UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 15, 2025

| AMERICAN BATTERY TECHNOLOGY COMPANY |

| (Exact name of registrant as specified in its charter) |

| Nevada | 001-41811 | 33-1227980 | ||

| (State or other jurisdiction of | (Commission | (IRS Employer | ||

| incorporation or organization) | File No.) | Identification Number) |

|

100 Washington Street, Suite 100 Reno, NV |

89503 | |

| (Address of principal executive offices) | (Zip Code) |

(775) 473-4744

(Registrant’s telephone number including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.001 par value | ABAT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 15, 2025, American Battery Technology Company (the “Company”) posted an investor presentation to its website used in an earnings call pertaining to the financial results for the fiscal quarter ended March 31, 2025. On May 16, 2025, the Company issued a press release relating to the Company’s financial results for the fiscal quarter ended March 31, 2025. The presentation and the press release are furnished hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description of Exhibit | |

| 99.1 | Investor Presentation, dated May 15, 2025 | |

| 99.2 | Press Release, dated May 16, 2025 | |

| 104 | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the inline XBRL document (contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMERICAN BATTERY TECHNOLOGY COMPANY | ||

| Date: May 19, 2025 | By: | /s/ Ryan Melsert |

| Ryan Melsert | ||

| Chief Executive Officer | ||

Exhibit 99.1

Exhibit 99.2

American Battery Technology Company Triples Quarterly Revenue as it Releases Third Quarter Fiscal Year 2025 Financial Report

Company achieves substantial 120% increase in battery recycling throughput as it accelerates commercial operations aimed to increase the onshoring of domestic critical mineral manufacturing

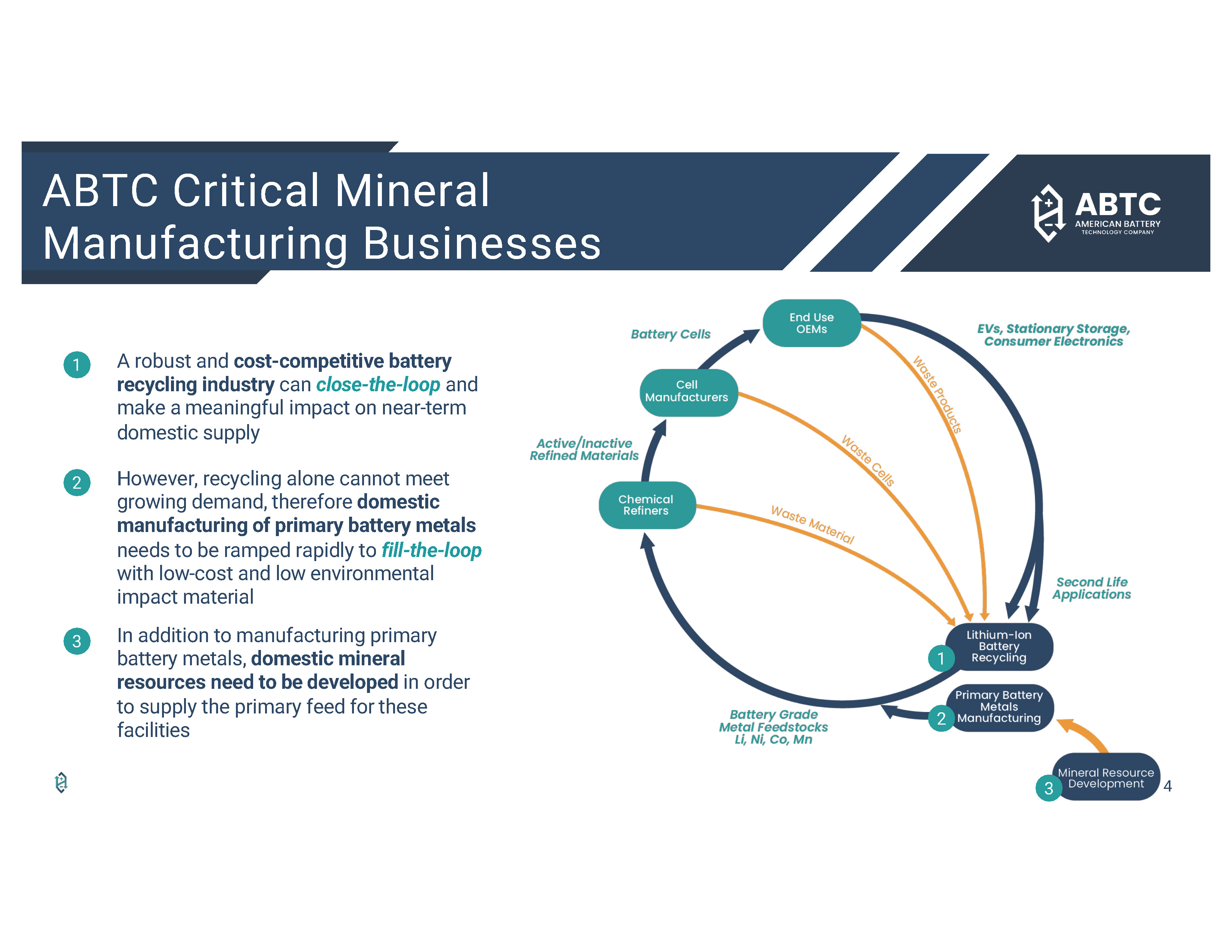

Reno, Nev., May 16, 2025 — American Battery Technology Company (ABTC) (NASDAQ: ABAT), an integrated critical battery minerals company that is commercializing its first-of-kind technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion battery recycling, announced it has tripled quarterly revenue as it releases its third quarter fiscal year (FY) 2025 financial results for the period ending March 31, 2025.

Battery Recycling Highlights from Third Fiscal Quarter 2025:

| ● | ABTC has implemented multi-shift, 24/7 operations at its first battery recycling facility and substantially increased the throughput during the quarter, more than doubling the mass of battery material recycled in the three months ended March 31, 2025, compared to the previous quarter. | |

| ● | ABTC continues to engage with its multiple strategic partners for the sourcing of commercial quantities of battery feedstock materials, and for the sale of recycled battery products. | |

| ● | The company expects to continue accelerating the ramp of operations at this facility in the following quarter. |

Primary Lithium Manufacturing Highlights from Third Fiscal Quarter 2025:

| ● | ABTC has developed its own set of technologies for the manufacturing of critical mineral lithium hydroxide from Nevada-based claystone material and has constructed a multi-tonne per day integrated pilot facility to demonstrate these technologies. | |

| ● | During the reported quarter, ABTC successfully completed a continuous, multi-week operation of this facility and produced large quantities of lithium hydroxide material. This material is currently being characterized and delivered to strategic customers for their internal evaluations. | |

| ● | Based on the pilot facility design, ABTC has designed a commercial scale lithium refinery to manufacture 30,000 tonnes of lithium hydroxide per year, and long-term commercial offtake agreements for this product are under negotiations with these strategic customers. | |

| ● | ABTC recently received an approved Letter of Interest from the Export-Import Bank of the United States for a $900,000,000 low-interest loan to support the construction of this commercial lithium mine and refinery. |

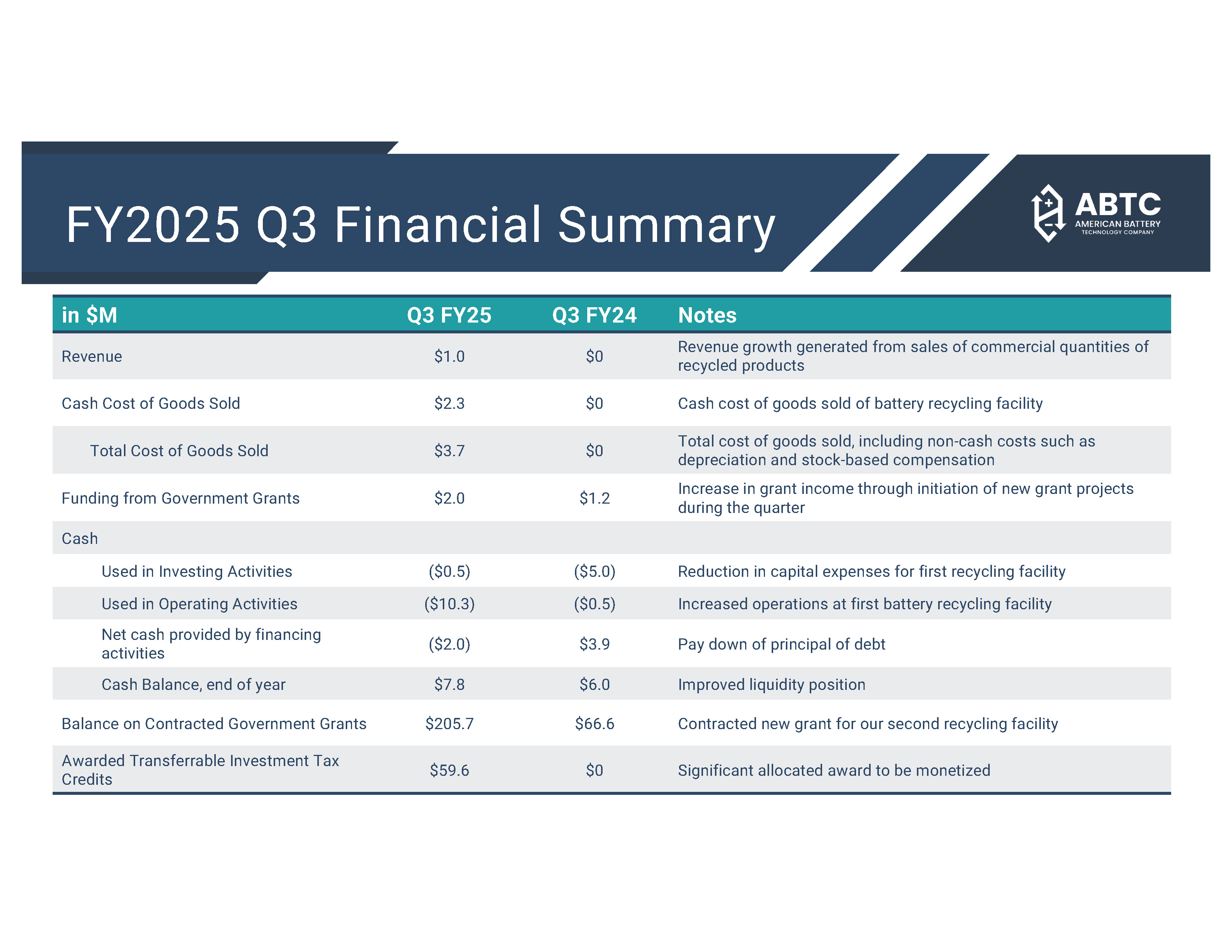

Financial Highlights from Third Fiscal Quarter 2025:

| ● | Total revenues from the sale of recycled battery materials increased to $1.0 million in the three months ended March 31, 2025, approximately tripling the revenue from the previous quarter. |

| ○ | Cash cost of goods sold, with the removal of non-cash items such as depreciation, for this period was $2.3 million compared to $2.1 million in the previous quarter. | |

| ○ | This represents a significant improvement in gross cash margin, with quarterly revenue increasing by approximately 200% with cash cost of goods sold increasing by only 9%. |

A reconciliation of quarterly GAAP to non-GAAP cost of goods sold.

| Description | Amount ($M) | |||

| GAAP Cost of Goods Sold | 3.7 | |||

| Less: Depreciation Expense | (1.0 | ) | ||

| Less: Stock-Based Compensation | (0.4 | ) | ||

| Non-GAAP Cash Cost of Goods Sold | 2.3 | |||

| ● | Company reimbursements from government grants increased to $2.0 million for the three months ended March 31, 2025, compared to $1.3 million during the same period of the prior year. |

| ○ | This reimbursement of $2.0 million is shown as an offset to research and development costs within the condensed consolidated statement of operations. |

| ● | As of March 31, 2025, the company had total cash on hand of $7.8 million, of which $2.8 million was available and $5 million restricted for compliance with its Note obligations. | |

| ● | On April 1, 2025 the company entered into an agreement for the sale of one of its unused, legacy properties located at 395 Logan Lane in Fernley, Nevada for $6.75 million. The transaction is expected to close on or before July 10, 2025. | |

| ● | On April 20, 2025 the company entered into an agreement for the sale of a portion of its unused water rights in Fernley, Nevada for $4.7 million. The transaction is expected to close on or before May 21, 2025. |

www.americanbattery.com/events-and-presentations.

About American Battery Technology Company

Additional recent company information and updates can be found at American Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.” Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going concern; interpretations or reinterpretations of geologic information, unfavorable exploration results, inability to obtain permits required for future exploration, development or production, general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices, final investment approval and the ability to obtain necessary financing on acceptable terms or at all. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2024. The Company assumes no obligation to update any of the information contained or referenced in this press release.

###

American Battery Technology Company

Media Contact:

Tiffiany Moehring

tmoehring@batterymetals.com

720-254-1556

AMERICAN BATTERY TECHNOLOGY COMPANY

Unaudited Condensed Consolidated Statements of Operations Unaudited Condensed Consolidated Balance Sheets

AMERICAN BATTERY TECHNOLOGY COMPANY