring of office loans greater than $2 million shows minimal concerns • Projects generally characterized by 25-30% cash equity requirement, loan to value maximums of 70%-75% at origination, and requests for guarantors Geographic exposure Note: Data as of September 30, 2025. Data is only non-owner occupied CRE & C&D loans. Data excludes medical office buildings. Credit detail by class Wtd. Avg Occupancy Wtd. Avg. LTV Avg. BalanceOutstandingClass 94.5%49.4%$9.5$142.3Class A > $2 million 79.9%63.3%5.7229.7Class B > $2 million 83.9%64.0%5.864.0Class C > $2 million 85.2%58.9%6.6436.0Total > $2 million N/AN/A0.6119.1Total < $2 million NAN/A$2.0$555.1Total Office Exposure by class

13 Valuable deposit base Cost of deposits 20.3% 18.9% 19.3% 19.2% 19.5% 2.83% 2.70% 2.54% 2.48% 2.53% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 3Q24 4Q24 1Q25 2Q25 3Q25 Noninterest-bearing as % of total deposits Cost of total deposits (%) Deposits by customer segment ($billions) • ~$2.5 billion in deposit balances acquired during the quarter due to the completion of the Southern States merger • Post-merger net deposit balances declined during the quarter by ~$59 million • Strategic run-off of higher cost non-relationship deposits & brokered deposit balances • Run-off balances partially replaced with core bank deposits generated through retail bank deposit gathering programs Highlights Noninterest -bearing checking 19% Interest- bearing checking 18% Money market & savings 43% Time 20% 37% Checking accounts 3Q25 Deposit composition $4.7 $4.9 $4.9 $4.8 $6.0 $4.9 $4.8 $4.7 $4.8 $6.0 $1.4 $1.6 $1.6 $1.8 $1.8 3Q24 4Q24 1Q25 2Q25 3Q25 Consumer Commercial Public $11.0 $11.3 $11.2 $11.4 $13.8

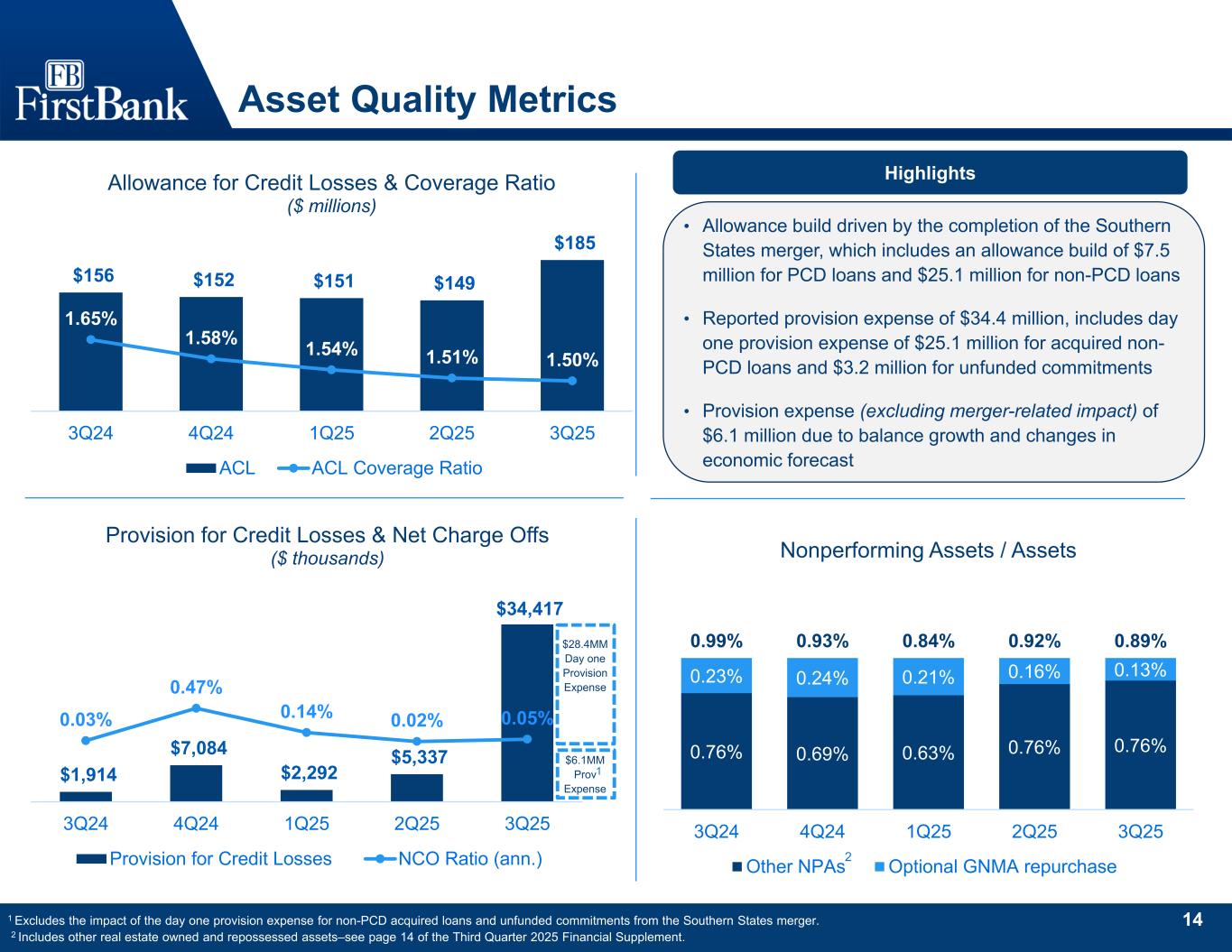

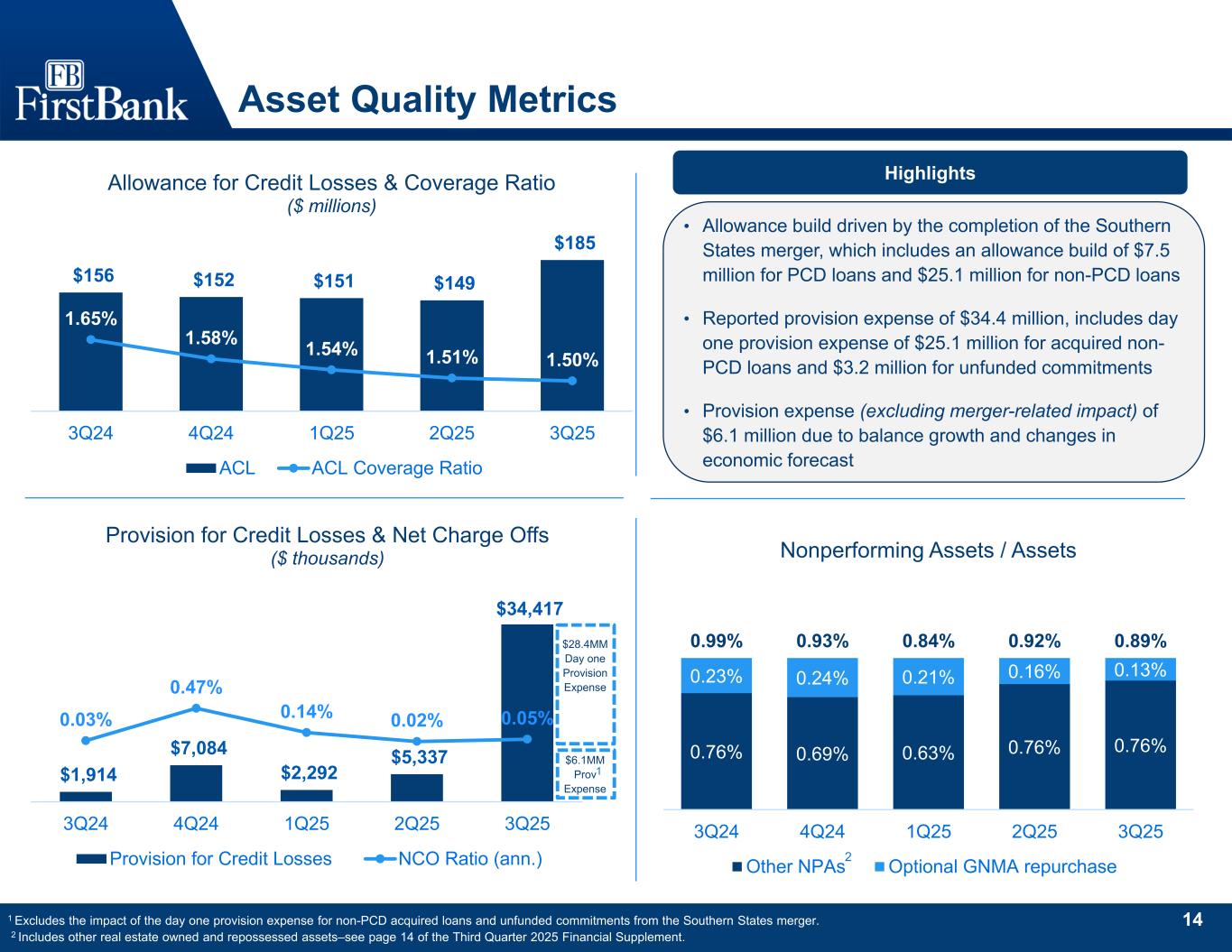

14 Asset Quality Metrics 0.76% 0.69% 0.63% 0.76% 0.76% 0.23% 0.24% 0.21% 0.16% 0.13% 0.99% 0.93% 0.84% 0.92% 0.89% 3Q24 4Q24 1Q25 2Q25 3Q25 Nonperforming Assets / Assets Other NPAs Optional GNMA repurchase • Allowance build driven by the completion of the Southern States merger, which includes an allowance build of $7.5 million for PCD loans and $25.1 million for non-PCD loans • Reported provision expense of $34.4 million, includes day one provision expense of $25.1 million for acquired non- PCD loans and $3.2 million for unfunded commitments • Provision expense (excluding merger-related impact) of $6.1 million due to balance growth and changes in economic forecast $156 $152 $151 $149 $185 1.65% 1.58% 1.54% 1.51% 1.50% 3Q24 4Q24 1Q25 2Q25 3Q25 Allowance for Credit Losses & Coverage Ratio ($ millions) ACL ACL Coverage Ratio 1 Excludes the impact of the day one provision expense for non-PCD acquired loans and unfunded commitments from the Southern States merger. 2 Includes other real estate owned and repossessed assets–see page 14 of the Third Quarter 2025 Financial Supplement. Highlights 2 $1,914 $7,084 $2,292 $5,337 $34,417 0.03% 0.47% 0.14% 0.02% 0.05% 3Q24 4Q24 1Q25 2Q25 3Q25 Provision for Credit Losses & Net Charge Offs ($ thousands) Provision for Credit Losses NCO Ratio (ann.) $28.4MM Day one Provision Expense $6.1MM Prov Expense 1

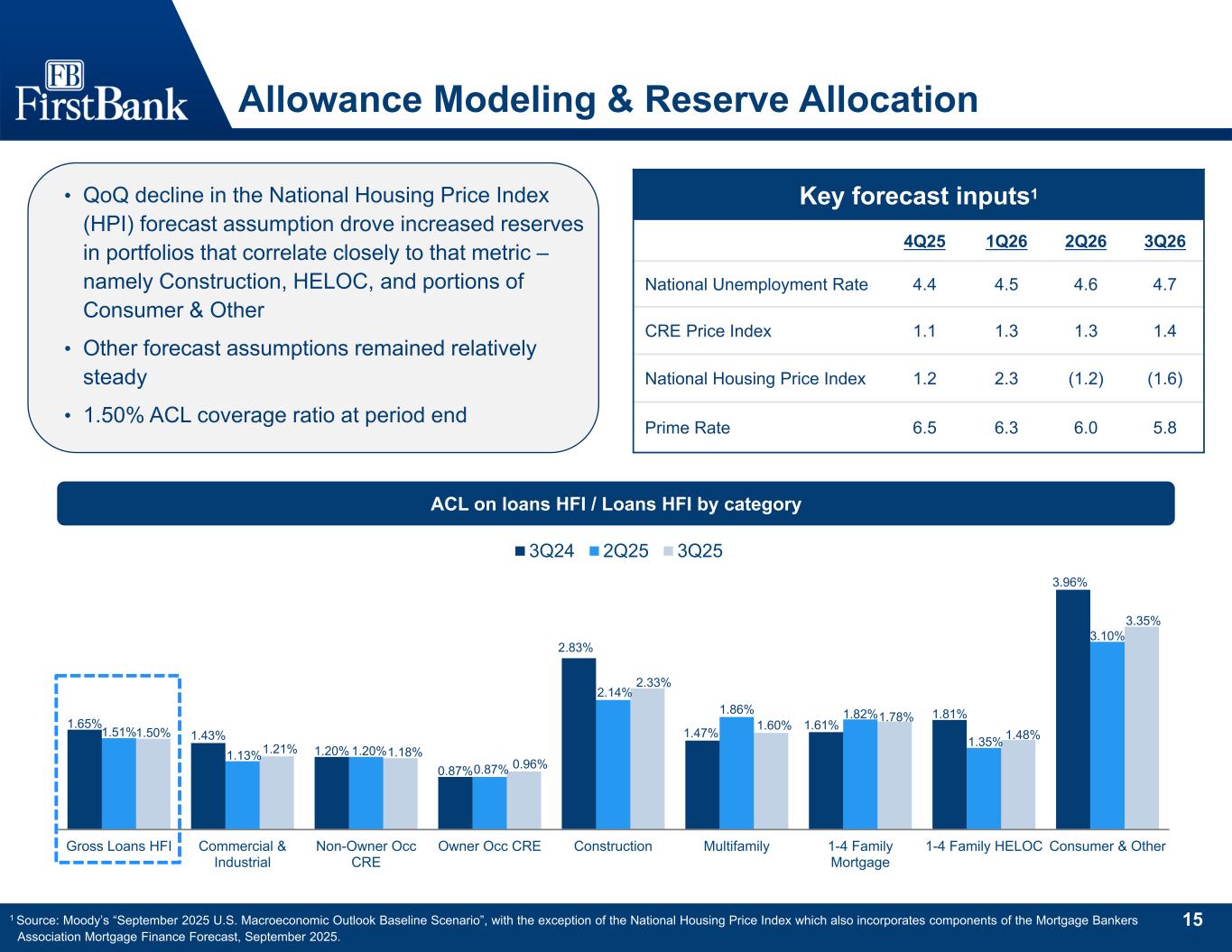

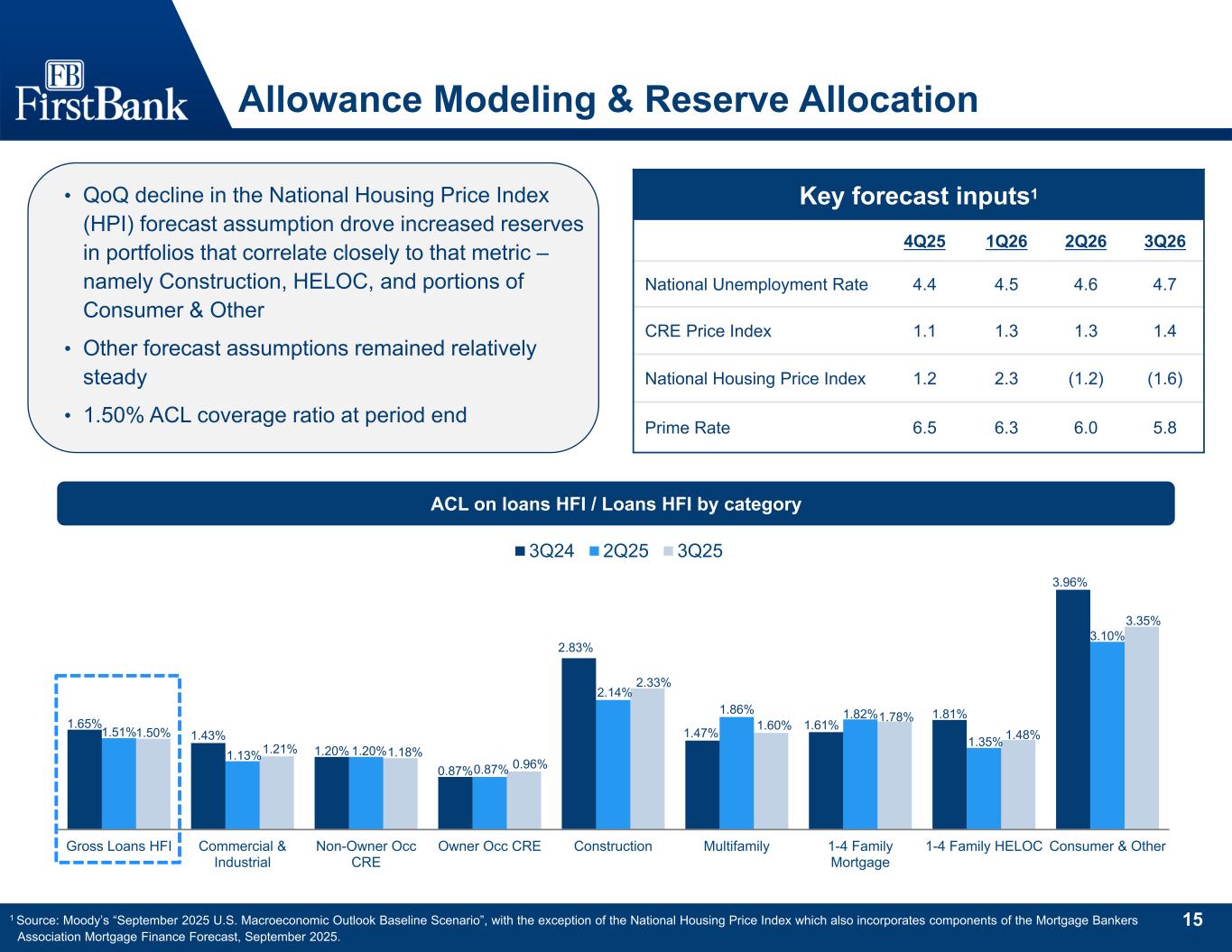

15 1.65% 1.43% 1.20% 0.87% 2.83% 1.47% 1.61% 1.81% 3.96% 1.51% 1.13% 1.20% 0.87% 2.14% 1.86% 1.82% 1.35% 3.10% 1.50% 1.21% 1.18% 0.96% 2.33% 1.60% 1.78% 1.48% 3.35% Gross Loans HFI Commercial & Industrial Non-Owner Occ CRE Owner Occ CRE Construction Multifamily 1-4 Family Mortgage 1-4 Family HELOC Consumer & Other 3Q24 2Q25 3Q25 Allowance Modeling & Reserve Allocation ACL on loans HFI / Loans HFI by category • QoQ decline in the National Housing Price Index (HPI) forecast assumption drove increased reserves in portfolios that correlate closely to that metric – namely Construction, HELOC, and portions of Consumer & Other • Other forecast assumptions remained relatively steady • 1.50% ACL coverage ratio at period end Key forecast inputs1 3Q262Q261Q264Q25 4.74.64.54.4National Unemployment Rate 1.41.31.31.1CRE Price Index (1.6)(1.2)2.31.2National Housing Price Index 5.86.06.36.5Prime Rate 1 Source: Moody’s “September 2025 U.S. Macroeconomic Outlook Baseline Scenario”, with the exception of the National Housing Price Index which also incorporates components of the Mortgage Bankers Association Mortgage Finance Forecast, September 2025.

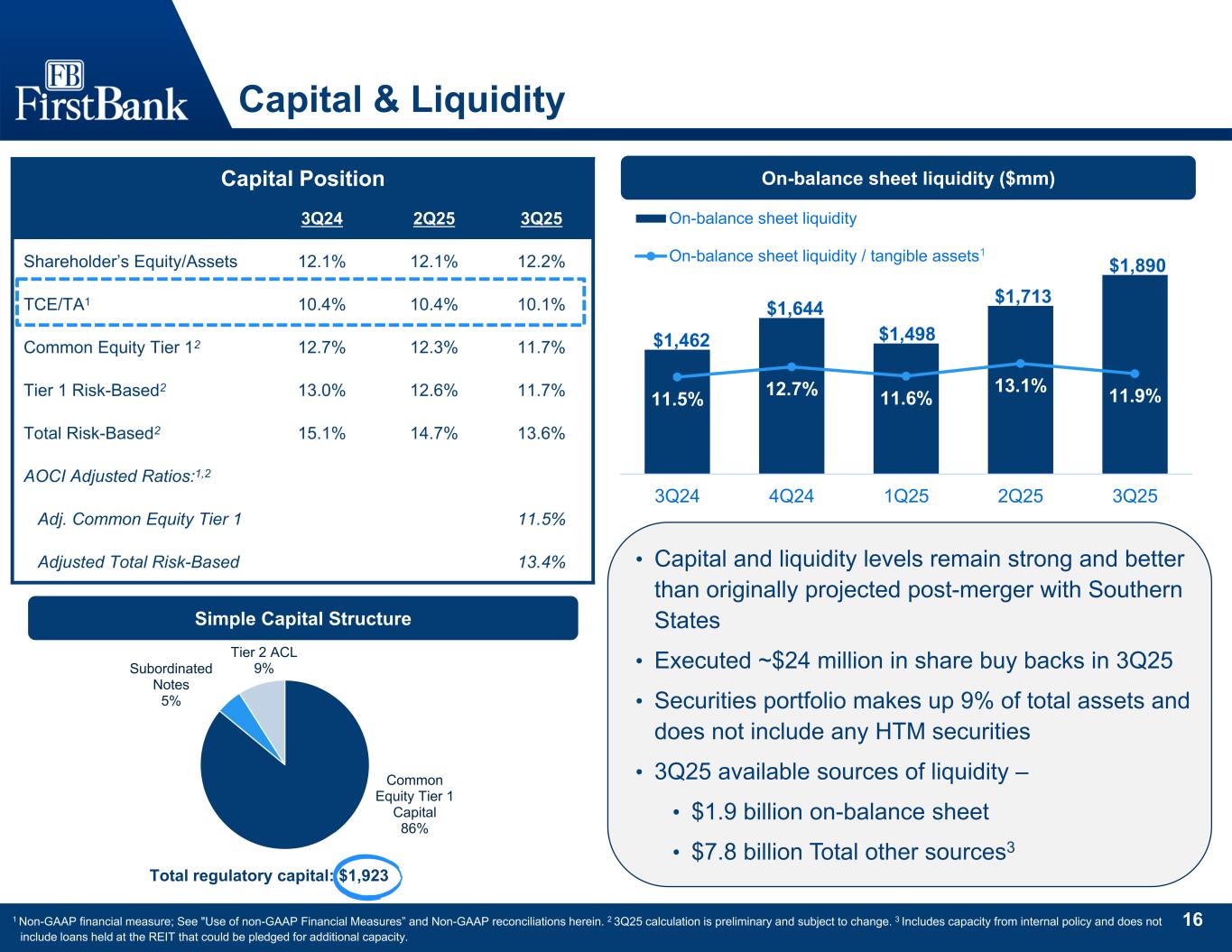

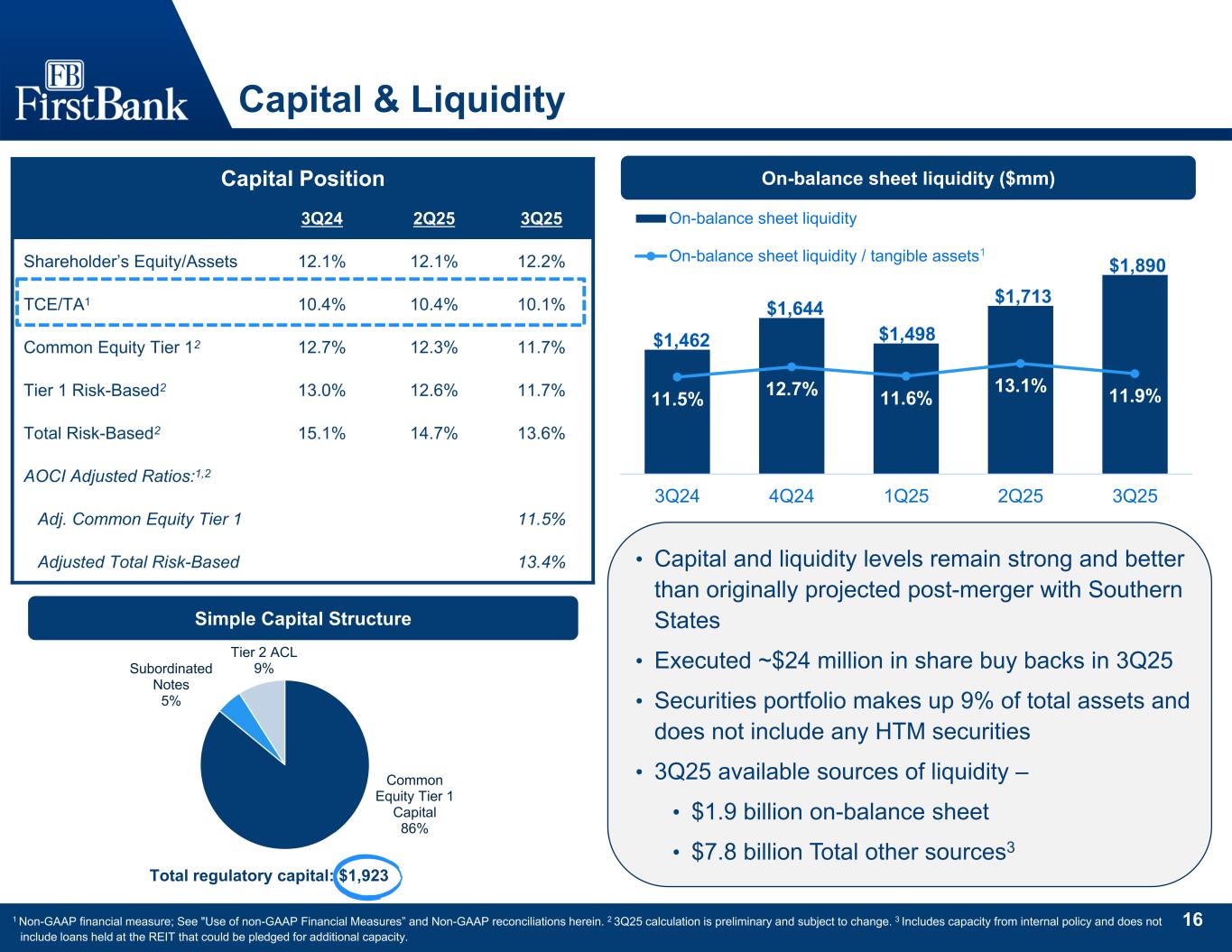

16 Capital & Liquidity Simple Capital Structure Common Equity Tier 1 Capital 86% Subordinated Notes 5% Tier 2 ACL 9% Total regulatory capital: $1,923 1 Non-GAAP financial measure; See "Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. 2 3Q25 calculation is preliminary and subject to change. 3 Includes capacity from internal policy and does not include loans held at the REIT that could be pledged for additional capacity. On-balance sheet liquidity ($mm) $1,462 $1,644 $1,498 $1,713 $1,890 11.5% 12.7% 11.6% 13.1% 11.9% 3Q24 4Q24 1Q25 2Q25 3Q25 On-balance sheet liquidity On-balance sheet liquidity / tangible assets Capital Position 3Q252Q253Q24 12.2%12.1%12.1%Shareholder’s Equity/Assets 10.1%10.4%10.4%TCE/TA1 11.7%12.3%12.7%Common Equity Tier 12 11.7%12.6%13.0%Tier 1 Risk-Based2 13.6%14.7%15.1%Total Risk-Based2 AOCI Adjusted Ratios:1,2 11.5%Adj. Common Equity Tier 1 13.4%Adjusted Total Risk-Based 1 • Capital and liquidity levels remain strong and better than originally projected post-merger with Southern States • Executed ~$24 million in share buy backs in 3Q25 • Securities portfolio makes up 9% of total assets and does not include any HTM securities • 3Q25 available sources of liquidity – • $1.9 billion on-balance sheet • $7.8 billion Total other sources3

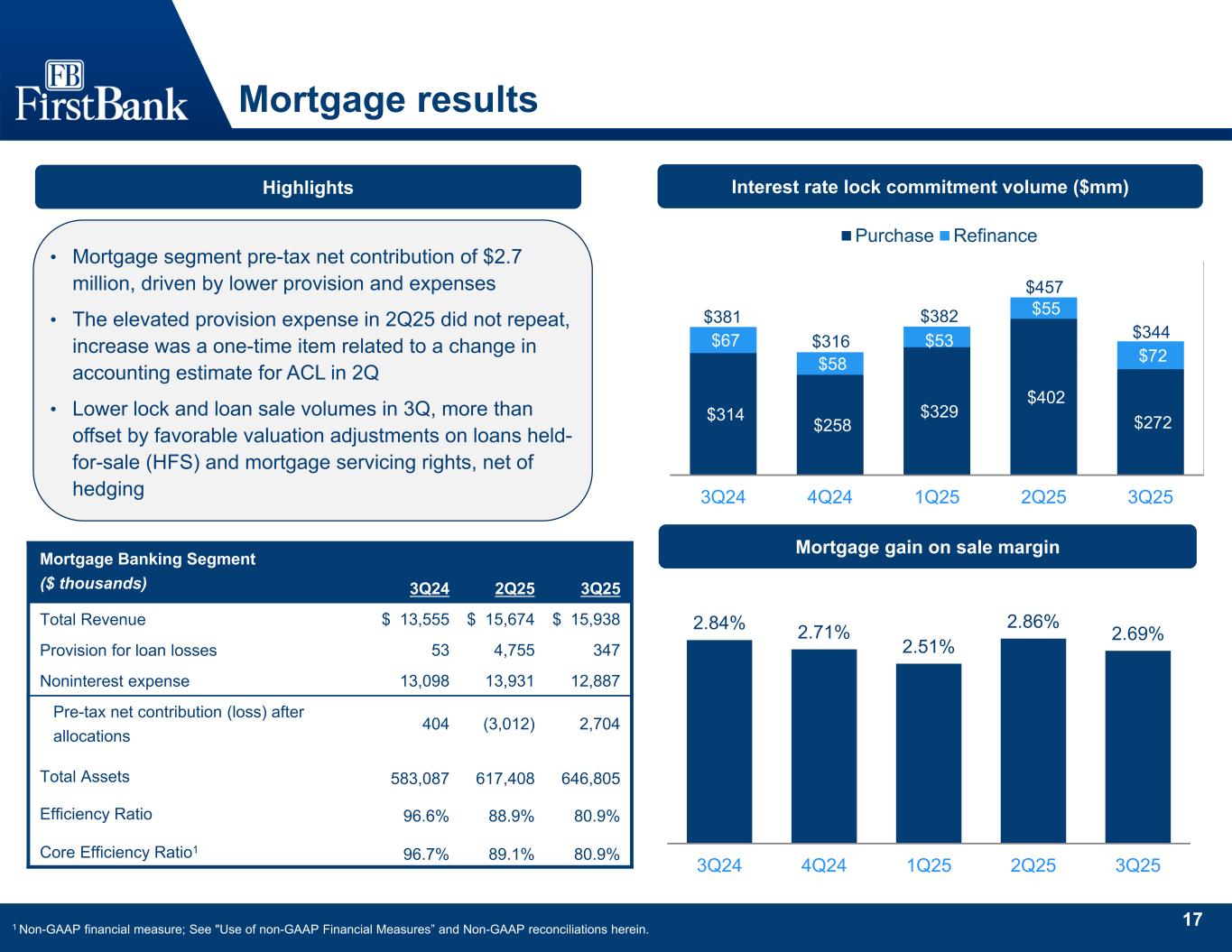

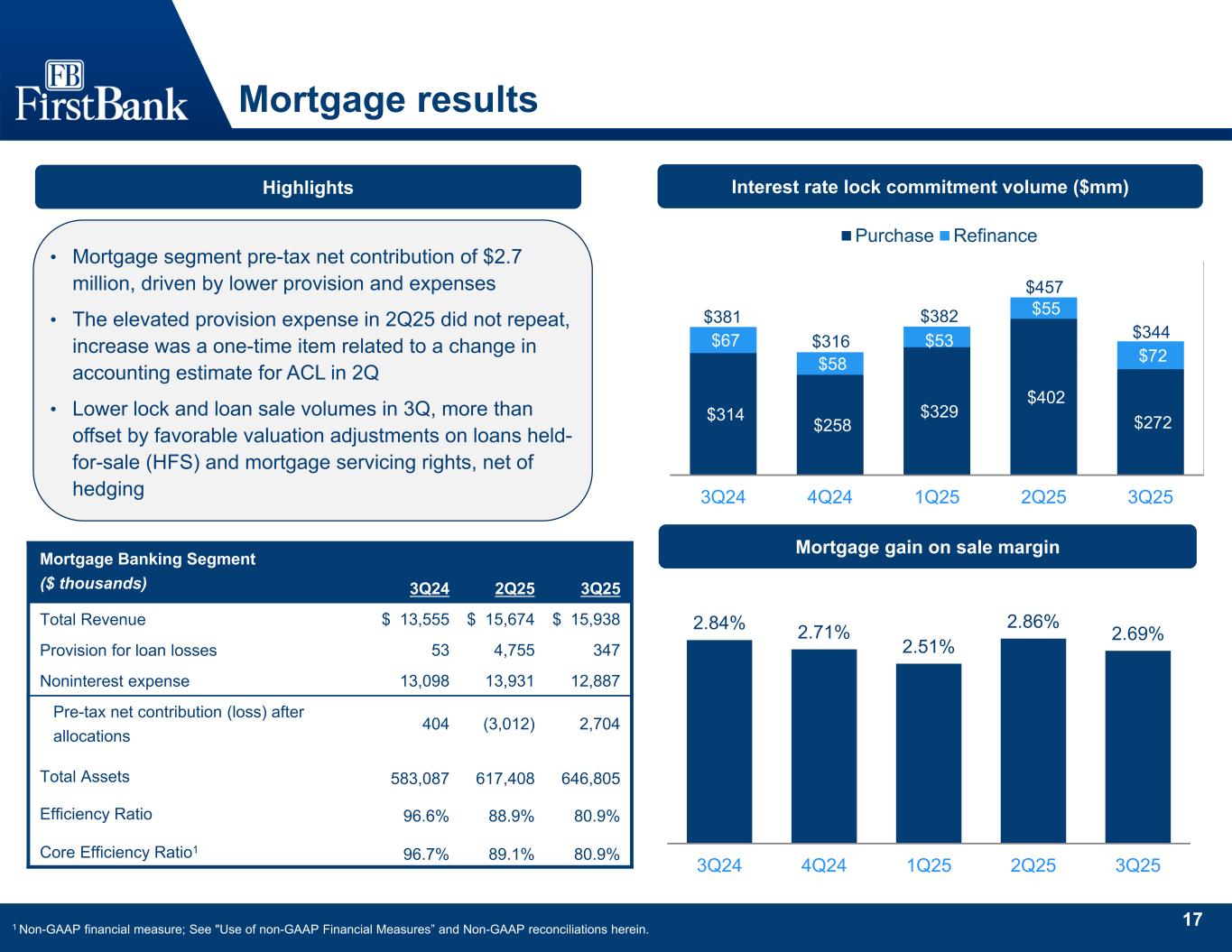

17 Mortgage results • Mortgage segment pre-tax net contribution of $2.7 million, driven by lower provision and expenses • The elevated provision expense in 2Q25 did not repeat, increase was a one-time item related to a change in accounting estimate for ACL in 2Q • Lower lock and loan sale volumes in 3Q, more than offset by favorable valuation adjustments on loans held- for-sale (HFS) and mortgage servicing rights, net of hedging 2.84% 2.71% 2.51% 2.86% 2.69% 3Q24 4Q24 1Q25 2Q25 3Q25 Interest rate lock commitment volume ($mm) Mortgage gain on sale margin $314 $258 $329 $402 $272 $67 $58 $53 $55 $72 $381 $316 $382 $457 $344 3Q24 4Q24 1Q25 2Q25 3Q25 Purchase Refinance Highlights 3Q252Q253Q24 Mortgage Banking Segment ($ thousands) $ 15,938$ 15,674$ 13,555Total Revenue 3474,75553Provision for loan losses 12,88713,93113,098Noninterest expense 2,704(3,012)404 Pre-tax net contribution (loss) after allocations 646,805617,408583,087Total Assets 80.9%88.9%96.6%Efficiency Ratio 80.9%89.1%96.7%Core Efficiency Ratio1 1 Non-GAAP financial measure; See "Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein.

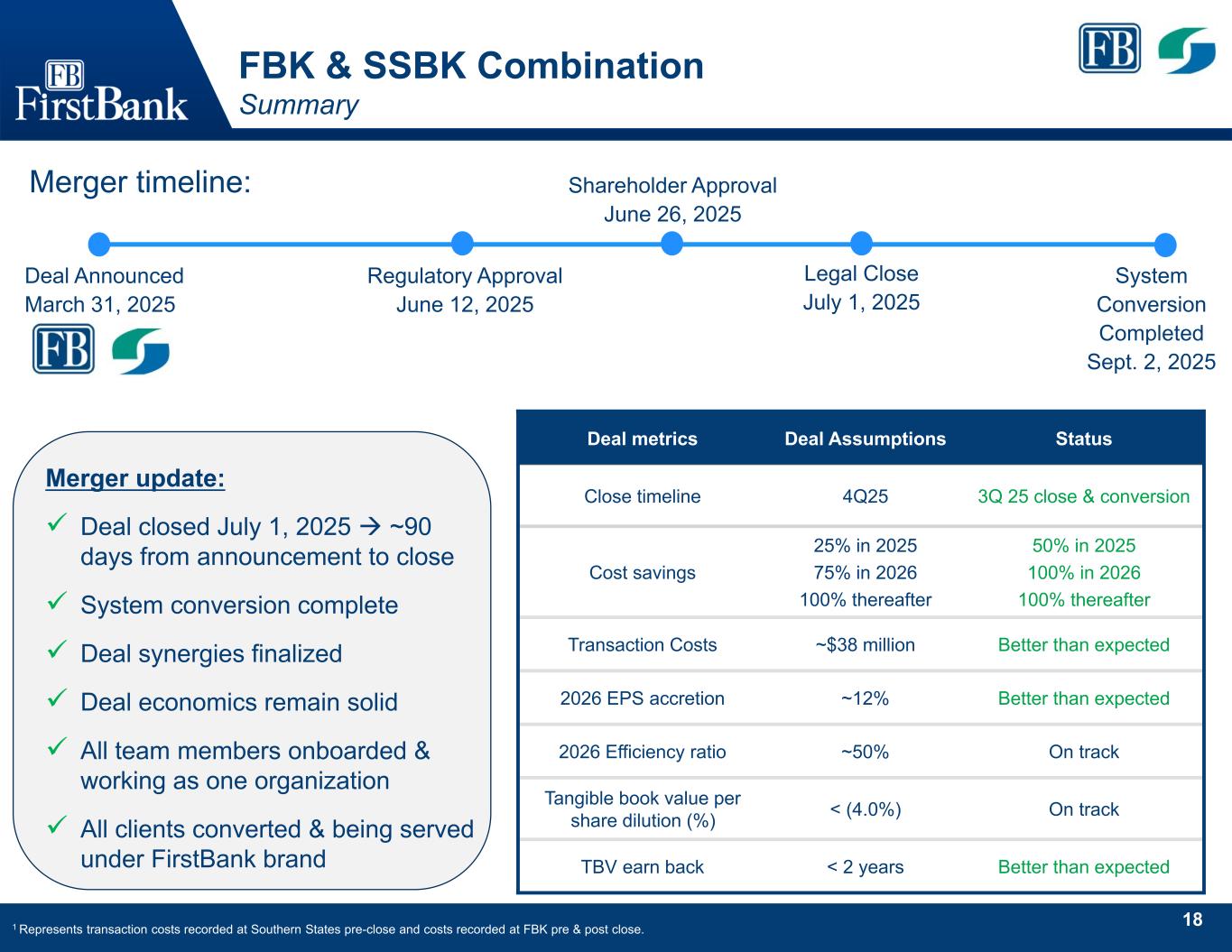

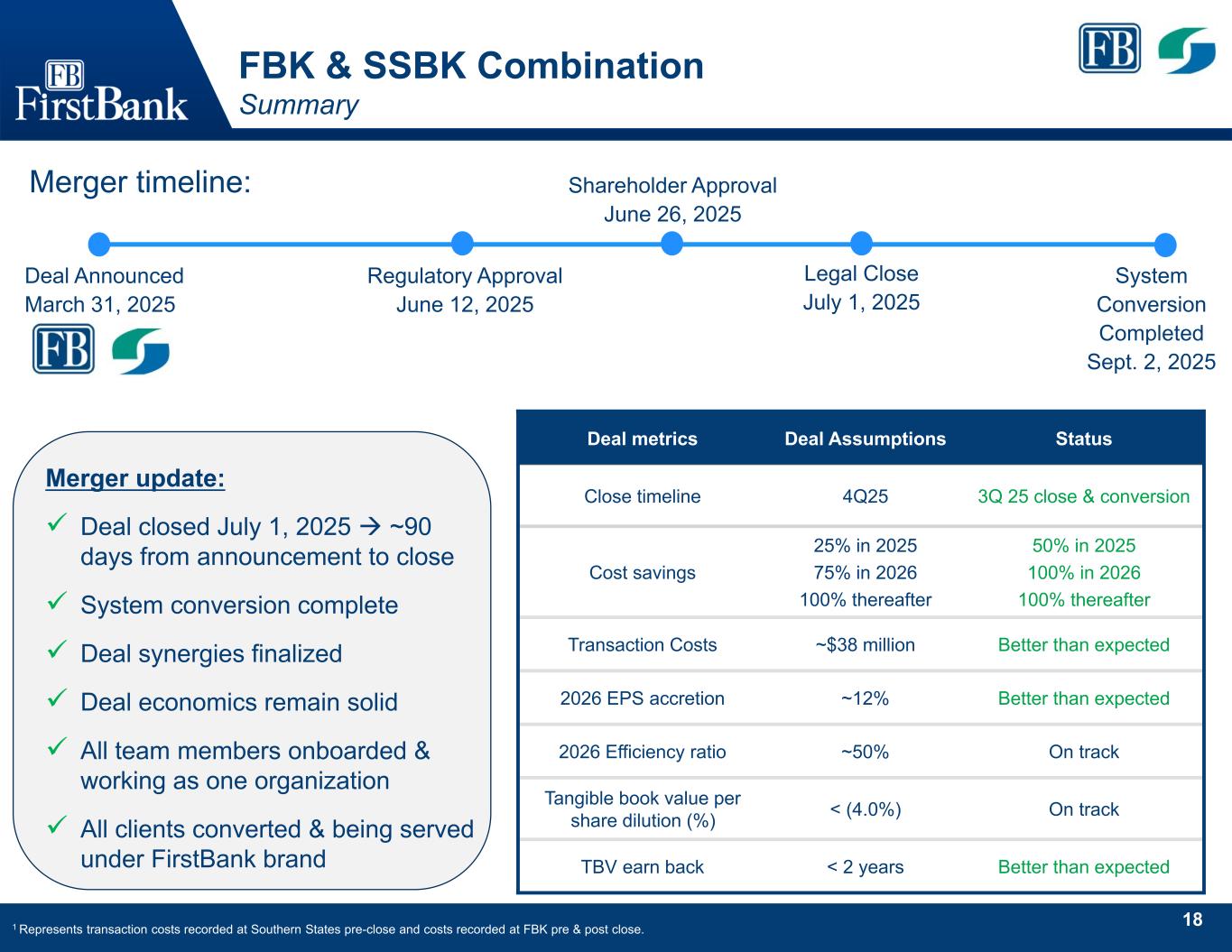

18 FBK & SSBK Combination Summary Deal Announced March 31, 2025 Regulatory Approval June 12, 2025 Shareholder Approval June 26, 2025 Legal Close July 1, 2025 System Conversion Completed Sept. 2, 2025 Merger timeline: Merger update: Deal closed July 1, 2025 ~90 days from announcement to close System conversion complete Deal synergies finalized Deal economics remain solid All team members onboarded & working as one organization All clients converted & being served under FirstBank brand StatusDeal AssumptionsDeal metrics 3Q 25 close & conversion 4Q25Close timeline 50% in 2025 100% in 2026 100% thereafter 25% in 2025 75% in 2026 100% thereafter Cost savings Better than expected~$38 millionTransaction Costs Better than expected~12%2026 EPS accretion On track~50%2026 Efficiency ratio On track< (4.0%)Tangible book value per share dilution (%) Better than expected< 2 yearsTBV earn back 1 Represents transaction costs recorded at Southern States pre-close and costs recorded at FBK pre & post close.

19 Appendix

20 GAAP reconciliations and use of non-GAAP financial measures Adjusted net income and diluted earnings per share

21 GAAP reconciliations and use of non-GAAP financial measures Adjusted net income and diluted earnings per share

22 GAAP reconciliations and use of non-GAAP financial measures Adjusted pre-tax pre-provision net revenue

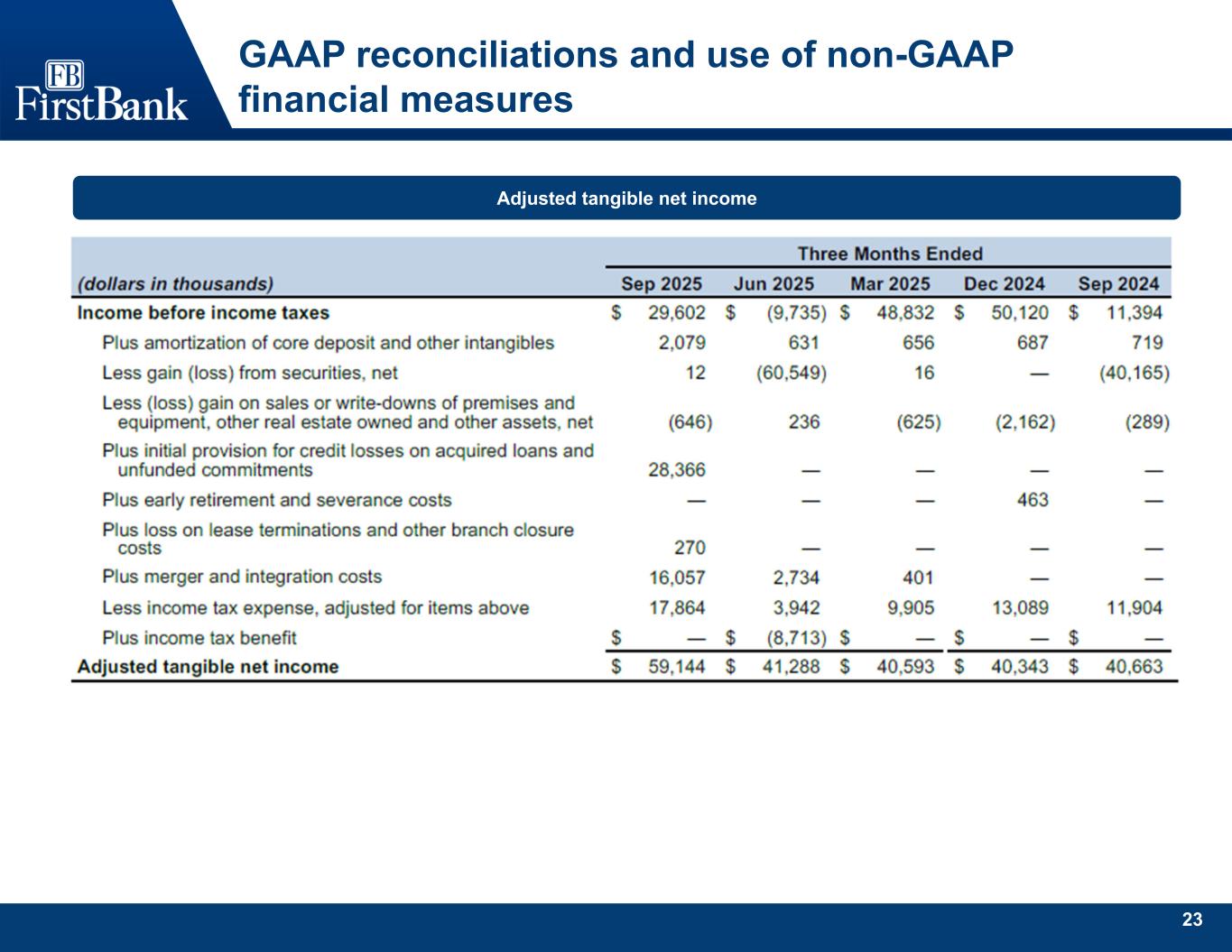

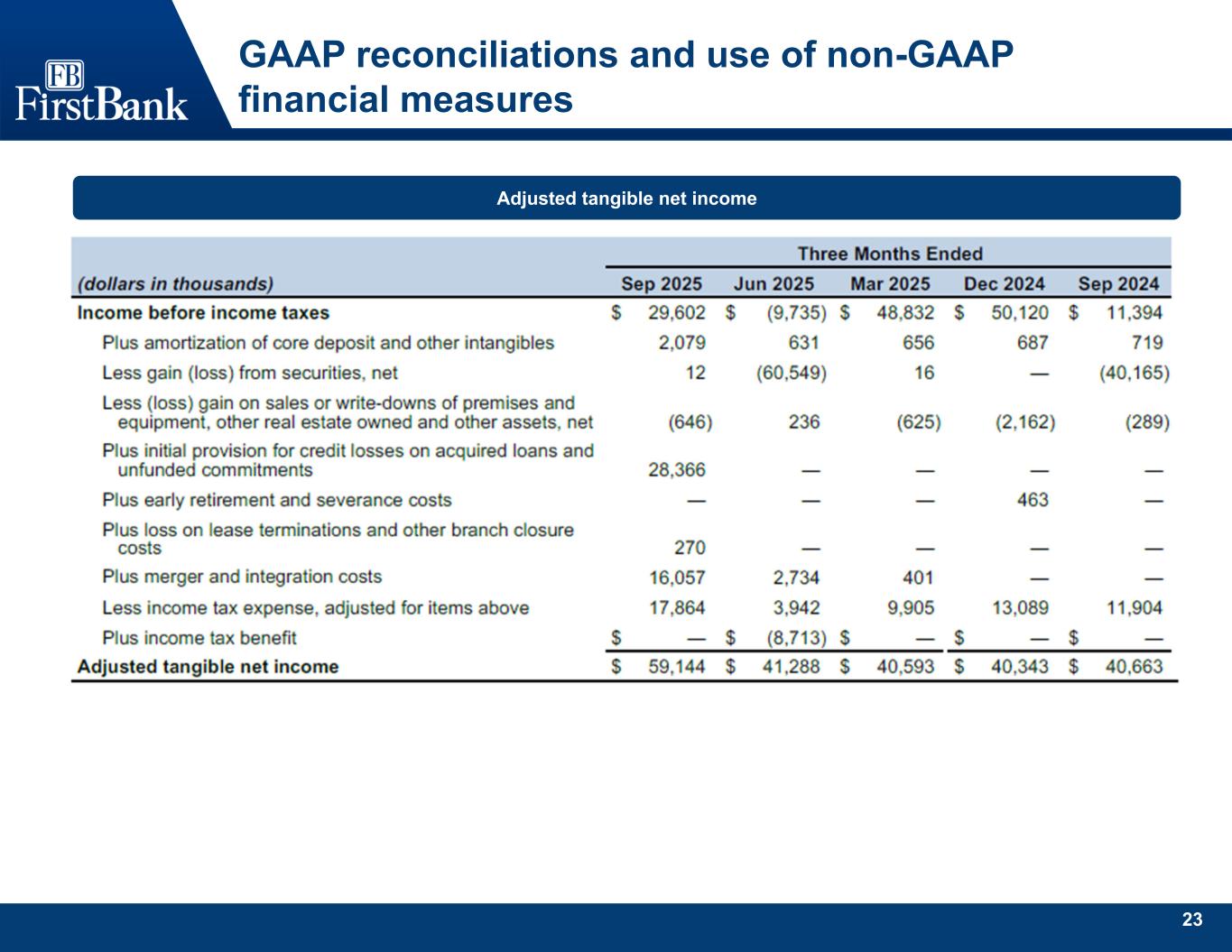

23 GAAP reconciliations and use of non-GAAP financial measures Adjusted tangible net income

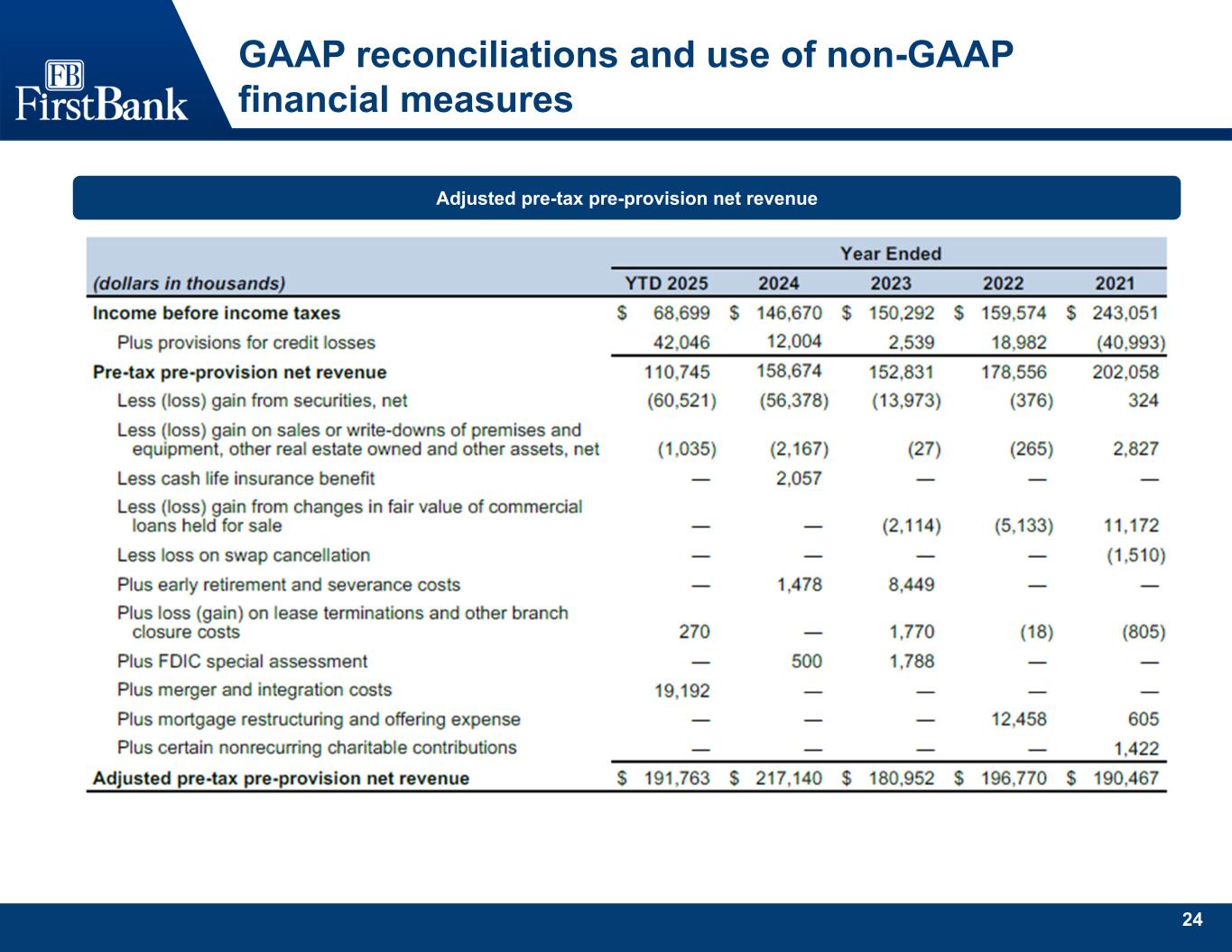

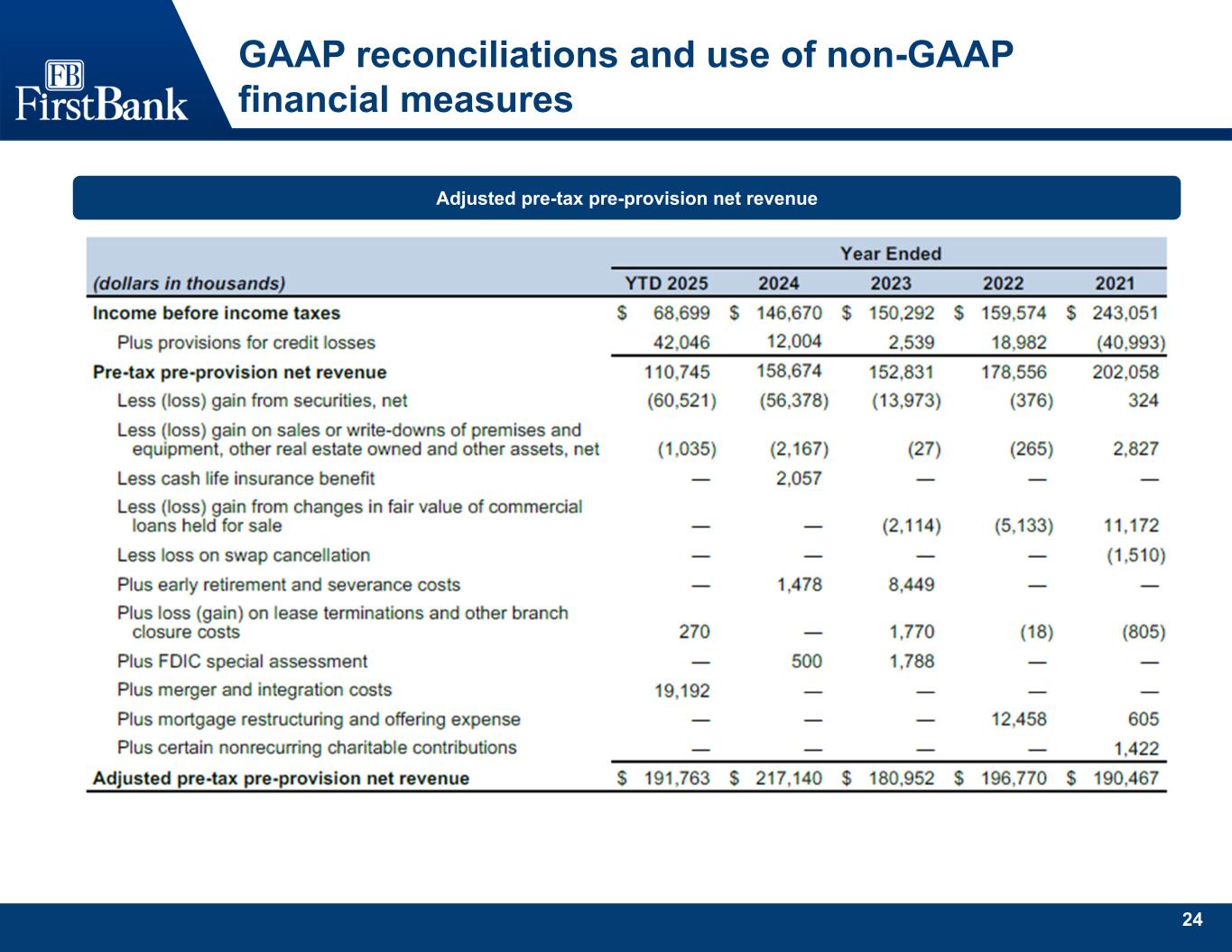

24 GAAP reconciliations and use of non-GAAP financial measures Adjusted pre-tax pre-provision net revenue

25 GAAP reconciliations and use of non-GAAP financial measures Adjusted tangible net income

26 GAAP reconciliations and use of non-GAAP financial measures Adjusted Common Equity Tier 1 and Total Risk-Based capital ratios

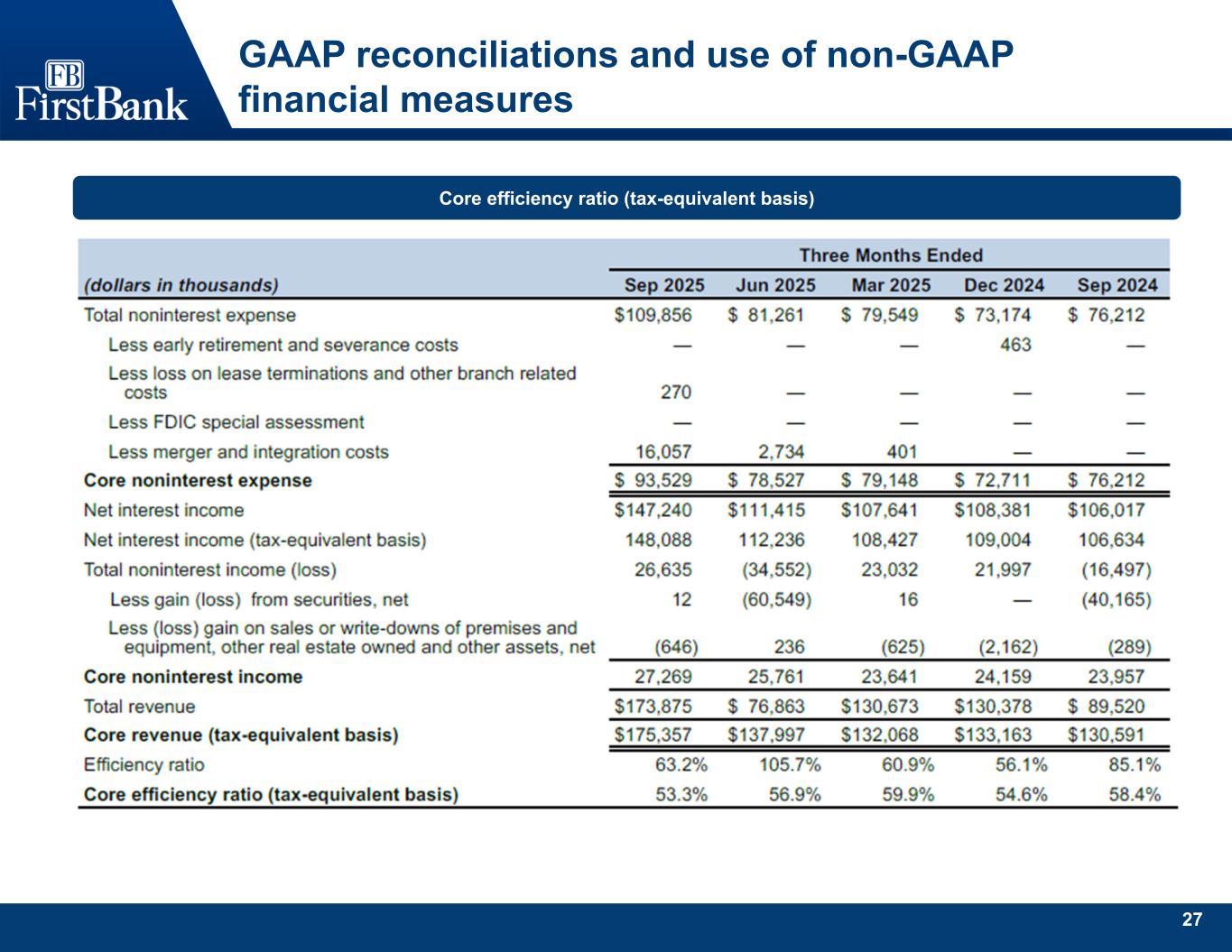

27 GAAP reconciliations and use of non-GAAP financial measures Core efficiency ratio (tax-equivalent basis)

28 GAAP reconciliations and use of non-GAAP financial measures Banking segment core efficiency ratio (tax-equivalent)

29 GAAP reconciliations and use of non-GAAP financial measures Mortgage segment core efficiency ratio (tax-equivalent)

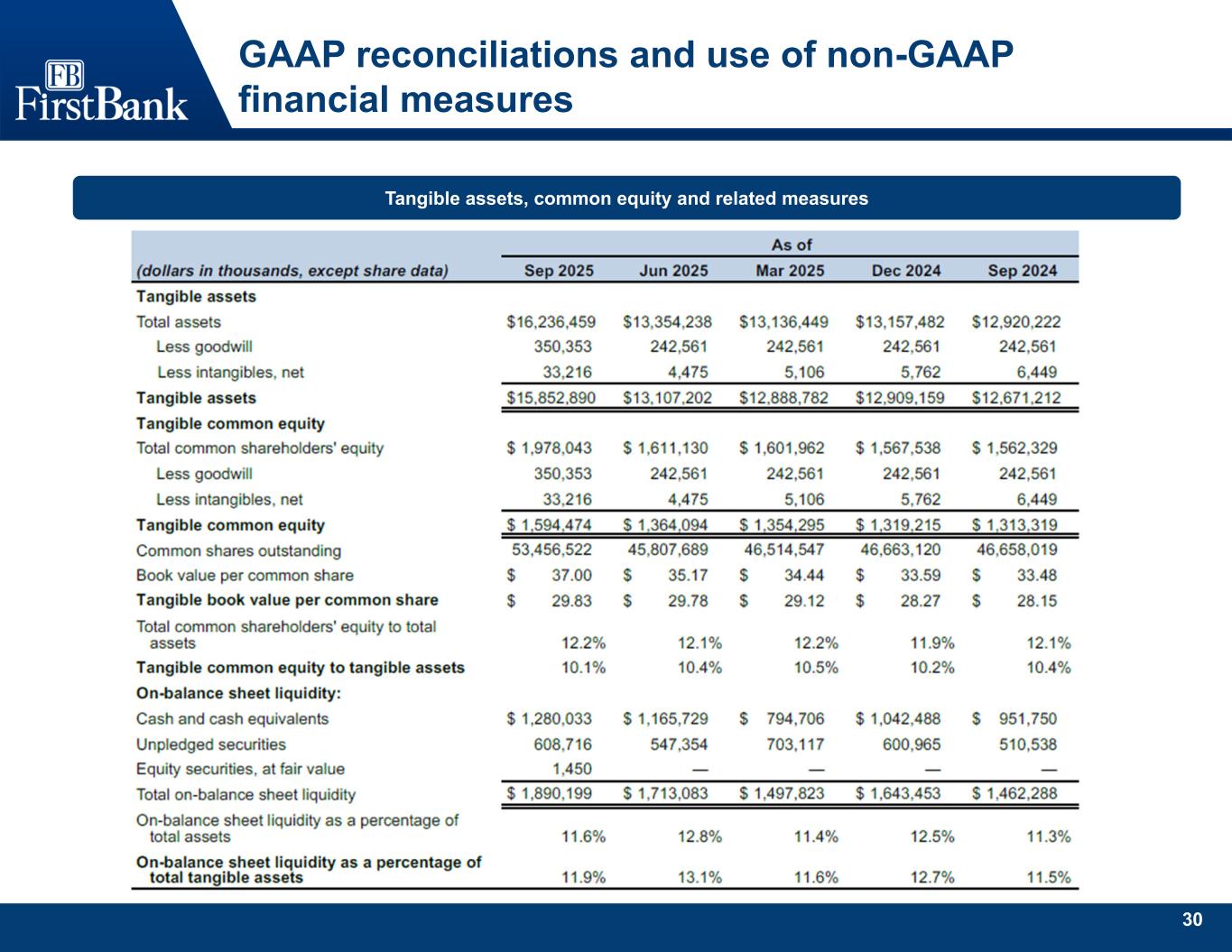

30 GAAP reconciliations and use of non-GAAP financial measures Tangible assets, common equity and related measures

31 GAAP reconciliations and use of non-GAAP financial measures Tangible assets, common equity and related measures

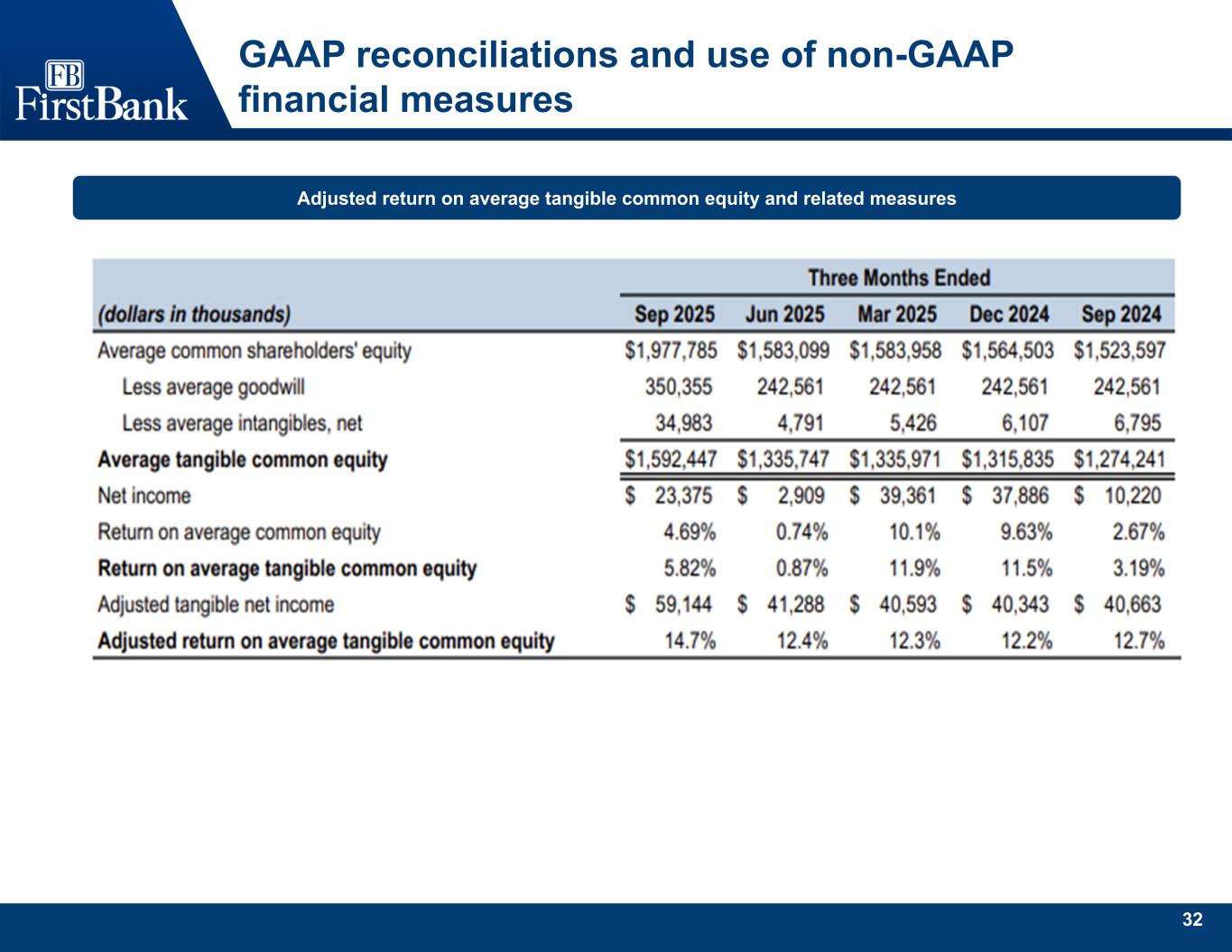

32 GAAP reconciliations and use of non-GAAP financial measures Adjusted return on average tangible common equity and related measures

33 GAAP reconciliations and use of non-GAAP financial measures Adjusted return on average assets, common equity and related measures

34 GAAP reconciliations and use of non-GAAP financial measures Adjusted return on average tangible common equity and related measures

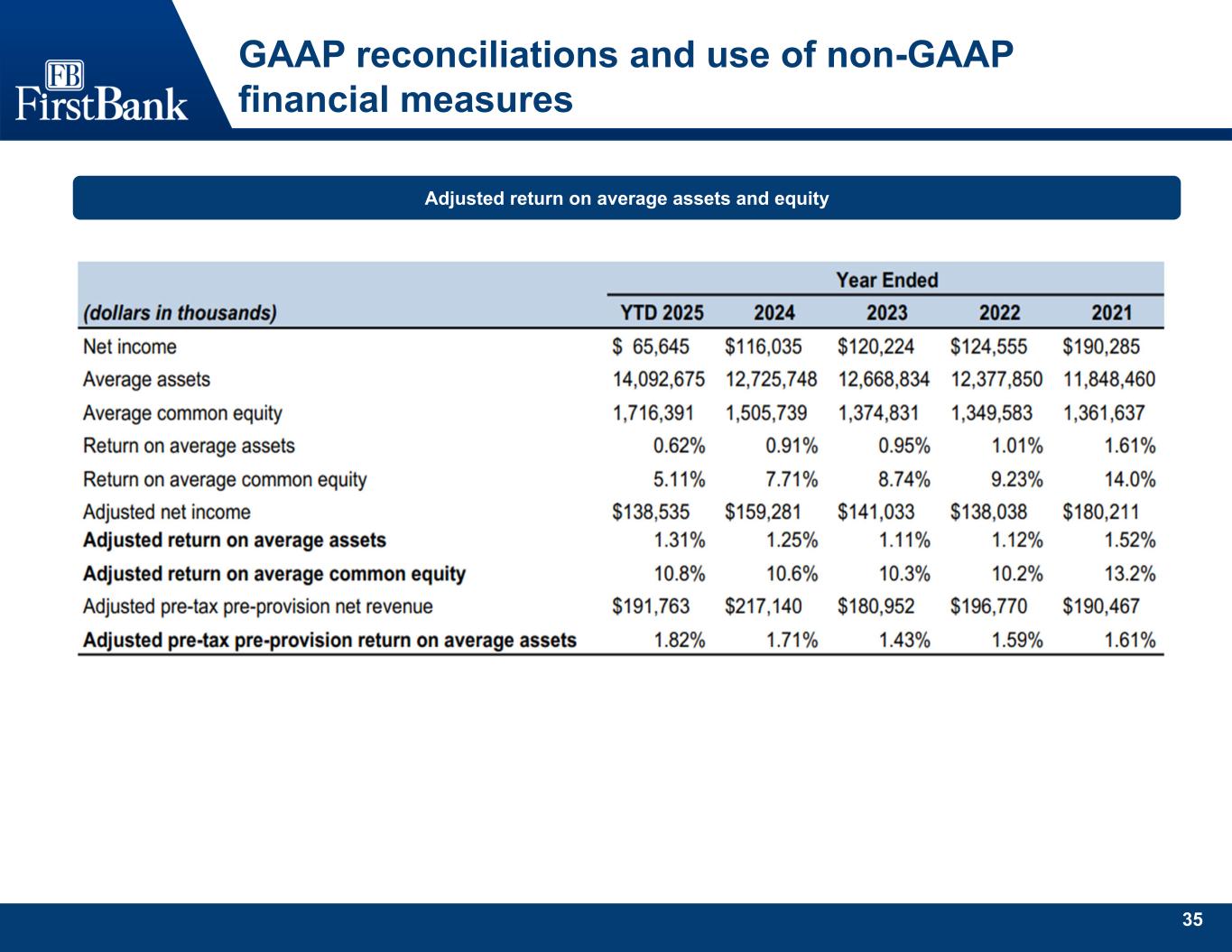

35 GAAP reconciliations and use of non-GAAP financial measures Adjusted return on average assets and equity