UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 4, 2025

PINEAPPLE FINANCIAL INC.

(Exact name of registrant as specified in charter)

| Canada | 001-41738 | Not applicable | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

Unit 200, 111 Gordon Baker Road

North York, Ontario M2H 3R1

(Address of principal executive offices) (Zip Code)

(416) 669-2046

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares, no par value | PAPL | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth ☒

If an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Subscription Receipt Agreement

As previously disclosed, on September 2, 2025, Pineapple Financial Inc. (the “Company”) entered into a securities purchase agreement (the “Securities Purchase Agreement”) with certain accredited investors (the “Purchasers”) pursuant to which the Company agreed to sell and issue to the Purchasers in a private placement offering (the “Private Placement”) subscription receipts (the “Subscription Receipts”) of the Company at an offering price of $3.80 per Subscription Receipt, with respect to certain purchasers, $4.16 per Subscription Receipt. Purchasers tendered, at the election of each Purchaser, U.S. dollars or INJ tokens to the Company as consideration for the Subscription Receipts (the aggregate amount paid in such INJ and United States Dollars, the “Subscription Amount”).

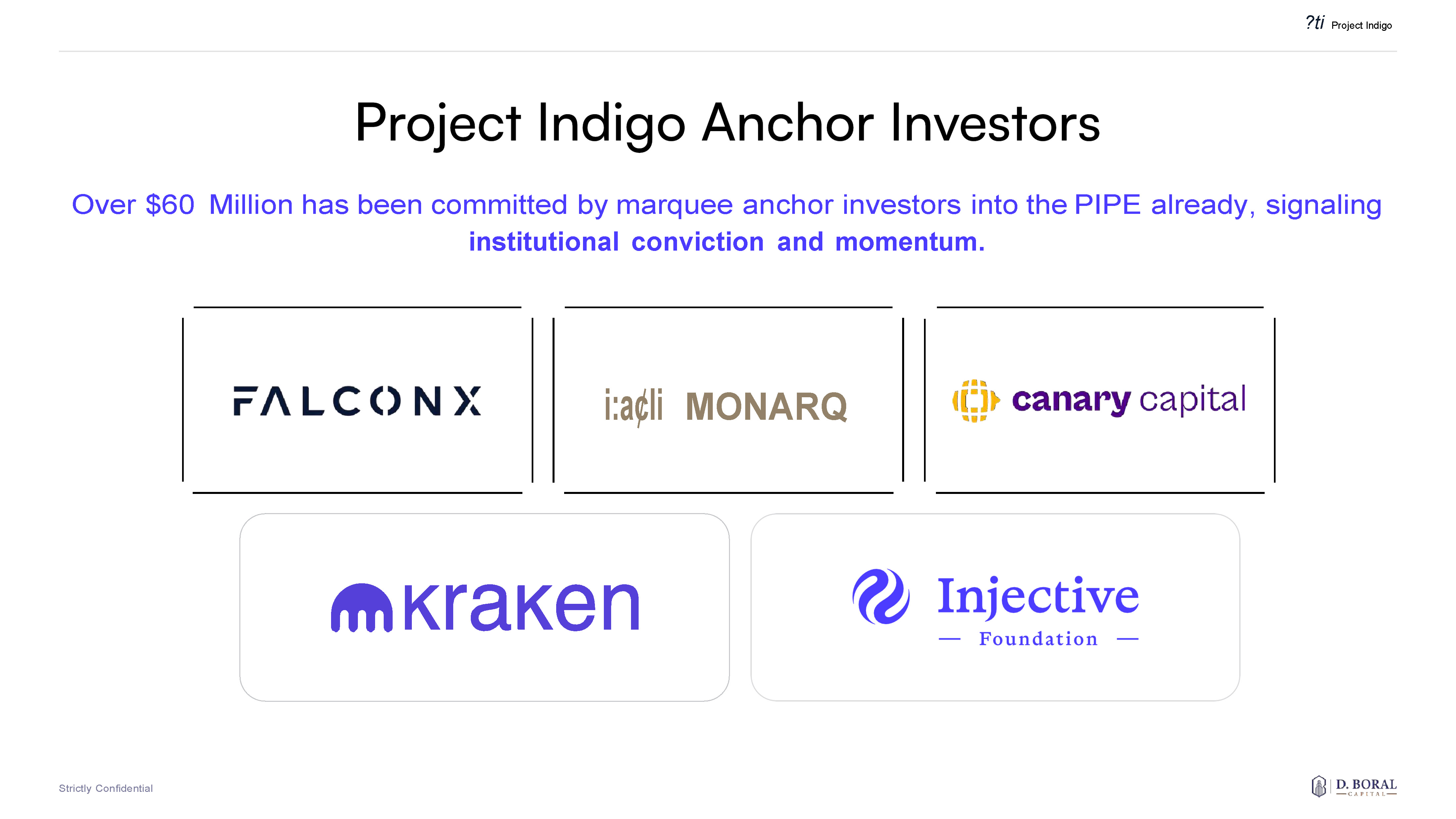

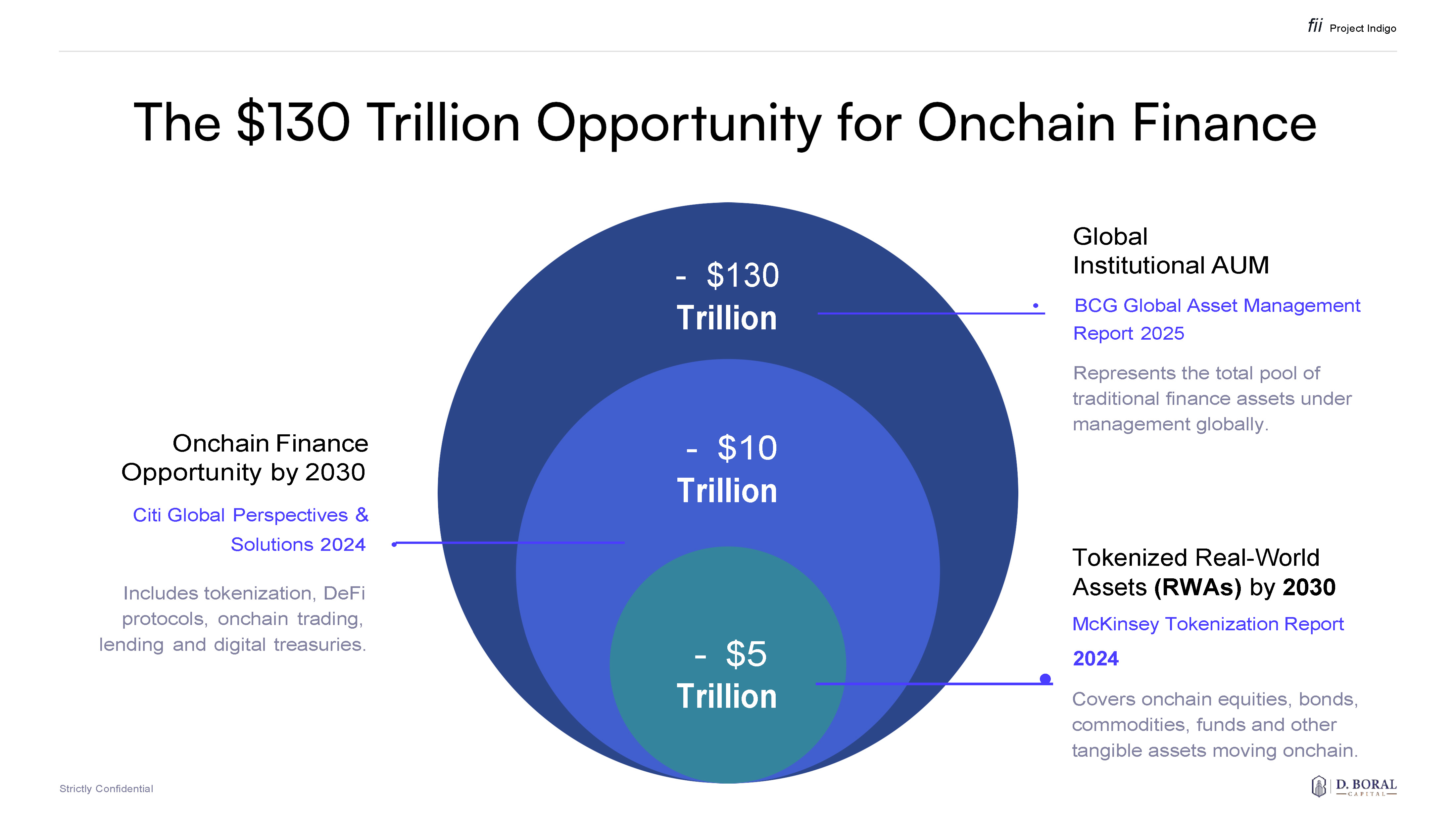

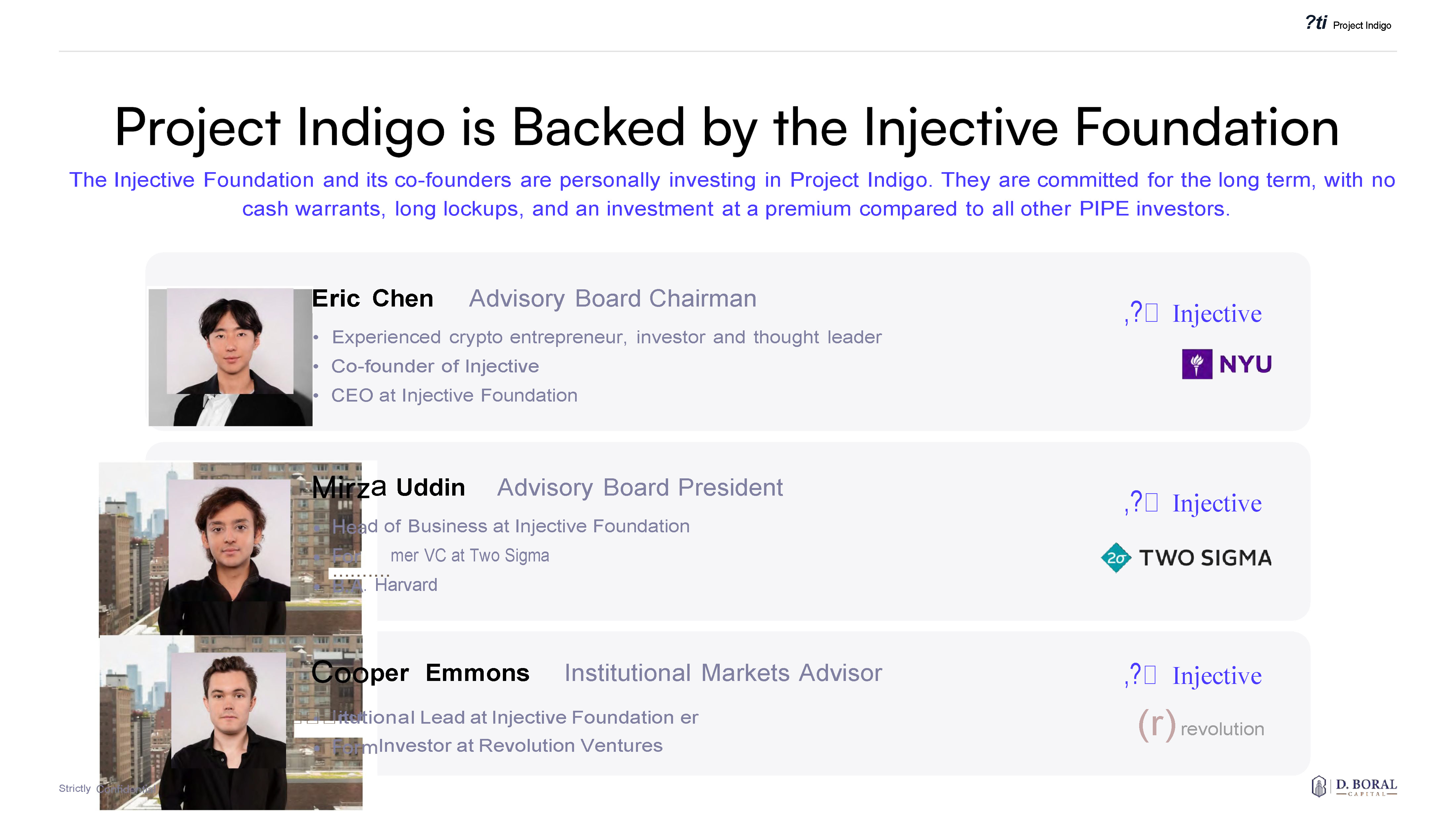

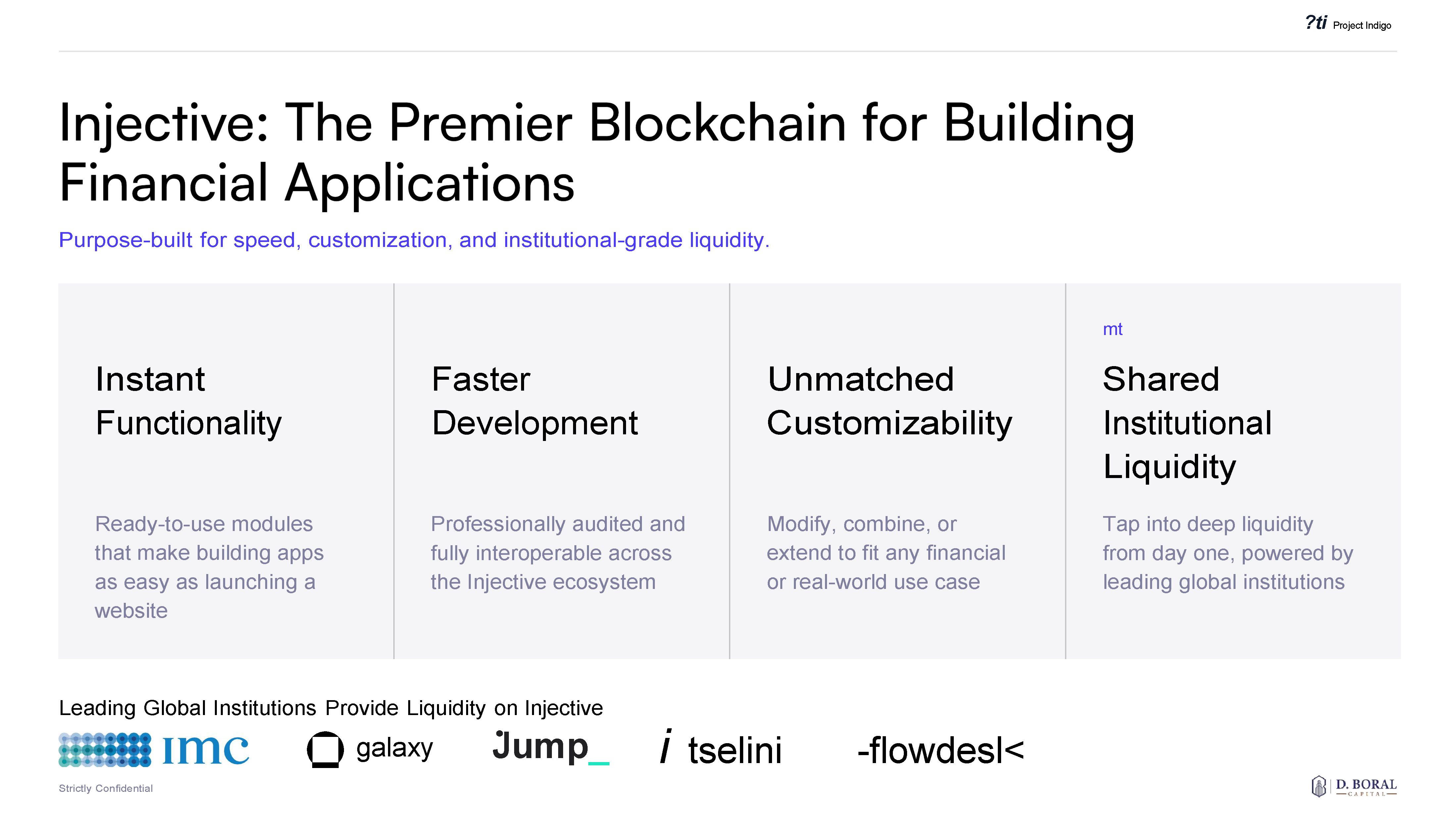

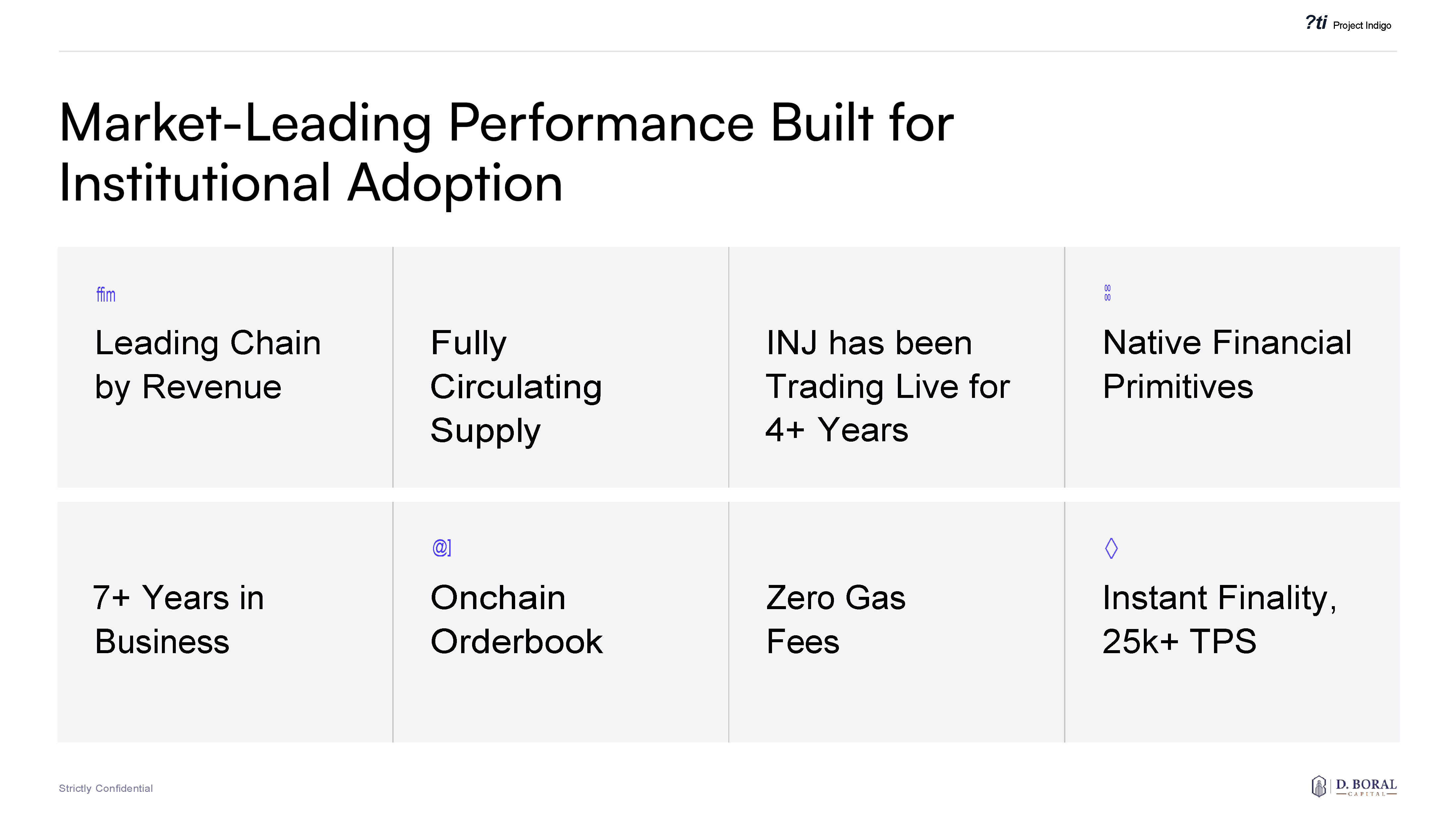

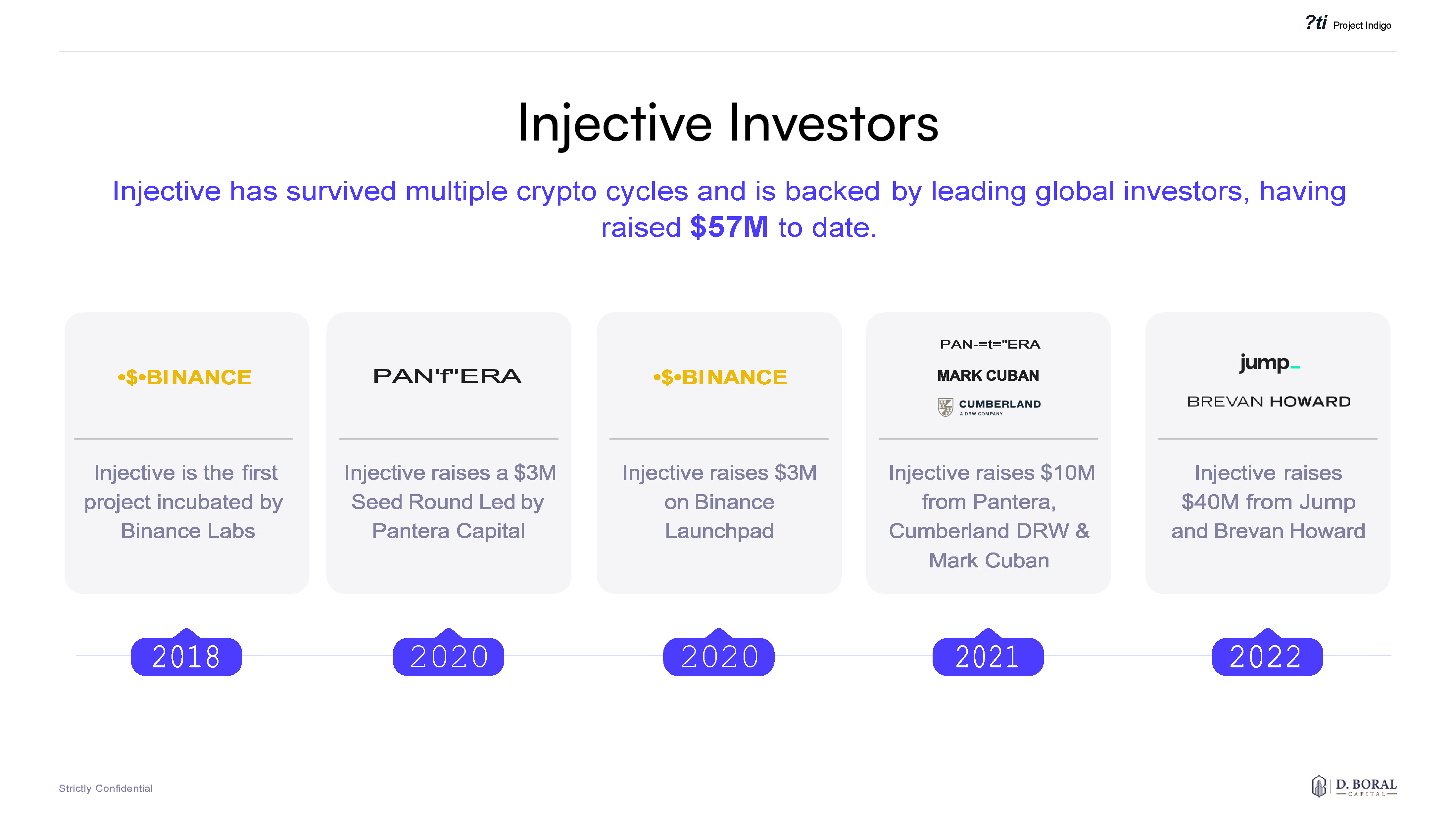

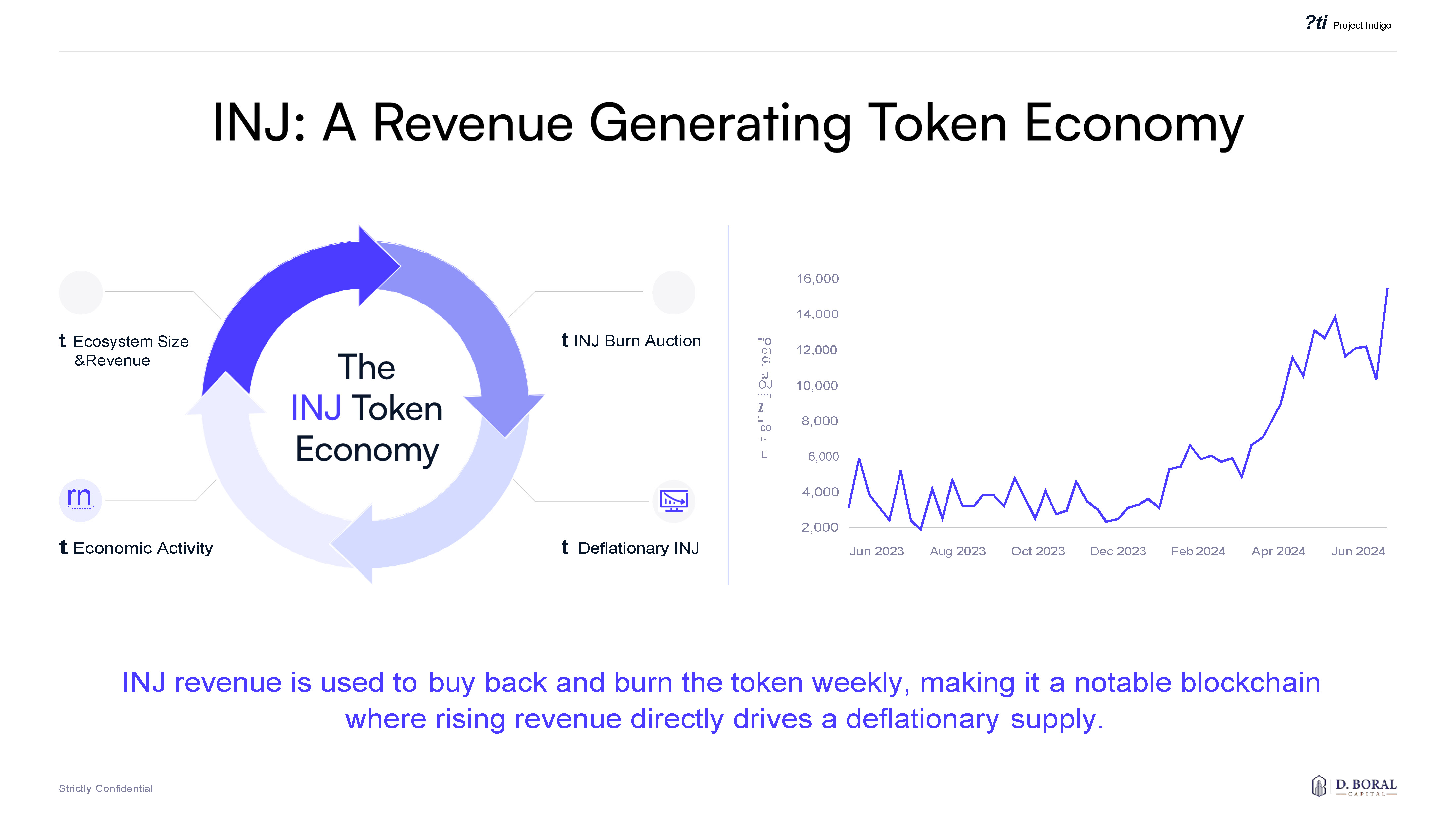

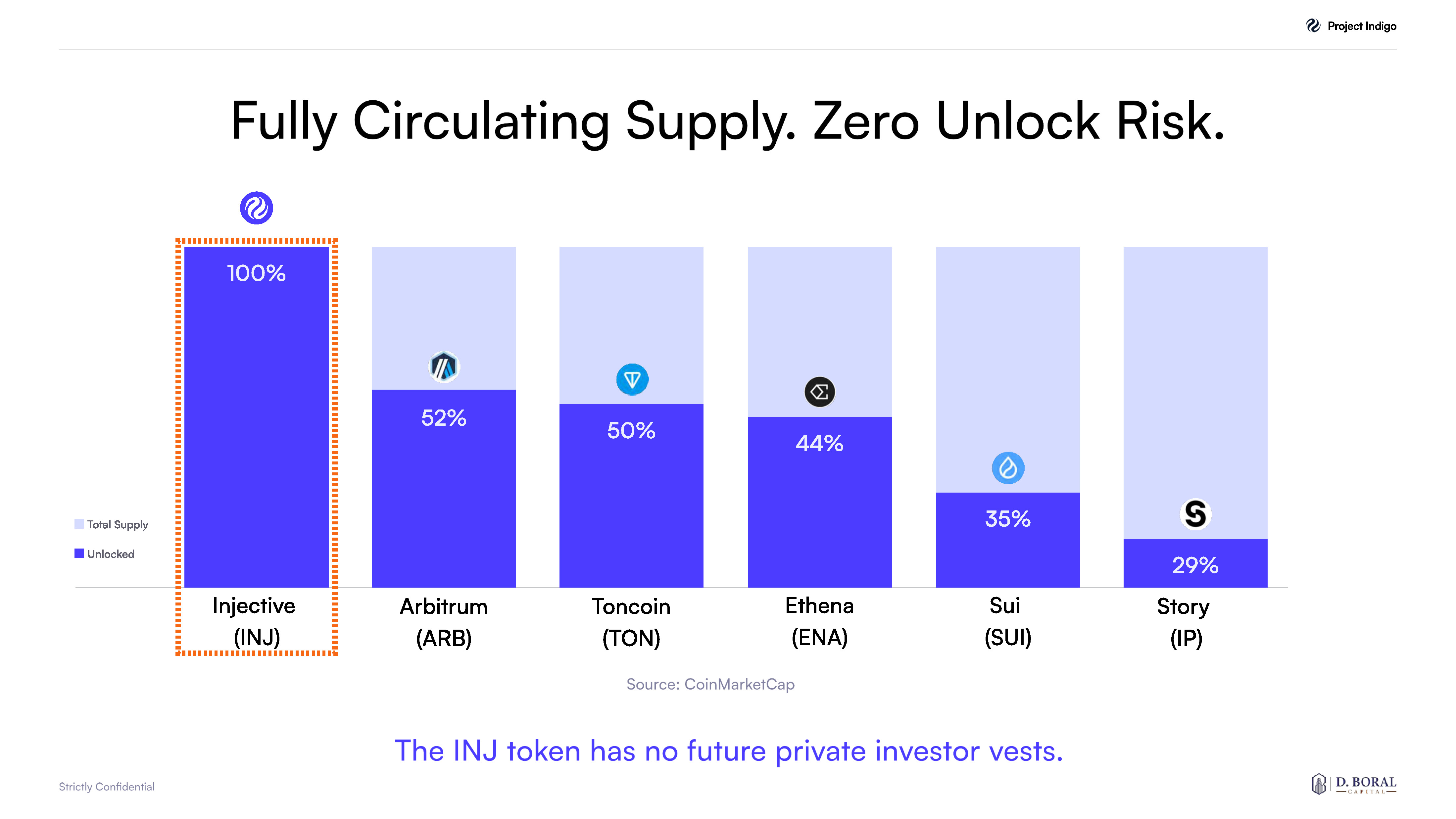

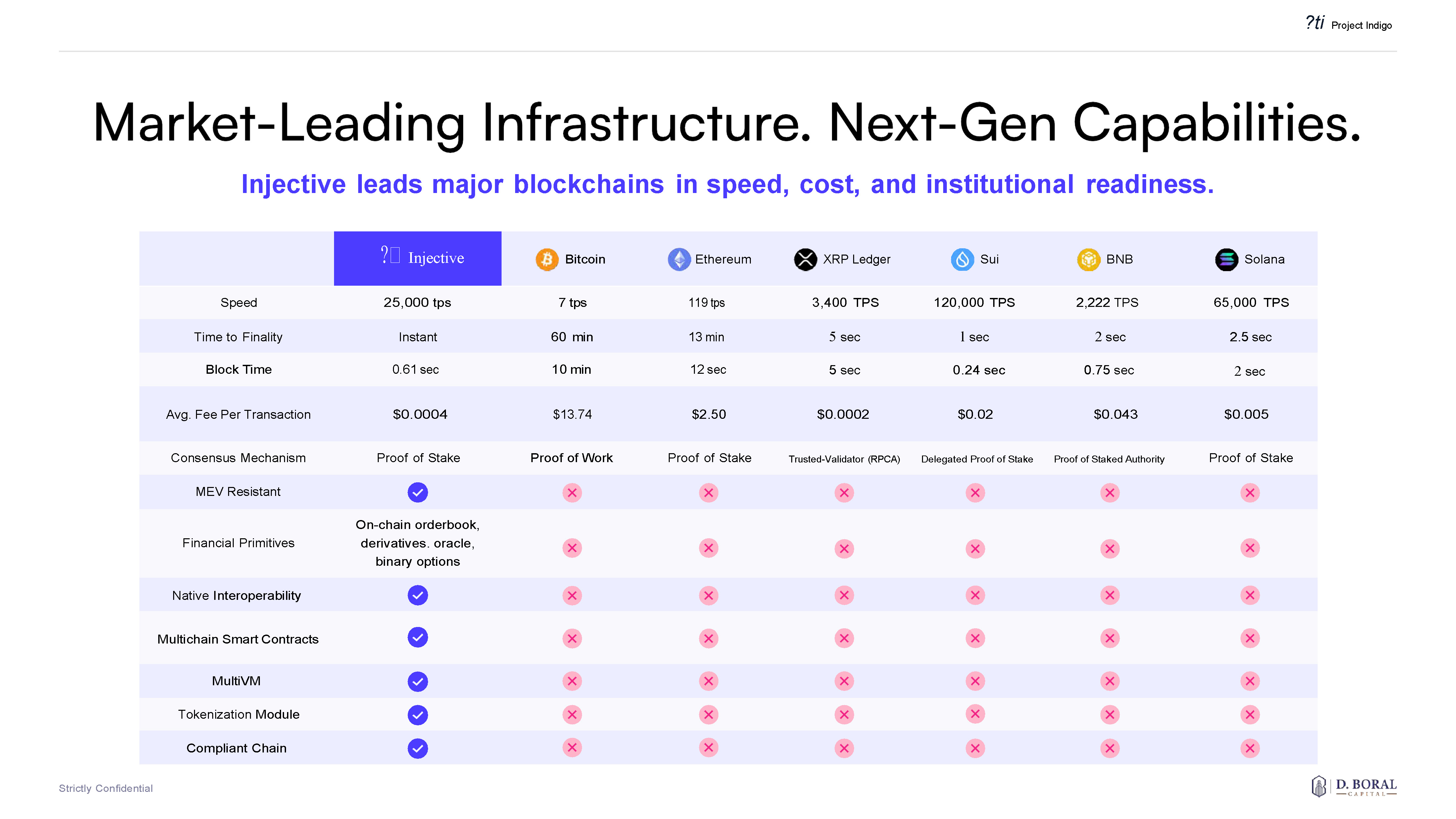

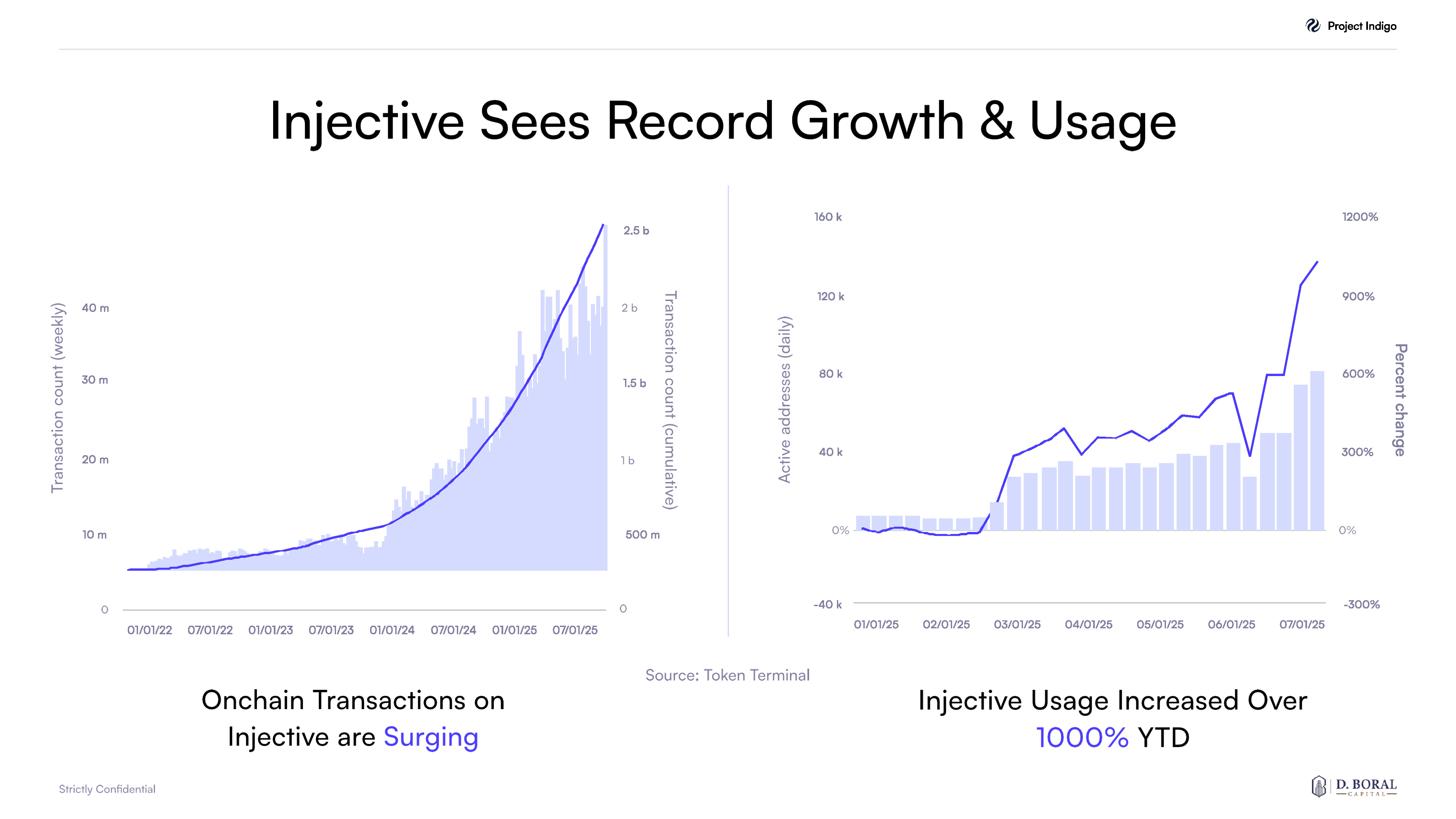

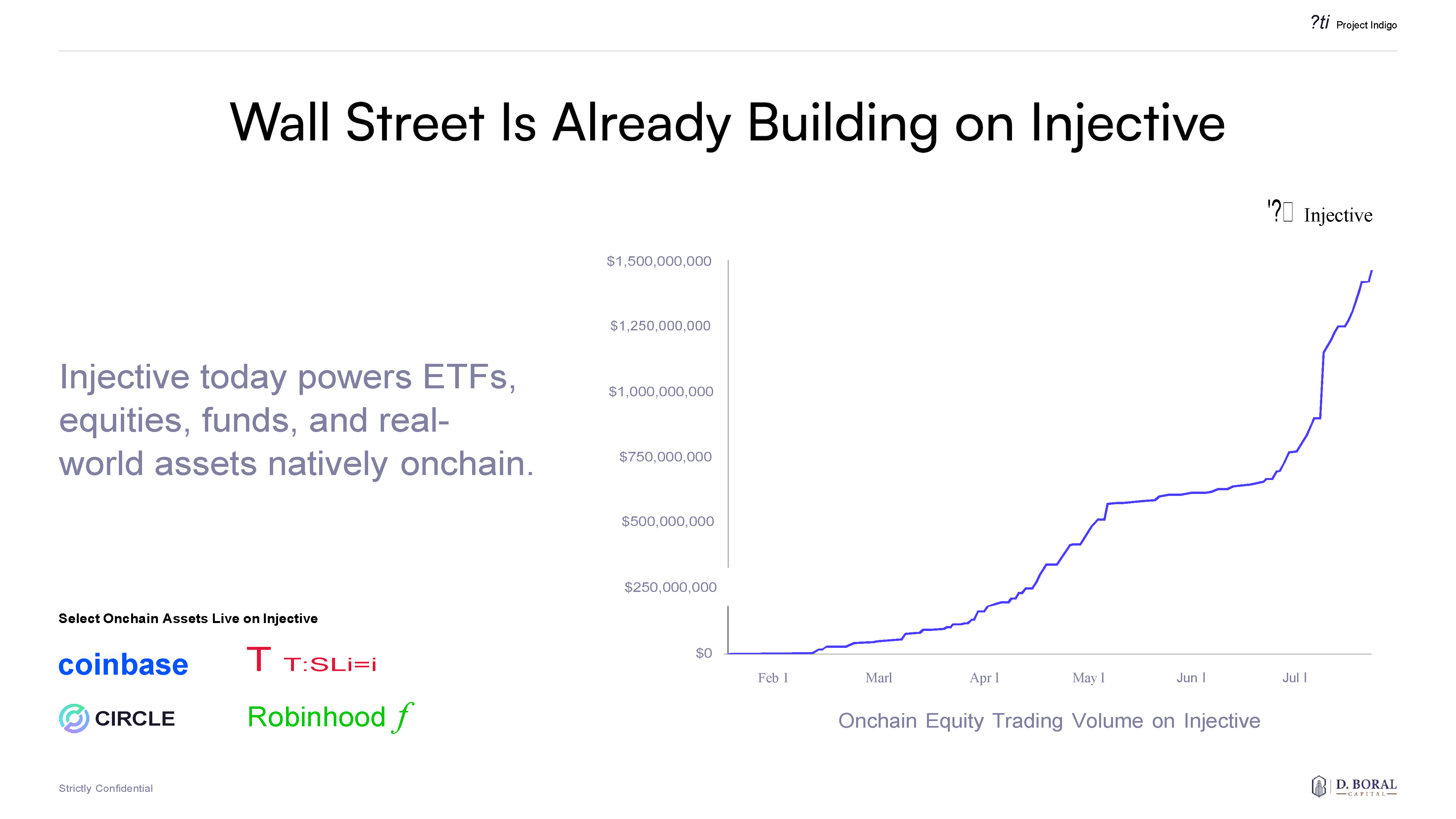

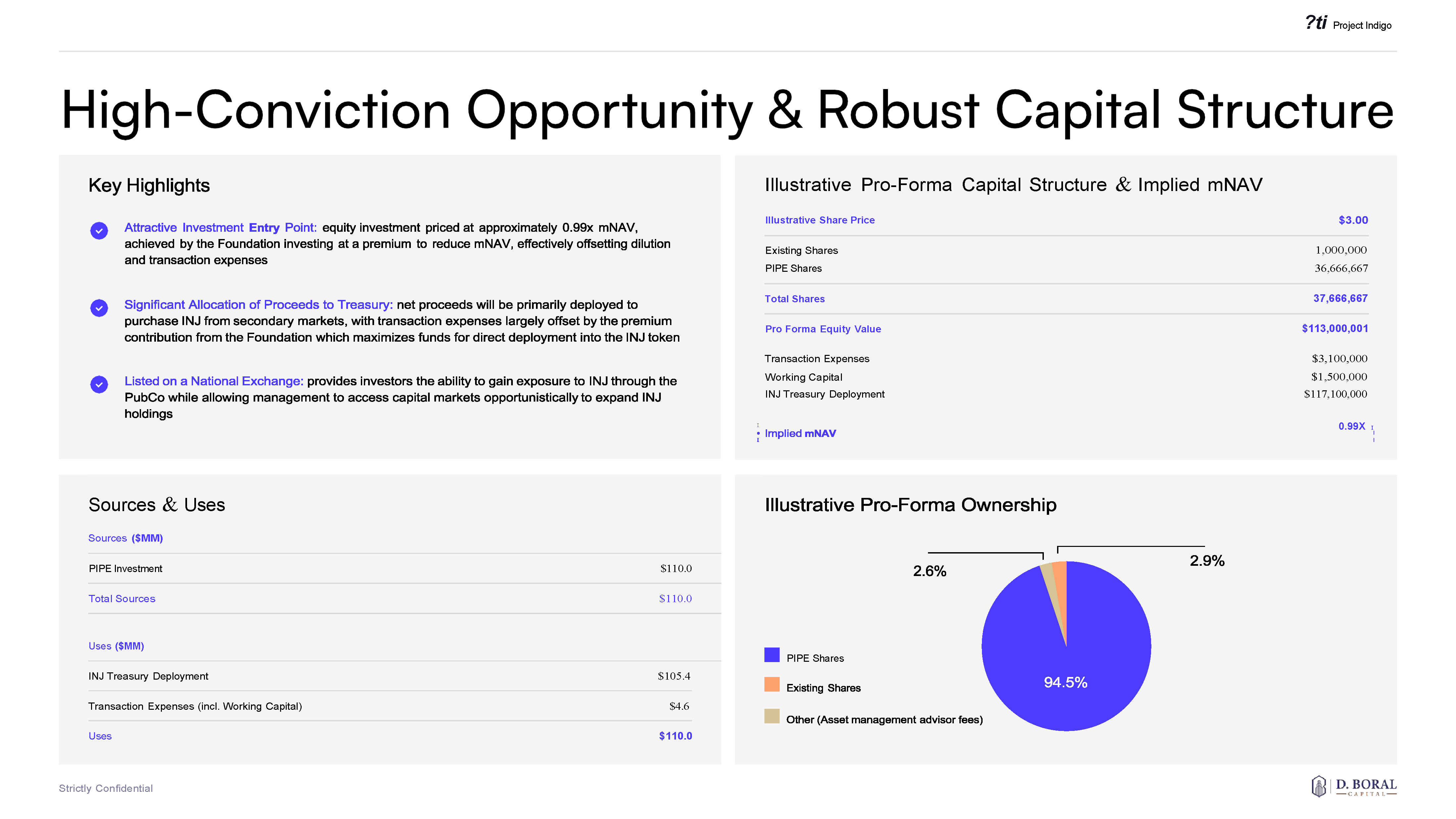

The Company raised proceeds of approximately $100 million in the Private Placement in order to adopt a digital asset treasury strategy under which the principal holding will be INJ, the native digital asset of the Injective blockchain (the “Treasury Strategy”).

The Subscription Receipts are governed by the terms of that certain subscription receipt agreement, dated September 4, 2025 (the “Subscription Receipt Agreement”), by and among the Company, Odyssey Transfer and Trust Company (the “Subscription Receipt Agent”) and D. Boral Capital LLC, the exclusive placement agent to the Company (the “Placement Agent”) entered into in connection with the closing of the Private Placement. Each Subscription Receipt is exchangeable for one common share, no par value of the Company (the “Common Share”) upon meeting certain Escrow Release Conditions (as defined below).

The issuance of the Common Shares to the holders of Subscription Receipts is subject to the satisfaction or waiver of certain escrow release conditions as set forth below (the “Escrow Release Conditions”):

a) the receipt of the Shareholder Approval (as defined below) by the Company; b) the Registration Statement (as defined below) being declared effective by the Commission within sixty (60) days from the closing date of the Securities Purchase Agreement, subject to one or more extensions pursuant to the Securities Purchase Agreement (the “Escrow Deadline”); c) the receipt of required approvals by the applicable stock exchange, third parties, court and regulatory approvals required by the Company; d) the approval of the Common Shares for listing on NYSE American and the completion, satisfaction or waiver by NYSE American of all conditions precedent to such listing; e) the Company shall not be in breach or default of any of its covenants or obligations under the Subscription Receipt Agreement or the agency agreement between the Company and the Placement Agent; f) from the date of the Securities Purchase Agreement until the earlier of (i) the Escrow Deadline, or (ii) such date on which all of conditions listed as items (a) through (f) above have been satisfied or waived, trading in the common shares shall not have been suspended by the Commission or the Company’s principal trading market, and trading in securities generally as reported by Bloomberg L.P. shall not have been suspended or limited, and minimum prices shall not have been established on securities whose trades are reported by such service or any trading market; and g) the Company and the Placement Agent, in compliance with the Side Letter (as defined below), shall have delivered a certain escrow release notice to the Subscription Receipt Agent in accordance with the Securities Purchase Agreement, confirming that items (a) through (g), above, inclusive, have been satisfied or waived.

Pursuant to the Securities Purchase Agreement, the Company shall call a meeting of its shareholders to approve (i) the issuance of the Common Shares to be delivered to the holders of Subscription Receipts, and (ii) the amendment to the constating documents of the Company to remove the restriction on transfers of the Common Shares contained in the Articles of Continuance of the Company (the “Shareholder Approval”). The Company shall, within 30 days following execution of the Securities Purchase Agreement, prepare and file a preliminary proxy statement with the U.S. Securities and Exchange Commission (the “Commission”) relating to the shareholders’ consideration and vote with respect to the Shareholder Approval.

Within five (5) business days of receiving Shareholder Approval, the Company shall file a registration statement on Form S-1 (the “Registration Statement”) with the Commission to permit the resale of the Common Shares. Pursuant to the Securities Purchase Agreement, and subject to the satisfaction or waiver of the other Escrow Release Conditions described therein, the Common Shares will not be issued until Shareholder Approval is received and the Registration Statement has been declared effective.

Upon satisfaction or waiver of the Escrow Release Conditions, (i) an aggregate of $2,100,000 shall be released to the Company by the Subscription Receipt Agent for legacy business expenses, working capital, general corporate purposes and for the payment of amounts owed by the Company, (ii) the balance of the aggregate Subscription Amount paid in cash shall be released directly to the Asset Manager and Advisor (each, as defined below) in furtherance of the Company’s Injective digital asset treasury strategy, and (iii) the Subscription Receipt Agent shall direct the INJ Escrow Agent (as defined below) to (A) deem that title to the aggregate Subscription Amount paid in the form of INJ, in addition to any staking rewards or other income earned thereon, be transferred to the Company and managed by the Asset Manager and the Advisor for the benefit of the Company.

In connection with the Private Placement, the Company has appointed Canary Capital Group LLC (in such capacity, the “INJ Escrow Agent”) to serve as escrow agent with respect to proceeds tendered in the form of INJ, until such proceeds are to be released pursuant to the Subscription Receipt Agreement to the Asset Manager and the Advisor upon satisfaction or waiver of the Escrow Release Conditions.

The Subscription Receipts are being offered in reliance upon the exemption from the registration requirement of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof and/or Rule 506(b) of Regulation D promulgated thereunder, and applicable state securities laws. The issuance of the Common Shares has not been registered under the Securities Act, and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

First Amendment to Securities Purchase Agreement

On September 4, 2025, the Company and the Purchasers of at least 50.1% in interest of the Subscription Receipts, entered into an amendment to the Securities Purchase Agreement (the “SPA Amendment”). Pursuant to the SPA Amendment, the parties agreed to amend the Securities Purchase Agreement in order to (i) provide that the Company shall, subject to the approval of the Compensation Committee of the Board of Directors of the Company, enter into management agreements prior to the Escrow Deadline with certain of its officers on terms substantially consistent with those set forth in the SPA Amendment, (ii) provide for payment of certain service provider expenses at the time of closing the Private Placement, and (iii) make certain corrections to figures and calculations referenced in the closing and use of proceeds provisions of the Securities Purchase Agreement.

The Company will use the net proceeds of the Private Placement to launch a dedicated Injective digital asset treasury strategy and purchase INJ in connection therewith.

Registration Rights Agreement

In connection with entering into the Securities Purchase Agreement, on September 2, 2025, the Company and the Purchasers entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which the Company agreed to file a registration statement with the Commission, within five (5) business days of receiving Stockholder Approval, registering the resale of the Common Shares issuable upon the exchange of the Subscription Receipts, the Meteora Warrants (as defined below) and the Common Shares issuable upon the exercise of the Meteora Warrants (the “Meteora Warrant Shares”).

Asset Management Agreement

Pursuant to the Securities Purchase Agreement, on September 4, 2025, the Company entered into an Asset Management Agreement (the “Asset Management Agreement”) with Canary Capital Group LLC (the “Asset Manager”). Under the Asset Management Agreement, the Asset Manager has been appointed to provide certain asset management services with respect to cryptocurrency assets acquired by the Company in connection with the Private Placement (the “Account Assets”) maintained with one or more custodians or cryptocurrency wallet providers acceptable to the Asset Manager. Such asset management services will commence when the Subscription Receipt Agent has (i) notified the INJ Escrow Agent that all Escrow Release Conditions have been satisfied or waived and (ii) has instructed the INJ Escrow Agent to deem that title to the INJ proceeds of the Private Placement be transferred to the Company, with such assets to be managed by the Asset Manager and the Advisor.

As consideration for the Asset Manager’s services, the Company will pay an asset-based fee equal to 1% per annum of the Account Assets, which shall be calculated and paid at the end of each quarter, as determined by the Asset Manager in a commercially reasonable manner based on available prices on Coinmarketcap.com. The Asset Management Agreement continues in effect until terminated for cause by the Company upon thirty (30) days’ prior written notice or terminated for cause by the Asset Manager upon thirty (60) days’ prior written notice. The Agreement contains customary representations, indemnification provisions, confidentiality obligations, and a non-exclusivity clause.

Trading Advisory Agreement

On September 4, 2025, the Company entered into a Trading Advisory Agreement (the “Trading Advisory Agreement”) with Monarq Asset Management LLC (the “Advisor”). Under the Trading Advisory Agreement, the Company appoints the Advisor to manage the investment of all digital assets, digital asset derivatives, cash and other assets contained in the Account (as defined in the Trading Advisory Agreement) established by the Company with Bitgo Trust Company, Inc. The Trading Advisory Agreement continues in effect until the earlier of: (i) termination by either party for upon the occurrence of a material breach that is not cured within fifteen days of notice from the non-breaching party, or (ii) the third anniversary of the Trading Advisory Agreement, provided that the Trading Advisory Agreement will be automatically renewed for successive one-year periods unless either party provides written notice of its intention not to renew at least thirty days prior to the expiration of such term.

The services of the Advisor under the Trading Advisory Agreement will commence when the Subscription Receipt Agent has (i) notified the INJ Escrow Agent that all Escrow Release Conditions have been satisfied or waived and (ii) has instructed the INJ Escrow Agent to deem that title to the INJ proceeds of the Private Placement be transferred to the Company, with such assets to be managed by the Asset Manager and the Advisor.

As consideration for the Advisor’s services, the Company will pay to the Advisor a quarterly management fee equal to 0.25% (a 1.0% annual rate) of the Account Equity (as defined in the Trading Advisory Agreement) as of the beginning of each calendar quarter regardless of whether there are realized or unrealized profits with respect to the account.

Placement Agency Agreement

In connection with the Private Placement, the Company entered into that certain Placement Agency Agreement with D. Boral Capital LLC, dated as of September 4, 2025 (the “Placement Agency Agreement”), appointing D. Boral Capital LLC as the exclusive Placement Agent in connection with the Private Placement and providing for a cash fee to D. Boral Capital LLC of $750,000.

Voting Agreement

Pursuant to the Securities Purchase Agreement, the Company has entered into a voting agreement, dated as of September 4, 2025 (the “Voting Agreement”), by and among the Company, Injective Foundation and each member of the Company’s board of directors (such members, collectively, the “Shareholders”). Pursuant to the Voting Agreement, the Shareholders have irrevocably committed to vote their Common Shares and any subsequently acquired Common Shares (the “Subject Shares”) in favor of the matters constituting the Shareholder Approval. The Shareholders additionally agreed to restrictions on the transfer of such Subject Shares and agreed not to take any action, including the exercise of rights of appraisal or rights of dissent, that might reasonably interfere with or delay the transactions contemplated by Securities Purchase Agreement.

Lock-up Agreement

Pursuant to the Securities Purchase Agreement, the Company entered into that certain Lock-up Agreement, dated as of September 4, 2025 (the “Lock-up Agreement”) with certain purchasers participating in the Private Placement. Under the Lock-up Agreement, such purchasers have agreed not to offer, sell, pledge or otherwise dispose of any Common Shares or securities convertible, exercisable or exchangeable into Common Shares (collectively, “Securities”), of the Company for a period of twelve (12) months following the Effective Date (as defined in the Securities Purchase Agreement), provided that, if at any time following the Effective Date, the closing sale price of the Common Shares equals or exceeds (i) $7.588, (ii) $11.382, (iii) $15.176, or (iv) $18.970, then in each case 25% of the Securities held by such purchasers shall be immediately and irrevocably released from the restrictions set forth in the Lock-up Agreement.

Side Letter Agreement

Pursuant to the Securities Purchase Agreement, the Company entered into that certain letter agreement, dated as of September 4, 2025 (the “Side Letter”), with the Placement Agent and Injective Foundation (the “Investor”). The Side Letter provides that, prior to the Escrow Release Notice (as defined in the Securities Purchase Agreement) being sent to the Subscription Receipt Agent, on the day when all of the Escrow Release Conditions (other than the requirement to deliver the Escrow Release Notice) have been waived or satisfied, the Company and the Placement Agent shall provide the Investor with notice, that in their reasonable determination, the Escrow Release Conditions have been met, including supporting documentation of such determination (such notice, the “Pre-release Notice”). The Investor shall be entitled to review the Pre-Release Notice and provide any comments within 24 hours of the receipt thereof, which comments shall be reasonably considered by the Company and the Placement Agent prior to the delivery of the Escrow Release Notice to the Subscription Receipt Agent.

The foregoing summaries of the Securities Purchase Agreement, the Registration Rights Agreement, the SPA Amendment, the Subscription Receipt Agreement, the Asset Management Agreement, the Trading Advisory Agreement, the ELOC Purchase Agreement, the Placement Agency Agreement, the Voting Agreement, the Lock-up Agreement and the Side Letter do not purport to be complete and are qualified in their entirety by reference to the complete text of those agreements, which are attached hereto as Exhibits 10.1 through 10.11 to this Current Report on Form 8-K and are hereby incorporated by reference herein.

Common Stock Purchase Agreement

On September 4, 2025, the Company entered into a Common Stock Purchase Agreement (the “ELOC Purchase Agreement”) with White Lion Capital, LLC (“White Lion”), whereby the Company has the right, but not the obligation, to sell to White Lion, and White Lion is obligated to purchase, up to an aggregate of $250,000,000 (the “Commitment Amount”) Common Shares.

The Company does not have a right to commence any sales of Common Shares to the Purchaser under the ELOC Purchase Agreement until all conditions to the Company’s right to commence sales, as set forth in the ELOC Purchase Agreement, have been satisfied, including that a registration statement covering the resale of such shares is declared effective by the SEC. The Company will control the timing and amount of any sales of Common Shares to White Lion during the period beginning with the effectiveness of such registration statement and ending on the earlier of (i) the date on which White Lion shall have purchased Common Shares pursuant to the ELOC Purchase Agreement for an aggregate purchase price equal to the Commitment Amount or (ii) twenty four (24) months following the Effective date of the ELOC Purchase Agreement (the “Commitment Period”), subject to the conditions of the ELOC Purchase Agreement. Actual sales of Common Shares to White Lion under the ELOC Purchase Agreement will depend on a variety of factors to be determined by the Company from time to time, including, among others, market conditions, the Beneficial Owner Limitation (as defined below) of White Lion, and other determinations made by the Company as to appropriate levels and sources of funding.

The purchase price of the Common Shares that the Company elects to sell to White Lion pursuant to the ELOC Purchase Agreement will be determined based on the type of Purchase Notice issued, as follows:

● Rapid Purchase Price Option 1: The lowest traded price of the Common Shares on the notice date.

● Rapid Purchase Option 2: ninety nine percent (99%) multiplied by the lowest traded price of the Common Stock two hours following the written confirmation of the acceptance of the Rapid Purchase Notice by White Lion.

● Regular Purchase Price: (i) ninety-seven percent (97%) multiplied by the lowest daily VWAP of the Common Shares during the Regular Purchase Valuation Period if the Purchase Notice was delivered prior to $20,000,000 in Investment Amount and (ii) ninety-seven and a half percent (97.5 %) multiplied by the lowest daily VWAP of the Common Shares during the Regular Purchase Valuation Period if the Purchase Notice was delivered following $20,000,000 in Investment Amount.

The ELOC Purchase Agreement prohibits the Company from directing White Lion to purchase any Common Shares if those shares, when aggregated with all other Common Shares then beneficially owned by White Lion (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended), would result in White Lion beneficially owning more than 4.99% of the outstanding Common Shares (the “Beneficial Ownership Limitation”), which may be increased to 9.99% at White Lion’s discretion upon 61 days’ prior written notice.

In consideration for White Lion’s execution and delivery of, and agreement to perform under the ELOC Purchase Agreement, the Company shall send to White Lion a number of Injective Tokens (INJ) equal to $1,500,000 divided by the lowest trade price of the token seen on Coinbase three (3) hours prior to delivery of the token (the “Commitment Fee”). The Company shall deliver the tokens within 24 hours of signing the binding term sheet dated on September 1, 2025 to a designated address provided by White Lion. The Company shall timely deliver all Commitment Fee owed, failure to timely do so will result in liquidated damages of $1,500,000, being immediately due and payable to White Lion at its election in the form of cash payment.

Concurrently with the ELOC Purchase Agreement, the Company and White Lion entered into the Registration Rights Agreement.

This Current Report shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption from the registration requirements, and certificates evidencing such shares, if any, will contain a legend stating the same.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure required by this Item is included in Item 1.01 of this Current Report on Form 8-K and is incorporated herein by reference. Based in part upon the representations of the Purchasers in the Securities Purchase Agreement, the offering and sale of the Common Shares, the Meteora Warrants, and the Meteora Warrant Shares, were exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended.

In connection with the Private Placement, the Company has also agreed to issue warrants to Meteora Capital, LLC, a consultant of the Company (the “Meteora Warrants”) equal to 4.0% of the total shares outstanding on a pro forma basis after giving effect to the transactions contemplated by the Securities Purchase Agreement, exerciseable into 1,045,654 Common Shares. The Meteora Warrants shall have a term of five (5) years and each Meteora Warrant will be exercisable for the purchase of one Common Share of the Company at an exercise price payable in cash of $3.80.

Item 7.01. Regulation FD Disclosure.

Press Release on Announcing the Offering

On September 2, 2025, the Company issued a press release announcing the signing of the Securities Purchase Agreements, pricing of the Private Placement and estimated aggregate gross proceeds of approximately $100 million in cash and INJ tokens, before deducting Placement Agent fees and other offering expenses, to implement an Injective treasury strategy. A copy of the press release is included as Exhibit 99.1 here and is incorporated herein by reference.

On September 5, 2025, the Company issued a press release announcing the closing of the Private Placement. A copy of the press release is included as Exhibit 99.2 here and is incorporated herein by reference.

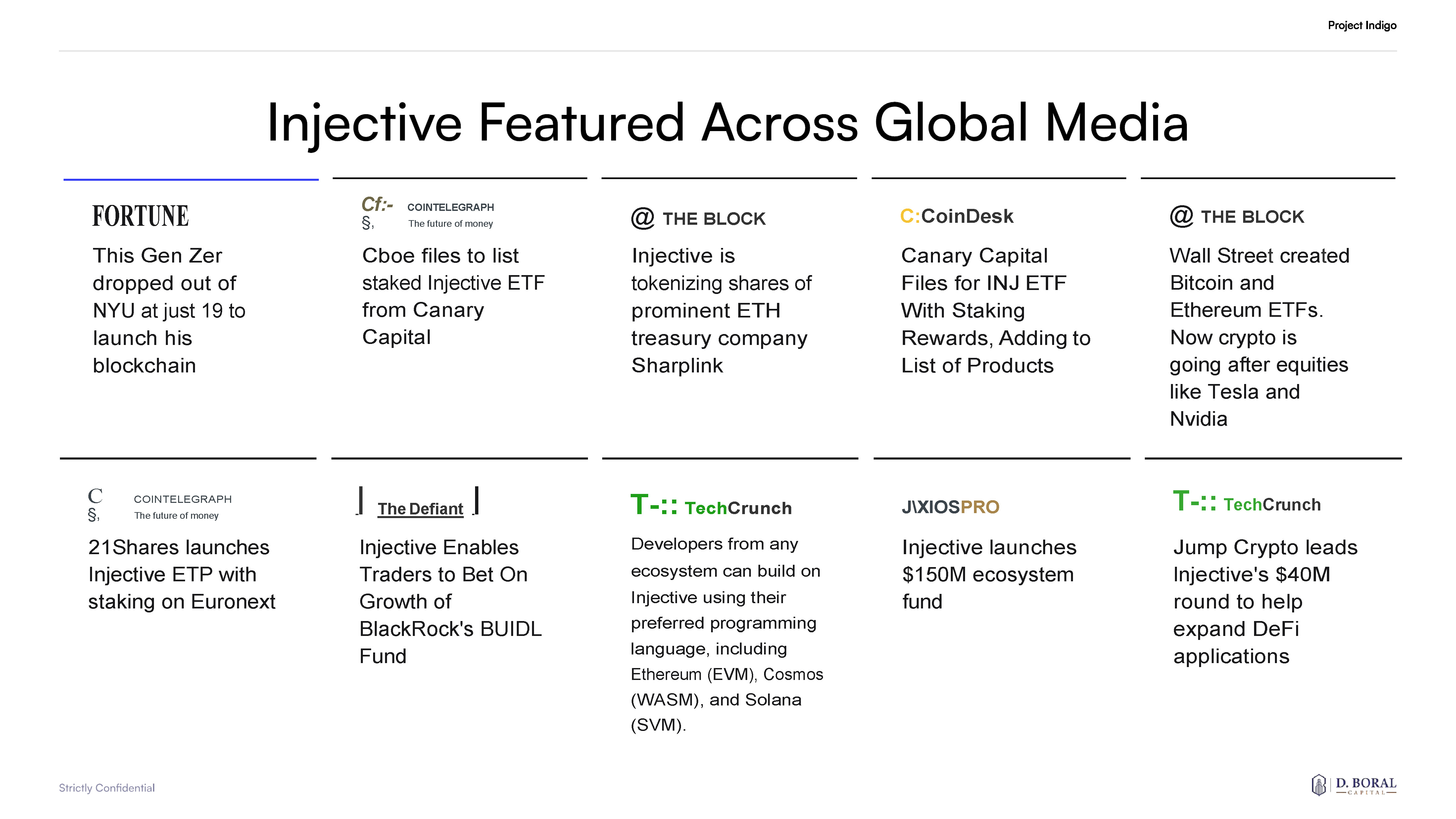

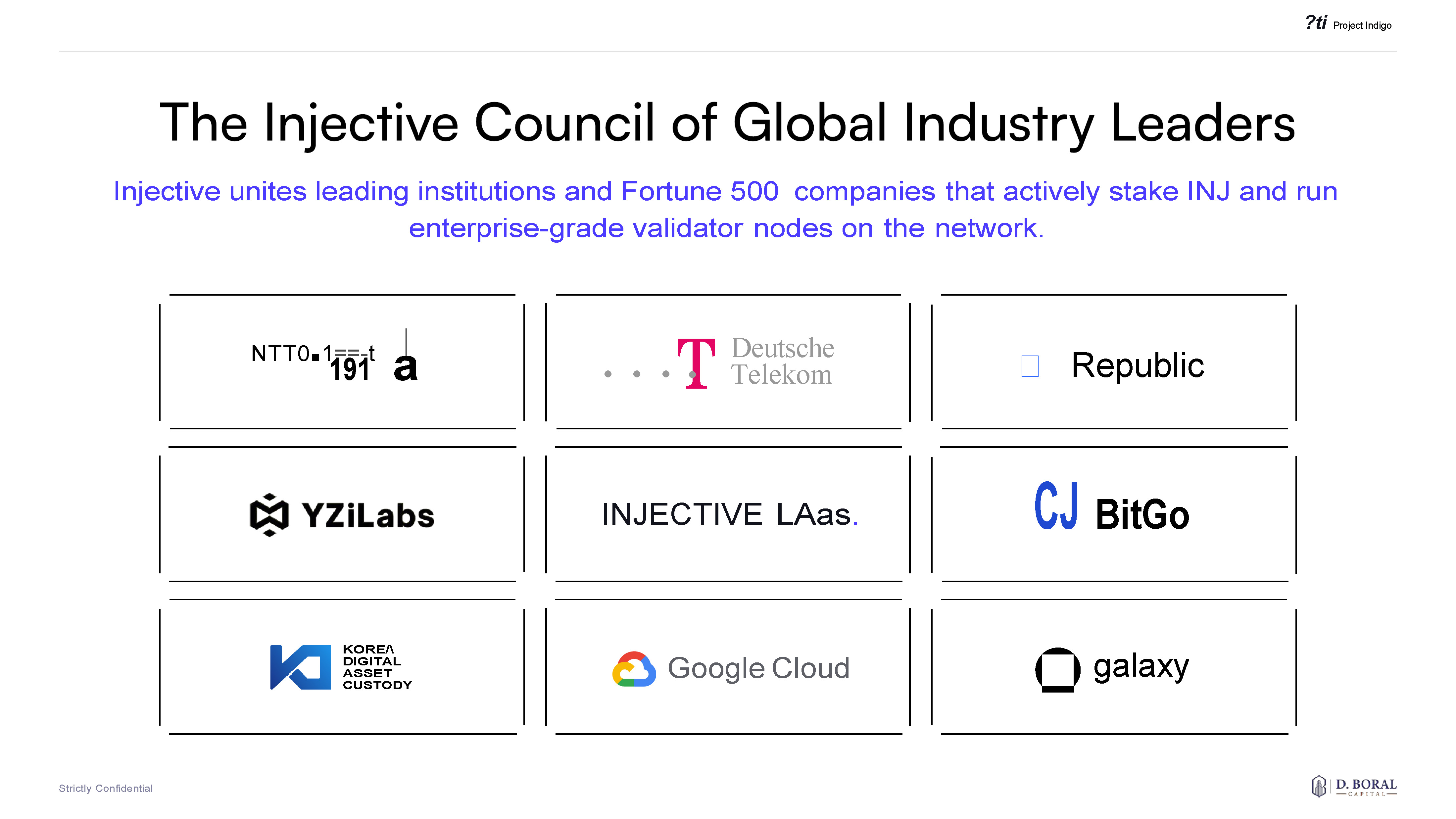

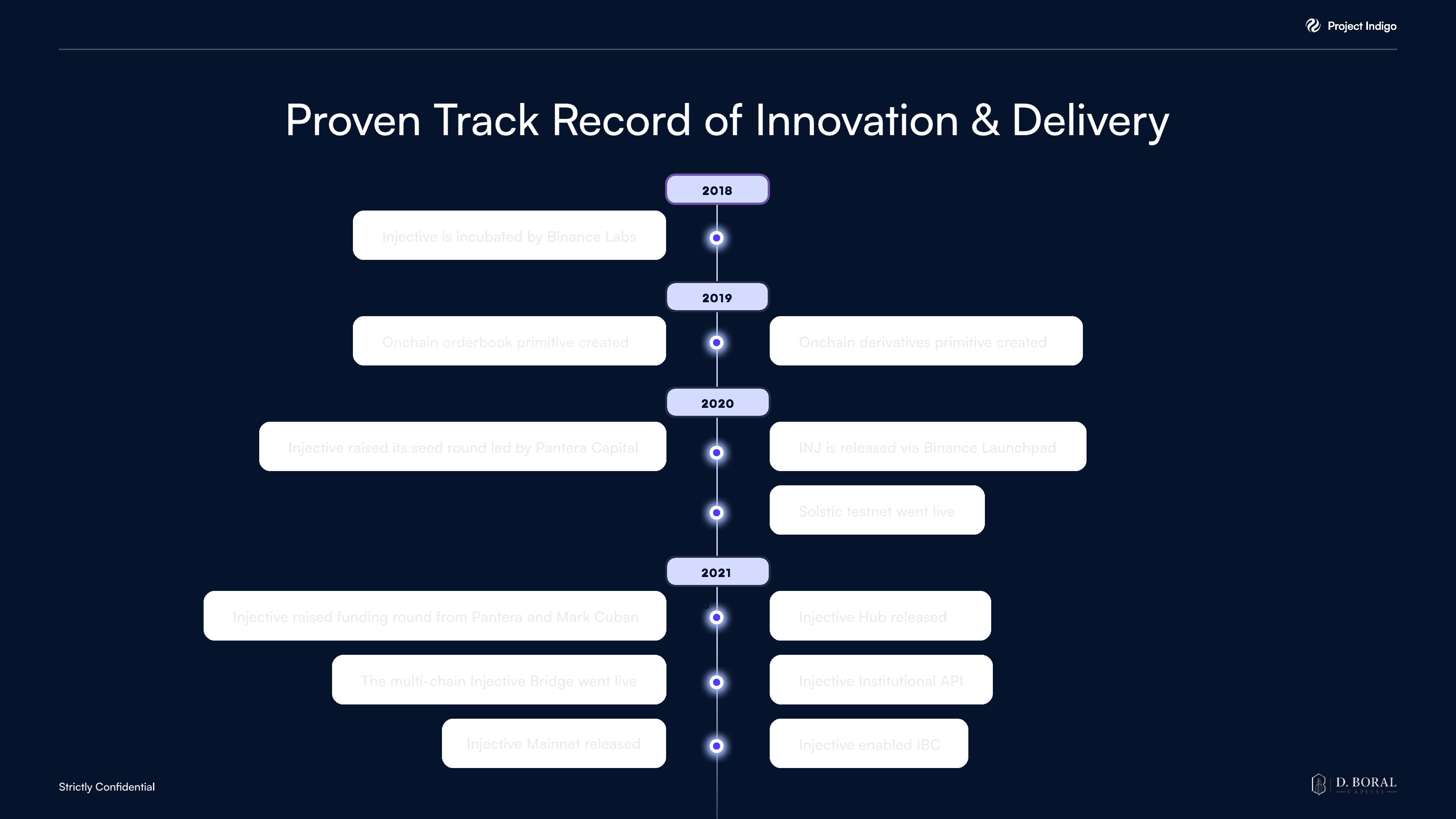

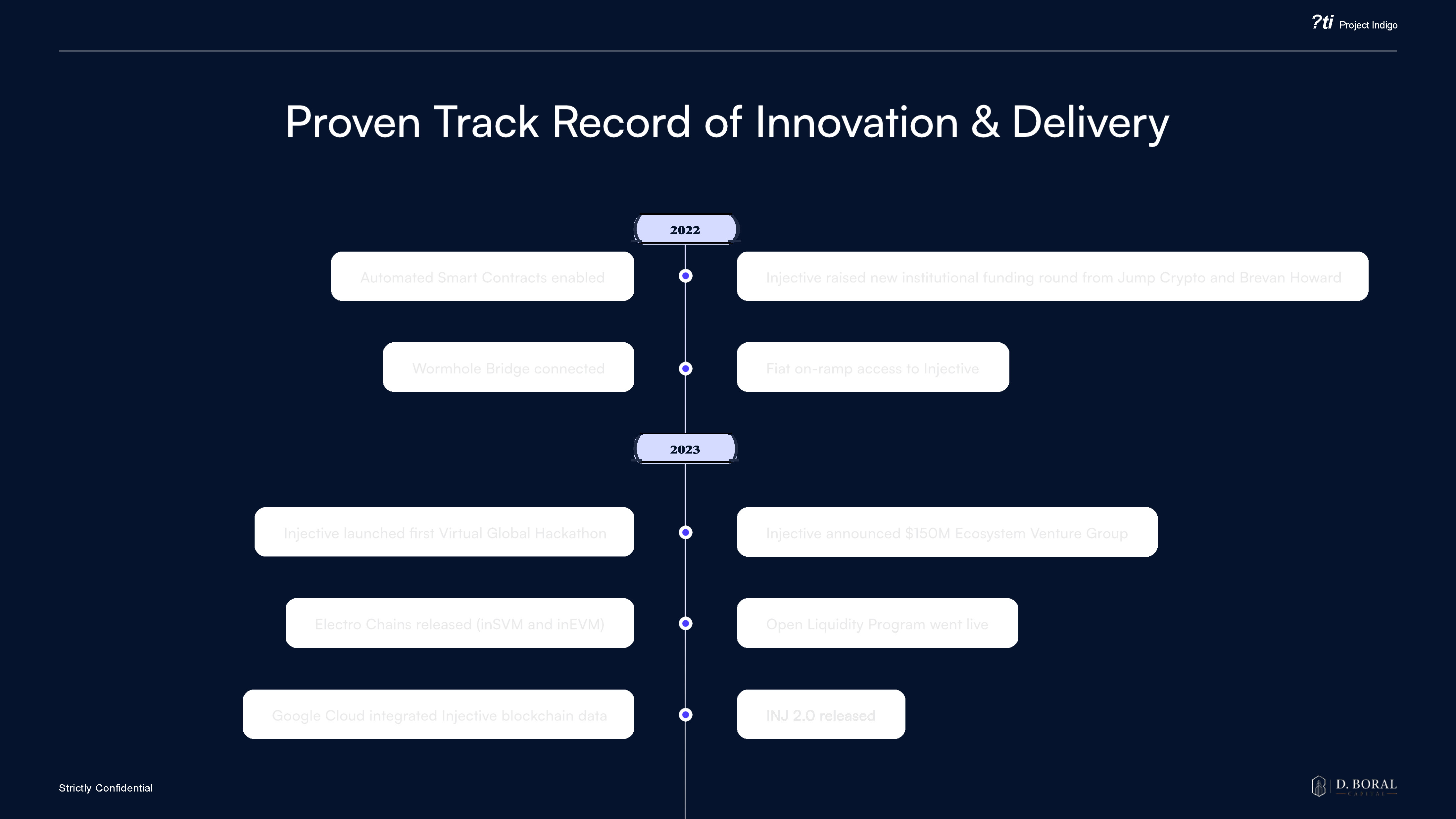

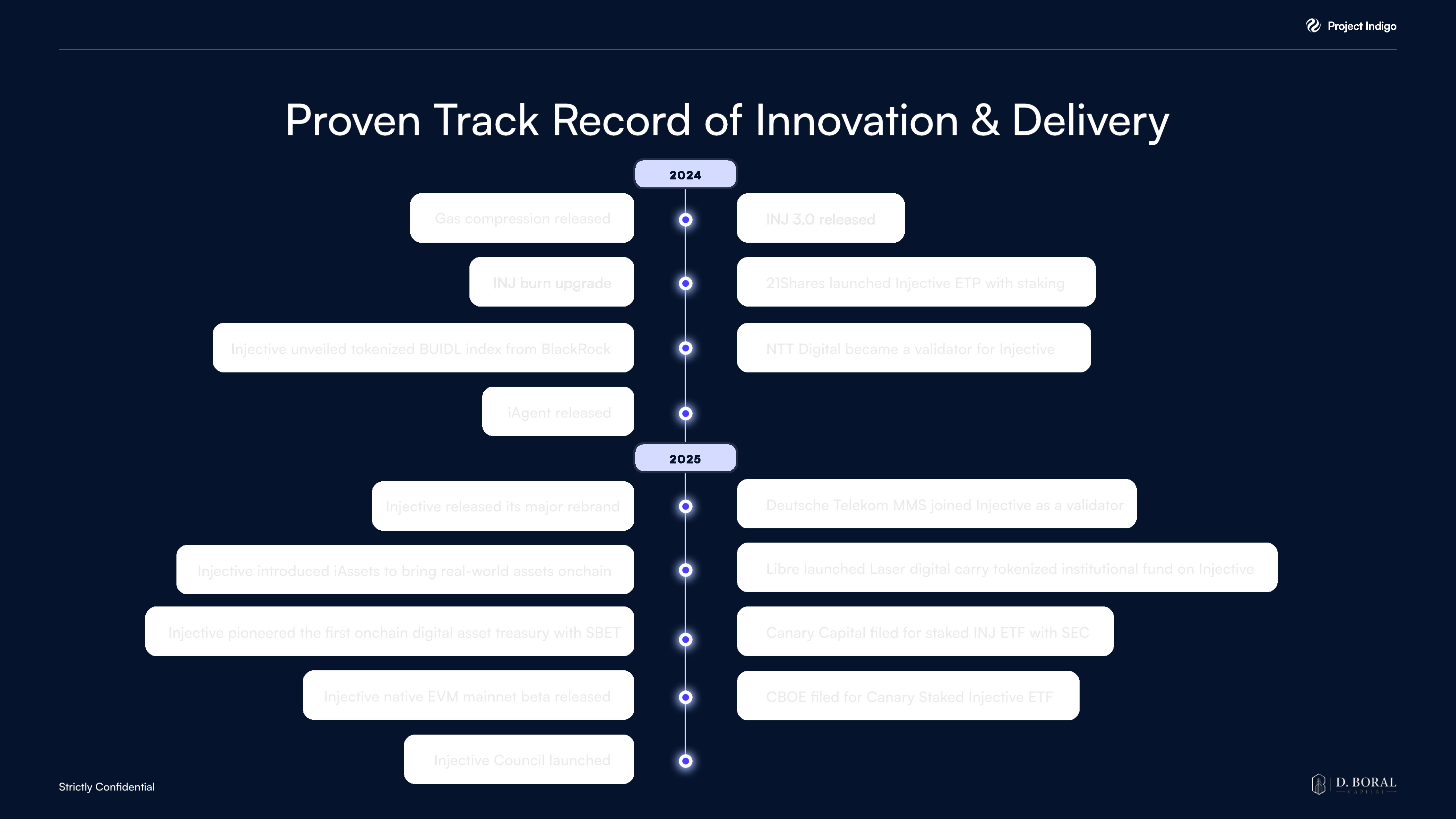

Corporate Presentation

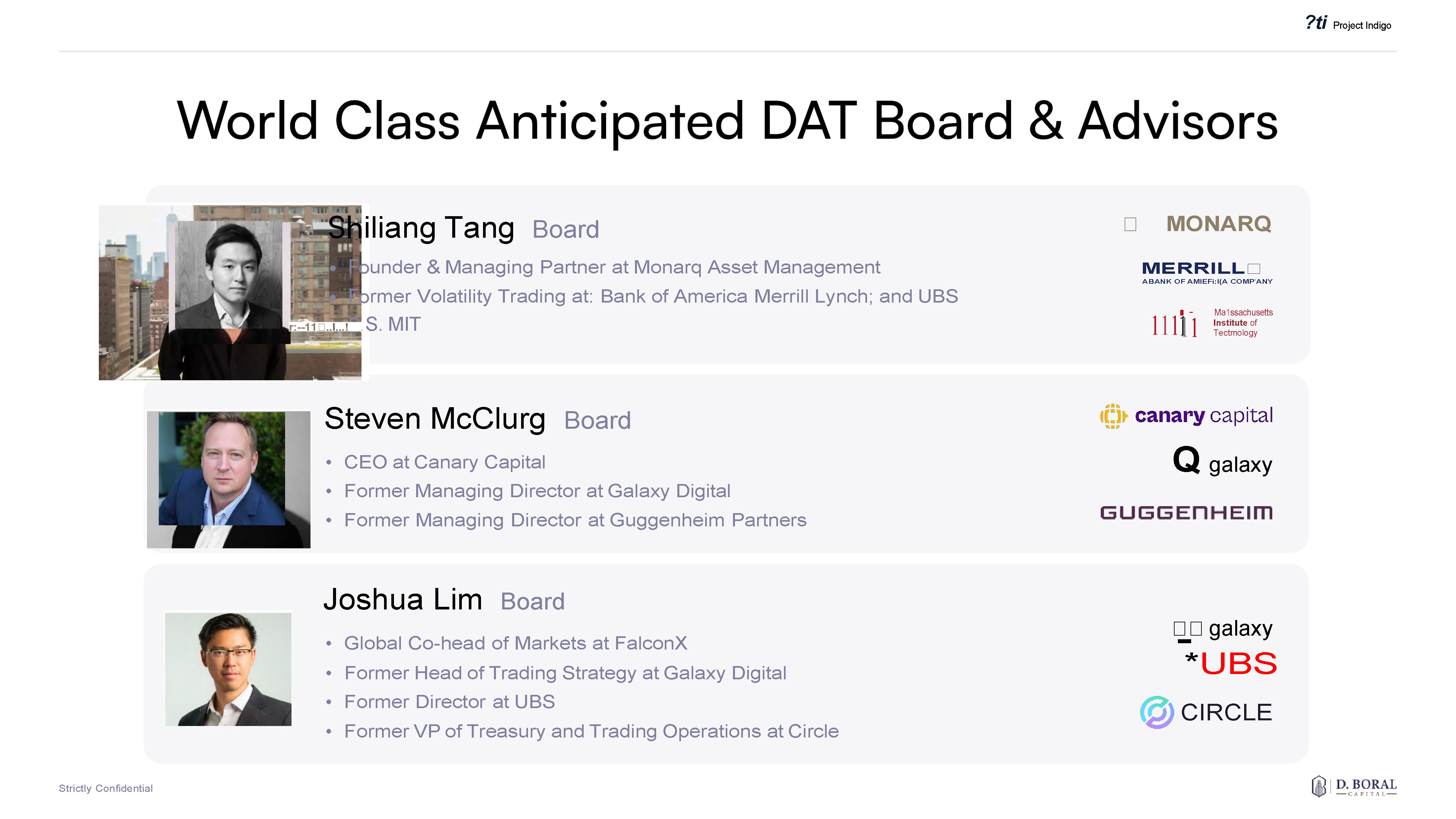

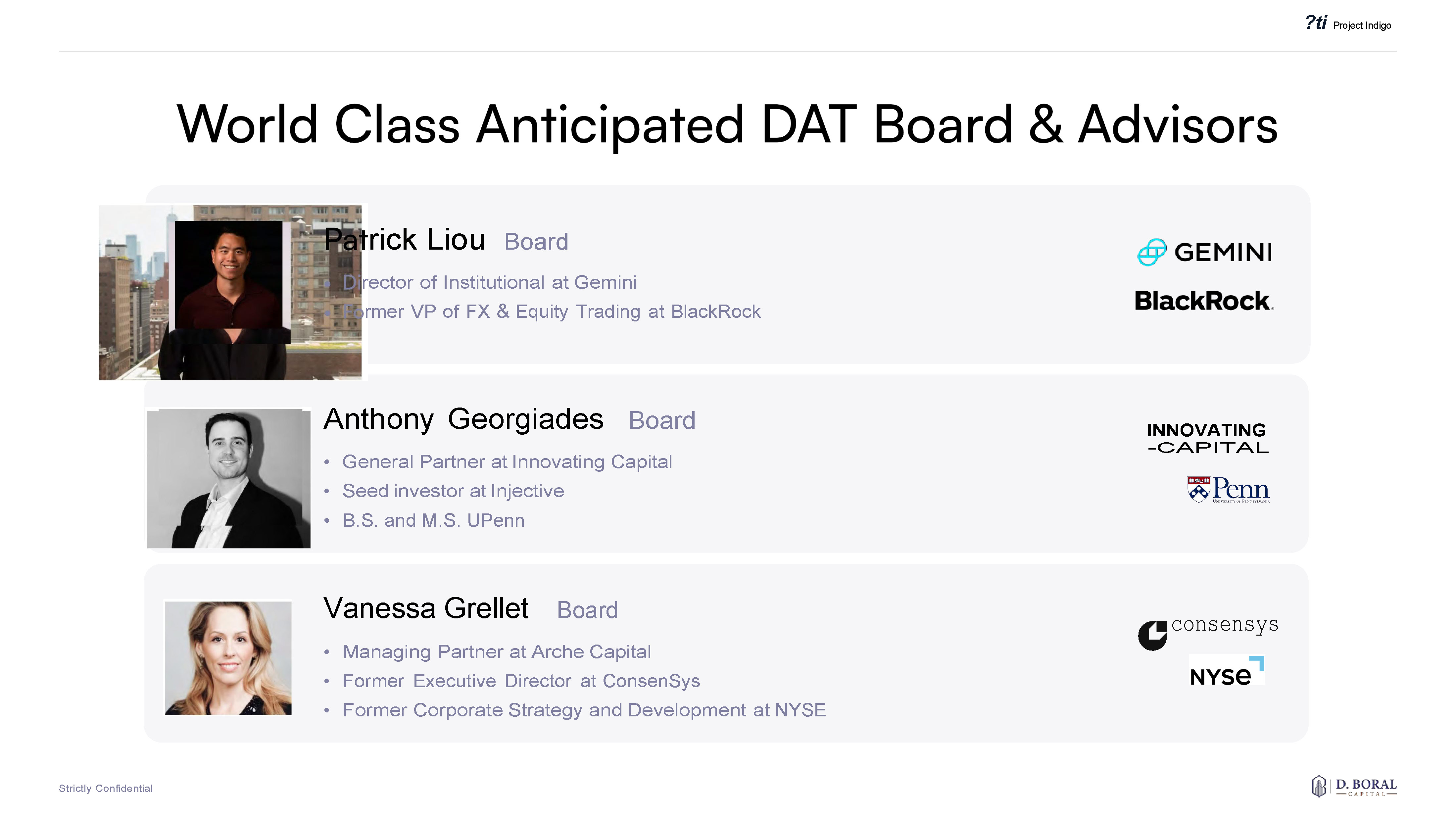

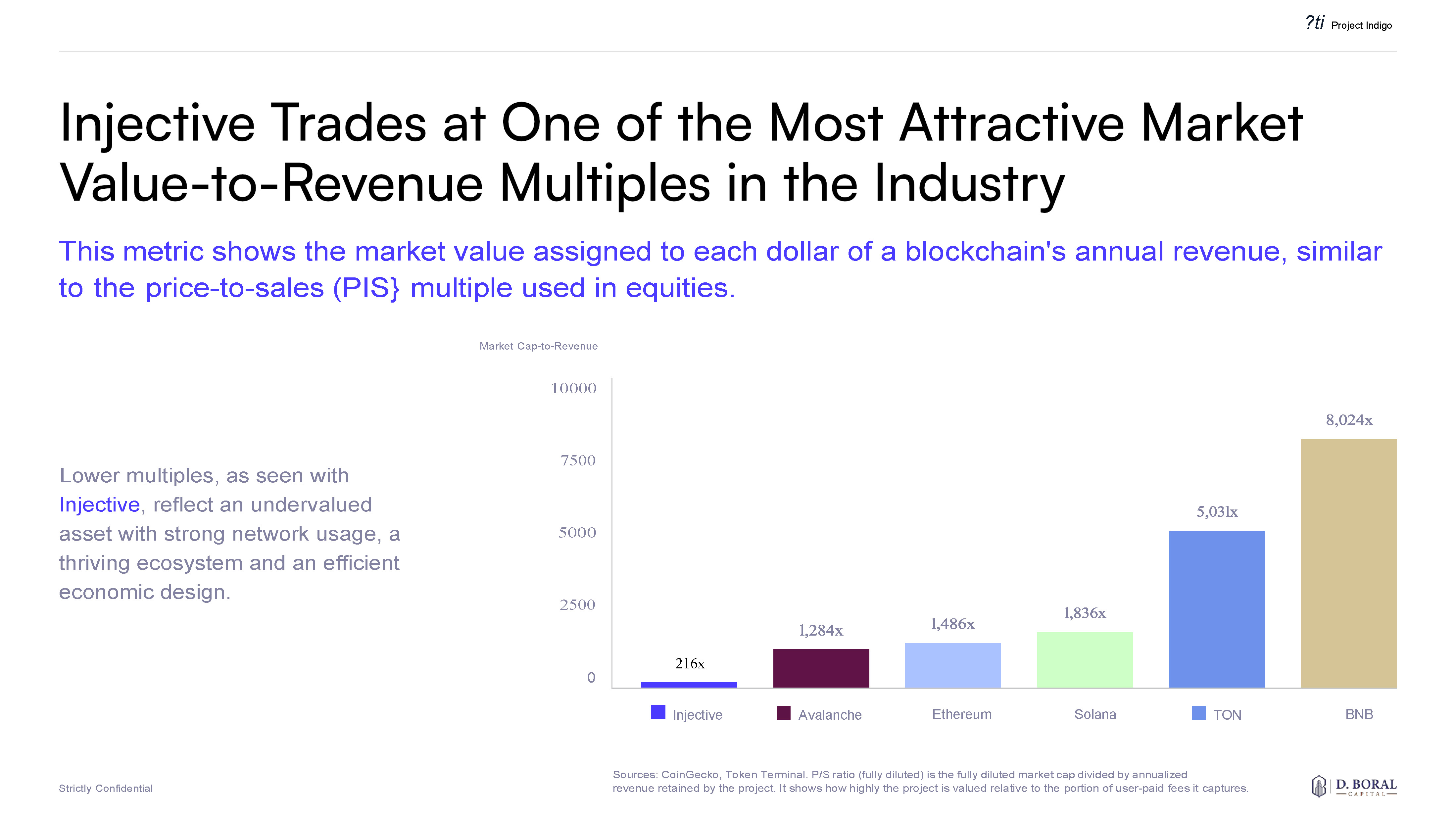

In connection with the Private Placement, the Company delivered an investor presentation to potential investors on a confidential basis, a copy of which is furnished as Exhibit 99.3 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(a) Exhibits

† Certain portions of Exhibits 10.1 to 10.11 have been omitted in accordance with Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish on a supplemental basis an unredacted copy of the exhibits and its materiality and privacy or confidentiality analyses to the Securities and Exchange Commission upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 10, 2025

| PINEAPPLE FINANCIAL INC. | ||

| By: | /s/ Shubha Dasgupta | |

| Shubha Dasgupta | ||

| Chief Executive Officer | ||

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of September 1, 2025, between Pineapple Financial Inc. (the “Company”), a corporation continued and existing under the Canada Business Corporations Act, and each purchaser identified on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and collectively, the “Purchasers”).

WHEREAS, subject to the terms and conditions set forth in this Agreement and pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) of Regulation D promulgated thereunder, and pursuant to Section 2.4 of Ontario Securities Commission Rule 72-503 – Distributions Outside Canada, the Company desires to issue and sell to each Purchaser, and each Purchaser, severally and not jointly, desires to purchase from the Company, securities of the Company as more fully described in this Agreement;

WHEREAS, the Company desires to sell to the Purchasers, and each Purchaser desires to purchase from the Company, severally and not jointly, upon the terms and subject to the conditions stated in this Agreement, subscription receipts (the “Subscription Receipts”) of the Company to be governed by the terms of the Subscription Receipt Agreement (as hereinafter defined) attached hereto as Exhibit E;

WHEREAS, at the election of a Purchaser as set out in Exhibit A hereto, each Subscription Receipt is exchangeable for (A) one Share (as herein defined) or (B) one Pre-Funded Warrant (as hereinafter defined), as the case may be;

WHEREAS, the gross proceeds from the sale of the Subscription Receipts, including the INJ delivered by certain Purchasers in satisfaction of their Subscription Amount payable in consideration of the Subscription Receipts subscribed for by such Purchasers (the “Escrowed Funds”), will be held in escrow as contemplated by the Subscription Receipt Agreement pending the satisfaction of the Escrow Release Conditions;

WHEREAS, subject to the terms of the Subscription Receipt Agreement and satisfaction of the Escrow Release Conditions (as hereinafter defined), on the Escrow Release Date (as defined in the Subscription Receipt Agreement), each Subscription Receipt will automatically be exchanged (without payment of any further consideration and subject to customary anti-dilution adjustments) for (A) one Share (as herein defined) or (B) one Pre- Funded Warrant (as hereinafter defined);

WHEREAS, if the Escrow Release Conditions are not satisfied prior to the Escrow Deadline, the Subscription Receipt Agent shall return the Escrowed Funds to the Purchasers and the Subscription Receipts will become null, void and of no further force or effect, and will only represent the holder’s right to receive such payment from the Subscription Receipt Agent in accordance with the terms of the Subscription Receipt Agreement. In such event, Purchasers who made payment in the form of INJ will receive INJ, and Purchasers who made cash payments will receive cash (the “Returned Consideration”);

WHEREAS, contemporaneously with the sale of the Subscription Receipts pursuant to the terms of this Agreement and the Subscription Receipt Agreement, the parties hereto will execute and deliver a registration rights agreement, substantially in the form attached hereto as Exhibit C (the “Registration Rights Agreement”), pursuant to which the Company will agree to provide certain registration rights in respect of the Shares, Pre-Funded Warrants and Pre-Funded Warrant Shares under the Securities Act and applicable state securities laws; and

WHEREAS, the Company and the Purchasers intend, to the extent permitted by the Code, the transactions contemplated by this Agreement to form one integrated transaction to which Section 351 of the Code applies.

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE I. DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Acquiring Person” shall have the meaning ascribed to such term in Section 4.5.

“Action” shall have the meaning ascribed to such term in Section 3.1(j).

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 under the Securities Act.

“Anti-Corruption Laws” means: (i) the U.S. Foreign Corrupt Practices Act of 1977, as amended (“FCPA”); (ii) the UK Bribery Act 2010 (“UKBA”); (iii) the Corruption of Foreign Public Official Act (Canada), the Criminal Code (Canada), and the Extractive Sector Transparency Measures Act (Canada); (iv) Laws adopted in furtherance of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions; and (v) all other applicable, similar or equivalent anti-corruption or anti-bribery Laws of any jurisdiction.

“Asset Management Agreements” means the Asset Management Agreements between the Company and each of the Asset Managers, to be executed on or prior to the Closing Date.

“Asset Managers” means MNNC Advisors (Cayman) SEZC, a Cayman Islands Company with a registered address at c/o Cayman Enterprise City Ltd, Fairbanks Road, P.O.Box CEC-1, Grand Cayman, Cayman Islands KY1- 9012 and Canary Capital Group LLC, a Delaware limited liability company with a registered address at c/o 850 New Burton Rd., Suite 201, Dover, DE 19904.

“Board of Directors” means the board of directors of the Company.

“Business Data” means all business information and data, including personal information and confidential information that is accessed, collected, used, stored, shared, distributed, transferred, disclosed, destroyed, disposed of or otherwise processed by or on behalf of the Company or its Subsidiaries in the course of the conduct of the business of the Company or its Subsidiaries.

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized or required by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized or required by law to remain closed due to “stay at home”, “shelter-in- place”, “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in The City of New York are generally open for use by customers on such day.

“Business Systems” means all software, computer hardware (whether general or special purpose), electronic data processors, databases, communications, telecommunications, networks, interfaces, platforms, workstations, hubs, switches, servers, peripherals, information technology, operational technology and computer systems, including any outsourced systems and processes, and any software and systems provided via the cloud or “as a service”, that are owned or administered by the Company or its Subsidiaries and used in the conduct of the business of the Company or its Subsidiaries.

“Canadian Corporate Counsel” means MLT Aikins LLP.

“Canadian Securities Counsel” means Blake, Cassels & Graydon LLP.

“Canadian Securities Laws” means the applicable securities laws, regulations and rules, blanket rulings, policies and written interpretations of and multilateral or national instruments adopted by the Ontario Securities Commission.

“Canadian Tax Act” means the Income Tax Act (Canada) and the regulations made thereunder.

“Clearance Deadline” shall have the meaning ascribed to such term in Section 2.5.

“Closing” means the closing of the purchase and sale of the Subscription Receipts pursuant to Section 2.1.

“Closing Date” means the Trading Day on which all of the Transaction Documents have been executed and delivered by the applicable parties thereto, and all conditions precedent to the Purchasers’ obligations to pay the Subscription Amount have been satisfied.

“Code” means the Internal Revenue Code of 1986, as amended.

“Commission” means the United States Securities and Exchange Commission.

“Common Shares” means the common shares without par value in the authorized share structure of the Company and any other class of securities into which such securities may hereafter be reclassified or changed.

“Common Share Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Shares, including, without limitation, any debt, preferred shares, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Shares.

“Company Counsel” means Sichenzia Ross Ference Carmel LLP.

“Custodian” means Bitgo Trust Company, Inc., in its capacity as the custodian of INJ tokens to be held in escrow until such time as the Escrow Release Conditions are met or waived.

“Disclosure Schedules” means the Disclosure Schedules of the Company delivered concurrently herewith.

“Disclosure Time” means, (i) if this Agreement is signed on a day that is not a Trading Day or after 9:00 a.m. (New York City time) and before midnight (New York City time) on any Trading Day, 9:01 a.m. (New York City time) on the Trading Day immediately following the date hereof, unless otherwise instructed as to an earlier time by the Placement Agent, and (ii) if this Agreement is signed between midnight (New York City time) and 9:00 a.m. (New York City time) on any Trading Day, no later than 9:01 a.m. (New York City time) on the date hereof, unless otherwise instructed as to an earlier time by the Placement Agent.

“Effective Date” means the date that the Registration Statement registering for resale all Shares, Pre-Funded Warrants and Pre-Funded Warrant Shares has been declared effective by the Commission and the Escrow Release Conditions have been met or waived.

“Escrowed Cash Proceeds” shall have the meaning ascribed to such term in Section 2.1.

“Escrow Deadline” means sixty (60) days from the Closing Date, subject (i) to an automatic extension to an aggregate of 90 days from the Closing Date in the event that the Commission notifies the Company that it will review the Registration Statement, and (ii) such further extension(s) to be agreed to in writing by the holders of 50.1% or more of the Subscription Amounts, including Injective Foundation, acting reasonably, in accordance with the Subscription Receipt Agreement.

“Escrowed Funds” shall have the meaning ascribed to such term in the recitals.

“Escrowed INJ Proceeds” shall have the meaning ascribed to such term in Section 2.1.

“Escrow Release Conditions” shall have the meaning ascribed to such term in Section 2.6.

“Escrow Release Notice” shall have the meaning ascribed to such term in Section 2.6.

“Evaluation Date” shall have the meaning ascribed to such term in Section 3.1(s).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exempt Issuance” means the issuance (a) of Common Shares or options to employees, officers or directors of the Company pursuant to any equity incentive plan duly adopted for such purpose, by a majority of the non- employee members of the Board of Directors or a majority of the members of a committee of non-employee directors established for such purpose for services rendered to the Company, (b) of securities upon the exercise or exchange or conversion of any Securities issued hereunder and/or securities (including options, rights or warrants) exercisable or exchangeable for or convertible into Common Shares issued and outstanding on the date of this Agreement, provided that such securities have not been amended since the date of this Agreement to increase the number of such securities or to decrease the exercise price, exchange price or conversion price of such securities (other than in connection with common share splits or combinations) or to extend the term of such securities, (c) upon conversion or settlement of outstanding debt as of the date hereof in an amount not to exceed $25,000, (d) of equity interests issued or issuable pursuant to agreements existing as of the date hereof and listed on Schedule 3.1(g) hereto, and (e) of any Common Shares issued pursuant to an equity line of credit or similar financing instrument for the purpose of raising funds to purchase INJ.

“Ex-Im Laws” means all applicable laws relating to export, re-export, transfer, and import controls, including but not limited to the U.S. Department of Commerce Export Administration Regulations, the customs and import Laws administered by U.S. Customs and Border Protection, the Export and Import Permits Act (Canada), the customs and import laws administered by the Canada Border Services Agency, the EU Dual Use Regulation, the customs and import laws administered by His Majesty’s Revenue and Customs and any similar Laws of any other relevant governmental authority.

“Financial Statements” shall have the meaning ascribed to such term in Section 3.1(h).

“FCPA” means the Foreign Corrupt Practices Act of 1977, as amended.

“GAAP” shall have the meaning ascribed to such term in Section 3.1(h).

“Government Official” means any officer or employee of a governmental authority, a public international organization, or any department or agency thereof or any Person acting in an official capacity for such government or organization, including (i) a foreign official as defined in the FCPA; (ii) a foreign public official as defined in the UKBA; (iii) a foreign public official as defined in the Corruption of Foreign Public Officials Act (Canada) and a public officer as defined in the Criminal Code (Canada); (iv) an officer or employee of a government-owned, controlled, operated enterprise, such as a national oil company; and (v) any non-U.S. political party, any party official or representative of a non-U.S. political party, or any candidate for a non-U.S. political office.

“Indebtedness” shall have the meaning ascribed to such term in Section 3.1(bb).

“INJ” means the native cryptocurrency of the Injective blockchain.

“INJ Escrow Agent” means Canary Capital Group LLC.

“Insolvency Event” means, in relation to an entity:

| i) | the entity goes, or proposes to go, into bankruptcy or liquidation; | |

| ii) | an order is made or an effective resolution is passed for the winding up or dissolution without winding up (otherwise than for the purposes of a solvent reconstruction or amalgamation) of the entity; | |

| iii) | a receiver, receiver and manager, judicial manager, liquidator, trustee, administrator or like official is appointed, or threatened or expected to be appointed, over the entity, the whole or a substantial part of the undertaking or property of the entity, or any application is made to a court for an order, or an order is made, or a meeting is convened, or a resolution is passed, for the purpose of appointing such a person; |

| iv) | the holder of a Lien takes possession of the whole or substantial part of the undertaking or property of the entity; | |

| v) | a writ of execution is issued against the entity or any of the entity’s assets; | |

| vi) | the entity is unable, or admits in writing its inability or failure, to pay its debts generally as they become due; | |

| vii) | the entity commits an act of bankruptcy under the Bankruptcy and Insolvency Act (Canada); | |

| viii) | the entity makes a general assignment for the benefit of creditors; | |

| ix) | the entity proposes or takes any steps to implement a reorganization or arrangement or other compromise with its creditors or any class of them, whether pursuant to the Companies’ Creditors Arrangement Act (Canada) or similar legislation in any jurisdiction or otherwise; or | |

| x) | the entity is declared or taken under applicable law to be insolvent or the entity’s board of directors resolve that it is, or is likely to become insolvent. |

“Intellectual Property Rights” shall have the meaning ascribed to such term in Section 3.1(p).

“Legend Removal Date” shall have the meaning ascribed to such term in Section 4.1(c).

“Liens” means a lien, charge, pledge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

“Lock-Up Agreement” means the Lock-Up Agreement, dated as of the date hereof, by and among the Company and the Lock-Up Parties, in the form of Exhibit D attached hereto.

“Lock-Up Parties” means Injective Foundation, [*] and [*].

“Management Agreements” means agreements entered into by and among the Company and certain officers of the Company.

“Material Adverse Effect” shall have the meaning assigned to such term in Section 3.1(b).

“Material Permits” shall have the meaning ascribed to such term in Section 3.1(n).

“Net Cash Proceeds” has the meaning ascribed to such term in Section 4.7.

“OSC Rule 72-503” means Ontario Securities Commission Rule 72-503 – Distributions Outside Canada.

“Permitted Withdrawals” has the meaning ascribed to such term in Section 4.7.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Personal Information” means personal information as defined under applicable privacy laws about the Purchasers.

“Placement Agent” means D. Boral Capital LLC.

“Placement Agent Agreement” means the placement agent agreement between the Company and the Placement Agent dated on or about the date hereof.

“Pre-Funded Warrant” means a pre-funded common share purchase warrant issuable on exchange of an applicable Subscription Receipt, with each Pre-Funded Warrant exercisable for one Pre-Funded Warrant Share following the Effective Date until the date on which the Pre-Funded Warrant is exercised in full, in the form of Exhibit B attached hereto.

“Pre-Funded Warrant Shares” means the Common Shares issuable upon exercise of the Pre-Funded Warrants.

“Proceeding” means an action, claim, suit, investigation or proceeding (including, without limitation, an informal investigation or partial proceeding, such as a deposition), whether commenced or threatened.

“Public Information Failure” shall have the meaning ascribed to such term in Section 4.2(b).

“Public Information Failure Payments” shall have the meaning ascribed to such term in Section 4.2(b).

“Purchaser Party” shall have the meaning ascribed to such term in Section 4.8.

“Registration Rights Agreement” shall have the meaning ascribed to such term in the recitals.

“Registration Statement” means a resale registration statement addressing the requirements of the Registration Rights Agreement and covering the resale by the Purchasers of the Shares, Pre-Funded Warrants and Pre- Funded Warrant Shares.

“Required Approvals” shall have the meaning ascribed to such term in Section 3.1(e).

“Returned Consideration” shall have the meaning ascribed to such term in the recitals.

“Rule 144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Rule 424” means Rule 424 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Sanctioned Jurisdiction” means at any time, a country, region or territory which is itself the subject or target of any comprehensive Sanctions.

“Sanctioned Person” means at any time any person that is: (i) listed on any Sanctions-related list of designated or blocked Persons administered by a Governmental Authority (including, but not limited to, the U.S. Department of Treasury’s Office of Foreign Assets Control’s (“OFAC”) Specially Designated Nationals List, Non-SDN Menu-Based Sanctions List, Sectoral Sanctions Identifications List, and Foreign Sanctions Evaders List, the Regulations under the Special Economic Measures Act (Canada), Justice for Victims of Corrupt Foreign Officials Act (Canada), United Nations Act (Canada), and Freezing of Assets of Corrupt Foreign Officials Act (Canada), the Regulations Establishing a List of Entities under the Criminal Code (Canada), the Denied Persons, Entity, and Unverified Lists of the U.S. Department of Commerce’s Bureau of Industry and Security, the Debarred List of the U.S. Department of State’s Directorate of Defense Trade Controls, any list of sanctioned persons administered and maintained by the U.S. Department of State relating to nonproliferation, terrorism and the EU Consolidated Financial Sanctions List), (ii) the government of, located in, resident in, or organized under the laws of a Sanctioned Jurisdiction, or (iii) directly or indirectly owned (50% or more) or controlled (as such term is used in the applicable Sanctions and any formal guidance associated with the same) by, or acting for or on behalf of, or at the direction of, a person or persons described in clauses (i) through (iii).

“Sanctions” means any and all trade, economic and financial sanctions Laws, regulations, embargoes, and restrictive measures imposed, administered, enacted or enforced by (i) the United States of America (including without limitation OFAC, the U.S. Department of State, and the U.S. Department of Commerce), (ii) Canada, (iii) the European Union and any European Union member states, (iv) the United Nations Security Council, or (v) the United Kingdom (including His Majesty’s Treasury).

“SEC Reports” shall have the meaning ascribed to such term in Section 3.1(h).

“Securities” means the Subscription Receipts, the Shares, the Pre-Funded Warrants and the Pre-Funded Warrant Shares.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Share” means a Common Share issuable on exchange of an applicable Subscription Receipt on a one for one basis.

“Shareholder Approval” shall have the meaning ascribed to such term in Section 2.4.

“Short Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be deemed to include locating and/or borrowing Common Shares).

“Side Letter” means a letter agreement by and among Injective Foundation, the Placement Agent and the Company regarding satisfaction of Escrow Release Conditions.

“Subscription Amount” means, as to each Purchaser, the aggregate amount to be paid, in INJ or United States Dollars, as the case may be, for Subscription Receipts purchased hereunder as specified below such Purchaser’s name on the signature page of this Agreement and next to the heading “Subscription Amount,” in immediately available funds or tokens (minus, if applicable, a Purchaser’s aggregate exercise price of the Pre-Funded Warrants, which amounts shall be paid as and when such Pre-Funded Warrants are exercised for cash).

“Subscription Receipt Agent” means Odyssey Transfer and Trust Company, or its successor, in its capacity as subscription receipt agent under the Subscription Receipt Agreement.

“Subscription Receipt Agreement” means the subscription receipt agreement to be entered into between the Company, the Placement Agent and the Subscription Receipt Agent in the form of Exhibit E hereto, governing the issuance of the Subscription Receipts and compliance with the Escrow Release Conditions.

“Subscription Receipt Purchase Price” equals $3.80, subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Common Shares that occur after the date of this Agreement, provided that the purchase price per Pre-Funded Warrant shall be the Subscription Receipt Purchase Price minus Pre-Funded Warrant exercise price of $0.001.

“Subscription Receipts” shall have the meaning ascribed to such term in the recitals.

“Subsidiary” means any subsidiary of the Company and shall, where applicable, also include any direct or indirect subsidiary of the Company formed or acquired after the date hereof.

“Tax” means any and all taxes, duties, levies, assessments, fees or other charges imposed by any Taxing Authority or by any statutory, governmental, state, provincial, federal, cantonal, municipal, local or similar authority of any jurisdiction, including income, capital stock, capital gains, profits, estimated, business, occupation, corporate, capital, gross receipts, transfer, stamp, registration, employment, payroll, unemployment, social security (or similar), employment insurance premiums, workers compensation, disability, Canada Pension Plan, Quebec Pension Plan or other similar contributions, withholding, occupancy, license, severance, production, ad valorem, excise, windfall profits, customs duties, real property, personal property, sales, use, turnover, value added, goods and services and franchise taxes, and alternative or add-on minimum and estimated taxes, whether disputed or not, together with all interest, penalties and additions to tax imposed with respect thereto.

“Tax Return” means any federal, state, local, provincial or non-Canadian return, declaration, disclosure, report, form, statement, claim for refund, election, information return or statement, or other document relating to Taxes, including any schedule, estimate or attachment thereto and any amendment or supplement thereof, in each case provided or required to be provided to a Taxing Authority.

“Taxing Authority” means, with respect to any Tax, any governmental authority or other authority competent to impose such Tax or responsible for the administration and/or collection of such Tax or enforcement of any Law in relation to Tax.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Common Shares are listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, OTCQB or OTCQX (or any successors to any of the foregoing).

“Transaction Documents” means this Agreement, the Lock-Up Agreements, the Registration Rights Agreement, the Subscription Receipt Agreement, the Pre-Funded Warrant, the Voting Agreements and the Management Agreements, and all exhibits and schedules thereto and hereto and any other documents or agreements executed in connection with the transactions contemplated hereunder.

“Transfer Agent” means Endeavor Trust Corporation, with a mailing address of 702 – 707 Hornby Street, Vancouver, BC, V6Z 1S4, and any successor transfer agent of the Company.

“Transfer Restriction” means the restriction on transfers of the Common Shares contained in the Articles of Continuance of the Company.

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Shares are then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Shares for such date (or the nearest preceding date) on the Trading Market on which the Common Shares are then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Shares for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Shares are not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Shares are then reported on the Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Shares so reported, or (d) in all other cases, the fair market value of a share of Common Shares as determined by an independent appraiser selected in good faith by the Purchasers of a majority in interest of the Securities then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“Voting Agreements” means voting agreements entered into by and between the Company and each officer and director of the company, in respect of such directors’ and officers’ commitment to vote in favor of the Shareholder Approval.

ARTICLE II.

PURCHASE AND SALE AND REGISTRATION STATEMENT

2.1 Closing. On the Closing Date, upon the terms and subject to the conditions set forth herein, substantially concurrent with the execution and delivery of this Agreement by the parties hereto, the Company agrees to sell, and the Purchasers, severally and not jointly, agree to purchase, the number and type of Subscription Receipts, for the aggregate purchase price, set forth opposite the Purchaser’s name on Exhibit A. The price per Subscription Receipt is $3.80. To the extent that a Purchaser determines, in its sole discretion, that such Purchaser’s Subscription Amount (together with such Purchaser’s Affiliates and any Person acting as a group together with such Purchaser or any of such Purchaser’s Affiliates) would cause such Purchaser’s beneficial ownership of the Common Shares underlying the Subscription Receipts to exceed the Beneficial Ownership Limitation, or as such Purchaser may otherwise choose, such Purchaser shall elect to purchase Subscription Receipts exchangeable for Pre-Funded Warrants. The “Beneficial Ownership Limitation” shall be 4.99% (or, at the election of the Purchaser, 9.99%) of the number of the Common Shares outstanding immediately after giving effect to the issuance of Shares underlying the Subscription Receipts on the Effective Date. In no event may the Beneficial Ownership Limitation exceed 9.99% of the number of Common Shares outstanding immediately after giving effect to the issuance of Pre-Funded Warrant Shares upon exercise of the Pre-Funded Warrant held by a Purchaser. Each Purchaser shall deliver its Subscription Amount at Closing in one of the following forms, as applicable: (i) United States dollars, in immediately available funds, via wire transfer, to the Subscription Receipt Agent (the “Escrowed Cash Proceeds”); or (ii) INJ, delivered to the INJ Escrow Agent in an amount equal to the Purchaser’s Subscription Amount set forth on Exhibit A-1 or A-2, as the case may be, (A) in the case of Purchasers listed on Exhibit A-1, such amount of INJ representing (x) a purchase price per Subscription Receipt of $3.80, (y) multiplied by the total number of Subscription Receipts set forth opposite such Purchasers name on Exhibit A-1, divided by (z) $13.90 (the “INJ Exchange Price”), or (B) in the case of Purchasers listed on Exhibit A-2, such amount of INJ representing (x) a purchase price per Subscription Receipt of $4.16, (y) multiplied by the total number of Subscription Receipts set forth opposite such Purchaser’s name on Exhibit A-2, divided by (z) $13.90 (the “INJ Contribution Price”) (in either case, the “Escrowed INJ Proceeds”). The Company and each Purchaser shall deliver the other items set forth in Section 2.2 deliverable at the Closing. Upon satisfaction of the covenants and conditions set forth in Sections 2.2 and 2.3, the Closing shall occur, by the mutual agreement of the parties, by means of electronic transmission of documents, at the offices of the Placement Agent, or at such other location as the parties may mutually agree.

2.2 Deliveries.

(a) On or prior to the Closing Date, the Company shall deliver or cause to be delivered to each Purchaser the following:

(i) this Agreement duly executed by the Company;

(ii) (A) the legal opinion of Canadian Corporate Counsel; (B) the legal opinion of Canadian Securities Counsel; and (C) the legal opinion and negative assurance letter of Company Counsel, each in a form reasonably acceptable to the Placement Agent and Injective Foundation;

(iii) a certificate, duly executed by the Chief Financial Officer of the Company, dated as of the Closing Date, in a form reasonably acceptable by the Placement Agent;

(iv) a copy of the irrevocable instructions to the Subscription Receipt Agent instructing the Subscription Receipt Agent to deliver, on an expedited basis, in book entry form (unless otherwise requested by the Purchasers) the number of Subscription Receipts (of the type elected by the Purchaser as set out in Exhibit A hereto) equal to such Purchaser’s Subscription Amount divided by the Subscription Receipt Purchase Price, registered in the name of such Purchaser;

(v) the Subscription Receipt Agent’s wire instructions;

(vi) the Lock-Up Agreements;

(vii) the Registration Rights Agreement duly executed by the Company;

(viii) the Subscription Receipt Agreement duly executed by the Company, Placement Agent and the Subscription Receipt Agent;

(ix) the wallet addresses maintained by Bitgo as Custodian for the INJ Escrow Agent;

(x) the Voting Agreements;

(xi) the Management Agreements; and

(xii) the Side Letter duly executed by the Company, the Placement Agent and Injective Foundation.

(b) On or prior to the Closing Date, each Purchaser shall deliver or cause to be delivered to the Company and the Subscription Receipt Agent, the following:

(i) this Agreement duly executed by such Purchaser; and

(ii) the Registration Rights Agreement duly executed by such Purchaser.

2.3 Closing Conditions.

(a) The obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) on the Closing Date of the representations and warranties of the Purchasers contained herein (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) all obligations, covenants and agreements of each Purchaser required to be performed at or prior to the Closing Date shall have been performed;

(iii) the delivery by each Purchaser of the items set forth in Section 2.2(b) of this Agreement.

(b) The respective obligations of the Purchasers hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) when made and on the Closing Date of the representations and warranties of the Company contained herein (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) all obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been performed;

(iii) the delivery by the Company of all the items set forth in Section 2.2(a) of this Agreement;

(iv) the Asset Management Agreements shall have been executed by the Company and each of the Asset Managers;

(v) there shall have been no Material Adverse Effect with respect to the Company since the date hereof; and

(vi) from the date hereof to the Closing Date, trading in the Common Shares shall not have been suspended by the Commission or the Company’s principal Trading Market, and, at any time prior to the Closing Date, trading in securities generally as reported by Bloomberg L.P. shall not have been suspended or limited, or minimum prices shall not have been established on securities whose trades are reported by such service, or any Trading Market, nor shall a banking moratorium have been declared either by the United States or New York State authorities nor shall there have occurred any material outbreak or escalation of hostilities or other national or international calamity of such magnitude in its effect on, or any material adverse change in, any financial market which, in each case, in the reasonable judgment of such Purchaser, makes it impracticable or inadvisable to purchase the Subscription Receipts at the Closing.

2.4 Shareholder Approvals; Proxy Statement. The Company shall, within 30 days following execution of this Agreement, prepare and file with the Commission (at the Company’s sole cost and expense) a preliminary proxy statement, as it may be amended or supplemented from time to time, related to the shareholders’ consideration and vote with respect to certain proposals, including, inter alia, (i) the issuance of the Shares or Pre-Funded Warrants to be delivered to the holders of Subscription Receipts, (ii) the amendment to the constating documents of the Company to remove the Transfer Restriction, and (iii) any other matters requiring shareholder approval in accordance with the Canada Business Corporations Act, the articles and by-laws of the Company, applicable securities exchange requirements and any other applicable requirements in connection with the transactions contemplated by this agreement (the approval of the matters described in clauses (i) and (ii) are referred to herein as the “Shareholder Approval”), as well as hold a duly called shareholders meeting to obtain the Shareholder Approval. The Company shall use its reasonable best efforts to make such filings and take such actions as are necessary to receive Shareholder Approval. Upon receipt of the requisite votes to approve such matters, the Company shall promptly deliver notice of the Shareholder Approval to each Purchaser and file with the Commission a Current Report on Form 8-K disclosing the same.

2.5 Registration Statement Filing. The Company shall (i) prepare, as soon as reasonably possible following the Closing Date, and shall file with the Commission within five Business Days of receiving the Shareholder Approval, the Registration Statement (on Form S-1 or other appropriate registration statement form reasonably acceptable to the Purchasers) under the Securities Act, at the sole expense of the Company, in respect of the Purchasers, so as to permit the resale of the Shares, the Pre-Funded Warrants and the Pre-Funded Warrant Shares in the United States under the Securities Act; and (ii) cause the Registration Statement to be declared effective by the Commission as soon as possible and not later than the Escrow Deadline. The Company will notify the Placement Agent immediately following effectiveness of the Registration Statement. The Registration Statement shall cover the resale of 100% of the Shares, Pre-Funded Warrants and Pre-Funded Warrant Shares (including such indeterminate number of Common Shares resulting from stock splits, stock dividends or similar transactions), for an offering to be made on a continuous basis pursuant to Rule 415 (as promulgated by the Commission pursuant to the Securities Act, as such rule may be amended from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such rule). The Securities registered for resale pursuant to the Registration Statement shall not be subject to resale restrictions under Canadian Securities Laws, provided the distribution of the Securities will not take place prior to the Effective Date and the Securities will be distributed under the Registration Statement.

2.6 Escrow Release Conditions. Upon satisfaction or waiver of the following escrow release conditions (the “Escrow Release Conditions”), the aggregate Subscription Amount, together with all interest and other income earned thereon, shall be released to the Company by the Subscription Receipt Agent in accordance with the terms of the Subscription Receipt Agreement:

| a) | the receipt of the Shareholder Approval by the Company; | |

| b) | the Registration Statement being declared effective by the Commission by the Escrow Deadline; | |

| c) | the receipt of required approvals by the applicable stock exchange, third parties, court and regulatory approvals required by the Company; | |

| d) | the Shares and Pre-Funded Warrant Shares being approved for listing on NYSE American and the completion, satisfaction or waiver by NYSE American of all conditions precedent to such listing; | |

| e) | the Company shall not be in breach or default of any of its covenants or obligations under the Subscription Receipt Agreement or the agency agreement between the Company and the Placement Agent; | |

| f) | from the date hereof until the earlier of (i) the Escrow Deadline, or (ii) such date on which all of conditions listed as items (a) through (f) above have been satisfied or waived, trading in the Common Shares shall not have been suspended by the Commission or the Company’s principal Trading Market, and trading in securities generally as reported by Bloomberg L.P. shall not have been suspended or limited, and minimum prices shall not have been established on securities whose trades are reported by such service or any Trading Market; and | |

| g) | the Company and the Placement Agent, in compliance with the Side Letter, shall have delivered a release notice (the “Escrow Release Notice”) to the Subscription Receipt Agent confirming that items (a) through (g), above, inclusive, have been satisfied or waived. |

In the event that the Subscription Receipt Agent does not receive the Escrow Release Notice at or before the Escrow Deadline, the Subscription Receipts will immediately be cancelled and become null and void and of no further effect, and will only represent the holder’s right to receive such payment from the Subscription Receipt Agent in accordance with the terms of the Subscription Receipt Agreement. A Purchaser who provided INJ in consideration for the Subscription Receipts subscribed for by such Purchaser shall receive the same INJ in satisfaction of such Purchaser’s pro rata entitlement to the Returned Consideration.

2.7 Automatic Exchange of Subscription Receipts. Immediately following the Effective Date and subject to the prior or concurrent satisfaction of all other Escrow Release Conditions, each Subscription Receipt shall be automatically exchanged (without payment of any further consideration and subject to customary anti-dilution adjustments) for (A) one Share or (B) one Pre-Funded Warrant, as provided in Exhibit A to this Agreement.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. Except as set forth in the Disclosure Schedules, which Disclosure Schedules shall be deemed a part hereof and shall qualify any representation or otherwise made herein to the extent of the disclosure contained in the corresponding section of the Disclosure Schedules, the Company hereby makes the following representations and warranties to each Purchaser:

(a) Subsidiaries. All of the direct and indirect subsidiaries of the Company are set forth in the SEC Reports or have otherwise been disclosed to Purchasers by the Company. The Company owns, directly or indirectly, all of its common shares or other equity interests of each Subsidiary free and clear of any Liens, and all of the issued and outstanding common shares of each Subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities. If the Company has no subsidiaries, all other references to the Subsidiaries or any of them in the Transaction Documents shall be disregarded.

(b) Organization and Qualification. The Company and each of the Subsidiaries is an entity duly incorporated or otherwise organized, continued, validly existing and in good standing under the laws of the jurisdiction of its incorporation, continuation or organization, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. The Company and its Subsidiaries carry on business solely within the province of Ontario. Neither the Company nor any Subsidiary is in violation nor default of any of the provisions of its respective certificate or articles of incorporation or continuation, bylaws or other organizational or charter documents. Each of the Company and the Subsidiaries is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not have or reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of any Transaction Document or the Asset Management Agreements, (ii) a material adverse effect on the results of operations, assets, business, prospects or condition (financial or otherwise) of the Company and the Subsidiaries, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document or the Asset Management Agreements (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no Proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(c) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and each of the other Transaction Documents and the Asset Management Agreements, and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and each of the other Transaction Documents or the Asset Management Agreements by the Company and the consummation by it of the transactions contemplated hereby and thereby have been, or will be, prior to the Closing Date, duly authorized by all necessary action on the part of the Company and no further action is required by the Company, the Board of Directors or the Company’s shareholders in connection herewith or therewith other than in connection with the Required Approvals. This Agreement and each other Transaction Document to which it is a party or the Asset Management Agreements have been (or upon delivery will have been) duly executed by the Company and, when delivered in accordance with the terms hereof and thereof, will constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

(d) No Conflicts. The execution, delivery and performance by the Company of this Agreement and the other Transaction Documents to which it is a party or the Asset Management Agreements, the issuance and sale of the Securities and the consummation by it of the transactions contemplated hereby and thereby do not and will not (i) subject to the removal of the Transfer Restriction from the constating documents of the Company, conflict with or violate any provision of the Company’s or any Subsidiary’s certificate or articles of incorporation or continuance, as the case may be, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company or any Subsidiary, or give to others any rights of termination, amendment, anti-dilution or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Company or Subsidiary debt or otherwise) or other understanding to which the Company or any Subsidiary is a party or by which any property or asset of the Company or any Subsidiary is bound or affected, or (iii) subject to the Required Approvals, conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company or a Subsidiary is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company or a Subsidiary is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result in a Material Adverse Effect.

(e) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other Person in connection with the execution, delivery and performance by the Company of the Transaction Documents or the Asset Management Agreements, other than: (i) the Shareholder Approval, (ii) the filings required pursuant to Section 4.4 of this Agreement, (iii) the notice and/or additional listing application(s) to each applicable Trading Market for the listing of the Shares and Pre-Funded Warrant Shares for trading thereon in the time and manner required thereby; (iv) the Registration Statement required to be filed by the Registration Rights Agreement; (v) the filing of Form D with the Commission and such filings as are required to be made under applicable state securities laws; and (vi) the filing of Form 72-503F Report of Distributions Outside Canada with the Ontario Securities Commission pursuant to Section 4.1 of OSC Rule 72-503 (collectively, the “Required Approvals”).

(f) Issuance of the Securities. The Securities are, or will be on or prior to the Closing Date, duly authorized for issuance and, when Shares are issued in accordance with the applicable Transaction Documents, such Shares will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company other than restrictions on transfer provided for in the Transaction Documents, subject to the removal of the Transfer Restriction from the constating documents of the Company, provided the Shares are distributed pursuant to the Registration Statement on or after the Effective Date. The Pre-Funded Warrant Shares, when issued in accordance with the terms of the Pre-Funded Warrants, will be validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company other than restrictions on transfer provided for in the Transaction Documents, subject to the removal of the Transfer Restriction from the constating documents of the Company, provided the Pre-Funded Warrants and Pre-Funded Warrant Shares are distributed pursuant to the Registration Statement on or after the Effective Date. The Company has, or will have on or prior to the Closing Date, reserved from its duly authorized share capital the maximum number of Common Shares issuable pursuant to this Agreement and the Pre-Funded Warrants, without taking into account any adjustment provisions. Subject to the accuracy of the representations and warranties made by the Purchasers in Section 3.2, the offer and sale of the Subscription Receipts to the Purchaser is and will be in compliance with applicable exemptions from (i) the registration and prospectus delivery requirements of the Securities Act, (ii) the registration and qualification requirements of applicable securities laws of the states of the United States, and (iii) the prospectus requirements of Canadian Securities Laws, subject to the distribution of the Subscription Receipts being materially compliant with the disclosure requirements of applicable securities law of the United States, as required by Section 2.4 of OSC Rule 72-503.