UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number 001-38308

Greenpro Capital Corp.

(Exact name of registrant issuer as specified in its charter)

| Nevada | 98-1146821 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

B-23A-02, G-Vestor Tower,

Pavilion Embassy, 200 Jalan Ampang,

50450 W.P. Kuala Lumpur, Malaysia

(Address of principal executive offices, including zip code)

Registrant’s phone number, including area code (60) 3 8408-1788

Securities registered pursuant to Section 12(b) of the Securities Exchange Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.0001 par value | GRNQ | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding twelve months (or shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ☒ | Smaller reporting company ☒ |

| Emerging growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Note - If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of reasonable assumptions under the circumstances, provided that the assumptions are set forth in this Form.

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2024 was $4,370,143, based on the last reported sale price of $1.06 per share.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of April 9, 2025, there were 7,575,813 shares, par value $0.0001 of the registrant’s Common Stock issued and outstanding.

Greenpro Capital Corp.

FORM 10-K

For the Fiscal Year Ended December 31, 2024

Index

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guaranteed to future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties, including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this Annual Report and in our other filings with the Securities and Exchange Commission or the SEC. |

This Annual Report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report are made as to the date of this Annual Report and should be evaluated with consideration of any changes occurring after the date of this Annual Report. We will not update forward-looking statements even though our situation may change in the future, and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Annual Report to:

| ● | The “Company,” “we,” “us,” or “our,” “Greenpro” are references to Greenpro Capital Corp., a Nevada corporation. | |

| ● | “Common Stock” refers to the common stock, par value $.0001, of the Company; | |

| ● | “HK” refers to Hong Kong; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

|

|

PART I

ITEM 1. BUSINESS

Corporate History

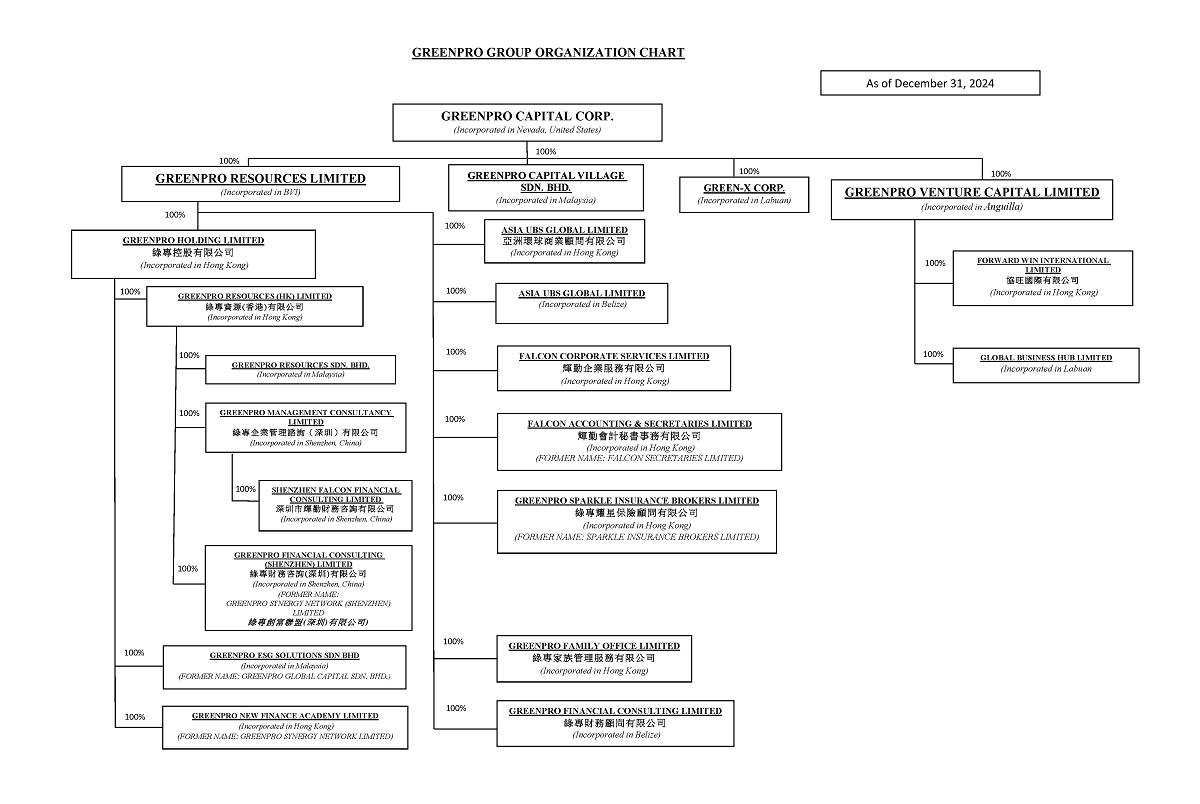

We were incorporated on July 19, 2013, in the state of Nevada under the name “Greenpro, Inc.”. On May 6, 2015, we changed our name to “Greenpro Capital Corp.”. Our corporate structure is set forth below:

|

|

A list of our group, including all subsidiaries with a brief description of respective businesses, is set forth below:

| Name (Domicile) | Business | |

| Greenpro Capital Corp. (Nevada, USA) | Provides financial consulting services and corporate services. | |

| Greenpro Resources Limited (British Virgin Islands) | A holding company. | |

| Greenpro Holding Limited (Hong Kong) | A holding company. | |

| Greenpro Resources (HK) Limited (Hong Kong) | Holds intellectual property and currently holds six trademarks and applications thereof. | |

| Greenpro Resources Sdn. Bhd. (Malaysia) | Holds investment in commercial real estate in Malaysia. | |

| Greenpro Management Consultancy Limited (China) | Provides corporate advisory services such as tax planning, cross-border listing solution and advisory in China. | |

| Shenzhen Falcon Financial Consulting Limited (China) | Provides Hong Kong company formation advisory services and company secretarial services and financial services. It focuses on China clients. | |

| Greenpro ESG Solutions Sdn. Bhd. (formerly known as Greenpro Global Capital Sdn. Bhd.) (Malaysia) | Provides corporate advisory services such as company review, bank loan advisory and bank products analysis services. | |

| Greenpro New Finance Academy Limited (formerly known as Greenpro Synergy Network Limited) (Hong Kong) | Provides a borderless platform through networking events and programs in Hong Kong. | |

|

Greenpro Financial Consulting (Shenzhen) Limited (formerly known as Greenpro Synergy Network (Shenzhen) Limited) (China) |

Provides corporate advisory services such as tax planning, cross-border listing solution and financial consulting for clients in China. |

|

|

| Asia UBS Global Limited (Hong Kong) | Provides business advisory services with a focus on Hong Kong company formation advisory and company secretarial services, such as tax planning, bookkeeping and financial review. It focuses on Hong Kong clients. | |

| Asia UBS Global Limited (Belize) | Provides business advisory services with a focus on offshore company formation advisory and company secretarial services, such as tax planning, bookkeeping and financial review. It focuses on Southeast Asia and China clients. | |

| Falcon Corporate Services Limited (Hong Kong) | Provides offshore company formation advisory services and company secretarial services. Clients based in Hong Kong and China. | |

| Falcon Accounting & Secretaries Limited (formerly known as Falcon Secretaries Limited) (Hong Kong) | Provides company formation advisory services and company secretarial services in Hong Kong. | |

| Greenpro Sparkle Insurance Brokers Limited (Hong Kong) | Provides insurance brokerage services with an insurance broker license in Hong Kong. | |

| Greenpro Family Office Limited (Hong Kong) | Provides multi-family office services such as wealth planning and administration, asset protection and performance monitoring, charity services, trusteeship and risk management, investment planning and business support services. | |

| Greenpro Financial Consulting Limited (Belize) | Provides corporate advisory services such as tax planning, cross-border listing solution and advisory transaction services. | |

| Greenpro Capital Village Sdn. Bhd. (Malaysia) |

Provides business consulting and advisory services in Malaysia.

|

|

| Green-X Corp. (Malaysia) |

A licensed asset platform operator under Labuan Financial Services Authority (LFSA), Malaysia.

|

|

| Greenpro Venture Capital Limited (Anguilla) | A holding company. | |

| Forward Win International Limited (Hong Kong) | Holds investment in commercial real estate in Hong Kong. | |

| Global Business Hub Limited (Malaysia) | Develops a digital banking business in Malaysia. |

|

|

Incorporation of Subsidiaries and VIE

Incorporation of Greenpro Resources Limited, a British Virgin Islands company

On July 3, 2012, Greenpro Resources Limited (“GRBVI”) was founded and incorporated by our directors, Mr. Lee Chong Kuang and Mr. Loke Che Chan Gilbert (“Messrs. Lee and Loke”) in the British Virgin Islands.

Incorporation of Greenpro Resources Limited’s wholly owned subsidiaries

Greenpro Resources (HK) Limited, a Hong Kong company

On April 5, 2012, Greenpro Resources (HK) Limited (“GRHK”) was founded and incorporated by our directors, Messrs. Lee and Loke in Hong Kong.

Greenpro Financial Consulting Limited, a Belize company

On July 26, 2012, Greenpro Financial Consulting Limited (formerly known as Weld Asia Financial Consulting Limited) (“GFCL”) was founded and incorporated by our director, Mr. Lee Chong Kuang (“Mr. Lee”), in Belize.

Greenpro Resources Sdn. Bhd., a Malaysia company

On April 25, 2013, Greenpro Resources Sdn. Bhd. (“GRSB”) was founded and incorporated by our director, Mr. Lee, and his spouse, Ms. Yap Pei Ling (“Ms. Yap”), in Malaysia.

Greenpro Holding Limited, a Hong Kong company

On July 22, 2013, Greenpro Holding Limited (“GHL”) was founded and incorporated by GRBVI in Hong Kong.

Greenpro Management Consultancy Limited, a Shenzhen, China company

On August 30, 2013, Greenpro Management Consultancy Limited (“GMCSZ”) was founded and incorporated by GRHK in Shenzhen, China.

Development of Greenpro Resources Limited and its wholly owned subsidiaries through acquisitions

On January 1, 2014, Greenpro Resources Limited (“GRBVI”) acquired 100% of the outstanding shares of GFCL, from our director, Mr. Lee, at a consideration of $1.

On January 22, 2014, GHL acquired 2 shares, representing 100% of the outstanding shares of GRHK from its shareholders, Messrs. Lee and Loke at a total consideration of HK$2 (approximately $0.26). On the same day after this acquisition, GRHK allotted an additional 1,075,000 shares to GHL for HK$1,075,000 (approximately $138,709).

On June 30, 2014, GRHK acquired 100% of the issued and outstanding shares of Greenpro Resources Sdn. Bhd., a Malaysia company (“GRSB”) from our director, Mr. Lee, and his spouse, Ms. Yap, for HK$2,943,298 (approximately $379,780). GRSB is principally engaged in commercial real estate investments in Malaysia.

Incorporation of Greenpro Venture Capital Limited, an Anguilla company

On September 5, 2014, Greenpro Venture Capital Limited (“GVCL”) was founded and incorporated by our directors, Messrs. Lee and Loke in Anguilla.

Incorporation and restructure of VIE, Greenpro New Finance Academy Limited, a Hong Kong company, and its wholly owned subsidiary, Greenpro Financial Consulting (Shenzhen) Limited (formerly known as Greenpro Synergy Network (Shenzhen) Limited), a Shenzhen, China company

On March 2, 2016, Greenpro New Finance Academy Limited (formerly known as Greenpro Synergy Network Limited) (“GNFA”) was incorporated in Hong Kong, as a variable interest entity (the “VIE”), which is required to consolidate with the Company. The principal activity of GNFA is to provide a borderless platform through networking events and programs in Hong Kong. The Company controlled GNFA through a series of contractual arrangements (the “VIE Agreements”) between Greenpro Holding Limited, a subsidiary of the Company (“GHL”), and GNFA. Our directors, Messrs. Lee and Loke, are also the shareholders of GNFA.

The VIE agreements included (i) an Exclusive Business Cooperation Agreement, (ii) a Loan Agreement, (iii) a Share Pledge Agreement, (iv) a Power of Attorney and (v) an Exclusive Option Agreement with the shareholders of GNFA.

GHL acquired a life insurance policy (the “Policy”) on May 15, 2015. On June 13, 2016, GHL transferred the ownership of the Policy to GNFA. On December 19, 2019, GNFA redeemed the Policy valued at $156,058. After deducting the loan balance of $115,889 and the insurance expense of $531 from the value of the Policy, GNFA received a net cash surrender value of $39,638.

On July 28, 2017, Greenpro Financial Consulting (Shenzhen) Limited (formerly known as Greenpro Synergy Network (Shenzhen) Limited) (“GFCSZ”), a wholly owned subsidiary of GNFA, was incorporated in Shenzhen, China. GFCSZ was initially engaged in the provision of a borderless platform through networking events and programs in China for our members to seek professional services and business opportunities and to exchange sources of information and research. Currently, GFCSZ principally provides corporate advisory and financial consulting services to clients in China.

On April 20, 2020, after our directors, Messrs. Lee and Loke transferred all shareholdings of GNFA to GHL, the VIE was dissolved and restructured as a subsidiary of the Company.

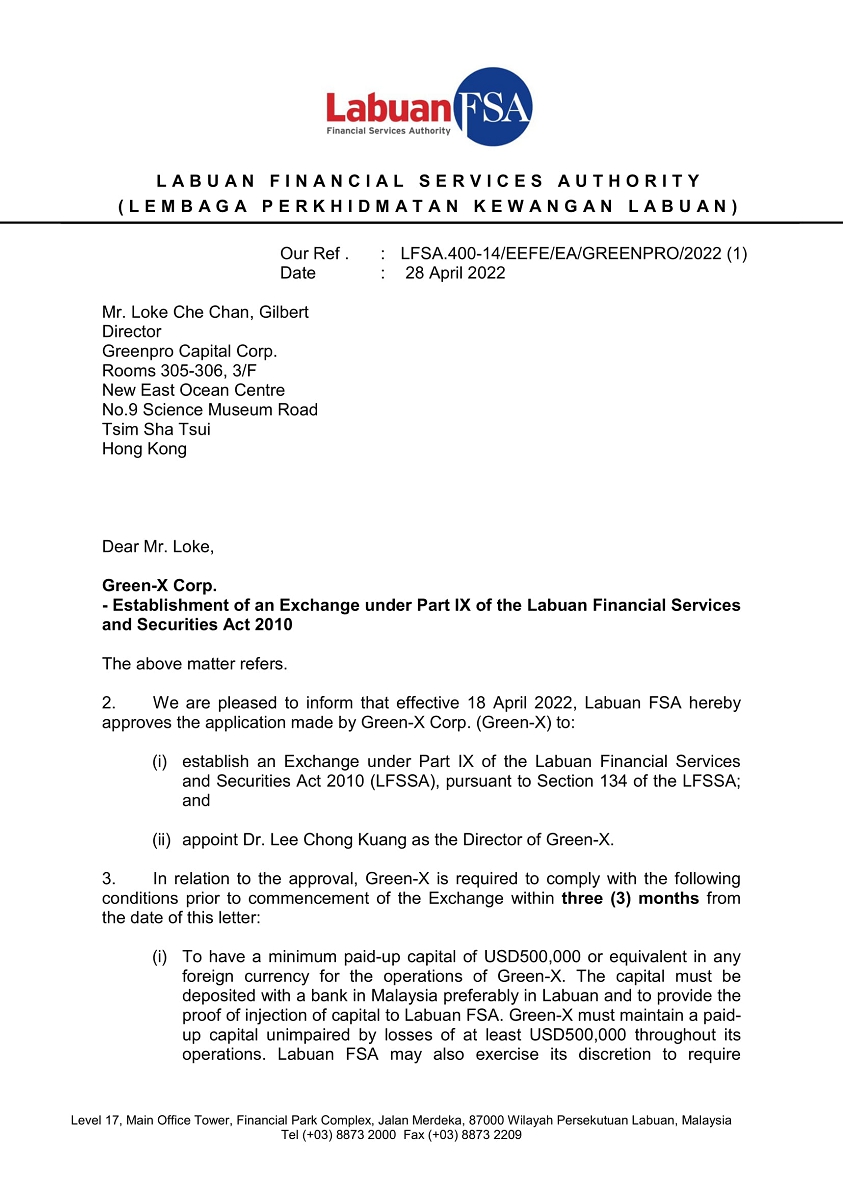

Incorporation of Green-X Corp., a Labuan, Malaysia company

On December 23, 2021, Green-X Corp. (“Green-X”) was founded and incorporated by our director, Mr. Lee Chong Kuang (“Mr. Lee”) in Labuan, Malaysia and consolidated with our group on June 22, 2022.

|

|

Acquisition and Reorganization of Subsidiaries

Acquisitions of entities under common control:

Acquisition of Greenpro Resources Limited, a British Virgin Islands company

On July 31, 2015, we acquired 100% of the issued and outstanding securities of Greenpro Resources Limited, a British Virgin Islands corporation (“GRBVI”), which had been our affiliate at the time of the acquisition. As consideration thereof, we issued 907,000 shares of our restricted Common Stock and paid $25,500 in cash.

At the time of the acquisition of GRBVI, Mr. Lee was the Company’s Chief Executive Officer, President and director, and Mr. Loke was the Company’s Chief Financial Officer, Secretary, Treasurer and director. Messrs. Lee and Loke each held a 44.6% interest in the Company. Before the transaction, Mr. Lee was GRBVI’s Chief Executive Officer and director, and Mr. Loke was GRBVI’s Chief Financial Officer and director, and Messrs. Lee and Loke each held a 50% interest in GRBVI. Upon the consummation of the acquisition, Messrs. Lee and Loke received, in aggregate, $25,500 in cash and 907,000 shares of restricted Common Stock of the Company, and the acquisition was accounted for as a transfer among entities under common control.

Acquisition of Greenpro Venture Capital Limited, an Anguilla corporation

On September 30, 2015, the Company acquired all the issued and outstanding securities of Greenpro Venture Capital Limited, an Anguilla corporation (“GVCL”), from its shareholders, Messrs. Lee and Loke, respectively. At the time of the acquisition of GVCL, Mr. Lee was the Company’s Chief Executive Officer, President and director, and Mr. Loke was the Company’s Chief Financial Officer, Secretary, Treasurer and director. Messrs. Lee and Loke each held a 43.02% interest in the Company. At the time of the acquisition of GVCL, Mr. Lee was GVCL’s Chief Executive Officer and director, Mr. Loke was GVCL’s Chief Financial Officer and director, and Messrs. Lee and Loke each held a 50% interest in GVCL. Upon the consummation of the acquisition, Messrs. Lee and Loke received, in aggregate, $6,000 in cash and 1,326,000 shares of restricted Common Stock of the Company, and the acquisition was accounted for as a transfer among entities under common control.

|

|

Acquisition of A&G International Limited, a Belize company

On September 30, 2015, we acquired 100% of the issued and outstanding securities of A&G International Limited, a Belize corporation (“A&G”), from Ms. Yap Pei Ling (“Ms. Yap”). Ms. Yap, a director and sole shareholder of A&G, is the spouse of our director, Mr. Lee.

In connection therewith, we issued to Ms. Yap, 184,200 shares of our restricted Common Stock and the acquisition was accounted for as a transfer among entities under common control.

A&G provided corporate and business advisory services through its wholly owned subsidiaries, Asia UBS Global Limited, a Hong Kong limited company (“AUH”) and Asia UBS Global Limited, a Belize corporation (“AUB”).

On December 30, 2015, A&G transferred all the issued and outstanding securities of AUH and AUB to GRBVI to simplify our corporate structure. Then A&G, a corporation with no assets, was subsequently transferred back to Ms. Yap.

Acquisition of Falcon Accounting & Secretaries Limited (formerly known as Falcon Secretaries Limited) and Falcon Corporate Services Limited (formerly known as Ace Corporate Services Limited), Hong Kong companies, and Shenzhen Falcon Financial Consulting Limited, a Shenzhen, China company

On September 30, 2015, we acquired all the issued and outstanding securities of Falcon Secretaries Limited (renamed to Falcon Accounting & Secretaries Limited on February 25, 2020), Ace Corporate Services Limited (renamed to Falcon Corporate Services Limited on August 26, 2016) and Shenzhen Falcon Financial Consulting Limited (these companies collectively known as “F&A”). As consideration thereto, we issued to Ms. Chen Yanhong, a sole shareholder of F&A (“Ms. Chen”), 208,020 shares of our restricted Common Stock, representing an aggregate purchase price of $1,081,704 based on the average closing price of the ten trading days preceding the date of the acquisition agreement on July 31, 2015, of $5.2 per share. The purchase price was determined based on the business value generated by F&A at the time of acquisition. The acquisition was accounted for as a transfer among entities under common control.

Ms. Chen, a director and sole shareholder of F&A, is also a director and legal representative of Greenpro Management Consultancy Limited, one of our subsidiaries in Shenzhen, China.

|

|

Acquisition of Greenpro ESG Solutions Sdn. Bhd., (formerly known as Greenpro Global Capital Sdn. Bhd.) a Malaysia company

On May 23, 2016, our wholly owned subsidiary, Greenpro Holding Limited (“GHL”), acquired 400 shares, representing 40% of the outstanding shares of Greenpro Wealthon Sdn. Bhd. (renamed to Greenpro Global Capital Sdn. Bhd. on June 13, 2018, and subsequently renamed Greenpro ESG Solutions Sdn. Bhd. on June 1, 2023) (“GPESG”), from our director, Mr. Lee, for MYR1 (approximately $0.25), and the acquisition was accounted for as a transfer among entities under common control. On June 7, 2016, GPESG issued another 200 shares to GHL at the price of MYR120,000 (approximately $30,000), resulting in GHL owning 60% of GPESG.

On August 30, 2018, the remaining 40% of the outstanding shares of GPESG were transferred to GHL, and currently, GHL holds 100% of GPESG.

Acquisition of Greenpro Credit Limited (formerly known as Gushen Credit Limited), a Hong Kong company

On April 27, 2017, our wholly owned subsidiary, GRBVI and Gushen Credit Limited (renamed to Greenpro Credit Limited on May 16, 2017) (“GCL”), a Hong Kong corporation, entered into an asset purchase agreement, pursuant to which GRBVI purchased all the assets of GCL. As consideration thereto, GRBVI agreed to pay a purchase price of $105,000 and the acquisition was accounted for as a transfer among entities under common control.

GCL operates a money lending business in Hong Kong. On April 28, 2017, GCL sold two (2) ordinary shares, representing 100% of its ownership, at a total consideration of $0.26 in cash to GRBVI. The purchase price was determined based on the mutual agreement between GCL and GRBVI.

Acquisition of Greenpro Family Office Limited, a Hong Kong company

On July 21, 2017, our wholly owned subsidiary, GRBVI, acquired 51% of the outstanding shares of Greenpro Family Office Limited (“GFOL”) from our director, Mr. Loke. Mr. Loke was the sole shareholder of GFOL before the acquisition. This acquisition was accounted for as a transfer among entities under common control. On September 21, 2018, the remaining 49% of the shareholdings of GFOL were transferred to GRBVI, and currently, GRBVI holds 100% of GFOL.

Acquisition of Greenpro Sparkle Brokers Limited (formerly known as Sparkle Insurance Brokers Limited), a Hong Kong company

On January 2, 2019, the Company acquired Sparkle Insurance Brokers Limited (renamed Greenpro Sparkle Brokers Limited on April 4, 2019) (“Sparkle”) from Mr. Teh Boo Yim and Ms. Teh Jocelyn Nga Man, the former 100% shareholders of Sparkle for total consideration of $170,322, made up of $129,032 in cash and the issuance of 860 shares of the Company’s Common Stock valued at $41,290. The shares were valued based on the closing price of the Company’s Common Stock of $48 per share at acquisition. The acquisition was accounted for as a transfer among entities under common control. The Company aims to expand its long-term and general insurance services through the acquisition of Sparkle.

|

|

Acquisition of Forward Win International Limited, a Hong Kong company

On February 25, 2015, we acquired 60% of the issued and outstanding shares of Forward Win International Limited, a Hong Kong company (“FWIL”) at a consideration of $774. FWIL is principally engaged in commercial real estate investments in Hong Kong.

On April 15, 2024, we acquired the remaining 40% shares of FWIL from the non-controlling interest (the “NCI”) by distribution of 40% of FWIL’s real estate properties for consideration of its acquisition and settlement of loan from the NCI.

Acquisition of Global Business Hub Limited, a Labuan, Malaysia company

On June 6, 2024, we acquired Global Business Hub Limited (“GBHL”) from our Chief Executive Officer and director, Mr. Lee Chong Kuang for a price of $100. We acquired GBHL and aim to develop a digital banking business in Malaysia.

Acquisition, disposal, and reacquisition of Greenpro Capital Village Sdn. Bhd. (formerly known as Weld Asia Global Advisory Sdn. Bhd.), a Malaysia company

On February 25, 2013, Greenpro Financial Consulting Limited, a subsidiary of the Company, acquired 100% of Weld Asia Global Advisory Sdn. Bhd., a Malaysia company, from its shareholders, Mr. Lee Chong Kuang, and his spouse, Ms. Yap Pei Ling, for MYR2 (approximately $0.50). At the time of the acquisition, Mr, Lee Chong Kuang was the Company’s Chief Executive Officer, President and director and the acquisition was accounted for as a transfer among entities under common control.

In 2015, Weld Asia Global Advisory Sdn. Bhd. was renamed Greenpro Capital Village Sdn. Bhd. (“GCVSB”). On October 1, 2015, the Company sold 49% of the outstanding shares of GCVSB to QSC Asia Sdn. Bhd., an unrelated party (“QSC”), for MYR49,000 (approximately $12,794). On June 26, 2019, the Company disposed of GCVSB due to continued losses incurred by GCVSB and sold its remaining 51% interest in GCVSB to Ms. Tan Tee Yong, an unrelated party (“Ms. Tan”), for MYR51 (approximately $12).

On June 22, 2020, our director, Mr. Lee, acquired respective 51% and 49% shareholdings of GCVSB (51,000 shares and 49,000 shares of common stock of GCVSB) from Ms. Tan and QSC at a price of MYR51,000 and MYR49,000, respectively, or MYR1 per share.

In July 2021, the Company acquired all the issued and outstanding shares of common stock of GCVSB from our director, Mr. Lee, at a consideration of MYR167 (approximately $40) and redeemed 347,000 shares out of a total of 504,750 shares of preferred stock from 25 preferred stock shareholders of GCVSB by issuance of 7,953 shares of the Company’s Common Stock valued at $69,191 or $8.7 per share. The total consideration of the acquisition was $69,231. The Company’s reacquisition of GCVSB aimed to expand its business consulting services in Malaysia.

Disposal of subsidiaries

Disposal of Greenpro Credit Limited, a Hong Kong company

On August 2, 2021, the Company sold its entire 100% interest in Greenpro Credit Limited (“GCL”) to an unrelated party for HK$30,000 (approximately $3,847), due to continuing losses incurred by GCL.

As of August 2, 2021, GCL had no assets or liabilities, resulting in a gain on disposal of $3,847, after consideration of foreign currency adjustments.

Acquisition of an associate company

Acquisition of Greenpro KSP Holding Group Company Limited (formerly known as KSP Holding Group Company Limited), a Thailand company

On July 20, 2018, our wholly owned subsidiary, Greenpro Venture Capital Limited (“GVCL”) entered into a sale and purchase agreement with Mr. Prapakorn Saokliew and Ms. Surapa Jamjang, each holding 45.13% and 45.12% shareholdings of a Thailand company, KSP Holding Group Company Limited (renamed to Greenpro KSP Holding Group Company Limited on August 7, 2018) (“KSP”), respectively. Pursuant to the agreement, GVCL agreed to acquire approximately 49% of the shareholdings of KSP in exchange for $363,930, made up of $75,000 in cash and 3,852 shares of the Company’s Common Stock valued at $288,930. The Company also issued 58 shares of the Company’s Common Stock valued at $75 per share, or a total of $4,335, as a commission that was also capitalized as the cost of investment in KSP. KSP provides accounting, auditing, and consulting services in Thailand. The Company accounted for its investment in KSP under the equity method of accounting.

On December 31, 2018, the Company determined that its investment in KSP was impaired and recorded an impairment of unconsolidated investment of $363,930. We currently hold approximately 48% of the issued and outstanding shares of KSP.

|

|

Acquisitions of other investments

| Name (Domicile) | Acquisition Date | Equity Interest | Business | |||||||

| 1. | Greenpro Trust Limited | March 30, 2015 | 8.33 | % | Provides trusteeship, custodial and fiduciary services. | |||||

| (Hong Kong) | April 13, 2016 | 2.78 | % | |||||||

| 2. | Millennium Fine Art Inc. (Wyoming, USA) | June 29, 2020 | 4.65 | % | Invests in art (Millennium Sapphire). | |||||

| 3. | Ata Plus Sdn. Bhd. (Malaysia) | July 8, 2020 | 4.45 | % | Provides an online equity crowd funding platform to assist small to medium-sized enterprises (SMEs) to access funding through its platform. | |||||

| 4. | Global Leaders Corporation (Nevada, USA) | August 30, 2020 | 5.83 | % | Provides training and consulting services. | |||||

| 5. | First Bullion Holdings Inc. | October 19, 2020 | 10 | % | Provides cryptocurrency trading and digital asset exchange services. | |||||

| (British Virgin Islands) | February 17, 2021 | 8 | % | |||||||

| 6. | New Business Media Sdn. Bhd. (Malaysia) | November 1, 2020 | 18 | % | Provides a capital market-focused portal to |

|||||

| 7. | Angkasa-X Holdings Corp. (British Virgin Islands) | February 3, 2021 | 12.23 | % | Provides turnkey services, from strategic satellite anchor station solutions to fully deployable, integrated tactical platform solutions. | |||||

| 8. | Jocom Holdings Corp. (Nevada, USA) | June 2, 2021 | 2.6 | % | Operates a Malaysia-based m-commerce platform specializing in online grocery shopping via smartphones. | |||||

| 9. | Ata Global Inc. (Nevada, USA) | July 30, 2021 | 5 | % | Provides financial technology (FinTech) services. | |||||

| 10. | catTHIS Holdings Corp. (Nevada, USA) | August 27, 2021 | 1.58 | % | Provides a digital catalog management platform for users to upload, share and retrieve digital catalogs from any device. | |||||

| 11. | ACT Wealth Academy Inc. (Nevada, USA) | February 21, 2022 | 9.8 | % | Provides training, seminars, events and academies in fields related, but not limited to, financial and wealth. | |||||

| 12. | Best2bid Technology Corp. (Nevada, USA) | June 9, 2022 | 9.17 | % | Provides an online bidding platform for the art and creative industry stakeholders. | |||||

| 13. | SEATech Ventures Corp. (Nevada, USA) |

August 8, 2024 | 2.8 | % | Provision of mentoring and incubation services to clients. | |||||

|

|

| 1. | Acquisition of Greenpro Trust Limited |

On March 30, 2015, our wholly owned subsidiary, Greenpro Resources Limited, a British Virgin Islands company (“GRBVI”), acquired 300,000 shares, representing approximately 8% of the issued and outstanding shares of Greenpro Trust Limited, a Hong Kong company (“GTL”), from its shareholders at a price of HK$300,000 (approximately $38,710) or HK$1 per share. GTL is principally engaged in the provision of trusteeship, custodial and fiduciary services to clients in Hong Kong.

On April 13, 2016, another wholly owned subsidiary of the Company, Asia UBS Global Limited, a Belize company (“AUB”), acquired 100,000 shares, representing approximately 3% of the issued and outstanding shares of GTL for HK$100,000 (approximately $12,903) or HK$1 per share.

The Company indirectly has an aggregate of approximately 11% interest in GTL with an investment value of $51,613. Messrs. Lee and Loke are common directors of GTL and the Company.

On December 31, 2022, the net asset value (“NAV”) of GTL was $107,835 and according to the Company’s 11% interest in GTL’s NAV, our investment was valued at approximately $11,981. Hence, the Company recorded an impairment loss of $39,632 for the year ended December 31, 2022.

Since 2023, no indicator of impairment has occurred and hence, our investment value in GTL remains the same at $11,981 as of December 31, 2024, and 2023, respectively.

| 2. | Acquisition of Millennium Fine Art Inc. |

On June 29, 2020, the Company entered into a purchase and sale agreement with its Wyoming-incorporated subsidiary, Millennium Fine Art Inc. (“MFAI”). Pursuant to the agreement, the Company agreed to sell its 4% ownership interest in a 12.3-kilogram carved natural blue sapphire (the “Millennium Sapphire”) to MFAI and MFAI agreed to acquire the 4% ownership of the Millennium Sapphire from the Company. As consideration thereto, on July 1, 2020, MFAI issued 2,000,000 restricted shares of its Class B common stock to the Company valued at $5,000,000 ($5 per share), in which 1,000,000 shares were retained by the Company and the other 1,000,000 shares were reserved as a dividend to the shareholders of the Company. The Company expects to distribute these 1,000,000 shares to its shareholders later. A gain on disposal of $1,000,000 was recorded at the Company level but was eliminated upon consolidation.

On July 1, 2020, MFAI issued 19,200,000 restricted shares of its Class A common stock to a majority owner of the Millennium Sapphire, Mr. Daniel McKinney, valued at $96,000,000 ($5 per share) to acquire the remaining 96% interest in the Millennium Sapphire. MFAI is an investment company and has a 100% interest in the Millennium Sapphire.

As of December 31, 2022, the Company owns 2,000,000 shares of Class B common stock of MFAI, in which 1,000,000 shares were retained by the Company and recognized our investment in MFAI at historical cost of $4,000,000 (by issuance of 444,444 shares of the Company’s restricted Common Stock at $9 per share) under other investments, representing approximately 5% of the issued and outstanding shares of MFAI and approximately 1% of MFAI’s total voting rights.

The other 1,000,000 shares were reserved as a dividend to the shareholders of the Company and as of the date of this report, the dividend has not been distributed.

For the year ended December 31, 2023, the Company made a full impairment of $4,000,000 for the investment in MFAI due to continuing losses incurred by MFAI and uncertainty of the existence of the Millennium Sapphire. As a result, our investment in MFAI was recorded with a nil value as of December 31, 2023.

As of December 31, 2024, our investment in MFAI remains with a nil value.

| 3. | Acquisition of Ata Plus Sdn. Bhd. |

On July 8, 2020, GVCL entered into an acquisition agreement with all eight shareholders of Ata Plus Sdn. Bhd., a company incorporated in Malaysia and a Recognized Market Operator (RMO) by the Securities Commission of Malaysia (“APSB”). Pursuant to the agreement, GVCL agreed to acquire 15% of the issued and outstanding shares of APSB for a purchase price of $749,992. The purchase price was paid by the Company issuing to the shareholders approximately 45,731 shares of the Company’s restricted Common Stock, which was based on the average closing price of the Company’s Common Stock for the five trading days preceding the date of the agreement, $16.4 per share, on November 18, 2020.

On December 31, 2022, the fair value of APSB was appraised by an independent appraiser, Ravia Global Appraisal Advisory Limited (the “Appraiser”) and according to our 15% interest in APSB, our investment was valued at approximately $736,000. Hence, the Company recorded an impairment loss of $13,992 for the year ended December 31, 2022.

For the year ended December 31, 2023, the Company made a further impairment of $736,000 for investment in APSB due to APSB’s continuing losses, and the Company’s shareholdings in APSB were diluted from 15% to approximately 4% at the end of 2023. As a result, our investment in APSB was fully impaired with a nil value as of December 31, 2023.

As of December 31, 2024, our investment in APSB remains the same with a nil value.

|

|

| 4. | Acquisition of Global Leaders Corporation |

On August 30, 2020, GVCL entered into a subscription agreement with Global Leaders Corporation, a Nevada corporation (“GLC”), to acquire 9,000,000 shares of common stock of GLC at a price of $900 or $0.0001 per share, representing approximately 6% of the total issued and outstanding shares of GLC. GLC’s principal activities are to provide training and consulting services to corporate clients in Hong Kong and China.

Upon acquisition, GVCL recognized the investment in GLC at a historical cost of $900 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $900 for the investment in GLC due to its continuous losses and stockholders’ deficit. As a result, our investment in GLC was fully impaired with a nil value as of December 31, 2024.

| 5. | Acquisition of First Bullion Holdings, Inc. |

On October 19, 2020, GVCL entered into a stock purchase and option agreement with Mr. Tang Ka Siu Johnny and First Bullion Holdings Inc. (“FBHI”). FBHI, a British Virgin Islands company, operates the businesses of banking, payment gateway, credit cards, debit cards, money lending, crypto trading, and securities token offerings, with corporate offices in the Philippines and Hong Kong. Pursuant to the agreement, GVCL agreed to acquire 10% of the issued and outstanding shares of FBHI for a purchase price of $1,000,000 by issuing approximately 68,587 shares of the Company’s restricted Common Stock to Mr. Tang, which was based on the average closing price of the Company’s Common Stock for the five trading days preceding the date of the agreement.

Pursuant to the agreement, Mr. Tang and FBHI also granted GVCL an option for 180 days following the date of the agreement to purchase an additional 8% of the issued and outstanding shares of FBHI, at an agreed valuation of FBHI equal to $20,000,000. In consideration of the acquisition of the option, GVCL agreed to issue 25,000 shares of the Company’s restricted Common Stock to Mr. Tang, which shall constitute partial payment for the option should GVCL elect to exercise the option.

On December 11, 2020, the Company issued 68,587 shares of its restricted Common Stock to two designees of Mr. Tang at $14.58 per share to acquire 10% of the issued and outstanding shares of FBHI for a purchase price of $1,000,000 and issued 25,000 shares of its restricted Common Stock at $364,500 or $14.58 per share in partial consideration of the additional 8% shareholdings of FBHI.

On February 17, 2021, GVCL exercised its option and FBHI issued to GVCL 160,000 ordinary shares of FBHI, comprising the additional 8% of the shares sold under the agreement valued at $20,000,000.

On February 26, 2021, the Company issued an additional 34,259 shares of its restricted Common Stock to two designees of Mr. Tang at $27 per share (valued at approximately $925,000). Therefore, GVCL, in aggregate, holds 360,000 ordinary shares of FBHI, representing 18% of the total issued and outstanding shares of FBHI. The investment was recognized at a historical cost of $2,289,500 under other investments.

On December 31, 2022, the fair value of FBHI was appraised by the Appraiser and according to our 18% interest in FBHI, our investment was valued at approximately $246,000. The depreciation of FHBI’s fair value was mainly due to a significant decrease in its revenue. Hence, the Company recorded an impairment loss of $2,043,500 for the year ended December 31, 2022.

For the year ended December 31, 2023, the Company made a further impairment of $246,000 for the investment in FBHI due to FBHI’s dormant status. As a result, our investment in FBHI was fully impaired with a nil value as of December 31, 2023.

As of December 31, 2024, our investment in FBHI remains the same with a nil value.

| 6. | Acquisition of New Business Media Sdn. Bhd. |

On November 1, 2020, GVCL entered into an acquisition agreement with Ms. Lee Yuet Lye and Mr. Chia Min Kiat, shareholders of New Business Media Sdn. Bhd (“NBMSB”). NBMSB is a Malaysian company involved in operating a Chinese media portal that provides digital news services focusing on Asian capital markets. NBMSB is also one of the biggest Chinese-language digital business news networks in Malaysia and has readers from across Southeast Asia.

Pursuant to the agreement, both Ms. Lee and Mr. Chia have agreed to sell to GVCL an 18% equity stake in NBMSB in consideration of a new issuance of 25,759 shares of the Company’s restricted Common Stock, valued at $411,120 or $15.96 per share. The consideration was derived from an agreed valuation of NBMSB of $2,284,000, based on its assets including customers, fixed assets, cash and cash equivalents, and liabilities as of November 1, 2020. Therefore, GVCL recognized the investment in NBMSB at a historical cost of $411,120 under other investments.

On December 31, 2022, the fair value of NBMSB was appraised by an independent appraiser, the Appraiser and according to our 18% interest in NBMSB, our investment was valued at approximately $82,000. The depreciation of NBMSB’s fair value was mainly due to its significant drop in revenue. Hence, the Company recorded an impairment loss of $329,120 for the year ended December 31, 2022.

During 2023, no indicator of impairment occurred and hence, our investment value in NBMSB remained the same at $82,000 as of December 31, 2023.

For the year ended December 31, 2024, the Company made a full impairment of $82,000 for the investment in NBMSB due to NBMSB’s failure to provide updated financial statements for evaluation. As a result, our investment in NBMSB was fully impaired with a nil value as of December 31, 2024.

|

|

| 7. | Acquisition of Angkasa-X Holdings Corp. |

On February 3, 2021, GVCL entered into a subscription agreement with Angkasa-X Holdings Corp., a British Virgin Islands corporation, which principally provides turnkey services, from strategic satellite anchor station solutions, including construction and facility design, and antenna integration to fully deployable, integrated tactical platform solutions (“Angkasa-X”). Pursuant to the agreement, GVCL acquired 28,000,000 ordinary shares of Angkasa-X at a price of $2,800 or $0.0001 per share.

Upon acquisition, GVCL recorded the investment in Angkasa-X at a historical cost of $2,800 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $2,800 for the investment in Angkasa-X due to its continuous losses and stockholders’ deficit. As a result, our investment in Angkasa-X was fully impaired with a nil value as of December 31, 2024.

| 8. | Acquisition of Jocom Holdings Corp. |

On June 2, 2021, GVCL entered into a subscription agreement with Jocom Holdings Corp., a Nevada corporation, which operates a Malaysia-based m-commerce platform specializing in online grocery shopping via smartphones (“Jocom”). Pursuant to the agreement, GVCL acquired 1,500,000 shares of common stock of Jocom at a price of $150 or $0.0001 per share.

Upon acquisition, the Company recorded the investment in Jocom at a historical cost of $150 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $150 for the investment in Jocom due to its continuous losses and stockholders’ deficit. As a result, our investment in Jocom was fully impaired with a nil value as of December 31, 2024.

| 9. | Acquisition of Ata Global Inc. |

On July 30, 2021, GVCL entered into a subscription agreement with Ata Global Inc., a Nevada corporation, principally in the provision of financial technology (“FinTech”) services (“Ata Global”). Pursuant to the agreement, GVCL acquired 2,250,000 shares of common stock of Ata Global at a price of $225 or $0.0001 per share.

Upon acquisition, the Company recorded the investment in Ata Global at a historical cost of $225 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $225 for the investment in Ata Global due to its failure to provide updated financial statements for evaluation. As a result, our investment in Ata Global was fully impaired with a nil value as of December 31, 2024.

| 10. | Acquisition of catTHIS Holdings Corp. |

On August 27, 2021, GVCL entered into a subscription agreement with catTHIS Holdings Corp., a Nevada corporation, which provides a digital catalog management platform for users to upload, share and retrieve digital catalogs from any device (“catTHIS”). Pursuant to the agreement, GVCL acquired 2,000,000 shares of common stock of catTHIS at a price of $200 or $0.0001 per share.

Upon acquisition, the Company recorded the investment in catTHIS at a historical cost of $200 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $200 for the investment in catTHIS due to its continuous loss and stockholders’ deficit. As a result, our investment in catTHIS was fully impaired with a nil value as of December 31, 2024.

| 11. | Acquisition of ACT Wealth Academy Inc. |

On February 21, 2022, GVCL entered into a subscription agreement with ACT Wealth Academy Inc., a Nevada corporation, which provides training, seminars, and events in the academic fields (“ACT Wealth”). Pursuant to the agreement, GVCL acquired 6,000,000 shares of common stock of ACT Wealth at a price of $600 or $0.0001 per share.

Upon acquisition, the Company recorded the investment in ACT Wealth at a historical cost of $600 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $600 for the investment in ACT Wealth due to its failure to provide updated financial statements for evaluation. As a result, our investment in ACT Wealth was fully impaired with a nil value as of December 31, 2024.

| 12. | Acquisition of Best2bid Technology Corp. |

On June 9, 2022, GVCL entered into a subscription agreement with Best2bid Technology Corp., a Nevada corporation, which provides an online bidding cum e-commerce platform enabling participants to auction or sell their merchandise to bidders (“Best2bid”). Pursuant to the agreement, GVCL acquired 5,500,000 shares of common stock of Best2bid at a price of $550 or $0.0001 per share.

Upon acquisition, the Company recorded the investment in Best2Bid at a historical cost of $550 under other investments.

For the year ended December 31, 2024, the Company made a full impairment of $550 for the investment in Best2bid due to its failure to provide updated financial statements for evaluation. As a result, our investment in Best2bid was fully impaired with a nil value as of December 31, 2024.

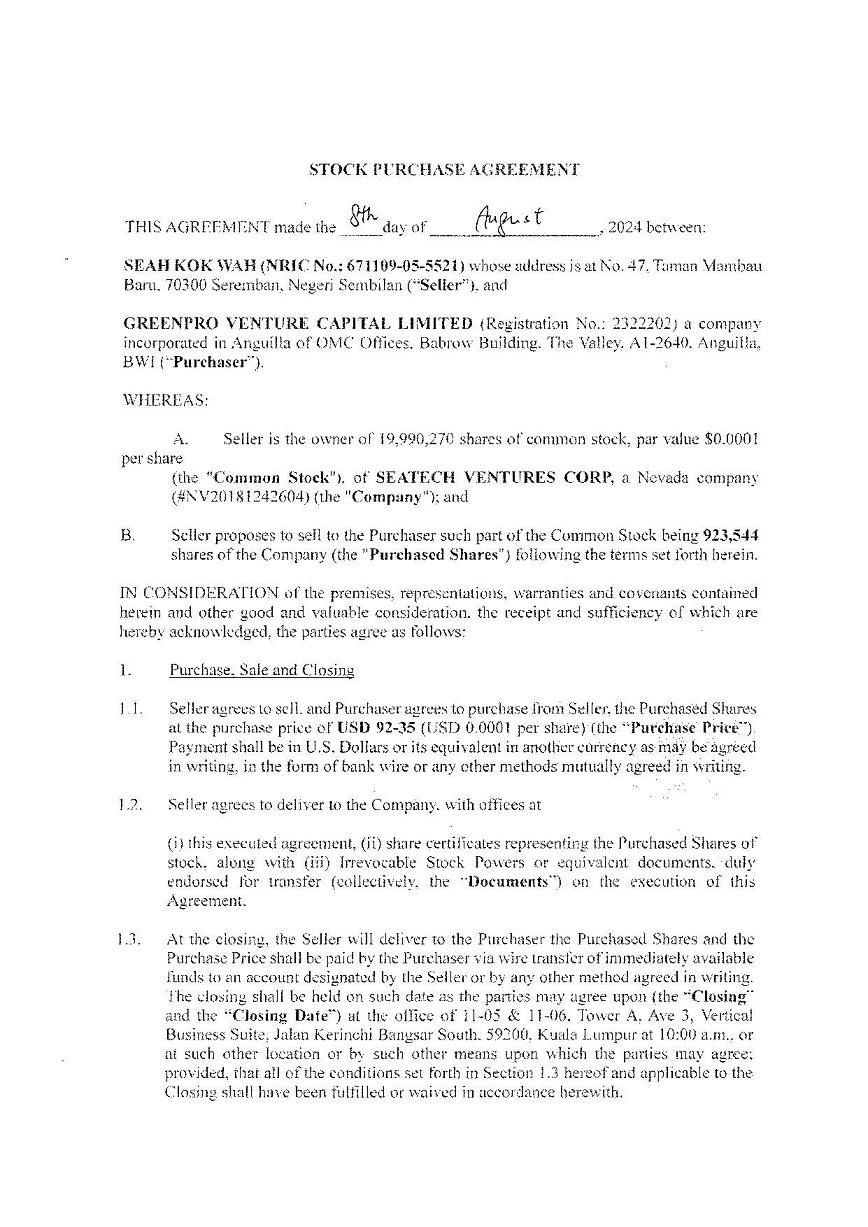

| 13. | Acquisition of SEATech Ventures Corp. |

On August 8, 2024, GVCL entered into a stock purchase agreement with an unrelated party, Seah Kok Wah (“Mr. Seah”). Pursuant to the agreement, Mr. Seah agreed to sell his 923,544 shares of common stock of SEATech Ventures Corp. (“SEATech”) to GVCL for approximately $92 or $0.0001 per share. SEATech is a Nevada corporation and principally provides mentoring and incubation services to clients. The investment was recognized at a cost of $92 under other investments.

In addition to the acquisition in August 2024, together with the remaining 2,279,813 SEATech shares which were acquired and impaired during 2018, GVCL in aggregate holds 3,203,357 shares of common stock of SEATech as of December 31, 2024.

As of December 31, 2024, the Company recorded the investment in SEATech at a historical cost of $92 under other investments.

|

|

Acquisition and disposal or termination of other investments

| 1. | Acquisition and disposal of Agape ATP Corporation |

On April 14, 2017, our wholly owned subsidiary, Greenpro Venture Capital Limited (“GVCL”), acquired 17,500,000 shares of common stock of Agape ATP Corporation, a Nevada corporation (“Agape”), par value of $0.0001 per share, for $1,750. Agape is principally engaged in the provision of health and wellness products and advisory services to clients in Malaysia. As of December 31, 2021, GVCL holds approximately 5% of the total outstanding shares of Agape and recognized the investment at a historical cost of $1,750 under other investments.

On January 21, 2022, GVCL entered into a forfeiture agreement with Agape. Pursuant to the agreement, GVCL agreed to transfer 16,500,000 shares out of its total invested 17,500,000 shares of common stock from Agape to Agape for nil consideration. As a result, GVCL holds approximately 1% of the total outstanding shares of Agape and recognized a loss on forfeiture of other investment of $1,650.

Since October 10, 2023, Agape’s common stock has been uplisted from OTC to The Nasdaq Stock Market LLC (“NASDAQ”).

On December 31, 2023, GVCL owned 1,000,000 shares of common stock of Agape and recognized our investment in Agape under a historical cost of $100 or $0.0001 per share.

On February 16, 2024, GVCL sold 200,000 shares of Agape’s common stock through a broker at a price of $180,000. As a result, GVC recognized a gain on disposal of other investment of $179,980.

On August 15, 2024, Agape filed a Certificate of Change with the Secretary of State of the State of Nevada to effect a 1-for-20 reverse stock split of the shares of Agape’s common stock, par value $0.0001 per share on August 30, 2024. As a result of the reverse stock split, our 800,000 shares of Agape’s common stock were reduced to 40,000 shares, and the investment cost was retained at $80.

On August 30, 2024, GVCL sold all remaining 40,000 Agape shares through a broker at a price of $127,697. As a result, GVCL recognized a gain on disposal of other investment of $127,617.

| 2. | Acquisition and disposal of Celmonze Wellness Corporation. |

On February 8, 2023, GVCL entered into a subscription agreement with Celmonze Wellness Corporation, a Nevada corporation, which provides beauty and wellness solutions to clients (“Celmonze”). Pursuant to the agreement, GVCL acquired 5,000,000 shares of common stock of Celmonze at a price of $500 or $0.0001 per share. The investment was recognized at a historical cost of $500 under other investments.

Upon acquisition, the Company recorded the investment in Celmonze at a historical cost of $500 under other investments.

On January 17, 2024, GVCL entered a repurchase agreement with Celmonze. Pursuant to the agreement, GVCL agreed to sell back all our 5,000,000 owned Celmonze shares to Celmonze for $500. We received cash of $500 from Celmonze in exchange for our return of Celmonze shares.

| 3. | Acquisition and disposal of MU Global Holding Limited |

On July 25, 2018, GVCL entered into a subscription agreement with MU Global Holding Limited, a Nevada corporation, which provides spa and wellness services and products to clients (“MUGH”). Pursuant to the agreement, GVCL acquired 2,165,000 shares of common stock of MUGH at a price of $217 or $0.0001 per share. The investment was recognized at a historical cost of $217 under other investments.

On December 31, 2018, GVCL made an impairment of $217 and hence, the investment was fully impaired with nil value.

On April 10, 2024, GVCL entered into a stock purchase agreement with an unrelated party, Chen Shu-Jen (“Mr. Chen”). Pursuant to the agreement, GVCL agreed to sell all 2,165,000 MUGH shares to Mr. Chen for $17,320. As a result, GVCL recognized a gain on disposal of investment of $17,320.

| 4. | Acquisition and termination of REBLOOD Biotech Corp. |

On April 1, 2022, GVCL entered into a subscription agreement with REBLOOD Biotech Corp., a Nevada corporation, which is principally in the provision of health management and biotechnology services (“REBLOOD”). Pursuant to the agreement, GVCL acquired 1,000,000 shares of common stock of REBLOOD at a price of $100 or $0.0001 per share.

On December 20, 2024, REBLOOD’s sole director resolved to dissolve REBLOOD in Nevada, and filed a special resolution for dissolution with the Nevada Secretary of State effective December 31, 2024.

As a result of the dissolution, all REBLOOD shares are annulled, GVCL’s investment is terminated with a nil value. On December 31, 2024, GVCL recognized a loss on termination of investment of $100.

|

|

Business Overview

During 2024, through Green-X Corp. (“Green-X”), one of our subsidiaries in Labuan, we expanded our blockchain initiative in Indonesia by conducting training programs in collaboration with institutions like Dubai Blockchain Center. We also signed a strategic agreement with Pondok Pesantren Darul Fiqhi to promote blockchain technology through Islamic boarding schools. Additionally, we plan to implement a Brunei Darussalam, Indonesia, Malaysia and the Philippines East ASEAN Growth Area (BIMP-EAGA) digital wallet in Indonesia, that facilitates and enables us to raise funds through digital means by issuing or offering Shariah-compliant securities token (RAMZ) in Labuan International Business and Financial Centre (Labuan IBFC).

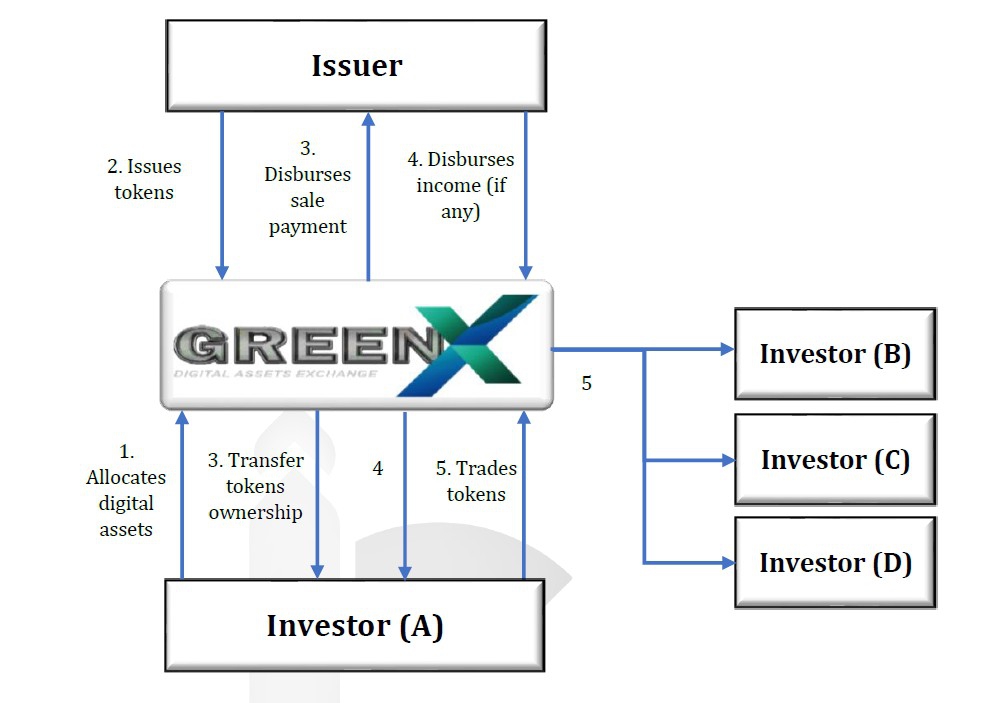

Green-X is a platform operator licensed under the Labuan Financial Services and Securities Act 2010 (LFSSA) whereby security token issuers (“Issuers”) offer their security tokens for subscription and trading by investors (“Investors”) through Green-X digital asset exchange (“Green-X DAX”) platform. ISRA International Consulting Sdn. Bhd. (“ISRA Consulting/Shariah Adviser of the platform”) is responsible for advising on and ensuring end-to-end Shariah compliance for the Green-X DAX platform’s operations.

Key Highlights of Green-X DAX and Shariah Compliance

| ● | The platform adopts the contract of Ijarah, which shall be subject to all rules and requirements relating thereto. | |

| ● | Ijarah is a contract that involves the hiring of services from an entity for a specified period, in exchange for a fee (ujrah). This contract enables Green-X, as a platform provider, to offer its services, including but not limited to the facilitation of security token trading, benefits, and platform access to counterparties, such as Listing Sponsors, Issuers and Investors, in exchange for a fee. | |

| ● | Digital assets: |

| i. | The digital assets consist of cryptocurrencies, stablecoins and security tokens. |

| ii. | Cryptocurrencies (digital currencies) are recognized as assets (mal) from the Shariah perspective. |

| iii. | Cryptocurrencies that are based on technology without any underlying assets are categorized as goods (`urudh) and not subject to the principle of currency exchange (bay` al-sarf). |

| iv. | Stablecoins are a type of cryptocurrency whereby their values are pegged and/or backed to another currency or commodity. |

| v. | In the event that the stablecoins’ values are: |

| a) | pegged and backed by ribawi items comprising gold, silver and currency, such as Tether, which is pegged and backed to USD, it is categorized as a currency from the Shariah perspective and subject to the principle of currency exchange, which is the same value of the same type and on a spot basis. |

| b) | pegged and/or backed by non-ribawi items, such as crude oil, it is categorized as goods and not subject to the principle of currency exchange. |

| vi. | The security tokens can be categorized into two categories: |

| a) | asset-backed tokens - represent the digitalization of valuable assets into fractional digital |

certificates, indicating ownership rights over the asset.

| b) | equity-based tokens - represent direct ownership or shares in a company, which may include rights to dividends, voting, and other benefits. |

The former a) is considered an asset, while the latter b) represents equity.

| vii. | For transactions on the platform, the usage of digital assets shall be limited to those that have been approved by the Shariah Adviser of the platform. |

|

|

| ● | Green-X e-wallet: |

| i. | An individual or entity wishing to trade on the platform must deposit their digital assets into the Green-X e-wallet. These assets will be used as payment for the subscription to security tokens. |

| ii. | The Green-X e-wallet operates on the principle of Wadi’ah, a custodianship based on trust. The custodian is responsible for the safekeeping of the assets and must return them at the depositor’s request. |

| iii. | As this is a trust-based arrangement, the custodian is not permitted to utilize the assets or derive any profits from them. The custodian is also not liable for any loss or damage to the assets unless it results from misconduct, negligence, or a breach of specified terms. |

| iv. | The custodian shall not transfer the assets to a third party without the depositor’s consent. If such a transfer occurs without consent, the custodian will be fully responsible for any loss or damage to the assets. |

| v. | For the Green-X e-wallet, a certain percentage of the stored digital assets will be transferred to a Cold Wallet provided by BitGo. A Cold Wallet is a secure, offline storage solution designed to protect assets from theft, hacks, and similar risks. |

| vi. | The Cold Wallet provided by BitGo also operates under the concept of Wadi’ah, wherein the custodian is responsible for the safekeeping of the assets and must return them upon the depositor’s request. |

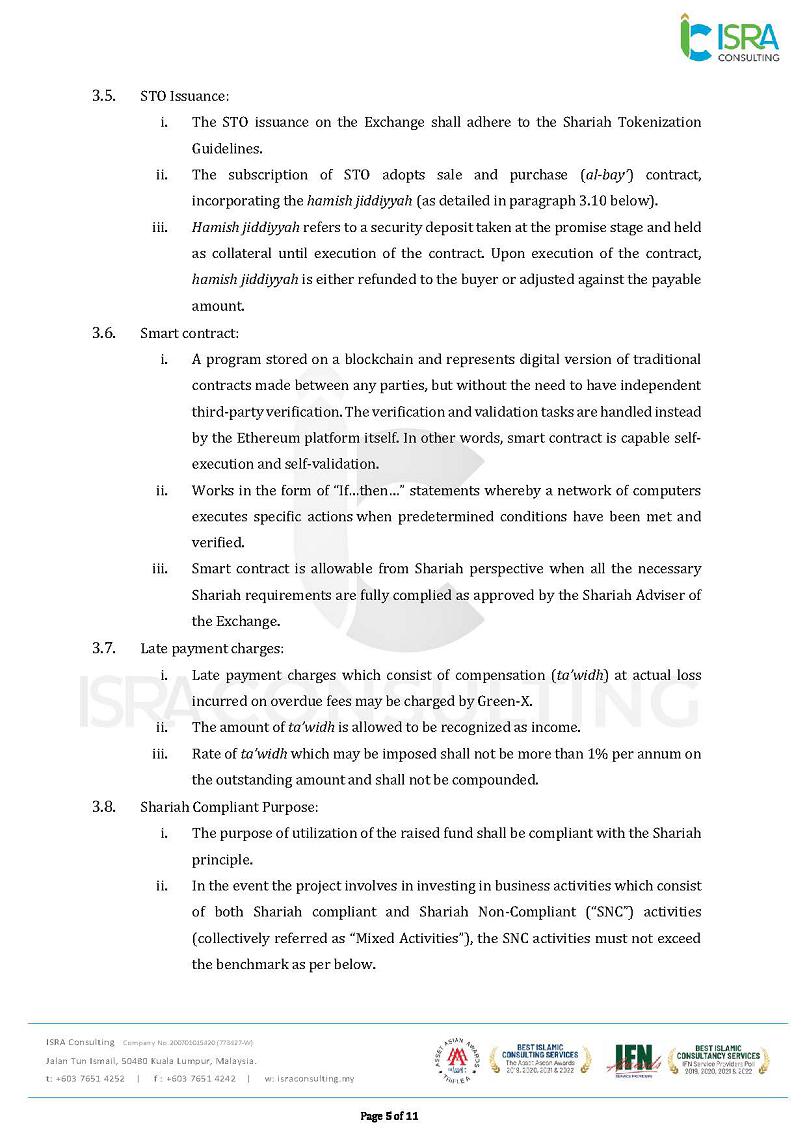

| ● | STO issuance: |

| i. | The STO issuance on the platform shall adhere to the Shariah Tokenization Guidelines. |

| ii. | The subscription of STO adopts a sale and purchase (al-bay’) contract, incorporating the hamish jiddiyyah. |

| iii. | Hamish jiddiyyah refers to a security deposit taken at the promise stage and held as collateral until the execution of the contract. Upon execution of the contract, hamish jiddiyyah is either refunded to the buyer or adjusted against the payable amount. |

| ● | Smart contract: |

| i. | A program stored on a blockchain, representing a digital version of traditional contracts made between any parties, but without the need to have independent third-party verification. The verification and validation tasks are handled instead by the Ethereum platform itself. In other words, smart contracts are capable of self-execution and self-validation. |

| ii. | Works in the form of “If…then…” statements whereby a network of computers executes specific actions when predetermined conditions have been met and verified. |

| iii. | Smart contracts are allowable from a Shariah perspective when all the necessary Shariah requirements are fully complied with as approved by the Shariah Adviser of the platform. |

| ● | Late payment charges: |

| i. | Late payment charges which consist of compensation (ta’widh) at actual loss incurred on overdue fees may be charged by Green-X. |

| ii. | The amount of ta’widh is allowed to be recognized as income. |

| iii. | Rate of ta’widh which may be imposed shall not be more than 1% per annum on the outstanding amount and shall not be compounded. |

| ● | Shariah-compliant purpose: |

| i. | The purpose of utilization of the raised funds shall be compliant with the Shariah principle. |

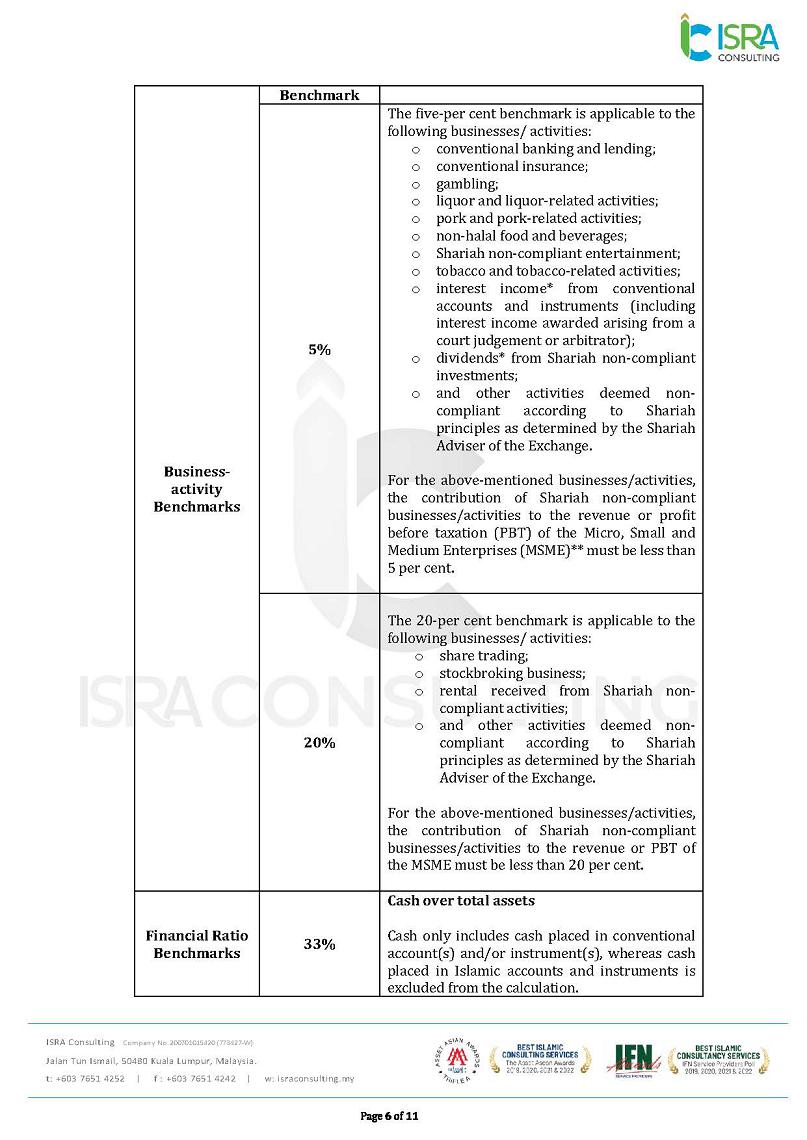

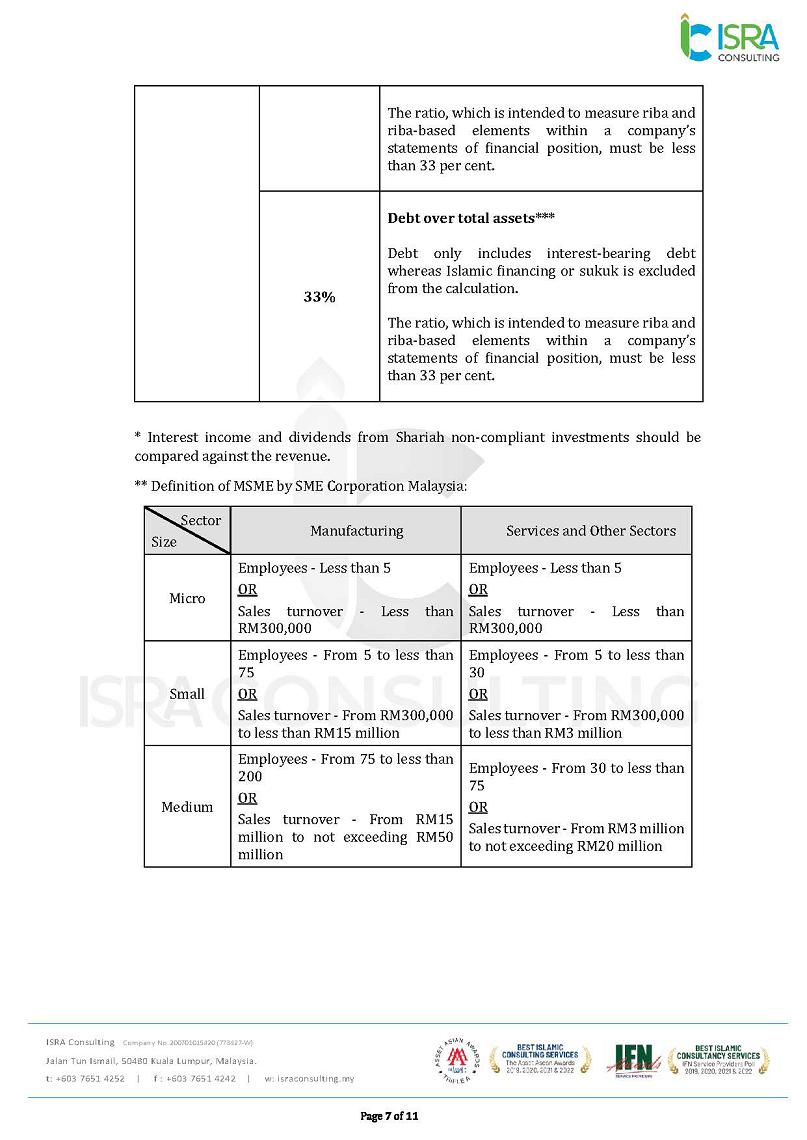

| ii. | In the event that the project involves investing in business activities which consist of both Shariah-compliant and Shariah Non-Compliant (“SNC”) activities (collectively referred to as “Mixed Activities”), the SNC activities must not exceed the designated benchmarks. |

|

|

| ● | Below are the parties on the Green-X DAX platform: |

Green-X: A platform operator, licensed under the LFSSA. Green-X operates a Shariah-compliant platform that facilitates the listing of the Issuer’s security tokens, subscription for security tokens by the Investor and trading of security tokens.

Issuer: A company that issues Shariah-compliant security tokens through the Green-X DAX platform and intends to raise funds for Shariah-compliant purposes.

Investor: Individual or entity that has successfully registered as a Green-X e-wallet user on the Green-X DAX platform and subscribes to security tokens through payment of consideration in the form of digital assets on the Green-X DAX platform.

DAX Listing Sponsor: The adviser who is authorized to undertake both Initial Listing Activities and Post Listing Activities including but not limited to performing due diligence on the Issuer’s assets and business, preparing the Pre-Consultation Presentation and drafting the STO Business Memorandum.

Shariah Adviser of the Platform: Herein referred to ISRA Consulting, provides guidelines to the Green-X DAX platform and ensures operations of the platform are compliant with Shariah rules and principles.

Shariah Adviser of the Issuer: Shariah Adviser appointed by the Issuer to ensure that the Issuer’s assets and purpose of utilization for security token issuance are operated and managed in compliance with Shariah rules and principles.

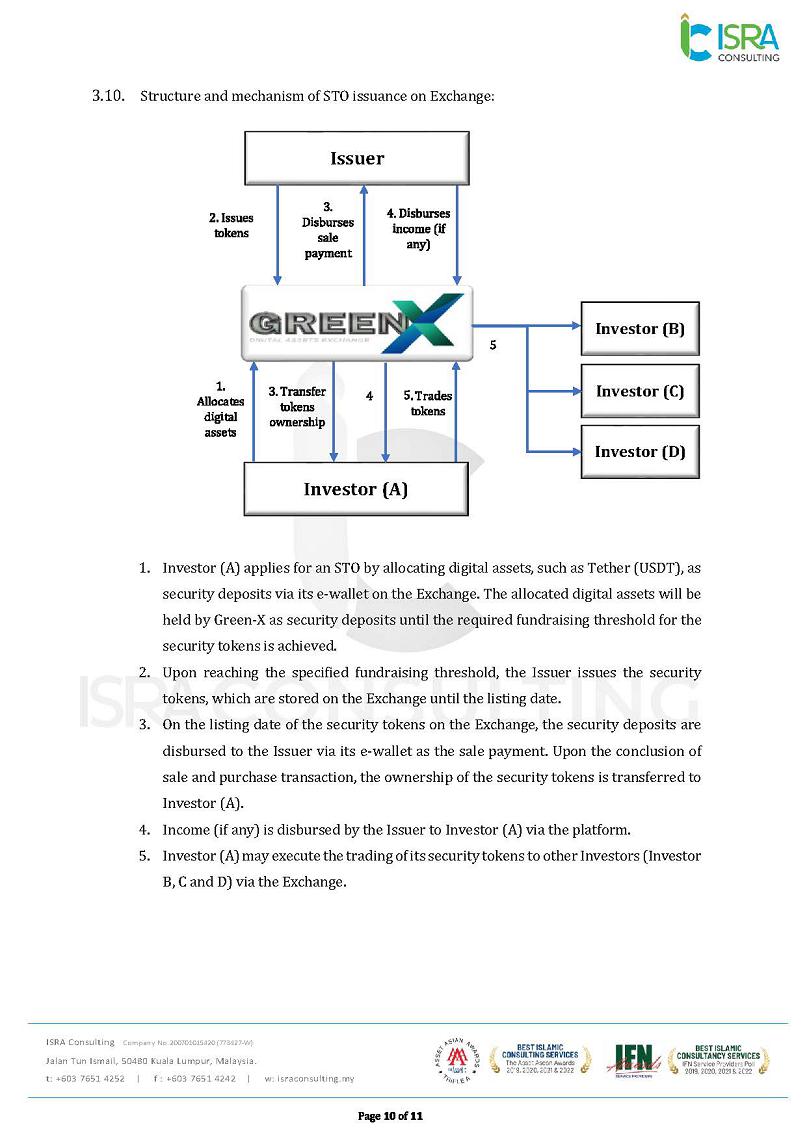

| ● | Structure and mechanism of STO issuance on the Green-X DAX platform: |

| 1. | Investor (A) applies for an STO by allocating digital assets, such as Tether (USDT), as security deposits via its e-wallet on the platform. The allocated digital assets will be held by Green-X as security deposits until the required fundraising threshold for the security tokens is achieved. |

| 2. | Upon reaching the specified fundraising threshold, the Issuer issues the security tokens, which are stored on the platform until the listing date. |

| 3. | On the listing date of the security tokens on the platform, the security deposits are disbursed to the Issuer via its e-wallet as the sale payment. Upon the conclusion of the sale and purchase transaction, the ownership of the security tokens is transferred to Investor (A). |

| 4. | Income (if any) is disbursed by the Issuer to Investor (A) via the platform. |

| 5. | Investor (A) may execute the trading of its security tokens to other Investors (Investor B, C and D) via the platform. |

On June 15, 2024, Green-X entered into a sale and purchase agreement with a founder of a Delaware company, Dignity Corp. (referred as “Seller”) and subsequently on December 12, 2024, entered into a supplementary agreement with the Seller (collectively, the “SPA”). Pursuant to the SPA, in consideration of the total token of four million (4,000,000) in our digital assets, GX Token, paid and / or exchange by Green-X, and in consideration of the total token five million (5,000,000) in Dignity Token, an asset-backed crypto security token (“DiGau”), The Seller grants to Green-X an option whereby Green-X may at the end of sixty (60) months of period, with consent from both parties require the Seller to exchange back whichever balance of GX Token back to Green-X and vice versa (the “Option”).

DiGau was initially traded on the Green-X digital asset exchange (“Green-X DAX”) platform on April 10, 2024, with a closing price of $2.3204 per token. On December 31, 2024, DiGau was traded on the Green-X DAX platform with a closing price of $3.9006 per token.

Based on the pricing data from CoinGecko, a cryptocurrency data aggregator, DiGau’s closing price on December 31, 2024, was $6.02 per token.

In reference to a valuation report issued by an independent appraiser, as of July 1, 2024, DiGau was valued in the range of $9.70 to $10.93 per token on a marketable basis and valued in the range of $9.51 to $10.71 per token on a non-marketable basis, respectively.

Despite the token exchange, DiGau was not recognized in our consolidated balance sheet as of December 31, 2024, as the transaction did not meet the criteria for asset recognition. As of the date of this report, the Company has yet determined the value of DiGau due to a lack of observable market transactions and price information. As a result, the transaction was not disclosed in our consolidated financial statements for the year ended December 31, 2024.

The Company does not expect that the exclusion of the transaction will have a significant effect on its consolidated financial statements as of December 31, 2024.

|

|

As our core business, we operate and provide a wide range of business solution services to small and medium-sized businesses located in Southeast Asia and East Asia, with an initial focus on Hong Kong, China and Malaysia, and subsequently in Thailand and Taiwan. Our comprehensive range of services includes cross-border business solutions, record management services, and accounting outsourcing services. Our cross-border business services include, among other services, tax planning, trust and wealth management, cross-border listing advisory services and transaction services. As part of the cross-border business solutions, we have developed a package solution of services (“Package Solution”) that can reduce business costs and enhance revenues.

We also operate a venture capital business through Greenpro Venture Capital Limited, an Anguilla corporation. Our venture capital business is focused on (1) establishing a business incubator for start-up and high-growth companies to support such companies during critical growth periods, which includes education and support services, and (2) searching for investment opportunities in selected start-up and high-growth companies, which we expect can generate significant returns to the Company. We expect to target companies located in Asia including Hong Kong, Malaysia, China, Thailand and Singapore. We anticipate our venture capital business will also engage in the purchase or lease of commercial properties in the same Asian region.

Our Services

We provide a range of services to our clients as part of the Package Solution that we have developed. We believe that our clients can reduce their business costs and enhance their revenues by utilizing our Package Solution.

Cross-Border Business Solutions

We provide a full range of cross-border services to small to medium-sized enterprises (SMEs) to assist them in conducting their business effectively. Our “Cross-Border Business Solutions” includes the following services:

| ● | Advising clients on company formation in Hong Kong, the United States, the British Virgin Islands, and other overseas jurisdictions; | |

| ● | Assisting companies to set up bank accounts with banks in Hong Kong to facilitate clients’ banking operations; | |

| ● | Providing bank loan referral services; | |

| ● | Providing company secretarial services; | |

| ● | Assisting companies in applying for business registration certificates with the Inland Revenue Department of Hong Kong; | |

| ● | Providing corporate finance consulting services; | |

| ● | Providing due diligence investigations and valuations of companies; | |

| ● | Advising clients regarding debt and company restructurings; | |

| ● | Providing liquidation, insolvency, bankruptcy and individual voluntary arrangement advice and assistance; | |

| ● | Designing a marketing strategy and promoting the company’s business, products, and services; | |

| ● | Providing financial and liquidity analysis; | |

| ● | Assisting in setting up cloud invoicing systems for clients; |

| ● | Assisting in liaising with investors for the purpose of raising capital; | |

| ● | Assisting in setting up cloud inventory systems to assist clients in recording, maintaining and controlling their inventories and tracking their inventory levels; | |

| ● | Assisting in setting up cloud accounting systems to enable clients to keep track of their financial performance; | |

| ● | Assisting clients in payroll matters operated in our cloud payroll system; | |

| ● | Assisting clients in tax planning, preparing the tax computation, and making tax filings with the Inland Revenue Department of Hong Kong; | |

| ● | Providing cross-border listing advisory services, including but not limited to, United States, United Kingdom, Hong Kong, and Australia; | |

| ● | Providing international tax planning in China; | |

| ● | Advising on trust and wealth management; | |

| ● | Providing an online equity crowdfunding platform to assist small to medium-sized enterprises (SMEs) to access funding through its platform; | |

| ● | Providing cryptocurrency trading and digital asset exchange services; | |

| ● | Providing a capital market-focused portal to browse business markets or corporate news; | |

| ● | Providing big data and focusing on artificial intelligence (AI) providing financial services; | |

| ● | Providing financial technology (FinTech) services; and | |

| ● | Transaction services. |

|

|

There is a growing market in Asia for companies who are seeking to go public and become listed on a recognized exchange in a foreign jurisdiction. We see tremendous opportunity to the extent that this trend continues worldwide. With respect to cross-border listing advisory services, we assist private companies in their desire to list and trade on public exchanges, including the NASDAQ and OTC Markets in the U.S.. The Jumpstart Our Business Startups Act, or JOBS Act, signed in 2012, eases the initial public offering (“IPO”) process for “emerging growth companies” and reduces their regulatory burden, (2) improves the ability of these companies to access capital through private offerings and small public offerings without SEC registration, and (3) allows private companies with a substantial shareholder base to delay becoming a public reporting company.

Through our cross-border listing advisory services, we seek to form the bridge between these companies seeking to conduct their IPO (or in some cases, self-directed public offerings), and their goal of becoming a listed company on a recognized U.S. national exchange, such as NASDAQ and the NYSE.

While there are several alternatives for companies seeking to go public and trade on the U.S. OTC markets, we primarily focus on three methods:

| ● | Registration Statement on Form S-1 | |

| ● | Regulation A+ offering | |

| ● | The Form 10 shell company |

The way the OTC markets are structured provides companies the ability to “uplist” in the marketplace as they provide better transparency. These OTC markets include:

| ● | OTCQX Best Marketplace: offers transparent and efficient trading of established investor-focused U.S. and global companies. | |

| ● | OTCQB Venture Marketplace: for early-stage and developing U.S. and international companies that are not yet able to qualify for OTCQX. | |

| ● | OTC Pink Open Marketplace: offers trading in a wide spectrum of securities through any broker. With no minimum financial standards, this market includes foreign companies that limit their disclosure, penny stocks and shells, as well as distressed, delinquent, and dark companies not willing or able to provide adequate information to investors. |

We act as a case reference for our clients, as we originally had our shares quoted in the OTC markets and subsequently “uplisted” to The Nasdaq Stock Market LLC., a U.S. national securities exchange.

|

|

With growing competition and increasing economic sophistication, we believe more companies need strategies for cross-border restructuring and other corporate matters. Our plan is to bundle our Cross-Border Business Solutions services with our cloud accounting solutions and Accounting Outsourcing Services described below.

Accounting Outsourcing Services

We intend to develop relationships with professional firms from Hong Kong, Malaysia, China, and Thailand that can provide company secretarial, business centers and virtual offices, bookkeeping, tax compliance and planning, payroll management, business valuation, and wealth management services to our clients. We intend to include local accounting firms within this network to provide general accounting, financial evaluation, and advisory services to our clients. Our expectation is that firms within our professional network will refer their international clients to us who may need our bookkeeping, payroll, company secretarial and tax compliance services. We believe that this accounting outsourcing service arrangement will be beneficial to our clients by providing a convenient, one-stop firm for their local and international business and financial compliance and governance needs.

Our Service Rates

We intend to have a two-tiered rate system based upon the type of services being offered. We may impose project-based fees, where we charge 10% - 25% of the revenues generated by the client on projects that are completed using our services, such as transaction projects, contract compliance projects, and business planning projects. We may also charge a flat rate fee or fixed fee based on the estimated complexity and timing of a project when our professionals provide specified expertise to our clients on a project. For example, for our Cross-Border Business Solutions services, we plan to charge our client a monthly fixed fee.

Our Venture Capital Business Segment

Venture Capital Investment

As a result of our acquisition of Greenpro Venture Capital Limited (“GVCL”) in 2015, we entered a venture capital business in Hong Kong with a focus on companies located in Southeast Asia and East Asia, including Hong Kong, Malaysia, China, Thailand, and Singapore. Our venture capital business is focused on (1) establishing a business incubator for start-ups and high-growth companies to support such companies during critical growth periods and (2) investment opportunities in select start-ups and high-growth companies.

We believe that a company’s life cycle can be divided into five stages, including the seed stage, start-up stage, expansion stage, mature stage and decline stage. We anticipate that most of a company’s funding needs will occur during these first three stages.

| ● | Seed stage: Financing is needed for assets, and research and development of an initial business concept. The company usually has relatively low costs in developing the business idea. The ownership model is considered and implemented. | |

| ● | Start-up stage: Financing is needed for product development and initial marketing. Firms in this phase may be in the process of setting up a business or they might have been operating the business for a short period of time but may not have sold their products commercially. In this phase, costs are increasing due to product development, market research and the need to recruit personnel. Low levels of revenue are starting to be generated. | |

| ● | Expansion stage: Financing is needed for growth and expansion. Capital may be used to finance increased production capacity, product, or marketing development or to hire additional personnel. In the early expansion phase, sales and production increase but there is not yet any profit. In the later expansion stage, the business typically needs extra capital in addition to organically generated profit, for further development, marketing, or product development. |

|

|

We intend for our business incubators to provide valuable support to young, emerging growth and potential high-growth companies at critical junctures of their development. For example, our incubators will offer office space at a below-market rental rate. We will also provide our expertise, business contacts, introductions, and other resources to assist their development and growth. Depending on each individual circumstance, we may also take an active advisory role in our venture capital companies including board representation, strategic marketing, corporate governance, and capital structuring. We believe that there will be potential investment opportunities for us in these start-up companies.

Our business processes for our investment strategy in select start-up and high-growth companies are as follows:

| ● | Step 1. Generating Deal Flow: We expect to actively search for entrepreneurial firms and to generate deal flow through our business incubator and the personal contacts of our executive team. We also anticipate that entrepreneurs will approach us for financing. | |

| ● | Step 2. Investment Decision: We will evaluate, examine, and engage in the diligence of a prospective portfolio company, including but not limited to product/service viability, market potential and integrity as well as the capability of the management. After that, both parties arrive at an agreed value for the deal. Following that is a process of negotiation which, if successful, ends with capital transformation and restructuring. | |