UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2025

FUNDAMENTAL GLOBAL INC.

FG NEXUS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 001-36366 | 46-1119100 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

|

6408 Bannington Road Charlotte, NC |

28226 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (704) 994-8279

FUNDAMENTAL GLOBAL INC.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value per share | FGNX | The Nasdaq Stock Market LLC | ||

| 8.00% Cumulative Preferred Stock, Series A, $25.00 par value per share | FGNXP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

FG Nexus Inc. formerly known as Fundamental Global Inc. (the “Company”) previously announced that on July 29, 2025 it entered into securities purchase agreement with certain accredited investors (the “Purchasers”) pursuant to which the Company agreed to sell and issue to the Purchasers in a private placement offering (the “Offering”) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to an aggregate of 40,000,000 shares (the “Pre-Funded Warrant Shares,”) of the Company’s common stock, par value $.001 per share (the “Common Stock”) at an offering price of $5.00 per Pre-Funded Warrant including the nominal exercise price of $.001 per Pre-Funded Warrant Share (the “PFW Purchase Price”), payable at the option of the Purchaser in cash, Bitcoin, USDC or ETH, the native token of the Ethereum network. If Purchaser elects to pay the PFW Purchase Price in a cryptocurrency, then the amount of such cryptocurrency to be paid shall equal (a) the per PFW Purchase Price, divided by (b) the spot exchange rate for that cryptocurrency (i.e. BTC, ETH or USDC, as applicable) as published by Coinbase.com at 8:00 p.m. (New York City time) on July 25, 2025.

Each of the Pre-Funded Warrants is immediately exercisable, upon the effectiveness of an amendment to the Company’s Articles of Incorporation providing for, another other things, an increase in the amount of authorized shares of Common Stock, for one share of Common Stock at the exercise price of $0.001 per Pre-Funded Warrant Share and may be exercised at any time until all of the Pre-Funded Warrants issued in the Offering are exercised in full. Certain Pre-Funded Warrants were issued with an automatic exercise feature (the “Automatic PFWs”), which will result in the automatic exercise of such Pre-Funded Warrant upon the effectiveness of an amendment to the Company’s amended and restated articles of incorporation providing for, among other things, an increase in the amount of authorized shares of Common Stock (the “Charter Amendment”).

On September 5, 2025, the Charter Amendment was declared effective by the Nevada Secretary of State. Accordingly, when the Charter Amendment was declared effective 34,026,811 Automatic PFWs converted into 34,026,811 shares of Common Stock. As of the filing of this Current Report on Form 8-K, the Company has 35,355,365 shares of Common Stock issued and outstanding.

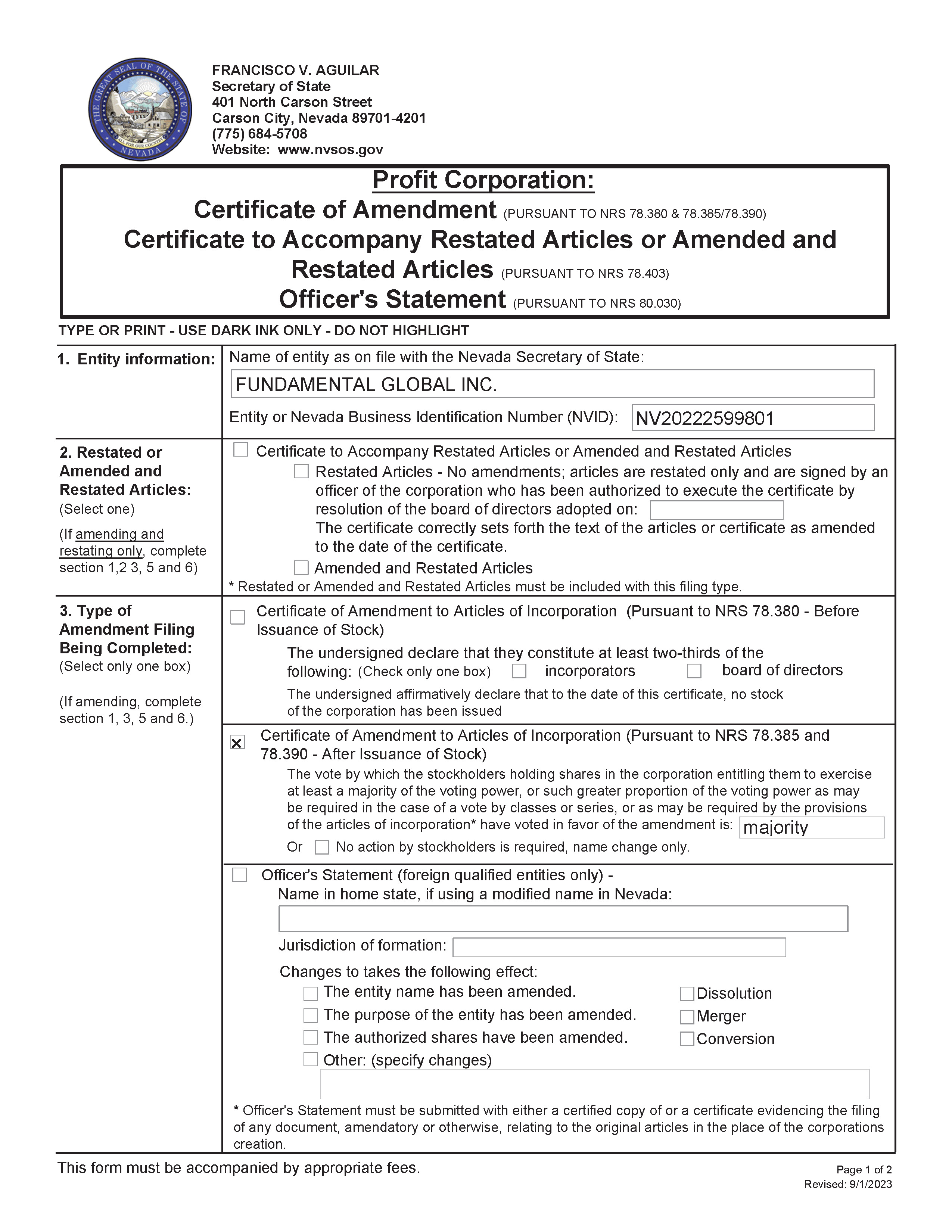

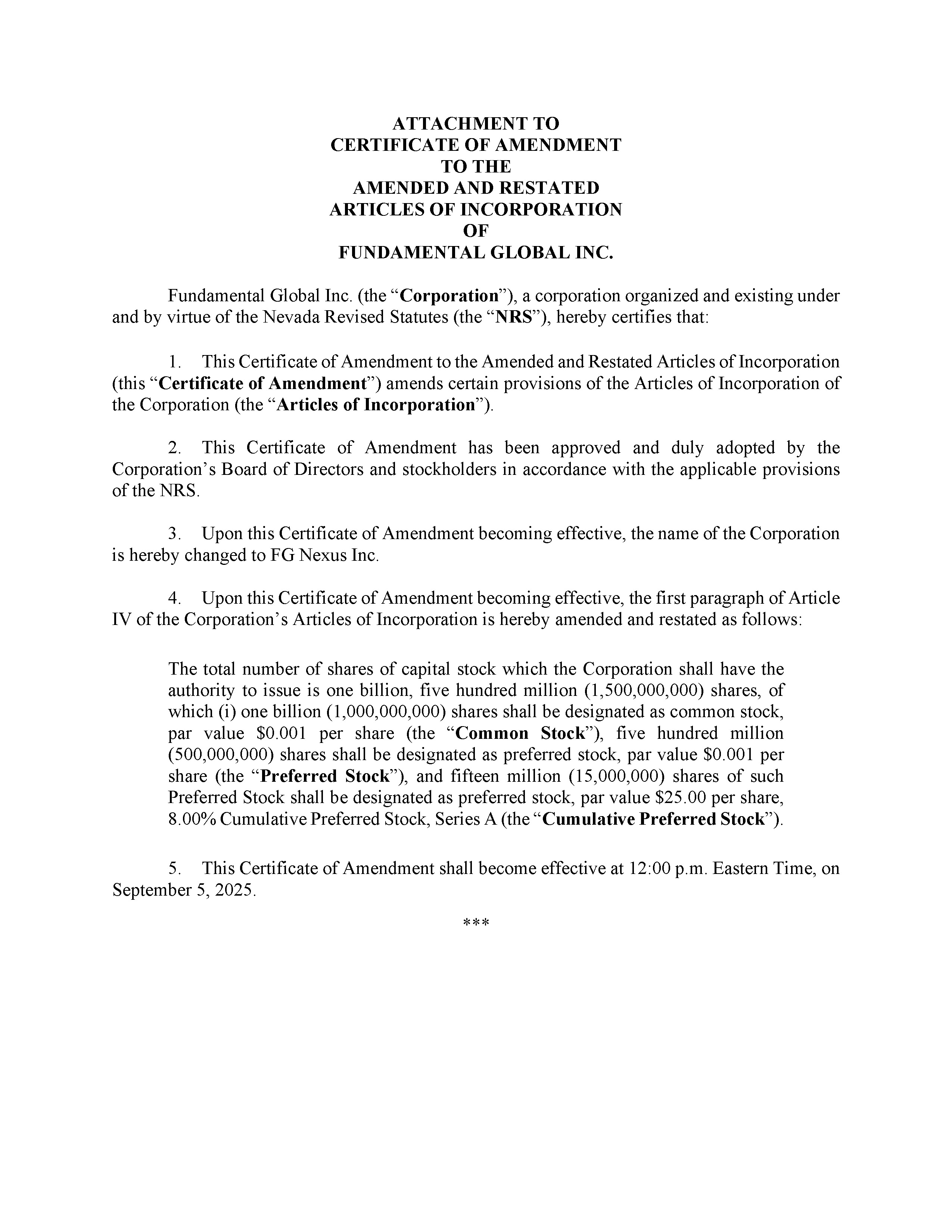

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As approved by a majority of its stockholders by written consent, dated July 23, 2025, the Company filed a certificate of amendment to its amended and restated articles of incorporation with the Nevada Secretary of State on September 5, 2025 to (i) increase the total number of authorized shares of Common Stock from 4,000,000 to 1,000,000,000, (ii) increase the total the number of authorized shares of preferred stock, par value $.001 per share (the “Undesignated Preferred Stock”) from 100,000,000 to 500,000,000, (iii) increase the total the number of authorized shares of 8% cumulative preferred stock, Series A (the “Series A Preferred Stock”) from 1,000,000 to 15,000,000 and (iv) change the name of the Company to “FG Nexus Inc.” (the “Charter Amendment”). The Charter Amendment was declared effective on September 5, 2025.

A copy of the Charter Amendment is filed as Exhibit 3.1 hereto and is incorporated by reference herein.

Item 7.01 Regulation FD

Fundamental Global Inc. (the “Company”) issued a press release on September 5, 2025, announcing the filing of the Charter Amendment and the conversion of the Automatic PFWs into shares of common stock of the Company (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 7.01 and Exhibit 99.1 are “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit | Description | |

| 3.1 | Certificate of Amendment, dated September 5, 2025, to the Amended and Restated Articles of Incorporation of FG Financial Group, Inc., as filed with the Secretary of State of the State of Nevada | |

| 99.1 | Press Release Issued by FG Nexus Inc. on September 5, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FG NEXUS INC | ||

| Date: September 5, 2025 | By: | /s/ Mark D. Roberson |

| Name: | Mark D. Roberson | |

| Title: | Chief Financial Officer | |

Exhibit 3.1

Exhibit 99.1

Fundamental Global Inc. Amends its Charter with the State of Nevada

Certificate of Amendment Changes Name to FG Nexus Inc.,

Increases Authorized Shares, Triggers Conversion of Automatic Exercise Pre-Funded Warrants to Common Stock and Expands Outstanding Share Count to Over 35 million

Charlotte, NC – September 5, 2025 - Fundamental Global Inc. (Nasdaq: FGNX, FGNXP) (the “Company” or “FG Nexus”), announced that its Certificate of Amendment to its amended and restated articles of incorporation has been declared effective by the Nevada Secretary of State today.

Pursuant to the Certificate of Amendment:

| ● | The name of the Company has been changed from Fundamental Global Inc. to FG Nexus Inc. | |

| ● | The Company’s authorized shares will increase as follows: |

| ○ | Total authorized shares of common stock, par value $0.001, will increase from 4,000,000 to 1,000,000,000 | |

| ○ | Total authorized shares of preferred stock, par value $0.001, will increase from 100,000,000 to 500,000,000 | |

| ○ | Total authorized shares of Series A 8% cumulative Preferred stock, par value $25.00, will increase from 1,000,000 to 15,000,000 |

Additionally, as a result of the Certificate of Amendment being declared effective by the Nevada Secretary of State the outstanding automatic exercise pre-funded warrants will convert to common shares, immediately increasing the Company’s common shares outstanding from 1.3 million to 35.4 million.

“Today marks a pivotal milestone in our corporate evolution to becoming the largest corporate holder of ETH in the world,” said Kyle Cerminara, CEO of FG Nexus.

FG Nexus Inc.

FG Nexus Inc. (Nasdaq: FGNX, FGNXP), (the “Company” or “FG Nexus”), is on the Ethereum Standard, and singularly focused on becoming the largest corporate holder of ETH in the world by an order of magnitude. In order to enhance our ETH YIELD, the Company will stake and restake, serving as a strategic gateway into Ethereum-powered finance, including tokenized RWAs and stablecoin yield.

The FGNX® logo and Fundamental Global® are registered trademarks of Fundamental Global LLC.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “budget,” “can,” “contemplate,” “continue,” “could,” “envision,” “estimate,” “expect,” “evaluate,” “forecast,” “goal,” “guidance,” “indicate,” “intend,” “likely,” “may,” “might,” “outlook,” “plan,” “possibly,” “potential,” “predict,” “probable,” “probably,” “pro-forma,” “project,” “seek,” “should,” “target,” “view,” “will,” “would,” “will be,” “will continue,” “will likely result” or the negative thereof or other variations thereon or comparable terminology. In particular, discussions and statements regarding the Company’s future business plans and initiatives are forward-looking in nature. We have based these forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these to be reasonable, such forward-looking statements are only predictions and involve a number of risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results, performance, or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements and may impact our ability to implement and execute on our future business plans and initiatives. Management cautions that the forward-looking statements in this press release are not guarantees of future performance, and we cannot assume that such statements will be realized or the forward-looking events and circumstances will occur. Factors that might cause such a difference include, without limitation, fluctuations in the market price of ETH and any associated impairment charges that the Company may incur as a result of a decrease in the market price of ETH below the value at which the Company’s ETH are carried on its balance sheet, changes in the accounting treatment relating to the Company’s ETH holdings, the Company’s ability to achieve profitable operations, government regulation of cryptocurrencies and online betting, changes in securities laws or regulations such as accounting rules as discussed below, customer acceptance of new products and services including the Company’s ETH treasury strategy, general conditions in the global economy; risks associated with operating in the merchant banking and managed services industries, including inadequately priced insured risks and credit risk; risks of not being able to execute on our asset management strategy and potential loss of value of our holdings; risk of becoming an investment company; fluctuations in our short-term results as we implement our business strategies; risks of not being able to attract and retain qualified management and personnel to implement and execute on our business and growth strategy; failure of our information technology systems, data breaches and cyber-attacks; our ability to establish and maintain an effective system of internal controls; the requirements of being a public company and losing our status as a smaller reporting company or becoming an accelerated filer; any potential conflicts of interest between us and our controlling stockholders and different interests of controlling stockholders; and potential conflicts of interest between us and our directors and executive officers.

Our expectations and future plans and initiatives may not be realized. If one of these risks or uncertainties materializes, or if our underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected. You are cautioned not to place undue reliance on forward-looking statements. Under U.S. generally accepted accounting principles, entities are required to measure certain crypto assets at fair value, with changes reflected in net income each reporting period. Changes in the fair value of crypto assets could result in significant fluctuations to the income statement results. The forward-looking statements are made only as of the date hereof and do not necessarily reflect our outlook at any other point in time. We do not undertake and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect new information, future events or developments.

Investor Contact

invest@fgnexus.io

Media Contact

media@fgnexus.io