UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2025

Commission File Number: 001-38269

FinVolution Group

Building G1, No. 999 Dangui Road

Pudong New District, Shanghai 201203

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FinVolution Group | ||

| By: | /s/ Jiayuan Xu | |

| Name: | Jiayuan Xu | |

| Title: | Chief Financial Officer | |

Date: August 21, 2025

Exhibit Index

Exhibit 99.1—Press Release—FinVolution Group Reports Second Quarter 2025 Unaudited Financial Results

Exhibit 99.1

FinVolution Group Reports Second Quarter 2025 Unaudited Financial Results

-H1 Transaction Volume reached RMB106.1 billion, up 9.4% year-over-year-

-H1 International Transaction Volume reached RMB6.2 billion, up 37.8% year-over-year-

-H1 Revenue reached RMB7,059.0 million, up 11.5% year-over-year-

-H1 International Revenues reached RMB1,507.2 million, up 30.2% year-over-year and representing 21.4% of total net revenues-

SHANGHAI, August 20, 2025 /PRNewswire/ -- FinVolution Group (“FinVolution” or the “Company”) (NYSE: FINV), a leading fintech platform in China, Indonesia and the Philippines, today announced its unaudited financial results for the second quarter ended June 30, 2025.

| For the Three Months Ended/As of |

YoY |

|||||||||||

| June 30, 2024 | June 30, 2025 | Change | ||||||||||

| Total Transaction Volume (RMB in billions)1 | 48.7 | 54.0 | 10.9 | % | ||||||||

| Transaction Volume (China’s Mainland)2 | 46.4 | 50.8 | 9.5 | % | ||||||||

| Transaction Volume (International)3 | 2.3 | 3.2 | 39.1 | % | ||||||||

| Total Outstanding Loan Balance (RMB in billions) | 65.6 | 77.5 | 18.1 | % | ||||||||

| Outstanding Loan Balance (China’s Mainland)4 | 64.2 | 75.4 | 17.4 | % | ||||||||

| Outstanding Loan Balance (International)5 | 1.4 | 2.1 | 50.0 | % | ||||||||

Second Quarter 2025 China Market Operational Highlights

| ● | Cumulative registered users6 reached 180.9 million as of June 30, 2025, an increase of 11.5% compared with June 30, 2024. |

| ● | Cumulative borrowers7 reached 27.9 million as of June 30, 2025, an increase of 7.7% compared with June 30, 2024. |

| ● | Number of unique borrowers8 for the second quarter of 2025 was 2.2 million, an increase of 22.2% compared with the same period of 2024. |

| ● | Transaction volume2 reached RMB50.8 billion for the second quarter of 2025, an increase of 9.5% compared with the same period of 2024. |

| ● | Transaction volume facilitated for repeat individual borrowers9 for the second quarter of 2025 was RMB43.8 billion, an increase of 8.1% compared with the same period of 2024. |

| ● | Outstanding loan balance4 reached RMB75.4 billion as of June 30, 2025, an increase of 17.4% compared with June 30, 2024. |

| ● | Average loan size10 was RMB10,056 for the second quarter of 2025, compared with RMB9,956 for the same period of 2024. |

| ● | Average loan tenure11 was 8.3 months for the second quarter of 2025, compared with 8.0 months for the same period of 2024. |

| ● | 90 day+ delinquency ratio12 was 1.92% as of June 30, 2025. |

|

|

Second Quarter 2025 International Market Operational Highlights

| ● | Cumulative registered users13 reached 42.8 million as of June 30, 2025, an increase of 47.1% compared with June 30, 2024. |

| ● | Cumulative borrowers14 for the international market reached 8.7 million as of June 30, 2025, an increase of 55.4% compared with June 30, 2024. |

| ● | Number of unique borrowers15 for the second quarter of 2025 was 2.3 million, an increase of 122.2% compared with the same period of 2024. |

| ● | Number of new borrowers16 for the second quarter of 2025 was 1.1 million, an increase of 126.4% compared with the same period of 2024. |

| ● | Transaction volume3 reached RMB3.2 billion for the second quarter of 2025, an increase of 39.1% compared with the same period of 2024. |

| ● | Outstanding loan balance5 reached RMB2.1 billion as of June 30, 2025, an increase of 50.0% compared with June 30, 2024. |

| ● | International business revenue was RMB796.7 million (US$111.2 million) for the second quarter of 2025, an increase of 41.5% compared with the same period of 2024, representing 22.3% of total revenue for the second quarter of 2025. |

Second Quarter 2025 Financial Highlights

| ● | Net revenue was RMB3,578.0 million (US$499.5 million) for the second quarter of 2025, compared with RMB3,168.0 million for the same period of 2024. |

| ● | Net profit was RMB751.3 million (US$104.9 million) for the second quarter of 2025, compared with RMB551.0 million for the same period of 2024. |

| ● | Non-GAAP adjusted operating income17, which excludes share-based compensation expenses before tax, was RMB854.8 million (US$119.3 million) for the second quarter of 2025, compared with RMB598.6 million for the same period of 2024. |

| ● | Diluted net profit per American depositary share (“ADS”) was RMB2.82 (US$0.39) and diluted net profit per share was RMB0.56 (US$0.08) for the second quarter of 2025, compared with RMB2.07 and RMB0.41 for the same period of 2024, respectively. |

| ● | Non-GAAP diluted net profit per ADS was RMB2.97 (US$0.41) and non-GAAP diluted net profit per share was RMB0.59 (US$0.08) for the second quarter of 2025, compared with RMB2.22 and RMB0.44 for the same period of 2024, respectively. Each ADS of the Company represents five Class A ordinary shares of the Company. |

1 Represents the total transaction volume facilitated in China’s Mainland and the international markets on the Company’s platforms during the period presented.

2 Represents our transaction volume facilitated in China’s Mainland during the period presented. During the second quarter, RMB20.5 billion was facilitated under the capital-light model, for which the Company does not bear principal risk.

3 Represents our transaction volume facilitated in markets outside China’s Mainland during the period presented.

4 Outstanding loan balance (China’s Mainland) as of any date refers to the balance of outstanding loans in China’s Mainland market excluding loans delinquent for more than 180 days from such date. As of June 30, 2025, RMB36.2 billion was facilitated under the capital-light model, for which the Company does not bear principal risk.

5 Outstanding loan balance (international) as of any date refers to the balance of outstanding loans in the international markets excluding loans delinquent for more than 30 days from such date.

6 On a cumulative basis, the total number of users in China’s Mainland market registered on the Company’s platform as of June 30, 2025.

7 On a cumulative basis, the total number of borrowers in China’s Mainland market registered on the Company’s platform as of June 30, 2025.

8 Represents the total number of borrowers in China’s Mainland who successfully borrowed on the Company’s platform during the period presented.

9 Represents the transaction volume facilitated for repeat borrowers in China’s Mainland who successfully completed a transaction on the Company’s platform during the period presented.

10 Represents the average loan size on the Company’s platform in China’s Mainland during the period presented.

11 Represents the average loan tenor on the Company’s platform in China’s Mainland during the period presented.

|

|

12 “90 day+ delinquency ratio” refers to the outstanding principal balance of loans, excluding loans facilitated under the capital-light model, that were 90 to 179 calendar days past due as a percentage of the total outstanding principal balance of loans, excluding loans facilitated under the capital-light model on the Company’s platform as of a specific date. Loans that originated outside China’s Mainland are not included in the calculation.

13 On a cumulative basis, the total number of users registered on the Company’s platforms outside China’s Mainland market, as of June 30, 2025.

14 On a cumulative basis, the total number of borrowers on the Company’s platforms outside China’s Mainland market, as of June 30, 2025.

15 Represents the total number of borrowers outside China’s Mainland who successfully borrowed on the Company platforms during the period presented.

16 Represents the total number of new borrowers outside China’s Mainland whose transactions were facilitated on the Company’s platforms during the period presented.

17 Please refer to “UNAUDITED Reconciliation of GAAP and Non-GAAP Results” for reconciliation between GAAP and Non-GAAP adjusted operating income.

18 Change in Presentation of Consolidated Statements of Cash Flows: During the fourth quarter of 2024, the Company elected to change its presentation of the cash flows associated with funds held for customers and funds paid on behalf of customers within its Consolidated Statements of Cash Flows. The balances for the second quarter of 2024 have been adjusted to conform to the current period presentation.

Mr. Tiezheng Li, Vice Chairman and Chief Executive Officer of FinVolution, commented, “We sustained healthy growth momentum in the second quarter of 2025, with total transaction volume reaching RMB54.0 billion, up 10.9% year-over-year. Net revenue rose 12.9% to RMB3.6 billion, while net income grew 36.4% to RMB751.3 million year-over-year. These results reflect our strong execution and the resilience of our ‘Local Excellence, Global Outlook’ strategy amid evolving market conditions.

“We also added 1.6 million new borrowers during the quarter, our fourth consecutive quarter exceeding the one-million mark, thanks to effective data-driven marketing and our expanding global footprint. Supported by pioneering technology, international diversification and rising brand recognition, we remain confident in our ability to capture growth opportunities and create long-term value for all stakeholders,” concluded Mr. Li.

Mr. Jiayuan Xu, Chief Financial Officer of FinVolution, continued, “Our second quarter financial performance remained strong across all key metrics. International transaction volume surged 39.1% year-over-year, with loan balance rising 50.0%. Revenue from international markets increased 41.5% to RMB796.7 million, contributing 22.3% of total net revenue, up from 17.8% a year ago, underscoring our accelerating global traction.

“Meanwhile, we maintained a healthy balance sheet with RMB7.9 billion in cash and short-term investments and a conservative leverage ratio of 2.6x. In addition, we further strengthened our financial position by completing a US$150 million convertible bond offering in June and repurchasing US$63.8 million in shares during the first half of 2025, reaffirming our commitment to capital efficiency and shareholder returns,” concluded Mr. Xu.

Second Quarter 2025 Financial Results

Net revenue for the second quarter of 2025 was RMB3,578.0 million (US$499.5 million), compared with RMB3,168.0 million for the same period of 2024. This increase was primarily due to the increase in loan facilitation service fees and other revenue, partially offset by the decrease in guarantee income.

Loan facilitation service fees were RMB1,515.3 million (US$211.5 million) for the second quarter of 2025, compared with RMB1,110.5 million for the same period of 2024. The increase was primarily due to the increase in the transaction volume and average rate of transaction service fees.

Post-facilitation service fees were RMB425.6 million (US$59.4 million) for the second quarter of 2025, compared with RMB389.2 million for the same period of 2024. This increase was primarily due to the rolling impact of deferred transaction fees.

|

|

Guarantee income was RMB1,046.6 million (US$146.1 million) for the second quarter of 2025, compared with RMB1,298.9 million for the same period of 2024. This decrease was primarily due to the decrease in risk-bearing loans in the China market and was partially offset by an increase in such loans in international markets, as well as the rolling impact of deferred guarantee income. The fair value of quality assurance commitment upon loan origination is released as guarantee income systematically over the term of the loans subject to quality assurance commitment.

Net interest income was RMB272.1 million (US$38.0 million) for the second quarter of 2025, compared with RMB218.8 million for the same period of 2024. This increase mainly resulted from the increase in the average outstanding loan balances of on-balance sheet loans in the China market and was partly offset by a decrease in net interest income in international markets due to our strategy of deepening cooperation with local institutional partners.

Other revenue was RMB318.3 million (US$44.4 million) for the second quarter of 2025, compared with RMB150.5 million for the same period of 2024. This increase was primarily due to the increase in the contributions from other revenue streams.

Origination, servicing expenses and other costs of revenue were RMB674.5 million (US$94.2 million) for the second quarter of 2025, compared with RMB575.2 million for the same period of 2024. This increase was primarily due to the increase in facilitation costs and loan collection expenses as a result of higher outstanding loan balances.

Sales and marketing expenses were RMB606.4 million (US$84.7 million) for the second quarter of 2025, compared with RMB473.3 million for the same period of 2024, as a result of our more proactive customer acquisition efforts focusing on quality borrowers in both China and the international markets.

Research and development expenses were RMB129.0 million (US$18.0 million) for the second quarter of 2025, compared with RMB119.3 million for the same period of 2024. This increase was primarily due to the increased investment in technology development.

General and administrative expenses were RMB110.2 million (US$15.4 million) for the second quarter of 2025, compared with RMB101.9 million for the same period of 2024. This increase was primarily due to the increased benefits we provided to our employees.

Provision for accounts receivable and contract assets was RMB106.3 million (US$14.8 million) for the second quarter of 2025, compared with RMB57.2 million for the same period of 2024. The increase was primarily due to higher transaction volume of off-balance sheet loans in the international markets.

Provision for loans receivable was RMB98.4 million (US$13.7 million) for the second quarter of 2025, compared with RMB92.0 million for the same period of 2024. This increase was primarily due to the increase in the outstanding loan balance in the China market, partially offset by improved credit performance in the international markets.

Credit losses for quality assurance commitment were RMB987.1 million (US$137.8 million) for the second quarter of 2025, compared with RMB1,190.6 million for the same period of 2024. The decrease was primarily due to the decrease in risk-bearing loans in the China market, partially offset by the increase in risk-bearing loans in the international markets.

Impairment of goodwill, intangible assets and other long-lived assets was RMB50.4 million (US$7.0 million) for the second quarter of 2025, compared with nil for the same period of 2024. The increase was primarily due to an impairment of goodwill related to a certain micro-lending company acquired by the Group in 2017, following a performance review during the quarter.

|

|

Operating profit was RMB815.5 million (US$113.8 million) for the second quarter of 2025, compared with RMB558.5 million for the same period of 2024.

Non-GAAP adjusted operating income, which excludes share-based compensation expenses before tax, was RMB854.8 million (US$119.3 million) for the second quarter of 2025, compared with RMB598.6 million for the same period of 2024.

Other income was RMB114.5 million (US$16.0 million) for the second quarter of 2025, compared with RMB67.7 million for the same period of 2024. The increase was mainly due to the increase in government subsidies.

Income tax expense was RMB178.7 million (US$24.9 million) for the second quarter of 2025, compared with RMB75.2 million for the same period of 2024. This increase was mainly due to the increase in pre-tax profit and the increase in effective tax rate.

Net profit was RMB751.3 million (US$104.9 million) for the second quarter of 2025, compared with RMB551.0 million for the same period of 2024.

Net profit attributable to ordinary shareholders of the Company was RMB747.0 million (US$104.3 million) for the second quarter of 2025, compared with RMB551.1 million for the same period of 2024.

Diluted net profit per ADS was RMB2.82 (US$0.39) and diluted net profit per share was RMB0.56 (US$0.08) for the second quarter of 2025, compared with RMB2.07 and RMB0.41 for the same period of 2024, respectively.

Non-GAAP diluted net profit per ADS was RMB2.97 (US$0.41) and non-GAAP diluted net profit per share was RMB0.59 (US$0.08) for the second quarter of 2025, compared with RMB2.22 and RMB0.44 for the same period of 2024, respectively. Each ADS represents five Class A ordinary shares of the Company.

As of June 30, 2025, the Company had cash and cash equivalents of RMB5,297.3 million (US$739.5 million) and short-term investments, mainly in wealth management products and term deposits, of RMB2,595.0 million (US$362.3 million).

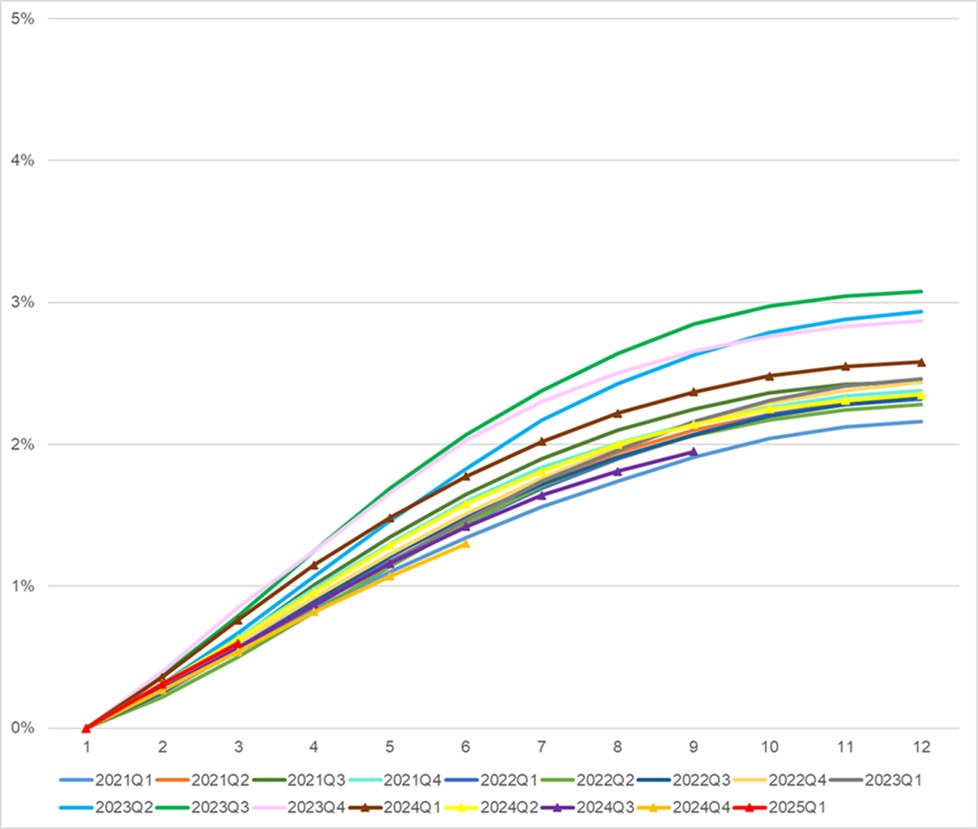

The following chart shows the historical cumulative 30-day plus past due delinquency rates by loan origination vintage for loan products facilitated through the Company’s platform in China’s Mainland as of June 30, 2025. Loans facilitated under the capital-light model, for which the Company does not bear principal risk, are excluded from the chart.

|

|

Capital Market Update

On June 24, 2025, the Company announced the completion of the offering of the convertible senior notes in an aggregate principal amount of US$150 million due 2030. Concurrently with the pricing of this offering, the Company repurchased approximately 6.4 million ADSs with an aggregate value of approximately US$60.7 million at a price of US$9.51 per ADS (“concurrent repurchase”).

Business Outlook

We achieved strong growth by firmly executing our “Local Excellence, Global Outlook” strategy, driven by effective customer acquisition and product diversification. Amid evolving market dynamics, we remain confident in our ability to navigate market evolution while accelerating our global expansion and international growth trajectory. The Company reiterates its full-year 2025 total revenue guidance to be in the range of approximately RMB14.4 billion to RMB15.0 billion, representing year-over-year growth of approximately 10.0% to 15.0%.

|

|

The above forecast is based on the current market conditions and reflects the Company’s current preliminary views and expectations on market and operational conditions and the regulatory and operating environment, as well as customers’ and institutional partners’ demands, all of which are subject to change.

Conference Call

The Company’s management will host an earnings conference call at 8:30 PM U.S. Eastern Time on August 20, 2025 (8:30 AM Beijing/Hong Kong Time on August 21, 2025).

Dial-in details for the earnings conference call are as follows:

| United States (toll free): | +1-888-346-8982 | |||

| Canada (toll free): | +1-855-669-9657 | |||

| International: | +1-412-902-4272 | |||

| Hong Kong, China (toll free): | 800-905-945 | |||

| Hong Kong, China: | +852-3018-4992 | |||

| Mainland, China: | 400-120-1203 |

Participants should dial in at least five minutes before the scheduled start time and ask to be connected to the call for “FinVolution Group”.

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.finvgroup.com.

A replay of the conference call will be accessible approximately one hour after the conclusion of the live call until August 27, 2025, by dialing the following telephone numbers:

| United States (toll free): | +1-877-344-7529 | |||

| Canada (toll free): | +1-855-669-9658 | |||

| International: | +1-412-317-0088 | |||

| Replay Access Code: | 6937491 |

About FinVolution Group

FinVolution Group is a leading fintech platform with strong brand recognition in China, Indonesia and the Philippines, connecting borrowers of the young generation with financial institutions. Established in 2007, the Company is a pioneer in China’s online consumer finance industry and has developed innovative technologies and has accumulated in-depth experience in the core areas of credit risk assessment, fraud detection, big data and artificial intelligence. The Company’s platforms, empowered by proprietary cutting-edge technologies, features a highly automated loan transaction process, which enables a superior user experience. As of June 30, 2025, the Company had 223.6 million cumulative registered users across China, Indonesia and the Philippines.

For more information, please visit https://ir.finvgroup.com

Use of Non-GAAP Financial Measures

We use non-GAAP adjusted operating income, non-GAAP operating margin, non-GAAP net profit, non-GAAP net profit attributable to FinVolution Group, and non-GAAP basic and diluted net profit per share and per ADS which are non-GAAP financial measures, in evaluating our operating results and for financial and operational decision-making purposes. We believe that these non-GAAP financial measures help identify underlying trends in our business by excluding the impact of share-based compensation expenses and expected discretionary measures. We believe that non-GAAP financial measures provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

|

|

Non-GAAP adjusted operating income, non-GAAP operating margin, non-GAAP net profit, non-GAAP net profit attributable to FinVolution Group, and non-GAAP basic and diluted net profit per share and per ADS are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. These non-GAAP financial measures have limitations as analytical tool, and when assessing our operating performance, cash flows or our liquidity, investors should not consider it in isolation, or as a substitute for net income, cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP. The Company encourages investors and others to review our financial information in its entirety and not rely on a single financial measure.

For more information on this non-GAAP financial measure, please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.1636 to US$1.00, the rate in effect as of June 30, 2025 as certified for customs purposes by the Federal Reserve Bank of New York.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident” and similar statements. Such statements are based upon management’s current expectations and current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, uncertainties as to the Company’s ability to attract and retain borrowers and investors on its marketplace, its ability to increase volume of loans facilitated through the Company’s marketplace, its ability to introduce new loan products and platform enhancements, its ability to compete effectively, laws, regulations and governmental policies relating to the online consumer finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the NYSE, including its ability to cure any non-compliance with the NYSE’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and FinVolution does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

FinVolution Group

Head of Capital Markets

Yam Cheng

Tel: +86 (21) 8030-3200 Ext. 8601

E-mail: ir@xinye.com

Piacente Financial Communications

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: finv@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: finv@tpg-ir.com

|

|

FinVolution Group

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(All amounts in thousands, except share data, or otherwise noted)

| As of December 31, | As of June 30, | |||||||||||

| 2024 | 2025 | |||||||||||

| RMB | RMB | USD | ||||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | 4,672,772 | 5,297,339 | 739,480 | |||||||||

| Restricted cash | 2,074,300 | 1,774,995 | 247,780 | |||||||||

| Short-term investments | 2,832,382 | 2,595,018 | 362,251 | |||||||||

| Investments | 1,173,003 | 1,144,284 | 159,736 | |||||||||

| Quality assurance receivable, net of credit loss allowance for quality assurance receivable of RMB426,949 and RMB471,131 as of December 31, 2024 and June 30, 2025, respectively | 1,639,591 | 1,472,700 | 205,581 | |||||||||

| Intangible assets | 137,298 | 147,898 | 20,646 | |||||||||

| Property, equipment and software, net | 623,792 | 617,701 | 86,228 | |||||||||

| Loans receivable, net of credit loss allowance for loans receivable of RMB226,467 and RMB319,957 as of December 31, 2024 and June 30, 2025, respectively | 4,157,621 | 5,307,486 | 740,896 | |||||||||

| Accounts receivable and contract assets, net of credit loss allowance for accounts receivable and contract assets of RMB290,267 and RMB326,977 as of December 31, 2024 and June 30, 2025, respectively | 2,405,880 | 2,779,486 | 388,001 | |||||||||

| Deferred tax assets | 2,513,865 | 3,111,379 | 434,332 | |||||||||

| Right of use assets | 36,826 | 39,620 | 5,531 | |||||||||

| Prepaid expenses and other assets | 1,289,380 | 1,359,190 | 189,736 | |||||||||

| Goodwill | 50,411 | - | - | |||||||||

| Total assets | 23,607,121 | 25,647,096 | 3,580,198 | |||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||

| Deferred guarantee income | 1,515,950 | 1,360,750 | 189,953 | |||||||||

| Liability from quality assurance commitment | 2,964,116 | 3,183,737 | 444,433 | |||||||||

| Payroll and welfare payable | 290,389 | 237,223 | 33,115 | |||||||||

| Taxes payable | 705,928 | 412,869 | 57,634 | |||||||||

| Short-term borrowings | 5,594 | 67,326 | 9,398 | |||||||||

| Funds payable to investors of consolidated trusts | 796,122 | 1,168,407 | 163,103 | |||||||||

| Contract liability | 10,185 | 835 | 117 | |||||||||

| Deferred tax liabilities | 491,213 | 604,602 | 84,399 | |||||||||

| Accrued expenses and other liabilities | 1,245,184 | 1,400,813 | 195,546 | |||||||||

| Leasing liabilities | 28,765 | 33,904 | 4,733 | |||||||||

| Convertible senior notes | - | 1,034,437 | 144,402 | |||||||||

| Total liabilities | 8,053,446 | 9,504,903 | 1,326,833 | |||||||||

| Commitments and contingencies | ||||||||||||

| FinVolution Group Shareholders’ equity | ||||||||||||

| Ordinary shares | 103 | 103 | 14 | |||||||||

| Additional paid-in capital | 5,815,437 | 5,838,926 | 815,083 | |||||||||

| Treasury stock | (1,765,542 | ) | (2,163,698 | ) | (302,041 | ) | ||||||

| Statutory reserves | 852,723 | 852,723 | 119,036 | |||||||||

| Accumulated other comprehensive income | 92,626 | 77,058 | 10,758 | |||||||||

| Retained earnings | 10,208,717 | 11,191,919 | 1,562,332 | |||||||||

| Total FinVolution Group shareholders’ equity | 15,204,064 | 15,797,031 | 2,205,182 | |||||||||

| Non-controlling interest | 349,611 | 345,162 | 48,183 | |||||||||

| Total shareholders’ equity | 15,553,675 | 16,142,193 | 2,253,365 | |||||||||

| Total liabilities and shareholders’ equity | 23,607,121 | 25,647,096 | 3,580,198 | |||||||||

|

|

FinVolution Group

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(All amounts in thousands, except share data, or otherwise noted)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2024 | 2025 | 2024 | 2025 | |||||||||||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||||||||||

| Operating revenue: | ||||||||||||||||||||||||

| Loan facilitation service fees | 1,110,528 | 1,515,349 | 211,535 | 2,096,468 | 2,993,147 | 417,827 | ||||||||||||||||||

| Post-facilitation service fees | 389,236 | 425,595 | 59,411 | 854,428 | 806,209 | 112,542 | ||||||||||||||||||

| Guarantee income | 1,298,927 | 1,046,615 | 146,102 | 2,645,042 | 2,146,129 | 299,588 | ||||||||||||||||||

| Net interest income | 218,803 | 272,098 | 37,983 | 450,110 | 513,712 | 71,711 | ||||||||||||||||||

| Other revenue | 150,506 | 318,294 | 44,432 | 287,033 | 599,795 | 83,728 | ||||||||||||||||||

| Net revenue | 3,168,000 | 3,577,951 | 499,463 | 6,333,081 | 7,058,992 | 985,396 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Origination, servicing expenses and other cost of revenue | (575,231 | ) | (674,544 | ) | (94,163 | ) | (1,114,786 | ) | (1,295,009 | ) | (180,776 | ) | ||||||||||||

| Sales and marketing expenses | (473,295 | ) | (606,444 | ) | (84,656 | ) | (922,504 | ) | (1,136,147 | ) | (158,600 | ) | ||||||||||||

| Research and development expenses | (119,252 | ) | (128,974 | ) | (18,004 | ) | (239,747 | ) | (255,015 | ) | (35,599 | ) | ||||||||||||

| General and administrative expenses | (101,892 | ) | (110,196 | ) | (15,383 | ) | (184,219 | ) | (217,090 | ) | (30,305 | ) | ||||||||||||

| Provision for accounts receivable and contract assets | (57,237 | ) | (106,345 | ) | (14,845 | ) | (122,899 | ) | (224,063 | ) | (31,278 | ) | ||||||||||||

| Provision for loans receivable | (91,988 | ) | (98,379 | ) | (13,733 | ) | (173,273 | ) | (183,793 | ) | (25,657 | ) | ||||||||||||

| Credit losses for quality assurance commitment | (1,190,572 | ) | (987,139 | ) | (137,799 | ) | (2,388,671 | ) | (1,998,754 | ) | (279,015 | ) | ||||||||||||

| Impairment of goodwill, intangible assets and other long-lived assets | - | (50,411 | ) | (7,037 | ) | - | (50,411 | ) | (7,037 | ) | ||||||||||||||

| Total operating expenses | (2,609,467 | ) | (2,762,432 | ) | (385,620 | ) | (5,146,099 | ) | (5,360,282 | ) | (748,267 | ) | ||||||||||||

| Operating profit | 558,533 | 815,519 | 113,843 | 1,186,982 | 1,698,710 | 237,129 | ||||||||||||||||||

| Other income, net | 67,657 | 114,464 | 15,979 | 98,661 | 122,845 | 17,149 | ||||||||||||||||||

| Profit before income tax expense | 626,190 | 929,983 | 129,822 | 1,285,643 | 1,821,555 | 254,278 | ||||||||||||||||||

| Income tax expenses | (75,152 | ) | (178,670 | ) | (24,941 | ) | (202,629 | ) | (332,601 | ) | (46,429 | ) | ||||||||||||

| Net profit | 551,038 | 751,313 | 104,881 | 1,083,014 | 1,488,954 | 207,849 | ||||||||||||||||||

| Less: Net profit/(loss) attributable to non-controlling interest shareholders | (107 | ) | 4,316 | 602 | 4,168 | (4,449 | ) | (621 | ) | |||||||||||||||

| Net profit attributable to FinVolution Group | 551,145 | 746,997 | 104,279 | 1,078,846 | 1,493,403 | 208,470 | ||||||||||||||||||

| Foreign currency translation adjustment, net of nil tax | (47,923 | ) | 705 | 98 | (36,791 | ) | (15,568 | ) | (2,173 | ) | ||||||||||||||

Total comprehensive income attributable to FinVolution Group |

503,222 | 747,702 | 104,377 | 1,042,055 | 1,477,835 | 206,297 | ||||||||||||||||||

|

Weighted average number of ordinary shares used in computing net income per share |

||||||||||||||||||||||||

| Basic | 1,298,653,314 | 1,280,035,833 | 1,280,035,833 | 1,305,081,766 | 1,272,937,319 | 1,272,937,319 | ||||||||||||||||||

| Diluted | 1,334,219,839 | 1,322,804,429 | 1,322,804,429 | 1,337,706,499 | 1,319,415,709 | 1,319,415,709 | ||||||||||||||||||

|

Net profit per share attributable to FinVolution Group’s ordinary shareholders |

||||||||||||||||||||||||

| Basic | 0.42 | 0.58 | 0.08 | 0.83 | 1.17 | 0.16 | ||||||||||||||||||

| Diluted | 0.41 | 0.56 | 0.08 | 0.81 | 1.13 | 0.16 | ||||||||||||||||||

|

Net profit per ADS attributable to FinVolution Group’s ordinary shareholders (one ADS equal five ordinary shares) |

||||||||||||||||||||||||

| Basic | 2.12 | 2.92 | 0.41 | 4.13 | 5.87 | 0.82 | ||||||||||||||||||

| Diluted | 2.07 | 2.82 | 0.39 | 4.03 | 5.66 | 0.79 | ||||||||||||||||||

|

|

FinVolution Group

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS18

(All amounts in thousands, except share data, or otherwise noted)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||

| 2024 | 2025 | 2024 | 2025 | |||||||||||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||||||||||

| Net cash provided by operating activities | 977,910 | 8,627 | 1,206 | 1,191,219 | 530,962 | 74,121 | ||||||||||||||||||

| Net cash used in investing activities | (581,936 | ) | (1,025,083 | ) | (143,097 | ) | 343,759 | (659,887 | ) | (92,118 | ) | |||||||||||||

| Net cash provided by/(used in) financing activities | (487,946 | ) | 658,029 | 91,858 | (798,088 | ) | 459,698 | 64,172 | ||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (21,347 | ) | 5,754 | 802 | (29,551 | ) | (5,511 | ) | (770 | ) | ||||||||||||||

| Net increase in cash, cash equivalent and restricted cash | (113,319 | ) | (352,673 | ) | (49,231 | ) | 707,339 | 325,262 | 45,405 | |||||||||||||||

| Cash, cash equivalent and restricted cash at beginning of period | 7,590,048 | 7,425,007 | 1,036,491 | 6,769,390 | 6,747,072 | 941,855 | ||||||||||||||||||

| Cash, cash equivalent and restricted cash at end of period | 7,476,729 | 7,072,334 | 987,260 | 7,476,729 | 7,072,334 | 987,260 | ||||||||||||||||||

|

|

FinVolution Group

UNAUDITED Reconciliation of GAAP and Non-GAAP Results

(All amounts in thousands, except share data, or otherwise noted)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||||||||

| 2024 | 2025 | 2024 | 2025 | |||||||||||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||||||||||

| Net Revenues | 3,168,000 | 3,577,951 | 499,463 | 6,333,081 | 7,058,992 | 985,396 | ||||||||||||||||||

| Less: total operating expenses | (2,609,467 | ) | (2,762,432 | ) | (385,620 | ) | (5,146,099 | ) | (5,360,282 | ) | (748,267 | ) | ||||||||||||

| Operating Income | 558,533 | 815,519 | 113,843 | 1,186,982 | 1,698,710 | 237,129 | ||||||||||||||||||

| Add: share-based compensation expenses | 40,100 | 39,318 | 5,489 | 70,389 | 73,997 | 10,330 | ||||||||||||||||||

| Non-GAAP adjusted operating income | 598,633 | 854,837 | 119,332 | 1,257,371 | 1,772,707 | 247,459 | ||||||||||||||||||

| Operating Margin | 17.6 | % | 22.8 | % | 22.8 | % | 18.7 | % | 24.1 | % | 24.1 | % | ||||||||||||

| Non-GAAP operating margin | 18.9 | % | 23.9 | % | 23.9 | % | 19.9 | % | 25.1 | % | 25.1 | % | ||||||||||||

| Non-GAAP adjusted operating income | 598,633 | 854,837 | 119,332 | 1,257,371 | 1,772,707 | 247,459 | ||||||||||||||||||

| Add: other income, net | 67,657 | 114,464 | 15,979 | 98,661 | 122,845 | 17,149 | ||||||||||||||||||

| Less: income tax expenses | (75,152 | ) | (178,670 | ) | (24,941 | ) | (202,629 | ) | (332,601 | ) | (46,429 | ) | ||||||||||||

| Non-GAAP net profit | 591,138 | 790,631 | 110,370 | 1,153,403 | 1,562,951 | 218,179 | ||||||||||||||||||

| Less: Net profit/(loss) attributable to non-controlling interest shareholders | (107 | ) | 4,316 | 602 | 4,168 | (4,449 | ) | (621 | ) | |||||||||||||||

| Non-GAAP net profit attributable to FinVolution Group | 591,245 | 786,316 | 109,768 | 1,149,235 | 1,567,400 | 218,800 | ||||||||||||||||||

| Weighted average number of ordinary shares used in computing net income per share | ||||||||||||||||||||||||

| Basic | 1,298,653,314 | 1,280,035,833 | 1,280,035,833 | 1,305,081,766 | 1,272,937,319 | 1,272,937,319 | ||||||||||||||||||

| Diluted | 1,334,219,839 | 1,322,804,429 | 1,322,804,429 | 1,337,706,499 | 1,319,415,709 | 1,319,415,709 | ||||||||||||||||||

| Non-GAAP net profit per share attributable to FinVolution Group’s ordinary shareholders | ||||||||||||||||||||||||

| Basic | 0.46 | 0.61 | 0.09 | 0.88 | 1.23 | 0.17 | ||||||||||||||||||

| Diluted | 0.44 | 0.59 | 0.08 | 0.86 | 1.19 | 0.17 | ||||||||||||||||||

| Non-GAAP net profit per ADS attributable to FinVolution Group’s ordinary shareholders (one ADS equal five ordinary shares) | ||||||||||||||||||||||||

| Basic | 2.28 | 3.07 | 0.43 | 4.40 | 6.16 | 0.86 | ||||||||||||||||||

| Diluted | 2.22 | 2.97 | 0.41 | 4.30 | 5.94 | 0.83 | ||||||||||||||||||

|

|