UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the quarterly period ended June 30, 2025

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38529

AIRO Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3721 | 88-0812695 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5001 Indian School Road NE, Suite 100

Albuquerque, New Mexico 87110

(505) 338-2434

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Captain Joseph D. Burns

Chief Executive Officer

5001 Indian School Road NE, Suite 100

Albuquerque, New Mexico 87110

(505) 338-2434

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.000001 per share | AIRO | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer ☐ | ||

| Non-accelerated filer ☒ | Smaller reporting company ☒ | ||

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 13, 2025, there were 27,421,095 shares of the registrant’s common stock, $0.000001 par value, outstanding.

AIRO GROUP HOLDINGS, INC.

Table of Contents

|

|

Item 1. Financial Statements

AIRO GROUP HOLDINGS, INC.

Condensed Consolidated Balance Sheets

unaudited

| June 30, 2025 | December 31, 2024 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 40,341,555 | $ | 20,740,590 | ||||

| Restricted cash | 193,780 | 170,088 | ||||||

| Accounts receivable, net | 23,655,866 | 8,960,705 | ||||||

| Related party receivables | 790,967 | 790,967 | ||||||

| Inventory | 10,609,390 | 8,822,721 | ||||||

| Prepaid expenses and other current assets | 3,572,701 | 2,309,676 | ||||||

| Deferred offering costs | - | 798,796 | ||||||

| Total current assets | 79,164,259 | 42,593,543 | ||||||

| Property and equipment, net | 7,390,447 | 6,833,817 | ||||||

| Right-of-use operating lease assets | 370,578 | 352,486 | ||||||

| Goodwill | 572,031,507 | 557,508,331 | ||||||

| Intangible assets, net | 88,647,429 | 93,502,277 | ||||||

| Other assets | 245,590 | 208,333 | ||||||

| Total assets | $ | 747,849,810 | $ | 700,998,787 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 14,213,380 | $ | 16,439,760 | ||||

| Related party payables | 1,104,525 | 1,099,970 | ||||||

| Accrued expenses | 18,796,560 | 17,457,155 | ||||||

| Operating lease liabilities, current | 267,763 | 212,591 | ||||||

| Deferred revenue | 3,942,806 | 10,339,978 | ||||||

| Related party borrowings | 5,601,091 | 5,971,281 | ||||||

| Revolving lines of credit | - | 126,589 | ||||||

| Current maturities of debt | 8,079,126 | 27,992,450 | ||||||

| Investor notes at fair value | 3,795,934 | 13,819,000 | ||||||

| Deferred compensation | 9,716,243 | - | ||||||

| Due to seller | 1,000,000 | 3,147,762 | ||||||

| Total current liabilities | 66,517,428 | 96,606,536 | ||||||

| Long-term debt, net of current maturities | 847,766 | 688,270 | ||||||

| Long-term deferred compensation | - | 11,218,573 | ||||||

| Deferred tax liability | 767,331 | 767,331 | ||||||

| Long-term deferred revenue | 7,943 | 10,158 | ||||||

| Operating lease liabilities, noncurrent | 99,746 | 146,214 | ||||||

| Other long-term liabilities | 50,000 | 50,000 | ||||||

| Contingent consideration | - | 42,782,276 | ||||||

| Total liabilities | 68,290,214 | 152,269,358 | ||||||

| Commitments and contingencies (Note 10) | - | - | ||||||

| Stockholders’ equity: | ||||||||

| Common stock, $0.000001 par value; 35,000,000 shares authorized; 27,025,503 and 16,387,180 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | 27 | 16 | ||||||

| Additional paid-in capital | 873,379,525 | 764,691,988 | ||||||

| Stockholder loan | (5 | ) | (5 | ) | ||||

| Accumulated other comprehensive loss | 8,735,660 | (9,509,285 | ) | |||||

| Accumulated deficit | (202,555,611 | ) | (206,453,285 | ) | ||||

| Total stockholders’ equity | 679,559,596 | 548,729,429 | ||||||

| Total liabilities and stockholders’ equity | $ | 747,849,810 | $ | 700,998,787 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

|

AIRO Group Holdings, Inc.

Condensed Consolidated Statements of Operations

unaudited

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenue | $ | 24,550,193 | $ | 9,780,336 | $ | 36,344,878 | $ | 23,520,272 | ||||||||

| Cost of revenue | 9,515,626 | 4,005,251 | 14,377,786 | 9,258,106 | ||||||||||||

| Gross profit | 15,034,567 | 5,775,085 | 21,967,092 | 14,262,166 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 4,101,005 | 3,161,395 | 7,767,469 | 6,318,255 | ||||||||||||

| Sales and marketing | 1,758,223 | 1,409,648 | 3,191,221 | 2,660,058 | ||||||||||||

| General and administrative | 28,864,680 | 3,897,598 | 33,778,492 | 8,440,883 | ||||||||||||

| Total operating expenses | 34,723,908 | 8,468,641 | 44,737,182 | 17,419,196 | ||||||||||||

| Loss from operations | (19,689,341 | ) | (2,693,556 | ) | (22,770,090 | ) | (3,157,030 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense, net | (8,010,246 | ) | (953,260 | ) | (9,277,321 | ) | (1,241,748 | ) | ||||||||

| Gain on extinguishment of debt | 15,559,069 |

- | 15,559,069 |

- | ||||||||||||

| Other income (expense), net | 20,068,254 | (1,514,016 | ) | 22,730,295 | (1,782,165 | ) | ||||||||||

| Total other income (expense) | 27,617,077 | (2,467,276 | ) | 29,012,043 | (3,023,913 | ) | ||||||||||

| Income (loss) before income tax expense | 7,927,736 | (5,160,832 | ) | 6,241,953 | (6,180,943 | ) | ||||||||||

| Income tax expense | (2,057,307 | ) | (439,009 | ) | (2,344,279 | ) | (1,428,587 | ) | ||||||||

| Net income (loss) | $ | 5,870,429 | $ | (5,599,841 | ) | $ | 3,897,674 | $ | (7,609,530 | ) | ||||||

| Net income (loss) per share – basic(1) | $ | 0.32 | $ | (0.34 | ) | $ | 0.22 | $ | (0.46 | ) | ||||||

| Net income (loss) per share – diluted (1) | $ | 0.30 | $ | (0.34 | ) | $ | 0.20 | $ | (0.46 | ) | ||||||

| Weighted-average number of shares of common stock used in computing net income (loss) per share, basic (1) | 18,490,316 | 16,387,180 | 17,444,558 | 16,387,180 | ||||||||||||

| Weighted-average number of shares of common stock used in computing net income (loss) per share, diluted(1) | 19,472,648 | 16,387,180 | 19,592,255 | 16,387,180 | ||||||||||||

| (1) | Prior year share and per share amounts have been retroactively adjusted to reflect the impact of a 1-for-1.7 reverse stock split effected on March 7, 2025, as discussed in Note 1. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

|

AIRO Group Holdings, Inc.

Condensed Consolidated Statements of Comprehensive Income (loss)

unaudited

Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net income (loss) | $ |

5,870,429 | $ |

(5,599,841 | ) | $ | 3,897,674 | $ | (7,609,530 | ) | ||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Foreign currency translation, net of tax | 12,604,232 | (670,937 | ) | 18,244,945 | (3,052,010 | ) | ||||||||||

| Total other comprehensive income (loss) | 12,604,232 | (670,937 | ) | 18,244,945 | (3,052,010 | ) | ||||||||||

| Comprehensive income (loss) | $ | 18,474,661 | $ | (6,270,778 | ) | $ | 22,142,619 | $ | (10,661,540 | ) | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

|

AIRO Group Holdings, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

unaudited

| Common Stock |

Additional Paid-In |

Stockholder |

Accumulated Other Comprehensive Income |

Accumulated |

Total Stockholders’ |

|||||||||||||||||||||||

| Shares | Amount | Capital | Loan | (Loss) | Deficit | Equity | ||||||||||||||||||||||

| Balance as of April 1, 2025 | 16,387,180 | $ | 16 | $ | 764,816,530 | $ | (5 | ) | $ | (3,868,572 | ) | $ | (208,426,040 | ) | $ | 552,521,929 | ||||||||||||

| Conversion of Coastal Defense promissory note | 203,707 | - | 2,037,070 | - | - | - | 2,037,070 | |||||||||||||||||||||

| Conversion of Aspen Bridge Notes | 440,584 | 1 | 4,405,840 | - | - | - | 4,405,841 | |||||||||||||||||||||

| Conversion of Jaunt Carter debt | 1,122,437 | 1 | 11,224,369 | - | - | - | 11,224,370 | |||||||||||||||||||||

| Issuance of investor note interest shares | 1,126,043 | 1 | 11,260,423 | - | - | - | 11,260,424 | |||||||||||||||||||||

| Conversion of Airo Drone debt | 37,080 | - | 370,800 | - | - | - | 370,800 | |||||||||||||||||||||

| Conversion of Agile Defense debt | 34,360 | - | 343,600 | - | - | - | 343,600 | |||||||||||||||||||||

| Conversion of Aspen Contingent Debt | 43,512 | - | 435,120 | - | - | - | 435,120 | |||||||||||||||||||||

| Conversion of Jaunt deferred compensation | 46,017 | - | 460,170 | - | - | - | 460,170 | |||||||||||||||||||||

| Reclassification of Libertas Warrants | - | - | 1,042,000 | - | - | - | 1,042,000 | |||||||||||||||||||||

Exercise of Libertas Warrants |

- | 2,088 | - | - | - | 2,088 | ||||||||||||||||||||||

| Issuance of Underwriter Warrants | - | - | 2,029,900 | - | - | - | 2,029,900 | |||||||||||||||||||||

| Sale of common stock in initial public offering, including over-allotment, net of $12,686,393 offering costs | 6,900,000 | 7 | 56,313,600 | - | - | - | 56,313,607 | |||||||||||||||||||||

| Shares issued to NGA | 33,995 | - | 339,950 | - | - | - | 339,950 | |||||||||||||||||||||

| Shares issued to Dangroup | 546,173 | 1 | 5,461,730 | - | - | - | 5,461,731 | |||||||||||||||||||||

| Stock-based compensation | - | - | 12,836,335 | - | - | - | 12,836,335 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 12,604,232 | - | 12,604,232 | |||||||||||||||||||||

| Net income | - | - | - | - | - | 5,870,429 | 5,870,429 | |||||||||||||||||||||

| Balance as of June 30, 2025 | 27,025,503 | $ | 27 | $ | 873,379,525 | $ | (5 | ) | $ | 8,735,660 | $ | (202,555,611 | ) | $ | 679,559,596 | |||||||||||||

| Common Stock |

Additional Paid-In |

Stockholder |

Accumulated Other Comprehensive |

Accumulated |

Total Stockholders’ |

|||||||||||||||||||||||

| Shares | Amount | Capital | Loan | Loss | Deficit | Equity | ||||||||||||||||||||||

| Balance as of April 1, 2024 (1) | 16,387,180 | $ | 16 | $ | 764,267,961 | $ | (5 | ) | $ | (3,142,236 | ) | $ | (169,768,735 | ) | $ | 591,357,001 | ||||||||||||

| Stock-based compensation | - | - | 179,022 | - | - | - | 179,022 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (670,937 | ) | - | (670,937 | ) | |||||||||||||||||||

| Net loss | - | - | - | - | - | (5,599,841 | ) | (5,599,841 | ) | |||||||||||||||||||

| Balance as of June 30, 2024(1) | 16,387,180 | $ | 16 | $ | 764,446,983 | $ | (5 | ) | $ | (3,813,173 | ) | $ | (175,368,576 | ) | $ | 585,265,245 | ||||||||||||

| Common Stock | Additional Paid-In |

Stockholder | Accumulated Other Comprehensive Income |

Accumulated | Total Stockholders’ |

|||||||||||||||||||||||

| Shares | Amount | Capital | Loan | (Loss) | Deficit | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2025 | 16,387,180 | $ | 16 | $ | 764,691,988 | $ | (5 | ) | $ | (9,509,285 | ) | $ | (206,453,285 | ) | $ | 548,729,429 | ||||||||||||

| Conversion of Coastal Defense promissory note | 203,707 | - | 2,037,070 | - | - | - | 2,037,070 | |||||||||||||||||||||

| Conversion of Aspen Bridge notes | 440,584 | 1 | 4,405,840 | - | - | - | 4,405,841 | |||||||||||||||||||||

| Conversion of Jaunt Carter debt | 1,122,437 | 1 | 11,224,369 | - | - | - | 11,224,370 | |||||||||||||||||||||

| Issuance of investor note interest shares | 1,126,043 | 1 | 11,260,423 | - | - | - | 11,260,424 | |||||||||||||||||||||

| Conversion of Airo Drone debt | 37,080 | - | 370,800 | - | - | - | 370,800 | |||||||||||||||||||||

| Conversion of Agile Defense debt | 34,360 | - | 343,600 | - | - | - | 343,600 | |||||||||||||||||||||

| Conversion of Aspen Contingent Debt | 43,512 | - |

435,120 | - |

- |

- |

435,120 | |||||||||||||||||||||

| Conversion of Jaunt deferred compensation | 46,017 | - |

460,170 | - |

- |

- |

460,170 | |||||||||||||||||||||

| Reclassification of Libertas Warrants | - | - | 1,042,000 | - | - | - | 1,042,000 | |||||||||||||||||||||

Exercise of Libertas Warrants |

- |

2,088 |

- |

- |

- |

2,088 |

||||||||||||||||||||||

| Issuance of Underwriter Warrants | - |

- | 2,029,900 | - |

- |

- |

2,029,900 | |||||||||||||||||||||

| Sale of common stock in initial public offering, including over-allotment, net of $12,686,393 offering costs | 6,900,000 | 7 | 56,313,600 | - | - | - | 56,313,607 | |||||||||||||||||||||

| Shares issued to NGA | 33,995 | - | 339,950 | - | - | - | 339,950 | |||||||||||||||||||||

| Shares issued to Dangroup | 546,173 | 1 | 5,461,730 | - | - | - | 5,461,731 | |||||||||||||||||||||

| Stock-based compensation | - | - | 12,960,877 | - | - | - | 12,960,877 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 18,244,945 | - | 18,244,945 | |||||||||||||||||||||

| Net income | - | - | - | - | - | 3,897,674 | 3,897,674 | |||||||||||||||||||||

| Balance as of June 30, 2025 | 27,025,503 | $ | 27 | $ | 873,379,525 | $ | (5 | ) | $ | 8,735,660 | $ | (202,555,611 | ) | $ | 679,559,596 | |||||||||||||

| Common Stock | Additional Paid-In |

Stockholder | Accumulated Other Comprehensive |

Accumulated | Total Stockholders’ |

|||||||||||||||||||||||

| Shares | Amount | Capital | Loan | Loss | Deficit | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2024 (1) | 16,387,180 | $ | 16 | $ | 763,975,896 | $ | (5 | ) | $ | (761,163 | ) | $ | (167,759,046 | ) | $ | 595,455,698 | ||||||||||||

| Stock-based compensation | - | - | 471,087 | - | - | - | 471,087 | |||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | (3,052,010 | ) | - | (3,052,010 | ) | |||||||||||||||||||

| Net loss | - | - | - | - | - | (7,609,530 | ) | (7,609,530 | ) | |||||||||||||||||||

| Balance as of June 30, 2024(1) | 16,387,180 | $ | 16 | $ | 764,446,983 | $ | (5 | ) | $ | (3,813,173 | ) | $ | (175,368,576 | ) | $ | 585,265,245 | ||||||||||||

| (1) | Share and per share amounts have been retroactively adjusted to reflect the impact of a 1-for-1.7 reverse stock split effected on March 7, 2025, as discussed in Note 1. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

|

AIRO Group Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

unaudited

| Six months ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income (loss) | $ | 3,897,674 | $ | (7,609,530 | ) | |||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | - | |||||||

| Stock-based compensation | 18,762,558 | 471,087 | ||||||

| Non-cash gain on IPO transactions | (932,170 | ) | - | |||||

| Note issuance for legal settlement | 750,000 |

|||||||

| Provision for credit losses | 7,016 | 1,326 | ||||||

| Non-cash interest | 1,064,130 | 897,718 | ||||||

| Non-cash investor note interest | 6,731,103 |

- |

||||||

| Non-cash gain on debt extinguishment | (15,559,069 | ) | - | |||||

| Change in investor notes at fair value | 186,000 | - | ||||||

| Depreciation and amortization | 6,125,888 | 6,343,846 | ||||||

| Amortization of right-of-use lease assets | 86,221 | 143,758 | ||||||

| Change in fair value of contingent consideration | (20,271,826 | ) | 1,700,000 | |||||

| Change in fair value of warrant liability | (1,843,000) | - | ||||||

| Change in deferred taxes | - | (71,389 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (12,612,699 | ) | (2,866,043 | ) | ||||

| Related party receivables | - | (129,523 | ) | |||||

| Prepaid expenses and other assets | (119,036 | ) | (219,959 | ) | ||||

| Inventory | (633,018 | ) | (2,402,759 | ) | ||||

| Accounts payable, accrued expenses and other long-term liabilities | (9,404,463 | ) | 3,370,937 | |||||

| Related party payables | 4,555 | 74,257 | ||||||

| Lease liabilities | (103,575 | ) | (149,337 | ) | ||||

| Deferred revenue | (7,216,365 | ) | (8,531,557 | ) | ||||

| Deferred compensation | 325,130 | 1,148,410 | ||||||

| Net cash used in operating activities | (30,754,946 | ) | (7,828,758 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of property and equipment and investment in intangible assets | (1,066,934 | ) | (454,254 | ) | ||||

| Net cash used in investing activities | (1,066,934 | ) | (454,254 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from the sale of common stock, net | 61,471,250 | - | ||||||

| Change in lines of credit | (127,396 | ) | (8,935 | ) | ||||

| Proceeds from borrowings | 8,500,000 | 1,700,000 |

||||||

| Repayments on borrowings | (14,071,726 | ) | (416,898 | ) | ||||

| Proceeds from related party borrowings | 230,900 | 834,000 | ||||||

| Repayments on related borrowings | (708,899 |

) | (25,000 | ) | ||||

| Debt issuance costs paid | (170,000 | ) | (25,000 | ) | ||||

| Proceeds from the exercise of warrants | 2,088 | - | ||||||

| Payment of contingent consideration | (3,266,622 |

) | - | |||||

Cash paid to seller |

(2,245,769 | ) | (1,311,941 |

) | ||||

| Net cash provided by financing activities | 49,613,826 | 746,226 | ||||||

| Effect of exchange rate changes | 1,832,711 | (311,566 | ) | |||||

| Net increase (decrease) in cash and restricted cash | 19,624,657 | (7,848,352 | ) | |||||

| Cash and restricted cash as of beginning of period | 20,910,678 | 13,102,312 | ||||||

| Cash and restricted cash as of end of period | $ | 40,535,335 | $ | 5,253,960 | ||||

| Supplemental disclosures of non-cash information: | ||||||||

| Deferred compensation settled in common stock | $ | 460,170 | $ | - | ||||

| Reclass between accrued expenses and notes payable | $ | 621,716 | $ | - | ||||

| Reclass between accrued expenses and contingent consideration | $ | 5,267,988 | $ | - | ||||

| Financing of insurance premiums | $ | 926,744 | $ | - | ||||

| Initial recognition of warrant liability | $ | 2,885,000 | $ | - | ||||

| Reclass of warrants to equity | $ | 1,042,000 | $ | - | ||||

Deferred offering cost in accounts payable |

$ |

3,125,655 |

$ |

- |

||||

| Debt settled in common stock | $ | 8,935,160 | $ | - | ||||

| Contingent consideration settled in common stock | $ | 13,975,851 | $ | - | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

|

AIRO Group Holdings, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

| 1. | The Company and Summary of Significant Accounting Policies |

Nature of Operations

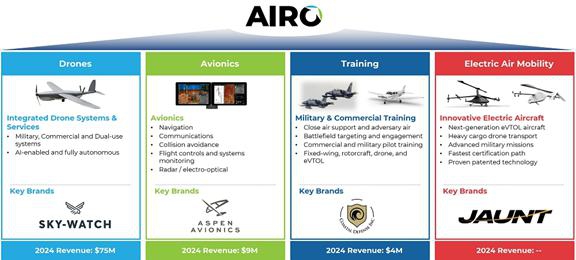

AIRO Group Holdings, Inc., a Delaware corporation (“Holdings” or the “Company”), is a technologically differentiated aerospace, autonomy, and air mobility platform targeting 21st century aerospace and defense opportunities. The Company is organized into four operating segments: (i) Drones, (ii) Avionics, (iii) Training and (iv) Electric Air Mobility. The Drones segment develops, manufactures, and sells drones and expects to provide drone services, such as Drone as a Service (“DaaS”), for military and commercial end users. The Avionics segment develops, manufactures, and sells avionics for military and general aviation aircraft, drones, and electric vertical takeoff and landing (“eVTOL”) aircraft. The Training segment currently provides military pilot training and expects to provide commercial pilot training in the future. The Electric Air Mobility segment is developing a rotorcraft eVTOL for cargo and passenger use for fixed route flights, on-demand trips, and cargo operations.

In October 2021, Holdings entered into agreements and plans of merger (the “Merger Agreements”) with AIRO Drone, LLC (“AIRO Drone”), Agile Defense, LLC (“Agile Defense”), Coastal Defense, Inc. (“Coastal Defense”), Jaunt Air Mobility, LLC (“Jaunt”), and Aspen Avionics, Inc. (“Aspen Avionics”). Holdings also entered into an equity purchase agreement (“Equity Purchase Agreement”) with Sky-Watch A/S (“Sky-Watch”). AIRO Drone, Agile Defense, Coastal Defense, Jaunt, Aspen Avionics and Sky-Watch together represent the “Merger Entities.” Under the Merger Agreements and Equity Purchase Agreement, the parties entered into a series of transactions in which Holdings acquired all of the equity of the Merger Entities. The acquisitions of the Merger Entities by Holdings were completed between February and April 2022.

On March 3, 2023, the Company entered into a Business Combination Agreement, as amended by that certain First Amendment to the Business Combination Agreement, dated August 29, 2023, that certain Second Amendment to the Business Combination Agreement, dated January 16, 2024, that certain Third Amendment to the Business Combination Agreement, dated February 5, 2024, and that certain Fourth Amendment to the Business Combination Agreement, dated June 24, 2024, with Kernel Group Holdings, Inc., a Cayman Islands exempted company (“Kernel”), AIRO Group, Inc., a Delaware corporation (“ParentCo”), Kernel Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of ParentCo, AIRO Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of ParentCo, VKSS Capital, LLC, a Delaware limited liability company, in the capacity as the representative for the stockholders of Kernel and ParentCo and also in the capacity as Kernel’s sponsor, and Dr. Chirinjeev Kathuria, in the capacity as the representative for the stockholders (the “Business Combination Agreement”), pursuant to which a series of transactions would have occurred that would have resulted in the Company becoming a wholly-owned subsidiary of ParentCo with ParentCo becoming a publicly listed company (collectively, the “BCA Transactions”). On August 5, 2024, the Business Combination Agreement (“BCA”) was terminated and, as a result, none of the BCA Transactions were effectuated.

On June 16, 2025, the Company completed its initial public offering of 6.9 million shares of its common stock (the “IPO”), which included an additional 0.9 million shares of common stock pursuant to the full exercise of the underwriters’ option to purchase additional shares, at an initial public offering price of $10.00 per share. The shares began trading on the Nasdaq Global Market under the ticker symbol “AIRO” on June 13, 2025. The net proceeds to AIRO from the IPO, after deducting $7.5 million of underwriting discounts and commissions and issuance costs paid were $61.5 million.

Consolidation and Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of Holdings and its wholly owned subsidiaries, including Old AGI, Inc. f/k/a AIRO Group, Inc. (“AIRO Group”), AIRO Drone, Agile Defense, Jaunt, Sky-Watch, Coastal Defense, and Aspen Avionics. All intercompany accounts and transactions have been eliminated in consolidation.

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information. In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of such interim results. Certain information and disclosures normally included in unaudited condensed consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. Accordingly, the unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes included in the Company’s final prospectus, dated June 12, 2025, filed with the SEC pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”), on June 16, 2025 (the “Prospectus”) in connection with the IPO. The condensed consolidated balance sheet as of December 31, 2024 has been derived from the audited consolidated financial statements as of that date.

The results for the unaudited interim condensed consolidated statements of operations are not necessarily indicative of results to be expected for the year ending December 31, 2025 or for any future interim period.

Reverse Stock Split

On March 7, 2025, the Board of Directors approved a 1-for-1.7 reverse stock split (“Stock Split”) of the Company’s issued and outstanding shares of common stock and options to purchase common stock. The Stock Split reduced the number of shares of the Company’s issued and outstanding common stock, as well as the numbers of shares reserved and available for future issuance and underlying outstanding options to purchase common stock. No fractional shares were distributed as a result of the reverse stock split, and stockholders were entitled to a cash payment in lieu of fractional shares. The Stock Split did not affect the par values per share or total authorized common stock. Accordingly, all share and per share amounts for all periods presented in the condensed consolidated financial statements have been adjusted retroactively, where applicable, to reflect this Stock Split.

|

|

Liquidity and Management’s Plans

The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. As of March 31. 2025, the Company had incurred recurring losses from operations and negative cash flows, which raised substantial doubt about its ability to continue as a going concern. On June 16, 2025, the Company completed its IPO of common stock, which resulted in net proceeds of $61.5 million after deducting underwriting discounts and commissions and issuance costs paid of $7.5 million.

Management believes that the net proceeds from the IPO, together with existing cash on hand, are sufficient to meet its obligations and fund planned operations for at least the next twelve months from the date these condensed consolidated financial statements are issued. Accordingly, the conditions that previously raised substantial doubt about the Company’s ability to continue as a going concern have been alleviated.

As of June 30, 2025, the Company had cash and restricted cash of $40.5 million of which $0.2 million was either restricted or was designated to only being used for Sky-Watch operations and working capital of $12.6 million. Based on its current operating plan and available liquidity, management believes that the Company has sufficient cash and resources to meet its obligations and continue its operations for at least the next 12 months from the date of issuance of the financial statements.

The Company is opportunistically pursuing additional capital through equity or debt financing to support growth initiatives. There can be no assurance that additional financing will be available on terms acceptable to the Company, if at all.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. These judgments, estimates and assumptions are used to determine litigation and claims and other asset and liability amounts. The Company bases its estimates and judgments on historical experience along with other pertinent information available at the time the estimate is made. However, future events are subject to change and the estimates and judgments may require adjustments. Actual results could differ from these estimates and these differences may be material.

Business Combinations and Asset Acquisitions

The Company recognizes identifiable assets acquired and liabilities assumed at their acquisition date fair values. Goodwill is measured as the excess of the consideration transferred over the fair value of assets acquired and liabilities assumed on the acquisition date. While the Company uses its best estimates and assumptions as part of the purchase price allocation process to accurately value assets acquired and liabilities assumed, these estimates are inherently uncertain and subject to refinement. Examples of estimates and assumptions in valuing certain of the intangible assets and goodwill the Company has acquired include, but are not limited to, future expected cash flows from acquired developed technologies, customer relationships, and tradenames. Unanticipated events and circumstances may occur that may affect the accuracy or validity of such assumptions, estimates or actual results.

The authoritative guidance allows a measurement period of the purchase price allocation that ends when the entity has obtained all relevant information about facts that existed at the acquisition date, and that cannot exceed one year from the date of acquisition. As a result, during the measurement period the Company may record adjustments to the fair values of assets acquired and liabilities assumed, with the corresponding offset to goodwill to the extent that it identifies adjustments to the preliminary purchase price allocation. Upon conclusion of the measurement period or final determination of the values of the assets acquired and liabilities assumed, whichever comes first, any subsequent adjustments will be recorded to the condensed consolidated statements of operations.

Where the purchase of an entity or net assets does not meet the definition of a business, the Company accounts for the transaction as an asset acquisition. In an asset acquisition, the purchase price is allocated to the net assets acquired on a relative fair value basis, and no goodwill is recognized in the transaction. Direct costs for asset acquisitions are generally considered part of the purchase price.

|

|

Business Risk and Concentration of Credit Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist primarily of cash and accounts receivable. Cash is maintained with financial institutions and the composition and maturities are regularly monitored by management. Deposits at any time may exceed federally insured limits. The Company performs ongoing credit evaluations of its customers and generally does not require collateral for accounts receivable. A large portion of the Company’s sales result in partial prepayments prior to shipment from customers. Otherwise, customer invoices generally have payment terms of net 30 days and do not have a significant financing component.

The Company’s operational structure includes an existing operating business and early-stage businesses in emerging and developing markets that are concentrated in an industry characterized by rapid technological advances, changes in customer requirements, and evolving regulatory requirements and industry standards. Any significant delays in the development or introduction of products or services, or any failure by the Company to anticipate or to respond adequately to technological developments in its industry, changes in customer requirements, or changes in regulatory requirements or industry standards, could have a material adverse effect on the Company’s business and operating results.

The Company’s business, results of operations, and financial condition for the foreseeable future will likely continue to depend on sales to a relatively small number of customers. In the future, these customers may decide not to purchase the Company’s products, may purchase fewer products than in previous years, or may alter their purchasing patterns. Further, the amount of revenue attributable to any single customer or customer concentration generally may fluctuate in any given period. In addition, a decline in the production levels of one or more of the Company’s major customers could reduce revenue. The loss of one or more key customers, a reduction in sales to any key customer or the Company’s inability to attract new significant customers could negatively impact revenue and adversely affect the Company’s business, results of operations, and financial condition.

Cash Equivalents

The Company considers all highly liquid investments with an original or remaining maturity of three months or less from the date of purchase to be cash equivalents. The Company had no cash equivalents as of June 30, 2025 and December 31, 2024.

Restricted Cash

The Company had $0.2 million in restricted cash as of June 30, 2025 and December 31, 2024. As of June 30, 2025 and December 31, 2024, restricted cash was primarily deposits from a customer contract that have been placed in an escrow account to be released upon shipment of orders.

Accounts Receivable, Net

Accounts receivable are reported on the accompanying condensed consolidated balance sheets at the gross outstanding amount adjusted for a provision for credit losses. The Company determines the provision for credit losses by regularly evaluating expected loss as well as individual customer receivables and considering a customer’s financial condition, credit history, and current economic conditions. As of June 30, 2025 and December 31, 2024, the Company provided a provision for credit losses of $0.1 million for amounts that may ultimately be uncollectible. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received.

|

|

Inventory

Inventory is stated at the lower of cost or net realizable value. Cost is primarily determined based on standard cost and approximates actual cost on a first-in, first-out basis. Work-in-process and finished goods include materials, labor and allocated overhead. The Company writes down its inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated net realizable value based upon assumptions about future demand and market conditions. Reductions to the carrying value of inventory are charged to cost of revenue and a new, lower cost basis for that inventory is established. Subsequent changes to facts or circumstances do not result in the restoration or increase in the related inventory value. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

Deferred Offering Costs

The Company capitalizes certain legal, professional, accounting, and other third-party fees that are directly associated with in-process equity issuances as deferred offering costs until such equity issuances are consummated. During the quarter ended June 30, 2025, $12.7 million of offering costs were recorded as a reduction to the net proceeds received from the IPO. As of December 31, 2024, the Company had a balance of $0.8 million of deferred offering costs on the condensed consolidated balance sheet.

Fair Value Measurements

The Company applies the requirements of the fair value measurements framework, which establishes a hierarchy for measuring fair value and requires enhanced disclosures about fair value measurements. The fair value measurement guidance clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value measurement guidance also requires disclosure about how fair value is determined for assets and liabilities and establishes a hierarchy in which these assets and liabilities must be grouped based on significant levels of inputs as follows:

| Level 1: | Quoted prices in active markets for identical assets or liabilities. | |

| Level 2: | Quoted prices in active markets for similar assets and liabilities and inputs that are observable for the asset or liability. | |

| Level 3: | Unobservable inputs in which there is little or no market data, which requires the reporting entity to develop its own assumptions. |

The determination of where assets and liabilities fall within this hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The following is a summary of the financial liabilities measured at fair value on a recurring basis by caption and by level within the fair value hierarchy as of June 30, 2025 and December 31, 2024:

Summary of the Financial Liabilities Measured at Fair Value on a Recurring Basis

| Fair value as of June 30, 2025 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities: | ||||||||||||||||

| Investor Notes at fair value | $ |

- | $ |

- | $ |

3,795,934 | $ |

3,795,934 | ||||||||

| Total financial liabilities | $ | - | $ | - | $ | 3,795,934 | $ | 3,795,934 | ||||||||

| Fair value as of December 31, 2024 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities: | ||||||||||||||||

| Contingent consideration | $ | - | $ | - | $ | 42,782,276 | $ | 42,782,276 | ||||||||

| Investor Notes at fair value | - | - | 13,819,000 | 13,819,000 | ||||||||||||

| Total financial liabilities | $ | - | $ | - | $ | 56,601,276 | $ | 56,601,276 | ||||||||

There were no financial assets measured at fair value on a recurring basis as of June 30, 2025 and December 31, 2024. There were no transfers between Levels 1, 2, or 3 within the fair value hierarchy during the six months ended June 30, 2025 nor during the year ended December 31, 2024.

|

|

Contingent Consideration

As of December 31, 2024, contingent consideration included an obligation assumed from the Jaunt acquisition that was contingent on future cash receipts (the “Jaunt Contingent Arrangement”) and promissory notes issued in conjunction with the acquisitions of Agile Defense, Airo Drone, and Coastal Defense.

The contingent consideration liabilities were measured at fair value on a recurring basis for which there was no available quoted market prices or principal markets. The inputs for this measurement were unobservable and were, therefore, classified as Level 3 inputs.

The Jaunt Contingent Arrangement was valued using discounted cash flow models. As of December 31, 2024, the significant inputs included discount factors ranging from 21% to 45% and a 67% initial public offering (“IPO”) likelihood to arrive at a total fair value of $33.4 million.

The fair value of the contingent consideration promissory notes issued to the former equity holders of Agile Defense, AIRO Drone and Coastal Defense totaled $9.4 million as of December 31, 2024. Valuations were based on a 67% probability of the IPO closing and a discount rate of 3% as of December 31, 2024 based on proximity to an estimated closing date.

As a result of the closing of the IPO, the contingencies on the liabilities discussed above were resolved and the Company recorded the fair the value of the expected settlement in shares of common stock and cash, resulting in income of $17.5 million being recorded to other income (expense), net. During the three months ended June 30, 2025, 1.4 million shares were issued at a fair value of $10.00 per share and $3.3 million in cash was paid related to these obligations. The remaining cash obligations totaling $5.3 million are reflected as accrued expenses on the Company’s condensed consolidated balance sheet as of June 30, 2025. The Company funded $4.2 million of the remaining cash obligations in July 2025 and agreed to fund the remaining $1.1 million to Carter Aviation Technologies LLC on September 10, 2025 through an unsecured promissory note, dated July 10, 2025.

Investor Notes at fair value

The Company has historically issued unsecured promissory notes to certain investors (“the Investor Notes”), which have included various interest features in the form of both stock and cash and were contingently payable upon the closing of the IPO or qualified financing. The Company has evaluated these features and determined that they do not meet the criteria for being accounted as an embedded derivative under Accounting Standards Codification (“ASC”) 815. During the fourth quarter of 2024, certain Investor Notes were amended such that when the Company performed a significance test as of the modification date in accordance with ASC 470-50, the Company determined that the change in terms of these Investor Notes were substantially different than the previous terms such that the Company recorded a loss on extinguishment of $10.5 million.

As this significant modification created an election date for the fair value option and as the fair value election is applied on an instrument-by-instrument basis, the Company chose to record these Investor Notes at fair value beginning on the modification date in October 2024 (“Investor Notes at fair value”). Significant judgment was required in estimating the fair value of debt prior to the IPO. The fair value estimates are based on available historical information and on future expectations and assumptions deemed reasonable by management but are inherently uncertain.

To determine the fair value of Investor Notes at fair value, the Company estimated stock pricing and incorporated the probability of both the IPO and non-IPO scenario with the IPO probability being 67% as of December 31, 2024. Significant estimates and assumptions inherent in the valuations reflect a consideration of other marketplace participants and include the amount and timing of future cash flows. The Company used a present value model for the expected cash payments, and a probability-weighted calculation to fair value the contingent interest shares to be paid. This probability-weighted calculation incorporated expectations to complete the IPO as well as a probability derived from a lattice model with key assumptions being equity volatility and discount for lack of marketability (“DLOM”). Equity volatility rates utilized were 70% and the DLOM rates selected were 10% for December 31, 2024. As described in Note 2, the terms of the Investor Notes at fair value were further amended and then partially settled through the issuance of common stock during the six months ended June 30, 2025. As of June 30, 2025, the $3.8 million of Investor Notes at fair value included unpaid cash amounts of which $2.1 million was repaid in July of 2025. During July 2025, the Company modified the remaining notes which totaled $1.7 million such that $1.8 million, inclusive of a $0.1 million fee, would be due by December 16, 2025.

|

|

Warrant liability

During the quarter ended March 31, 2025, the Company entered into two warrant agreements whereby Libertas Funding, LLC (“Libertas”) agreed to purchase an aggregate of 0.5% of the fully diluted number of shares of common stock of the Company immediately before the closing of the Company’s IPO at an exercise price of $0.02 per share (“Libertas Warrants”). At inception, prior to the IPO, the Libertas Warrants did not meet the indexation criteria in ASC 815-40; accordingly, the Libertas Warrants were recorded as a liability measured at fair value as of March 31, 2025. During the three months ended March 31, 2025, in conjunction with the Libertas Agreements, as defined in Note 2, the Company allocated the net proceeds to the $2.9 million warrant liability with the residual proceeds then being allocated to the debt associated with the Libertas Agreements, which resulted in the recording of a debt discount of $2.9 million.

Upon the closing of the IPO, the number of shares issuable became fixed such that the Libertas Warrants became indexed to the Company’s stock and were eligible to be classified in stockholders’ equity on the Company’s condensed consolidated balance sheets at that time. As such, the Company reclassified the fair value of the warrant liability of $1.0 million as of June 12, 2025 to stockholders’ equity and recognized $1.8 million of income due to the change in fair value of the Libertas Warrants within other income (expense), net on the condensed consolidated statements of operations.

To determine the fair value of the Libertas Warrants, the Company utilized the Black-Scholes model to determine the common stock price on a non-controlling, non-marketable value basis. Key assumptions included equity volatility rate of 70%.

Debt

The Company modified certain debt arrangements as of March 31, 2022. The debt was recorded at present value to estimate the fair value of the debt obligation as of March 31, 2024 and December 31, 2023. Since the debt was fully accreted to its expected value during the six months ended June 30, 2024, the debt is no longer measured at fair value on a recurring basis and was transferred out of Level 3 fair value measurements.

The changes in fair value of the Level 3 financial liabilities for the three and six months ended June 30, 2025 and 2024 were as follows:

| Debt | Investor Notes at Fair Value |

Warrant liability |

Contingent Consideration |

|||||||||||||

| Balance as of April 1, 2025 | $ | - | $ | 14,005,000 | $ | 2,885,000 | $ | 40,044,022 | ||||||||

| Change in fair value | - | (5,679,746 | ) | (1,843,000 | ) | (17,533,572 | ) | |||||||||

| Settlement | - | (4,529,320 | ) | - | (17,242,462 | ) | ||||||||||

| Transfers out | - | - | (1,042,000 | ) | (5,267,988 | ) | ||||||||||

| Balance as of June 30, 2025 | $ | - | $ | 3,795,934 | $ | - | $ | - | ||||||||

| Debt | Investor Notes at Fair Value |

Warrant liability | Contingent consideration | |||||||||||||

| Balance as of April 1, 2024 | $ | 19,440,519 | $ | - | $ | - | $ | 45,382,276 | ||||||||

| Change in fair value | - | - | - | 1,500,000 | ||||||||||||

| Transfers out | (19,440,519 | ) | - | - | - | |||||||||||

| Balance as of June 30, 2024 | $ | - | $ | - | $ | - | $ | 46,882,276 |

| Debt |

Investor Notes at Fair Value |

Warrant liability |

Contingent Consideration |

|||||||||||||

| Balance as of January 1, 2025 | $ | - | $ | 13,819,000 | $ | - | $ | 42,782,276 | ||||||||

| Addition | - | - | 2,885,000 | - | ||||||||||||

| Change in fair value | - | (5,493,746 | ) | (1,843,000 | ) | (20,271,826 | ) | |||||||||

| Settlement | - | (4,529,320 | ) | - | (17,242,462 | ) | ||||||||||

| Transfers out | - | - | (1,042,000 | ) | (5,267,988 | ) | ||||||||||

| Balance as of June 30, 2025 | $ | - | $ | 3,795,934 | $ | - | $ | - | ||||||||

| Debt |

Investor Notes at Fair Value |

Warrant liability |

Contingent Consideration |

|||||||||||||

| Balance as of January 1, 2024 | $ | 19,426,848 | $ | - | $ | - | $ | 45,182,276 | ||||||||

| Change in fair value | 13,671 | - | - | 1,700,000 | ||||||||||||

| Transfers out | (19,440,519 |

) | - |

- |

- |

|||||||||||

| Balance as of June 30, 2024 | $ | - | $ | - | $ | - | $ | 46,882,276 | ||||||||

The change in the fair value of the debt is included in interest expense, net on the condensed consolidated statements of operations and represents the amortization of the debt discount. The change in the fair value of the Investor Notes at fair value is included in interest expense, net on the condensed consolidated statements of operations. The change in the fair value of the contingent consideration and warrant liability is included in other income (expense), net on the condensed consolidated statements of operations.

Fair Value of Financial Instruments

The carrying value of accounts receivable, prepaid expenses and other current assets, accounts payable, and accrued expenses approximate fair value due to the short time to maturity. The carrying value of the Company’s borrowings approximates fair value based on current rates available to the Company.

Income Taxes

The Company accounts for income taxes in accordance with the asset and liability approach method. Deferred tax assets and liabilities are recognized for future tax consequences attributable to temporary differences between the condensed consolidated financial statements carrying amounts of existing assets and liabilities and their respective tax bases, as well as for net operating losses and tax credit carryforwards. Deferred tax amounts are determined by using the enacted tax rates expected to be in effect when the temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance reduces the deferred tax assets to the amount that is more-likely-than-not to be realized.

|

|

The Company evaluates its tax positions taken or expected to be taken in the course of preparing the Company’s tax returns to determine whether the tax positions will more-likely-than-not be sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are not recorded as a tax benefit or expense in the current year. Interest and penalties, if applicable, are recorded in the period assessed as income tax expense. No interest or penalties have been accrued for as of June 30, 2025 or December 31, 2024. On July 4, 2025, the One Big Beautiful Bill Act (“OBBBA”) was enacted. While this event has no effect on the financial results for the three and six months ended June 30, 2025, we are currently evaluating the impact of the new legislation.

Property and equipment

Property and equipment are stated at cost, net of accumulated depreciation. Depreciation of property and equipment is provided primarily utilizing the straight-line method for condensed consolidated financial statement purposes at rates based on the following useful lives:

Schedule of Property and Equipment Estimated Useful Lives

| Aircraft equipment | 5 - 20 years | |

| Machinery and equipment | 2 - 15 years | |

| Furniture and fixtures | 3 - 10 years | |

| Leasehold improvements | The shorter of the useful life or term of the lease | |

| Software | 3 - 7 years |

Additions, improvements, and expenditures that significantly add to the productivity or extend the economic life of assets are capitalized. Any amounts incurred as recurring expenditures or that do not extend or improve the economic life of the asset are expensed as incurred.

Goodwill

Goodwill represents the excess of the aggregate purchase price over the fair value of net identifiable assets acquired in a business combination. Goodwill is not amortized and is tested at the reporting unit level for impairment on an annual basis or whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The Company has selected October 1st as the date to perform its annual impairment test. In the valuation of goodwill, management must make assumptions regarding estimated future cash flows to be derived from the Company’s business. If these estimates or their related assumptions change in the future, the Company may be required to record an impairment for these assets. Management may first evaluate qualitative factors to assess if it is more likely than not that the fair value of a reporting unit is less than its carrying amount and to determine if an impairment test is necessary. Management may choose to proceed directly to the evaluation, bypassing the initial qualitative assessment. The impairment test involves comparing the fair value of the reporting unit to which goodwill is allocated to its net book value, including goodwill. A goodwill impairment loss would be the amount by which a reporting unit’s carrying value exceeds its fair value, however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. See Note 5 for additional considerations related to goodwill impairment recorded in 2024.

Definite-lived Intangible Assets

The Company performs valuations of assets acquired and liabilities assumed on each acquisition accounted for as a business combination and allocates the purchase price of the acquired business to the respective net tangible and intangible assets. The Company determines the appropriate useful life by performing an analysis of expected cash flows based on historical experience of the acquired businesses. Intangible assets are amortized over their estimated useful lives using the straight-line method which approximates the pattern in which the economic benefits are consumed. The Company capitalizes third-party legal costs and filing fees, if any, associated with obtaining patents. Once the patent asset has been placed in service, the Company amortizes these costs over the shorter of the asset’s legal life, generally 20 years from the initial filing date, or its estimated economic life using the straight-line method.

|

|

The estimated useful lives for the Company’s intangible assets are as follows:

Schedule of Estimated Useful Lives for Company’s Intangible Assets

| Estimated useful life | ||

| Developed technology | 8 to 13 years | |

| Tradenames - definite-lived | 4 to 8 years | |

| Customer relationships | 3 to 7 years | |

| Patents | up to 20 years |

Impairment of Long-Lived Assets

The Company evaluates long-lived assets, including property and equipment and intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets held and used is measured by a comparison of the carrying amount of an asset or an asset group to estimated undiscounted future net cash flows expected to be generated by the asset or asset group. If such evaluation indicates that the carrying amount of the asset or the asset group is not recoverable, any impairment loss would be equal to the amount the carrying value exceeds the fair value.

Revenue Recognition

The Company recognizes revenue when, or as, it satisfies performance obligations by transferring promised products or services to its customers in an amount that reflects the consideration the Company expects to receive. The Company applies the following five steps: (1) identify the contract with a customer, (2) identify the performance obligations in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance obligations in the contract, and (5) recognize revenue when a performance obligation is satisfied. The Company accounts for a contract with a customer when there is a legally enforceable contract, the rights of the parties are identified, the contract has commercial terms, and collectibility of the contract consideration is probable.

For certain sales, the Company has contracts with customers that include multiple performance obligations. For these contracts, the Company accounts for individual performance obligations separately, by allocating the contract’s total transaction price to each performance obligation in an amount based on the relative standalone selling price (“SSP”) of each distinct good or service in the contract. The Company determines the SSP based on its overall pricing objectives, taking into consideration market conditions. Determining whether products or services are considered distinct performance obligations that should be accounted for separately versus together may require significant judgment. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. Revenue is recognized when control of the promised services is transferred to the customer in an amount that reflects the consideration the Company expects to be entitled to receive in exchange for those services. The Company’s contracts do not include highly variable components. The timing of revenue recognition, billings, and cash collections can result in billed accounts receivable, unbilled receivables (contract assets), and deferred revenue (contract liabilities). The costs to obtain contracts, primarily commission expenses, are expensed when incurred.

Amounts that are invoiced are recorded in accounts receivable and revenues or deferred revenue, depending on whether the revenue recognition criteria have been met. A large portion of the Company’s sales result in partial prepayments prior to shipment from customers. Otherwise customer invoices generally have payment terms of net 30 days and do not have a significant financing component.

The Company’s revenues are derived from various sources: (i) avionics products consisting primarily of hardware with embedded firmware sold to an authorized dealer network and avionics and global navigation satellite system technologies (“GNSS”) products sold to original equipment manufacturers (“OEMs”), (ii) research and development (“R&D”) projects, (iii) sales-based royalties related to GNSS technology licensed to OEMs, (iv) consultation and training services related to aerial integration and close air support providing the latest tactics, technique, and procedures (“TTP”) to incorporate contract close air support/intelligence surveillance reconnaissance (“CCAS/ISR”) with video downlink systems into tactical operations, (v) technology and equipment sales, (vi) mini unmanned aerial systems (“MUAS” or “commercial drones”) sales, including hardware, software, training, support and product service, and (vii) drone services, including surveys, imaging, security, and other drone applications.

|

|

The Company expenses costs to obtain a contract as incurred when the amortization period is one year or less.

In general, revenue is disaggregated by segment and geography. See Note 11. Segment Information.

Product Revenue

Product revenue, which includes avionics, MUAS/commercial drones and other equipment sales, is recognized upon the transfer of control of promised products to the customer in an amount that depicts the consideration the Company is entitled to for the related products. Product revenue is recognized upon shipment or delivery and title and risk of loss have transferred to the customer.

Service and Extended Warranty Revenue

Service revenue includes drone services, support, training, consultations, and out-of-warranty repairs. Revenue from services rendered is recognized over time in amounts that correspond directly with the value to the customer when performance is completed. Support revenue is recognized on a straight line basis over the support period, which is generally one year.

Extended warranties are service-type warranties and are typically sold under separate contracts. Revenue for those extended warranties is recognized over the contractual service period, which is typically two or three years.

Research and Development Contracts

Revenue from engineering development projects is recognized over a period of time based on the input method and is measured by the percentage of total labor and materials cost incurred to date to estimated total labor and materials cost at completion for each contract. The input method of accounting involves considerable use of estimates in determining revenues, costs, and profits and in assigning the amounts to accounting periods; as a result, there can be a significant disparity between earnings as reported and actual cash received by the Company during any reporting period.

Sales-based Royalties

Revenue for sales-based royalties is recognized at a point in time as subsequent sales occur.

The following table summarizes the revenue recognition based on time periods:

Schedule of Revenue Recognition based on Time Period

| Three Months ended June 30, | Six Months ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Point in time | $ | 22,814,809 | $ | 8,847,400 | $ | 32,734,066 | $ | 21,790,943 | ||||||||

| Over time | 1,735,384 | 932,936 | 3,610,812 | 1,729,329 | ||||||||||||

| Revenue | $ | 24,550,193 | $ | 9,780,336 | $ | 36,344,878 | $ | 23,520,272 | ||||||||

The contract liabilities as of June 30, 2025 and December 31, 2024 were $4.0 million and $10.4 million, respectively. The majority of contract liabilities are expected to be recognized as revenue through 2025. The Company had no significant contract assets as of June 30, 2025 and December 31, 2024. During the three and six months ended June 30, 2025, the Company recognized $1.6 million and $8.7 million, respectively, in revenue previously included in contract liabilities as of December 31, 2024.

|

|

Cost of Revenue

Cost of revenue includes labor cost and direct material cost, including freight and duties. Indirect production costs comprising of consumables, cost of sales freight, quality related costs and production maintenance costs are also included in cost of revenue.

Shipping and Handling

Shipping charges billed to customers are included in revenue and related costs are included in cost of revenue.

Research and Development

Research and development costs are expensed when incurred.

Product Warranty

Drone Product Warranty

The Company provides a one-year warranty on drone sales. Estimated future warranty obligations related to those products are recorded as a component of cost of revenue in the condensed consolidated statements of operations at the time of sale.

Avionics Product Warranty

The Company establishes warranty reserves based on estimates of avionics product warranty return rates over two or three years depending on the product and the related warranty period and the expected costs to repair or to replace the avionics products under warranty. The warranty provision is recorded as a component of cost of revenue in the condensed consolidated statements of operations. The Company does not offer returns unless special circumstances exist and the return is approved by the Company.

Stock-Based Compensation

The Company recognizes compensation expense for stock-based awards based on the grant-date estimated fair value of the awards. Options and restricted stock awards may be granted as time-based awards, performance-based awards or combinations of the time-based and performance-based awards. The Company expenses the fair value of its options to employees and non-employees on a straight-line basis over the associated service period for time-based awards, which is generally the vesting period. The performance-based awards begin their period of ratable vesting at the time that the Company determines that the achievement of the performance thresholds is probable. The Company accounts for forfeitures as they occur and does not estimate forfeitures at the time of grant. Ultimately, the actual expense recognized over the vesting period will be for only those options that vest.

Comprehensive Income (Loss)

Comprehensive income (loss) generally represents all changes in the equity of a business except those resulting from investments or contributions by stockholders. Unrealized gains and losses on foreign currency translation adjustments, net of tax are included in the Company’s components of comprehensive income (loss), which are excluded from net loss.

Lease Accounting

At contract inception, the Company determines whether the contract is, or contains, a lease and whether the lease should be classified as an operating or a financing lease and reassesses that conclusion if the contract is modified. Operating leases are recorded in operating lease right-of-use (“ROU”) assets, lease liability, current and lease liability, noncurrent on the condensed consolidated balance sheets. The Company did not have any finance leases during the periods presented.

|

|

The Company recognizes operating lease ROU assets and operating lease liabilities based on the present value of the future minimum lease payments over the lease term at commencement date. The lease ROU asset is reduced for tenant incentives, if any, and excludes any initial direct costs incurred, if any. The Company uses its incremental borrowing rate based on the information available at commencement date to determine the present value of future payments and the appropriate lease classification. In determining the inputs to the incremental borrowing rate calculation, the Company makes judgments about the value of the leased asset, its credit rating and the lease term including the probability of its exercising options to extend or terminate the underlying lease. The Company defines the initial lease term to include renewal options determined to be reasonably certain. If the Company determines the option to extend or terminate is reasonably certain, it is included in the determination of lease assets and liabilities. The Company reassesses the lease term if and when a significant event or change in circumstances occurs within the control of the Company, such as construction of significant leasehold improvements that are expected to have economic value when the option becomes exercisable.

The Company recognizes a single lease cost on a straight-line basis over the term of the lease, and the Company classifies all cash payments within operating activities in the condensed consolidated statements of cash flows.

The Company has lease agreements with lease and non-lease components, which it has elected to not combine for all asset classes. In addition, the Company does not recognize ROU assets or lease liabilities for leases with a term of 12 months or less of all asset classes.

Basic net income (loss) per share is determined using the weighted average number of common shares outstanding during the period. Diluted net income (loss) per share is determined using the weighted average number of common shares and potential common shares (representing the hypothetical number of incremental shares issuable under the assumed exercise of outstanding stock options and vesting of outstanding RSUs) during the period using the treasury stock method. The calculation of dilutive shares outstanding excludes securities that would have an antidilutive effect on net income per share.

Schedule of Basic and Diluted Net Income (Loss) Per Share

| Three Months ended June 30, | Six Months ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Numerator: Net income (loss) | $ | 5,870,429 | $ | (5,599,841 | ) | $ | 3,897,674 | $ | (7,609,530 | ) | ||||||

| Denominator: Basic weighted average shares outstanding | 18,490,316 | 16,387,180 | 17,444,558 | 16,387,180 | ||||||||||||

| Dilutive effect of common equivalent shares outstanding | 982,332 | - | 2,147,697 | - | ||||||||||||

| Diluted weighted average shares outstanding | 19,472,648 | 16,387,180 | 19,592,255 | 16,387,180 | ||||||||||||

| Net income (loss) per share – basic | $ | 0.32 | $ | (0.34 | ) | $ | 0.22 | $ | (0.46 | ) | ||||||

| Net income (loss) per share - diluted | $ | 0.30 | $ | (0.34 | ) | $ | 0.20 | $ | (0.46 | ) | ||||||

| Anti-dilutive securities | - | 2,972,284 | - | 2,972,284 | ||||||||||||

Debt Discounts

Debt issuance costs are presented as a discount to the related debt and are amortized over the term of the related loan for which the fees were incurred using the straight-line method, which approximates the effective interest method. As of June 30, 2025 and December 31, 2024, unamortized debt discount totaled $0.0 million and $0.3 million, respectively.

Foreign Currency

The functional currency of the Company’s foreign subsidiary is its local currency. As such, assets and liabilities are translated to U.S. dollars at the exchange rates on the date of consolidation and related revenues and expenses are generally translated at average exchange rates prevailing during the period included in results of operations. Adjustments resulting from foreign currency translation are recorded in accumulated other comprehensive loss on the condensed consolidated balance sheets. Foreign currency transaction gains and losses are included in other income (expense), net on the condensed consolidated statements of operations. Losses from foreign currency transactions were not significant for the three and six months ended June 30, 2025 and 2024, respectively.

|

|

Recent Accounting Pronouncements Not Yet Adopted

In December 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU is intended to improve the transparency of income tax disclosures by requiring (1) consistent categories and greater disaggregation of information in the rate reconciliation and (2) income taxes paid disaggregated by jurisdiction. It also includes certain other amendments to improve the effectiveness of income tax disclosures. The ASU’s amendments are effective for public business entities for annual periods beginning after December 15, 2025. Entities are permitted to early adopt the standard for annual financial statements that have not yet been issued or made available for issuance. Adoption is either prospectively or retrospectively. The Company will adopt this ASU on a prospective basis. The Company is currently evaluating the impact of the new standard on the annual consolidated financial statements and related disclosures.

On January 6, 2025 and November 4, 2024, the FASB issued ASU No. 2025-01, “Expense Disaggregation Disclosures (Subtopic 220-40): Clarifying the Effective Date” (“ASU 2025-01”) and ASU No. 2024-03, “Income Statement — Reporting Comprehensive Income — Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses” (“ASU 2024-03”), respectively. ASU 2025-01 and ASU 2024-03 requires disclosure of certain costs and expenses on an interim and annual basis in the notes to the condensed consolidated financial statements. The guidance is effective for annual reporting periods beginning after December 15, 2026 and interim periods within annual reporting periods beginning after December 15, 2027. Early adoption is permitted. The guidance is to be applied either (1) prospectively to financial statements issued for reporting periods after the effective date or (2) retrospectively to any or all prior periods presented in the financial statements. The Company is currently evaluating the potential impact of adopting this new guidance on its condensed consolidated financial statements and related disclosures.

On May 12, 2025, the FASB issued ASU No. 2025-03, “Business Combinations (Topic 805) and Consolidation (Topic 810): Determining the Accounting Acquirer in the Acquisition of a Variable Interest Entity”. This guidance revises ASC 805 on identifying the accounting acquirer in a business combination in which the legal acquiree is a variable interest entity (VIE). The ASU is intended to improve comparability between business combinations and is effective for fiscal years beginning after December 15, 2026. Early adoption is permitted. The Company is currently evaluating the potential impact of adopting this new guidance on its condensed consolidated financial statements and related disclosures.

On May 15, 2025, the FASB issued ASU No. 2025-04, “Compensation – Stock Compensation (Topic 718) and Revenue from Contracts with Customers (Topic 606): Clarifications to Share-based Consideration Payable to a Customer.” This guidance clarifies ASC 606 and ASC 718 on the accounting for share-based payment awards that are granted by an entity as consideration payable to its customer. The ASU is intended to reduce diversity in practice and improve existing guidance, primarily by revising the definition of a “performance condition” and eliminating a forfeiture policy election for service conditions associated with share-based consideration payable to a customer. In addition, the ASU clarifies that the guidance in ASC 606 on the variable consideration constraint does not apply to share-based consideration payable to a customer “regardless of whether an award’s grant date has occurred” (as determined under ASC 718). Entities can use either a modified retrospective or a retrospective method to adopt the ASU’s amendments. The guidance is effective for fiscal years beginning after December 15, 2026. Early adoption is permitted. The Company is currently evaluating the potential impact of adopting this new guidance on its condensed consolidated financial statements and related disclosures.

On July 30, 2025, the FASB issued ASU 2025-05, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses for Accounts Receivable and Contract Assets.” This guidance amends ASC 326-20 to provide a practical expedient and an accounting policy election related to the estimation of expected credit losses for current accounts receivable and current contract assets that arise from transactions accounted for under ASC 606. The guidance is effective for fiscal years beginning after December 15, 2025. Early adoption is permitted. The Company is currently evaluating the potential impact of adopting this new guidance on its condensed consolidated financial statements and related disclosures.

| 2. | Revolving Lines of Credit and Long-Term Debt |

Revolving Lines of Credit

In February 2020, Aspen Avionics entered into a Loan and Security Agreement for an asset-based loan facility (the “Facility”) with Crestmark, a Division of Pathward (formerly known as Metabank), with a maximum advance limit of $2.5 million. The Facility was due on demand, carried variable interest at the greater of 9% or prime plus 4.25% and was collateralized by substantially all assets of Aspen Avionics. In October 2024, Aspen Avionics terminated the Facility and repaid the Facility in full.