UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September 2025

Commission File Number: 001-42459

DIGINEX LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

25 Wilton Road, Victoria

London

Greater London

SW1V 1LW

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

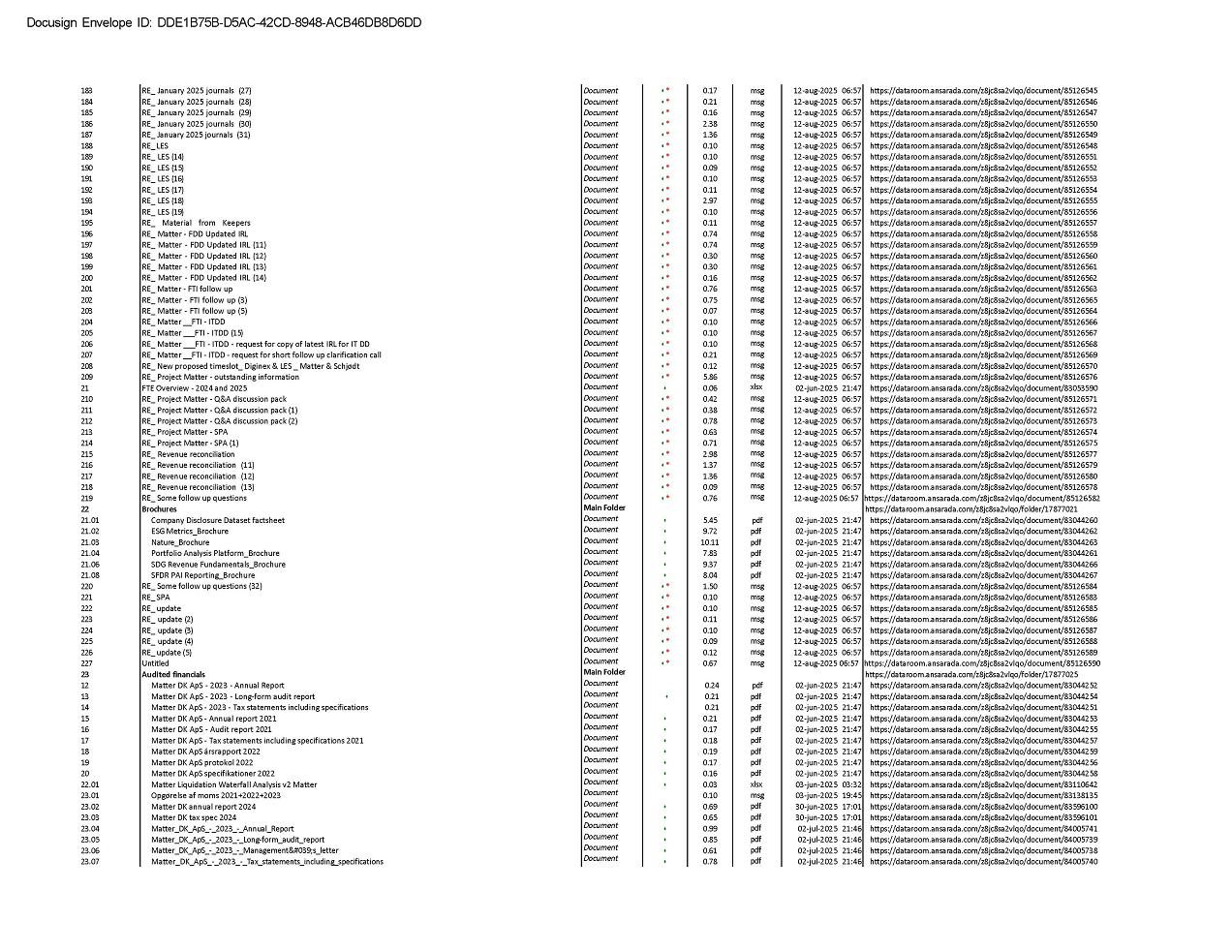

Matter DK ApS Transactions

Matter MOU

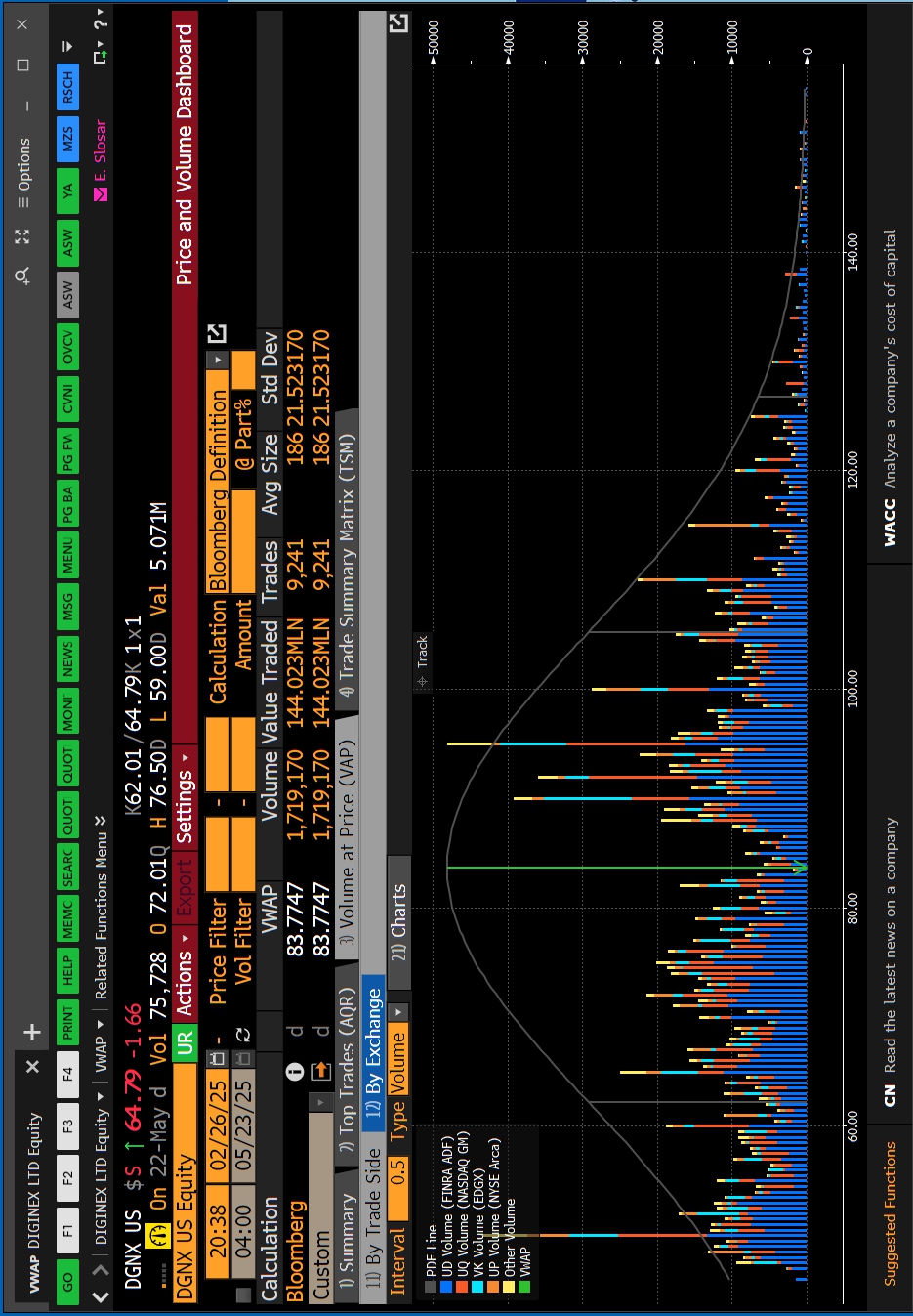

On May 23, 2025, Diginex signed a memorandum of understanding (the “Matter MOU”) to acquire Matter DK ApS (“Matter”) in an all share acquisition. Matter is an innovative ESG data company focused on delivering sustainability data and analytics solutions to the investment industry and helping financial institutions understand and communicate the sustainability of investments. Matter is based in Copenhagen, Denmark, and their largest shareholder is NASDAQ. The Matter MOU values the equity of Matter at $13 million which will be paid through the issuance of Diginex ordinary shares valued at the 60-trading day trailing VWAP (volume weighted average price) as of May 23, 2025, and such shares issued to Matter will be subject to an 18-month lock-up period. Diginex aims to enhance its portfolio by integrating Matter’s advanced ESG data analytics, benchmarking and reporting capabilities. We expect the acquisition will enable Diginex to offer more comprehensive ESG solutions to organizations worldwide, helping them navigate the complexities of sustainability and meet evolving regulatory and stakeholder expectations for ESG reporting. A copy of the Matter MOU is attached hereto as Exhibit 10.1.

The Matter Loan Agreement

Also on May 23, 2025, Diginex entered into a loan agreement with Matter (the “Matter Loan Agreement”), pursuant to which Diginex agreed to loan Matter EUR 250,000, as follows: (1) EUR 150,000 within 3 business days of the signing of the Matter MOU, (2) EUR 50,000 within 30 days following the signing of the Matter MOU, and (3) EUR 50,000 within 60 days following the signing of the Matter MOU. The loan principal shall accrue interest at a rate of 5% per annum. Matter shall repay all amounts outstanding under the Matter Loan Agreement together with all accrued interest only if the Diginex fails to acquire 100% of the share capital of Matter under permitted reasons set forth in the Matter MOU. Repayment will be due 60 days after notification from Diginex that they will not proceed with the acquisition of Matter. A copy of the Matter Loan Agreement is attached hereto as Exhibit 10.2.

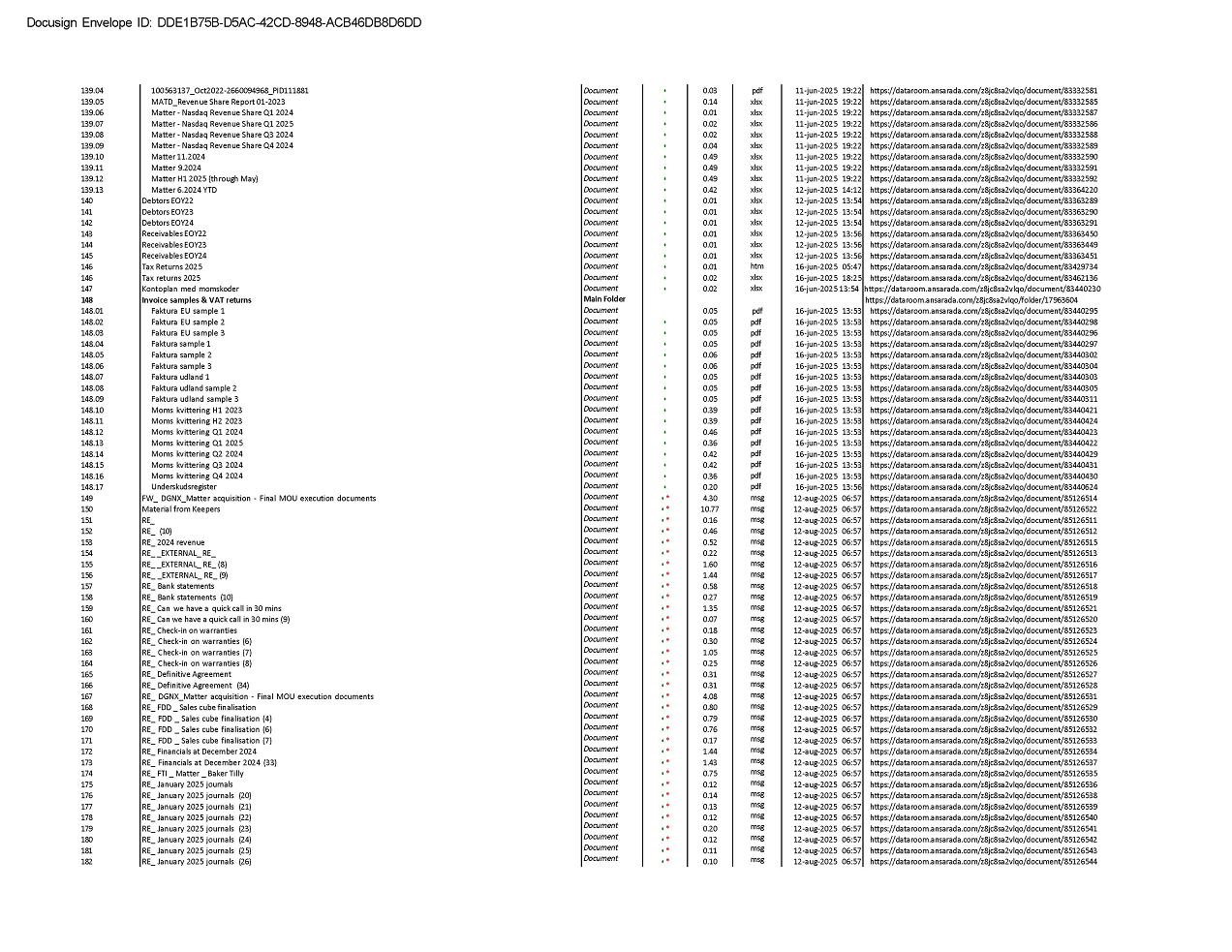

The Matter SPA

Diginex and Matter signed a Share Purchase Agreement (“Matter SPA”) dated August 14, 2025 memorializing Diginex’s acquisition of Matter (the “Acquisition”) pursuant to the terms and conditions set forth in the Matter MOU, subject to certain closing conditions set forth in the Matter SPA. Terms not otherwise defined shall have the meaning ascribed to them in the Matter SPA.

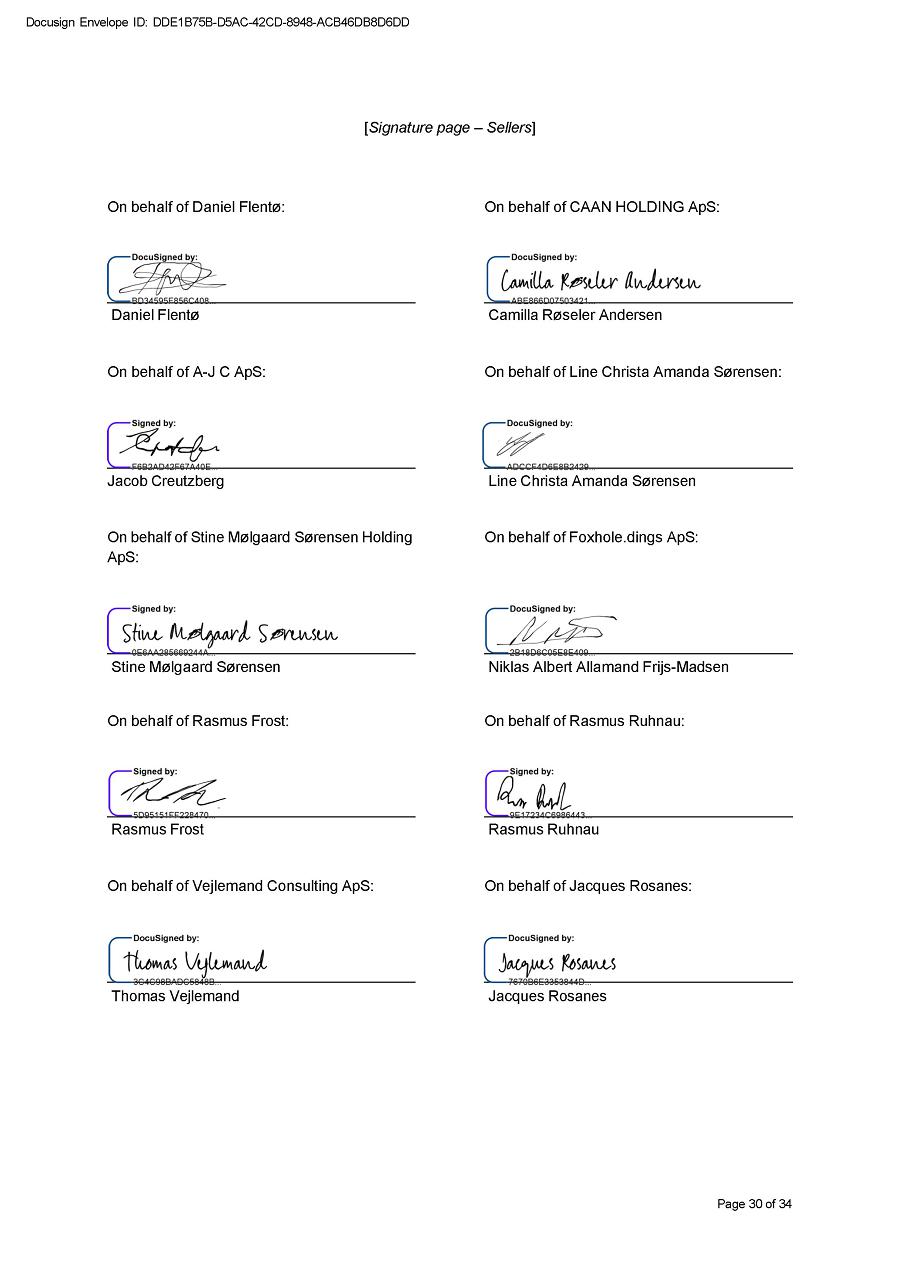

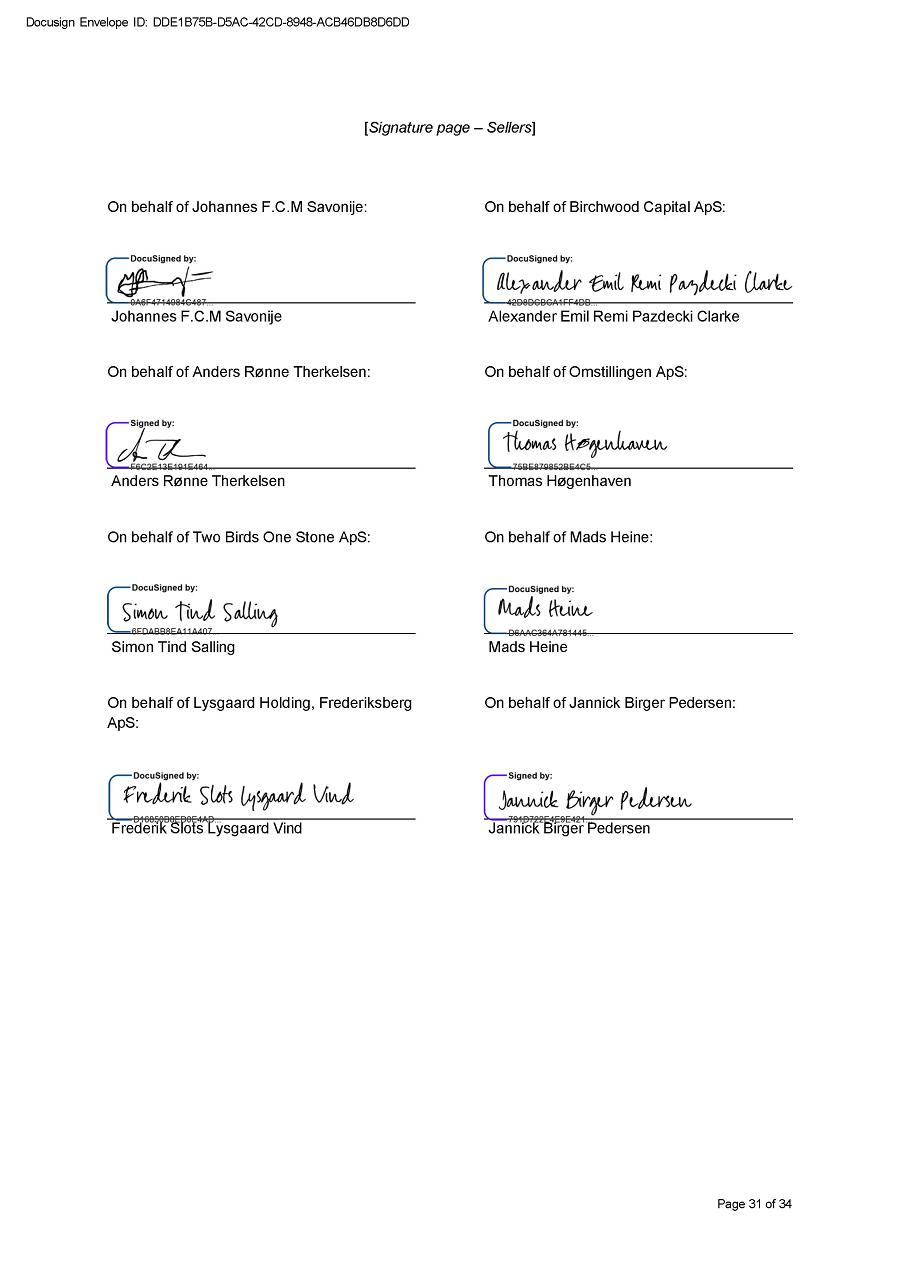

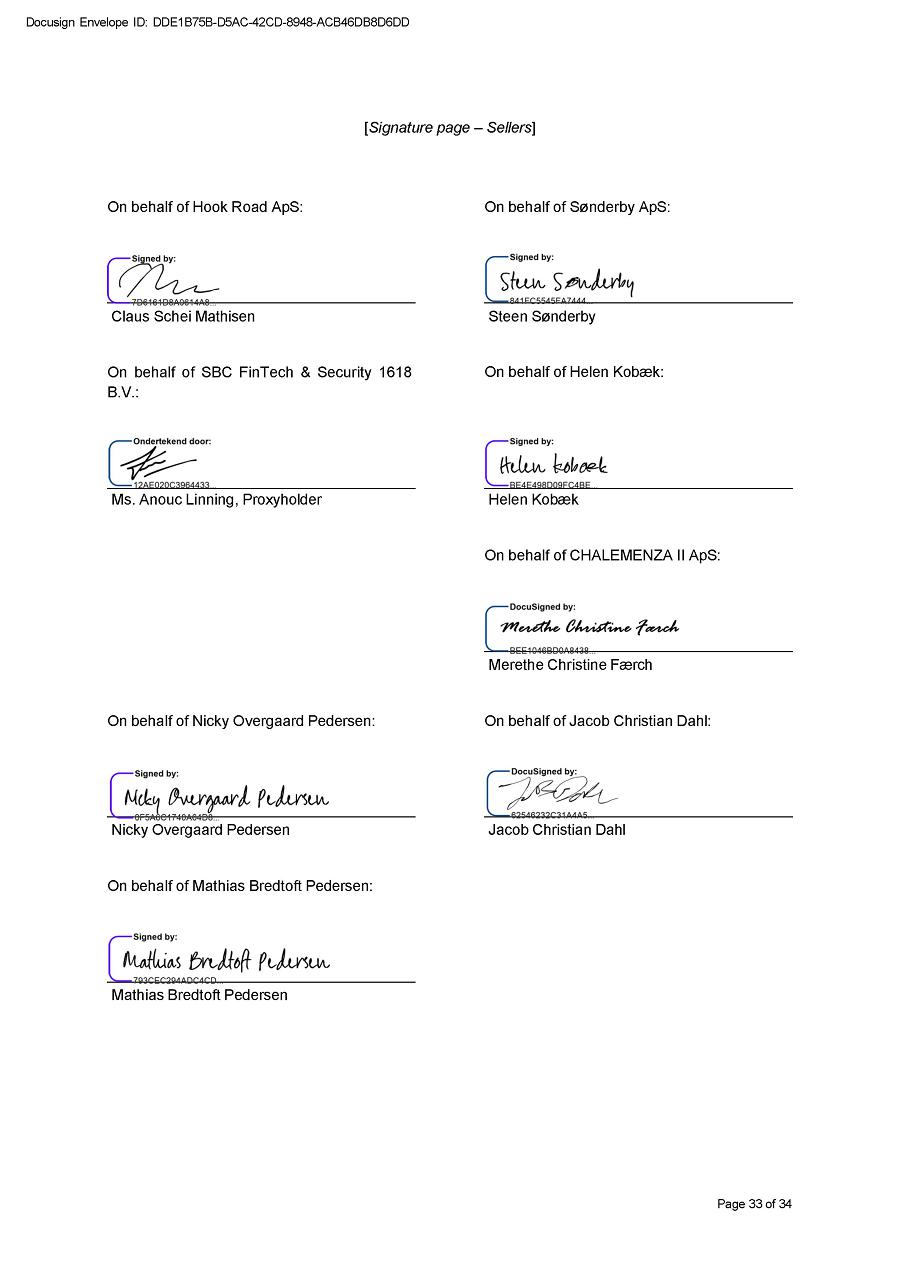

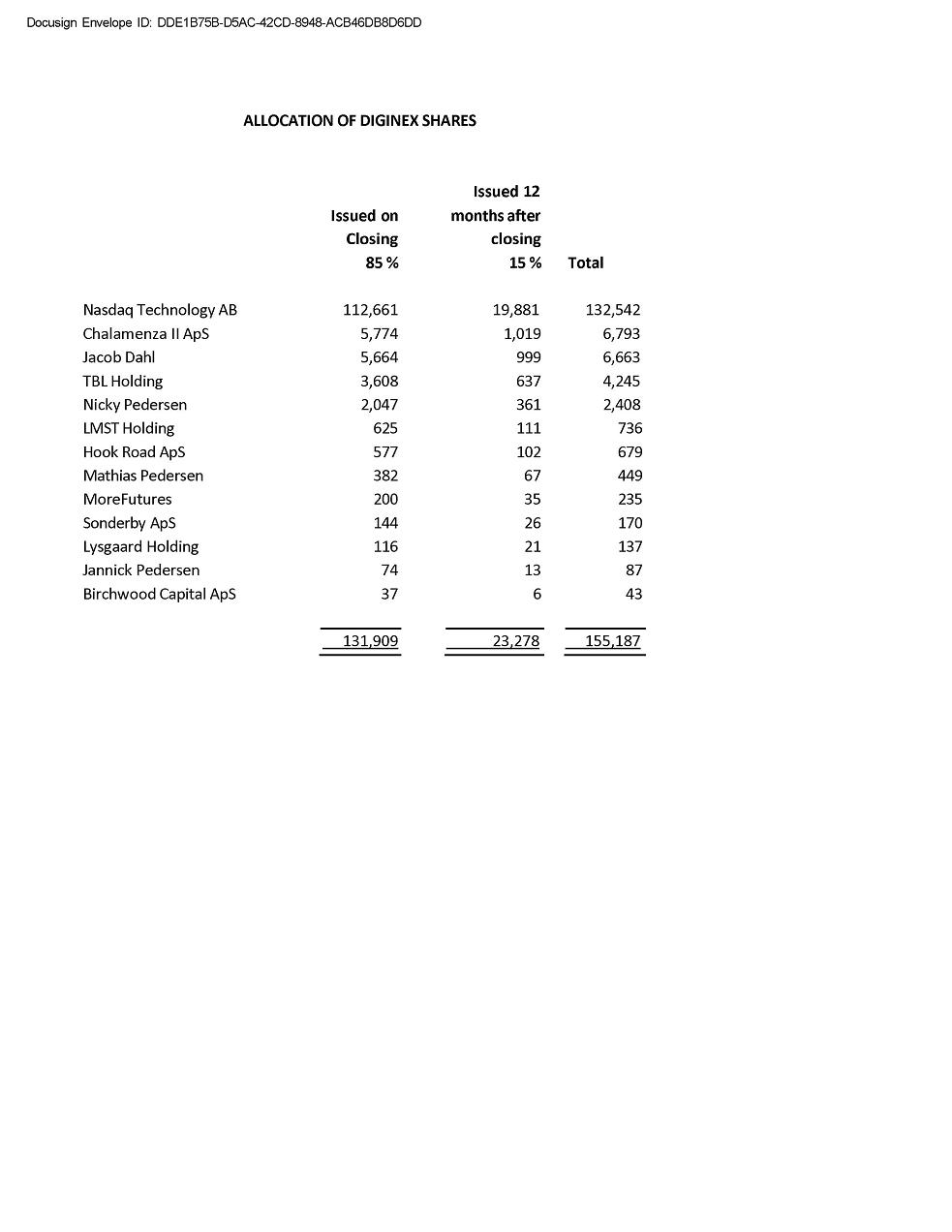

Pursuant to the Matter SPA, Diginex will acquire 100% of the Matter’s nominal share capital, corresponding to nominally DKK 109,236.82 fully paid-in shares, representing all equity-related rights in the Company on a fully diluted, as-if-converted basis (the “Matter Shares”) in exchange for a total of 155,187 ordinary shares of Diginex, valued by the Parties at $83.77 per ordinary share (the :Consideration Shares”), payable as follows:

1. Firstly, an amount corresponding to 85% of the Purchase Price (USD$11,050,000) shall be settled on the Closing Date through the issuance of 131,909 Diginex ordinary shares, such shares having an aggregate value equal to 85% of the Purchase Price based on the volume-weighted average price of Diginex’s ordinary shares over the 60 trading days immediately preceding 23 May 2025, which was $83.77; and

2. Secondly, the remaining 15% of the Purchase Price (USD$1,950,000) shall be settled 12 months after the Closing Date through the issuance of 23,278 Diginex ordinary shares, such shares having an aggregate value equal to 15% of the Purchase Price based on the volume-weighted average price of Diginex’s ordinary shares over the 60 trading days immediately preceding 23 May 2025, which was $83.77.

In exchange for the Noteholders, as defined in the Matter SPA, receipt of the Consideration Shares the Convertible Note, as defined in the Matter SPA, shall be satisfied and cancelled. All of the recipients of the Consideration Shares shall be subject to a lock-up for a period of 18 months from the Closing Date.

Diginex will at Closing also reserve a total of 29,844 ordinary shares (the “Incentive Shares”) for distribution to the Key Persons, as defined in the Matter SPA. The Incentive Shares have an indicative value of USD 2,500,000 based upon the agreement between the Parties. The Incentive Shares shall vest in equal proportions, 50% of the Incentive Shares will vest 12 months after the Closing and the remaining 50% of the Incentive Shares will vest 24 months after the Closing.

Diginex agrees to file a registration statement on Form F-1 (the “Registration Statement”) with the Securities and Exchange Commission (“SEC”) within 90 days of Closing in respect of the Consideration Shares and Incentive Shares. Diginex shall use its reasonable best efforts to have the Registration Statement, and any amendment, declared effective by the SEC at the earliest date thereafter. The Parties expect the Acquisition to close in the next thirty (30) days.

The foregoing is just a summary of the Matter SPA and is qualified in its entirety by the actual Matter SPA, a copy of which is attached hereto as Exhibit 10.3 and is incorporated by reference.

Addendum to the Matter SPA

On August 29, 2025, the parties entered into an addendum to the Matter SPA (the “Addendum”), which provided that the Consideration Shares and the Incentive Shares to be issued pursuant to the Matter SPA will be adjusted to account for Diginex bonus share issuance that occurred on September 8, 2025, whereby seven bonus ordinary shares were issued for every one ordinary share held on September 5, 2025, the record date. A copy of the Addendum is attached hereto as Exhibit 10.5.

The Second Matter Loan Agreement

On August 29, 2025, Diginex and Matter entered into a new loan agreement pursuant to which Diginex agreed to loan to the Matter a total principal amount of up to EUR500,000 to be drawn down in tranches mutually agreed between the Parties (the “Second Matter Loan Agreement”). Matter shall pay interest on the Loan to Diginex at the rate of 5% per annum, accruing from drawdown until repayment or conversion of loan closing of the Acquisition. As of September 9, 2025, Diginex has loaned Matter EUR 250,000 under the Second Matter Loan Agreement. A copy of the Second Matter Loan Agreement is attached hereto as Exhibit 10.4.

Completion of Eight to One Stock Split Paid as Bonus Shares

The Company has completed the distribution of a bonus shares issuance, whereby seven bonus ordinary shares were issued for every one ordinary share held on September 5, 2025, the record date. As of the close of business on September 8, 2025, each shareholder of record, as of September 5, 2025, received seven bonus ordinary shares for every one ordinary share held.

Following the distribution, the Company’s issued and outstanding ordinary shares have increased proportionately. As of September 8, 2025, the Company has approximately 201,950,104 ordinary shares issued and outstanding. The securities held by the holders of the Company’s warrants and employee share options, outstanding as of the record date, will be adjusted to account for the bonus share issuance. The Company’s authorized share capital and the par value per ordinary share remain unchanged, and there is no change to the Company’s CUSIP number or trading symbol.

On September 8, 2025, the Company issued a press release concerning the bonus share issuance, a copy of which is attached hereto as Exhibit 99.1

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| DIGINEX LIMITED | ||

| Date: September 10, 2025 | /s/ Mark Blick | |

| Name: | Mark Blick | |

| Title: | Chief Executive Officer | |

| (Principal Executive Officer) | ||

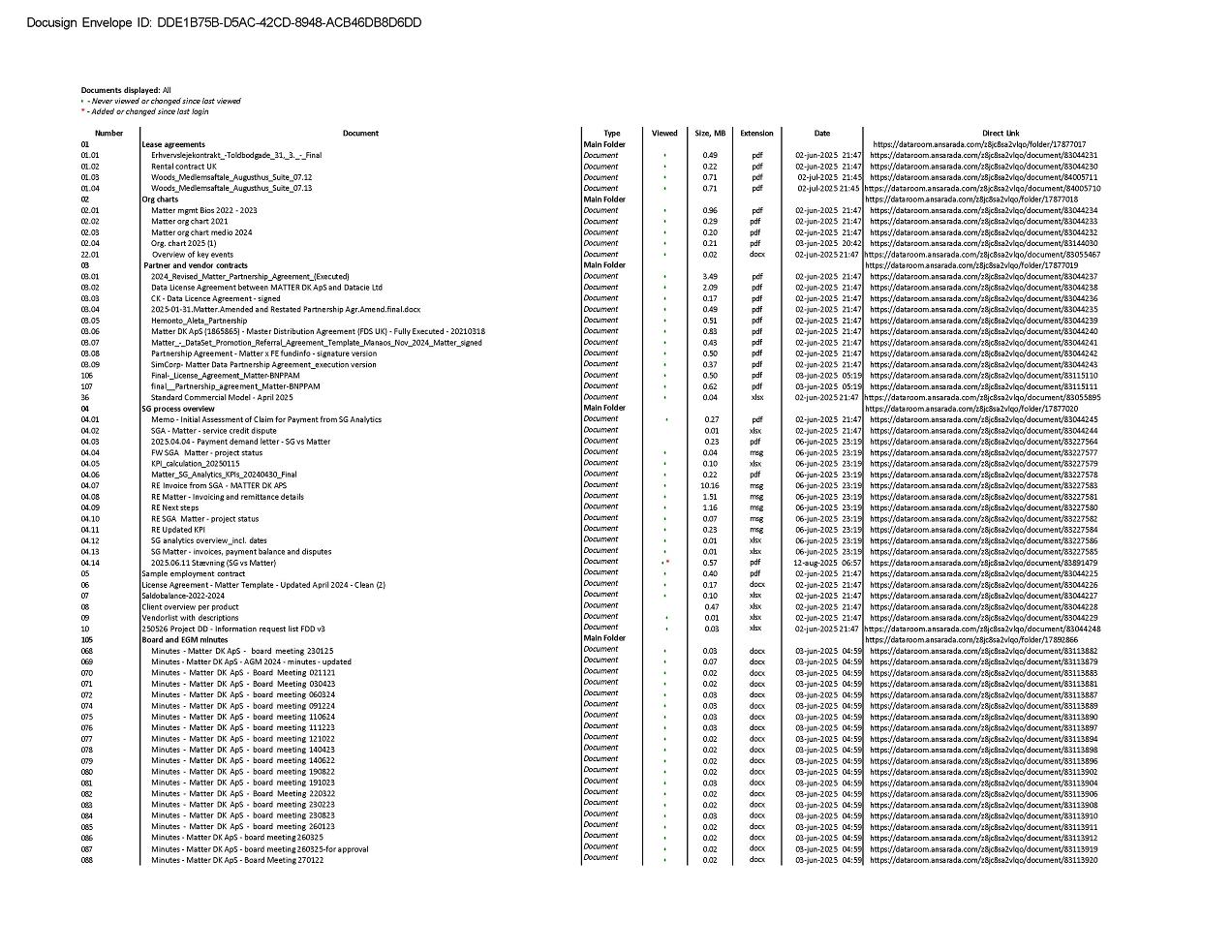

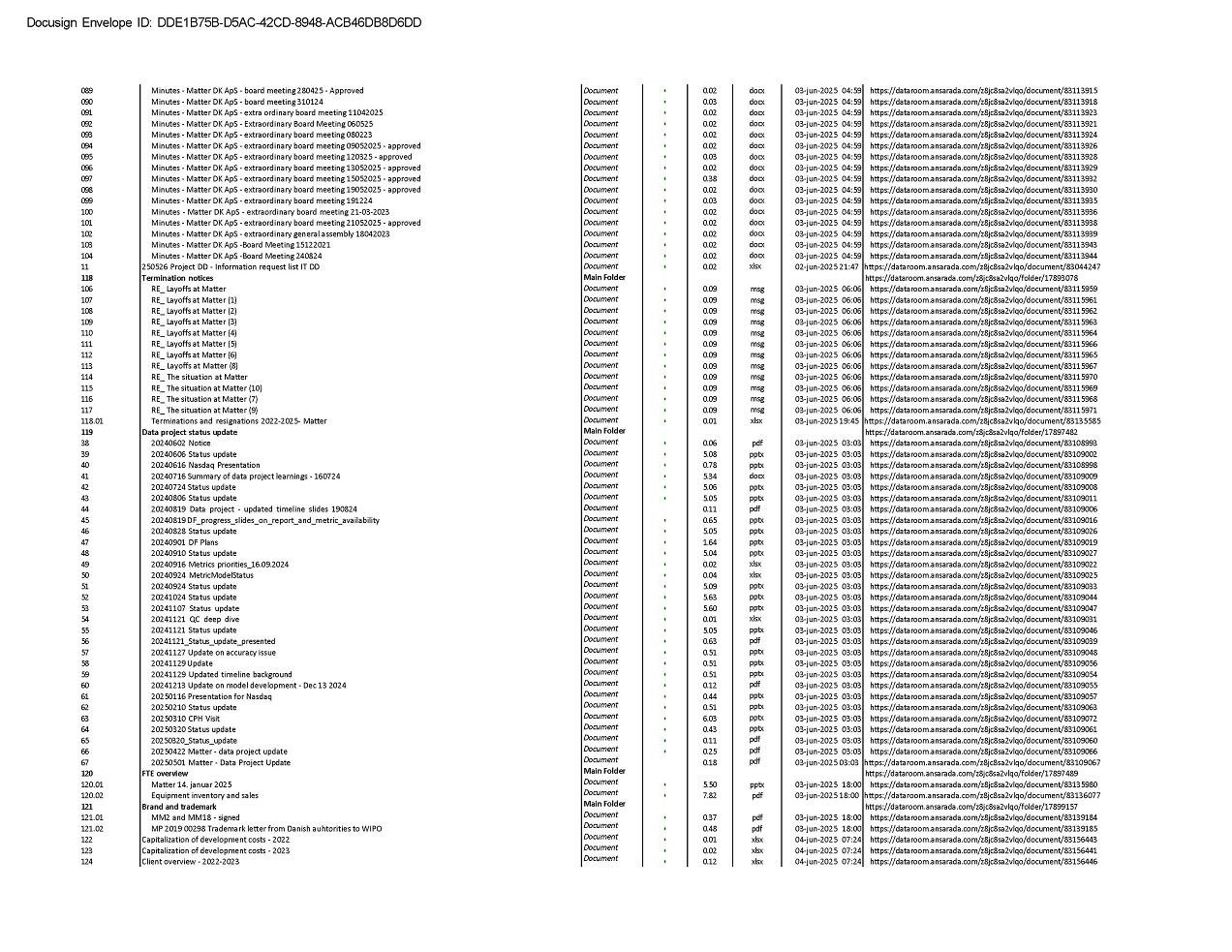

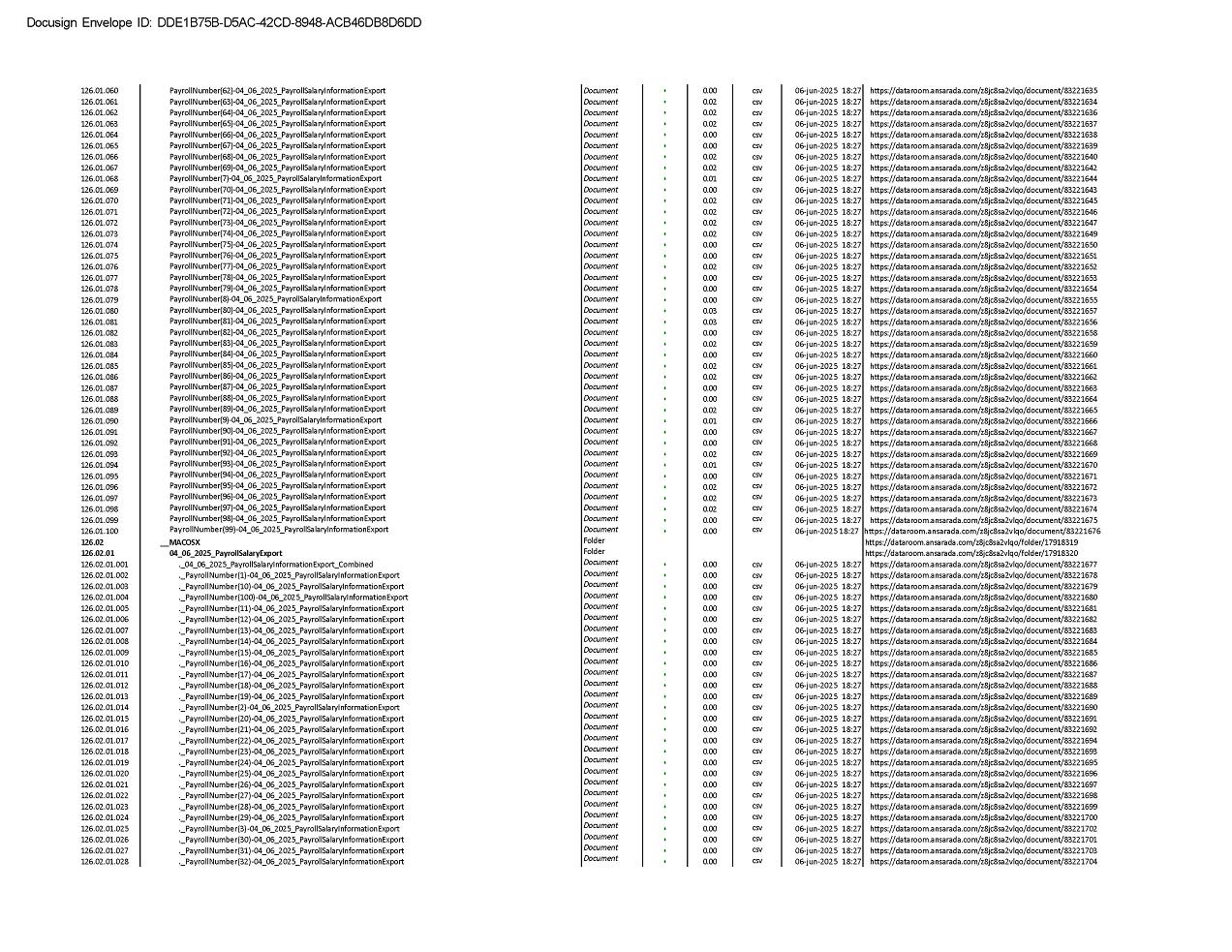

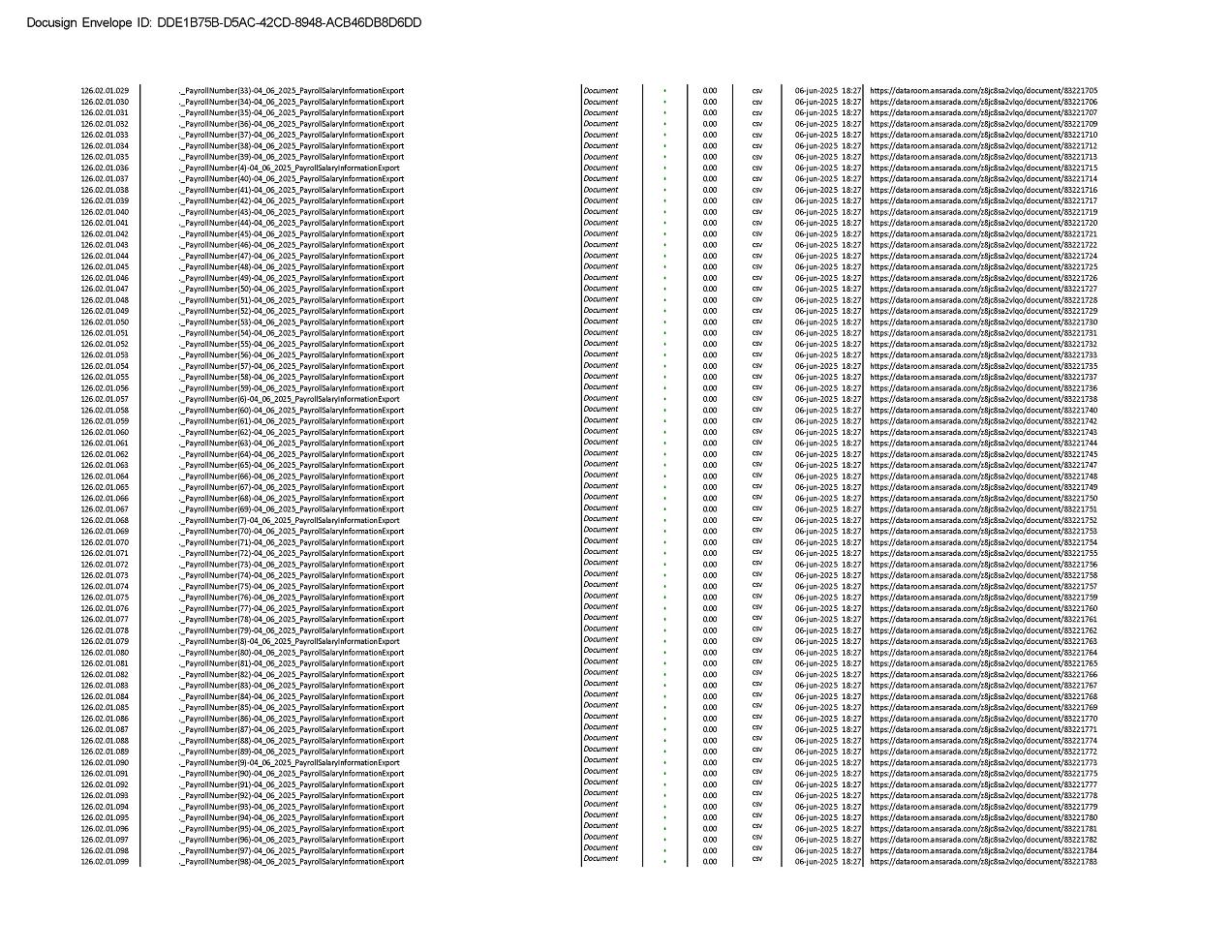

Exhibit 10.1

CONFIDENTIAL MEMORANDUM OF UNDERSTANDING

23 May, 2025

The following letter of intent is a summary of the principal terms contemplated for the proposed transaction described below (“MOU”).

| 1. | Proposed Transaction and Structure Matters | Pursuant to the terms and conditions of a Definitive Agreement (as herein defined), Diginex Limited (the “Company”), will acquire, either directly or indirectly, through a wholly-owned subsidiary of the Company, 100% of the issued and outstanding equity interests (collectively, the “Shares”) of Matter DK ApS (“Target” and such transaction, the “Proposed Transaction”). The structure of the Proposed Transaction is subject to the Company’s diligence and discussion amongst the parties hereto. | |

| 2. | Purchase Price | As consideration for the Shares in the Proposed Transaction and subject to the terms and conditions of this MOU (including the satisfactory completion of the Company’s due diligence), the Company is prepared to offer US$13,000,000 of Diginex Limited shares (valued at the 45 day volume weighed average price upon signing of this MOU), on debt-free basis at the closing of the Proposed Transaction. The shares will be subject to an 18 month lock up period. The Company will also offer $2,500,000 of Diginex Limited shares to be shared between the Target executives and key employees with 50% released from a lock-up after 18 months for 12 months good service, and the balance released after 30 months, for 24 months good service. | |

| 3. | Documentation | As soon as reasonably practicable following the date this MOU is signed by Target, the Company and Target will commence to negotiate a definitive acquisition agreement (the “Definitive Agreement”) and any ancillary agreements contemplated thereby, to be initially drafted by the Company’s counsel. The Definitive Agreement and any such ancillary agreements will contain representations, warranties, covenants, and other customary terms and conditions for a transaction of the nature contemplated by this MOU. | |

| 4. | Due Diligence |

Target will permit, and will cause its representatives to permit, the Company and the Company representatives, during normal business hours and upon reasonable notice, access to Target’s facilities, books and records, key employees, customers, suppliers and advisors for the purpose of completing the Company’s due diligence review. The due diligence investigation will include, but is not limited to, a complete review of Target’s financial, legal, tax, environmental, intellectual property and labor records and agreements, and any other matters the Company and the Company representatives deem relevant.

Due Diligence shall start at the date of this MOU and shall be completed on or before 31st July 2025 (the “Due Diligence Period”). |

| 5. | Due Diligence Period Funding | It is acknowledged that the Target is in a critical cash position and will run out of funding within the Due Diligence Period. As such, subject to the negotiation and execution of satisfactory definitive documentation with respect thereto, the Company is willing to make a loan of USD150,000 to the Target on terms and conditions and a date to be mutually agreed by the parties following the date hereof; provided, that the loan will only be repayable if, during the Due Diligence Period, the Company (in its sole discretion) identifies material discrepancies from the information upon which the Company made its decision to enter into this MOU (as to be further defined in the definitive documentation with respect to the loan). | |

| 6. | Conditions | The Company’s obligation to close the Proposed Transaction will be subject to the satisfaction of customary conditions, including (without limitation): (i) Target’s operation of its business in the ordinary course, consistent with past practice, in all material respects, (ii) the accuracy of Target’s representations and warranties except for any inaccuracies therein that would not reasonably be expected to have a material adverse effect (other than fundamental representations and warranties, which shall be accurate in all respects), (iii) the accuracy of Target covenants in all material respects, (iv) the approval of the Proposed Transaction by the board of directors of the Company, (v) the satisfaction or receipt of any material regulatory (including competition or antitrust) requirements or approvals, (vi) there being no material adverse effect on the business, results of operations, condition (financial or otherwise) or assets of Target, and (vii) if requested by the Company, the Target management team entering into new offer letters and/or employment agreements with the Company, which employment arrangements shall be entered into concurrently with the signing of the Definitive Agreement and shall be effective as of the closing. | |

| 7. | Confidentiality | The non-disclosure agreement dated 24 April, 2025 between Matter DK ApS and Diginex Limited remains in full force and effect. | |

| 8. | Announcement | No announcement in respect of the matters covered by this MOU may be made unless agreed in writing by both parties or required by relevant regulatory authorities as a legal obligation (including applicable listing standards and securities laws). |

| 9. | Exclusivity/Access |

In consideration of the expenses that the Company has incurred and will incur in connection with the Proposed Transaction, commencing on the date this MOU is signed by Target and continuing until such time as this MOU has terminated in accordance with the provisions of Section 11 (such period, the “Exclusivity Period”), neither Target nor any of its affiliates or any of its or their respective equityholders, employees, officers, directors, representatives, agents and advisors (collectively, the “Target Group”) shall initiate, solicit, entertain, facilitate, negotiate, accept or discuss, directly or indirectly, any proposal or offer from any person or group of persons other than the Company and its representatives to acquire all or any significant part of the business and properties, assets, capital stock or capital stock equivalents of Target, whether by merger, purchase of shares, purchase of assets, tender offer or otherwise (an “Acquisition Proposal”), or provide any confidential information to any third party in connection with an Acquisition Proposal, or enter into any agreement, arrangement or understanding requiring Target or any Target shareholder to abandon, terminate or fail to consummate the Proposed Transaction with the Company.

Target agrees to promptly notify the Company if any member of the Target Group receives any indications of interest, requests for information or offers in respect of an Acquisition Proposal during the Exclusivity Period, and will communicate to the Company in reasonable detail the terms of any such indication, request or offer.

Immediately upon execution of this MOU by Target, Target shall, and shall cause the Target Group to, terminate any and all existing discussions or negotiations with any person or group of persons other than the Company regarding an Acquisition Proposal. Target represents that no member of the Target Group is party to or bound by any agreement with respect to an Acquisition Proposal other than under this MOU.

In the event that Target or any member of the Target Group breaches or violates any of the first three paragraphs of this Section 9, Target shall reimburse the Company for all reasonable and documented out-of-pocket expenses of the Company incurred in connection with the Proposed Transaction promptly upon demand by the Company with respect thereto. |

|

| 10. | Governing Law, Expenses & Specified Provisions | This MOU will be governed by and construed under the laws of the State of New York without regard to conflicts of laws principles. Except as otherwise expressly provided in the Definitive Agreement or in Section 9 (Exclusivity/Access) above, the Company and the Target Group will be responsible for and bear all of their respective costs and expenses (including the expenses of their respective representatives) incurred at any time in connection with pursuing or consummating the Proposed Transaction. Except for the provisions of this Section 10 and Section 7 (Confidentiality), Section 8 (Announcement) Section 9 (Exclusivity/Access), Section 11 (Termination and Survival), and Section 12 (Miscellaneous) which are the legally binding and enforceable agreements of the parties to this MOU (the “Specified Provisions”), this MOU is merely an expression of interest and no obligations shall be created or come into existence hereunder (with the exception of the Specified Provisions), except after the negotiation, execution, and delivery of a definitive agreement, and then only in accordance with the terms and conditions thereof. Without limiting the foregoing, entry into a Definitive Agreement will be subject to (a) the Company having completed and, in its sole discretion, being satisfied with its due diligence and verification of the assumptions relied upon by the Company in structuring the Proposed Transaction and in establishing the consideration payable in the Proposed Transaction and (b) the approval of the Proposed Transaction by the board of directors and stockholders, if applicable, of the Company. | |

| 11. | Termination and Survival | This MOU shall automatically terminate, without any action by the parties hereto, upon the earlier of (a) execution of the Definitive Agreement as contemplated by this MOU, (b) 5:00 p.m., New York City (“NYC”) time on the 90th day following the date this MOU is signed by Target, unless the parties mutually agree to extend such date, and (c) the Company’s termination at any time upon written notice to Target; provided, however, that the Specified Provisions, other than the first three paragraphs of Section 9 (Exclusivity/Access), shall survive the expiration or termination of this MOU. | |

| 12. | Miscellaneous |

Except for the Company’s assignment to its wholly owned subsidiary, now existing or to be formed in contemplation of the Proposed Transaction, this MOU may not be assigned by any party hereto and may only be amended by a writing signed by the parties.

This MOU may be executed in counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. This MOU and any amendments hereto, to the extent signed and delivered by means of electronic transmission of .pdf files or other image files via e-mail, cloud-based transfer or file transfer protocol, or use of a facsimile machine, shall be treated in all manner and respects and for all purposes as an original agreement or instrument and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. |

SCHEDULE 1

60 trading day DGNX VWAP price

[Signature Page Follows]

Please evidence acceptance of this MOU by delivery of an executed copy of this MOU by Target to the Company no later than 5:00 p.m., NYC time, on May 23, 2025, after such time this MOU shall be null and void.

| DIGINEX LIMITED | ||

| By: | /s/ Miles Pelham | |

| Name: | Miles Pelham | |

| Title: | Chairman | |

Agreed to and accepted this 23 day of May, 2025 by:

| Matter DK ApS | ||

| By: | /s/ Niels Fibæk-Jensen | |

| Name: | Niels Fibæk-Jensen | |

| Title: | CEO | |

| Matter DK ApS | ||

| By: | /s/ Jacob C. Dahl | |

| Name: | Jacob C. Dahl | |

| Title: | Chairman of the Board | |

| Matter DK ApS | ||

| By: | /s/ Steen Sønderby | |

| Name: | Steen Sønderby | |

| Title: | Board member | |

| Matter DK ApS | ||

| By: | /s/ Morten Tinggaard | |

| Name: | Morten Tinggaard | |

| Title: | Board member & shareholder | |

| On behalf of Fibaek-Jensen Holding | ||

| By: | /s/ Niels Fibæk-Jensen | |

| Name: | Niels Fibæk-Jensen | |

| Title: | CEO | |

[Signature Page to Memorandum of Understanding]

| On behalf of ESF Holding | ||

| By: | /s/ Emil Stigsgaard Fuglsang | |

| Name: | Emil Stigsgaard Fuglsang | |

| Title: | CEO | |

| On behalf of Arx Holding | ||

| By: | /s/ Johan Emil Rasmussen | |

| Name: | Johan Emil Rasmussen | |

| Title: | ||

| Matter DK ApS | ||

| By: | /s/ Morten Tinggaard | |

| Name: | Morten Tinggaard | |

| Title: | Board member & shareholder | |

| On behalf of TBL Holding ApS | ||

| By: | /s/ Steen Sønderby | |

| Name: | Steen Sønderby | |

| Title: | CEO | |

| On behalf of TBL Holding ApS | ||

| By: | /s/ Rasmus Nørgaard | |

| Name: | Rasmus Nørgaard | |

| Title: | CEO | |

[Signature Page to Memorandum of Understanding]

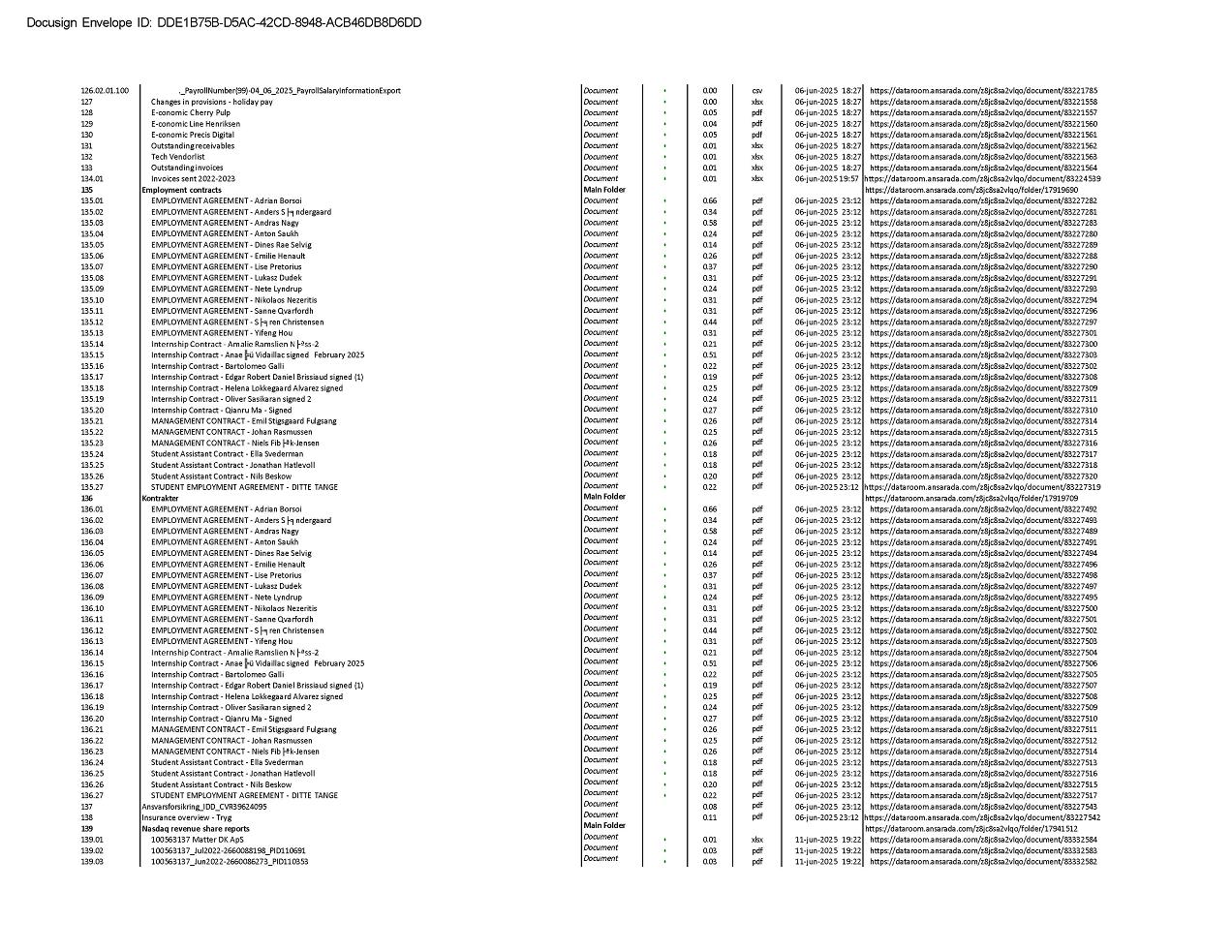

Exhibit 10.2

Diginex Limited

and

Matter DK ApS

LOAN AGREEMENT

THIS AGREEMENT is dated 23rd May 2025 and is made

BETWEEN:

| (1) | Diginex Limited whose registered address 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9009 Cayman Islands (the” Lender”); |

| (2) | Matter DK ApS, a company incorporated in Denmark whose registered company CVR number is 38402021, and whose registered office is at Toldbodgade 31,3. Floor, 1253 Copenhagen, Denmark (the “Borrower”) |

The Lender and the Borrower together the “Parties”.

WHEREAS:

IT IS HEREBY AGREED:

| 1.1 | The definitions and rules of interpretation in this clause apply in this agreement. |

| “Business Day” | a day (other than a Saturday or a Sunday) on which commercial banks are open for general business in London; |

| “Event of Default” | any event or circumstance listed in Schedule 1; |

| “Loan” | the total principal amount outstanding under this agreement; |

| “Indebtedness” | any obligation to pay or repay money, present or future, whether actual or contingent, sole or joint; |

| “MOU” | Memorandum of Understanding as signed by the parties on 23 May 2025 in relation to the Acquisition. |

| “Acquisition” | The completion of the purchase of 100% of the share capital of the Borrower by the Lender. |

| “EUR” | EURO, currency of European Union |

| 1.2 | Clause, schedule and paragraph headings do not affect the interpretation of this agreement. |

| 1.3 | A reference to a person shall include a reference to an individual, firm, company, corporation, unincorporated body of persons, or any state or any agency of that person). |

| 1.4 | A reference to a statute, statutory provision or subordinate legislation is a reference to it as it is in force for the time being, taking account of any amendment or extension, or re-enactment and includes any former statute, statutory provision or subordinate legislation which it amends or re-enacts. |

|

|

Confidential |

| 1.5 | A reference to a clause or schedule is to a clause of or a schedule to this agreement unless the context requires otherwise. |

| 1.6 | A reference to writing or written includes faxes but not e-mail. |

| 1.7 | Unless the context otherwise requires, a reference to one gender shall include a reference to the other genders. |

| 1.8 | Unless the context otherwise requires, words in the singular include the plural and in the plural include the singular. |

| 1.9 | A reference to continuing in relation to an Event of Default means an Event of Default which has not been remedied or waived. |

The Lender will loan to the Borrower a total principal amount of EUR250,000 on the terms and subject to the conditions of this agreement.

The loan will be drawn down in three tranches:

| Within 3 business days of the date of this MOU | EUR 150,000 | |||

| 30 days following the signing of the MOU | EUR 50,000 | |||

| 60 days after the signing of the MOU | EUR 50,000 |

| 3.1 | The Borrower shall pay interest on the Loan at a rate of 5% per annum, accruing from the day the Loan principal is credited to the Borrower’s bank account until Repayment Date. |

| 3.2 | If the Borrower fails to make any payment due under this agreement on the due date for payment, interest on the unpaid amount shall accrue daily, from the date of non-payment to the date of actual payment, at a rate of 25% per annum. |

Repayment

| 4.1 | The Borrower will repay all amounts outstanding together with all accrued interest only if the Lender fails to acquire 100% of the share capital of the Borrower under permitted reasons disclosed in the MOU. Repayment will be due 60 days after notification from the Lender that they will not proceed with the Acquisition. |

Early Repayment

| 4.2 | This Loan can be repaid early at the discretion of the Borrower any time from the date of this Agreement |

| 4.3 | This Loan must be repaid immediately with the proceeds raised from either a debt or equity placing made by the Borrower. |

|

|

Confidential |

| 5.1 | All payments made by the Borrower under this agreement shall be in EUR: |

| (a) | in full, without any deduction, set-off or counterclaim; and |

| (b) | in immediately available cleared funds on the due date to the account that the Lender may specify to the Borrower. |

| 5.2 | Time shall be of essence in making each payment under this agreement. |

At any time after an Event of Default has occurred and is continuing, the Lender may give notice to the Borrower, stating that the Loan is immediately due and payable or payable on demand.

Each party shall pay its own costs in relation to the preparation and negotiation of the terms of this agreement.

| 8.1 | Any amendment to this agreement shall be in writing and signed by, or on behalf of, each party. |

| 8.2 | Any waiver of any right or consent given under this agreement is only effective if it is in writing and signed by the waiving or consenting party. It shall apply only in the circumstances for which it is given and shall not prevent the party giving it from subsequently relying on the relevant provision. |

| 8.3 | No delay or failure to exercise any right under this agreement shall operate as a waiver of that right. |

| 8.4 | No single or partial exercise of any right under this agreement shall prevent any further exercise of that right (or any other right under this agreement). |

| 8.5 | Rights and remedies under this agreement are cumulative and do not exclude any other rights or remedies provided by law or otherwise. |

| 9.1 | The invalidity, unenforceability or illegality of any provision (or part of a provision) of this agreement under the laws of any jurisdiction shall not affect the validity, enforceability or legality of the other provisions. |

| 9.2 | If any invalid, unenforceable or illegal provision would be valid, enforceable and legal if some part of it were deleted, the provision shall apply with whatever modification as is necessary to give effect to the commercial intention of the parties. |

This agreement may be executed and delivered in any number of counterparts, each of which is an original and which, together, have the same effect as if each party had signed the same document.

A person who is not a party to this agreement cannot enforce, or enjoy the benefit of, any term of this agreement.

|

|

Confidential |

| 12.1 | Each notice or other communication required to be given under, or in connection with, this agreement shall be: |

| (a) | in writing, delivered personally or sent by pre-paid first-class letter, registered airmail or fax; and |

| (b) | sent for the attention of the relevant party to its registered office or to any other addresses or fax numbers that are notified in writing by one party to the other from time to time. |

| 12.2 | Any notice or other communication given by a party shall be deemed to have been received: |

| (a) | if sent by fax, when received in legible form; |

| (b) | if given by hand, at the time of actual delivery; |

| (c) | if posted within the Denmark, on the second Business Day following the day on which it was despatched by pre-paid first-class post; and |

| (d) | if posted overseas, on the fifth Business Day following the day on which it was despatched by pre-paid registered airmail. |

| 12.3 | A notice or other communication given as described in clause 12.2(a) or clause 12.2(b) on a day which is not a Business Day, or after normal business hours in the place of receipt, shall be deemed to have been received on the next Business Day. |

| 13.1 | This agreement and any dispute or claim arising out of or in connection with it or its subject matter or formation (including non-contractual disputes or claims) shall be governed by, and construed in accordance with, the law of Cayman Islands. |

| 13.2 | The parties to this agreement irrevocably agree that the courts of Cayman Islands shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with this agreement or its subject matter or formation (including non-contractual disputes or claims). |

IN WITNESS WHEREOF this agreement has been entered into on the date first stated above.

|

|

Confidential |

SCHEDULE 1

EVENTS OF DEFAULT

The Borrower fails to pay any sum payable under this agreement when due, unless its failure to pay is caused solely by an administrative error or technical problem and payment is made within three Business Days of its due date.

| 2.1 | The Borrower stops or suspends payment of any of its debts, or is unable to, or admits its inability to pay its debts as they fall due. |

| 2.2 | The Borrower commences negotiations, or enters into any composition or arrangement, with one or more of its creditors with a view to rescheduling any of its Indebtedness (because of actual or anticipated financial difficulties). |

| 2.3 | A moratorium is declared over any of the Borrower’s Indebtedness. |

| 2.4 | Any bona fide action, proceedings, procedure or step is taken for: |

| (a) | the suspension of payments, winding up, dissolution, administration or reorganisation (using a voluntary arrangement, scheme of arrangement or otherwise) of the Borrower; or |

| (b) | the appointment of a liquidator, receiver, administrative receiver, administrator, compulsory manager or other similar officer in respect of the Borrower or any of its assets. |

| 2.5 | A distress, attachment, execution, expropriation, sequestration or other legal process is levied, enforced or sued out on, or against, the Borrower’s assets and is not discharged or stayed within 21 days. |

| 2.6 | An event or circumstance referred to in paragraphs 2.1 – 2.5 inclusive shall not apply to any winding-up petition which is frivolous or vexatious and is discharged, stayed or dismissed within 14 days of commencement or, if earlier, the date on which it is advertised. |

All or any part of this agreement becomes invalid, unlawful, unenforceable, terminated, disputed or ceases to have full force and effect.

The Borrower repudiates (or shows an intention to repudiate) this agreement.

|

|

Confidential |

Executed

by Diginex Limited as Lender |

) | Miles Pelham |

| _______________ | ) | Chairman |

| ) | ||

| /s/ Miles Pelham |

Executed by Matter DK ApS as Borrower |

) | Niels Fibaek-Jensen |

| _______________ | ) | Chief Executive Officer |

| ) | /s/ Niels Fibaek-Jensen |

|

|

Confidential |

Exhibit 10.3

Exhibit 10.4

Exhibit 10.5

Exhibit 99.1

Diginex Announces Completion of Eight to One Stock Split Paid as Bonus Shares

LONDON, Sept 8, 2025 (GLOBE NEWSWIRE) – Diginex Limited (NASDAQ: DGNX) (“Diginex”), a leading provider of Sustainability RegTech solutions, today announced that it has completed the distribution of the bonus shares issuance, whereby 7 bonus ordinary shares were issued for every one ordinary share held on September 5, 2025, the record date. As of the close of business on September 8, 2025, each shareholder of record, as of September 5, 2025, received seven bonus ordinary shares for every one ordinary share held.

Following the distribution, the Company’s issued and outstanding ordinary shares have increased proportionately. As of September 8, 2025, the Company has approximately 201,950,104 ordinary shares issued and outstanding. The securities held by the holders of the Company’s warrants and options outstanding as of the record date, will be adjusted for the bonus shares issuance. As a result of the bonus share issuance, the Company’s authorized share capital and the par value per ordinary share remain unchanged, and there is no change to the Company’s CUSIP number or trading symbol.

The bonus share issuance was effected by the resolutions adopted by the Company’s board of directors, and no action was required from the Company’s shareholders. Shareholders holding shares through a brokerage account had their holdings automatically adjusted to reflect the bonus shares, while registered shareholders received their bonus shares via book entry by the Company’s transfer agent.

About Diginex

Diginex Limited (Nasdaq: DGNX; ISIN KYG286871044), headquartered in London, is a sustainable RegTech business that empowers businesses and governments to streamline ESG, climate, and supply chain data collection and reporting. The Company utilizes blockchain, AI, machine learning and data analysis technology to lead change and increase transparency in corporate regulatory reporting and sustainable finance. Diginex’s products and services solutions enable companies to collect, evaluate and share sustainability data through easy-to-use software.

The award-winning diginexESG platform supports 19 global frameworks, including GRI (the “Global Reporting Initiative”), SASB (the “Sustainability Accounting Standards Board”), and TCFD (the “Task Force on Climate-related Financial Disclosures”). Clients benefit from end-to-end support, ranging from materiality assessments and data management to stakeholder engagement, report generation and an ESG Ratings Support Service.

For more information, please visit the Company’s website:

https://www.diginex.com/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results disclosed in the Company’s filings with the SEC.

Diginex

Investor Relations

Email: ir@diginex.com

IR Contact - Europe

Anna Höffken

Phone: +49.40.609186.0

Email: diginex@kirchhoff.de

IR Contact - US

Jackson Lin

Lambert by LLYC

Phone: +1 (646) 717-4593

Email: jian.lin@llyc.global

IR Contact - Asia

Shelly Cheng

Strategic Financial Relations Ltd.

Phone: +852 2864 4857

Email: sprg_diginex@sprg.com.hk