UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________.

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission file number: 333-283619

FBS Global Limited

(Exact name of Registrant as Specified in its Charter)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

74 Tagore Lane, #02-00 Sindo Industrial Estate

Singapore 787498

Tel: +65 62857781

(Address of Principal Executive Offices)

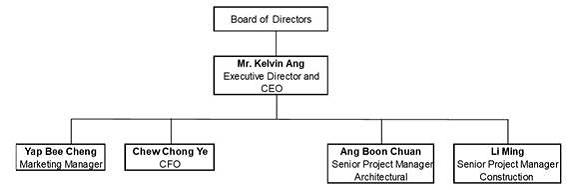

Kelvin Ang, Chief Executive Officer

+65-62857781

74 Tagore Lane, #02-00 Sindo Industrial Estate

Singapore 787498

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange On Which Registered | ||

| Ordinary shares, par value US$0.001 per share | FBGL | The NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2024 was: 11,250,000 ordinary shares, par value $0.001 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | U.S. GAAP | ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board |

☐ | Other |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s of assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court:

Yes ☐ No ☐

Table of Contents

|

|

INTRODUCTION

FBS Global Limited is a holding company with operations conducted primarily in Singapore through its operating subsidiary in Singapore, using Singapore Dollars. Our reporting currency is the United States Dollar. This annual report also contains translations of certain foreign currency amounts into U.S. Dollars for the convenience of the reader. Unless otherwise stated, all translations of Singapore Dollars into U.S. Dollars were made at S$1.3520 to US$1.00 for the financial year ended December 31, 2023 amounts and S$1.3363 to US$1.00 for the financial year ended December 31, 2024 amounts, in accordance with our internal exchange rate. We make no representation that the Singapore Dollar or U.S. Dollar amounts referred to in this annual report could have been or could be converted into U.S. Dollars or Singapore Dollars, as the case may be, at any particular rate or at all.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

3.D. Risk Factors

Risk Factor Summary

An investment in our Ordinary Shares is highly speculative and involves a significant degree of risk. Below is a summary of the principal risks and uncertainties we face, organized under relevant headings. Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

|

|

Risks related to Our Business and Industry

We are dependent on the construction industry in Singapore and other countries which we operate in

We are dependent on the pipeline of new building development and major additional and alteration works (“A&A projects”), as our sources of revenue come from interior-fitting out works, construction and building works. We operate mainly in Singapore and new building development projects are in part affected by the general economic, regulatory, political and social conditions, property market, construction industry, government initiatives and spending (including spending on healthcare that includes the building and/or refurbishment of hospitals), property and resale prices and rental yields (as the case may be), factors which are beyond our control. Other factors such as natural disasters, recession, epidemics and any other incidents in Singapore and/or countries which we operate in may adversely affect our business, financial position, financial performance and prospects. The construction industry in Singapore is also subject to cyclical fluctuations, and any downturn in the construction industry will have direct impact on our business, financial performance and financial position, due to possibility of postponement, delay or cancellation of new building and A&A projects and delay in the recovery of receivables.

Our contracts are typically on a non-recurring and project basis, and therefore we cannot guarantee that we will continue to secure new projects from our customers after the completion of our existing projects. In the event that the construction industry in Singapore or other countries that we operate in undergoes a downturn or other factors lead to a reduced pipeline of construction projects, we may not be able to secure new projects, or secure new projects of similar value as we had in the past. In the case of such an event, our business, financial performance, financial position and prospects will be materially and adversely affected.

We are dependent on our major customers and any significant decrease in projects secured from them may affect our operations and financial performance

Our top two customers listed under the section entitled “Business – Our Major Customers” contributed 32% and 15% for the year ended December 31, 2023, respectively, and 24% and 22% of our revenue for the year ended December 31, 2024. Given that our contracts are typically secured via invited tenders from our customers, we are dependent on our major customers or past customers inviting us for future tenders. However, there is no assurance that these customers will continue to invite us for tenders or award tenders to us at contract values and/or terms comparable to those which we have received in the past. As such, if we are not invited to tender or are unable to secure new projects with our major and past customers, or secure replacement customers, or are unable to secure new projects on terms that are favorable to us, our business, financial performance, financial position and liquidity will be materially and adversely affected.

We are subject to the risks of default or delays in the collection of our trade receivables

Our major customers are all private customers, and therefore, we are subject to higher risks of default or delays in collection of our trade receivables as compared to contracting with Singapore government agencies. We typically make monthly progress claims to our customers for the value of the work we have performed as of that time, and our billings are subject to our customer’s approval of our progress claims. Accounts receivable are recognized and carried at original invoiced amount net of allowance for credit losses. Accounts are considered overdue after 120 days. Please refer to the section entitled “Business – Credit Management” for further details.

In accordance with the Building and Construction Industry Security of Payment Act 2004 of Singapore, referred to as BCISPA, we must make payment to our suppliers and subcontractors carrying out work in Singapore within a specific period, whether or not we have received payment from our customers. Please refer to the section entitled “Government Regulations” of this prospectus for further details on BCISPA.

Further, a portion of the contract value (typically 5% or 10%) is withheld by our customers as retention money, a portion of which will be released upon substantial completion and the remaining amounts will be released upon final completion (which is after the defects liability period, being typically 12 months from date of substantial completion).

If a customer fails to make payment of our progress claims in a timely manner or at all, or fails to release our retention monies as scheduled, there is a time lag which could potentially be significant, between any costs incurred for the work we have performed and the receipt of any payment from our customers. Any progress claim that we submit may also be the subject of a dispute between us and our customer which could not only delay any payment made to us but also could be such that the amount that is paid to us being less than the amount we claim for. In this event, our cash flow and working capital may be materially and adversely affected.

Even when we are able to recover any part of the contracted value pursuant to the terms of the contract, the process of such recovery is usually time-consuming and requires financial and other resources to settle the disputes. Furthermore, there can be no assurance that any outcome will be in our favor or that any dispute will be resolved in a timely manner. Failure to collect adequate payments in time or to manage past due debts effectively will have a material and adverse effect on our business, liquidity, financial performance and financial position.

|

|

We are reliant on the renewal of our existing registrations and licenses

We are regulated in Singapore by the Commissioner of Building Control (“CBC”), which is the body that oversees compliance with the BCA and various other regulatory bodies. These regulatory bodies stipulate the criteria that must be satisfied before registrations and licenses are granted to, and/or renewed and/or maintained for, our business. The maintenance and renewal of our registrations and licenses are subject to compliance with the relevant regulations. BCA designates what are known as “workhead” gradings and we are designated to have met certain qualifications to perform various construction works under the Singapore’s Construction Registration System (“CRS”). In particular, we are graded L5 under the workhead category CR06 for interior decoration and finishing works and B2 under the workhead category CW01 for general building. Our private customers would typically have a preferred workhead grading of their subcontractors for their projects and should we tender directly for Singapore government projects, the required workhead grading will also be stipulated in the tender for bid.

Our current workhead gradings will expire on July 1, 2025 and as the requirements laid down by BCA may change from time to time, there is no assurance that we will be able to meet the changing requirements and maintain and/or renew our registrations and licenses. In the event that we fail to maintain or renew our existing workhead registrations, our business, financial performance and prospects will be adversely affected. For details, please refer to the section entitled “Government Regulations”.

We have not encountered any non-renewal or suspension of BCA registrations and licenses which had a material adverse impact on our business.

We are dependent on foreign workers and may face debarment from hiring (including due to non-compliance with the relevant employment laws and regulations), imposition of penalties, labor shortages or increased labor costs for our operations

Our business is highly dependent on foreign workers as the pool of local construction workers is scarce. As of the date of this prospectus, approximately 3/4ths of our workforce is made up of foreign employees (including site workers and other employees). Any shortage in the supply of foreign workers, increase in foreign worker levy or restriction on the number of foreign workers that we can employ will adversely affect our operations and financial performance. The supply of foreign labor in Singapore is highly controlled and subject to a number of policies and regulations.

We are required to comply with all relevant laws and regulations and we may be liable to penalties if there are any breaches relating thereto. While we aim to comply with the relevant laws and regulations at all times and have put in place the necessary systems to monitor our compliance, we are susceptible to breaches that may arise from inadvertent oversight.

In the past, we have received notices in relation to non-compliance with the numerous regulations that apply to us and been subject to fines for failure to comply with rules relating to foreign workers’ accommodation.

While we have taken steps to ensure compliance with laws relating to the hiring of foreign workers, we cannot be assured that we will not inadvertently be subject to additional fines or punishments.

There is no assurance that we and/or our Executive Directors will not be penalized for past contraventions or that we will not inadvertently contravene any employment laws and regulations in the future. Any further debarment from applying for new work passes for foreign workers may cause disruptions to our operations and adversely affect our operations and financial performance.

|

|

Moreover, the MOM imposes a MYE quota in respect of the number of foreign workers (excluding those from Malaysia and NAS countries/regions) that the main contractor and its subcontractors can employ in respect of each construction project that was awarded or had the tender called on or before 18 February 2022. The number of foreign workers a company can employ in respect of construction projects awarded or which had the tender called after 18 February 2022 does not depend on MYE quota, but instead, on the dependency ratio ceiling applicable to that company (as described below). Depending on the requirements of our projects, the tightening of such quota on the number of foreign workers that the main contractors and their subcontractors can employ may affect our operations and accordingly our business and financial performance. We are also subject to dependency ratio ceilings, being the percentage of foreign employees permitted in a company calculated as a ratio to local employees. Any changes in the policies of the foreign workers’ countries of origin may affect the supply of foreign labor and cause disruptions to our operations which may in turn result in a delay in the completion of our projects. We are also subject to foreign worker levy for foreign workers (subject to changes as and when announced by the Singapore government) and any increase in foreign worker levy may materially and adversely affect our business and financial performance.

We are subject to a number of project execution risks, many of which are beyond our control

In the preparation of our bid tenders, we will carry out internal cost estimates that are based on, among other factors, the anticipated schedule for the project execution. Our revenue is recognized on the stage of completion method, and billing is based on approved monthly progress claims. Any delay in a project will therefore affect our billings, revenue, increase our operating costs (for instance, labor costs and equipment leasing costs), operational cash flows and financial performance. We are also required to pay our suppliers and subcontractors regardless of such delay if the purchase orders have been fulfilled, therefore affecting our operational cash flows. A delay in the project can be due to various factors, including but not limited to, shortage of manpower, materials and/or equipment, delays by subcontractors, accidents at the work site, adverse weather or other unforeseen circumstances. In the event of a delay, we are liable to pay our contracting parties for the liquidated damages stipulated in our contracts, and our reputation (including our prospects for being invited for future bid tenders) will also be materially and adversely affected.

Moreover, other than liquidated damages, we may also have to bear additional costs as our customers can require us to complete the uncompleted works within a reasonable period at our expense, to avoid or minimize further delay. In addition, to minimize further delay, we may also be required to incur overtime man hours and the related labor costs at our own expense. In such circumstances, our operations and financial performance will be materially and adversely affected.

Additionally, our contracts with our customers are typically on a fixed and pre-determined fee basis for the duration of the contract period and the terms of the contracts allow limited price adjustments. Nonetheless, we still have to bear the risk of any cost fluctuations due to, including but not limited to, inaccurate costs estimation at the tender stage, ineffective cost management during project implementation, higher than estimated costs of materials, labor, subcontracting fees or equipment leasing. Other situations such as changes in the regulatory requirements, disputes with suppliers and subcontractors, labor disputes as well as accidents, delays and other unforeseen problems may also adversely affect our project costs. Should we be unable to control our costs within our original estimates, or we are not able to fully cover the increases in costs during the project, our business, financial performance and liquidity will be materially and adversely affected.

We are dependent on our suppliers and subcontractors to fulfil their contractual obligations to us, and the inability of these suppliers and contractors, due to increased demand or other factors, to deliver key materials at prices and volumes, performance and specifications acceptable to us, could have a material adverse effect on our business, prospects, financial condition and operating results.

We rely on our suppliers and subcontractors to provide us with quality and timely delivery of materials, equipment rental and services. As we do not sign any long-term contracts with our suppliers and subcontractors, there is no assurance that we will continue to be provided with materials and services at prices acceptable to us for future projects. Additionally, our key materials such as calcium silicate boards, gypsum boards or plasterboards, fasteners, joint materials, metal bracing, metal studs, screws, adhesives or sealants are common building materials and while we will typically notify our suppliers of our project needs in advance, we place a purchase order after confirmation of the project as and when required for delivery to the work site. As such, there is assurance that during the course of the project, our suppliers will not increase the price of their materials.

|

|

We are also subject to risks and challenges in engaging subcontractors, including difficulties in overseeing the performance of such subcontractors in a direct and effective manner, failure to complete the contracted scope of works or inability to hire suitable subcontractors. As the subcontractors have no direct contractual relationships with our customers, we are subject to risks associated with their non-performance, late performance or poor performance.

In the case where the suppliers and subcontractors are selected by us, our selection criteria is based on, among others, their track record, price competitiveness, quality of products or services and timeliness in delivery and completion. We cannot be assured that the products and services rendered by our suppliers and subcontractors will continue to meet our requirements for quality, or that they will be able or willing to continue to provide supplies and services to us. In the event that any of our major suppliers and subcontractors is unable to provide the required supplies and services to our Group and we are unable to obtain alternative providers on similar or more favorable terms to us in a timely manner, our business, financial performance and financial position will be materially and adversely affected.

In addition, we are also subject to claims arising from defective work performed by subcontractors. While we may attempt to claim from the relevant subcontractors or require our subcontractors to make good the default or defect, we may be required to make good the default or defect at our own cost before receiving any compensation from the subcontractors. If no corresponding claim can be asserted against a subcontractor, or the amounts of the claim cannot be recovered in full or at all from the subcontractors, we may be required to bear some or all the costs of the claims, in which case our business, financial performance and liquidity will be materially and adversely affected.

We are subject to risks associated with the quality of our works

Our quality of work is assessed by our customers, and poor quality of works could be due to poor execution and quality control of our employees or that of our subcontractors. We may incur reworks and additional costs to improve the quality of our works, or we may be subject to claims from our customers for such inferior works. Costs incurred for reworks in a certain financial year/period will also affect the financial performance and cashflows in that certain financial year/ period, notwithstanding the overall profitability of the project. If we fail to achieve a satisfactory quality of work, our reputation and our likelihood of being invited for future bid tenders could be materially and adversely affected, and increase the likelihood of increased costs, liquidated damages, deduction against performance bonds and/or retention monies, and accordingly, materially and adversely affect our business, reputation, prospects and financial performance.

Our short-term revenue and profitability may not be indicative of the long-term results of operations

Revenue from some ongoing contracts may be recognized across financial years, depending on the stage of completion of each contract. The revenue and profitability of different contracts vary and should more works be performed in a certain financial year, we will record better short-term results for that particular financial year. Similarly, our revenue and profitability during a certain period of the financial year may also not be indicative of the financial results for other periods of the financial year. There is, therefore, no assurance that our short-term results of operations will be indicative of our long-term results of operations.

Further, as the projects undertaken by us are on a non-recurring and project basis, our revenue and profitability may fluctuate from period to period and from year to year. In order to grow or even maintain the revenue and profitability of our business, we have to continually and consistently secure new projects which have higher or comparable contract values and margins, and in greater or comparable numbers. In the event that we are not able to continually and consistently do so on terms that are favorable to us, our business, financial performance and prospects will be materially and adversely affected.

In addition, there may be a lapse of time between the completion of our existing projects and the commencement of new projects. Accordingly, any unutilized capacity in between projects would have an adverse effect on our overall margins and results of operations.

We operate in a highly competitive industry and may not be able to compete effectively

The construction industry, including the interior fitting-out works segment, in which we operate, is competitive, and some of our competitors may have more manpower, resources, higher gradings in various construction workhead designations needed to operate in this field in Singapore, stronger track record in terms of the diversity, size and/or complexity of the projects undertaken or greater exposure to potential business opportunities. As of November 21, 2024, there were over 44 and 84 contractors with the highest L6 and L5 grading in the workhead category CR06 (Interior Decoration and Finishing Works) respectively, the workhead category gradings in which we primarily seek projects, and over 2,413 contractors registered under all CR06 workhead, and this figure may increase.

|

|

We may face increased competition from existing or new competitors, and we may not adapt effectively to market conditions, industry developments, customer preferences and/or competitive environment. Moreover, our competitors may also adopt aggressive pricing policies or develop relationships with our customers in a manner that could significantly harm our ability to secure contracts. We may also compete in other areas including for services of subcontractors and qualified employees. If we cannot attract their services or are unable to compete in such other areas including providing competitive pricing and/or quality works on a timely basis, our business, financial performance, financial position and prospects will be materially and adversely affected.

Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Shares.

To implement Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on the company’s internal control over financial reporting. Prior to our initial public offering, we were a private company with limited accounting personnel and other resources for addressing our internal control over financial reporting. Our management has not completed an assessment of the effectiveness of our internal control over financial reporting and our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. Our independent registered public accounting firm did not conduct an audit of our internal control over financial reporting. However, in connection with the audits of our consolidated financial statements as of December 31, 2022 and 2023, we and our independent registered public accounting firms identified the following material weakness in our internal control over financial reporting PCAOB of the United States, a “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. There are three material weaknesses identified: (1) our lack of sufficient full-time personnel with appropriate levels of accounting knowledge and experience to monitor the daily recording of transactions, address complex U.S. GAAP accounting issues and to prepare and review financial statements and related disclosures under U.S. GAAP; (2) our lack of formal internal control policy and procedures to establish formal risk assessment process and internal control framework; and (3) our lack of formal IT process and procedures related to risk and vulnerability assessment, data backup and recovery management, and password management.

We are implementing measures designed to improve our internal control over financial reporting to address the underlying causes of the material weaknesses, including (i) hiring more qualified staff to fill up the key roles in the operations, providing internal training to our accounting staff on U.S. GAAP, requiring our staff to participate in trainings and seminars provided by professional service firms on a regular basis to gain knowledge on regular accounting and SEC reporting updates, (ii) setting up an adequate financial and internal control framework with formal documentation of polices and controls in place, and (iii) establishing a formal IT process in order to strengthen the internal control policies.

We will be subject to the requirement that we maintain internal controls and that management perform periodic evaluation of the effectiveness of the internal controls. Effective internal control over financial reporting is important to prevent fraud. As a result, our business, financial condition, results of operations and prospects, as well as the market for and trading price of our Ordinary Shares, may be materially and adversely affected if we do not have effective internal controls. Before the Company’s initial public offering, we were a private company with limited resources. As a result, we may not discover any problems in a timely manner and current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our Ordinary Shares. The absence of internal controls over financial reporting may inhibit investors from purchasing our Ordinary Shares and may make it more difficult for us to raise funds in a debt or equity financing.

Additional material weaknesses or significant deficiencies may be identified in the future. If we identify such issues or if we are unable to produce accurate and timely financial statements, our Ordinary Share price may decline and we may be unable to maintain compliance with the Nasdaq Listing Rules.

|

|

Our Chief Executive Officer will continue to own a substantial number of our ordinary shares and, as a result, may be able to exercise control over us, including the outcome of shareholder votes.

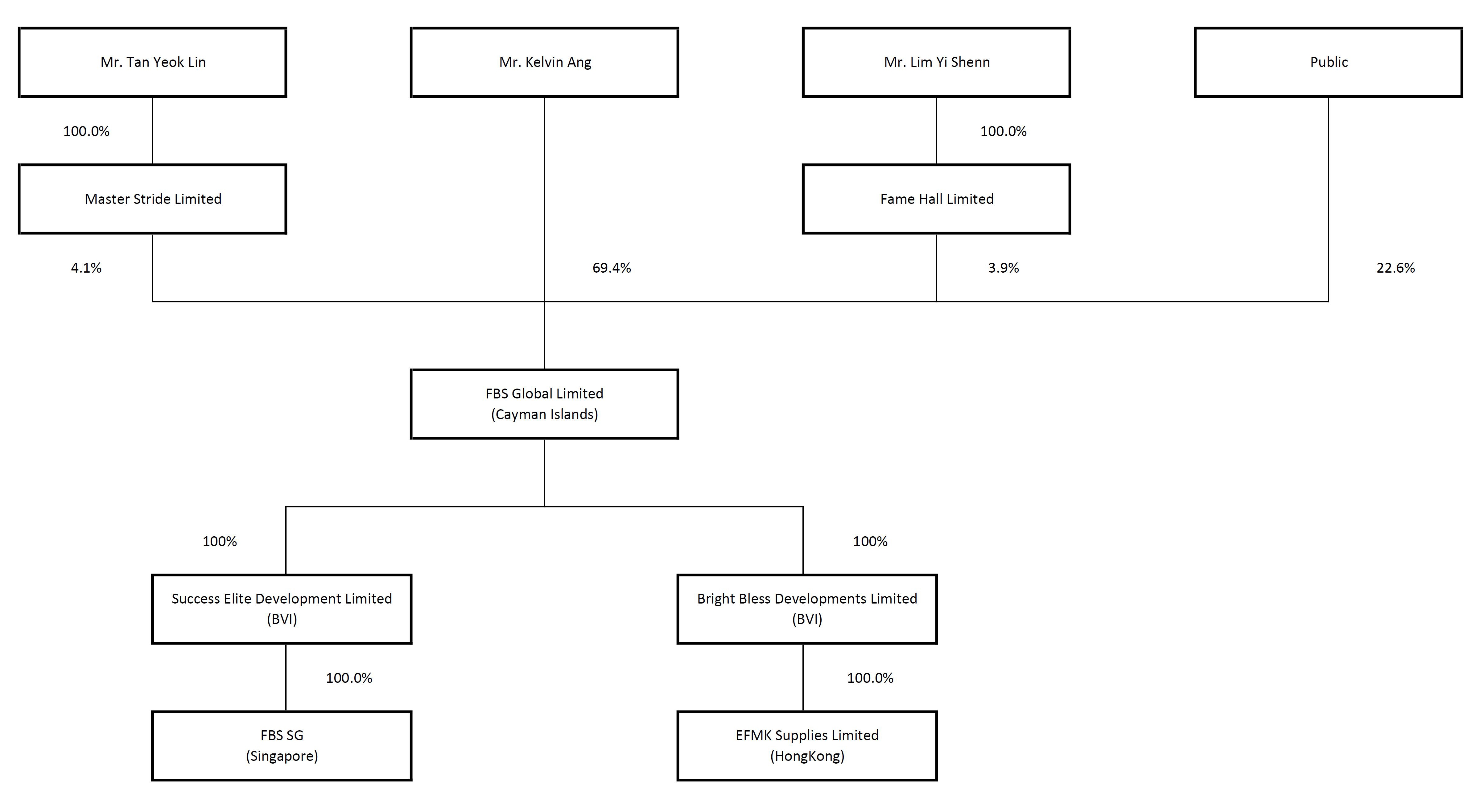

Our controlling shareholder, Kelvin Ang, holds over 69.4% of our total outstanding ordinary shares. As a result, he may be able to determine matters requiring shareholder approval and affect the market price of our ordinary shares. For example, he may be able to exert control over our business, including significant corporate actions such as mergers, schemes of arrangement, sales of substantially all of our assets, and election, re-election and removal of directors. This concentration of power may prevent or discourage unsolicited acquisition proposals or offers for our ordinary shares, or other such changes in control, that you may feel are in your best interest. The interests of Mr. Ang may not always coincide with your interests or the interests of other shareholders and he may act in a manner that does not necessarily advance the best interests of those who purchase ordinary shares in the future, including seeking a premium value for their ordinary shares.

For more information, see “Principal Shareholders.”

We are subject to compliance with and changes in regulatory requirements and codes

Our operations are subject to laws and regulations that relate to matters such as licensing, employment of foreign workers, workplace health and safety, and environmental protection in Singapore. Please refer to the section entitled “Government Regulations” of this prospectus for further details. In the event that our operations fail to comply with such laws and regulations, we may be subject to fines or be required to take remedial measures or they may affect our ability to obtain new projects or carry on our operations without disruptions. If any of these events occurs, it will adversely affect our reputation, business, financial condition and financial performance.

We are also subject to changing requirements applicable for the construction industry in Singapore. For instance, there are numerous codes, laws, regulations and certification schemes that we are subject to such as the Code of Practice on Buildability, CONQUAS and BCA Green Mark, which is the benchmarking scheme that incorporates internationally recognized best practices in environmental design and performance. Requirements for obtaining a certain grading under certain workhead requirements may also change from time to time.

We are also affected by regulatory changes and requirements on the employment of foreign workers, which may change from time to time. Any failure to comply could result in penalties such as fines and/or not being able to continue or expand our business. Our ability to remain compliant with the many regulations and standards applied to our business is time consuming, and our failure to do so will negatively impact our performance. Changes in or introduction of new laws, and policies applicable to our business may also increase our operating costs, in particular if the competitive environment or other factors do not allow us to fully recover all the additional costs. Should this occur, our financial performance will be materially and adversely affected.

Our cash flows may fluctuate due to the payment practice applied to our projects or foreign currency exchange rates.

Our projects normally incur net cash outflows at the early stage of carrying out our works when we are required to incur setting-up expenditures, purchase materials, and commence works prior to payment received from our customers. Our customers will make payments pursuant to our progress claims which have to be approved by our customers. Accordingly, we experience accumulative net inflows gradually as the project progress. We typically do not receive a deposit from customer for offsetting the initial cash outflows. As we undertake a number of projects at any given period, the cash outflow of a particular project could be offset by the cash inflows of other projects. Accordingly, as a result of the general mismatch in the timing of our cash flow movements between our outlay and receipt of payments, we could potentially experience negative operating cash flows. If at any time, we undertake more projects which are at the initial stage of works than projects which are at the later stages, our corresponding cash flow position will be adversely affected. Further, our revenues and financial statements are denominated in the Singapore dollars but presented in US dollars and, our daily transactions are mainly denominated in the Singapore dollar. As such, we are exposed to the risk of adverse exchange rate fluctuations against the Singapore dollar, which may negatively impact our results of operations when our financials are presented in US dollars.

|

|

We are required by our customers to arrange performance bonds or banker’s guarantee to secure our due performance of contracts.

It is common practice in the construction industry that contractors are required by their customers to take out performance bonds or banker’s guarantee at a fixed sum or a certain percentage of the contract sum to secure due performance and compliance with the contracts. In lieu of performance bonds or banker’s guarantee, we may be required to place cash deposit or accept a higher percentage for retention monies. In the event that we default on our contractual obligations, our customer will be entitled to call on the bond with the financial institution. If the performance bond is called upon, we will be required to indemnify the relevant financial institution for such payment, and our liquidity, business, reputation, financial performance, financial position and prospects may be adversely affected.

The amount paid up for the performance bonds may be locked up for a prolonged period of time, depending on contract period. Further we cannot guarantee we will not undertake projects which have performance bonds requirements in the future, and should we fail to satisfactorily complete our contracted works, the amount paid up for the performance bonds may not be released to us, which may adversely affect our cash flows and financial position. In the event that our contracts are negotiated without performance bonds but with a higher percentage of retention monies, the performance of our works and our monthly progress claims and billings will be subject to a higher amount of retention. Similarly, should we not satisfactorily complete our contracted works, we may not receive the full amount of the retention monies upon the completion of the project and expiration of the defect liability period. In such event, our financial performance and cashflows will be materially and adversely affected.

We may be subject to litigation, claims or other disputes.

We may from time-to-time encounter disputes arising from contracts with customers, suppliers, subcontractors or other third parties. Claims brought by customers against us may involve defective works, damaged works as we are obliged to protect our completed or partially completed works on-site, property damages or other contractual breaches which may result in us incurring liquidated damages under the terms of our contracts with our customers. Claims may also arise from disputes with suppliers and subcontractors on matters relating to payment and/or contractual performance. Claims involving us could result in time-consuming and costly litigations, arbitration, administrative proceedings or other legal procedures. Expenses we incur in legal proceedings or arising from claims brought by or against us will materially and adversely affect our business, financial position, financial performance and prospects.

Moreover, legal proceedings resulting in unfavorable judgment or findings may harm our reputation, cause financial losses and damage our prospects of being awarded future contracts, thereby materially and adversely affecting our operations, financial position, financial performance and prospects.

The nature of our work also involves certain risks as employees work at the work sites with equipment and tools, or work from height. Our employees who have suffered an injury arising out of and in the course of his employment can choose to either submit a claim under the Work Injury Compensation Act 2019 of Singapore (“WICA”) for compensation through MOM without needing to prove negligence or breach of statutory duty by employer or commence legal proceedings to claim damages under common law against employer for breach of duty or negligence. Pursuant to the WICA, an injured employee is entitled to claim medical leave wages, medical expenses and lump sum compensation for permanent incapacity or death, subject to certain stipulated limits. Damages under a common law claim are usually higher than an award under the WICA and may include compensation for pain and suffering, loss of wages, medical expenses and any future loss of earnings. In the event that the litigation costs, time involved and/or claim amounts are substantial, our financial performance will be materially and adversely affected.

We may not be able to implement our future plans and strategies successfully.

Our future plans and strategies include, inter alia, strengthening our market position in the interior fitting-out industry in Singapore and participating in joint ventures or strategic alliances with suitable partners. The successful implementation of our business plan may be affected by a number of factors including the availability of sufficient funds, government policies relevant to our industry, the economic conditions, our ability to maintain our existing competitive advantages, our relationships with our customers, the threat of substitutes and new market entrants. Participation in joint ventures and/or strategic alliances locally or overseas also involves numerous risks, including but not limited to regulatory risks, political risks, execution risks in relation to identification of suitable partners, integration of operations and/or cooperation in projects or business management. There can be no assurance that we will be able to execute such future plans and strategies successfully and as such, the actual outcome may fall short of expectations.

|

|

Our insurance coverage may not be sufficient to cover all losses or potential claims and insurance premiums may increase.

We obtain public liability insurance for injuries to third parties and the required policies for our staff, such as work injury compensation and medical insurance. For projects where we are the main contractor, we also procure contractors’ all risks insurance. Please refer to the section entitled “Business – Insurance” of this prospectus for further details on our insurance coverage. For our interior fitting-out projects, we do not need to procure specific insurance as it is usually covered by the insurance procured by the main contractor. However, we may become subject to liabilities against which we are not insured adequately or at all or exposure which cannot be insured.

Although we believe our insurance coverage is sufficient for the needs of our operations and appropriate for our current risk profile, we cannot guarantee that our current levels of insurance are sufficient to cover all potential risks and losses. Moreover, we may not be able to recover the losses in full or on a timely basis from our insurers. There are also certain risks that are not covered by our insurance policies because they are either uninsurable or not economically insurable including acts of war and terrorism. In addition, our insurers will review our policies each year and we cannot guarantee that we can renew our policies or renew our policies on similar or other acceptable terms. If we suffer from losses that exceed our insurance coverage or are not covered by our insurance policies, we may be liable to bear such losses and our business, financial performance and financial position will be adversely affected.

We are affected by the macroeconomic, political, social and other factors beyond our control in Singapore and other countries which we operate in.

We are affected by macroeconomic factors, such as general economic conditions, population growth, household formation, market sentiment which are in part, influenced by unemployment rates, real disposable income, inflation, recession, stock market performance, interest rate environment, regulatory policies, foreign investment, gross domestic product growth, business sentiment, all of which are beyond our control. For example, there has been increased inflationary pressure on the cost of materials and labor and increased bank loan rates. As of yet, we have not yet seen a material impact to our business, but if inflation increases, the increased cost of completing projects and financing our business may have a negative impact on our financial performance. Moreover, political and social stability, taxation, price and exchange control regulations, industry laws and regulations in Singapore and other countries may also affect our business. There is no assurance that such conditions will not develop in a manner that will have an adverse effect on our business operations.

We may also expand into other countries in which we presently do not have a business presence. Factors beyond our control include the abovementioned, and other conditions such as internal strife, epidemics, severe weather conditions, natural or other catastrophes, terrorist attacks or acts of violence that may materially and adversely affect financial markets, business and consumer confidence that will materially and adversely affect our operations, financial performance and financial position.

Our business, financial performance and results of operations depend significantly on worldwide macroeconomic economic conditions and their impact on material supplies. Recessionary economic cycles, higher interest rates, volatile fuel and energy costs, inflation, levels of unemployment and other economic factors that may affect material costs and adversely affect costs of revenue of our services and products. In addition, negative national or global economic conditions may materially and adversely affect our suppliers’ financial performance, liquidity and access to capital. This may affect their ability to maintain their inventories, production levels and/or product quality and could cause them to raise prices, lower production levels or cease their operations.

Economic factors such as increased commodity prices, shipping costs, higher costs of labor, insurance and healthcare, and changes in or interpretations of other laws, regulations and taxes may also increase our cost of revenue and our selling, general and administrative expenses, and otherwise adversely affect our financial condition and results of operations. Global inflation rose in 2023 and may continue through 2024. To date, we have not been subject to inflationary pressures. We cannot assure you that we will not be adversely affected in the future.

|

|

We are exposed to risks of infringement of our intellectual property rights and the unauthorized use of our trademarks by third parties

We have registered our trademark to protect our intellectual property rights in Singapore. Please refer to the section entitled “Business – Intellectual Property” of this prospectus for more details. Should our trademark be violated or infringed, there may be confusion by potential customers who have not previously worked with us or we may be exposed to the risk of claims against us for intellectual property rights infringement.

Given our limited resources, we may not be able to effectively prevent third parties from violating our Group’s intellectual property rights. There is also no assurance that we will be able to obtain adequate remedies in the event of a violation of our trademark by our competitors or other third parties. If we fail to protect our intellectual property rights adequately, there may be an adverse impact on our Group’s reputation, goodwill and financial performance.

While we have not experienced any claims for intellectual property rights infringement, there is no assurance that we will not infringe any intellectual property rights of third parties in the future. In the event of any claims or litigation by third parties involving infringement of their intellectual property rights, whether with or without merit, our operations and financial performance may be adversely affected.

Geopolitical conditions, including direct or indirect acts of war or terrorism, could have an adverse effect on our operations and financial results.

Our operations could be disrupted by geopolitical conditions, political and social instability, acts of war, terrorist activity or other similar events. In February 2022, Russia initiated significant military action against Ukraine. In response, the U.S. and certain other countries imposed significant sanctions and export controls against Russia, Belarus and certain individuals and entities connected to Russian or Belarusian political, business, and financial organizations, and the U.S. and certain other countries could impose further sanctions, trade restrictions, and other retaliatory actions should the conflict continue or worsen. It is not possible to predict the broader consequences of the conflict, including related geopolitical tensions, and the measures and retaliatory actions taken by the U.S. and other countries in respect thereof as well as any counter measures or retaliatory actions by Russia or Belarus in response, including, for example, potential cyberattacks or the disruption of energy exports, is likely to cause regional instability, geopolitical shifts, and could materially adversely affect global trade, currency exchange rates, regional economies and the global economy. The situation remains uncertain, and while it is difficult to predict the impact of any of the foregoing, the conflict and actions taken in response to the conflict could increase our costs, disrupt our supply chain, reduce our sales and earnings, impair our ability to raise additional capital when needed on acceptable terms, if at all, or otherwise adversely affect our business, financial condition, and results of operations. At this time, we have not been impacted by the conflict between Russia and Ukraine, nor the most recent conflicts taking place in the Middle East, as all of our major suppliers of material are based in Asia and we have not been impacted by supply chain disruptions or sanctions resulting from the conflict. But if the conflict prolongs, there could be long term ramifications on the global economy through trade restrictions or cyberactivity that could negatively impact our operations.

Our financial condition and results of operations may be adversely affected by the recurrence of a global pandemic.

A significant outbreak, epidemic or pandemic of a contagious disease such as COVID-19 in any geographic area in which we operate or plan to operate could result in a health crisis adversely affecting the economies, financial markets and overall demand for our services in such areas. In addition, any preventative or protective actions that governments implement or that we take in response to a health crisis, such as travel restrictions, quarantines, or site closures, may interfere with the ability of our employees, suppliers and customers to perform their responsibilities. At this time, we are not experiencing negative impacts due to COVID-19 cases, but if cases increase and/or new shutdowns are implemented or a similar global health threat arises, this is expected to have a material adverse effect on our business.

|

|

Certain market opportunity data, forecasts, third-party website data and imagery contained in this prospectus were obtained from third-party sources and were not independently verified by us. We believe the data represented in those images, estimates of market opportunity data, forecasts of market growth included in this prospectus are reliable, but may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, our business could fail to grow at similar rates, if at all.

This filing contains certain data, imagery, and information that we obtained from various government, private entity publications, third party websites, and reports. There is no guarantee that any particular images or data represented therein are reliable. There is no guarantee that any number or percentage of market participants covered by our market opportunity estimates will purchase our services at all or generate any particular level of revenue for us. While we have not independently verified the data and information contained in the represented images and reports because such data and information may have been collected using third-party methodologies, we believe that the data and information, including projections based on a number of assumptions, from these third-party publications and reports used in this prospectus is reliable. Any expansion in the construction industry in Singapore is dependent a number of factors, including the cost and perceived value associated with our services and those of our competitors. Even if the markets in which we compete meet the size estimates and growth forecast in this prospectus, our business could fail to grow at the rate we anticipate, if at all, which could adversely affect our business, financial condition, results of operations and prospects. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the data represented in the images representing projects we have worked on and certain forecasts of market growth included in this prospectus should not be taken as indicative of our future growth.

Risks Related to Our Securities

An active trading market for our Ordinary Shares may not be established and the trading price for our Ordinary Shares may fluctuate significantly.

We cannot assure you that a liquid public market for our Ordinary Shares will be established, in which case the market price and liquidity of our shares may be materially and adversely affected. As a result, investors in our shares may experience a significant decrease in the value of their shares.

We may not maintain the listing of our Ordinary Shares on the Nasdaq which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions.

In order to continue listing our shares on the Nasdaq, we must maintain certain financial and share price levels and we may be unable to meet these requirements. We cannot assure you that our shares will continue to be listed on the Nasdaq in the future. The continued listing requirement of Nasdaq under Nasdaq Listing Rules 5550(a)(2) requires that a Nasdaq listed company maintain a minimum bid price of $1 per share Our share price has been below $1.00 since March 28. There is no assurance that we will be able to raise our share price at the level required to maintain our listing on the Nasdaq.

If the Nasdaq delists our Ordinary Shares and we are unable to list our shares on another national securities exchange, we expect our shares could be quoted on an over-the-counter market in the United States. If this were to occur, we could face significant material adverse consequences, including:

| ● | a limited availability of market quotations for our Ordinary Shares; | |

| ● | reduced liquidity for our Ordinary Shares; | |

| ● | a determination that our Ordinary Shares are “penny stock,” which will require brokers trading in our shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Ordinary Shares; | |

| ● | a limited amount of news and analyst coverage; and | |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

As long as our Ordinary Shares are listed on the Nasdaq, U.S. federal law prevents or preempts the states from regulating their sale. However, the law does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar their sale. Further, if we were no longer listed on the Nasdaq, we would be subject to regulations in each state in which we offer our shares.

|

|

The trading price of our Ordinary Shares may be subject to rapid and substantial volatility, which could make it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares and result in substantial losses to investors.

There have been instances of extreme stock price run-ups followed by rapid price declines and strong stock price volatility with recent initial public offerings, especially among those with relatively smaller public floats. As a relatively small-capitalization company with relatively small public float, we may experience greater share price volatility, extreme price run-ups, lower trading volume and less liquidity than large-capitalization companies. In particular, our Ordinary Shares may be subject to rapid and substantial price volatility, low volumes of trades and large spreads in bid and ask prices. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares.

The trading price of our Ordinary Shares may be volatile and could fluctuate widely due to factors beyond our control and for reasons that are unrelated to our actual or expected performance. In addition, if the trading volumes of our Ordinary Shares are low, persons buying or selling in relatively small quantities may easily influence prices of our Ordinary Shares. This low volume of trades could also cause the price of our Ordinary Shares to fluctuate greatly. Holders of our Ordinary Shares may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. Broad market fluctuations and general economic and political conditions may also adversely affect the market price of our Ordinary Shares.

In addition to market and industry factors, the price and trading volume for our shares may be highly volatile for factors specific to our own operations, including the following:

| ● | fluctuations in our revenues, earnings and cash flow; | |

| ● | changes in financial estimates by securities analysts; | |

| ● | additions or departures of key personnel; | |

| ● | release of lock-up or other transfer restrictions on our issued and outstanding equity securities or sales of additional equity securities; and | |

| ● | potential litigation or regulatory investigations. |

Any of these factors may result in significant and sudden changes in the volume and price at which our shares will trade.

In the event of market volatility, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline.

The trading market for our shares may be influenced by research or reports that industry or securities analysts publish about our business. If one or more analysts downgrade our shares, the market price for our shares would likely decline. If one or more of these analysts cease to cover us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the market price or trading volume for our shares to decline.

|

|

Short selling may drive down the market price of our Ordinary Shares.

Short selling is the practice of selling shares that the seller does not own but rather has borrowed from a third party with the intention of buying identical shares back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the shares between the sale of the borrowed shares and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is in the short seller’s interest for the price of the shares to decline, many short sellers publish, or arrange for the publication of, negative opinions and allegations regarding the relevant issuer and its business prospects in order to create negative market momentum and generate profits for themselves after selling the shares short. These short attacks have, in the past, led to selling of shares in the market. If we were to become the subject of any unfavorable publicity, whether such allegations are proven to be true or untrue, we could have to expend significant resources to investigate such allegations and/or defend ourselves. While we would strongly defend against any such short seller attacks, we may be constrained in the manner in which we can proceed against the relevant short seller by principles of freedom of speech, applicable state law or issues of commercial confidentiality.

Because we do not expect to declare dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment.

We currently intend to retain all of our available funds and any future earnings after this offering to fund the development and growth of our business. As a result, we do not expect to declare any cash dividends in the foreseeable future. Therefore, you should not rely on an investment in our shares as a source for any future dividend income. Our board of directors has discretion as to whether to distribute dividends, subject to applicable laws. Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of profits or its share premium account, provided that in no circumstances may a dividend be paid out of the share premium account unless, immediately following the date on which the dividend is proposed to be paid, the company shall be able to pay its debts as they fall due in the ordinary course of business. Even if our board of directors decides to declare and pay dividends, the timing, amount and form of future dividends, if any, will depend on, among other things, our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiaries, our financial condition, contractual restrictions and other factors as determined by our board of directors. Accordingly, the return on your investment in our Ordinary Shares will likely depend entirely upon any future price appreciation of our Ordinary Shares. There is no guarantee that our Ordinary Shares will appreciate in value or even maintain the price at which an investor may have purchased our shares. You may not realize a return on your investment in our shares and you may even lose your entire investment.

Our Amended Articles of Association contains anti-takeover provisions that could discourage a third party from acquiring us and adversely affect the rights of holders of our Ordinary Shares.

Our Amended Articles of Association contains provisions that may limit the ability of others to acquire control of our Company. These provisions could have the effect of depriving our shareholders of an opportunity to sell their shares at a premium over prevailing market prices by discouraging third parties from seeking to obtain control of our Company in a tender offer or similar transaction. Our board of directors has the authority to issue preferred shares in one or more series and to fix their designations, powers, preferences, privileges, and relative participating, optional or special rights and the qualifications, limitations or restrictions, including dividend rights, conversion rights, voting rights, terms of redemption and liquidation preferences, any or all of which may be greater than the rights associated with our Ordinary Shares. Preferred shares could be issued with terms calculated to delay or prevent a change in control of our Company or make removal of management more difficult. If our board of directors decides to issue preferred shares, the price of our Ordinary Shares may fall and the voting and other rights of the holders of our Ordinary Shares may be materially and adversely affected.

If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences.

We are a non-U.S. corporation and, as such, we will be classified as a passive foreign investment company, which is known as a PFIC, for any taxable year if, for such year, either

| ● | At least 75% of our gross income for the year is passive income; or | |

| ● | The average percentage of our assets (determined at the end of each quarter) during the taxable year that produce passive income or that are held for the production of passive income is at least 50%. |

|

|

Passive income generally includes dividends, interest, rents, royalties (other than rents or royalties derived from the active conduct of a trade or business) and gains from the disposition of passive assets.

If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. taxpayer who holds our securities, the U.S. taxpayer may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements.

It is possible that, for our current taxable year or for any subsequent year, more than 50% of our assets may be assets which produce passive income. We will make this determination following the end of any particular tax year. We treat our affiliated entities as being owned by us for United States federal income tax purposes, not only because we exercise effective control over the operation of such entities but also because we are entitled to substantially all of their economic benefits, and, as a result, we consolidate their operating results in our consolidated financial statements. For purposes of the PFIC analysis, in general, a non-U.S. corporation is deemed to own its pro rata share of the gross income and assets of any entity in which it is considered to own at least 25% of the equity by value.

For a more detailed discussion of the application of the PFIC rules to us and the consequences to U.S. taxpayers if we were determined to be a PFIC, see “Material Tax Considerations — Passive Foreign Investment Company Considerations.”

Our controlling shareholder has substantial influence over the Company. His interests may not be aligned with the interests of our other shareholders, and it could prevent or cause a change of control or other transactions.

Our Chief Executive Officer, Kelvin Ang, owns approximately 69.4% of our issued and outstanding Ordinary Shares. Accordingly, as our controlling shareholder he could control the outcome of any corporate transaction or other matter submitted to the shareholders for approval, including mergers, consolidations, the election of directors and other significant corporate actions, including the power to prevent or cause a change in control. The interests of our largest shareholder may differ from the interests of our other shareholders. Without the consent of our controlling shareholder, we may be prevented from entering into transactions that could be beneficial to us or our other shareholders. The concentration in the ownership of our shares may cause a material decline in the value of our shares. For more information regarding our principal shareholders and their affiliated entities, see “Principal Shareholders.”

As a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards. In the event we rely on these exemptions, these practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

As a foreign private issuer that has listed our Ordinary Shares on the Nasdaq, we have the ability to rely on a provision in the Nasdaq corporate governance listing standards that allows us to follow Cayman Islands law with regard to certain aspects of corporate governance. This would allow us to follow certain corporate governance practices that differ in significant respects from the corporate governance requirements applicable to U.S. companies listed on the Nasdaq.

For example, we are exempt from Nasdaq regulations that require a listed U.S. company to:

- have a majority of the board of directors consist of independent directors;

- require non-management directors to meet on a regular basis without management present;

- have an independent compensation committee;

- have an independent nominating committee; and-

- seek shareholder approval for the implementation of certain equity compensation plans and dilutive issuances of Ordinary Shares, such as transactions, other than a public offering, involving the sale of 20% or more of our Ordinary Shares for less than the greater of book or market value of the shares.

|

|

As a foreign private issuer, we are permitted to follow home country practice in lieu of the above requirements and our audit committee is not subject to additional Nasdaq corporate governance requirements applicable to listed U.S. companies, including the requirements to have a minimum of three members and to affirmatively determine that all members are “independent,” using more stringent criteria than those applicable to us as a foreign private issuer. Our audit committee is required to comply with the provisions of Rule 10A-3 of the Exchange Act, which is applicable to U.S. companies listed on the Nasdaq. Therefore, we have a fully independent audit committee in accordance with Rule 10A-3 of the Exchange Act, and we will also meet the more stringent requirements of having three “independent” audit committee members.

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

We are an exempted company incorporated under the laws of the Cayman Islands with limited liability. Our corporate affairs are governed by our memorandum and articles of association, as amended from time to time, the Companies Act and the common law of the Cayman Islands. The rights of our shareholders to take action against our directors and us, actions by minority shareholders and the fiduciary duties of our directors to our Company under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the Cayman Islands. The rights of our shareholders and the fiduciary duties of our directors under the laws of the Cayman Islands are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a different body of securities laws than the United States, which may provide significantly less protection to investors. In addition, Cayman Islands companies may not have the standing to initiate a shareholder derivative action in a federal court of the United States.

Shareholders of Cayman Islands exempted companies like us have no general rights under Cayman Islands law to inspect corporate records (other than the Memorandum and Articles of Association) or to obtain copies of lists of shareholders of these companies. Our directors are not required under our Memorandum and Articles of Association to make our corporate records available for inspection by our shareholders. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder resolution or to solicit proxies from other shareholders in connection with a proxy contest.

Certain corporate governance practices in the Cayman Islands, which is our home country, differ significantly from requirements for companies incorporated in other jurisdictions such as U.S. states. Currently, we do not plan to rely on home country practice with respect to any corporate governance matter. In the event we opt to do so in the future, our shareholders may be afforded less protection than they otherwise would under rules and regulations applicable to U.S. domestic issuers.

As a result of all of the above, shareholders may have more difficulty in protecting their interests in the face of actions taken by our management, members of the board of directors or controlling shareholders than they would as shareholders of a company incorporated in a U.S. state. For a discussion of significant differences between the provisions of the Companies Act and the laws applicable to companies incorporated in a U.S. state and their shareholders, see “Certain Cayman Islands Company Considerations — Differences in Corporate Law.”

Certain judgments obtained against us by our shareholders may not be enforceable.