Document

|

|

|

|

|

|

| Contacts: |

|

| Thomas G. Zernick |

Scott J. McKim |

| Chief Executive Officer |

Chief Financial Officer |

| 727.399.5680 |

727.521.7085 |

BayFirst Financial Corp. Reports Second Quarter 2025 Results

ST. PETERSBURG, FL. — July 29, 2025 — BayFirst Financial Corp. (NASDAQ: BAFN) (“BayFirst” or the “Company”), parent company of BayFirst National Bank (the “Bank”) today reported a net loss of $1.2 million, or $(0.39) per common share and diluted common share, for the second quarter of 2025, compared to a net loss of $0.3 million, or $(0.17) per common share and diluted common share, in the first quarter of 2025.

“As we announced last quarter, Management and the Board initiated a comprehensive strategic review aimed at derisking unguaranteed SBA 7(a) balances on the balance sheet and positioning the company for long-term growth and enhanced shareholder value,” stated Thomas G. Zernick, Chief Executive Officer. “Much progress is being made, and we expect to have additional information on our plans and the expected results in the coming weeks. In conjunction with the review, BayFirst reported charge offs and fair value write downs on related SBA 7(a) loans with elevated levels of risk. This will provide for a stronger balance sheet to take advantage of community banking opportunities. Furthermore, to offset the impact of these changes, the Board has voted to suspend common and preferred stock dividend payments and board of director fees. We will continue to evaluate strategic alternatives to ensure an optimal path in the best long-term interests of our shareholders, customers, and the communities we serve.

“We expanded our net interest margin and kept controllable operating expenses in check during the second quarter as compared to the first quarter, reflecting the continued strength in our community banking operations. Credit challenges extended into the second quarter, with net charge-offs and fair value write-downs on Bolt SBA 7(a) loans increasing compared to the prior quarter. Notably, we recorded some loan production measured at fair value because of production delays experienced with SBA's Standard Operating Procedures update, which increased application processing time and prevented us from executing some loan sales as planned. Although our core SBA and conventional commercial loan portfolio performance remains strong, many of our SBA small business clients continue to struggle in a difficult environment even though many have shown some resilience in the face of inflation and persistent high interest rates. As we monitor the evolving impact of the economy and recent policy changes, we remain committed to strong loan oversight and maintaining close relationships with our borrowers to support their long-term success.

“We continue to support our community bank first and foremost, serving individuals, families, and small businesses with a strong emphasis on stable, low-cost checking and savings accounts—products that are less sensitive to rate changes and contribute to a more predictable funding base,” said Zernick. “This focus not only supports relationship-driven banking but also broadens our reach across the vibrant Tampa Bay region, enhancing our franchise and creating more opportunities to offer residential mortgages, consumer loans, and small business financing. During the second quarter, we continued to focus on growing core deposits. This is a key component of our broader strategy to increase recurring revenue through net interest income and reduce our reliance on gains from the sale of government-guaranteed loans. As we continue to expand our conventional commercial and consumer loan portfolios, we are also taking proactive steps to manage credit risk. These efforts include strengthening underwriting standards for SBA 7(a) loans and exploring options such as portfolio sales to reduce exposure to unguaranteed SBA balances. We remain focused on aligning our loan growth with strong risk oversight to support long-term performance.

“A key achievement in the second quarter was the continued momentum in loan growth across our community bank operations, fueled by consistent demand across the greater Tampa Bay region,” said Zernick. “Community bank loans rose 3% during the quarter, demonstrating that our balance sheet growth is aligned with our strategic priority of growing the community bank segment.

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 2

We are seeing the early results of strategic initiatives designed to enhance earnings and reduce our reliance on less predictable income sources. While the broader economic environment remains uncertain, our disciplined focus on local relationship banking and tailored financial solutions positions us well for continued improvement.”

Second Quarter 2025 Performance Review

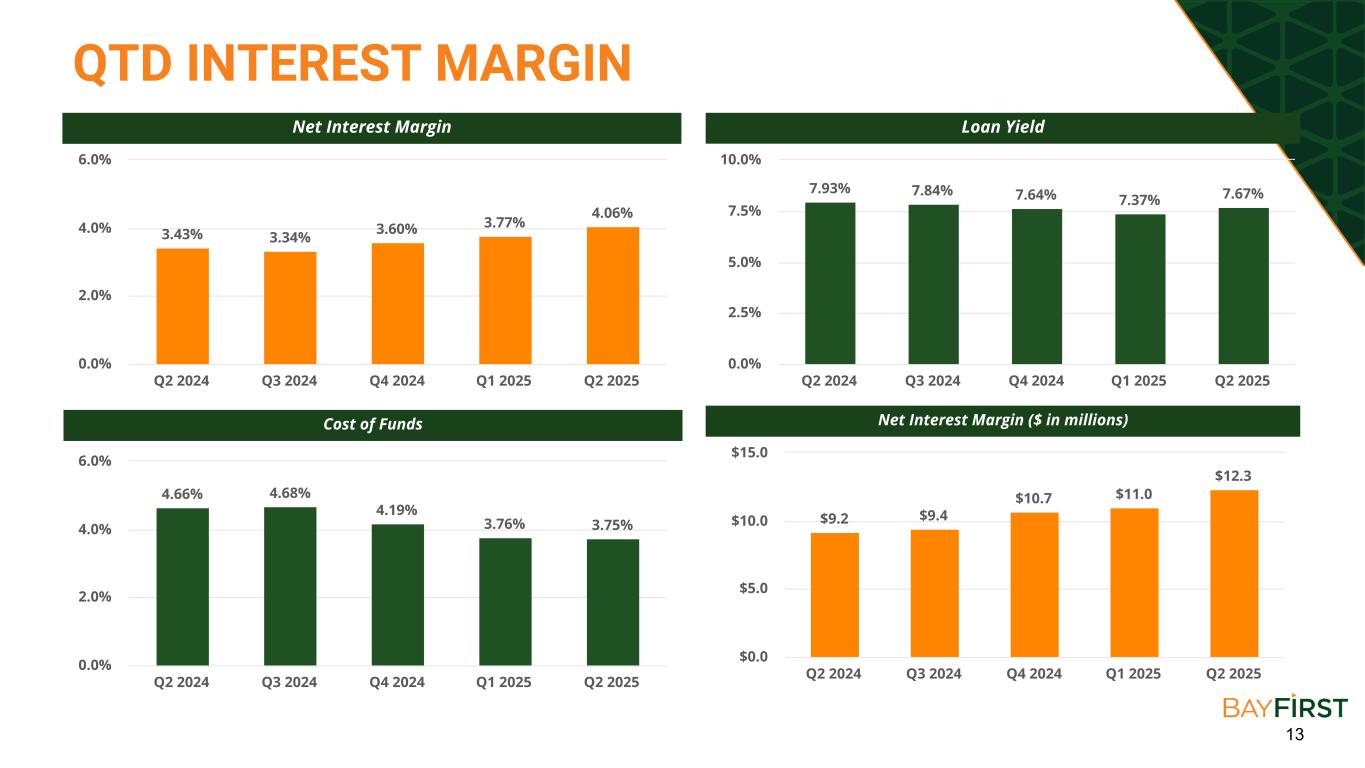

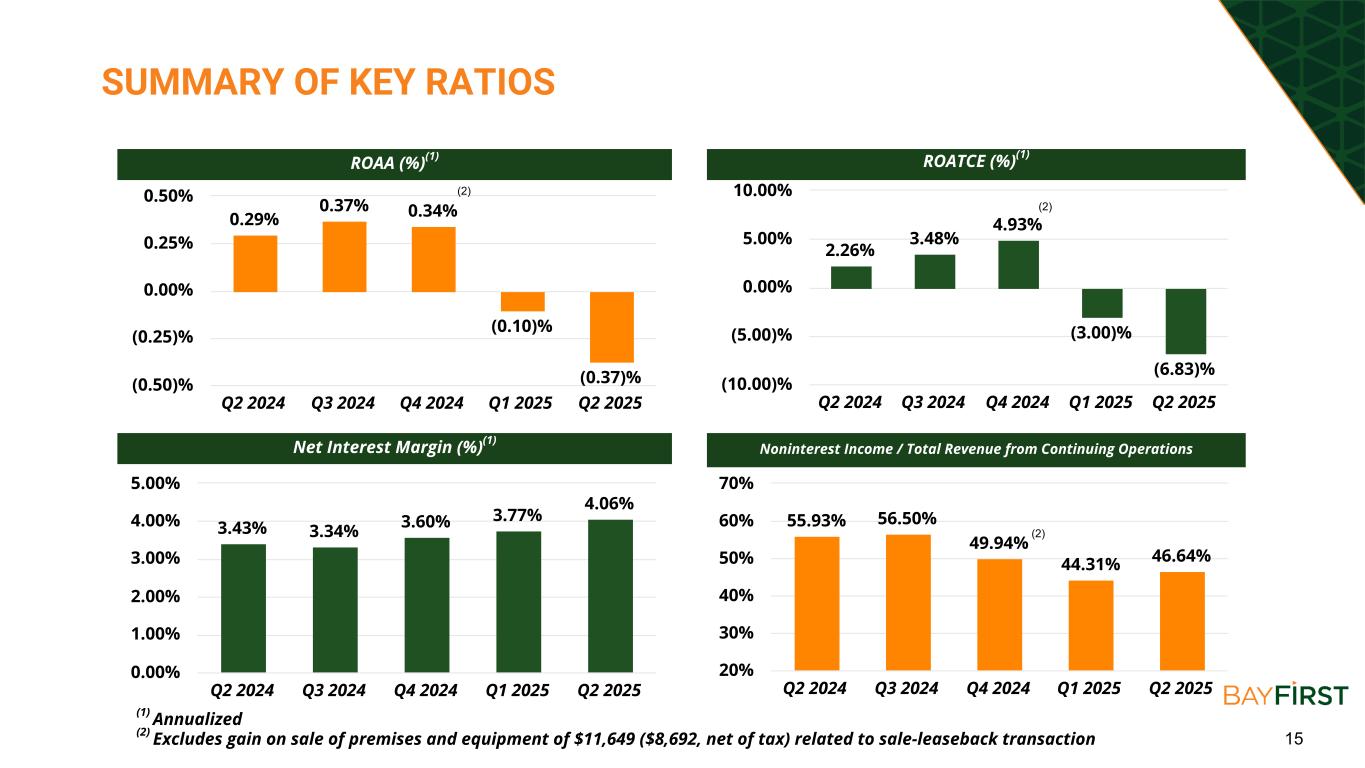

•Net interest margin was 4.06% in the second quarter of 2025, an increase of 29 basis points from 3.77% in the first quarter of 2025 and an increase of 63 basis points from 3.43% in the second quarter of 2024.

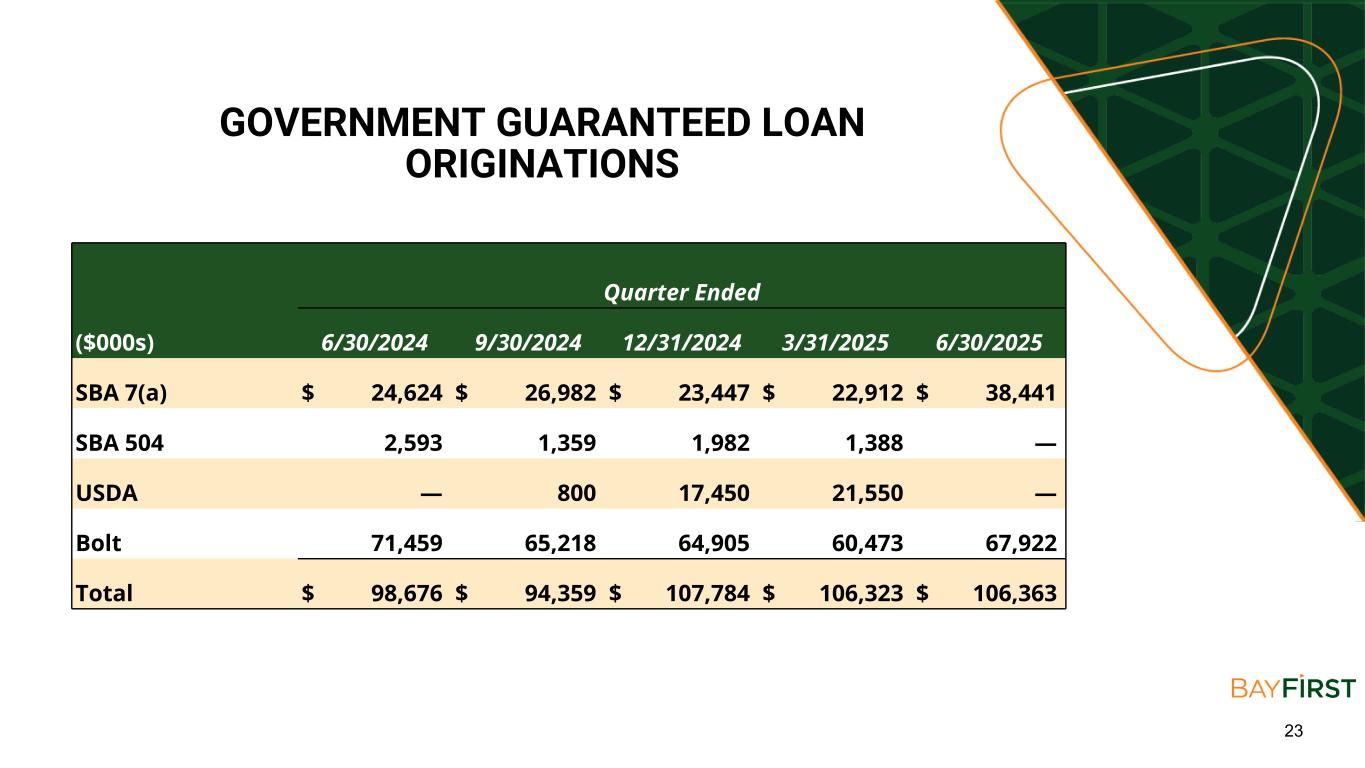

•The Company’s government guaranteed loan team originated $106.4 million in new loans during the second quarter of 2025, a slight increase from $106.3 million of loans produced in the previous quarter, and an increase from $98.7 million of loans produced during the second quarter of 2024. Since the launch in 2022 of the Company's Bolt loan program, an SBA 7(a) loan product designed to expeditiously provide working capital loans of $150 thousand or less, the Company has originated 6,745 Bolt loans totaling $869.9 million, of which 538 Bolt loans totaling $67.9 million were originated during the second quarter.

•Loans held for investment increased by $41.0 million, or 3.8%, during the second quarter of 2025 to $1.13 billion and increased $117.5 million, or 11.7%, over the past year. During the quarter, the Company originated $157.0 million of loans and sold $66.8 million of government guaranteed loan balances.

•Deposits increased $35.5 million, or 3.1%, during the second quarter of 2025 and increased $121.4 million, or 11.6%, over the past year to $1.16 billion. The increase in deposits during the quarter was primarily due to increases in noninterest-bearing account balances, savings and money market account balances, and time deposit balances, partially offset by a decrease in interest-bearing transaction account balances.

•Book value and tangible book value at June 30, 2025 were $22.30 per common share, a decrease from $22.77 at March 31, 2025.

Results of Operations

Net Income (Loss)

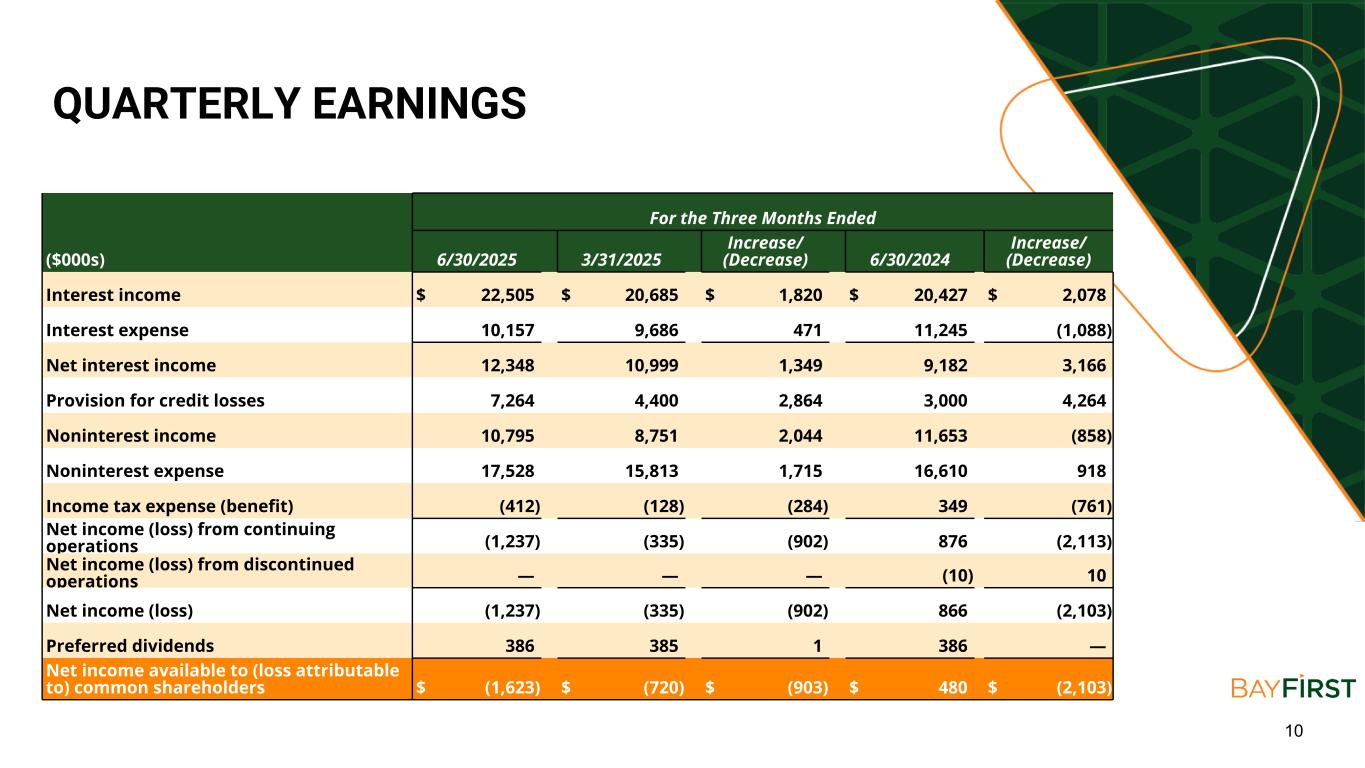

The Company had a net loss of $1.2 million for the second quarter of 2025, compared to a net loss of $0.3 million in the first quarter of 2025 and net income of $0.9 million in the second quarter of 2024. The change in the second quarter of 2025 from the preceding quarter was primarily the result of an increase in provision for credit losses of $2.9 million, a decrease in gain on sale of government guaranteed loans of $1.2 million, and an increase in noninterest expense of $1.7 million. This was partially offset by an increase in net interest income of $1.3 million and an increase in government guaranteed loan fair value gains of $3.2 million. The change from the second quarter of 2024 was due to an increase in provision for credit losses of $4.3 million and an increase in noninterest expense of $0.9 million, partially offset by an increase in net interest income of $3.2 million.

In the first six months of 2025, the Company had a net loss of $1.6 million, a decrease from net income of $1.7 million for the first six months of 2024. The decrease was primarily due to an increase in provision for credit losses of $4.6 million, a decrease in government guaranteed loan fair value gains of $4.8 million, and a decrease of government guaranteed loan packaging fees of $1.1 million. This was partially offset by an increase in net interest income of $5.4 million and a decrease in noninterest expense of $1.0 million.

Net Interest Income and Net Interest Margin

Net interest income from continuing operations was $12.3 million in the second quarter of 2025, an increase from $11.0 million during the first quarter of 2025, and an increase from $9.2 million during the second quarter of 2024. The net interest margin was 4.06% in the second quarter of 2025, an increase of 29 basis points from 3.77% in the first quarter of 2025 and an increase of 63 basis points from 3.43% in the second quarter of 2024.

The increase in net interest income from continuing operations during the second quarter of 2025, as compared to the first quarter of 2025, was mainly due to an increase in loan interest income, including fees, of $1.7 million, partially offset by an increase in interest expense from borrowings of $0.6 million.

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 3

The increase in net interest income from continuing operations during the second quarter of 2025, as compared to the year ago quarter, was mainly due to an increase in loan interest income, including fees, of $2.0 million and a decrease in interest expense on deposits of $1.2 million.

Net interest income from continuing operations was $23.3 million in the first six months of 2025, an increase from $17.9 million in the first six months of 2024. The increase was mainly due to an increase in loan interest income, including fees, of $3.6 million and a decrease in interest expense of $1.8 million.

Noninterest Income

Noninterest income from continuing operations was $10.8 million for the second quarter of 2025, which was an increase from $8.8 million in the first quarter of 2025 and a decrease from $11.7 million in the second quarter of 2024. The increase in the second quarter of 2025, as compared to the first quarter of 2025, was primarily the result of an increase in government guaranteed loan fair value gains of $3.2 million, partially offset by a decrease in gain on sale of government guaranteed loans of $1.2 million. The decrease in the second quarter of 2025, as compared to the second quarter of 2024, was the result of decreases in loan servicing income of $0.3 million, fair value gains on government guaranteed loans of $0.8 million, and government guaranteed loan packaging fees of $0.4 million, partially offset by an increase in gain on sale of government guaranteed loans of $0.5 million.

Noninterest income from continuing operations was $19.5 million for the first six months of 2025, which was a decrease from $25.9 million for the first six months of 2024. The decrease was primarily the result of a decrease in government guaranteed loan fair value gains of $4.8 million and a decrease in government guaranteed loan packaging fees of $1.1 million.

Noninterest Expense

Noninterest expense from continuing operations was $17.5 million in the second quarter of 2025 compared to $15.8 million in the first quarter of 2025 and $16.6 million in the second quarter of 2024. The increase in the second quarter of 2025, as compared to the prior quarter, was primarily due to an increase in loan origination and collection expenses of $1.5 million. The increase in the second quarter of 2025, as compared to the second quarter of 2024, was primarily due to higher loan origination and collection expenses of $0.6 million, occupancy expense of $0.3 million, and data processing expense of $0.4 million, partially offset by lower compensation expense of $0.1 million and marketing and business development expenses of $0.1 million.

Noninterest expense from continuing operations was $33.3 million for the first six months of 2025 compared to $34.4 million for the first six months of 2024. The decrease was the result of lower compensation expense of $1.6 million and professional service expense of $0.7 million, partially offset by higher occupancy and equipment expense of $0.8 million and data processing expense of $0.9 million.

Balance Sheet

Assets

Total assets increased $51.9 million, or 4.0%, during the second quarter of 2025 to $1.34 billion, mainly due to increases in loans held for investment of $41.0 million and cash and cash equivalents of $14.1 million. Compared to the end of the second quarter last year, total assets increased $126.0 million, or 10.3%, driven primarily by growth in loans held for investment of $117.5 million.

Loans

Loans held for investment increased $41.0 million, or 3.8%, during the second quarter of 2025 and $117.5 million, or 11.7%, over the past year to $1.13 billion, due to originations in both conventional community bank loans and government guaranteed loans, partially offset by government guaranteed loan sales.

Deposits

Deposits increased $35.5 million, or 3.1%, during the second quarter of 2025 and increased $121.4 million, or 11.6%, from the second quarter of 2024, ending June 30, 2025 at $1.16 billion. During the second quarter, there were increases in noninterest-bearing account balances of $3.5 million, savings and money market account balances of $25.2 million, and time deposit balances of $29.7 million, partially offset by a decrease in interest-bearing transaction account balances of $22.9 million.

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 4

At June 30, 2025, approximately 80% of total deposits were insured by the FDIC. At times, the Bank has brokered time deposit and non-maturity deposit relationships available to diversify its funding sources. At June 30, 2025, March 31, 2025, and June 30, 2024, the Company had $186.7 million, $112.3 million, and $60.1 million, respectively, of brokered deposits.

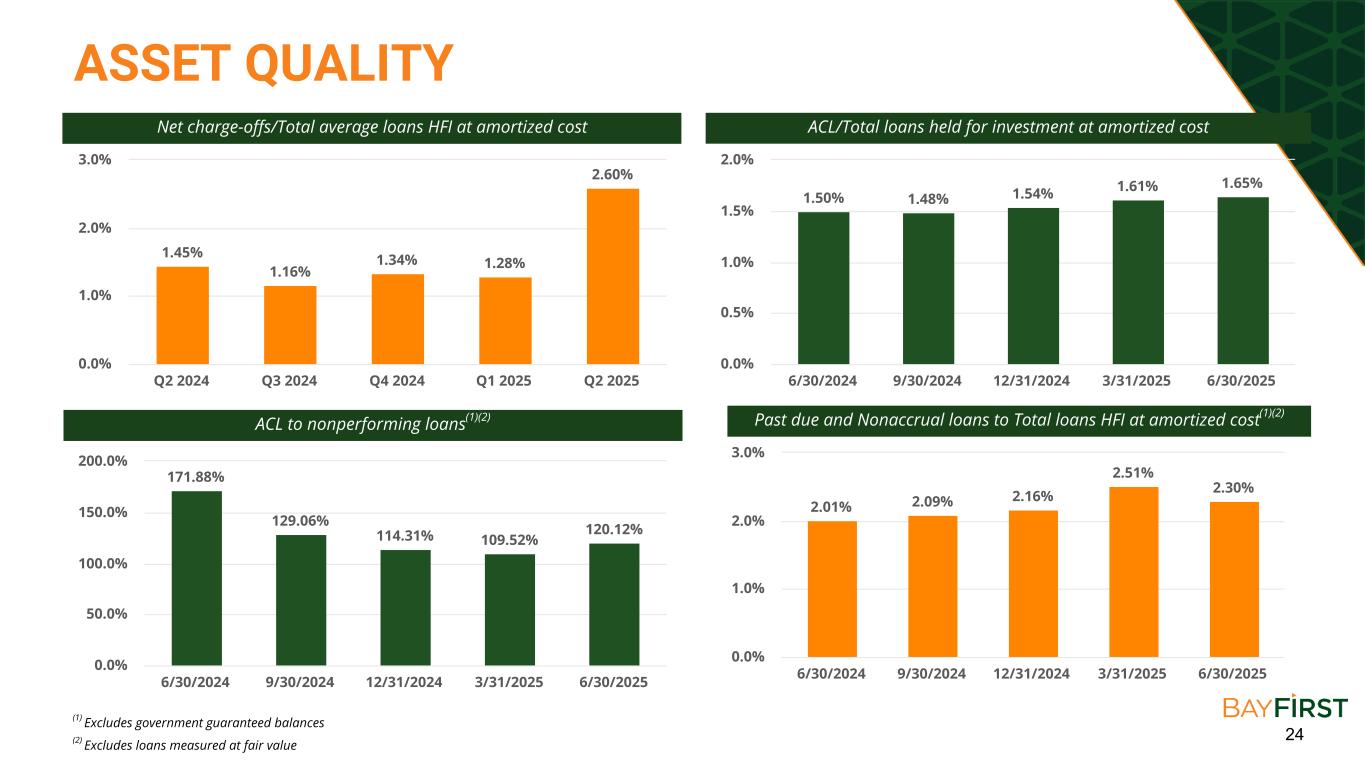

Asset Quality

The Company recorded a provision for credit losses in the second quarter of $7.3 million, compared to provisions of $4.4 million for the first quarter of 2025 and $3.0 million during the second quarter of 2024.

The ratio of ACL to total loans held for investment at amortized cost was 1.65% at June 30, 2025, 1.61% as of March 31, 2025, and 1.50% as of June 30, 2024. The ratio of ACL to total loans held for investment at amortized cost, excluding government guaranteed loan balances, was 1.85% at June 30, 2025, 1.84% as of March 31, 2025, and 1.73% as of June 30, 2024.

Net charge-offs for the second quarter of 2025 were $6.8 million, which was an increase from $3.3 million for the first quarter of 2025 and the second quarter of 2024. Annualized net charge-offs as a percentage of average loans held for investment at amortized cost were 2.60% for the second quarter of 2025, compared to 1.28% in the first quarter of 2025 and 1.45% in the second quarter of 2024. Nonperforming assets were 1.79% of total assets as of June 30, 2025, compared to 2.08% as of March 31, 2025, and 1.28% as of June 30, 2024. Nonperforming assets, excluding government guaranteed loan balances, were 1.12% of total assets as of June 30, 2025, compared to 1.22% as of March 31, 2025, and 0.82% as of June 30, 2024.

Capital

The Bank’s Tier 1 leverage ratio was 8.11% as of June 30, 2025, compared to 8.56% as of March 31, 2025, and 8.73% as of June 30, 2024. The CET 1 and Tier 1 capital ratios to risk-weighted assets were 9.98% as of June 30, 2025, compared to 10.47% as of March 31, 2025, and 10.54% as of June 30, 2024. The total capital to risk-weighted assets ratio was 11.23% as of June 30, 2025, compared to 11.73% as of March 31, 2025, and 11.79% as of June 30, 2024.

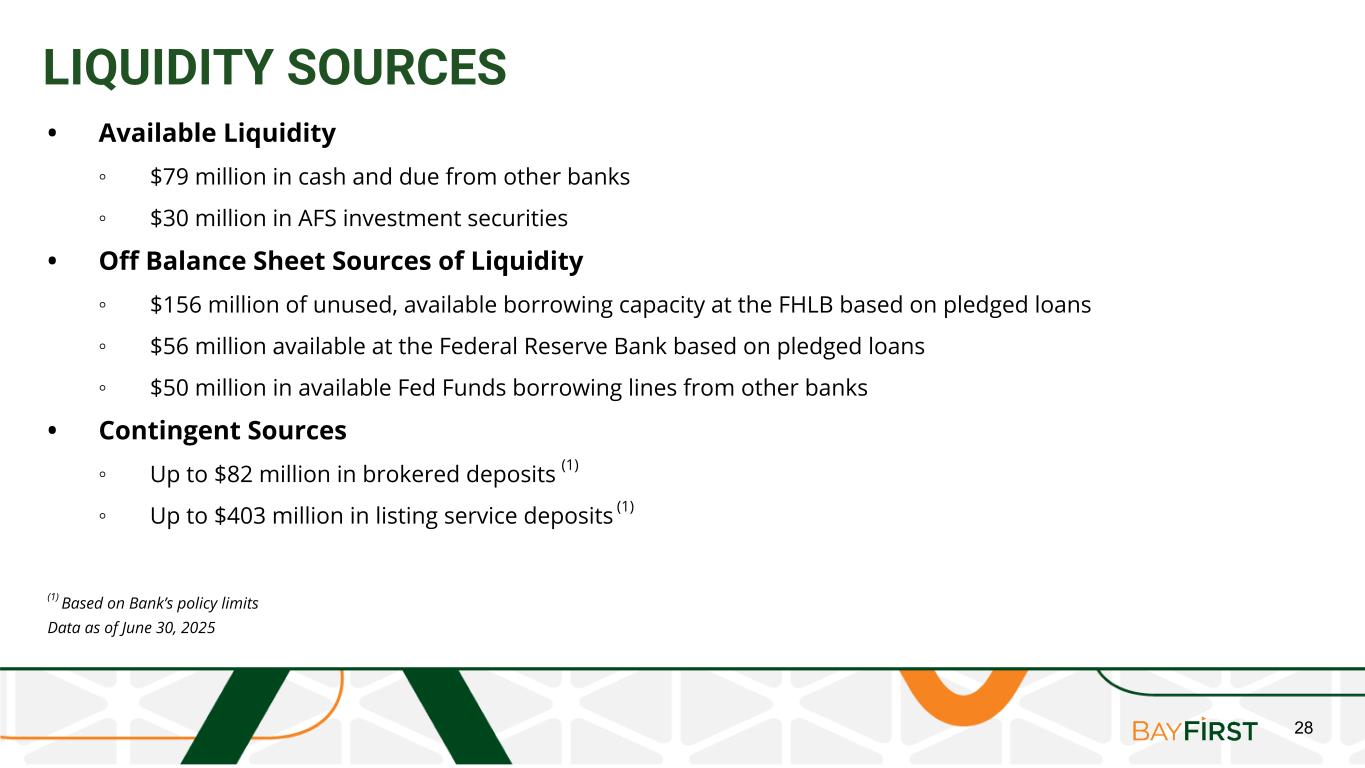

Liquidity

The Bank's overall liquidity position remains strong and stable with liquidity in excess of internal minimums as stated by policy and monitored by management and the Board. The on-balance sheet liquidity ratio at June 30, 2025 was 8.28%, as compared to 9.17% at December 31, 2024. The Bank has robust liquidity resources which include secured borrowings available from the Federal Home Loan Bank, the Federal Reserve, and lines of credit with other financial institutions. As of June 30, 2025, the Bank had $40.0 million of borrowings from the FHLB and no borrowings from the FRB or other financial institutions. This compared to $20.0 million of borrowings from the FHLB and no borrowings from the FRB or other financial institutions at March 31, 2025.

Conference Call

BayFirst will host a conference call on Wednesday, July 30, 2025, at 9:00 a.m. ET to discuss its second quarter results. Interested parties may listen to the call live under the Investor Relations tab at www.bayfirstfinancial.com or are invited to dial (800) 549-8228 to participate in the call using Conference ID 29222. A replay of the call will be available for one year at www.bayfirstfinancial.com.

About BayFirst Financial Corp.

BayFirst Financial Corp. is a registered bank holding company based in St. Petersburg, Florida which commenced operations on September 1, 2000. Its primary source of income is derived from its wholly owned subsidiary, BayFirst National Bank, a national banking association which commenced business operations on February 12, 1999. The Bank currently operates twelve full-service banking offices throughout the Tampa Bay-Sarasota region and offers a broad range of commercial and consumer banking services to businesses and individuals. The Bank was the 8th largest SBA 7(a) lender by number of units originated and 18th largest by dollar volume nationwide through the SBA's quarter ended June 30, 2025. As of June 30, 2025, BayFirst Financial Corp. had $1.34 billion in total assets.

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 5

Forward-Looking Statements

In addition to the historical information contained herein, this presentation includes "forward-looking statements" within the meaning of such term in the Private Securities Litigation Reform Act of 1995. These statements are subject to many risks and uncertainties, including, but not limited to, the effects of health crises, global military hostilities, weather events, or climate change, including their effects on the economic environment, our customers and our operations, as well as any changes to federal, state or local government laws, regulations or orders in connection with them; the ability of the Company to implement its strategy and expand its banking operations; changes in interest rates and other general economic, business and political conditions, including changes in the financial markets; changes in business plans as circumstances warrant; risks related to mergers and acquisitions; changes in benchmark interest rates used to price loans and deposits, changes in tax laws, regulations and guidance; and other risks detailed from time to time in filings made by the Company with the SEC, including, but not limited to those “Risk Factors” described in our most recent Form 10-K and Form 10-Q. Readers should note that the forward-looking statements included herein are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as "will," "propose," "may," "plan," "seek," "expect," "intend," "estimate," "anticipate," "believe," "continue," or similar terminology. Any forward-looking statements presented herein are made only as of the date of this document, and the Company does not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 6

BAYFIRST FINANCIAL CORP.

SELECTED FINANCIAL DATA (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the three months ended |

| (Dollars in thousands, except for share data) |

6/30/2025 |

|

3/31/2025 |

|

12/31/2024 |

|

9/30/2024 |

|

6/30/2024 |

| Net income (loss) |

$ |

(1,237) |

|

|

$ |

(335) |

|

|

$ |

9,776 |

|

|

$ |

1,137 |

|

|

$ |

866 |

|

| Balance sheet data: |

|

|

|

|

|

|

|

|

|

| Average loans held for investment at amortized cost |

1,047,568 |

|

|

1,027,648 |

|

|

1,003,867 |

|

|

948,528 |

|

|

902,417 |

|

| Average total assets |

1,324,455 |

|

|

1,287,618 |

|

|

1,273,296 |

|

|

1,228,040 |

|

|

1,178,501 |

|

| Average common shareholders’ equity |

95,049 |

|

|

96,053 |

|

|

87,961 |

|

|

86,381 |

|

|

84,948 |

|

| Total loans held for investment |

1,125,799 |

|

|

1,084,817 |

|

|

1,066,559 |

|

|

1,042,445 |

|

|

1,008,314 |

|

|

|

|

|

|

|

|

|

|

|

| Total loans held for investment, excl gov’t gtd loan balances |

972,942 |

|

|

943,979 |

|

|

917,075 |

|

|

885,444 |

|

|

844,659 |

|

| Allowance for credit losses |

17,041 |

|

|

16,513 |

|

|

15,512 |

|

|

14,186 |

|

|

13,843 |

|

| Total assets |

1,343,867 |

|

|

1,291,957 |

|

|

1,288,297 |

|

|

1,245,099 |

|

|

1,217,869 |

|

| Total deposits |

1,163,796 |

|

|

1,128,267 |

|

|

1,143,229 |

|

|

1,112,196 |

|

|

1,042,388 |

|

| Common shareholders’ equity |

92,172 |

|

|

94,034 |

|

|

94,869 |

|

|

86,242 |

|

|

84,911 |

|

| Share data: |

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per common share |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

2.27 |

|

|

$ |

0.18 |

|

|

$ |

0.12 |

|

| Diluted earnings (loss) per common share |

(0.39) |

|

|

(0.17) |

|

|

2.11 |

|

|

0.18 |

|

|

0.12 |

|

| Dividends per common share |

0.08 |

|

|

0.08 |

|

|

0.08 |

|

|

0.08 |

|

|

0.08 |

|

| Book value per common share |

22.30 |

|

|

22.77 |

|

|

22.95 |

|

|

20.86 |

|

|

20.54 |

|

Tangible book value per common share (1) |

22.30 |

|

|

22.77 |

|

|

22.95 |

|

|

20.86 |

|

|

20.54 |

|

| Performance and capital ratios: |

|

|

|

|

|

|

|

|

|

Return on average assets(2) |

(0.37) |

% |

|

(0.10) |

% |

|

3.07 |

% |

|

0.37 |

% |

|

0.29 |

% |

Return on average common equity(2) |

(6.83) |

% |

|

(3.00) |

% |

|

42.71 |

% |

|

3.48 |

% |

|

2.26 |

% |

Net interest margin(2) |

4.06 |

% |

|

3.77 |

% |

|

3.60 |

% |

|

3.34 |

% |

|

3.43 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset quality ratios: |

|

|

|

|

|

|

|

|

|

| Net charge-offs |

$ |

6,799 |

|

|

$ |

3,301 |

|

|

$ |

3,369 |

|

|

$ |

2,757 |

|

|

$ |

3,261 |

|

Net charge-offs/avg loans held for investment at amortized cost(2) |

2.60 |

% |

|

1.28 |

% |

|

1.34 |

% |

|

1.16 |

% |

|

1.45 |

% |

Nonperforming loans(3) |

$ |

21,665 |

|

|

$ |

24,806 |

|

|

$ |

17,607 |

|

|

$ |

15,489 |

|

|

$ |

12,312 |

|

Nonperforming loans (excluding gov't gtd balance)(3) |

$ |

14,187 |

|

|

$ |

15,078 |

|

|

$ |

13,570 |

|

|

$ |

10,992 |

|

|

$ |

8,054 |

|

Nonperforming loans/total loans held for investment(3) |

2.09 |

% |

|

2.42 |

% |

|

1.75 |

% |

|

1.62 |

% |

|

1.34 |

% |

Nonperforming loans (excl gov’t gtd balance)/total loans held for investment(3) |

1.37 |

% |

|

1.47 |

% |

|

1.35 |

% |

|

1.15 |

% |

|

0.87 |

% |

| ACL/Total loans held for investment at amortized cost |

1.65 |

% |

|

1.61 |

% |

|

1.54 |

% |

|

1.48 |

% |

|

1.50 |

% |

|

|

|

|

|

|

|

|

|

|

| ACL/Total loans held for investment at amortized cost, excl government guaranteed loans |

1.85 |

% |

|

1.84 |

% |

|

1.79 |

% |

|

1.70 |

% |

|

1.73 |

% |

| Other Data: |

|

|

|

|

|

|

|

|

|

| Full-time equivalent employees |

300 |

|

305 |

|

299 |

|

295 |

|

302 |

| Banking center offices |

12 |

|

12 |

|

12 |

|

12 |

|

12 |

|

|

|

|

|

|

|

|

|

|

(1) See section entitled "GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures" below for a reconciliation to most comparable GAAP equivalent. |

(2) Annualized |

(3) Excludes loans measured at fair value |

|

|

|

|

|

|

|

|

|

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 7

Reconciliation and Management Explanation of Non-GAAP Financial Measures

Some of the financial measures included in this report are not measures of financial condition or performance recognized by GAAP. These non-GAAP financial measures include tangible common shareholders' equity and tangible book value per common share. Our management uses these non-GAAP financial measures in its analysis of our performance, and we believe that providing this information to financial analysts and investors allows them to evaluate capital adequacy.

The following presents the calculation of the non-GAAP financial measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible Common Shareholders' Equity and Tangible Book Value Per Common Share (Unaudited) |

|

|

As of |

| (Dollars in thousands, except for share data) |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

| Total shareholders’ equity |

|

$ |

108,223 |

|

|

$ |

110,085 |

|

|

$ |

110,920 |

|

|

$ |

102,293 |

|

|

$ |

100,962 |

|

| Less: Preferred stock liquidation preference |

|

(16,051) |

|

|

(16,051) |

|

|

(16,051) |

|

|

(16,051) |

|

|

(16,051) |

|

| Total equity available to common shareholders |

|

92,172 |

|

|

94,034 |

|

|

94,869 |

|

|

86,242 |

|

|

84,911 |

|

| Less: Goodwill |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Tangible common shareholders' equity |

|

$ |

92,172 |

|

|

$ |

94,034 |

|

|

$ |

94,869 |

|

|

$ |

86,242 |

|

|

$ |

84,911 |

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

4,134,127 |

|

|

4,129,027 |

|

|

4,132,986 |

|

|

4,134,059 |

|

|

4,134,219 |

|

| Tangible book value per common share |

|

$ |

22.30 |

|

|

$ |

22.77 |

|

|

$ |

22.95 |

|

|

$ |

20.86 |

|

|

$ |

20.54 |

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 8

|

|

|

|

|

|

|

|

|

|

|

|

| BAYFIRST FINANCIAL CORP. |

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

| (Dollars in thousands) |

6/30/2025 |

3/31/2025 |

6/30/2024 |

| Assets |

|

|

|

| Cash and due from banks |

$ |

6,142 |

|

$ |

6,517 |

|

$ |

4,226 |

|

| Interest-bearing deposits in banks |

71,157 |

|

56,637 |

|

56,546 |

|

| Cash and cash equivalents |

77,299 |

|

63,154 |

|

60,772 |

|

| Time deposits in banks |

1,280 |

|

2,025 |

|

2,261 |

|

Investment securities available for sale, at fair value (amortized cost $33,410, $39,507, and $42,885 at June 30, 2025, March 31, 2025, and June 30, 2024, respectively) |

30,256 |

|

36,318 |

|

38,685 |

|

Investment securities held to maturity, at amortized cost, net of allowance for credit losses of $9, $12, and $14 (fair value: $2,369, $2,356, and $2,273 at June 30, 2025, March 31, 2025, and June 30, 2024, respectively) |

2,491 |

|

2,488 |

|

2,486 |

|

Nonmarketable equity securities |

6,551 |

|

5,480 |

|

7,132 |

|

|

|

|

|

| Government guaranteed loans held for sale |

— |

|

— |

|

— |

|

Government guaranteed loans held for investment, at fair value |

90,687 |

|

57,901 |

|

86,142 |

|

| Loans held for investment, at amortized cost |

1,035,112 |

|

1,026,916 |

|

922,172 |

|

| Allowance for credit losses on loans |

(17,041) |

|

(16,513) |

|

(13,843) |

|

| Net Loans held for investment, at amortized cost |

1,018,071 |

|

1,010,403 |

|

908,329 |

|

| Accrued interest receivable |

9,495 |

|

9,153 |

|

8,000 |

|

| Premises and equipment, net |

32,407 |

|

32,769 |

|

39,088 |

|

| Loan servicing rights |

16,074 |

|

16,460 |

|

15,770 |

|

|

|

|

|

| Right-of-use operating lease assets |

15,160 |

|

15,484 |

|

2,305 |

|

| Bank owned life insurance |

26,881 |

|

26,696 |

|

26,150 |

|

| Other real estate owned |

400 |

|

132 |

|

1,633 |

|

| Other assets |

16,815 |

|

13,494 |

|

19,080 |

|

| Assets from discontinued operations |

— |

|

— |

|

36 |

|

| Total assets |

$ |

1,343,867 |

|

$ |

1,291,957 |

|

$ |

1,217,869 |

|

| Liabilities: |

|

|

|

| Noninterest-bearing deposit accounts |

$ |

109,698 |

|

$ |

106,236 |

|

$ |

94,040 |

|

| Interest-bearing transaction accounts |

238,215 |

|

261,074 |

|

236,447 |

|

| Savings and money market deposit accounts |

493,005 |

|

467,766 |

|

420,271 |

|

| Time deposits |

322,878 |

|

293,191 |

|

291,630 |

|

| Total deposits |

1,163,796 |

|

1,128,267 |

|

1,042,388 |

|

|

|

|

|

| FHLB borrowings |

40,000 |

|

20,000 |

|

55,000 |

|

| Subordinated debentures |

5,959 |

5,957 |

5,952 |

| Notes payable |

1,707 |

|

1,820 |

|

2,162 |

|

|

|

|

|

| Accrued interest payable |

1,148 |

|

1,053 |

|

1,172 |

|

| Operating lease liabilities |

13,819 |

|

14,102 |

|

2,497 |

|

| Deferred income tax liabilities |

895 |

|

648 |

|

1,000 |

|

| Accrued expenses and other liabilities |

8,320 |

|

10,025 |

|

6,565 |

|

| Liabilities from discontinued operations |

— |

|

— |

|

171 |

|

| Total liabilities |

1,235,644 |

|

1,181,872 |

|

1,116,907 |

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 9

|

|

|

|

|

|

|

|

|

|

|

|

| BAYFIRST FINANCIAL CORP. |

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

| (Dollars in thousands) |

6/30/2025 |

3/31/2025 |

6/30/2024 |

| Shareholders’ equity: |

|

|

|

Preferred stock, Series A; no par value, 10,000 shares authorized, 6,395 shares issued and outstanding at June 30, 2025, March 31, 2025, and June 30, 2024; aggregate liquidation preference of $6,395 each period |

6,161 |

|

6,161 |

|

6,161 |

|

Preferred stock, Series B; no par value, 20,000 shares authorized, 3,210 shares issued and outstanding at June 30, 2025, March 31, 2025, and June 30, 2024; aggregate liquidation preference of $3,210 each period |

3,123 |

|

3,123 |

|

3,123 |

|

Preferred stock, Series C; no par value, 10,000 shares authorized, 6,446 shares issued and outstanding at June 30, 2025, March 31, 2025, and June 30, 2024; aggregate liquidation preference of $6,446 at June 30, 2025, March 31, 2025, and June 30, 2024 |

6,446 |

|

6,446 |

|

6,446 |

|

Common stock and additional paid-in capital; no par value, 15,000,000 shares authorized, 4,134,127, 4,129,027, and 4,134,219 shares issued and outstanding at June 30, 2025, March 31, 2025, and June 30, 2024, respectively |

54,739 |

|

54,657 |

|

54,773 |

|

| Accumulated other comprehensive loss, net |

(2,368) |

|

(2,378) |

|

(3,113) |

|

| Unearned compensation |

(1,006) |

|

(1,006) |

|

(1,081) |

|

| Retained earnings |

41,128 |

|

43,082 |

|

34,653 |

|

| Total shareholders’ equity |

108,223 |

|

110,085 |

|

100,962 |

|

| Total liabilities and shareholders’ equity |

$ |

1,343,867 |

|

$ |

1,291,957 |

|

$ |

1,217,869 |

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BAYFIRST FINANCIAL CORP. |

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

For the Quarter Ended |

|

Year-to-Date |

| (Dollars in thousands, except per share data) |

6/30/2025 |

|

3/31/2025 |

|

6/30/2024 |

|

6/30/2025 |

|

6/30/2024 |

| Interest income: |

|

|

|

|

|

|

|

|

|

| Loans, including fees |

$ |

21,459 |

|

|

$ |

19,751 |

|

|

$ |

19,414 |

|

|

$ |

41,210 |

|

|

$ |

37,642 |

|

| Interest-bearing deposits in banks and other |

1,046 |

|

|

934 |

|

|

1,013 |

|

|

1,980 |

|

|

1,972 |

|

| Total interest income |

22,505 |

|

|

20,685 |

|

|

20,427 |

|

|

43,190 |

|

|

39,614 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

| Deposits |

9,282 |

|

|

9,431 |

|

|

10,448 |

|

|

18,713 |

|

|

20,663 |

|

| Other |

875 |

|

|

255 |

|

|

797 |

|

|

1,130 |

|

|

1,027 |

|

| Total interest expense |

10,157 |

|

|

9,686 |

|

|

11,245 |

|

|

19,843 |

|

|

21,690 |

|

| Net interest income |

12,348 |

|

|

10,999 |

|

|

9,182 |

|

|

23,347 |

|

|

17,924 |

|

| Provision for credit losses |

7,264 |

|

|

4,400 |

|

|

3,000 |

|

|

11,664 |

|

|

7,058 |

|

| Net interest income after provision for credit losses |

5,084 |

|

|

6,599 |

|

|

6,182 |

|

|

11,683 |

|

|

10,866 |

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan servicing income, net |

484 |

|

|

736 |

|

|

805 |

|

|

1,220 |

|

|

1,600 |

|

| Gain on sale of government guaranteed loans, net |

6,136 |

|

|

7,327 |

|

|

5,595 |

|

|

13,463 |

|

|

13,684 |

|

| Service charges and fees |

473 |

|

|

449 |

|

|

452 |

|

|

922 |

|

|

896 |

|

| Government guaranteed loans fair value gain (loss), net |

2,442 |

|

|

(755) |

|

|

3,202 |

|

|

1,687 |

|

|

6,507 |

|

| Government guaranteed loan packaging fees |

577 |

|

|

716 |

|

|

1,022 |

|

|

1,293 |

|

|

2,429 |

|

|

|

|

|

|

|

|

|

|

|

| Other noninterest income |

683 |

|

|

278 |

|

|

577 |

|

|

961 |

|

|

805 |

|

| Total noninterest income |

10,795 |

|

|

8,751 |

|

|

11,653 |

|

|

19,546 |

|

|

25,921 |

|

| Noninterest Expense: |

|

|

|

|

|

|

|

|

|

| Salaries and benefits |

8,113 |

|

|

7,998 |

|

|

7,829 |

|

|

16,111 |

|

|

15,834 |

|

| Bonus, commissions, and incentives |

262 |

|

|

71 |

|

|

659 |

|

|

333 |

|

|

2,230 |

|

|

|

|

|

|

|

|

|

|

|

| Occupancy and equipment |

1,579 |

|

|

1,634 |

|

|

1,273 |

|

|

3,213 |

|

|

2,383 |

|

| Data processing |

2,078 |

|

|

2,045 |

|

|

1,647 |

|

|

4,123 |

|

|

3,207 |

|

| Marketing and business development |

403 |

|

|

487 |

|

|

540 |

|

|

890 |

|

|

1,128 |

|

| Professional services |

782 |

|

|

732 |

|

|

877 |

|

|

1,514 |

|

|

2,226 |

|

| Loan origination and collection |

2,558 |

|

|

1,035 |

|

|

1,958 |

|

|

3,593 |

|

|

3,677 |

|

| Employee recruiting and development |

462 |

|

|

617 |

|

|

549 |

|

|

1,079 |

|

|

1,146 |

|

| Regulatory assessments |

352 |

|

|

339 |

|

|

279 |

|

|

691 |

|

|

561 |

|

|

|

|

|

|

|

|

|

|

|

| Other noninterest expense |

939 |

|

|

855 |

|

|

999 |

|

|

1,794 |

|

|

1,991 |

|

| Total noninterest expense |

17,528 |

|

|

15,813 |

|

|

16,610 |

|

|

33,341 |

|

|

34,383 |

|

| Income (loss) before taxes from continuing operations |

(1,649) |

|

|

(463) |

|

|

1,225 |

|

|

(2,112) |

|

|

2,404 |

|

| Income tax expense (benefit) from continuing operations |

(412) |

|

|

(128) |

|

|

349 |

|

|

(540) |

|

|

645 |

|

| Net income (loss) from continuing operations |

(1,237) |

|

|

(335) |

|

|

876 |

|

|

(1,572) |

|

|

1,759 |

|

| Loss from discontinued operations before income taxes |

— |

|

|

— |

|

|

(14) |

|

|

— |

|

|

(92) |

|

| Income tax benefit from discontinued operations |

— |

|

|

— |

|

|

(4) |

|

|

— |

|

|

(23) |

|

| Net loss from discontinued operations |

— |

|

|

— |

|

|

(10) |

|

|

— |

|

|

(69) |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

(1,237) |

|

|

(335) |

|

|

866 |

|

|

(1,572) |

|

|

1,690 |

|

| Preferred dividends |

386 |

|

|

385 |

|

|

386 |

|

|

771 |

|

|

771 |

|

Net income available to (loss attributable to) common shareholders |

$ |

(1,623) |

|

|

$ |

(720) |

|

|

$ |

480 |

|

|

$ |

(2,343) |

|

|

$ |

919 |

|

|

|

|

|

|

|

|

|

|

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BAYFIRST FINANCIAL CORP. |

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

For the Quarter Ended |

|

Year-to-Date |

| (Dollars in thousands, except per share data) |

6/30/2025 |

|

3/31/2025 |

|

6/30/2024 |

|

6/30/2025 |

|

6/30/2024 |

| Basic earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

| Continuing operations |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

0.12 |

|

|

$ |

(0.57) |

|

|

$ |

0.24 |

|

| Discontinued operations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.02) |

|

| Basic earnings (loss) per common share |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

0.12 |

|

|

$ |

(0.57) |

|

|

$ |

0.22 |

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

| Continuing operations |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

0.12 |

|

|

$ |

(0.57) |

|

|

$ |

0.24 |

|

| Discontinued operations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.02) |

|

| Diluted earnings (loss) per common share |

$ |

(0.39) |

|

|

$ |

(0.17) |

|

|

$ |

0.12 |

|

|

$ |

(0.57) |

|

|

$ |

0.22 |

|

BayFirst Financial Corp. Reports Second Quarter 2025 Results

July 29, 2025

Page 12

Loan Composition

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

6/30/2025 |

|

3/31/2025 |

|

12/31/2024 |

|

9/30/2024 |

|

6/30/2024 |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

Real estate: |

|

|

|

|

|

|

|

|

|

Residential |

$ |

356,559 |

|

|

$ |

339,886 |

|

|

$ |

330,870 |

|

|

$ |

321,740 |

|

|

$ |

304,234 |

|

Commercial |

292,923 |

|

|

296,351 |

|

|

305,721 |

|

|

292,026 |

|

|

288,185 |

|

Construction and land |

53,187 |

|

|

46,740 |

|

|

32,914 |

|

|

33,784 |

|

|

35,759 |

|

Commercial and industrial |

223,239 |

|

|

234,384 |

|

|

226,522 |

|

|

200,212 |

|

|

192,140 |

|

Commercial and industrial - PPP |

191 |

|

|

457 |

|

|

941 |

|

|

1,656 |

|

|

2,324 |

|

Consumer and other |

93,333 |

|

|

93,889 |

|

|

93,826 |

|

|

92,546 |

|

|

85,789 |

|

Loans held for investment, at amortized cost, gross |

1,019,432 |

|

|

1,011,707 |

|

|

990,794 |

|

|

941,964 |

|

|

908,431 |

|

Deferred loan costs, net |

21,118 |

|

|

20,521 |

|

|

19,499 |

|

|

18,060 |

|

|

17,299 |

|

Discount on government guaranteed loans |

(8,780) |

|

|

(8,727) |

|

|

(8,306) |

|

|

(7,880) |

|

|

(7,731) |

|

Premium on loans purchased, net |

3,342 |

|

|

3,415 |

|

|

3,739 |

|

|

3,860 |

|

|

4,173 |

|

Loans held for investment, at amortized cost, net |

1,035,112 |

|

|

1,026,916 |

|

|

1,005,726 |

|

|

956,004 |

|

|

922,172 |

|

| Government guaranteed loans held for investment, at fair value |

90,687 |

|

|

57,901 |

|

|

60,833 |

|

|

86,441 |

|

|

86,142 |

|

Total loans held for investment, net |

$ |

1,125,799 |

|

|

$ |

1,084,817 |

|

|

$ |

1,066,559 |

|

|

$ |

1,042,445 |

|

|

$ |

1,008,314 |

|

Nonperforming Assets (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands) |

6/30/2025 |

|

3/31/2025 |

|

12/31/2024 |

|

9/30/2024 |

|

6/30/2024 |

Nonperforming loans (government guaranteed balances), at amortized cost, gross |

$ |

7,478 |

|

|

$ |

9,728 |

|

|

$ |

4,037 |

|

|

$ |

4,497 |

|

|

$ |

4,258 |

|

Nonperforming loans (unguaranteed balances), at amortized cost, gross |

14,187 |

|

|

15,078 |

|

|

13,570 |

|

|

10,992 |

|

|

8,054 |

|

Total nonperforming loans, at amortized cost, gross |

21,665 |

|

|

24,806 |

|

|

17,607 |

|

|

15,489 |

|

|

12,312 |

|

Nonperforming loans (government guaranteed balances), at fair value |

502 |

|

|

507 |

|

|

— |

|

|

24 |

|

|

341 |

|

Nonperforming loans (unguaranteed balances), at fair value |

1,430 |

|

|

1,419 |

|

|

1,490 |

|

|

1,535 |

|

|

1,284 |

|

Total nonperforming loans, at fair value |

1,932 |

|

|

1,926 |

|

|

1,490 |

|

|

1,559 |

|

|

1,625 |

|

OREO |

400 |

|

|

132 |

|

|

132 |

|

|

— |

|

|

1,633 |

|

| Repossessed assets |

— |

|

|

36 |

|

|

36 |

|

|

94 |

|

|

— |

|

Total nonperforming assets, gross |

$ |

23,997 |

|

|

$ |

26,900 |

|

|

$ |

19,265 |

|

|

$ |

17,142 |

|

|

$ |

15,570 |

|

Nonperforming loans as a percentage of total loans held for investment(1) |

2.09 |

% |

|

2.42 |

% |

|

1.75 |

% |

|

1.62 |

% |

|

1.34 |

% |

Nonperforming loans (excluding government guaranteed balances) to total loans held for investment(1) |

1.37 |

% |

|

1.47 |

% |

|

1.35 |

% |

|

1.15 |

% |

|

0.87 |

% |

Nonperforming assets as a percentage of total assets |

1.79 |

% |

|

2.08 |

% |

|

1.50 |

% |

|

1.38 |

% |

|

1.28 |

% |

Nonperforming assets (excluding government guaranteed balances) to total assets |

1.12 |

% |

|

1.22 |

% |

|

1.06 |

% |

|

0.88 |

% |

|

0.82 |

% |

ACL to nonperforming loans(1) |

78.66 |

% |

|

66.57 |

% |

|

88.10 |

% |

|

91.59 |

% |

|

112.44 |

% |

ACL to nonperforming loans (excluding government guaranteed balances)(1) |

120.12 |

% |

|

109.52 |

% |

|

114.31 |

% |

|

129.06 |

% |

|

171.88 |

% |

(1) Excludes loans measured at fair value

Note: Transmitted on Globe Newswire on July 29, 2025, at 4:00 p.m. ET.