UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 11, 2025

POWERFLEET, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-39080 | 83-4366463 | ||

| (State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 123 Tice Boulevard, Woodcliff Lake, New Jersey | 07677 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (201) 996-9000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.01 per share | AIOT | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 11, 2025, Powerfleet, Inc. (the “Company”) issued a press release regarding financial results for the fiscal quarter ended June 30, 2025. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 7.01. Regulation FD Disclosure.

As previously announced, the Company will hold a conference call on August 11, 2025 at 8:30 a.m. Eastern time (5:30 a.m. Pacific time) to discuss the financial results for the fiscal quarter ended June 30, 2025 and provide a business update. The slide presentation that will accompany the conference call is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this report is being furnished pursuant to Items 2.02 and 7.01 of Form 8-K. In accordance with General Instruction B.2. of Form 8-K, the information in this report, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements

This report, including Exhibits 99.1 and 99.2, contains forward-looking statements within the meaning of federal securities laws. The Company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements may be identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements include, without limitation, the Company’s expectations with respect to its beliefs, plans, goals, objectives, expectations, anticipations, assumptions, estimates, intentions and future performance, as well as anticipated financial impacts of the business combination with MiX Telematics and the acquisition of Fleet Complete. Forward-looking statements involve significant known and unknown risks, uncertainties and other factors, which may cause their actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. Most of these factors are outside the Company’s control and are difficult to predict. The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) the Company’s ability to realize all of the anticipated benefits of the business combination with MiX Telematics and the acquisition of Fleet Complete, and the potential challenges associated with the ongoing integration of the businesses; (ii) global economic conditions as well as exposure to political, trade and geographic risks, including tariffs and the conflict in the Middle East; (iii) disruptions or limitations in the Company’s supply chain, particularly with respect to key components; (iv) technological changes or product developments that may be more complex, costly, or less effective than expected; (v) cybersecurity risks and the Company’s ability to protect its information technology systems from breaches; (vi) the Company’s inability to adequately protect its intellectual property; (vii) competitive pressures from a broad range of local, regional, national and other providers of wireless solutions; (viii) the Company’s ability to effectively navigate the international political, economic and geographic landscape; (ix) changes in applicable laws and regulations or changes in generally accepted accounting policies, rules and practices, and (x) such other factors as are set forth in the periodic reports filed by the Company with the Securities and Exchange Commission (“SEC”), including but not limited to those described under the heading “Risk Factors” in its annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at http://www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this report are made only as of the date of this report, and except as otherwise required by applicable securities law, the Company assumes no obligation, nor does the Company intend to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press release, dated August 11, 2025. | |

| 99.2 | Slide presentation, dated August 11, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| POWERFLEET, INC. | ||

| By: | /s/ David Wilson | |

| Name: | David Wilson | |

| Title: | Chief Financial Officer | |

Date: August 11, 2025

Exhibit 99.1

Powerfleet

Drives SaaS Flywheel in Q1 FY2026: 6% Sequential Services Growth, Margin

Expansion, and Strong Progress Towards Achieving its EBITDA Expansion Targets

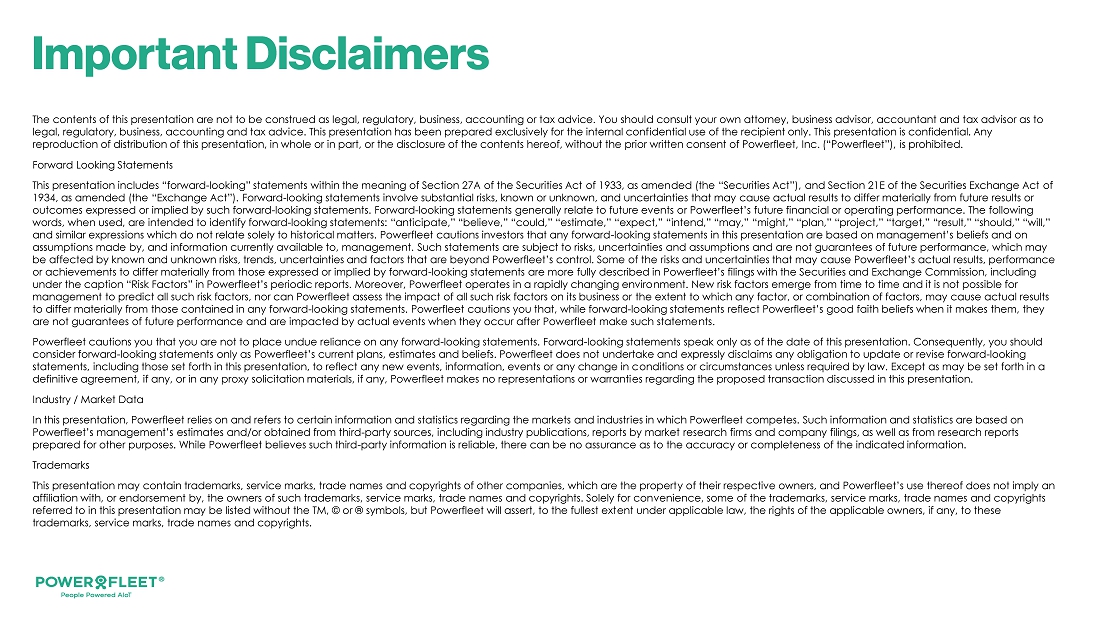

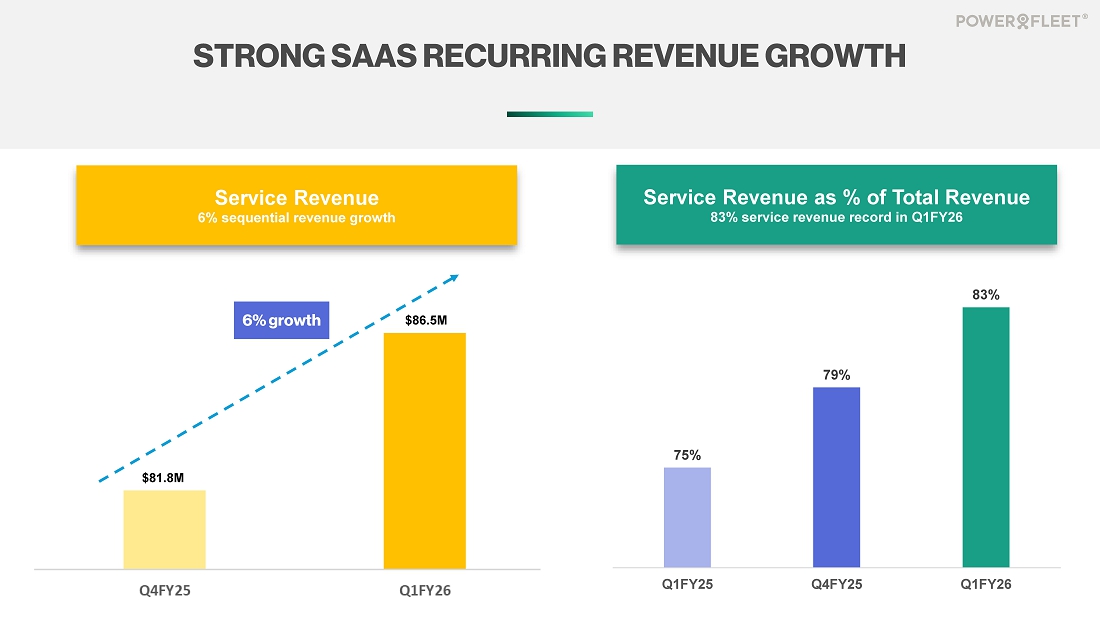

Quarterly services revenue jumped by 6% sequentially to $86.5 million, increasing from $81.8 million in Q4’25.

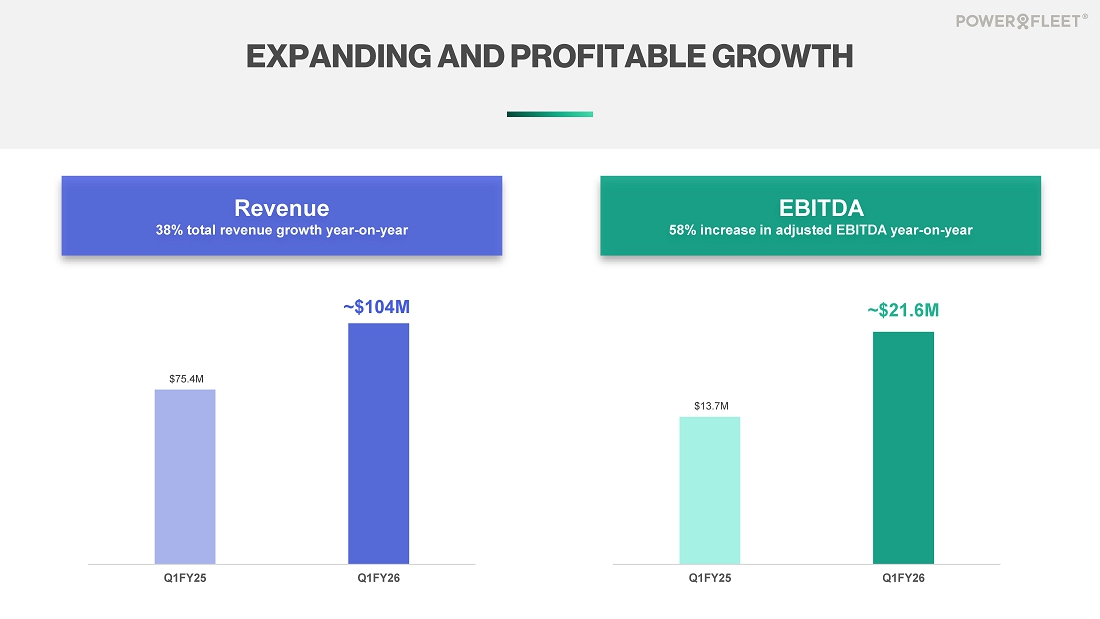

Total revenue grew by 38% year-over-year to $104.1million driven by strength in services revenue, which increased to a record high of 83% of total revenue.

Adjusted EBITDA increased by 58% to $21.6 million, with adjusted EBITDA margin expanding 260 basis points to 21%.

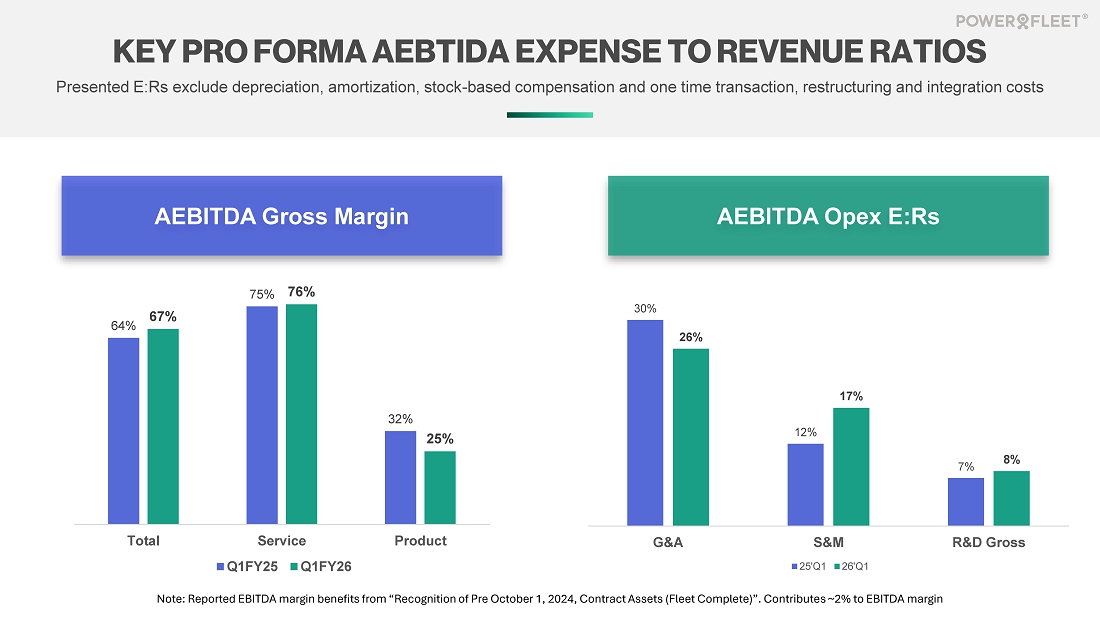

Gross profit increased year over year by $16.8 million to $56.5 million, with adjusted EBITDA gross margins expanding by 3% to 67%.

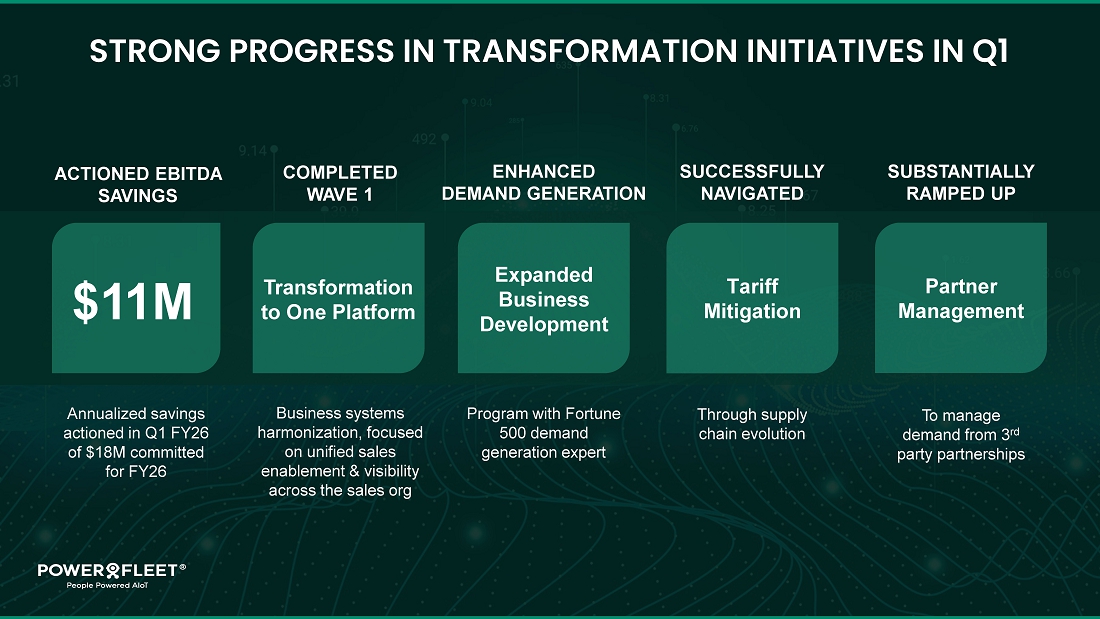

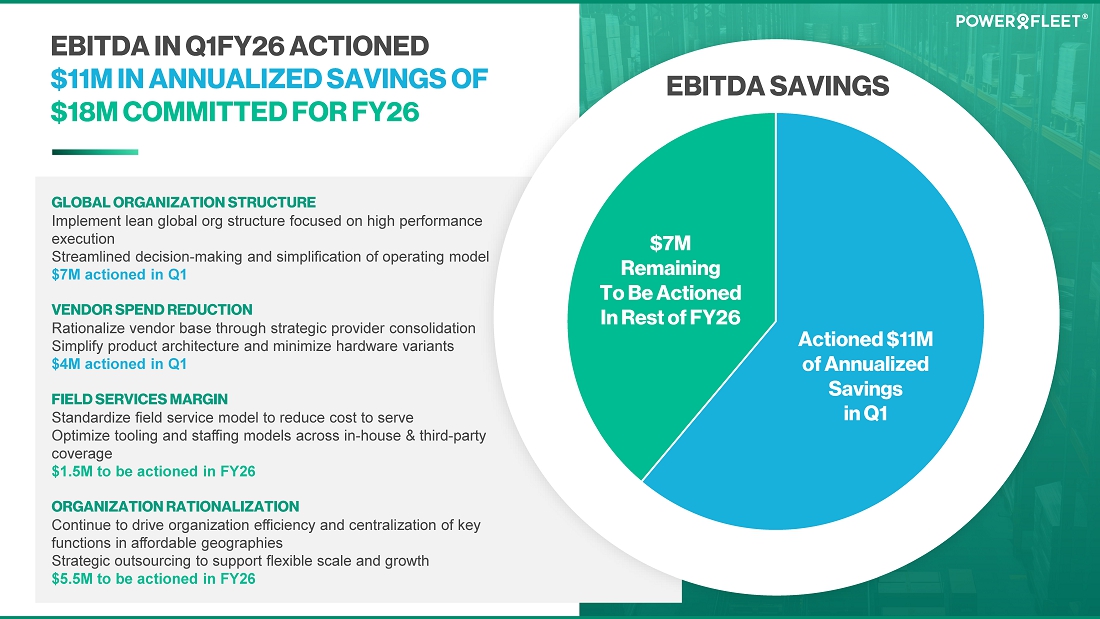

The EBITDA expansion program delivered $11 million in annual savings exiting the first quarter of FY26, achieving 60% of the full-year target of $18 million.

FY26 total revenue guidance raised to $430-$440 million from $420-$440 million.

WOODCLIFF LAKE, NJ – August 11, 2025 – Powerfleet, Inc. (Nasdaq: AIOT) reported its financial results for the first quarter ended June 30, 2025.

MANAGEMENT COMMENTARY

“Q1 marked a strong start to FY26 as we delivered profitable growth ahead of expectations, anchored by a standout 6% sequential increase in services revenue,” said Steve Towe, Chief Executive Officer of Powerfleet. “This performance underscores accelerating adoption of Unity’s AI-driven SaaS solutions and validates the long-term value we’re creating as we transition deeper into a recurring, high-margin business model.”

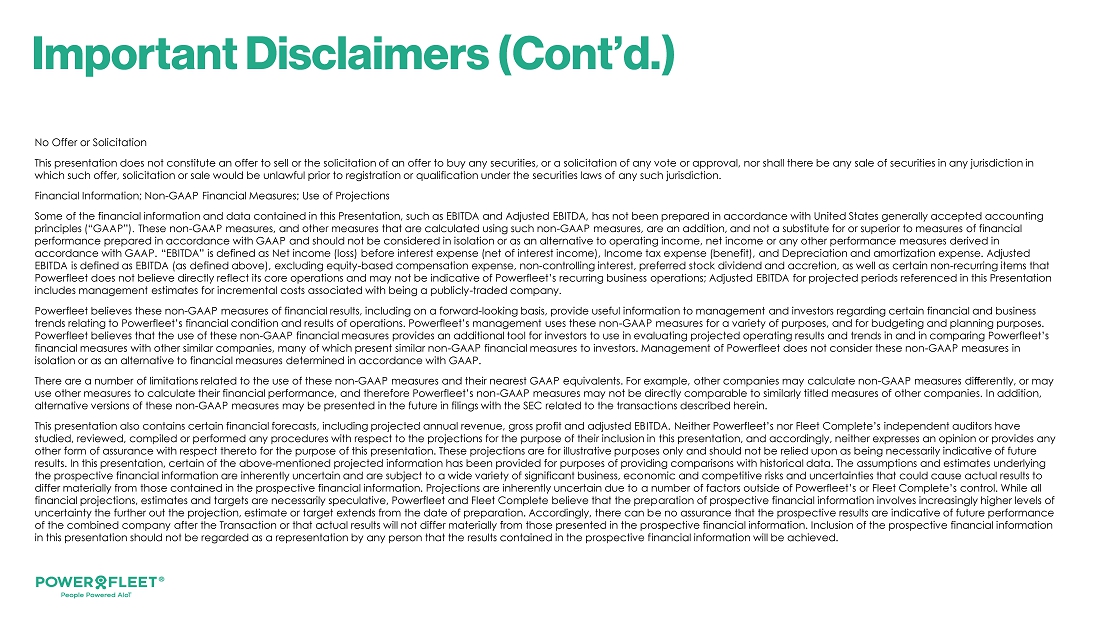

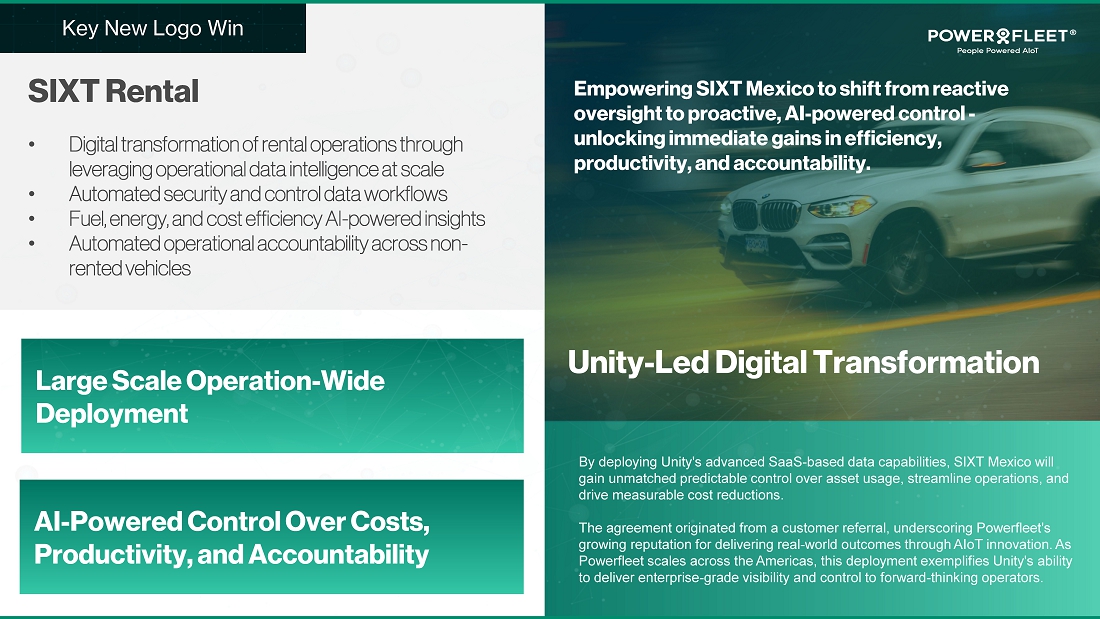

“Our AI Video annual recurring revenue (ARR) bookings grew 52% quarter-over-quarter, reflecting robust market demand, particularly through our major indirect channel partners.” Towe continued. “We also achieved a 14% sequential increase in new logo wins, alongside six-figure ARR deals across 11 diverse industry sectors - clear indicators that our growth engine is scaling efficiently across verticals.”

“In parallel, we’re driving structural improvements across the business,” he added. “This quarter, services revenue represented a record 83% of total revenue, highlighting our shift to higher-quality SaaS revenue. We accomplished this while successfully navigating tariff headwinds, accelerating supply chain efficiencies, and executing decisively on our adjusted EBITDA expansion initiatives. These results reflect our sharpened focus on scaling profitably while building long-term enterprise value.”

|

|

FIRST QUARTER FY2026 OPERATIONAL AND FINANCIAL HIGHLIGHTS

Powerfleet’s first quarter results underscore the strength of its bold business combination strategy, reflected in accelerated service revenue growth and rapid progress toward EBITDA expansion targets.

Go-To-Market Momentum

| ● | 11 diverse sectors contributed to ARR wins over $100k. |

| ● | Indirect channel partner momentum was strong, with sales success contributing significantly to ARR in AI video bookings surging 52% quarter-over-quarter. |

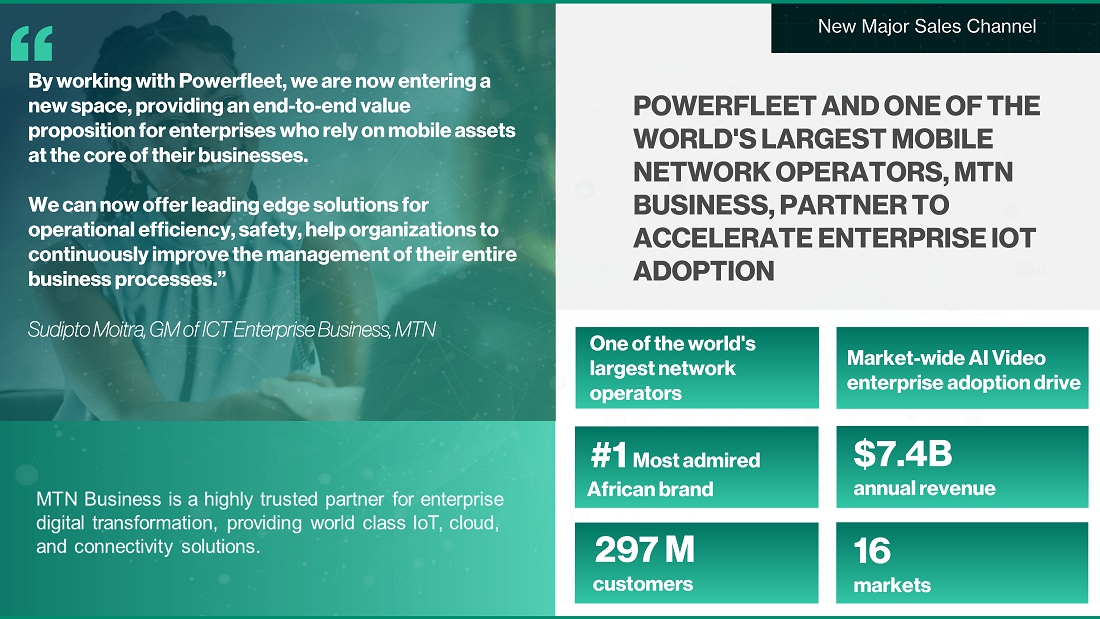

| ● | Major new strategic sales channel partnership signed with MTN Group, one of the world’s largest network providers, to white label Powerfleet’s portfolio of solutions to enterprise customers. MTN supports approximately 300 million customers across 16 markets. |

Technology and Innovation

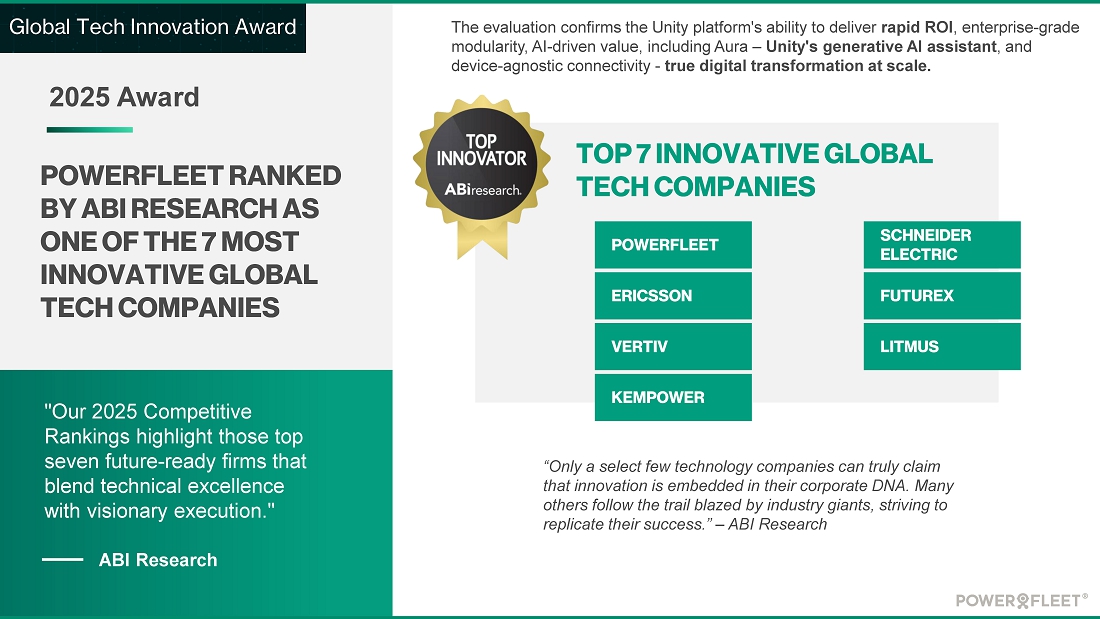

| ● | Powerfleet ranked by ABI Research as one of the 7 most innovative global tech companies |

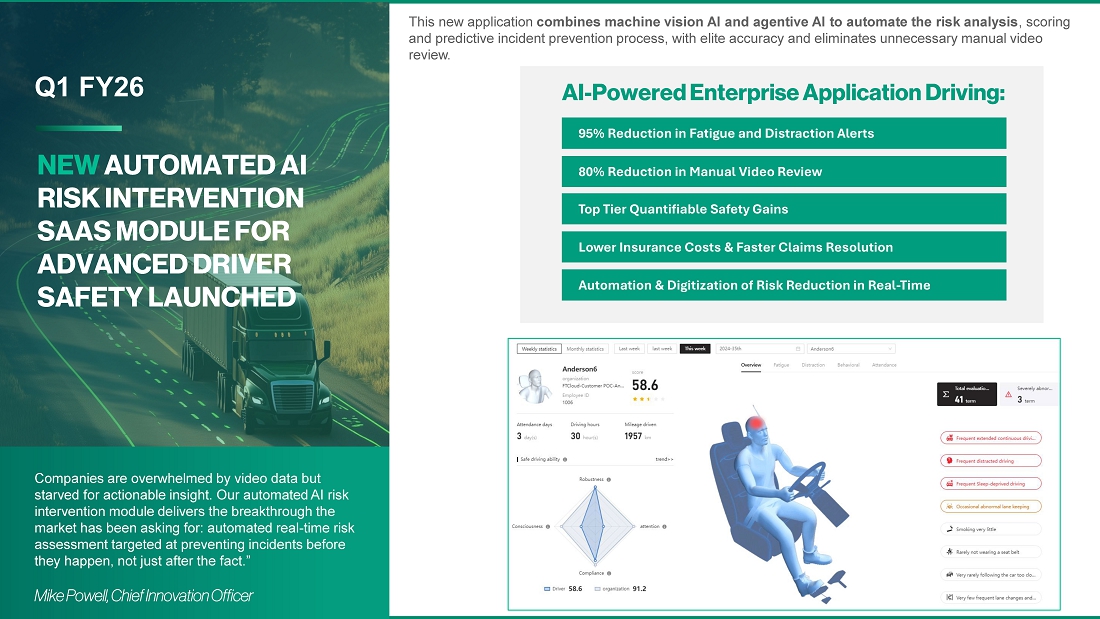

| ● | Launched new AI-powered automated risk application to drive top tier quantifiable enterprise safety benefits |

| ● | Announcing Powerfleet will host an Investor Innovation Session showcasing Unity AIoT product and technology, in November 2025. |

First Quarter Financial Highlights

Total revenue for the first quarter increased 38% year-over-year to $104.1 million, benefiting from the Fleet Complete acquisition and organic growth in recurring services.

Services revenue was particularly strong, rising 53% year-over-year and 6% sequentially to $86.5 million. Services revenue accounted for 83% of total revenue, up from 75% in the prior year and 79% in the prior quarter, underscoring the continued shift toward high-quality, recurring revenue streams.

The improved revenue mix, combined with strong and stable service adjusted EBITDA gross margins of 75%, contributed to meaningful margin expansion. Adjusted EBITDA gross margin increased 300 basis points year-over-year to 67%, up from 64% in the same period last year.

Total operating expenses were $58.5 million in the quarter, which included $4.2 million in one-time transaction and restructuring costs. Excluding these items, adjusted operating expenses totaled $54.3 million.

On an adjusted EBITDA basis, general and administrative expense represented 26% of revenue, a 400 basis point improvement from the prior year, reflecting continued progress from the Company’s EBITDA expansion program. Sales and marketing expenses increased to 17% of revenue, up 500 basis points year-over-year, in line with planned reinvestments to drive growth. Research and development expense was 5% of total revenue up from 4% in the prior year.

|

|

Adjusted EBITDA increased 58% to $21.6 million, up from $13.7 million in the prior year, reflecting contributions from the Fleet Complete acquisition, organic growth, gross margin expansion and cost synergies net of planned reinvestment in sales and marketing. Net loss attributable to common stockholders was $0.08 per share, compared to $0.21 per share in the prior year, reflecting improved financial performance and an increase in shares outstanding. After adjusting for one-time expenses and amortization of acquisition-related intangibles, adjusted net income per share was $0.01 compared with $0.00 in the prior year.

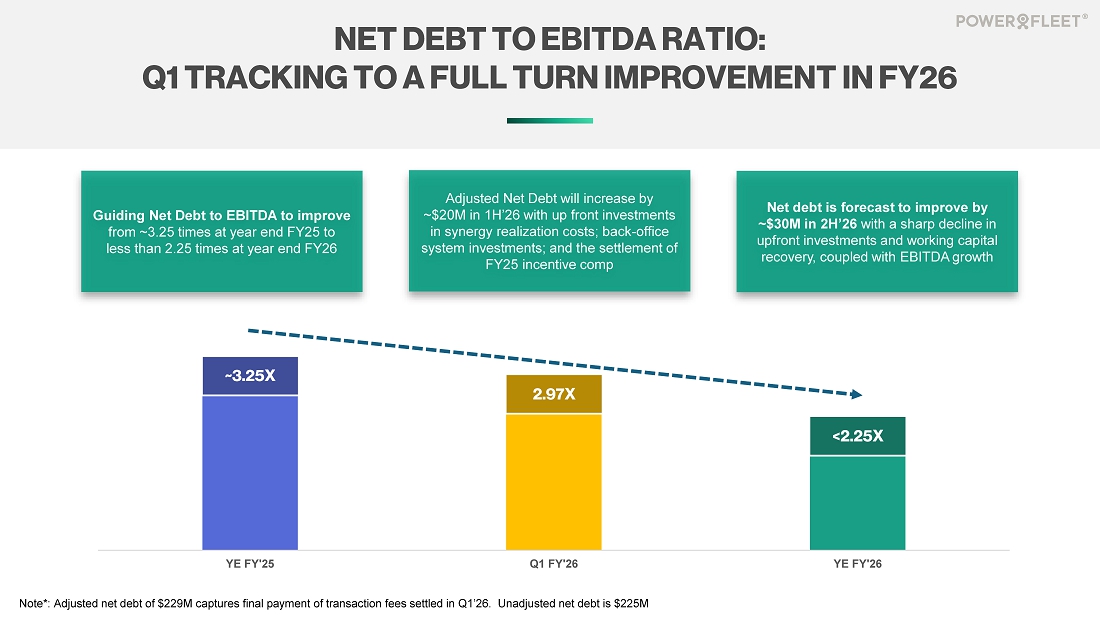

Adjusted net debt to adjusted EBITDA was 2.97x, an improvement from the 3.22x at the end of fiscal year 2025. Net debt at quarter end was $234.8 million, consisting of $35.6 million in cash and $270.4 million total debt.

FULL-YEAR 2026 FINANCIAL OUTLOOK

The company is increasing its financial guidance for revenue, with revenue now expected to be in the range of $430 million to $440million versus the prior guidance of approximately $420 million to $440 million.

The company is maintaining its annual guidance for:

| ● | Annual adjusted EBITDA, with annual growth of 45% to 55% | |

| ● | Adjusted net debt to adjusted EBITDA leverage ratio which is expected to improve from 3.2x as of March 31, 2025, to below 2.25x by March 31, 2026 |

INVESTOR CONFERENCE CALL AND BUSINESS UPDATE

Powerfleet management will hold a conference call on Monday, August 11, 2025, at 8:30 a.m. Eastern time (5:30 a.m. Pacific time) to discuss results for the first quarter fiscal 2026 ended June 30, 2025, and provide a business update.

Date: Monday, August 11, 2025

Time: 8:30 a.m. Eastern time (5:30 a.m. Pacific time)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 321752

The conference call will be broadcast simultaneously and available for replay here. Additionally, both the webcast and accompanying slide presentation will be available via the investor section of Powerfleet’s website at ir.powerfleet.com.

NON-GAAP FINANCIAL MEASURES

To supplement its financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), Powerfleet provides certain non-GAAP measures of financial performance. These non-GAAP measures include adjusted EBITDA, adjusted EBITDA gross margin, adjusted EBITDA gross profit, adjusted EBITDA service margin, adjusted product margin, adjusted EBITDA operating expenses, adjusted net income per share and net debt. Reference to these non-GAAP measures should be considered in addition to results prepared under current accounting standards, but are not a substitute for, or superior to, GAAP results. These non-GAAP measures are provided to enhance investors’ overall understanding of Powerfleet’s current financial performance. Specifically, Powerfleet believes the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses and fluctuations in currency rates that may not be indicative of its core operating results and business outlook. These non-GAAP measures are not measures of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income, gross margin, gross profit, total debt, cash flow from operating activities or earnings per share as an indicator of operating performance or liquidity. Because Powerfleet’s method for calculating the non-GAAP measures may differ from other companies’ methods, the non-GAAP measures may not be comparable to similarly titled measures reported by other companies. Reconciliation of all non-GAAP measures included in this press release to the most directly comparable GAAP measures can be found in the financial tables included in this press release.

|

|

ABOUT POWERFLEET

Powerfleet (Nasdaq: AIOT; JSE: PWR) is a global leader in the artificial intelligence of things (AIoT) software-as-a-service (SaaS) mobile asset industry. With more than 30 years of experience, Powerfleet unifies business operations through the ingestion, harmonization, and integration of data, irrespective of source, and delivers actionable insights to help companies save lives, time, and money. Powerfleet’s ethos transcends our data ecosystem and commitment to innovation; our people-centric approach empowers our customers to realize impactful and sustained business improvement. The company is headquartered in New Jersey, United States, with offices around the globe. Explore more at www.powerfleet.com. Powerfleet has a primary listing on The Nasdaq Global Market and a secondary listing on the Main Board of the Johannesburg Stock Exchange (JSE).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of federal securities laws. Powerfleet’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements may be identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions.

These forward-looking statements include, without limitation, our expectations with respect to our beliefs, plans, goals, objectives, expectations, anticipations, assumptions, estimates, intentions and future performance, as well as anticipated financial impacts of the business combination with MiX Telematics and the acquisition of Fleet Complete. Forward-looking statements involve significant known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. Most of these factors are outside our control and are difficult to predict. The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) our ability to realize all of the anticipated benefits of the business combination with MiX Telematics and the acquisition of Fleet Complete, and the potential challenges associated with the ongoing integration of the businesses; (ii) global economic conditions as well as exposure to political, trade and geographic risks, including tariffs and the conflict in the Middle East; (iii) disruptions or limitations in our supply chain, particularly with respect to key components; (iv) technological changes or product developments that may be more complex, costly, or less effective than expected; (v) cybersecurity risks and our ability to protect our information technology systems from breaches; (vi) our inability to adequately protect our intellectual property; (vii) competitive pressures from a broad range of local, regional, national and other providers of wireless solutions; (viii) our ability to effectively navigate the international political, economic and geographic landscape; (ix) changes in applicable laws and regulations or changes in generally accepted accounting policies, rules and practices; and (x) such other factors as are set forth in the periodic reports filed by us with the Securities and Exchange Commission (SEC), including but not limited to those described under the heading “Risk Factors” in our annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at http://www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

|

|

The forward-looking statements included in this press release are made only as of the date of this press release, and except as otherwise required by applicable securities law, we assume no obligation, nor do we intend to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Powerfleet Investor Contacts

Carolyn Capaccio and Jody Burfening

Alliance Advisors IR

AIOTIRTeam@allianceadvisors.com

Powerfleet Media Contact

Jonathan Bates

jonathan.bates@powerfleet.com

+44 121 717-5360

|

|

POWERFLEET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Revenues: | ||||||||

| Products | $ | 18,738 | $ | 17,657 | ||||

| Services | 56,692 | 86,464 | ||||||

| Total revenues | 75,430 | 104,121 | ||||||

| Cost of revenues: | ||||||||

| Cost of products | 12,751 | 13,228 | ||||||

| Cost of services | 23,031 | 34,412 | ||||||

| Total cost of revenues | 35,782 | 47,640 | ||||||

| Gross profit | 39,648 | 56,481 | ||||||

| Operating expenses: | ||||||||

| Selling, general and administrative expenses | 54,782 | 53,663 | ||||||

| Research and development expenses | 3,101 | 4,857 | ||||||

| Total operating expenses | 57,883 | 58,520 | ||||||

| Loss from operations | (18,235 | ) | (2,039 | ) | ||||

| Interest income | 304 | 196 | ||||||

| Interest expense, net | (2,691 | ) | (6,786 | ) | ||||

| Other expense, net | (624 | ) | (1,243 | ) | ||||

| Net loss before income taxes | (21,246 | ) | (9,872 | ) | ||||

| Income tax expense | (1,053 | ) | (362 | ) | ||||

| Net loss before non-controlling interest | (22,299 | ) | (10,234 | ) | ||||

| Non-controlling interest | (13 | ) | — | |||||

| Net loss | (22,312 | ) | (10,234 | ) | ||||

| Preferred stock dividend | (25 | ) | — | |||||

| Net loss attributable to common stockholders | $ | (22,337 | ) | $ | (10,234 | ) | ||

| Net loss per share attributable to common stockholders - basic and diluted | $ | (0.21 | ) | $ | (0.08 | ) | ||

| Weighted average common shares outstanding - basic and diluted | 107,136 | 133,313 | ||||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

| March 31, 2025 | June 30, 2025 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 44,392 | $ | 31,196 | ||||

| Restricted cash | 4,396 | 4,447 | ||||||

| Accounts receivables, net | 78,623 | 81,482 | ||||||

| Inventory, net | 18,350 | 23,892 | ||||||

| Prepaid expenses and other current assets | 23,319 | 26,762 | ||||||

| Total current assets | 169,080 | 167,779 | ||||||

| Fixed assets, net | 58,011 | 62,712 | ||||||

| Goodwill | 383,146 | 394,668 | ||||||

| Intangible assets, net | 258,582 | 263,745 | ||||||

| Right-of-use asset | 12,339 | 11,935 | ||||||

| Severance payable fund | 3,796 | 4,097 | ||||||

| Deferred tax asset | 3,934 | 3,926 | ||||||

| Other assets | 21,183 | 21,920 | ||||||

| Total assets | $ | 910,071 | $ | 930,782 | ||||

| LIABILITIES | ||||||||

| Current liabilities: | ||||||||

| Short-term bank debt and current maturities of long-term debt | $ | 41,632 | $ | 37,426 | ||||

| Accounts payable | 41,599 | 48,341 | ||||||

| Accrued expenses and other current liabilities | 45,327 | 48,755 | ||||||

| Deferred revenue - current | 17,375 | 17,116 | ||||||

| Lease liability - current | 5,076 | 4,965 | ||||||

| Total current liabilities | 151,009 | 156,603 | ||||||

| Long-term debt - less current maturities | 232,160 | 232,954 | ||||||

| Deferred revenue - less current portion | 5,197 | 5,133 | ||||||

| Lease liability - less current portion | 8,191 | 7,994 | ||||||

| Accrued severance payable | 6,039 | 6,754 | ||||||

| Deferred tax liability | 57,712 | 57,387 | ||||||

| Other long-term liabilities | 3,021 | 3,077 | ||||||

| Total liabilities | 463,329 | 469,902 | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock | — | — | ||||||

| Common stock | 1,343 | 1,343 | ||||||

| Additional paid-in capital | 671,400 | 673,253 | ||||||

| Accumulated deficit | (205,783 | ) | (216,017 | ) | ||||

| Accumulated other comprehensive loss | (8,850 | ) | 13,669 | |||||

| Treasury stock | (11,518 | ) | (11,518 | ) | ||||

| Total stockholders’ equity | 446,592 | 460,730 | ||||||

| Non-controlling interest | 150 | 150 | ||||||

| Total equity | 446,742 | 460,880 | ||||||

| Total liabilities and stockholders’ equity | $ | 910,071 | $ | 930,782 | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (22,312 | ) | $ | (10,234 | ) | ||

| Adjustments to reconcile net loss to cash (used in) provided by operating activities: | ||||||||

| Non-controlling interest | 13 | — | ||||||

| Inventory reserve | 257 | 193 | ||||||

| Stock based compensation expense | 5,929 | 1,853 | ||||||

| Depreciation and amortization | 10,335 | 16,031 | ||||||

| Right-of-use assets, non-cash lease expense | 760 | 974 | ||||||

| Derivative mark-to-market adjustment | — | 104 | ||||||

| Bad debts expense | 1,993 | 1,856 | ||||||

| Deferred income taxes | 1,021 | (3,157 | ) | |||||

| Shares issued for transaction bonuses | 889 | — | ||||||

| Lease termination and modification losses | — | 59 | ||||||

| Other non-cash items | 482 | (513 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivables | (6,973 | ) | (2,391 | ) | ||||

| Inventories | (624 | ) | (4,733 | ) | ||||

| Prepaid expenses and other current assets | (1,518 | ) | (1,284 | ) | ||||

| Deferred costs | (1,789 | ) | (2,730 | ) | ||||

| Deferred revenue | (142 | ) | (420 | ) | ||||

| Accounts payable, accrued expenses and other current liabilities | 4,993 | 9,637 | ||||||

| Lease liabilities | (927 | ) | (881 | ) | ||||

| Accrued severance payable, net | (2 | ) | 357 | |||||

| Net cash (used in) provided by operating activities | (7,615 | ) | 4,721 | |||||

| Cash flows from investing activities: | ||||||||

| Acquisition, net of cash assumed | 27,531 | — | ||||||

| Proceeds from sale of fixed assets | — | 16 | ||||||

| Capitalized software development costs | (2,308 | ) | (3,724 | ) | ||||

| Capital expenditures | (5,586 | ) | (8,114 | ) | ||||

| Net cash provided by (used in) investing activities | 19,637 | (11,822 | ) | |||||

| Cash flows from financing activities: | ||||||||

| Repayment of long-term debt | (493 | ) | (1,341 | ) | ||||

| Short-term bank debt, net | 4,161 | (5,428 | ) | |||||

| Purchase of treasury stock upon vesting of restricted stock | (2,836 | ) | — | |||||

| Payment of preferred stock dividend and redemption of preferred stock | (90,298 | ) | — | |||||

| Cash paid on dividends to affiliates | (4 | ) | — | |||||

| Net cash used in financing activities | (89,470 | ) | (6,769 | ) | ||||

| Effect of foreign exchange rate changes on cash and cash equivalents | (823 | ) | 725 | |||||

| Net decrease in cash and cash equivalents, and restricted cash | (78,271 | ) | (13,145 | ) | ||||

| Cash and cash equivalents, and restricted cash at beginning of the period | 109,664 | 48,788 | ||||||

| Cash and cash equivalents, and restricted cash at end of the period | $ | 31,393 | $ | 35,643 | ||||

| Reconciliation of cash, cash equivalents, and restricted cash, beginning of the period | ||||||||

| Cash and cash equivalents | 24,354 | 44,392 | ||||||

| Restricted cash | 85,310 | 4,396 | ||||||

| Cash, cash equivalents, and restricted cash, beginning of the period | $ | 109,664 | $ | 48,788 | ||||

| Reconciliation of cash, cash equivalents, and restricted cash, end of the period | ||||||||

| Cash and cash equivalents | 30,242 | 31,196 | ||||||

| Restricted cash | 1,151 | 4,447 | ||||||

| Cash, cash equivalents, and restricted cash, end of the period | $ | 31,393 | $ | 35,643 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid (received) for: | ||||||||

| Taxes | $ | 41 | $ | 873 | ||||

| Interest | $ | 3,057 | $ | 5,994 | ||||

| Noncash investing and financing activities: | ||||||||

| Common stock issued for transaction bonus | $ | 9 | $ | — | ||||

| Shares issued in connection with MiX Combination | $ | 362,005 | $ | — | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO ADJUSTED EBITDA FINANCIAL MEASURES

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Net loss attributable to common stockholders | $ | (22,337 | ) | $ | (10,234 | ) | ||

| Non-controlling interest | 13 | — | ||||||

| Preferred stock dividend | 25 | — | ||||||

| Interest expense, net | 2,916 | 6,590 | ||||||

| Other expense, net | — | 23 | ||||||

| Income tax expense | 1,053 | 362 | ||||||

| Depreciation and amortization | 10,335 | 16,031 | ||||||

| Stock-based compensation | 5,929 | 1,853 | ||||||

| Foreign currency losses | 109 | 1,161 | ||||||

| Restructuring-related expenses | 1,198 | 2,442 | ||||||

| Derivative mark-to-market adjustment | — | 104 | ||||||

| Recognition of pre-October 1, 2024 contract assets (Fleet Complete) | — | 1,503 | ||||||

| Acquisition-related expenses | 14,494 | 1,130 | ||||||

| Integration-related expenses | — | 675 | ||||||

| Adjusted EBITDA | $ | 13,735 | $ | 21,640 | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME FINANCIAL MEASURES

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Net loss | $ | (22,312 | ) | $ | (10,234 | ) | ||

| Incremental intangible assets amortization expense as a result of business combinations | 2,995 | 5,830 | ||||||

| Stock-based compensation (non-recurring/accelerated cost) | 4,693 | — | ||||||

| Foreign currency losses | 109 | 1,161 | ||||||

| Income tax effect of net foreign exchange losses | (747 | ) | (496 | ) | ||||

| Restructuring-related expenses | 1,198 | 2,442 | ||||||

| Income tax effect of restructuring costs | (103 | ) | (66 | ) | ||||

| Derivative mark-to-market adjustment | — | 104 | ||||||

| Acquisition-related expenses | 14,494 | 1,130 | ||||||

| Integration-related expenses | — | 675 | ||||||

| Inventory rationalization and other | — | 415 | ||||||

| Non-GAAP net income | $ | 327 | $ | 961 | ||||

| Weighted average shares outstanding | 107,136 | 133,313 | ||||||

| Non-GAAP net income per share - basic | $ | 0.00 | $ | 0.01 | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

ADJUSTED GROSS PROFIT MARGINS

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Products: | ||||||||

| Product revenues | $ | 18,738 | $ | 17,657 | ||||

| Cost of products | 12,751 | 13,228 | ||||||

| Products gross profit | $ | 5,987 | $ | 4,429 | ||||

| Products gross profit margin | 32.0 | % | 25.1 | % | ||||

| Depreciation and amortization | $ | — | $ | — | ||||

| Adjusted products gross profit | $ | 5,987 | $ | 4,429 | ||||

| Adjusted products gross profit margin | 32.0 | % | 25.1 | % | ||||

| Services: | ||||||||

| Services revenues | $ | 56,692 | $ | 86,464 | ||||

| Cost of services | 23,031 | 34,412 | ||||||

| Services gross profit | $ | 33,661 | $ | 52,052 | ||||

| Services gross profit margin | 59.4 | % | 60.2 | % | ||||

| Depreciation and amortization | $ | 8,729 | $ | 13,241 | ||||

| Adjusted services gross profit | $ | 42,390 | $ | 65,293 | ||||

| Adjusted services gross profit margin | 74.8 | % | 75.5 | % | ||||

| Total: | ||||||||

| Total revenues | $ | 75,430 | $ | 104,121 | ||||

| Total cost of revenues | 35,782 | 47,640 | ||||||

| Total gross profit | $ | 39,648 | $ | 56,481 | ||||

| Total gross profit margin | 52.6 | % | 54.2 | % | ||||

| Depreciation and amortization | $ | 8,729 | $ | 13,241 | ||||

| Adjusted total gross profit | $ | 48,377 | $ | 69,722 | ||||

| Adjusted total gross profit margin | 64.1 | % | 67.0 | % | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

NON-GAAP EXPENSE RATIOS

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Total revenues | $ | 75,430 | $ | 104,121 | ||||

| Selling, general and administrative expenses | ||||||||

| Selling, general and administrative expenses | 54,782 | 53,663 | ||||||

| Restructuring-related expenses | (1,198 | ) | (2,442 | ) | ||||

| Acquisition-related expenses | (14,494 | ) | (1,130 | ) | ||||

| Integration-related costs | — | (675 | ) | |||||

| Depreciation and amortization | (1,606 | ) | (2,790 | ) | ||||

| Stock-based compensation | (5,929 | ) | (1,853 | ) | ||||

| Non-GAAP selling, general and administrative expenses | 31,555 | 44,773 | ||||||

| Non-GAAP sales and marketing expenses | 9,052 | 17,958 | ||||||

| Non-GAAP general and administrative expenses | 22,503 | 26,815 | ||||||

| Non-GAAP selling, general and administrative expenses | $ | 31,555 | $ | 44,773 | ||||

| Non-GAAP sales and marketing expenses as a percentage of total revenue | 12.0 | % | 17.2 | % | ||||

| Non-GAAP general and administrative expenses as a percentage of total revenue | 29.8 | % | 25.8 | % | ||||

| Research and development expenses | ||||||||

| Research and development incurred | $ | 5,213 | $ | 8,559 | ||||

| Research and development capitalized | (2,112 | ) | (3,702 | ) | ||||

| Research and development expenses | $ | 3,101 | $ | 4,857 | ||||

| Research and development incurred as a percentage of total revenues | 6.9 | % | 8.2 | % | ||||

| Research and development expenses as a percentage of total revenues | 4.1 | % | 4.7 | % | ||||

|

|

POWERFLEET, INC. AND SUBSIDIARIES

ADJUSTED OPERATING EXPENSES

(In thousands)

| Three Months Ended June 30, | ||||||||

| 2024 | 2025 | |||||||

| Total operating expenses | $ | 57,883 | $ | 58,520 | ||||

| Adjusted for once-off costs | ||||||||

| Acquisition-related expenses | 14,494 | 1,130 | ||||||

| Integration-related costs | — | 675 | ||||||

| Stock-based compensation (non-recurring/accelerated cost) | 4,693 | — | ||||||

| Restructuring-related expenses | 1,198 | 2,442 | ||||||

| 20,385 | 4,247 | |||||||

| Adjusted operating expenses | $ | 37,498 | $ | 54,273 | ||||

|

|

Exhibit 99.2